QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2008, or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to . |

Commission file number: 1-6948

SPX Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) | 38-1016240 (I.R.S. Employer Identification No.) |

13515 Ballantyne Corporate Place

Charlotte, NC 28277

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code:704-752-4400

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, Par Value $10.00 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 28, 2008 was $6,910,385,877. The determination of affiliate status for purposes of the foregoing calculation is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of each of the registrant's classes of common stock as of February 23, 2009 was 49,612,024.

Documents incorporated by reference: Portions of the Registrant's Proxy Statement for its Annual Meeting to be held on April 22, 2009 are incorporated by reference into Part III of this Annual Report on Form 10-K.

(All dollar and share amounts are in millions, except per share data)

Forward-Looking Information

Some of the statements in this document and any documents incorporated by reference constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our businesses' or our industries' actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. Such statements include statements about our plans, strategies, prospects, changes and trends in our business and the markets in which we operate under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations" ("MD&A"). In some cases, you can identify forward-looking statements by terminology such as "may," "could," "would," "should," "expect," "plan," "anticipate," "intend," "believe," "estimate," "predict," "potential" or "continue" or the negative of those terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially because of market conditions in our industries or other factors, and forward-looking statements should not be relied upon as a prediction of actual results. In addition, management's estimates of future operating results are based on our current complement of businesses, which is subject to change. All the forward-looking statements are qualified in their entirety by reference to the factors discussed in this document under the heading "Risk Factors" and in any documents incorporated by reference that describe risks and factors that could cause results to differ materially from those projected in these forward-looking statements. We undertake no obligation to update or publicly revise these forward-looking statements to reflect events or circumstances that arise after the date of this document.

We were incorporated in Muskegon, Michigan in 1912 as the Piston Ring Company and adopted our current name in 1988. Since 1968, we have been incorporated under the laws of Delaware, and we have been listed on the New York Stock Exchange since 1972.

We are a global multi-industry manufacturing company with operations in over 40 countries and sales in over 150 countries around the world. The majority of our revenues, approximately 56% in 2008, are driven by global infrastructure development. Our infrastructure-related products and services include wet and dry cooling systems, thermal service and repair work, heat exchangers and power transformers that we sell into the global power market. In addition, we provide pumps, metering systems and valves for the global oil and gas, chemical and petrochemical exploration, refinement and distribution markets. Our infrastructure-related products also include packaged cooling towers, boilers, heating and ventilation equipment and filters. We continue to focus on developing and acquiring products and services to serve global infrastructure development, as we believe that future investments in these end markets in both emerging and developed economies around the world provide significant opportunities for growth.

Our other two key global end markets are tools and diagnostics and food and beverage. During 2008, approximately 30% of our revenues were generated from serving these two end markets. Our primary offerings to the tools and diagnostics end market include, among other things, electronic diagnostic systems, specialty service tools, service equipment and technical information services with a primary focus on the global transportation market. Our strategy includes partnering with manufacturers of automobiles, agricultural and construction equipment and recreational vehicles, among others, to provide solutions for maintaining and servicing these vehicles after sale, with a continued focus on global expansion. For 2008, we estimate that we generated over 45% of our tools and diagnostic revenue outside North America. With the expanding global population and demand for vehicles, we believe there are significant international opportunities in this market, particularly in China and Russia.

Our acquisition of APV at the end of 2007 significantly increased our presence in the global food and beverage market. The products we provide to the food and beverage market include a variety of process equipment used to control flow and temperature during manufacturing, including various pumps, heat exchangers, valves and mixers. Growth for the food and beverage market is expected to continue throughout the globe, with the highest growth targeted for Asia Pacific and Latin America. We believe that our acquisition of APV leaves us well positioned to take advantage of these growth opportunities.

1

Our operating strategy is focused on an integrated leadership process that aligns performance measurement, decision support, compensation and communication. This process includes:

- •

- a demanding set of corporate values to drive achievement of results with integrity;

- •

- expanding our technological leadership and service offerings with a market focus on providing innovative, critical solutions to our customers;

- •

- growing through internal development and strategic, financially compelling acquisitions;

- •

- increased globalization with a focus on emerging and developing economies and markets;

- •

- right-sizing our businesses to market and economic conditions to protect against economic downturns and take advantage of strong economic cycles;

- •

- focusing on continuous improvement to drive results and create shareholder value; and

- •

- strategically analyzing our businesses to determine their long-term fit.

Unless otherwise indicated, amounts provided throughout this Annual Report on Form 10-K relate to continuing operations only.

Over the last few years, we have implemented a number of operating initiatives, including a focus on emerging and developing markets, new product development, continuous lean improvement, efficient supply chain management, information technology infrastructure improvement, and organizational and talent development, with the intent, among other things, of capturing synergies that exist within our businesses and, ultimately, on driving revenue, profit margin and cash flow growth. We believe that our businesses are well positioned for long-term growth in these financial metrics based on our current continuous improvement initiatives, the potential within the current markets they serve and the potential for expansion into additional markets.

We aggregate our operating segments into four reportable segments in accordance with the criteria defined in Statement of Financial Accounting Standards ("SFAS") No. 131, "Disclosures about Segments of an Enterprise and Related Information." The segments are Flow Technology, Test and Measurement, Thermal Equipment and Services and Industrial Products and Services. The factors considered in determining our aggregated segments are the economic similarity of the businesses, the nature of products sold or services provided, production processes, types of customers and distribution methods. In determining our segments, we apply the threshold criteria of SFAS No. 131 to operating income or loss of each segment before considering impairment and special charges, pensions and postretirement expense, stock-based compensation and other indirect corporate expense. This is consistent with the way our chief operating decision maker evaluates the results of each segment. For more information on the results of our segments, including revenues by geographic area, see Note 5 to our consolidated financial statements.

Flow Technology

Our Flow Technology segment had revenues of $1,998.7, $1,070.0 and $815.4 in 2008, 2007 and 2006, respectively. APV, a global manufacturer of process equipment and engineering solutions primarily for the food and beverage market, had revenues of approximately $876.0 and $753.0 in 2007 and 2006, respectively, which were not included in our results of operations for 2007 and 2006, as we acquired APV on December 31, 2007. The Flow Technology segment designs, manufactures and markets products and solutions that are used to blend, meter and transport fluids, as well as air and gas filtration and dehydration products. Our focus is on innovative, highly engineered new product introductions and expansion from products to systems and services in order to create total customer solutions. Our primary products include high-integrity pumps, valves, heat exchangers, fluid mixers, agitators, metering systems, filters and dehydration equipment. Our primary global end markets are food and beverage and pharmaceutical processing, power generation, general industrial, chemical processing, oil and gas processing, air dehydration and mining. We sell to these end markets under the brand names of Waukesha Cherry-Burrell, Lightnin, Copes-Vulcan, M&J Valves, Bran & Luebbe, APV, APV Gaulin, APV Rannie, Pneumatic Products, Delair, Dollinger Filtration, Jemaco, Kemp, Vokes, Deltech and Hankinson. Competitors in these fragmented markets include Alfa Laval AB, GEA Group AG, Fisher Controls International LLC, Hayward Filtration, Chemineer, Inc., EKATO Group, LEWA, Inc., Fristam Pumpen F. Stamp KG (GmbH & Co.) and Südmo North America, Inc. The segment continues to focus on initiatives such as the continued integration of APV, a global enterprise resource planning ("ERP") system implementation and lean manufacturing improvements. Channels to market include stocking distributors, manufacturers' representatives and direct sales.

2

Test and Measurement

Our Test and Measurement segment had revenues of $1,100.3, $1,079.8 and $1,049.7 in 2008, 2007 and 2006, respectively. This segment engineers and manufactures branded, technologically advanced test and measurement products used on a global basis across the transportation, telecommunications and utility industries. Our technology supports the introduction of new systems, expanded services and sophisticated testing and validation. Products for the segment include specialty diagnostic service tools, fare-collection systems and portable cable and pipe locators. Our diagnostic service tools product line includes diagnostic systems and service equipment, as well as specialty tools. We sell diagnostic service tools to the franchised vehicle dealers of original equipment manufacturers ("OEM"s), aftermarket franchised and independent repair facilities, under the OTC, Actron, AutoXray, Tecnotest and Robinair brand names. These products compete with brands such as Snap-on and Bosch. We intend to grow this business by developing new service capabilities and strengthening alliances in diagnostic platforms, as well as through acquisitions. We are a primary global provider of diagnostic service tools for motor vehicle manufacturers' dealership networks such as those belonging to General Motors, Ford, Chrysler, BMW, Volkswagen, Renault, Nissan, Harley Davidson and John Deere. Sales of specialty service tools essential to dealerships tend to vary with changes in vehicle systems design and the number of dealerships and are not directly correlated with the volume of vehicles produced by the motor vehicle manufacturers. The segment sells automated fare-collection systems to municipal bus and rail transit systems, as well as ride ticket vending systems, primarily within the North American market. Our portable cable and pipe locator line is composed of electronic testing, monitoring and inspection equipment for locating and identifying metallic sheathed fiber optic cable, horizontal boring guidance systems and inspection cameras. The segment sells this product line to a wide customer base, including utility and construction companies, municipalities and telecommunication companies. The segment continues to focus on initiatives such as lean manufacturing, expanding its commercialization of the European and Chinese markets, and leveraging its outsourcing model. The primary distribution channels for the Test and Measurement segment are direct to OEMs and OEM dealers, aftermarket tool and equipment providers and retailers.

Thermal Equipment and Services

Our Thermal Equipment and Services segment had revenues of $1,690.1, $1,560.5 and $1,327.7 in 2008, 2007 and 2006, respectively. This segment engineers, manufactures and services cooling, heating and ventilation products for markets throughout the world. Products for the segment include dry, wet and hybrid cooling systems for the power generation, refrigeration, HVAC and industrial markets, as well as hydronic and heating and ventilation products for the commercial and residential markets. This segment also provides thermal components for power and steam generation plants and engineered services to maintain, refurbish, upgrade and modernize power stations. We sell our cooling products and services under the brand names of Marley, Balcke-Duerr, Ceramic and Hamon Dry Cooling, with the major competitors to these product and service lines being Baltimore Aircoil Company, Evapco, Inc., GEA Group AG, Alstom SA, Siemens AG and Babcock & Wilcox Company. Our hydronic products include a complete line of gas and oil fired cast iron boilers for space heating in residential and commercial applications, as well as ancillary equipment. The segment's primary hydronic products competitors are Burnham Holdings, Inc. and Buderus. Our heating and ventilation product line includes i) baseboard, wall unit and portable heaters, ii) commercial cabinet and infrared heaters, iii) thermostats and controls, iv) air curtains and v) circulating fans. The segment sells heating and ventilation products under the Berko, Qmark, Farenheat, Aztec, Patton and Leading Edge brand names, with the principal competitors being TPI Corporation, Ouellet, King Electric, Systemair MFG. LLC, Cadet Manufacturing Company and Dimplex North America Ltd for heating products and TPI Corporation, Broan-NuTone LLC and Airmaster Fan Company for ventilation products. The segment continues to focus on expanding its global reach, as well as increasing thermal components and service offerings, particularly in South Africa, Europe and Asia Pacific. The segment's South African subsidiary has a Black Economic Empowerment minority shareholder, which holds a 25.1% interest. The primary distribution channels for the Thermal Equipment and Services segment are direct to customers, independent manufacturing representatives, third-party distributors and retailers.

Industrial Products and Services

Our Industrial Products and Services segment had revenues of $1,066.6, $865.1 and $741.6 in 2008, 2007 and 2006, respectively. Of the segment's 2008 revenue, approximately 47% was from the sale of power transformers into the US transmission and distribution market. We are a leading provider of medium sized transformers (MVA between 10 and 60 mega-watts) in the United States. Our transformers are sold under the Waukesha Electric brand name. This brand is recognized for quality and reliability by our customers. Typical customers for this product line are public and privately held utilities. Our key competitors in this market include ABB Ltd, (Kuhlman Electric Corporation) and GE-Prolec.

Additionally, this segment includes operating units that design and manufacture industrial tools and hydraulic units, precision machine components for the aerospace industry, crystal growing machines for the solar power generation market,

3

and television and radio broadcast antenna systems, communications and signal monitoring systems, and precision controlled industrial ovens and chambers. The primary distribution channels for the Industrial Products and Services segment are direct to customers, independent manufacturing representatives and third-party distributors.

We regularly review and negotiate potential acquisitions in the ordinary course of business, some of which are or may be material. We will continue to pursue acquisitions and we may consider acquisitions of businesses with more than $1,000.0 in annual revenues.

In September 2008, in the Test and Measurement segment, we completed the acquisition of Autoboss Tech, Inc., a China-based manufacturer of diagnostic tools and equipment serving China's vehicle maintenance and repair market, for a purchase price of $9.7. The acquired business had revenues of approximately $7.9 in the twelve months prior to its acquisition.

As part of our operating strategy, we regularly review and negotiate potential divestitures in the ordinary course of business, some of which are or may be material. As a result of this continuous review, we determined that certain of our businesses would be better strategic fits with other companies or investors. In accordance with SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets," we report businesses or asset groups as discontinued operations when the operations and cash flows of the business or asset group have been or are expected to be eliminated, when we do not expect to have any continuing involvement with the business or asset group after the disposal transaction, and when we have met these additional six criteria:

- •

- management has approved a plan to sell the business or asset group;

- •

- the business or asset group is available for immediate sale;

- •

- an active program to sell the business or asset group has been initiated;

- •

- the sale of the business or asset group is probable within one year;

- •

- the marketed sales value of the business or asset group is reasonable in relation to its current fair value; and

- •

- it is unlikely that the plan to divest the business or asset group will be significantly altered or withdrawn.

The following businesses, which have been sold, met the above requirements and therefore have been reported as discontinued operations for all periods presented:

Business | Quarter Discontinued | Actual Closing Date of Sale | |||||

|---|---|---|---|---|---|---|---|

Scales and Counting Systems business ("Scales") | Q3 2008 | Q4 2008 | |||||

Vibration Testing and Data Acquisition Equipment business ("LDS") | Q1 2008 | Q4 2008 | |||||

Air Filtration | Q3 2007 | Q3 2008 | |||||

Balcke-Duerr Austria GmbH ("BD Austria") | Q4 2007 | Q4 2007 | |||||

Nema AirFin GmbH ("Nema") | Q4 2007 | Q4 2007 | |||||

Contech ("Contech") | Q3 2006 | Q2 2007 | |||||

Dock Products ("Dock") | Q2 2006 | Q4 2006 | |||||

Dielectric Tower ("Tower") | Q4 2005 | Q1 2006 | |||||

Security and protection business ("Vance") | Q3 2005 | Q1 2006 | |||||

During the third and fourth quarters of 2008, we committed to plans to divest a business within our Flow Technology segment and a business within our Industrial Products and Services segment, respectively. We have reported, for all periods presented, the financial condition, results of operations, and cash flows of these businesses as discontinued operations in our consolidated financial statements. As a result of these planned divestitures, we recorded a net charge of $29.0 during 2008 to "Gain (loss) on disposition of discontinued operations, net of tax" in order to reduce the carrying value of the related net assets to be sold to their estimated net realizable value (i.e., projected sales price, net of estimated transaction costs, the expected payment to a minority shareholder and a charge of $7.0 related to tax matters). In January 2009, we sold the business within the Flow Technology segment for cash and a promissory note totaling $23.5. We are actively pursuing the sale of the business

4

within the Industrial Products and Services segment and anticipate that the sale will be completed during the next twelve months.

We have a joint venture, EGS Electrical Group, LLC and Subsidiaries ("EGS"), with Emerson Electric Co., in which we hold a 44.5% interest. Emerson Electric Co. controls and operates the joint venture. EGS operates primarily in the United States, Canada and France and is engaged in the manufacture of electrical fittings, hazardous location lighting and power conditioning products. We account for our investment under the equity method of accounting, on a three-month lag basis. We typically receive our share of this joint venture's earnings in cash dividends paid quarterly.

See Note 9 to our consolidated financial statements for more information on EGS.

We are a multinational corporation with operations in over 40 countries. Our export sales from the United States were $553.5 in 2008, $332.5 in 2007 and $328.6 in 2006.

See Note 5 to our consolidated financial statements for more information on our international operations.

We are actively engaged in research and development programs designed to improve existing products and manufacturing methods and to develop new products to better serve our current and future customers. These efforts encompass all of our products with divisional engineering teams coordinating their resources. We place particular emphasis on the development of new products that are compatible with, and build upon, our manufacturing and marketing capabilities.

We spent $67.2 on research activities relating to the development and improvement of our products in 2008, $60.4 in 2007 and $51.9 in 2006. In addition, we expensed purchased in-process research and development of $0.9 during 2007 related to the APV acquisition.

We own over 700 domestic patents and 200 foreign patents, including approximately 50 patents that were issued in 2008, covering a variety of our products and manufacturing methods. We also own a number of registered trademarks. Although in the aggregate our patents and trademarks are of considerable importance in the operation of our business, we do not consider any single patent or trademark to be of such importance that its absence would adversely affect our ability to conduct business as presently constituted to a significant extent. We are both a licensor and licensee of patents. For more information, please refer to "Risk Factors."

We manufacture many of the components used in our products; however, our strategy includes outsourcing some components and sub-assemblies to other companies where strategically and economically feasible. In instances where we depend on third-party suppliers for outsourced products or components, we are subject to the risk of customer dissatisfaction with the quality or performance of the products we sell due to supplier failure. In addition, business difficulties experienced by a third-party supplier can lead to the interruption of our ability to obtain the outsourced product and ultimately to our inability to supply products to our customers. We believe that we generally will be able to continue to obtain adequate supplies of major items or appropriate substitutes at reasonable costs.

We are subject to potential increases in the prices of many of our key raw materials, including petroleum-based products, steel and copper. In recent years we have generally been able to offset increases in raw material costs across our segments mainly through effective price increases.

Because of our diverse products and services, as well as the wide geographic dispersion of our production facilities, we use numerous sources for the raw materials needed in our operations. We are not significantly dependent on any one or a limited number of suppliers, and we have been able to obtain suitable quantities of necessary raw materials at competitive prices.

5

Although our businesses are in highly competitive markets, our competitive position cannot be determined accurately in the aggregate or by segment since our competitors do not offer all of the same product lines or serve all of the same markets as we do. In addition, specific reliable comparative figures are not available for many of our competitors. In most product groups, competition comes from numerous concerns, both large and small. The principal methods of competition are price, service, product performance and technical innovation. These methods vary with the type of product sold. We believe that we can compete effectively on the basis of each of these factors as they apply to the various products offered. See "Segments" above for a discussion of our competitors.

See "MD&A — Critical Accounting Policies and Use of Estimates — Contingent Liabilities," "Risk Factors" and Note 14 to our consolidated financial statements for information regarding environmental matters.

At December 31, 2008, we had approximately 17,800 employees associated with businesses that have been classified in our consolidated financial statements as continuing operations. Additionally, we had approximately 700 employees associated with two businesses that we have sold, or intend to sell, in 2009 and have classified in our consolidated financial statements as discontinued operations. Eleven domestic collective bargaining agreements cover approximately 1,300 employees, one of which relates to a business classified in our consolidated financial statements as a discontinued operation. We also have various collective labor arrangements covering certain non-U.S. employee groups. While we generally have experienced satisfactory labor relations, we are subject to potential union campaigns, work stoppages, union negotiations and other potential labor disputes.

See Part III, Item 10 of this report for information about our executive officers.

No customer or group of customers that, to our knowledge, are under common control accounted for more than 10% of our consolidated revenues for any period presented.

Our businesses maintain sufficient levels of working capital to support customer requirements, particularly inventory. We believe that our businesses' sales and payment terms are generally similar to those of our competitors.

Many of our businesses closely follow changes in the industries and end-markets that they serve. In addition, certain businesses have seasonal fluctuations. Revenues for our Test and Measurement segment primarily follow customer-specified program launch timing for diagnostic systems and service equipment. Demand for products in our Thermal Equipment and Services segment is correlated to contract timing on large construction contracts and is also driven by seasonal weather patterns, both of which may cause significant fluctuations from period to period. Historically, our businesses generally tend to be stronger in the second half of the year.

Our website address is www.spx.com. Information on our website is not incorporated by reference herein. We file reports with the Securities and Exchange Commission ("SEC"), including our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and any amendments to those reports. Copies of these reports are available free of charge on our website as soon as reasonably practicable after we file the reports with the SEC. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov. Additionally, you may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

6

(All amounts are in millions, except per share data)

You should consider the risks described below and elsewhere in our documents filed with the SEC before investing in any of our securities. We may amend, supplement or add to the risk factors described below from time to time in future reports filed with the SEC.

Worldwide economic conditions could negatively impact our businesses.

The general worldwide deterioration of economic conditions and tightening of credit markets beginning in 2008 are contributing to slowdowns in many industries, including industries in which we or our customers operate. This deterioration and tightening affects businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. These conditions could negatively impact our businesses by adversely affecting, among other things, our:

- •

- revenues;

- •

- profits;

- •

- margins;

- •

- cash flows;

- •

- suppliers' and distributors' ability to perform;

- •

- derivative counterparties' ability to perform their obligations;

- •

- levels of customers' orders;

- •

- order cancellation activity;

- •

- customers' ability to access credit; and

- •

- customers' ability to pay amounts due to us.

We cannot predict the duration or severity of these conditions, but, if they worsen or continue for an extended time, the negative impact on our businesses could increase. See MD&A for further discussion of how these conditions have affected our businesses to date and how they may affect it in the future.

Difficulties presented by international economic, political, legal, accounting and business factors could negatively affect our interests and business effort.

We are an increasingly global company, with a significant portion of our sales taking place outside the United States. In 2008, approximately 48% of our revenues were generated outside the United States, and we expect that over 50% of our revenues will be generated outside the United States in 2009. We have placed a particular emphasis on expanding our presence in emerging and developing markets.

As part of our strategy, we manage businesses with manufacturing facilities worldwide, many of which are located outside the United States.

Our reliance on non-U.S. revenues and non-U.S. manufacturing bases exposes us to a number of risks, including:

- •

- possible significant competition from local or long-time participants in non-U.S. markets who may have significantly greater market knowledge and substantially greater resources than we do;

- •

- local customers may have a preference for locally-produced products. For example, we are facing increased competition from local suppliers in China;

- •

- regulatory or political systems or barriers may make it difficult or impossible to enter new markets. In addition, these barriers may impact our existing businesses, including making it more difficult for them to grow;

- •

- domestic and foreign customs and tariffs may make it difficult or impossible for us to move our products or profits across borders in a cost-effective manner;

7

- •

- adverse tax consequences, including imposition or increase of income and other taxes on remittances and earnings by subsidiaries may impact our net income;

- •

- transportation and shipping expenses add cost to our products, and may impact our profit margins or lead to lost business;

- •

- credit risk or financial condition of local customers and distributors;

- •

- nationalization of private enterprises;

- •

- government embargos or foreign trade restrictions such as anti-dumping duties. Also, the imposition of trade sanctions by the United States or the European Union against a class of products imported by us from, sold by us to, or the loss of "normal trade relations" status with, countries in which we conduct business could significantly increase our cost of products imported into the United States or Europe or reduce our sales and harm our business;

- •

- environmental and other laws and regulations;

- •

- our ability to obtain supplies from foreign vendors and ship products internationally may be impaired during times of crisis or otherwise;

- •

- difficulties in protecting intellectual property;

- •

- local, regional or worldwide hostilities;

- •

- distance, language and cultural differences may make it more difficult to manage the business and employees, and to effectively market our products and services;

- •

- potential imposition of restrictions on investments; and

- •

- local political, economic and social conditions, including the possibility of hyperinflationary conditions and political instability.

As an increasing percentage of our products is manufactured in China, South Africa and other developing countries, health conditions and other factors affecting social and economic activity in these countries or affecting the movement of people and products into and from these countries to our major markets, including North America and Europe, could have a significant negative effect on our operations. Because of the importance of our international sales and sourcing of manufacturing, the occurrence of any risk described above could have a material adverse effect on our financial position, results of operations or cash flows.

Our sales are translated into U.S. dollars for reporting purposes. The strengthening or weakening of the U.S. dollar could result in unfavorable translation effects as the results of transactions in foreign countries are translated into U.S. dollars. In addition, sales and purchases in currencies other than the U.S. dollar expose us to fluctuations in foreign currencies relative to the U.S. dollar. Increased strength of the U.S. dollar will increase the effective price of our products sold in U.S. dollars into other countries, which may have a material adverse effect on sales or require us to lower our prices, and also decrease our reported revenues or margins in respect of sales conducted in foreign currencies to the extent we are unable or determine not to increase local currency prices. Likewise, decreased strength of the U.S. dollar could have a material adverse effect on the cost of materials and products purchased overseas.

Our indebtedness may affect our business and may restrict our operating flexibility.

At December 31, 2008, we had $1,344.7 in total indebtedness. On that same date, we had $411.8 of available borrowing capacity under our revolving credit facilities after giving effect to borrowings under our domestic revolving loan facility of $65.0 and to $123.2 reserved for outstanding letters of credit. In addition, we had $257.6 of available issuance capacity under our foreign trade facility after giving effect to $692.4 reserved for outstanding letters of credit. At December 31, 2008, our cash and equivalents balance was $475.9. See MD&A and Note 12 to our consolidated financial statements for further discussion. We may incur additional indebtedness in the future, including indebtedness incurred to finance, or which is assumed in connection with, acquisitions. We may in the future renegotiate or refinance our senior credit facilities, senior notes or other debt facilities, or enter into additional agreements that have different or more stringent terms. The level of our indebtedness could:

- •

- limit cash flow available for general corporate purposes, such as acquisitions and capital expenditures, due to the ongoing cash flow requirements for debt service;

8

- •

- limit our ability to obtain, or obtain on favorable terms, additional debt financing in the future for working capital, capital expenditures or acquisitions;

- •

- limit our flexibility in reacting to competitive and other changes in the industry and economic conditions;

- •

- expose us to a risk that a substantial decrease in net operating cash flows due to economic developments or adverse developments in our business could make it difficult to meet debt service requirements; and

- •

- expose us to risks inherent in interest rate fluctuations to the extent existing borrowings are, and any new borrowings may be, at variable rates of interest, which could result in higher interest expense and interest payments in the event of increases in interest rates.

Our ability to make scheduled payments of principal or pay interest on, or to refinance, our indebtedness and to satisfy our other debt obligations will depend upon our future operating performance, which will be affected by general economic, financial, competitive, legislative, regulatory, business and other factors beyond our control. In addition, we cannot assure that future borrowings or equity financing will be available for the payment or refinancing of our indebtedness. If we are unable to service our indebtedness, whether in the ordinary course of business or upon an acceleration of such indebtedness, we may pursue one or more alternative strategies, such as restructuring or refinancing our indebtedness, selling assets, reducing or delaying capital expenditures, revising implementation of or delaying strategic plans or seeking additional equity capital. Any of these actions could have a material adverse effect on our business, financial condition, results of operations and stock price. In addition, we cannot assure that we would be able to take any of these actions, that these actions would enable us to continue to satisfy our capital requirements, or that these actions would be permitted under the terms of our various debt agreements.

Numerous banks in many countries are syndicate members in our credit facility. Failure of one or more of our larger lenders, or several of our smaller lenders, could reduce availability of our credit, which could harm our liquidity.

We are subject to laws, regulations and potential liability relating to claims, complaints and proceedings, including those relating to environmental and other matters.

We are subject to various laws, ordinances, regulations and other requirements of government authorities in the United States and other nations. With respect to acquisitions, divestitures and continuing operations, we may acquire or retain liabilities of which we are not aware, or of a different character or magnitude than expected. Additionally, changes in laws, ordinances, regulations or other governmental policies may significantly increase our expenses and liabilities.

We face environmental exposures including, for example, those relating to discharges from and materials handled as part of our operations, the remediation of soil and groundwater contaminated by petroleum products or hazardous substances or wastes, and the health and safety of our employees. We may be liable for the costs of investigation, removal or remediation of hazardous substances or petroleum products on, under, or in our current or formerly owned or leased property, or from a third-party disposal facility that we may have used, without regard to whether we knew of, or caused, the presence of the contaminants. The presence of, or failure to properly remediate, these substances may have adverse effects, including, for example, substantial investigative or remedial obligations and limitations on the ability to sell or rent affected property or to borrow funds using affected property as collateral. New or existing environmental matters or changes in environmental laws or policies could lead to material costs for environmental compliance or cleanup. There can be no assurance that these liabilities and costs will not have a material adverse effect on our financial position, results of operations or cash flows. See Note 14 to our consolidated financial statements for further discussion.

We face numerous claims, complaints and proceedings. Class actions, derivative lawsuits and contracts, intellectual property, competitive, personal injury, product liability, workers' compensation and other claims have been filed against us and certain of our subsidiaries and some of these remain pending. From time to time, we face actions by governmental authorities, both in and outside the United States. Additionally, we may become subject to significant claims, of which we are currently unaware, or the claims, of which we are aware, may result in our incurring a significantly greater liability than we anticipate. Our insurance may be insufficient or unavailable to protect us against potential loss exposures. We have increased our self-insurance limits over the past several years, which has increased our uninsured exposure.

We devote significant time and expense to defense against the various claims, complaints and proceedings brought against us, and we cannot assure that the expenses or distractions from operating our businesses arising from these defenses will not increase materially.

We cannot assure that our accruals and right to indemnity and insurance will be sufficient, that recoveries from insurance or indemnification claims will be available or that any of our current or future claims or other matters will not have a material

9

adverse effect on our financial position, results of operations or cash flows. See "MD&A — Critical Accounting Policies and Use of Estimates — Contingent Liabilities."

The price of raw materials may adversely affect our results.

We are exposed to a variety of market risks, including inflation in the prices of raw materials. In recent years, we have faced significant volatility in the prices of many of our key raw materials, including petroleum-based products, steel and copper. Increases in the prices of raw materials may have a material adverse effect on our financial position, results of operations or cash flows, as we may not be able to pass cost increases on to our customers, or our sales may be reduced.

A portion of our revenues is generated through long-term fixed-price contracts, which could expose us to various risks including the risks of cost overruns, inflation and credit and other counterparty risks.

A portion of our revenues and earnings is generated through long-term fixed-price contracts. We recognize revenues from certain of these contracts using the percentage-of-completion method of accounting whereby revenues and expenses, and thereby profit, in a given period are determined based on our estimates as to the project status and the costs remaining to complete a particular project. Estimates of total revenues and cost at completion are subject to many variables, including the length of time to complete a contract. To the extent that we underestimate the remaining cost to complete a project, we may overstate the revenues and profit in a particular period. Further, certain of these contracts provide for penalties for failure to timely perform our obligations under the contract, or require that we, at our expense, correct and remedy to the satisfaction of the other party certain defects. Because some of our long-term contracts are at a fixed price, we face the risk that cost overruns or inflation may exceed, erode or eliminate our expected profit margin, or cause us to take a loss on our projects. Additionally, even though we perform credit checks and conduct other due diligence on those with whom we do business, customers of our long-term contracts may suffer financial difficulties that make them unable to pay for a project when completed or they may decide, either as a matter of corporate decision-making or in response to changes in local laws and regulations, not to pay us. We cannot assure that expenses or losses for uncollectible billings relating to our long-term fixed-price contracts will not have a material adverse effect on our revenues and earnings.

Our failure to successfully integrate acquisitions could have a negative effect on our operations; our acquisitions could cause financial difficulties.

As part of our business strategy, we evaluate potential acquisitions in the ordinary course, some of which could be and have been material. Our acquisitions involve a number of risks and present financial, managerial and operational challenges, including:

- •

- adverse effects on our reported operating results due to charges to earnings, including impairment charges associated with goodwill and other intangibles;

- •

- diversion of management attention from running our businesses;

- •

- integration of technology, operations, personnel and financial and other systems;

- •

- increased expenses;

- •

- increased foreign operations, often with unique issues relating to corporate culture, compliance with legal and regulatory requirements and other challenges;

- •

- assumption of known and unknown liabilities and exposure to litigation;

- •

- increased levels of debt or dilution to existing shareholders; and

- •

- potential disputes with the sellers of acquired businesses, technology, services or products.

In addition, internal controls over financial reporting of acquired companies may not be up to required standards. Issues may exist that could rise to the level of significant deficiencies or, in some cases, material weaknesses, particularly with respect to foreign companies or non-public U.S. companies acquired.

Our integration activities may place substantial demands on our management, operational resources and financial and internal control systems. Customer dissatisfaction or performance problems with an acquired business, technology, service or product could also have a material adverse effect on our reputation and business. In addition, any acquired business, technology, service or product could under-perform relative to our expectations.

10

We may not achieve the expected cost savings and other benefits of our acquisitions.

We strive for and expect to achieve cost savings in connection with our acquisitions, including: (i) manufacturing process and supply chain rationalization, including plant closings in some cases; (ii) streamlining redundant administrative overhead and support activities; and (iii) restructuring and repositioning sales and marketing organizations to eliminate redundancies. Cost savings expectations are inherently estimates that are difficult to predict and are necessarily speculative in nature, and we cannot assure that we will achieve expected, or any, cost savings. In addition, we cannot assure that unforeseen factors will not offset the estimated cost savings or other benefits from our acquisitions. As a result, our actual cost savings, if any, and other anticipated benefits could be delayed and could differ significantly from our estimates and the other information contained in this report.

Our failure to successfully complete acquisitions could negatively affect us.

We may not be able to consummate desired acquisitions, which could materially impact our growth rate, results of operations, future cash flows and stock price. Our ability to achieve our goals depends upon, among other things, our ability to identify and successfully acquire companies, businesses and product lines, to effectively integrate them and to achieve cost effectiveness. We may also be unable to raise any additional funds necessary to consummate these acquisitions. In addition, decreases in our stock price may adversely affect our ability to consummate acquisitions. Competition for acquisitions in our business areas may be significant and result in higher prices for businesses, including businesses that we may target, which may also affect our acquisition rate or benefits achieved from our acquisitions.

We operate in highly competitive industries. Our failure to compete effectively could harm our business.

We operate in a highly competitive environment, competing on the basis of product offerings, technical capabilities, quality, service and pricing. We have a number of competitors, some of which are large, with substantial technological and financial resources, brand recognition and established relationships with global service providers. Some of our competitors have low cost structures, support from governments in their home countries, or both. In addition, new competitors may enter the industry. We cannot assure that we will be able to compete successfully against existing or future competitors. Competitors may be able to offer lower prices, additional products or services or a more attractive mix of products or services, or services or other incentives that we cannot or will not match. These competitors may be in a stronger position to respond quickly to new or emerging technologies and may be able to undertake more extensive marketing campaigns, and make more attractive offers to potential customers, employees and strategic partners than we can.

Our strategy to outsource various elements of the products we sell subjects us to the business risks of our suppliers, which could have a material adverse impact on our operations.

In areas where we depend on third-party suppliers for outsourced products or components, we are subject to the risk of customer dissatisfaction with the quality or performance of the products we sell due to supplier failure. In addition, business difficulties experienced by a third-party supplier can lead to the interruption of our ability to obtain the outsourced product and ultimately our inability to supply products to our customers. Third-party supplier business interruptions can include, but are not limited to, work stoppages and union negotiations and other labor disputes. Current economic conditions could impact the ability of suppliers to access credit and, thus, possibly impair their ability to provide us quality product in a timely manner, or at all.

Changes in key estimates and assumptions, such as discount rates, assumed long-term return on assets, assumed long-term trends of future costs, accounting and legislative changes as well as our actual investment returns on our pension plan assets and other actuarial factors could affect our results of operations and cash flows.

We have defined benefit pension and postretirement plans, including both qualified and non-qualified plans that cover a portion of our salaried and hourly paid employees and retirees including certain employees and retirees in foreign countries. As of December 31, 2008, these plans were underfunded by $450.8. The determination of funding requirements and pension expense or income associated with these plans involves significant judgement, particularly with respect to discount rates, long-term returns on assets, long-term trends of future costs and other actuarial assumptions. If our assumptions change significantly due to changes in economic, legislative and/or demographic experience or circumstances, our pension and other benefit plans' expense, funded status and our cash contributions to such plans could be negatively impacted. In addition, the difference between our actual investment returns and our long-term return on assets assumptions would result in a change to

11

our pension plans' expense, funded status and our required contributions to the plans. See "MD&A—Critical Accounting Policies and Use of Estimates" for the impact that changes in certain assumptions used in the calculation of our costs and obligations associated with these plans could have on our results of operations and financial position.

Dispositions or our failure to successfully complete dispositions could negatively affect us.

We continually review each of our businesses in order to determine their long-term strategic fit. As part of this strategy, we dispose of certain of our businesses in the ordinary course, some of which dispositions could be and have been material. Our dispositions involve a number of risks and present financial, managerial and operational challenges, including diversion of management attention from running our core businesses, increased expense associated with the dispositions, potential disputes with the acquirers of the disposed businesses and a potential dilutive effect on our earnings per share. If dispositions are not completed in a timely manner there may be a negative effect on our cash flows and/or our ability to execute our strategy. See "Business" and Note 4 to our consolidated financial statements for the status of our divestitures.

Increases in the number of shares of our outstanding common stock could adversely affect our common stock price or dilute our earnings per share.

Sales of a substantial number of shares of common stock into the public market, or the perception that these sales could occur, could have a material adverse effect on our stock price. As of December 31, 2008, approximately 1.3 shares of our common stock were issuable upon exercise of outstanding stock options by employees and non-employee directors and we had the ability to issue up to an additional 5.8 shares as restricted stock, restricted stock units, or stock options under our 2002 Stock Compensation Plan. Additionally, we may issue a significant number of additional shares, in connection with acquisitions or otherwise. We also have a shelf registration statement for 8.3 shares of common stock that may be issued in connection with acquisitions. Additional shares issued will have a dilutive effect on our earnings per share.

We may not be able to finance future needs or adapt our business plan to react to changes in economic or business conditions because of restrictions placed on us by our senior credit facilities and any existing or future instruments governing our other indebtedness.

Our senior credit facilities, the indentures governing our senior notes and agreements governing our other indebtedness contain, or may contain, a number of restrictions and covenants that limit our ability to make distributions or other payments to our investors and creditors unless certain financial tests or other criteria are satisfied. We also must comply with certain specified financial ratios and tests. Our subsidiaries may also be subject to restrictions on their ability to make distributions to us. In addition, our senior credit facilities, indentures governing our senior notes and any other agreements contain or may contain additional affirmative and negative covenants. Existing restrictions are described more fully under MD&A. Each of these restrictions could affect our ability to operate our business and may limit our ability to take advantage of potential business opportunities, such as acquisitions.

If we do not comply with the covenants and restrictions contained in our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness, we could be in default under those agreements, and the debt, together with accrued interest, could then be declared immediately due and payable. If we default under our senior credit facilities, the lenders could cause all our outstanding debt obligations under our senior credit facilities to become due and payable or require us to apply all of our cash to repay the indebtedness we owe. If our debt is accelerated, we may not be able to repay or refinance our debt. Even if we are able to obtain new financing, we may not be able to repay our debt or borrow sufficient funds to refinance it. In addition, any default under our senior credit facilities, indentures governing our senior notes or agreements governing our other indebtedness could lead to an acceleration of debt under other debt instruments that contain cross-acceleration or cross-default provisions. If the indebtedness under our senior credit facilities is accelerated, we may not have sufficient assets to repay amounts due under our senior credit facilities, senior notes or other debt securities then outstanding. Our ability to comply with these provisions of our senior credit facilities, indentures governing our senior notes and agreements governing our other indebtedness will be affected by changes in the economic or business conditions or other events beyond our control. Complying with our covenants may also cause us to take actions that are not favorable to us and may make it more difficult for us to successfully execute our business strategy and compete, including against companies that are not subject to such restrictions.

12

The loss of key personnel and any inability to attract and retain qualified employees could have a material adverse effect on our operations.

We are dependent on the continued services of our leadership team. The loss of these personnel without adequate replacement could have a material adverse effect on our operations. Additionally, we need qualified managers and skilled employees with technical and manufacturing industry experience in order to operate our business successfully. From time to time, there may be a shortage of skilled labor, which may make it more difficult and expensive for us to attract and retain qualified employees. If we were unable to attract and retain sufficient numbers of qualified individuals or our costs to do so were to increase significantly, our operations could be materially adversely affected.

Many of the industries in which we operate are cyclical, and our results will be and have been affected as a result.

Many of the business areas in which we operate are subject to specific industry and general economic cycles. Certain businesses are subject to industry cycles, including, but not limited to:

- •

- the oil and gas, chemical and petrochemical markets, which influence our Flow Technology segment;

- •

- the electric power and infrastructure markets, which influence our Thermal Equipment and Services and Industrial Products and Services segments;

- •

- the U.S. auto manufacturers and franchise dealers are facing significant competitive and other challenges, and we face pressure on revenues and margins in our Test and Measurement segment as a result; and

- •

- demand for cooling systems and towers within our Thermal Equipment and Services segment is correlated to contract timing on large construction contracts, which could cause significant fluctuations in revenues and profits from period to period.

Cyclical changes could also affect sales of products in our other businesses. The downturns in the business cycles of our different operations may occur at the same time, which could exacerbate any material adverse effects to our business. See "MD&A — Segment Results of Operations." In addition, certain of our businesses have seasonal fluctuations. Historically, our businesses generally tend to be stronger in the second half of the year.

Cost reduction actions may affect our business.

Cost reduction actions often result in charges against earnings. We expect to take charges against earnings in 2009 in connection with implementing additional cost reduction actions at certain of our businesses. These charges can vary significantly from period to period and, as a result, we may experience fluctuations in our reported net income and earnings per share due to the timing of restructuring actions, which in turn can have a material adverse effect on our financial position, results of operations or cash flows.

If the fair value of any of our reporting units is insufficient to recover the carrying value of the goodwill and other intangibles of the respective reporting unit, a material non-cash charge to earnings could result.

At December 31, 2008, we had goodwill and other intangible assets, net of $2,426.5. We account for goodwill and indefinite-lived intangibles in accordance with SFAS No. 142, "Goodwill and Other Intangible Assets." SFAS No. 142 states that goodwill and indefinite-lived intangible assets are not amortized, but are instead reviewed for impairment annually (or more frequently if impairment indicators arise). We conduct annual impairment testing to determine if we will be able to recover all or a portion of the carrying value of goodwill and indefinite-lived intangibles. In addition, we review goodwill and indefinite-lived intangible assets for impairment more frequently if impairment indicators arise. If the fair value is insufficient to recover the carrying value of our goodwill and indefinite-lived intangibles, we may be required to record a material non-cash charge to earnings.

Consistent with the requirements of SFAS No. 142, the fair values of our reporting units generally are based on discounted cash flow projections that are believed to be reasonable under current and forecasted circumstances, the results of which form the basis for making judgments about carrying values of the reported net assets of our reporting units. Other considerations are also incorporated, including comparable industry price multiples. Many of our businesses closely follow changes in the industries and end-markets that they serve. Accordingly, we consider estimates and judgments that affect the future cash flow projections, including principal methods of competition such as volume, price, service, product performance and technical innovations and estimates associated with cost improvement initiatives, capacity utilization, and assumptions for inflation and foreign currency changes. We monitor impairment indicators across all of our businesses. Any significant change in market

13

conditions and estimates or judgments used to determine expected future cash flows that indicate a reduction in carrying value may give rise to impairment in the period that the change becomes known.

We are subject to work stoppages, union negotiations, labor disputes and other matters associated with our labor force, which may adversely impact our operations and cause us to incur incremental costs.

At December 31, 2008, we had approximately 17,800 employees associated with businesses that have been classified in our consolidated financial statements as continuing operations. Additionally, we had approximately 700 employees associated with two businesses that we have sold, or intend to sell, in 2009 and have classified in our consolidated financial statements as discontinued operations. Eleven domestic collective bargaining agreements cover approximately 1,300 employees, one of which relates to a business classified in our consolidated financial statements as a discontinued operation. We also have various collective labor arrangements covering certain non-U.S. employee groups. We are subject to potential union campaigns, work stoppages, union negotiations and other potential labor disputes. Further, we may be subject to work stoppages, which are beyond our control, at our suppliers or customers.

Our technology is important to our success, and failure to develop new products may result in a significant competitive disadvantage.

We believe that the development and protection of our intellectual property rights is critical to the success of our business. In order to maintain our market positions and margins, we need to continually develop and introduce high quality, technologically advanced and cost effective products on a timely basis. The failure to do so could result in a significant competitive disadvantage.

Additionally, despite our efforts to protect our proprietary rights, unauthorized parties or competitors may copy or otherwise obtain and use our products or technology. The steps we have taken may not prevent unauthorized use of our technology, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States. Expenses in connection with defending our rights may be material.

If we are unable to protect our information systems against data corruption, cyber-based attacks or network security breaches, our operations could be disrupted.

We are increasingly dependent on information technology networks and systems, including the Internet, to process, transmit and store electronic information. In particular, we depend on our information technology infrastructure for electronic communications among our locations around the world and between our personnel and suppliers and customers. Security breaches of this infrastructure can create system disruptions, shutdowns or unauthorized disclosure of confidential information. If we are unable to prevent such breaches, our operations could be disrupted or we may suffer financial damage or loss because of lost or misappropriated information.

Our current and planned products may contain defects or errors that are detected only after delivery to customers. If that occurs, our reputation may be harmed and we may face additional costs.

We cannot assure that our product development, manufacturing and integration testing will be adequate to detect all defects, errors, failures and quality issues that could impact customer satisfaction or result in claims against us with regard to our products. As a result, we may have to replace certain components and/or provide remediation in response to the discovery of defects in products that are shipped. The occurrence of any defects, errors, failures or quality issues could result in cancellation of orders, product returns, diversion of our resources, legal actions by our customers or our customers' end users and other losses to us or to our customers or end users, and could also result in the loss of or delay in market acceptance of our products and loss of sales, which would harm our business and adversely affect our revenues and profitability.

14

Provisions in our corporate documents and Delaware law may delay or prevent a change in control of our company, and accordingly, we may not consummate a transaction that our shareholders consider favorable.

Provisions of our Certificate of Incorporation and By-laws may inhibit changes in control of our company not approved by our Board. These provisions include, for example: a staggered board of directors; a prohibition on shareholder action by written consent; a requirement that special shareholder meetings be called only by our Chairman, President or our Board; advance notice requirements for shareholder proposals and nominations; limitations on shareholders' ability to amend, alter or repeal the By-laws; enhanced voting requirements for certain business combinations involving substantial shareholders; the authority of our Board to issue, without shareholder approval, preferred stock with terms determined in its discretion; and limitations on shareholders ability to remove directors. In addition, we are afforded the protections of Section 203 of the Delaware General Corporation Law, which could have similar effects. In general, Section 203 prohibits us from engaging in a "business combination" with an "interested shareholder" (each as defined in Section 203) for at least three years after the time the person became an interested shareholder unless certain conditions are met. These protective provisions could result in our not consummating a transaction that our shareholders consider favorable or discourage entities from attempting to acquire us, potentially at a significant premium to our then-existing stock price.

ITEM 1B. Unresolved Staff Comments

Not applicable.

The following is a summary of our principal properties, as of December 31, 2008, classified by segment:

| | | | Approximate Square Footage | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | No. of Facilities | ||||||||||

| | Location | Owned | Leased | |||||||||

| | | | (in millions) | |||||||||

Flow Technology | 11 states and 22 foreign countries | 61 | 2.7 | 1.6 | ||||||||

Test and Measurement | 6 states and 6 foreign countries | 29 | 0.6 | 1.0 | ||||||||

Thermal Equipment and Services | 10 states and 7 foreign countries | 31 | 4.2 | 3.3 | ||||||||

Industrial Products and Services | 14 states and 5 foreign countries | 26 | 1.5 | 0.6 | ||||||||

Total | 147 | 9.0 | 6.5 | |||||||||

In addition to manufacturing plants, we lease our corporate office in Charlotte, NC, our Asia-Pacific center in Shanghai, China, and various sales, service and other locations throughout the world. We consider these properties, as well as the related machinery and equipment, to be well maintained and suitable and adequate for their intended purposes.

(All amounts are in millions)

We are subject to legal proceedings and claims that arise in the normal course of business. In our opinion, these matters are either without merit or of a kind that should not have a material adverse effect individually or in the aggregate on our financial position, results of operations, or cash flows. However, we cannot assure that these proceedings or claims will not have a material adverse effect on our financial position, results of operations, or cash flows.

See "MD&A — Critical Accounting Policies and Estimates — Contingent Liabilities," "Risk Factors" and Note 14 to our consolidated financial statements for further discussion of legal proceedings.

ITEM 4. Submission Of Matters To A Vote Of Security Holders

Not applicable.

15

ITEM 5. Market For Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is traded on the New York Stock Exchange under the symbol "SPW."

Set forth below are the high and low sales prices for our common stock as reported on the New York Stock Exchange composite transaction reporting system for each quarterly period during the years 2008 and 2007, together with dividend information.

| | High | Low | Dividends per Share | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

2008 | |||||||||||

4th Quarter | $ | 77.00 | $ | 26.32 | $ | 0.25 | |||||

3rd Quarter | 133.52 | 81.97 | 0.25 | ||||||||

2nd Quarter | 139.72 | 104.55 | 0.25 | ||||||||

1st Quarter | 114.04 | 92.03 | 0.25 | ||||||||

| | High | Low | Dividends per Share | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

2007 | |||||||||||

4th Quarter | $ | 109.88 | $ | 90.72 | $ | 0.25 | |||||

3rd Quarter | 94.70 | 79.81 | 0.25 | ||||||||

2nd Quarter | 89.39 | 69.11 | 0.25 | ||||||||

1st Quarter | 71.86 | 60.98 | 0.25 | ||||||||

The actual amount of each quarterly dividend, as well as each declaration date, record date and payment date is subject to the discretion of the Board of Directors, and the target dividend level may be adjusted during the year at the discretion of the Board of Directors. The factors the Board of Directors consider in determining the actual amount of each quarterly dividend includes our financial performance and on-going capital needs, our ability to declare and pay dividends under the terms of our credit facilities and any other debt instruments, and other factors deemed relevant.

Issuer Purchases of Equity Securities

The following table summarizes the repurchases of common stock during the three months ended December 31, 2008:

Period | Total number of shares purchased(1) | Average price per share | Total number of shares purchased as part of a publicly announced plan or program | Maximum number of shares that may yet be purchased under the plan or program | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

9/28/08 – 11/1/08 | — | $ | — | — | — | |||||||||

11/2/08 – 11/29/08 | 1,600,000 | 34.34 | 1,600,000 | 1,400,000 | ||||||||||

11/30/08 – 12/31/08 | 1,775,000 | 33.95 | 1,775,000 | 2,625,000 | ||||||||||

Total | 3,375,000 | 3,375,000 | 2,625,000 | |||||||||||

Repurchases of common stock totaled $115.2 million during the three months ended December 31, 2008. The approximate number of shareholders of record of our common stock as of February 23, 2009 was 4,184.

16

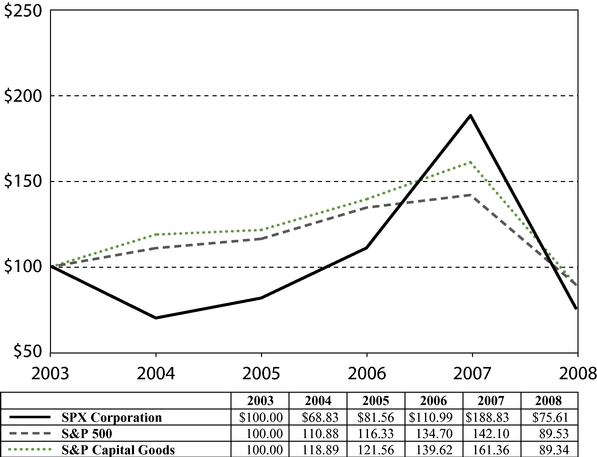

This graph shows a five year comparison of cumulative total returns for SPX, the S&P Composite Index and the S&P Capital Goods Index. The graph assumes an initial investment of $100 on December 31, 2003 and the reinvestment of dividends.

17

ITEM 6. Selected Financial Data

| | As of and for the year ended December 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||

| | (In millions, except per share amounts) | ||||||||||||||||

Summary of Operations | |||||||||||||||||

Revenues(1)(2) | $ | 5,855.7 | $ | 4,575.4 | $ | 3,934.4 | $ | 3,505.3 | $ | 3,317.9 | |||||||

Operating income(2)(3) | 473.4 | 413.7 | 299.3 | 245.4 | 22.4 | ||||||||||||

Other expense, net(4) | (7.8 | ) | (2.7 | ) | (25.9 | ) | (16.9 | ) | (6.9 | ) | |||||||

Interest expense, net(5)(6) | (105.1 | ) | (71.1 | ) | (50.2 | ) | (163.9 | ) | (153.2 | ) | |||||||

Equity earnings in joint ventures | 45.6 | 39.9 | 40.8 | 23.5 | 25.9 | ||||||||||||

Income (loss) from continuing operations before income taxes | 406.1 | 379.8 | 264.0 | 88.1 | (111.8 | ) | |||||||||||

(Provision) benefit for income taxes(7) | (152.9 | ) | (85.5 | ) | (50.7 | ) | (64.7 | ) | 38.8 | ||||||||

Income (loss) from continuing operations | 253.2 | 294.3 | 213.3 | 23.4 | (73.0 | ) | |||||||||||

Income (loss) from discontinued operations, net of tax(6) | (5.3 | ) | (0.1 | ) | (42.6 | ) | 1,066.6 | 55.9 | |||||||||

Net income (loss) | $ | 247.9 | $ | 294.2 | $ | 170.7 | $ | 1,090.0 | $ | (17.1 | ) | ||||||

Basic earnings (loss) per share of common stock: | |||||||||||||||||

Income (loss) from continuing operations | $ | 4.77 | $ | 5.37 | $ | 3.66 | $ | 0.33 | $ | (0.98 | ) | ||||||

Income (loss) from discontinued operations | (0.10 | ) | (0.01 | ) | (0.73 | ) | 15.00 | 0.75 | |||||||||

Net income (loss) per share | $ | 4.67 | $ | 5.36 | $ | 2.93 | $ | 15.33 | $ | (0.23 | ) | ||||||

Diluted earnings (loss) per share of common stock: | |||||||||||||||||

Income (loss) from continuing operations | $ | 4.68 | $ | 5.23 | $ | 3.53 | $ | 0.32 | $ | (0.98 | ) | ||||||

Income (loss) from discontinued operations | (0.09 | ) | (0.01 | ) | (0.70 | ) | 14.78 | 0.75 | |||||||||

Net income (loss) per share | $ | 4.59 | $ | 5.22 | $ | 2.83 | $ | 15.10 | $ | (0.23 | ) | ||||||

Dividends declared per share | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | $ | 1.00 | |||||||

Other financial data: | |||||||||||||||||

Total assets | $ | 6,121.6 | $ | 6,237.4 | $ | 5,437.1 | $ | 5,306.4 | $ | 7,588.5 | |||||||

Total debt | 1,344.7 | 1,567.8 | 962.5 | 780.7 | 2,526.1 | ||||||||||||

Other long-term obligations | 913.6 | 813.3 | 831.5 | 986.4 | 1,206.3 | ||||||||||||

Shareholders' equity | 2,010.8 | 2,006.0 | 2,109.4 | 2,111.2 | 2,127.8 | ||||||||||||

Capital expenditures | 116.4 | 82.6 | 49.2 | 37.8 | 29.4 | ||||||||||||

Depreciation and amortization | 104.5 | 73.5 | 67.7 | 61.7 | 65.4 | ||||||||||||

- (1)

- On December 31, 2007, we completed the acquisition of APV within our Flow Technology segment. Revenues for APV in 2007, 2006, 2005 and 2004, which are not included above, totaled approximately $876.0, $753.0, $653.0 and $712.0, respectively.