UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-Q

_____________________________

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-11356

_______________________________

Radian Group Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 23-2691170 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 1601 Market Street, Philadelphia, PA | 19103 | |

| (Address of principal executive offices) | (Zip Code) | |

(215) 231-1000

(Registrant’s telephone number, including area code)

_____________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | Emerging growth company o | |||

| (Do not check if a smaller reporting company) | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 215,095,131 shares of common stock, $0.001 par value per share, outstanding on May 3, 2017.

| TABLE OF CONTENTS | ||

Page Number | ||

| Item 1. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Item 1. | ||

| Item 1A. | ||

| Item 2. | ||

| Item 6. | ||

2

GLOSSARY OF ABBREVIATIONS AND ACRONYMS

The following list defines various abbreviations and acronyms used throughout this report, including the Condensed Consolidated Financial Statements, the Notes to Unaudited Condensed Consolidated Financial Statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations.

| Term | Definition |

| 2014 Master Policy | Radian Guaranty’s Master Policy that became effective October 1, 2014 |

| 2016 Form 10-K | Annual Report on Form 10-K for the year ended December 31, 2016 |

| ABS | Asset-backed securities |

| Alt-A | Alternative-A loans represent loans for which the underwriting documentation is generally limited as compared to fully documented loans (considered a non-prime loan grade) |

| AOCI | Accumulated other comprehensive income (loss) |

| Appeals | Internal Revenue Service Office of Appeals |

| Available Assets | As defined in the PMIERs, these assets primarily include the liquid assets of a mortgage insurer and its exclusive affiliated reinsurers, and exclude premiums received but not yet earned |

| BofA Settlement Agreement | The Confidential Settlement Agreement and Release dated September 16, 2014, by and among Radian Guaranty and Countrywide Home Loans, Inc. and Bank of America, N.A., as a successor to BofA Home Loan Servicing f/k/a Countrywide Home Loan Servicing LP, entered into in order to resolve various actual and potential claims or disputes as to mortgage insurance coverage on certain Subject Loans |

| Claim Curtailment | Our legal right, under certain conditions, to reduce the amount of a claim, including due to servicer negligence |

| Claim Denial | Our legal right, under certain conditions, to deny a claim |

| Claim Severity | The total claim amount paid divided by the original coverage amount |

| Clayton | Clayton Holdings LLC, a Delaware domiciled indirect non-insurance subsidiary of Radian Group |

| CMBS | Commercial mortgage-backed securities |

| Convertible Senior Notes due 2017 | Our 3.000% convertible unsecured senior notes due November 2017 ($450 million original principal amount) |

| Convertible Senior Notes due 2019 | Our 2.250% convertible unsecured senior notes due March 2019 ($400 million original principal amount) |

| Cures | Loans that were in default as of the beginning of a period and are no longer in default because payments were received and the loan is no longer 60 days past due |

| Default to Claim Rate | The assumed rate at which defaulted loans will result in a claim |

| Deficiency Amount | The assessed tax liabilities, penalties and interest associated with a formal notice of deficiency letter from the IRS |

| Exchange Act | Securities Exchange Act of 1934, as amended |

| Fannie Mae | Federal National Mortgage Association |

| FASB | Financial Accounting Standards Board |

| FHA | Federal Housing Administration |

| FHFA | Federal Home Finance Agency |

| FICO | Fair Isaac Corporation (“FICO”) credit scores used throughout this report, for Radian’s portfolio statistics, represent the borrower’s credit score at origination and, in circumstances where there is more than one borrower, the FICO score for the primary borrower is utilized |

| Foreclosure Stage Default | The Stage of Default indicating that the foreclosure sale has been scheduled or held |

3

| Term | Definition |

| Freddie Mac | Federal Home Loan Mortgage Corporation |

| Freddie Mac Agreement | The Master Transaction Agreement between Radian Guaranty and Freddie Mac entered into in August 2013 |

| Future Legacy Loans | With respect to the BofA Settlement Agreement, Legacy Loans where a claim decision has been or will be communicated by Radian Guaranty after February 13, 2013 |

| GAAP | Accounting principles generally accepted in the United States of America |

| Green River Capital | Green River Capital LLC, a wholly-owned subsidiary of Clayton |

| GSEs | Government-Sponsored Enterprises (Fannie Mae and Freddie Mac) |

| HARP | Home Affordable Refinance Program |

| IBNR | Losses incurred but not reported |

| IIF | Insurance in force is equal to the aggregate unpaid principal balances of the underlying loans |

| Insureds | Insured parties with respect to the BofA Settlement Agreement, consisting of Countrywide Home Loans, Inc. and Bank of America, N.A., as a successor to BofA Home Loan Servicing f/k/a Countrywide Home Loans Servicing LP |

| IRS | Internal Revenue Service |

| JCT | Congressional Joint Committee on Taxation |

| LAE | Loss adjustment expenses, which include the cost of investigating and adjusting losses and paying claims |

| Legacy Loans | With respect to the BofA Settlement Agreement, loans that were originated or acquired by an Insured and were insured by Radian Guaranty prior to January 1, 2009, excluding such loans that were refinanced under HARP 2 (the FHFA’s extension of and enhancements to the HARP program) |

| Legacy Portfolio | Mortgage insurance written during the poor underwriting years of 2005 through 2008, together with business written prior to 2005 |

| Loss Mitigation Activity/Activities | Activities such as Rescissions, Claim Denials, Claim Curtailments and cancellations |

| LTV | Loan-to-value ratio which is calculated as the percentage of the original loan amount to the original value of the property |

| Master Policies | The Prior Master Policy and the 2014 Master Policy, collectively |

| Minimum Required Assets | A risk-based minimum required asset amount, as defined in the PMIERs, calculated based on net RIF (RIF, net of credits permitted for reinsurance) and a variety of measures related to expected credit performance and other factors |

| Model Act | Mortgage Guaranty Insurers Model Act |

| Monthly and Other | Insurance policies where premiums are paid on a monthly or other installment basis, excluding Single Premium Policies |

| Monthly Premium Policies | Insurance policies where premiums are paid on a monthly installment basis |

| Mortgage Insurance | Radian’s Mortgage Insurance business segment, which provides credit-related insurance coverage, principally through private mortgage insurance, to mortgage lending institutions |

| MPP Requirement | Certain states’ statutory or regulatory risk-based capital requirement that the mortgage insurer must maintain a minimum policyholder position, which is calculated based on both risk and surplus levels |

| NAIC | National Association of Insurance Commissioners |

| NIW | New insurance written |

| NOL | Net operating loss, calculated on a tax basis |

4

| Term | Definition |

| Notices of Deficiency | Formal letters from the IRS informing the taxpayer of an IRS determination of tax deficiency and appeal rights |

| OCI | Other comprehensive income (loss) |

| Persistency Rate | The percentage of insurance in force that remains in force over a period of time |

| PMIERs | Private Mortgage Insurer Eligibility Requirements effective on December 31, 2015, issued by the GSEs under oversight of the FHFA to set forth requirements an approved insurer must meet and maintain to provide mortgage guaranty insurance on loans acquired by the GSEs |

| Pool Insurance | Pool Insurance differs from primary insurance in that our maximum liability is not limited to a specific coverage percentage on an individual mortgage loan. Instead, an aggregate exposure limit, or “stop loss,” is applied to the initial aggregate loan balance on a group or “pool” of mortgages |

| Post-legacy | The time period subsequent to 2008 |

| Prior Master Policy | Radian Guaranty’s master insurance policy in effect prior to the effective date of its 2014 Master Policy |

| QSR Transactions | The quota share reinsurance agreements entered into with a third-party reinsurance provider in the second and fourth quarters of 2012, collectively |

| Radian | Radian Group Inc. together with its consolidated subsidiaries |

| Radian Asset Assurance | Radian Asset Assurance Inc., a New York domiciled insurance company that was formerly a subsidiary of Radian Guaranty |

| Radian Group | Radian Group Inc., the registrant |

| Radian Guaranty | Radian Guaranty Inc., a Pennsylvania domiciled insurance subsidiary of Radian Group |

| Radian Reinsurance | Radian Reinsurance Inc., a Pennsylvania domiciled insurance subsidiary of Radian Group |

| RBC States | Risk-based capital states, which are those states that currently impose a statutory or regulatory risk-based capital requirement |

| Red Bell | Red Bell Real Estate, LLC, a wholly-owned subsidiary of Clayton |

| Reinstatements | Reversals of previous Rescissions, Claim Denials and Claim Curtailments |

| REMIC | Real Estate Mortgage Investment Conduit |

| REO | Real estate owned |

| Rescission | Our legal right, under certain conditions, to unilaterally rescind coverage on our mortgage insurance policies if we determine that a loan did not qualify for insurance |

| RIF | Risk in force for primary insurance is equal to the underlying loan unpaid principal balance multiplied by the insurance coverage percentage; whereas for Pool Insurance it represents the remaining exposure under the agreements |

| Risk-to-capital | Under certain state regulations, a minimum ratio of statutory capital calculated relative to the level of net RIF |

| RMBS | Residential mortgage-backed securities |

| S&P | Standard & Poor’s Financial Services LLC |

| SAPP | Statutory accounting principles and practices include those required or permitted, if applicable, by the insurance departments of the respective states of domicile of our insurance subsidiaries |

| SEC | United States Securities and Exchange Commission |

| Second-lien | Second-lien mortgage loan |

| Senior Notes due 2017 | Our 9.000% unsecured senior notes due June 2017 ($195.5 million principal amount) |

5

| Term | Definition |

| Senior Notes due 2019 | Our 5.500% unsecured senior notes due June 2019 ($300 million principal amount) |

| Senior Notes due 2020 | Our 5.250% unsecured senior notes due June 2020 ($350 million principal amount) |

| Senior Notes due 2021 | Our 7.000% unsecured senior notes due March 2021 ($350 million principal amount) |

| Services | Radian’s Services business segment, which provides mortgage- and real estate-related products and services to the mortgage finance market |

| Servicing Only Loans | With respect to the BofA Settlement Agreement, loans other than Legacy Loans that were or are serviced by the Insureds and were 90 days or more past due as of July 31, 2014, or if servicing has been transferred to a servicer other than the Insureds, 90 days or more past due as of the transfer date |

| SFR | Single family rental |

| Single Premium Policy/Policies | Insurance policies where premiums are paid in a single payment and includes policies written on an individual basis (as each loan is originated) and on an aggregated basis (in which each individual loan in a group of loans is insured in a single transaction, typically after the loans have been originated) |

| Single Premium QSR Transaction | Quota share reinsurance agreement entered into with a panel of third-party reinsurance providers in the first quarter of 2016 |

| Stage of Default | The stage a loan is in relative to the foreclosure process, based on whether a foreclosure sale has been scheduled or held |

| Statutory RBC Requirement | Risk-based capital requirement imposed by the RBC States, requiring a minimum surplus level and, in certain states, a minimum ratio of statutory capital relative to the level of risk |

| Subject Loans | Loans covered under the BofA Settlement Agreement, comprising Legacy Loans and Servicing Only Loans |

| Surplus Note | An intercompany 0.000% surplus note due December 31, 2025 ($325 million principal amount), issued by Radian Guaranty to Radian Group in December 2015 and repaid by Radian Guaranty on June 30, 2016 |

| Time in Default | The time period from the point a loan reaches default status (based on the month the default occurred) to the current reporting date |

| TRID | Truth in Lending Act - Real Estate Settlement Procedures Act of 1974 (“RESPA”) Integrated Disclosure |

| U.S. Treasury | United States Department of the Treasury |

| VA | U.S. Department of Veterans Affairs |

| ValuAmerica | ValuAmerica, Inc., a wholly-owned subsidiary of Clayton |

6

Cautionary Note Regarding Forward-Looking Statements—Safe Harbor Provisions

All statements in this report that address events, developments or results that we expect or anticipate may occur in the future are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Exchange Act and the U.S. Private Securities Litigation Reform Act of 1995. In most cases, forward-looking statements may be identified by words such as “anticipate,” “may,” “will,” “could,” “should,” “would,” “expect,” “intend,” “plan,” “goal,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “seek,” “strategy,” “future,” “likely” or the negative or other variations on these words and other similar expressions. These statements, which may include, without limitation, projections regarding our future performance and financial condition, are made on the basis of management’s current views and assumptions with respect to future events. Any forward-looking statement is not a guarantee of future performance and actual results could differ materially from those contained in the forward-looking statement. These statements speak only as of the date they were made, and we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We operate in a changing environment. New risks emerge from time to time and it is not possible for us to predict all risks that may affect us. The forward-looking statements, as well as our prospects as a whole, are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in the forward-looking statements. These risks and uncertainties include, without limitation:

| • | changes in general economic and political conditions, including unemployment rates, interest rates and changes in housing and mortgage credit markets, that impact the size of the insurable market, the credit performance of our insured portfolio, and the business opportunities in our Services business; |

| • | changes in the way customers, investors, regulators or legislators perceive the performance and financial strength of private mortgage insurers; |

| • | Radian Guaranty’s ability to remain eligible under the PMIERs and other applicable requirements imposed by the FHFA and by the GSEs to insure loans purchased by the GSEs; |

| • | our ability to successfully execute and implement our capital plans and to maintain sufficient holding company liquidity to meet our short- and long-term liquidity needs; |

| • | our ability to successfully execute and implement our business plans and strategies, including plans and strategies that require GSE and/or regulatory approvals and licenses; |

| • | our ability to maintain an adequate level of capital in our insurance subsidiaries to satisfy existing and future state regulatory requirements; |

| • | changes in the charters or business practices of, or rules or regulations imposed by or applicable to, the GSEs, including the GSEs’ interpretation and application of the PMIERs to our mortgage insurance business; |

| • | changes in the current housing finance system in the U.S., including the role of the FHA, the GSEs and private mortgage insurers in this system; |

| • | any disruption in the servicing of mortgages covered by our insurance policies, as well as poor servicer performance; |

| • | a significant decrease in the Persistency Rates of our mortgage insurance policies; |

| • | competition in our mortgage insurance business, including price competition and competition from the FHA, VA and other forms of credit enhancement; |

| • | the effect of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) on the financial services industry in general, and on our businesses in particular; |

| • | the adoption of new laws and regulations, or changes in existing laws and regulations (including the Dodd-Frank Act), or the way they are interpreted or applied; |

| • | the outcome of legal and regulatory actions, reviews, audits, inquiries and investigations that could result in adverse judgments, settlements, fines, injunctions, restitutions or other relief that could require significant expenditures or have other effects on our business; |

7

| • | the amount and timing of potential payments or adjustments associated with federal or other tax examinations, including deficiencies assessed by the IRS resulting from its examination of our 2000 through 2007 tax years, which we are currently contesting; |

| • | the possibility that we may fail to estimate accurately the likelihood, magnitude and timing of losses in connection with establishing loss reserves for our mortgage insurance business; |

| • | volatility in our results of operations caused by changes in the fair value of our assets and liabilities, including a significant portion of our investment portfolio; |

| • | changes in GAAP or SAPP rules and guidance, or their interpretation; |

| • | our ability to attract and retain key employees; |

| • | legal and other limitations on dividends and other amounts we may receive from our subsidiaries; and |

| • | the possibility that we may need to impair the carrying value of goodwill established in connection with our acquisition of Clayton. |

For more information regarding these risks and uncertainties as well as certain additional risks that we face, you should refer to the Risk Factors detailed in Item 1A of our 2016 Form 10-K, and in our subsequent quarterly and other reports filed from time to time with the SEC. We caution you not to place undue reliance on these forward-looking statements, which are current only as of the date on which we issued this report. We do not intend to, and we disclaim any duty or obligation to, update or revise any forward-looking statements to reflect new information or future events or for any other reason.

8

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

Radian Group Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| ($ in thousands, except per-share amounts) | March 31, 2017 | December 31, 2016 | |||||

| Assets | |||||||

| Investments (Note 5) | |||||||

| Fixed-maturities available for sale—at fair value (amortized cost $2,941,528 and $2,856,468) | $ | 2,937,415 | $ | 2,838,512 | |||

| Equity securities available for sale—at fair value (cost $1,330 and $1,330) | 1,330 | 1,330 | |||||

| Trading securities—at fair value | 811,313 | 879,862 | |||||

| Short-term investments—at fair value | 686,685 | 741,531 | |||||

| Other invested assets | 973 | 1,195 | |||||

| Total investments | 4,437,716 | 4,462,430 | |||||

| Cash | 73,701 | 52,149 | |||||

| Restricted cash | 12,689 | 9,665 | |||||

| Accounts and notes receivable | 73,794 | 77,631 | |||||

| Deferred income taxes, net (Note 9) | 369,209 | 411,798 | |||||

| Goodwill and other intangible assets, net (Note 6) | 273,068 | 276,228 | |||||

| Prepaid reinsurance premium | 230,148 | 229,438 | |||||

| Other assets (Note 8) | 357,435 | 343,835 | |||||

| Total assets | $ | 5,827,760 | $ | 5,863,174 | |||

| Liabilities and Stockholders’ Equity | |||||||

| Unearned premiums | $ | 684,797 | $ | 681,222 | |||

| Reserve for losses and loss adjustment expense (“LAE”) (Note 10) | 726,169 | 760,269 | |||||

| Long-term debt (Note 11) | 1,008,777 | 1,069,537 | |||||

| Reinsurance funds withheld | 167,427 | 158,001 | |||||

| Other liabilities | 319,282 | 321,859 | |||||

| Total liabilities | 2,906,452 | 2,990,888 | |||||

| Commitments and contingencies (Note 12) | |||||||

| Equity component of currently redeemable convertible senior notes (Note 11) | 883 | — | |||||

| Stockholders’ equity | |||||||

| Common stock: par value $.001 per share; 485,000,000 shares authorized at March 31, 2017 and December 31, 2016; 232,663,818 and 232,091,921 shares issued at March 31, 2017 and December 31, 2016, respectively; 215,090,781 and 214,521,079 shares outstanding at March 31, 2017 and December 31, 2016, respectively | 233 | 232 | |||||

| Treasury stock, at cost: 17,573,037 and 17,570,842 shares at March 31, 2017 and December 31, 2016, respectively | (893,372 | ) | (893,332 | ) | |||

| Additional paid-in capital | 2,743,594 | 2,779,891 | |||||

| Retained earnings | 1,073,333 | 997,890 | |||||

| Accumulated other comprehensive income (loss) (“AOCI”) (Note 14) | (3,363 | ) | (12,395 | ) | |||

| Total stockholders’ equity | 2,920,425 | 2,872,286 | |||||

| Total liabilities and stockholders’ equity | $ | 5,827,760 | $ | 5,863,174 | |||

See Notes to Unaudited Condensed Consolidated Financial Statements.

9

Radian Group Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three Months Ended March 31, | |||||||

| (In thousands, except per-share amounts) | 2017 | 2016 | |||||

| Revenues: | |||||||

| Net premiums earned—insurance | $ | 221,800 | $ | 220,950 | |||

| Services revenue | 38,027 | 32,849 | |||||

| Net investment income | 31,032 | 27,201 | |||||

| Net gains (losses) on investments and other financial instruments | (2,851 | ) | 31,286 | ||||

| Other income | 746 | 666 | |||||

| Total revenues | 288,754 | 312,952 | |||||

| Expenses: | |||||||

| Provision for losses | 46,913 | 42,991 | |||||

| Policy acquisition costs | 6,729 | 6,389 | |||||

| Cost of services | 28,375 | 23,550 | |||||

| Other operating expenses | 68,377 | 57,188 | |||||

| Interest expense | 15,938 | 21,534 | |||||

| Loss on induced conversion and debt extinguishment (Note 11) | 4,456 | 55,570 | |||||

| Amortization and impairment of intangible assets | 3,296 | 3,328 | |||||

| Total expenses | 174,084 | 210,550 | |||||

| Pretax income | 114,670 | 102,402 | |||||

| Income tax provision | 38,198 | 36,153 | |||||

| Net income | $ | 76,472 | $ | 66,249 | |||

| Net income per share: | |||||||

| Basic | $ | 0.36 | $ | 0.33 | |||

| Diluted | $ | 0.34 | $ | 0.29 | |||

| Weighted-average number of common shares outstanding—basic | 214,925 | 203,706 | |||||

| Weighted-average number of common and common equivalent shares outstanding—diluted | 221,497 | 239,707 | |||||

| Dividends per share | $ | 0.0025 | $ | 0.0025 | |||

See Notes to Unaudited Condensed Consolidated Financial Statements.

10

Radian Group Inc.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 | |||||

| Net income | $ | 76,472 | $ | 66,249 | |||

| Other comprehensive income (loss), net of tax (Note 14): | |||||||

| Unrealized gains (losses) on investments: | |||||||

| Unrealized holding gains (losses) arising during the period | 7,367 | 39,374 | |||||

| Less: Reclassification adjustment for net gains (losses) included in net income | (1,631 | ) | (2,157 | ) | |||

| Net unrealized gains (losses) on investments | 8,998 | 41,531 | |||||

| Net foreign currency translation adjustments | 34 | (85 | ) | ||||

| Net actuarial gains (losses) | — | (178 | ) | ||||

| Other comprehensive income (loss), net of tax | 9,032 | 41,268 | |||||

| Comprehensive income | $ | 85,504 | $ | 107,517 | |||

See Notes to Unaudited Condensed Consolidated Financial Statements.

11

Radian Group Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN COMMON STOCKHOLDERS’ EQUITY (UNAUDITED)

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 | |||||

| Common Stock | |||||||

| Balance, beginning of period | $ | 232 | $ | 224 | |||

| Impact of extinguishment of Convertible Senior Notes due 2017 and 2019 (Note 11) | — | 17 | |||||

| Issuance of common stock under incentive and benefit plans | 1 | — | |||||

| Shares repurchased under share repurchase program (Note 13) | — | (9 | ) | ||||

| Balance, end of period | 233 | 232 | |||||

| Treasury Stock | |||||||

| Balance, beginning of period | (893,332 | ) | (893,176 | ) | |||

| Repurchases of common stock under incentive plans | (40 | ) | — | ||||

| Balance, end of period | (893,372 | ) | (893,176 | ) | |||

| Additional Paid-in Capital | |||||||

| Balance, beginning of period | 2,779,891 | 2,716,618 | |||||

| Issuance of common stock under incentive and benefit plans | 3,548 | 659 | |||||

| Share-based compensation | 3,222 | 4,612 | |||||

| Impact of extinguishment of Convertible Senior Notes due 2017 and 2019 (Note 11) | (42,940 | ) | 151,639 | ||||

| Cumulative effect of adoption of the accounting standard update for share-based payment transactions | 756 | — | |||||

| Change in equity component of currently redeemable convertible senior notes | (883 | ) | — | ||||

| Shares repurchased under share repurchase program (Note 13) | — | (100,179 | ) | ||||

| Balance, end of period | 2,743,594 | 2,773,349 | |||||

| Retained Earnings | |||||||

| Balance, beginning of period | 997,890 | 691,742 | |||||

| Net income | 76,472 | 66,249 | |||||

| Dividends declared | (538 | ) | (789 | ) | |||

| Cumulative effect of adoption of the accounting standard update for share-based payment transactions, net of tax | (491 | ) | — | ||||

| Balance, end of period | 1,073,333 | 757,202 | |||||

| Accumulated Other Comprehensive Income (Loss) (“AOCI”) | |||||||

| Balance, beginning of period | (12,395 | ) | (18,477 | ) | |||

| Net foreign currency translation adjustment, net of tax | 34 | (85 | ) | ||||

| Net unrealized gains (losses) on investments, net of tax | 8,998 | 41,531 | |||||

| Net actuarial gains (losses) | — | (178 | ) | ||||

| Balance, end of period | (3,363 | ) | 22,791 | ||||

| Total Stockholders’ Equity | $ | 2,920,425 | $ | 2,660,398 | |||

See Notes to Unaudited Condensed Consolidated Financial Statements.

12

| Radian Group Inc. | |||||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) | |||||||

| (In thousands) | Three Months Ended March 31, | ||||||

| 2017 | 2016 | ||||||

| Cash flows from operating activities: | |||||||

| Net cash provided by (used in) operating activities | $ | 83,932 | $ | 38,929 | |||

| Cash flows from investing activities: | |||||||

| Proceeds from sales of: | |||||||

| Fixed-maturity investments available for sale | 253,121 | 111,099 | |||||

| Equity securities available for sale | — | 74,868 | |||||

| Trading securities | 46,688 | 65,163 | |||||

| Proceeds from redemptions of: | |||||||

| Fixed-maturity investments available for sale | 123,683 | 58,856 | |||||

| Trading securities | 19,543 | 34,105 | |||||

| Purchases of: | |||||||

| Fixed-maturity investments available for sale | (444,873 | ) | (753,660 | ) | |||

| Sales, redemptions and (purchases) of: | |||||||

| Short-term investments, net | 57,923 | 341,365 | |||||

| Other assets and other invested assets, net | 222 | 132 | |||||

| Purchases of property and equipment, net | (7,687 | ) | (6,518 | ) | |||

| Acquisitions, net of cash acquired | (86 | ) | — | ||||

| Net cash provided by (used in) investing activities | 48,534 | (74,590 | ) | ||||

| Cash flows from financing activities: | |||||||

| Dividends paid | (538 | ) | (497 | ) | |||

| Issuance of long-term debt, net | — | 344,139 | |||||

| Purchases and redemptions of long-term debt | (110,160 | ) | (192,722 | ) | |||

| Issuance of common stock | 2,865 | 24 | |||||

| Purchase of common shares | — | (100,188 | ) | ||||

| Excess tax benefits from share-based awards (Note 1) | — | 20 | |||||

| Repayment of other borrowings | (81 | ) | (108 | ) | |||

| Net cash provided by (used in) financing activities | (107,914 | ) | 50,668 | ||||

| Effect of exchange rate changes on cash and restricted cash | 24 | (1 | ) | ||||

| Increase (decrease) in cash and restricted cash | 24,576 | 15,006 | |||||

| Cash and restricted cash, beginning of period | 61,814 | 59,898 | |||||

| Cash and restricted cash, end of period | $ | 86,390 | $ | 74,904 | |||

See Notes to Unaudited Condensed Consolidated Financial Statements.

13

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

1. Condensed Consolidated Financial Statements—Business Overview and Significant Accounting Policies

Business Overview

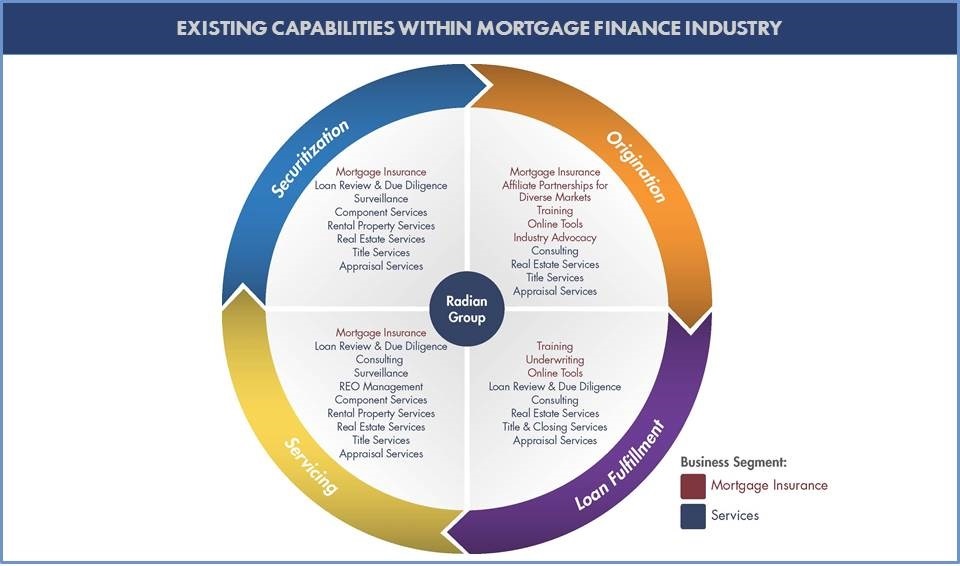

We provide mortgage insurance on first-lien mortgage loans, and products and services to the real estate and mortgage finance industries through our two business segments—Mortgage Insurance and Services.

Mortgage Insurance

Our Mortgage Insurance segment provides credit-related insurance coverage, principally through private mortgage insurance, to mortgage lending institutions nationwide. Private mortgage insurance helps protect mortgage lenders and third-party beneficiaries by mitigating default-related losses on residential mortgage loans. Generally, these loans are made to home buyers who make down payments of less than 20% of the purchase price for their homes. Private mortgage insurance also facilitates the sale of these low down payment mortgage loans in the secondary mortgage market, most of which are sold to the GSEs.

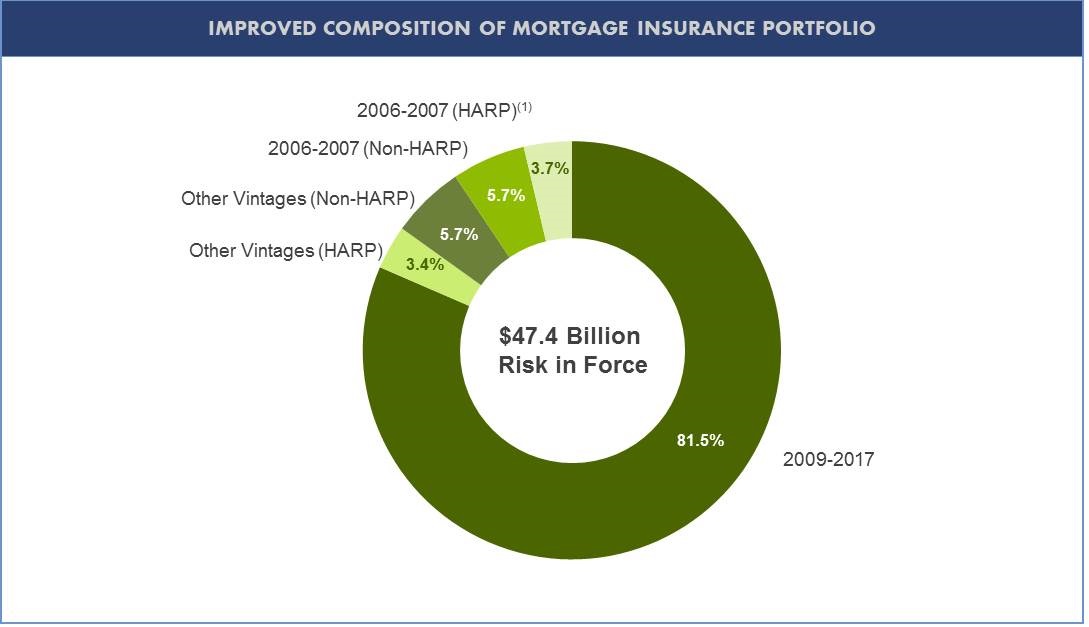

Our Mortgage Insurance segment currently offers primary mortgage insurance coverage on residential first-lien mortgage loans, which comprised 98.0% of our $48.4 billion total direct RIF as of March 31, 2017. At March 31, 2017, Pool Insurance represented 1.9% of our total direct RIF. We provide our mortgage insurance products and services mainly through our wholly-owned subsidiary, Radian Guaranty.

The GSEs and state insurance regulators impose various capital and financial requirements on our insurance subsidiaries. These include Risk-to-capital, other risk-based capital measures and surplus requirements, as well as the PMIERs financial requirements. Failure to comply with these capital and financial requirements may limit the amount of insurance that our insurance subsidiaries may write. The GSEs and state insurance regulators also possess significant discretion with respect to our insurance subsidiaries and their business. See Note 15 for additional regulatory information.

Private mortgage insurers, including Radian Guaranty, are required to comply with the PMIERs to remain eligible insurers of loans purchased by the GSEs. At March 31, 2017, Radian Guaranty is an approved mortgage insurer under the PMIERs and is in compliance with the PMIERs financial requirements.

The PMIERs are comprehensive, covering virtually all aspects of a private mortgage insurer’s business and operations, including internal risk management and quality controls, the relationship between the GSEs and the approved insurer as well as the approved insurer’s financial condition. The GSEs have a broad range of consent rights to approve various actions of the approved insurer. If Radian Guaranty is unable to satisfy the requirements set forth in the PMIERs, the GSEs could restrict it from conducting certain types of business with them or take actions that may include not purchasing loans insured by Radian Guaranty. See Note 1 of Notes to Consolidated Financial Statements in our 2016 Form 10-K for additional information about the PMIERs.

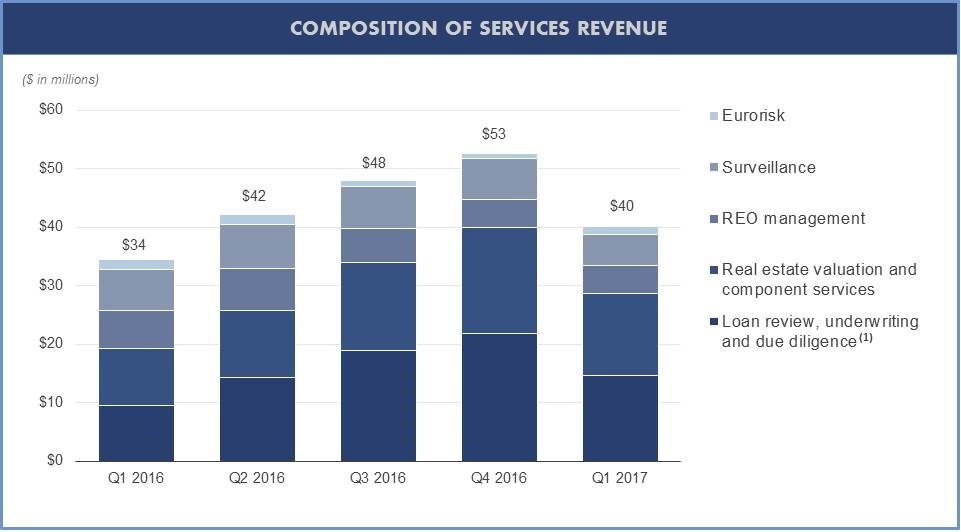

Services

Our Services segment provides services and solutions to the real estate and mortgage finance industries. Our Services segment provides analytics and outsourced services, including residential loan due diligence and underwriting, valuations, servicing surveillance, title and escrow, and consulting services. We provide these services to buyers and sellers of, and investors in, mortgage- and real estate-related loans and securities as well as other consumer ABS. These services and solutions are provided primarily through Clayton and its subsidiaries, including Green River Capital, Red Bell and ValuAmerica. The primary lines of business in our Services segment include:

| • | loan review, underwriting and due diligence; |

| • | real estate valuation and component services that provide outsourcing and technology solutions for the SFR and residential real estate markets, as well as outsourced solutions for appraisal, title and closing services; |

| • | surveillance services, including surveillance services for RMBS and other consumer ABS, loan servicer oversight, loan-level servicing compliance reviews and operational reviews of mortgage servicers and originators; |

| • | REO management services; and |

| • | services for the United Kingdom and European mortgage markets through our EuroRisk operations. |

14

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

First Quarter 2017 Developments

During the first quarter of 2017, we settled our obligations on the remaining $68.0 million aggregate principal amount of our Convertible Senior Notes due 2019. The obligations were settled on January 27, 2017 for a cash payment of $110.1 million and resulted in a loss on induced conversion and debt extinguishment of $4.5 million for the three months ended March 31, 2017. As of the settlement date, this transaction resulted in an aggregate decrease of 6.4 million diluted shares for purposes of determining diluted net income per share. See Note 11 for additional information.

Significant Accounting Policies

Basis of Presentation

Our condensed consolidated financial statements include the accounts of Radian Group Inc. and its subsidiaries. We refer to Radian Group Inc. together with its consolidated subsidiaries as “Radian,” the “Company,” “we,” “us” or “our,” unless the context requires otherwise. We generally refer to Radian Group Inc. alone, without its consolidated subsidiaries, as “Radian Group.” Unless otherwise defined in this report, certain terms and acronyms used throughout this report are defined in the Glossary of Abbreviations and Acronyms included as part of this report.

Our condensed consolidated financial statements are prepared in accordance with GAAP and include the accounts of all wholly-owned subsidiaries. All intercompany accounts and transactions, and intercompany profits and losses, have been eliminated. We have condensed or omitted certain information and footnote disclosures normally included in consolidated financial statements prepared in accordance with GAAP pursuant to the instructions set forth in Article 10 of Regulation S-X of the SEC.

The financial information presented for interim periods is unaudited; however, such information reflects all adjustments that are, in the opinion of management, necessary for the fair statement of the financial position, results of operations, comprehensive income and cash flows for the interim periods presented. Such adjustments are of a normal recurring nature. The year-end condensed balance sheet data was derived from our audited financial statements, but does not include all disclosures required by GAAP. These interim financial statements should be read in conjunction with the audited financial statements and notes thereto included in our 2016 Form 10-K. The results of operations for interim periods are not necessarily indicative of results to be expected for the full year or for any other period. Certain prior period amounts have been reclassified to conform to current period presentation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of our contingent assets and liabilities at the dates of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. While the amounts included in our condensed consolidated financial statements include our best estimates and assumptions, actual results may vary materially.

Other Significant Accounting Policies

See Note 2 of Notes to Consolidated Financial Statements in our 2016 Form 10-K for information regarding other significant accounting policies.

Recent Accounting Pronouncements

Accounting Standards Adopted During 2017. In March 2016, the FASB issued an update to the accounting standards for share-based payment transactions, including: (i) accounting for income taxes; (ii) classification of excess tax benefits on the statement of cash flows; (iii) forfeitures; (iv) minimum statutory tax withholding requirements; (v) classification of employee taxes paid on the statement of cash flows when an employer withholds shares for tax withholding purposes; (vi) the practical expedient for estimating the expected term; and (vii) intrinsic value. Among other things, the update requires: (i) all excess tax benefits and tax deficiencies to be recognized as income tax expense or benefit in the income statement as they occur; (ii) recognition of excess tax benefits, regardless of whether the benefits reduce taxes payable in the current period; and (iii) excess tax benefits to be classified along with other cash flows as an operating activity, rather than separated from other income tax cash flows as a financing activity. This update is effective for public companies for fiscal years beginning after December 15, 2016. Our adoption of this update, effective January 1, 2017, had an immaterial impact on our financial statements at implementation. As a result of implementing this new standard, however, we expect the potential for limited increased volatility in our effective tax rate and net earnings, and possible additional dilution in earnings per share calculations.

15

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

Accounting Standards Not Yet Adopted. In May 2014, the FASB issued an update to the accounting standard regarding revenue recognition. In accordance with the new standard, recognition of revenue occurs when a customer obtains control of promised goods or services, in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In addition, the new standard requires that reporting companies disclose the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. This update is not expected to change revenue recognition principles related to our investments and insurance products, which combined represent a significant portion of our total revenues. This update is primarily applicable to revenues from our Services segment. In July 2015, the FASB delayed the effective date for this updated standard for public companies to interim and annual periods beginning after December 15, 2017, and subsequently issued various clarifying updates. Early adoption is permitted. This standard permits the use of the retrospective or cumulative effective transition method. We are currently in the process of categorizing the Services revenues to evaluate the impact to our financial statements and future disclosures as a result of the updates.

In January 2016, the FASB issued an update that makes certain changes to the standard for the accounting of financial instruments. Among other things, the update requires: (i) equity investments to be measured at fair value with changes in fair value recognized in net income; (ii) the use of the exit price notion when measuring the fair value of financial instruments for disclosure purposes; (iii) separate presentation of financial assets and financial liabilities by measurement category and form of financial asset; and (iv) separate presentation in other comprehensive income of the portion of the total change in the fair value of a liability resulting from a change in the instrument-specific credit risk (also referred to as “own credit”) when the organization has elected to measure the liability at fair value in accordance with the fair value option for financial instruments. The update also eliminates the requirement to disclose the methods and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost on the balance sheet. This update is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. Early adoption is not permitted, with the exception of the “own credit” provision. We are currently evaluating the impact to our financial statements and future disclosures as a result of this update, but we do not expect the impact to be material due to our currently insignificant investments in equity securities and our investment strategy.

In February 2016, the FASB issued an update that replaces the existing accounting and disclosure requirements for leases of property, plant and equipment. The update requires lessees to recognize, as of the lease commencement date, assets and liabilities for all leases with lease terms of more than 12 months, which is a change from the current GAAP requirement to recognize only capital leases on the balance sheet. Pursuant to the new standard, the liability initially recognized for the lease obligation is equal to the present value of the lease payments not yet made, discounted over the lease term at the implicit interest rate of the lease, if available, or otherwise at the lessee’s incremental borrowing rate. The lessee is also required to recognize an asset for its right to use the underlying asset for the lease term, based on the liability subject to certain adjustments, such as for initial direct costs. Leases are required to be classified as either operating or finance, with expense on operating leases recorded as a single lease cost on a straight-line basis. For finance leases, interest expense on the lease liability is required to be recognized separately from the straight-line amortization of the right-of-use asset. Quantitative disclosures are required for certain items, including the cost of leases, the weighted-average remaining lease term, the weighted-average discount rate and a maturity analysis of lease liabilities. Additional qualitative disclosures are also required regarding the nature of the leases, such as basis, terms and conditions of: (i) variable interest payments; (ii) extension and termination options; and (iii) residual value guarantees. This update is effective for public companies for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption is permitted. The new standard must be adopted by applying the new guidance as of the beginning of the earliest comparative period presented, using a modified retrospective transition approach with certain optional practical expedients. We are currently evaluating the impact to our financial statements and future disclosures as a result of this update.

In June 2016, the FASB issued an update to the accounting standard regarding the measurement of credit losses on financial instruments. This update requires that financial assets measured at their amortized cost basis be presented at the net (of allowance for credit losses) amount expected to be collected. Credit losses relating to available-for-sale debt securities are to be recorded through an allowance for credit losses, rather than a write-down of the asset, with the amount of the allowance limited to the amount by which fair value is less than amortized cost. This update is effective for public companies for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is permitted as of the fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. We are currently evaluating the impact to our financial statements and future disclosures as a result of this update.

16

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

In October 2016, the FASB issued an update to the accounting standard regarding the accounting for income taxes. This update requires an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. This update will be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. This update is effective for public companies for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years. Early adoption is permitted, including adoption in the first interim period of the adoption year. We are currently evaluating the impact to our financial statements and future disclosures as a result of this update.

In January 2017, the FASB issued an update to the accounting standard regarding goodwill and other intangibles. This update simplifies the subsequent measurement of goodwill by eliminating step two of the goodwill impairment test. Instead, an entity should perform its annual or interim goodwill impairment test by comparing the fair value of a reporting unit with its carrying amount and recognize an impairment charge for any excess of the reporting unit’s carrying amount over the reporting unit’s estimated fair value. The provisions of this update are effective for interim and annual goodwill impairment tests in fiscal years beginning after December 15, 2019, with early adoption permitted for interim or annual goodwill impairment tests performed after January 1, 2017. We intend to early adopt this update, effective as of our next quantitative goodwill impairment test.

In March 2017, the FASB issued an update to the accounting standard regarding receivables. The new standard requires certain premiums on purchased callable debt securities to be amortized to the earliest call date. The amortization period for callable debt securities purchased at a discount will not be impacted. The provisions of this update are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. Early adoption is permitted, including adoption in an interim period. We are currently evaluating the impact to our financial statements and future disclosures as a result of this update.

2. Net Income Per Share

Basic net income per share is computed by dividing net income by the weighted-average number of common shares outstanding, while diluted net income per share is computed by dividing net income attributable to common shareholders by the sum of the weighted-average number of common shares outstanding and the weighted-average number of dilutive potential common shares. Dilutive potential common shares relate to our share-based compensation arrangements and our outstanding convertible senior notes.

17

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

The calculation of basic and diluted net income per share was as follows:

| Three Months Ended March 31, | |||||||

| (In thousands, except per-share amounts) | 2017 | 2016 | |||||

| Net income—basic | $ | 76,472 | $ | 66,249 | |||

Adjustment for dilutive Convertible Senior Notes due 2019, net of tax (1) | (215 | ) | 3,390 | ||||

| Net income—diluted | $ | 76,257 | $ | 69,639 | |||

| Average common shares outstanding—basic | 214,925 | 203,706 | |||||

Dilutive effect of Convertible Senior Notes due 2017 (2) | 701 | — | |||||

| Dilutive effect of Convertible Senior Notes due 2019 | 1,854 | 33,583 | |||||

Dilutive effect of share-based compensation arrangements (2) | 4,017 | 2,418 | |||||

| Adjusted average common shares outstanding—diluted | 221,497 | 239,707 | |||||

| Net income per share: | |||||||

| Basic | $ | 0.36 | $ | 0.33 | |||

| Diluted | $ | 0.34 | $ | 0.29 | |||

______________________

| (1) | As applicable, includes coupon interest, amortization of discount and fees, and other changes in income or loss that would result from the assumed conversion. Due to the January 2017 settlement of our obligations on the remaining Convertible Senior Notes due 2019, a benefit was recorded to adjust estimated accrued expense to actual amounts. |

| (2) | The following number of shares of our common stock equivalents issued under our share-based compensation arrangements and convertible debt were not included in the calculation of diluted net income per share because they were anti-dilutive: |

| Three Months Ended March 31, | ||||

| (In thousands) | 2017 | 2016 | ||

| Shares of common stock equivalents | 445 | 709 | ||

| Shares of Convertible Senior Notes due 2017 | — | 1,902 | ||

3. Segment Reporting

We have two strategic business units that we manage separately—Mortgage Insurance and Services. Adjusted pretax operating income (loss) for each segment represents segment results on a standalone basis; therefore, inter-segment eliminations and reclassifications required for consolidated GAAP presentation have not been reflected.

In the fourth quarter of 2016, we completed an organizational change that resulted in a change to our segment financial reporting structure. Previously, contract underwriting activities on behalf of third parties were reported in either the Mortgage Insurance segment or the Services segment, based on the customer relationship. Management responsibility for this contract underwriting business was moved entirely to the Services segment. This organizational change resulted in the transfer to the Services segment of revenue and expenses for all contract underwriting performed on behalf of third parties. This change aligns with recent changes in personnel reporting lines and management oversight, and is consistent with the way the chief operating decision maker began assessing the performance of the reportable segments in the fourth quarter of 2016. As a result, on a segment basis, Services revenue, cost of services and other operating expenses have increased, with offsetting reductions in Mortgage Insurance other income and other operating expenses. This change has been reflected in our segment operating results. Mortgage Insurance underwriting continues to be reported as an expense in the Mortgage Insurance segment.

18

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

We include underwriting-related expenses for mortgage insurance, based on a pro-rata volume of mortgage applications excluding third-party contract underwriting services, in our Mortgage Insurance segment’s other operating expenses before corporate allocations. We include underwriting-related expenses for third-party contract underwriting services, based on a pro-rata volume of mortgage applications, in our Services segment’s cost of services and other operating expenses before corporate allocations, as applicable.

We allocate to our Mortgage Insurance segment: (i) corporate expenses based on an allocated percentage of time spent on the Mortgage Insurance segment; (ii) all interest expense except for interest expense related to the Senior Notes due 2019 that were issued to fund our purchase of Clayton; and (iii) all corporate cash and investments.

We allocate to our Services segment: (i) corporate expenses based on an allocated percentage of time spent on the Services segment and (ii) as noted above, all interest expense related to the Senior Notes due 2019. No material corporate cash or investments are allocated to the Services segment. Inter-segment activities are recorded at market rates for segment reporting and eliminated in consolidation.

Adjusted Pretax Operating Income (Loss)

Our senior management, including our Chief Executive Officer (Radian’s chief operating decision maker), uses adjusted pretax operating income (loss) as our primary measure to evaluate the fundamental financial performance of each of Radian’s business segments and to allocate resources to the segments. Adjusted pretax operating income (loss) is defined as pretax income (loss) excluding the effects of: (i) net gains (losses) on investments and other financial instruments; (ii) loss on induced conversion and debt extinguishment; (iii) acquisition-related expenses; (iv) amortization and impairment of intangible assets; and (v) net impairment losses recognized in earnings.

Although adjusted pretax operating income (loss) excludes certain items that have occurred in the past and are expected to occur in the future, the excluded items represent those that are: (i) not viewed as part of the operating performance of our primary activities or (ii) not expected to result in an economic impact equal to the amount reflected in consolidated pretax income (loss). These adjustments, along with the reasons for their treatment, are described below.

| (1) | Net gains (losses) on investments and other financial instruments. The recognition of realized investment gains or losses can vary significantly across periods as the activity is highly discretionary based on the timing of individual securities sales due to such factors as market opportunities, our tax and capital profile and overall market cycles. Unrealized investment gains and losses arise primarily from changes in the market value of our investments that are classified as trading securities. These valuation adjustments may not necessarily result in realized economic gains or losses. |

Trends in the profitability of our fundamental operating activities can be more clearly identified without the fluctuations of these realized and unrealized gains or losses. We do not view them to be indicative of our fundamental operating activities. Therefore, these items are excluded from our calculation of adjusted pretax operating income (loss).

| (2) | Loss on induced conversion and debt extinguishment. Gains or losses on early extinguishment of debt and losses incurred to purchase our convertible debt prior to maturity are discretionary activities that are undertaken in order to take advantage of market opportunities to strengthen our financial and capital positions; therefore, we do not view these activities as part of our operating performance. Such transactions do not reflect expected future operations and do not provide meaningful insight regarding our current or past operating trends. Therefore, these items are excluded from our calculation of adjusted pretax operating income (loss). |

| (3) | Acquisition-related expenses. Acquisition-related expenses represent the costs incurred to effect an acquisition of a business (i.e., a business combination). Because we pursue acquisitions on a strategic and selective basis and not in the ordinary course of our business, we do not view acquisition-related expenses as a consequence of a primary business activity. Therefore, we do not consider these expenses to be part of our operating performance and they are excluded from our calculation of adjusted pretax operating income (loss). |

| (4) | Amortization and impairment of intangible assets. Amortization of intangible assets represents the periodic expense required to amortize the cost of intangible assets over their estimated useful lives. Intangible assets with an indefinite useful life are also periodically reviewed for potential impairment, and impairment adjustments are made whenever appropriate. These charges are not viewed as part of the operating performance of our primary activities and therefore are excluded from our calculation of adjusted pretax operating income (loss). |

19

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

| (5) | Net impairment losses recognized in earnings. The recognition of net impairment losses on investments can vary significantly in both size and timing, depending on market credit cycles. We do not view these impairment losses to be indicative of our fundamental operating activities. Therefore, whenever these losses occur, we exclude them from our calculation of adjusted pretax operating income (loss). |

Summarized operating results for our segments as of and for the periods indicated, are as follows:

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 (1) | |||||

| Mortgage Insurance | |||||||

Net premiums written—insurance (2) | $ | 224,665 | $ | 26,310 | |||

| (Increase) decrease in unearned premiums | (2,865 | ) | 194,640 | ||||

| Net premiums earned—insurance | 221,800 | 220,950 | |||||

| Net investment income | 31,032 | 27,201 | |||||

| Other income | 746 | 666 | |||||

Total (3) | 253,578 | 248,817 | |||||

| Provision for losses | 47,232 | 43,275 | |||||

| Policy acquisition costs | 6,729 | 6,389 | |||||

| Other operating expenses before corporate allocations | 39,289 | 32,546 | |||||

Total (4) | 93,250 | 82,210 | |||||

| Adjusted pretax operating income before corporate allocations | 160,328 | 166,607 | |||||

| Allocation of corporate operating expenses | 14,186 | 9,329 | |||||

| Allocation of interest expense | 11,509 | 17,112 | |||||

| Adjusted pretax operating income | $ | 134,633 | $ | 140,166 | |||

______________________

| (1) | Reflects changes to align our segment reporting structure with recent changes in personnel reporting lines and management oversight related to contract underwriting performed on behalf of third parties. Revenue and expenses for this business are now reflected in the Services segment. As a result, Services revenue, cost of services and other operating expenses have increased, with offsetting reductions in Mortgage Insurance other income and other operating expenses. |

| (2) | Net of ceded premiums written under the QSR Transactions and the Single Premium QSR Transaction. See Note 7 for additional information. |

| (3) | Excludes net losses on investments and other financial instruments of $2.9 million for the three months ended March 31, 2017, and net gains on investments and other financial instruments of $31.3 million for the three months ended March 31, 2016, not included in adjusted pretax operating income. |

| (4) | Includes inter-segment expenses as follows: |

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 | |||||

| Inter-segment expenses | $ | 2,062 | $ | 1,599 | |||

20

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 (1) | |||||

| Services | |||||||

Services revenue (2) | $ | 40,089 | $ | 34,448 | |||

| Cost of services | 28,690 | 23,854 | |||||

| Other operating expenses before corporate allocations | 12,604 | 14,368 | |||||

| Total | 41,294 | 38,222 | |||||

| Adjusted pretax operating income (loss) before corporate allocations | (1,205 | ) | (3,774 | ) | |||

| Allocation of corporate operating expenses | 3,718 | 1,751 | |||||

| Allocation of interest expense | 4,429 | 4,422 | |||||

| Adjusted pretax operating income (loss) | $ | (9,352 | ) | $ | (9,947 | ) | |

______________________

| (1) | Reflects changes to align our segment reporting structure with recent changes in personnel reporting lines and management oversight related to contract underwriting performed on behalf of third parties. Revenue and expenses for this business are now reflected in the Services segment. As a result, Services revenue, cost of services and other operating expenses have increased, with offsetting reductions in Mortgage Insurance other income and other operating expenses. |

| (2) | Includes inter-segment revenues as follows: |

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 | |||||

| Inter-segment revenues | $ | 2,062 | $ | 1,599 | |||

Selected balance sheet information for our segments, as of the periods indicated, is as follows:

| At March 31, 2017 | |||||||||||

| (In thousands) | Mortgage Insurance | Services | Total | ||||||||

| Total assets | $ | 5,475,502 | $ | 352,258 | $ | 5,827,760 | |||||

| At December 31, 2016 | |||||||||||

| (In thousands) | Mortgage Insurance | Services | Total | ||||||||

| Total assets | $ | 5,506,338 | $ | 356,836 | $ | 5,863,174 | |||||

21

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

The reconciliation of adjusted pretax operating income to consolidated pretax income is as follows:

| Three Months Ended March 31, | |||||||

| (In thousands) | 2017 | 2016 | |||||

| Adjusted pretax operating income (loss): | |||||||

Mortgage Insurance (1) | $ | 134,633 | $ | 140,166 | |||

Services (1) | (9,352 | ) | (9,947 | ) | |||

| Total adjusted pretax operating income | 125,281 | 130,219 | |||||

| Net gains (losses) on investments and other financial instruments | (2,851 | ) | 31,286 | ||||

| Loss on induced conversion and debt extinguishment | (4,456 | ) | (55,570 | ) | |||

Acquisition-related expenses (2) | (8 | ) | (205 | ) | |||

| Amortization and impairment of intangible assets | (3,296 | ) | (3,328 | ) | |||

| Consolidated pretax income | $ | 114,670 | $ | 102,402 | |||

______________________

| (1) | Includes inter-segment expenses and revenues as listed in the notes to the preceding tables. |

| (2) | Acquisition-related expenses represent expenses incurred to effect the acquisition of a business, net of adjustments to accruals previously recorded for acquisition expenses. |

On a consolidated basis, “adjusted pretax operating income” is a measure not determined in accordance with GAAP. Total adjusted pretax operating income is not a measure of total profitability, and therefore should not be viewed as a substitute for GAAP pretax income. Our definition of adjusted pretax operating income may not be comparable to similarly-named measures reported by other companies.

4. Fair Value of Financial Instruments

Available for sale securities, trading securities and certain other assets are recorded at fair value. All changes in the fair value of trading securities and certain other assets are included in our condensed consolidated statements of operations. All changes in the fair value of available for sale securities are recorded in AOCI. There were no significant changes to our fair value methodologies during the three months ended March 31, 2017.

In accordance with GAAP, we established a three-level valuation hierarchy for disclosure of fair value measurements based on the transparency of inputs to the valuation of an asset or liability as of the measurement date. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level I measurements) and the lowest priority to unobservable inputs (Level III measurements). The level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the measurement in its entirety. The three levels of the fair value hierarchy are defined below:

| Level I | — Unadjusted quoted prices for identical assets or liabilities in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

| Level II | — Prices or valuations based on observable inputs other than quoted prices in active markets for identical assets and liabilities; and |

| Level III | — Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable. Level III inputs are used to measure fair value only to the extent that observable inputs are not available. |

The level of market activity used to determine the fair value hierarchy is based on the availability of observable inputs market participants would use to price an asset or a liability, including market value price observations. We provide a qualitative description of the valuation techniques and inputs used for recurring and non-recurring fair value measurements in our audited financial statements and notes thereto included in our 2016 Form 10-K. For a complete understanding of the valuation techniques and inputs used as of March 31, 2017, these unaudited condensed consolidated financial statements should be read in conjunction with the audited financial statements and notes thereto included in our 2016 Form 10-K.

22

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

The following is a list of assets that are measured at fair value by hierarchy level as of March 31, 2017:

| (In thousands) | Level I | Level II | Level III | Total | |||||||||||

| Assets at Fair Value | |||||||||||||||

| Investment Portfolio: | |||||||||||||||

| U.S. government and agency securities | $ | 267,524 | $ | 4,906 | $ | — | $ | 272,430 | |||||||

| State and municipal obligations | — | 341,197 | — | 341,197 | |||||||||||

| Money market instruments | 384,225 | — | — | 384,225 | |||||||||||

| Corporate bonds and notes | — | 2,115,001 | — | 2,115,001 | |||||||||||

| RMBS | — | 309,460 | — | 309,460 | |||||||||||

| CMBS | — | 473,505 | — | 473,505 | |||||||||||

| Other ABS | — | 488,340 | — | 488,340 | |||||||||||

| Foreign government and agency securities | — | 38,035 | — | 38,035 | |||||||||||

| Equity securities | — | 830 | 500 | 1,330 | |||||||||||

Other investments (1) | — | 12,720 | 500 | 13,220 | |||||||||||

Total Investments at Fair Value (2) | 651,749 | 3,783,994 | 1,000 | 4,436,743 | |||||||||||

| Total Assets at Fair Value | $ | 651,749 | $ | 3,783,994 | $ | 1,000 | $ | 4,436,743 | |||||||

______________________

| (1) | Comprising short-term certificates of deposit and commercial paper, included within Level II, and convertible notes of non-reporting issuers, included within Level III. |

| (2) | Does not include certain other invested assets ($1.0 million), primarily invested in limited partnerships, accounted for as cost-method investments and not measured at fair value. |

The following is a list of assets that are measured at fair value by hierarchy level as of December 31, 2016:

| (In thousands) | Level I | Level II | Level III | Total | |||||||||||

| Assets at Fair Value | |||||||||||||||

| Investment Portfolio: | |||||||||||||||

| U.S. government and agency securities | $ | 237,479 | $ | — | $ | — | $ | 237,479 | |||||||

| State and municipal obligations | — | 358,536 | — | 358,536 | |||||||||||

| Money market instruments | 431,472 | — | — | 431,472 | |||||||||||

| Corporate bonds and notes | — | 2,024,205 | — | 2,024,205 | |||||||||||

| RMBS | — | 388,842 | — | 388,842 | |||||||||||

| CMBS | — | 507,273 | — | 507,273 | |||||||||||

| Other ABS | — | 450,128 | — | 450,128 | |||||||||||

| Foreign government and agency securities | — | 32,807 | — | 32,807 | |||||||||||

| Equity securities | — | 830 | 500 | 1,330 | |||||||||||

Other investments (1) | — | 28,663 | 500 | 29,163 | |||||||||||

Total Investments at Fair Value (2) | 668,951 | 3,791,284 | 1,000 | 4,461,235 | |||||||||||

| Total Assets at Fair Value | $ | 668,951 | $ | 3,791,284 | $ | 1,000 | $ | 4,461,235 | |||||||

______________________

| (1) | Comprising short-term certificates of deposit and commercial paper, included within Level II, and convertible notes of non-reporting issuers, included within Level III. |

| (2) | Does not include certain other invested assets ($1.2 million), primarily invested in limited partnerships, accounted for as cost-method investments and not measured at fair value. |

23

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

At both March 31, 2017 and December 31, 2016, total Level III assets of $1.0 million accounted for less than 0.1% of total assets measured at fair value. Within other investments is a Level III investment which was purchased during the three months ended June 30, 2016, and there were no related gains or losses recorded during the three months ended March 31, 2017 or the year ended December 31, 2016. Within equity securities is a Level III investment that was purchased during the three months ended June 30, 2015, and there were no related gains or losses recorded during the three months ended March 31, 2017 or the year ended December 31, 2016. There were no Level III liabilities at March 31, 2017 or December 31, 2016.

There were no transfers between Level I and Level II for the three months ended March 31, 2017 and 2016. There were also no transfers involving Level III assets or liabilities for the three months ended March 31, 2017 and 2016.

Other Fair Value Disclosure

The carrying value and estimated fair value of other selected assets and liabilities not carried at fair value on our condensed consolidated balance sheets were as follows as of the dates indicated:

| March 31, 2017 | December 31, 2016 | ||||||||||||||

| (In thousands) | Carrying Amount | Estimated Fair Value | Carrying Amount | Estimated Fair Value | |||||||||||

| Assets: | |||||||||||||||

| Other invested assets | $ | 973 | $ | 3,751 | $ | 1,195 | $ | 3,789 | |||||||

| Liabilities: | |||||||||||||||

| Long-term debt | 1,008,777 | 1,104,711 | 1,069,537 | 1,214,471 | |||||||||||

5. Investments

Available for Sale Securities

Our available for sale securities within our investment portfolio consisted of the following as of the dates indicated:

| March 31, 2017 | |||||||||||||||

| (In thousands) | Amortized Cost | Fair Value | Gross Unrealized Gains | Gross Unrealized Losses | |||||||||||

| Fixed-maturities available for sale: | |||||||||||||||

| U.S. government and agency securities | $ | 128,347 | $ | 125,466 | $ | 279 | $ | 3,160 | |||||||

| State and municipal obligations | 67,600 | 69,284 | 2,316 | 632 | |||||||||||

| Corporate bonds and notes | 1,555,516 | 1,556,643 | 17,823 | 16,696 | |||||||||||

| RMBS | 278,710 | 273,549 | 445 | 5,606 | |||||||||||

| CMBS | 402,847 | 402,525 | 2,248 | 2,570 | |||||||||||

| Other ABS | 477,251 | 478,099 | 1,945 | 1,097 | |||||||||||

| Foreign government and agency securities | 29,257 | 29,849 | 645 | 53 | |||||||||||

| Other investments | 2,000 | 2,000 | — | — | |||||||||||

| Total fixed-maturities available for sale | 2,941,528 | 2,937,415 | 25,701 | 29,814 | |||||||||||

Equity securities available for sale (1) | 1,330 | 1,330 | — | — | |||||||||||

| Total debt and equity securities | $ | 2,942,858 | $ | 2,938,745 | $ | 25,701 | $ | 29,814 | |||||||

______________________

| (1) | Primarily consists of investments in Federal Home Loan Bank stock as required in connection with the memberships of Radian Guaranty and Radian Reinsurance in the Federal Home Loan Bank of Pittsburgh. |

24

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)

| December 31, 2016 | |||||||||||||||

| (In thousands) | Amortized Cost | Fair Value | Gross Unrealized Gains | Gross Unrealized Losses | |||||||||||

| Fixed-maturities available for sale: | |||||||||||||||

| U.S. government and agency securities | $ | 78,931 | $ | 75,474 | $ | 2 | $ | 3,459 | |||||||

| State and municipal obligations | 66,124 | 67,171 | 1,868 | 821 | |||||||||||

| Corporate bonds and notes | 1,463,720 | 1,455,628 | 14,320 | 22,412 | |||||||||||

| RMBS | 358,262 | 350,628 | 197 | 7,831 | |||||||||||

| CMBS | 429,057 | 428,289 | 2,255 | 3,023 | |||||||||||

| Other ABS | 433,603 | 434,728 | 2,037 | 912 | |||||||||||

| Foreign government and agency securities | 24,771 | 24,594 | 148 | 325 | |||||||||||

| Other investments | 2,000 | 2,000 | — | — | |||||||||||

| Total fixed-maturities available for sale | 2,856,468 | 2,838,512 | 20,827 | 38,783 | |||||||||||

Equity securities available for sale (1) | 1,330 | 1,330 | — | — | |||||||||||

| Total debt and equity securities | $ | 2,857,798 | $ | 2,839,842 | $ | 20,827 | $ | 38,783 | |||||||

______________________

| (1) | Primarily consists of investments in Federal Home Loan Bank stock as required in connection with the memberships of Radian Guaranty and Radian Reinsurance in the Federal Home Loan Bank of Pittsburgh. |

Gross Unrealized Losses and Fair Value of Available for Sale Securities

The following tables show the gross unrealized losses and fair value of our securities deemed “available for sale” aggregated by investment category and length of time that individual securities have been in a continuous unrealized loss position, as of the dates indicated:

| March 31, 2017 | ||||||||||||||||||||||||||||||||

($ in thousands) Description of Securities | Less Than 12 Months | 12 Months or Greater | Total | |||||||||||||||||||||||||||||

# of securities | Fair Value | Unrealized Losses | # of securities | Fair Value | Unrealized Losses | # of securities | Fair Value | Unrealized Losses | ||||||||||||||||||||||||

| U.S. government and agency securities | 9 | $ | 74,457 | $ | 3,160 | — | $ | — | $ | — | 9 | $ | 74,457 | $ | 3,160 | |||||||||||||||||

| State and municipal obligations | 5 | 19,981 | 632 | — | — | — | 5 | 19,981 | 632 | |||||||||||||||||||||||

| Corporate bonds and notes | 150 | 620,609 | 16,360 | 2 | 4,471 | 336 | 152 | 625,080 | 16,696 | |||||||||||||||||||||||

| RMBS | 54 | 217,577 | 5,541 | 3 | 7,308 | 65 | 57 | 224,885 | 5,606 | |||||||||||||||||||||||

| CMBS | 38 | 186,354 | 2,519 | 3 | 9,924 | 51 | 41 | 196,278 | 2,570 | |||||||||||||||||||||||

| Other ABS | 75 | 186,578 | 949 | 5 | 21,978 | 148 | 80 | 208,556 | 1,097 | |||||||||||||||||||||||

| Foreign government and agency securities | 4 | 4,321 | 53 | — | — | — | 4 | 4,321 | 53 | |||||||||||||||||||||||

| Total | 335 | $ | 1,309,877 | $ | 29,214 | 13 | $ | 43,681 | $ | 600 | 348 | $ | 1,353,558 | $ | 29,814 | |||||||||||||||||

25

Radian Group Inc.

Notes to Unaudited Condensed Consolidated Financial Statements — (Continued)