0000884614us-gaap:IntersegmentEliminationMemberugi:MidstreamAndMarketingMember2021-10-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED SEPTEMBER 30, 2024

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 1-11071

UGI CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Pennsylvania | | 23-2668356 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

500 North Gulph Road, King of Prussia, PA 19406

(Address of Principal Executive Offices) (Zip Code)

(610) 337-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class: | Trading Symbol(s): | Name of each exchange on which registered: |

| Common Stock, without par value | UGI | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | | Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of UGI Corporation Common Stock held by non-affiliates of the registrant on March 28, 2024 was $5,134,363,782.

At November 15, 2024, there were 214,698,169 shares of UGI Corporation Common Stock issued and outstanding.

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on January 31, 2025 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

GLOSSARY OF TERMS AND ABBREVIATIONS

Terms and abbreviations used in this Form 10-K are defined below:

UGI Corporation and Related Entities

AmeriGas Finance Corp. - A wholly owned subsidiary of AmeriGas Partners

AmeriGas OLP - AmeriGas Propane, L.P., the principal operating subsidiary of AmeriGas Partners

AmeriGas Partners - AmeriGas Partners, L.P., an indirect wholly owned subsidiary of UGI; also referred to, together with its consolidated subsidiaries, as the “Partnership”

AmeriGas Propane - Reportable segment comprising AmeriGas Propane, Inc. and its subsidiaries, including AmeriGas Partners and AmeriGas OLP

AmeriGas Propane, Inc. - A wholly owned second-tier subsidiary of UGI and the general partner of AmeriGas Partners; also referred to as the “General Partner”

AvantiGas - AvantiGas Limited, an indirect wholly owned subsidiary of UGI International, LLC

Company - UGI and its consolidated subsidiaries collectively

DVEP - DVEP Investeringen B.V., an indirect wholly owned subsidiary of UGI International, LLC

Electric Utility - UGI Utilities’ regulated electric distribution utility located in northeastern Pennsylvania

Energy Services - UGI Energy Services, LLC, a wholly owned subsidiary of Enterprises

Enterprises - UGI Enterprises, LLC, a wholly owned subsidiary of UGI

ESFC - Energy Services Funding Corporation, a wholly owned subsidiary of Energy Services

Flaga - Flaga GmbH, an indirect wholly owned subsidiary of UGI International, LLC

Gas Utility - UGI’s regulated natural gas businesses, inclusive of PA Gas Utility and WV Gas Utility

General Partner - AmeriGas Propane, Inc., the general partner of AmeriGas Partners

GHI - GHI Energy, LLC, a Houston-based renewable natural gas company and indirect wholly owned subsidiary of Energy Services

MBL Bioenergy - MBL Bioenergy, LLC

Midstream & Marketing - Reportable segment comprising Energy Services and its subsidiaries including UGID

Mountaineer - Mountaineer Gas Company, a natural gas distribution company in West Virginia and a wholly owned subsidiary of Mountaintop Energy Holdings, LLC

Mountaintop Energy Holdings, LLC - Parent company of Mountaineer and wholly owned subsidiary of UGI

PA Gas Utility - UGI Utilities’ regulated natural gas distribution business, primarily located in Pennsylvania

Partnership - AmeriGas Partners and its consolidated subsidiaries, including AmeriGas OLP; also referred to as “AmeriGas Partners”

Pennant - Pennant Midstream, LLC, an indirect wholly owned subsidiary of Energy Services

Pine Run - Pine Run Gathering, LLC

Stonehenge - Stonehenge Appalachia, LLC, a midstream natural gas gathering business

UGI - UGI Corporation or, collectively, UGI Corporation and its consolidated subsidiaries

UGI Appalachia - UGI Appalachia, LLC, a wholly owned subsidiary of Energy Services

UGI France - UGI France SAS (a Société par actions simplifiée), an indirect wholly owned subsidiary of UGI International, LLC

UGI International - Reportable segment principally comprising UGI International, LLC and its foreign operations

UGI International Holdings, B.V. - An indirect wholly owned subsidiary of UGI International, LLC

UGI International, LLC - UGI International, LLC, a wholly owned subsidiary of Enterprises

UGI Moraine East - UGI Moraine East Gathering LLC, a wholly owned subsidiary comprising the assets acquired in the Stonehenge Acquisition

UGI Pine Run, LLC - A wholly owned subsidiary of Energy Services that holds a 49% membership interest in Pine Run

Utilities - Reportable segment comprising UGI Utilities and Mountaintop Energy Holdings, LLC

UGI Utilities - UGI Utilities, Inc., a wholly owned subsidiary of UGI comprising PA Gas Utility and Electric Utility

UGID - UGI Development Company, a wholly owned subsidiary of Energy Services prior to its sale on September 30, 2024

UniverGas - UniverGas Italia S.r.l, an indirect wholly owned subsidiary of UGI International, LLC

WV Gas Utility - Mountaineer’s regulated natural gas distribution business, located in West Virginia

Other Terms and Abbreviations

2013 OICP - UGI Corporation 2013 Omnibus Incentive Compensation Plan

5.625% Senior Notes - An underwritten public offering of $675 million aggregate principal amount of notes due May 2024, issued by AmeriGas Partners. Pursuant to the tender offer, dated May 22, 2023, AmeriGas Partners, in June 2023, redeemed all outstanding 5.625% Senior Notes due May 2024 and in so doing was released from the obligations with respect to the indenture for the 5.625% Senior Notes

5.50% Senior Notes - An underwritten private offering of senior notes due May 2025, co-issued by AmeriGas Partners and AmeriGas Finance Corp

5.875% Senior Notes - An underwritten private offering of senior notes due August 2026, co-issued by AmeriGas Partners and AmeriGas Finance Corp

5.75% Senior Notes - An underwritten private offering of senior notes due May 2027, co-issued by AmeriGas Partners and AmeriGas Finance Corp

6.02% Senior Note - A private placement of $25 million principal amount of senior notes due November 2030, issued by UGI Utilities

6.10% Senior Note - A private placement of $150 million principal amount of senior notes due November 2033, issued by UGI Utilities

6.40% Senior Note - A private placement of $75 million principal amount of senior notes due November 2053, issued by UGI Utilities

5.24% Senior Note - A private placement of $50 million principal amount of senior notes due November 30, 2029, issued by UGI Utilities

5.52% Senior Note - A private placement of $125 million principal amount of senior notes due November 30, 2034, issued by UGI Utilities

9.375% Senior Notes - An underwritten private offering of senior notes due May 2028, co-issued by AmeriGas Partners and AmeriGas Finance Corp.

2021 IAP - UGI Corporation 2021 Incentive Award Plan

2022 AmeriGas OLP Credit Agreement - Revolving credit agreement entered into by AmeriGas OLP on September 28, 2022, terminated concurrently with the execution of the AmeriGas Senior Secured Revolving Credit Facility

2024 Purchase Contract - A forward stock purchase contract issued by UGI Corporation in May 2021, as a part of the issuance of Equity Units which obligated holders to purchase a number of shares of UGI Common Stock from the Company on June 1, 2024

ABO - Accumulated Benefit Obligation

ACE - AmeriGas Cylinder Exchange

AFUDC - Allowance for Funds Used During Construction

AmeriGas Senior Secured Revolving Credit Facility - Revolving credit agreement entered into by AmeriGas OLP on August 2, 2024 and scheduled to expire in August 2029

AOCI - Accumulated Other Comprehensive Income (Loss)

ASC - Accounting Standards Codification

ASC 606 - ASC 606, “Revenue from Contracts with Customers”

ASC 820 - ASC 820, “Fair Value Measurement”

ASC 980 - ASC 980, “Regulated Operations”

ASU - Accounting Standards Update

ASU 2020-06 - An amendment of FASB ASC, “Debt – Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging – Contracts in Entity’s Own Equity (Subtopic 815-40)”

Bcf - Billions of cubic feet

Board of Directors - The board of directors of UGI

Btu - British thermal unit

CARES - Coronavirus Aid, Relief, and Economic Security Act

CERCLA - Comprehensive Environmental Response, Compensation and Liability Act

CFTC - Commodity Futures Trading Commission

COA - Consent Order and Agreement

CODM - Chief Operating Decision Maker as defined in ASC 280, “Segment Reporting”

Common Stock - Shares of UGI common stock

Common Units - Limited partnership ownership interests in AmeriGas Partners

Convertible Preferred Stock - Preferred stock of UGI titled 0.125% series A cumulative perpetual convertible preferred stock without par value and having a liquidation preference of $1,000 per share

Core market - Comprises (1) firm residential, commercial and industrial customers to whom Utilities has a statutory obligation to provide service who purchase their natural gas or electricity from Utilities; and (2) residential, commercial and industrial customers to whom Utilities has a statutory obligation to provide service who purchase their natural gas or electricity from others

DOT - U.S. Department of Transportation

DS - Delivery Service

DSIC - Distribution System Improvement Charge

EBITDA - Earnings before Interest, Taxes, Depreciation and Amortization

Energy Services Credit Agreement - Revolving credit agreement entered into by Energy Services on March 6, 2020, as amended, scheduled to expire in May 2028

Energy Services Term Loan Credit Agreement - Term loan credit agreement entered into by Energy Services in August 2019, as amended, with a final maturity of February 2030

EPACT 2005 - Energy Policy Act of 2005

ERISA - Employee Retirement Income Security Act of 1974

ERO - Electric Reliability Organization

EU - European Union

Equity Unit Agreements - Collection of agreements governing the rights, privileges and obligations of the holders of the Equity Units and UGI as issuer of the Equity Units, which were filed with the SEC on Form 8-K on May 25, 2021

Equity Unit - A corporate unit consisting of a 2024 Purchase Contract and 1/10th or 10% undivided interest in one share of Convertible Preferred Stock

Exchange Act - Securities Exchange Act of 1934, as amended

FDIC - Federal Deposit Insurance Corporation

FERC - Federal Energy Regulatory Commission

FIFO - First-in, first-out inventory valuation method

Fiscal 2021 - The fiscal year ended September 30, 2021

Fiscal 2022 - The fiscal year ended September 30, 2022

Fiscal 2023 - The fiscal year ended September 30, 2023

Fiscal 2024 - The fiscal year ended September 30, 2024

Fiscal 2025 - The fiscal year ending September 30, 2025

Fiscal 2026 - The fiscal year ending September 30, 2026

Fiscal 2027 - The fiscal year ending September 30, 2027

Fiscal 2028 - The fiscal year ending September 30, 2028

Fiscal 2029 - The fiscal year ending September 30, 2029

FTC - Foreign Tax Credit

GAAP - U.S. generally accepted accounting principles

GDPR - General Data Protection Regulation

GHG - Greenhouse gas

GILTI - Global Intangible Low Taxed Income

Gwh - Millions of kilowatt hours

Hunlock - Hunlock Creek Energy Center located near Wilkes-Barre, Pennsylvania, a 174-megawatt natural gas-fueled electricity generating station

ICE - Intercontinental Exchange

IRC - Internal Revenue Code

IREP - Infrastructure Replacement and Expansion Plan

IRPA - Interest rate protection agreement

IRS - Internal Revenue Service

IT - Information technology

LIBOR - London Inter-bank Offered Rate

LNG - Liquefied natural gas

LPG - Liquefied petroleum gas

LTIIP - Long-term infrastructure improvement plans

MD&A - Management’s Discussion and Analysis of Financial Condition and Results of Operations

MDPSC - Maryland Public Service Commission

MGP - Manufactured gas plant

Mountaineer Acquisition - Acquisition of Mountaintop Energy Holdings LLC, which closed on September 1, 2021

Mountaineer 2023 Credit Agreement - Revolving credit agreement entered into by Mountaineer on November 26, 2019, as amended, scheduled to expire in December 2025

NAV - Net asset value

NOAA - National Oceanic and Atmospheric Administration

NOL - Net operating loss

NPNS - Normal purchase and normal sale

NTSB - National Transportation Safety Board

NYDEC - New York State Department of Environmental Conservation

NYMEX - New York Mercantile Exchange

OSHA - Occupational Safety and Health Administration

PADEP - Pennsylvania Department of Environmental Protection

PAPUC - Pennsylvania Public Utility Commission

Partnership Agreement - Fourth amended and restated agreement of Limited Partnership of AmeriGas Partners, L.P. dated as of July 27, 2009, as amended

PBO - Projected benefit obligation

Pennant Acquisition - Energy Services’ Fiscal 2022 acquisition of the remaining 53% equity interest in Pennant

PennEnergy - PennEnergy Resources, LLC

PGA - Purchased gas adjustment

PGC - Purchased gas costs

PJM - PJM Interconnection, LLC

PRP - Potentially responsible party

PUHCA 2005 - Public Utility Holding Company Act of 2005

Receivables Facility - A receivables purchase facility of Energy Services with an issuer of receivables-backed commercial paper

Retail core-market - Comprises firm residential, commercial and industrial customers to whom Utilities has a statutory obligation to provide service that purchase their natural gas from Utilities

RNG - Renewable natural gas

ROU - Right-of-use

ROD - Record of Decision

SARs - Stock Appreciation Rights

SEC - U.S. Securities and Exchange Commission

SERC - Safety, Environmental, and Regulatory Compliance

Series B preferred stock - Preferred stock of UGI titled 0.125% series B cumulative perpetual preferred stock with terms substantially identical to the Convertible Preferred Stock, except that it will not be convertible

SOFR - Secured Overnight Financing Rate

Stonehenge - Stonehenge Energy Resources III, LLC, a portfolio company of Energy Spectrum Partners VIII, L.P.

Stonehenge Acquisition - Acquisition of Stonehenge Appalachia, LLC, which closed January 27, 2022

Stock Unit - Unit awards that entitle the grantee to shares of UGI Common Stock or cash subject to service conditions

TCJA - Tax Cuts and Jobs Act

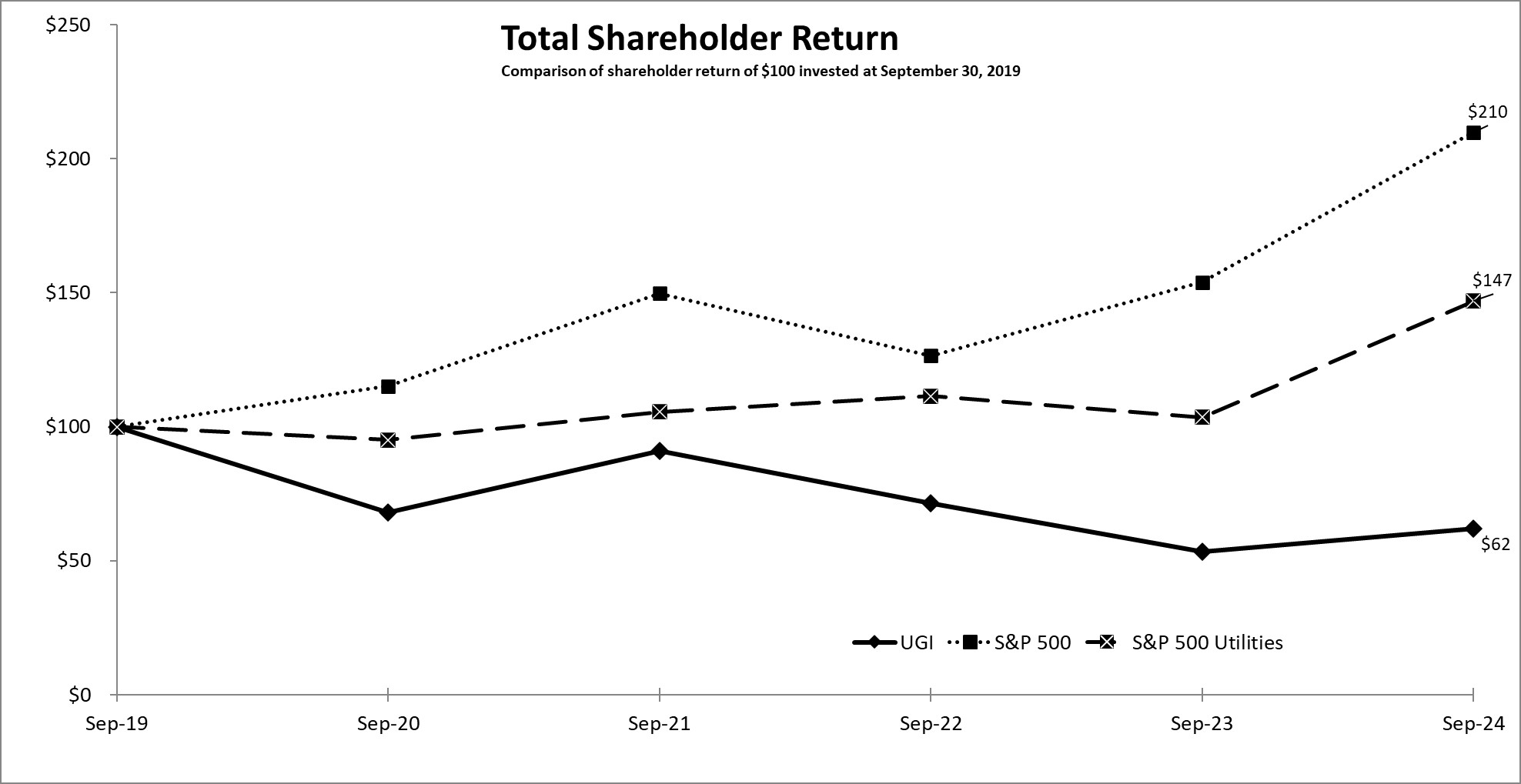

TSR - Total Shareholder Return

U.K. - United Kingdom

U.S. - United States of America

UGI comparator group - The Russell Midcap Utility Index, excluding telecommunications companies, and beginning in Fiscal 2021, a custom UGI performance peer group

UGI Corporation Senior Notes - Aggregate $700 million convertible senior notes entered into by UGI Corporation on June 11, 2024, with a final maturity date of June 2028

UGI Corporation 2025 Credit Agreement - Unsecured senior facilities agreement entered into by UGI Corporation on October 11, 2024, comprising a $475 million revolving credit facility, with a maturity date of October, 11, 2028, and a $400 million term loan facility with a maturity date of October 11, 2027.

UGI Corporation Credit Facility Agreement - An amended and restated unsecured senior credit facilities agreement entered into by UGI Corporation on May 4, 2021, comprising (1) a $250 million term loan facility, (2) a $300 million term loan facility, (3) a $300 million delayed draw term loan facility, and (4) a $300 million revolving credit facility, paid off in full and terminated in October 2024

UGI International 2023 Credit Agreement - A five-year unsecured senior facilities agreement entered into in March 2023, as amended, comprising a €300 million variable-rate term loan facility and a €500 million multicurrency revolving credit facility scheduled to expire in March 2028

UGI Performance Units - Unit awards that entitle the grantee to shares of UGI Common Stock or cash subject to service and market performance conditions

UGI Utilities 2023 Credit Agreement - Revolving credit agreement entered into by UGI Utilities on November 9, 2023, as amended, scheduled to expire in November 2028

UGI Utilities Credit Agreement - Revolving credit agreement entered into by UGI Utilities on June 27, 2019, as amended, repaid in full and terminated concurrently with the execution of the UGI Utilities 2023 Credit Agreement

USD - U.S. dollar

U.S. Pension Plans - Consists of (1) a defined benefit pension plan for employees hired prior to January 1, 2009 of UGI, UGI Utilities and certain of UGI’s other domestic wholly owned subsidiaries; and (2) a defined benefit pension plan for employees of Mountaineer hired prior to January 1, 2023

VDP - Voluntary Departure Plan

VEBA - Voluntary Employees’ Beneficiary Association

WVPSC - Public Service Commission of West Virginia

FORWARD-LOOKING INFORMATION

Information contained in this Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements use forward-looking words such as “believe,” “plan,” “anticipate,” “continue,” “estimate,” “expect,” “may,” or other similar words and terms of similar meaning, although not all forward-looking statements contain such words. These statements discuss plans, strategies, events or developments that we expect or anticipate will or may occur in the future. All forward-looking statements made in this Report rely upon the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, we caution you against relying on any forward-looking statement as these statements are subject to risks and uncertainties that may cause actual results to vary from assumed facts or bases, and the differences between actual results and assumed facts or bases can be material, depending on the circumstances. When considering forward-looking statements, you should keep in mind our Risk Factors included in Item 1A herein and the following important factors that could affect our future results and could cause those results to differ materially from those expressed in our forward-looking statements: (1) weather conditions (including increasingly uncertain weather patterns due to climate change) resulting in reduced demand, the seasonal nature of our business, and disruptions in our operations and supply chain; (2) cost volatility and availability of energy products, including propane and other LPG, natural gas, and electricity, as well as the availability of LPG cylinders, and the capacity to transport product to our customers; (3) changes in domestic and foreign laws and regulations, including safety, health, tax, transportation, consumer protection, data privacy, accounting, and environmental matters, such as regulatory responses to climate change; (4) inability to timely recover costs through utility rate proceedings; (5) increased customer conservation measures due to high energy prices and improvements in energy efficiency and technology resulting in reduced demand; (6) adverse labor relations and our ability to address existing or potential workforce shortages; (7) the impact of pending and future legal or regulatory proceedings, inquiries or investigations; (8) competitive pressures from the same and alternative energy sources; (9) failure to acquire new customers or retain current customers, thereby reducing or limiting any increase in revenues; (10) liability for environmental claims; (11) customer, counterparty, supplier, or vendor defaults; (12) liability for uninsured claims and for claims in excess of insurance coverage, including those for personal injury and property damage arising from explosions, acts of war, terrorism, natural disasters, pandemics, and other catastrophic events that may result from operating hazards and risks incidental to generating and distributing electricity and transporting, storing and distributing natural gas and LPG in all forms; (13) transmission or distribution system service interruptions; (14) political, regulatory and economic conditions in the United States, Europe and other foreign countries, including uncertainties related to the war between Russia and Ukraine, the conflict in the Middle East, the European energy crisis, and foreign currency exchange rate fluctuations (particularly the euro); (15) credit and capital market conditions, including reduced access to capital markets and interest rate fluctuations; (16) changes in commodity market prices resulting in significantly higher cash collateral requirements; (17) impacts of our indebtedness and the restrictive covenants in our debt agreements; (18) reduced distributions from subsidiaries impacting the ability to pay dividends or service debt; (19) changes in Marcellus and Utica Shale gas production; (20) the success of our strategic initiatives and investments intended to advance our business strategy; (21) our ability to successfully integrate acquired businesses and achieve anticipated synergies; (22) the interruption, disruption, failure, malfunction, or breach of our information technology systems, and those of our third-party vendors or service providers, including due to cyber attack; (23) the inability to complete pending or future energy infrastructure projects; (24) our ability to attract, develop, retain and engage key employees; (25) uncertainties related to global pandemics; (26) the impact of a material impairment of our assets; (27) the impact of proposed or future tax legislation; (28) the impact of declines in the stock market or bond market, and a low interest rate environment, on our pension liability; (29) our ability to protect our intellectual property; (30) our ability to overcome supply chain issues that may result in delays or shortages in, as well as increased costs of, equipment, materials or other resources that are critical to our business operations; and (31) our ability to control operating costs and realize cost savings.

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. Any forward-looking statement speaks only as of the date on which such statement is made. We undertake no obligation (and expressly disclaim any obligation) to update publicly any forward-looking statement whether as a result of new information or future events except as required by the federal securities laws.

PART I:

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

CORPORATE OVERVIEW

UGI Corporation is a holding company that, through subsidiaries and affiliates, distributes, stores, transports and markets energy products and related services. In the U.S., we own and operate (1) natural gas and electric distribution utilities, (2) energy marketing (including RNG), midstream infrastructure, storage, natural gas gathering and processing, natural gas production and energy services businesses, and (3) a retail propane marketing and distribution business. In Europe, we market and distribute propane and other LPG, and market other energy products and services. Our subsidiaries and affiliates operate principally in the following four business segments:

•Utilities

•Midstream & Marketing

•UGI International

•AmeriGas Propane

The Utilities segment consists of the regulated natural gas (PA Gas Utility) and electric (Electric Utility) distribution businesses of our wholly owned subsidiary, UGI Utilities, and the regulated natural gas distribution business of our indirect, wholly owned subsidiary, Mountaineer. PA Gas Utility serves customers in eastern and central Pennsylvania and in portions of one Maryland county, and Mountaineer serves customers in West Virginia. Electric Utility serves customers in portions of Luzerne and Wyoming counties in northeastern Pennsylvania. PA Gas Utility is subject to regulation by the PAPUC and FERC and, with respect to its customers in Maryland, the MDPSC. Mountaineer is subject to regulation by the WVPSC and FERC. Electric Utility is subject to regulation by the PAPUC and FERC.

The Midstream & Marketing segment consists of energy-related businesses conducted by our indirect, wholly owned subsidiary, Energy Services. These businesses (i) conduct energy marketing, including RNG, in the Mid-Atlantic region of the United States, (ii) own and operate natural gas liquefaction, storage and vaporization facilities and propane-air mixing assets, (iii) manage natural gas pipeline and storage contracts, (iv) develop, own and operate pipelines, gathering infrastructure and gas storage facilities in the Marcellus and Utica Shale regions of Pennsylvania, eastern Ohio, and the panhandle of West Virginia, and (v) develop, own and operate RNG production facilities. Energy Services and its subsidiaries’ storage, LNG and portions of its midstream transmission operations are subject to regulation by FERC.

The UGI International segment consists of LPG distribution businesses conducted by our subsidiaries and affiliates in Austria, Belgium, the Czech Republic, Denmark, Finland, France, Hungary, Italy, Luxembourg, the Netherlands, Norway, Poland, Romania, Slovakia, Sweden and the United Kingdom. Based on reported market volumes for 2023, which is the most recent information available, UGI International believes that it is the largest distributor of LPG in France, Austria, Belgium, Denmark and Luxembourg and one of the largest distributors of LPG in Hungary, Norway, Poland, the Czech Republic, Slovakia, the Netherlands, Sweden and Finland. During Fiscal 2024, we completed our previously announced exit of substantially all of our non-core European energy marketing business, which had primarily marketed natural gas and electricity to customers in France, Belgium, the Netherlands and the United Kingdom. In addition, we divested all of our LPG business in Switzerland.

The AmeriGas Propane segment consists of the propane distribution business of AmeriGas Partners, an indirect, wholly owned subsidiary of UGI. The Partnership conducts its domestic propane distribution business through its principal operating subsidiary, AmeriGas OLP, and is the nation’s largest retail propane distributor based on the volume of propane gallons distributed annually. The general partner of AmeriGas Partners is our wholly owned subsidiary, AmeriGas Propane, Inc.

Business Strategy

Our business strategy is to grow the Company by focusing on our core competencies of distributing, storing, transporting and marketing energy products. We utilize our core competencies from our existing diversified businesses and our international experience, extensive asset base and access to customers to accelerate both organic growth in our existing businesses as well as in related and complementary businesses.

In Fiscal 2024, the Company embarked on a journey to enhance its financial profile and unlock greater value for shareholders. Our journey ahead is a multi-year process to optimize our Company’s operating model, establish a culture of high performance, pursue operational excellence through continuous improvement, and drive reliable earnings growth. Accordingly, we are focused on (1) pursuing opportunities to optimize our portfolio and drive reliable earnings growth in the base businesses; (2) executing on an operational improvement plan at AmeriGas Propane; (3) creating operational efficiencies to improve cost agility and deliver sustainable cost savings; and (4) enhancing our capital structure and credit metrics to provide greater financial flexibility.

We are committed to pursuing opportunities to optimize our portfolio and drive reliable earnings growth in our regulated utilities businesses, primarily through robust investments in our regulated utilities businesses, optimizing our cost structure, and effectively managing our global LPG businesses, which generate significant free cash flow. We strive to be the preferred provider in all markets we serve and to return value to our shareholders.

Environmental Strategy

We believe that corporate sustainability is critical to our overall business success and we are committed to growing the Company in an environmentally responsible way. UGI’s environmental strategy is focused on three main areas: reducing our emissions; reducing our customers’ emissions affordably, reliably, and responsibly; and investing in renewable solutions. To support our strategy, we have made the following environmental commitments discussed below while also committing to continue to grow our earnings per share and dividends.

•Scope 1 Emissions Reduction Commitment – Reduce Scope 1 GHG emissions by 55% by 2025 (using Fiscal 2020 as a baseline). Our Scope 1 emissions reduction target does not include emissions from the Mountaineer Acquisition, which closed in September 2021. The target also excluded the Stonehenge Acquisition and only accounts for our ownership interest in Pennant at the time we set the target. The emissions from the Pine Run acquisition were included in the baseline 2020 number as this investment contributed to our goal. The 2020 base number also takes a five-year emissions average from the Hunlock generation facility to account for year-over-year differences in run time.

•Methane Emissions Reduction Commitment – 92% reduction by 2030, and 95% reduction by 2040.

•Pipeline Replacement and Betterment Commitment – Replace all cast iron pipelines by 2027 and all bare steel by 2041. Our pipeline replacement and betterment activities better enable us to achieve our emissions reductions goals.

We report our progress on the environmental goals and commitments annually in our Sustainability Reports, including our Scope 1, 2 and 3 emissions, air quality impact, and water management efforts. Our Scope 3 emissions stem primarily from the extraction (upstream) and combustion (downstream) of the molecules we distribute, and from our supply chain. Our Sustainability Reports may be accessed on our website under “ESG - Resources - Sustainability Reports.” Information published in our Sustainability Reports is not incorporated by reference in this Report.

In formulating our environmental strategy, our management and Board of Directors consider certain risks and uncertainties that may materially impact our financial condition and results of operations. For more information on these risks and uncertainties, see “Risk Factors - The potential effects of climate change may affect our business, operations, supply chain and customers, which could adversely impact our financial condition and results of operations.”

Corporate Information

UGI was incorporated in Pennsylvania in 1991. The Company is not subject to regulation by the PAPUC but, following completion of the Mountaineer Acquisition, is a regulated “holding company” under PUHCA 2005. PUHCA 2005 and the implementing regulations of FERC give FERC access to certain holding company books and records and impose certain accounting, record-keeping, and reporting requirements on holding companies. PUHCA 2005 also provides state utility regulatory commissions with access to holding company books and records in certain circumstances.

Our executive offices are located at 500 North Gulph Road, King of Prussia, Pennsylvania 19406, and our telephone number is (610) 337-1000. In this Report, the terms “Company” and “UGI,” as well as the terms “our,” “we,” “us,” and “its” are sometimes used as abbreviated references to UGI Corporation or, collectively, UGI Corporation and its consolidated subsidiaries. For further information on the meaning of certain terms used in this Report, see “Glossary of Terms and Abbreviations.”

The Company’s corporate website can be found at www.ugicorp.com. Information on our website, including the information published in our Sustainability Reports, is not incorporated by reference in this Report. The Company makes available free of charge at this website (under the “Investors - Financial Reports - SEC Filings and Proxies” caption) copies of its reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, including its Annual Reports on Form 10-K, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. The Company’s Principles of Corporate Governance, Code of Business Conduct and Ethics, Supplier Code of Business Conduct and Ethics, and Information Security Program Policy are available on the Company’s website under the caption “Company - Leadership and Governance - Governance Documents.” The charters of the Audit, Corporate Governance, Compensation and Management Development, and Safety, Environmental and Regulatory Compliance Committees of the Board of Directors are available on the Company’s website under the caption “Company - Leadership and Governance - Committees & Charters.” All of these documents are also available free of charge by writing to Senior Director, Investor Relations, UGI Corporation, P.O. Box 858, Valley Forge, PA 19482.

UTILITIES

PA GAS UTILITY

PA Gas Utility consists of the regulated natural gas distribution business of our subsidiary, UGI Utilities. PA Gas Utility serves customers in eastern and central Pennsylvania and in portions of one Maryland county, and therefore is regulated by the PAPUC and, with respect to its customers in Maryland, the MDPSC.

Service Area; Revenue Analysis

PA Gas Utility provides natural gas distribution services to approximately 689,000 customers in certificated portions of 46 eastern and central Pennsylvania counties through its distribution system. Contemporary materials, such as plastic or coated steel, comprise approximately 93% of PA Gas Utility’s 12,700 miles of gas mains, with bare steel pipe comprising approximately 6% and cast and wrought iron pipe comprising approximately 1% of PA Gas Utility’s gas mains. In accordance with PA Gas Utility’s agreement with the PAPUC, PA Gas Utility will replace the cast iron portion of its gas mains by March 2027 and the bare steel portion of its gas mains by September 2041. Located in PA Gas Utility’s service area are major production centers for basic industries such as specialty metals, aluminum, glass, paper product manufacturing and several power generation facilities. PA Gas Utility also distributes natural gas to more than 550 customers in portions of one Maryland county.

System throughput (the total volume of gas sold to or transported for customers within PA Gas Utility’s distribution system) for Fiscal 2024 was approximately 327 Bcf. System sales of gas accounted for approximately 17% of system throughput, while gas transported for residential, commercial and industrial customers who bought their gas from others accounted for approximately 83% of system throughput.

Sources of Supply and Pipeline Capacity

PA Gas Utility is permitted to recover all prudently incurred costs of natural gas it sells to its customers. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures” and Note 9 to Consolidated Financial Statements. PA Gas Utility meets its service requirements by utilizing a diverse mix of natural gas purchase contracts with marketers and producers, along with storage and transportation service contracts. These arrangements enable PA Gas Utility to purchase gas from Marcellus, Gulf Coast, Mid-Continent, and Appalachian sources. For its transportation and storage functions, PA Gas Utility has long-term agreements with a number of pipeline companies, including Texas Eastern Transmission, LP, Columbia Gas Transmission, LLC, Transcontinental Gas Pipeline Company, LLC, Eastern Gas Transmission and Storage, Inc., Tennessee Gas Pipeline Company, L.L.C., and Energy Services and its subsidiaries (including UGI Storage Company and UGI Sunbury, LLC).

Gas Supply Contracts

During Fiscal 2024, PA Gas Utility purchased approximately 82 Bcf of natural gas for sale to retail core-market customers (principally comprised of firm residential, commercial and industrial customers that purchase their gas from PA Gas Utility) and off-system sales customers. Approximately 97% of the volumes purchased were supplied under agreements with ten suppliers, with the remaining volumes supplied primarily by 21 producers and marketers. Gas supply contracts for PA Gas Utility vary in length by counterparty and type of supply. Typically, pipeline and storage contracts range from one to five years in length. PA Gas Utility also has long-term contracts with suppliers for natural gas peaking supply during the months of November through March.

Seasonality

Because many of its customers use natural gas for heating purposes, PA Gas Utility’s sales are seasonal. For Fiscal 2024, approximately 58% of PA Gas Utility’s sales volume was supplied, and approximately 89% of PA Gas Utility’s operating income was earned, during the peak heating season from October through March.

Competition

Natural gas is a fuel that competes with electricity and oil and, to a lesser extent, with propane and coal. Competition among these fuels is primarily a function of their comparative price and the relative cost and efficiency of the equipment. Natural gas generally benefits from a competitive price advantage over oil, electricity and propane. Fuel oil dealers compete for customers in all categories, including industrial customers. PA Gas Utility responds to this competition with marketing and sales efforts designed to retain, expand and grow its customer base.

In substantially all of its service territories, PA Gas Utility is the only regulated gas distribution utility having the right, granted by the PAPUC or by law, to provide gas distribution services. All of PA Gas Utility’s customers, including core-market customers, have the right to purchase gas supplies from entities other than natural gas distribution utility companies.

A number of PA Gas Utility’s commercial and industrial customers have the ability to switch to an alternate fuel at any time and, therefore, are served on an interruptible basis under rates that are competitively priced with respect to the alternate fuel. Margin from these customers, therefore, is affected by the difference or “spread” between the customers’ delivered cost of gas and the customers’ delivered cost of the alternate fuel, the frequency and duration of interruptions, and alternative firm service options. See “Utilities Regulation - State Utility Regulation - PA Gas Utility.”

Approximately 75% of PA Gas Utility’s annual throughput volume for commercial and industrial customers includes customers at locations that afford them the opportunity of seeking transportation service directly from interstate pipelines, thereby bypassing PA Gas Utility. During Fiscal 2024, PA Gas Utility had 17 such customers, 13 of which have transportation contracts extending beyond Fiscal 2025. The majority of these customers are served under transportation contracts having three to 20-year terms and all are among the largest customers for PA Gas Utility in terms of annual volumes. No single customer represents, or is anticipated to represent, more than five percent of PA Gas Utility’s total revenues.

Outlook for Gas Service and Supply

PA Gas Utility anticipates having adequate pipeline capacity, peaking services and other sources of supply available to it to meet the full requirements of all firm customers on its system through Fiscal 2025. Supply mix is diversified, market priced and delivered pursuant to a number of long-term and short-term primary firm transportation and storage arrangements, including transportation contracts held by some of PA Gas Utility’s larger customers and natural gas suppliers serving customers on PA Gas Utility’s distribution system.

During Fiscal 2024, PA Gas Utility supplied transportation service to 11 electric generation facilities and 28 major co-generation facilities. PA Gas Utility continues to seek new residential, commercial and industrial customers for both firm and interruptible service. In Fiscal 2024, PA Gas Utility connected more than 1,250 new commercial and industrial customers. In the residential market sector, PA Gas Utility added more than 9,800 residential heating customers during Fiscal 2024. Approximately 50% of these customers converted to natural gas heating from other energy sources, mainly oil and electricity. New home construction and existing non-heating gas customers who added gas heating systems to replace other energy sources primarily accounted for the other residential heating connections in Fiscal 2024.

PA Gas Utility continues to monitor and participate, where appropriate, in rulemaking and individual rate and tariff proceedings before FERC affecting the rates and the terms and conditions under which PA Gas Utility transports and stores natural gas using interstate natural gas pipelines. Among these proceedings are those arising out of certain FERC orders and/or pipeline filings that relate to (i) the pricing of pipeline services in a competitive energy marketplace, (ii) the flexibility of the terms and conditions of pipeline service tariffs and contracts, and (iii) pipelines’ requests to increase their base rates, or change the terms and conditions of their storage and transportation services.

PA Gas Utility’s objective in negotiations with providers of gas supply resources, and in proceedings before regulatory agencies, is to ensure availability of supply, transportation and storage alternatives to serve market requirements at the lowest cost possible, taking into account the need for safety, security and reliability of supply. Consistent with that objective, PA Gas Utility negotiates certain terms of firm transportation capacity on all pipelines serving it, arranges for appropriate storage and peak-shaving resources, negotiates with producers for competitively priced gas purchases and participates in regulatory proceedings related to transportation rights and costs of service.

At September 30, 2024, PA Gas Utility had approximately 1,550 employees.

MOUNTAINEER

Mountaineer provides a regulated natural gas distribution business to approximately 210,000 customers in 50 of West Virginia’s 55 counties. Mountaineer’s system is comprised of approximately 6,200 miles of distribution, transmission and gathering pipelines. Contemporary materials, such as plastic or coated steel, comprise approximately 77% of Mountaineer’s gas mains, with bare steel pipe comprising the remaining 23%.

As of September 30, 2024, Mountaineer’s customer base was approximately 90% residential, and 10% commercial and industrial customers, with throughput volumes consisting of approximately 23% residential, 32% commercial and 45% industrial and other. Because many of its customers use gas for heating purposes, Mountaineer’s sales are seasonal. For Fiscal 2024, approximately 66% of Mountaineer’s sales volume (including transport volumes) was supplied, and all of Mountaineer’s operating income was earned, during the peak heating season from October through March. No single customer represents, or is anticipated to represent, more than five percent of Mountaineer’s total revenues.

System throughput (the total volume of gas sold to or transported for customers within Mountaineer’s distribution system) for Fiscal 2024 was approximately 51 Bcf. Retail core-market sales of gas accounted for approximately 37% of system throughput, while gas transported for commercial and industrial customers who bought their gas from others accounted for approximately 63% of system throughput. Mountaineer anticipates having adequate pipeline capacity, peaking services and other sources of supply available to it to meet the full requirements of all firm customers on its system through Fiscal 2025.

Approximately 51% of Mountaineer’s annual throughput volume for commercial and industrial customers represents customers who are served under interruptible rates and are also in a location near an interstate pipeline. As of September 30, 2024, Mountaineer had 19 such customers, one of which has a transportation contract extending beyond September 30, 2025. The majority of these customers, including 10 of Mountaineer’s largest customers in terms of annual volumes, are served under evergreen transportation contracts having a 30- to 180-day termination notice.

Mountaineer meets its service requirements by utilizing a diverse mix of natural gas purchase contracts with marketers and producers, along with storage and transportation service contracts. During Fiscal 2024, Mountaineer purchased approximately 20 Bcf of natural gas for sale to retail core-market customers (principally comprised of firm- residential, commercial and industrial customers that purchase their gas from Mountaineer). Approximately 83% of the volume purchased was supplied under agreements with 10 suppliers, with the remaining volumes supplied by various producers and marketers. Gas supply contracts for Mountaineer are generally evergreen agreements with a 30-day termination notice.

At September 30, 2024, Mountaineer had approximately 470 employees.

ELECTRIC UTILITY

Electric Utility supplies electric service to approximately 62,900 customers in portions of Luzerne and Wyoming counties in northeastern Pennsylvania through a system consisting of approximately 2,700 miles of transmission and distribution lines and 14 substations. For Fiscal 2024, approximately 56% of sales volume came from residential customers, 33% from commercial customers and 11% from industrial and other customers. During Fiscal 2024, 11 retail electric generation suppliers provided energy for customers representing approximately 23% of Electric Utility’s sales volume. At September 30, 2024, UGI Utilities’ electric utility operations had approximately 80 employees.

UTILITIES REGULATION

State Utility Regulation

PA Gas Utility

PA Gas Utility is subject to regulation by the PAPUC as to rates, terms and conditions of service, accounting matters, issuance of securities, contracts and other arrangements with affiliated entities, gas safety and various other matters. Rates that PA Gas Utility may charge for gas service come in two forms: (i) rates designed to recover PGCs; and (ii) rates designed to recover costs other than PGCs. Rates designed to recover PGCs are reviewed in PGC proceedings. Rates designed to recover costs other than PGCs are primarily established in general base rate proceedings.

Act 11 of 2012 authorized the PAPUC to permit electric and gas distribution companies, between base rate cases and subject to certain conditions, to recover reasonable and prudent costs incurred to repair, improve or replace eligible property through a DSIC assessed to customers. Among other requirements, DSICs are subject to quarterly reconciliation of over-/under- collection and are capped at five percent of total customer charges absent a PAPUC-granted exception. In addition, Act 11 requires affected utilities to obtain approval of LTIIPs from the PAPUC. Act 11 also authorized electric and gas distribution companies to utilize a fully projected future test year when establishing rates in base rate cases before the PAPUC.

On August 16, 2024, PA Gas Utility filed its third LTIIP covering calendar years 2025-2029. PA Gas Utility projects spending approximately $1.7 billion on DSIC-eligible property identified within the five year LTIIP period. A Commission Order on the LTIIP is anticipated prior to December 31, 2024.

On September 15, 2022, the PAPUC issued a final order approving a settlement of a base rate proceeding by PA Gas Utility that permitted PA Gas Utility to implement a $49 million annual base distribution rate increase through a phased approach, with $38 million beginning October 29, 2022 and an additional $11 million beginning October 1, 2023. In accordance with the terms of the final order, PA Gas Utility was not permitted to file a rate case prior to January 1, 2024. Also in accordance with the terms of the final order, PA Gas Utility implemented a weather normalization adjustment rider as a five-year pilot program beginning on November 1, 2022. Under this rider, customer billings for distribution services are adjusted monthly to reflect normal weather conditions where weather deviates more than three percent from normal. Additionally, under the terms of the final order, PA Gas Utility is authorized to implement a DSIC once its total property, plant and equipment less accumulated depreciation reached $3.368 billion. This threshold was achieved in September 2022 and PA Gas Utility implemented a new DSIC effective January 1, 2023.

In addition to base distribution rates and various surcharges designed to recover specified types of costs, PA Gas Utility’s tariff also includes a uniform PGC rate applicable to firm retail rate schedules for customers who do not obtain natural gas supply service from an alternative supplier. The PGC rate permits recovery of all prudently incurred costs of natural gas that PA Gas Utility sells to its retail customers. PGC rates are reviewed and approved annually by the PAPUC. PA Gas Utility may request quarterly or, under certain conditions, monthly adjustments to reflect the actual cost of gas. Quarterly adjustments become effective on one day’s notice to the PAPUC and are subject to review during the next annual PGC filing. Each proposed annual PGC rate is required to be filed with the PAPUC six months prior to its effective date. During this period, the PAPUC investigates and may hold hearings to determine whether the proposed rate reflects a least-cost fuel procurement policy consistent with the obligation to provide safe, adequate and reliable service. After completion of these hearings, the PAPUC issues an order permitting the collection of gas costs at levels that meet such standard. The PGC mechanism also provides for an annual reconciliation and for the payment or collection of interest on over and under collections. On October 10, 2024, the PAPUC entered an Order approving a settlement of PA Gas Utility’s recent annual PGC filing.

PA Gas Utility’s gas service tariff also contains a state tax surcharge clause. The surcharge is recomputed whenever any of the tax rates included in their calculation are changed. These clauses protect PA Gas Utility from the effects of increases in certain of the Pennsylvania taxes to which it is subject.

Mountaineer

Mountaineer is subject to regulation of rates and other aspects of its business by the WVPSC. When necessary, Mountaineer seeks general base rate increases to recover increased operating costs and a fair return on rate base investments. Base rates are determined by the cost-of-service by rate class, and the rate design methodology allocates the majority of operating costs through volumetric charges.

Mountaineer makes routine filings with the WVPSC to reflect changes in the costs of purchased gas. These purchased gas costs are subject to rate recovery through a mechanism that provides dollar-for-dollar recovery of prudently incurred costs. Costs in excess of revenues that are expected to be recovered in future rates are deferred as regulatory assets; conversely, revenues in excess of costs are deferred as a regulatory liability. The PGA filings generally cover a prospective 12-month period. By orders issued on November 29, 2022 and December 1, 2022 the WVPSC created for Mountaineer’s residential customers only, a new monthly fixed charge of $11.08 to levelize the collection of the pipeline demand charges. The WVPSC issued a final order and a further final order on April 12, 2023 and April 14, 2023, respectively, which established final purchased gas rates, keeping in place the residential pipeline demand charge of $11.08 and permitted partial recovery of interest on the unrecovered balance that was deferred. In July 2023, Mountaineer filed a PGA case, and an interim rate order was issued on October 5, 2023 that established new reduced interim rates effective November 1, 2023. On April 5, 2024, the WVPSC entered a final order adopting the purchased gas cost recovery rate increments approved by the recommended decision entered March 1, 2024 but rejected the recommended decision’s requirement for Mountaineer to eliminate the monthly residential pipeline demand charge in the next annual PGA proceeding. On July 31, 2024, Mountaineer filed its current PGA proceeding including the pipeline demand charge of $11.08 for residential customers and reflecting a decrease in purchased gas costs associated with lower natural gas costs. On October 4, 2024, an interim recommended decision was entered approving Mountaineer’s proposed rates as filed to be effective as interim rates on November 1, 2024. The final PGA rate order is not expected until the first quarter of 2025.

As permitted by West Virginia law, the WVPSC has also approved a standalone cost recovery rider to recover specified costs and a return on infrastructure projects between general base rate cases in accordance with its IREP. Mountaineer makes an annual IREP filing, which is subject to an over/under-recovery mechanism similar to purchased gas costs. In December 2023, the WVPSC issued a final order approving a settlement in Mountaineer’s 2024 IREP filing, including a revenue requirement of $9.6 million effective January 1, 2024. In July 2024, Mountaineer submitted its annual IREP filing to the WVPSC requesting a revenue increase of $8.9 million effective January 1, 2025, based on the forecasted 2025 calendar year IREP-eligible capital investments of $74 million and recovery of eligible costs. On October 28, 2024, the WVPSC issued a final order approving Mountaineer’s requested IREP rates.

Mountaineer filed a base rate proceeding on March 6, 2023. By statute, the WVPSC suspended the rate increase until December 31, 2023. On October 6, 2023, Mountaineer filed a joint stipulation and agreement for settlement of the base rate case, which included a net revenue increase of approximately $13.9 million. On December 21, 2023, the WVPSC issued a final order approving the stipulated net revenue increase that provided an overall increase in total revenues of 4.16%. The WVPSC also approved Mountaineer’s filed five-year Weather Normalization Adjustment Program with the requirement that Mountaineer provide further justification or modification for some elements of the program. On March 28, 2024, Mountaineer filed its response recommending limited modifications to the program. By order entered April 11, 2024, the WVPSC approved Mountaineer’s WNA incorporating the proposed modifications and revised tariff language filed by Mountaineer. Mountaineer’s WNA was implemented for service rendered on and after October 1, 2024.

Electric Utility

Electric Utility is permitted to recover prudently incurred electricity costs, including costs to obtain supply to meet its customers’ energy requirements, pursuant to a supply plan filed with and approved by the PAPUC. Electric Utility distributes electricity that it purchases from wholesale markets and electricity that customers purchase from other suppliers.

On January 27, 2023, Electric Utility filed for a base rate increase with the PAPUC. On July 14, 2023, Electric Utility filed a joint petition for settlement of the rate case, which included a revenue increase of approximately $8.5 million. In an order dated September 21, 2023, the PAPUC approved the settlement and authorized the increased rate to become effective October 1, 2023.

Electric Utility’s tariff includes rates, applicable to so-called “default service” customers who do not obtain electric generation service from an alternative supplier, incurred pursuant to a PAPUC-approved supply plan. These default service rates are reconcilable, may be adjusted quarterly, and are designed to permit Electric Utility to recover the full costs of providing default service in a full and timely manner. Electric Utility’s default service rates include recovery of costs associated with compliance with the AEPS Act, which requires Electric Utility to directly or indirectly acquire certain percentages of its supplies from designated alternative energy sources. In an order dated January 14, 2021, the PAPUC authorized Electric Utility to implement its current Default Service plan for the period June 1, 2021 through May 31, 2025, in accordance with a settlement filed in that proceeding on October 23, 2020.

On May 31, 2024, Electric Utility filed its next default service plan with the PAPUC for the period June 1, 2025 through May 31, 2029, which is pending before the PAPUC.

Electric Utility’s tariff also includes a DSIC surcharge mechanism that was authorized by the PAPUC in 2019. Electric Utility’s first LTIIP, approved in 2017, provided the basis for its current DSIC charges through September 30, 2022. That authority was extended by order of the PAPUC issued August 25, 2022, in which Electric Utility’s second LTIIP filing was approved, authorizing the expenditure of $50.6 million of DSIC-eligible plant over the five-year period ending September 30, 2027.

With the implementation of new base rates on October 1, 2023 pursuant to the PAPUC’s September 21, 2023 order in the 2023 Electric Utility base rate case, Electric Utility’s DSIC-eligible plant associated revenue requirement was rolled into Electric Utility’s base rates. The final order issued by the PAPUC approved the settlement of the base rate proceeding and authorized Electric Utility to implement a new DSIC surcharge once Electric Utility’s total gross plant balance exceeds $275 million.

Utility Franchises

PA Gas Utility and Electric Utility hold certificates of public convenience issued by the PAPUC and certain “grandfather rights” predating the adoption of the Pennsylvania Public Utility Code and its predecessor statutes, which authorize it to carry on its business in the territories in which it renders gas service. Under applicable Pennsylvania law, PA Gas Utility and Electric Utility also have certain rights of eminent domain as well as the right to maintain their facilities in public streets and highways in their respective territories. PA Gas Utility also holds certain franchise rights issued by the Maryland Public Service Commission, which authorizes it to carry on its business in Maryland.

Similarly, Mountaineer holds certificates of public convenience issued by the WVPSC, which authorize it to carry on its business in substantially all of the territories in which it now renders gas service. Under applicable West Virginia law, Mountaineer also has certain rights of eminent domain as well as the right to maintain its facilities in public streets and highways in its territories.

Federal Energy Regulation

With the acquisition of Mountaineer on September 1, 2021, UGI and its subsidiaries became subject to FERC regulation under PUHCA 2005 pertaining to record-keeping and affiliate service pricing requirements. UGI provided notice of its non-exempt status on September 17, 2021.

Utilities is subject to Section 4A of the Natural Gas Act, which prohibits the use or employment of any manipulative or deceptive devices or contrivances in connection with the purchase or sale of natural gas or natural gas transportation subject to the jurisdiction of FERC, and FERC regulations that are designed to promote the transparency, efficiency, and integrity of gas markets.

Similarly, UGI Utilities is also subject to Section 222 of the Federal Power Act, which prohibits the use or employment of any manipulative or deceptive devices or contrivances in connection with the purchase or sale of electric energy or transmission service subject to the jurisdiction of FERC, and FERC regulations that are designed to promote the transparency, efficiency, and integrity of electric markets.

FERC has jurisdiction over the rates and terms and conditions of service of electric transmission facilities used for wholesale or retail choice transactions. Electric Utility owns electric transmission facilities that are within the control area of PJM and are dispatched in accordance with a FERC-approved open access tariff and associated agreements administered by PJM. PJM is a regional transmission organization that regulates and coordinates generation, supply and the wholesale delivery of electricity. Electric Utility receives certain revenues collected by PJM, determined under a formulary rate schedule that is adjusted in June of each year to reflect annual changes in Electric Utility’s electric transmission revenue requirements, when its transmission facilities are used by third parties. FERC has jurisdiction over the rates and terms and conditions of service of wholesale sales of electric capacity and energy. Electric Utility has a tariff on file with FERC pursuant to which it may make power sales to wholesale customers at market-based rates.

Under provisions of EPACT 2005, Electric Utility is subject to certain electric reliability standards established by FERC and administered by an ERO. Electric Utility anticipates that substantially all the costs of complying with the ERO standards will be recoverable through its PJM formulary electric transmission rate schedule.

EPACT 2005 also granted FERC authority to impose substantial civil penalties for the violation of any regulations, orders or provisions under the Federal Power Act and Natural Gas Act and clarified FERC’s authority over certain utility or holding company mergers or acquisitions of electric utilities or electric transmitting utility property valued at $10 million or more.

Other Government Regulation

In addition to state and federal regulation discussed above, Utilities is subject to various federal, state and local laws governing environmental matters, occupational health and safety, pipeline safety and other matters. Each is subject to the requirements of the Resource Conservation and Recovery Act, CERCLA and comparable state statutes with respect to the release of hazardous substances. See Note 16 to Consolidated Financial Statements.

MIDSTREAM & MARKETING

Retail Energy Marketing

Our retail energy marketing business is conducted through Energy Services and its subsidiaries, and sells natural gas, RNG, liquid fuels and electricity to approximately 10,800 residential, commercial, and industrial customers at approximately 40,000 locations. In Fiscal 2024, we (i) served customers in all or portions of Pennsylvania, New Jersey, Delaware, New York, Ohio, Maryland, Virginia, North Carolina, South Carolina, Massachusetts, New Hampshire, Rhode Island, California, and the District of Columbia, (ii) distributed natural gas through the use of the distribution systems of 47 local gas utilities, and (iii) supplied power to customers through the use of the transmission and distribution lines of 20 utility systems.

Historically, a majority of Energy Services’ commodity sales have been made under fixed-price agreements, which typically contain a take-or-pay arrangement that permits customers to purchase a fixed amount of product for a fixed price during a specified period, and requires payment even if the customer does not take delivery of the product. However, a growing number of Energy Services’ commodity sales are currently being made under requirements contracts, under which Energy Services is typically an exclusive supplier and will supply as much product at a fixed price as the customer requires. Energy Services manages supply cost volatility related to these agreements by (i) entering into fixed-price supply arrangements with a diverse group of suppliers, (ii) holding its own interstate pipeline transportation and storage contracts to efficiently utilize gas supplies, (iii) entering into exchange-traded futures contracts on NYMEX and ICE, (iv) entering into over-the-counter derivative arrangements with major international banks and major suppliers, (v) utilizing supply assets that it owns or manages, and (vi) utilizing financial transmission rights to hedge price risk against certain transmission costs. Energy Services also bears the risk for balancing and delivering natural gas and power to its customers under various gas pipeline and utility company tariffs. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Market Risk Disclosures.”

Midstream Assets

LNG

Our LNG assets, which are owned by Energy Services and its subsidiaries, comprise a natural gas liquefaction, storage and vaporization facility in Temple, Pennsylvania, a natural gas liquefaction and storage facility in Mehoopany, Pennsylvania, liquefied natural gas vaporization and storage facilities in Steelton and Bethlehem, Pennsylvania, and three small mobile facilities located in Reading, Mount Carmel and Stroudsburg, Pennsylvania.

In addition, Energy Services sells LNG to customers for use by trucks, drilling rigs, other motor vehicles and facilities located off the natural gas grid. In Fiscal 2024, Energy Services sold LNG to Mountaineer under a WVPSC-approved contract. Further, in Fiscal 2024, our Midstream & Marketing segment also managed natural gas pipeline and storage contracts for utility company customers, including UGI Utilities.

Natural Gas and Propane Storage

Energy Services and its subsidiaries own propane storage and propane-air mixing stations in Bethlehem, Reading, Hunlock Creek and White Deer, Pennsylvania. Energy Services and its subsidiaries also operate propane storage, rail transshipment terminals and propane-air mixing stations in Steelton and Williamsport, Pennsylvania. These assets are used in Midstream & Marketing’s energy peaking business that provides supplemental energy, primarily LNG and propane-air mixtures, to gas utilities at times of high demand (generally during periods of coldest winter weather).

A wholly owned subsidiary of Energy Services owns and operates underground natural gas storage and related high pressure pipeline facilities, which have FERC approval to sell storage services at market-based rates. The storage facilities are located in the Marcellus Shale region of north-central Pennsylvania and have a total storage capacity of 15 million dekatherms and a maximum daily withdrawal quantity of 224,000 dekatherms. In Fiscal 2024, Energy Services leased approximately 72% of the firm capacity at its underground natural gas facilities to third parties.

Gathering Systems and Pipelines

Energy Services operates the Auburn gathering system in the Marcellus Shale region of northeastern Pennsylvania with a total pipeline system capacity of 635,000 dekatherms per day. The gathering system delivers into both the Tennessee Gas and Transcontinental Gas pipelines and receives gas from Tennessee Gas Pipeline as part of a capacity lease with UGI Utilities. Energy Services also operates a 6.5-mile pipeline, known as the Union Dale pipeline, that gathers gas in Susquehanna County and has a capacity of 100,000 dekatherms per day. In addition, Energy Services owns and operates approximately 95 miles of natural gas gathering lines, dehydration and compression facilities, known as Texas Creek, Marshlands, and Ponderosa, located in Bradford, Tioga, Lycoming, Potter and Clinton Counties, Pennsylvania. The combined capacity of these three systems is more than 250,000 dekatherms per day.

Energy Services and its subsidiaries also own and operate a 35-mile, 20-inch pipeline, known as the Sunbury pipeline, with related facilities located in Snyder, Union, Northumberland, Montour, and Lycoming Counties, Pennsylvania, which has a design capacity of 200,000 dekatherms per day. In addition, Energy Services owns and operates the Mt. Bethel pipeline, which runs 12.5 miles in Northampton County, Pennsylvania and is designed to provide 72,000 dekatherms per day.

Including its joint venture with Stonehenge Energy Holdings III LLC in Pine Run Midstream, Energy Services’ subsidiary, UGI Appalachia, consists of seven natural gas gathering systems with approximately 330 miles of natural gas gathering pipelines and gas compressors and one processing plant in southwestern Pennsylvania, eastern Ohio, and the panhandle of West Virginia. The UGI Appalachia assets provide natural gas gathering and processing services in the Appalachian Basin with gathering capacity of approximately 3,110,000 dekatherms per day and processing capacity of approximately 240,000 dekatherms per day.

Electric Generation Assets

During Fiscal 2024, Midstream & Marketing held electric generation facilities conducted by Energy Services’ wholly owned subsidiary, UGID. Energy Services sold all of its ownership interest in UGID in September 2024. Accordingly, UGID’s ownership interest in the Hunlock Creek Energy Center located in Wilkes-Barre, Pennsylvania, a natural gas-fueled electricity generating station, was also disposed of in September 2024. UGID Solar, a wholly owned subsidiary of Energy Services, continues to own and operate 13.5 megawatts of solar-powered generation capacity in Pennsylvania, Maryland and New Jersey.

Renewable Natural Gas

GHI, a wholly owned subsidiary of Energy Services, purchases gas produced from landfills and biodigesters and resells the gas to fleet operators. Environmental credits are generated through this process, which are then sold to various third parties for an additional revenue stream. See “Business Strategy – Investment in Renewable Energy” in this Item 1. and 2. Business and Properties for information on transactions Energy Services completed to further UGI’s foundation for growth within the renewable energy space.

Competition

Our Midstream & Marketing segment competes with other midstream operators to sell gathering, compression, storage and pipeline transportation services. Our Midstream & Marketing segment competes in both the regulated and non-regulated environment against interstate and intrastate pipelines that gather, compress, process, transport and market natural gas. Our Midstream & Marketing segment sells midstream services primarily to producers, marketers and utilities on the basis of price, customer service, flexibility, reliability and operational experience. The competition in the midstream segment is significant as more competitors seek opportunities offered by the development of the Marcellus and Utica Shales.

Our Midstream & Marketing segment also competes with other marketers, consultants and local utilities to sell natural gas, liquid fuels, electric power and related services to customers in its service area principally on the basis of price, customer service and reliability. Midstream & Marketing’s midstream asset base is relatively well-established, though still faces competition from large, national competitors that can offer a suite of services across all customer segments.

Prior to the disposition of UGID, our electricity generation assets competed with other generation stations on the interface of PJM, a regional transmission organization that coordinates the movement of wholesale electricity in certain states, including the states in which we operate, and bases sales on bid pricing.

Through our wholly owned subsidiary, GHI, Energy Services has the capability to source and deliver RNG to customers throughout the U.S. GHI currently delivers RNG to transportation fleets for utilization in their compressed natural gas and LNG fueled vehicles, resulting in the creation and monetization of California Low Carbon Fuel Standard credits and Renewable Fuel Standard Renewable Identification Number credits. GHI competes with other RNG marketers and brokers on the basis of price, customer service and reliability. Further, our Midstream & Marketing segment competes with other RNG project developers, which is a more competitive environment. We compete to acquire the projects from the feedstock generators, which are typically farmers (for manure digesters) and landfill operators, including through offerings of joint venture ownership interests, feedstock payments and royalties. In addition, there has been significant consolidation over the past few years with both agricultural and landfill RNG project owners/developers.

Government Regulation

FERC has jurisdiction over the rates and terms and conditions of service of wholesale sales of electric capacity and energy, as well as the sales for resale of natural gas and related storage and transportation services. Energy Services has a tariff on file with FERC, pursuant to which it may make power sales to wholesale customers at market-based rates, to the extent that Energy Services purchases power in excess of its retail customer needs. Two subsidiaries of Energy Services, UGI LNG, Inc. and UGI Storage Company, currently operate natural gas storage facilities under FERC certificate approvals and offer services to wholesale customers at FERC-approved market-based rates. Two other Energy Services subsidiaries operate natural gas pipelines that are subject to FERC regulation. UGI Mt. Bethel Pipeline Company, LLC operates a 12.5-mile, 12-inch pipeline located in Northampton County, Pennsylvania, and UGI Sunbury, LLC operates the Sunbury Pipeline, a 35-mile, 20-inch diameter pipeline located in central Pennsylvania. Both pipelines offer open-access transportation services at cost-based rates approved by FERC. Energy Services and its subsidiaries undertake various activities to maintain compliance with the FERC Standards of Conduct with respect to pipeline operations. Energy Services is also subject to FERC reporting requirements, market manipulation rules and other FERC enforcement and regulatory powers with respect to its wholesale commodity business.

Midstream & Marketing’s midstream assets include natural gas gathering pipelines and compression and processing in northeastern Pennsylvania, southwestern Pennsylvania, eastern Ohio and the panhandle of West Virginia that are regulated under federal pipeline safety laws and subject to operational oversight by both the Pipeline and Hazardous Materials Safety Administration and the state public utility commissions for the states in which the specific pipelines are located.