U.S. Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended April 30, 2008

Commission File Number 0-20424

Hi-Tech Pharmacal Co., Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Delaware | | 11-2638720 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

369 Bayview Avenue, Amityville, New York 11701

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (631) 789-8228

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.01 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes x No

The aggregate market value of the voting stock held by non-affiliates of the registrant as of October 31, 2007, the last business day of the registrant’s most recently completed second fiscal quarter, was $73,986,000, based upon the closing price of the common stock on that date, as reported by NASDAQ. Shares of common stock known to be owned by directors and executive officers of the registrant subject to Section 16 of the Securities Exchange Act of 1934 are not included in the computation. No determination has been made that such persons are “affiliates” within the meaning of Rule 12b-2 under the Exchange Act.

The number of shares of common stock of the registrant outstanding as of July 10, 2008 was 11,424,000.

DOCUMENTS INCORPORATED BY REFERENCE: None

HI-TECH PHARMACAL CO., INC.

INDEX TO FORM 10-K

FOR THE YEAR ENDED APRIL 30, 2008

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K and certain information incorporated herein by reference contains forward-looking statements which are not historical facts made pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not promises or guarantees and investors are cautioned that all forward looking statements involve risks and uncertainties, including but not limited to the impact of competitive products and pricing, product demand and market acceptance, new product development, the regulatory environment, including without limitation, reliance on key strategic alliances, availability of raw materials, fluctuations in operating results and other risks detailed from time to time in the Company’s filings with the Securities and Exchange Commission. These statements are based on management’s current expectations and are naturally subject to uncertainty and changes in circumstances. We caution you not to place undue reliance upon any such forward-looking statements which speak only as of the date made. Hi-Tech is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

2

PART I

General

Hi-Tech Pharmacal Co., Inc. (“Hi-Tech” or the “Company”, which may be referred to as “we”, “us” or “our”), a Delaware corporation, incorporated in April 1982, is a specialty manufacturer and marketer of prescription, over-the-counter and nutritional products.

We develop, manufacture and market products in two categories – generics and over the counter (OTC) brands. We produce a wide range of products for various disease states, including asthma, bronchial disorders, dermatological disorders, allergies, pain, stomach, oral care, neurological disorders and other conditions.

The Company’s generic products are primarily prescription items and include oral solutions and suspensions, topical creams and ointments as well as nasal sprays. We also specialize in the manufacture of products in our state of the art sterile facility capable of producing liquid ophthalmic, otic and inhalation products. Additionally, in December 2007, the Company purchased the assets of Midlothian Laboratories, a generic pharmaceutical company specializing in cough and cold products and prescription vitamins. The generic product category includes a small amount of contract manufacturing sales for both the prescription and OTC markets.

Our Health Care Products Division markets a line of OTC branded products primarily for people with diabetes, including Diabetic Tussin®, DiabetiDerm®, Multi-betic®, DiabetiSweet®. The division also sells Zostrix® brand of capsaisin products for pain and arthritis.

Our customers include chain drug stores, drug wholesalers, managed care purchasing organizations, certain Federal government agencies, generic distributors, mass merchandisers, and mail-order pharmacies. Some of our key customers include McKesson Corporation, AmeriSourceBergen Corporation, Cardinal Health, Inc., CVS, Wal-Mart and Walgreens.

For the fiscal year ended April 30, 2008 sales of generic pharmaceuticals including the Company’s Midlothian division represented 81% of total sales and sales of the Health Care Products line of OTC products accounted for 19% of total sales.

Generic Products

Our top 5 selling generic products in fiscal 2008 were:

| | • | | Sulfamethoxazole & Trimethoprim (the generic equivalent of Bactrim® from Roche) |

| | • | | Promethazine products including Plain, Codeine and Dextromethorphan varieties (the generic equivalent of Phenergan® products from Wyeth) |

| | • | | Chlorhexadine Gluconate (the generic equivalent of Periogard® from Colgate and Peridex® from Zila) |

| | • | | Pediatric multivitamins (the generic equivalent of various brands) |

| | • | | Urea based products including creams, lotion, gels and nail sticks (the generic equivalent of Carmol 40® and Keralac™ from Nycomed and Vanamide™ from Dermik) |

Generic Approvals and Product Launches

We have 37 prescription products approved for marketing by the Food and Drug Administration (“FDA”) and 3 products with tentative approvals. In addition, we have 12 products submitted to the FDA and pending approval, and approximately 20 products in various stages of development.

We received tentative Abbreviated New Drug Application (“ANDA”) approval for the following product in fiscal 2008:

| | • | | Dorzolamide Hydrochloride with Timolol Maleate Ophthalmic Solution (the generic equivalent of Merck’s Cosopt® Ophthalmic solution, indicated for the treatment of glaucoma) |

In our fiscal 2008, we launched four products upon receiving the FDA’s final approval for the Company’s ANDAs:

| | • | | Ciclopirox topical solution, 8% (the generic equivalent of Dermik Laboratories’ Penlac® topical solution, indicated for the treatment of nail fungus) |

| | • | | Fluticasone proprionate nasal spray, 50 mcg (the generic equivalent of GlaxoSmithKline’s Flonase®, indicated for the management of the nasal symptoms of seasonal and perennial allergic and non-allergic rhinitis) |

3

| | • | | Hydrocodone Bitartrate and Homatropine Methylbromide Syrup (the generic equivalent of Endo Pharmaceuticals’ Hycodan® , indicated for the symptomatic relief of cough) |

| | • | | Oflaxacin Otic solution, 0.3% (the generic equivalent of Daiichi’s Floxin® otic solution, 0.3%, indicated for the treatment of bacterial infections of the ear) |

Health Care Products Division

Our Health Care Products Division (“HCP”) is a leading marketer of branded products that include over-the-counter, nutritional lines, and prescription products, primarily for people with diabetes. HCP also has several lines that fall outside the diabetic area. The Health Care Products Division is composed of several products lines which account for a majority of its sales.

The top five product lines, in order of sales, are:

| | • | | Diabetic Tussin® cough products |

| | • | | Zostrix® pain relief products |

| | • | | Multibetic® multi-vitamins |

| | • | | DiabetiDerm® dermatological and footcare products |

| | • | | DiabetiSweet® sugar substitutes |

The Diabetic Tussin® line accounted for approximately half of Health Care Products sales.

HCP launched the following products this year:

| | • | | Diabetic Tussin® Mucous Relief Tablets and Liquid |

| | • | | Diabetic Tussin® Cold and Flu Tablets |

| | • | | Diabetic Tussin® Allergy Tablets |

| | • | | DiabetiDerm® Antifungal Cream |

| | • | | Zostrix® Neuropathy Cream |

| | • | | Nasal Ease® Allergy and Flu Blockers |

Growth Strategy

Management believes that growth in the generic pharmaceutical industry is driven by several factors which should continue in the coming years. These factors include:

| | • | | The increasing number of branded pharmaceutical products that have lost or will lose patent protection |

| | • | | Efforts by federal and state governments, employers, third-party payers and consumers to control health care costs |

| | • | | The aging of the U.S. population |

| | • | | Increased acceptance of generic products by physicians, pharmacists and consumers |

Management hopes to exploit these macroeconomic trends by making strategic decisions which will result in the Company’s growth. Our growth strategy is based on the following:

| | • | | Increase the number of new product introductions by expanding our research and development efforts and increasing our ANDA submissions |

| | • | | Increase market share for our core prescription generic products by adding new customers and introducing products to existing customers |

| | • | | Continue to develop and license branded products with a focus on niche markets, such as diabetes care and related areas, such as podiatry |

| | • | | Acquire products and businesses that management believes can contribute to the Company’s growth strategy |

| | • | | Leverage our manufacturing capabilities primarily focusing on the development of liquid and semi-solid dosage forms and products requiring sterile manufacturing |

4

Product Development Strategy

We have identified over $9 billion of brand name drugs in the liquid, sterile, inhalation, nasal spray and semi-solid dosage forms in our target market. These products either have patents which expire in the next five years or have patents which the Company believes that it can successfully challenge. We are currently developing drugs with total branded sales of over $2 billion and plan to take advantage of this opportunity.

Our product development strategy focuses on products in the following areas:

| | • | | Products that will have limited competition due to smaller market size but can generate long term revenues |

| | • | | Products with significant volume and high annual sales |

| | • | | Products that are difficult to bring to market and more likely to face limited competition, enabling us to earn higher margins for a longer period of time. These opportunities include nasal sprays and sterile products, including ophthalmics and inhalation products |

| | • | | Products with patents that we believe we can successfully challenge through the patent challenge process of the Hatch-Waxman Act |

Research and Development

The Company obtains new generic pharmaceutical products primarily through internal product development and from strategic arrangements with other pharmaceutical companies. These strategic arrangements include both development contracts where Hi-Tech pays a third party to develop a new product and licensing arrangements where Hi-Tech sells a product and pays a royalty to the owner of the ANDA or NDA.

For the fiscal years ended April 30, 2008, 2007 and 2006 total R&D expenditures were $6,208,000, $4,733,000 and $3,334,000, respectively. The increase is the result of expenditures on both internal and external development projects. The Company’s largest expenditure on a single project was for a product line that is being jointly developed with two other generic drug companies. The Company spent $1,591,000 and $409,000 in FY 2008 and FY 2007, respectively, on this project including expenditures on a clinical trial. The clinical trial for this product is ongoing, and the Company believes that it will file ANDAs for the products in this product line in late FY 2009 and in FY 2010.

We have 12 ANDA applications pending at the FDA that address over $0.5 billion in annual brand and generic product sales in the United States in 2007 according to IMS Health. Additionally, the Company has approximately 20 products targeting over $2 billion in branded revenue in development. The Company does not know when any of these products will be approved.

Customers and Marketing

We market our products to chain drug stores, drug wholesalers, managed care purchasing organizations, certain Federal government agencies, generic distributors, mass merchandisers and mail order pharmacies. We sell our generic products to over 100 active accounts located throughout the United States. For the fiscal year ended April 30, 2008, McKesson Corporation, AmerisourceBergen, and Cardinal Health accounted for net sales of approximately 15%, 10%, and 10%, respectively. These customers represented approximately 58% of the outstanding accounts receivable at April 30, 2008. Our top five customers accounted for approximately 49% and 47% of the Company’s total sales for the fiscal years ended April 30, 2008 and 2007, respectively. If any of our top five customers discontinues or substantially reduces its purchases from the Company, it may have a material adverse effect on our business and financial condition. We believe, however, that we have good relationships with our customers.

We utilize our state of the art manufacturing facilities and laboratories to offer contract manufacturing services to our existing as well as potential customers.

We market HCP brands using various marketing strategies which include professional and consumer sampling programs, telemarketing, coupon promotions, contemporary packaging, print media, national radio, direct response advertising and in store promotions. We also have placed a significant emphasis on the use of the internet as a vehicle to promote our brands and emphasize our Company’s goal of helping people with diabetes live a healthier life. We view the internet as an effective vehicle to educate people with diabetes about making good decisions in helping manage their condition. Our websites are registered under the domain names of diabeticproducts.com, Nasaleaseblocker.com and Zostrix.com, which are linked to most search engines and diabetic based websites.

Health Care Products currently employs 10 full time employees in sales, marketing and administration, and 12 independent commission sales representative organizations.

5

We are focused on growth and will continue to develop new branded and generic products as well as devise new marketing strategies to penetrate our markets. We are seeking to complement this internal effort by acquiring products for future marketing, as well as licensing rights to proprietary products and technologies for development and commercialization. We will place increasing emphasis on establishing co-development and co-marketing agreements with strategic partners.

Manufacturing

Our manufacturing facilities are designed to be flexible in order to allow for the low cost production of a variety of products of different dosages, sizes, packaging and quantities while maintaining a high level of quality and customer service. This flexible production capability allows us to adjust on-line production in order to meet customer requirements.

Facilities

We operate from six buildings owned by the Company on one site in Amityville, New York, totaling approximately 197,000 square feet. Additionally, the Company leases a 15,000 square foot facility which houses the Midlothian division acquired in December 2007.

Raw Materials/Active Pharmaceutical Ingredients

The active compounds for our products, also called active pharmaceutical ingredients or APIs, are purchased from specialized manufacturers and are essential to our business and success. API manufacturers are required to file a Drug Master File with the FDA. Each individual API must be approved by the FDA as part of the ANDA approval process. API manufacturers are also regularly inspected by the FDA.

In some cases, the raw materials used to manufacture pharmaceutical products are only available from a single FDA-approved supplier. Even when more than one supplier exists, the Company may elect to list, and in most cases has only listed, one supplier in its applications with the FDA. Any change in a supplier not previously approved must then be submitted through a formal approval process with the FDA.

It is crucial for the business to select suppliers that meet Current Good Manufacturing Practices (“cGMP”) requirements and that are reliable and offer competitive prices. We are proactive in maintaining good relationships with our API suppliers because we believe that these relationships allow us to save crucial time and be cost competitive. For new products in development, the timely selection of the right API suppliers who have access to cutting-edge chemical and process technologies, and in some cases offer proprietary and patented methods for chemical synthesis and manufacturing processes, can potentially give us a significant advantage over our competitors.

We believe we have good, cooperative working relationships with our suppliers and are not experiencing any difficulty in obtaining raw materials. If a supplier were unable to supply us, we believe we could locate an alternative supplier. However, any change in suppliers of a raw material could cause significant delays and cost increases in the manufacture of products. To mitigate this risk, the Company is currently beginning the process of certifying alternative suppliers for several key APIs.

Competition

The market for generic pharmaceuticals is highly competitive. Our direct competition consists of numerous generic drug manufacturers, many of which have greater financial and other resources than we do. If one or more other generic pharmaceutical manufacturers significantly reduce their prices in an effort to gain market share, our profitability or market position could be adversely affected. Such competitive pressures caused our decline in sales and profitability over the last two years. Competition is based principally on price, quality of products, customer service levels, reputation and marketing support.

Seasonality

We experience seasonal variations in the demand for our cough and cold products. Therefore, no one quarter’s performance can be used to indicate a full year results. Our revenues are typically lower during the first and fourth quarters of our fiscal year. We expect this seasonality to continue in the future.

Government Regulation

FDA Oversight

Our products and facilities are subject to regulation by a number of Federal and state governmental agencies. The FDA, in particular, maintains oversight of our manufacturing process as well as the distribution of our products. Facilities, procedures, operations and/or testing of products are subject to periodic inspection by the FDA, the Drug Enforcement Administration and other authorities. In

6

addition, the FDA conducts pre-approval and post-approval reviews and plant inspections to determine whether our systems and processes are in compliance with cGMP and other FDA regulations. Certain of our suppliers are subject to similar regulations and periodic inspections. We have had several FDA inspections including our most recent which took place in the third quarter of fiscal 2008. We believe the issues cited during the inspection have been adequately addressed by the Company.

A sponsor of a New Drug Application (“NDA”) is required to identify in its application any patent that claims the drug or a use of the drug, which is the subject of the application. Upon NDA approval, the FDA lists the approved drug product and these patents in the Orange Book.

In addition to patent exclusivity, the holder of the NDA for the listed drug may be entitled to a period of non-patent, market exclusivity, during which the FDA cannot approve an application for a bioequivalent product. If the listed drug is a new chemical entity, the FDA may not accept an ANDA for a bioequivalent product for up to five years following approval of the NDA for the new chemical entity. If it is not a new chemical entity but the holder of the NDA conducted clinical trials essential to approval of the NDA or a supplement thereto, the FDA may not approve an ANDA for a bioequivalent product before expiration of three years. Certain other periods of exclusivity may be available if the listed drug is indicated for treatment of a rare disease or is studied for pediatric indications.

The FDA has extensive enforcement powers, including the power to seize noncomplying products, to seek court action to prohibit their sale and to seek criminal penalties for noncomplying manufacturers. Although it has no statutory power to force the recall of products, the FDA usually accomplishes a recall as a result of the threat of judicially imposed seizure, injunction and/or criminal penalties.

ANDA Process

Although many of the products we currently manufacture and market do not require prior specific approval of the FDA, certain products which we currently market and intend to market under our product development program require prior FDA approval using the ANDA procedure prior to being marketed. We currently have 37 approved products, 3 tentatively approved products, 12 products pending FDA approval, and 20 products in active development, of which the majority will require ANDA submissions.

The ANDA approval process is generally less time-consuming and complex than the NDA approval process. It generally does not require new preclincal and clinical studies because it relies on the studies establishing safety and efficacy conducted for the drug previously approved through the NDA process. The ANDA process does, however, occasionally, require one or more bioequivalency studies to show that the ANDA drug is bioequivalent to the previously approved drug. Bioequivalence compares the bioavailability of one drug product with that of referenced brand formulation containing the same active ingredient. When established, bioequivalency confirms that the rate of absorption and levels of concentration in the bloodstream of a formulation of the previously approved drug and the generic drug are equivalent. Bioavailability indicates the rate and extent of absorption and levels of concentration of a drug product in the bloodstream needed to produce the same therapeutic effect. Such studies are not generally required to be performed for solutions (oral, ophthalmic, or solutions for inhalation). Suspensions and certain types of topical products do require bioequivalency testing. Topical creams and ointments require clinical testing. Fluticasone propionate required a large and expensive clinical trial. In certain cases, such as nasal spray suspensions, clinical studies are required in addition to bioequivalency studies to show efficacy compared to the branded product. Such studies, though not as extensive as corresponding studies conducted by innovator companies as part of their NDA process, could require substantial funding.

7

The completion of a prospective product’s formulation, testing and FDA approval generally takes several years. Development activities could begin several years in advance of the patent expiration date, and may include bioequivalency and clinical studies. Consequently, we are presently selecting and will continue to select and develop drugs we expect to market several years in the future.

The timing of final FDA approval of ANDA applications depends on a variety of factors, including whether the applicant challenges any listed patents for the drug and/or its use and whether the brand-name manufacturer is entitled to one or more statutory exclusivity periods. Pending the resolution of any such issues the FDA is prohibited from granting final approval to generic products. In certain circumstances, a regulatory exclusivity period can extend beyond the life of a patent, and thus block ANDAs from being approved on the patent expiration date. For example, the FDA may now extend the exclusivity of a product by six months past the date of patent expiry if the manufacturer undertakes studies on the effect of their product in children (“pediatric extension”). See “Patent Challenge Process.”

Before approving a product, the FDA also requires that a company’s procedures and operations conform to cGMP regulations, as defined in the U.S. Code of Federal Regulations. The Company must follow the cGMP regulations at all times during the manufacture of its products.

If the FDA concludes that all substantive ANDA requirements (chemistry, bioequivalency, labeling and manufacturing) have been satisfied, but a final ANDA approval cannot be granted because of patent or exclusivity-related considerations, the FDA may issue a tentative approval.

Patent Challenge Process

The Hatch-Waxman Act provides incentives for generic pharmaceutical manufacturers to challenge patents on branded pharmaceutical products, their methods of use and specific formulations, as well as to develop non-infringing forms of the patented subject matter. The purpose of the Hatch-Waxman Act is to stimulate competition by providing incentives to generic companies to introduce their products early, and at the same time to ensure that such suits are not frivolous.

If there is a patent listed in the FDA’s Orange Book at the time of filing an ANDA with the FDA and the generic drug company intends to market the generic equivalent prior to the expiration of that patent, the generic company files with its ANDA a certification asserting that the patent is invalid, unenforceable and/or not infringed (“Paragraph IV certification”). After receiving notice from the FDA that its application is acceptable for filing, the generic company sends the patent holder and the holder of the New Drug Application (“NDA”) for the brand-name drug a notice explaining why it believes that the patents in question are invalid, unenforceable or not infringed. Upon receipt of the notice from the generic company, the patent holder has 45 days during which to bring a patent infringement suit in federal district court against the generic company. The discovery, trial and appeals process in such suits can take several years and have high legal costs.

If a suit is commenced by the patent holder, the Hatch-Waxman Act provides for an automatic stay on the FDA’s ability to grant final approval of the ANDA for the generic product. The period during which the FDA may not approve the ANDA and the patent challenger therefore may not market the generic product is 30 months, or such shorter or longer period as may be ordered by the court. The 30-month period may or may not, and often does not, coincide with the timing of the resolution of the lawsuit or the expiration of a patent, but if the patent challenge is successful or the challenged patent expires during the 30-month period, the FDA may approve the generic drug for marketing, assuming there are no other obstacles to approval such as exclusivities given to the NDA holder.

Under the Hatch-Waxman Act, the developer of a proposed generic drug which is the first to have its ANDA accepted for filing by the FDA, and whose filing includes a Paragraph IV certification, may be eligible to receive a 180-day period of generic market exclusivity. This period of market exclusivity may provide the patent challenger with the opportunity to earn a return on the risks taken and its legal and development costs and to build its market share before competitors can enter the market.

Medicaid and Medicare

Medicaid, Medicare and other reimbursement legislation or programs govern reimbursement levels and require all pharmaceutical manufacturers to rebate a percentage of their revenues arising from Medicaid-reimbursed drug sales to individual states. The required rebate is currently 11% of the average manufacturer’s price for sales of Medicaid-reimbursed products marketed under ANDAs. We believe that Federal or state governments may continue to enact measures aimed at reducing the cost of drugs to the public. For example, Congress passed the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, which provides a comprehensive pharmacy benefit for Medicare recipients.

8

DEA

Because the Company sells and develops products containing controlled substances, it must meet the requirements and regulations of the Controlled Substances Act which are administered by the Drug Enforcement Agency (“DEA”). These regulations include stringent requirements for manufacturing controls and security to prevent diversion of or unauthorized access to the drugs in each stage of the production and distribution process. We have the approval of the DEA to sell certain generic pharmaceutical products containing narcotics. We are currently manufacturing 7 preparations containing narcotics and are developing other products that contain narcotics. In order to manufacture and sell products containing narcotics, we have implemented stringent security precautions to insure that the narcotics are accounted for and properly stored. We believe that the Company is currently in compliance with all applicable DEA requirements.

Environment

We believe that our operations comply in all material respects with applicable laws and regulations concerning the environment. While it is impossible to predict accurately the future costs associated with environmental compliance and potential remediation activities, compliance with environmental laws is not expected to require significant capital expenditures and has not had, and is not expected to have, a material adverse effect on our earnings or competitive position.

Product Liability

The sale of pharmaceutical products can expose the manufacturer of such products to product liability claims by consumers. A product liability claim, if successful and in excess of our insurance coverage, could have a material adverse effect on our financial condition. We maintain product liability insurance policies which provide coverage in the amount $10,000,000 per claim and in the aggregate.

Employees

As of April 30, 2008, we employed 258 full-time persons and 18 part-time persons, of whom 30 were engaged in executive, financial and administrative capacities; 25 in marketing, sales and service; 121 full-time employees and 18 part-time employees in production, warehousing and distribution; and 82 in research and development and quality control functions. We are not a party to a collective bargaining agreement. The management of the Company considers its relations with its employees to be satisfactory.

Website Access to Filings with the Securities and Exchange Commission

Additional information about the Company is available on our website at www.hitechpharm.com. All of our electronic filings with the SEC including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, are available on our website free of charge as soon as reasonably practicable after they are electronically filed with and furnished to the SEC. The SEC’s internet site contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Our SEC filings are also available through the SEC’s website at http://www.sec.gov. You may read and copy any material we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.W., Washington, D.C. 20549. You may obtain information on the operation of the Public Room by calling the SEC at 1-800-SEC-0330. Information contained on our website is not incorporated by reference in the Annual Report on Form 10-K and shall not be deemed “filed” under the Securities Exchange Act of 1934.

The following risk factors could have a material adverse effect on the Company’s business, financial position or results of operations. These risk factors may not include all of the important factors that could affect our business or our industry or that could cause our future financial results to differ materially from historic or expected results or cause the market price of our common stock to fluctuate or decline.

9

Delays in New Product Introductions

Our future revenue growth and profitability are dependent upon our ability to develop and introduce new products on a timely basis in relation to our competitors’ product introductions. Our failure to do so successfully could have a material adverse effect on our financial position and results of operations.

Many products require FDA approval prior to being marketed. The process of obtaining FDA approval to manufacture and market new and generic pharmaceutical products is rigorous, time-consuming, costly and largely unpredictable. We may be unable to obtain requisite FDA approvals on a timely basis for new generic products that we may develop. The timing and cost of obtaining FDA approvals could adversely affect our product introduction plans, financial position and results of operations.

10

The ANDA process often results in the FDA granting final approval to a number of ANDAs for a given product. We may face immediate competition when we introduce a generic product into the market. These circumstances could result in significantly lower prices, as well as reduced margins, for generic products compared to brand products. New generic market entrants generally cause continued price and margin erosion over the generic product life cycle.

Approved Products May Not Achieve Expected Levels of Market Acceptance

Our approved products may not achieve expected levels of market acceptance, which could have a material adverse effect on our profitability, financial position and results of operations. Even if we were able to obtain regulatory approvals of our new pharmaceutical products, generic or brand, the success of those products is dependent upon market acceptance. Levels of market acceptance for new products could be impacted by several factors, including:

| | • | | the availability of alternative products from our competitors |

| | • | | the price of our products relative to that of our competitors |

| | • | | the availability of authorized generics |

| | • | | the timing of our market entry |

| | • | | the ability of our customers to market our products effectively to the retail level |

| | • | | the acceptance of our products by government and private formularies |

Some of these factors are not within our control.

Unapproved Products

The Company sells several products which do not have ANDAs. These products either fall under the grandfathered or Drug Efficacy Study Implementation (“DESI”) classification. Grandfathered drugs are drugs that were on the market prior to the passage of the Food, Drug and Cosmetic Act of 1938. It was not until the passage of the Food, Drug and Cosmetic Act of 1938 that a New Drug Application (NDA) was required for marketing a drug product as the regulatory mechanism for insuring that all new drugs were cleared for safety prior to distribution. The requirement for pre-clearance for effectiveness was added by the 1962 amendment.

Following enactment of the 1938 law, drugs on the market prior to that time were exempted or “grandfathered” and manufacturers were not required to file an NDA. The premise was that all pre-1938 drugs were considered safe, and if the manufacturer did not change the product formulation or indication, then an NDA was not required.

DESI drugs are drugs that were approved solely on the basis of their safety prior to 1962. Thereafter, Congress required drugs to be shown to be effective as well. The FDA initiated the DESI program to evaluate the effectiveness of those drugs that had been previously approved on safety grounds alone. These drugs, and those identical, related, and similar to them, may continue to be marketed until the administrative proceedings evaluating their effectiveness have been concluded, at which point continued marketing is only permitted if an NDA is approved for such drugs. The vast majority of the DESI proceedings have been concluded, but a few are still pending.

Continuing studies of the proper utilization, safety and efficacy of pharmaceutical products are being conducted by the industry, government agencies and others. Such studies, which increasingly employ sophisticated methods and techniques, can call into question the utilization, safety and efficacy of currently marketed products. In some cases, these studies have resulted, and may in the future result, in the discontinuance of product marketing. These situations, should they occur, could have a material adverse effect on our profitability, financial position and results of operations.

Industry is Highly Competitive

We face competition from other pharmaceutical manufacturers that threatens the commercial acceptance and pricing of our products, which could have a material adverse effect on our business, financial position and results of operations.

Our competitors may be able to develop products and processes competitive with or superior to our own for many reasons, including that they may have:

| | • | | proprietary processes or delivery systems |

| | • | | larger research and development staffs |

| | • | | larger sales and marketing staffs |

11

| | • | | larger production capabilities |

| | • | | more experience in developing new drugs and greater financial resources |

Each of these factors and others could have a material adverse effect on our business, financial position and results of operations.

Government Regulation

Because the pharmaceutical industry is heavily regulated, we face significant costs and uncertainties associated with our efforts to comply with applicable regulations. Should we fail to comply, we could experience material adverse effects on our business, financial position and results of operations.

The pharmaceutical industry is subject to regulation by various Federal and state governmental authorities. For instance, we must comply with FDA requirements with respect to the manufacture, labeling, sale, distribution, marketing, advertising, promotion and development of pharmaceutical products. Failure to comply with FDA and other governmental regulations can result in fines, disgorgement, unanticipated compliance expenditures, recall or seizure of products, total or partial suspension of production and/or distribution, suspension of FDA’s review of ANDAs, enforcement actions, injunctions and criminal prosecution. Under certain circumstances, the FDA also has the authority to revoke previously granted drug approvals. Although we have internal regulatory compliance programs and policies and have had a favorable compliance history, there is no guarantee that we may not be deemed to be deficient in some manner in the future. If we were deemed to be deficient in any significant way, it could have a material adverse effect on our business, financial position and results of operations.

In addition to the new drug approval process, the FDA also regulates the facilities and operational procedures that we use to manufacture our products. We must register our facilities with the FDA. All products manufactured in those facilities must be made in a manner consistent with current Good Manufacturing Practices (“cGMP”). Compliance with cGMP regulations requires substantial expenditures of time, money and effort in such areas as production and quality control to ensure full technical compliance. Failure to comply with cGMP regulations could result in an enforcement action brought by the FDA, which periodically inspects our manufacturing facilities for compliance, which could include withholding the approval of ANDAs or other product applications of a facility if deficiencies are found at that facility. FDA approval to manufacture a drug is site-specific. If the FDA would cause our manufacturing facilities to cease or limit production, our business could be adversely affected. Delay and cost in obtaining FDA approval to manufacture at a different facility also could have a material adverse effect on our business, financial position and results of operations.

We are subject, as are generally all manufacturers, to various Federal, state and local laws of general applicability, such as laws regulating working conditions, as well as environmental protection laws and regulations, including those governing the discharge of materials into the environment. Although we have not incurred significant costs associated with complying with such environmental provisions in the past, if changes to such environmental provisions are made in the future that require significant changes in our operations or if we engage in the development and manufacturing of new products requiring new or different environmental controls, we may be required to expend significant funds. Such changes could have a material adverse effect on our business, financial position and results of operations.

Limited Number of Major Customers

Our top 5 customers, based on sales, accounted for 49% of our total sales for fiscal 2008. Any significant reduction of business with any of our top 5 customers could have a material adverse effect on our business, financial position and results of operations.

Third Party Suppliers

Active pharmaceutical ingredients, packaging components, and other materials and supplies that we use in our pharmaceutical manufacturing operations, as well as certain finished products, are generally available and purchased from many different foreign and domestic suppliers. Additionally, we maintain sufficient raw materials inventory, and in certain cases where we have listed only one supplier in our applications with the FDA, we have received FDA approval to use alternative suppliers should the need arise. However, there is no guarantee that we will always have timely and sufficient access to a critical raw material or finished product. A prolonged interruption in the supply of a single-sourced active ingredient or finished product could cause our financial position and results of operations to be materially adversely affected.

12

Limited Number of Manufacturing Facilities

Our generic products and some of our branded products are produced at our two manufacturing facilities located at one site. A significant disruption at these facilities, even on a short-term basis, could impair our ability to produce and ship products to the market on a timely basis, which could have a material adverse effect on our business, financial position and results of operations.

Consolidation of Customers

Significant amounts of our sales are made to a relatively small number of drug wholesalers, retail drug chains, managed care purchasing organizations, mail order pharmacies and hospitals. These customers represent an essential part of the distribution chain of generic pharmaceutical products. These customers have undergone, and are continuing to undergo, significant consolidation. This consolidation may result in these groups gaining additional purchasing leverage and consequently increasing the product pricing pressures facing our business. Additionally, the emergence of large buying groups representing independent retail pharmacies and the prevalence and influence of managed care organizations and similar institutions potentially enable those groups to attempt to extract price discounts on our products. The result of these developments may have a material adverse effect on our business, financial position and results of operations.

Indemnification Obligations

In the normal course of business, we periodically enter into employment, legal settlements, and other agreements which incorporate indemnification provisions. We maintain insurance coverage which we believe will effectively mitigate our obligations under these indemnification provisions. However, should our obligation under an indemnification provision exceed our coverage or should coverage be denied, it could have a material adverse effect on our business, financial position and results of operations.

Uncertainties of Estimates and Assumptions

There are inherent uncertainties involved in estimates, judgments and assumptions used in the preparation of financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Any changes in estimates, judgments and assumptions used could have a material adverse effect on our business, financial position and results of operations.

The financial statements included in the periodic reports we file with the Securities and Exchange Commission (“SEC”) are prepared in accordance with GAAP. The preparation of financial statements in accordance with GAAP involves making estimates of expenses and income. This includes, but is not limited to, estimates, judgments and assumptions used in the adoption of the provisions of SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets and SFAS No. 123, revised 2004, Accounting for Stock-Based Compensation. Estimates, judgments and assumptions are inherently subject to change in the future, and any such changes could result in corresponding changes to the amounts of assets, liabilities, revenues, expenses and income. Any such changes could have a material adverse effect on our business, financial position and results of operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None

Our executive offices and manufacturing facilities are owned by the Company and are located in Amityville, New York, comprise six buildings with approximately 197,000 square feet. These include:

| | • | | A 42,000 square foot facility dedicated to liquid and semi-solid production |

| | • | | A 28,000 square foot facility housing a sterile manufacturing facility, DEA manufacturing, chemistry and microbiology laboratories |

| | • | | A 62,500 square foot facility used for the warehousing of finished goods which also houses our Health Care Products Division |

| | • | | A 21,500 square foot facility with 3,500 square feet of research and development space and 18,000 square feet of warehouse space |

| | • | | An 8,000 square foot office building which is utilized for administrative functions |

| | • | | A 35,000 square foot facility acquired in April 2006 with mixed office, laboratory and manufacturing space which was partially renovated in FY2007 |

13

Additionally, the Company leases a 15,000 square foot facility located in Montgomery, Alabama which houses our Midlothian division. The lease on this facility expires in February 2009 and is renewable.

We believe that our properties are adequately covered by insurance and are suitable and adequate for our needs for several years.

| ITEM 3. | LEGAL PROCEEDINGS. |

The disclosure under Note M, Commitments, Contingencies and Other Matters, Legal Proceedings included in Part II Item 8 of this report is incorporated in this Part I Item 3 by reference.

| ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

No matters were submitted to a vote of security holders during the quarter ended April 30, 2008.

14

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information

The Company’s common stock is traded on the National Global Market System of the National Association of Securities Dealers Automated Quotation System (“NASDAQ”) under the symbol HITK.

The following table sets forth the high and low closing sales prices per share of the Company’s common stock for the periods indicated on the NASDAQ National Global Market System. The quotations are inter-dealer prices, without retail mark-up, mark-down or commissions paid, and may not necessarily reflect actual transactions.

| | | | |

Quarter Ended | | High | | Low |

Fiscal 2007 | | | | |

July 31, 2006 | | 24.63 | | 15.71 |

October 31, 2006 | | 18.81 | | 12.10 |

January 31, 2007 | | 15.52 | | 10.78 |

April 30, 2007 | | 13.41 | | 10.19 |

Fiscal 2008 | | | | |

July 31, 2007 | | 13.36 | | 9.62 |

October 31, 2007 | | 11.95 | | 9.90 |

January 31, 2008 | | 12.40 | | 8.72 |

April 30, 2008 | | 12.38 | | 8.60 |

As of July 10, 2008 the closing price of the Common Stock on the Nasdaq Global Market System was $ 10.39.

Equity Compensation Plan Information

The table below sets forth, as of the end of the fiscal year ended April 30, 2008, for the Hi-Tech Pharmacal Co., Inc. Employee Stock Option Plan and Director Stock Option Plan (“Plan”) the number of securities to be issued upon the exercise of outstanding options, warrants and rights; the weighted-average exercise price of the outstanding options warrants and rights; and the number of securities remaining for future issuance under the Plan:

| | | | | | | |

Plan Category | | Number of securities to

be issued upon exercise of

outstanding options,

warrants and rights | | Weighted-average

exercise price of

outstanding options,

warrants and rights | | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column

(a)) |

| | | (a) | | (b) | | (c) |

Equity compensation plans approved by security holders | | 2,770,000 | | $ | 11.06 | | 755,000 |

Equity compensation plans not approved by security holders | | — | | | — | | — |

| | | | | | | |

Total | | 2,770,000 | | $ | 11.06 | | 755,000 |

| | | | | | | |

There are no Company equity compensation plans not approved by the Company’s stockholders.

15

UNREGISTERED SALES OF EQUITY SECURITIES, USE OF PROCEEDS AND ISSUER PURCHASES OF EQUITY SECURITIES

Recent Sales of Unregistered Shares

| | | | | | | | | | |

Period | | Total Number of

Shares Purchased | | Average Price

per Share | | Total Number of Shares

Purchased as Part of Publicly

Announced Plans | | Approximate

Dollar Value

of Shares

that May Yet

Be

Purchased

Under the

Plans (1) |

02/01/08 – 02/28/08 | | 0 | | $ | 0.00 | | 0 | | $ | 1,993,000 |

03/01/08 – 03/31/08 | | 39,000 | | $ | 8.92 | | 39,000 | | $ | 1,649,000 |

04/01/08 – 04/30/08 | | 0 | | $ | 0.00 | | 0 | | $ | 1,649,000 |

| (1) | During the three months ended April 30, 2008 the Company repurchased approximately 39,000 shares of the Company’s common stock for a purchase price of $344,000. The Company’s Board of Directors has authorized $23,000,000 to repurchase the Company’s common stock. Pursuant to the terms of a Rule 10b5-1 stock repurchase plan, these repurchases may be made from time to time in the open market or in private transactions as market conditions dictate. As of April 30, 2008 the Company has purchased 2,202,000 shares for $21,351,000. |

Common Stock Holders

The Company believes there are approximately 3,800 holders of Common Stock, not including shares held in street name by brokers and nominees as of July 10, 2008.

Dividends

The Company has never declared or paid any cash dividends, and it does not anticipate that it will pay cash dividends in the foreseeable future. The declaration of dividends by the Company in the future is subject to the sole discretion of the Company’s Board of Directors and will depend upon the operating results, capital requirements and financial position of the Company, general economic conditions and other pertinent conditions or restrictions relating to any financing. The Company’s loan agreement prohibits the payment of cash dividends by the Company.

16

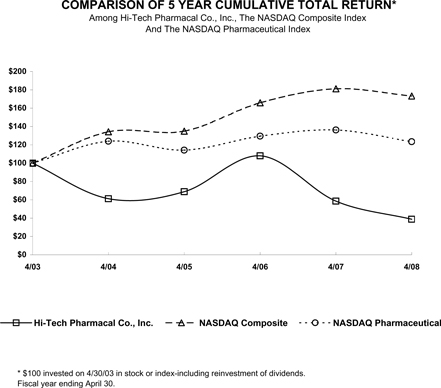

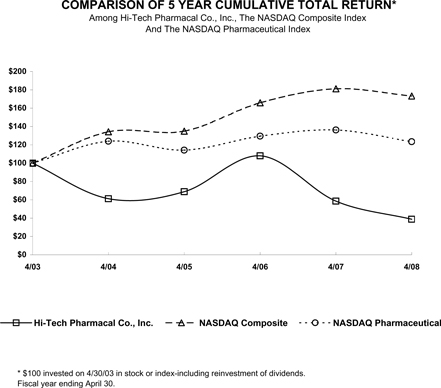

Performance Graph

This performance graph shall not be deemed “filed” for purposed of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended or the Exchange Act.

The following graph compares, for the five year period ended April 30, 2008, the cumulative total stockholder return for our common stock, the Nasdaq Stock Market (U.S. companies) Index (the “Nasdaq Composite”) and the Nasdaq Pharmaceutical Index (the “Nasdaq Pharmaceutical”). The graph assumes that $100 was invested on May 1, 2003 in the common stock of the Company, and in the Nasdaq Composite and the Nasdaq Pharmaceutical and assumes reinvestment of any dividends. The stock price performance on the following graph is not necessarily indicative of future stock price performance.

17

| ITEM 6. | SELECTED FINANCIAL DATA |

The selected financial data presented below for the five years ended April 30, 2008 are derived from the audited financial statements of the Company. This data is qualified in its entirety by reference to, and should be read in conjunction with, Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Company’s financial statements and related notes thereto for the years ended April 30, 2008, 2007 and 2006.

| | | | | | | | | | | | | | | | | | | | |

YEAR ENDED APRIL 30, | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Statement of operations data | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 62,017,000 | | | | 58,898,000 | | | $ | 78,020,000 | | | $ | 67,683,000 | | | $ | 56,366,000 | |

Costs and expenses: | | | | | | | | | | | | | | | | | | | | |

Costs of goods sold | | | 40,505,000 | | | | 35,704,000 | | | | 35,833,000 | | | | 31,360,000 | | | | 26,207,000 | |

Research and development | | | 6,208,000 | | | | 4,733,000 | | | | 3,334,000 | | | | 4,373,000 | | | | 3,820,000 | |

Selling, general and administrative | | | 22,625,000 | | | | 23,914,000 | | | | 23,210,000 | | | | 19,574,000 | | | | 16,758,000 | |

Contract research (income) | | | — | | | | (123,000 | ) | | | (27,000 | ) | | | (50,000 | ) | | | (504,000 | ) |

Interest expense | | | 27 ,000 | | | | 18,000 | | | | 12,000 | | | | 24,000 | | | | 24,000 | |

Interest (income) and other | | | (480,000 | ) | | | (1,314,000 | ) | | | (1,937,000 | ) | | | (655,000 | ) | | | (281,000 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total | | $ | 68,885,000 | | | | 62,932,000 | | | $ | 60,425,000 | | | $ | 54,626,000 | | | $ | 46,024,000 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before (benefit) provision for income taxes | | | (6,868,000 | ) | | | (4,034,000 | ) | | | 17,595,000 | | | | 13,057,000 | | | | 10,342,000 | |

(Benefit) provision for income taxes | | | (1,770,000 | ) | | | (1,998,000 | ) | | | 6,142,000 | | | | 4,769,000 | | | | 3,750,000 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | | (5,098,000 | ) | | | (2,036,000 | ) | | $ | 11,453,000 | | | $ | 8,288,000 | | | $ | 6,592,000 | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share | | $ | (0.45 | ) | | $ | (0.17 | ) | | $ | 0.96 | | | $ | 0.70 | | | $ | 0.56 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per share | | $ | (0.45 | ) | | $ | (0.17 | ) | | $ | 0.85 | | | $ | 0.64 | | | $ | 0.50 | |

| | | | | | | | | | | | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share | | | 11,353,000 | | | | 11,884,000 | | | | 11,939,000 | | | | 11,858,000 | | | | 11,809,000 | |

Effect of potential common shares | | | — | | | | — | | | | 1,465,000 | | | | 1,130,000 | | | | 1,478,000 | |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per share | | | 11,353,000 | | | | 11,884,000 | | | | 13,404,000 | | | | 12,988,000 | | | | 13,287,000 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

APRIL 30, | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

Balance sheet data: | | | | | | | | | | | | | | | | | | | | |

Working capital | | $ | 45,875,000 | | | $ | 55,540,000 | | | $ | 65,234,000 | | | $ | 54,021,000 | | | $ | 55,772,000 | |

Total assets | | $ | 85,012,000 | | | $ | 97,742,000 | | | $ | 100,379,000 | | | $ | 81,612,000 | | | $ | 75,552,000 | |

Long-term debt | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

Stockholders’ equity | | $ | 75,165,000 | | | $ | 82,985,000 | | | $ | 88,442,000 | | | $ | 69,665,000 | | | $ | 66,788,000 | |

18

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

GENERAL

The following discussion and analysis should be read in conjunction with the Financial Statements and Notes thereto appearing elsewhere in this Report.

The following table sets forth, for all periods indicated, the percentage relationship that items in the Company’s Statements of Operations bear to net sales.

| | | | | | | | | |

| | | YEAR ENDED APRIL 30, | |

| | | 2008 | | | 2007 | | | 2006 | |

Net Sales | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Cost of Sales | | 65.3 | % | | 60.6 | % | | 45.9 | % |

| | | | | | | | | |

Gross profit | | 34.7 | % | | 39.4 | % | | 54.1 | % |

| | | | | | | | | |

Selling, general & administrative expense | | 36.5 | % | | 40.6 | % | | 29.7 | % |

Research & development costs | | 10.0 | % | | 8.0 | % | | 4.3 | % |

Contract research (income) | | 0.0 | % | | -0.2 | % | | 0.0 | % |

Interest expense | | 0.0 | % | | 0.0 | % | | 0.0 | % |

Interest (income) and other | | -0.8 | % | | -2.2 | % | | -2.5 | % |

| | | | | | | | | |

Total expenses | | 45.7 | % | | 46.2 | % | | 31.5 | % |

| | | | | | | | | |

Income (loss) before tax provision | | -11.0 | % | | -6.8 | % | | 22.6 | % |

Income (benefit) tax provision | | 2.8 | % | | 3.4 | % | | 7.9 | % |

| | | | | | | | | |

Net income (loss) | | -8.2 | % | | -3.4 | % | | 14.7 | % |

| | | | | | | | | |

RESULTS OF OPERATIONS FOR YEARS ENDED APRIL 30, 2008 AND 2007

Revenue

| | | | | | | | | | | | | |

| | | 2008 | | 2007 | | Change | | | % Change | |

Hi-Tech Generics | | $ | 46,256,000 | | $ | 46,361,000 | | $ | (105,000 | ) | | 0 | % |

Health Care Products | | | 10,846,000 | | | 10,845,000 | | | 1,000 | | | 0 | % |

Midlothian | | | 4,216,000 | | | — | | | 4,216,000 | | | N/A | |

Naprelan® | | | 699,000 | | | 1,692,000 | | | (993,000 | ) | | -59 | % |

| | | | | | | | | | | | | |

Total | | $ | 62,017,000 | | $ | 58,898,000 | | $ | 3,119,000 | | | 5 | % |

| | | | | | | | | | | | | |

Net sales of Hi-Tech generic pharmaceutical products, which includes some private label contract manufacturing, decreased due to continued pricing pressure on many of the Company’s core products offset by new product launches including Ciclopirox topical solution, 8%, Fluticasone proprionate nasal spray, 50 mcg, Hydrocodone Bitartrate and Homatropine Methylbromide Syrup and Oflaxacin Otic solution, 0.3%. These increases were partially offset by decreases in sales of cough and flu products as well as urea based products.

The Health Care Products division, which markets the Company’s branded products, had lower sales of Diabetic Tussin® due to the discontinuation of Children’s Diabetic Tussin® at certain retail chains. These decreases were offset by increases in sales of Multibetic® and Zostrix®, including the newly launched Zostrix® Neuropathy product.

In December 2007, Hi-Tech acquired the assets of Midlothian Laboratories, a company which markets and distributes generic products in the cough and cold and prescription vitamin markets. In April 2007, Hi-Tech divested Naprelan®. Sales of Naprelan® in the current year represent inventory sold as part of the divestiture.

19

Cost of Sales

| | | | | | | | | | |

| | | 2008 | | | 2007 | |

| | | $ | | % of sales | | | $ | | % of sales | |

Cost of Sales | | 40,505,000 | | 65 | % | | 35,704,000 | | 61 | % |

The increase in cost of sales as a percentage of net sales is due to decreased unit sales of higher margin branded products, increased unit sales of lower margin products, increased raw material prices and pricing pressure which lowered margins on several generic products. Additionally, raw material and component prices have increased due to the price of oil increasing the costs for plastic bottles, increases in the price of corn and other sweeteners, and the decline of the U.S. dollar which is driving price increases from certain foreign raw material suppliers. These trends were partially offset by the acquisition of Midlothian Laboratories, since, on average, this division has higher gross margins than Hi-Tech’s core generic business.

Expense Items

| | | | | | | | | | | | | | | |

| | | 2008 | | | 2007 | | | Change | | | % Change | |

Selling, general and administrative expense | | $ | 22,625,000 | | | $ | 23,914,000 | | | $ | (1,289,000 | ) | | -5 | % |

Research and product development costs | | $ | 6,208,000 | | | $ | 4,733,000 | | | $ | 1,475,000 | | | 31 | % |

Contract research (income) | | | — | | | $ | (123,000 | ) | | $ | (123,000 | ) | | N/A | |

Interest expense | | $ | 27,000 | | | $ | 18,000 | | | $ | 9,000 | | | 50 | % |

Interest (income) and other | | $ | (480,000 | ) | | $ | (1,314,000 | ) | | $ | (834,000 | ) | | -63 | % |

Provision for income tax (benefit)/expense | | $ | (1,770,000 | ) | | $ | (1,998,000 | ) | | $ | (228,000 | ) | | -11 | % |

Decreases in selling, general and administrative expenses are related to lower legal fees and cost reduction efforts by management.

The increase in expenditures for research and development were driven by increased expenditures on externally developed projects. The Company’s largest expenditure on a single project was for a product line that is being jointly developing with two other generic drug companies. The Company spent $1,591,000 and $409,000 in fiscal year 2008 and fiscal year 2007, respectively, on this project including expenditures on a clinical trial. The clinical trial for this product is ongoing, and the Company believes that it will file ANDAs for these products in late fiscal year 2009 and fiscal year 2010.

The Company did not have any projects that resulted in contract research income in 2008.

Interest income decreased in 2008, because the Company had lower average cash and investment balances. Also, included in other (income) expense is the other than temporary write down in the value of adjustable rate securities of $500,000.

Income Analysis

| | | | | | | | | | | | | | | |

| | | 2008 | | | 2007 | | | Change | | | % Change | |

Net Income (Loss) | | $ | (5,098,000 | ) | | $ | (2,036,000 | ) | | $ | (3,062,000 | ) | | 150 | % |

Basic Earnings (Loss) Per Share | | $ | (0.45 | ) | | $ | (0.17 | ) | | $ | (0.28 | ) | | 165 | % |

Diluted Earnings (Loss) Per Share | | $ | (0.45 | ) | | $ | (0.17 | ) | | $ | (0.28 | ) | | 165 | % |

Weighted Average Common Shares Outstanding, Basic | | | 11,353,000 | | | | 11,884,000 | | | | (531,000 | ) | | -4 | % |

Effect of Potential Common Shares | | | — | | | | — | | | | | | | | |

Weighted Average Common Shares Outstanding, Diluted | | | 11,353,000 | | | | 11,884,000 | | | | (531,000 | ) | | -4 | % |

The reduced share count in 2008 reflects the Company’s activity in repurchasing shares, which was partially offset by option exercises.

20

RESULTS OF OPERATIONS FOR YEARS ENDED APRIL 30, 2007 AND 2006

Revenue

| | | | | | | | | | | | | |

| | | 2007 | | 2006 | | Change | | | % Change | |

Hi-Tech Generics | | $ | 46,361,000 | | $ | 65,471,000 | | $ | (19,110,000 | ) | | -29 | % |

Health Care Products | | | 10,845,000 | | | 9,767,000 | | | 1,078,000 | | | 11 | % |

Midlothian | | | — | | | — | | | — | | | N/A | |

Naprelan® | | | 1,692,000 | | | 2,782,000 | | | (1,090,000 | ) | | -39 | % |

| | | | | | | | | | | | | |

Total | | $ | 58,898,000 | | $ | 78,020,000 | | $ | (19,122,000 | ) | | -25 | % |

| | | | | | | | | | | | | |

The decrease of Hi-Tech generic sales is primarily due to pricing declines on our existing product line and a decrease in unit volume due to a weaker than normal cold and flu season in the spring and fall of 2006. The Company’s leading generic product for the fiscal year ended April 30, 2007, Sulfamethoxazole with Trimethoprim, faced two new competitors resulting in lower sales volumes and lower prices.

The Health Care Products division increased sales primarily as the result of increased sales of the Zostrix® line of products, acquired in July of 2005, and increased sales of Diabetic Tussin® due to product line extensions. Diabetic Tussin® accounted for net sales of approximately $6,000,000 for the twelve months ended April 30, 2007 and $5,200,000 for the twelve months ended April 30, 2006.

The Company divested the Naprelan® brand on April 30, 2007. A portion of 2007 sales were to the purchaser at cost.

Cost of Sales

| | | | | | | | | | |

| | | 2007 | | | 2006 | |

| | | $ | | % of sales | | | $ | | % of sales | |

Cost of Sales | | 35,704,000 | | 61 | % | | 35,833,000 | | 46 | % |

This increase in cost of sales as a percentage of sales was due to price reductions on higher margin products and the implementation of FAS 123(R) which resulted in $584,000 of cost related to the expensing of stock options. Additionally, as part of the sale of the Naprelan® brand, some Naprelan® product sales to the purchaser were at cost, increasing the cost of sales percentage of the Company.

Expense Items

| | | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | | Change | | | % Change | |

Selling, general and administrative expense | | $ | 23,914,000 | | | $ | 23,210,000 | | | $ | 704,000 | | | 3 | % |

Research and product development costs | | $ | 4,733,000 | | | $ | 3,334,000 | | | $ | 1,399,000 | | | 42 | % |

Contract research (income) | | $ | (123,000 | ) | | $ | (27,000 | ) | | $ | (96,000 | ) | | 356 | % |

Interest expense | | $ | 18,000 | | | $ | 12,000 | | | $ | 6,000 | | | 50 | % |

Interest (income) and other | | $ | (1,314,000 | ) | | $ | (1,937,000 | ) | | $ | 623,000 | | | -32 | % |

Provision for income tax (benefit)/expense | | $ | (1,998,000 | ) | | $ | 6,142,000 | | | $ | (8,140,000 | ) | | -133 | % |

Selling, general and administrative expenses increased due to increased stock-based compensation related to stock options of $2,027,000 and increases in amortization expense offset by decreased legal fees and selling expenses.

Research and product development costs for fiscal 2007 increased primarily due to external development spending, increased salary expense and expense related to stock options of $219,000.

The Company incurred a one time expense of $1,800,000 in fiscal 2007 as it settled a lawsuit with MedPointe Pharmaceuticals. Additionally, the Company realized a $1,848,000 gain on the sale of the Naprelan® brand. These items are included on the income statement in interest (income) and other.

21

The Company incurred a $2,830,000 expense, net of tax benefit, due to the implementation of FAS 123(R) in the year ended April 30, 2007.

| | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | | Change | | | % Change | |

Net Income (Loss) | | $ | (2,036,000 | ) | | $ | 11,453,000 | | $ | (13,489,000 | ) | | -118 | % |

Basic Earnings (Loss) Per Share | | $ | (0.17 | ) | | $ | 0.96 | | $ | (1.13 | ) | | -118 | % |

Diluted Earnings (Loss) Per Share | | $ | (0.17 | ) | | $ | 0.85 | | $ | (1.02 | ) | | -120 | % |

Weighted Average Common Shares Outstanding, Basic | | | 11,884,000 | | | | 11,939,000 | | | (55,000 | ) | | 0 | % |

Effect of Potential Common Shares | | | — | | | | 1,465,000 | | | (1,465,000 | ) | | -100 | % |

Weighted Average Common Shares Outstanding, Diluted | | | 11,884,000 | | | | 13,404,000 | | | (1,520,000 | ) | | -11 | % |

The Company’s loss of $.17 per basic and fully diluted share for the year ended April 30, 2007 includes approximately $.15 per share of costs relating to the expensing of stock options for the period ending April 30, 2007. Expense related to stock options was not included in prior periods.

LIQUIDITY AND CAPITAL RESOURCES

The Company’s operations are historically financed principally by cash flow from operations. At April 30, 2008 and April 30, 2007, working capital was approximately $45,875,000 and $55,540,000, respectively. The decrease of $9,665,000 was primarily due to cash used to fund the current year loss, the purchase of treasury stock and capital expenditures.

Cash flows used in operating activities were approximately $9,448,000, which was primarily the result of a net loss and an increase in accounts receivable offset by depreciation and amortization of $2,923,000, stock based compensation expense of $3,151,000, and increases and decreases in other operating assets and liabilities.

Cash flows provided by investing activities were approximately $13,036,000 and were principally proceeds from the sale of marketable securities offset by investments in fixed assets and the purchase of the assets of Midlothian Laboratories, LLC. Cash flows used in financing activities were $1,064,000 which was primarily due to purchases of treasury stock offset by the net proceeds of the exercise of stock options.

In May 2006, the Company amended the revolving credit facility and increased the borrowing limit to $10,000,000. Under the agreement the revolving credit facility bears interest at a rate elected by the Company equal to the Prime Rate or LIBOR plus 0.75%. Loans are collateralized by inventory, accounts receivable and other assets. The agreement contains covenants with respect to working capital, net worth and certain ratios, as well as other covenants and prohibits the payment of cash dividends. In April 2008, the Company amended the revolving credit facility and the lender waived the Company’s non-compliance with certain covenants. The Company’s ability to borrow is limited by the amendment until the Company returns to profitability. No borrowings have been made through April 30, 2008 under the credit facility.

The Company believes that its financial resources consisting of current working capital, anticipated future operating revenue and its credit line will be sufficient to enable it to meet its working capital requirements for at least the next twelve months.

In May 1997, the Company announced a stock buy-back program under which the Board of Directors authorized the purchase of up to $1,000,000 of its common stock. In November 2003, the Company increased the stock buy-back program to an aggregate of $3,000,000. The Company’s Board of Directors authorized the repurchase of up to an additional $10,000,000 of the Company’s common stock in August 2004 and again in September 2006. As of April 30, 2008, the Company had the ability to purchase up to $23,000,000 under the stock buy-back program. As of April 30, 2008, the Company has purchased 2,202,000 shares at a cost of $21,351,000. In the fiscal year ended 2008 the Company purchased 205,000 shares for $1,961,000.

RECENT ACCOUNTING PRONOUNCEMENTS

In May 2008, FASB issued Statement 163, “Accounting for Financial Guarantee Insurance Contracts”. This new standard clarifies how FAS Statement No. 60,Accounting and Reporting by Insurance Enterprises, applies to financial guarantee insurance contracts issued by insurance enterprises, including the recognition and measurement of premium revenue and claim liabilities. It also requires expanded disclosures about financial guarantee insurance contracts. The Statement is effective for financial statements issued for fiscal years beginning after December 15, 2008. The Company does not expect the adoption of SFAS 163 to have any impact on its financial position or results of operations.

22

In March 2008, the FASB issued Statement 161, “Disclosures about Derivative Instruments and Hedging Activities.” Due to the use and complexity of derivative instruments, there were concerns regarding the existing disclosure requirements in FASB 133. Accordingly, this Statement requires enhanced disclosures about an entity’s derivative and hedging activities. Entities will be required to provide enhanced disclosures about (i) how and why an entity uses derivative instruments, (ii) how derivative instruments and related hedging items are accounted for under Statement 133 and its related interpretations, and (iii) how derivative instruments and related hedging items affect an entity’s financial position, financial performance, and cash flows. This Statement is effective for financial statements issued for fiscal years after November 15, 2008. No impact is expected for the Company as it does not hold any financial instruments for which FAS 133 is applicable.

On December 4, 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” which replaces SFAS 141 but retains the fundamental concept of purchase method of accounting in a business combination and improves reporting by creating greater consistency in the accounting and financial reporting of business combinations, resulting in more complete, comparable, and relevant information for investors and other users of financial statements. To achieve this goal, the new standard requires the acquiring entity in a business combination to recognize all the assets acquired and liabilities assumed in the transaction and any noncontrolling interest at the acquisition date measured at their fair value as of that date. This statement requires measuring a noncontrolling interest in the acquiree at fair value which will result in recognizing the goodwill attributable to the noncontrolling interest in addition to that attributable to the acquirer. This statement also requires the recognition of assets acquired and liabilities assumed arising from contractual contingencies as of the acquisition date, measured at their acquisition fair values. SFAS No. 141(R) is effective for fiscal years beginning after December 15, 2008. The Company is currently evaluating the impact of SFAS No. 141(R) on its financial position and results of operations.

On December 4, 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements” an amendment of ARB No. 51, which will affect only those entities that have an outstanding noncontrolling interest in one or more subsidiaries or that deconsolidate a subsidiary by requiring all entities to report noncontrolling (minority) interests in subsidiaries in the same way as equity in the consolidated financial statements. In addition, SFAS No. 160 eliminates the diversity that currently exists in accounting for transactions between an entity and noncontrolling interests by requiring they be treated as equity transactions. SFAS No. 160 is effective for fiscal years beginning after December 15, 2008. The Company is currently evaluating the impact of SFAS No. 160 on its financial position and results of operations.

In December 2007, the EITF issued EITF Issue No. 07-1 (“EITF 07-1”),Accounting for Collaborative Arrangements.EITF 07-1 affects entities that participate in collaborative arrangements for the development and commercialization of intellectual property. The EITF affirmed the tentative conclusions reached on (1) what constitutes a collaborative arrangement, (2) how the parties should present costs and revenues in their respective income statements, (3) how the parties should present cost-sharing payments, profit-sharing payments, or both in their respective income statements, and (4) disclosure in the annual financial statements of the partners. EITF 07-1 should be applied as a change in accounting principle through retrospective application to all periods presented for collaborative arrangements existing as of the date of adoption. EITF 07-1 is effective for financial statements issued for fiscal years beginning after December 15, 2007.