qualify for the derivative scope exception are removed and, as a result, more equity contracts will qualify for the scope exception. The ASU also simplifies the diluted

calculation in certain areas. Upon the adoption of this ASU, we reclassified the equity component related to the convertible notes, net of deferred taxes, reducing accumulated deficit by $0.6 million, increasing the carrying value of the convertible notes by $4.1 million, reducing additional

paid-in

capital by $3.7 million and reducing deferred tax liabilities by $1.0 million. These updates also reduced interest expense recognized on our convertible notes by approximately $0.4 million per quarter. See Note 11 to our Consolidated Financial Statements for additional information.

On January 1, 2021, we adopted ASU

2019-12,

Income Taxes (Topic 740) – Simplifying the Accounting for Income Taxes

(ASU

2019-12).

The main objective of the standard is to reduce complexity in the accounting for income taxes by removing the following exceptions: (1) exception to the incremental approach for intraperiod tax allocation when there is a loss from continuing operations and income or a gain from other items (for example, discontinued operations or other comprehensive income); (2) exception to the requirement to recognize a deferred tax liability for equity method investments when a foreign subsidiary becomes an equity method investment; (3) exception to the ability not to recognize a deferred tax liability for a foreign subsidiary when a foreign equity method investment becomes a subsidiary; and (4) exception to the general methodology for calculating income taxes in an interim period when a

loss exceeds the anticipated loss for the year. The standard also simplifies the accounting for income taxes by enacting the following: (a) requiring that an entity recognize a franchise tax (or similar tax) that is partially based on income as an income-based tax and account for any incremental amount as a

non-income-based

tax; (b) requiring that an entity evaluate when a step up in the tax basis of goodwill should be considered part of the business combination in which the book goodwill was originally recognized and when it should be considered as a separate transaction; (c) specifying that an entity is not required to allocate the consolidated amount of current and deferred tax expense to a legal entity that is not subject to tax in its separate financial statements; and (d) requiring that an entity reflect the enacted change in tax laws or rates in the annual effective tax rate computation in the interim period that includes the enactment date. We have determined that the adoption of this standard did not have a material impact on our financial statements.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The following information, together with information included in other parts of this Management’s Discussion and Analysis of Financial Condition and Results of Operations, describes key aspects of our market risk.

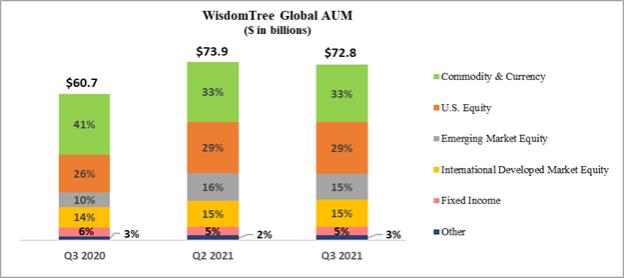

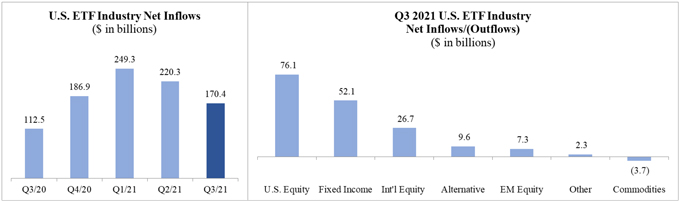

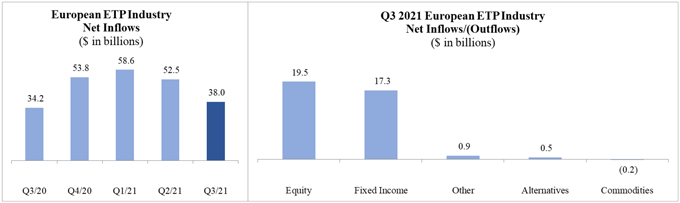

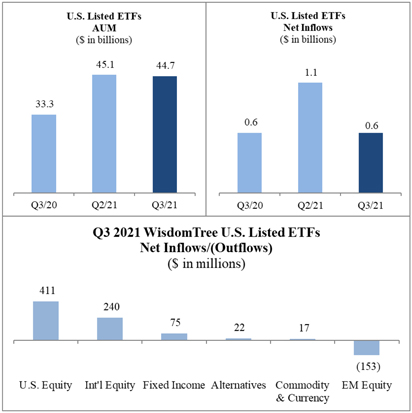

Market risk to us generally represents the risk of changes in the value of our ETPs that results from fluctuations in securities or commodity prices, foreign currency exchange rates against the U.S. dollar, and interest rates. Nearly all our revenues are derived from advisory agreements for the WisdomTree ETPs. Under these agreements, the advisory fee we receive is based on the average market value of the assets in the WisdomTree ETP portfolios we manage.

Fluctuations in the value of the ETPs are common and are generated by numerous factors such as market volatility, the global economy, inflation, changes in investor strategies and sentiment, availability of alternative investment vehicles, domestic and foreign government regulations, emerging markets developments and others. Accordingly, changes in any one or a combination of these factors may reduce the value of investment securities and, in turn, the underlying AUM on which our revenues are earned. These declines may cause investors to withdraw funds from our ETPs in favor of investments that they perceive as offering greater opportunity or lower risk, thereby compounding the impact on our revenues. We believe challenging and volatile market conditions will continue to be present in the foreseeable future.

We invest our corporate cash in short-term interest earning assets, primarily in WisdomTree fixed income ETFs, federal agency debt instruments, corporate bonds, money market instruments at a commercial bank and other securities which totaled $36.0 million and $139.9 million as of December 31, 2020 and September 30, 2021, respectively. We do not anticipate that changes in interest rates will have a material impact on our financial condition, operating results or cash flows.

In addition, our Convertible Notes bear interest at a fixed rate of 3.25% to 4.25%. Therefore, we have no direct financial statement risk associated with changes in interest rates. However, the fair value of the Convertible Notes changes primarily when the market price of our common stock fluctuates or interest rates change.

We are subject to currency translation exposure on the results of our

non-U.S.

operations, primarily in the United Kingdom and Europe. Foreign currency translation risk is the risk that exchange rate gains or losses arise from translating foreign entities’ statements of earnings and balance sheets from functional currency to our reporting currency (the U.S. dollar) for consolidation purposes. The advisory fees earned on our international listed ETPs are predominantly in U.S. dollars (and also paid in gold ounces, as described below); however, expenses for corporate overhead are generally incurred in British pounds. Currently, we do not enter into derivative financial instruments aimed at offsetting certain exposures in the statement of operations or the balance sheet but may seek to do so in the future.