SUMMARY

The following summary highlights certain information contained elsewhere in this prospectus supplement and the accompanying prospectus and is qualified in its entirety by the more detailed information and historical financial statements incorporated by reference. Because this is a summary, it is not complete and may not contain all of the information that may be important to you in making a decision to invest in the common stock. Before making an investment decision, you should carefully read the entire prospectus supplement and the accompanying prospectus, including the information presented elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. For a list of the documents incorporated by reference and where to find them, see the section entitled “Incorporation by Reference.”

Unless otherwise indicated or the context otherwise requires, references in this prospectus supplement to (i) the “Issuer” refer to Chart Industries, Inc. and not to any of its subsidiaries; (ii) LTM refers to the last twelve months ended period referred to; (iii) “we,” “us,” “our” and the “Company” refer to Chart Industries, Inc. and its consolidated subsidiaries and, unless otherwise indicated or the context otherwise requires, do not include Howden; and (iv) “pro forma” information give pro forma effect to the Transactions described under “—Description of the Acquisition and Concurrent Financing Transactions” as if they had occurred on January 1, 2021 in the case of pro forma financial information for the year ended December 31, 2021 and the twelve months ended September 30, 2022 and on September 30, 2022 for pro forma financial information as of such date. Unless otherwise indicated, the information herein does not give effect to the exercise by the underwriters of their option to purchase additional shares in this offering or over-allotment option in the Concurrent Depositary Shares Offering.

OUR COMPANY

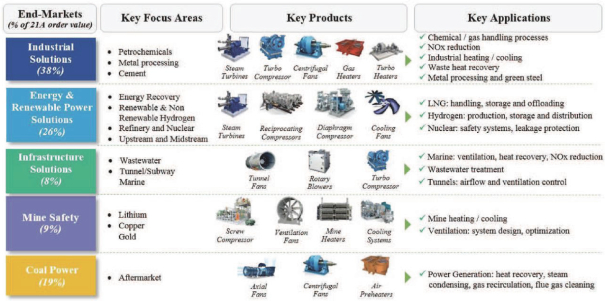

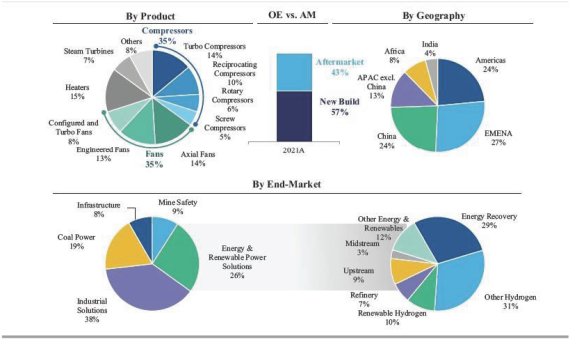

We are a leading global manufacturer of highly engineered process technologies and cryogenic equipment servicing multiple market applications in the industrial gas and clean energy, clean water, and clean food industries. Our unique product portfolio is used in every phase of the liquid gas supply chain including upfront engineering, service and repair. Being at the forefront of the clean energy transition, Chart is a leading provider of technology, equipment and services related to liquefied natural gas, hydrogen, biogas, CO2 Capture and water treatment, among other applications. We are committed to excellence in environmental, social and corporate governance (ESG) issues both for our company as well as our customers. With 36 global locations including in the United States, Europe, China, India, Australia and South America, we maintain accountability and transparency to our team members, suppliers, customers and communities.

We sell our products and services to a global customer base, having developed long-standing relationships with leading companies in the gas production, distribution and processing industries as well as those involved in liquefied natural gas (“LNG”), hydrogen, water, food and beverage, space exploration, rail, chemicals and industrial gasses. Our well-established relationships extend to truck manufacturers in addition to those in other clean energy industries such as biofuels, hydrogen and CO2 capture. Our customers include: Chick-fil-A, Linde, Air Liquide, IVECO, Air Products, Shell, Chevron, ExxonMobil, New Fortress Energy, Samsung, Plug Power, United Launch Alliance, and Blue Origin, some of whom have been purchasing our products for over 30 years.

We have achieved this competitive position by capitalizing on our technical expertise, broad product and service offering, reputation for a high-quality global manufacturing footprint and sales and customer support presence, and by focusing on attractive, growth markets. For the LTM period ended September 30, 2022, and the years ended December 31, 2021, 2020 and 2019, we reported sales of $1,550 million, $1,318 million, $1,177 million, and $1,216 million, respectively. Over the same periods, we generated net income of $77 million, $59 million, $69 million and $31 million, respectively, and Pro Forma Adjusted EBITDA of $267 million, $231 million, $222 million and $204 million, respectively.