Securities Act File No. 333-132032

As filed with the Securities and Exchange Commission on February 24, 2006

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

Pre-Effective Amendment No. [ ]

Post-Effective Amendment No. [ ]

SECURITY EQUITY FUND

(Exact Name of Registrant as Specified in Charter)

One Security Benefit Place, Topeka, Kansas 66636-0001

(Address of Principal Executive Offices) (Zip Code)

(785) 438-3000

(Registrant’s Area Code and Telephone Number)

Amy J. Lee

Security Management Company, LLC

One Security Benefit Place

Topeka, Kansas 66636-0001

(Name and Address of Agent for Service)

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on March 24, 2006 pursuant to Rule 488 under the Securities Act of 1933.

No filing fee is required because an indefinite number of shares has previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

Pursuant to Rule 429 under the Securities Act of 1933, this registration statement relates to shares of common stock previously registered on Form N-1A (File No. 2-19458).

Security Equity Fund

One Security Benefit Place

Topeka, KS 66636-0001

(Toll Free) (800) 888-2461

April 17, 2006

Dear Shareholder:

Your Board of Directors (“Board”) has called a special meeting of shareholders of Large Cap Growth Fund, Enhanced Index Fund, and Social Awareness Fund (each an “Acquired Fund”), each of which is a series of Security Equity Fund, to be held on June 1, 2006 at 1:00 p.m. (Central time), or any adjournment(s) or postponement(s) thereof (the “Special Meeting”), at the executive offices of Security Equity Fund, One Security Benefit Place, Topeka, Kansas 66636-0001. The Board has called the Special Meeting so that shareholders can vote on a proposed Plan of Reorganization (“Reorganization Plan”) regarding the Acquired Funds, as discussed below.

The Board has approved the reorganization of each of Large Cap Growth Fund, Enhanced Index Fund, and Social Awareness Fund into Select 25 Fund (the “Acquiring Fund”), another series of Security Equity Fund (the “Reorganization”). Security Management Company, LLC serves as investment adviser to the Acquired and Acquiring Funds, and each Acquired Fund has investment objectives and policies that are comparable in many respects to those of the Acquiring Fund.

After careful consideration, the Board unanimously approved this proposal with respect to the Acquired Funds and recommended that shareholders of each Acquired Fund vote “FOR” the proposal. Accordingly, you are asked to authorize the Reorganization.

A Proxy Statement/Prospectus that describes the Reorganization is enclosed. We urge you to vote your shares by completing and returning the enclosed proxy in the envelope provided, or vote by Internet, fax or telephone, at your earliest convenience.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement/Prospectus and cast your vote. It is important that your vote be received no later than 9:00 a.m. on June 1, 2006.

We appreciate your participation and prompt response in this matter and thank you for your continued support.

Michael G. Odlum

President

Security Equity Fund

One Security Benefit Place

Topeka, KS 66636-0001

(Toll Free) (800) 888-2461

Notice of Special Meeting of Shareholders of

Large Cap Growth Fund, Enhanced Index Fund and Social Awareness Fund

to be held June 1, 2006

To the Shareholders:

The Board of Directors of Security Equity Fund has called a special meeting of shareholders of Large Cap Growth Fund, Enhanced Index Fund, and Social Awareness Fund (each an “Acquired Fund”), each of which is a series of Security Equity Fund, to be held June 1, 2006 at 1:00 p.m. (Central time) or any adjournment(s) or postponement(s) thereof (the “Special Meeting”), at the executive offices of Security Equity Fund, One Security Benefit Place, Topeka, Kansas 66636-0001.

At the Special Meeting you will be asked:

| 1. | | To approve a Plan of Reorganization providing for the acquisition of all of the assets and liabilities of each Acquired Fund by Select 25 Fund (the “Acquiring Fund”), a series of Security Equity Fund, solely in exchange for shares of the Acquiring Fund, followed by the complete liquidation of the Acquired Fund; and |

| 2. | | To transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Shareholders of each Acquired Fund vote separately on Proposal 1. Shareholders of record at the close of business on April 3, 2006 are entitled to notice of, and to vote at, the Special Meeting. Your attention is called to the accompanying Proxy Statement/Prospectus. Shareholders who do not expect to attend the Special Meeting in person are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting via telephone, fax or the Internet, if you wish to take advantage of these voting options. Proxies may be revoked at any time by executing and submitting a revised proxy, by giving written notice of revocation to Security Equity Fund, or by voting in person at the Special Meeting.

By Order of the Board of Directors

Amy J. Lee

Secretary

April 17, 2006

TABLE OF CONTENTS

Introduction | | | | | 2 | |

Summary | | | | | 4 | |

| The Proposed Reorganization | | | | | 4 | |

Comparison of Investment Objectives, Principal Investment Strategies, Risks and Management of the Acquired and

Acquiring Funds | | | | | 5 | |

| Principal Risks of Investing in the Funds | | | | | 14 | |

| Comparison of Portfolio Characteristics | | | | | 17 | |

Comparison of Fees and Expenses for Acquired and

Acquiring Funds | | | | | 19 | |

| Shareholder Fees | | | | | 20 | |

| Comparison of Operating Expenses | | | | | 21 | |

| Example | | | | | 24 | |

Additional Information about the Acquiring Fund | | | | | 28 | |

| Performance of the Acquiring Fund | | | | | 28 | |

| Select 25 Fund — Class A | | | | | 28 | |

| Investment Manager | | | | | 29 | |

| Portfolio Manager | | | | | 30 | |

| Form of Organization | | | | | 30 | |

Information about the Reorganization | | | | | 30 | |

| The Reorganization Plan | | | | | 30 | |

| Reasons for the Reorganization | | | | | 31 | |

| Board Considerations | | | | | 31 | |

| Tax Considerations | | | | | 32 | |

| Expenses of the Reorganization | | | | | 33 | |

| Dividends and Other Distributions | | | | | 33 | |

| Capitalization of the Funds | | | | | 34 | |

General Information | | | | | 34 | |

More Information Regarding the Acquiring Fund | | | | | 38 | |

| Management of the Acquiring Fund | | | | | 51 | |

Financial Highlights for the Acquiring Fund | | | | | 55 | |

Appendix A — Plan of Reorganization | | | | | A-1 | |

Appendix B — Additional Investment Techniques and

Associated Risks | | | | | B-1 | |

Appendix C — Performance Update | | | | | C-1 | |

Appendix D — Ownership Information | | | | | D-1 | |

1

PROXY STATEMENT/PROSPECTUS

Security Equity Fund

One Security Benefit Place

Topeka, Kansas 66636-0001

(Toll Free) (800) 888-2461

Introduction

This Proxy Statement/Prospectus provides you with information about the proposed transfer of all of the assets of each Acquired Fund to the Acquiring Fund as set forth in the table below in exchange solely for shares of the Acquiring Fund; the assumption by the Acquiring Fund of all liabilities of the Acquired Funds; and the distribution of the Acquiring Fund shares to the shareholders of the Acquired Funds in complete liquidation of the Acquired Funds (each such proposed transaction a “Reorganization” and collectively, the “Reorganization”) as provided upon the terms and conditions set forth in a Plan of Reorganization (“Reorganization Plan”).

Acquired Funds

| | | | Acquiring Fund

|

|---|

| Large Cap Growth Fund | | | | | | |

| Enhanced Index Fund | | | | Select 25 Fund |

| Social Awareness Fund | | | | | | |

This Proxy Statement/Prospectus solicits your vote in connection with a special meeting (“Special Meeting”) of shareholders, to be held June 1, 2006, at which shareholders of the Acquired Funds will vote on the Reorganization Plan through which these transactions will be accomplished. Because you, as a shareholder of an Acquired Fund, are being asked to approve a transaction that will result in your holding shares of the Acquiring Fund, this document also serves as a prospectus for the Acquiring Fund, whose investment objective is long-term growth of capital.

This Proxy Statement/Prospectus, which you should retain for future reference, contains important information about the Acquiring Fund that you should know before investing. A Statement of Additional Information (“SAI”) dated March 27, 2006 relating to this Proxy Statement/Prospectus, and containing additional information about the Reorganization and the parties thereto, has been filed with the U.S. Securities and Exchange Commission (“SEC”) and is incorporated herein by reference. For a more detailed discussion of the investment objectives, policies, restrictions and risks of each of the Funds, see the Security Equity Fund Prospectus and Statement of Additional Information dated February 1, 2006, each of which is incorporated herein by reference and is available, without charge, by calling (800) 888-2461. The Security Equity Fund annual report dated September 30, 2005 is incorporated herein by reference.

2

You also may obtain proxy materials, reports and other information filed by the Security Equity Fund from the SEC’s Public Reference Section (1-202-942-8090) in Washington, D.C., or from the SEC’s internet website at www.sec.gov. Copies of materials also may be obtained, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549-0102.

The SEC has not approved or disapproved these securities, or determined that this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Date: April 17, 2006

3

Summary

You should read this entire Proxy Statement/Prospectus and accompanying materials carefully. For additional information, you should consult the Security Equity Fund Prospectus and the Reorganization Plan, which is attached hereto as Appendix A; Appendix B, Additional Investment Techniques and Associated Risks; Appendix C, Performance Update; and Appendix D, Ownership Information; each of which is an integral part of this Proxy Statement/Prospectus.

The Proposed Reorganization — On November 18, 2005, the Board of Directors of Security Equity Fund (“Board”) approved the Reorganization Plan with respect to Large Cap Growth, Social Awareness and Select 25 Funds. On February 10, 2006, the Board approved the Reorganization Plan with respect to Enhanced Index and Select 25 Funds. Subject to the approval of shareholders of the Acquired Funds, the Reorganization Plan provides for:

| • | | the transfer of all of the assets of the Acquired Funds to the Acquiring Fund, in exchange for shares of the Acquiring Fund; |

| • | | the assumption by the Acquiring Fund of all of the liabilities of the Acquired Funds; |

| • | | the distribution of shares of the Acquiring Fund to the shareholders of the Acquired Funds; and |

| • | | the complete liquidation of the Acquired Funds. |

The Reorganization is expected to be effective immediately after the close of business June 16, 2006, or on a later date as the parties may agree (the “Closing”). As a result of the Reorganization, each shareholder of an Acquired Fund will become a shareholder of the Acquiring Fund. Each shareholder will hold, immediately after the Closing, shares of the Acquiring Fund having an aggregate value equal to the aggregate value of the shares of the Acquired Fund held by that shareholder as of the close of business on the date of the Closing.

The expenses of the Reorganization are estimated to be approximately $93,000. The Acquired Funds collectively will bear one-half of the expenses relating to the Reorganization, split evenly among each Acquired Fund whose shareholders approve the Reorganization. The Investment Manager will bear the remainder of the expenses relating to the Reorganization.

The Reorganization is intended to eliminate duplication of costs and other inefficiencies arising from having comparable mutual funds within the same family of funds, as well as to assist in achieving economies of scale. Shareholders in the Acquired Funds are expected to benefit from the larger asset base and lower gross operating expenses as a percentage of Acquiring Fund assets that will result from the Reorganization.

4

Approval of the Reorganization Plan with respect to an Acquired Fund requires the affirmative vote of a majority of the outstanding voting securities of that Acquired Fund. In the event that the shareholders of an Acquired Fund do not approve the Reorganization, that Acquired Fund will continue to operate as a separate entity, and the Board will determine what further action, if any, to take.

After careful consideration, the Board unanimously approved the proposed Reorganization. The Board recommends that you vote “FOR” the proposed Reorganization.

In considering whether to approve the Reorganization, you should note that:

| • | | As described below, each Acquired Fund has investment objectives and investment policies that are comparable in many respects to the investment objective and investment policies of the Acquiring Fund. The Acquiring Fund’s investment objectives and investment policies do, however, differ in certain material respects, including the Acquiring Fund’s relatively lower level of diversification and its “bottom-up” approach to stock selection. |

| • | | The Funds have the same investment manager, Security Management Company, LLC (the “Investment Manager” or “SMC”), One Security Benefit Place, Topeka, Kansas 66636-0001. |

| • | | The proposed Reorganization offers reductions in gross operating expenses, and comparable or lower operating expenses net of voluntary reimbursements and waivers by SMC, for shareholders of each of the Acquired Funds. SMC is expected to benefit from the Reorganization because it will be relieved of its voluntary undertaking to limit the total operating expenses of each Acquired Fund. |

| • | | The share purchase, exchange and redemption provisions for each Fund are the same. For additional information on purchase and redemption provisions, see “More Information Regarding the Acquiring Fund.” |

| • | | The Funds expect that the Reorganization will be considered a tax-free reorganization within the meaning of section 368(a)(1) of the Internal Revenue Code of 1986 (the “Code”). As such, shareholders of the Funds will not recognize gain or loss as a result of the Reorganization. See “Information About the Reorganization — Tax Considerations.” |

Comparison of Investment Objectives, Principal Investment Strategies, Risks and Management of the Acquired and Acquiring Funds

The investment objectives, principal investment strategies, and risks of the Funds are similar. Each Fund is managed by the same investment manager. Because Large Cap Growth Fund, Enhanced Index Fund, Social Awareness Fund and Select 25 Fund

5

have similar investment objectives and investment policies, the principal investment strategies and principal risks of an investment in the Funds are generally comparable, although there are certain differences. The chart below summarizes the similarities and differences, between the Funds’ investment objectives, principal investment strategies and principal risks. There can be no assurance that a Fund will achieve its stated objective.

Large Cap Growth Fund/Select 25 Fund

|

| Large Cap Growth Fund

|

| Select 25 Fund

|

|

|---|

Investment Objective | Long-term growth of capital

| | Long-term growth of capital

|

Principal Investment Strategies | Large Cap Growth Fund pursues its objective by investing, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in common stock and other equity securities of large capitalization companies, and principally invests in companies that, in the opinion of the Investment Manager, have long-term capital growth potential. | | Select 25 Fund pursues its objective by focusing its investments in a core position of 20–30 common stocks of growth companies which have exhibited consistent above average earnings and/or revenue growth. |

Investment Manager | Security Management

Company, LLC

| | Security Management

Company, LLC

|

Sub-Adviser | None

| | None

|

Portfolio Manager | Mark Mitchell

| | Mark Mitchell

|

Comparison of Principal Investment

Strategies | | | | Similar Strategies | | • Each Fund may invest a portion of its assets in options and futures contracts, which may be used to hedge each Fund’s portfolio, maintain exposure to the equity markets or to increase returns.

• Each Fund may invest in a variety of investment vehicles, including those that seek to track the composition and performance of a specific index. Each Fund may use these index-based investments as a way of managing its cash position or to gain exposure to the equity markets or a particular sector of the equity market, while maintaining liquidity. |

6

|

| Large Cap Growth Fund

|

| Select 25 Fund

|

|

|---|

| | | | | Differences in Strategy | | • Large Cap Growth Fund may concentrate its investments in a particular industry that represents 20% or more of the Fund’s benchmark index, the Russell 1000 Growth Index. Concentration means investment of more than 25% of the value of the Fund’s assets in any one industry. This policy would allow the Fund to overweight an industry relative to the index even if such overweighting resulted in investment of more than 25% of the Large Cap Growth Fund’s assets in that industry. Currently, no industry represents 20% or more of the index.

• The Investment Manager uses a growth-oriented strategy to choose equity securities, which means that it invests in companies whose earnings are believed to be in a relatively strong growth trend. In identifying companies with favorable growth prospects, the Investment Manager considers many factors including, but not limited to: prospects for above-average sales and earnings growth; high return on invested capital; overall financial strength; competitive advantages, including innovative products and services; effective research, product development and marketing; and stable, effective management.

• Large Cap Growth Fund typically sells a stock when the reasons for buying it no longer apply, or when the company begins to show deteriorating fundamentals or poor relative performance. | | • Select 25 Fund pursues its objective by focusing its investments in a core position of 20–30 common stocks of growth companies which have exhibited consistent above average earnings and/or revenue growth. The Fund is non-diversified, which means that it may invest a larger portion of its assets in a limited number of companies than a diversified fund.

• The Investment Manager selects what it believes to be premier growth companies as the core position for the Select 25 Fund using a “bottom-up” approach in selecting growth stocks. A bottom-up approach means that the Investment Manager primarily analyzes the fundamentals of individual companies rather than focusing on broader market or sector themes. When analyzing individual companies, the Investment Manager considers various factors, which may include relative earnings growth, profitability trends, the company’s financial strength, valuation analysis and strength of management. Portfolio holdings will be replaced when one or more of a company’s fundamentals have changed and, in the opinion of the Investment Manager, it is no longer a premier growth company. |

7

|

| Large Cap Growth Fund

|

| Select 25 Fund

|

|

|---|

Comparison of Principal Risks | | | | Similar Risks | | • Under adverse or unstable market conditions, each Fund’s policies allow it to invest some or all of its assets in cash or money market securities for the purpose of avoiding losses, in which case each Fund may be unable to pursue its investment objective during that time or benefit from any market upswings.

• Each Fund also shares the following principal investment risks:

• market risk

• growth stock risk

• equity derivatives risk

• non-diversification risk

• investment in investment companies risk

A summary description of each of these risks, as well as other principal investment risks associated with an investment in the Funds, is provided below under “Principal Risks of Investing in the Funds.” In addition, Appendix B contains additional information regarding other investment strategies and risk considerations of the Funds. |

| | | | | Differences in Risks | | • In addition to the above risks, Large Cap Growth Fund is also subject to the following principal investment risks:

• Industry Concentration Risk

• Leverage Risk

A summary description of each of these risks is provided below under “Principal Risks of Investing in the Funds.” | | • In addition to the above risks, Select 25 Fund is also subject to the following principal investment risks:

• Focused Investment

Strategy Risk

• Overweighting Risk

A summary description of each of these risks is provided below under “Principal Risks of Investing in the Funds.” |

8

Enhanced Index Fund/Select 25 Fund

|

| Enhanced Index Fund

|

| Select 25 Fund

|

|

|---|

Investment Objective | Outperform the S&P 500 Index through stock selection resulting in different weightings of common stocks relative to the index | | Long-term growth of capital |

Principal Investment Strategies | Enhanced Index Fund pursues its objective by investing, under normal market conditions, at least 80% of its net assets (plus borrowings for investment purposes) in equity securities of companies in the S&P 500 Index and futures contracts representative of the stocks which make up the index. | | Select 25 Fund pursues its objective by focusing its investments in a core position of 20–30 common stocks of growth companies which have exhibited consistent above average earnings and/or revenue growth. |

Investment Manager | Security Management

Company, LLC

| | Security Management

Company, LLC

|

Sub-Adviser | Northern Trust Investments,

N.A. (“NTI”)

| | None

|

Portfolio Manager(s) | Robert H. Bergson and

Gail Grove

| | Mark Mitchell

|

Comparison of Principal Investment

Strategies | | | | Similar Strategies | | • Each Fund may invest a portion of its assets in options and futures contracts, which may be used to hedge each Fund’s portfolio, maintain exposure to the equity markets or to increase return potential. |

9

|

| Enhanced Index Fund

|

| Select 25 Fund

|

|

|---|

| | | | | Differences in Strategy | | • Enhanced Index Fund employs a quantitative discipline to determine which S&P 500 stocks should be overweighted, underweighted, or held in a neutral position relative to the proportion of the S&P 500 Index that the stock represents. Approximately 150 issues will be over- or underweighted relative to the index, and certain securities represented in the index will not be held by the Fund. The Fund also may invest a limited portion of its assets in equity securities that are not included in the S&P 500 Index.

• NTI may invest up to 25% of the Fund’s assets in short-term debt securities and money market instruments to meet redemption requests or to facilitate investment in the securities of the S&P 500 Index. | | • Select 25 Fund pursues its objective by focusing its investments in a core position of 20–30 common stocks of growth companies which have exhibited consistent above average earnings and/or revenue growth. The Fund is non-diversified, which means that it may invest a larger portion of its assets in a limited number of companies than a diversified fund.

• The Investment Manager selects what it believes to be premier growth companies as the core position for the Select 25 Fund using a “bottom-up” approach in selecting growth stocks. A bottom-up approach means that the Investment Manager primarily analyzes the fundamentals of individual companies rather than focusing on broader market or sector themes. When analyzing individual companies, the Investment Manager considers various factors, which may include relative earnings growth, profitability trends, the company’s financial strength, valuation analysis and strength of management. Portfolio holdings will be replaced when one or more of a company’s fundamentals have changed and, in the opinion of the Investment Manager, it is no longer a premier growth company.

• Select 25 Fund may invest in a variety of investment companies, including those that seek to track the composition and performance of a specific index. The Fund may use these index-based investments as a way of managing its cash position, to gain exposure to the equity markets, or a particular sector of the equity market, while maintaining liquidity. |

10

|

| Enhanced Index Fund

|

| Select 25 Fund

|

|

|---|

Comparison of Principal Risks | | | | Similar Risks | | • Under adverse or unstable market conditions, each Fund’s policies allows it to invest some or all of its assets in cash or money market securities for the purpose of avoiding losses, in which case each Fund may be unable to pursue its investment objective during that time or benefit from any market upswings.

• Each Fund also shares the following principal investment risks:

• market risk

• growth stock risk

• equity derivatives risk

• overweighting risk

A summary description of each of these risks, as well as other principal investment risks associated with an investment in the Funds, is provided below under “Principal Risks of Investing in the Funds.” In addition, Appendix B contains additional information regarding other investment strategies and risk considerations of the Funds. |

| | | | | Differences in Risks | | • In addition to the above risks, Enhanced Index Fund is also subject to the following principal investment risk:

• Leverage Risk

A summary description of this risk is provided below under “Principal Risks of Investing in the Funds.” | | • In addition to the above risks, Select 25 Fund is also subject to the following principal investment risks:

• Focused Investment Strategy Risk

• Non-Diversification Risk

• Investment in Investment Companies Risk

A summary description of each of these risks is provided below under “Principal Risks of Investing in the Funds.” |

11

Social Awareness Fund/Select 25 Fund

|

| Social Awareness Fund

|

| Select 25 Fund

|

|

|---|

Investment Objective | Capital appreciation

| | Long-term growth of capital

|

Principal Investment Strategies | Social Awareness Fund pursues its objective by investing, under normal market conditions, in a well-diversified portfolio of equity securities that the Investment Manager believes have above-average earnings potential and which meet certain established social criteria. The Fund typically invests in the common stock of companies whose total market value is $5 billion or greater at the time of purchase. | | Select 25 Fund pursues its objective by focusing its investments in a core position of 20–30 common stocks of growth companies which have exhibited consistent above average earnings and/or revenue growth. |

Investment Manager | Security Management

Company, LLC

| | Security Management

Company, LLC

|

Portfolio Managers | Mark Mitchell

| | Mark Mitchell

|

Comparison of Principal Investment

Strategies | | | | Similar Strategies | | • Each Fund may invest a portion of its assets in options and futures contracts, which may be used to hedge each Fund’s portfolio, maintain exposure to the equity markets or to increase returns. |

12

|

| Social Awareness Fund

|

| Select 25 Fund

|

|

|---|

Comparison

of Principal Strategies (continued) | | | | Differences in Strategy | | • Social Awareness Fund seeks to hold a portfolio of equity securities that have above-average earnings potential and meets established social criteria. The fund typically invests in the common stock of securities whose total market value is $5 billion or greater at the time of purchase.

• Social Awareness Fund may also invest in companies that are included in the Domini 400 Social Index (DSI). (The DSI is not the benchmark against which the Fund measures its performance.)

• The Investment Manager uses a “bottom-up” approach, which analyzes the fundamentals of individual companies instead of focusing on broad market or sector themes.

• The Social Awareness Fund seeks to invest in companies that contribute substantially to the communities in which they operate, demonstrate a positive record on employment relations, demonstrate substantial progress in the promotion of women and minorities or in the implementation of policies that support working parents and take notably positive steps in addressing environmental challenges. Thus, the Fund will not invest in companies that engage in: nuclear energy production, alcoholic beverages, tobacco products, weapons manufacturing, practices that detrimentally affect the environment, and the gambling industry. | | • Select 25 Fund pursues its objective by focusing its investments in a core position of 20-30 common stocks of growth companies which have exhibited consistent above average earnings and/or revenue growth. The Fund is non-diversified, which means that it may invest a larger portion of its assets in a limited number of companies than a diversified fund.

• The Investment Manager selects what it believes to be premier growth companies as the core position for the Select 25 Fund using a “bottom-up” approach in selecting growth stocks. A bottom-up approach means that the Investment Manager primarily analyzes the fundamentals of individual companies rather than focusing on broader market or sector themes. When analyzing individual companies, the Investment Manager considers various factors, which may include relative earnings growth, profitability trends, the company’s financial strength, valuation analysis and strength of management. Portfolio holdings will be replaced when one or more of a company’s fundamentals have changed and, in the opinion of the Investment Manager, it is no longer a premier growth company.

• Select 25 Fund may invest in a variety of investment companies, including those that seek to track the composition and performance of a specific index. The Fund may use these index-based investments as a way of managing its cash position, to gain exposure to the equity markets, or a particular sector of the equity market, while maintaining liquidity. |

13

|

| Social Awareness Fund

|

| Select 25 Fund

|

|

|---|

Comparison of Principal Risks | | | | Similar Risks | | • Under adverse or unstable market conditions, each Fund’s policies allow it to invest some or all of its assets in cash or money market securities for the purpose of avoiding losses, in which case each Fund may be unable to pursue its investment objective during that time or benefit from any market upswings.

• Each Fund also shares the following principal investment risks:

• market risk

• growth stock risk

A summary description of each of these risks, as well as other principal investment risks associated with an investment in the Funds, is provided below under “Principal Risks of Investing in the Funds.” In addition, Appendix B contains additional information regarding other investment strategies and risk considerations of the Funds. |

| | | | | Differences in Risks | | • In addition to the above risks, Social Awareness Fund is also subject to the following principal investment risk:

• Social Investing Risk

A summary description of this risk is provided below under “Principal Risks of Investing in the Funds.” | | • In addition to the above risks, Select 25 Fund is also subject to the following principal investment risks:

• Equity Derivatives Risk

• Focused Investment Strategy Risk

• Non-Diversification Risk

• Investment in Investment Companies Risk

• Overweighting Risk

A summary description of each of these risks is provided below under “Principal Risks of Investing in the Funds.” |

Principal Risks of Investing in the Funds — The discussion below provides more information about the principal risks of investing in the Funds. Each Fund may invest in various types of securities or use certain investment techniques to achieve its objective. The following is a summary of the principal risks associated with such securities and investment techniques. As with any security, an investment in a Fund involves certain risks, including loss of principal. The Funds are subject to varying degrees of financial, market and credit risk. An investment in the Funds is not a deposit of a bank and is not insured by the Federal Deposit Insurance Corporation or any other government agency. The fact that a particular risk is not identified means only that it is not a principal risk of investing in the Funds, but it does not mean that a Fund is prohibited from investing its assets in securities that give rise to that risk. Please refer to Appendix B for information about additional investment techniques that the Funds may utilize and related risks.

Market Risk. Equity securities fluctuate in price and their prices tend to fluctuate more dramatically over the shorter term than do the prices of other asset classes. These movements may result from factors affecting individual

14

companies, or from broader influences like changes in interest rates, market conditions, investor confidence or changes in economic, political or financial market conditions.

Growth Stocks Risk. Investments in growth stocks may lack the dividend yield that can cushion stock prices in market downturns. Growth companies often are expected to increase their earnings at a certain rate. If expectations are not met, investors can punish the stocks, even if earnings do increase.

Equity Derivatives Risk. Equity derivatives include options, futures and options on futures, which may be used to hedge a Fund’s portfolio, to increase returns or to maintain exposure to a market without buying individual securities. These investments may pose risks in addition to those associated with investing directly in securities or other investments. These risks may include illiquidity of the equity derivative, imperfect correlation with underlying investments or the Fund’s other portfolio holdings, and lack of availability. Accordingly, there is the risk that such practices may fail to serve their intended purposes, and may reduce returns or increase volatility. These practices also entail transactional expenses.

Social Investing Risk. Social investing may present additional risks to the Social Awareness Fund because it will limit the availability of investment opportunities compared to those of similar funds which do not impose such restrictions on investment. In addition, if SMC determines that securities held by the Fund do not comply with its social criteria, the Fund must sell the security at a time or price that may not be advantageous to the Fund.

Focused Investment Strategy Risk. The typical diversified stock mutual fund might hold between 80 and 120 stocks in its portfolio. Because Select 25 Fund focuses its investments in a smaller number of stocks, it may be more volatile than the typical diversified stock fund, because a change in the market value of a single security may have a greater impact on the Fund’s net asset value and total return.

Non-Diversification Risk. A non-diversified Fund such as Select 25 Fund or Large Cap Growth Fund may hold larger positions in a smaller number of securities than a diversified Fund. As a result, a change in the market value of a single security may have a greater impact on a non-diversified Fund’s net asset value and total return. A non-diversified Fund is expected to be more volatile than a diversified Fund.

Overweighting Risk. Overweighting investments in certain sectors or industries of the stock market increases the risk that Select 25 Fund will suffer a loss because of general declines in the prices of stocks in those sectors or industries.

Investment In Investment Companies Risk. Investment in other investment companies or investment vehicles may include index-based investments such as Standard & Poors Depository Receipts (“SPDRs”) (based on the S&P 500 Index), MidCap SPDRs (based on the S&P MidCap 400 Index), Select Sector SPDRs

15

(based on sectors or industries of the S&P 500 Index), Nasdaq-100 Index Tracking Stocks (based on the Nasdaq-100 Index) and DIAMONDS (based on the Dow Jones Industrial Average). Such index-based investments are securities issued by an investment company or investment vehicle whose shares are intended to closely track the performance of the applicable index. To the extent a Fund invests in other investment companies or investment vehicles, it will incur its pro rata share of the underlying investment companies’ or investment vehicles’ expenses, such as investment advisory and other management expenses, and shareholders will be required to pay the operating expenses of two investment companies or investment vehicles. In addition, a Fund will be subject to the effects of business and regulatory developments that affect an underlying investment company or investment vehicle or the investment company industry generally.

Industry Concentration Risk. Large Cap Growth Fund may be prone to industry concentration risk due to its investment strategy, which allows it to concentrate its investments in a particular industry that represents 20% or more of its benchmark index. Industry concentration risk is the risk that the Fund’s return could be hurt significantly by problems affecting a particular industry or sector. For the Large Cap Growth Fund, “concentration” refers to investment of more than 25% of the value of the Fund’s assets in any one industry. The Fund’s concentration policy allows it to overweight an industry relative to its index, even if overweighting resulted in investment of more than 25% of the Fund’s assets in that industry. When the Fund concentrates its investments in a particular industry or group of related industries, its performance may significantly increase or decrease due to developments in that particular industry or group of industries.

Leverage Risk. Certain of the Funds may be prone to leverage risk due to investment strategies which allow the Funds to invest a portion of their assets in options and futures contracts. This use of derivatives may create leveraging risk. For example, because of the low margin deposits required, futures trading involves an extremely high degree of leverage. As a result, a relatively small price movement in a futures contract may result in an immediate and substantial impact on the net asset value of a Fund. Leveraging may cause a Fund to be more volatile than if it had not been leveraged. To mitigate leveraging risk, a Fund segregates liquid assets to meet its obligations under, or otherwise covers, the transactions that may give rise to this risk.

16

Comparison of Portfolio Characteristics

The following tables compare certain characteristics of the portfolios of the Funds as of December 31, 2005:

|

|

|

| Acquired Funds

|

| Acquiring Fund

| |

|---|

|

|

|

| Large Cap

Growth Fund

|

| Enhanced

Index Fund

|

| Social

Awareness

Fund

|

| Select 25 Fund

|

|---|

| Net Assets (thousands) | | | | $16,881.60 | | $14,305.90 | | $16,954.30 | | $25,127.70 |

| Number of Holdings | | | | 38 | | 249 | | 38 | | 27 |

Portfolio Turnover Rate

(12 months ended 12/31/05) | | | | 58% | | 101% | | 52% | | 30% |

| As a percentage of Net Assets | | | | | | | | | | |

| — U.S. Government Obligations | | | | — | | — | | — | | — |

| — U.S. Government Agency Obligations | | | | — | | — | | — | | — |

| — Foreign Government Obligations | | | | — | | — | | — | | — |

| — Corporate Debt Securities | | | | — | | — | | — | | — |

| — Convertible Bonds | | | | — | | — | | — | | — |

| — Convertible Preferred Stocks | | | | — | | — | | — | | — |

| — Preferred Stocks | | | | — | | — | | — | | — |

| — Common Stocks | | | | 97.14% | | 96.86% | | 97.36% | | 95.81% |

17

Top 10 Holdings (as a % of net assets)

Acquired Funds

| | Acquiring Fund

| |

|---|

Large Cap Growth Fund

| | | | %

| | Enhanced Index Fund

| | %

| | Social Awareness Fund

| | %

| | Select 25 Fund

| | %

|

|---|

| American International Group, Inc. | | | | | 4.20 | | | Exxon Mobil Corporation | | | 3.26 | | | American International Group, Inc. | | | 4.77 | | | Shaw Group, Inc. | | 7.35 |

| General Electric Company | | | | | 4.07 | | | General Electric Company | | | 2.93 | | | Microsoft Corporation | | | 4.09 | | | KFX, Inc. | | 5.54 |

| Carnival Corporation | | | | | 3.99 | | | Microsoft Corporation | | | 2.12 | | | Fedex Corporation | | | 3.90 | | | Fedex Corporation | | 5.27 |

| Microsoft Corporation | | | | | 3.81 | | | Bank of America Corporation | | | 1.97 | | | Univision Communications, Inc. | | | 3.87 | | | BJ Services Company | | 4.69 |

| Univision Communications, Inc. | | | | | 3.67 | | | Johnson & Johnson | | | 1.83 | | | Medtronic, Inc. | | | 3.84 | | | Carnival Corporation | | 4.53 |

| Home Depot, Inc. | | | | | 3.52 | | | Citigroup, Inc. | | | 1.81 | | | Home Depot, Inc. | | | 3.29 | | | Williams Companies, Inc. | | 4.30 |

| Medtronic, Inc. | | | | | 3.51 | | | Pfizer, Inc. | | | 1.77 | | | Shaw Group, Inc. | | | 3.17 | | | Medtronic, Inc. | | 4.26 |

| J.B. Hunt Transport Services, Inc. | | | | | 3.39 | | | Intel Corporation | | | 1.59 | | | CVS Corporation | | | 3.05 | | | American International Group, Inc. | | 4.21 |

| Fedex Corporation | | | | | 3.31 | | | International Business Machines Corporation | | | 1.47 | | | Zimmer Holdings, Inc. | | | 3.02 | | | L-3 Communications Holding, Inc. | | 4.08 |

| Zimmer Holdings, Inc. | | | | | 3.28 | | | Proctor & Gamble Company | | | 1.36 | | | Viacom, Inc. (CL B) | | | 3.00 | | | ADC Telecommunications, Inc. | | 3.97 |

18

Comparison of Fees and Expenses for Acquired and Acquiring Funds

The following describes and compares the fees and expenses that you may pay if you buy and hold shares of each Fund. It is expected that combining the Funds in the manner proposed in the Reorganization Plan would allow shareholders of the Large Cap Growth, Enhanced Index, and Social Awareness Funds to realize economies of scale and lower operating expenses before any waiver or reimbursement by SMC. While the Reorganization will not affect the management fee payable with respect to Select 25 Fund (as a percentage of the Fund’s average daily net assets), SMC may be deemed to have a material interest in the proposed Reorganization because combination of the Funds will relieve SMC of its obligation to pay sub-advisory fees to NTI under the sub-advisory agreement applicable to Enhanced Index Fund. In addition, SMC will be relieved of its voluntary undertaking to limit the total operating expenses of each Acquired Fund, which resulted in SMC waiving fees and/or reimbursing expenses in the following amounts during the Acquired Funds’ last fiscal year: Large Cap Growth Fund — $43,378; Enhanced Index Fund — $39,111; and Social Awareness Fund — $42,472.

Class A, Class B and Class C shares of the Acquiring Fund issued to an Acquired Fund shareholder in connection with the Reorganization will not be subject to any additional front-end sales charges, but will be subject to the same contingent deferred sales charge, if any, applicable to the corresponding Acquired Fund shares held by that shareholder immediately prior to the Reorganization. In addition, the period that the shareholder held shares of an Acquired Fund would be included in the holding period of Acquiring Fund shares for purposes of calculating any contingent deferred sales charge, as well as for federal income tax purposes. Similarly, Class B shares of the Acquiring Fund issued to a shareholder in connection with the Reorganization will convert to Class A shares eight years after the date that the corresponding Class B shares of an Acquired Fund were purchased by the shareholder. Purchases of shares of the Acquiring Fund after the Reorganization will be subject to the sales load structure described in the table below for the Acquiring Fund. This is the same sales load structure that is currently in effect for each Acquired Fund.

For further information on the fees and expenses of the Select 25 Fund, please see “More Information Regarding the Acquiring Fund” in this Proxy Statement/Prospectus.

19

Shareholder Fees — For each Fund, the following table describes the fees that are paid directly from a shareholder’s investment:

| | | | Class A

Shares

| | Class B

Shares(1)

| | Class C

Shares

|

|---|

Maximum Sales Charge Imposed on Purchases

(as a percentage of offering price) | | | | | 5.75 | % | | | None | | | | None | |

| Maximum Deferred Sales Charge (as a percentage of original purchase price or redemption proceeds, whichever is lower) | | | | | None | (2) | | 5%(3)

| | 1%(4) |

| (1) | | Class B shares convert tax-free to Class A shares automatically after eight years. |

| (2) | | Purchases of Class A shares in amounts of $1,000,000 or more are not subject to an initial sales load; however, a deferred sales charge of 1% is imposed in the event of redemption within one year of purchase. |

| (3) | | 5% during the first year, decreasing to 0% in the sixth and following years. |

| (4) | | A deferred sales charge of 1% is imposed in the event of redemption within one year of purchase. |

20

Comparison of Operating Expenses — The current expenses of Large Cap Growth Fund, Enhanced Index Fund, Social Awareness Fund and Select 25 Fund and estimated pro forma expenses after giving effect to the proposed Reorganization of each Acquired Fund into the Acquiring Fund are shown in the table below. Expenses for the Funds are based on the operating expenses incurred for the year ended September 30, 2005. Pro forma fees and expenses show estimated fees and expenses of Select 25 Fund after giving effect to the proposed Reorganization as of September 30, 2005. Pro forma numbers are estimated in good faith and are hypothetical.

| | | | Class A

| | Class B and Class C

| |

|---|

| | | | Large Cap

Growth

| | Enhanced

Index

Fund

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Large Cap

Growth

| | Enhanced

Index

Fund

| | Social

Awareness

| | Select 25

| | Pro Forma

|

|---|

| Management Fees | | | | | 1.00 | % | | | 0.75 | % | | | 1.00 | % | | | 0.75 | % | | | 0.75 | % | | | 1.00 | % | | | 0.75 | % | | | 1.00 | % | | | 0.75 | % | | | 0.75 | % |

| Distribution (12b-1) Fees | | | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Other expenses | | | | | 1.32 | % | | | 0.81 | % | | | 0.79 | % | | | 0.67 | % | | | 0.50 | % | | | 1.32 | % | | | 0.81 | % | | | 0.79 | % | | | 0.67 | % | | | 0.50 | % |

Total annual fund operating expenses(1) | | | | | 2.57 | % | | | 1.81 | % | | | 2.04 | % | | | 1.67 | % | | | 1.50 | % | | | 3.32 | % | | | 2.56 | % | | | 2.79 | % | | | 2.42 | % | | | 2.25 | % |

| (1) | | During the fiscal year ended September 30, 2005, SMC voluntarily waived management fees and/or reimbursed expenses in order to limit the net annual fund operating expenses of each Acquired Fund to the indicated levels (as a percentage of average daily net assets): (1) Large Cap Growth Fund — Class A (2.25%), Class B (3.00%) and Class C (3.00%); Enhanced Index Fund — Class A (1.56%), Class B (2.31%) and Class C (2.31%); and Social Awareness Fund — Class A (1.79%), Class B (2.54%) and Class C (2.54%). SMC currently continues this voluntary undertaking, which may be discontinued at any time. |

21

The current expenses of Large Cap Growth Fund and Select 25 Fund and estimated pro forma expenses after giving effect to the proposed Reorganization of Large Cap Growth Fund and Select 25 Fund are shown in the table below.

| | | | Large Cap Growth

Class A

| | Select 25

| | Pro Forma

| | Large Cap Growth

Class B and Class C

| | Select 25

| | Pro Forma

|

|---|

| Management Fees | | | | | 1.00 | % | | | 0.75 | % | | | 0.75 | % | | | 1.00 | % | | | 0.75 | % | | | 0.75 | % |

| Distribution (12b-1) Fees | | | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Other expenses | | | | | 1.32 | % | | | 0.67 | % | | | 0.68 | % | | | 1.32 | % | | | 0.67 | % | | | 0.68 | % |

Total annual fund operating expenses(1) | | | | | 2.57 | % | | | 1.67 | % | | | 1.68 | % | | | 3.32 | % | | | 2.42 | % | | | 2.43 | % |

| (1) | | During the fiscal year ended September 30, 2005, SMC voluntarily waived management fees and/or reimbursed expenses in order to limit the net annual fund operating expenses of the Acquired Fund to the indicated levels (as a percentage of average daily net assets): Large Cap Growth Fund — Class A (2.25%), Class B (3.00%) and Class C (3.00%). SMC currently continues this voluntary undertaking, which may be discontinued at any time. |

The current expenses of Enhanced Index Fund and Select 25 Fund and estimated pro forma expenses after giving effect to the proposed Reorganization of Enhanced Index Fund and Select 25 Fund are shown in the table below.

| | | | Enhanced Index

Class A

| | Select 25

| | Pro Forma

| | Enhanced Index

Class B and Class C

| | Select 25

| | Pro Forma

|

|---|

| Management Fees | | | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % |

| Distribution (12b-1) Fees | | | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Other expenses | | | | | 0.81 | % | | | 0.67 | % | | | 0.52 | % | | | 0.81 | % | | | 0.67 | % | | | 0.52 | % |

Total annual fund operating expenses(1) | | | | | 1.81 | % | | | 1.67 | % | | | 1.52 | % | | | 2.56 | % | | | 2.42 | % | | | 2.27 | % |

| (1) | | During the fiscal year ended September 30, 2005, SMC voluntarily waived management fees and/or reimbursed expenses in order to limit the net annual fund operating expenses of the Acquired Fund to the indicated levels (as a percentage of average daily net assets): Enhanced Index Fund — Class A (1.56%), Class B (2.31%) and Class C (2.31%). SMC currently continues this voluntary undertaking, which may be discontinued at any time. |

22

The current expenses of Social Awareness Fund and Select 25 Fund and estimated pro forma expenses after giving effect to the proposed Reorganization of Social Awareness Fund and Select 25 Fund are shown in the table below.

| | | | Social Awareness

Class A

| | Select 25

| | Pro Forma

| | Social Awareness

Class B and Class C

| | Select 25

| | Pro Forma

|

|---|

| Management Fees | | | | | 1.00 | % | | | 0.75 | % | | | 0.75 | % | | | 1.00 | % | | | 0.75 | % | | | 0.75 | % |

| Distribution (12b-1) Fees | | | | | 0.25 | % | | | 0.25 | % | | | 0.25 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

| Other expenses | | | | | 0.79 | % | | | 0.67 | % | | | 0.54 | % | | | 0.79 | % | | | 0.67 | % | | | 0.54 | % |

Total annual fund operating expenses(1) | | | | | 2.04 | % | | | 1.67 | % | | | 1.54 | % | | | 2.79 | % | | | 2.42 | % | | | 2.29 | % |

| (1) | | During the fiscal year ended September 30, 2005, SMC voluntarily waived management fees and/or reimbursed expenses in order to limit the net annual fund operating expenses of the Acquired Fund to the indicated levels (as a percentage of average daily net assets): Social Awareness Fund — Class A (1.79%), Class B (2.54%) and Class C (2.54%). SMC currently continues this voluntary undertaking, which may be discontinued at any time. |

23

Example — The example below is intended to help you compare the cost of investing in the Funds and in the combined Funds (after the Reorganization) on a pro forma basis. Your actual costs may be higher or lower. The example assumes that you invest $10,000 in each Fund and in the Select 25 Fund after the Reorganization for the time periods indicated and redeemed your shares at the end of each period. The Example also assumes that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. The 5% return is an assumption and is not intended to portray past or future investment results. Based on the above assumptions, you would pay the following expenses if you redeemed your shares at the end of each period shown.

Example of Fees and Expenses — if shares are redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Large

Cap

Growth

| | Enhanced

Index

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Large

Cap

Growth

| | Enhanced

Index

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Large

Cap

Growth

| | Enhanced

Index

| | Social

Awareness

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 820 | | | $ | 748 | | | $ | 770 | | | $ | 735 | | | $ | 719 | | | $ | 835 | | | $ | 759 | | | $ | 782 | | | $ | 745 | | | $ | 728 | | | $ | 435 | | | $ | 359 | | | $ | 382 | | | $ | 345 | | | $ | 328 | |

| 3 Years | | | | $ | 1,329 | | | $ | 1,112 | | | $ | 1,178 | | | $ | 1,071 | | | $ | 1,022 | | | $ | 1,321 | | | $ | 1,096 | | | $ | 1,165 | | | $ | 1,055 | | | $ | 1,003 | | | $ | 1,021 | | | $ | 796 | | | $ | 865 | | | $ | 755 | | | $ | 703 | |

| 5 Years | | | | $ | 1,862 | | | $ | 1,499 | | | $ | 1,610 | | | $ | 1,430 | | | $ | 1,346 | | | $ | 1,931 | | | $ | 1,560 | | | $ | 1,674 | | | $ | 1,491 | | | $ | 1,405 | | | $ | 1,731 | | | $ | 1,360 | | | $ | 1,474 | | | $ | 1,291 | | | $ | 1,205 | |

| 10 Years | | | | $ | 3,313 | | | $ | 2,579 | | | $ | 2,808 | | | $ | 2,438 | | | $ | 2,263 | | | $ | 3,440 | | | $ | 2,712 | | | $ | 2,940 | | | $ | 2,571 | | | $ | 2,396 | | | $ | 3,612 | | | $ | 2,895 | | | $ | 3,119 | | | $ | 2,756 | | | $ | 2,585 | |

Example of Fees and Expenses — if shares are not redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Large

Cap

Growth

| | Enhanced

Index

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Large

Cap

Growth

| | Enhanced

Index

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Large

Cap

Growth

| | Enhanced

Index

| | Social

Awareness

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 820 | | | $ | 748 | | | $ | 770 | | | $ | 735 | | | $ | 719 | | | $ | 335 | | | $ | 259 | | | $ | 282 | | | $ | 245 | | | $ | 228 | | | $ | 335 | | | $ | 259 | | | $ | 282 | | | $ | 245 | | | $ | 228 | |

| 3 Years | | | | $ | 1,329 | | | $ | 1,112 | | | $ | 1,178 | | | $ | 1,071 | | | $ | 1,022 | | | $ | 1,021 | | | $ | 796 | | | $ | 865 | | | $ | 755 | | | $ | 703 | | | $ | 1,021 | | | $ | 796 | | | $ | 865 | | | $ | 755 | | | $ | 703 | |

| 5 Years | | | | $ | 1,862 | | | $ | 1,499 | | | $ | 1,610 | | | $ | 1,430 | | | $ | 1,346 | | | $ | 1,731 | | | $ | 1,360 | | | $ | 1,474 | | | $ | 1,291 | | | $ | 1,205 | | | $ | 1,731 | | | $ | 1,360 | | | $ | 1,474 | | | $ | 1,291 | | | $ | 1,205 | |

| 10 Years | | | | $ | 3,313 | | | $ | 2,579 | | | $ | 2,808 | | | $ | 2,438 | | | $ | 2,263 | | | $ | 3,440 | | | $ | 2,712 | | | $ | 2,940 | | | $ | 2,571 | | | $ | 2,396 | | | $ | 3,612 | | | $ | 2,895 | | | $ | 3,119 | | | $ | 2,756 | | | $ | 2,585 | |

The examples below are intended to help you compare the cost of investing in each Fund and in the combined Funds (after each Reorganization) on a pro forma basis. Your actual costs may be higher or lower. The example assumes that you invest $10,000 in each Fund and in the Select 25 Fund after the Reorganization for the time periods indicated and redeemed your shares at the end

24

of each period. The Examples also assume that your investment has a 5% return each year and that each Fund’s operating expenses remain the same. The 5% return is an assumption and is not intended to portray past or future investment results. Based on the above assumptions, you would pay the following expenses if you redeemed your shares at the end of each period shown.

Example of Fees and Expenses — if shares are redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Large Cap

Growth

| | Select 25

| | Pro Forma

| | Large Cap

Growth

| | Select 25

| | Pro Forma

| | Large Cap

Growth

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 820 | | | $ | 735 | | | $ | 736 | | | $ | 835 | | | $ | 745 | | | $ | 746 | | | $ | 435 | | | $ | 345 | | | $ | 346 | |

| 3 Years | | | | $ | 1,329 | | | $ | 1,071 | | | $ | 1,074 | | | $ | 1,321 | | | $ | 1,055 | | | $ | 1,058 | | | $ | 1,021 | | | $ | 755 | | | $ | 758 | |

| 5 Years | | | | $ | 1,862 | | | $ | 1,430 | | | $ | 1,435 | | | $ | 1,931 | | | $ | 1,491 | | | $ | 1,496 | | | $ | 1,731 | | | $ | 1,291 | | | $ | 1,296 | |

| 10 Years | | | | $ | 3,313 | | | $ | 2,438 | | | $ | 2,448 | | | $ | 3,440 | | | $ | 2,571 | | | $ | 2,581 | | | $ | 3,612 | | | $ | 2,756 | | | $ | 2,766 | |

Example of Fees and Expenses — if shares are not redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Large Cap

Growth

| | Select 25

| | Pro Forma

| | Large Cap

Growth

| | Select 25

| | Pro Forma

| | Large Cap Growth

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 820 | | | $ | 735 | | | $ | 36 | | | $ | 335 | | | $ | 245 | | | $ | 246 | | | $ | 335 | | | $ | 245 | | | | 758 | |

| 3 Years | | | | $ | 1,329 | | | $ | 1,071 | | | $ | 1,074 | | | $ | 1,021 | | | $ | 755 | | | $ | 758 | | | $ | 1,021 | | | $ | 755 | | | $ | 703 | |

| 5 Years | | | | $ | 1,862 | | | $ | 1,430 | | | $ | 1,435 | | | $ | 1,731 | | | $ | 1,291 | | | $ | 1,296 | | | $ | 1,731 | | | $ | 1,291 | | | $ | 1,296 | |

| 10 Years | | | | $ | 3,313 | | | $ | 2,438 | | | $ | 2,448 | | | $ | 3,440 | | | $ | 2,571 | | | $ | 2,581 | | | $ | 3,612 | | | $ | 2,756 | | | $ | 2,766 | |

25

Example of Fees and Expenses — if shares are redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Enhanced Index

| | Select 25

| | Pro Forma

| | Enhanced Index

| | Select 25

| | Pro Forma

| | Enhanced Index

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 748 | | | $ | 735 | | | $ | 721 | | | $ | 759 | | | $ | 745 | | | $ | 730 | | | $ | 359 | | | $ | 345 | | | $ | 330 | |

| 3 Years | | | | $ | 1,112 | | | $ | 1,071 | | | $ | 1,028 | | | $ | 1,096 | | | $ | 1,055 | | | $ | 1,009 | | | $ | 796 | | | $ | 755 | | | $ | 709 | |

| 5 Years | | | | $ | 1,499 | | | $ | 1,430 | | | $ | 1,356 | | | $ | 1,560 | | | $ | 1,491 | | | $ | 1,415 | | | $ | 1,360 | | | $ | 1,291 | | | $ | 1,215 | |

| 10 Years | | | | $ | 2,579 | | | $ | 2,438 | | | $ | 2,283 | | | $ | 2,712 | | | $ | 2,571 | | | $ | 2,417 | | | $ | 2,895 | | | $ | 2,756 | | | $ | 2,605 | |

Example of Fees and Expenses — if shares are not redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Enhanced Index

| | Select 25

| | Pro Forma

| | Enhanced Index

| | Select 25

| | Pro Forma

| | Enhanced Index

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 748 | | | $ | 735 | | | $ | 721 | | | $ | 259 | | | $ | 245 | | | $ | 230 | | | $ | 259 | | | $ | 245 | | | $ | 230 | |

| 3 Years | | | | $ | 1,112 | | | $ | 1,071 | | | $ | 1,028 | | | $ | 796 | | | $ | 755 | | | $ | 709 | | | $ | 796 | | | $ | 755 | | | $ | 709 | |

| 5 Years | | | | $ | 1,499 | | | $ | 1,430 | | | $ | 1,356 | | | $ | 1,360 | | | $ | 1,291 | | | $ | 1,215 | | | $ | 1,360 | | | $ | 1,291 | | | $ | 1,215 | |

| 10 Years | | | | $ | 2,579 | | | $ | 2,438 | | | $ | 2,283 | | | $ | 2,712 | | | $ | 2,571 | | | $ | 2,417 | | | $ | 2,895 | | | $ | 2,756 | | | $ | 2,605 | |

26

Example of Fees and Expenses — if shares are redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Social

Awareness

| | Select 25

| | Pro Forma

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Social

Awareness

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 770 | | | $ | 735 | | | $ | 723 | | | $ | 782 | | | $ | 745 | | | $ | 732 | | | $ | 382 | | | $ | 345 | | | $ | 332 | |

| 3 Years | | | | $ | 1,178 | | | $ | 1,071 | | | $ | 1,033 | | | $ | 1,165 | | | $ | 1,055 | | | $ | 1,015 | | | $ | 865 | | | $ | 755 | | | $ | 715 | |

| 5 Years | | | | $ | 1,610 | | | $ | 1,430 | | | $ | 1,366 | | | $ | 1,674 | | | $ | 1,491 | | | $ | 1,425 | | | $ | 1,474 | | | $ | 1,291 | | | $ | 1,225 | |

| 10 Years | | | | $ | 2,808 | | | $ | 2,438 | | | $ | 2,304 | | | $ | 2,940 | | | $ | 2,571 | | | $ | 2,438 | | | $ | 3,119 | | | $ | 2,756 | | | $ | 2,626 | |

Example of Fees and Expenses — if shares are not redeemed

| | | | Class A

| | Class B

| | Class C

| |

|---|

| | | | Social

Awareness

| | Select 25

| | Pro Forma

| | Social

Awareness

| | Select 25

| | Pro Forma

| | Social

Awareness

| | Select 25

| | Pro Forma

|

|---|

| 1 Year | | | | $ | 770 | | | $ | 735 | | | $ | 723 | | | $ | 282 | | | $ | 245 | | | $ | 232 | | | $ | 282 | | | $ | 245 | | | $ | 232 | |

| 3 Years | | | | $ | 1,178 | | | $ | 1,071 | | | $ | 1,033 | | | $ | 865 | | | $ | 755 | | | $ | 715 | | | $ | 865 | | | $ | 755 | | | $ | 715 | |

| 5 Years | | | | $ | 1,610 | | | $ | 1,430 | | | $ | 1,366 | | | $ | 1,474 | | | $ | 1,291 | | | $ | 1,225 | | | $ | 1,474 | | | $ | 1,291 | | | $ | 1,225 | |

| 10 Years | | | | $ | 2,808 | | | $ | 2,438 | | | $ | 2,304 | | | $ | 2,940 | | | $ | 2,571 | | | $ | 2,438 | | | $ | 3,119 | | | $ | 2,756 | | | $ | 2,626 | |

27

Additional Information about the Acquiring Fund

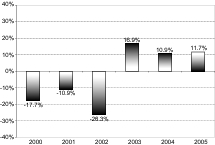

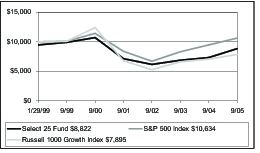

Performance of the Acquiring Fund — The charts and tables below provide some indication of the risks of investing in the Acquiring Fund by showing changes in the Acquiring Fund’s Class A share performance from year to year and by showing how the Acquiring Fund’s average annual returns have compared to those of a broad-based securities market index — the Russell 1000 Growth Index. As with all mutual funds, past performance (before and after taxes) is not a prediction of future results.

The bar charts do not reflect the impact of taxes and distributions or the sales charge applicable to Class A shares which, if reflected, would lower the returns shown. Average annual total returns for the Acquiring Fund’s Class A shares include a deduction of the 5.75% front-end sales charge. Class B shares include a deduction of the appropriate deferred sales charge (5% in the first year declining to 0% in the sixth and later years). Class C shares include a deduction of the deferred sales charge of 1% in the first year.

Select 25 Fund — Class A

Highest and Lowest Returns

Highest Quarter

| | | | | | |

| Q4 ended December 31, 2001 | | | | | 20.45 | % |

| |

Lowest Quarter

| | | | | | |

| Q3 ended September 30, 2001 | | | | | –18.76 | % |

28

Average Annual Total Returns

(through December 31, 2005)

| | | | 1 Year

| | 5 Years

| | Since

Inception(2)

|

|---|

Class A

| | | | | | | | | | | | | | |

| Return Before Taxes | | | | | 5.29 | % | | | –2.17 | % | | | –1.21 | % |

Return After Taxes on Distributions(1) | | | | | 5.29 | % | | | –2.17 | % | | | –1.21 | % |

Return After Taxes on Distributions and

Sale of Fund Shares(1) | | | | | 3.44 | % | | | –1.83 | % | | | –1.03 | % |

| Class B | | | | | 5.75 | % | | | –2.14 | % | | | –1.09 | % |

| Class C | | | | | 9.85 | % | | | –1.75 | % | | | –1.04 | % |

Russell 1000 Growth Index

(reflects no deduction for fees,

expenses or taxes)(3) | | | | | 5.26 | % | | | –3.58 | % | | | –2.95 | % |

| (1) | | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of any state or local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Class A only. After-tax returns for Class B and C will vary. |

| (2) | | For the period beginning January 29, 1999 (date of inception) to December 31, 2005. |

| (3) | | The Russell 1000 Growth Index is an unmanaged index which includes stocks incorporated in the United States and its territories and measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. Index performance assumes reinvestment of dividends and distributions. |

For additional information about the Acquiring Fund’s performance, including a discussion about market conditions and investment strategies that significantly affected its performance during its last fiscal year, please refer to Appendix C.

Investment Manager — SMC is located at One Security Benefit Place, Topeka, Kansas 66636. The Investment Manager has overall responsibility for the management of the Acquiring Fund. The Investment Manager furnishes investment advisory, statistical and research facilities, supervises and arranges for the purchase and sale of securities on behalf of the Acquiring Fund, and provides for the compilation and maintenance of records pertaining to such investment advisory services, subject to the control and supervision of the Board. For such services, the Investment Manager is entitled to receive compensation on an annual basis equal to 0.75% of the average net assets of the Acquiring Fund, computed on a daily basis and payable monthly.

29

A discussion regarding the basis of the Board’s approval of the Acquiring Fund’s investment advisory contract is available in the Funds’ semiannual report for the fiscal half-year ended March 31, 2005.

Portfolio Manager — Mark Mitchell has responsibility for the day-to-day management of the Acquiring Fund. Mr. Mitchell, Vice President and Portfolio Manager of the Investment Manager, has managed the Acquiring Fund since February 2004. He has 16 years of finance and investment experience and is a Chartered Financial Analyst charterholder. Prior to joining the Investment Manager, Mr. Mitchell was employed by GE Investments and its successor company, GE Asset Management from 1994 to 2002, serving as: Vice President and Assistant Portfolio Manager from 1998 to 1999; Vice President, Sector Portfolio Manager and Research Analyst from 1999 to 2001; and most recently as Vice President, Portfolio Manager, US Equities. Prior to 1999, Mr. Mitchell served in various portfolio management-related positions with GE Asset Management Capital.

The Statement of Additional Information provides additional information about the portfolio manager’s compensation, other accounts managed, and ownership of Acquiring Fund shares.

Form of Organization — The Acquiring Fund is a series of Security Equity Fund, a Kansas corporation registered as an open-end management investment company. Security Equity Fund is governed by the Board, which currently consists of seven directors.

Information About the Reorganization

The Reorganization Plan — The Reorganization Plan provides for the transfer of all of the assets and liabilities of each Acquired Fund to the Acquiring Fund solely in exchange for shares of the Acquiring Fund. Each Acquired Fund will distribute the shares of the Acquiring Fund received in the exchange to its shareholders, and then the Acquired Funds will be liquidated.

After the Reorganization, each shareholder of an Acquired Fund will own shares in the Acquiring Fund having an aggregate value equal to the aggregate value of shares of the Acquired Fund held by that shareholder as of the close of business on the business day preceding the Closing.

Until the Closing, shareholders of the Acquired Funds will continue to be able to redeem their shares. Redemption requests received after the Closing will be treated as requests received by the respective Acquired Fund for the redemption of Acquiring Fund shares received by the shareholder in the Reorganization.

The obligations of the Funds under the Reorganization Plan are subject to various conditions, including approval of the shareholders of the Acquired Funds. The Reorganization Plan also requires that the Funds take, or cause to be taken, all actions, and do or cause to be done, all things reasonably necessary, proper or

30

advisable to consummate and make effective the transactions contemplated by the Reorganization Plan. The Reorganization Plan may be terminated by mutual agreement of the parties or on certain other grounds. For a complete description of the terms and conditions of the Reorganization, see the Reorganization Plan at Appendix A, which qualifies in its entirety the foregoing summary of the Reorganization Plan.

The foregoing summarizes the material aspects of the Reorganization Plan. For a complete description of the terms and conditions of the Reorganization, see the Reorganization Plan at Appendix A, which qualifies in its entirety the foregoing summary of the Reorganization Plan.

Reasons for the Reorganization — The Funds have investment objectives, investment strategies and risks that are comparable in many respects. Accordingly, the Funds are somewhat duplicative. In addition, the Reorganizations would create a larger Acquiring Fund, which should benefit shareholders of each of the Funds by spreading costs across a larger asset base, and which will allow shareholders of the Acquired Funds to continue to participate in a professionally managed portfolio at a lower level of gross operating expenses without relying on SMC’s voluntary undertaking to limit net operating expenses. Also, a larger Acquiring Fund may improve trading efficiency and may eventually realize economies of scale and lower operating expenses. Based upon these considerations, the Board determined that the Acquired Funds should be reorganized.

The proposed Reorganization was presented to the Board for consideration and approval at meetings held on November 18, 2005 and February 10, 2006. For the reasons discussed below, the Directors, including all of the Directors who are not “interested persons” (as defined in the Investment Company Act of 1940) of Security Equity Fund, determined that the interests of the shareholders of the respective Funds would not be diluted as a result of the proposed Reorganization, and that the proposed Reorganization was in the best interests of each of the Funds and its shareholders.

Board Considerations — The Board, in recommending the Reorganization, considered a number of factors, including the following:

| 1. | | expense ratios and information regarding fees and expenses of the Acquired Funds and the Acquiring Fund, which indicate that current shareholders of the Acquired Funds will benefit from the Reorganization by getting a comparable investment at a lower cost than their current investment, and at a lower cost before taking voluntary expense limitations or reimbursements into account; |

| 2. | | the Reorganization would not dilute the interests of any Fund’s current shareholders; |

31

| 3. | | the stronger relative investment performance of the Acquiring Fund as compared to the Acquired Funds over most measuring periods; |

| 4. | | the similarity of the Acquired Funds’ investment objectives, policies and restrictions and share class structure to those of the Acquiring Fund, which indicates that Acquired Fund shareholders will continue in a comparable investment vehicle; |

| 5. | | elimination of duplication of costs and inefficiencies of having four similar Funds; and |

| 6. | | the tax-free nature of the Reorganization to each Fund and its shareholders. |

The Board also considered the future potential benefits to the Acquiring Fund in that its operating costs may be reduced if the Reorganization is approved.

The Board recommends that shareholders of the Acquired Funds approve the Reorganization.

Tax Considerations — The Reorganization is intended to qualify for federal income tax purposes as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, pursuant to this treatment, neither the Acquired Funds, the Acquiring Fund, nor the shareholders will recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Reorganization Plan. As a condition to the closing of the Reorganization, the Funds will receive an opinion from the law firm of Dechert LLP to the effect that the Reorganization will qualify as a tax-free reorganization for federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Funds.

Immediately prior to the Reorganization, each Acquired Fund will pay a dividend or dividends which, together with all previous dividends, will have the effect of distributing to the shareholders all of the Acquired Fund’s investment company taxable income for taxable years ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gains, if any, realized in taxable years ending on or prior to the Reorganization (after reduction for any available capital loss carryforward). Such dividends will be included in the taxable income of the Acquired Funds’ shareholders.

As of September 30, 2005, Large Cap Growth Fund, Enhanced Index Fund, Social Awareness Fund, and Select 25 Fund, respectively, had accumulated capital loss carryforwards in the amount of approximately $2,312,370, $4,110,950, $1,499,176, and $11,459,603, respectively. Each Fund’s capital loss carryforwards may be used to offset, at least in part, any capital gains realized by that Fund prior to the Reorganization. After the Reorganization, any remaining capital loss carryforwards may be available to the Acquiring Fund to offset its capital gains, although the amount of these losses which may offset the Acquiring Fund’s capital gains in any given year may be limited. As a result of this limitation, it is possible

32

that the Acquiring Fund may not be able to use these losses as rapidly as the Acquired Funds might have, and part or all of these losses may not be useable at all. The ability of the Acquiring Fund to absorb losses in the future depends upon a variety of factors that cannot be known in advance, including the existence of capital gains against which these losses may be offset. In addition, the benefits of any capital loss carryforwards currently are available only to shareholders of the respective Acquired Funds. After the Reorganization, however, these benefits will inure to the benefit of all shareholders of the Acquiring Fund.