SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 31, 2015

or

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the period from to

Commission File No. 001-31390

CHRISTOPHER & BANKS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

| 06 - 1195422 |

(State or other jurisdiction of |

| (I.R.S. Employer |

incorporation or organization) |

| Identification No.) |

|

|

|

2400 Xenium Lane North, Plymouth, Minnesota |

| 55441 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code (763) 551-5000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

| Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

| New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ YES ☒ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ YES ☒ NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ YES ☐ NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ YES ☐ NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

Large accelerated filer ☐ |

| Accelerated filer ☒ |

|

|

|

Non-accelerated filer ☐ |

| Smaller reporting company ☐ |

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ YES ☒ NO

The aggregate market value of the Common Stock, par value $0.01 per share, held by non-affiliates of the registrant as of August 1, 2014, was approximately $313.6 million based on the closing price of such stock as quoted on the New York Stock Exchange ($8.67) on such date.

The number of shares outstanding of the registrant’s Common Stock, par value $0.01 per share, was 36.9 million as of April 3, 2015 (excluding treasury shares of 9.8 million).

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held (the “Proxy Statement”) are incorporated by reference into Part III.

CHRISTOPHER & BANKS CORPORATION

2014 ANNUAL REPORT ON FORM 10-K

1

General

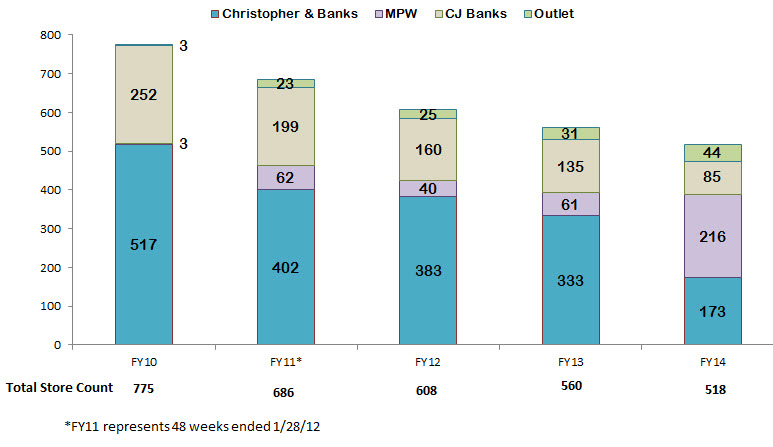

Christopher & Banks Corporation is a Minneapolis, Minnesota-based retailer of women’s apparel and accessories, which operates retail stores through its wholly owned subsidiaries, Christopher & Banks, Inc. and Christopher & Banks Company (collectively referred to as “Christopher & Banks”, “the Company”, “we�� or “us”). As of January 31, 2015, we operated 518 stores in 43 states, including 173 Christopher & Banks stores, 85 C.J. Banks stores, 216 Missy, Petite, Women ("MPW") stores and 44 outlet stores. We also operate an eCommerce web site for our brands at www.christopherandbanks.com which, in addition to offering the apparel and accessories found in our stores, also offers exclusive sizes and styles available only online.

The Company’s fiscal year is a 52- or 53-week year that ends on the Saturday closest to January 31. This Annual Report on Form 10-K ("Annual Report") covers the following fiscal periods: the fifty-two weeks ended January 31, 2015 ("fiscal 2014"), the fifty-two weeks ended February 1, 2014 ("fiscal 2013"), and the fifty-three weeks ended February 2, 2013 (“ fiscal 2012").

History

Christopher & Banks Corporation, a Delaware corporation, was incorporated in 1986 to acquire Braun’s Fashions, Inc., which had operated as a family-owned business since 1956. We became a publicly traded corporation in 1992 and, in July 2000, our stockholders approved a company name change from Braun’s Fashions Corporation to Christopher & Banks Corporation. Our women’s plus size C.J. Banks brand was developed internally and we opened our first C.J. Banks stores in August 2000. Our Christopher & Banks and C.J. Banks eCommerce websites began operating in February 2008 to further meet our customers’ needs for style, quality, value and convenience. During 2014, in keeping with our strategy to provide access to cross-shopping of brands and sizes, the two websites were combined into one, thereby providing a one-stop on-line shopping experience.

Christopher & Banks/C.J. Banks brands

Our Christopher & Banks brand offers unique and classic fashions featuring exclusively designed, coordinated assortments of women’s apparel and accessories in missy sizes 4 to 16 and petite sizes 4P to 16P in our Christopher & Banks stores. Our C.J. Banks brand offers similar assortments of apparel and accessories in women’s sizes 14W to 26W in our C.J. Banks stores. Our MPW stores, our outlet stores and our eCommerce website all offer merchandise from both our Christopher & Banks and C.J. Banks brands and all three size ranges (missy, petite and women) within each location, resulting in a greater opportunity to service our customers, increase store productivity, and enhance operating efficiencies.

The lifestyle brand assortments sold by Christopher & Banks and C.J. Banks are typically suitable for both work and leisure activities and are offered at moderate price points. The target customer for Christopher & Banks and C.J. Banks generally ranges in age from 45 to 60, a portion of which represents the female baby-boomer demographic.

Segments

For details regarding the operating performance of our reportable segment, see Note 18 - Segment Reporting, to the consolidated financial statements in Item 8.

2

Strategy

Our vision is to be our customer’s trusted brand by delivering style and value every day. Our mission is to provide her with the style and versatility that reflects who she is, the lasting quality and affordable value that she expects, and the personalized attention that she deserves.

We strive to provide our customer with experiences that make her look and feel her best. Our overall strategy for our two brands, Christopher & Banks and C.J. Banks, is to offer a compelling, fashion relevant merchandise assortment through our stores and eCommerce web site in order to satisfy our customers’ expectations for style, quality, value, versatility and fit, while providing knowledgeable and personalized customer service.

Customer insights gathered in 2014 validated our opportunity to refine our merchandising and visual presentation. While our loyal customers have great affinity for us, our opportunity is to strengthen our brand positioning and heighten our image to more closely mirror our merchandise assortment and to appeal to new customers. We learned that prospective customers are generally surprised and delighted by what they find once they experience our brand; however, we are still perceived by many as too conservative and casual. Therefore, creating an enhanced brand image will be an important focus for us in 2015.

We have positioned ourselves to offer merchandise assortments balancing unique, novelty apparel with more classic and basic core pieces, at affordable prices. To differentiate ourselves from our competitors, our buyers, working in conjunction with our internal design group, strive to create a merchandise assortment of coordinated outfits, the majority of which are manufactured exclusively for us under our proprietary Christopher & Banks® and C.J. Banks® brand names.

Merchandise

Our merchandise assortments include women’s apparel, generally consisting of knit tops, woven tops, jackets, sweaters, skirts, denim bottoms, bottoms made of other fabrics, leisure wear, and dresses in missy, petite and women sizes. We also offer a selection of jewelry and accessories in all stores and on our web site.

Our merchant team is currently focused on delivering increased sales and improved gross profit through executing the following initiatives:

Consistently deliver a balanced and compelling assortment designed to maximize sales and gross margin

The evolution of our merchandise strategy began in late fiscal 2012 and carried into fiscal 2013, through reducing the number of unique styles offered and increasing the depth provided in key merchandise categories. Our merchants focused on building assortments with fewer styles that are more balanced, by increasing the amount of "good" and "better" product offerings and decreasing the number of "best" offerings. More focus was placed on our core knit business and providing the appropriate balance of unique novelty styles. Our bottoms business concentrated on delivering consistent fit, versatility and comfort. We also continued to increase the penetration of vests and jackets in our assortments, balancing casual and wear-to-work styles at opening price points and more unique styles at "better" and "best" retail prices to maximize our price/value proposition.

In fiscal 2014, we continued to refine the merchandise assortment by balancing relevant fashion with core basic programs. We had considerable success in developing businesses in several key categories, including denim, solution bottoms, essential tees and accessories. In addition, we began to expand our assortment beyond casual wear, which we have been known for historically. We also made strides to become a wear-to-work destination, including items such as sweater twin sets, wrinkle resistant shirts and career tops and bottoms. We were pleased with the strong performance of our Relaxed Restyled; Leisure and Sport; and Easy Wear, Every Wear categories, which demonstrated that there is significant opportunity in these categories beyond our initial expectations. Collectively, we provided our customers with easy, complete outfitting solutions and complementary accessories.

3

We look forward to the launch of activewear, an additional component of our Relaxed Restyled line, as well as sleepwear, shapewear, and casual footwear, in the fall. Our ultimate goal is for our customers to view Christopher & Banks as her go-to destination for all of her lifestyle wardrobe needs.

Optimize inventory productivity and margin performance

Another key goal for us at Christopher & Banks is to maximize inventory productivity through focused and timely markdown management, refined analysis of the appropriate merchandise receipt level required to drive sales and improved margins, and ongoing refinement of the appropriate timing and number of major merchandise deliveries.

Historically, we have developed and delivered a full, unique merchandise assortment to our stores on a monthly basis. In order to simplify and accelerate our product development process, beginning in September 2012, we reduced the number of major product deliveries to our stores by half. These deliveries reflect increased depth with a greater number of units of key styles.

Late in fiscal 2013 and throughout 2014, we increased our penetration of core merchandise to optimize margin performance. Additionally, in fiscal 2014 we took initial steps to improve our business processes, enhance our technology and invest in new tools that will enable our planning and allocation team to manage inventory at the individual store level to better appeal to our customers’ preferences with a localized assortment. In fiscal 2015 we will continue to evaluate and improve the amount and timing of product flow between major assortment deliveries with the goal of consistently providing ongoing fresh colors and styles to our stores, while being consistently in stock on basics.

Enhanced promotional strategy

While we anticipate that we will need to continue to be selectively promotional in order to be competitive, we have implemented more targeted, pre-planned promotions in an effort to improve merchandise margins and lessen our reliance on storewide promotional events. We have also developed product that supports specific promotional events and delivers improved margin performance. In addition to our direct mail program, we continue to update our store signage and messaging to drive incremental traffic. As we design our product assortments, we are developing enhanced marketing programs to communicate these improvements to the customer. In addition, we have adopted a more focused and timely approach to our markdown process that more quickly addresses underperforming styles on an individual basis in an effort to utilize our markdowns as efficiently as possible. We are also placing a greater emphasis on liquidating merchandise in-store and utilizing our growing outlet store base as a liquidation channel for older product deliveries rather than utilizing a third-party liquidator.

Sourcing

We have analyzed and continue to assess our product development and sourcing practices to identify opportunities to simplify and accelerate the process. We directly imported approximately 39%, 37% and 28% of our merchandise purchases in fiscal 2014, 2013 and 2012, respectively, from overseas manufacturers. We are looking for opportunities to increase our direct penetration over the next several years as we believe this will add exclusivity and enhance our product margins. Going forward, we believe it is critical to continue to concentrate more of our merchandise purchases with fewer key suppliers to become more significant to our vendor base. We believe this will allow us to achieve better pricing by leveraging larger order quantities and receive faster delivery times from these key vendors. At the same time, we are working to ensure our vendor matrix is balanced to reduce the potential risks associated with reliance on limited resources. We also continue to leverage fabric purchases across our brands and product offerings to help minimize the cost of goods.

Our merchandise product costs, particularly the cost of cotton, moderated in fiscal 2012, declining to more historical levels in fiscal 2013 and 2014. We currently expect production costs to remain steady in fiscal 2015.

Labor issues at West Coast ports caused a disruption to our merchandise product flow in late fiscal 2014, continuing into fiscal 2015. Following a proposed settlement of those issues in early 2015, we expect product flow to return to normalized levels by the end of the second fiscal quarter.

4

Compelling and Easy-to-Shop Store Experience

In an effort to drive improved sales productivity, we continue to strive to enhance our customers’ experience. We have a highly loyal customer base largely attributable to our pleasant shopping environment and our engaged, knowledgeable store associates. We have refined our selling program, including a significant focus on service through personal connections with our customers while improving our store associates' product knowledge through more frequent collaboration with our merchant team. In addition, we have added new visual merchandising elements to our stores to maximize merchandise displays, highlight outfitting options and provide more compelling window presentations, incorporating product and marketing messages in order to drive increased numbers of new and existing customers into our stores. As we migrate stores to the MPW format, we have rebalanced fixtures, product placement and visual elements to assist customers of all sizes to quickly find the product they seek.

Customer/Marketing

Strengthen customer communication/customer relationship management/loyalty program

During 2014, in an effort to gain market share, we focused on increased retention and spend of existing customers while raising brand awareness to potential new customers. We garnered insights from both qualitative and quantitative research done over the year, including a brand tracking study and focus groups held throughout the year. In addition, we invested in new public relations initiatives, including the launch of our Amazing Women campaign, as well as gaining exposure in magazines, targeted local television and radio placement. We also expanded our presence on social media, increasing customer engagement and serving as a vehicle for customer acquisition. Digital marketing continues to offer immense opportunity as a viable marketing tool for us. During 2014, we gained efficiencies in our marketing investments through improved customer segmentation.

As we look to 2015, we expect to use a number of tools to drive brand awareness, including making greater use of digital paid media to drive traffic to both stores and on-line.

We continue to be focused on maximizing the benefits of our customer relationship management ("CRM") system database and Friendship Rewards Loyalty Program to strengthen engagement with our customers. Friendship Rewards is a point-based program where members earn points based on purchases. After reaching a certain level of accumulated points, members are rewarded with a certificate which may be applied towards purchases at our stores or web site. The program has helped us build our customer file in our database, allowing us to analyze purchasing behavior and to communicate with our customers. Our goal is to design a more effective and personalized reward system that is differentiated by level of loyalty and provides enhanced benefits, which we plan to roll out in the second half of fiscal 2015.

Grow private label credit card program

During fiscal 2012, we launched a private label credit card ("PLCC") program with a sponsoring bank which provides for the issuance of credit cards bearing the Christopher & Banks and C.J. Banks brands. The sponsoring bank manages and extends credit to our customers and is the sole owner of the accounts receivable generated under the program. As part of the program, we received a signing bonus of $0.5 million from the sponsoring bank and earn revenue based on the PLCC usage by our customers. We are pleased with our customers' acceptance of the program and have seen the number of opened accounts grow from 281,000 at the end of fiscal 2012, to over 782,000 at the end of fiscal 2014. In addition to the credit aspect of the PLCC, the card is tied into our Friendship Rewards Loyalty Program. For purchases on the PLCC, customers earn 1.5 times the standard loyalty program points. In fiscal 2014, approximately 31% of all sales were on the PLCC. In addition to signing up active customers, the program has been successful in re-engaging lapsed customers and attracting new customers. Of the PLCC customers who purchased our products in fiscal 2014, approximately 10% represented new customers and 11.5% represented reactivated customers. Late in fiscal 2013, we added the convenience of in-store payment, giving her another reason to visit our store.

5

Focus on Omni-Channel/Customer First initiative

In February 2008, we launched separate eCommerce web sites for our Christopher & Banks and C.J. Banks brands at www.christopherandbanks.com and www.cjbanks.com. In keeping with our strategy to provide easier access to cross-shopping of brands and sizes by our customers, during 2014 the two websites were combined into one at www.christopherandbanks.com, providing a one-stop on-line shopping experience. Today, the site generally offers the entire assortment of merchandise carried at our retail stores in addition to extended sizes and lengths, as well as some exclusive styles unique to eCommerce. Inventory and order fulfillment for our eCommerce operations are handled by a third-party provider. Returns can be made by our customers either by sending the product back to the third-party provider or by returning the product to one of our stores.

During 2014, several other visual upgrades and site enhancements were made to the website to improve the customers’ experience, aid in navigation, and simplify the check-out process. We believe we have further opportunities to leverage our eCommerce platform to gain brand awareness and improve our customers’ shopping experience.

Our increased focus on the customer during 2014 was the catalyst for our Omni-Channel, or “Customer First”, initiative. This program is 100% about offering our customers a seamless and fully integrated shopping experience – wherever, however, and whenever she interacts with our brand. By having an enhanced single view of the customer and inventory, we will be able to optimize her experience across all touch points.

The website referenced above and elsewhere in this Annual Report is for textual reference only and such references are not intended to incorporate our web site into this Annual Report.

Restructuring/Store Closing Initiative

Prior to fiscal 2012, the Board approved a plan to close approximately 100 stores, most of which were underperforming. Ultimately, 103 stores were identified for closure, and the occupancy costs for approximately half of our remaining stores were restructured.

Prior to fiscal 2012, we recorded approximately $21.2 million of restructuring and impairment charges related to this initiative. During fiscal 2012, we recorded a net benefit of $5.2 million related to stores where the amount recorded for net lease termination liabilities exceeded the actual settlements negotiated with landlords. There were no restructuring charges relating to the store closing initiative in fiscal 2013 or fiscal 2014. For further details, please refer to Note 2 - Restructuring in the consolidated financial statements.

Growth/MPW

After completing our store closing/restructuring initiative in fiscal 2012, we focused on increasing the number of MPW and outlet stores in fiscal 2013. We began fiscal 2014 with a total of 560 stores: 333 Christopher & Banks stores, 135 C.J. Banks stores, 61 MPW stores and 31 outlet stores. During fiscal 2014, we opened 10 new MPW stores and 13 outlet stores. In addition, we converted 190 existing Christopher & Banks and C.J. Banks stores into 146 MPW stores. During fiscal 2014 we also closed an additional 21 stores, substantially all of which were underperforming.

We ended the fiscal year with a total of 518 stores: 173 Christopher & Banks stores, 85 C.J. Banks stores, 216 MPW stores and 44 outlet stores. Approximately 66% of our leases expire within the next three fiscal years, which we believe will offer us significant flexibility to convert additional Christopher & Banks ("CB") and C.J. Banks ("CJ") stores into the MPW format.

Store count by format is as shown in the following graph:

6

Existing stores are primarily converted into MPW stores in the following ways:

· | where square footage is adequate: adding CJ product to an existing CB store; |

· | where square footage is insufficient: closing or expanding the CB store, opening a new, larger store and adding CJ product; |

· | in locations where both a CB and CJ store exist and square footage is adequate in one of the stores: closing one of the locations and combining the operations into the store that has adequate square footage; and |

· | in locations where both a CB and CJ store exist but square footage is not adequate: closing both stores and opening one new store with adequate square footage to combine operations. |

We continue to be very pleased with the performance of our MPW stores, which generate higher productivity per square foot, higher gross margin and higher operating margin than either our CB or CJ stores. We will continue to migrate existing stores to the MPW format by evaluating our portfolio of stores by location, lease and market data in order to determine the best way to leverage our square footage in terms of collapse and combine versus CJ adds.

Our new store growth strategy will primarily be focused on outlets. To-date, outlet store sales and profitability levels have exceeded our expectations. These stores enable us to expand our customer reach to new geographies and heighten brand awareness. We continue to see opportunity to further enhance the sales and operating margins of our outlets as we increase the percentage of made-for-outlet product in these stores, as well as more efficiently clearing our excess inventory through these stores. We see significant growth opportunity in the outlet business and believe we can successfully operate at least 100 outlet locations.

We plan to end fiscal 2015 with approximately 530 stores in total, of which approximately 337 will be in the MPW format. We plan to open 10 to 12 MPW stores and 25 to 30 outlets. Our real estate actions, collectively, are expected to result in a 5% increase in our total square footage in fiscal 2015.

7

Store Operations

We manage our store organization in a manner that encourages participation by our field associates in the execution of our business and operational strategies. Our store operations are organized geographically into districts and regions. Each district is managed by a district manager, who typically supervises an average of approximately 13 stores. We have several regional managers who supervise our district managers.

Information Technology

We see meaningful opportunity to further improve upon store productivity and operating margin as we focus on developing processes and upgrading systems that will enable us to better manage inventory by store. With these new and upgraded systems our teams will be able to better analyze data at the store level, and procure and allocate merchandise by geography, size, demographic and store type. We had previously been managing our business with legacy systems and by taking these steps to enhance our technology and leverage new tools, our team can get the right product into the right stores, leading to improved assortments, higher average unit retail (“AUR”), and better sell-through, which we expect to translate into higher merchandise margins.

Competition

The women’s retail apparel business is highly competitive. Our competitors include a broad range of national and regional retail chains that sell similar merchandise, including department stores, specialty stores, discount stores, mass merchandisers and Internet-based retailers. Many of these competitors are larger and have greater financial resources than we do, allowing them to engage in significant marketing campaigns and aggressive promotions. We believe that the principal basis upon which we compete is by providing fashionable, versatile, quality merchandise assortments at a great value and with a consistent fit. We also believe our visual merchandise presentation, personalized customer service and store locations help to differentiate us from our competition.

Employees

As of February 28, 2015, we had approximately 1,330 full-time and 3,275 part-time associates. The number of part-time associates typically increases during November and December in connection with the holiday selling season and during our semi-annual Friends & Family events. Approximately 225 of our associates are employed at our corporate office and distribution center facility, with the remaining associates employed in our store field organization. Our employees are not represented by a labor union or subject to a collective bargaining agreement. We have never experienced a work stoppage and consider our relationship with our employees to be good.

Seasonality

Our quarterly results may fluctuate significantly depending on a number of factors, including general economic conditions, consumer confidence, customer response to our seasonal merchandise mix, timing of new store openings, adverse weather conditions, shifts in the timing of certain holidays and shifts in the timing of promotional events.

Trademarks and Service Marks

Our wholly owned subsidiary, Christopher & Banks Company, is the owner of the federally registered trademarks and service marks “christopher & banks®,” which is our predominant private brand, and “cj banks®,” our private brand for women sizes 14W to 26W. Management believes these primary marks are important to our business and are recognized in the women’s retail apparel industry. Accordingly, we intend to maintain these marks and the related registrations. U.S. trademark registrations are for a term of ten years and are renewable every ten years as long as the trademarks are used in the regular course of trade. Management is not aware of any challenges to our right to use either of these marks.

8

Available Information

We make available, on or through our web site, located at www.christopherandbanks.com under the heading “Company - For Investors”, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, (the “Exchange Act”) as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”).

Our business is subject to a variety of risks and thus an investment in our stock is also subject to risk. The following risk factors should be read carefully in connection with evaluating our business and the forward-looking statements that are contained in this Annual Report on Form 10-K, as well as certain of our other filings with the SEC. Any of the following risks and uncertainties could materially adversely affect our business, financial condition, results of operations, cash flow, the trading price of our stock and the outcome of matters to which forward-looking statements are made in this Report. The risk factors described below should not be construed as an exhaustive list of all the risks we face. There may be other risk factors not identified in this Report, that are either not presently known to us or that we currently believe to be immaterial, that could cause materially adverse effects.

All of our stores are located within the United States, making us highly susceptible to macroeconomic conditions and consumer confidence in the United States, and both of these factors may have a significant impact on consumer demand for our apparel and accessories.

Our performance is subject to worldwide economic conditions, but is particularly impacted by those in the United States, and how those conditions in turn influence consumer spending levels. Apparel retailing is a cyclical industry that is highly dependent upon the overall level of consumer spending. Purchases of specialty apparel and related goods tend to be highly correlated with the cycles of the levels of disposable income for consumers and overall consumer confidence.

Consumer purchases of discretionary items generally decline during recessionary periods and other periods when disposable income is adversely affected. Any downturn in the U.S. economy may affect consumer purchases of our merchandise and have an adverse impact on our sales, results of operations and cash flows. Because apparel generally is a discretionary purchase, declines in consumer spending may have a more negative effect on apparel retailers than on other retailers. We may not be profitable if there is a decline in consumer spending.

In addition, economic conditions could negatively impact the Company's retail landlords and their ability to maintain their shopping centers in a first-class condition and otherwise perform their obligations, which in turn could negatively impact our sales, results of operations and cash flows.

The geographic concentration of our stores makes us particularly susceptible to economic conditions in a small number of states.

A significant portion of our total sales is derived from stores located in ten states: Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, Ohio, New York, Pennsylvania and Wisconsin. Therefore, we are particularly dependent on local economic conditions in these states. An economic downturn in any of these states that leads to decreased consumer spending could have a disproportionate negative impact on our sales, results of operations and cash flows.

The ability to attract customers to our stores that are located in regional malls and other shopping centers depends heavily on the success of the malls and the centers in which our stores are located, and any decrease in customer traffic to these malls and centers could cause our sales to be less than expected, which could adversely affect our results of operations and cash flow.

9

The majority of our current stores are located in shopping malls and other retail centers. Sales at these stores are derived in considerable part from the volume of traffic generated in those malls or retail centers and surrounding areas. To take advantage of customer traffic and the shopping preferences of our customers, we need to maintain or acquire stores in desirable locations where competition for suitable store locations is strong. Our stores benefit from the ability of nearby tenants to generate consumer traffic near our stores, and the continuing popularity of the regional malls and outlet, lifestyle and power centers where our stores are located. Customer traffic and, in turn, our sales volume may be adversely affected by a wide variety of factors. A reduction in customer traffic could result in lower sales and leave us with excess inventory. In such circumstances, we may have to respond by increasing markdowns or initiating marketing promotions to reduce excess inventory, which could adversely impact our merchandise margins and operating income.

Continuing to improve our store productivity will be largely dependent upon our success in converting stores to the missy, petite and women’s format (“MPW stores”) and the performance of our outlet stores, as well as in maintaining or increasing customer traffic in our stores and converting that traffic into sales.

Improving the profitability of our existing stores and optimizing store productivity is critical to our future growth and profitability. Our ability to increase the productivity of our stores will be largely dependent upon our ability to continue to rationalize our existing store portfolio, primarily through store conversions and new outlets, as well as our ability to generate customer traffic to our stores and to convert that traffic into sales.

Over the past several years, the Company has opened a number of outlet stores and either opened or converted existing stores into MPW stores. We expect that the continued conversion of stores to the MPW format and the opening of additional outlet stores will increase our store productivity by eliminating overlap in certain markets and allow management to focus its resources, such as store merchandise inventories and capital expenditures, on a more streamlined and more productive store base. If the improvements in store productivity are not at the level that we expect, our revenues, margins, liquidity and results of operations could be adversely affected.

We are subject to risks associated with leasing all of our store locations.

We currently lease all of our store locations. Our leases range from month-to-month to approximately ten years in length. A number of our leases have early termination provisions that apply if we do not achieve specified sales levels after an initial term and, in some cases, allow us to pay rent based on a percent of sales if we fail to achieve certain specified sales levels. The leases for approximately 33% of our store base expire between February 1, 2015 and January 30, 2016. We believe that, over the last few years, we have generally been able to negotiate favorable rental rates and extend leases due, in part, to the state of the economy and higher than usual vacancy rates. It is possible this trend may not continue and that we may not be able to renew our leases on as favorable terms, or in certain circumstances, at all. As a result, we may need to pay higher occupancy costs or close stores, which could adversely impact our financial performance, results of operations and ability to generate positive cash flow.

Our growth plan is dependent upon our ability to successfully implement our strategic and tactical initiatives.

The Company has implemented a growth plan that contemplates sales per store to grow at a low-single digit rate; improved selling, general and administrative expense leverage; and gross margin expansion intended to result in operating income as a percentage of net sales in the high single digits over the long term. Our ability to achieve our growth plan depends upon a variety of factors, including a number of factors that are beyond our control. If we are unable to successfully implement and execute the strategic and tactical initiatives underlying our growth plan, our results of operations could be adversely affected.

If we are unable to sustain an acceptable level of gross margins, it could have a material adverse impact on our business, profitability and liquidity.

The Company’s gross margins have improved over the past several fiscal years. However, our ability to maintain or improve these margins is subject to a variety of challenges. The apparel industry is subject to significant pricing pressure caused by many factors. These factors may cause us to reduce our sales prices to consumers, which could cause our gross margins to decline if we are unable to appropriately manage inventory levels and/or otherwise offset price reductions

10

with comparable reductions in our operating costs or cost of goods. If our sales prices decline and we fail to sufficiently reduce our product costs or operating expenses, it will adversely impact our operating income. This could have a material adverse effect on our results of operations, liquidity and financial condition.

Our sales and results of operations could be adversely affected if we fail to retain our current leadership team and to attract, develop and retain qualified employees.

Our business requires disciplined execution at all levels of our organization in order to timely deliver and display fashionable, quality merchandise in appropriate quantities in our stores. This execution requires experienced and talented management. Our continued success will also depend to a significant extent on the continued services of our executive officers and senior personnel. There can be no assurance that we will be able to retain their services.

There is considerable competition for personnel in the retail industry. Like most retailers, we experience significant employee turnover rates, particularly among store sales associates and store managers. We therefore must continually attract, hire and train new personnel to meet our staffing needs. If we are unable to maintain or lower our turnover rate or attract, train, assimilate and retain other skilled personnel in the future, we may not be able to service our customers as effectively, which could impair our ability to increase sales and could otherwise harm our business.

We operate in a highly competitive retail apparel industry. The size and resources of some of our competitors may allow them to compete more effectively than we can, which could reduce our revenues and gross margins.

The women's specialty retail apparel business is highly competitive. We believe we compete primarily with department stores, specialty stores, discount stores, mass merchandisers, business to consumer websites, off-price retailers and direct marketers that sell women's apparel. Because a number of our competitors are companies with greater financial, distribution, marketing and other resources available to them, and may offer a broader selection of merchandise than we do or maintain comparatively lower costs of operations, we may lack the resources to effectively compete with them. They may be able to adapt to changes in customer preferences more quickly, devote greater resources to the marketing and sale of their products, generate greater national brand recognition or adopt more aggressive pricing policies than we can. Given greater financial resources and larger staff, our competitors may be better able to prioritize and manage large or complex projects, as well as respond more quickly to economic, operational, regulatory or organizational changes. Further, we do not typically advertise using television or radio media and thus do not reach customers through methods some of our competitors may use. In addition to competing for sales, we compete for favorable store locations, lease terms and qualified associates. Increased competition in any of these areas may result in higher costs, which could reduce our revenue and gross margins.

Failure to successfully manage and execute our marketing initiatives could have a negative impact on our business.

Our future success and growth is dependent on both retaining existing customers and acquiring new customers in order to gain sales momentum in our stores and drive traffic to our website. Successful marketing efforts require the ability to reach customers through various methods of communication. A number of our marketing programs are planned well in advance of the date the related product is available for sale. Our inability to accurately predict our customers’ preferences, to utilize their desired mode of communication, or to ensure availability of advertised products could adversely affect our business and operating results.

Our ability to anticipate or react to changing consumer preferences in a timely and accurate manner and offer a compelling product at an attractive price impacts our sales, gross margins and results of operations.

Our success largely depends on our ability to consistently gauge and respond on a timely basis to fashion trends and provide a balanced assortment of merchandise that satisfies changing fashion tastes and customer demands for style, fit, quality and price. Forecasting consumer demand for our merchandise is challenging. In addition, our merchandise assortment differs from season to season and, at any given time, our assortment may not resonate with our customers in terms of style, fit, quality or price. Generally, we begin the design process for apparel six to nine months before the merchandise is available to customers, and we typically begin to make purchase commitments several months in advance of delivery to stores. These lead times can make it difficult for us to respond quickly to changes in the demand for our

11

products or to adjust the cost of the product in response to customers' fashion or price preferences. Any missteps may affect merchandise desirability and gross margins, and result in excess inventory levels, which could impair our profitability.

If we miscalculate the market for our merchandise, our customers' tastes or purchasing habits or the demand for our products, we may have fewer sales at an acceptable mark-up over cost. As a result, we may be required to sell a significant amount of unsold inventory at below-average markups over cost, or below cost, which would have an adverse effect on our margins and results of operations. On the other hand, if we underestimate demand for our merchandise, we may experience inventory shortages, resulting in missed sales opportunities and lost revenues.

There are risks associated with our eCommerce business.

We sell merchandise over the internet through our web site, www.christopherandbanks.com, which represents a modest percentage of our overall net sales. Our eCommerce operations are subject to numerous risks, including:

· | unanticipated operating problems; |

· | rapid technological change; |

· | the successful implementation of, and costs to implement, new systems and upgrades; |

· | reliance on a single third-party relating to the operation of the website, order fulfillment and customer service; |

· | reliance on third-party computer hardware and software; |

· | the need to invest in additional computer systems; |

· | diversion of sales from our stores; |

· | liability for on-line content; |

· | lack of compliance with, or violations of, applicable state or federal laws and regulations, including those relating to privacy and the resulting impact on consumer purchases; |

· | increased or unfavorable governmental regulation of eCommerce (which may include regulation of privacy, data protection, eCommerce payment services and other related topics); |

· | credit card fraud; |

· | system failures or security breaches and the costs to address and remedy such failures or breaches; and |

· | untimely delivery of our merchandise to our customers by third parties. |

If we do not successfully manage these operations, we may not realize the full benefits of our Omni-Channel business model, which could adversely affect our results of operations. There also can be no assurance that our eCommerce operations will meet our sales and profitability plans, and the failure to do so could negatively impact our revenues and earnings.

Costs of raw materials, commodities, transportation or labor may rise resulting in an increase in component and delivery costs, and overall product costs, all of which could erode margins and impact our profitability.

The raw materials and labor used to manufacture our products and our transportation and contract manufacturing labor costs are subject to availability constraints and price volatility. The results of our business operations could suffer due to significant increases or volatility in the prices of certain commodities, including but not limited to cotton, polyester and other items used in the production of fabric and accessories, as well as fuel, oil and natural gas. Price increases of these items or other inflationary pressures may result in significant cost increases for our raw materials, product components and finished products, as well as increases in the cost of distributing merchandise to our retail locations. Consequently, higher product costs as a result of one or more of these factors could have a negative effect on our gross profits, as we may not be able to pass such costs on to our customers.

Our reliance on foreign sources of production poses various risks.

For the last fiscal year, we directly imported approximately 39% of our merchandise, and much of the merchandise we purchase domestically is made overseas. Substantially all of our directly imported merchandise is manufactured in Asia.

12

Because a significant portion of our merchandise is produced overseas, we are subject to the various risks of doing business in foreign markets and importing merchandise from abroad, such as:

· | delays in the delivery of cargo; |

· | imposition of, or increases in, duties, taxes or other charges on imports; |

· | new legislation or regulations relating to increased tariffs, import quotas, embargoes, customs or other trade restrictions that may limit or prohibit merchandise that may be imported into the United States from countries or regions where we do business, or increase the cost or reduce the supply of the merchandise we purchase; |

· | financial or political instability in any of the countries in which our merchandise is manufactured; |

· | significant fluctuations in the value of the dollar against foreign currencies or restrictions on the transfer of funds, or additional trade restrictions imposed by the United States or foreign governments; |

· | supply chain security initiatives undertaken by the United States or foreign governments that delay or impede the delivery of imports and normal flow of product; |

· | delayed receipt or non-delivery of goods due to the failure of suppliers to comply with applicable import regulations; |

· | delayed receipt or non-delivery of goods due to labor strikes or unexpected or significant port congestion at United States or foreign ports; |

· | potential recalls or cancellations of orders for any merchandise that does not meet our quality standards; |

· | inability to meet our production needs due to labor shortages; |

· | natural disasters, extreme weather, political or military conflicts, terrorism, disease epidemics and public health related concerns, which could result in closed factories, reduced workforces, scarcity of raw materials and scrutiny or embargoing of goods produced in affected areas; and |

· | the United States may impose new initiatives that adversely affect the trading status of countries where our apparel is manufactured. These initiatives may include retaliatory duties or other trade sanctions that, if enacted, would increase the cost of products imported from countries where our suppliers manufacture merchandise. |

Any of the foregoing factors, or a combination of them, could increase our costs or result in our inability to obtain sufficient quantities of merchandise, thereby negatively impacting sales, gross profit and operating income.

It is also possible that the inability of our suppliers to access credit may cause them to extend less favorable terms to us, which could adversely affect our cash flows, margins and financial condition. Additionally, delays by our vendors in supplying our inventory needs could cause us to incur more expensive transportation charges, which may adversely affect our margins.

Our reliance on a few suppliers means that our business could suffer if we needed to replace them.

We do not own or operate any manufacturing facilities. Instead we depend on independent third parties to manufacture our merchandise. For the most recently completed fiscal year, our ten largest suppliers accounted for approximately 70% of the merchandise we purchased, and we purchased 27.6% and 9.5% of our goods respectively from our two largest suppliers.

We generally maintain non-exclusive relationships with the suppliers that manufacture our merchandise, and we compete with other companies for production facilities. As a result, we have no contractual assurances of continued supply or pricing, and any supplier, including our key suppliers, could discontinue selling to us at any time. Moreover, a key supplier may not be able to supply our inventory needs due to capacity constraints, financial instability or other factors beyond our control, or we could decide to stop using a supplier due to quality or other performance or cost issues. If we determined to cease doing business with one or more of our key suppliers or if a key supplier were unable to supply desired merchandise in sufficient quantities on acceptable terms, we could experience delays in receipt of inventory until

13

alternative supply arrangements were secured; such delays could result in lost sales and adversely effect our results of operations and cash flow.

If third parties with whom we do business do not adequately perform their functions, we might experience disruptions in our business, resulting in decreased profits, or losses, and damage to our reputation.

We depend upon independent third parties, both domestic and foreign, for the manufacture of all of the goods that we sell. The inability of a manufacturer to ship orders in a timely manner or to meet our standards could have a material adverse impact on our business.

We also use third parties in various aspects of our business to support our operations. We have a long-term contract with a third party to manage most of our eCommerce operations, including order management, order fulfillment and customer service. We rely on third parties to inspect the factories where our products are made for compliance with our vendor code of conduct. From time-to-time we may rely on a third party for assistance with the implementation and/or management of certain aspects of our information technology infrastructure. We also rely on third parties to transport merchandise and deliver it to our distribution center, as well as to ship merchandise to our stores and to our third-party eCommerce fulfillment center.

Failure by any of these third parties to perform these functions effectively and properly, or any disruption in our business relationships with any of these third parties, could negatively impact our operations, profitability and reputation.

Our business could suffer if one or more of our suppliers fails to comply with applicable laws or to follow acceptable labor practices, or is accused of such non-compliance.

We expect the manufacturers of the goods that we sell to operate in compliance with applicable laws and regulations and comply with our social compliance program. Although each of our purchase orders requires adherence to accepted labor practices, applicable laws and compliance with our vendor code of conduct, we do not supervise or control our suppliers or the manufacturers that produce the merchandise we sell. Our staff and the staff of third-party auditing services periodically visit to inspect the operations of a number of our independent manufacturers to, among other things, assess compliance with our vendor code of conduct. Nonetheless, we cannot ensure that these manufacturers will conduct their businesses using ethical or legal labor practices, and the violation of any labor or other laws, or the divergence from ethical labor practices, by any of our suppliers or their U.S. or non-U.S. factories could damage our reputation, interrupt or disrupt shipment of products, result in a decrease in customer traffic to our stores or website and adversely affect our sales and net income. Because manufacturers act in their own interests, they may act in a manner which results in negative public perceptions of us. Moreover, apparel companies can, in some cases, be held jointly liable for the wrongdoings of the manufacturers of their products. Therefore, in certain circumstances, we may be subject to liability or negative publicity which could adversely affect our brand and our business as a result of actions or a lack of actions taken by these manufacturers.

Our business could suffer if parties with whom the Company does business become insolvent or otherwise become unable or unwilling to perform their obligations to the Company.

We are party to contracts, transactions and business relationships with various third parties, including vendors, suppliers, service providers and lenders, pursuant to which such third parties have performance, payment and other obligations to us. If any of these third parties were to become subject to bankruptcy, receivership or similar proceedings, our rights and benefits pursuant to these contracts, transactions and business relationships with such third parties could be terminated, modified in a manner adverse to us, or otherwise impaired. We cannot make any assurance that we would be able to arrange alternate or replacement contracts, transactions or business relationships with other third parties on terms as favorable as our existing contracts, transactions or business relationships, if at all. Any inability on our part to do so could negatively affect our cash flows, financial condition and business.

14

There are risks relating to the transportation of our merchandise to our distribution center, to our stores, and to our eCommerce customers.

We currently rely upon independent third-party transportation providers for substantially all of our merchandise shipments, including shipments to our distribution center, our stores, our eCommerce fulfillment center and our eCommerce customers. Our use of outside delivery services for shipments is subject to a variety of risks which may impact a shipper's ability to provide delivery services that adequately meet our shipping needs. If we change shipping companies, we could face logistical difficulties that could adversely impact deliveries and we would incur costs and expend resources in connection with such a change. Moreover, we may not be able to obtain terms as favorable as those received from the independent third-party transportation providers we currently use, which would increase our costs.

In addition, because the vast majority of our products are shipped by ocean from overseas, there are risks associated with a disruption in the operation of ports through which our products are imported. If a disruption occurs, we are likely to experience delays in the receipt of products, and we or our suppliers may have to find alternative shipping methods, possibly at greater expense, increased lead times and increased costs of our goods, which could have a material adverse effect on our results of operations and cash flows. As a large part of our merchandise is produced in Asia, it is largely shipped to us through the ports on the West Coast. The lengthy and contentious contract negotiations with respect to longshore labor agreements on the West Coast have resulted in port slowdowns and port congestion, which in turn has led to the delayed receipt of merchandise and adjustments in our marketing promotions as a result. These delays may result in lost sales and lower gross margins due to the lack of seasonality of the product at time of receipt, and thus adversely affect our results of operations, gross profit and cash flows.

We depend on a single facility to conduct our operations and distribute our merchandise. Our business could suffer a material adverse effect if this facility were shut down or its operations severely disrupted.

Our corporate headquarters and our only distribution facility are located in one facility in Plymouth, Minnesota. Our distribution facility supplies merchandise to our retail stores and our third party eCommerce provider. Any serious disruption to our distribution facility or a shut down for any reason, could delay shipments to stores and our eCommerce fulfillment center and result in inventory shortages which could negatively impact our sales and results of operations. In addition, much of our computer equipment and all of our senior management, including critical resources dedicated to merchandising, finance and administrative functions, are located at our corporate headquarters. In the event of a disaster or other calamity impacting our corporate facility, our management and staff would have to find and operate out of other suitable locations. We have little experience operating essential functions away from our main corporate offices and are uncertain what effect operating such satellite facilities might have on business, personnel and results of operations.

Although we maintain business interruption and property insurance, we cannot be assured that our insurance coverage will be sufficient or that any insurance proceeds will be timely paid to us if our distribution center or corporate offices were shut down for any unplanned reason.

If our long-lived assets become impaired, we may need to record significant non-cash impairment charges.

Periodically, we review our long-lived assets for impairment whenever economic events or changes in circumstances indicate that the carrying value of an asset may not be recoverable. Significant negative industry or general economic trends, disruptions to our business and unexpected significant changes or planned changes in our use of the assets (such as store relocations or closures) may result in impairment charges. Any such impairment charges, if significant, would adversely affect our financial position and results of operations.

Adverse and/or unseasonable weather conditions in the United States could have a disproportionate effect on our business, financial condition and results of operations.

Adverse weather conditions in the areas in which our stores are located could have an adverse effect on our business, financial condition and results of operation. For example, inclement weather conditions can make it difficult for our customers to travel to our stores and/or result in temporary store closures or reduced hours of operation. This will likely

15

result in reduced traffic in our stores and a corresponding reduction in sales and gross margin dollars. Our business is also susceptible to unseasonable weather conditions. For example, extended periods of unseasonably warm temperatures during the winter season or cool weather during the summer season could render a portion of our merchandise offerings incompatible with those unseasonable conditions in the affected areas. Such unseasonable weather conditions could have an adverse effect on our business, financial condition and results of operations.

Natural disasters, acts of war or other catastrophes could adversely affect our financial performance.

The occurrence of one or more natural disasters, pandemic outbreaks, terrorist acts, disruptive global political events, or similar catastrophes could adversely affect our operations and financial performance. To the extent these events result in the closure of our distribution center, corporate headquarters, or a significant number of our stores, or impact one or more of our key third-party providers of services or goods, our operations and financial performance could be adversely affected. These events also could have indirect consequences, such as loss of property or other damage which may or may not be covered by insurance.

We are heavily dependent on our information technology systems and our ability to maintain and upgrade these systems from time-to-time and operate them in a secure manner. Any failure, interruption or compromise of these systems could have a material adverse effect on our business, results of operation and cash flows.

The efficient operation of our business is heavily dependent on our information technology systems (“IT systems”). In particular, we rely on point-of-sale terminals, which provide information to our host analysis systems used to track sales and inventory, and we rely on our eCommerce website through which we sell merchandise to our customers. The host systems help integrate our design, third-party manufacturing, distribution and financial functions, and we integrate with our reporting structure to provide daily financial and sales information. Although our data is backed up and securely stored off-site, our main data center is located at our headquarters in Plymouth, Minnesota. The data center and our operations are vulnerable to damage or interruption from:

· | fire, flood and other natural disasters; |

· | generator loss, computer systems failures, technical malfunctions, inadequate systems capacity, Internet and telecommunications or data network failures, operator negligence, improper operation by or supervision of employees and similar events; |

· | physical and electronic loss of data or security breaches, IT systems appropriation and similar events; and |

· | computer viruses or software bugs. |

Any disruption in the operation of our IT systems, the loss of key employees knowledgeable about such systems or our failure to continue to effectively enhance such systems could interrupt our operations or interfere with our ability to sell goods in-store, which could result in reduced sales and affect our operations and financial performance. In addition, any interruption in the operation of our Internet website could cause us to lose sales due to the temporary inability of customers to purchase merchandise through our website.

From time-to-time, we improve and upgrade our IT systems and the functionality of our Internet website in an effort to ensure they meet our evolving business and security needs and are adequate to handle business growth. The cost of any such system upgrades or enhancements can be significant. We are currently in the process of implementing our Customer First initiative which involves an upgrade to, and greater integration among, our customer relationship management system, our order management system and our eCommerce and brick and mortar stores. If we are unable to maintain and upgrade our operating systems or Internet website, or effectively integrate new and updated systems, software or changes to our operating systems or our Internet website in an efficient, timely and secure manner, our business, financial condition and results of operations could be materially and adversely affected. While we believe that we are diligent in selecting vendors, systems and third party providers to assist us in maintaining the integrity of our information technology systems, we realize that there are risks and that no guarantee can be made that future disruptions, service outages and failures or unauthorized intrusions will not occur.

16

We are subject to cyber security risks and may incur additional expenses in order to mitigate such risks or in response to unauthorized access to our data. In addition, an incident in which we fail to protect our customers' information against a security breach could result in costly government enforcement actions and monetary damages against us from private litigation and could otherwise damage our reputation, harm our business and adversely impact our results of operations.

The Company and our third-party service providers that manage portions of the Company’s data are subject to cyber security risk. The nature of our business involves the receipt and transmission, and in some cases storage, of customers’ personal information, shopping preferences and credit and debit card information, in addition to employee information and the Company’s financial and strategic data. The protection of our customers’ data, as well as internal Company data is vitally important to the Company. The Company and its third-party service providers employ systems and/or websites that are intended to provide secure storage and/or transmission of proprietary or confidential information by us and these third-party service providers. While the Company has implemented measures to prevent and detect security breaches and cyber incidents, any failure of these measures and any failure of third parties that assist the Company in managing its data could adversely affect the Company's business, financial condition and results of operations.

Although the Company expects our third-party service providers to implement and use reasonable security measures to protect the proprietary and confidential information once it is received, we cannot control these service providers and cannot guarantee that a security breach will not occur in the future either at their location or within their systems. Because the techniques used to obtain unauthorized access to data, disable or degrade storage service, or sabotage systems change frequently and may be difficult to detect, we and the service providers may be unable to anticipate these techniques or implement adequate preventive measures. Unauthorized parties may also attempt to gain access to our systems or facilities, or those of third parties acting on our behalf, through fraud, trickery or other forms of deceiving our employees or those of our third-party providers. Despite our preventative efforts and those of our third-party service providers, we may be vulnerable to targeted or random security breaches, privacy attacks, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events which could expose us and our third-party service providers to a risk of loss or misuse of proprietary and confidential information, litigation and potential liability. Cyber security attacks may be targeted at us, our third-party service providers, or our customers. Actual or anticipated attacks may cause us to incur significant additional expense, including costs to deploy additional personnel and protection technologies, train employees, and engage third-party experts and consultants. Any cyber security or security breaches, including any breaches that result in theft, transfer or unauthorized disclosure of customer, employee or company information, or our lack of compliance with information security and privacy laws and regulations, may result in a violation of applicable privacy and other laws, significant legal and financial exposure, including claims for unauthorized purchases with stolen credit card information, impersonation or other similar fraud claims, and considerable other additional expenses. Some or all of these costs may not be adequately covered by our insurance, and could result in a loss of confidence in our security measures, any or all of which could have an adverse effect on our brand, business and reputation.

Consumer awareness and sensitivity to privacy breaches and cyber security threats is very prevalent. Any misappropriation of confidential or personally identifiable information gathered, stored or used by us or our service providers, be it intentional or accidental, could have a material impact on the operation of our business, including severely damaging our reputation and our relationships with our customers, employees and investors. Should customers lose confidence in our ability to protect their information, they may discontinue shopping in our stores or on our website.

State and federal laws on privacy continue to evolve and further limits on how we collect or use customer information could adversely affect our business.

We collect and store customer information primarily for marketing purposes. Some of this information is subject to federal and state privacy laws. These laws and the judicial interpretation of such laws are evolving on a frequent basis. If we fail to comply with these laws, we may be subject to fines or penalties, which could impact our business, financial condition and results of operations. In addition, any compromise of customer information could subject us to customer, third-party or government litigation and harm our reputation, which could adversely affect our business and financial condition. Any limitations imposed on the use of such customer information, whether imposed by federal or state governments or business partners, could have an adverse effect on our future marketing activities. Governmental focus on data security and/or privacy may lead to additional legislative action, and the increased emphasis on information

17

security may lead customers to request that we take additional measures to enhance security. As a result, we may have to modify our business with the goal of further improving data security, which would result in increased expenses and operating complexity.

A failure to comply with the Payment Card Industry Data Security Standards could adversely affect our business, financial condition and results of operations.

We are highly dependent on the use of credit and debit cards to complete sale transactions in our stores and through our website, and because of such use are subject to the Payment Card Industry Data Security Standards (“PCI Standards”). If we fail to comply with the PCI Standards, we may become subject to fines or limitations on our ability to accept credit or debit cards, which could adversely affect our sales and operating income. Also, any changes we may be required to make to our private label credit card program in the future could adversely affect the promotional financing arrangements available to our credit card customers and therefore our operating results.

The sufficiency and availability of our sources of liquidity may be affected by a variety of factors.

The sufficiency and availability of our sources of liquidity may be affected by a variety of factors, including, without limitation: (i) the level of our operating cash flows, which are impacted by consumer acceptance of our merchandise, general economic conditions and the level of consumer discretionary spending; and (ii) our ability to maintain borrowing availability and to comply with applicable covenants contained in our Credit Facility.

Our ability to continue to be profitable and to generate positive cash flows is dependent upon many factors, including favorable economic conditions and consumer confidence and our continued successful ability to execute our financial plan and strategic and tactical initiatives. There can be no assurance that our cash flows from operations will be sufficient at all times to support our Company without additional financing or credit availability. An inability to generate sufficient cash flow could have important consequences. For example, it could:

· | increase our vulnerability to general adverse economic and industry conditions; |

· | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

· | limit our ability to borrow money; |

· | make it more difficult for us to open new stores or improve or expand existing stores; and |

· | require us to incur significant additional indebtedness. |

Should we be unable in the future to borrow under the Credit Facility, it is possible, depending on the cause of our inability to borrow, that we may not have sufficient cash resources for our operations. If that were to occur, our liquidity would be significantly impaired, which could have a material adverse effect on our business, financial condition and results of operations.

Access to additional financing from the capital markets may be limited.

While we have availability under our Credit Facility to bolster our liquidity, we may need additional capital to fund our operations, particularly if our operating results and cash flows from operating activities were to decrease or if the Credit Facility were unavailable. The sale of additional equity securities or convertible debt securities in order to improve our liquidity could result in additional dilution to our stockholders. If we borrow under our Credit Facility or incur other debt, our expenses will increase and we could be subject to additional restrictions that may limit our operating flexibility. Newly issued securities may have rights, preferences and privileges that are senior or otherwise superior to those of our common stock. There is no assurance that equity or debt financing will be available in amounts or on terms acceptable to us. Without sufficient liquidity, we will be more vulnerable to any future downturns in our business or the general economy. Future increases in interest rates or other tightening of the credit markets, or future turmoil in the financial markets, could make it more difficult for us to access funds, to refinance our indebtedness (if necessary), to enter into agreements for new indebtedness, or to obtain funding through the issuance of our securities.

18

New regulations related to conflict minerals could adversely impact our business.

The SEC has promulgated final rules pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act regarding disclosure of the use of tin, tantalum, tungsten and gold, known as conflict minerals, included in components of products either manufactured by public companies or for which public companies have contracted to manufacture. These rules require due diligence to determine whether such minerals originated from the Democratic Republic of Congo (the “DRC”) or an adjoining country and whether such minerals helped finance the armed conflict in the DRC. The first conflict minerals report required by the rules was filed as required by June 2, 2014 and is due annually thereafter. While we do not manufacture products, we may be deemed to contract to manufacture products. There will be costs associated with complying with these disclosure requirements, including costs to determine the origin of conflict minerals used in any products we are deemed to contract to manufacture. In addition, by Executive Order in July 2014, the President expanded the sanctions criteria against United States companies to include the direct or indirect support of entities that engage in the illicit trade of the natural resources of the DRC. Complying with these rules and sanctions could adversely affect the sourcing, supply and pricing of materials used in our products. Also, we may face reputational challenges and potential fines or penalties if we fail to comply with these rules and sanctions.

Our ability to maintain the value of our brands and our trademarks impacts our business and financial performance.

The Christopher & Banks and C.J. Banks brand names are integral to our business. Maintaining, promoting, positioning and growing our brands will depend largely on the success of our design, merchandising and marketing efforts and on our ability to provide a consistent and positive customer experience. Also, our success depends on our ability to retain existing customers and attract new customers to shop our brand. Our business could be adversely affected if we fail to achieve these objectives for our brands. In addition, our public image and reputation could be tarnished by negative publicity. Any of these events could negatively impact sales.