0000888746 CCU:DerivativeFinancialLiabilitiesDesignatedAsHedgingInstrumentsMember CCU:AtBookValueMember 2022-12-31 0000888746 CCU:EurosMember CCU:ServicesProvidedMember CCU:HeinekenBrouwerijenBvMember 2023-12-31 0000888746 ifrs-full:AccumulatedDepreciationAndAmortisationMember CCU:OtherEquipmentMember 2023-12-31 0000888746 CCU:BancoDeChileMember CCU:DAndDSpAMember 2023-12-31 0000888746 ifrs-full:LaterThanOneYearAndNotLaterThanThreeYearsMember CCU:FinancialLeasesObligationsMember CCU:FinancialLiabilitiesInterestMember 2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2023 |

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to _____________

Commission file number 0-20486

COMPAÑÍA CERVECERÍAS UNIDAS S.A.

(Exact name of Registrant as specified in its charter)

UNITED BREWERIES COMPANY, INC.

(Translation of Registrant's name into English)

Republic of ChileF3

(Jurisdiction of incorporation or organization)

Vitacura 2670, Twenty-Third Floor, Santiago, Chile

(Address of principal executive offices)

Felipe Dubernet, (562-24273536), fdubern@ccu.cl, Vitacura 2670, Twenty-Third Floor, Santiago, Chile

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

7550098

Securities registered or to be registered pursuant to section 12(b) of the Act.

Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| American Depositary Shares, each representing two shares of our Common Stock, without par value | | CCU | | New York Stock Exchange |

Common Stock [Member] ADS [Member]

| Common Stock | | N/A* | | New York Stock Exchange* |

| | CCU | | Santiago Stock Exchange Chile Electronic Stock Exchange |

| | * | Not for trading, but only in connection with the registration of American Depositary Shares which are evidenced by American Depositary Receipts |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not applicable

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not applicable

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

Common stock, with no par value: 369,502,872

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YES ☒ NO ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitions of “accelerated filer”, “large accelerated filer”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

¨

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

¨

Indicate by checkmark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant period pursuant to §240.10D-1(b).

¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

ITEM 17 ☐ ITEM 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ☐ NO ☒

Table of Contents

Introduction

In this annual report on Form 20-F, all references to “we”, “us”, “Company” or “CCU” are to Compañía Cervecerías Unidas S.A., an open stock corporation (sociedad anónima abierta) organized under the laws of the Republic of Chile, and its consolidated subsidiaries. Our fiscal year ends on December 31st. The expression “last three years’’ means the years ended December 31, 2021, 2022 and 2023. Unless otherwise specified, all references to “U.S. dollars” “dollars” “USD” or “US$” are to United States dollars, references to “Chilean pesos” “pesos” “Ch$” or “CLP” are to Chilean pesos and references to “Argentine pesos” and “ARS” are to Argentine pesos. We prepare our consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS Accounting Standards"). See the notes to our consolidated financial statements included in pages F-1 through F-141 of this annual report. We use the metric system of weights and measures in calculating our operating and other data. The United States equivalent units of the most common metric units used by us are as shown below:

1 liter = 0.2642 gallons | 1 gallon = 3.7854 liters |

| 1 liter = 0.008522 US beer barrels | 1 US beer barrel = 117.34 liters |

| 1 liter = 0.1761 soft drink unit cases (8 oz cans) | 1 soft drink unit case (8 oz cans) = 5.6775 liters |

| 1 liter = 0.1174 beer unit cases (12 oz cans) | 1 beer unit case (12 oz cans) = 8.5163 liters |

| 1 hectoliter = 100 liters | 1 liter = 0.01 hectoliters |

| 1 US beer barrel = 31 gallons | 1 gallon = 0.0323 US beer barrels |

| 1 hectare = 2.4710 acres | 1 acre = 0.4047 hectares |

| 1 mile = 1.6093 kilometers | 1 kilometer = 0.6214 miles |

Forward Looking Statements

This annual report contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, which we refer to as the “Securities Act”, and Section 21E of the Securities and Exchange Act of 1934, which we refer to as the “Exchange Act”. These statements relate to analyses and other information, which are based on forecasts of future results and estimates of amounts not yet determinable. They also relate to our future prospects, development and business strategies.

These forward-looking statements are identified by the use of terms and phrases such as “anticipate”; “believes”; “could”; “expects”; “intends”; “may”; “plans”; “predicts”; “projects”; “will” and similar terms and phrases. We caution you that actual results could differ materially from those expected by us, depending on the outcome of certain factors, including, without limitation:

| · | local, regional, national and international economic conditions, including the risks of a global recession or a recession in one or more of our key markets, and the impact they may have on us and our customers and our assessment of that impact; |

| · | the impact of the occurrence or resurgence of global or regional health events, such as the COVID-19 pandemic, and government measures aimed at limiting the spread of pathogens; |

| · | financial risks, such as interest rate risk, foreign exchange rate risk, commodity risk, asset price risk, equity market risk, counterparty risk, sovereign risk, liquidity risk, inflation or deflation, including inability to achieve our optimal net debt level; |

| · | continued geopolitical instability, which may result in, among other things, economic and political sanctions and currency exchange rate volatility, and which may have a substantial impact on the economies of one or more of our key markets; |

| · | changes in government policies and currency controls; |

| · | continued availability of financing and our ability to achieve our targeted coverage and debt levels and terms, including the risk of constraints on financing in the event of a credit rating downgrade; |

| · | changes in applicable laws, regulations and taxes in jurisdictions in which we operate, including the laws and regulations governing our operations and changes to tax benefit programs, as well as actions or decisions of courts and regulators; |

| · | limitations on our ability to contain costs and expenses; |

| · | our expectations with respect to expansion plans, premium growth, accretion to reported earnings, working capital improvements and investment income or cash flow projections; |

| · | our ability to continue to introduce competitive new products and services on a timely, cost-effective basis; |

| · | the effects of competition and consolidation in the markets in which we operate, which may be influenced by regulation, deregulation or enforcement policies; |

| · | changes in consumer spending; |

| · | changes in pricing environments; |

| · | volatility in the prices of raw materials, commodities and energy; |

| · | supply chain constrains; |

| · | difficulties in maintaining relationships with employees; |

| · | regional or general changes in asset valuations; |

| · | greater than expected costs (including taxes) and expenses; |

| · | the risk of unexpected consequences resulting from acquisitions, joint ventures, strategic alliances, corporate reorganizations or divestiture plans, and our ability to successfully and cost-effectively implement these transactions and integrate the operations of businesses or other assets we have acquired; |

| · | natural and other disasters, including widespread health emergencies, cyberattacks and military conflict and political instability; |

| · | any inability to economically hedge certain risks; |

| · | inadequate impairment provisions and loss reserves; |

| · | delays in obtaining required licenses; |

| · | technological changes, threats to cybersecurity and the risk of loss or misuse of personal data; |

| · | political, social and economic developments in Chile, Argentina and other countries where we currently conduct business or may conduct business in the future, including other Latin American countries; and |

| · | other factors discussed under “Item 3: Key Information – Risk Factors”, “Item 4: Information on the Company” and “Item 5: Operating and Financial Review and Prospects”. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this annual report. We undertake no obligation to publicly update any of these forward-looking statements to reflect events or circumstances after the date of this annual report, including, without limitation, changes in our business strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

PART I

ITEM 1: Identity of Directors, Senior Management and Advisers

Not applicable.

ITEM 2: Offer Statistics and Expected Timetable

Not applicable.

ITEM 3: Key Information

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Our business, financial condition and results of operations could be materially and adversely affected if any of the risks described below occur. As a result, the market price of our common shares could decline, and you could lose all or part of your investment. This annual report also contains forward-looking statements that involve risks and uncertainties. See “Forward-Looking Statements.” The risks below are not the only ones facing our Company. Additional risks not currently known to us or that we currently deem immaterial may also adversely affect us. The following risk factors have been grouped as follows:

| · | Risks relating to our Business |

| · | Risks relating to Climate Change |

| · | Risks relating to Argentina |

| · | Risks relating to our ADS’s |

RISKS RELATING TO OUR BUSINESS

Possible changes in tax laws in the countries where we operate could affect our business and, in particular, changes in corporate and excise taxes could affect our results and investments.

Our businesses are subject to different taxes in the countries where we operate, including, among others, income taxes and specific taxes on alcoholic and non-alcoholic beverages. An increase in the rates or application of these taxes, or any other, could negatively affect our sales and profitability.

On January 2024, the Chilean Executive branch sent to Congress the Tax Compliance Bill. The objectives of this proposed bill are to address tax evasion and avoidance. It is also expected that during 2024 a second bill will be presented to modify the income tax system. As of the date of this report, the details of this proposal are not available.

Changes in the labor market in the countries in which we operate may affect profit margins in our business.

In all the countries where we operate, we are exposed to changes in the labor market that could affect our profitability and future growth. These changes could include fluctuations in the labor supply, as well as changes in labor legislation, among others.

In April 2023, the Chilean Congress passed Law N° 21,561 which reduces the work week from 45 hours to 40 hours, to be implemented over a five-year period starting in April 2024. Additionally, Argentina is experiencing high levels of inflation and union pressure. These factors may adversely affect our salary expenses.

The Company faces risks related to free competition in all the markets where it operates.

Our business is subject to free competition risks faced due to the market position in each of the markets in which it participates. For example, in Chile, where the Company holds a leading market participation, we have been sued by our main competitor for alleged abuse of dominant position. The Competition Tribunal (“TDLC”, which stands for “Tribunal de Defensa de la Libre Competencia” in Spanish) has not ruled on the lawsuit as of the date of this report. On the other hand, in response to a request from the National Economic Prosecutor's Office ("FNE", which stands for “Fiscalía Nacional Económica” in Spanish) in connection with possible abuse of dominant position, the TDLC approved a settlement between CCU S.A. and the FNE, by virtue of which CCU S.A. assumed a series of commitments in order to facilitate the entry of craft microbrewers to premises that sell beer to be consumed therein, such as hotels, restaurants, pubs, bars and clubs. Additionally, in the other countries where we are present, the Company is exposed to abuse of dominant position by some of its competitors. We have a free competition program and a free competition manual, which includes, among other initiatives, training for employees in these matters by the Compliance Department, who is responsible for free competition risk management.

Consolidation in the beer industry may impact our market share.

In all the countries where we operate, we compete with local and international brands, especially in the beer and non-alcoholic categories. In the beer category, we compete against Anheuser-Busch InBev S.A./N.V. (“ABI”) and its subsidiaries, the largest beer company in the world. In the non-alcoholic categories we mainly compete against bottlers of the products of The Coca-Cola Company.

Our main competitor in the Chilean beer market is Cervecería Chile S.A., a subsidiary of ABI, which has a distribution agreement with Embotelladora Andina S.A. and Embonor S.A., the main bottlers of The Coca-Cola Company's products in Chile. In the past, Cervecería Chile S.A. has implemented aggressive commercial practices. In Argentina, our main competitor is Cervecería y Maltería Quilmes S.A.I.C.A. y G. in Paraguay we compete with Cervecería Paraguaya S.A., in Uruguay with Fábricas Nacionales de Cerveza S.A., in Bolivia with Cervecería Boliviana Nacional S.A. and in Colombia with Bavaria & Cia S.C.A., all of them subsidiaries of ABI. As a result of their dominant position and large size in these countries, these companies benefit from economies of scale in beer production and distribution.

In non-alcoholic categories, our main competitors are Embotelladora Andina S.A. and Embonor S.A., in Chile, Paraguay Refrescos S.A. in Paraguay, Montevideo Refrescos S.R.L. in Uruguay and Embotelladoras Bolivianas Unidas, EMBOL S.A., in Bolivia. All of these entities are bottlers of The Coca-Cola Company's products.

Therefore, we cannot assure you that in the future the aggressiveness of competition will not increase given the financial capacity of our competitors, which could affect our market share and profitability.

We depend upon the renewal of certain license agreements to maintain our current operations.

Most of our license agreements include certain conditions that must be met during their term, as well as provisions for their renewal at their expiry date. We cannot guarantee that such conditions will be fulfilled, and therefore that the agreements will remain in place until their expiration or that they will be renewed, or that any of these contracts will not undergo early termination. Despite that over 70% of our sales volume are derived from proprietary brands, the termination of, or failure to renew our existing license agreements, could have an adverse impact on our operations.

Consolidation in the supermarket industry may affect our profitability.

The Chilean supermarket industry has experienced a consolidation process, which has increased the purchasing power of a few supermarket chains. As a result, we may not be able to negotiate favorable prices, which could negatively affect our sales and profitability. The Company's strengths and strategy, together with consumer trends, have allowed it to maintain the traditional channel as its main sales channel.

Additionally, and despite having insurance coverage, this supermarket chain consolidation has the effect of increasing our exposure to counterparty credit risk, given the fact that we have more exposure in the event one of these large customers fails to fulfill its payment obligations to us. For these cases, the Company has credit insurance coverage.

Fluctuations in the cost of our raw materials may adversely impact our profitability.

We purchase malt, rice and hops for beer, sugar for soft drinks, grapes for wine, pisco and cocktails, and packaging materials, such as aluminum cans, glass bottles and PET resins to produce plastic bottles from domestic producers or in the international markets. The prices of these materials are subject to volatility caused by market conditions, which have experienced significant fluctuations over time, reflecting global supply and demand for commodities as well as other factors, such as fluctuations in exchange rates, climate and social events, geopolitical conflicts, over which we have no control.

The Company has long-term supply agreements for certain raw materials with suppliers that incorporate adjustment polynomials to ensure that they reflect the actual cost of supplies. In the event of variations that could negatively affect our profitability, we seek internally to coordinate efficiency projects that help to offset this effect.

The shortage of critical raw and packaging materials along with disruptions in international trade could negatively impact our supply chain, affecting our operations and results.

The shortage of critical raw and packaging materials, either due to changes in consumption patterns, the level of crop production around the world, quality and availability of raw materials, and/or problems associated with international trade logistics, could affect our supply chain and negatively impact our production levels and, consequently, our results.

In Chile, Law N° 21,368 of 2021, known as the “PUSU Law”, regulates single-use plastic and reinforces recycling by requiring disposable plastic bottled to be produced with a certain percentage of plastic collected and recycled in Chile. A shortage of available recycled plastic in Chile would negatively impact our production levels.

Our supply, production and logistics chain is crucial for the delivery of our products to consumer centers. An interruption or a significant failure in this chain may negatively affect our results if the failure is not quickly resolved. An interruption in the chain could be caused by various factors, such as strikes, utility shutdowns such as customs and ports, planning errors of our suppliers, terrorism, safety failures, complaints by communities, or other factors which are beyond our control.

Health crises, pandemics or the outbreak of contagious diseases at a global or regional level could have a negative impact on our operations and financial position.

A health crisis, pandemic or the outbreak of disease at a global or regional level, could have a negative impact on our operations and financial position. The above-mentioned circumstances could impede the normal operation of the Company, interrupt our supply chain, limit our production and distribution capacity, and/or generate a contraction in the demand for our products. A long period of economic uncertainty could have a material negative impact on our business, our access to financing and our financial results.

Any prolonged restrictive measures put in place to control an outbreak of a contagious disease or other adverse public health developments in any of our markets may have a material and adverse effect on our business operations. The extent of the impact of a pandemic on our business and financial condition will depend largely on future developments, including the duration of the pandemic, the impact on capital and financial markets and the related impact on consumers’ and industries’ confidence, all of which are highly uncertain and cannot be accurately predicted.

The Company has contingency plans to protect the health of the people and to maintain the continuity of our operation, but we cannot assure you that these plans will be sufficient to mitigate a material impact on our results and financial position from such events.

Changes in consumers’ lifestyles and preferences could impact on our business, financial condition and results of operations.

The COVID-19 pandemic and other events caused changes in consumers’ lifestyles, and preferences and has generated an acceleration of the digital revolution. These changes require innovation to keep us competitive in line with the new consumption trends.

We are exposed to the risk of a cyber-attack affecting our information platforms, which could generate an interruption in our business.

Digital acceleration has largely generated a dependence of companies to digitize the business, from data networks to IT systems, which generates a security gap, where these components are increasingly vulnerable, which can cause disruptions in operations, financial losses, data loss and reputational damage. The Company relies on information technology networks and systems, including the Internet and cloud services, to process, transmit and store electronic and financial information, manage a variety of business processes and activities, and comply with regulatory, legal and tax requirements. The Company also depends on its information technology infrastructure to capture knowledge and to store confidential information. The Company’s ability to service customers is dependent on the continued operation of these systems.

Cyber-attacks can have a significant impact on operations, reputation and results, as they can cause interruptions in production, distribution and sales activities, with a risk of lost revenue and/or higher costs to resume operations and damage the reputation and trust of our customers. Moreover, the sophistication of cyber attackers has increased, in line with the evolution of technology.

At CCU we have implemented a cybersecurity plan, whose objective is to define, incorporate and strengthen critical capabilities and processes to prevent cyber-attacks and protect business continuity. This plan includes the incorporation of updated technology that supports us in the identification, protection and detection, as well as response and recovery of operations in its industrial and technological environments in the case of an event. In addition, CCU has defined a Corporate Governance, which among other aspects defines cybersecurity policies, education and training plans for employees on cybersecurity, and cybersecurity solutions. See “Item 16k: Cybersecurity”. While the Company takes various precautions and has enhanced controls around its IT systems, like other technology systems, they are susceptible to damage, disruptions or shutdowns, hardware or software failures, power outages, computer viruses, telecommunication failures, user errors, catastrophic events, or cyber-attacks including malware, other malicious software, phishing email attacks, attempts to gain unauthorized access to its data, the unauthorized release, corruption or loss of its data, loss or damage to its data delivery systems, ransomware, and other electronic security breaches. If the Company’s information technology systems suffer severe damage, disruption or shutdown, and its business continuity plans do not effectively resolve the issues in a timely manner, the Company’s business could be negatively affected. In addition, cyber-attacks could lead to potential unauthorized access and disclosure of confidential information, data loss and corruption. As a result of a cyber-attack the Company could also be vulnerable to fraud. While the Company is not currently aware of any material impact from cyber-attacks and the Company continues to devote time and resources to the remediation of such risks, there is the possibility of a material impact from such an attack in the future.

Changes to Regulations for labeling materials and the advertising of alcoholic beverages and other food products in the countries in which we operate could adversely affect us.

In August 2021, Law N° 21,363 was published establishing regulations regarding commercialization and advertising of alcoholic beverages including, among others, the incorporation of warnings about the consumption of alcohol on labeling and promotional materials, the obligation to inform the caloric content of the products on labeling, time restriction for advertising, and prohibited promotional activities or advertising of alcohol in relation to sport and cultural activities. These measures will enter into force immediately or deferred as established in the aforementioned Law. This Law and regulations could affect our alcoholic beverages portfolio and certain marketing activities. The Company is continually committed to being an active agent in the promotion of responsible alcohol consumption in society.

Currently, a bill is being discussed in Chilean Congress to amend Law N° 18,455, which sets standards on the production, processing and marketing of alcoholic beverages and vinegars, in matters relating to information on ingredients and mandatory nutritional information, as well as the incorporation of warning labels established for foods rated “high” in certain defined critical nutrients, when applicable.

If further legislation or other regulations that restrict the sale of alcoholic or non-alcoholic beverages is passed, it could affect the consumption of our products and therefore, adversely impact our business.

If we are unable to maintain the image and quality of our products and a good relationship with our clients and consumers, our financial results may suffer.

The image and quality of our products is essential for the success and development of the Company. Problems with product quality could tarnish the reputation of our products and may adversely affect our sales revenues. The Company must also ensure that our sales force provides good customer service and adapts to fulfill the needs and preferences of our consumers. Likewise, adverse or misleading information on social networks could affect our reputation. If we are unable to maintain a good relationship with our clients and consumers, our financial results may suffer.

The Company is committed to maintaining and continuously improving the quality and safety of raw materials and products, and ensuring the safety of CCU employees and consumers during the manufacturing, packaging and distribution processes of our products.

All our non-alcoholic beverage categories are developed under the Chilean Food Sanitary Regulations, and each country is governed by the existing regulations and, in special cases, the Catholic University and INTA are consulted.

Our certifications include: (i) Hazard Analysis and Critical Control Points (“HACCP”), (ii) ISO 22000, (iii) FSSC 22000 and (iv) British Retail Consortium (“BRC”).

Our insurance coverage may be insufficient or inadequate to cover certain losses we may incur.

Our insurance coverage is in line with our internal policies and in line with the industry standards. In the case of extraordinary events, our insurance may be insufficient to cover certain losses. As of the date of this annual report, we maintain full-risk insurance coverage for our physical assets, including machinery malfunctions and damage due to stoppages and earthquakes for all of our assets. Our insurance policies are subject to deductibles and coverage limits, and despite being in line with industry standards, may not be adequate to provide coverage for certain claims. Moreover, the insurance market remains cyclical and catastrophic events can change the state of the insurance market, leading to sudden and unexpected increases in premiums and deductibles or unavailability of coverage for reasons unrelated to our business. Additionally, we cannot guarantee that future policies will not have terms that are less favorable than those currently in place.

There can be no assurance that, due to the effects of climate change events, other natural disasters and increased social unrest, among others, our existing insurance coverage will continue to be available, or available on commercially reasonable terms or at commercially reasonable prices, or that the amounts for which we are insured, or the proceeds of such insurance, will fully compensate us for our losses.

The occurrence of material adverse events, losses or other damages that are not partially or fully covered by insurance or that exceed our insurance limits could result in unexpected additional costs and could have a material adverse effect on our business, financial condition and results of operations.

RISKS RELATING TO CLIMATE CHANGE

Water supply is essential to the development of our businesses.

Water is an essential component for the production of our beverage products and the irrigation of our fields. Any failures in our water supply, regulatory changes that limit the use of this resource, water scarcity due to climate change, or a contamination of our water sources, could negatively affect our sales and profitability.

The Company has processes, policies and procedures in place to optimize industrial water consumption and reduce the impact of our operations on the environment.

Since 2010, we have had an Environmental Vision that establishes goals for reducing water consumption in our operations. Between 2010 and 2023, the Company reduced water consumption per hectoliter produced by approximately 48%. CCU has also renewed its commitment to the new Sustainability Strategy through its Environmental Vision 2030 and its commitment to optimizing water consumption per hectoliter produced.

Catastrophic events in the regions in which we operate could have a significant adverse effect on our financial condition.

Natural disasters, pandemics or other catastrophic events could impair our ability to manufacture, distribute or sell our products. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to manage such events effectively if they occur, could adversely affect our sales volume, cost and supply of raw materials, earnings and could have a significant effect on our business, operational results, and financial position.

Chile has been affected in the past by several natural disasters, earthquakes, including large floods, mudslides and wildfires. To mitigate the impacts of these events or others, the Company has specially designed contingency plans, safety measures that contribute to mitigation and associated insurance. The effects of natural disasters could increase as a result of climate change.

New applicable environmental regulations could affect our business.

CCU’s operations are subject to local, national and international environmental norms and regulations. These regulations cover, among other things, emissions from different sources, noise, disposal of solid and liquid wastes, the temporary storage of residuals, hazardous and non-hazardous substances, odors and other activities inherent to our industry. In Chile, on June 1, 2016, Law N° 20,920 was enacted and established a framework for waste management and extended producer responsibility, and stimulation of recycling (“REP Law”), with the objective of lowering the generation of waste of priority products as determined by the bill and fostering recycling of the waste. On March 16, 2021, the Regulation of Law N° 20,920 was published that establishes collection, recovery and other obligations associated with containers and packaging, which will become effective as of September 2023 and progressively over the next few years, according to the percentages of each priority product. Additionally, CCU's subsidiaries, which are producers for the purposes of the REP Law, adhered as partners to the first Collective Management System called ReSimple, which in turn has environmental approvals and from the Competition Tribunal ("TDLC").

Additionally, on August 13, 2021, the PUSU Law was published requiring: (i) that disposable plastic bottles that are commercialized must be manufactured containing a percentage of plastic that has been collected and recycled within the country in the proportions to be established by means of a regulation to be issued within 18 months as of the date of publication of the law, with a minimum of 15% in 2025 (the above regulation is still pending), and (ii) retail businesses (including e-commerce and delivery applications) must offer beverages in returnable plastic bottles (excluding alcoholic and dairy products), effective for supermarkets 6 months as of the date of publication of the law and two years for all other retailers. See “Item 4: Information on the Company – E. Environmental Matters. In Chile, the 2022 reform of the Water Code establishes a new regime for the constitution of temporary water use rights, applicable to those rights granted in the future, and introduces a system of expiration for non-use when the construction works for the exercise of such rights are not carried out and such rights are published in the list of payment of non-use patent for a certain period of time. This, in addition to the introduction, within the environmental evaluation process, of criteria related to climate change, establishing a more demanding regime with respect to water resources, both for the constitution of new rights and for the environmental evaluation of new projects with water environmental variables.

Law N° 21,455 of 2022, Ley Marco de Cambio Climático in Chile, establishes a legal framework to deal with the challenges presented by climate change for the country, in order to achieve and maintain Greenhouse Gas (“GHG”) emissions neutrality by 2050. In this regard, and given the management instruments that will be issued, such as the guidelines that establish the synergistic effects and monitoring of environmental variables with a view to climate change, we believe that environmental regulation and processing will be more demanding and regulatory complexity.

On September 6, 2023, the Biodiversity Law was enacted, creating the Biodiversity Service, an institution aimed at conserving biological diversity and protecting the country's natural heritage, and the respective regulations are still pending, it will be necessary to review its implementation and its degree of impact on our operations.

In relation to environmental regulations, Law N° 21,595 of August 2023, "Economic Crimes Law", incorporated a new chapter to the Chilean Criminal Code called "Attempts against the Environment", which establishes specific criminal offenses in environmental matters framed, among others, in the release of polluting substances into the air, water, soil, illegal extraction of water and serious environmental damage, false and incomplete reporting that conceals or mitigates environmental consequences, as well as crimes associated with sectoral issues outside the competence of the Superintendence of the Environment. In this regard, the Company complies in all material respects with local regulations and continuously reviews its relevant policies, processes and protocols.

Finally, increasing concern over climate change also may result in additional legal or regulatory requirements designed to reduce or mitigate the effects of carbon dioxide and other greenhouse gas emissions on the environment and/or may result in increased disclosure obligations.

RISKS RELATING TO CHILE

We are substantially dependent on economic, political and social conditions in Chile, which may adversely impact the results of our operations and financial condition.

Chile is our most significant market. The Chile Operating segment generated 68.6% of our sales revenues in 2023, the International Business Operating segment (which includes Argentina, Bolivia, Paraguay and Uruguay) contributed 22.9%, and the Wine Operating segment, including the domestic markets in Chile and Argentina, as well as exports, accounted for 9.9% of revenues. Thus, our operating and financial performance is dependent, to a large extent, on the overall level of economic activity in Chile. The Chilean economy experienced an average annual growth rate (measured by GDP) of 2.0% between 2013 and 2023. In the past, slower economic growth in Chile resulted in a lower growth rate of consumption of our products and, consequently, adversely affected our profitability. Chile’s economic growth rate has been affected in the past by the disruption in the global financial markets by global recessions or a pandemic, as was the case in 2009 and 2020.

Although Chilean inflation has been limited in the last ten years, in line with the international trend, Chile experienced an increase in inflationary pressure in 2022, reaching an inflation of 12.8%, compared to an annual average of 4.5% from 2013 to 2023. In 2023 inflation returned to lower figures, closing at 3.9%. High levels of inflation and currency devaluation in Chile could adversely affect the Chilean economy and have a negative effect on our results. Even though the last estimates of the Central Bank of Chile forecast a reduction in inflation in 2024, we cannot assure you that Chilean inflation will remain at the actual level.

The measures taken in the past and particularly, during 2022, by the Central Bank of Chile to control inflation have included tightening the monetary policy and raising interest rates, which restricts credit availability and economic growth. Periods of higher inflation may also slow the growth rate of the Chilean economy, which occurred in 2022. Inflation is also likely to increase some of our costs and expenses, given that our supply contracts may be denominated in foreign currencies or indexed to the Chilean consumer price index. This could adversely affect our operating margins and financial results.

Furthermore, as an emerging and open economy, Chile is more exposed to unfavorable conditions in the international markets, which could have a negative impact on the demand for our products, as well as on third parties with whom we conduct business.

Any combination of lower consumer confidence, disrupted global capital markets and/or depressed international, economic conditions, greater commitment of public expending could have a negative impact on the Chilean economy and, consequently, on our business. In addition, a global liquidity crisis or an increase in interest rates could limit our ability to obtain the cash necessary to meet our commitments and, therefore, increase our financial expenses.

The Company maintains adequate liquidity levels, takes measures to secure the supply chain and, at the same time, implements efficiency plans, improvements in revenue, cost and expense management. On the other hand, it has diversified its operations geographically and maintains a solid financial health, as reflected in its local and international risk ratings which are: 'AA+' by Fitch Chile Clasificadora de Riesgo Limitada and by International Credit Rating Compañía Clasificadora de Riesgo Limitada ("ICR"), locally, and 'BBB' and 'A-' by Standard & Poor's and Fitch Ratings, respectively, internationally.

Any downgrading of Chile’s debt credit rating for domestic and international debt by international credit rating agencies may increase our financial costs or limit our access to capital markets.

Any future adverse revisions to Chile’s credit ratings for domestic and international debt by international rating agencies may adversely affect our ratings, our business, future financial performance, stockholders’ equity and the value of our securities. In addition, credit ratings affect the cost and other terms upon which we are able to obtain funding. Rating agencies regularly evaluate us and their ratings of our debt are based on a number of factors, including our financial strength and conditions affecting the financial services industry generally. There can be no assurance that rating agencies will maintain their current ratings or outlooks, and any downgrading in our debt credit ratings would likely limit our access to capital markets, increase our financial costs and adversely affect our results of operations and financial condition.

The relative liquidity and volatility of Chilean securities markets may increase the price volatility of our American Depositary Shares (“ADSs”) and adversely impact a holder’s ability to sell any shares of our common stock withdrawn from our American Depositary Receipt (“ADR”) facility.

The Chilean securities markets are substantially smaller, less liquid and more volatile than major securities markets in the United States. For example, the Santiago Stock Exchange, which is Chile’s principal stock exchange, had a market capitalization of approximately USD 180.3 billion as of December 31, 2023, while the New York Stock Exchange (“NYSE”) had a market capitalization of approximately USD 35.0 trillion and the NASDAQ National Market (“NASDAQ”) had a market capitalization of approximately USD 26.2 trillion as of the same date. In addition, the Chilean securities markets can be materially affected by developments in other emerging markets, particularly other countries in Latin America.

The lower liquidity and greater volatility of the Chilean markets relative to markets in the United States could increase the price volatility of the ADSs and may impair a holder’s ability to sell shares of our common stock withdrawn from the ADR facility in the Chilean market in the amount, at the price and at the time the holder wishes to do so. See “Item 9: The Offer and Listing”.

Currency fluctuations may affect our profitability

Because we purchase the majority of our supplies at prices set in USD and we export wine in prices set in USD, Canadian dollars, euros and pounds, we are exposed to foreign exchange risks that may adversely affect our financial condition and the results of our operations. The effect of the exchange rate variation on export revenues partially offsets the FX impact on the cost of raw materials expressed in CLP.

We are subject to different corporate disclosure requirements and accounting standards than U.S. companies.

Although the securities laws of Chile that govern open stock corporations and publicly listed companies such as us promote disclosure of all material corporate information to the public as a principal objective, Chilean disclosure requirements differ from those in the United States in certain important respects. In addition, although Chilean law imposes restrictions on insider trading and price manipulation, the Chilean securities market is not as highly regulated and supervised as the U.S. securities market. We have been subject to the periodic reporting requirements of the Exchange Act since our initial public offering of ADSs in September 1992.

RISKS RELATING TO ARGENTINA

We are substantially dependent on economic, political and social conditions in Argentina, which may adversely impact our operating results and financial position.

We have significant assets in Argentina and we generate significant income from our operations in this country.

The financial position and results of our operations in Argentina are, to a considerable extent, dependent upon political, social and economic conditions in Argentina, as demand for beverage products generally depends on the prevailing economic conditions in the local market. In the past, Argentina has suffered recessions, high levels of inflation, currency devaluations and significant economic decelerations in various periods of its history. The following paragraph summarizes the evolution of key economic indicators in Argentina:

During 2016, Argentina’s GDP contracted by 2.1% and inflation was close to 40%. In 2017, GDP growth was 2.8% and inflation close to 25%, showing a slight recovery in the economy. In 2018, Argentina once again entered into a recession and its GDP decreased by 2.6% and accumulated inflation reached 47.6%. Consequently, given that between 2016 and 2018 (three years) the cumulative inflation rate exceeded 100%, Argentina was deemed to be a hyperinflationary economy as of July 1, 2018.In 2021, the GDP expanded 10.7%, and inflation reached 50.9%, while in 2022 GDP grew 5.0% and inflation reached 94.8%. In 2023, GDP contracted by 1.6% and inflation reached 211%. Consequently, given that cumulative inflation between 2019 and 2022 exceeded 100%, Argentina continues to be considered a hyperinflationary economy (for more information see “Note 2” of our Consolidated Financial Statements as of December 2023 included herein).

If economic conditions in Argentina were to slow down or further contract, or if inflation continues to accelerate, or if the Argentine government’s ability to access the long-term financial markets to finance increased spending continues to be limited given the high levels of public sector indebtedness, Argentina’s economic growth and the financial health and results of our Argentine operations could be adversely affected.

Inflationary pressures in Argentina may negatively impact demand for our goods, profitability and future investments.

Argentina has faced and continues to face inflationary pressures. Increased inflationary risk may erode macroeconomic growth and limit the availability of financing, which may negatively impact our operations. In past periods of high inflation, the Argentine government had regulated prices of consumer goods, including beverages, which impacted our profitability. Even without government regulation, high inflation may impede our ability to pass on higher costs to customers, which would also negatively impact profitability.

The Argentine peso is subject to volatility which could adversely affect our results.

The devaluation of the ARS negatively affects our results. Our Argentine subsidiaries use the ARS as their functional currency, and their Financial Statements are translated into CLP for consolidation purposes, which impacts their results and equity evaluations due to the translation effect. In addition, the cost of most of our raw materials in Argentina is indexed to the USD price. In 2023, the ARS versus USD had an average devaluation of approximately 122.1% and end of period devaluation of 356.2%. All of the above generated a translation effect on reported revenues, costs and expenses, as well as pressure on USD-indexed costs.

Given that it is not possible to predict future economic conditions in Argentina or when Argentina will cease to be considered a hyperinflationary economy for accounting purposes, we cannot predict how CCU’s businesses will be affected by the future economic context in Argentina.

Argentina’s legal regime and economy are susceptible to changes that could adversely affect our Argentine operations.

On September 1, 2019, the Argentine Central Bank issued Communication “A” 6,770, which established various exchange controls for exports and imports of goods and services, holding of foreign assets, non-resident operations, foreign financial debt, debts between Argentine residents, repatriation of profits and payment of dividends, among others. The Communication was issued in response to the publication of Decree

N° 609/2019, pursuant to which the Argentine government implemented foreign exchange regulations originally until December 31, 2019, but subsequently extended for an indefinite period. Decree N° 609/2019 sets forth the obligation to convert the value of goods and services exported into Argentine pesos in the local financial system, in accordance with terms and conditions established by the Argentine Central Bank. All of these measures have negatively impacted the free import of goods and in practice restricted our ability to repatriate profits.

Since 2020 until the end of 2023, in an attempt to curb increasing inflation, the Argentine government applied various methods to regulate price increases of various consumer goods, directly and indirectly, including beer. During 2023, we were party to agreements with the Argentine government that require us to sell our products at a previously set price. These agreements and the various price control and price-fixing mechanisms were terminated by the new government that took office at the end of 2023.

As of the date of this report, there are several restrictions on the pricing of our products, the transfer of currency and repatriation of capital that could affect our subsidiaries’ ability to make payments and could in turn adversely affect our business and results of operations. We cannot assure that these measures will change nor the extent to which they will impact our business and results of operations.

In addition, the new government has issued the Necessity and Urgency Decree N° 70/2023, which introduces relevant amendments to the legal regime under which CCU Argentina and its subsidiaries operate, including: (i) the total repeal of the Supply Law N° 20,680; (ii) the total repeal of the Shelf Act N° 27,454; (iii) the total repeal of the Law on Price Observatory and Availability of Goods, Supplies and Services N° 26,992; (iv) amendments to the National Civil and Commercial Code regarding the extension of the autonomy of will in contracts; and (v) amendments to the labor regime. As of the date of this annual report, Decree of Necessity and Urgency N° 70/2023 is in force, but pending ratification by the National Congress, which will occur if at least one of its chambers ratifies it.

RISKS RELATING TO OUR ADSs

We are controlled by one majority shareholder, whose interests may differ from those of holders of our ADSs, and this shareholder may take actions that adversely affect the value of a holder’s ADSs or common stock.

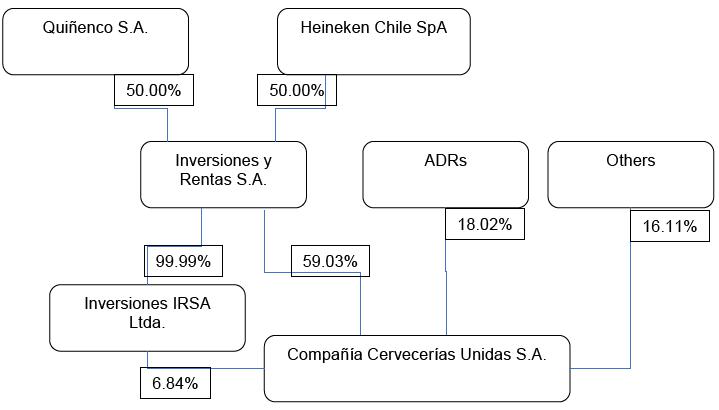

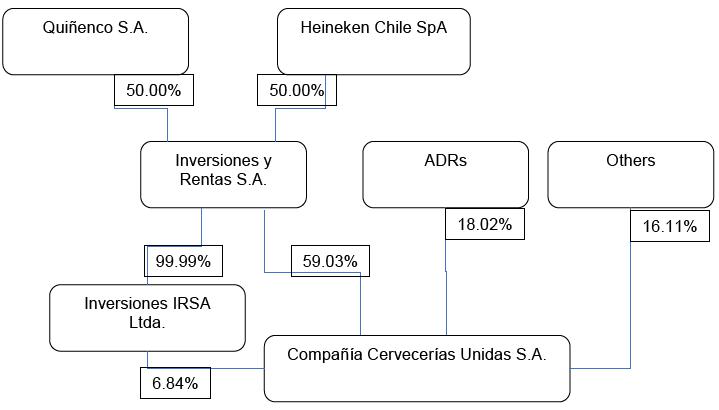

As of December 31, 2023, Inversiones y Rentas S.A. (“IRSA”) a Chilean closely held corporation, directly and indirectly owned 65.87% of our shares of common stock. Accordingly, IRSA has the power to control the election of most members of our board of directors and its interests may differ from those of the holders of our ADSs. IRSA also has significant influence in determining the outcome of any corporate transaction submitted to our shareholders for approval, including mergers, consolidations, the sale of all or substantially all of our assets and going-private transactions. In addition, actions by IRSA with respect to the disposal of the shares of common stock that it owns, or the perception that such actions may occur, may adversely affect the trading prices of our ADSs or common stock.

Chilean economic policies, currency fluctuations, exchange controls and currency devaluations may adversely affect the price of our ADSs.

The Chilean government’s economic policies and any future changes in the value of the CLP relative to the USD could adversely affect the USD value and the return on any investment in our ADSs. The CLP has been subject to nominal devaluations and appreciations in the past and may be subject to fluctuations in the future. For example, when comparing the average exchange rates for each period, the Chilean peso by depreciated by 9.7% and 12.8%, in 2019 and 2020, respectively, while it appreciated 4.2% in 2021, depreciated 14.9% in 2022 and appreciated 3.8% in 2023. When comparing the exchange rate as of the end of each period, the Chilean peso depreciated by 7.8% in 2019, appreciated 5.0% in 2020, and depreciated 18.8%, 1.3% and 2.5% in 2021, 2022 and 2023, respectively. See “Item 3: Key Information – A. Selected Financial Data – Exchange Rates.”

While our ADSs trade in USD, Chilean trading in the shares of our common stock underlying our ADSs is conducted in CLP. Cash distributions to be received by the depositary for the shares of our common stock underlying our ADSs will be denominated in CLP. The depositary will translate any CLP received by it to USD at the then-prevailing exchange rate with the purpose of making dividend and other distribution payments on the ADSs. If the value of the CLP declines relative to the USD, the value of our ADSs and any distributions to holders of our ADSs received from the depositary may be adversely affected. See “Item 8: Financial Information – A. Consolidated Statements and Other Financial Information – Dividend Policy and Dividends”.

For example, since our consolidated financial statements are reported in CLP, a decline in the value of the CLP against the USD would reduce our earnings as reported in USD. Any dividend we may pay in the future would be denominated in CLP. A decline in the value of the CLP against the USD would reduce the USD equivalent of any such dividend. Additionally, in the event of a dividend or other distribution, if exchange rates fluctuate during any period of time when the ADS depositary cannot convert a foreign currency into USD, a holder of our ADSs may lose some of the value of the distribution. Also, since dividends in Chile are subject to withholding taxes, which we retain until the following year when the exact amount to be paid is determined, if part of the retained amount is refunded to the shareholders, the amount received by holders of our ADSs would be subject to exchange rate fluctuations between the two dates.

Holders of our ADSs may be subject to certain risks since holders of our ADSs do not hold shares of our common stock directly.

ADS holders may exercise voting rights associated with common stock only in accordance with the deposit agreement governing our ADSs. Accordingly, ADS holders will face practical limitations when exercising their voting rights because ADS holders must first receive a notice of a shareholders’ meeting from the depositary and may then exercise their voting rights by instructing the depositary, on a timely basis, on how they wish to vote. This voting process necessarily will take longer for ADS holders than for direct common stockholders, who are able to exercise their vote by attending our shareholders’ meetings. Therefore, if the depositary fails to receive timely voting instructions from some or all ADS holders, the depositary will assume that ADS holders agree to give a discretionary proxy to a person designated by us to vote their ADSs on their behalf. Furthermore, ADS holders may not receive voting materials in time to instruct the depositary to vote. Accordingly, ADS holders may not be able to properly exercise their voting rights.

The right of a holder of our ADSs to force us to purchase the underlying shares of our common stock pursuant to Chilean corporate law upon the occurrence of certain events may be limited.

Because of the absence of legal precedent as to whether a shareholder that has voted both for and against a proposal, such as the depositary of our ADSs, may exercise withdrawal rights (as described in “Item 10. Additional Information – B. Memorandum and Articles of Association”) with respect to those shares voted against the proposal, there is doubt as to whether a holder of ADSs will be able to exercise withdrawal rights either directly or through the depositary for the shares of our common stock represented by their ADSs. Accordingly, for a holder of our ADSs to exercise its appraisal rights, it may be required to surrender its ADRs, withdraw the shares of our common stock represented by its ADSs, and vote those shares against the proposal.

In the past, Chile has imposed controls on foreign investment and repatriation of investments that affected investments in, and earnings from, our ADSs.

Equity investments in Chile by persons who are not Chilean residents have historically been subject to various exchange control regulations that restrict repatriation of investments and earnings therefrom. In April 2001, the Central Bank eliminated most of the regulations that affected foreign investors, although foreign investors still have to provide the Central Bank with information related to equity investments and must conduct such operations within the formal exchange market. Additional Chilean restrictions applicable to holders of our ADSs, the disposition of the shares underlying them, the repatriation of the proceeds from such disposition or the payment of dividends may be imposed in the future, and we cannot advise you as to the duration or impact of such restrictions if imposed. See also “Item 10: Additional Information – D. Exchange Controls”.

If for any reason, including changes in Chilean law, the depositary for our ADSs were unable to convert CLP to USD, investors would receive dividends and other distributions, if any, in CLP.

Preemptive rights to purchase additional shares of our common stock may be unavailable to holders of our ADSs in certain circumstances and, as a result, their ownership interest in our Company may be diluted.

The Ley sobre Sociedades Anónimas N° 18,046 (the “Chilean Corporations Act”), and its ordinance (Reglamento de Sociedades Anónimas), require us, whenever we issue new shares for cash, to grant preemptive rights to all holders of shares of our common stock, including shares of our common stock represented by ADSs, giving those holders the right to purchase a sufficient number of shares to maintain their existing ownership percentage. We may not be able to offer shares to holders of our ADSs pursuant to preemptive rights granted to our shareholders in connection with any future issuance of shares unless a registration statement under the Securities Act is effective with respect to those rights and shares, or an exemption from the registration requirements of the Securities Act is available.

We intend to evaluate at the time of any future offerings of shares of our common stock the costs and potential liabilities associated with any registration statement as well as the indirect benefits to us of enabling U.S. owners of our ADSs to exercise preemptive rights and any other factors that we consider appropriate at the time, before deciding whether or not to file such a registration statement. We cannot assure you that any such registration statement would be filed.

To the extent that a holder of our ADSs is unable to exercise their preemptive rights because a registration statement has not been filed, the depositary will attempt to sell the holder’s preemptive rights and distribute the net proceeds of the sale, net of the depositary’s fees and expenses, to the holder, provided that a secondary market for those rights exists and a premium can be recognized over the cost of the sale. A secondary market for the sale of preemptive rights can be expected to develop if the subscription price of the shares of our common stock upon exercise of the rights is below the prevailing market price of the shares of our common stock. Nonetheless, we cannot assure you that a secondary market in preemptive rights will develop in connection with any future issuance of shares of our common stock or that if a market develops, a premium can be recognized on their sale. Amounts received in exchange for the sale or assignment of preemptive rights relating to shares of our common stock will be taxable in Chile and in the United States. See “Item 10: Additional Information – E. Taxation – Chilean Tax Considerations – Capital Gains” and “– United States Federal Income Tax Considerations – Taxation of Capital Gains”. If the rights cannot be sold, they will expire and a holder of our ADSs will not realize any value from the grant of the preemptive rights. In either case, the equity interest of a holder of our ADSs in U.S. will be diluted proportionately.

ITEM 4: Information on the Company

| A. | History and Development of the Company |

Our current legal and commercial name is Compañía Cervecerías Unidas S.A. We are a public corporation (sociedad anónima abierta) organized by means of a public deed dated January 8, 1902, following the merger of two existing breweries, one of which traces its origins back to 1850, when Mr. Joaquín Plagemann founded one of the first breweries in Chile (in Valparaíso). By 1916, we owned and operated the largest brewing facilities in Chile. Our operations have also included the production and commercialization of soft drinks since the beginning of the last century, the bottling and selling of mineral water products since 1960, the production and commercialization of wine since 1994, the production and commercialization of beer in Argentina since 1995, the production and commercialization of pisco since 2003 and the production and commercialization of rum since 2007. Also, we had been involved in the production and commercialization of sweet snacks products from 2004 until December 2018.

We are subject to a full range of governmental regulation and supervision generally applicable to companies engaged in business in Chile, Argentina, Bolivia, Colombia, Paraguay and Uruguay. These regulations include labor laws, social security laws, public health, consumer protection and environmental laws, securities laws, and antitrust laws. In addition, regulations exist to ensure health and safety conditions in facilities for the production and distribution of beverages and sweet snacks products.

Our principal executive offices are located at Avenida Vitacura N° 2670, 23rd floor, Santiago, Chile. Our telephone number in Santiago is (56-2) 2427-3000, and our website is www.ccu.cl. Our authorized representative in the United States is Puglisi & Associates, located at 850 Library Avenue, Suite 204, Newark, Delaware 19711, USA, telephone number (302) 738-6680 and fax number (302) 738-7210. The information on our website is not incorporated by reference into this document. The SEC maintains a website at http://www.sec.gov/ that contains reports, proxy statements and other information regarding registrants that file electronically with the SEC. Form 20-F reports and the other information submitted by us to the SEC may be accessed through this website.

In 1986, IRSA, our current controlling shareholder, acquired its controlling interest in us through purchases of common stock at an auction conducted by a receiver who had assumed control of us following the economic crisis in Chile in the early 80’s, which resulted in our inability to meet our obligations to our creditors. IRSA, at that time, was a joint venture between Quiñenco S.A. (“Quiñenco”) and the Schörghuber Group from Germany, through its wholly owned subsidiary Finance Holding International B.V. (“FHI”) of the Netherlands.

In September 1992, we issued 4,520,582 American Depositary Shares (“ADSs”), each representing five shares of our common stock, in an international American Depositary Receipt (“ADR”) offering. The underlying ADSs were listed and traded on the NASDAQ, until March 25, 1999. Since that date, the ADSs have been listed and traded on the NYSE. On December 20, 2012, the ratio of ADSs to shares of common stock was changed from 1 to 5, to a new ratio of 1 to 2.

Prior to November 1994, we independently produced, bottled and distributed carbonated and non-carbonated soft drinks in Chile. In November 1994, we merged our soft drink and mineral water businesses with the one owned by Buenos Aires Embotelladora S.A. (“BAESA”) in Chile (PepsiCo’s bottler in Chile at that time) creating Embotelladoras Chilenas Unidas S.A. (“ECUSA”) for the production, bottling, distribution and commercialization of soft drink and mineral water products in Chile. Through ECUSA, we began producing PepsiCo brands under license. We have had control of ECUSA since January 1998, when the shareholders agreement was amended. On November 29, 1999, we purchased 45% of ECUSA’s shares owned by BAESA for approximately CLP 54,118 million. We currently own 99.98% of ECUSA’s shares. In January 2001, ECUSA and Schweppes Holdings Ltd. signed an agreement to continue bottling Crush and Canada Dry brands. See “Item 4. B. Business Overview – 4. Production and Marketing – Chile Operating segment”.

In 1994, we purchased 48.4% of the equity of the Chilean wine producer Viña San Pedro S.A. (“VSP”) for approximately CLP 17,470 million. During the first half of 1995, VSP’s capital was increased by approximately CLP 14,599 million, of which we contributed approximately CLP 7,953 million. From August through October 1997, VSP’s capital was increased again by approximately CLP 11,872 million, of which we contributed approximately CLP 6,617 million, plus approximately CLP 191 million in additional shares bought during October 1997 in the local stock market. Furthermore, in October 1998 and during 1999, we purchased additional shares in VSP through the local stock exchanges for an amount of approximately CLP 5,526 million.

From March through June 1999, VSP’s capital was increased by approximately CLP 17,464 million, of which we contributed approximately CLP 10,797 million.

In December 1995, we entered into a joint venture agreement pursuant to which Anheuser-Busch acquired a 4.4% interest in CCU Argentina. The agreement involved two different contracts: an investment and a licensing contract. Through CCU Argentina, we began our expansion into Argentina by acquiring an interest in two Argentine breweries: 62.7% of the outstanding shares of Compañía Industrial Cervecera S.A. (“CICSA”), were acquired during January and February 1995 and 98.8% of the outstanding shares of Cervecería Santa Fe S.A. (“CSF”), were acquired in September 1995. In 1997, CCU Argentina increased its interest in CICSA to 97.2% and in CSF to 99.9% through the purchase of non-controlling interests. In January 1998, we decided to merge these two breweries into one company operating under the name of CICSA. Following the merger, CCU Argentina’s interest in CICSA was 99.2%. In April 1998, CCU Argentina completed the purchase of the brands and assets of Cervecería Córdoba S.A. As of mid-1998, after the resolution of certain labor issues, we began the production of the Córdoba brand at our Santa Fe plant.

After a capital increase approved by our shareholders in October 1996, we raised approximately USD 196 million between December 1996 and April 1999. Part of this capital expansion was accomplished between December 1996 and January 1997 through our second ADR offering in the international markets.

In November 2000, we and Malterías Unidas S.A. (currently Maltexco S.A.) became joint owners (50% each) of Cervecería Austral S.A. (“Cervecería Austral”), a Chilean company located in the city of Punta Arenas that produces, sells and distributes Austral beer in Chile. Additionally, Cervecera CCU Chile Limitada (“Cervecería CCU”) has a two-year renewable license agreement, subject to compliance with the conditions established in the agreement, for the production of Austral Lager beer, returnable liter containers and kegs in Chile and a distribution agreement for the sale and marketing of all Austral products in Chile, with the exception of the Magallanes Region, where selling and distribution is carried out by Comercial Patagona Ltda., a subsidiary of Cervecería Austral.

During 2000, VSP, through its subsidiary Finca La Celia S.A. (“FLC”), acquired the winery Finca La Celia in Mendoza, Argentina, initiating its international expansion, allowing VSP to include fine quality Argentine wines into its export product portfolio. In December 2001, Viña Santa Helena S.A. (“VSH”) created its own commercial and productive winemaking operation, distinct from its parent, VSP, under the Viña Santa Helena label in the Colchagua Valley. Between November 2000 and March 2001, VSP’s capital was increased by approximately CLP 22,279 million, of which we contributed approximately CLP 13,402 million.

In May 2002, we acquired a 50% stake in Compañía Cervecera Kunstmann S.A., currently Cervecería Kunstmann S.A. (“CK”), a brewery located in the southern city of Valdivia, in Chile. In June 2003, our beer division began selling Kunstmann nationwide. In November 2006, we acquired additional shares of CK that allowed us to consolidate this subsidiary into our consolidated financial statements as of that month.

In February 2003, we began the sale of a new product for our beverage portfolio, pisco, under the brand Ruta Norte. Pisco is a grape spirit very popular in Chile that is produced in the northern part of the country. Our pisco, at that time, was only produced in the Elqui Valley in the Coquimbo Region and was sold throughout the country by our beer division sales force. In March 2005, we entered into an association with the second largest pisco producer at that time, Cooperativa Agrícola Control Pisquero de Elqui y Limarí Ltda. (“Control”). This new joint venture was named Compañía Pisquera de Chile S.A. (“CPCh”), to which the companies contributed principally with assets, commercial brands and – in the case of Control – also some financial liabilities. Currently we own 80% of CPCh and Control owns the remaining 20%.

On April 17, 2003, the Schörghuber Group, at the time an indirect owner of 30.8% of our ownership interest, gave Quiñenco, also at the time an indirect owner of 30.8% of our ownership interest, formal notice of its intent to sell 100% of its interest in FHI to Heineken Americas B.V., a subsidiary of Heineken International B.V. As a result of the sale, Quiñenco and Heineken Americas B.V., the latter through FHI, became the only two shareholders of IRSA, the owner of 61.6% of our equity at that time, each with a 50% interest in IRSA. Heineken International B.V. and FHI subsequently formed Heineken Chile Ltda., to hold the latter’s 50% interest in IRSA. Therefore, Quiñenco and Heineken Chile Ltda. were the only two shareholders of IRSA, with 50% equity each at that time. On December 30, 2003, FHI merged into Heineken Americas B.V., which together with Heineken International B.V. remained as the only shareholders of Heineken Chile Ltda.

In 2022, Heineken Chile Ltda. became Heineken Chile SpA, a Chilean corporation (sociedad por acciones) whose current controller is Heineken International B.V., a Dutch limited liability company, subsidiary of Heineken N.V. The majority shareholder of Heineken N.V. is the Dutch company Heineken Holding N.V., a Dutch subsidiary of L'Arche Green N.V., which is a subsidiary of L'Arche Holdings B.V., the latter ultimately controlled by Mrs. C.L. de Carvalho-Heineken. Currently, Quiñenco and Heineken Chile SpA, are the only shareholders of IRSA, each with a 50% equity interest. As of March 31, 2024, and as of the date of this annual report, IRSA directly and indirectly owned 65.87% of our shares of common stock.

In August 2003, VSP formed Viña Tabalí S.A., a joint venture in equal parts with Sociedad Agrícola y Ganadera Río Negro Ltda., for the production of premium wines. This winery is in the Limarí Valley, Chile’s northernmost winemaking region, which is noted for the production of outstanding wines.

In January 2004, we entered the sweet snacks business by means of a joint venture between CCU Inversiones S.A. and Industria Nacional de Alimentos S.A., a subsidiary of Quiñenco, with a 50% interest each in Calaf S.A., which was renamed Foods Compañía de Alimentos CCU S.A. (“Foods”), a corporation that acquired the trademarks, assets and know-how, among other things, of Calaf S.A.I.C. and Francisca Calaf S.A., traditional Chilean candy makers, renowned for more than a century. In 2007 we acquired the brand Natur, adding a new line of products to our ready-to-eat portfolio. In August 2008, Foods bought 50% of Alimentos Nutrabien S.A. (“Nutrabien”), a company that specializes in brownies and other high-quality baked goods under the brand Nutrabien.

In October 2004, VSP acquired the well-known Manquehuito Pop Wine brand, a sparkling fruit-flavored wine with low alcohol content, broadening its range of products. At VSP’s extraordinary shareholders meeting held on July 7, 2005, the shareholders approved a capital increase that was to be partially used for stock option programs. During October and November 2005, VSP’s capital was increased by approximately CLP 346 million. We did not participate in this capital increase.

In December 2006, we signed a joint venture agreement with Watt’s S.A. (“Watt’s”), a local food related company, under which, as of January 30, 2007, we participate in equal parts in Promarca S.A. (“Promarca”). This new company owns, among others, the brands “Watt’s”, “Watt’s Ice Frut”, “Yogu Yogu” and “Shake a Shake” in Chile. Promarca granted both of its shareholders (New Ecusa S.A., a former subsidiary of ECUSA, which as of the date of this annual report has been merged into ECUSA, and Watt’s Dos S.A., a subsidiary of Watt’s S.A.), for an indefinite period, the exclusive licenses for the production and sale of the different product categories.

In January 2007, Viña Tabalí S.A. bought the assets of Viña Leyda, located in the Leyda Valley, a new winemaking region south of Casablanca Valley and close to the Pacific Ocean. Viña Leyda produces excellent wines that have won awards in different international contests. After this acquisition, Viña Tabalí S.A. changed its name to Viña Valles de Chile S.A. In September 2007, VSP bought a 50% interest in Viña Altaïr S.A. which belonged to Château Dassault, in line with our strategy of focusing on premium wines. Consequently, VSP owns 100% of said company. Between April and June 2007, VSP’s capital was increased by approximately CLP 13,692 million, of which we contributed approximately CLP 5,311 million.

In May 2007, CPCh entered the rum market with our proprietary brand Sierra Morena and later, in 2008, added new rum brand extensions and introduced various pisco based cocktails. In June 2010 CPCh purchased Fehrenberg, a small, but well-recognized spirits brand produced in Chile. In July 2011 CPCh began the distribution of Pernod Ricard products (Chivas Regal, Ballantine’s, Havana Club, Absolut, among others). Furthermore, in 2011, CPCh signed a license agreement for the commercialization and distribution in Chile of the pisco brand Bauzá. In addition, in 2011 CPCh acquired 49% of the licensor company Compañía Pisquera Bauzá S.A. (“Bauza”), the owner of the brand in Chile, and CPCh sold such interest to Agroproductos Bauzá S.A. in January 2016.