UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811- 01136

Security Equity Fund

(Exact name of registrant as specified in charter)

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Donald C. Cacciapaglia, President

Security Equity Fund

805 King Farm Boulevard, Suite 600

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: September 30

Date of reporting period: September 30, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

| Item 1. | Reports to Stockholders. |

FUNDAMENTAL ALPHA

STYLEPLUS LARGE CORE FUND

(Formerly, Large Cap Core Fund)

MID CAP VALUE FUND

MID CAP VALUE INSTITUTIONAL FUND

SMALL CAP VALUE FUND

ENHANCED WORLD EQUITY FUND

WORLD EQUITY INCOME FUND

(Formerly, MSCI EAFE Equal Weight Fund)

OPPORTUNISTIC

ALPHA OPPORTUNITY FUND

SBE-ANN

GO GREEN!

ELIMINATE MAILBOX CLUTTER

Go paperless with Guggenheim Investments eDelivery—a service giving you full online access to account information and documents. Save time, cut down on mailbox clutter and be a friend to the environment with eDelivery.

With Guggenheim Investments eDelivery you can:

| · | View online confirmations and statements at your convenience. |

| · | Receive email notifications when your most recent confirmations, statements and other account documents are available for review. |

| · | Access prospectuses, annual reports and semiannual reports online. |

If you have questions about Guggenheim Investments

eDelivery services, contact one of our Shareholder Service

Representatives at 800.820.0888.

This report and the financial statements contained herein are submitted for the general information of our shareholders. The report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Guggenheim Distributors, LLC.

TABLE OF CONTENTS

THE GUGGENHEIM FUNDS ANNUAL REPORT | 1

September 30, 2013

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the annual shareholder report for one or more of our Funds (the “Funds”) for the year ended September 30, 2013.

The Investment Adviser is part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC, a global, diversified financial services firm.

Guggenheim Distributors, LLC is the distributor of the Funds. Guggenheim Distributors, LLC is affiliated with Guggenheim Partners, LLC and Security Investors, LLC.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter, and then the Managers’ Commentary for each Fund.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Donald C. Cacciapaglia

President

October 31, 2013

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

StylePlus Large Core Fund may not be suitable for all investors. • Investments in large capitalization stocks may underperform other segments of the equity market or the equity market as a whole. • Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing companies. Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market, or that the price goes down. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile than if it had not been leveraged. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund may invest in foreign securities which carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). • The Fund may invest in fixed income securities whose market value will change in response to interest rate changes and market conditions, among other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The Fund may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. • The Fund may invest in restricted securities which may involve financial and liquidity risk. • You may have a gain or loss when you sell your shares. • It is important to note that the Fund is not guaranteed by the U.S. government.

2 | THE GUGGENHEIM FUNDS ANNUAL REPORT

September 30, 2013

Mid Cap Value Fund and Mid Cap Value Institutional Fund may not be suitable for all investors. • An investment in the fund will fluctuate and is subject to investment risks, which means investors could lose money. • The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value. • Investments in small to mid- sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies.

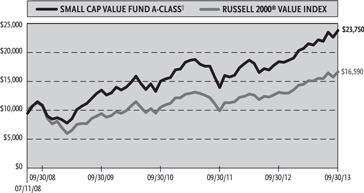

Small Cap Value Fund may not be suitable for all investors. • An investment in the fund will fluctuate and is subject to investment risks, which means investors could lose money. • The intrinsic value of the underlying stocks may never be realized, or the stock may decline in value. • Investments in small-sized company securities may present additional risks such as less predictable earnings, higher volatility and less liquidity than larger, more established companies.

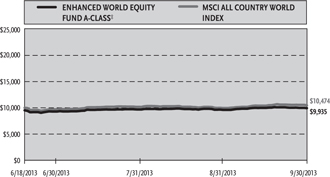

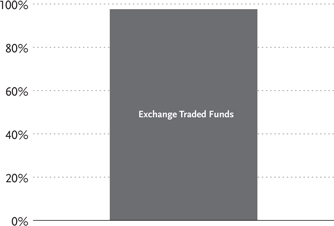

Enhanced World Equity Fund may not be suitable for all investors. • Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. • The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets securities are generally subject to an even greater level of risks). Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. dollar. • The Fund may invest in derivative instruments, which may be more volatile and less liquid, increasing the risk of loss when compared to traditional securities. Certain of the derivative instruments are also subject to the risks of counterparty default and adverse tax treatment. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund’s investment in fixed income securities will change in value in response to interest rate changes and other factors. In general, bond prices rise when interest rates fall and vice versa. • The Fund’s exposure to high yield securities may subject the Fund to greater volatility. • The Fund may invest in bank loans and asset-backed securities, including mortgage backed, which involve special types of risks. • The Funds may invest in restricted securities which may involve financial and liquidity risk. • The Fund’s use of leverage, through borrowings or instruments such as derivatives, may cause the Fund to be more volatile and riskier than if it had not been leveraged. • You may have a gain or loss when you sell your shares. • See the prospectus for more information on these and other risks.

World Equity Income Fund may not be suitable for all investors. • Investments in securities in general are subject to market risks that may cause their prices to fluctuate over time. • The Fund’s investments in foreign securities carry additional risks when compared to U.S. securities, due to the impact of diplomatic, political or economic developments in the country in question (investments in emerging markets are generally subject to an even greater level of risks). Additionally, the Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. dollar. • The Fund’s investments in derivatives may pose risks in addition to those associated with investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. • The Fund’s use of leverage, through instruments such as derivatives, may cause the fund to be more volatile than if it had not been leveraged. • The Fund’s investments in other investment vehicles subject the Fund to those risks and expenses affecting the investment vehicle. • The Fund may have significant exposure to securities in a particular capitalization range, e.g., large-, mid- or small-cap securities. As a result, the Fund may be subject to the risk that the predominant capitalization range may underperform other segments of the equity market or the equity market as a whole.

Alpha Opportunity Fund may not be suitable for all investors. • Value stocks are subject to the risk that the intrinsic value of the stock may never be realized by the market, or that the stock’s price will decline in value. • Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions regarding the growth potential of the issuing company.

THE GUGGENHEIM FUNDS ANNUAL REPORT | 3

| ECONOMIC AND MARKET OVERVIEW | September 30, 2013 |

For much of the 12-month period ended September 30, 2013, the U.S. economy and investment markets benefited from continued monetary accommodation from the world’s central banks and an improving picture for housing and employment.

Volatility rose in the final weeks of the period, however, as markets braced for a government shutdown over a budget impasse and suspected that the U.S. economy is not expanding quickly enough. In addition, confusion clouded the expected start of the end of quantitative easing (QE), speculation over which began rattling investors as far back as May. In refraining from tapering in September, the Fed made it clear that it does not currently see enough economic growth potential to remove extreme monetary accommodation.

The pace of job creation in this economic expansion continues to be subpar. Although the unemployment rate mid-year fell to a four and a half year low, its decline was more a function of a declining labor force participation rate than exuberant hiring. Additionally, solid job gains in the private sector over the period were overshadowed by sluggish growth in aggregate earnings, owing to a rising share of part-time employment which puts downward pressure on consumption growth.

Economic data continue to confirm that housing has been the key pillar supporting the ongoing U.S. expansion, generating 50% of growth in the first half of 2013. Concerns about tapering mid-year drove interest rates higher, with mortgage rates rising by over 100 basis points from May through August. This is having a severe impact on housing, even though it may not show up in the economic data until later in the year.

Markets also have had to deal with substantial uncertainty overseas. Fears of a Chinese credit crunch stoked investor anxiety, and measures implemented to address structural problems in China’s economy appear to be temporary rather than long-term solutions. The devaluation of the Japanese yen is putting pressure on all the economies in the region, making the global economy vulnerable to an unexpected economic shock. Europe, meanwhile, is bouncing along a bottom, and the growth outlook, while improving, remains weak.

From a policy standpoint, the Fed appears to be concerned about the impact higher interest rates are having on the economy and the housing sector in particular, and it seems to be guiding long-term rates closer to the rate of inflation to stimulate growth. The Federal Open Market Committee has been very clear that the Fed will not allow interest rates to rise significantly until output and the crucial real estate market have reaccelerated.

For the year ended September 30, 2013, the return of the Standard & Poor’s 500® Index* (“S&P 500”) was 19.34%. The Barclays U.S. Aggregate Bond Index* returned -1.68% for the period, while the Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index* returned 0.10%. The MSCI World Index* returned 20.23%, while the MSCI Emerging Markets Index* returned 0.98%.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bank of America Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets.

S&P 500® Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad economy, representing all major industries and is considered a representation of the U.S. stock market.

Russell 2500® Value Index measures the performance of the small- to mid-cap value segment of the U.S. equity universe. It includes those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 2000® Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

Russell 1000® Value Index: A measure of the performance for the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values.

MSCI All-Country World Index (ACWI) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

4 | THE GUGGENHEIM FUNDS ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning March 31, 2013 and ending September 30, 2013.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

THE GUGGENHEIM FUNDS ANNUAL REPORT | 5

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued)

| | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1 | | | Return | | | March 31, 2013 | | | September 30, 2013 | | | Period2 | |

| Table 1. Based on actual Fund return3 | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| StylePlus Large Core Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.40 | % | | | 6.08 | % | | | $1,000.00 | | | | $1,060.80 | | | | $ 7.23 | |

| B-Class | | | 2.71 | % | | | 5.32 | % | | | 1,000.00 | | | | 1,053.20 | | | | 13.95 | |

| C-Class | | | 2.37 | % | | | 5.55 | % | | | 1,000.00 | | | | 1,055.50 | | | | 12.21 | |

| Institutional Class | | | 1.24 | % | | | 6.13 | % | | | 1,000.00 | | | | 1,061.30 | | | | 6.41 | |

| | | | | | | | | | | | | | | | | | | | | |

| Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.39 | % | | | 7.80 | % | | | 1,000.00 | | | | 1,078.00 | | | | 7.24 | |

| B-Class | | | 2.16 | % | | | 7.39 | % | | | 1,000.00 | | | | 1,073.90 | | | | 11.23 | |

| C-Class | | | 2.16 | % | | | 7.39 | % | | | 1,000.00 | | | | 1,073.90 | | | | 11.23 | |

| | | | | | | | | | | | | | | | | | | | | |

| Mid Cap Value Institutional Fund | | | 1.04 | % | | | 7.74 | % | | | 1,000.00 | | | | 1,077.40 | | | | 5.42 | |

| | | | | | | | | | | | | | | | | | | | | |

| Small Cap Value Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.30 | % | | | 10.62 | % | | | 1,000.00 | | | | 1,106.20 | | | | 6.86 | |

| C-Class | | | 2.05 | % | | | 10.14 | % | | | 1,000.00 | | | | 1,101.40 | | | | 10.80 | |

| Institutional Class | | | 1.05 | % | | | 10.74 | % | | | 1,000.00 | | | | 1,107.40 | | | | 5.55 | |

| | | | | | | | | | | | | | | | | | | | | |

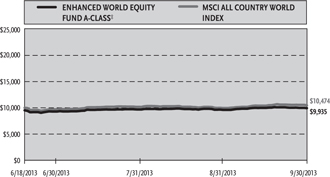

| Enhanced World Equity Fund5 | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.25 | % | | | 4.32 | % | | | 1,000.00 | | | | 1,043.20 | | | | 3.60 | |

| C-Class | | | 2.00 | % | | | 4.00 | % | | | 1,000.00 | | | | 1,040.00 | | | | 5.76 | |

| Institutional Class | | | 1.00 | % | | | 4.40 | % | | | 1,000.00 | | | | 1,044.00 | | | | 2.88 | |

| | | | | | | | | | | | | | | | | | | | | |

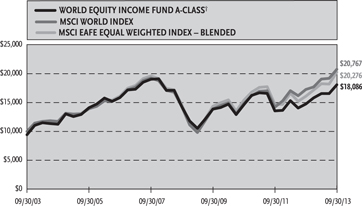

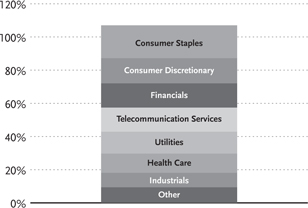

| World Equity Income Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.52 | % | | | 9.24 | % | | | 1,000.00 | | | | 1,092.40 | | | | 7.97 | |

| B-Class4 | | | 1.28 | % | | | 9.36 | % | | | 1,000.00 | | | | 1,093.60 | | | | 6.72 | |

| C-Class | | | 2.27 | % | | | 8.72 | % | | | 1,000.00 | | | | 1,087.20 | | | | 11.88 | |

| Institutional Class | | | 1.27 | % | | | 9.57 | % | | | 1,000.00 | | | | 1,095.70 | | | | 6.67 | |

| | | | | | | | | | | | | | | | | | | | | |

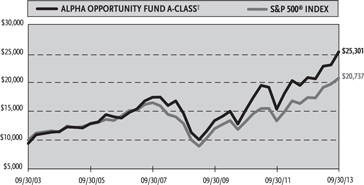

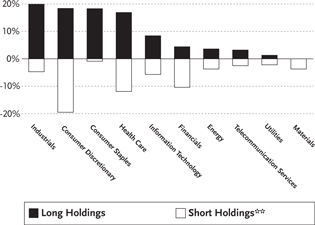

| Alpha Opportunity Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 2.14 | % | | | 10.90 | % | | | 1,000.00 | | | | 1,109.00 | | | | 11.31 | |

| B-Class | | | 2.87 | % | | | 10.44 | % | | | 1,000.00 | | | | 1,104.40 | | | | 15.14 | |

| C-Class | | | 2.88 | % | | | 10.52 | % | | | 1,000.00 | | | | 1,105.20 | | | | 15.20 | |

| Institutional Class | | | 1.90 | % | | | 11.05 | % | | | 1,000.00 | | | | 1,110.50 | | | | 10.05 | |

6 | THE GUGGENHEIM FUNDS ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded)

| | | | | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Fund | | | Account Value | | | Account Value | | | Paid During | |

| | | Ratio1 | | | Return | | | March 31, 2013 | | | September 30, 2013 | | | Period2 | |

| Table 2. Based on hypothetical 5% return (before expenses) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| StylePlus Large Core Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.40 | % | | | 5.00 | % | | $ | 1,000.00 | | | $ | 1,018.05 | | | $ | 7.08 | |

| B-Class | | | 2.71 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,011.48 | | | | 13.67 | |

| C-Class | | | 2.37 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,013.19 | | | | 11.96 | |

| Institutional Class | | | 1.24 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.85 | | | | 6.28 | |

| | | | | | | | | | | | | | | | | | | | | |

| Mid Cap Value Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.39 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.10 | | | | 7.03 | |

| B-Class | | | 2.16 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,014.24 | | | | 10.91 | |

| C-Class | | | 2.16 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,014.24 | | | | 10.91 | |

| | | | | | | | | | | | | | | | | | | | | |

| Mid Cap Value Institutional Fund | | | 1.04 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.85 | | | | 5.27 | |

| | | | | | | | | | | | | | | | | | | | | |

| Small Cap Value Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.30 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.55 | | | | 6.58 | |

| C-Class | | | 2.05 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,014.79 | | | | 10.35 | |

| Institutional Class | | | 1.05 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,019.80 | | | | 5.32 | |

| | | | | | | | | | | | | | | | | | | | | |

| Enhanced World Equity Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.25 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.80 | | | | 6.33 | |

| C-Class | | | 2.00 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.04 | | | | 10.10 | |

| Institutional Class | | | 1.00 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,020.05 | | | | 5.06 | |

| | | | | | | | | | | | | | | | | | | | | |

| World Equity Income Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 1.52 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,017.45 | | | | 7.69 | |

| B-Class4 | | | 1.28 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.65 | | | | 6.48 | |

| C-Class | | | 2.27 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,013.69 | | | | 11.46 | |

| Institutional Class | | | 1.27 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,018.70 | | | | 6.43 | |

| | | | | | | | | | | | | | | | | | | | | |

| Alpha Opportunity Fund | | | | | | | | | | | | | | | | | | | | |

| A-Class | | | 2.14 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,014.34 | | | | 10.81 | |

| B-Class | | | 2.87 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,010.68 | | | | 14.47 | |

| C-Class | | | 2.88 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,010.63 | | | | 14.52 | |

| Institutional Class | | | 1.90 | % | | | 5.00 | % | | | 1,000.00 | | | | 1,015.54 | | | | 9.60 | |

| 1 | Annualized and excludes expenses of the underlying funds in which the Funds invest. This ratio represents net expenses, which includes dividends on short sales and interest expenses. Excluding these expenses, the operating expense ratio of the Alpha Opportunity Fund would be 2.10%, 2.85%, 2.86% and 1.87% for the A-Class, B-Class, C-Class and Institutional Class, respectively. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| 3 | Actual cumulative return at net asset value for the period March 31, 2013 to September 30, 2013. |

| 4 | B-Class shares did not charge 12b-1 fees during the period. |

| 5 | Since commencement of operations: June 18, 2013. |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 7

| MANAGERS’ COMMENTARY (Unaudited) | September 30, 2013 |

To Our Shareholders:

Guggenheim StylePlus Large Core Fund (the “Fund”) is managed by a team of seasoned professionals, including B. Scott Minerd, Global Chief Investment Officer; Farhan Sharaff, Senior Managing Director and Assistant Chief Investment Officer, Equities; Jayson Flowers, Senior Managing Director and Head of Equity and Derivative Strategies; and Scott Hammond, Managing Director and Portfolio Manager. In the following paragraphs, the investment team discusses performance and changes to the Fund that occurred in the fiscal year ended September 30, 2013.

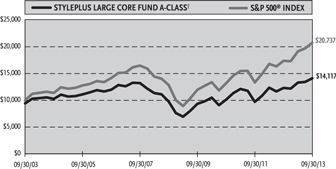

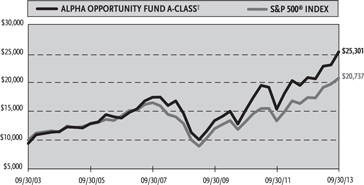

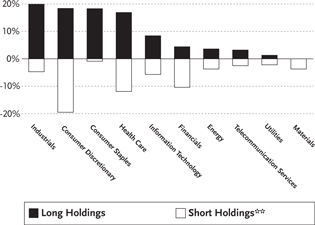

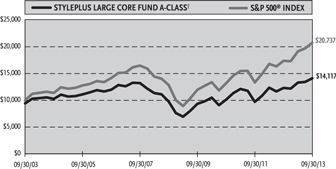

For the year ended September 30, 2013, the Guggenheim StylePlus Large Core Fund returned 14.64%1, compared with the 19.34% return of its benchmark, the S&P 500 Index.

The Fund’s Board of Directors approved the following changes, which became effective on April 30, 2013: a new Fund name, new principal investment strategies and new portfolio management team.

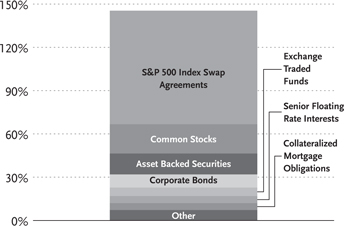

The Fund’s -investment objective is to deliver long-term growth of capital in excess of that produced by the total return of the S&P 500 Index. The Fund seeks to add alpha above the target index by leveraging Guggenheim’s competencies in fixed income and systematic stock selection. To accomplish this, the StylePlus strategy allocates to quantitative selection models when stock picking opportunities in the market are high. When stock selection opportunities are less attractive, the Fund invests in derivatives based on the target index, backed by a diversified portfolio of fixed income instruments. In this way, the Fund believes it will deliver the target index return plus an alpha component commensurate with the yield achieved on the active fixed income portfolio.

The Fund’s underperformance for the 12 months came predominantly during the seven months it was being managed according to the legacy strategy. Specifically—from October 1, 2012 through April 30, 2013—the Fund underperformed the benchmark by almost five percentage points, largely due to poor stock selection in the Information Technology and Financials sectors—the latter being the largest and best-performing sector in the benchmark. The Fund’s cash position was also a drag on performance. A sector overweight and stock selection in Consumer Discretionary contributed most to the Fund’s performance.

For the time the Fund was being managed according to the new strategy, the five months from April 30, 2013 through September 30, 2013, the Fund performed in-line with the benchmark. During this period, the Fund maintained an approximate allocation of 20% to systematic equity selection, 80% allocated to the passive equity position, which was maintained with a swap and futures contracts, and 46% allocated to fixed income investments (excluding short-term). The equity sleeve was additive, delivering the strongest returns during the month of May and June. The fixed income allocation was a net detractor to performance, with the greatest impact occurring during the substantial debt selloff that began at the end of May and lasted in to June.

Performance displayed represents past performance which is no guarantee of future results.

1 Performance figures are based on A-Class shares and do not reflect deduction of the sales charges or taxes that a shareholder would pay on distributions or the redemption of shares.

The opinions and forecast expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

8 | THE GUGGENHEIM FUNDS ANNUAL REPORT

| PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | September 30, 2013 |

STYLEPLUS LARGE CORE FUND

OBJECTIVE: Seeks long-term growth of capital.

Cumulative Fund Performance*

Average Annual Returns*

Periods Ended 09/30/13

| | | 1 Year | | | 5 Year | | | 10 Year | |

| A-Class Shares | | | 14.64 | % | | | 7.64 | % | | | 4.12 | % |

| A-Class Shares with sales charge† | | | 9.19 | % | | | 6.37 | % | | | 3.51 | % |

| B-Class Shares | | | 13.19 | % | | | 6.64 | % | | | 3.50 | % |

| B-Class Shares with CDSC‡ | | | 8.19 | % | | | 6.33 | % | | | 3.50 | % |

| C-Class Shares | | | 13.55 | % | | | 6.83 | % | | | 3.33 | % |

| C-Class Shares with CDSC§ | | | 12.55 | % | | | 6.83 | % | | | 3.33 | % |

| S&P 500 Index | | | 19.34 | % | | | 10.02 | % | | | 7.57 | % |

| | | | | | Since Inception | |

| | | 1 Year | | | (03/01/12) | |

| Institutional Class Shares | | | 14.79 | % | | | 10.55 | % |

| S&P 500 Index | | | 19.34 | % | | | 16.12 | % |

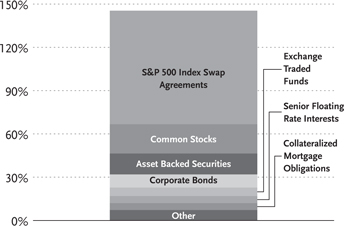

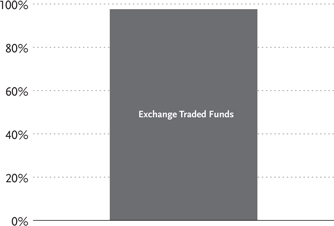

Holdings Diversification (Market Exposure as % of Net Assets)

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments.

| Inception Dates: | |

| A-Class | September 10, 1962 |

| B-Class | October 19, 1993 |

| C-Class | January 29, 1999 |

| Institutional Class | March 1, 2012 |

| * | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index is an unmanaged index and, unlike the Fund, has no management fees or operating expenses to reduce its reported return. |

| † | Effective February 22, 2011, the maximum sales charge decreased from 5.75% to 4.75%. A 5.75% maximum sales charge is used in the calculation of the 5 Year and 10 Year average annual returns (based on subscriptions made prior to February 22, 2011), and a 4.75% maximum sales charge will be used to calculate performance for periods based on subscriptions made on or after February 22, 2011. |

| ‡ | Fund returns include a CDSC of up to 5% if redeemed within 5 years of purchase. |

| § | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

THE GUGGENHEIM FUNDS ANNUAL REPORT | 9

| PERFORMANCE AND FUND PROFILE (Unaudited)(concluded) | September 30, 2013 |

| Ten Largest Holdings (% of Total Net Assets) | | | | |

| Dreyfus Treasury Prime Cash Management Fund | | | 18.3 | % |

| Geer Mountain Financing Ltd. — 2007-1A | | | 2.2 | % |

| Guggenheim Enhanced Short Duration ETF | | | 2.2 | % |

| Floating Rate Strategies Fund Institutional Class | | | 1.8 | % |

| Macro Opportunities Fund Institutional Class | | | 1.8 | % |

| New York City Water & Sewer System Revenue Bonds | | | 1.4 | % |

| Duane Street CLO IV Ltd. — 2007-4A | | | 1.4 | % |

| Apidos CDO VIII — 2011-8A | | | 1.3 | % |

| Wachovia Bank Commercial Mortgage Trust Series 2007-WHALE 2007-WHL8 | | | 1.3 | % |

| Guggenheim BulletShares 2014 High Yield Corporate Bond ETF | | | 1.2 | % |

| Top Ten Total | | | 32.9 | % |

Portfolio Composition by Quality Rating*

| Fixed Income Instruments | | | | |

| AAA | | | 21.7 | % |

| AA | | | 3.3 | % |

| A | | | 6.2 | % |

| BBB | | | 12.7 | % |

| BB | | | 3.6 | % |

| B | | | 3.5 | % |

| CCC | | | 0.4 | % |

| NR | | | 0.6 | % |

| Other Instruments | | | | |

| Common Stock | | | 20.2 | % |

| Short Term Investments | | | 18.3 | % |

| Exchanged Traded Funds | | | 5.9 | % |

| Mutual Funds | | | 3.6 | % |

| Total Investments | | | 100.0 | % |

The table above reflects percentages of the value of total investments.

| * | Source: Factset. Credit quality ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). All securities have been rated by Moody’s, Standard & Poor’s (“S&P”), or Fitch, which are all a Nationally Recognized Statistical Rating Organization (“NRSRO”). For purposes of this presentation, when ratings are available from more than one agency, the highest rating is used. Guggenheim Investments has converted Moody’s and Fitch ratings to the equivalent S&P rating. Unrated securities do not necessarily indicate low credit quality. Security ratings are determined at the time of purchase and may change thereafter. |

10 | THE GUGGENHEIM FUNDS ANNUAL REPORT

| SCHEDULE OF INVESTMENTS | September 30, 2013 |

| STYLEPLUS LARGE CORE FUND |

| | | Shares | | | Value | |

| | | | | | | |

| COMMON STOCKS† - 20.2% | | | | | | | | |

| | | | | | | | | |

| INFORMATION TECHNOLOGY - 3.8% | | | | | | | | |

| Apple, Inc. | | | 2,258 | | | $ | 1,076,501 | |

| International Business Machines Corp. | | | 3,528 | | | | 653,315 | |

| Cisco Systems, Inc. | | | 23,842 | | | | 558,380 | |

| Hewlett-Packard Co. | | | 25,642 | | | | 537,969 | |

| Microsoft Corp. | | | 15,294 | | | | 509,443 | |

| Intel Corp. | | | 19,074 | | | | 437,176 | |

| Corning, Inc. | | | 28,147 | | | | 410,665 | |

| Oracle Corp. | | | 11,865 | | | | 393,562 | |

| QUALCOMM, Inc. | | | 5,539 | | | | 373,107 | |

| Google, Inc. — Class A* | | | 413 | | | | 361,751 | |

| Applied Materials, Inc. | | | 17,932 | | | | 314,527 | |

| EMC Corp. | | | 12,118 | | | | 309,736 | |

| Symantec Corp. | | | 11,972 | | | | 296,307 | |

| TE Connectivity Ltd. | | | 5,612 | | | | 290,589 | |

| Visa, Inc. — Class A | | | 669 | | | | 127,846 | |

| Accenture plc — Class A | | | 1,611 | | | | 118,634 | |

| Automatic Data Processing, Inc. | | | 1,484 | | | | 107,412 | |

| Total Information Technology | | | | | | | 6,876,920 | |

| HEALTH CARE - 3.5% | | | | | | | | |

| Pfizer, Inc. | | | 31,082 | | | | 892,365 | |

| Johnson & Johnson | | | 8,089 | | | | 701,235 | |

| Merck & Company, Inc. | | | 13,878 | | | | 660,732 | |

| Abbott Laboratories | | | 17,020 | | | | 564,893 | |

| Express Scripts Holding Co.* | | | 9,010 | | | | 556,638 | |

| McKesson Corp. | | | 4,197 | | | | 538,475 | |

| Becton Dickinson and Co. | | | 4,191 | | | | 419,183 | |

| UnitedHealth Group, Inc. | | | 5,700 | | | | 408,177 | |

| Bristol-Myers Squibb Co. | | | 8,554 | | | | 395,879 | |

| Medtronic, Inc. | | | 6,990 | | | | 372,218 | |

| Covidien plc | | | 4,340 | | | | 264,480 | |

| Eli Lilly & Co. | | | 4,309 | | | | 216,872 | |

| AbbVie, Inc. | | | 3,951 | | | | 176,728 | |

| Intuitive Surgical, Inc.* | | | 277 | | | | 104,227 | |

| Baxter International, Inc. | | | 1,559 | | | | 102,411 | |

| Total Health Care | | | | | | | 6,374,513 | |

| INDUSTRIALS - 3.5% | | | | | | | | |

| General Electric Co. | | | 38,349 | | | | 916,158 | |

| General Dynamics Corp. | | | 6,223 | | | | 544,636 | |

| Boeing Co. | | | 4,439 | | | | 521,583 | |

| Waste Management, Inc. | | | 12,013 | | | | 495,416 | |

| Caterpillar, Inc. | | | 5,524 | | | | 460,536 | |

| CSX Corp. | | | 17,206 | | | | 442,883 | |

| United Parcel Service, Inc. — Class B | | | 4,548 | | | | 415,550 | |

| Raytheon Co. | | | 4,560 | | | | 351,439 | |

| Emerson Electric Co. | | | 4,961 | | | | 320,977 | |

| FedEx Corp. | | | 2,796 | | | | 319,052 | |

| Northrop Grumman Corp. | | | 3,176 | | | | 302,546 | |

| Union Pacific Corp. | | | 1,889 | | | | 293,437 | |

| Lockheed Martin Corp. | | | 1,878 | | | | 239,539 | |

| Norfolk Southern Corp. | | | 2,966 | | | | 229,420 | |

| Deere & Co. | | | 1,860 | | | | 151,385 | |

| Ingersoll-Rand plc | | | 2,107 | | | | 136,829 | |

| United Technologies Corp. | | | 1,071 | | | | 115,475 | |

| Illinois Tool Works, Inc. | | | 1,497 | | | | 114,176 | |

| Total Industrials | | | | | | | 6,371,037 | |

| CONSUMER STAPLES - 3.3% | | | | | | | | |

| Wal-Mart Stores, Inc. | | | 9,418 | | | | 696,555 | |

| CVS Caremark Corp. | | | 10,771 | | | | 611,254 | |

| Walgreen Co. | | | 10,921 | | | | 587,550 | |

| Procter & Gamble Co. | | | 6,760 | | | | 510,989 | |

| PepsiCo, Inc. | | | 6,185 | | | | 491,707 | |

| Kroger Co. | | | 10,344 | | | | 417,277 | |

| Archer-Daniels-Midland Co. | | | 11,117 | | | | 409,550 | |

| Philip Morris International, Inc. | | | 4,222 | | | | 365,582 | |

| Kimberly-Clark Corp. | | | 3,829 | | | | 360,768 | |

| Altria Group, Inc. | | | 10,213 | | | | 350,817 | |

| Mondelez International, Inc. — Class A | | | 9,911 | | | | 311,404 | |

| Sysco Corp. | | | 9,585 | | | | 305,091 | |

| General Mills, Inc. | | | 5,613 | | | | 268,975 | |

| Coca-Cola Co. | | | 4,367 | | | | 165,422 | |

| Costco Wholesale Corp. | | | 1,082 | | | | 124,560 | |

| Reynolds American, Inc. | | | 2,232 | | | | 108,877 | |

| Total Consumer Staples | | | | | | | 6,086,378 | |

| ENERGY - 2.4% | | | | | | | | |

| Exxon Mobil Corp. | | | 12,876 | | | | 1,107,850 | |

| Chevron Corp. | | | 4,519 | | | | 549,058 | |

| ConocoPhillips | | | 7,222 | | | | 502,001 | |

| Valero Energy Corp. | | | 13,976 | | | | 477,281 | |

| Anadarko Petroleum Corp. | | | 3,815 | | | | 354,757 | |

| Baker Hughes, Inc. | | | 6,335 | | | | 311,049 | |

| Occidental Petroleum Corp. | | | 3,075 | | | | 287,636 | |

| Phillips 66 | | | 4,103 | | | | 237,235 | |

| Marathon Oil Corp. | | | 5,858 | | | | 204,327 | |

| Apache Corp. | | | 2,029 | | | | 172,749 | |

| Devon Energy Corp. | | | 1,880 | | | | 108,589 | |

| Total Energy | | | | | | | 4,312,532 | |

| FINANCIALS - 1.5% | | | | | | | | |

| JPMorgan Chase & Co. | | | 11,813 | | | | 610,615 | |

| Wells Fargo & Co. | | | 10,151 | | | | 419,439 | |

| Citigroup, Inc. | | | 8,042 | | | | 390,117 | |

| MetLife, Inc. | | | 6,510 | | | | 305,645 | |

| Legg Mason, Inc. | | | 8,457 | | | | 282,802 | |

| American International Group, Inc. | | | 4,111 | | | | 199,918 | |

| Allstate Corp. | | | 2,875 | | | | 145,331 | |

| Bank of America Corp. | | | 8,782 | | | | 121,192 | |

| Aflac, Inc. | | | 1,854 | | | | 114,929 | |

| Capital One Financial Corp. | | | 1,665 | | | | 114,452 | |

| Total Financials | | | | | | | 2,704,440 | |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 11 |

| SCHEDULE OF INVESTMENTS (continued) | September 30, 2013 |

| STYLEPLUS LARGE CORE FUND | |

| | | Shares | | | Value | |

| | | | | | | |

| CONSUMER DISCRETIONARY - 1.2% | | | | | | | | |

| Comcast Corp. — Class A | | | 15,547 | | | $ | 701,948 | |

| Time Warner, Inc. | | | 6,775 | | | | 445,863 | |

| Target Corp. | | | 4,648 | | | | 297,379 | |

| Time Warner Cable, Inc. | | | 2,290 | | | | 255,564 | |

| Ford Motor Co. | | | 11,802 | | | | 199,099 | |

| Walt Disney Co. | | | 2,160 | | | | 139,298 | |

| General Motors Co.* | | | 3,179 | | | | 114,349 | |

| Total Consumer Discretionary | | | | | | | 2,153,500 | |

| UTILITIES - 0.6% | | | | | | | | |

| NextEra Energy, Inc. | | | 2,756 | | | | 220,920 | |

| DTE Energy Co. | | | 3,332 | | | | 219,846 | |

| American Electric Power Company, Inc. | | | 5,063 | | | | 219,481 | |

| Southern Co. | | | 5,320 | | | | 219,078 | |

| CenterPoint Energy, Inc. | | | 7,762 | | | | 186,055 | |

| Total Utilities | | | | | | | 1,065,380 | |

| TELECOMMUNICATION SERVICES - 0.3% | | | | | | | | |

| Verizon Communications, Inc. | | | 8,387 | | | | 391,338 | |

| CenturyLink, Inc. | | | 4,980 | | | | 156,272 | |

| Total Telecommunication Services | | | | | | | 547,610 | |

| MATERIALS - 0.1% | | | | | | | | |

| Mosaic Co. | | | 4,337 | | | | 186,578 | |

| Freeport-McMoRan Copper & Gold, Inc. | | | 3,500 | | | | 115,780 | |

| Total Materials | | | | | | | 302,358 | |

| Total Common Stocks | | | | | | | | |

| (Cost $35,054,971) | | | | | | | 36,794,668 | |

| EXCHANGE TRADED FUNDS†,5 - 5.9% | | | | | | | | |

| Guggenheim Enhanced Short Duration ETF | | | 78,942 | | | | 3,961,310 | |

| Guggenheim BulletShares 2014 | | | | | | | | |

| High Yield Corporate Bond ETF | | | 84,100 | | | | 2,244,797 | |

| Guggenheim BulletShares 2015 | | | | | | | | |

| High Yield Corporate Bond ETF | | | 84,000 | | | | 2,243,640 | |

| Guggenheim BulletShares 2016 | | | | | | | | |

| High Yield Corporate Bond ETF | | | 84,100 | | | | 2,242,106 | |

| Total Exchange Traded Funds | | | | | | | | |

| (Cost $10,701,818) | | | | | | | 10,691,853 | |

| MUTUAL FUNDS†,1 - 3.6% | | | | | | | | |

| Floating Rate Strategies Fund | | | | | | | | |

| Institutional Class | | | 125,103 | | | | 3,332,741 | |

| Macro Opportunities Fund | | | | | | | | |

| Institutional Class | | | 121,470 | | | | 3,199,526 | |

| Total Mutual Funds | | | | | | | | |

| (Cost $6,760,169) | | | | | | | 6,532,267 | |

| SHORT TERM INVESTMENTS† - 18.3% | | | | | | | | |

| Dreyfus Treasury Prime Cash | | | | | | | | |

| Management Fund | | | 33,228,393 | | | | 33,228,393 | |

| Total Short Term Investments | | | | | | | | |

| (Cost $33,228,393) | | | | | | | 33,228,393 | |

| | | | | | | |

| | | Face | | | | |

| | | Amount | | | | |

| | | | | | | | | |

| ASSET BACKED SECURITIES†† - 14.4% | | | | | | | | |

| Geer Mountain Financing Ltd. | | | | | | | | |

| 2007-1A, 0.57% due 04/01/142,3 | | $ | 4,000,000 | | | | 3,969,999 | |

| Duane Street CLO IV Ltd. | | | | | | | | |

| 2007-4A, 0.49% due 11/14/212,3 | | | 2,574,818 | | | | 2,504,010 | |

| Apidos CDO VIII | | | | | | | | |

| 2011-8A, 3.37% due 10/17/212,3 | | | 2,400,000 | | | | 2,400,010 | |

| Newcastle CDO Ltd. | | | | | | | | |

| 2007-9A, 0.43% due 05/25/52 | | | 2,160,965 | | | | 2,097,980 | |

| Garrison Funding Ltd. | | | | | | | | |

| 2013-2A, 2.05% due 09/25/232,3 | | | 1,980,000 | | | | 1,973,548 | |

| Brentwood CLO Corp. | | | | | | | | |

| 2006-1A, 0.54% due 02/01/222,3 | | | 1,263,398 | | | | 1,225,344 | |

| 2006-1A, 1.09% due 02/01/222,3 | | | 500,000 | | | | 444,844 | |

| Foothill CLO Ltd. | | | | | | | | |

| 2007-1A, 0.51% due 02/22/212,3 | | | 1,561,927 | | | | 1,526,335 | |

| Salus CLO Ltd. | | | | | | | | |

| 2013-1AN, 2.50% due 03/05/212,3 | | | 1,400,000 | | | | 1,407,742 | |

| N-Star REL CDO VIII Ltd. | | | | | | | | |

| 2006-8A, 0.47% due 02/01/412,3 | | | 1,315,492 | | | | 1,185,950 | |

| Bristol Bay Funding Ltd. | | | | | | | | |

| 2004-1A, 1.02% due 02/01/162,3 | | | 1,101,990 | | | | 1,099,235 | |

| KKR Financial CLO 2007-1 Corp. | | | | | | | | |

| 2007-1A, 2.51% due 05/15/212,3 | | | 1,150,000 | | | | 1,094,793 | |

| FM Leveraged Capital Fund II | | | | | | | | |

| 2006-2A, 1.86% due 11/15/202,3 | | | 1,000,000 | | | | 988,363 | |

| GreenPoint Mortgage | | | | | | | | |

| Funding Trust 2005-HE4 | | | | | | | | |

| 2005-HE4, 0.88% due 07/25/302 | | | 1,100,000 | | | | 962,609 | |

| TICC CLO LLC | | | | | | | | |

| 2011-1A, 2.52% due 07/25/21†††,2,3 | | | 850,000 | | | | 847,036 | |

| Northwoods Capital VII Ltd. | | | | | | | | |

| 2006-7A, 1.82% due 10/22/212,3 | | | 810,000 | | | | 743,490 | |

| NewStar Commercial Loan Trust 2007-1 | | | | | | | | |

| 2007-1A, 1.56% due 09/30/222,3 | | | 500,000 | | | | 461,354 | |

| Race Point IV CLO Ltd. | | | | | | | | |

| 2007-4A, 1.02% due 08/01/212,3 | | | 450,000 | | | | 417,454 | |

| Accredited Mortgage Loan Trust 2007-1 | | | | | | | | |

| 2007-1, 0.31% due 02/25/372 | | | 422,789 | | | | 381,122 | |

| Legg Mason Real Estate CDO I Ltd. | | | | | | | | |

| 2006-1A, 0.46% due 03/25/382,3 | | | 319,412 | | | | 305,950 | |

| NewStar Trust 2005-1 | | | | | | | | |

| 2005-1A, 0.77% due 07/25/182,3 | | | 240,717 | | | | 240,609 | |

| Total Asset Backed Securities | | | | | | | | |

| (Cost $26,352,763) | | | | | | | 26,277,777 | |

| U.S. TREASURY BILLS† - 12.8% | | | | | | | | |

| U.S. Treasury Bills6 | | | | | | | | |

| due 10/10/13 | | | 14,200,000 | | | | 14,199,943 | |

| due 10/03/13 | | | 5,000,000 | | | | 4,999,995 | |

| due 10/31/13 | | | 4,000,000 | | | | 3,999,884 | |

| Total U.S. Treasury Bills | | | | | | | | |

| (Cost $23,199,977) | | | | | | | 23,199,822 | |

| 12 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| SCHEDULE OF INVESTMENTS (continued) | September 30, 2013 |

| STYLEPLUS LARGE CORE FUND |

| | | Face | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| CORPORATE BONDS†† - 9.1% | | | | | | | | |

| FINANCIALS - 3.7% | | | | | | | | |

| Ford Motor Credit Company LLC | | | | | | | | |

| 7.00% due 04/15/15 | | $ | 1,370,000 | | | $ | 1,486,544 | |

| Aspen Insurance Holdings Ltd. | | | | | | | | |

| 6.00% due 08/15/14 | | | 1,300,000 | | | | 1,353,564 | |

| Citigroup, Inc. | | | | | | | | |

| 1.23% due 07/25/162 | | | 1,270,000 | | | | 1,281,279 | |

| Icahn Enterprises Limited Partnership / | | | | | | | | |

| Icahn Enterprises Finance Corp. | | | | | | | | |

| 7.75% due 01/15/16 | | | 520,000 | | | | 536,900 | |

| 8.00% due 01/15/18 | | | 230,000 | | | | 240,925 | |

| Nationstar Mortgage LLC / | | | | | | | | |

| Nationstar Capital Corp. | | | | | | | | |

| 6.50% due 08/01/18 | | | 570,000 | | | | 572,850 | |

| Mack-Cali Realty, LP | | | | | | | | |

| 5.13% due 02/15/14 | | | 560,000 | | | | 567,853 | |

| WEA Finance LLC / | | | | | | | | |

| WT Finance Aust Pty Ltd. | | | | | | | | |

| 5.75% due 09/02/153 | | | 380,000 | | | | 413,335 | |

| Emigrant Bancorp, Inc. | | | | | | | | |

| 6.25% due 06/15/143 | | | 320,000 | | | | 318,800 | |

| Total Financials | | | | | | | 6,772,050 | |

| MATERIALS - 2.1% | | | | | | | | |

| Glencore Funding LLC | | | | | | | | |

| 1.42% due 05/27/162,3 | | | 1,880,000 | | | | 1,840,975 | |

| Rio Tinto Finance USA plc | | | | | | | | |

| 1.09% due 06/17/162 | | | 1,300,000 | | | | 1,306,306 | |

| Anglo American Capital plc | | | | | | | | |

| 9.38% due 04/08/143 | | | 590,000 | | | | 614,656 | |

| Total Materials | | | | | | | 3,761,937 | |

| ENERGY - 1.3% | | | | | | | | |

| Ras Laffan Liquefied Natural Gas | | | | | | | | |

| Company Limited III | | | | | | | | |

| 5.83% due 09/30/163 | | | 1,785,819 | | | | 1,892,968 | |

| Petroleos Mexicanos | | | | | | | | |

| 2.29% due 07/18/182 | | | 550,000 | | | | 566,500 | |

| Total Energy | | | | | | | 2,459,468 | |

| INDUSTRIALS - 0.6% | | | | | | | | |

| International Lease Finance Corp. | | | | | | | | |

| 2.20% due 06/15/162 | | | 900,000 | | | | 895,500 | |

| Victor Technologies Group, Inc. | | | | | | | | |

| 9.00% due 12/15/17 | | | 160,000 | | | | 172,400 | |

| Total Industrials | | | | | | | 1,067,900 | |

| TELECOMMUNICATION SERVICES - 0.6% | | | | | | | | |

| WPP Finance UK | | | | | | | | |

| 8.00% due 09/15/14 | | | 1,000,000 | | | | 1,065,992 | |

| CONSUMER STAPLES - 0.3% | | | | | | | | |

| Harbinger Group, Inc. | | | | | | | | |

| 7.88% due 07/15/193 | | | 500,000 | | | | 517,500 | |

| CONSUMER DISCRETIONARY - 0.3% | | | | | | | | |

| ServiceMaster Co. | | | | | | | | |

| 7.00% due 08/15/20 | | | 270,000 | | | | 255,150 | |

| Sabre, Inc. | | | | | | | | |

| 8.50% due 05/15/193 | | | 210,000 | | | | 227,063 | |

| Total Consumer Discretionary | | | | | | | 482,213 | |

| INFORMATION TECHNOLOGY - 0.2% | | | | | | | | |

| iGATE Corp. | | | | | | | | |

| 9.00% due 05/01/16 | | | 290,000 | | | | 311,025 | |

| Total Corporate Bonds | | | | | | | | |

| (Cost $16,532,276) | | | | | | | 16,438,085 | |

| SENIOR FLOATING RATE INTERESTS†† - 4.9% | | | | | | | | |

| FINANCIALS - 1.5% | | | | | | | | |

| National Financial Partners | | | | | | | | |

| 5.25% due 07/01/20 | | | 1,276,800 | | | | 1,285,315 | |

| Knight/Getco | | | | | | | | |

| 5.75% due 11/30/17 | | | 1,170,000 | | | | 1,166,350 | |

| First Data Corp. | | | | | | | | |

| 4.18% due 03/23/18 | | | 150,000 | | | | 148,387 | |

| Cunningham Lindsey U.S., Inc. | | | | | | | | |

| 5.00% due 12/10/19 | | | 109,449 | | | | 108,628 | |

| Total Financials | | | | | | | 2,708,680 | |

| INFORMATION TECHNOLOGY - 1.4% | | | | | | | | |

| Travelport Holdings Ltd. | | | | | | | | |

| 6.25% due 06/26/19 | | | 1,566,075 | | | | 1,582,722 | |

| Blue Coat Systems, Inc. | | | | | | | | |

| 4.50% due 05/31/19 | | | 746,250 | | | | 748,116 | |

| Go Daddy Operating Company LLC | | | | | | | | |

| 4.25% due 12/17/18 | | | 177,259 | | | | 176,853 | |

| Total Information Technology | | | | | | | 2,507,691 | |

| CONSUMER DISCRETIONARY - 0.7% | | | | | | | | |

| Pinnacle Entertainment, Inc. | | | | | | | | |

| 3.75% due 08/15/16 | | | 1,114,750 | | | | 1,117,816 | |

| Sears Holdings Corp. | | | | | | | | |

| 5.50% due 06/30/18 | | | 200,000 | | | | 198,376 | |

| Total Consumer Discretionary | | | | | | | 1,316,192 | |

| ENERGY - 0.7% | | | | | | | | |

| Pacific Drilling | | | | | | | | |

| 4.50% due 05/18/18 | | | 668,325 | | | | 670,497 | |

| Ocean Rig ASA | | | | | | | | |

| 5.50% due 07/15/16 | | | 600,000 | | | | 606,378 | |

| Total Energy | | | | | | | 1,276,875 | |

| INDUSTRIALS - 0.4% | | | | | | | | |

| Thermasys Corp. | | | | | | | | |

| 5.25% due 05/03/19 | | | 650,000 | | | | 646,750 | |

| Laureate Education, Inc. | | | | | | | | |

| 5.25% due 06/15/18 | | | 124,366 | | | | 124,445 | |

| Total Industrials | | | | | | | 771,195 | |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 13 |

| SCHEDULE OF INVESTMENTS (concluded) | September 30, 2013 |

| STYLEPLUS LARGE CORE FUND |

| | | Face | | | | |

| | | Amount | | | Value | |

| | | | | | | |

| TELECOMMUNICATION SERVICES - 0.1% | | | | | | | | |

| Level 3 Financing, Inc. | | | | | | | | |

| 4.75% due 08/01/19 | | $ | 230,000 | | | $ | 229,568 | |

| HEALTH CARE - 0.1% | | | | | | | | |

| Apria Healthcare Group, Inc. | | | | | | | | |

| 6.75% due 04/01/20 | | | 149,625 | | | | 150,620 | |

| Total Senior Floating Rate Interests | | | | | | | | |

| (Cost $8,876,600) | | | | | | | 8,960,821 | |

| COLLATERALIZED MORTGAGE OBLIGATIONS†† - 4.8% | | | | | | | | |

| Wachovia Bank Commercial Mortgage | | | | | | | | |

| Trust Series 2007-WHALE 8 | | | | | | | | |

| 2007-WHL8, 0.26% due 06/15/202,3 | | | 2,386,029 | | | | 2,355,118 | |

| Boca Hotel Portfolio Trust 2013-BOCA | | | | | | | | |

| 2013-BOCA, 3.23% due 08/15/262,3 | | | 1,550,000 | | | | 1,550,000 | |

| SRERS Funding Ltd. | | | | | | | | |

| 2011-RS, 0.43% due 05/09/462,3 | | | 1,326,565 | | | | 1,153,265 | |

| COMM 2007-FL14 Mortgage Trust | | | | | | | | |

| 2007-FL14, 0.93% due 06/15/222,3 | | | 1,096,136 | | | | 1,074,476 | |

| Banc of America Merrill Lynch | | | | | | | | |

| Commercial Mortgage, Inc. | | | | | | | | |

| 2005-6, 6.33% due 09/10/472,3 | | | 900,500 | | | | 931,266 | |

| Banc of America Large | | | | | | | | |

| Loan Trust 2007-BMB1 | | | | | | | | |

| 2007-BMB1, 1.28% due 08/15/292,3 | | | 800,000 | | | | 792,191 | |

| GCCFC Commercial Mortgage Trust | | | | | | | | |

| 2006-FL4A, 0.41% due 11/05/21 | | | 800,000 | | | | 784,606 | |

| Total Collateralized Mortgage Obligations | | | | | | | | |

| (Cost $8,647,502) | | | | | | | 8,640,922 | |

| MUNICIPAL BONDS†† - 2.9% | | | | | | | | |

| NEW YORK - 2.7% | | | | | | | | |

| New York City Water & Sewer | | | | | | | | |

| System Revenue Bonds | | | | | | | | |

| 0.36% due 06/15/332 | | | 2,630,000 | | | | 2,630,000 | |

| City of New York New York | | | | | | | | |

| General Obligation Unlimited | | | | | | | | |

| 0.38% due 04/01/352 | | | 1,300,000 | | | | 1,300,000 | |

| 0.36% due 11/01/262 | | | 1,040,000 | | | | 1,040,000 | |

| Total New York | | | | | | | 4,970,000 | |

| MICHIGAN - 0.2% | | | | | | | | |

| Michigan Finance Authority | | | | | | | | |

| Revenue Notes | | | | | | | | |

| 4.38% due 08/20/14 | | | 300,000 | | | | 301,914 | |

| Total Municipal Bonds | | | | | | | | |

| (Cost $5,270,000) | | | | | | | 5,271,914 | |

| COMMERCIAL PAPER†† - 3.9% | | | | | | | | |

| American Water Capital Corp. | | | | | | | | |

| 0.26% due 10/01/13 | | | 1,400,000 | | | | 1,400,000 | |

| BAT International Finance plc | | | | | | | | |

| 0.21% due 10/02/133 | | | 1,400,000 | | | | 1,399,991 | |

| Nissan Motor Acceptance Corp. | | | | | | | | |

| 0.24% due 10/02/133 | | | 1,400,000 | | | | 1,399,990 | |

| VW Credit Canada, Inc. | | | | | | | | |

| 0.22% due 10/09/13 | | | 1,400,000 | | | | 1,399,932 | |

| Aon Corp. | | | | | | | | |

| 0.22% due 10/15/13 | | | 1,400,000 | | | | 1,399,880 | |

| Total Commercial Paper | | | | | | | | |

| (Cost $6,999,793) | | | | | | | 6,999,793 | |

| Total Investments - 100.8% | | | | | | | | |

| (Cost $181,624,262) | | | | | | $ | 183,036,315 | |

| Other Assets & Liabilities, net - (0.8)% | | | | | | | (1,517,952 | ) |

| Total Net Assets - 100.0% | | | | | | $ | 181,518,363 | |

| | | | | | | |

| | | | | | Unrealized | |

| | | Contracts | | | Gain (Loss) | |

| | | | | | | |

| EQUITY FUTURES CONTRACTS PURCHASED† | | | | | | | | |

| December 2013 S&P 500 Index | | | | | | | | |

| Mini Futures Contracts | | | | | | | | |

| (Aggregate Value of | | | | | | | | |

| Contracts $1,341,200) | | | 16 | | | $ | (11,851 | ) |

| | | | | | | |

| | | Units | | | | |

| EQUITY INDEX SWAP AGREEMENTS†† | | | | | | | | |

| Morgan Stanley Capital Services, Inc. | | | | | | | | |

| October 2013 S&P 500 Index | | | | | | | | |

| Swap, Terminating 10/05/134 | | | | | | | | |

| (Notional Value $142,825,812) | | | 84,937 | | | $ | 4,297,408 | |

| * | Non-income producing security. |

| † | Value determined based on Level 1 inputs — See Note 4. |

| †† | Value determined based on Level 2 inputs, unless otherwise noted — See Note 4. |

| ††† | Value determined based on Level 3 inputs — See Note 4. |

| 2 | Variable rate security. Rate indicated is rate effective at September 30, 2013. |

| 3 | Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2) securities is $39,317,660 (cost $39,519,563), or 21.7% of total net assets. |

| 4 | Total Return based on S&P 500 Index +/- financing at a variable rate. |

| 5 | Investment in a product that pays a management fee to a party related to the advisor. |

| 6 | Zero coupon rate security. |

plc — Public Limited Company

| 14 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| STYLEPLUS LARGE CORE FUND |

STATEMENT OF ASSETS

AND LIABILITIES

September 30, 2013

| Assets: | | | | |

| Investments in unaffiliated issuers, at value | | | | |

| (cost $174,864,093) | | $ | 176,504,048 | |

| Investments in affiliated issuers, at value | | | | |

| (cost $6,760,169) | | | 6,532,267 | |

| Total investments | | | | |

| (cost $181,624,262) | | | 183,036,315 | |

| Unrealized appreciation on swap agreements | | | 4,297,408 | |

| Cash | | | 5,424,322 | |

| Segregrated cash with broker | | | 56,000 | |

| Prepaid expenses | | | 22,882 | |

| Receivables: | | | | |

| Securities sold | | | 3,972,213 | |

| Interest | | | 277,501 | |

| Dividends | | | 78,338 | |

| Fund shares sold | | | 9,072 | |

| Total assets | | | 197,174,051 | |

| Liabilities: | | | | |

| Segregated cash from broker | | | 5,161,567 | |

| Payable for: | | | | |

| Securities purchased | | | 10,121,563 | |

| Fund shares redeemed | | | 124,437 | |

| Management fees | | | 112,491 | |

| Distribution and service fees | | | 41,235 | |

| Transfer agent/maintenance fees | | | 21,858 | |

| Fund accounting/administration fees | | | 14,249 | |

| Variation margin | | | 7,920 | |

| Directors’ fees* | | | 1,338 | |

| Miscellaneous | | | 49,030 | |

| Total liabilities | | | 15,655,688 | |

| Net assets | | $ | 181,518,363 | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 147,978,486 | |

| Undistributed net investment income | | | 94,876 | |

| Accumulated net realized gain on investments | | | 27,747,391 | |

| Net unrealized appreciation on investments | | | 5,697,610 | |

| Net assets | | $ | 181,518,363 | |

| A-Class: | | | | |

| Net assets | | $ | 175,600,751 | |

| Capital shares outstanding | | | 7,236,013 | |

| Net asset value per share | | $ | 24.27 | |

| Maximum offering price per share | | | | |

| (Net asset value divided by 95.25%) | | $ | 25.48 | |

| B-Class: | | | | |

| Net assets | | $ | 3,616,953 | |

| Capital shares outstanding | | | 186,515 | |

| Net asset value per share | | $ | 19.39 | |

| C-Class: | | | | |

| Net assets | | $ | 2,274,567 | |

| Capital shares outstanding | | | 107,720 | |

| Net asset value per share | | $ | 21.12 | |

| Institutional Class: | | | | |

| Net assets | | $ | 26,092 | |

| Capital shares outstanding | | | 1,076 | |

| Net asset value per share | | $ | 24.25 | |

STATEMENT OF

OPERATIONS

Year Ended September 30, 2013

| Investment Income: | | | | |

| Dividends from securities of unaffiliated issuers | | $ | 2,305,587 | |

| Dividends from securities of affiliated issuers | | | 135,197 | |

| Interest | | | 449,746 | |

| Total investment income | | | 2,890,530 | |

| | | | | |

| Expenses: | | | | |

| Management fees | | | 1,330,661 | |

| Transfer agent/maintenance fees: | | | | |

| A-Class | | | 270,382 | |

| B-Class | | | 26,127 | |

| C-Class | | | 7,210 | |

| Institutional Class | | | 51 | |

| Distribution and service fees: | | | | |

| A-Class | | | 428,291 | |

| B-Class | | | 41,610 | |

| C-Class | | | 19,253 | |

| Fund accounting/administration fees | | | 168,548 | |

| Directors’ fees* | | | 14,474 | |

| Tax expense | | | 8,201 | |

| Custodian fees | | | 7,390 | |

| Miscellaneous | | | 180,456 | |

| Total expenses | | | 2,502,654 | |

| Net investment income | | | 387,876 | |

| | | | | |

| Net Realized and Unrealized Gain (Loss): | | | | |

| Net realized gain (loss) on: | | | | |

| Investments in unaffiliated issuers | | | 38,190,991 | |

| Swap agreements | | | 3,715,099 | |

| Futures contracts | | | 71,206 | |

| Net realized gain | | | 41,977,296 | |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments in unaffiliated issuers | | | (22,375,412 | ) |

| Investments in affiliated issuers | | | (227,902 | ) |

| Swap agreements | | | 4,297,408 | |

| Futures contracts | | | (11,851 | ) |

| Net change in unrealized appreciation (depreciation) | | | (18,317,757 | ) |

| Net realized and unrealized gain | | | 23,659,539 | |

| Net increase in net assets resulting from operations | | $ | 24,047,415 | |

* Relates to Directors not deemed “interested persons” within the meaning of Section 2(a)(19) of the 1940 Act.

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 15 |

| STYLEPLUS LARGE CORE FUND |

STATEMENTS OF CHANGES IN NET ASSETS

| | | Year Ended | | | Year Ended | |

| | | September 30, | | | September 30, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Increase (Decrease) In Net Assets From Operations: | | | | | | | | |

| Net investment income | | $ | 387,876 | | | $ | 502,602 | |

| Net realized gain on investments | | | 41,977,296 | | | | 5,641,857 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (18,317,757 | ) | | | 36,158,986 | |

| Net increase in net assets resulting from operations | | | 24,047,415 | | | | 42,303,445 | |

| | | | | | | | | |

| Distributions to shareholders from: | | | | | | | | |

| Net investment income | | | | | | | | |

| A-Class | | | (616,535 | ) | | | (200,274 | ) |

| Institutional Class | | | (73 | ) | | | — | 1 |

| Total distributions to shareholders | | | (616,608 | ) | | | (200,274 | ) |

| | | | | | | | | |

| Capital share transactions: | | | | | | | | |

| Proceeds from sale of shares | | | | | | | | |

| A-Class | | | 3,891,702 | | | | 3,926,067 | |

| B-Class | | | 216,333 | | | | 147,411 | |

| C-Class | | | 827,015 | | | | 118,320 | |

| Institutional Class | | | 12,929 | | | | 10,0001 | |

| Distributions reinvested | | | | | | | | |

| A-Class | | | 571,200 | | | | 187,685 | |

| Institutional Class | | | 73 | | | | — | 1 |

| Cost of shares redeemed | | | | | | | | |

| A-Class | | | (23,445,161 | ) | | | (28,967,385 | ) |

| B-Class | | | (1,828,228 | ) | | | (1,734,071 | ) |

| C-Class | | | (459,100 | ) | | | (443,550 | ) |

| Institutional Class | | | — | | | | — | 1 |

| Net decrease from capital share transactions | | | (20,213,237 | ) | | | (26,755,523 | ) |

| Net increase in net assets | | | 3,217,570 | | | | 15,347,648 | |

| | | | | | | | | |

| Net assets: | | | | | | | | |

| Beginning of year | | | 178,300,793 | | | | 162,953,145 | |

| End of year | | $ | 181,518,363 | | | $ | 178,300,793 | |

| Undistributed net investment income at end of year | | $ | 94,876 | | | $ | 317,574 | |

| | | | | | | | | |

| Capital share activity: | | | | | | | | |

| Shares sold | | | | | | | | |

| A-Class | | | 171,925 | | | | 200,433 | |

| B-Class | | | 12,018 | | | | 9,082 | |

| C-Class | | | 41,241 | | | | 7,018 | |

| Institutional Class | | | 592 | | | | 480 | 1 |

| Shares issued from reinvestment of distributions | | | | | | | | |

| A-Class | | | 27,448 | | | | 10,201 | |

| Institutional Class | | | 4 | | | | — | 1 |

| Shares redeemed | | | | | | | | |

| A-Class | | | (1,051,893 | ) | | | (1,425,434 | ) |

| B-Class | | | (100,705 | ) | | | (108,033 | ) |

| C-Class | | | (23,259 | ) | | | (25,344 | ) |

| Institutional Class | | | — | | | | — | 1 |

| Net decrease in shares | | | (922,629 | ) | | | (1,331,597 | ) |

1 Since the commencement of operations: March 1, 2012.

| 16 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| STYLEPLUS LARGE CORE FUND |

FINANCIAL HIGHLIGHTS

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | September 30, | | | September 30, | | | September 30, | | | September 30, | | | September 30, | |

| A-Class | | 2013 | | | 2012 | | | 2011e | | | 2010e | | | 2009e | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 21.25 | | | $ | 16.79 | | | $ | 17.56 | | | $ | 16.20 | | | $ | 17.04 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment incomea | | | .06 | | | | .06 | | | | .01 | | | | .04 | | | | .04 | |

| Net gain (loss) on investments (realized and unrealized) | | | 3.04 | | | | 4.42 | | | | (.74 | ) | | | 1.32 | | | | (.80 | ) |

| Total from investment operations | | | 3.10 | | | | 4.48 | | | | (.73 | ) | | | 1.36 | | | | (.76 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (.08 | ) | | | (.02 | ) | | | (.04 | ) | | | — | | | | (.04 | ) |

| Return of capital | | | — | | | | — | | | | — | | | | — | | | | (.04 | ) |

| Total distributions | | | (.08 | ) | | | (.02 | ) | | | (.04 | ) | | | — | | | | (.08 | ) |

| Net asset value, end of period | | $ | 24.27 | | | $ | 21.25 | | | $ | 16.79 | | | $ | 17.56 | | | $ | 16.20 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Returnb | | | 14.64 | % | | | 26.71 | % | | | (4.11 | %) | | | 8.40 | % | | | (4.32 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 175,601 | | | $ | 171,907 | | | $ | 156,232 | | | $ | 174,371 | | | $ | 175,404 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.26 | % | | | 0.32 | % | | | 0.06 | % | | | 0.31 | % | | | 0.28 | % |

| Total expensesc | | | 1.37 | % | | | 1.36 | % | | | 1.35 | % | | | 1.43 | % | | | 1.49 | % |

| Portfolio turnover rate | | | 217 | % | | | 101 | % | | | 92 | % | | | 100 | % | | | 69 | % |

| | | | | | | | | | | | | | | | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | September 30, | | | September 30, | | | September 30, | | | September 30, | | | September 30, | |

| B-Class | | 2013 | | | 2012 | | | 2011e | | | 2010e | | | 2009e | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 17.13 | | | $ | 13.69 | | | $ | 14.40 | | | $ | 13.36 | | | $ | 14.12 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment lossa | | | (.17 | ) | | | (.15 | ) | | | (.11 | ) | | | (.08 | ) | | | (.04 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | 2.43 | | | | 3.59 | | | | (.60 | ) | | | 1.12 | | | | (.68 | ) |

| Total from investment operations | | | 2.26 | | | | 3.44 | | | | (.71 | ) | | | 1.04 | | | | (.72 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Return of capital | | | — | | | | — | | | | — | | | | — | | | | (.04 | ) |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | (.04 | ) |

| Net asset value, end of period | | $ | 19.39 | | | $ | 17.13 | | | $ | 13.69 | | | $ | 14.40 | | | $ | 13.36 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Returnb | | | 13.19 | % | | | 25.13 | % | | | (4.93 | %) | | | 7.78 | % | | | (4.96 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 3,617 | | | $ | 4,714 | | | $ | 5,121 | | | $ | 6,817 | | | $ | 7,784 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.94 | %) | | | (0.92 | %) | | | (0.70 | %) | | | (0.48 | %) | | | (0.46 | %) |

| Total expensesc | | | 2.59 | % | | | 2.59 | % | | | 2.10 | % | | | 2.17 | % | | | 2.24 | % |

| Portfolio turnover rate | | | 217 | % | | | 101 | % | | | 92 | % | | | 100 | % | | | 69 | % |

| SEE NOTES TO FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 17 |

| STYLEPLUS LARGE CORE FUND |

FINANCIAL HIGHLIGHTS (concluded)

This table is presented to show selected data for a share outstanding throughout each period and to assist shareholders in evaluating a Fund’s performance for the periods presented.

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | September 30, | | | September 30, | | | September 30, | | | September 30, | | | September 30, | |

| C-Class | | 2013 | | | 2012 | | | 2011e | | | 2010e | | | 2009e | |

| Per Share Data | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 18.60 | | | $ | 14.81 | | | $ | 15.56 | | | $ | 14.48 | | | $ | 15.24 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment lossa | | | (.15 | ) | | | (.10 | ) | | | (.12 | ) | | | (.08 | ) | | | (.04 | ) |

| Net gain (loss) on investments (realized and unrealized) | | | 2.67 | | | | 3.89 | | | | (.63 | ) | | | 1.16 | | | | (.68 | ) |

| Total from investment operations | | | 2.52 | | | | 3.79 | | | | (.75 | ) | | | 1.08 | | | | (.72 | ) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| Return of capital | | | — | | | | — | | | | — | | | | — | | | | (.04 | ) |

| Total distributions | | | — | | | | — | | | | — | | | | — | | | | (.04 | ) |

| Net asset value, end of period | | $ | 21.12 | | | $ | 18.60 | | | $ | 14.81 | | | $ | 15.56 | | | $ | 14.48 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Returnb | | | 13.55 | % | | | 25.59 | % | | | (4.82 | %) | | | 7.46 | % | | | (4.60 | %) |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 2,275 | | | $ | 1,669 | | | $ | 1,600 | | | $ | 2,158 | | | $ | 2,244 | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.77 | %) | | | (0.55 | %) | | | (0.70 | %) | | | (0.44 | %) | | | (0.47 | %) |

| Total expensesc | | | 2.34 | % | | | 2.22 | % | | | 2.10 | % | | | 2.18 | % | | | 2.24 | % |

| Portfolio turnover rate | | | 217 | % | | | 101 | % | | | 92 | % | | | 100 | % | | | 69 | % |

| | | | | | | |

| | | Year Ended | | | Period Ended | |

| | | September 30, | | | September 30, | |

| Institutional Class | | 2013 | | | 2012d | |

| Per Share Data | | | | | | | | |

| Net asset value, beginning of period | | $ | 21.28 | | | $ | 20.84 | |

| Income (loss) from investment operations: | | | | | | | | |

| Net investment incomea | | | .06 | | | | .07 | |

| Net gain on investments (realized and unrealized) | | | 3.06 | | | | .37 | |

| Total from investment operations | | | 3.12 | | | | .44 | |

| Less distributions from: | | | | | | | | |

| Net investment income | | | (.15 | ) | | | — | |

| Total distributions | | | (.15 | ) | | | — | |

| Net asset value, end of period | | $ | 24.25 | | | $ | 21.28 | |

| | | | | | | | | |

| Total Returnb | | | 14.79 | % | | | 2.11 | % |

| Ratios/Supplemental Data | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 26 | | | $ | 10 | |

| Ratios to average net assets: | | | | | | | | |

| Net investment income | | | 0.26 | % | | | 0.59 | % |

| Total expensesc | | | 1.25 | % | | | 1.12 | % |

| Portfolio turnover rate | | | 217 | % | | | 101 | % |

| a | Net investment income (loss) per share was computed using average shares outstanding throughout the period. |

| b | Total return does not reflect the impact of any applicable sales charges and has not been annualized. |

| c | Does not include expenses of the underlying funds in which the Fund invests. |

| d | Since commencement of operations: March 1, 2012. Percentage amounts for the period, except total return and portfolio turnover rate, have been annualized. The portfolio turnover rate stated is for the entire fiscal year of the Fund, not since commencement of operations of the Class. |

| e | Reverse share split—Per share amounts for period September 30, 2009 through April 8, 2011 have been restated to reflect a 1:4 reverse share split effective April 8, 2011. |

| 18 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO FINANCIAL STATEMENTS. |

| MANAGERS’ COMMENTARY (Unaudited) | September 30, 2013 |

To Our Shareholders:

Guggenheim Mid Cap Value Fund (the “Fund”) is managed by a team of seasoned professionals led by James Schier, CFA, Portfolio Manager. In the following paragraphs, he discusses performance of the Fund for the fiscal year ended September 30, 2013.

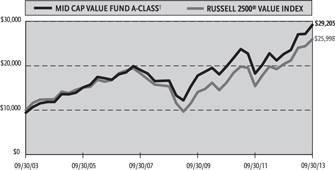

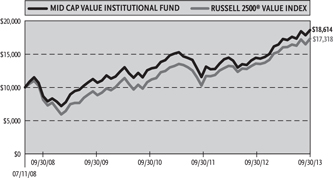

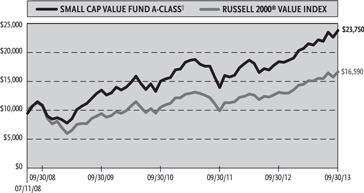

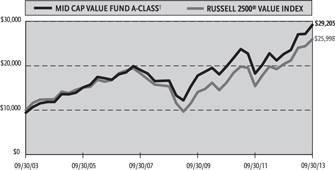

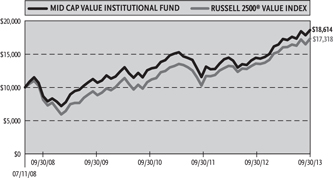

For the year ended September 30, 2013, the Guggenheim Mid Cap Value Fund returned 28.93%1, compared with the 27.58% return of its benchmark, the Russell 2500 Value Index.

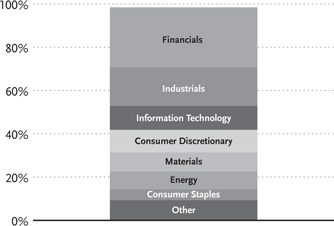

The strategy is to select securities of companies that appear undervalued by the overall market relative to assets, earnings, growth potential or cash flows. The investment approach is a defined and disciplined process with three key philosophical tenets that drive investment decisions: a valuation focus, a long-term investment horizon and an opportunistic approach.

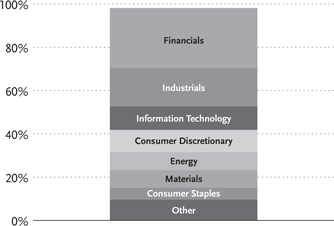

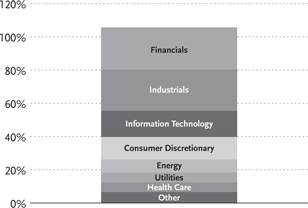

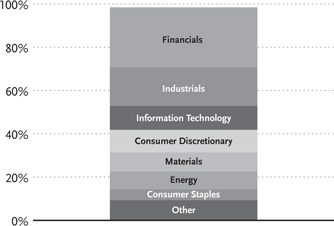

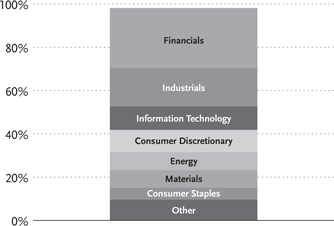

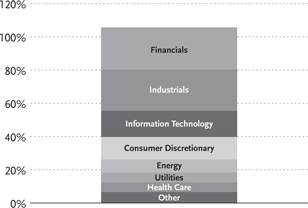

The portfolio’s performance for the period was helped most by stock selection in the Financials and Information Technology sectors. The largest detractor from performance was stock selection in the Materials and Consumer Discretionary sectors.

The holdings contributing most to portfolio performance over the period were Cree, Inc., a maker of LED lighting; Ocwen Financial Corp., a mortgage servicer with a large presence in the subprime mortgage market; and Computer Sciences Corp., a business information technology company. Stock price gains for Cree and Computer Sciences were the main driver of the Information Technology sector performance for the period.

The main detractors were two precious metals mining companies, Allied Nevada Gold Corp. and Coeur Mining, Inc., which underperformed due to the selloff in gold earlier in 2013; and SandRidge Energy, Inc., an independent oil and natural gas company.