| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Delaware | 13-3487784 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

250 West 34 th Street3 rd FloorNew York, New York | 10119 | |

(Address of principal executive offices) | (Zip Code) | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Common Stock, $0.01 par value | WETF | The NASDAQ Stock Market LLC |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

WISDOMTREE INVESTMENTS, INC.

Form 10-Q

For the Quarterly Period Ended September 30, 2022

TABLE OF CONTENTS

PART I: | FINANCIAL INFORMATION | 4 | ||||

ITEM 1. | Financial Statements | 4 | ||||

ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 33 | ||||

ITEM 3. | Quantitative and Qualitative Disclosures About Market Risk | 51 | ||||

ITEM 4. | Controls and Procedures | 52 | ||||

PART II: | OTHER INFORMATION | 52 | ||||

ITEM 1. | Legal Proceedings | 52 | ||||

ITEM 1A. | Risk Factors | 52 | ||||

ITEM 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 52 | ||||

ITEM 3. | Default Upon Senior Securities | 53 | ||||

ITEM 4. | Mine Safety Disclosures | 53 | ||||

ITEM 5. | Other Information | 53 | ||||

ITEM 6. | Exhibits | 54 | ||||

Unless otherwise indicated, references to “the Company,” “we,” “us,” “our” and “WisdomTree” mean WisdomTree Investments, Inc. and its subsidiaries.

WisdomTree®, WisdomTree Prime™ and Modern Alpha® are trademarks of WisdomTree Investments, Inc. in the United States and in other countries. All other trademarks are the property of their respective owners.

2

| • | the ultimate duration of the COVID-19 pandemic, or the war in Ukraine, and their short-term and long-term impact on our business and the global economy; |

| • | anticipated trends, conditions and investor sentiment in the global markets and exchange traded products, or ETPs; |

| • | anticipated levels of inflows into and outflows out of our ETPs; |

| • | our ability to deliver favorable rates of return to investors; |

| • | competition in our business; |

| • | whether we will experience future growth; |

| • | our ability to develop new products and services and their success; |

| • | our ability to maintain current vendors or find new vendors to provide services to us at favorable costs; |

| • | our ability to successfully implement our strategy relating to digital assets and blockchain-enabled financial services, including WisdomTree Prime ™ , and achieve its objectives; |

| • | our ability to successfully operate and expand our business in non-U.S. markets; and |

| • | the effect of laws and regulations that apply to our business. |

ITEM 1. | FINANCIAL STATEMENTS |

September 30, 2022 | December 31, 2021 | |||||||

(unaudited) | ||||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 132,700 | $ | 140,709 | ||||

Securities owned, at fair value (including $12,387 and $18,526 invested in WisdomTree ETFs at September 30, 2022 and December 31, 2021, respectively) | 125,110 | 127,166 | ||||||

Accounts receivable (including $21,222 and $25,628 due from related parties at September 30, 2022 and December 31, 2021, respectively) | 25,306 | 31,864 | ||||||

Prepaid expenses | 6,035 | 3,952 | ||||||

Other current assets | 332 | 276 | ||||||

Total current assets | 289,483 | 303,967 | ||||||

Fixed assets, net | 575 | 557 | ||||||

Indemnification receivable (Note 19) | 1,220 | 21,925 | ||||||

Securities held-to-maturity | 267 | 308 | ||||||

Deferred tax assets, net | 6,947 | 8,881 | ||||||

Investments (Note 7) | 26,339 | 14,238 | ||||||

Right of use assets—operating leases (Note 12) | 1,720 | 520 | ||||||

Goodwill (Note 21) | 85,856 | 85,856 | ||||||

Intangible assets (Note 21) | 603,204 | 601,247 | ||||||

Other noncurrent assets | 766 | 361 | ||||||

Total assets | $ | 1,016,377 | $ | 1,037,860 | ||||

Liabilities and stockholders’ equity | ||||||||

Liabilities | ||||||||

Current liabilities: | ||||||||

Convertible notes—current (Note 10) | $ | 173,760 | $ | — | ||||

Fund management and administration payable | 21,466 | 20,661 | ||||||

Compensation and benefits payable | 26,455 | 32,782 | ||||||

Deferred consideration—gold payments (Note 9) | 15,162 | 16,739 | ||||||

Operating lease liabilities (Note 12) | 1,186 | 209 | ||||||

Income taxes payable | 2,094 | 3,979 | ||||||

Accounts payable and other liabilities | 13,122 | 9,297 | ||||||

Total current liabilities | 253,245 | 83,667 | ||||||

Convertible notes—long term (Note 10) | 146,805 | 318,624 | ||||||

Deferred consideration—gold payments (Note 9) | 149,595 | 211,323 | ||||||

Operating lease liabilities (Note 12) | 554 | 328 | ||||||

Other noncurrent liabilities (Note 19) | 1,220 | 21,925 | ||||||

Total liabilities | 551,419 | 635,867 | ||||||

Preferred stock—Series A Non-Voting Convertible, par value $0.01; 14.750 shares authorized, issued and outstanding; redemption value of $73,594 and $90,741 at September 30, 2022 and December 31, 2021, respectively) (Note 11) | 132,569 | 132,569 | ||||||

Contingencies (Note 13) | ||||||||

Stockholders’ equity | ||||||||

Preferred stock, par value $0.01; 2,000 shares authorized: | — | — | ||||||

Common stock, par value $0.01; 400,000 shares authorized; issued and outstanding: 146,520 and 145,107 at September 30, 2022 and December 31, 2021, respectively | 1,465 | 1,451 | ||||||

Additional paid-in capital | 289,284 | 289,736 | ||||||

Accumulated other comprehensive (loss) income | (5,209) | 682 | ||||||

Retained earnings/(accumulated deficit) | 46,849 | (22,445) | ||||||

Total stockholders’ equity | 332,389 | 269,424 | ||||||

Total liabilities and stockholders’ equity | $ | 1,016,377 | $ | 1,037,860 | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||

Operating Revenues: | ||||||||||||||||

Advisory fees | $ | 70,616 | $ | 76,400 | $ | 222,719 | $ | 220,611 | ||||||||

Other income | 1,798 | 1,712 | 5,316 | 4,532 | ||||||||||||

Total revenues | 72,414 | 78,112 | 228,035 | 225,143 | ||||||||||||

Operating Expenses: | ||||||||||||||||

Compensation and benefits | 23,714 | 22,027 | 73,066 | 64,985 | ||||||||||||

Fund management and administration | 16,285 | 15,181 | 47,855 | 43,495 | ||||||||||||

Marketing and advertising | 3,145 | 2,925 | 11,062 | 9,525 | ||||||||||||

Sales and business development | 2,724 | 2,935 | 8,464 | 7,239 | ||||||||||||

Contractual gold payments (Note 9) | 4,105 | 4,250 | 13,001 | 12,834 | ||||||||||||

Professional fees | 2,367 | 1,583 | 11,134 | 5,517 | ||||||||||||

Occupancy, communications and equipment | 986 | 1,163 | 2,788 | 3,904 | ||||||||||||

Depreciation and amortization | 58 | 185 | 158 | 693 | ||||||||||||

Third-party distribution fees | 1,833 | 1,873 | 5,863 | 5,346 | ||||||||||||

Other | 2,324 | 1,787 | 6,278 | 5,110 | ||||||||||||

Total operating expenses | 57,541 | 53,909 | 179,669 | 158,648 | ||||||||||||

Operating income | 14,873 | 24,203 | 48,366 | 66,495 | ||||||||||||

Other Income/(Expenses): | ||||||||||||||||

Interest expense | (3,734 | ) | (3,729 | ) | (11,199 | ) | (8,592 | ) | ||||||||

Gain on revaluation of deferred consideration—gold payments (Note 9) | 77,895 | 1,737 | 63,188 | 5,066 | ||||||||||||

Interest income | 811 | 689 | 2,375 | 1,145 | ||||||||||||

Impairments (Notes 8, 12 and 23) | — | (15,853 | ) | — | (16,156 | ) | ||||||||||

Other losses, net | (5,289 | ) | (714 | ) | (34,470 | ) | (6,558 | ) | ||||||||

Income before income taxes | 84,556 | 6,333 | 68,260 | 41,400 | ||||||||||||

Income tax expense/(benefit) | 3,327 | 500 | (10,713 | ) | 2,790 | |||||||||||

Net income | $ | 81,229 | $ | 5,833 | $ | 78,973 | $ | 38,610 | ||||||||

Earnings per share—basic | $ | 0.50 | $ | 0.04 | $ | 0.49 | $ | 0.24 | ||||||||

Earnings per share—diluted | $ | 0.50 | $ | 0.04 | $ | 0.49 | $ | 0.24 | ||||||||

Weighted-average common shares—basic | 143,120 | 142,070 | 142,984 | 144,445 | ||||||||||||

Weighted-average common shares—diluted | 158,953 | 159,213 | 158,741 | 161,706 | ||||||||||||

Cash dividends declared per common share | $ | 0.03 | $ | 0.03 | $ | 0.09 | $ | 0.09 | ||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||

Net income | $ | 81,229 | $ | 5,833 | $ | 78,973 | $ | 38,610 | ||||||||

Other comprehensive loss | ||||||||||||||||

Foreign currency translation adjustment, net of income taxes | (3,684) | (302) | (5,891) | (249) | ||||||||||||

Other comprehensive loss | (3,684) | (302) | (5,891) | (249) | ||||||||||||

Comprehensive income | $ | 77,545 | $ | 5,531 | $ | 73,082 | $ | 38,361 | ||||||||

For the Three Months Ended September 30, 2022 | ||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income | (Accumulated Deficit)/Retained Earnings | Total | ||||||||||||||||||||

Shares Issued | Par Value | |||||||||||||||||||||||

Balance—July 1, 2022 | 146,511 | $ | 1,465 | $ | 286,854 | $ | (1,525 | ) | $ | (29,538 | ) | $ | 257,256 | |||||||||||

Restricted stock issued and vesting of restricted stock units, net | 13 | — | — | — | — | — | ||||||||||||||||||

Shares repurchased | (4 | ) | — | (24 | ) | — | — | (24 | ) | |||||||||||||||

Stock-based compensation | — | — | 2,454 | — | — | 2,454 | ||||||||||||||||||

Other comprehensive loss | — | — | — | (3,684 | ) | — | (3,684 | ) | ||||||||||||||||

Dividends | — | — | — | — | (4,842 | ) | (4,842 | ) | ||||||||||||||||

Net income | — | — | — | — | 81,229 | 81,229 | ||||||||||||||||||

Balance—September 30, 2022 | 146,520 | $ | 1,465 | $ | 289,284 | $ | (5,209 | ) | $ | 46,849 | $ | 332,389 | ||||||||||||

For the Three Months Ended September 30, 2021 | ||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total | ||||||||||||||||||||

Shares Issued | Par Value | |||||||||||||||||||||||

Balance—July 1, 2021 | 145,114 | $ | 1,451 | $ | 285,002 | $ | 1,155 | $ | (29,871 | ) | $ | 257,737 | ||||||||||||

Restricted stock issued and vesting of restricted stock units, net | 36 | — | — | — | — | — | ||||||||||||||||||

Stock-based compensation | — | — | 2,397 | — | — | 2,397 | ||||||||||||||||||

Other comprehensive loss | — | — | — | (302 | ) | — | (302 | ) | ||||||||||||||||

Dividends | — | — | — | — | (4,797 | ) | (4,797 | ) | ||||||||||||||||

Net income | — | — | — | — | 5,833 | 5,833 | ||||||||||||||||||

Balance—September 30, 2021 | 145,150 | $ | 1,451 | $ | 287,399 | $ | 853 | $ | (28,835 | ) | $ | 260,868 | ||||||||||||

For the Nine Months Ended September 30, 2022 | ||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income | (Accumulated Deficit)/Retained Earnings | Total | ||||||||||||||||||||

Shares Issued | Par Value | |||||||||||||||||||||||

Balance—January 1, 2022 | 145,107 | $ | 1,451 | $ | 289,736 | $ | 682 | $ | (22,445 | ) | $ | 269,424 | ||||||||||||

Restricted stock issued and vesting of restricted stock units, net | 2,006 | 20 | (20 | ) | — | — | — | |||||||||||||||||

Shares repurchased | (593 | ) | (6 | ) | (3,412 | ) | — | — | (3,418 | ) | ||||||||||||||

Stock-based compensation | — | — | 7,822 | — | — | 7,822 | ||||||||||||||||||

Other comprehensive loss | — | — | — | (5,891 | ) | — | (5,891 | ) | ||||||||||||||||

Dividends | — | — | (4,842 | ) | — | (9,679 | ) | (14,521 | ) | |||||||||||||||

Net income | — | — | — | — | 78,973 | 78,973 | ||||||||||||||||||

Balance—September 30, 2022 | 146,520 | $ | 1,465 | $ | 289,284 | $ | (5,209 | ) | $ | 46,849 | $ | 332,389 | ||||||||||||

For the Nine Months Ended September 30, 2021 | ||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Accumulated Other Comprehensive Income | Accumulated Deficit | Total | ||||||||||||||||||||

Shares Issued | Par Value | |||||||||||||||||||||||

Balance—January 1, 2021 | 148,716 | $ | 1,487 | $ | 317,075 | $ | 1,102 | $ | (53,399 | ) | $ | 266,265 | ||||||||||||

Reclassification of equity component related to convertible notes, net deferred taxes of $1,022, upon the implementation of Accounting Standards Update 2020-06 (Note 10) | — | — | (3,682 | ) | — | 616 | (3,066 | ) | ||||||||||||||||

Balance—January 1, 2021 (as adjusted) | 148,716 | $ | 1,487 | $ | 313,393 | $ | 1,102 | $ | (52,783 | ) | $ | 263,199 | ||||||||||||

Restricted stock issued and vesting of restricted stock units, net | 1,412 | 13 | (13 | ) | — | — | — | |||||||||||||||||

Shares repurchased | (5,121 | ) | (51 | ) | (34,455 | ) | — | — | (34,506 | ) | ||||||||||||||

Exercise of stock options, net | 143 | 2 | 813 | — | — | 815 | ||||||||||||||||||

Stock-based compensation | — | — | 7,661 | — | — | 7,661 | ||||||||||||||||||

Other comprehensive loss | — | — | — | (249 | ) | — | (249 | ) | ||||||||||||||||

Dividends | — | — | — | — | (14,662 | ) | (14,662 | ) | ||||||||||||||||

Net income | — | — | — | — | 38,610 | 38,610 | ||||||||||||||||||

Balance—September 30, 2021 | 145,150 | $ | 1,451 | $ | 287,399 | $ | 853 | $ | (28,835 | ) | $ | 260,868 | ||||||||||||

Nine Months Ended September 30, | ||||||||

2022 | 2021 | |||||||

Cash flows from operating activities: | ||||||||

Net income | $ | 78,973 | $ | 38,610 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Gain on revaluation of deferred consideration—gold payments | (63,188 | ) | (5,066 | ) | ||||

Advisory and license fees paid in gold, other precious metals and cryptocurrency | (44,886 | ) | (57,617 | ) | ||||

Losses on securities owned, at fair value | 15,633 | 2,099 | ||||||

Contractual gold payments | 13,001 | 12,834 | ||||||

Stock-based compensation | 7,822 | 7,661 | ||||||

Deferred income taxes | 2,233 | 1,515 | ||||||

Amortization of issuance costs—convertible notes | 1,941 | 1,542 | ||||||

Amortization of right of use asset | 648 | 1,860 | ||||||

Depreciation and amortization | 158 | 693 | ||||||

Impairments | — | 16,156 | ||||||

Gain on sale—Canadian ETF business, including remeasurement of contingent consideration | — | (787 | ) | |||||

Other | (223 | ) | (369 | ) | ||||

Changes in operating assets and liabilities: | ||||||||

Accounts receivable | 4,076 | (1,273 | ) | |||||

Prepaid expenses | (2,356 | ) | (1,888 | ) | ||||

Gold and other precious metals | 33,598 | 44,006 | ||||||

Other assets | (503 | ) | (315 | ) | ||||

Intangibles—software development | (1,958 | ) | — | |||||

Fund management and administration payable | 1,369 | 2,868 | ||||||

Compensation and benefits payable | (4,990 | ) | 1,756 | |||||

Income taxes payable | (1,822 | ) | (1,050 | ) | ||||

Operating lease liabilities | (644 | ) | (15,462 | ) | ||||

Accounts payable and other liabilities | 4,231 | 2,336 | ||||||

Net cash provided by operating activities | 43,113 | 50,109 | ||||||

Cash flows from investing activities: | ||||||||

Purchase of securities owned, at fair value | (41,240 | ) | (97,570 | ) | ||||

Purchase of investments | (11,863 | ) | (5,750 | ) | ||||

Purchase of fixed assets | (211 | ) | (237 | ) | ||||

Proceeds from the sale of securities owned, at fair value | 27,650 | 10,976 | ||||||

Proceeds from held-to-maturity | 38 | 114 | ||||||

Net cash used in investing activities | (25,626 | ) | (92,467 | ) | ||||

Cash flows from financing activities: | ||||||||

Dividends paid | (14,521 | ) | (14,662 | ) | ||||

Shares repurchased | (3,418 | ) | (34,506 | ) | ||||

Convertible notes issuance costs | — | (4,297 | ) | |||||

Proceeds from the issuance of convertible notes | — | 150,000 | ||||||

Proceeds from exercise of stock options | — | 815 | ||||||

Net cash (used in)/provided by financing activities | (17,939 | ) | 97,350 | |||||

Decrease in cash flow due to changes in foreign exchange rate | (7,557 | ) | (493 | ) | ||||

Net (decrease)/increase in cash and cash equivalents | (8,009 | ) | 54,499 | |||||

Cash and cash equivalents—beginning of year | 140,709 | 73,425 | ||||||

Cash and cash equivalents—end of period | $ | 132,700 | $ | 127,924 | ||||

Supplemental disclosure of cash flow information: | ||||||||

Cash paid for income taxes | $ | 8,769 | $ | 7,332 | ||||

Cash paid for interest | $ | 6,156 | $ | 3,719 | ||||

| • | WisdomTree Asset Management, Inc. non-consolidated Delaware statutory trust registered with the SEC as anopen-end management investment company. The Company has licensed to WTT the use of certain of its own indexes on an exclusive basis for the WisdomTree ETFs in the U.S. |

| • | WisdomTree Management Jersey Limited leveraged-and-inverse |

| • | WisdomTree Multi Asset Management Limited non-consolidated public limited company domiciled in Ireland. |

| • | WisdomTree Management Limited non-consolidated public limited company domiciled in Ireland. |

| • | WisdomTree UK Limited |

| • | WisdomTree Europe Limited |

| • | WisdomTree Ireland Limited |

| • | WisdomTree Digital Commodity Services, LLC |

| • | WisdomTree Digital Management, Inc. SEC-registered investment adviser and will provide investment advisory and other management services to blockchain-enabled mutual funds whose shares are secondarily recorded on a blockchain. |

| • | WisdomTree Digital Movement, Inc |

| • | WisdomTree Securities, Inc. |

Equipment | 3 to 5 years | |||

Internally-developed software | 3 years | |||

September 30, 2022 | ||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | |||||||||||||

Assets: | ||||||||||||||||

Recurring fair value measurements: | ||||||||||||||||

Cash equivalents | $ | 284 | $ | 284 | $ | — | $ | — | ||||||||

Securities owned, at fair value | ||||||||||||||||

ETFs | 12,621 | 12,621 | — | — | ||||||||||||

U.S. treasuries | 8,437 | 8,437 | — | — | ||||||||||||

Pass-through GSEs | 102,248 | 23,694 | 78,554 | — | ||||||||||||

Corporate bonds | 1,804 | — | 1,804 | — | ||||||||||||

Investments in Convertible Notes | ||||||||||||||||

Securrency, Inc.—convertible note(Note 7) | 5,844 | — | — | 5,844 | ||||||||||||

Fnality International Limited—convertible note (Note 7) | 6,195 | — | — | 6,195 | ||||||||||||

Total | $ | 137,433 | $ | 45,036 | $ | 80,358 | $ | 12,039 | ||||||||

Non-recurring fair value measurements: | ||||||||||||||||

Onramp Invest, Inc.—preferred stock (Note 7) (1) | $ | 312 | $ | — | $ | — | $ | 312 | ||||||||

Liabilities: | ||||||||||||||||

Recurring fair value measurements: | ||||||||||||||||

Deferred consideration (Note 9) | $ | 164,757 | $ | — | $ | — | $ | 164,757 | ||||||||

December 31, 2021 | ||||||||||||||||

Total | Level 1 | Level 2 | Level 3 | |||||||||||||

Assets: | ||||||||||||||||

Recurring fair value measurements: | ||||||||||||||||

Cash equivalents | $ | 11,488 | $ | 11,488 | $ | — | $ | — | ||||||||

Securities owned, at fair value | ||||||||||||||||

ETFs | 18,812 | 18,812 | — | — | ||||||||||||

Pass-through GSEs | 106,245 | 24,720 | 81,525 | — | ||||||||||||

Corporate bonds | 2,109 | — | 2,109 | — | ||||||||||||

Total | $ | 138,654 | $ | 55,020 | $ | 83,634 | $ | — | ||||||||

Non-recurring fair value measurements: | ||||||||||||||||

Securrency, Inc.—Series A convertible preferred stock (1) | $ | 8,488 | $ | — | $ | — | $ | 8,488 | ||||||||

Liabilities: | ||||||||||||||||

Recurring fair value measurements: | ||||||||||||||||

Deferred consideration (Note 9) | $ | 228,062 | $ | — | $ | — | $ | 228,062 | ||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||

Investments in Convertible Notes (Note 7) | ||||||||||||||||

Beginning balance | $ | 11,712 | $ | — | $ | — | $ | — | ||||||||

Purchases | — | — | 11,863 | — | ||||||||||||

Net unrealized gains (1) | 327 | — | 176 | — | ||||||||||||

Ending balance | $ | 12,039 | $ | — | $ | 12,039 | $ | — | ||||||||

Deferred Consideration (Note 9) | ||||||||||||||||

Beginning balance | $ | 242,767 | $ | 226,706 | $ | 228,062 | $ | 230,137 | ||||||||

Net realized losses (2) | 4,105 | 4,250 | 13,001 | 12,834 | ||||||||||||

Net unrealized gains (3) | (77,895 | ) | (1,737 | ) | (63,188 | ) | (5,066 | ) | ||||||||

Settlements | (4,220 | ) | (4,266 | ) | (13,118 | ) | (12,952 | ) | ||||||||

Ending balance | $ | 164,757 | $ | 224,953 | $ | 164,757 | $ | 224,953 | ||||||||

| (1) | Recorded in other losses, net in the Consolidated Statements of Operations. |

| (2) | Recorded as contractual gold payments expense in the Consolidated Statements of Operations. |

| (3) | Recorded as gain on revaluation of deferred consideration—gold payments in the Consolidated Statements of Operations |

Securities Owned | September 30, 2022 | December 31, 2021 | ||||||||

Trading securities | $ | 125,110 | $ | 127,166 | ||||||

September 30, 2022 | December 31, 2021 | |||||||||

Debt instruments: Pass-through GSEs (amortized cost) | $ | 267 | $ | 308 | ||||||

September 30, 2022 | December 31, 2021 | |||||||||

Cost/amortized cost | $ | 267 | $ | 308 | ||||||

Gross unrealized gains | — | 13 | ||||||||

Gross unrealized losses | (23) | — | ||||||||

Fair value | $ | 244 | $ | 321 | ||||||

September 30, 2022 | December 31, 2021 | |||||||||

Due within one year | $ | — | $ | — | ||||||

Due one year through five years | — | — | ||||||||

Due five years through ten years | 29 | — | ||||||||

Due over ten years | 238 | 308 | ||||||||

Total | $ | 267 | $ | 308 | ||||||

September 30, 2022 | December 31, 2021 | |||||||||||||||

Carrying Value | Cost | Carrying Value | Cost | |||||||||||||

Securrency, Inc.—Series A convertible preferred stock | $ | 8,488 | $ | 8,112 | $ | 8,488 | $ | 8,112 | ||||||||

Securrency, Inc.—Series B convertible preferred stock | 5,500 | 5,500 | 5,500 | 5,500 | ||||||||||||

Securrency, Inc.—convertible note | 5,844 | 5,000 | — | — | ||||||||||||

Subtotal—Securrency, Inc. | $ | 19,832 | $ | 18,612 | $ | 13,988 | $ | 13,612 | ||||||||

Fnality International Limited—convertible note | 6,195 | 6,863 | — | — | ||||||||||||

Onramp Invest, Inc.—Series A-4 preferred stock | 312 | 250 | 250 | 250 | ||||||||||||

| $ | 26,339 | $ | 25,725 | $ | 14,238 | $ | 13,862 | |||||||||

Inputs | ||||||||||

June 9, 2021 | March 8, 2021 | |||||||||

Expected volatility | 50% | 55% | ||||||||

Time to exit (in years) | 4.75 | 5.00 | ||||||||

September 30, 2022 | ||||||

Conversion of note upon a future equity financing | 85% | |||||

Redemption of note upon a corporate transaction | 10% | |||||

Default | 5% | |||||

Time to potential outcome (in years) | 0.25 | |||||

September 30, 2022 | ||||

Conversion of note upon a future financing round | 85% | |||

Redemption of note upon a change of control | 10% | |||

Default | 5% | |||

Time to potential outcome (in years) | 0.25 |

September 30, 2022 | December 31, 2021 | |||||||||

Equipment | $ | 919 | $ | 784 | ||||||

Less: accumulated depreciation | (344) | (227) | ||||||||

Total | $ | 575 | $ | 557 | ||||||

September 30, 2022 | December 31, 2021 | |||||||

Forward-looking gold price (low)—per ounce | $ | 1,665 | $ | 1,833 | ||||

Forward-looking gold price (high)—per ounce | $ | 3,027 | $ | 2,705 | ||||

Forward-looking gold price (weighted average)—per ounce | $ | 2,037 | $ | 2,106 | ||||

Discount rate | 12.25% | 9.0% | ||||||

Perpetual growth rate | 1.54% | 1.0% | ||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||||||

Contractual gold payments | $ | 4,105 | $ | 4,250 | $ | 13,001 | $ | 12,834 | ||||||||||||

Contractual gold payments—gold ounces paid | 2,375 | 2,375 | 7,125 | 7,125 | ||||||||||||||||

Gain on revaluation of deferred consideration—gold payments (1) | $ | 77,895 | $ | 1,737 | $ | 63,188 | $ | 5,066 | ||||||||||||

| (1) | Gains on revaluation of deferred consideration—gold payments result from a decrease in spot gold prices, a decrease in the forward-looking price of gold, a decrease in the perpetual growth rate and an increase in the discount rate used to compute the present value of the annual payment obligations. |

2021 Notes | 2020 Notes | |||||||||

Maturity date (unless earlier converted, repurchased or redeemed) | June 15, 2026 | June 15, 2023 | ||||||||

Interest rate | 3.25% | 4.25% | ||||||||

Conversion price | $11.04 | $5.92 | ||||||||

Conversion rate | 90.5797 | 168.9189 | ||||||||

Redemption price | $14.35 | $7.70 | ||||||||

| • | Interest rate |

| • | Conversion price |

| • | Conversion Holders may convert at their option at any time prior to the close of business on the business day immediately preceding March 15, 2026 and March 15, 2023 in respect of the 2021 Notes and 2020 Notes, respectively, only under the following circumstances: (i) if the last reported sale price of the Company’s common stock for at least 20 trading days during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price on each applicable trading day; (ii) during the five business day period after any ten consecutive trading day period (the “measurement period”) in which the trading price per $1,000 principal amount of the Convertible Notes for each trading day of the measurement period was less than 98% of the product of the last reported sales price of the Company’s common stock and the conversion rate on each such trading day; (iii) upon a notice of redemption delivered by the Company in accordance with the terms of the indentures but only with respect to the Convertible Notes called (or deemed called) for redemption; or (iv) upon the occurrence of specified corporate events. On or after March 15, 2026 and March 15, 2023 in respect of the 2021 Notes and 2020 Notes, respectively, until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their Convertible Notes at any time, regardless of the foregoing circumstances. |

| • | Cash settlement of principal amount |

| • | Redemption price: th scheduled trading day immediately preceding the maturity date, if the last reported sale price of the Company’s common stock has been at least 130% of the conversion price then in effect for at least 20 trading days, including the trading day immediately preceding the date on which the Company provides notice of redemption, during any 30 consecutive trading day period ending on, and including, the trading day immediately preceding the date on which the Company provides notice of redemption, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding the redemption date. No sinking fund is provided for the Convertible Notes. |

| • | Limited investor put rights |

| • | Conversion rate increase in certain customary circumstances |

| • | Seniority and Security Non-Voting Convertible Preferred Stock (Note 12). |

September 30, 2022 | December 31, 2021 | |||||||||||||||||||||||

2021 Notes | 2020 Notes | Total | 2021 Notes | 2020 Notes | Total | |||||||||||||||||||

Principal amount | $ | 150,000 | $ | 175,000 | $ | 325,000 | $ | 150,000 | $ | 175,000 | $ | 325,000 | ||||||||||||

Plus: Premium | — | 250 | 250 | — | 250 | 250 | ||||||||||||||||||

Gross proceeds | $ | 150,000 | $ | 175,250 | $ | 325,250 | $ | 150,000 | $ | 175,250 | $ | 325,250 | ||||||||||||

Less: Unamortized issuance costs (1) | (3,195 | ) | (1,490 | ) | (4,685 | ) | (3,833 | ) | (2,793 | ) | (6,626 | ) | ||||||||||||

Carrying amount | $ | 146,805 | $ | 173,760 | $ | 320,565 | $ | 146,167 | $ | 172,457 | $ | 318,624 | ||||||||||||

Effective interest rate (1) | 3.83% | 5.26% | 4.60% | 3.83% | 5.26% | 4.60% | ||||||||||||||||||

September 30, 2022 | December 31, 2021 | |||||||

Issuance of Preferred Shares | $ | 132,750 | $ | 132,750 | ||||

Less: Issuance costs | (181 | ) | (181 | ) | ||||

Preferred Shares—carrying value | $ | 132,569 | $ | 132,569 | ||||

Cash dividends declared per share | $ | 0.03 | $ | 0.03 | ||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||

Lease cost: | ||||||||||||||||

Operating lease cost | $ | 316 | $ | 520 | $ | 648 | $ | 1,860 | ||||||||

Short-term lease cost | 296 | 242 | 856 | 797 | ||||||||||||

Total lease cost | $ | 612 | $ | 762 | $ | 1,504 | $ | 2,657 | ||||||||

Other information: | ||||||||||||||||

Cash paid for amounts included in the measurement of operating liabilities (operating leases) | $ | 296 | $ | 13,804 | $ | 644 | $ | 15,462 | ||||||||

Right-of-use | n/a | n/a | n/a | n/a | ||||||||||||

Weighted-average remaining lease term (in years)—operating leases | 1.5 | 1.8 | 1.5 | 1.8 | ||||||||||||

Weighted-average discount rate—operating leases | 6.3% | 4.4% | 6.3% | 4.4% | ||||||||||||

Remainder of 2022 | $ | 317 | ||||

2023 | 1,110 | |||||

2024 | 397 | |||||

2025 | — | |||||

2026 | — | |||||

2027 and thereafter | — | |||||

Total future minimum lease payments (undiscounted) | $ | 1,824 | ||||

Amounts recognized in the Consolidated Balance Sheets | ||||||

Lease liability—short term | $ | 1,186 | ||||

Lease liability—long term | 554 | |||||

Subtotal | 1,740 | |||||

Difference between undiscounted and discounted cash flows | 84 | |||||

Total future minimum lease payments (undiscounted) | $ | 1,824 | ||||

September 30, 2022 | December 31, 2021 | |||||||||

Carrying Amount Assets (Securrency) | ||||||||||

Preferred stock—Series A Shares | $ | 8,488 | $ | 8,488 | ||||||

Preferred stock—Series B Shares | 5,500 | 5,500 | ||||||||

Convertible note | 5,844 | — | ||||||||

Subtotal—Securrency | $ | 19,832 | $ | 13,988 | ||||||

Carrying Amount Assets (Fnality) | ||||||||||

Convertible note | 6,195 | — | ||||||||

Carrying Amount Assets (Onramp) | ||||||||||

Preferred stock | 312 | 250 | ||||||||

Total (Note 7) | $ | 26,339 | $ | 14,238 | ||||||

Maximum exposure to loss | $ | 26,339 | $ | 14,238 | ||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||

Revenues from contracts with customers: | ||||||||||||||||

Advisory fees | $ | 70,616 | $ | 76,400 | $ | 222,719 | $ | 220,611 | ||||||||

Other | 1,798 | 1,712 | 5,316 | 4,532 | ||||||||||||

Total operating revenues | $ | 72,414 | $ | 78,112 | $ | 228,035 | $ | 225,143 | ||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||

Revenues from contracts with customers: | ||||||||||||||||

United States | $ | 45,263 | $ | 46,523 | $ | 137,299 | $ | 131,744 | ||||||||

Jersey | 23,702 | 28,724 | 80,111 | 85,953 | ||||||||||||

Ireland | 3,449 | 2,865 | 10,625 | 7,446 | ||||||||||||

Total operating revenues | $ | 72,414 | $ | 78,112 | $ | 228,035 | $ | 225,143 | ||||||||

September 30, 2022 | December 31, 2021 | |||||||||

Receivable from WTT | $ | 14,618 | $ | 15,987 | ||||||

Receivable from ManJer Issuers | 4,624 | 6,460 | ||||||||

Receivable from WMAI and WTI | 1,980 | 3,181 | ||||||||

Total | $ | 21,222 | $ | 25,628 | ||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||||

Advisory services provided to WTT | $ | 45,112 | $ | 46,386 | $ | 136,852 | $ | 131,364 | ||||||||||

Advisory services provided to ManJer Issuers | 22,055 | 24,759 | 75,242 | 75,296 | ||||||||||||||

Advisory services provided to WMAI and WTI | 3,449 | 5,255 | 10,625 | 13,951 | ||||||||||||||

Total | $ | 70,616 | $ | 76,400 | $ | 222,719 | $ | 220,611 | ||||||||||

Stock options: | Generally issued for terms of ten years and may vest after at least one year of service and have an exercise price equal to the Company’s stock price on the grant date. The Company estimates the fair value of stock options (when granted) using the Black-Scholes option pricing model. | |

RSAs/RSUs: | Awards are valued based on the Company’s stock price on grant date and generally vest ratably over three years. | |

| PRSUs: | These awards cliff vest three years from the grant date and contain a market condition whereby the number of PRSUs ultimately vesting is tied to how the Company’s total shareholder return (“TSR”) compares to a peer group of other publicly traded asset managers over the three-year period. A Monte Carlo simulation is used to value these awards. | |

The number of PRSUs vesting ranges from 0% to 200% of the target number of PRSUs granted, as follows: • If the relative TSR is below the 25 th percentile, then 0% of the target number of PRSUs granted will vest;• If the relative TSR is at the 25 th percentile, then 50% of the target number of PRSUs granted will vest; and• If the relative TSR is above the 25 th percentile, then linear scaling is applied such that the percent of the target number of PRSUs vesting is 100% at the 50th percentile and capped at 200% of the target number of PRSUs granted for performance at the 85th percentile (or 100th percentile for grants made during 2019 and 2020).• If the Company’s TSR is negative, the target number of PRSUs vesting is capped at 100% regardless of the relative TSR percentile. | ||

September 30, 2022 | ||||||||

Unrecognized Stock- Based Compensation | Average Remaining Vesting Period (Years) | |||||||

Employees and directors | $ | 15,109 | 1.63 | |||||

RSAs | RSUs | PRSUs | ||||||||||

Balance at July 1, 2022 | 3,399,274 | 47,656 | 668,188 | |||||||||

Granted | 82,458 | 95,687 | — | |||||||||

Exercised/vested | (19,210 | ) | — | — | ||||||||

Forfeitures | (69,272 | ) | (1,380 | ) | — | |||||||

Balance at September 30, 2022 | 3,393,250 | 141,963 | 668,188 | |||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

Basic Earnings per Share | 2022 | 2021 | 2022 | 2021 | ||||||||||||

Net income | $ | 81,229 | $ | 5,833 | $ | 78,973 | $ | 38,610 | ||||||||

Less: Income distributed to participating securities | (546 | ) | (538 | ) | (1,644 | ) | (1,634 | ) | ||||||||

Less: Undistributed income allocable to participating securities | (8,583 | ) | (115 | ) | (7,268 | ) | (2,666 | ) | ||||||||

Net income available to common stockholders—Basic EPS | $ | 72,100 | $ | 5,180 | $ | 70,061 | $ | 34,310 | ||||||||

Weighted average common shares (in thousands) | 143,120 | 142,070 | 142,984 | 144,445 | ||||||||||||

Basic earnings per share | $ | 0.50 | $ | 0.04 | $ | 0.49 | $ | 0.24 | ||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

Diluted Earnings per Share | 2022 | 2021 | 2022 | 2021 | ||||||||||||

Net income available to common stockholders | $ | 72,100 | $ | 5,180 | $ | 70,061 | $ | 34,310 | ||||||||

Add back: Undistributed income allocable to participating securities | 8,583 | 115 | 7,268 | 2,666 | ||||||||||||

Less: Reallocation of undistributed income allocable to participating securities considered potentially dilutive | (8,568 | ) | (115 | ) | (7,257 | ) | (2,647 | ) | ||||||||

Net income available to common stockholders—Diluted EPS | $ | 72,115 | $ | 5,180 | $ | 70,072 | $ | 34,329 | ||||||||

Weighted Average Diluted Shares (in thousands): | ||||||||||||||||

Weighted average common shares | 143,120 | 142,070 | 142,984 | 144,445 | ||||||||||||

Dilutive effect of common stock equivalents, excluding participating securities | 287 | 1,072 | 261 | 1,159 | ||||||||||||

Weighted average diluted shares, excluding participating securities (in thousands) | 143,407 | 143,142 | 143,245 | 145,604 | ||||||||||||

Diluted earnings per share | $ | 0.50 | $ | 0.04 | $ | 0.49 | $ | 0.24 | ||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

Reconciliation of Weighted Average Diluted Shares (in thousands) | 2022 | 2021 | 2022 | 2021 | ||||||||||||

Weighted average diluted shares as disclosed on the consolidated statements of operations | 158,953 | 159,213 | 158,741 | 161,706 | ||||||||||||

Less: Participating securities | ||||||||||||||||

Weighted average shares of common stock issuable upon conversion of the Preferred Shares (Note 11) | (14,750 | ) | (14,750 | ) | (14,750 | ) | (14,750 | ) | ||||||||

Potentially dilutive restricted stock awards | (796 | ) | (1,321 | ) | (746 | ) | (1,352 | ) | ||||||||

Weighted average diluted shares used to calculate diluted earnings/(loss) per share as disclosed in the table above | 143,407 | 143,142 | 143,245 | 145,604 | ||||||||||||

September 30, 2022 | December 31, 2021 | |||||||||

Deferred tax assets: | ||||||||||

Capital losses | $ | 17,033 | $ | 16,601 | ||||||

Accrued expenses | 4,228 | 4,993 | ||||||||

Unrealized losses | 3,938 | 614 | ||||||||

NOLs—Foreign | 1,607 | 1,934 | ||||||||

Goodwill and intangible assets | 1,133 | 1,276 | ||||||||

Stock-based compensation | 1,107 | 1,359 | ||||||||

Interest carryforwards | 321 | 437 | ||||||||

NOLs—U.S. | 255 | 382 | ||||||||

Foreign currency translation adjustment | 169 | — | ||||||||

Outside basis differences | 122 | 122 | ||||||||

Other | 354 | 376 | ||||||||

Deferred tax assets | 30,267 | 28,094 | ||||||||

Deferred tax liabilities: | ||||||||||

Fixed assets and prepaid assets | 422 | 257 | ||||||||

Unremitted earnings—International subsidiaries | 198 | 118 | ||||||||

Foreign currency translation adjustment | — | 181 | ||||||||

Deferred tax liabilities | 620 | 556 | ||||||||

Total deferred tax assets less deferred tax liabilities | 29,647 | 27,538 | ||||||||

Less: Valuation allowance | (22,700) | (18,657) | ||||||||

Deferred tax assets, net | $ | 6,947 | $ | 8,881 | ||||||

Total | Unrecognized Tax Benefits | Interest and Penalties | ||||||||||||

Balance on January 1, 2022 | $ | 21,925 | $ | 18,218 | $ | 3,707 | ||||||||

Decrease—Settlements (1) | (13,052 | ) | (11,865 | ) | (1,187 | ) | ||||||||

Decrease—Lapse of statute of limitations (1) | (6,845 | ) | (4,825 | ) | (2,020 | ) | ||||||||

Increases | 7 | — | 7 | |||||||||||

Foreign currency translation (2) | (583 | ) | (485 | ) | (98 | ) | ||||||||

Balance at March 31, 2022 | $ | 1,452 | $ | 1,043 | $ | 409 | ||||||||

Increases | 7 | — | 7 | |||||||||||

Foreign currency translation (2) | (108 | ) | (78 | ) | (30 | ) | ||||||||

Balance at June 30, 2022 | $ | 1,351 | $ | 965 | $ | 386 | ||||||||

Increases | 6 | — | 6 | |||||||||||

Foreign currency translation (2) | (137 | ) | (98 | ) | (39 | ) | ||||||||

Balance at September 30, 2022 | $ | 1,220 | $ | 867 | $ | 353 | ||||||||

| (1) | In January 2022, an audit of ManJer’s tax returns (a Jersey-based subsidiary) for the years ended December 31, 2014, 2016, 2017 and 2018 were resolved in favor of ManJer. The settlement, as well as the reduction in unrecognized tax benefits from the lapse of the statute of limitations totaling $19,897 during the three months ended March 31, 2022, was recorded as an income tax benefit with an equal and offsetting amount recorded in other losses, net, to recognize a reduction in the indemnification asset. During the three months ended March 31, 2021, an income tax benefit of $5,171 was recorded along with an equal and offsetting amount in other losses, net. |

| (2) | The gross unrecognized tax benefits were accrued in British pounds. |

Total | ||||

Balance at January 1, 2022 | $ | 85,856 | ||

Changes | — | |||

Balance at September 30, 2022 | $ | 85,856 | ||

Item | Gross Asset | Accumulated Amortization | Net Asset | |||||||||

ETFS acquisition | $ | 601,247 | $ | — | $ | 601,247 | ||||||

Software development | 1,958 | (1) | 1,957 | |||||||||

Balance at September 30, 2022 | $ | 603,205 | $ | (1) | $ | 603,204 | ||||||

Remainder of 2022 | $ | 57 | ||

2023 | 653 | |||

2024 | 653 | |||

2025 | 594 | |||

2026 | — | |||

2027 and thereafter | — | |||

Total expected amortization expense | $ | 1,957 | ||

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||

2022 | 2021 | 2022 | 2021 | |||||||||||||||

Lease termination—New York office (Note 12) | $ | — | $ | 9,277 | $ | — | $ | 9,277 | ||||||||||

Fixed assets—New York office (Note 8) | — | 6,576 | — | 6,576 | ||||||||||||||

Lease termination—London office (Note 12) | — | — | — | 303 | ||||||||||||||

Total | $ | — | $ | 15,853 | $ | — | $ | 16,156 | ||||||||||

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our consolidated financial statements and the related notes and the other financial information included elsewhere in this Report. In addition to historical consolidated financial information, the following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below. For a more complete description of the risks noted above and other risks that could cause our actual results to materially differ from our current expectations, please see Item 1A “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as amended, and Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. We assume no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, unless required by law.

Executive Summary

Introduction

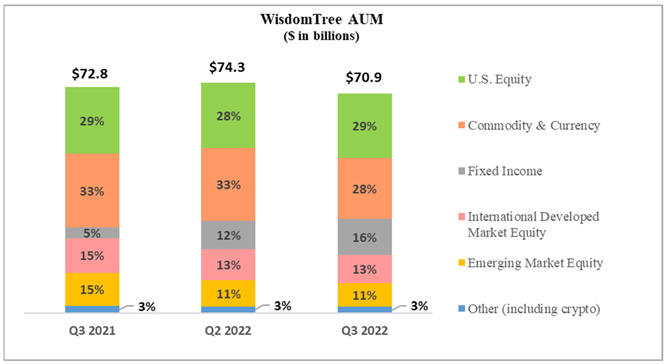

We are an asset management company in the business of offering transparent financial exposures to our clients and are a leading global ETP sponsor based on assets under management, or AUM, with AUM of $70.9 billion as of September 30, 2022. More recently, we have been positioning ourselves to expand beyond our existing ETP business by leveraging blockchain technology, digital assets and principles of decentralized finance, or DeFi, to deliver transparency, choice and inclusivity to customers and consumers around the world.

Our family of ETPs includes providing exposure to equities, commodities, fixed income, leveraged and inverse, currency, cryptocurrency and alternative strategies. We have launched many first-to-market products and pioneered alternative weighting we call “Modern Alpha,” which combines the outperformance potential of active management with the benefits of passive management to offer investors cost-effective funds that are built to perform. Most of our equity-based funds employ a fundamentally weighted investment methodology, which weights securities based on factors such as dividends, earnings or investment factors, whereas most other industry indexes use a capitalization weighted methodology. These products are distributed through all major channels in the asset management industry, including banks, brokerage firms, registered investment advisers, institutional investors, private wealth managers and online brokers primarily through our sales force.

We are at the forefront of innovation and have differentiated ourselves through continued investments in technology-enabled and research-driven solutions such as our Advisor Solutions program, which includes portfolio construction, asset allocation, practice management services and digital tools for financial advisors. We seek to usher in the next chapter of financial services by introducing new revenue streams and expanding our offerings to include a new financial services mobile application, branded WisdomTree Prime™, a digital wallet that is native to the blockchain and being developed for saving, spending and investing in both native crypto assets and tokenized versions of mainstream financial assets (e.g., blockchain enabled investment funds). We also are planning to launch asset- and fund-tokenization products beginning with a dollar token, gold token and digital short term treasury fund which will be available on multiple public and permissioned blockchains, leveraging federal and state regulated entities. As we pursue our digital assets strategy, we are embracing a concept we refer to as “responsible DeFi,” which we believe upholds the foundational principles of regulation in this innovative and quickly evolving space.

We were incorporated under the laws of the state of Delaware on September 19, 1985 as Financial Data Systems, Inc. and ultimately renamed WisdomTree Investments, Inc. on September 6, 2005.

33

Assets Under Management

WisdomTree ETPs

We offer ETPs covering equity, commodity, fixed income, leveraged and inverse, currency, cryptocurrency and alternative strategies. The chart below sets forth the asset mix of our ETPs at September 30, 2021, June 30, 2022 and September 30, 2022:

Market Environment

The third quarter of 2022 saw a continuation of the significant market volatility that has dominated much of 2022. Investors remained worried about high inflation, slowing growth and the rising probability of recession and as a result, broad-based equity markets dropped into bear market territory. Gold prices decreased as the dollar and Treasury yields increased amid expectations for aggressive monetary policy tightening by major central banks.

The S&P 500, MSCI EAFE (local currency), MSCI Emerging Markets Index (U.S. dollar) and gold prices decreased by 4.9%, 3.5%, 11.4% and 8.0%, respectively, during the quarter. In addition, the European and Japanese equities markets both depreciated with the MSCI EMU Index and MSCI Japan Index decreasing 4.5% and 1.5%, respectively, in local currency terms for the quarter. Also, the U.S. dollar rose 7.2%, 10.1% and 5.6% versus the euro, British pound and the Japanese yen, respectively, the during the quarter.

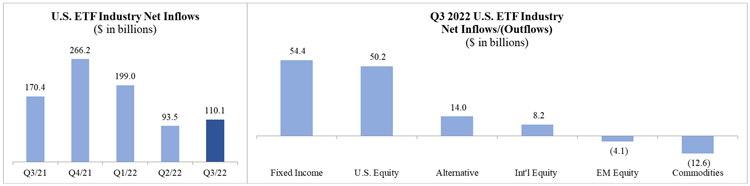

U.S. Listed ETF Industry Flows

U.S. listed ETF industry net flows for the three months ended September 30, 2022 were $110.1 billion. Fixed income and U.S. Equity gathered the majority of those flows.

Source: Morningstar

34

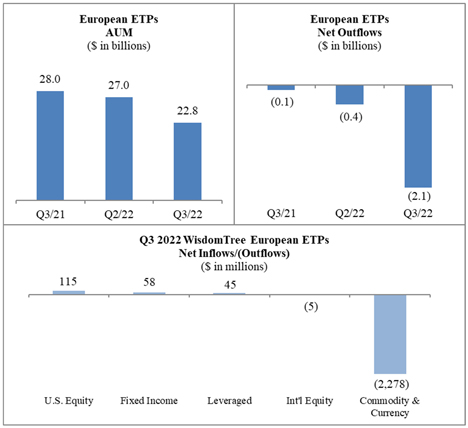

European Listed ETP Industry Flows

European listed ETP industry net flows were ($8.0) billion for the three months ended September 30, 2022. Equities and commodities contributed to most of the outflows, partially offset by inflows into fixed income.

Source: Morningstar

Our Operating and Financial Results

We operate as an ETP sponsor and asset manager providing investment advisory services globally through our subsidiaries in the United States and Europe.

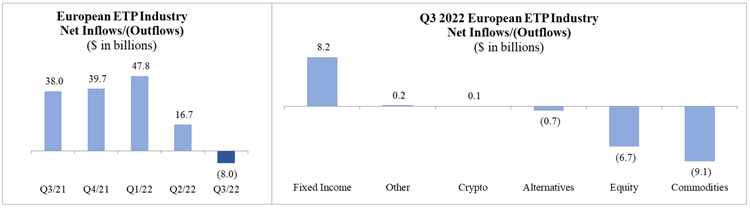

U.S. Listed ETFs

Our U.S. listed ETFs’ AUM increased from $47.3 billion at June 30, 2022 to $48.0 billion at September 30, 2022 due to net inflows, partly offset by market depreciation.

35

European Listed ETPs

Our European listed ETPs’ AUM decreased from $27.0 billion at June 30, 2022 to $22.8 billion at September 30, 2022 due to market depreciation and net outflows.

Consolidated Operating Results

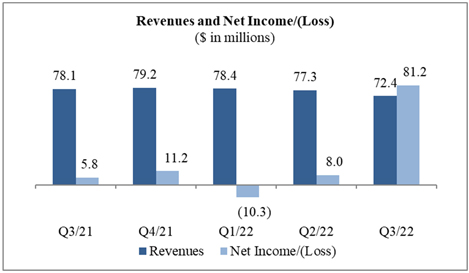

The following table sets forth our revenues and net income/(loss) for the most recent five quarters.

36

| • | Revenues – We recorded operating revenues of $72.4 million during the three months ended September 30, 2022, down 7.3% from the three months ended September 30, 2021 due to a lower average advisory fee. |

| • | Operating Expenses – Total operating expenses increased 6.7% from the three months ended September 30, 2021 to $57.5 million primarily due to higher incentive compensation and headcount, fund management and administration costs, professional fees incurred in connection with our digital assets initiative and other expenses, partly offset by lower sales and business development expenses, occupancy expenses, contractual gold payments and depreciation and amortization expenses. |

| • | Other Income/(Expenses) – Other income/(expenses) includes interest income and interest expense, gains on revaluation of deferred consideration—gold payments, impairments and other net losses. For the three months ended September 30, 2022 and 2021, the gains on revaluation of deferred consideration—gold payments were $77.9 million and $1.7 million, respectively. In addition, during the three months ended September 30, 2022 we recognized losses on our securities owned and investments of $6.3 million. |

| • | Net income – We reported net income of $81.2 million during the three months ended September 30, 2022, compared to net income of $5.8 million during the three months ended September 30, 2021. The change in net income was primarily due to the gain on revaluation of deferred consideration—gold payments. |

Expense Guidance Update for the Year Ending December 31, 2022

Compensation Expense

Our compensation expense for the year ending December 31, 2022 is currently estimated to range from $96.0 million to $99.0 million (unchanged from the three months ended June 30, 2022).

Discretionary Spending

Discretionary spending includes marketing, sales, professional fees, occupancy and equipment, depreciation and amortization and other expenses. We currently estimate our discretionary spending for the year ending December 31, 2022 to range from $50.0 million to $51.0 million (previously $51.0 million to $53.0 million).

Not included in the guidance above are non-recurring expenses of $4.5 million incurred during the six months ended June 30, 2022 in response to an activist campaign. We do not anticipate any significant activist campaign expenses during the remainder of 2022.

Gross Margin

We define gross margin as total operating revenues less fund management and administration expenses. Gross margin percentage is calculated as gross margin divided by total operating revenues. At current AUM and flow levels, we estimate our gross margin percentage will be 78% to 79% for the year ending December 31, 2022 (previously 79%).

Contractual Gold Payments

We currently estimate our contractual gold payments expense for the year ending December 31, 2022 to be approximately $17.0 million (unchanged from the three months ended June 30, 2022) taking into consideration current gold prices.

Third-Party Distribution Expense

We currently estimate third-party distribution expense to be approximately $8.0 million (previously $8.5 million) as recent market volatility has suppressed AUM growth on our third-party platforms.

Income Tax Expense

We currently estimate that our consolidated normalized effective tax rate will be 22% for the year ending December 31, 2022 (previously 21% to 22%). This estimated rate may change and is dependent upon our actual taxable income earned in relation to our forecasts as well as any other items that may arise that are not currently forecasted. Such items may include, but are not limited to, any revaluation on deferred consideration—gold payments, reductions in unrecognized tax benefits and any stock-based compensation windfalls or shortfalls.

37

Key Operating Statistics

The following table presents key operating statistics that serve as indicators for the performance of our business:

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, 2022 | June 30, 2022 | September 30, 2021 | September 30, 2022 | September 30, 2021 | ||||||||||||||||

GLOBAL ETPs (in millions) | ||||||||||||||||||||

Beginning of period assets | $ | 74,292 | $ | 79,384 | $ | 73,918 | $ | 77,450 | $ | 67,365 | ||||||||||

Inflows/(outflows) | 1,747 | 3,852 | 548 | 6,918 | 2,758 | |||||||||||||||

Market (depreciation)/appreciation | (5,162 | ) | (8,940 | ) | (1,711 | ) | (13,487 | ) | 2,636 | |||||||||||

Fund closures | — | (4 | ) | — | (4 | ) | (4 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 70,877 | $ | 74,292 | $ | 72,755 | $ | 70,877 | $ | 72,755 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 74,681 | $ | 77,735 | $ | 74,527 | $ | 76,735 | $ | 72,559 | ||||||||||

Average ETP advisory fee during the period | 0.38% | 0.39% | 0.41% | 0.39% | 0.41% | |||||||||||||||

Revenue days | 92 | 91 | 92 | 273 | 273 | |||||||||||||||

Number of ETPs—end of period | 347 | 344 | 322 | 347 | 322 | |||||||||||||||

U.S. LISTED ETFs (in millions) | ||||||||||||||||||||

Beginning of period assets | $ | 47,255 | $ | 48,622 | $ | 45,129 | $ | 48,210 | $ | 38,517 | ||||||||||

Inflows/(outflows) | 3,812 | 4,278 | 612 | 10,340 | 3,085 | |||||||||||||||

Market (depreciation)/appreciation | (3,024 | ) | (5,645 | ) | (999 | ) | (10,507 | ) | 3,140 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 48,043 | $ | 47,255 | $ | 44,742 | $ | 48,043 | $ | 44,742 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 49,473 | $ | 48,278 | $ | 45,507 | $ | 48,418 | $ | 43,465 | ||||||||||

Number of ETFs—end of the period | 78 | 77 | 73 | 78 | 73 | |||||||||||||||

EUROPEAN LISTED ETPs (in millions) | ||||||||||||||||||||

Beginning of period assets | $ | 27,037 | $ | 30,762 | $ | 28,789 | $ | 29,240 | $ | 28,848 | ||||||||||

(Outflows)/inflows | (2,065 | ) | (426 | ) | (64 | ) | (3,422 | ) | (327 | ) | ||||||||||

Market (depreciation)/appreciation | (2,138 | ) | (3,295 | ) | (712 | ) | (2,980 | ) | (504 | ) | ||||||||||

Fund closures | — | (4 | ) | — | (4 | ) | (4 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 22,834 | $ | 27,037 | $ | 28,013 | $ | 22,834 | $ | 28,013 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 25,208 | $ | 29,457 | $ | 29,020 | $ | 28,317 | $ | 29,094 | ||||||||||

Number of ETPs—end of period | 269 | 267 | 249 | 269 | 249 | |||||||||||||||

PRODUCT CATEGORIES (in millions) | ||||||||||||||||||||

U.S. Equity | ||||||||||||||||||||

Beginning of period assets | $ | 21,058 | $ | 23,738 | $ | 21,285 | $ | 23,860 | $ | 18,367 | ||||||||||

Inflows/(outflows) | 1,239 | 306 | 351 | 2,324 | 760 | |||||||||||||||

Market (depreciation)/appreciation | (1,344 | ) | (2,986 | ) | (253 | ) | (5,231 | ) | 2,256 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 20,953 | $ | 21,058 | $ | 21,383 | $ | 20,953 | $ | 21,383 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 22,540 | $ | 22,370 | $ | 21,792 | $ | 22,683 | $ | 20,698 | ||||||||||

Commodity & Currency | ||||||||||||||||||||

Beginning of period assets | $ | 23,625 | $ | 26,302 | $ | 24,772 | $ | 24,598 | $ | 25,878 | ||||||||||

(Outflows)/inflows | (2,179 | ) | (475 | ) | (249 | ) | (3,707 | ) | (1,228 | ) | ||||||||||

Market (depreciation)/appreciation | (1,885 | ) | (2,202 | ) | (698 | ) | (1,330 | ) | (825 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 19,561 | $ | 23,625 | $ | 23,825 | $ | 19,561 | $ | 23,825 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 21,628 | $ | 25,771 | $ | 24,850 | $ | 24,429 | $ | 25,230 | ||||||||||

Fixed Income | ||||||||||||||||||||

Beginning of period assets | $ | 9,191 | $ | 5,416 | $ | 3,435 | $ | 4,351 | $ | 3,305 | ||||||||||

Inflows/(outflows) | 2,627 | 4,038 | 115 | 7,907 | 293 | |||||||||||||||

Market (depreciation)/appreciation | (124 | ) | (263 | ) | (26 | ) | (564 | ) | (74 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 11,694 | $ | 9,191 | $ | 3,524 | $ | 11,694 | $ | 3,524 | ||||||||||

|

|

|

| �� |

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 10,077 | $ | 7,424 | $ | 3,496 | $ | 7,396 | $ | 3,352 | ||||||||||

38

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, 2022 | June 30, 2022 | September 30, 2021 | September 30, 2022 | September 30, 2021 | ||||||||||||||||

International Developed Market Equity | ||||||||||||||||||||

Beginning of period assets | $ | 9,958 | $ | 11,401 | $ | 10,772 | $ | 11,870 | $ | 9,392 | ||||||||||

(Outflows)/inflows | (115 | ) | 79 | 404 | 61 | 820 | ||||||||||||||

Market (depreciation)/appreciation | (661 | ) | (1,522 | ) | (17 | ) | (2,749 | ) | 947 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 9,182 | $ | 9,958 | $ | 11,159 | $ | 9,182 | $ | 11,159 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 10,027 | $ | 10,682 | $ | 11,126 | $ | 10,744 | $ | 10,469 | ||||||||||

Emerging Market Equity | ||||||||||||||||||||

Beginning of period assets | $ | 8,386 | $ | 9,991 | $ | 11,519 | $ | 10,375 | $ | 8,539 | ||||||||||

Inflows/(outflows) | 114 | (223 | ) | (149 | ) | 80 | 2,044 | |||||||||||||

Market (depreciation)/appreciation | (1,005 | ) | (1,382 | ) | (704 | ) | (2,960 | ) | 83 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 7,495 | $ | 8,386 | $ | 10,666 | $ | 7,495 | $ | 10,666 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 8,329 | $ | 9,155 | $ | 11,038 | $ | 9,200 | $ | 10,642 | ||||||||||

Leveraged & Inverse | ||||||||||||||||||||

Beginning of period assets | $ | 1,618 | $ | 1,856 | $ | 1,691 | $ | 1,775 | $ | 1,475 | ||||||||||

Inflows/(outflows) | 45 | 90 | 41 | 133 | 34 | |||||||||||||||

Market (depreciation)/appreciation | (140 | ) | (328 | ) | (69 | ) | (385 | ) | 154 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 1,523 | $ | 1,618 | $ | 1,663 | $ | 1,523 | $ | 1,663 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 1,589 | $ | 1,765 | $ | 1,715 | $ | 1,728 | $ | 1,644 | ||||||||||

Alternatives | ||||||||||||||||||||

Beginning of period assets | $ | 305 | $ | 293 | $ | 198 | $ | 261 | $ | 215 | ||||||||||

Inflows/(outflows) | 16 | 34 | 22 | 79 | (17 | ) | ||||||||||||||

Market (depreciation)/appreciation | (15 | ) | (22 | ) | 2 | (34 | ) | 24 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 306 | $ | 305 | $ | 222 | $ | 306 | $ | 222 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 313 | $ | 299 | $ | 214 | $ | 296 | $ | 223 | ||||||||||

Cryptocurrency | ||||||||||||||||||||

Beginning of period assets | $ | 151 | $ | 383 | $ | 229 | $ | 357 | $ | 168 | ||||||||||

Inflows/(outflows) | — | 3 | 12 | 40 | 56 | |||||||||||||||

Market appreciation/(depreciation) | 12 | (235 | ) | 54 | (234 | ) | 71 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | 163 | $ | 151 | $ | 295 | $ | 163 | $ | 295 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | 178 | $ | 265 | $ | 277 | $ | 256 | $ | 280 | ||||||||||

Closed ETPs | ||||||||||||||||||||

Beginning of period assets | $ | — | $ | 4 | $ | 17 | $ | 3 | $ | 26 | ||||||||||

Inflows/(outflows) | — | — | 1 | 1 | (4 | ) | ||||||||||||||

Fund closures | — | (4 | ) | — | (4 | ) | (4 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

End of period assets | $ | — | $ | — | $ | 18 | $ | — | $ | 18 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Average assets during the period | $ | — | $ | 4 | $ | 19 | $ | 3 | $ | 21 | ||||||||||

Headcount: | 274 | 264 | 235 | 274 | 235 | |||||||||||||||

Note: Previously issued statistics may be restated due to fund closures and trade adjustments

Source: WisdomTree

39

Three Months Ended September 30, 2022 Compared to Three Months Ended September 30, 2021

Selected Operating and Financial Information

| Three Months Ended September 30, | Change | Percent Change | ||||||||||||||

| AUM (in millions) | 2022 | 2021 | ||||||||||||||

Average AUM | $ | 74,681 | $ | 74,527 | $ | 154 | 0.2% | |||||||||

|

|

|

|

|

|

|

| |||||||||

Operating Revenues (in thousands) | ||||||||||||||||

Advisory fees | $ | 70,616 | $ | 76,400 | $ | (5,784) | (7.6%) | |||||||||

Other income | 1,798 | 1,712 | 86 | 5.0% | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenues | $ | 72,414 | $ | 78,112 | $ | (5,698) | (7.3%) | |||||||||

|

|

|

|

|

|

|

| |||||||||

Average AUM

Our average AUM was essentially unchanged from the three months ended September 30, 2021.

Operating Revenues

Advisory fees

Advisory fee revenues decreased 7.6% from $76.4 million during the three months ended September 30, 2021 to $70.6 million in the comparable period in 2022 due to a lower average advisory fee. Our average advisory fee was 0.38% during the three months ended September 30, 2022 and 0.41% during the same period in 2021.

Other income

Other income increased 5.0% from $1.7 million during the three months ended September 30, 2021 to $1.8 million in the comparable period in 2022 primarily due to higher fees associated with our European listed products.

Operating Expenses

| Three Months Ended September 30, | Change | Percent Change | ||||||||||||||||

(in thousands) | 2022 | 2021 | ||||||||||||||||

Compensation and benefits | $ | 23,714 | $ | 22,027 | $ | 1,687 | 7.7% | |||||||||||

Fund management and administration | 16,285 | 15,181 | 1,104 | 7.3% | ||||||||||||||

Marketing and advertising | 3,145 | 2,925 | 220 | 7.5% | ||||||||||||||

Sales and business development | 2,724 | 2,935 | (211 | ) | (7.2%) | |||||||||||||

Contractual gold payments | 4,105 | 4,250 | (145 | ) | (3.4%) | |||||||||||||

Professional fees | 2,367 | 1,583 | 784 | 49.5% | ||||||||||||||

Occupancy, communications and equipment | 986 | 1,163 | (177 | ) | (15.2%) | |||||||||||||

Depreciation and amortization | 58 | 185 | (127 | ) | (68.6%) | |||||||||||||

Third-party distribution fees | 1,833 | 1,873 | (40 | ) | (2.1%) | |||||||||||||

Other | 2,324 | 1,787 | 537 | 30.1% | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Total operating expenses | $ | 57,541 | $ | 53,909 | $ | 3,632 | 6.7% | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||

40

| Three Months Ended September 30, | ||||||||

As a Percent of Revenues: | 2022 | 2021 | ||||||

Compensation and benefits | 32.7% | 28.3% | ||||||

Fund management and administration | 22.5% | 19.4% | ||||||

Marketing and advertising | 4.3% | 3.7% | ||||||

Sales and business development | 3.8% | 3.8% | ||||||

Contractual gold payments | 5.7% | 5.4% | ||||||

Professional fees | 3.3% | 2.0% | ||||||

Occupancy, communications and equipment | 1.4% | 1.5% | ||||||

Depreciation and amortization | 0.1% | 0.2% | ||||||

Third-party distribution fees | 2.5% | 2.4% | ||||||

Other | 3.2% | 2.3% | ||||||

|

|

|

| |||||

Total operating expenses | 79.5% | 69.0% | ||||||

|

|

|

| |||||

Compensation and benefits

Compensation and benefits expense increased 7.7% from $22.0 million during the three months ended September 30, 2021 to $23.7 million in the comparable period in 2022 due to higher incentive compensation and headcount. Headcount was 235 and 274 at September 30, 2021 and 2022, respectively.

Fund management and administration

Fund management and administration expense increased 7.3% from $15.2 million during the three months ended September 30, 2021 to $16.3 million in the comparable period in 2022 due to higher AUM and transaction fees associated with our U.S. listed products, partly offset by lower European-listed AUM.

Marketing and advertising

Marketing and advertising expense increased 7.5% from $2.9 million during the three months ended September 30, 2021 to $3.1 million in the comparable period in 2022 primarily due to higher spending on online and television marketing campaigns.

Sales and business development

Sales and business development expense decreased 7.2% from $2.9 million during the three months ended September 30, 2021 to $2.7 million in the comparable period in 2022 primarily due to lower spending on sales tools.

Contractual gold payments

Contractual gold payments expense decreased 3.4% from $4.3 million during the three months ended September 30, 2021 to $4.1 million in the comparable period in 2022. This expense was associated with the payment of 2,375 ounces of gold and was calculated using the average daily spot price of $1,789 and $1,728 per ounce during the three months ended September 30, 2021 and 2022, respectively.

Professional fees

Professional fees increased 49.5% from $1.6 million during the three months ended September 30, 2021 to $2.4 million in the comparable period in 2022 due to spending related to our digital assets initiative.

Occupancy, communications and equipment

Occupancy, communications and equipment expense decreased 15.2% from $1.2 million during the three months ended September 30, 2021 to $1.0 million in the comparable period in 2022 due to our reduced office footprint.

Depreciation and amortization

Depreciation and amortization expense decreased 68.6% from $0.2 million during the three months ended September 30, 2021 to $0.1 million in the comparable period in 2022 due to lower spending on fixed assets.

41

Third-party distribution fees

Third-party distribution fees decreased 2.1% from $1.9 million during the three months ended September 30, 2021 to $1.8 million in the comparable period in 2022 primarily due to lower fees paid to our third-party marketing agent in Latin America, partly offset by new platform relationships in Europe.

Other

Other expenses increased 30.1% from $1.8 million during the three months ended September 30, 2021 to $2.3 million in the comparable period in 2022 due to higher insurance costs and other miscellaneous items.

Other Income/(Expenses)

| Three Months Ended September 30, | Change | Percent Change | ||||||||||||||

| (in thousands) | 2022 | 2021 | ||||||||||||||

Interest expense | $ | (3,734) | $ | (3,729) | $ | (5) | 0.1% | |||||||||

Gain on revaluation of deferred consideration—gold payments | 77,895 | 1,737 | 76,158 | 4,384.5% | ||||||||||||

Interest income | 811 | 689 | 122 | 17.7% | ||||||||||||

Impairments | — | (15,853) | 15,853 | (100%) | ||||||||||||

Other losses, net | (5,289) | (714) | (4,575) | 640.8% | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total other income/(expenses), net | $ | 69,683 | $ | (17,870) | $ | 87,553 | (489.9%) | |||||||||

|

|

|

|

|

|

|

| |||||||||

| Three Months Ended September 30, | ||||||||

As a Percent of Revenues: | 2022 | 2021 | ||||||

Interest expense | (5.2%) | (4.8%) | ||||||

Gain on revaluation of deferred consideration—gold payments | 107.6% | 2.2% | ||||||

Interest income | 1.1% | 0.9% | ||||||

Impairments | — | (20.3%) | ||||||

Other losses, net | (7.3%) | (0.9%) | ||||||

|

|

|

| |||||

Total other income/(expenses), net | 96.2% | (22.9%) | ||||||

|

|

|

| |||||

Interest expense

Interest expense was essentially unchanged from the three months ended September 30, 2021. Our effective interest rate was 4.6% during the three months ended September 30, 2021 and 2022.

Gain on revaluation of deferred consideration

We recognized a non-cash gain on revaluation of deferred consideration of $1.7 million and $77.9 million during the three months ended September 30, 2021 and 2022, respectively. The gain in the current quarter arose primarily from an increase in the discount rate (from 9.0% to 12.3%) used to compute the present value of the annual payment obligations as well as lower spot gold prices. The magnitude of any gain or loss is highly correlated to changes in the discount rate and the magnitude of the change in the forward-looking price of gold.

Interest income

Interest income increased 17.7% from $0.7 million during the three months ended September 30, 2021 to $0.8 million in the comparable period in 2022 due to an increase in securities owned.

Impairments

During the three months ended September 30, 2021, we recognized a loss of approximately $15.8 million upon exiting our New York office, which is included in impairments in our Consolidated Statements of Operations. There were no impairment charges during the three months ended September 30, 2022.

Other losses, net

Other losses, net were ($0.7) million and ($5.3) million during the three months ended September 30, 2021 and 2022, respectively. During the three months ended September 30, 2022, we recognized losses on our securities owned and investments of $6.3 million.

42

Gains and losses also generally arise from the sale of gold earned from management fees paid by our physically-backed gold ETPs, foreign exchange fluctuations and other miscellaneous items.

Income taxes

Our effective income tax rate for the three months ended September 30, 2022 of 3.9% resulted in an income tax expense of $3.3 million. Our tax rate differs from the federal statutory rate of 21% primarily due to a non-taxable gain on revaluation of deferred consideration. This was partly offset by an increase in the deferred tax asset valuation allowance on losses recognized on securities owned.

Our effective income tax rate for the three months ended September 30, 2021 of 7.9% resulted in income tax expense of $0.5 million. Our effective income tax rate differs from the federal statutory tax rate of 21% primarily due to a lower tax rate on foreign earnings and a non-taxable gain on revaluation of deferred consideration, partly offset by higher non-deductible compensation.

Nine Months Ended September 30, 2022 Compared to Nine Months Ended September 30, 2021

Selected Operating and Financial Information

| Nine Months Ended September 30, | Change | Percent Change | ||||||||||||||

| 2022 | 2021 | |||||||||||||||

Global AUM (in millions) | ||||||||||||||||

Average global AUM | $ | 76,735 | $ | 72,559 | $ | 4,176 | 5.8% | |||||||||

|

|

|

|

|

|

|

| |||||||||

Revenues (in thousands) | ||||||||||||||||

Advisory fees | $ | 222,719 | $ | 220,611 | $ | 2,108 | 1.0% | |||||||||

Other income | 5,316 | 4,532 | 784 | 17.3% | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenues | $ | 228,035 | $ | 225,143 | $ | 2,892 | 1.3% | |||||||||

|

|

|

|

|

|

|

| |||||||||

Average Global AUM

Our average global AUM increased 5.8% from $72.6 billion at September 30, 2021 to $76.7 billion at September 30, 2022 due to net inflows, partly offset by market depreciation.

Operating Revenues

Advisory fees

Advisory fee revenues were essentially unchanged from the nine months ended September 30, 2021. Our average global advisory fee was 0.41% and 0.39% during the nine months ended September 30, 2021 and September 30, 2022, respectively.

Other income

Other income increased 17.3% from $4.5 million during the nine months ended September 30, 2021 to $5.3 million in the comparable period in 2022 primarily due to higher fees associated with our European listed products.

Operating Expenses

| Nine Months Ended September 30, | Change | Percent Change | ||||||||||||||

| (in thousands) | 2022 | 2021 | ||||||||||||||

Compensation and benefits | $ | 73,066 | $ | 64,985 | $ | 8,081 | 12.4% | |||||||||

Fund management and administration | 47,855 | 43,495 | 4,360 | 10.0% | ||||||||||||

Marketing and advertising | 11,062 | 9,525 | 1,537 | 16.1% | ||||||||||||

Sales and business development | 8,464 | 7,239 | 1,225 | 16.9% | ||||||||||||

Contractual gold payments | 13,001 | 12,834 | 167 | 1.3% | ||||||||||||

Professional fees | 11,134 | 5,517 | 5,617 | 101.8% | ||||||||||||

Occupancy, communications and equipment | 2,788 | 3,904 | (1,116) | (28.6%) | ||||||||||||

Depreciation and amortization | 158 | 693 | (535) | (77.2%) | ||||||||||||

Third-party distribution fees | 5,863 | 5,346 | 517 | 9.7% | ||||||||||||

Other | 6,278 | 5,110 | 1,168 | 22.9% | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||

Total operating expenses | $ | 179,669 | $ | 158,648 | $ | 21,021 | 13.3% | |||||||||

|

|

|

|

|

|

|

|

|

| |||||||

43

| Nine Months Ended September 30, | ||||||||

As a Percent of Revenues: | 2022 | 2021 | ||||||

Compensation and benefits | 31.9% | 28.9% | ||||||

Fund management and administration | 21.0% | 19.3% | ||||||

Marketing and advertising | 4.9% | 4.2% | ||||||

Sales and business development | 3.7% | 3.2% | ||||||

Contractual gold payments | 5.7% | 5.7% | ||||||

Professional fees | 4.9% | 2.5% | ||||||

Occupancy, communications and equipment | 1.2% | 1.7% | ||||||

Depreciation and amortization | 0.1% | 0.3% | ||||||

Third-party distribution fees | 2.6% | 2.4% | ||||||

Other | 2.8% | 2.3% | ||||||

|

|

|

|

| ||||

Total operating expenses | 78.8% | 70.5% | ||||||

|

|

|

|

| ||||

Compensation and benefits