Second quarter 2024 EARNINGS CALL August 6, 2024 Exhibit 99.2

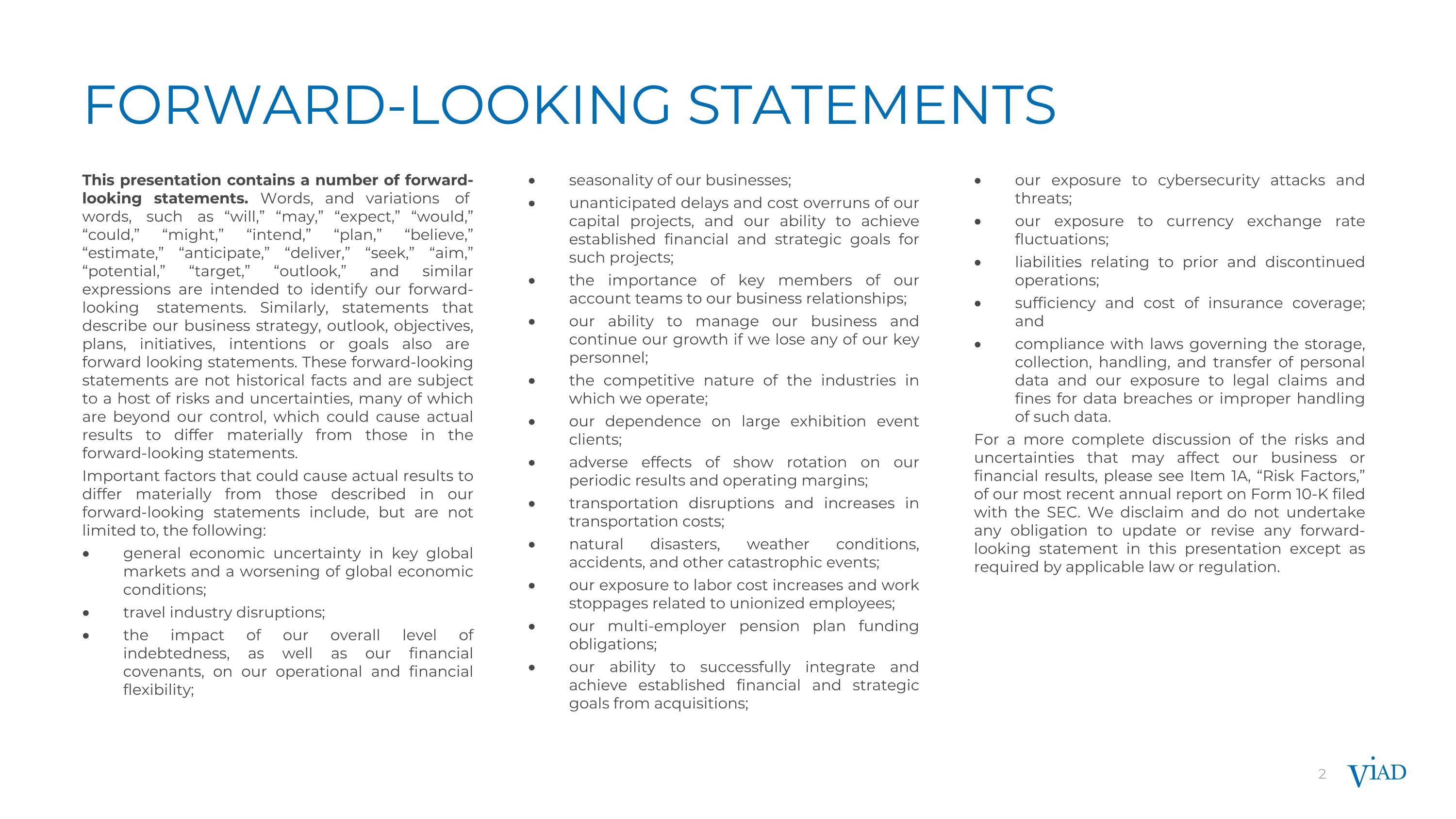

Forward-looking statements This presentation contains a number of forward-looking statements. Words, and variations of words, such as “will,” “may,” “expect,” “would,” “could,” “might,” “intend,” “plan,” “believe,” “estimate,” “anticipate,” “deliver,” “seek,” “aim,” “potential,” “target,” “outlook,” and similar expressions are intended to identify our forward-looking statements. Similarly, statements that describe our business strategy, outlook, objectives, plans, initiatives, intentions or goals also are forward looking statements. These forward-looking statements are not historical facts and are subject to a host of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those in the forward-looking statements. Important factors that could cause actual results to differ materially from those described in our forward-looking statements include, but are not limited to, the following: general economic uncertainty in key global markets and a worsening of global economic conditions; travel industry disruptions; the impact of our overall level of indebtedness, as well as our financial covenants, on our operational and financial flexibility; seasonality of our businesses; unanticipated delays and cost overruns of our capital projects, and our ability to achieve established financial and strategic goals for such projects; the importance of key members of our account teams to our business relationships; our ability to manage our business and continue our growth if we lose any of our key personnel; the competitive nature of the industries in which we operate; our dependence on large exhibition event clients; adverse effects of show rotation on our periodic results and operating margins; transportation disruptions and increases in transportation costs; natural disasters, weather conditions, accidents, and other catastrophic events; our exposure to labor cost increases and work stoppages related to unionized employees; our multi-employer pension plan funding obligations; our ability to successfully integrate and achieve established financial and strategic goals from acquisitions; our exposure to cybersecurity attacks and threats; our exposure to currency exchange rate fluctuations; liabilities relating to prior and discontinued operations; sufficiency and cost of insurance coverage; and compliance with laws governing the storage, collection, handling, and transfer of personal data and our exposure to legal claims and fines for data breaches or improper handling of such data. For a more complete discussion of the risks and uncertainties that may affect our business or financial results, please see Item 1A, “Risk Factors,” of our most recent annual report on Form 10-K filed with the SEC. We disclaim and do not undertake any obligation to update or revise any forward-looking statement in this presentation except as required by applicable law or regulation.

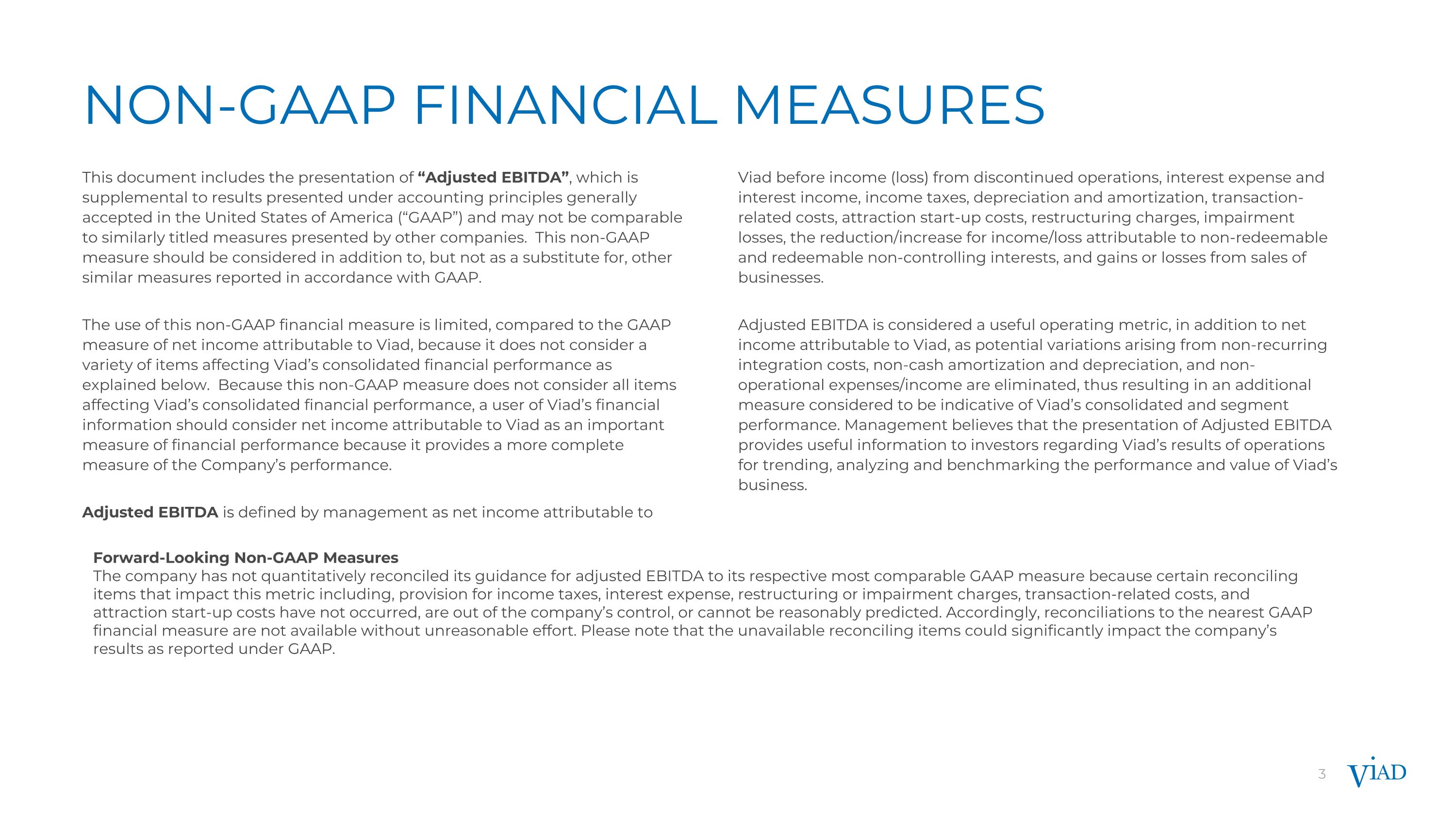

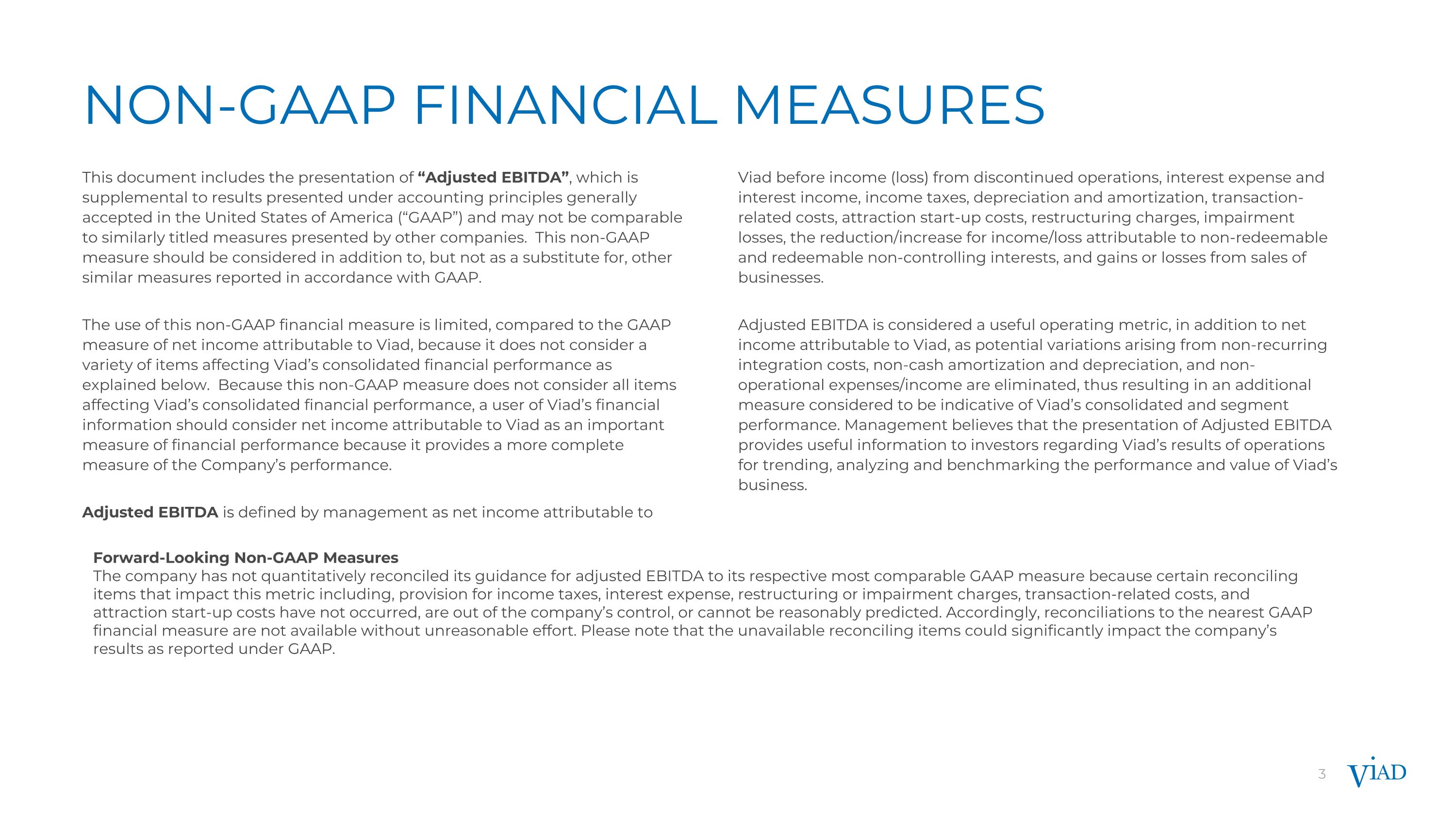

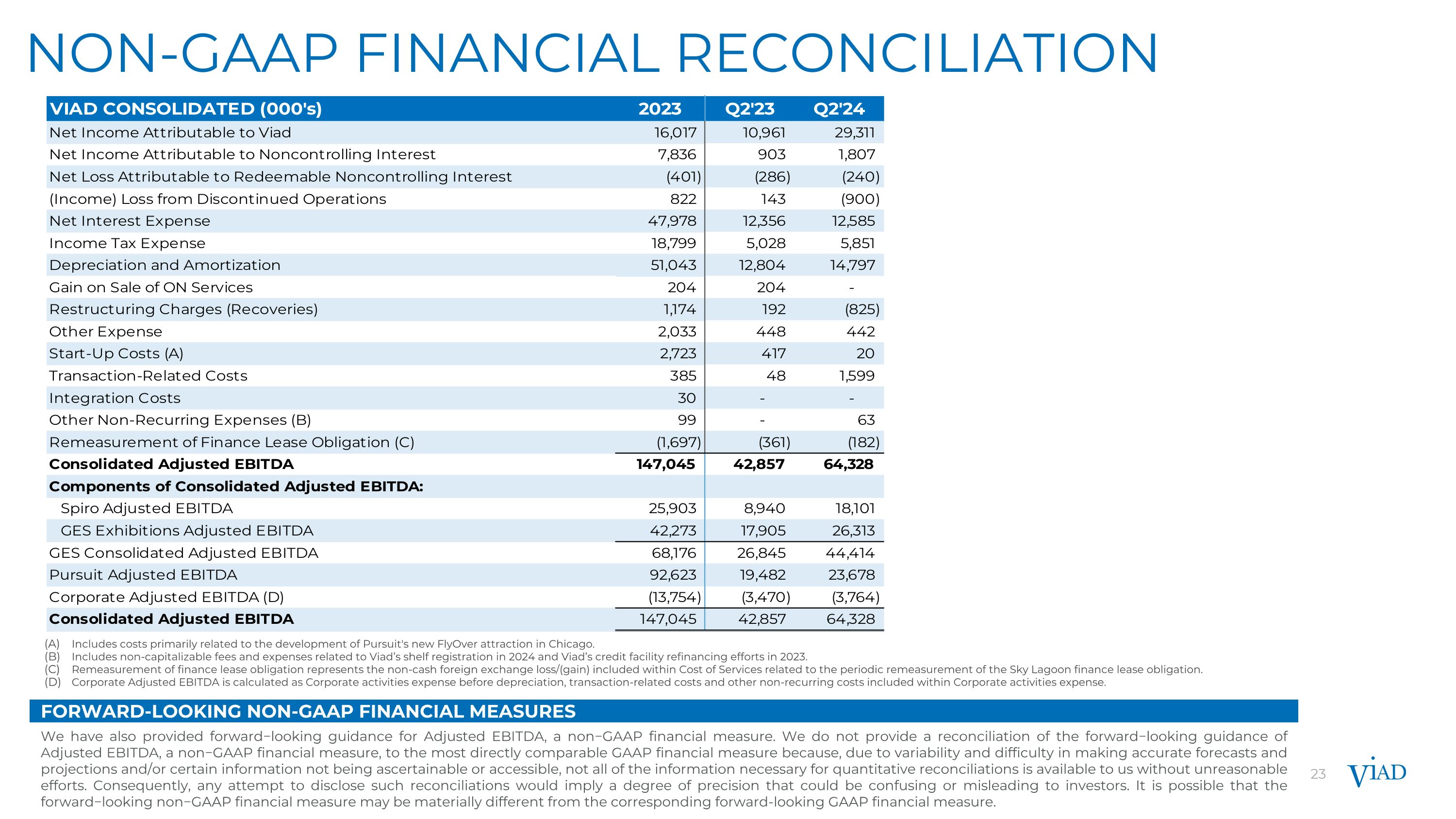

NON-GAAP FINANCIAL MEASURES This document includes the presentation of “Adjusted EBITDA”, which is supplemental to results presented under accounting principles generally accepted in the United States of America (“GAAP”) and may not be comparable to similarly titled measures presented by other companies. This non-GAAP measure should be considered in addition to, but not as a substitute for, other similar measures reported in accordance with GAAP. The use of this non-GAAP financial measure is limited, compared to the GAAP measure of net income attributable to Viad, because it does not consider a variety of items affecting Viad’s consolidated financial performance as explained below. Because this non-GAAP measure does not consider all items affecting Viad’s consolidated financial performance, a user of Viad’s financial information should consider net income attributable to Viad as an important measure of financial performance because it provides a more complete measure of the Company’s performance. Adjusted EBITDA is defined by management as net income attributable to Viad before income (loss) from discontinued operations, interest expense and interest income, income taxes, depreciation and amortization, transaction-related costs, attraction start-up costs, restructuring charges, impairment losses, the reduction/increase for income/loss attributable to non-redeemable and redeemable non-controlling interests, and gains or losses from sales of businesses. Adjusted EBITDA is considered a useful operating metric, in addition to net income attributable to Viad, as potential variations arising from non-recurring integration costs, non-cash amortization and depreciation, and non-operational expenses/income are eliminated, thus resulting in an additional measure considered to be indicative of Viad’s consolidated and segment performance. Management believes that the presentation of Adjusted EBITDA provides useful information to investors regarding Viad’s results of operations for trending, analyzing and benchmarking the performance and value of Viad’s business. Forward-Looking Non-GAAP Measures The company has not quantitatively reconciled its guidance for adjusted EBITDA to its respective most comparable GAAP measure because certain reconciling items that impact this metric including, provision for income taxes, interest expense, restructuring or impairment charges, transaction-related costs, and attraction start-up costs have not occurred, are out of the company’s control, or cannot be reasonably predicted. Accordingly, reconciliations to the nearest GAAP financial measure are not available without unreasonable effort. Please note that the unavailable reconciling items could significantly impact the company’s results as reported under GAAP.

Q2’24 Earnings Call HIGHLIGHTS Strong second quarter results exceed prior guidance 1 GES show performance and client spend remain strong; raising full year outlook 2 Pursuit experiencing stronger guest demand; wildfires in Jasper bring uncertainty to full year outlook 3

FINANCIAL PERFORMANCE

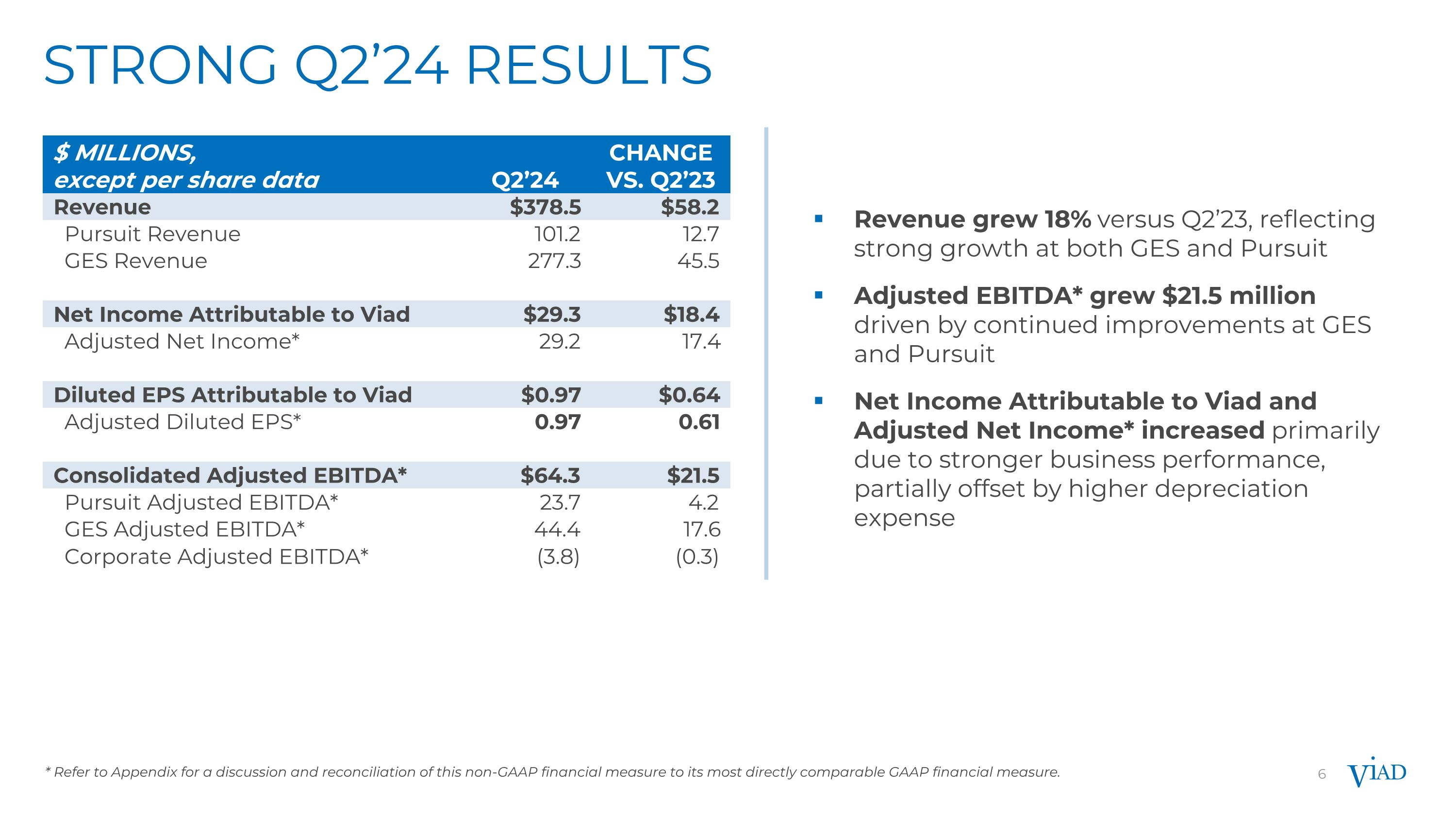

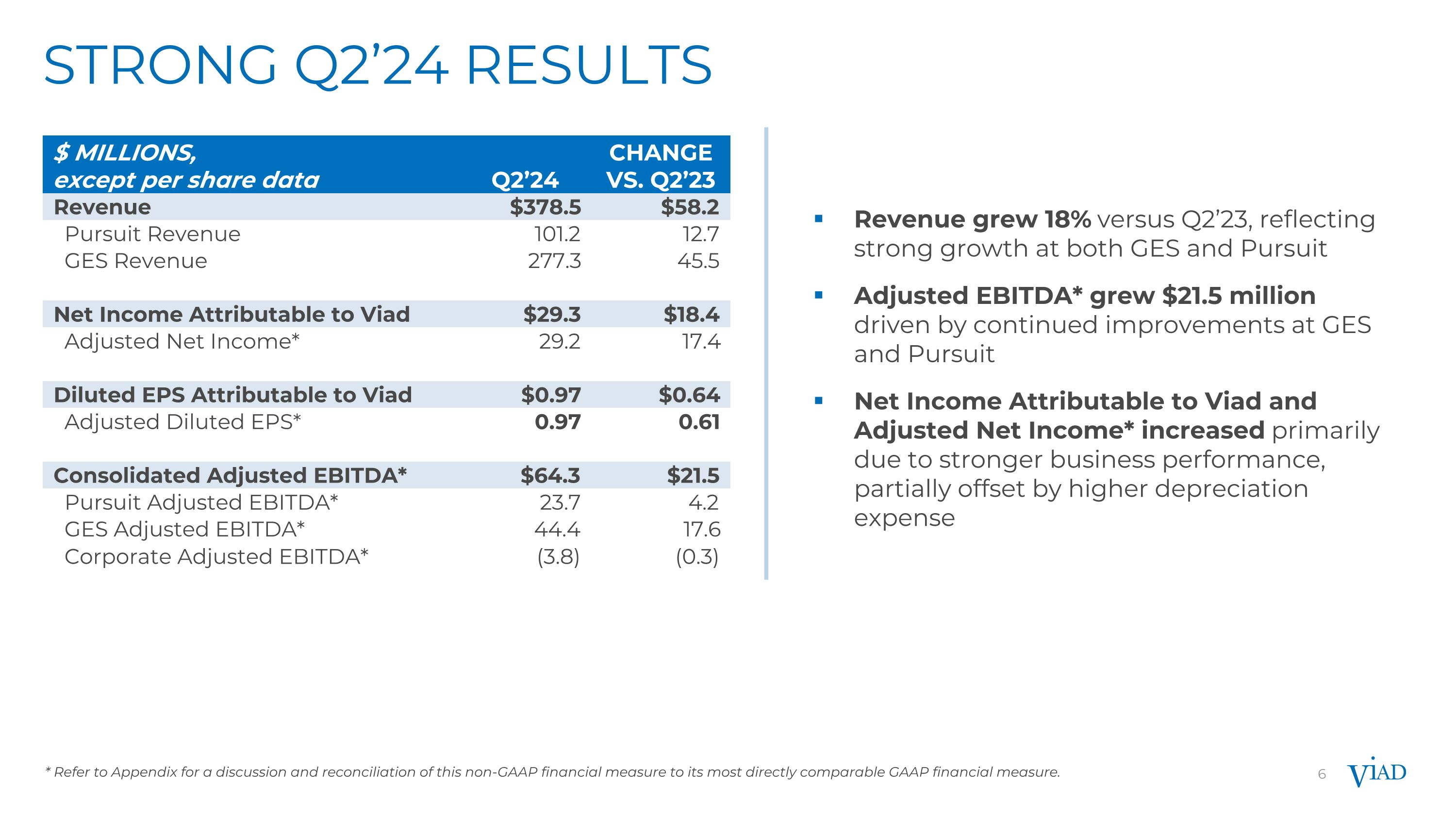

6 STRONG Q2’24 RESULTS Revenue grew 18% versus Q2’23, reflecting strong growth at both GES and Pursuit Adjusted EBITDA* grew $21.5 million driven by continued improvements at GES and Pursuit Net Income Attributable to Viad and Adjusted Net Income* increased primarily due to stronger business performance, partially offset by higher depreciation expense * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. $ MILLIONS, except per share data Q2’24 CHANGE VS. Q2’23 Revenue $378.5 $58.2 Pursuit Revenue 101.2 12.7 GES Revenue 277.3 45.5 Net Income Attributable to Viad $29.3 $18.4 Adjusted Net Income* 29.2 17.4 Diluted EPS Attributable to Viad $0.97 $0.64 Adjusted Diluted EPS* 0.97 0.61 Consolidated Adjusted EBITDA* $64.3 $21.5 Pursuit Adjusted EBITDA* 23.7 4.2 GES Adjusted EBITDA* 44.4 17.6 Corporate Adjusted EBITDA* (3.8) (0.3)

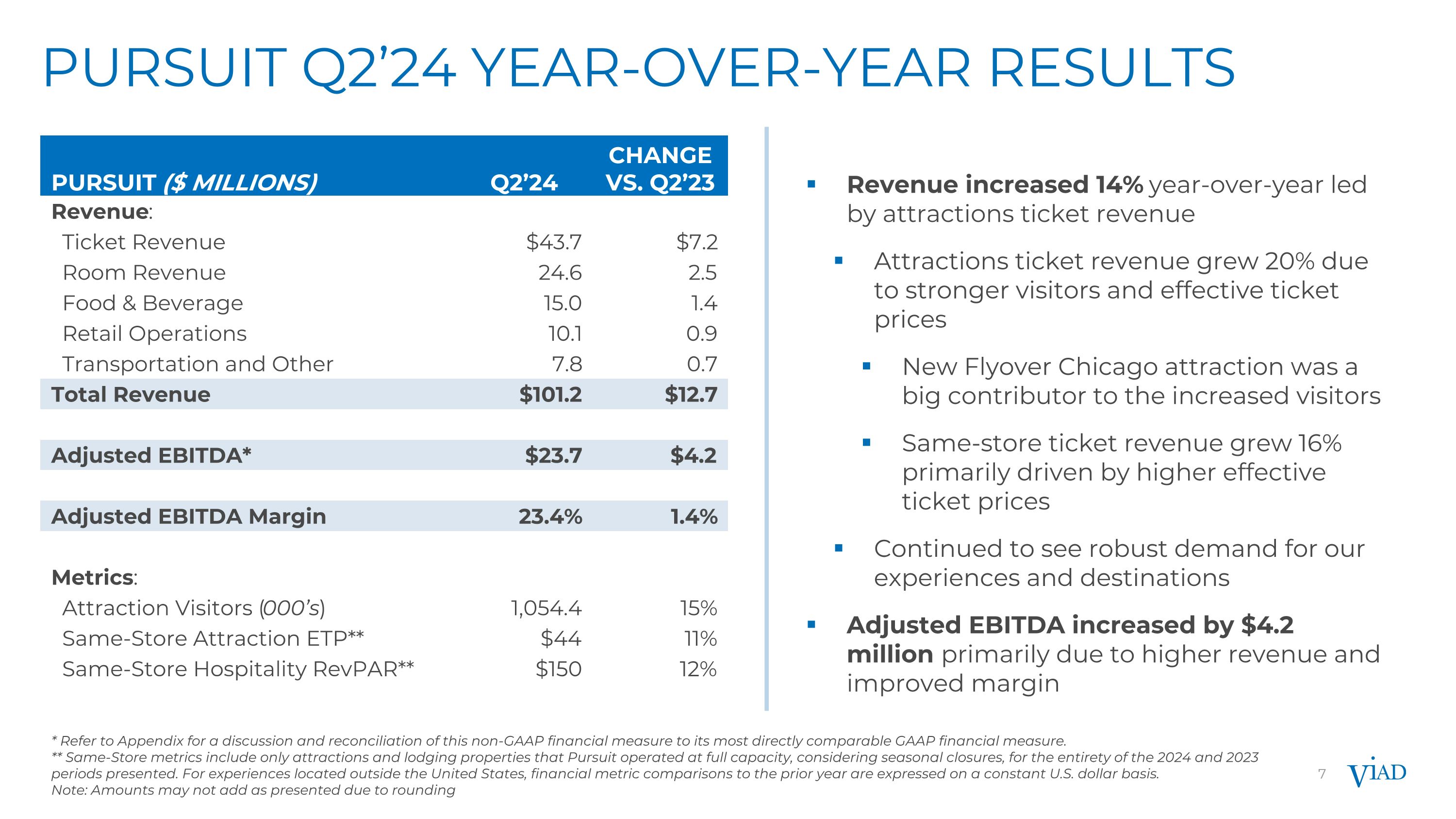

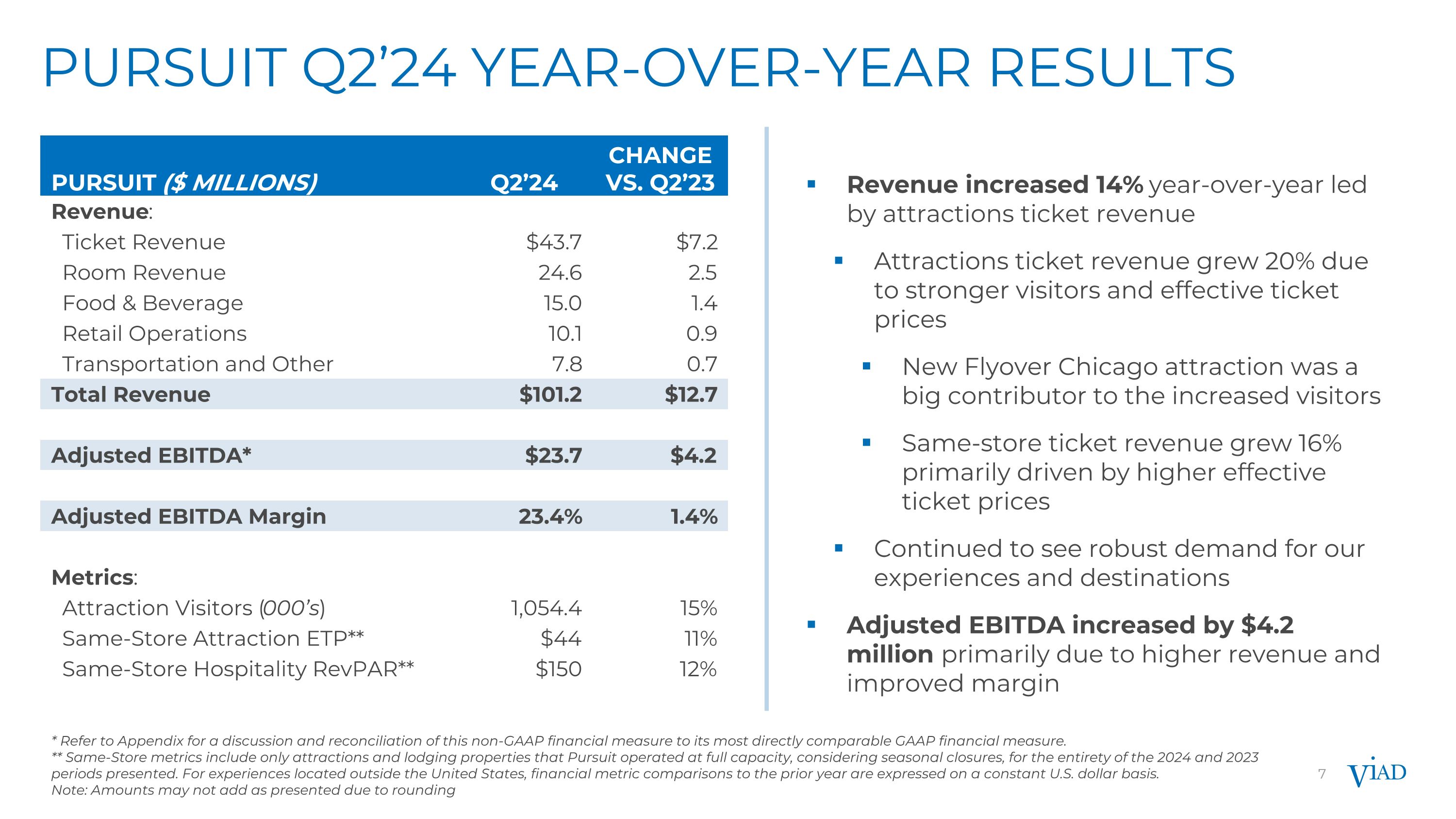

7 PURSUIT Q2’24 YEAR-OVER-YEAR RESULTS * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. ** Same-Store metrics include only attractions and lodging properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis. Note: Amounts may not add as presented due to rounding Revenue increased 14% year-over-year led by attractions ticket revenue Attractions ticket revenue grew 20% due to stronger visitors and effective ticket prices New Flyover Chicago attraction was a big contributor to the increased visitors Same-store ticket revenue grew 16% primarily driven by higher effective ticket prices Continued to see robust demand for our experiences and destinations Adjusted EBITDA increased by $4.2 million primarily due to higher revenue and improved margin PURSUIT ($ MILLIONS) Q2’24 CHANGE VS. Q2’23 Revenue: Ticket Revenue $43.7 $7.2 Room Revenue 24.6 2.5 Food & Beverage 15.0 1.4 Retail Operations 10.1 0.9 Transportation and Other 7.8 0.7 Total Revenue $101.2 $12.7 Adjusted EBITDA* $23.7 $4.2 Adjusted EBITDA Margin 23.4% 1.4% Metrics: Attraction Visitors (000’s) 1,054.4 15% Same-Store Attraction ETP** $44 11% Same-Store Hospitality RevPAR** $150 12%

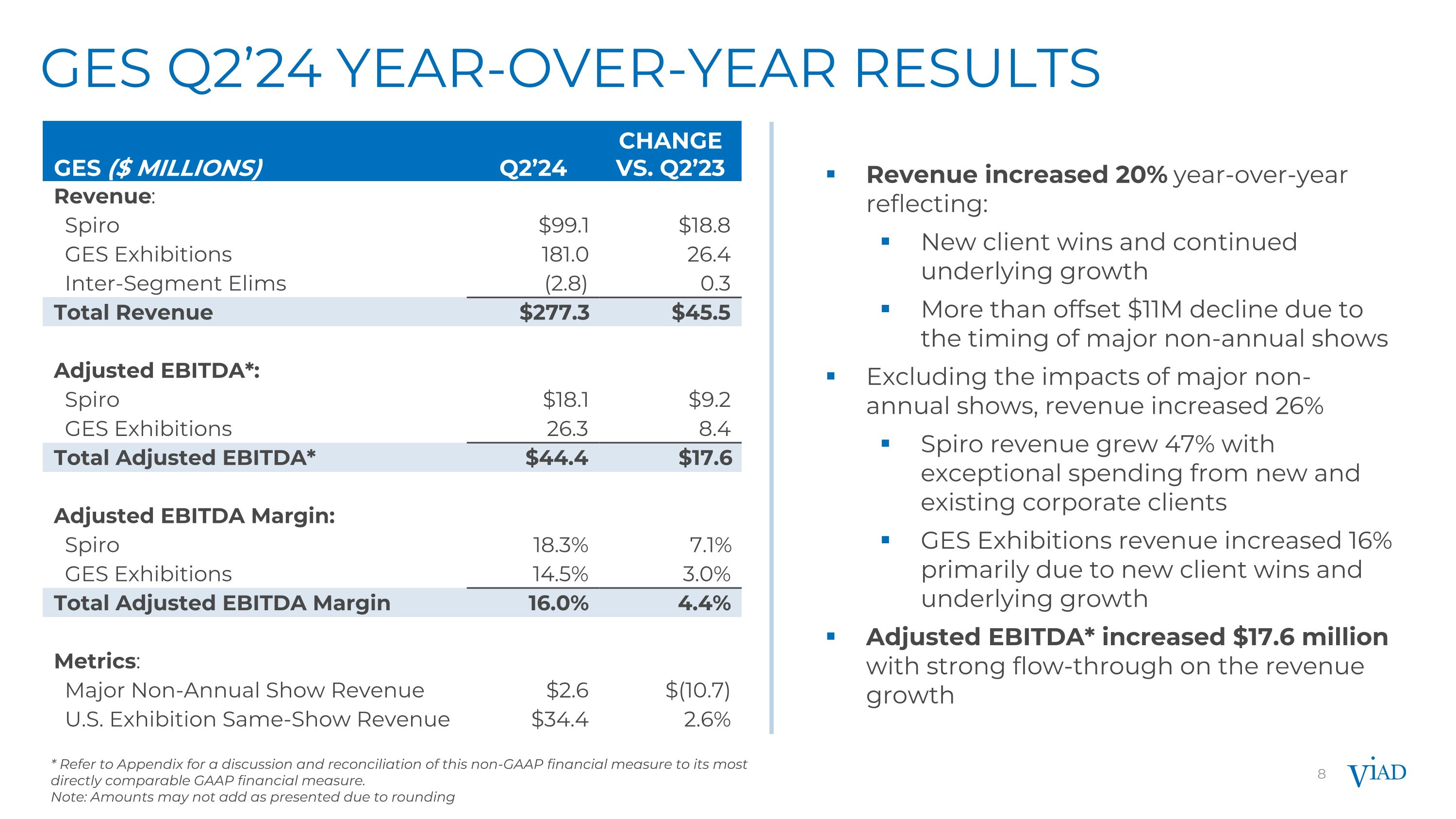

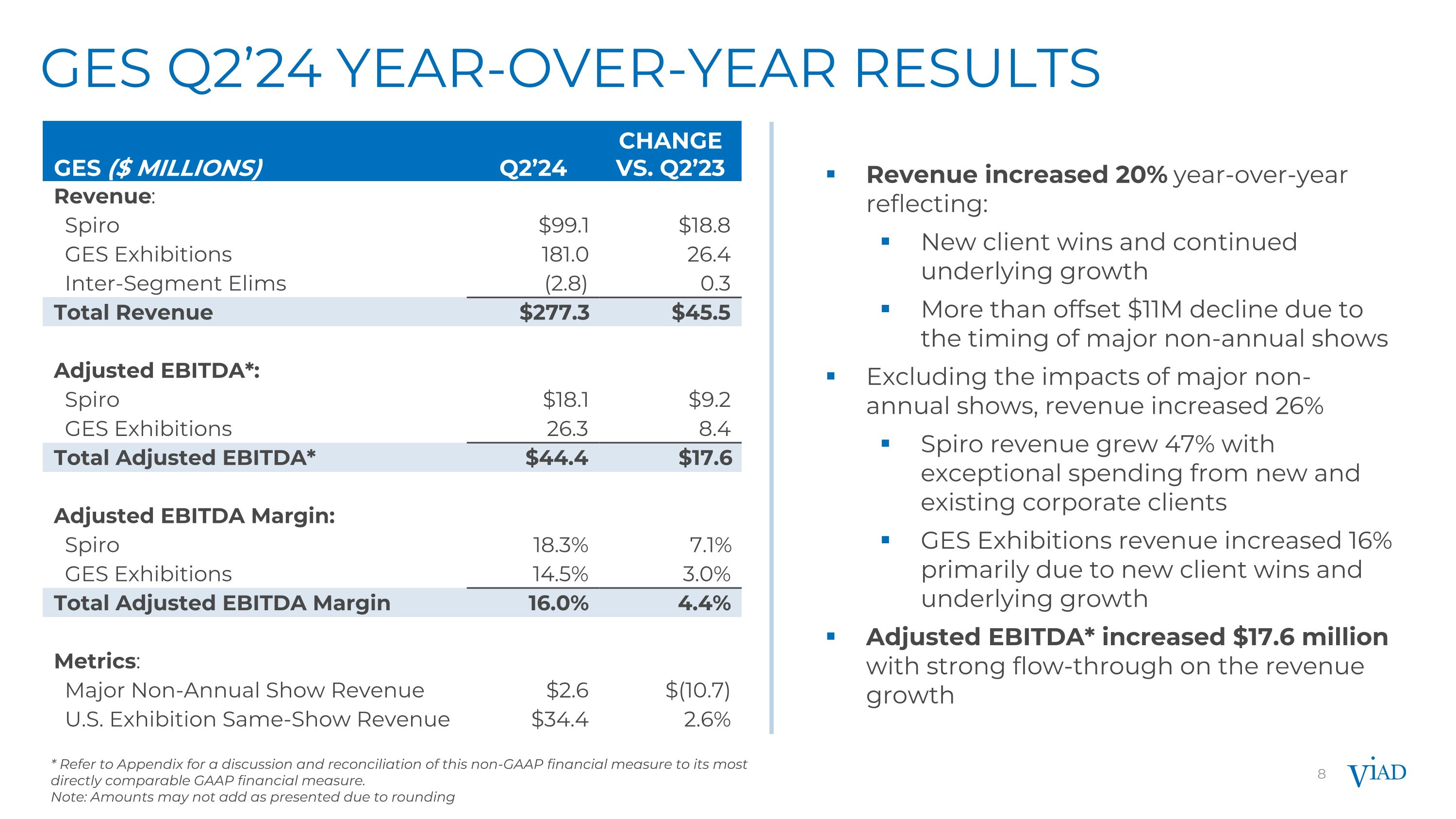

8 GES Q2’24 YEAR-OVER-YEAR RESULTS Revenue increased 20% year-over-year reflecting: New client wins and continued underlying growth More than offset $11M decline due to the timing of major non-annual shows Excluding the impacts of major non-annual shows, revenue increased 26% Spiro revenue grew 47% with exceptional spending from new and existing corporate clients GES Exhibitions revenue increased 16% primarily due to new client wins and underlying growth Adjusted EBITDA* increased $17.6 million with strong flow-through on the revenue growth GES ($ MILLIONS) Q2’24 CHANGE VS. Q2’23 Revenue: Spiro $99.1 $18.8 GES Exhibitions 181.0 26.4 Inter-Segment Elims (2.8) 0.3 Total Revenue $277.3 $45.5 Adjusted EBITDA*: Spiro $18.1 $9.2 GES Exhibitions 26.3 8.4 Total Adjusted EBITDA* $44.4 $17.6 Adjusted EBITDA Margin: Spiro 18.3% 7.1% GES Exhibitions 14.5% 3.0% Total Adjusted EBITDA Margin 16.0% 4.4% Metrics: Major Non-Annual Show Revenue $2.6 $(10.7) U.S. Exhibition Same-Show Revenue $34.4 2.6% * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure. Note: Amounts may not add as presented due to rounding

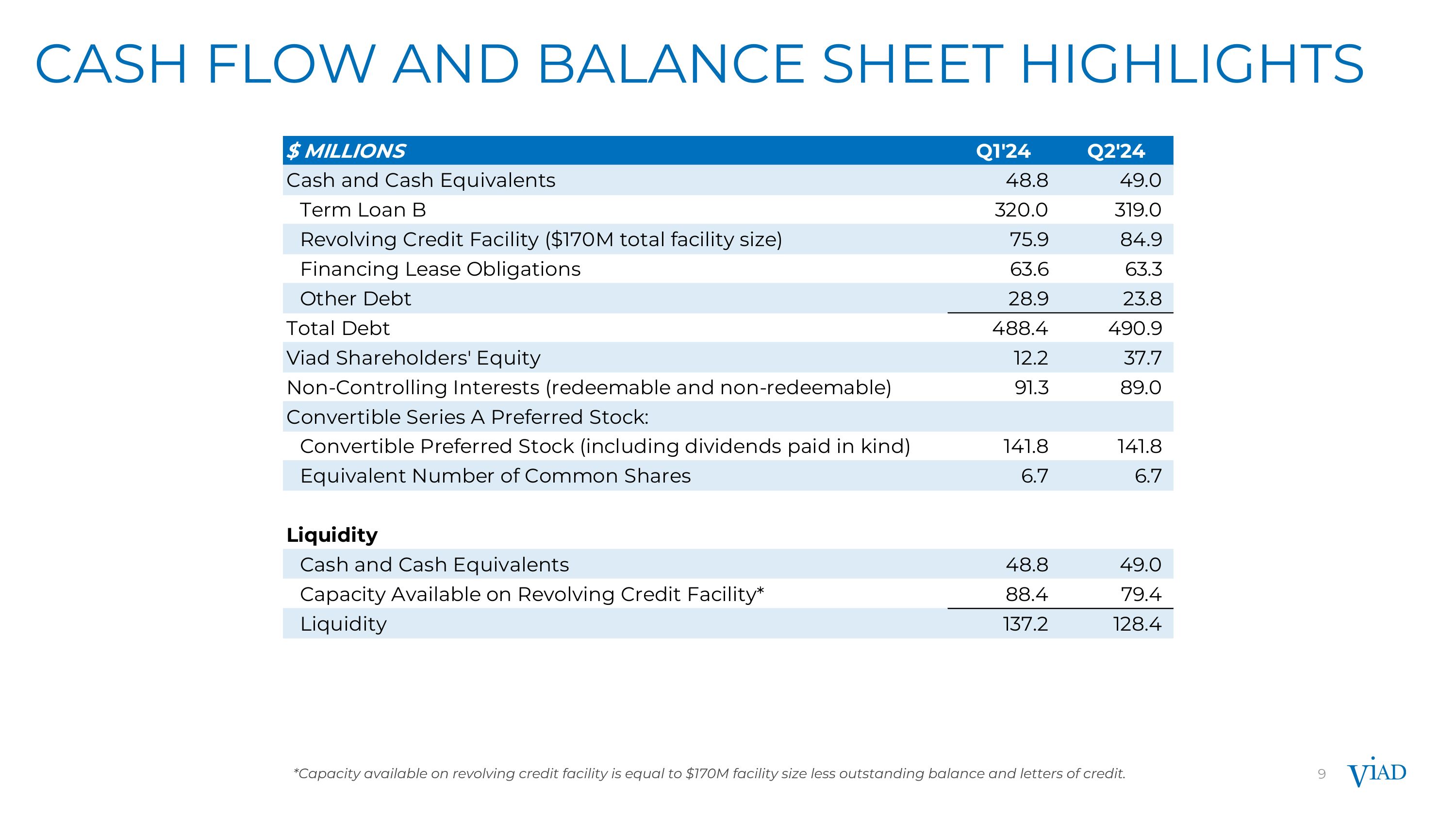

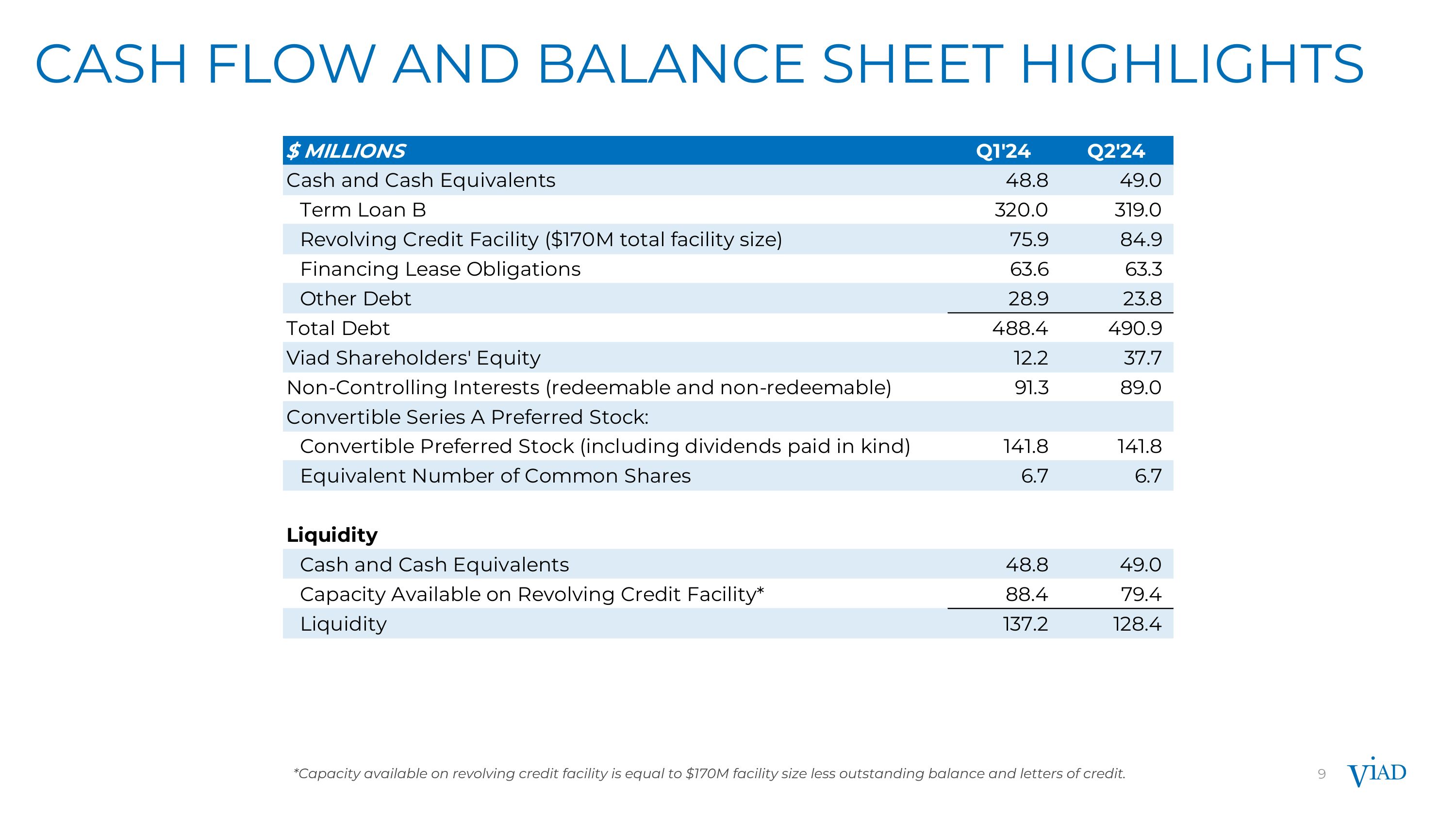

9 Cash Flow and Balance Sheet highlights *Capacity available on revolving credit facility is equal to $170M facility size less outstanding balance and letters of credit.

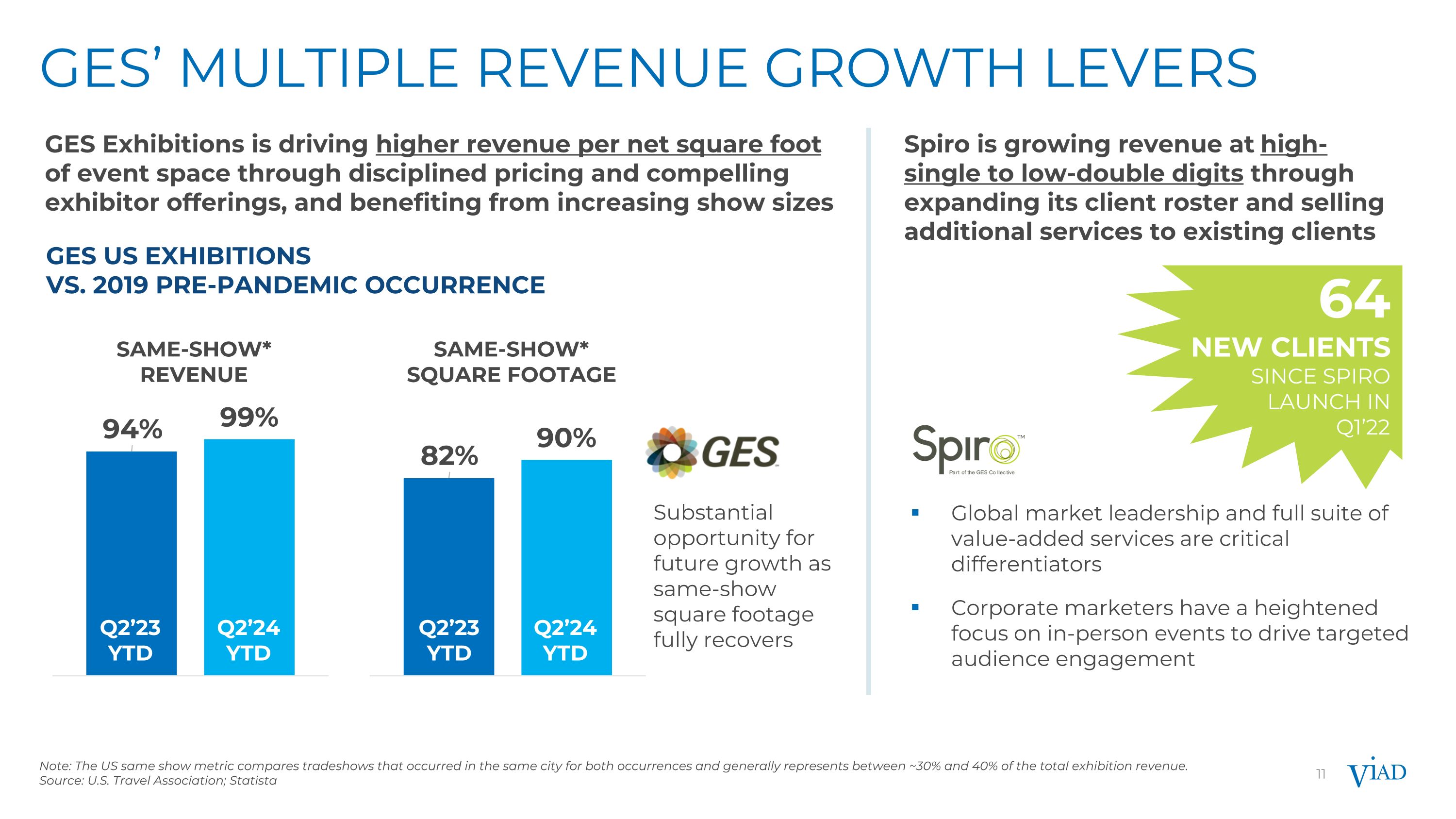

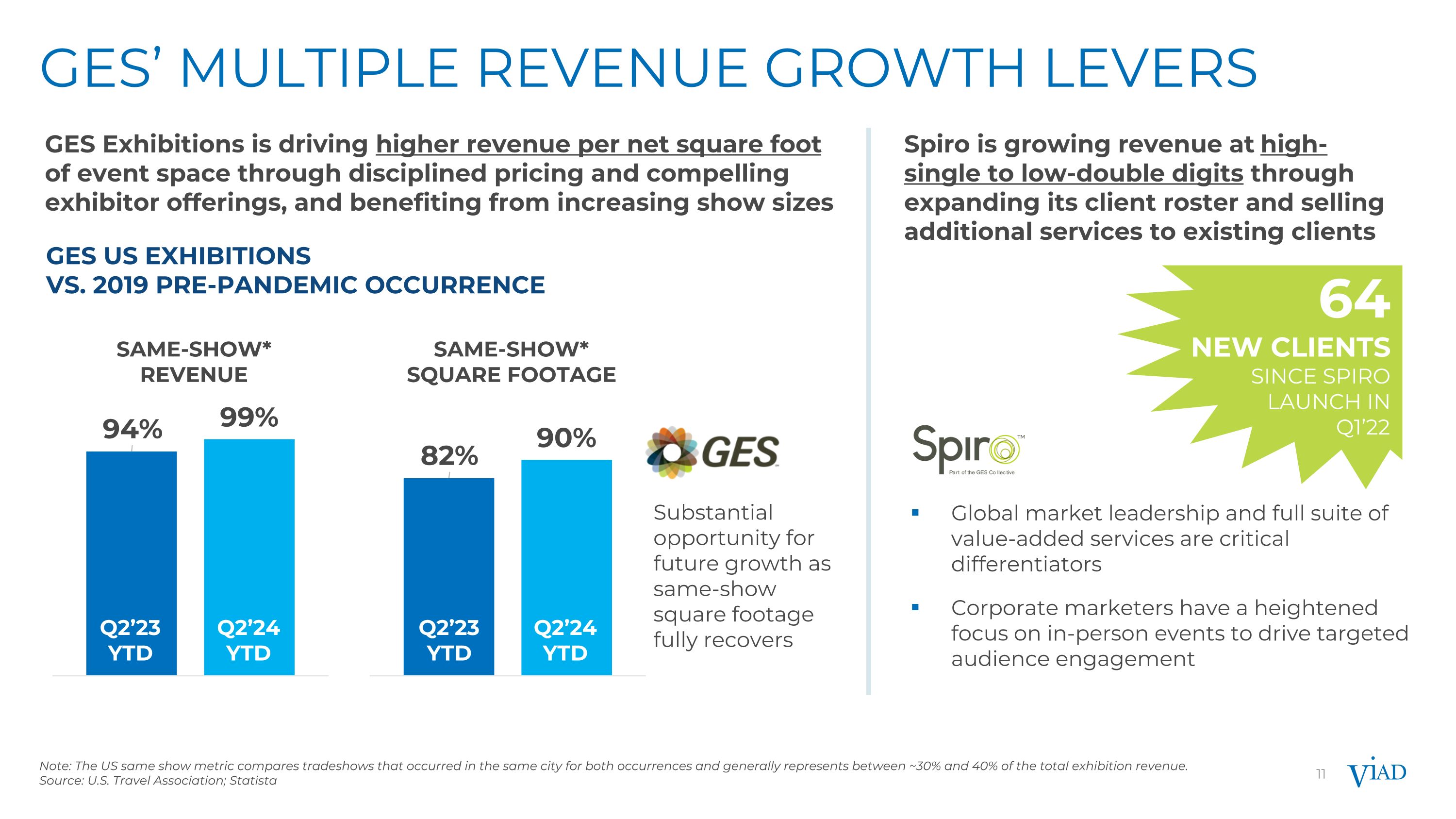

11 GES’ multiple revenue growth levers Note: The US same show metric compares tradeshows that occurred in the same city for both occurrences and generally represents between ~30% and 40% of the total exhibition revenue. Source: U.S. Travel Association; Statista GES US Exhibitions vs. 2019 Pre-Pandemic Occurrence Q2’23 YTD Q2’24 YTD SAME-SHOW* REVENUE SAME-SHOW* SQUARE FOOTAGE Q2’23 YTD Q2’24 YTD GES Exhibitions is driving higher revenue per net square foot of event space through disciplined pricing and compelling exhibitor offerings, and benefiting from increasing show sizes 64 New clients SINCE SPIRO LAUNCH IN Q1’22 Spiro is growing revenue at high-single to low-double digits through expanding its client roster and selling additional services to existing clients Substantial opportunity for future growth as same-show square footage fully recovers Global market leadership and full suite of value-added services are critical differentiators Corporate marketers have a heightened focus on in-person events to drive targeted audience engagement

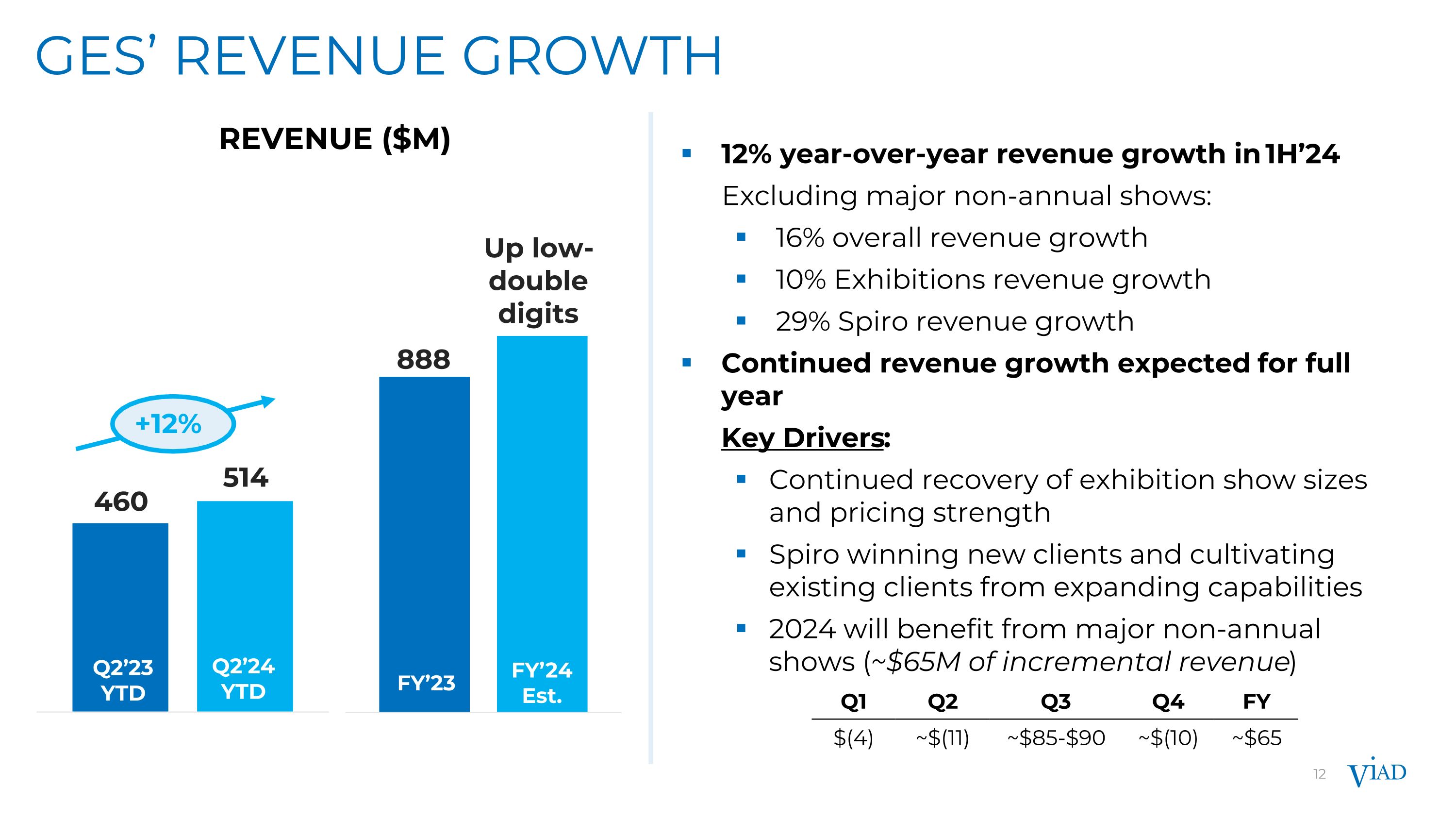

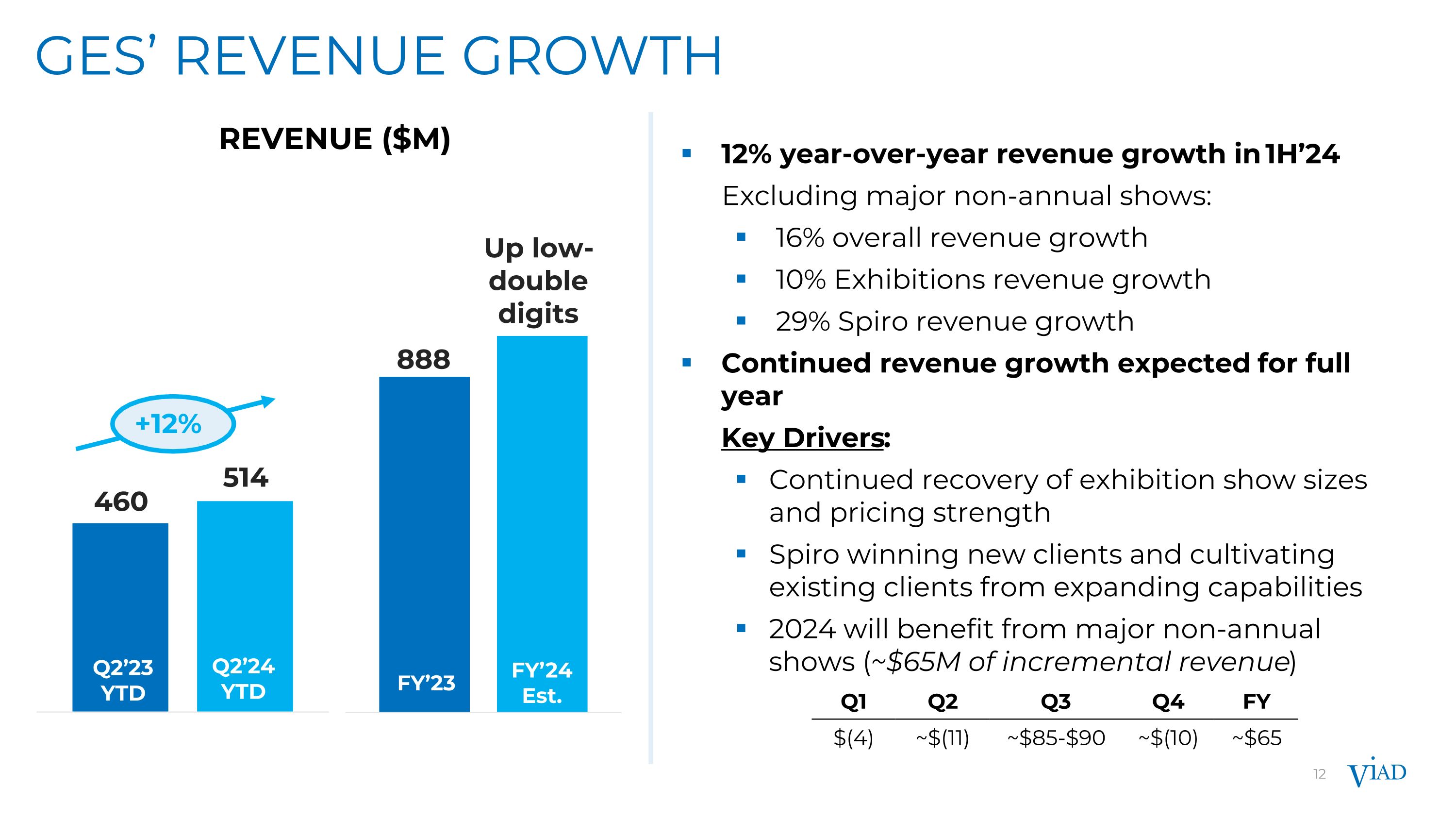

GES’ REVENUE GROWTH 12% year-over-year revenue growth in 1H’24 Excluding major non-annual shows: 16% overall revenue growth 10% Exhibitions revenue growth 29% Spiro revenue growth Continued revenue growth expected for full year Key Drivers: Continued recovery of exhibition show sizes and pricing strength Spiro winning new clients and cultivating existing clients from expanding capabilities 2024 will benefit from major non-annual shows (~$65M of incremental revenue) Q2’23 YTD Q2’24 YTD FY’23 FY’24 Est. REVENUE ($M) +12% Up low-double digits Q1 Q2 Q3 Q4 FY $(4) ~$(11) ~$85-$90 ~$(10) ~$65

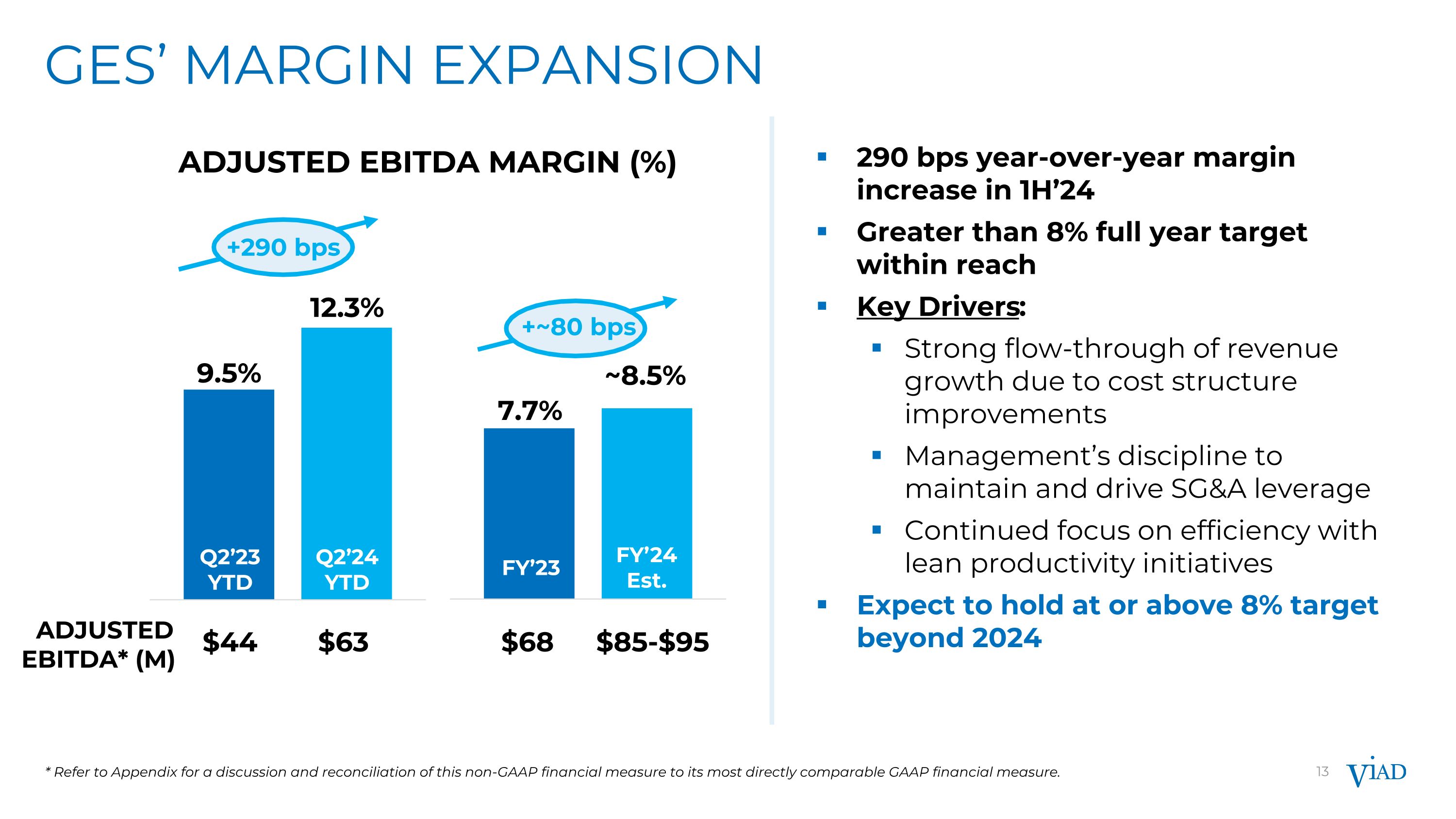

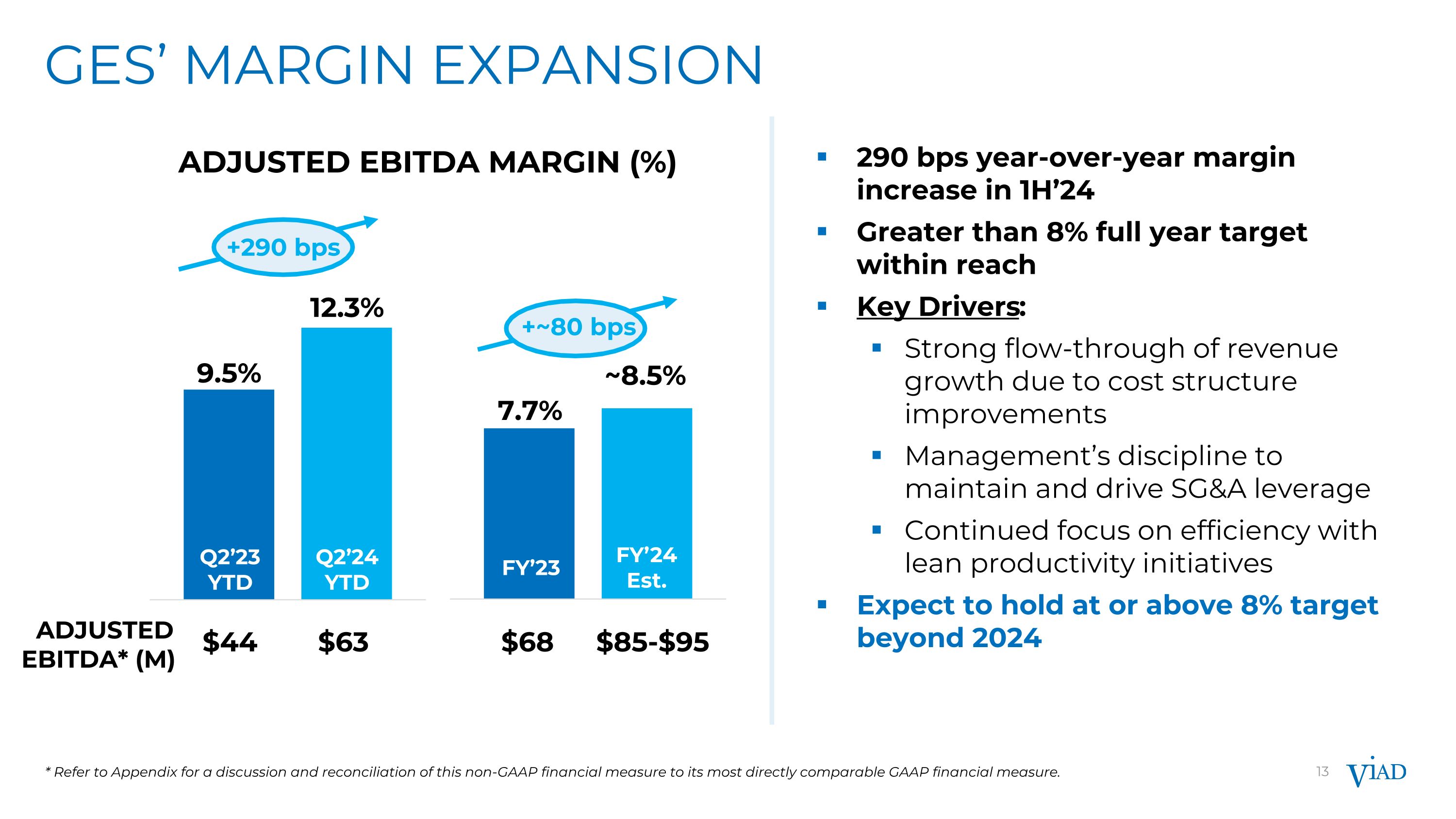

GES’ margin expansion 290 bps year-over-year margin increase in 1H’24 Greater than 8% full year target within reach Key Drivers: Strong flow-through of revenue growth due to cost structure improvements Management’s discipline to maintain and drive SG&A leverage Continued focus on efficiency with lean productivity initiatives Expect to hold at or above 8% target beyond 2024 ADJUSTED EBITDA MARGIN (%) ADJUSTED EBITDA* (M) Q2’23 YTD Q2’24 YTD +~80 bps FY’23 FY’24 Est. +290 bps $44 $63 $68 $85-$95 * Refer to Appendix for a discussion and reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure.

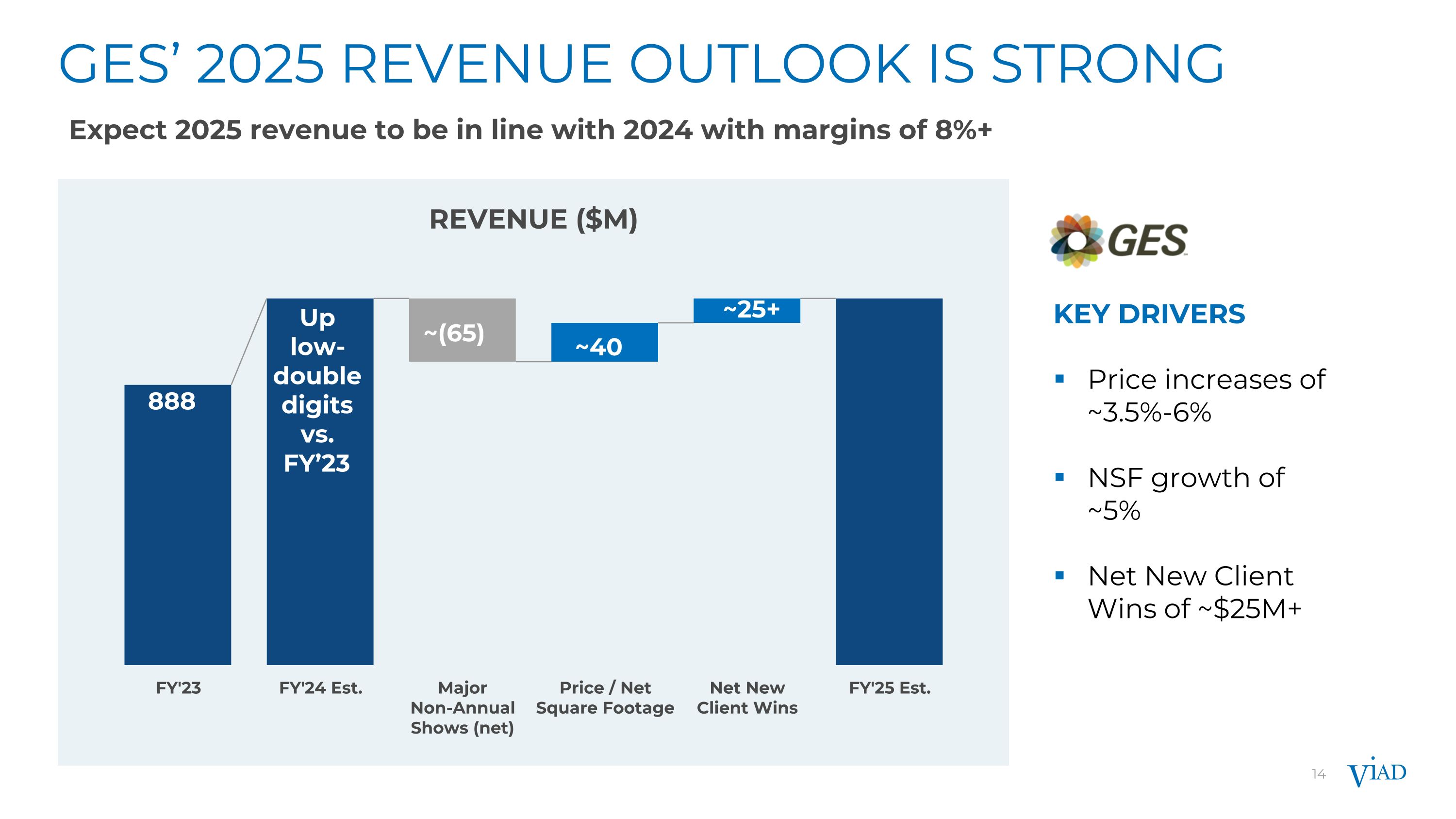

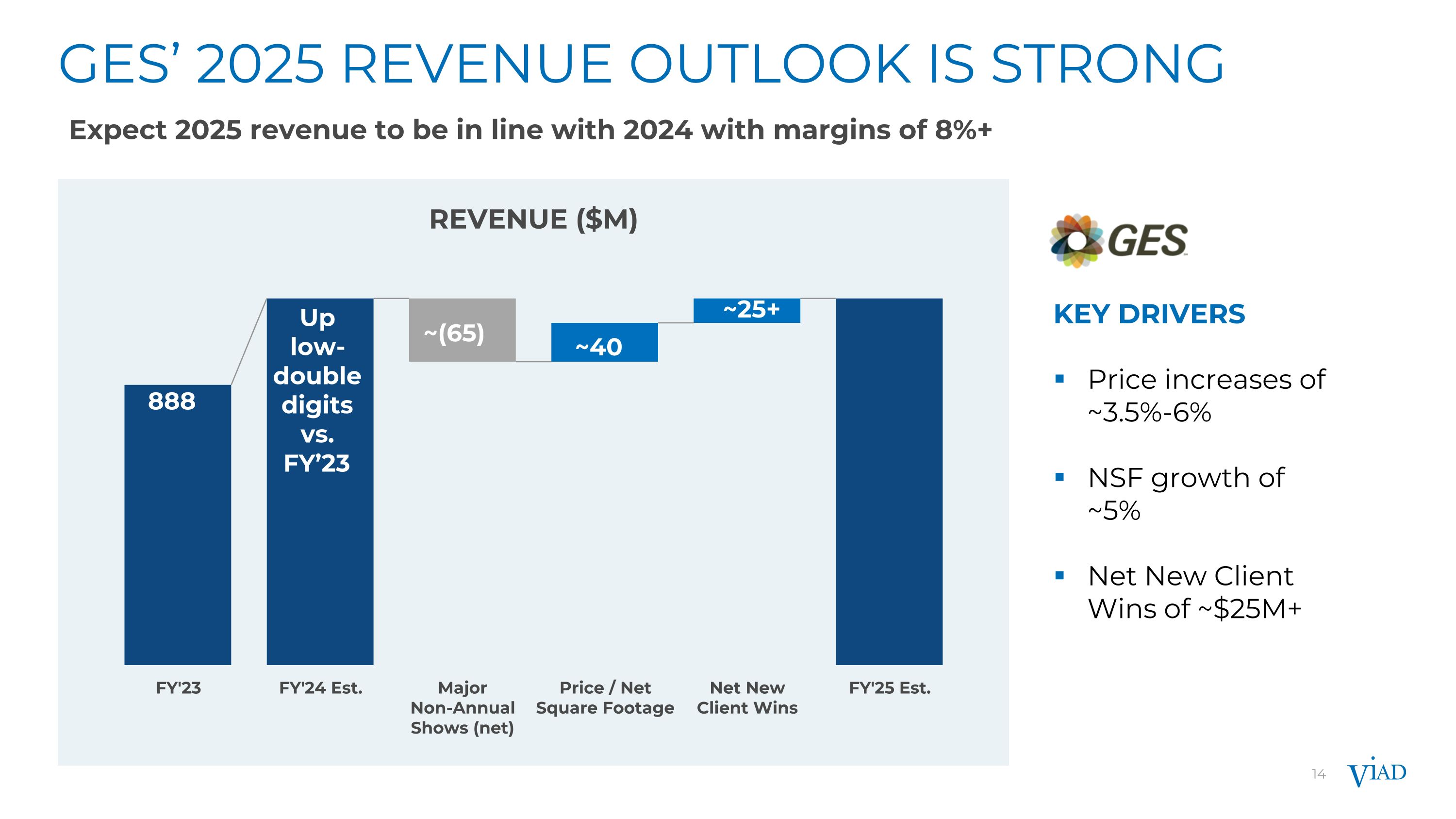

GES’ 2025 REVENUE OUTLOOK IS STRONG Expect 2025 revenue to be in line with 2024 with margins of 8%+ REVENUE ($M) KEY DRIVERS Price increases of ~3.5%-6% NSF growth of ~5% Net New Client Wins of ~$25M+ Up low-double digits vs. FY’23 888 ~(65) ~40 ~25+

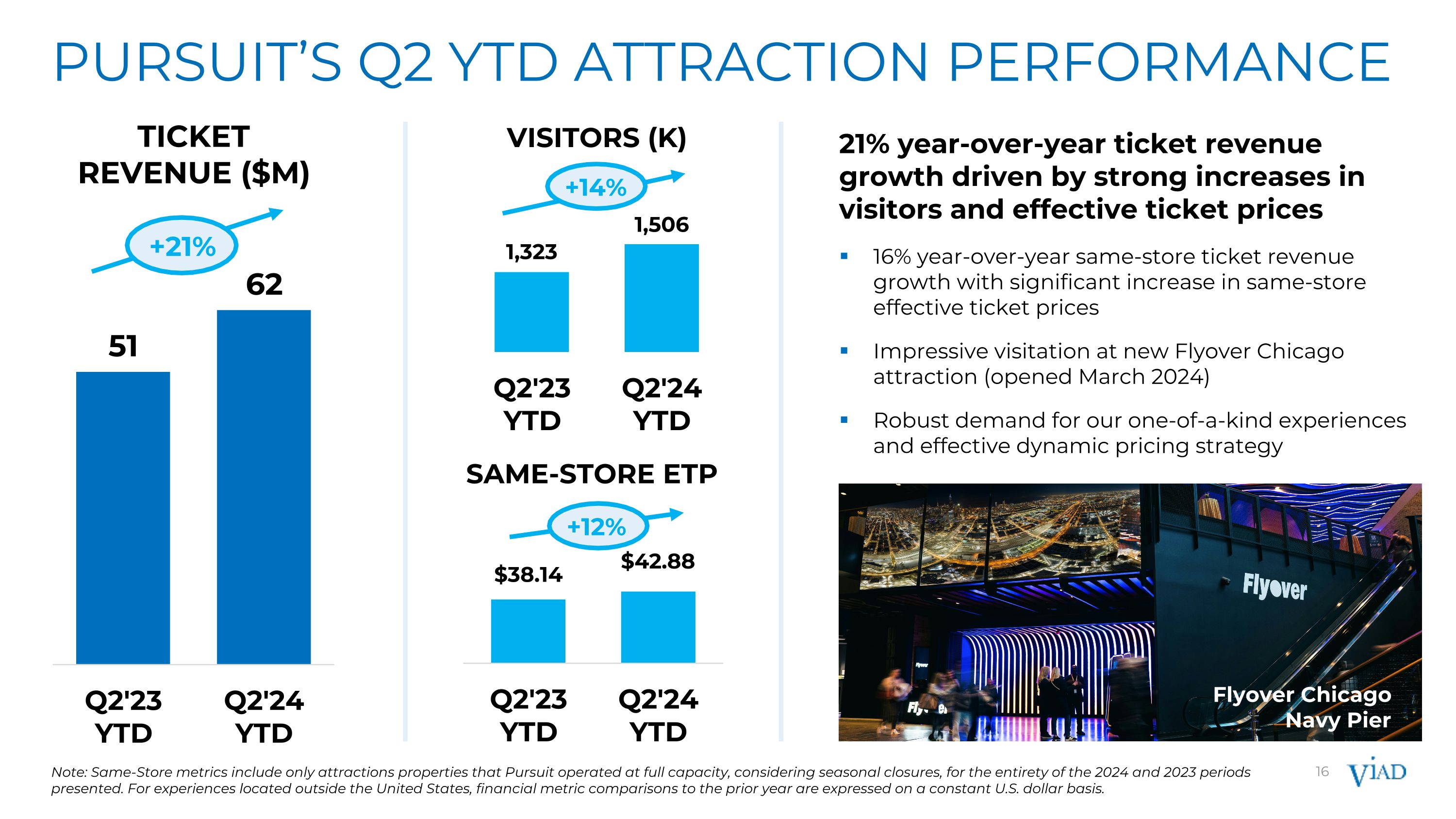

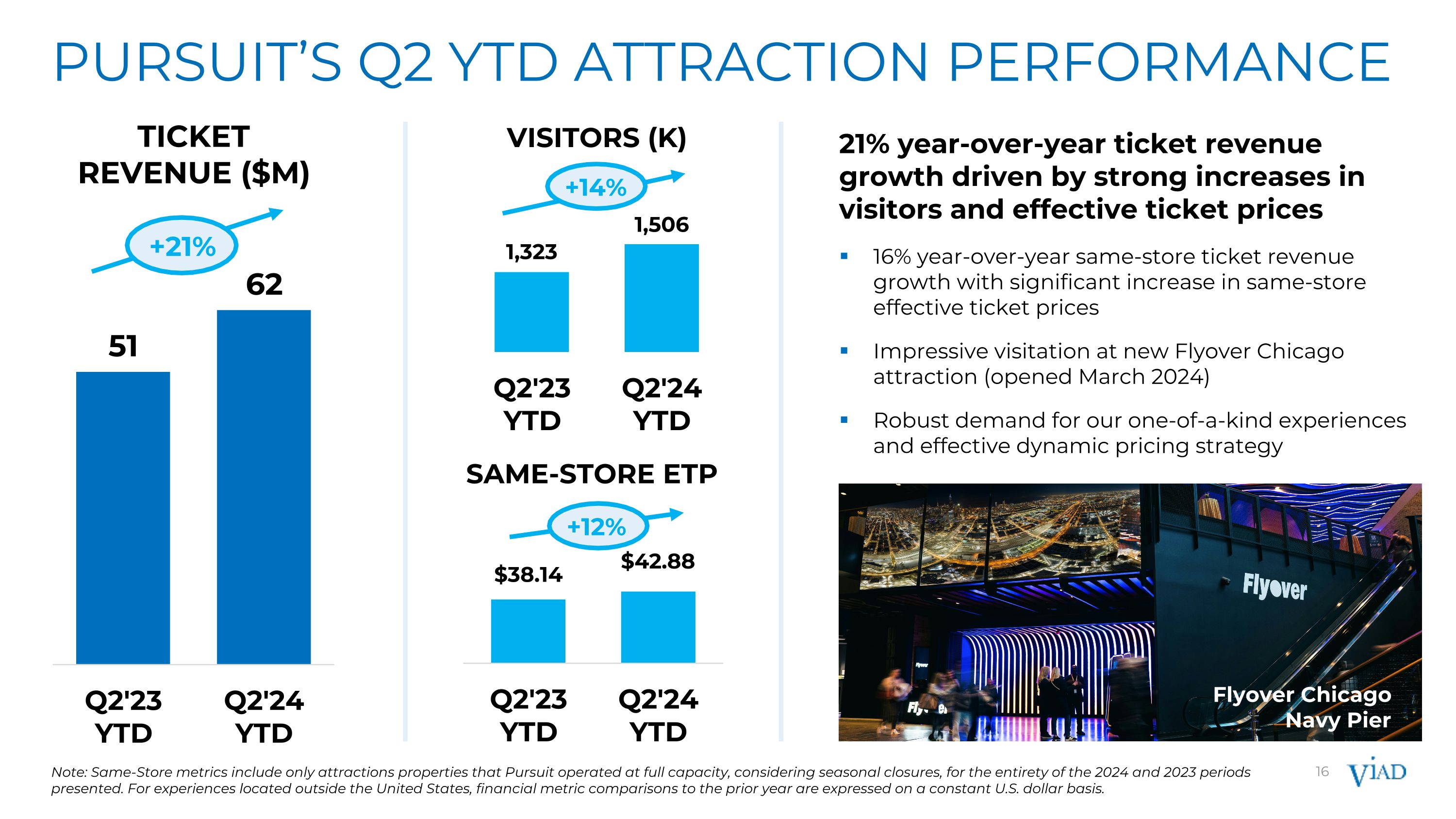

PURSUIT’s Q2 YTD attraction PERFORMANCE TICKET REVENUE ($M) +21% 2023F 2024P 21% year-over-year ticket revenue growth driven by strong increases in visitors and effective ticket prices 16% year-over-year same-store ticket revenue growth with significant increase in same-store effective ticket prices Impressive visitation at new Flyover Chicago attraction (opened March 2024) Robust demand for our one-of-a-kind experiences and effective dynamic pricing strategy VISITORS (K) SAME-STORE ETP +14% +12% Note: Same-Store metrics include only attractions properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis. Flyover Chicago Navy Pier

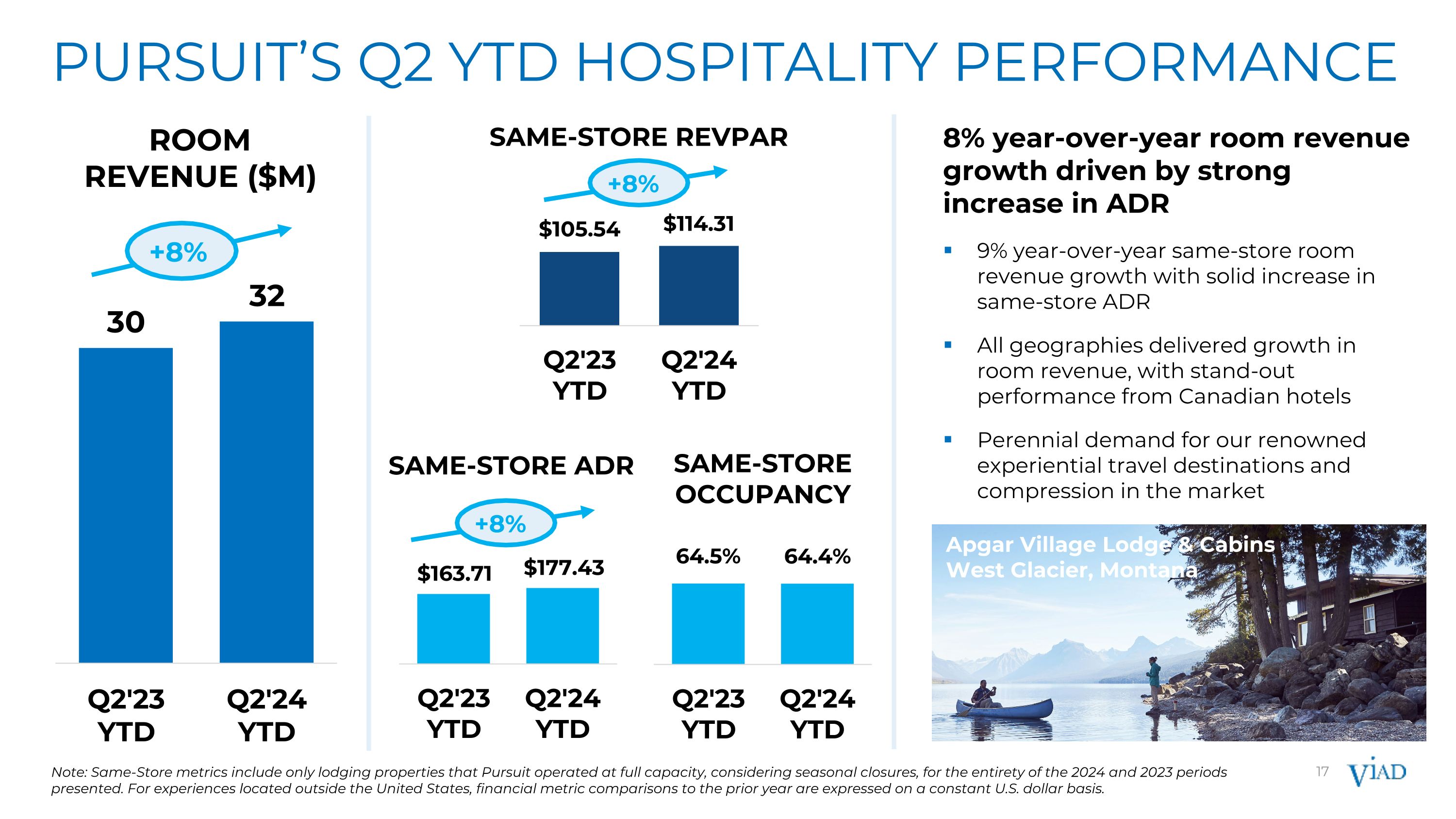

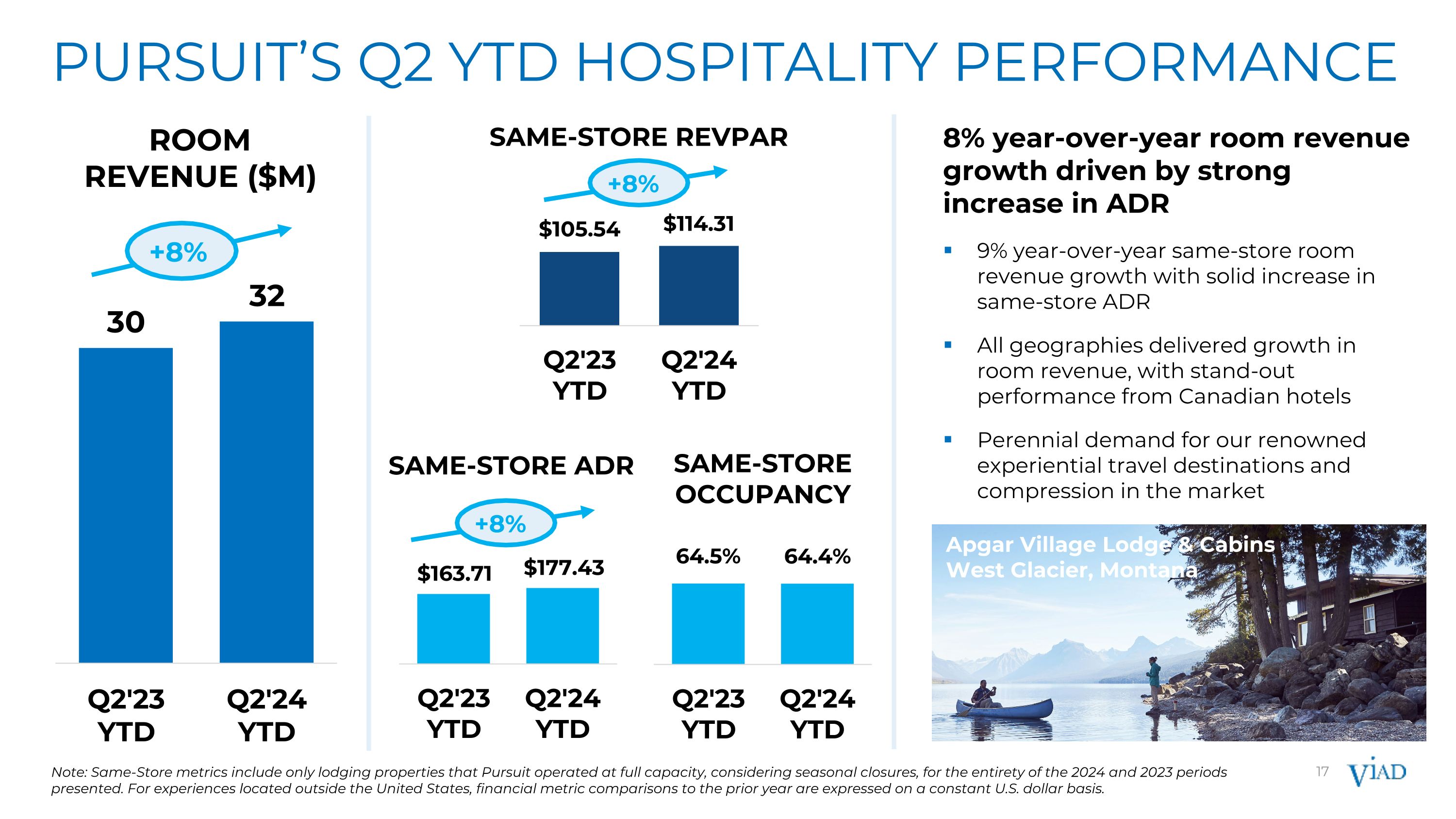

PURSUIT’s Q2 YTD HOSPITALITY PERFORMANCE ROOM REVENUE ($M) 2023F 2024P 8% year-over-year room revenue growth driven by strong increase in ADR 9% year-over-year same-store room revenue growth with solid increase in same-store ADR All geographies delivered growth in room revenue, with stand-out performance from Canadian hotels Perennial demand for our renowned experiential travel destinations and compression in the market SAME-STORE ADR SAME-STORE OCCUPANCY SAME-STORE REVPAR Note: Same-Store metrics include only lodging properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis. Apgar Village Lodge & Cabins West Glacier, Montana +8% +8% +8%

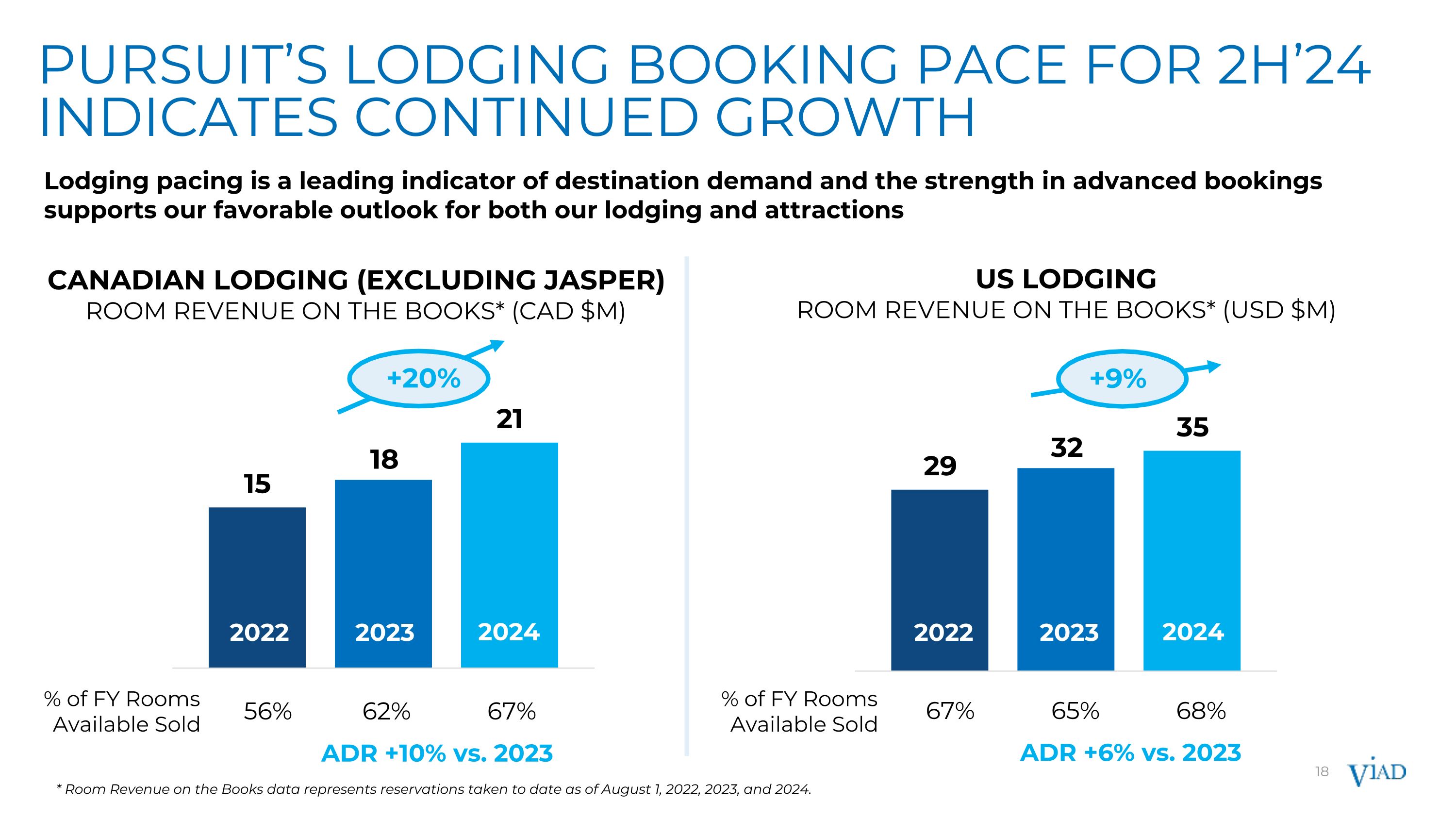

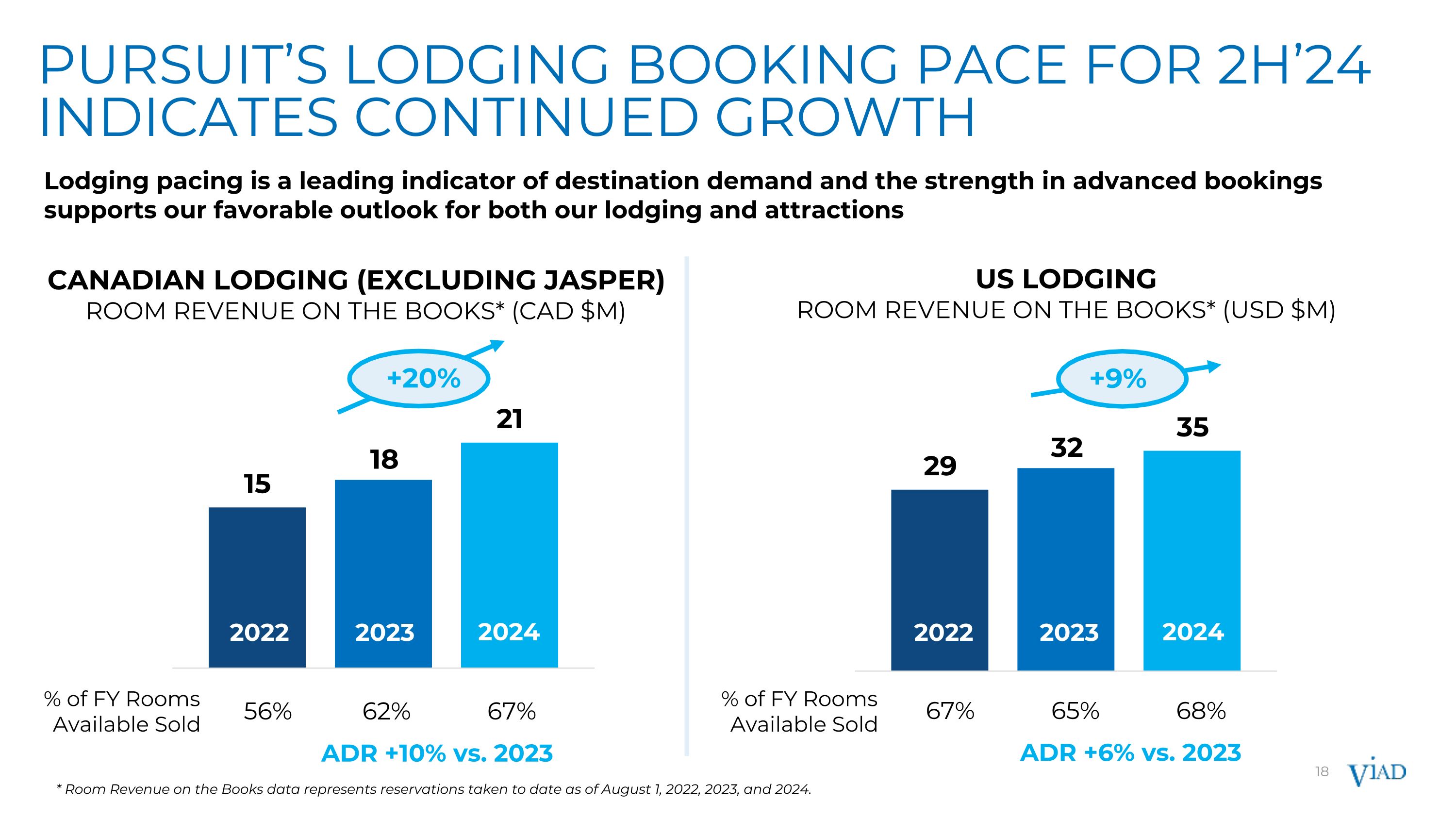

+20% US LODGING ROOM REVENUE ON THE BOOKS* (USD $M) +9% CANADIAN LODGING (EXCLUDING JASPER) ROOM REVENUE ON THE BOOKS* (CAD $M) 2022 2023 2024 * Room Revenue on the Books data represents reservations taken to date as of August 1, 2022, 2023, and 2024. 2022 2023 2024 ADR +10% vs. 2023 ADR +6% vs. 2023 % of FY Rooms Available Sold % of FY Rooms Available Sold 67% 65% 68% 56% 62% 67% Lodging pacing is a leading indicator of destination demand and the strength in advanced bookings supports our favorable outlook for both our lodging and attractions PURSUIT’s LODGING BOOKING pace for 2h’24 indicates continued growth

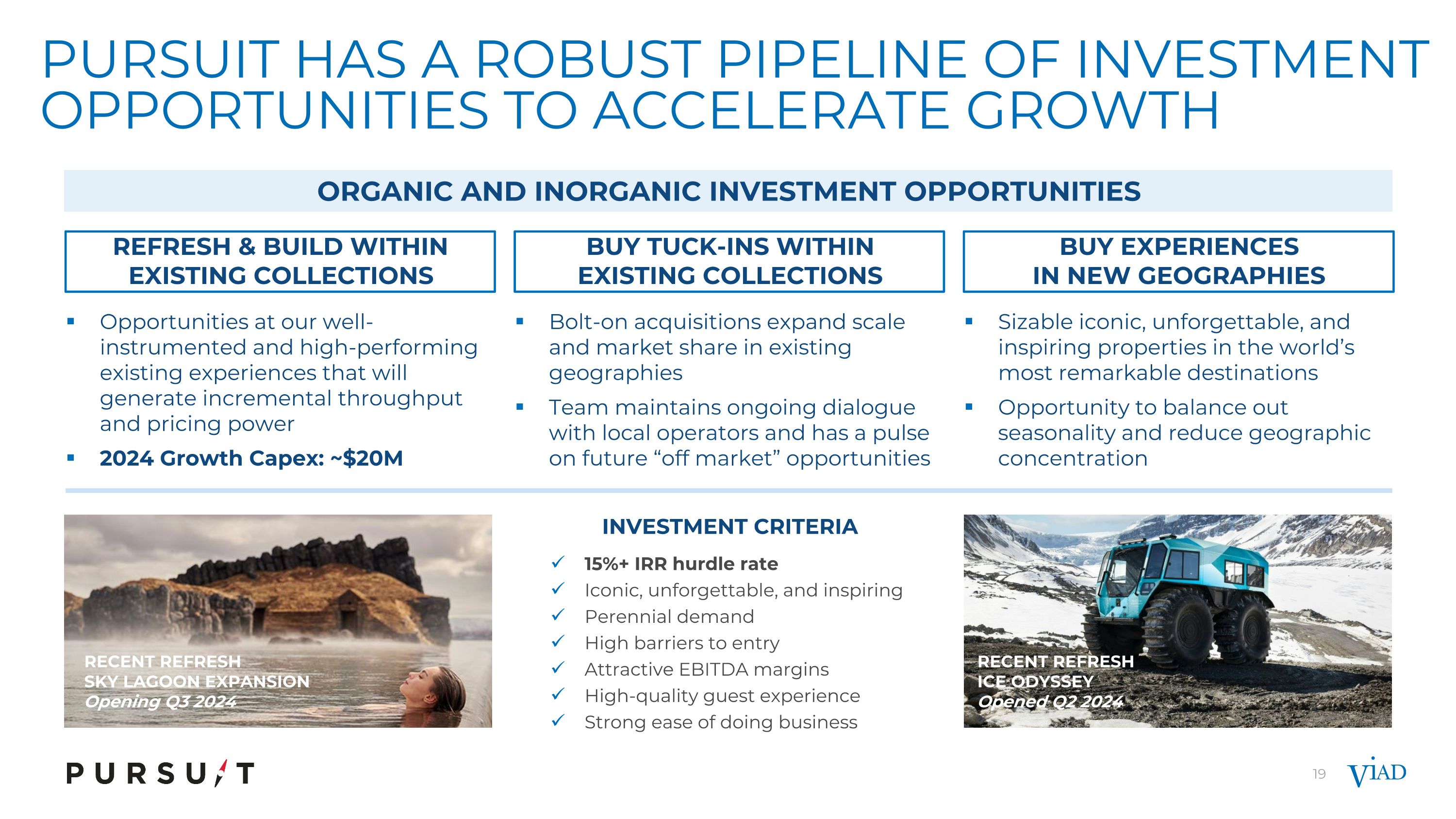

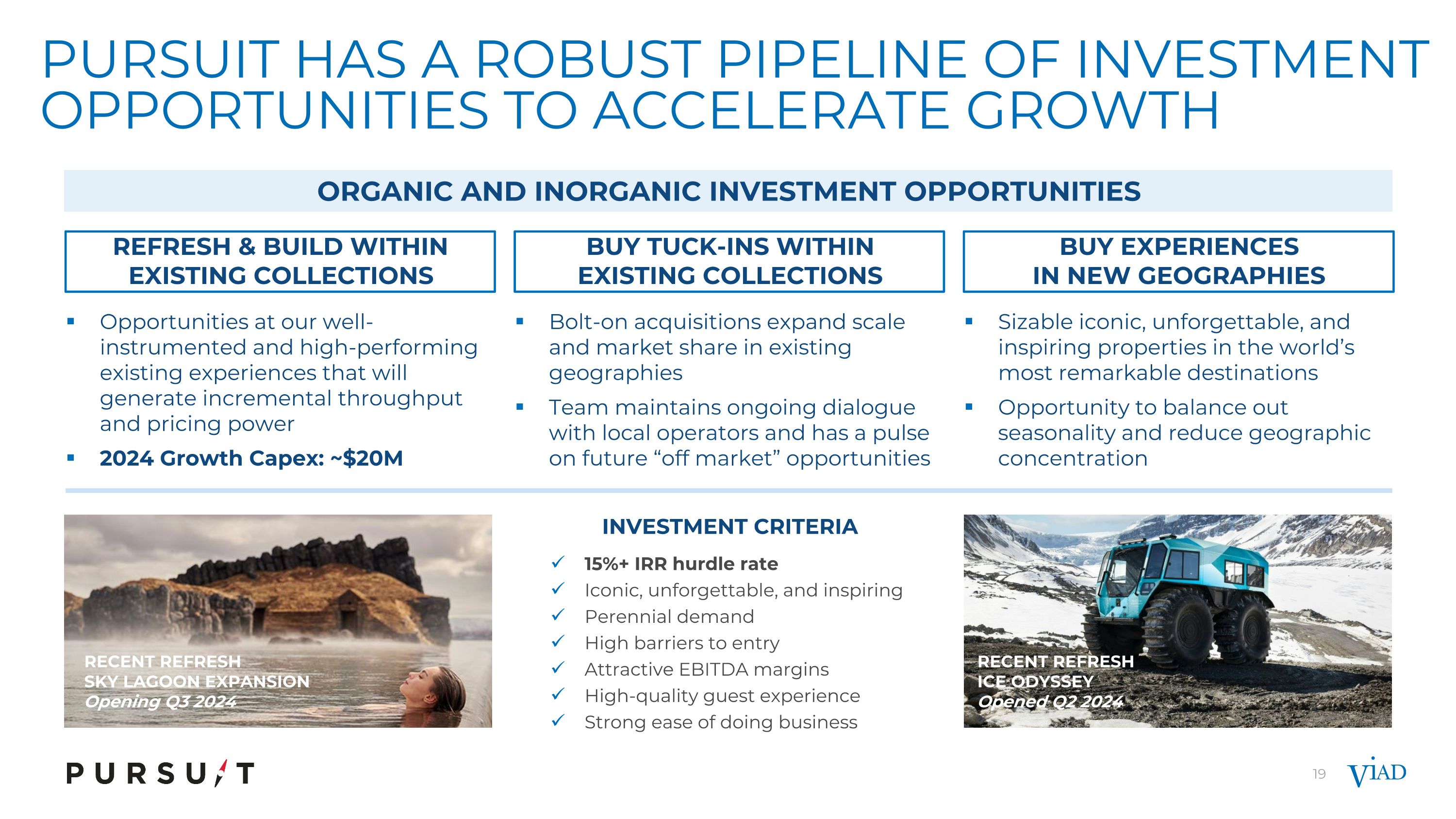

PURSUIT has a ROBUST pipeline of investment opportunities to accelerate growth INVESTMENT CRITERIA 15%+ IRR hurdle rate Iconic, unforgettable, and inspiring Perennial demand High barriers to entry Attractive EBITDA margins High-quality guest experience Strong ease of doing business BUY EXPERIENCES IN NEW GEOGRAPHIES Sizable iconic, unforgettable, and inspiring properties in the world’s most remarkable destinations Opportunity to balance out seasonality and reduce geographic concentration BUY TUCK-INS WITHIN EXISTING COLLECTIONS Bolt-on acquisitions expand scale and market share in existing geographies Team maintains ongoing dialogue with local operators and has a pulse on future “off market” opportunities REFRESH & BUILD WITHIN EXISTING COLLECTIONS RECENT REFRESH SKY LAGOON EXPANSION Opening Q3 2024 Opportunities at our well-instrumented and high-performing existing experiences that will generate incremental throughput and pricing power 2024 Growth Capex: ~$20M organic and inorganic investment opportunities RECENT REFRESH ICE ODYSSEY Opened Q2 2024

FINANCIAL OUTLOOK

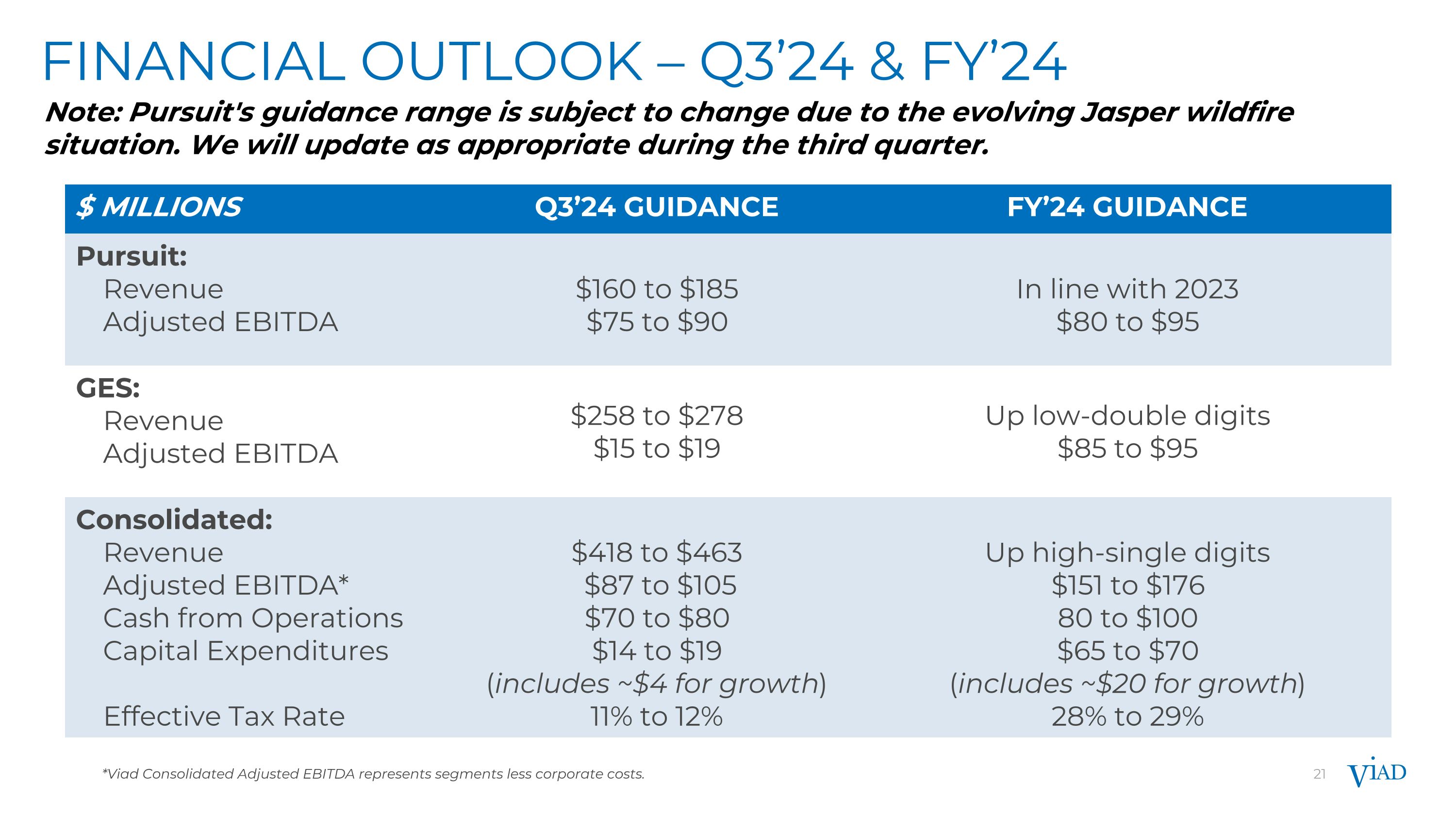

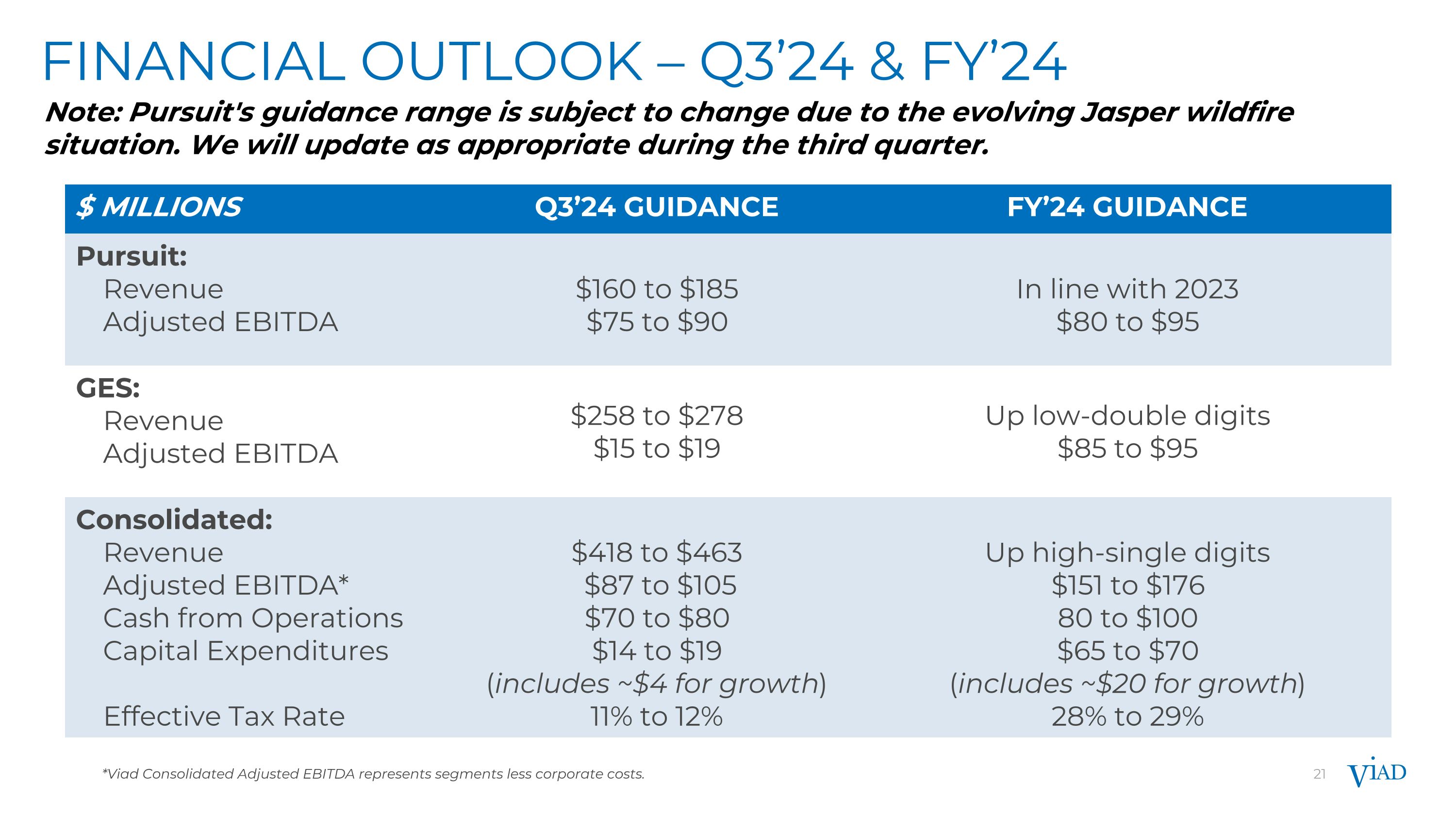

FINANCIAL OUTLOOK – Q3’24 & FY’24 $ MILLIONS Q3’24 GUIDANCE FY’24 GUIDANCE Pursuit: Revenue Adjusted EBITDA $160 to $185 $75 to $90 In line with 2023 $80 to $95 GES: Revenue Adjusted EBITDA $258 to $278 $15 to $19 Up low-double digits $85 to $95 Consolidated: Revenue Adjusted EBITDA* Cash from Operations Capital Expenditures Effective Tax Rate $418 to $463 $87 to $105 $70 to $80 $14 to $19 (includes ~$4 for growth) 11% to 12% Up high-single digits $151 to $176 80 to $100 $65 to $70 (includes ~$20 for growth) 28% to 29% *Viad Consolidated Adjusted EBITDA represents segments less corporate costs. Note: Pursuit's guidance range is subject to change due to the evolving Jasper wildfire situation. We will update as appropriate during the third quarter.

APPENDIX

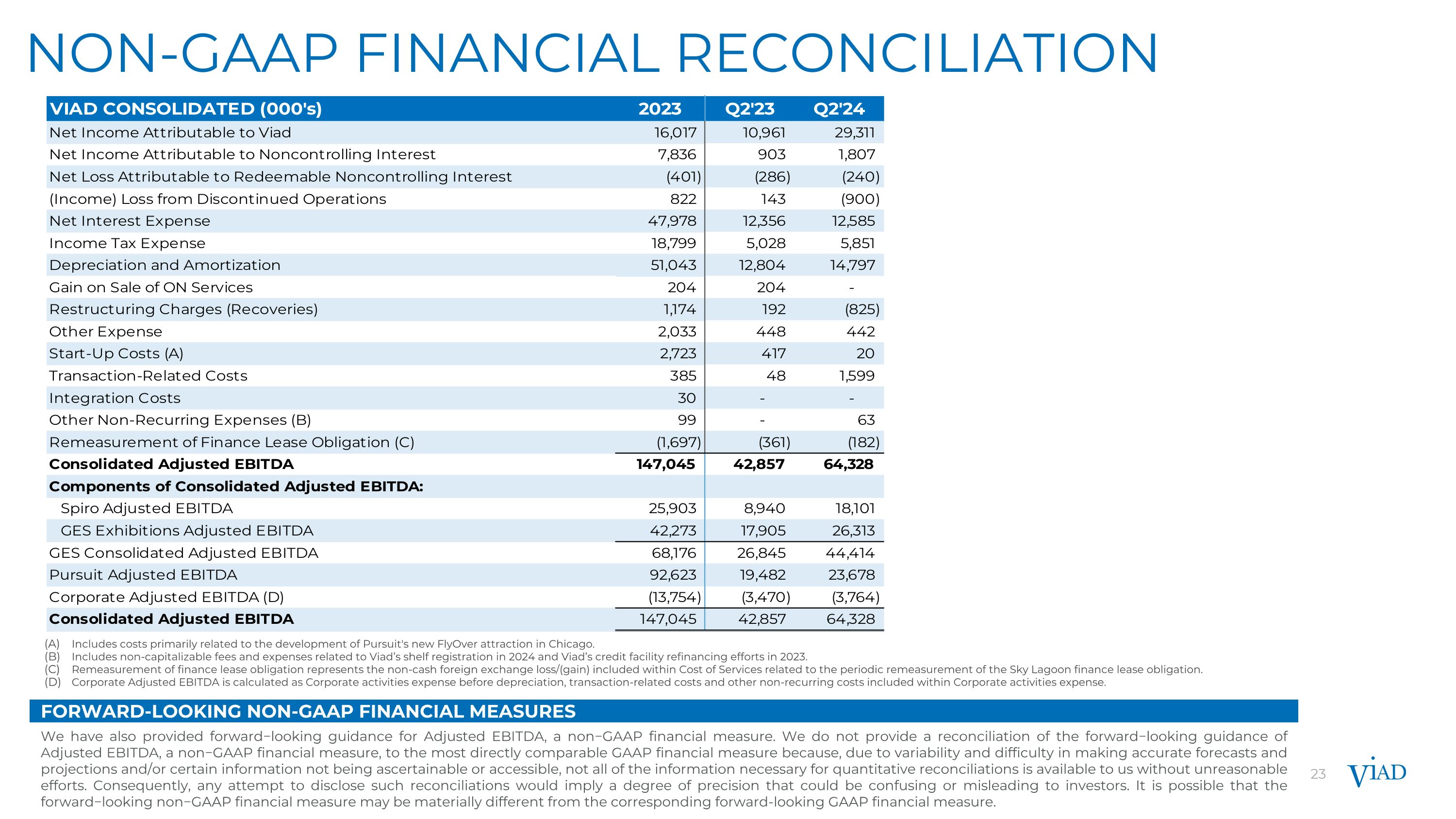

FORWARD-LOOKING NON-GAAP FINANCIAL MEASURES We have also provided forward−looking guidance for Adjusted EBITDA, a non−GAAP financial measure. We do not provide a reconciliation of the forward−looking guidance of Adjusted EBITDA, a non−GAAP financial measure, to the most directly comparable GAAP financial measure because, due to variability and difficulty in making accurate forecasts and projections and/or certain information not being ascertainable or accessible, not all of the information necessary for quantitative reconciliations is available to us without unreasonable efforts. Consequently, any attempt to disclose such reconciliations would imply a degree of precision that could be confusing or misleading to investors. It is possible that the forward−looking non−GAAP financial measure may be materially different from the corresponding forward-looking GAAP financial measure. NON-GAAP FINANCIAL RECONCILIATION Includes costs primarily related to the development of Pursuit's new FlyOver attraction in Chicago. Includes non-capitalizable fees and expenses related to Viad’s shelf registration in 2024 and Viad’s credit facility refinancing efforts in 2023. Remeasurement of finance lease obligation represents the non-cash foreign exchange loss/(gain) included within Cost of Services related to the periodic remeasurement of the Sky Lagoon finance lease obligation. Corporate Adjusted EBITDA is calculated as Corporate activities expense before depreciation, transaction-related costs and other non-recurring costs included within Corporate activities expense.

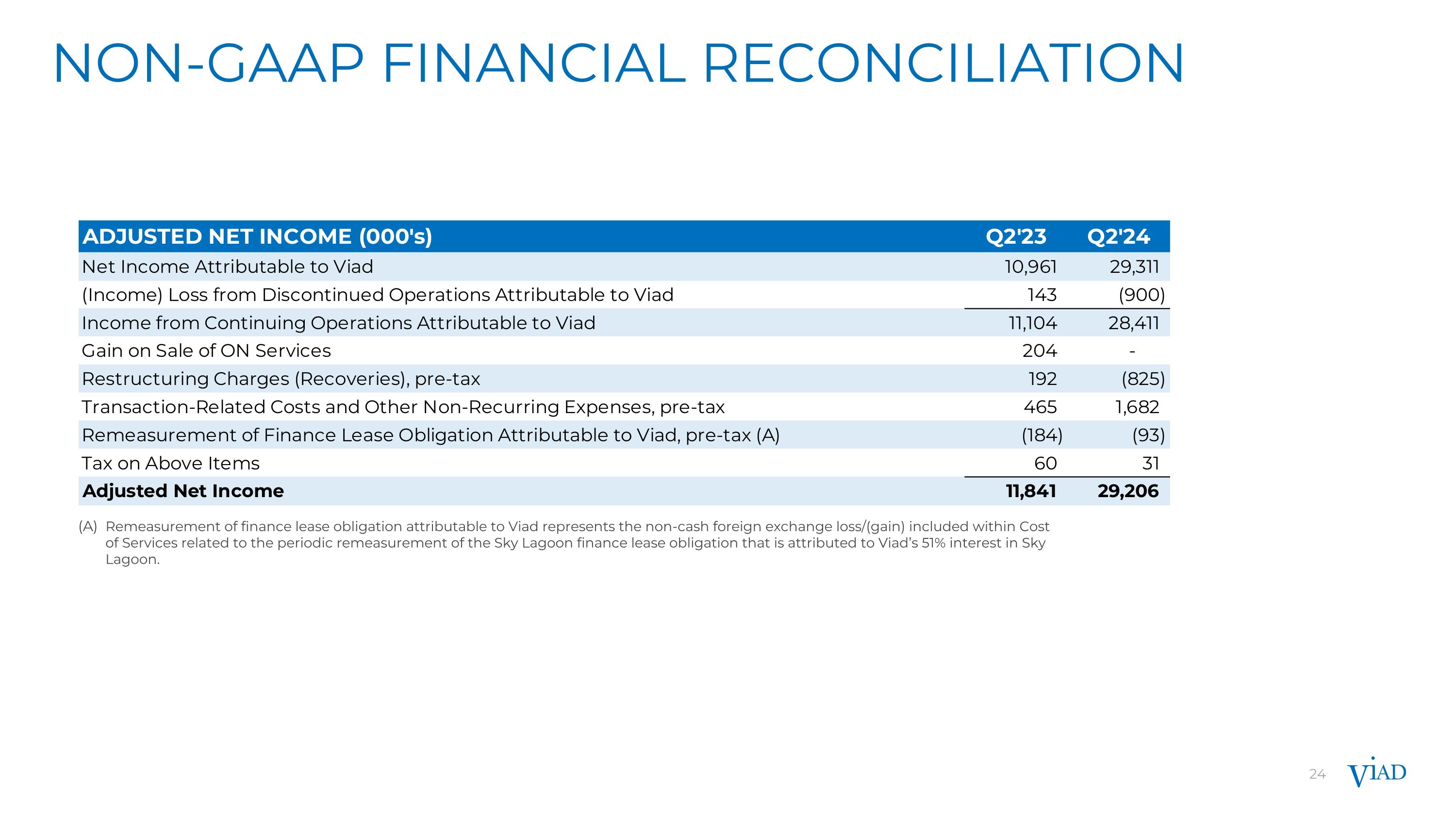

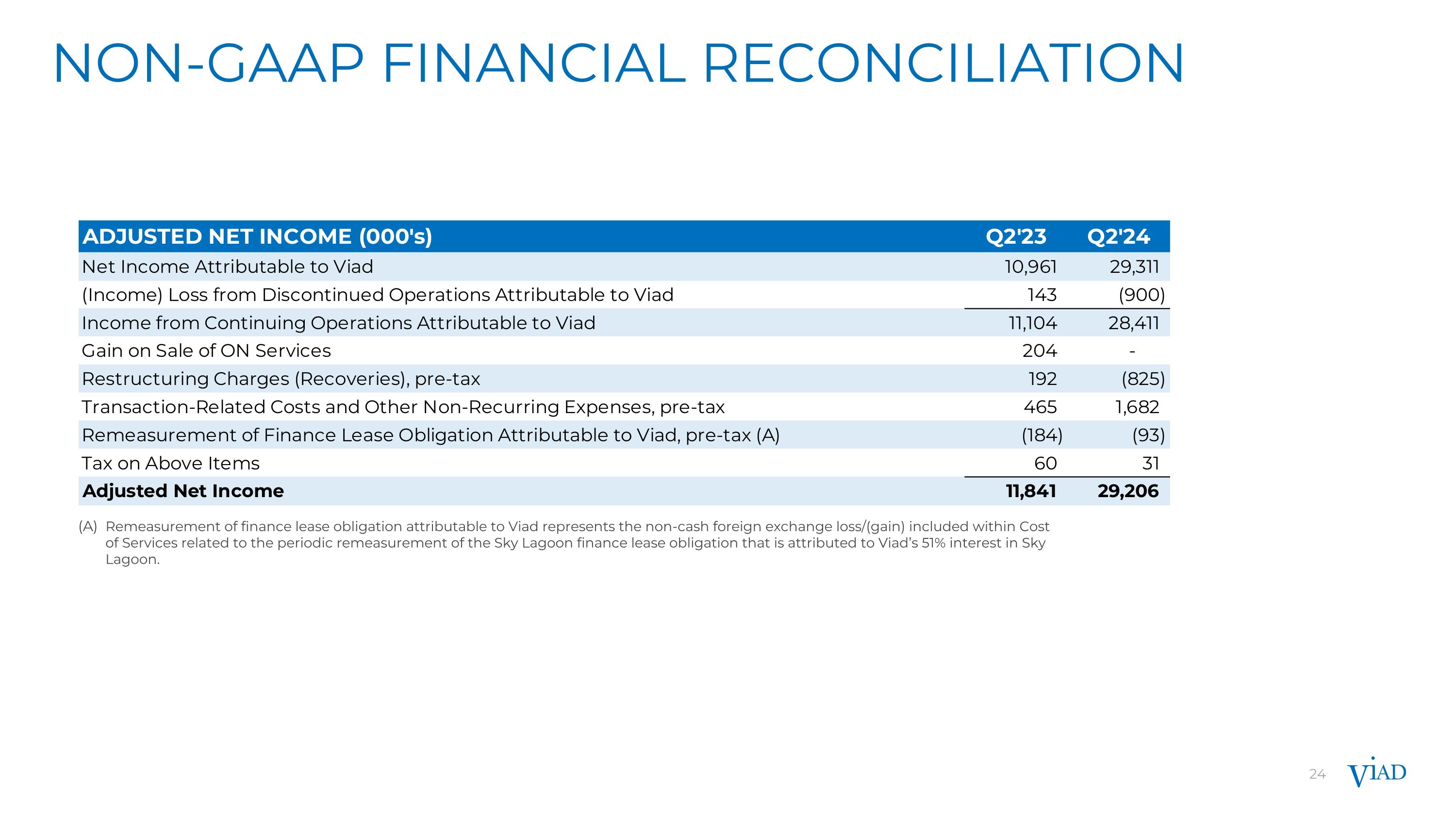

NON-GAAP FINANCIAL RECONCILIATION Remeasurement of finance lease obligation attributable to Viad represents the non-cash foreign exchange loss/(gain) included within Cost of Services related to the periodic remeasurement of the Sky Lagoon finance lease obligation that is attributed to Viad’s 51% interest in Sky Lagoon.

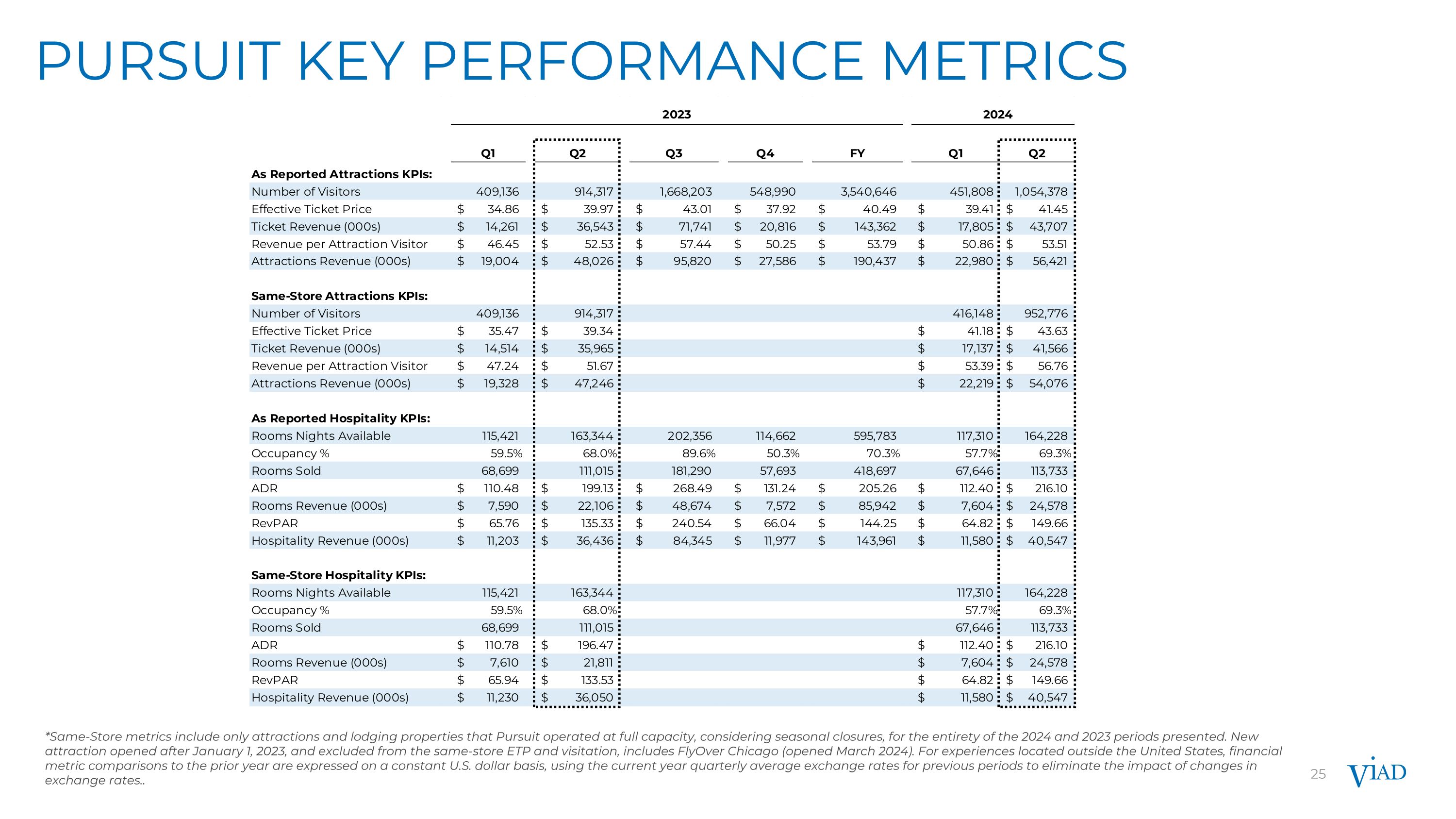

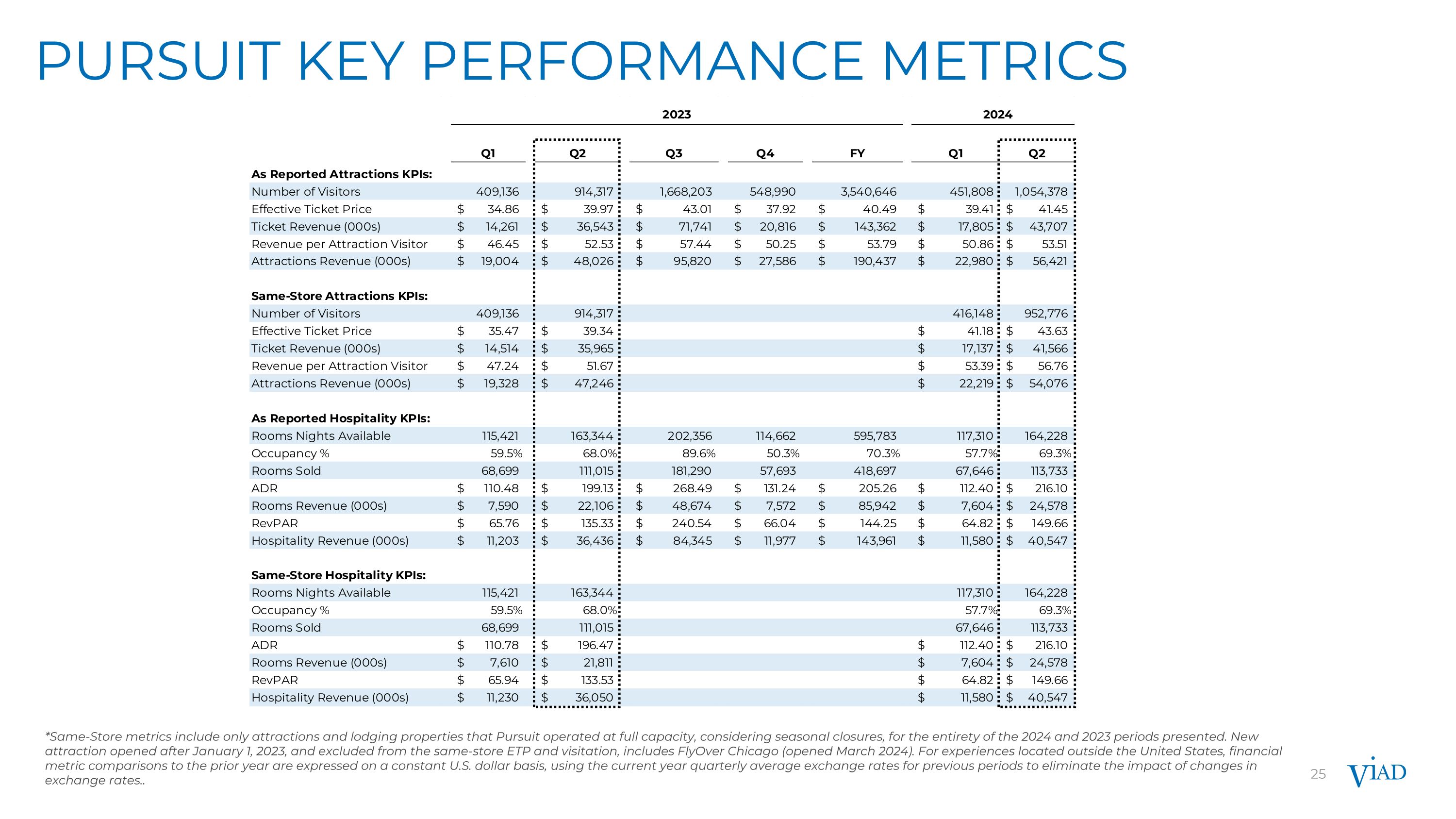

25 Pursuit key performance metrics *Same-Store metrics include only attractions and lodging properties that Pursuit operated at full capacity, considering seasonal closures, for the entirety of the 2024 and 2023 periods presented. New attraction opened after January 1, 2023, and excluded from the same-store ETP and visitation, includes FlyOver Chicago (opened March 2024). For experiences located outside the United States, financial metric comparisons to the prior year are expressed on a constant U.S. dollar basis, using the current year quarterly average exchange rates for previous periods to eliminate the impact of changes in exchange rates..

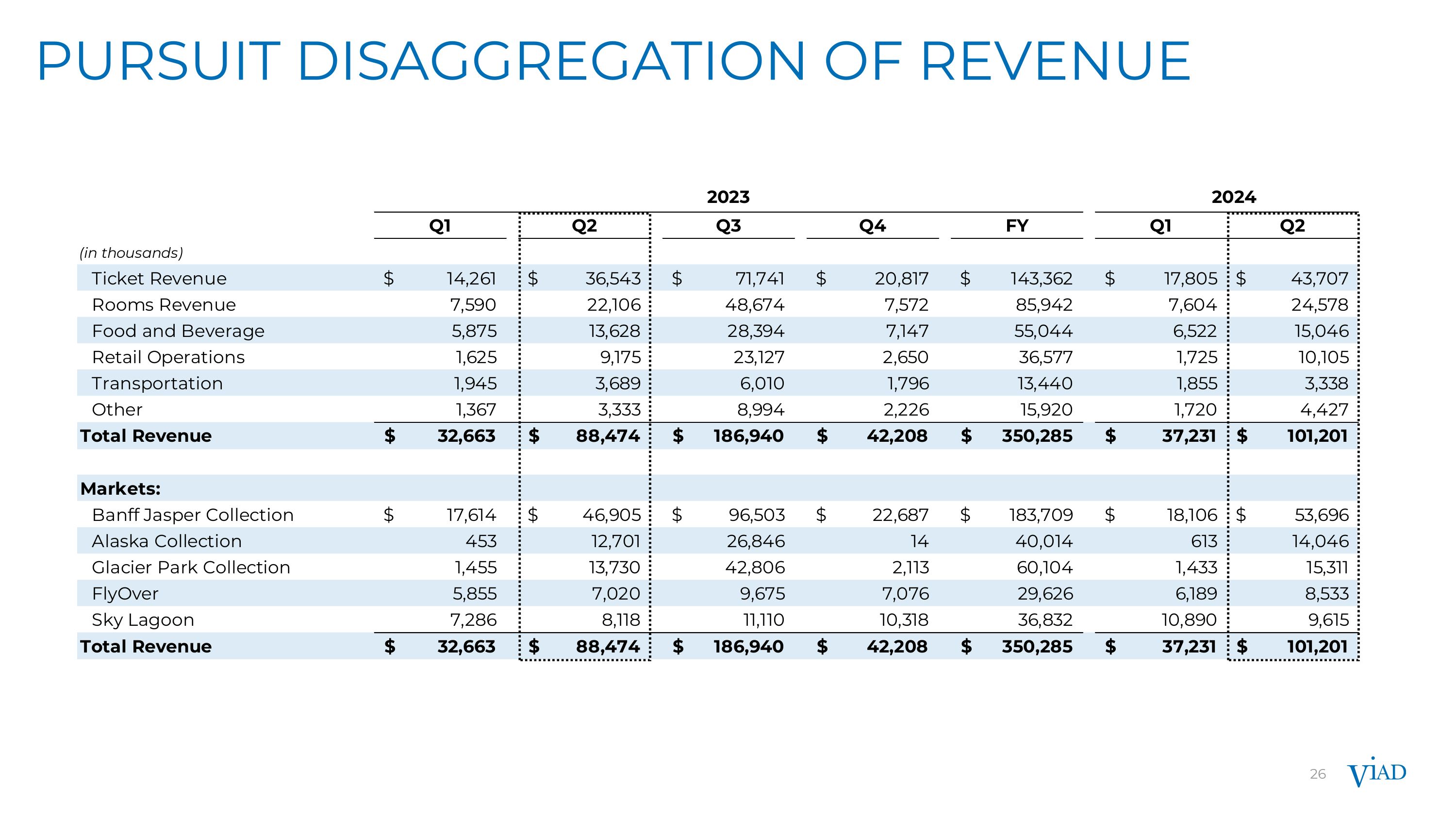

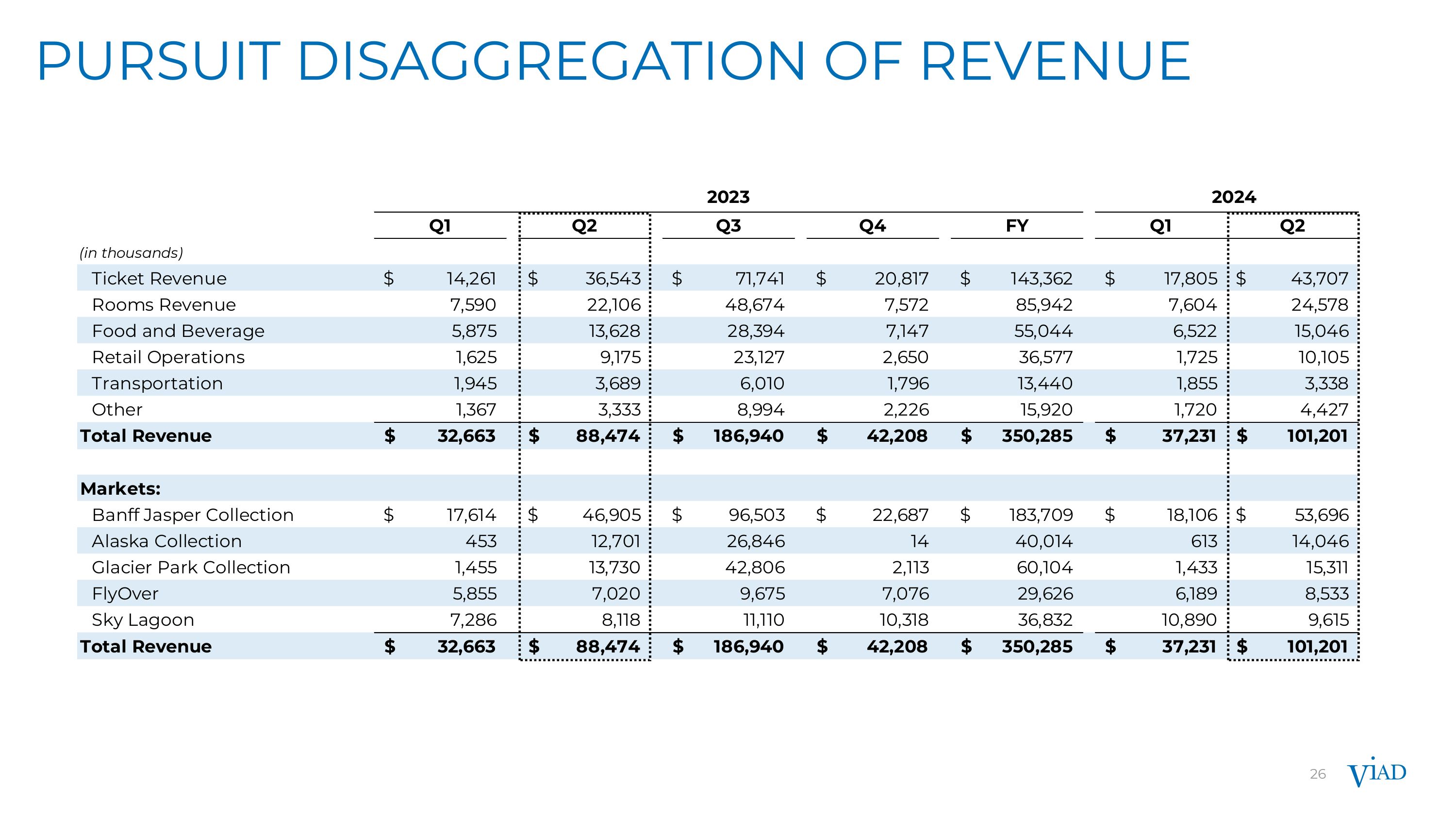

26 Pursuit disaggregation of revenue