As filed with the Securities and Exchange Commission on May 23, 2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM N-CSR/A

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-07168)

Hennessy Funds Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Neil J. Hennessy

7250 Redwood Blvd., Suite 200

Novato, CA 94945

(Name and address of agent for service)

(Name and address of agent for service)

800-966-4354

Registrant’s telephone number, including area code

Date of fiscal year end: October 31, 2016

Date of reporting period: October 31, 2016

Explanatory Note

On January 6, 2017, the undersigned registrant filed its Certified Shareholder Report on Form N-CSR for the annual period ended October 31, 2016. The registrant hereby amends the original Certified Shareholder Report on Form N-CSR by amending and restating Item 1, “Report to Stockholders,” only with respect to the Hennessy Cornerstone Mid Cap 30 Fund, to correct (1) the amounts for “Capital stock” and “Unrealized net appreciation on investments” under the subheading “Net Assets Consist Of:” in the Statement of Assets and Liabilities and (2) the amounts for “Other accumulated loss” and “Total accumulated loss” in Footnote 8 in the Notes to the Financial Statements.

This amendment does not reflect events occurring after the filing of the original Certified Shareholder Report on Form N-CSR for the annual period ended October 31, 2016, and, other than amending and restating Item 1, “Report to Stockholders,” for the Hennessy Cornerstone Mid Cap 30 Fund, does not modify or update the disclosures in the original Certified Shareholder Report on Form N-CSR in any way.

HENNESSY FUNDS

Supplement dated May 23, 2017, to the

Hennessy Cornerstone Mid Cap 30 Fund Annual Report for the period ended October 31, 2016

We are providing this supplement to the Hennessy Cornerstone Mid Cap 30 Fund Annual Report for the period ended October 31, 2016, to correct (1) the amounts for “Capital stock” and “Unrealized net appreciation on investments” under the subheading “Net Assets Consist Of:” in the Statement of Assets and Liabilities and (2) the amounts for “Other accumulated loss” and “Total accumulated loss” (now labeled “Total accumulated gain”) in Footnote 8 in the Notes to the Financial Statements.

On page 11 of the Annual Report, the “Net Assets Consist Of:” subsection is hereby replaced in its entirety by the first table below. Additionally, on page 24 of the Annual Report, the table under Footnote 8, Federal Tax Information, is hereby replaced in its entirety by the second table below.

This Supplement provides additional information beyond that contained in the Annual Report and should be read in conjunction with the Annual Report.

Excerpt from page 11:

| NET ASSETS CONSIST OF: | ||||

Capital stock(1) | $ | 1,042,655,967 | ||

| Accumulated net investment loss | (1,670,147 | ) | ||

| Accumulated net realized gain on investments | 4,701,455 | |||

Unrealized net appreciation on investments(1) | 194,429,376 | |||

| Total Net Assets | $ | 1,240,116,651 | ||

Excerpt from page 24:

| Cost of investments for tax purposes | $ | 1,054,679,591 | ||

| Gross tax unrealized appreciation | $ | 277,332,537 | ||

| Gross tax unrealized depreciation | (86,056,399 | ) | ||

| Net tax unrealized appreciation | $ | 191,276,138 | ||

| Undistributed ordinary income | $ | — | ||

| Undistributed long-term capital gains | 7,854,693 | |||

| Total distributable earnings | $ | 7,854,693 | ||

Other accumulated loss(2) | $ | (1,670,147 | ) | |

Total accumulated gain (2) | $ | 197,460,684 |

1 | “Capital stock” and “unrealized net appreciation on investments” include an adjustment to correct a clerical error. Capital stock was reduced by $257,627,279 and unrealized net appreciation on investments was increased by the same amount to correct the error. This adjustment had no impact on total net assets, net asset values per share, or the Financial Highlights of the Fund. |

2 | “Other accumulated loss” and “Total accumulated gain” (previously labeled “Total accumulated loss”) include an adjustment to correct a clerical error. Other accumulated loss and total accumulated gain were both increased by $257,627,279. This adjustment had no impact on total net assets, net asset values per share, or the Financial Highlights of the Fund. |

Item 1. Reports to Stockholders.

ANNUAL REPORT

OCTOBER 31, 2016

HENNESSY CORNERSTONE

MID CAP 30 FUND

Investor Class HFMDX

Institutional Class HIMDX

hennessyfunds.com | 1-800-966-4354

(This Page Intentionally Left Blank.)

| CONTENTS |

Contents

| Letter to Shareholders | 2 | ||

| Performance Overview | 4 | ||

| Financial Statements | |||

| Schedule of Investments | 7 | ||

| Statement of Assets and Liabilities | 11 | ||

| Statement of Operations | 12 | ||

| Statements of Changes in Net Assets | 13 | ||

| Financial Highlights | 14 | ||

| Notes to the Financial Statements | 18 | ||

| Report of Independent Registered Public Accounting Firm | 26 | ||

| Trustees and Officers of the Fund | 27 | ||

| Expense Example | 30 | ||

| Proxy Voting | 32 | ||

| Quarterly Filings on Form N-Q | 32 | ||

| Federal Tax Distribution Information | 32 | ||

| Householding | 32 | ||

| Privacy Policy | 33 |

| HENNESSY FUNDS | 1-800-966-4354 |

December 2016

Dear Hennessy Funds Shareholder:

Over the past year investors here in the U.S. and around the world have weathered a great deal of turmoil, especially in the political arena. Foremost, the bitterly divisive and all-consuming U.S. Presidential election, with its unanticipated outcome, is finally behind us. While the equity markets were jittery at first, they now appear more comfortable with the prospect of a Trump presidency and seem to be looking forward to diminished government regulation and intervention.

The Brexit vote in the U.K. cast a shadow over the European Union’s future. There remains uncertainty over the details and timing of the break and the economic consequences for both Britain and Europe, but early signs suggest the impact on growth in Britain will not be as severe as initially feared.

Additionally, uncertainty over whether the Federal Reserve would raise short-term interest rates has hung over the economy for well over a year now. The effects that higher rates could have on growth, the strength of the U.S. Dollar, corporate profits and loan supply and demand seem to have weighed heavily on investors, causing paralysis and money to remain on the sidelines of the market.

Despite all these concerns, U.S. equity markets have pushed higher, with both the Dow Jones Industrial Average and S&P 500 Index posting returns of approximately 5% during the twelve-month period ended October 31, 2016. The U.S. economy has continued to grow at a respectable annual rate of about 2%, and corporate profits have started to move higher. Today, as of mid-December, bond and Treasury yields have risen a bit from record lows just this summer, and the bond market is finishing the year on slightly rocky footing. Bond yields are still very low relative to historical averages, while the prospective PE multiples for the Dow Jones Industrial Average and S&P 500 Index are just above long-term averages at 18.0x and 18.9x, respectively. We believe that equity valuations could go considerably higher and still be at appropriate levels relative to bond yields. And, while we do expect the Fed to raise interest rates in the coming year, we believe that inflation will stay under control, so that short-term interest rates will not have to rise too fast or too far.

As I reflect over the past twelve months, what I realize is that many of the worries this year are not new. For the past several years, American businesses have operated in an environment characterized by highly partisan politics, mounting regulations, uncertainty over interest rates, and a lack of clarity regarding taxes and healthcare costs. Despite all these headwinds, U.S. corporations have been incredibly resilient and found ways to impress investors. If the newly elected administration follows through on campaign promises of reigning in regulation, lowering taxes for corporations and individuals, or reforming healthcare to drive down costs, then companies, which are already lean, should be able to post higher profits. And, that growth should lead to more jobs and a stronger economy, potentially creating a very positive cycle going forward.

With the bull market in U.S. equities entering its ninth year, many believe the economy is due for a recession and the market is due for a downturn. But, the euphoria that usually accompanies a peak in the market is absent. Since the recovery began after the financial crisis, I have found myself pondering the bull run of 1982 to 2000, powered, in part, by a significant increase in valuations. I believe today’s market displays the fundamentals to sustain a similarly strong and lengthy bull market. Meanwhile, companies are largely profitable and many corporate balance sheets are cash-rich, with

HENNESSYFUNDS.COM

2

| LETTER TO SHAREHOLDERS |

relatively little debt. Unemployment is low and real wages are rising, helping to drive consumption. We are hopeful that these factors will provide support for positive market returns in the year to come.

Thank you for your continued confidence and investment in our funds. If you have any questions or would like to speak with us directly, please don’t hesitate to call us at (800) 966-4354.

Best regards,

Neil J. Hennessy

President and Chief Investment Officer

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible.

Opinions expressed are those of Neil Hennessy and are subject to change, are not guaranteed and should not be considered investment advice.

The Dow Jones Industrial Average and S&P 500 Index are unmanaged indices commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index.

PE, or price to earnings, is calculated by dividing a company’s market price per share by its earnings per share.

| HENNESSY FUNDS | 1-800-966-4354 |

3

Performance Overview (Unaudited)

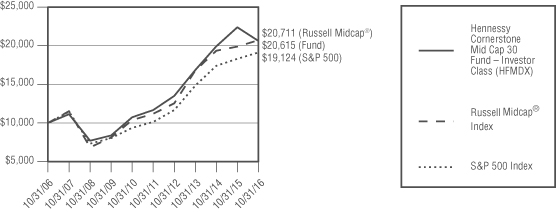

CHANGE IN VALUE OF $10,000 INVESTMENT

This graph illustrates the performance of an initial investment of $10,000 made in the Fund ten years ago and assumes the reinvestment of dividends.

AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED OCTOBER 31, 2016

| One | Five | Ten | |

Year | Years | Years | |

| Hennessy Cornerstone Mid Cap 30 Fund – | |||

| Investor Class (HFMDX) | -7.89% | 12.06% | 7.50% |

| Hennessy Cornerstone Mid Cap 30 Fund – | |||

Institutional Class (HIMDX)(1) | -7.53% | 12.41% | 7.82% |

Russell Midcap® Index | 4.17% | 13.12% | 7.55% |

| S&P 500 Index | 4.51% | 13.57% | 6.70% |

Expense ratios: 1.33% (Investor Class); 0.97% (Institutional Class)

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The performance graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting hennessyfunds.com.

The expense ratios presented are from the most recent prospectus.

(1) | The inception date of Institutional Class shares is March 3, 2008. Performance shown prior to the inception of Institutional Class shares reflects the performance of Investor Class shares and includes expenses that are not applicable to and are higher than those of Institutional Class shares. |

PERFORMANCE NARRATIVE

Portfolio Managers Neil J. Hennessy and Brian E. Peery

Performance:

For the twelve-month period ended October 31, 2016, the Investor Class of the Hennessy Cornerstone Mid Cap 30 Fund returned -7.89%, underperforming both the Russell Midcap® Index and the S&P 500 Index, which returned 4.17% and 4.51% for the same period, respectively.

HENNESSYFUNDS.COM

4

| PERFORMANCE OVERVIEW |

The Fund’s underperformance relative to its benchmark index was due to stock selection and an overweight position within the Consumer Discretionary sector. Express, Inc., GameStop Corporation, AutoNation, Inc. and Lithia Motors, Inc. all contributed significantly to the underperformance over the period. Price weakness in three other investments, JetBlue Airways Corporation, Ciena Corporation and Sinclair Broadcast Group, largely accounted for the remaining underperformance. We no longer hold any of the stocks mentioned.

Portfolio Strategy:

We believe that limiting the Fund to 30 stocks produces a relatively concentrated portfolio, where individual stock performance can influence the performance of the portfolio as a whole, while at the same time providing what we consider to be ample diversification. Additionally, the Fund employs a strict price-to-sales ratio limit of 1.5, resulting in the Fund investing in what we deem to be reasonably valued stocks rather than those whose price may be predicated on expected future growth. We believe this “growth at a reasonable price” stock selection approach has served us well over time, and we wholeheartedly support utilizing this methodology when investing.

In September, the Fund’s investment advisor purchased the assets related to the management of two funds previously managed by Westport Advisers, LLC (the “Westport Funds”), and reorganized the assets of the Westport Funds into the Fund. The securities held by the Westport Funds were added to the Fund’s portfolio on September 26, 2016, and were held in the portfolio as of the end of the Fund’s fiscal year. The Fund’s policy with regards to stock holdings acquired in a reorganization is to make appropriate purchase and sale decisions in conjunction with the Fund’s annual rebalance. The Fund’s annual rebalance took place in November, during which time the number of stock holdings in the Fund was reduced to 30.*

Market Outlook:

Over the twelve-month period ended October 31, 2016, U.S. equities produced moderate, positive returns. The period was once again marked by a great deal of volatility, with major market indices dropping more than 10% at one point early in the year before recovering all of their losses. Throughout this period, there have been concerns about interest rates, commodity prices, economic growth (both domestic and international) and the U.S. Presidential election. Many, if not all, of these concerns still exist in the marketplace today, but we have reasons to be hopeful for the year to come.

First, while corporate profits have been on a gentle slide downwards since the fourth quarter of 2014, market analysts are now forecasting a return to growth in profits in the fourth quarter of this year. We believe these forecasts have a good chance of being proved correct. Second, mergers and acquisitions have been strong and steady this year and we believe such activity will continue next year, helping drive revenue and earnings for the acquiring companies. Third, we do not believe the majority of stocks are expensive at this point, though many are probably fairly valued. The Dow Jones Industrial Average and the S&P 500 Index have forward PE ratios of roughly 18x and 19x, respectively, close to long-term averages although slightly higher than six months ago. Corporate balance sheets appear to be in excellent shape, and while executives have shown some reluctance to increase capital spending beyond maintenance levels this cycle, we believe companies outside of the Energy sector will eventually start investing for expansion. Overall, we believe the basic fundamentals of the market are attractive, and we continue to be optimistic about the possibility of further moderate market advances over the course of next year.

| HENNESSY FUNDS | 1-800-966-4354 |

5

Investment Outlook:

We continue to believe that there are good investment opportunities among mid-cap stocks. Many investors gravitated away from the stocks of small and mid sized companies last year as they sought safety in larger, more well-established businesses in a year of much political uncertainty. Many of these smaller and mid-sized companies have purely domestic businesses, which are benefiting from steady, albeit slow, economic growth at home, low inflation and low energy prices. With consumer debt levels falling and wage growth finally starting to accelerate, we are expecting a good year for domestically oriented small and mid-cap stocks. We believe that investors will also begin to favor stocks of small and mid sized companies as valuations of larger capitalization stocks continue to rise, leaving small and mid-cap stocks looking attractive on a relative basis.

We remain pleased with the positioning of the portfolio, which remains overweight in cyclical stocks, which generally fare better in a period of economic expansion, and domestically oriented stocks that we believe are reasonably valued and appear poised for growth. Relative to the Fund’s benchmarks, the portfolio remains overweight in both the Consumer Discretionary and Industrial sectors, and we think that these areas of the market offer great growth potential in 2017.

______________

| * | The Fund’s most recent holdings list, including all of the stocks in the rebalanced portfolio, may be obtained by visiting hennessyfunds.com. |

Opinions expressed are those of the Portfolio Managers as of the date written and are subject to change, are not guaranteed, and should not be considered investment advice or an indication of trading intent.

The Russell Midcap® Index is an index commonly used to measure the performance of U.S. medium-capitalization stocks. The S&P 500 Index and Dow Jones Industrial Average are unmanaged indices commonly used to measure the performance of U.S. stocks. One cannot invest directly in an index.

The Fund invests in small and medium capitalized companies, which may have limited liquidity and greater price volatility than large capitalization companies. The Fund’s formula-based strategy may cause the Fund to buy or sell securities at times when it may not be advantageous. Please see the Fund’s prospectus for a more complete discussion of these and other risks.

References to specific securities should not be considered a recommendation to buy or sell any security. Fund holdings and sector allocations are subject to change. Please refer to the Schedule of Investments included in this report for additional portfolio information.

Diversification does not assure a profit or protect against loss in a declining market. Price-to-sales ratio is a tool for calculating a stock’s valuation relative to other companies. It is calculated by dividing a company’s market price per share by its revenue per share. PE, or price to earnings, is calculated by dividing a company’s market price per share by its earnings per share. Earnings growth is not a measure of the Fund’s future performance.

HENNESSYFUNDS.COM

6

| PERFORMANCE OVERVIEW/SCHEDULE OF INVESTMENTS |

Financial Statements

Schedule of Investments as of October 31, 2016 |

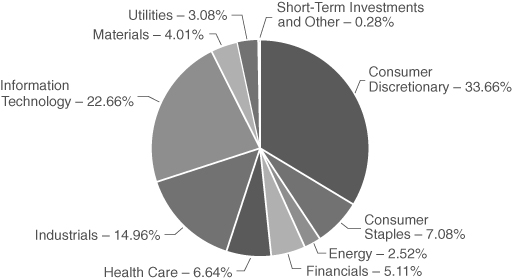

HENNESSY CORNERSTONE MID CAP 30 FUND

(% of Net Assets)

| TOP TEN HOLDINGS (EXCLUDING CASH/CASH EQUIVALENTS) | % NET ASSETS |

| Ingredion, Inc. | 3.57% |

| The Interpublic Group of Companies, Inc. | 3.56% |

| Hawaiian Holdings, Inc. | 3.33% |

| Synopsys, Inc. | 3.12% |

| Atmos Energy Corp. | 3.08% |

| SYNNEX Corp. | 3.00% |

| Pool Corp. | 2.95% |

| Avery Dennison Corp. | 2.77% |

| Tech Data Corp. | 2.72% |

| Casey's General Stores, Inc. | 2.70% |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

| HENNESSY FUNDS | 1-800-966-4354 |

7

| COMMON STOCKS – 99.72% | Number | % of | |||||||||||

| of Shares | Value | Net Assets | |||||||||||

| Consumer Discretionary – 33.66% | |||||||||||||

| AutoNation, Inc. (a) | 510,500 | $ | 22,395,635 | 1.81 | % | ||||||||

| Big Lots, Inc. | 204,800 | 8,888,320 | 0.72 | % | |||||||||

| Boyd Gaming Corp. (a) | 1,584,600 | 28,300,956 | 2.28 | % | |||||||||

| Express, Inc. (a) | 1,662,900 | 19,988,058 | 1.61 | % | |||||||||

| GameStop Corp., Class A | 700,400 | 16,844,620 | 1.36 | % | |||||||||

| JC Penney Co., Inc. (a) | 3,597,600 | 30,903,384 | 2.49 | % | |||||||||

| Lear Corp. | 256,000 | 31,431,680 | 2.53 | % | |||||||||

| Lennar Corp. | 642,500 | 26,785,825 | 2.16 | % | |||||||||

| Lithia Motors, Inc., Class A | 275,418 | 23,625,356 | 1.91 | % | |||||||||

| Mohawk Industries, Inc. (a) | 13,400 | 2,469,620 | 0.20 | % | |||||||||

| NVR, Inc. (a) | 19,614 | 29,872,122 | 2.41 | % | |||||||||

| Pool Corp. | 395,000 | 36,569,100 | 2.95 | % | |||||||||

| Ross Stores, Inc. | 264,600 | 16,548,084 | 1.33 | % | |||||||||

| Sinclair Broadcast Group Inc. | 1,032,600 | 25,918,260 | 2.09 | % | |||||||||

| The Goodyear Tire & Rubber Co. | 965,700 | 28,034,271 | 2.26 | % | |||||||||

| The Interpublic Group of Companies, Inc. | 1,969,779 | 44,103,352 | 3.56 | % | |||||||||

| Wayfair, Inc., Class A (a) | 741,757 | 24,722,761 | 1.99 | % | |||||||||

| 417,401,404 | 33.66 | % | |||||||||||

| Consumer Staples – 7.08% | |||||||||||||

| Casey's General Stores, Inc. | 295,900 | 33,433,741 | 2.70 | % | |||||||||

| CVS Health Corp. | 119,690 | 10,065,929 | 0.81 | % | |||||||||

| Ingredion, Inc. | 337,700 | 44,296,109 | 3.57 | % | |||||||||

| 87,795,779 | 7.08 | % | |||||||||||

| Energy – 2.52% | |||||||||||||

| Anadarko Petroleum Corp. | 115,800 | 6,883,152 | 0.56 | % | |||||||||

| EOG Resources, Inc. | 269,500 | 24,368,190 | 1.96 | % | |||||||||

| 31,251,342 | 2.52 | % | |||||||||||

| Financials – 5.11% | |||||||||||||

| AmTrust Financial Services, Inc. | 955,000 | 25,202,450 | 2.03 | % | |||||||||

| Hanover Insurance Group, Inc. | 375,200 | 28,586,488 | 2.31 | % | |||||||||

| Willis Towers Watson PLC (b) | 75,800 | 9,543,220 | 0.77 | % | |||||||||

| 63,332,158 | 5.11 | % | |||||||||||

| Health Care – 6.64% | |||||||||||||

| Abbott Laboratories | 122,100 | 4,791,204 | 0.39 | % | |||||||||

| Charles River Laboratories International, Inc. (a) | 105,300 | 7,990,164 | 0.64 | % | |||||||||

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

8

| SCHEDULE OF INVESTMENTS |

| COMMON STOCKS | Number | % of | |||||||||||

| of Shares | Value | Net Assets | |||||||||||

| Health Care (Continued) | |||||||||||||

| Owens & Minor, Inc. | 892,700 | $ | 28,968,115 | 2.33 | % | ||||||||

| Universal Health Services, Inc., Class B | 197,427 | 23,831,413 | 1.92 | % | |||||||||

| Varian Medical Systems, Inc. (a) | 185,500 | 16,830,415 | 1.36 | % | |||||||||

| 82,411,311 | 6.64 | % | |||||||||||

| Industrials – 14.96% | |||||||||||||

| Dycom Industries, Inc. (a) | 403,400 | 31,033,562 | 2.50 | % | |||||||||

| Expeditors International of Washington, Inc. | 636,700 | 32,770,949 | 2.64 | % | |||||||||

| FedEx Corp. | 90,500 | 15,775,960 | 1.27 | % | |||||||||

| Hawaiian Holdings, Inc. (a) | 916,000 | 41,242,900 | 3.33 | % | |||||||||

| JetBlue Airways Corp. (a) | 1,257,500 | 21,981,100 | 1.77 | % | |||||||||

| ManpowerGroup, Inc. | 348,300 | 26,749,440 | 2.16 | % | |||||||||

| Rockwell Collins, Inc. | 59,000 | 4,974,880 | 0.40 | % | |||||||||

| United Rentals, Inc. (a) | 146,100 | 11,053,926 | 0.89 | % | |||||||||

| 185,582,717 | 14.96 | % | |||||||||||

| Information Technology – 22.66% | |||||||||||||

| Amphenol Corp., Class A | 248,500 | 16,383,605 | 1.32 | % | |||||||||

| CACI International, Inc., Class A (a) | 29,400 | 2,876,790 | 0.23 | % | |||||||||

| CDW Corp. | 724,500 | 32,537,295 | 2.62 | % | |||||||||

| Check Point Software Technologies Ltd. (a)(b) | 227,500 | 19,237,400 | 1.55 | % | |||||||||

| Ciena Corp. (a) | 1,323,900 | 25,657,182 | 2.07 | % | |||||||||

| IPG Photonics Corp. (a) | 128,900 | 12,504,589 | 1.01 | % | |||||||||

| Mastercard, Inc., Class A | 122,100 | 13,067,142 | 1.05 | % | |||||||||

| PTC, Inc. (a) | 699,200 | 33,170,048 | 2.68 | % | |||||||||

| Rogers Corp. (a) | 136,900 | 7,451,467 | 0.60 | % | |||||||||

| SYNNEX Corp. | 363,000 | 37,222,020 | 3.00 | % | |||||||||

| Synopsys, Inc. (a) | 652,412 | 38,694,556 | 3.12 | % | |||||||||

| Tech Data Corp. (a) | 437,500 | 33,696,250 | 2.72 | % | |||||||||

| Teradata Corp. (a) | 175,380 | 4,728,245 | 0.38 | % | |||||||||

| Zebra Technologies Corp., Class A (a) | 57,700 | 3,798,968 | 0.31 | % | |||||||||

| 281,025,557 | 22.66 | % | |||||||||||

| Materials – 4.01% | |||||||||||||

| Agrium, Inc. (b) | 29,400 | 2,699,508 | 0.22 | % | |||||||||

| Avery Dennison Corp. | 492,300 | 34,357,617 | 2.77 | % | |||||||||

| FMC Corp. | 269,500 | 12,636,855 | 1.02 | % | |||||||||

| 49,693,980 | 4.01 | % | |||||||||||

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 |

9

| COMMON STOCKS | Number | % of | |||||||||||

| of Shares | Value | Net Assets | |||||||||||

| Utilities – 3.08% | |||||||||||||

| Atmos Energy Corp. | 513,100 | $ | 38,169,509 | 3.08 | % | ||||||||

| Total Common Stocks | |||||||||||||

| (Cost $1,042,234,381) | 1,236,663,757 | 99.72 | % | ||||||||||

| SHORT-TERM INVESTMENTS – 0.75% | |||||||||||||

| Money Market Funds – 0.75% | |||||||||||||

| Fidelity Government Portfolio, Institutional Class, 0.27% (c) | 9,291,972 | 9,291,972 | 0.75 | % | |||||||||

| Total Short-Term Investments | |||||||||||||

| (Cost $9,291,972) | 9,291,972 | 0.75 | % | ||||||||||

| Total Investments | |||||||||||||

| (Cost $1,051,526,353) – 100.47% | 1,245,955,729 | 100.47 | % | ||||||||||

| Liabilities in Excess of Other Assets – (0.47)% | (5,839,078 | ) | (0.47 | )% | |||||||||

TOTAL NET ASSETS – 100.00% | $ | 1,240,116,651 | 100.00 | % | |||||||||

Percentages are stated as a percent of net assets.

| (a) | Non-income producing security. |

| (b) | U.S. traded security of a foreign corporation. |

| (c) | The rate listed is the fund's 7-day yield as of October 31, 2016. |

Summary of Fair Value Exposure at October 31, 2016

The following is a summary of the inputs used to value the Fund's net assets as of October, 2016 (see Note 3 in the accompanying notes to the financial statements):

| Common Stocks | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Consumer Discretionary | $ | 417,401,404 | $ | — | $ | — | $ | 417,401,404 | ||||||||

| Consumer Staples | 87,795,779 | — | — | 87,795,779 | ||||||||||||

| Energy | 31,251,342 | — | — | 31,251,342 | ||||||||||||

| Financials | 63,332,158 | — | — | 63,332,158 | ||||||||||||

| Health Care | 82,411,311 | — | — | 82,411,311 | ||||||||||||

| Industrials | 185,582,717 | — | — | 185,582,717 | ||||||||||||

| Information Technology | 281,025,557 | — | — | 281,025,557 | ||||||||||||

| Materials | 49,693,980 | — | — | 49,693,980 | ||||||||||||

| Utilities | 38,169,509 | — | — | 38,169,509 | ||||||||||||

| Total Common Stocks | $ | 1,236,663,757 | $ | — | $ | — | $ | 1,236,663,757 | ||||||||

| Short-Term Investments | ||||||||||||||||

| Money Market Funds | $ | 9,291,972 | $ | — | $ | — | $ | 9,291,972 | ||||||||

| Total Short-Term Investments | $ | 9,291,972 | $ | — | $ | — | $ | 9,291,972 | ||||||||

| Total Investments | $ | 1,245,955,729 | $ | — | $ | — | $ | 1,245,955,729 | ||||||||

Transfers between levels are recognized at the end of the reporting period. During the year ended October 31, 2016, the Fund recognized no transfers between levels.

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

10

| SCHEDULE OF INVESTMENTS/STATEMENT OF ASSETS AND LIABILITIES |

Financial Statements

Statement of Assets and Liabilities as of October 31, 2016 |

| ASSETS: | ||||

| Investments in securities, at value (cost $1,051,526,353) | $ | 1,245,955,729 | ||

| Dividends and interest receivable | 282,563 | |||

| Receivable for fund shares sold | 831,788 | |||

| Prepaid expenses and other assets | 58,537 | |||

| Total Assets | 1,247,128,617 | |||

| LIABILITIES: | ||||

| Payable for fund shares redeemed | 5,538,041 | |||

| Payable to advisor | 851,049 | |||

| Payable to administrator | 210,799 | |||

| Payable to auditor | 22,881 | |||

| Accrued distribution fees | 83,969 | |||

| Accrued service fees | 59,264 | |||

| Accrued interest payable | 1,780 | |||

| Accrued trustees fees | 3,898 | |||

| Accrued expenses and other payables | 240,285 | |||

| Total Liabilities | 7,011,966 | |||

| NET ASSETS | $ | 1,240,116,651 | ||

| NET ASSETS CONSIST OF: | ||||

Capital stock(1) | $ | 1,042,655,967 | ||

| Accumulated net investment loss | (1,670,147 | ) | ||

| Accumulated net realized gain on investments | 4,701,455 | |||

Unrealized net appreciation on investments(1) | 194,429,376 | |||

| Total Net Assets | $ | 1,240,116,651 | ||

| NET ASSETS | ||||

| Investor Class: | ||||

| Shares authorized (no par value) | Unlimited | |||

| Net assets applicable to outstanding Investor Class shares | $ | 485,147,576 | ||

| Shares issued and outstanding | 26,408,820 | |||

| Net asset value, offering price and redemption price per share | $ | 18.37 | ||

| Institutional Class: | ||||

| Shares authorized (no par value) | Unlimited | |||

| Net assets applicable to outstanding Institutional Class shares | $ | 754,969,075 | ||

| Shares issued and outstanding | 40,167,581 | |||

| Net asset value, offering price and redemption price per share | $ | 18.80 | ||

| (1) | “Capital stock” and “unrealized net appreciation on investments” include an adjustment to correct a clerical error. Capital stock was reduced by $257,627,279 and unrealized net appreciation on investments was increased by the same amount to correct the error. This adjustment had no impact on total net assets, net asset values per share, or the Financial Highlights of the Fund. |

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 |

11

Financial Statements

Statement of Operations for the year ended October 31, 2016 |

| INVESTMENT INCOME: | ||||

Dividend income(1) | $ | 11,472,235 | ||

| Interest income | 39,471 | |||

| Total investment income | 11,511,706 | |||

| EXPENSES: | ||||

| Investment advisory fees (See Note 5) | 7,856,506 | |||

| Sub-transfer agent expenses – Investor Class (See Note 5) | 1,420,424 | |||

| Sub-transfer agent expenses – Institutional Class (See Note 5) | 391,620 | |||

| Administration, fund accounting, custody and transfer agent fees (See Note 5) | 1,034,908 | |||

| Distribution fees – Investor Class (See Note 5) | 963,758 | |||

| Service fees – Investor Class (See Note 5) | 642,505 | |||

| Federal and state registration fees | 152,884 | |||

| Reports to shareholders | 125,770 | |||

| Audit fees | 23,842 | |||

| Compliance expense (See Note 5) | 23,709 | |||

| Trustees' fees and expenses | 18,314 | |||

| Interest expense (See Note 7) | 14,025 | |||

| Legal fees | 12,786 | |||

| Other expenses | 54,880 | |||

| Total expenses | 12,735,931 | |||

| NET INVESTMENT LOSS | $ | (1,224,225 | ) | |

| REALIZED AND UNREALIZED GAINS (LOSSES): | ||||

| Net realized gain on investments | $ | 5,942,875 | ||

| Net change in unrealized appreciation on investments | (104,787,882 | ) | ||

| Net loss on investments | (98,845,007 | ) | ||

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (100,069,232 | ) | |

(1) | Net of foreign taxes withheld of $4,594. |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

12

| STATEMENT OF OPERATIONS/STATEMENTS OF CHANGES IN NET ASSETS |

Financial Statements

| Statements of Changes in Net Assets |

| Year Ended | Year Ended | |||||||

| October 31, 2016 | October 31, 2015 | |||||||

| OPERATIONS: | ||||||||

| Net investment income (loss) | $ | (1,224,225 | ) | $ | 1,830,521 | |||

| Net realized gain on investments | 5,942,875 | 8,189,909 | ||||||

| Net change in unrealized appreciation on investments | (104,787,882 | ) | 19,847,205 | |||||

| Net increase in net assets resulting from operations | (100,069,232 | ) | 29,867,635 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM: | ||||||||

| Net investment income | ||||||||

| Investor Class | (983,702 | ) | — | |||||

| Institutional Class | (1,004,373 | ) | — | |||||

| Net realized gains | ||||||||

| Investor Class | (5,450,291 | ) | (16,025,638 | ) | ||||

| Institutional Class | (2,201,769 | ) | (4,641,869 | ) | ||||

| Total distributions | (9,640,135 | ) | (20,667,507 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Proceeds from shares issued in the Reorganization – | ||||||||

| Institutional Class (See Note 8) | 434,529,979 | — | ||||||

| Proceeds from shares subscribed – Investor Class | 281,456,239 | 626,037,117 | ||||||

| Proceeds from shares subscribed – Institutional Class | 340,887,989 | 265,472,593 | ||||||

| Dividends reinvested – Investor Class | 6,357,569 | 15,829,426 | ||||||

| Dividends reinvested – Institutional Class | 2,729,983 | 4,211,897 | ||||||

| Cost of shares redeemed – Investor Class | (500,557,212 | ) | (143,926,929 | ) | ||||

| Cost of shares redeemed – Institutional Class | (287,519,806 | ) | (38,580,417 | ) | ||||

| Net increase in net assets derived | ||||||||

| from capital share transactions | 277,884,741 | 729,043,687 | ||||||

| TOTAL INCREASE IN NET ASSETS | 168,175,374 | 738,243,815 | ||||||

| NET ASSETS: | ||||||||

| Beginning of year | 1,071,941,277 | 333,697,462 | ||||||

| End of year | $ | 1,240,116,651 | $ | 1,071,941,277 | ||||

| Undistributed net investment | ||||||||

| income (loss), end of year | $ | (1,670,147 | ) | $ | 797,037 | |||

| CHANGES IN SHARES OUTSTANDING: | ||||||||

| Shares issued in the Reorganization – Institutional Class | 22,309,002 | — | ||||||

| Shares sold – Investor Class | 15,025,505 | 30,736,606 | ||||||

| Shares sold – Institutional Class | 17,897,465 | 12,673,580 | ||||||

| Shares issued to holders as reinvestment | ||||||||

| of dividends – Investor Class | 332,871 | 847,400 | ||||||

| Shares issued to holders as reinvestment | ||||||||

| of dividends – Institutional Class | 140,179 | 221,213 | ||||||

| Shares redeemed – Investor Class | (27,012,121 | ) | (7,112,737 | ) | ||||

| Shares redeemed – Institutional Class | (15,071,054 | ) | (1,904,158 | ) | ||||

| Net increase in shares outstanding | 13,621,847 | 35,461,904 | ||||||

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 |

13

Financial Statements

| Financial Highlights |

For an Investor Class share outstanding throughout each year

PER SHARE DATA:

Net asset value, beginning of year

Income from investment operations:

Net investment income (loss)

Net realized and unrealized gains (losses) on investments

Total from investment operations

Less distributions:

Dividends from net investment income

Dividends from net realized gains

Total distributions

Net asset value, end of year

TOTAL RETURN

SUPPLEMENTAL DATA AND RATIOS:

Net assets, end of year (millions)

Ratio of expenses to average net assets

Ratio of net investment income (loss) to average net assets

Portfolio turnover rate(1)

(1) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

14

| FINANCIAL HIGHLIGHTS — INVESTOR CLASS |

| Year Ended October 31, | ||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

| $ | 20.12 | $ | 19.00 | $ | 17.32 | $ | 14.06 | $ | 12.15 | |||||||||

| (0.07 | ) | 0.10 | (0.05 | ) | 0.09 | 0.08 | ||||||||||||

| (1.51 | ) | 2.16 | 3.04 | 3.35 | 1.83 | |||||||||||||

| (1.58 | ) | 2.26 | 2.99 | 3.44 | 1.91 | |||||||||||||

| (0.03 | ) | — | (0.05 | ) | (0.18 | ) | — | |||||||||||

| (0.14 | ) | (1.14 | ) | (1.26 | ) | — | — | |||||||||||

| (0.17 | ) | (1.14 | ) | (1.31 | ) | (0.18 | ) | — | ||||||||||

| $ | 18.37 | $ | 20.12 | $ | 19.00 | $ | 17.32 | $ | 14.06 | |||||||||

| (7.89 | )% | 12.35 | % | 18.25 | % | 24.78 | % | 15.72 | % | |||||||||

| $ | 485.15 | $ | 765.90 | $ | 258.17 | $ | 159.45 | $ | 145.85 | |||||||||

| 1.35 | % | 1.17 | % | 1.25 | % | 1.31 | % | 1.37 | % | |||||||||

| (0.24 | )% | 0.27 | % | (0.47 | )% | 0.51 | % | 0.59 | % | |||||||||

| 108 | % | 5 | % | 132 | % | 212 | % | 25 | % | |||||||||

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 |

15

Financial Statements

| Financial Highlights |

For an Institutional Class share outstanding throughout each year

PER SHARE DATA:

Net asset value, beginning of year

Income from investment operations:

Net investment income (loss)

Net realized and unrealized gains (losses) on investments

Total from investment operations

Less distributions:

Dividends from net investment income

Dividends from net realized gains

Total distributions

Net asset value, end of year

TOTAL RETURN

SUPPLEMENTAL DATA AND RATIOS:

Net assets, end of year (millions)

Ratio of expenses to average net assets:

Before reimbursement

After reimbursement

Ratio of net investment income (loss) to average net assets:

Before reimbursement

After reimbursement

Portfolio turnover rate(2)

(1) | Amount is less than $0.01. |

(2) | Portfolio turnover is calculated on the basis of the Fund as a whole. |

The accompanying notes are an integral part of these financial statements.

HENNESSYFUNDS.COM

16

| FINANCIAL HIGHLIGHTS — INSTITUTIONAL CLASS |

| Year Ended October 31, | ||||||||||||||||||

| 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

| $ | 20.55 | $ | 19.36 | $ | 17.62 | $ | 14.31 | $ | 12.32 | |||||||||

| 0.00 | (1) | (0.03 | ) | (0.08 | ) | 0.14 | 0.09 | |||||||||||

| (1.54 | ) | 2.38 | 3.17 | 3.41 | 1.90 | |||||||||||||

| (1.54 | ) | 2.35 | 3.09 | 3.55 | 1.99 | |||||||||||||

| (0.06 | ) | — | (0.09 | ) | (0.24 | ) | — | |||||||||||

| (0.15 | ) | (1.16 | ) | (1.26 | ) | — | — | |||||||||||

| (0.21 | ) | (1.16 | ) | (1.35 | ) | (0.24 | ) | — | ||||||||||

| $ | 18.80 | $ | 20.55 | $ | 19.36 | $ | 17.62 | $ | 14.31 | |||||||||

| (7.53 | )% | 12.62 | % | 18.57 | % | 25.15 | % | 16.15 | % | |||||||||

| $ | 754.97 | $ | 306.04 | $ | 75.53 | $ | 51.19 | $ | 41.62 | |||||||||

| 0.97 | % | 0.96 | % | 1.07 | % | 1.11 | % | 1.16 | % | |||||||||

| 0.97 | % | 0.97 | % | 0.98 | % | 0.98 | % | 0.98 | % | |||||||||

| 0.07 | % | 0.41 | % | (0.29 | )% | 0.71 | % | 0.90 | % | |||||||||

| 0.07 | % | 0.41 | % | (0.20 | )% | 0.84 | % | 1.08 | % | |||||||||

| 108 | % | 5 | % | 132 | % | 212 | % | 25 | % | |||||||||

The accompanying notes are an integral part of these financial statements.

| HENNESSY FUNDS | 1-800-966-4354 |

17

Financial Statements

Notes to the Financial Statements October 31, 2016 |

1). ORGANIZATION

The Hennessy Cornerstone Mid Cap 30 Fund (the “Fund”) is a series of Hennessy Funds Trust (the “Trust”), which was organized as a Delaware statutory trust on September 17, 1992. The Fund is an open-end management investment company registered under the Investment Company Act of 1940, as amended. The Fund is a successor to a fund with the same name (the “Predecessor Fund”) that was a series of Hennessy Mutual Funds, Inc., a Maryland corporation, pursuant to a reorganization that took place after the close of business on February 28, 2014. Prior to February 28, 2014, the Fund had no investment operations. As a result of the reorganization, holders of Investor Class shares of the Predecessor Fund received Investor Class shares of the Fund (the Investor Class shares of the Fund are the successor to the accounting and performance information of the corresponding shares of the Predecessor Fund), and holders of Institutional Class shares of the Predecessor Fund received Institutional Class shares of the Fund (the Institutional Class shares of the Fund are the successor to the accounting and performance information of the corresponding shares of the Predecessor Fund). The investment objective of the Fund is long-term growth of capital. The Fund is a diversified fund.

The Fund offers Investor Class and Institutional Class shares. Each class of shares differs principally in its respective administration, 12b-1 distribution and service, shareholder servicing, and transfer agent expenses (there are no sales charges). Each class has identical rights to earnings, assets, and voting privileges, except for class-specific expenses and exclusive rights to vote on matters affecting only an individual class.

As an investment company, the Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services—Investment Companies.”

2). SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies conform with U.S. generally accepted accounting principles (“GAAP”).

| a). | Investment Valuation – All investments in securities are recorded at their estimated fair value, as described in Note 3. |

| b). | Federal Income Taxes – No provision for federal income taxes or excise taxes has been made since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Net investment income or loss and realized gains and losses for federal income tax purposes may differ from that reported on the financial statements because of temporary book and tax basis differences. Temporary differences are primarily the result of the treatment of wash sales for tax reporting purposes. The Fund recognizes interest and penalties related to income tax benefits, if any, in the statement of operations as an income tax expense. Distributions from net realized gains for book purposes may include short-term capital gains, which are included as ordinary income to shareholders for tax purposes. |

HENNESSYFUNDS.COM

18

| NOTES TO THE FINANCIAL STATEMENTS |

| Due to inherent differences in the recognition of income, expenses, and realized gains/losses under GAAP and federal income tax regulations, permanent differences between book and tax basis for reporting for the fiscal year ended October 31, 2016, have been identified and appropriately reclassified on the Statement of Assets and Liabilities. The adjustments are as follows: |

| Undistributed | Accumulated | |||

| Net Investment | Net Realized | |||

Income/(Loss) | Gain/(Loss) | Paid-in Capital | ||

| $745,116 | $(745,116) | $— |

| c). | Accounting for Uncertainty in Income Taxes – The Fund has accounting policies regarding recognition and measurement of tax positions taken or expected to be taken on a tax return. The tax returns of the Fund for the prior three fiscal years are open for examination. The Fund has reviewed all open tax years in major jurisdictions and concluded that there is no impact on the Fund’s net assets and no tax liability resulting from unrecognized tax benefits relating to uncertain income tax positions taken or expected to be taken on a tax return. The Fund’s major tax jurisdictions are U.S. federal and Delaware. |

| d). | Income and Expenses – Dividend income is recognized on the ex-dividend date or as soon as information is available to the Fund. Interest income, which includes the amortization of premium and accretion of discount, is recognized on an accrual basis. The Fund is charged for those expenses that are directly attributable to the portfolio, such as advisory, administration, and certain shareholder service fees. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its respective net assets. |

| e). | Distributions to Shareholders – Dividends from net investment income for the Fund, if any, are declared and paid annually, usually in December. Distributions of net realized capital gains, if any, are declared and paid annually, usually in December. |

| f). | Security Transactions – Investment and shareholder transactions are recorded on the trade date. The Fund determines the gain or loss realized from the investment transactions by comparing the original cost of the security lot sold with the net sale proceeds. Discounts and premiums on securities purchased are accreted/amortized over the life of the respective security. |

| g). | Use of Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported change in net assets during the reporting period. Actual results could differ from those estimates. |

| h). | Share Valuation – The net asset value (“NAV”) per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on days the New York Stock Exchange is closed for trading. The offering and redemption price per share for the Fund is equal to the Fund’s NAV per share. |

| i). | Repurchase Agreements – The Fund may enter into repurchase agreements with member banks or security dealers of the Federal Reserve Board whom the investment advisor deems creditworthy. The repurchase price generally equals the price paid by the Fund plus interest negotiated on the basis of current short-term rates. |

| HENNESSY FUNDS | 1-800-966-4354 |

19

| Securities pledged as collateral for repurchase agreements are held by the custodian bank until the respective agreements mature. Provisions of the repurchase agreements ensure that the market value of the collateral, including accrued interest thereon, is sufficient to cover the repurchase amount in the event of default of the counterparty. If the counterparty defaults and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Fund may be delayed or limited. During the fiscal year ended October 31, 2016, the Fund did not enter into any repurchase agreements. | |

| j). | Derivatives – The Fund may invest in, or enter into, derivatives, such as options, futures contracts, options on futures contracts, and swaps, for a variety of reasons, including to hedge certain risks, to provide a substitute for purchasing or selling particular securities, or to increase potential income gain. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives may allow the Fund to increase or decrease the level of risk to which the Fund is exposed more quickly and efficiently than transactions in other types of instruments. The main purpose of utilizing derivative instruments is for hedging purposes. |

| The Fund follows the financial accounting reporting rules as required by the Derivatives and Hedging Topic of the FASB Accounting Standards Codification. Under such rules, the Fund is required to include enhanced disclosure that enables investors to understand how and why an entity uses derivatives, how derivatives are accounted for, and how derivatives instruments affect an entity’s results of operations and financial position. During the fiscal year ended October 31, 2016, the Fund did not hold any derivative instruments. | |

| k). | New Accounting Pronouncements – In May 2015, the FASB issued ASU No. 2015-07 “Disclosure for Investments in Certain Entities that Calculate Net Asset Value per Share (or Its Equivalent).” The amendments in ASU No. 2015-07 remove the requirement to categorize within the fair value hierarchy investments measured at NAV and require the disclosure of sufficient information to reconcile the fair value of the remaining assets categorized within the fair value hierarchy to the financial statements. The amendments in ASU No. 2015-07 are effective for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Management has reviewed the requirements and believes the adoption of ASU 2015-07 will not have a material impact on the Fund’s financial statements and related disclosures. |

3). SECURITIES VALUATION

The Fund follows authoritative fair valuation accounting standards that establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| Level 1 – | Unadjusted, quoted prices in active markets for identical instruments that the Fund has the ability to access at the date of measurement. | |

| Level 2 – | Other significant observable inputs (including, but not limited to, quoted prices in active markets for similar instruments, quoted prices in markets that are not active for identical or similar instruments, and model-derived valuations in which all significant inputs and significant value drivers are |

HENNESSYFUNDS.COM

20

| NOTES TO THE FINANCIAL STATEMENTS |

| observable in active markets (such as interest rates, prepayment speeds, credit risk curves, default rates, and similar data)). | ||

| Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions about what market participants would use to price the asset or liability based on the best available information) when observable inputs are unavailable. |

Following is a description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis.

Equity Securities – Equity securities, including common stocks, preferred stocks, exchange-traded funds, closed-end mutual funds, partnerships, rights, and real estate investment trusts, that are traded on a securities exchange for which a last-quoted sales price is readily available will generally be valued at the last sales price as reported by the primary exchange on which the securities are listed. Securities listed on The NASDAQ Stock Market (“NASDAQ”) will generally be valued at the NASDAQ Official Closing Price, which may differ from the last sales price reported. Securities traded on a securities exchange for which a last-quoted sales price is not readily available will generally be valued at the mean between the bid and ask prices. To the extent these securities are actively traded and valuation adjustments are not applied, they are classified in Level 1 of the fair value hierarchy.

Registered Investment Companies – Investments in registered investment companies (e.g., mutual funds) are generally priced at the ending NAV provided by the applicable registered investment company’s service agent and will be classified in Level 1 of the fair value hierarchy.

Debt Securities – Debt securities, including corporate bonds, asset-backed securities, mortgage-backed securities, municipal bonds, U.S. Treasuries, and U.S. government agency issues, are generally valued at market on the basis of valuations furnished by an independent pricing service that utilizes both dealer-supplied valuations and formula-based techniques. The pricing service may consider recently executed transactions in securities of the issuer or comparable issuers, market price quotations (where observable), bond spreads, and fundamental data relating to the issuer. In addition, the model may incorporate observable market data, such as reported sales of similar securities, broker quotes, yields, bids, offers, and reference data. Certain securities are valued primarily using dealer quotations. These securities are generally classified in Level 2 of the fair value hierarchy.

Short-Term Securities – Short-term equity investments, including money market funds, are valued in the manner specified above. Short-term debt investments with an original term to maturity of 60 days or less are valued at amortized cost, which approximates fair market value. If the original term to maturity of a short-term debt investment exceeded 60 days, then the values as of the 61st day prior to maturity are amortized. Amortized cost is not used if its use would be inappropriate due to credit or other impairments of the issuer, in which case the security’s fair value would be determined, as described below. Short-term securities are generally classified in Level 1 or Level 2 of the fair market hierarchy depending on the inputs used and market activity levels for specific securities.

The Board of Trustees of the Fund (the “Board”) has adopted fair value pricing procedures that are followed when a price for a security is not readily available or if a significant event has occurred that indicates the closing price of a security no longer represents the true value of that security. Fair value pricing determinations are made in good faith in accordance with these procedures. There are numerous criteria that will be given consideration in determining a fair value of a security, such as the trading volume of a security and markets, the value of other like securities, and news events with direct

| HENNESSY FUNDS | 1-800-966-4354 |

21

bearing to a security or markets. Fair value pricing results in an estimated price for a security that reflects the amount the Fund might reasonably expect to receive in a current sale. Depending on the relative significance of the valuation inputs, these securities may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The Board has delegated day-to-day valuation matters to a Valuation Committee comprised of one or more representatives from Hennessy Advisors, Inc., the Fund’s investment advisor. The function of the Valuation Committee is to value securities where current and reliable market quotations are not readily available. All actions taken by the Valuation Committee are reviewed by the Board.

The Fund has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. Various inputs are used in determining the value of the Fund’s investments. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Details related to the fair valuation hierarchy of the Fund’s securities as of October 31, 2016, are included in the Fund’s Schedule of Investments.

4). INVESTMENT TRANSACTIONS

Purchases and sales of investment securities (excluding government and short-term investments) for the Fund during the fiscal year ended October 31, 2016, were $1,142,738,094 and $1,243,780,938, respectively.

There were no purchases or sales/maturities of long-term U.S. government securities for the Fund during the fiscal year ended October 31, 2016.

The Fund is permitted to purchase or sell securities from or to another fund in the Hennessy Funds family of funds (the “Hennessy Funds”) under specified conditions outlined in procedures adopted by the Board of Trustees. The procedures have been designed to ensure that any purchase or sale of securities by the Fund from or to another Hennessy Fund complies with Rule 17a-7 of the Investment Company Act of 1940. For the fiscal year ended October 31, 2016, the Fund did not engage in purchases and sales of securities pursuant to Rule 17a-7 of the Investment Company Act of 1940.

5). INVESTMENT MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES

Hennessy Advisors, Inc. (the “Advisor”) is the investment advisor of the Fund. The Advisor provides the Fund with investment management services under an Investment Advisory Agreement. The Advisor furnishes all investment advice, office space, facilities, and provides most of the personnel needed by the Fund. As compensation for its services, the Advisor is entitled to a monthly fee from the Fund. The fee is based upon the average daily net assets of the Fund at the annual rate of 0.74%. The net investment advisory fees payable by the Fund as of October 31, 2016, were $851,049.

The Board has approved a Shareholder Servicing Agreement for Investor Class shares of the Fund, which was instituted to compensate the Advisor for the non-investment management services it provides to the Fund. The Shareholder Servicing Agreement provides for a monthly fee paid to the Advisor at an annual rate of 0.10% of the average daily net assets of the Fund attributable to Investor Class shares. Shareholder service fees payable by the Fund as of October 31, 2016, were $59,264.

The Fund has adopted a plan pursuant to Rule 12b-1 under the Investment Company Act of 1940, as amended, that authorizes payments in connection with the distribution of the Fund’s shares at an annual rate of up to 0.25% of the Fund’s average daily net assets attributable to Investor Class shares. Even though the authorized rate is up to 0.25%, the Fund has only used up to 0.15% of its average daily net assets attributable to Investor Class shares for such purpose since the plan was implemented on

22

| NOTES TO THE FINANCIAL STATEMENTS |

November 1, 2015. Amounts paid under the plan may be spent on any activities or expenses primarily intended to result in the sale of shares, including, but not limited to, advertising, shareholder account servicing, the printing and mailing of prospectuses to other than current shareholders, the printing and mailing of sales literature, and compensation for sales and marketing activities or to financial institutions and others, such as dealers and distributors.

The Fund has entered into agreements with various brokers, dealers, and financial intermediaries in connection with the sale of shares of the Fund. The agreements provide for periodic payments by the Fund to the brokers, dealers, and financial intermediaries for providing certain shareholder maintenance services (sub-transfer agent expenses). These shareholder services include the pre-processing and quality control of new accounts, shareholder correspondence, answering customer inquiries regarding account status, and facilitating shareholder telephone transactions. Fees paid by the Fund to various brokers, dealers, and financial intermediaries during the fiscal year ended October 31, 2016, were $1,812,044.

U.S. Bancorp Fund Services, LLC (“USBFS”) provides the Fund with administrative, fund accounting, and transfer agent services, and necessary office equipment. As administrator, USBFS is responsible for activities such as (i) preparing various federal and state regulatory filings, reports, and returns for the Fund, (ii) preparing reports and materials to be supplied to the Board, (iii) monitoring the activities of the Fund’s custodian, transfer agent, and accountants, and (iv) coordinating the preparation and payment of the Fund’s expenses and reviewing the Fund’s expense accruals. Fees paid to USBFS during the fiscal year ended October 31, 2016, were $1,034,908.

U.S. Bank, N.A., an affiliate of USBFS, serves as the Fund’s custodian. Quasar Distributors, LLC acts as the Fund’s principal underwriter in a continuous public offering of the Fund’s shares. Quasar Distributors, LLC is an affiliate of USBFS and U.S. Bank, N.A.

The officers of the Fund are affiliated with the Advisor. Such officers, with the exception of the Chief Compliance Officer and the Senior Compliance Officer, receive no compensation from the Fund for serving in their respective roles. The Fund, along with the other Hennessy Funds, makes reimbursement payments, on an equal basis, to the Advisor for a portion of the salary and benefits associated with the office of the Chief Compliance Officer and for all of the salary and benefits associated with the office of the Senior Compliance Officer. Such amounts are included on the Statement of Operations.

6). GUARANTEES AND INDEMNIFICATIONS

Under the Hennessy Funds’ organizational documents, their officers and trustees are indemnified by the Hennessy Funds against certain liabilities arising out of the performance of their duties to the Hennessy Funds. Additionally, in the normal course of business, the Hennessy Funds enter into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

7). LINE OF CREDIT

The Fund has an uncommitted line of credit with the other Hennessy Funds in the amount of the lesser of (i) $100,000,000 or (ii) 33.33% of each Hennessy Fund’s net assets, or 30% for the Hennessy Gas Utility Fund and 10% for the Hennessy Balanced Fund, intended to provide short-term financing, if necessary, subject to certain restrictions, in connection with shareholder redemptions. The credit facility is with the Hennessy Funds’ custodian bank, U.S. Bank, N.A. Borrowings under this arrangement

| HENNESSY FUNDS | 1-800-966-4354 |

23

bear interest at the bank’s prime rate and are secured by all of the Fund’s assets (as to its own borrowings only). During the fiscal year ended October 31, 2016, the Fund had an outstanding average daily balance and a weighted average interest rate of $346,842 and 3.47%, respectively. The maximum amount outstanding for the Fund during the period was $31,985,000. At October 31, 2016, the Fund did not have any borrowings outstanding under the line of credit.

8). FEDERAL TAX INFORMATION

As of October 31, 2016, the components of accumulated earnings (losses) for income tax purposes were as follows:

| Cost of investments for tax purposes | $ | 1,054,679,591 | |||

| Gross tax unrealized appreciation | $ | 277,332,537 | |||

| Gross tax unrealized depreciation | (86,056,399 | ) | |||

| Net tax unrealized appreciation | $ | 191,276,138 | |||

| Undistributed ordinary income | $ | — | |||

| Undistributed long-term capital gains | 7,854,693 | ||||

| Total distributable earnings | $ | 7,854,693 | |||

Other accumulated loss(1) | $ | (1,670,147 | ) | ||

Total accumulated gain(1) | $ | 197,460,684 |

| (1) | “Other accumulated loss” and “Total accumulated gain” (previously labeled “Total accumulated loss”) include an adjustment to correct a clerical error. Other accumulated loss and total accumulated gain were both increased by $257,627,279. This adjustment had no impact on total net assets, net asset values per share, or the Financial Highlights of the Fund. |

The difference between book-basis unrealized appreciation/depreciation (as shown in the Statement of Assets and Liabilities) and tax-basis unrealized appreciation/depreciation (as shown above) is attributable primarily to wash sales.

At October 31, 2016, the Fund had no tax basis capital losses to offset future capital gains.

During the fiscal year ended October 31, 2016, the capital loss carryforwards utilized for the Fund were $493,673.

At October 31, 2016, the Fund deferred on a tax basis, a post-December late year ordinary loss deferral of $1,670,147.

During the fiscal years ended October 31, 2016 and 2015, the tax character of distributions paid by the Fund was as follows:

| Year Ended | Year Ended | ||||||||

| October 31, 2016 | October 31, 2015 | ||||||||

Ordinary income(1) | $ | 8,894,689 | $ | 44,515 | |||||

| Long-term capital gain | 745,446 | 20,622,992 | |||||||

| $ | 9,640,135 | $ | 20,667,507 | ||||||

(1) | Ordinary income includes short-term gain or loss. |

9). AGREEMENT AND PLAN OF REORGANIZATION

On September 23, 2016, shareholders of the Westport Fund and the Westport Select Cap Fund approved an Agreement and Plan of Reorganization between the Trust, on behalf of the Fund, and The Westport Funds, a Delaware statutory trust, on behalf of the Westport Fund and the Westport Select Cap Fund. The Agreement and Plan of Reorganization provides for the transfer of all of the assets of the Westport Fund and the Westport Select Cap Fund to the Fund and the assumption of the liabilities (other than any excluded liabilities) of the

HENNESSYFUNDS.COM

24

| NOTES TO THE FINANCIAL STATEMENTS |

Westport Fund and the Westport Select Cap Fund by the Fund. Each of the Westport Fund, the Westport Select Cap Fund, and the Fund have substantially similar investment objectives. The following tables illustrate the specifics of the Fund’s reorganization:

| Shares issued | Westport | Shares issued | Hennessy | |||

| to Shareholders | Select Cap | to Shareholders | Mid Cap 30 | |||

| Westport Fund | of Westport | Fund | of Westport | Fund | Combined | Tax Status |

Net Assets | Fund | Net Assets | Select Cap Fund | Net Assets | Net Assets | of Transfer |

$327,593,695(1) | 16,818,829 | $106,936,284(2) | 5,490,173 | $944,525,090 | $1,379,055,069 | Non-taxable |

(1) | Includes accumulated realized losses and unrealized appreciation in the amounts of $24,482,976 and $179,647,207, respectively. |

(2) | Includes accumulated realized losses and unrealized appreciation in the amounts of $49,229,674 and $77,980,073, respectively. |

Assuming the reorganization had been completed on November 1, 2015, the beginning of the annual reporting period of the Fund, the pro forma results of operation (unaudited) for the year ended October 31, 2016, would have been as follows:

| Net investment loss | $ | (3,630,389 | ) | ||

| Net realized gain on investments | $ | 187,733,108 | |||

| Net change in unrealized appreciation on investments | $ | 5,795,235 | |||

| Net increase in net assets resulting from operations | $ | 189,897,954 |

Because the combined investment portfolios have been managed as a single integrated portfolio since the reorganization was completed, it is not practicable to separate the amounts of revenue and earnings of the Westport Fund and the Westport Select Cap Fund that have been included in the Fund’s Statement of Operations since September 23, 2016.

10). EVENTS SUBSEQUENT TO YEAR END

Management has evaluated the Fund’s related events and transactions that occurred subsequent to October 31, 2016, through the date of issuance of the Fund’s financial statements. Other than as disclosed below, management has determined that there were no subsequent events requiring recognition or disclosure in the financial statements.

On December 7, 2016, capital gains were declared and paid to shareholders of record as of December 6, 2016, as follows:

| Long-term | ||

Amount Per Share | ||

| Investor Class | $0.12486 | |

| Institutional Class | $0.12776 |

| HENNESSY FUNDS | 1-800-966-4354 |

25

Report of Independent Registered Public Accounting Firm

The Board of Trustees of Hennessy Funds Trust

and the Shareholders of the Hennessy Cornerstone Mid Cap 30 Fund:

We have audited the accompanying statement of assets and liabilities of the Hennessy Cornerstone Mid Cap 30 Fund (the Fund), a series of Hennessy Funds Trust, including the schedule of investments, as of October 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two year period then ended, and the financial highlights for each of the years in the five year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2016, by correspondence with custodians and brokers or by other appropriate auditing procedures. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of October 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two year period then ended, and the financial highlights for each of the years in the five year period then ended, in conformity with U.S. generally accepted accounting principles.

Chicago, Illinois

December 22, 2016

HENNESSYFUNDS.COM

26

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM/TRUSTEES AND OFFICERS |

Trustees and Officers of the Fund (Unaudited)

The business and affairs of the Fund are managed under the direction of the Board of Trustees of the Trust, and the Board of Trustees elects the Officers of the Trust. Beginning in March 2015, the Board of Trustees has from time to time appointed advisers (“Advisers “) to the Board of Trustees, with the intention of having qualified individuals serve in an advisory capacity in order to garner experience in the mutual fund and asset management industry and be considered as potential Trustees in the future. There are currently three Advisers to the Board of Trustees: Brian Alexander, Doug Franklin, and Claire Knoles. As Advisers, Mr. Alexander, Mr. Franklin, and Ms. Knoles attend meetings of the Board and act as non-voting participants. Information pertaining to the Trustees, Advisers, and the Officers of the Trust is set forth below. The Trustees and Officers serve until their successors are duly elected and qualified or until their earlier death, resignation, or removal. Each of the Trustees oversees 16 Hennessy Funds. Unless otherwise indicated, the address of all persons listed below is 7250 Redwood Boulevard, Suite 200, Novato, CA 94945. The Fund’s Statement of Additional Information includes more information about the persons listed below and is available, without charge, upon request by calling 1-800-966-4354.

| Other | |||

| Directorships | |||

| Held Outside | |||

| Name, (Year of Birth), | of Fund | ||

| and Position Held | Start Date | Principal Occupation(s) | Complex During |

with the Trust | of Service | During Past Five Years | Past Five Years(1) |

| Disinterested Trustees and Advisers | |||

| J. Dennis DeSousa | January 1996 | Mr. DeSousa is a real estate investor. | None. |

| (1936) | |||

| Trustee | |||

| Robert T. Doyle | January 1996 | Mr. Doyle has been the Sheriff of | None. |

| (1947) | Marin County, California since 1996. | ||

| Trustee | |||

| Gerald P. Richardson | May 2004 | Mr. Richardson is an independent | None. |

| (1945) | consultant in the securities industry. | ||

| Trustee | |||

| Brian Alexander | March 2015 | Mr. Alexander has been employed | None. |

| (1981) | by Sutter Health Novato Community | ||

| Adviser to the Board | Hospital since 2012, first as an | ||

| Assistant Administrator and then, | |||

| beginning in 2013, as the Chief | |||

| Administrative Officer. From 2011 | |||

| through 2012, Mr. Alexander was | |||

| employed by Sutter Health West Bay | |||

| Region as the Regional Director of | |||

| Strategic Decision Support. Prior to | |||

| that, in 2011, he served as the | |||

| Director of Managed Care | |||

| Contracting and also the Director of | |||

| Compensation, Benefits, and | |||

| Compliance for the Rehabilitation | |||

| Institute of Chicago. | |||

| HENNESSY FUNDS | 1-800-966-4354 |

27

| Other | |||

| Directorships | |||

| Held Outside | |||

| Name, (Year of Birth), | of Fund | ||

| and Position Held | Start Date | Principal Occupation(s) | Complex During |

with the Trust | of Service | During Past Five Years | Past Five Years(1) |

| Doug Franklin | March 2016 | Mr. Franklin is a retired insurance | None. |

| (1964) | industry executive. From 1987 | ||

| Adviser to the Board | through 2015, he was employed by | ||

| the Allianz-Fireman’s Fund Insurance | |||

| Company in various positions, | |||

| including as its Chief Actuary and | |||

| Chief Risk Officer. | |||

| Claire Knoles | December 2015 | Ms. Knoles is a founder of Kiosk and | None. |

| (1974) | has served as its Chief Operating | ||

| Adviser to the Board | Officer since 2004. Kiosk is a full | ||

| service marketing agency with | |||

| offices in the San Francisco Bay | |||

| Area, Toronto, and Liverpool, UK. | |||

Interested Trustee(2) | |||

| Neil J. Hennessy | January 1996 as | Mr. Hennessy has been employed by | Hennessy |

| (1956) | a Trustee and | Hennessy Advisors, Inc. since 1989 | Advisors, Inc. |

| Trustee, Chairman of | June 2008 as | and currently serves as its President, | |

| the Board, Chief | an Officer | Chairman and Chief Executive Officer. | |

| Investment Officer, | |||

| Portfolio Manager, | |||

| and President |

| Name, (Year of Birth), | ||

| and Position Held | Start Date | Principal Occupation(s) |

with the Trust | of Service | During Past Five Years |

| Officers | ||

| Teresa M. Nilsen | January 1996 | Ms. Nilsen has been employed by Hennessy Advisors, Inc. |

| (1966) | since 1989 and currently serves as its Executive Vice President, | |

| Executive Vice President | Chief Operations Officer, Chief Financial Officer, and Secretary. | |

| and Treasurer | ||

| Daniel B. Steadman | March 2000 | Mr. Steadman has been employed by Hennessy Advisors, Inc. |

| (1956) | since 2000 and currently serves as its Executive Vice President | |

| Executive Vice President | and Chief Compliance Officer. | |

| and Secretary | ||

| Jennifer Cheskiewicz | June 2013 | Ms. Cheskiewicz has been employed by Hennessy Advisors, Inc. |

| (1977) | as its General Counsel since June 2013. She previously served | |

| Senior Vice President and | as in-house counsel to Carlson Capital, L.P., an SEC-registered | |

| Chief Compliance Officer | investment advisor to several private funds, from | |

| February 2010 to May 2013. | ||

| Brian Carlson | December 2013 | Mr. Carlson has been employed by Hennessy Advisors, Inc. |

| (1972) | since December 2013. Mr. Carlson was previously a co-founder | |

| Senior Vice President and | and principal of Trivium Consultants, LLC from February 2011 | |

| Head of Distribution | through November 2013. |

HENNESSYFUNDS.COM

28

| TRUSTEES AND OFFICERS OF THE FUND |

| Name, (Year of Birth), | ||

| and Position Held | Start Date | Principal Occupation(s) |