0000895728us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberenb:DeferredAmountsAndOtherMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| | | | | | | | |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15254

_______________________________

ENBRIDGE INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Canada | | 98-0377957 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

200, 425 - 1st Street S.W.

Calgary, Alberta, Canada T2P 3L8

(Address of Principal Executive Offices) (Zip Code)

(403) 231-3900

(Registrant’s Telephone Number, Including Area Code)

_______________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares | ENB | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

_______________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common shares held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2024, was approximately US$77.5 billion.

As at February 7, 2025, the registrant had 2,179,049,670 common shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Not applicable.

EXPLANATORY NOTE

Enbridge Inc., a corporation existing under the Canada Business Corporations Act, qualifies as a foreign private issuer in the United States (US) for purposes of the Securities Exchange Act of 1934, as amended (the Exchange Act). Although, as a foreign private issuer, Enbridge Inc. is not required to do so, Enbridge Inc. currently files annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K with the Securities and Exchange Commission (SEC) instead of filing the reporting forms available to foreign private issuers.

Enbridge Inc. intends to prepare and file a management information circular and related material under Canadian requirements. As Enbridge Inc.’s management information circular is not filed pursuant to Regulation 14A, Enbridge Inc. may not incorporate by reference information required by Part III of this Form 10-K from its management information circular. Accordingly, in reliance upon and as permitted by Instruction G(3) to Form 10-K, Enbridge Inc. will be filing an amendment to this Form 10-K containing the Part III information no later than 120 days after the end of the fiscal year covered by this Form 10-K.

| | | | | | | | |

| | PAGE |

| PART I | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

GLOSSARY

| | | | | | |

| "we", "our", "us" and "Enbridge" | | Enbridge Inc. |

| AFUDC | | Allowance for funds used during construction |

| Aitken Creek | | Aitken Creek Gas Storage Facility |

| | |

| AOCI | | Accumulated other comprehensive income/(loss) |

| ARO | | Asset retirement obligations |

| ATM Program | | The at-the-market equity issuance program |

| Aux Sable | | US Midstream ownership interest in Aux Sable Liquid Products LP, Aux Sable Midstream LLC, Aux Sable Canada LP |

| BC | | British Columbia |

| bcf/d | | Billion cubic feet per day |

| CER | | Canada Energy Regulator |

| DAPL | | Dakota Access Pipeline |

| Dawn | | An extensive network of underground storage pools at the Tecumseh Gas Storage facility and Dawn Hub |

| DCP | | DCP Midstream, LP |

| EBITDA | | Earnings before interest, income taxes and depreciation and amortization |

| EEP | | Enbridge Energy Partners, L.P. |

| EIEC | | Enbridge Ingleside Energy Center |

| EIS | | Environmental Impact Statement |

| Enbridge Gas Ontario | | Enbridge Gas Inc. |

| EOG | | The East Ohio Gas Company |

| EPS | | Emissions performance Standards |

| ESG | | Environment, Social and Governance |

| Exchange Act | | United States Securities Exchange Act of 1934 |

| FERC | | Federal Energy Regulatory Commission |

| GHG | | Greenhouse gas |

| Gray Oak | | Gray Oak Pipeline, LLC |

| IAA | | The Impact Assessment Act by the Government of Canada |

| Idaho Commission | | The Idaho Public Utilities Commission |

| | |

| ISO | | Incentive Stock Options |

| kbpd | | Thousand barrels per day |

| LMCI | | Land Matters Consultation Initiative |

| LNG | | Liquefied natural gas |

| M&N | | Maritimes & Northeast Pipeline |

| M&N Canada | | Canadian portion of our Maritimes & Northeast Pipeline |

| MPLX | | MPLX LP |

| MTS | | Mainline Tolling Settlement |

| MW | | Megawatts |

| NEXUS | | NEXUS Gas Transmission, LLC

|

| NGL | | Natural gas liquids |

| North Carolina Commission | | The North Carolina Utilities Commission |

| NRGreen | | NRGreen Power Limited Partnership |

| | | | | | |

| OCI | | Other comprehensive income/(loss) |

| OEB | | Ontario Energy Board |

| Ohio Commission | | The Public Utilities Commission of Ohio |

| OPEB | | Other postretirement benefit obligations |

| | |

| Phase 1 Decision | | The Ontario Energy Board's Decision and Order on December 21, 2023, on Phase 1 of Enbridge Gas Inc.'s application to establish a 2024 through 2028 Incentive Regulation rate setting framework |

| | |

| PIR | | Pipeline Infrastructure Replacement |

| PPA | | Power purchase agreements |

| PSNC | | Public Service Company of North Carolina, Incorporated |

| PSU | | Performance Stock Units |

| Questar | | Questar Gas Company |

| RNG | | Renewable natural gas |

| ROE | | Return on Equity |

| ROU | | Right-of-use |

| RSU | | Restricted Stock Units |

| SEC | | US Securities and Exchange Commission |

| SEP | | Spectra Energy Partners, LP |

| Spectra Energy | | Spectra Energy Corp |

| Texas Eastern | | Texas Eastern Transmission, LP |

| TGE | | Tri Global Energy, LLC |

| the Acquisitions | | Enbridge Inc.'s acquisitions of three US gas utilities from Dominion Energy, Inc. |

| the Band | | Bad River Band of the Lake Superior Tribe of Chippewa Indians |

| the Board | | Board of Directors |

| the Court | | The US District Court for the Western District of Wisconsin |

| the EOG Acquisition | | Enbridge Inc.'s acquisition of all of the outstanding shares of capital stock of The East Ohio Gas Company on March 6, 2024 |

| the Partnerships | | Spectra Energy Partners, LP and Enbridge Energy Partners, L.P. |

| the PSNC Acquisition | | Enbridge Inc.'s acquisition of all of the membership interests of Fall North Carolina Holdco LLC, which owns 100% of Public Service Company of North Carolina, Incorporated on September 30, 2024 |

| the Questar Acquisition | | Enbridge Inc.'s acquisition of all of the membership interests of Fall West Holdco LLC which owns 100% of Questar Gas Company and its related Wexpro companies on May 31, 2024 |

| the Reservation | | The Bad River Reservation |

| the Whistler Parent JV | | The joint venture formed by Enbridge Inc., WhiteWater/I Squared Capital and MPLX LP on May 29, 2024 |

| Tomorrow RNG | | Six Morrow Renewables operating landfill gas-to-renewable natural gas production facilities |

| Tres Palacios | | Tres Palacios Holdings LLC |

| UK | | The United Kingdom |

| US | | United States of America |

| US District Court | | US District Court in the Western District of Michigan |

| US GAAP | | Generally accepted accounting principles in the United States of America |

| Utah Commission | | The Utah Public Service Commission |

| | | | | | |

| Vector | | Vector Pipeline L.P. |

| VIEs | | Variable interest entities |

| Wexpro | | Wexpro Company and its consolidated subsidiaries |

| Wyoming Commission | | The Wyoming Public Service Commission |

CONVENTIONS

The terms "we", "our", "us" and "Enbridge" as used in this report refer collectively to Enbridge Inc. and its subsidiaries unless the context suggests otherwise. These terms are used for convenience only and are not intended as a precise description of any separate legal entity within Enbridge.

Unless otherwise specified, all dollar amounts are expressed in Canadian dollars, all references to "dollars" or "$" are to Canadian dollars and all references to "US$" are to US dollars. All amounts are provided on a before-tax basis, unless otherwise stated.

FORWARD-LOOKING INFORMATION

Forward-looking information, or forward-looking statements, have been included in this Annual Report on Form 10-K to provide information about us and our subsidiaries and affiliates, including management’s assessment of our and our subsidiaries’ future plans and operations. This information may not be appropriate for other purposes. Forward-looking statements are typically identified by words such as ‘‘anticipate”, “believe”, “estimate”, “expect”, “forecast”, “intend”, “likely”, “plan”, “project”, “target” and similar words suggesting future outcomes or statements regarding an outlook. Forward-looking information or statements included or incorporated by reference in this document include, but are not limited to, statements with respect to the following: our corporate vision and strategy, including strategic priorities and enablers; expected supply of, demand for, exports of and prices of crude oil, natural gas, natural gas liquids (NGL), liquefied natural gas (LNG), renewable natural gas (RNG) and renewable energy; energy transition and lower-carbon energy, and our approach thereto; environmental, social and governance (ESG) goals, practices and performance; industry and market conditions; anticipated utilization of our assets; dividend growth and payout policy; financial strength and flexibility; expectations on sources of liquidity and sufficiency of financial resources; expected strategic priorities and performance of the Liquids Pipelines, Gas Transmission, Gas Distribution and Storage, and Renewable Power Generation businesses; the characteristics, anticipated benefits, financing and timing of our acquisitions, dispositions and other transactions, including the anticipated benefits of the acquisition of three US gas utilities (US Gas Utilities) from Dominion Energy, Inc. (the Acquisitions); expected costs, benefits and in-service dates related to announced projects and projects under construction; expected capital expenditures; investable capacity and capital allocation priorities; expected equity funding requirements for our commercially secured growth program; expected future growth, development and expansion opportunities; expected optimization and efficiency opportunities; expectations about our joint venture partners’ ability to complete and finance projects under construction; expected closing of acquisitions, dispositions and other transactions and the timing thereof; expected benefits of transactions, including the Acquisitions; our ability to successfully integrate the US Gas Utilities; expected future actions of regulators and courts, government trade policies, including potential impacts of tariffs, duties, fees, economic sanctions, or other trade measures, and the timing and impact thereof; toll and rate cases discussions and proceedings and anticipated timeline and impact therefrom, including those relating to the Gas Distribution and Storage and Gas Transmission businesses; operational, industry, regulatory, climate change and other risks associated with our businesses; and our assessment of the potential impact of the various risk factors identified herein.

Although we believe these forward-looking statements are reasonable based on the information available on the date such statements are made and processes used to prepare the information, such statements are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking statements. By their nature, these statements involve a variety of assumptions, known and unknown risks and uncertainties and other factors, which may cause actual results, levels of activity and achievements to differ materially from those expressed or implied by such statements. Material assumptions include assumptions about the following: the expected supply of, demand for, export of and prices of crude oil, natural gas, NGL, LNG, RNG and renewable energy; anticipated utilization of assets; exchange rates; inflation; interest rates; availability and price of labor and construction materials; the stability of our supply chain; operational reliability; maintenance of support and regulatory approvals for our projects and transactions; anticipated in-service dates; weather; the timing, terms and closing of acquisitions, dispositions and other transactions; the realization of anticipated benefits of transactions, including the Acquisitions; governmental legislation; litigation; estimated future dividends and impact of our dividend policy on our future cash flows; our credit ratings; capital project funding; hedging program; expected earnings before interest, income taxes, and depreciation and amortization (EBITDA); expected earnings/(loss); expected future cash flows; and expected distributable cash flow. Assumptions regarding the expected supply of and demand for crude oil, natural gas, NGL, LNG, RNG and renewable energy, and the prices of these commodities, are material to and underlie all forward-

looking statements, as they may impact current and future levels of demand for our services. Similarly, exchange rates, inflation and interest rates impact the economies and business environments in which we operate and may impact levels of demand for our services and cost of inputs, and are therefore inherent in all forward-looking statements. The most relevant assumptions associated with forward-looking statements regarding announced projects and projects under construction, including estimated completion dates and expected capital expenditures, include the following: the availability and price of labor and construction materials; the stability of our supply chain; the effects of inflation and foreign exchange rates on labor and material costs; the effects of interest rates on borrowing costs; the impact of weather; and customer, government, court and regulatory approvals on construction and in-service schedules and cost recovery regimes.

Our forward-looking statements are subject to risks and uncertainties pertaining to the successful execution of our strategic priorities; operating performance; legislative and regulatory parameters; litigation; acquisitions, dispositions and other transactions and the realization of anticipated benefits therefrom (including the anticipated benefits from the Acquisitions); operational dependence on third parties; dividend policy; project approval and support; renewals of rights-of-way; weather; economic and competitive conditions; public opinion; changes in tax laws and tax rates; exchange rates; inflation; interest rates; commodity prices; access to and cost of capital; political decisions; and evolving government trade policies, including potential and announced tariffs, duties, fees, economic sanctions, or other trade measures, global geopolitical conditions; and the supply of, demand for and prices of commodities and other alternative energy, including but not limited to, those risks and uncertainties discussed in this Annual Report on Form 10-K and in our other filings with Canadian and US securities regulators. The impact of any one assumption, risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these are interdependent and our future course of action depends on management’s assessment of all information available at the relevant time. Except to the extent required by applicable law, Enbridge assumes no obligation to publicly update or revise any forward-looking statement made in this Annual Report on Form 10-K or otherwise, whether as a result of new information, future events or otherwise. All forward-looking statements, whether written or oral, attributable to us or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

NON-GAAP AND OTHER FINANCIAL MEASURES

Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A) in this Annual Report on Form 10-K makes reference to non-GAAP and other financial measures, including EBITDA. EBITDA is defined as earnings before interest, income taxes and depreciation and amortization. Management uses EBITDA to assess performance of Enbridge and to set targets. Management believes the presentation of EBITDA gives useful information to investors as it provides increased transparency and insight into the performance of Enbridge.

The non-GAAP and other financial measures are not measures that have a standardized meaning prescribed by the accounting principles generally accepted in the US (US GAAP) and are not US GAAP measures. Therefore, these measures may not be comparable with similar measures presented by other issuers. A reconciliation of historical non-GAAP and other financial measures to the most directly comparable GAAP measures is set out in this MD&A and is available on our website. Additional information on non-GAAP and other financial measures may be found on our website, www.sedarplus.ca or www.sec.gov.

PART I

ITEM 1. BUSINESS

Enbridge is a leading North American energy infrastructure company. Our core businesses include Liquids Pipelines, which consists of pipelines and terminals in Canada and the US that transport and export various grades of crude oil and other liquid hydrocarbons; Gas Transmission, which consists of investments in natural gas pipelines and gathering and processing facilities in Canada and the US; Gas Distribution and Storage, which consists of natural gas utility operations that serve residential, commercial and industrial customers in Canada and the US; and Renewable Power Generation, which consists primarily of investments in wind and solar assets, as well as geothermal and power transmission assets, in North America and Europe.

Enbridge is a public company, with common shares that trade on the Toronto Stock Exchange (TSX) and New York Stock Exchange (NYSE) under the symbol ENB. We were incorporated on April 13, 1970 under the Companies Ordinance of the Northwest Territories and were continued under the Canada Business Corporations Act on December 15, 1987.

A more detailed description of each of our businesses and underlying assets is provided below under Business Segments.

CORPORATE VISION AND STRATEGY

VISION

Enbridge through its diversified businesses, fuels people’s quality of life in a safe and socially responsible manner in North America and beyond. Our vision is to provide energy in a planet-friendly way, everywhere people need it. In pursuing this vision, we seek to play a critical role in enabling the economic and social well-being of society by providing access to affordable, reliable, and secure energy through our infrastructure which transports, distributes, and generates energy, including liquids, natural gas, renewable power, and low-carbon fuels. We recognize that the energy system is changing, and we aim to provide a bridge to a cleaner energy future in a socially-responsible way, including selectively investing in lower-carbon energy technologies.

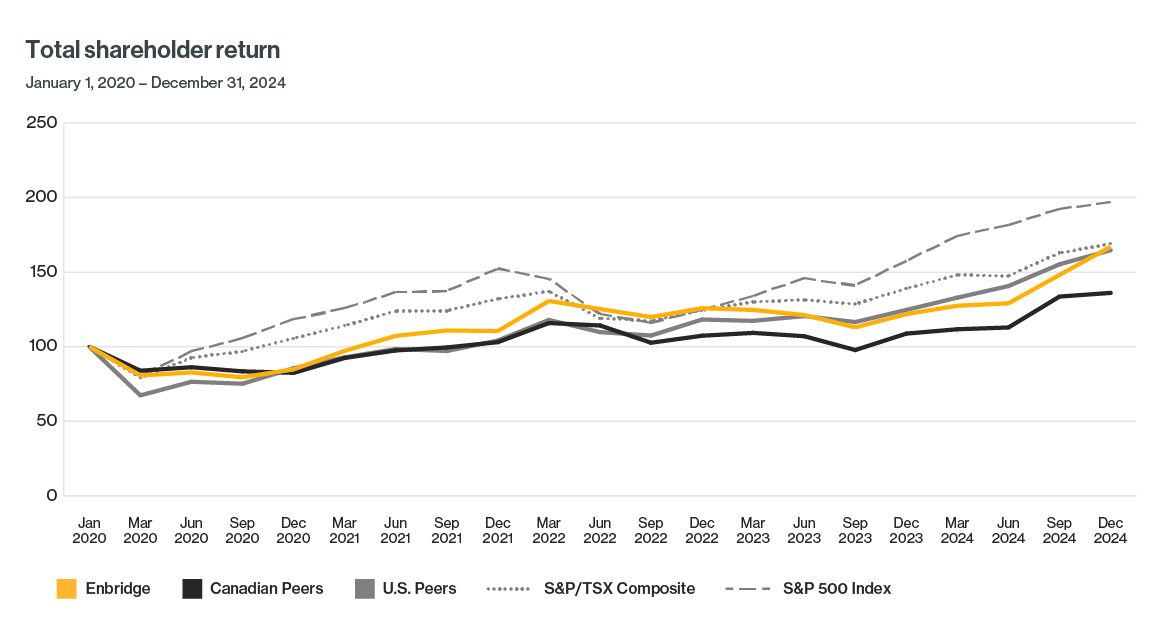

We aim to be a first-choice investment, supported by our investor value proposition of predictable and stable cash flows, a strong investment grade balance sheet to facilitate growth, a history of dividend increases, and a diversified opportunity set of growth projects in multiple jurisdictions to support continued EBITDA and distributable cash flow per share growth. Our assets are underpinned by long-term contracts, regulated cost-of-service tolling frameworks, power purchase agreements (PPAs), and other low-risk commercial arrangements.

We strive to be the leading first-choice energy delivery company in North America and beyond—for customers, communities, investors, regulators, policymakers, and employees. We approach this goal with a focus on worker and public safety, stakeholder relations, customer service, community investment, sustainability leadership, and employee engagement and satisfaction. As part of our community engagement, we remain committed to meaningful dialogue with Indigenous peoples to achieve common goals and constructive outcomes from our projects and operations. We also are committed to advancing investment opportunities with Indigenous groups, as demonstrated by recent partnerships on our oil pipelines and in the development of renewable energy projects.

STRATEGY

Our strategy is underpinned by a deep understanding of both local and global energy supply and demand fundamentals. Through disciplined capital allocation, aligned with our outlook on energy markets, we have become an industry leader with a diversified portfolio of infrastructure super systems across the North American continent, creating a platform for incremental growth. Our robust pipeline of project development opportunities, the integration of recent strategic acquisitions, and ongoing efficiency improvements are expected to drive our business forward. We remain confident in our balanced growth strategy and expect to continue to invest in our diversified footprint of both conventional businesses and complementary lower-carbon platforms. This includes extension and expansion opportunities to meet LNG exports and offshore gas, as well as leveraging North American electrification trends, including the expansion of data centers, where we can provide integrated customer solutions through our natural gas and renewable power businesses. Additionally, we are committed to effectively managing our emissions from our operations and building lasting and inclusive relationships with our stakeholders, including Indigenous peoples, our customers and employees.

Our assets have reliably generated low-risk, resilient cash flows through many different commodity, economic, and geopolitical environments. We believe that our asset quality, diversity, and ability to provide comprehensive solutions to customers which leverages expertise across our four business lines are key differentiators that enable us to be flexible in an uncertain business environment.

In order to continue to be an industry leader and to create value over the short and long term, we maintain a robust strategic planning process. We regularly conduct scenario and resiliency analysis on both our assets and business strategy. We test various value enhancement and maximization options, and we regularly engage with our Board of Directors (the Board) to promote alignment and maintain active oversight. This Board participation includes updates and discussions throughout the year and a dedicated annual strategic planning session. Going forward, we will continue to use this comprehensive approach to guide our investment decisions.

Consistent with our strategy, we have progressed several of our priorities in 2024. For example:

•We completed the acquisition of the US Gas Utilities with operations in Idaho, North Carolina, Ohio, Utah and Wyoming, creating the largest natural gas utility franchise in North America, providing visible, low-risk, long-term, rate base growth.

•Our Liquids Pipelines business exported record volumes through our Enbridge Ingleside Energy Center (EIEC), received approval from the Canada Energy Regulator (CER) in 2024 for our Mainline Tolling negotiated settlement through to 2028, sanctioned an expansion of the Gray Oak pipeline and incremental capacity at the EIEC following successful open seasons, and acquired marine docks with land adjacent to EIEC, further advancing our Permian export strategy.

•Our Gas Transmission business reached a negotiated settlement with shippers on Texas Eastern, announced and closed the Whistler Parent JV, a joint venture formed by Enbridge, WhiteWater/I Squared Capital and MPLX LP, connecting Permian Basin natural gas supply to growing LNG and other US Gulf Coast demand, and achieved final investment decision on the Tennessee Ridgeline Expansion and Blackcomb Natural Gas Pipeline. We also expanded our footprint in the Gulf Coast by sanctioning the Canyon System Pipelines and the formation of a joint venture to service the Sparta offshore development to serve BP, Shell and Equinor Gulf Coast developments. We also expanded our exposure to LNG by sanctioning the Venice Extension Project, which supplies the Venture Global Plaquemines LNG facility. We continue to work with customers on opportunities to supply new gas-fired power generation relating to data centers and growth of electricity demand generally, and capitalize on strong gas fundamentals to deliver safe, reliable, and lower-carbon energy to North Americans while simultaneously growing LNG exports.

•Our Gas Distribution and Storage business continued to advance its incentive regulation rate application in Ontario by filing a settlement proposal for the second phase of our 2024 rebasing application with the Ontario Energy Board (OEB), added approximately 36,000 new customers across our Ontario utilities business, commenced the integration of the Acquisitions, including its three million customers, and capitalized on increasing electric power and industrial demand - for example, by contracting gas supply to provide 200 megawatts (MW) of data center power in Utah and building the Moriah Energy Center, a 2 billion cubic feet LNG facility, to enable system growth and maintain reliability in North Carolina. We remain committed to assessing low-risk, capital investment opportunities, and providing cost-effective, reliable and lower-carbon energy to customers in Ontario, Quebec, Ohio, North Carolina, Utah, Wyoming, and Idaho.

•Our Renewable Power Generation business continued to execute on growth opportunities, including through our onshore business with the sanctioning of Orange Grove Solar in Texas (backed by a PPA with AT&T), Sequoia Solar in Texas (backed by a PPA with AT&T and Toyota), completion of Fox Squirrel Solar Phase 2 and 3 in Ohio (backed by a PPA with Amazon), and the announcement of the Seven Stars Energy Project, our first renewable power indigenous partnership focused on wind energy generation in Saskatchewan. We also continued to progress opportunities in our Offshore Wind business in Europe, including placing the Fécamp project into service, delivering first power to the French grid from the Provence Grand Large floating offshore wind project and more recently, winning an offshore wind farm tender for a project in the Mediterranean Sea off the southern coast of France.

•We continued to make meaningful progress towards our ESG goals. We further strengthened our relationships with Indigenous communities across North America while advancing our reconciliation commitments as a part of our Indigenous Reconciliation Action Plan, meeting 12 of 22 commitments. We are striving to reduce emissions from our operations through multiple pathways, including system modernization, and continued investment in our lower-carbon businesses.

•We continue to recycle capital at attractive valuations; in 2024, this included completing the sale of our interests in the Alliance Pipeline and Aux Sable facility. We remain focused on disciplined capital allocation, portfolio optimization and diversification, the continued enhancement of our industry leading cash flow profile and financial strength and flexibility. In addition, we continue to prioritize operating cost reductions across our business to increase our competitiveness and profitability.

These achievements are discussed in further detail in Part II. Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Looking ahead, our near-term strategic priorities remain similar to past years. As always, proactively advancing the safety of our assets, protecting the environment, and maintaining system reliability remain our top priorities. We are focused on enhancing the value of our existing assets through further optimization, capitalizing on our extensive infrastructure to meet evolving customer needs, prioritizing in-franchise organic growth and export-driven opportunities, and continuing to develop lower-carbon platforms across all our businesses.

As an example, we are continuing to pursue opportunities related to electrification in North America, where we can utilize our existing gas transmission and distribution infrastructure to safely deliver gas to new and existing power plants being developed, given surging power demand. We are also pursuing opportunities to build new natural gas infrastructure along our network and within our gas distribution territories, combined with providing gas supply and storage to customers, to support this growth. To complement our natural gas offerings, we are also able to provide renewable energy solutions (electricity and renewable credits/offsets) to customers, which we view as a strategic competitive advantage, enabling us to expand our customer base and further extend our growth.

We expect to continue to invest on an attractive, risk-adjusted basis to advance our strategy and build a sustainable competitive advantage.

Our key strategic priorities include:

Safety and Operational Reliability

Safety and operational reliability are the foundation of our strategy. We strive to achieve and maintain industry leadership in all facets of safety - process, public, and personal - and ensure the highest standards of reliability and integrity across our system to protect our communities and the environment.

Extend Growth

The cornerstone of our growth lies in the successful execution of our slate of secured projects (currently $26 billion through 2029) on schedule and within estimated costs, while maintaining standards for safety, quality, customer satisfaction, and environmental and regulatory compliance. For a discussion of our current portfolio of capital projects refer to Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Growth Projects - Commercially Secured Projects.

We continue to seek additional high-quality growth opportunities across all our platforms, and deploy capital towards optimal uses, prioritizing balance sheet strength, investment in low capital intensity growth, and regulated utility or utility-like projects. Our scale and diversification drive competitive advantages across the enterprise and generate opportunities for collaboration across the business units. The four business segments we operate share commercial advantages and strong stakeholder relationships that enable opportunities to cross-sell to customers across the business units, providing additional value and the potential for future growth. We will carefully assess our remaining investable capacity, deploying capital to the most value-enhancing opportunities available to us, including further organic growth, and complementary accretive "tuck-in" acquisitions that improve our competitive positioning or further strengthen our balance sheet.

Looking ahead, we see strong utilization of our network and opportunities for growth within each of our businesses. For example, we expect that:

•Our liquids pipelines infrastructure will remain a vital connection between key supply basins and demand-pull markets such as the refinery hubs in the US Midwest, eastern Canada, and the US Gulf Coast. We are advancing discussions with customers for additional Western Canadian Sedimentary Basin pipeline capacity in 2026 and beyond. We will continue to explore capital efficient growth opportunities via system expansions and optimization of operations. Our export infrastructure will also enable the transportation of crude oil, cleaner fuels, and other export opportunities. Building on our early experience, we expect that carbon capture and storage (CCS) offers the potential to provide additional new growth opportunities within our footprint in jurisdictions with supportive regulatory regimes.

•Our natural gas transmission business will seek extension and expansion opportunities driven by new load demand from gas-fired power generation (including for data centers, electrification, and reshoring), industrial growth, and coastal LNG plants. The strategic asset position we possess produces opportunities to accelerate growth and meet customer needs. Our rate regulated cost-of-service business model creates secured growth opportunities that yield predictable, low-risk cash flows. We are also focused on facilitating the connection of new gas supply to key demand centers and the build-out of our Permian gas value chain. Looking forward, we expect the integration of producing and blending RNG into our system to enhance asset longevity, enable us to offer differentiated lower-carbon solutions to customers and further decarbonize our gas offerings.

•Our North American gas distribution and storage business will continue to grow through customer additions and modernization investments. Data center driven demand presents an opportunity for the business to expand services by fueling natural gas power plants. We believe system and storage enhancements in the business will increase system flexibility, reliability, and price stability for customers.

•Our renewable power business continues to be well positioned to capitalize on the growth of renewables in North America and Europe through disciplined investment in diversified renewable technologies and selective development in supportive jurisdictions where we have an established presence. We will continue to leverage our strong internal capabilities and our existing partnerships to successfully execute our large development portfolio.

In addition, we aim to drive growth with a focus on optimization, modernization, productivity, and efficiency across all our businesses. Examples include: the application of drag-reducing agents and pump station modifications to optimize throughput on our liquids system, the execution of toll settlements and rate case filings to optimize revenue within our liquids pipeline and gas transmission franchises, the expansion of lower-carbon gas offerings to modernize and integrate value chains at our gas utilities, and the creation of sustainable cost savings across the organization through innovation, process improvement and system enhancements.

Maintain Financial Strength and Flexibility

Our financing strategies are designed to retain strong, investment-grade credit ratings so that we have the financial capacity to meet our capital funding needs and the flexibility to manage capital market disruptions. We expect that the current secured capital program can be readily financed through an equity self-funded model. For further discussion on our financing strategies, refer to Part II. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources.

Disciplined Capital Allocation

We assess the latest fundamental trends, monitor the business landscape, and proactively conduct business development activities with the goal of identifying an industry-leading capital deployment opportunity set. We screen, analyze, and assess these opportunities using a disciplined investment framework with the objective of effectively deploying capital to grow while achieving attractive risk-adjusted returns, within our low-risk "utility-like" business model.

All investment opportunities are evaluated based on their potential to advance our strategy, mitigate risks, support our ESG goals, and create additional financial flexibility. Our primary emphasis in the near term is on low capital intensity opportunities to enhance returns across existing businesses (organic expansions and optimizations), system modernization, and utility rate-based investments. We also continue to assess other strong value-enhancing opportunities, including accretive acquisitions that can complement our portfolio.

In evaluating typical investment opportunities, we also consider other potential capital allocation alternatives. Other alternatives for capital deployment depend on our current outlook and include further debt reduction, dividend increases, and share buy-backs.

Participate in Energy Transition Over Time

As the global population grows and standards of living continue to improve around the world, we expect energy demand to rise. We, and our society, increasingly recognize the need for secure and reliable energy while concurrently reducing global greenhouse gas (GHG) emissions. Accordingly, energy systems around the world are being gradually reshaped as industry participants, regulators, and consumers seek to balance these factors. As a diversified energy infrastructure company, we believe that we are well positioned to play a role in the energy transition by lowering the emissions-intensity of the conventional fuels we transport and store, supporting the switching from higher emission energy sources to lower-carbon options for our customers, and selectively developing and constructing future lower-carbon energy infrastructure.

We believe that diversification and innovation will play a significant role in the energy transition. To date, we have made significant investments in natural gas infrastructure, emissions reduction technologies, and renewable energy assets, helping to decrease our emissions and further expand our platforms to support the global energy transition. Our focus areas in renewable energy remain in utility-scale onshore solar and wind projects, and integrated clean-energy offerings and solutions for customers. We are also participating in the development of other lower-carbon platforms like RNG, blue ammonia, CCS, and hydrogen gas (H2) where we can leverage our infrastructure, capabilities, and stakeholder relationships to accelerate growth and extend the value of our existing assets. Additionally, potential new investments are evaluated to assess their alignment with our GHG emissions reduction goals.

We work closely with our customers and stakeholders to maintain a pulse on the pace of the energy transition and are actively leveraging our execution capabilities and sustainability leadership to advance our positioning as a differentiated energy provider. We regularly test our assets under various transition scenarios to assess the resiliency of our business.

STRATEGIC ENABLERS

To successfully execute on our strategy and build competitive advantage, we focus on maintaining leading-edge capabilities in sustainability, talent, technology, operations, development, and growth capabilities.

Sustainability and Environmental, Social and Governance

Sustainability is integral to our ability to deliver energy in a safe and reliable manner. How well we perform as a steward of our environment; as a safe operator of essential energy infrastructure; as an inclusive employer; and as a responsible corporate citizen is inextricably linked to our ability to achieve our strategic priorities and create long-term value for all our stakeholders.

In 2024, we published our 23rd annual Sustainability Report outlining our progress against our ESG goals1. In particular, we:

•achieved our goal to reduce the emissions intensity of our operations (Scope 1 and Scope 2) from our 2018 base level through modernization and innovation of our system, front of the meter renewables, and execution of additional renewable power PPAs;

•surpassed both of our Board composition goals, progressed our efforts to strengthen inclusion in our workforce to enhance our business, and empowered our workforce through employee resource groups1;

•made progress towards our Indigenous Reconciliation Action plan, including meeting 12 of 22 commitments; and

•continued to drive improvements towards our goal of zero safety incidents and injuries and progressed implementation of robust cyber defense programs.

Since setting our ESG goals in 2020, we have made considerable progress integrating sustainability into our strategy, governance, operations, and decision-making. We have linked sustainability performance to incentive compensation and are making meaningful progress towards these goals by executing on our action plans.

We are undertaking the following additional actions in support of our ESG goals:

•proactively working with organizations that are advancing emissions measurement and reduction guidelines for the midstream sector;

•collaborating with key suppliers on emissions reduction plans;

•further developing lower-carbon energy partnerships to drive innovation across our businesses, with a focus on renewable power, RNG, H2 and CCS; and

•continuing to advance our commitment to meaningful reconciliation and to building respectful and collaborative Indigenous partnerships.

We provide annual progress updates in our annual Sustainability Report which can be found at https://www.enbridge.com/sustainability-reports. Unless otherwise specifically stated, none of the information contained on, or connected to, the Enbridge website, including our annual Sustainability Report, is incorporated by reference in, or otherwise part of, this Annual Report on Form 10-K.

Operations & Development

As a major infrastructure developer and operator, Enbridge focuses on excellence in our business, specifically in safety, regulatory, project execution, and efficiency. Safety is foundational at Enbridge and our safety-first mindset reflects our commitment to protecting the public, our workers, the environment, and the health of our pipelines and facilities. We recognize the importance of having strong trusted relationships with our regulators as we plan and execute projects and sustain ongoing operations. We are committed to being proactive on regulatory matters at the federal, regional, and local levels to develop and maintain a safe and reliable energy system that our customers and the public can count on.

Robust project development, execution, governance, stakeholder relations, and supply chain processes are also key to delivering projects on time, at high quality, and within estimated costs. We continually seek ways to improve our organizational efficiency and effectiveness across all our core functions, including by streamlining structures, simplifying processes, improving accountability, and effectively managing risk to drive top-tier performance.

1All percentages or specific goals regarding ESG are aspirational goals which we intend to achieve in a manner compliant with state, local, provincial and federal law, including, but not limited to, executive orders, US federal regulations, the Equal Employment Opportunity Commission, and the Department of Labor.

Talent

Our workforce is essential to our success and our focus remains on enhancing the capabilities and skills of our people. We are evolving our talent strategy enhancing our employee experience, and elevating our focus on learning and development. We value diversity of thought, and the focus on our approach to people leadership drives business performance. Furthermore, we strive to maintain industry-competitive compensation, flexibility, and retention programs that provide both short- and long-term performance incentives. We prioritize inclusion, along with our other business strategies because it is fundamentally important to our values and culture.

Technology

We recognize the vital role technology plays in helping us achieve our strategic objectives. We are committed to pursuing innovation and technology solutions that further our safety and reliability, maximize revenues, reduce costs, and enable transition to new, cleaner energy solutions. We continue to focus on resilience and reliability of our systems from a cybersecurity perspective and work to enhance our capabilities and educate our workforce to protect our critical infrastructure system from increasing threats. We also announced a collaboration with Microsoft leveraging artificial intelligence (AI) to drive advancements in safety, emissions reductions, and asset optimization.

Growth Capabilities

To achieve our vision and mission, we emphasize specific capabilities that will help us grow and build competitive advantage within our core and potential new businesses. We are increasing our focus on our customers so that we are responsive to their needs while also proactively helping them meet their decarbonization objectives. We are continuing to invest in leading corporate development capabilities to ensure we identify and execute on attractive capital recycling opportunities and acquisitions. Finally, we believe that the future energy system will not only continue to be highly integrated, but also become more complex. This will require an ecosystem of stakeholders to develop and manage from customers and lenders to equipment manufacturers and regulators. We believe it is critical to have strengths in partnership structuring and relationship management to build and maintain the robust energy infrastructure systems.

BUSINESS SEGMENTS

During 2024, our activities were carried out through four business segments: Liquids Pipelines, Gas Transmission, Gas Distribution and Storage, and Renewable Power Generation, as discussed below.

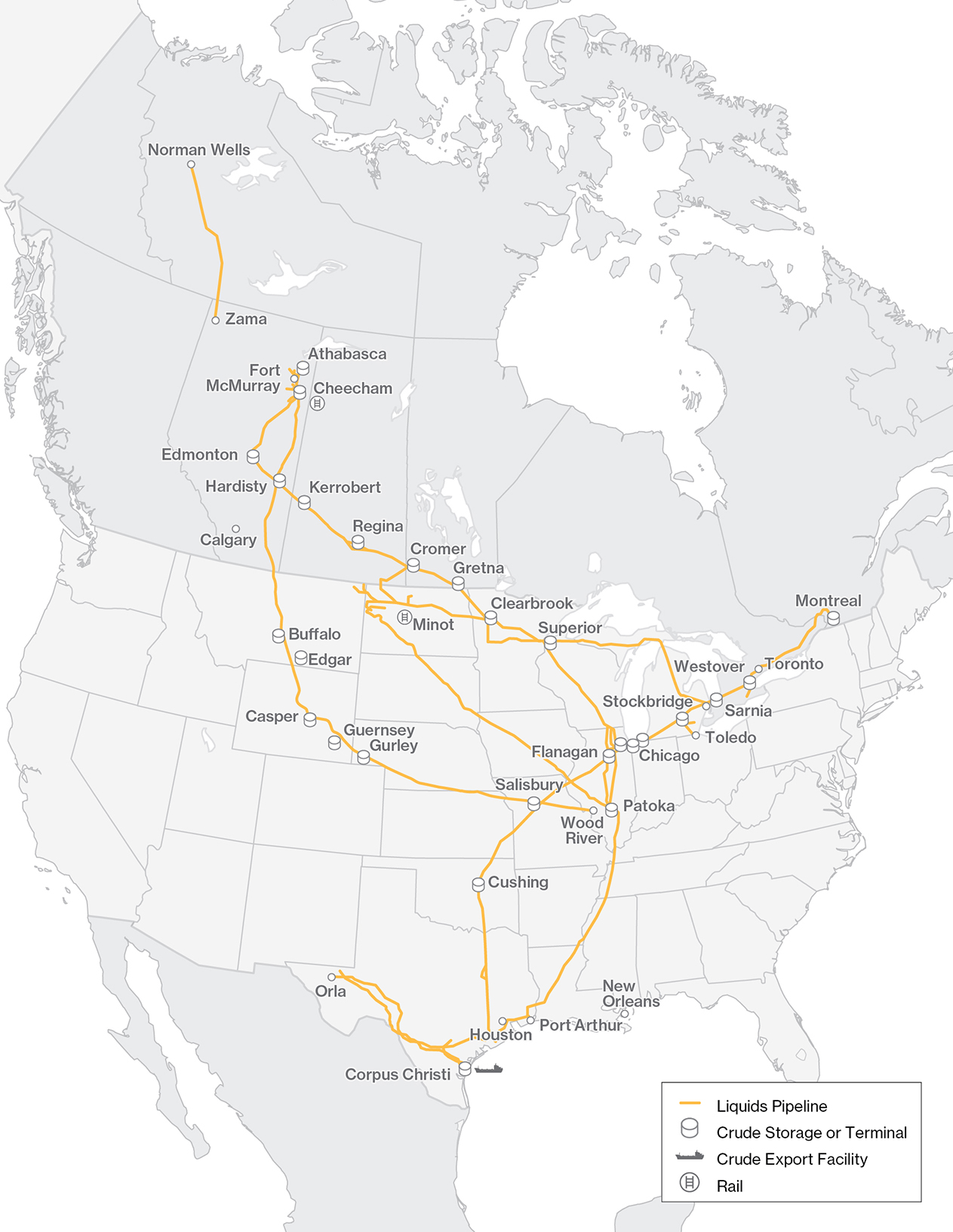

LIQUIDS PIPELINES

Liquids Pipelines consists of pipelines and terminals in Canada and the US that transport and export various grades of crude oil and other liquid hydrocarbons, which delivers approximately six million barrels per day (mmbpd) and is the largest global crude oil and liquids network.

MAINLINE SYSTEM

The Mainline System is a common carrier pipeline comprised of the Canadian Mainline and the Lakehead System. The Canadian Mainline transports various grades of crude oil and other liquid hydrocarbons within western Canada and from western Canada to the Canada/US border near Gretna, Manitoba and Neche, North Dakota and from the US/Canada border near Port Huron, Michigan and Sarnia, Ontario to eastern Canada. The Canadian Mainline includes six adjacent pipelines with a combined operating capacity of approximately 3.2 mmbpd that connect with the Lakehead System at the Canada/US border, as well as five pipelines that deliver crude oil and refined products into eastern Canada. Through our predecessors, we have operated, and frequently expanded, the Canadian Mainline since 1949. The Lakehead System is the portion of the Mainline System in the US. It is an interstate common carrier pipeline system regulated by the Federal Energy Regulatory Commission (FERC) and is the primary transporter of crude oil and liquid hydrocarbons from western Canada to the US.

Tolling Framework

The Mainline Tolling Settlement (MTS) is a negotiated settlement with a term of seven and a half years through the end of 2028 that covers both the Canadian and US portions of the Mainline, except for Lines 8 and 9 which are tolled on a separate basis. Enbridge filed an application with the CER for approval of the MTS on December 15, 2023 and the CER issued an order on March 4, 2024 approving Enbridge’s application as filed. The MTS provides for a Canadian Local Toll for deliveries within western Canada, as well as an International Joint Tariff (IJT) for crude oil shipments originating in western Canada, on the Canadian Mainline, and delivered into the US, via the Lakehead System, and into eastern Canada. Under the MTS, the Mainline operates as a common carrier system available to all shippers on a monthly nomination basis.

The MTS includes:

•an IJT, for heavy crude oil movements from Hardisty to Chicago, comprised of an initial Canadian Mainline Toll of $1.65 per barrel plus an initial Lakehead System Toll of US$2.57 per barrel, plus the applicable Line 3 Replacement surcharge;

•toll escalation for operation, administration, and power costs tied to US consumer price and US and Canadian power indices;

•tolls that are distance and commodity adjusted, and utilize a dual currency IJT; and

•a financial performance collar that provides incentives for Enbridge to optimize throughput and cost, but also provides downside protection in the event of extreme supply or demand disruptions or unforeseen operating cost exposure. This performance collar is intended to ensure the Mainline earns 11% to 14.5% returns, on a deemed 50% equity capitalization.

Approximately 70% of Mainline deliveries are tolled under this settlement, while approximately 30% of deliveries are tolled on a full path basis to markets downstream of the Mainline.

Lakehead System Local Tolls

Transportation rates are governed by the FERC for deliveries from the Canada/US border near Neche, North Dakota, Clearbrook, Minnesota and other points to principal delivery points on the Lakehead System. The Lakehead System periodically adjusts these transportation rates as allowed under the FERC’s index methodology and tariff agreements, the main components of which are index rates and the Facilities Surcharge Mechanism. Index rates, the base portion of the transportation rates for the Lakehead System, are subject to an annual inflationary adjustment which cannot exceed established ceiling rates as approved by the FERC. The Facilities Surcharge Mechanism allows the Lakehead System to recover costs associated with certain shipper-requested projects through an incremental surcharge in addition to the existing base rates and is subject to annual adjustment on April 1 of each year.

The Lakehead tolls are subject to an Offer of Settlement approved by the FERC on November 27, 2023 (Lakehead System Settlement). Lakehead System tolls were revised to reflect the terms of the Lakehead System Settlement effective December 1, 2023.

The Lakehead System Settlement includes:

•a resolution of litigation related to the index portion of the Lakehead System rate; and

•a depreciation truncation date of December 31, 2048 for the rate base applicable to the Index and Facilities Surcharge and agreement on the terms for future recovery through the Facilities Surcharge of costs related to two Line 5 projects: the Wisconsin Relocation Project and the Straits of Mackinac Tunnel.

REGIONAL OIL SANDS SYSTEM

The Regional Oil Sands System includes seven intra-Alberta long-haul pipelines: the Athabasca Pipeline, Waupisoo Pipeline, Woodland and Woodland Extension Pipelines, Wood Buffalo and Wood Buffalo Extension/Athabasca Twin pipeline system and the Norlite Pipeline System (Norlite), as well as two large terminals: the Athabasca Terminal located north of Fort McMurray, Alberta and the Cheecham Terminal, located south of Fort McMurray, Alberta. The Regional Oil Sands System also includes numerous laterals and related facilities which provide connectivity for several oil sands customers to the Edmonton and Hardisty areas.

The combined capacity of the intra-Alberta long-haul pipelines is approximately 1,120 thousand barrels per day (kbpd) to Edmonton and 1,415 kbpd into Hardisty, with Norlite providing approximately 218 kbpd of diluent capacity into the Fort McMurray region. We have a 50% interest in the Woodland Pipeline and a 70% interest in Norlite. The Regional Oil Sands System is anchored by long-term agreements with multiple oil sands producers that provide cash flow stability and also include provisions for the recovery of some of the operating costs of this system.

On October 5, 2022, we completed a transaction with Athabasca Indigenous Investments Limited Partnership (Aii), a newly created entity representing 23 First Nation and Metis communities, pursuant to which Aii acquired an 11.6% non-operating interest in the seven intra-Alberta long-haul pipelines in the Regional Oil Sands System.

GULF COAST AND MID-CONTINENT

Gulf Coast includes Flanagan South, Spearhead Pipeline, Seaway Crude Pipeline System (Seaway Pipeline), the Mid-Continent System (Cushing Terminal), Gray Oak, and the EIEC.

Flanagan South is a 950 kilometer (590 mile), 36-inch diameter interstate crude oil pipeline that originates at our terminal at Flanagan, Illinois, a delivery point on the Lakehead System, and terminates in Cushing, Oklahoma. Flanagan South has a capacity of approximately 700 kbpd.

Spearhead Pipeline is a long-haul pipeline that delivers crude oil from Flanagan, Illinois, a delivery point on the Lakehead System, to Cushing, Oklahoma. The Spearhead Pipeline has a capacity of approximately 193 kbpd.

We have a 50% interest in the 1,078 kilometer (670 mile) Seaway Pipeline, including the 805 kilometer (500 mile), 30-inch diameter long-haul system between Cushing, Oklahoma and Freeport, Texas, as well as the Texas City Terminal and Distribution System which serve refineries in the Houston and Texas City areas. Total aggregate capacity on the Seaway Pipeline system is approximately 950 kbpd. The Seaway Pipeline also includes 8.8 million barrels of crude oil storage tank capacity on the Texas Gulf Coast.

The Mid-Continent System is comprised of storage terminals at Cushing Terminal, consisting of over 110 individual storage tanks ranging in size from 78 to 570 thousand barrels. Total storage shell capacity of Cushing Terminal is approximately 26 million barrels. A portion of the storage facilities are used for operational purposes, while the remainder is contracted to various crude oil market participants for their term storage requirements. Contract fees include fixed monthly storage fees, throughput fees for receiving and delivering crude to and from connecting pipelines and terminals, and blending fees.

Gray Oak is a 1,368 kilometer (850 mile) crude oil system, transporting light crude oil, with origination points in the Eagle Ford and Permian Basins in West Texas. Gray Oak has delivery points at the US Gulf Coast and Houston refining region and currently has an average annual capacity of 900 kbpd; a planned expansion in 2025 will increase average annual capacity to 1,020 kbpd. Our effective economic interest in Gray Oak is 68.5% after our acquisition of Rattler Midstream’s 10% interest in the pipeline in 2023. We assumed operatorship of Gray Oak in April 2023.

In October 2021, we acquired 100% of Moda Midstream Operating, LLC, which includes the EIEC, the largest crude oil export terminal by volume in North America. EIEC has an export capability of 1.6 million barrels per day. In 2024 we added a further 2 million barrels of storage at EIEC, bringing EIEC’s total storage capability to 17.6 million barrels. We also own 100% interest in each of the 300-kbpd Viola pipeline, and the 350-thousand barrel Taft Terminal, both located near Corpus Christi, Texas. Additionally, in October 2024 we completed the acquisition of two marine docks and land adjacent to EIEC from Flint Hills Resources. This acquisition will add crude oil export capacity and streamline existing EIEC operations by increasing Very Large Crude Carrier windows on the primary facility docks. In November 2022, we acquired an additional 10% ownership interest in Cactus II Pipeline, a pipeline that travels from Wink to Ingleside within Texas, bringing our total non-operating ownership to 30%.

OTHER

Other includes Southern Lights Pipeline, Express-Platte System, Bakken System and Feeder Pipelines and Other.

The Southern Lights Pipeline is a single stream 180 kbpd 16/18/20-inch diameter pipeline that ships diluent from the Manhattan Terminal near Chicago, Illinois to three western Canadian delivery facilities, located at the Edmonton and Hardisty terminals in Alberta and the Kerrobert terminal in Saskatchewan. Both the Canadian portion and the US portions of the Southern Lights Pipeline receive tariff revenues under long-term contracts with committed shippers. The Southern Lights Pipeline capacity is 90% contracted with the remaining 10% of the capacity assigned for shippers to ship uncommitted volumes. A fully subscribed open season was completed in December 2023, which has ensured contract levels remain at 90% through mid-2030.

The Express-Platte System consists of the Express Pipeline and the Platte Pipeline, and crude oil storage of approximately 5.6 million barrels. It is an approximate 2,736 kilometer (1,700 mile) long crude oil transportation system, which begins at Hardisty, Alberta, and terminates at Wood River, Illinois. The 310 kbpd Express Pipeline carries crude oil to US refining markets in the Rocky Mountains area, including Montana, Wyoming, Colorado and Utah. The 145 to 164 kbpd Platte Pipeline, which interconnects with the Express Pipeline at Casper, Wyoming, transports crude oil predominantly from the Bakken shale and western Canada to refineries in the Midwest. The Express Pipeline capacity is typically committed under long-term take-or-pay contracts with shippers. A small portion of the Express Pipeline capacity and all of the Platte Pipeline capacity is used by uncommitted shippers who pay only for the pipeline capacity they actually use in a given month.

The Bakken System consists of the North Dakota System and the Bakken Pipeline System. The North Dakota System services the Bakken Basin in North Dakota and is comprised of a crude oil gathering and interstate pipeline transportation system. The gathering system provides delivery to Clearbrook, Minnesota for service on the Lakehead system or a variety of interconnecting pipelines. The interstate portion of the system has both US and Canadian components that extend from Berthold, North Dakota into Cromer, Manitoba.

Tariffs on the US portion of the North Dakota System are regulated by the FERC. The Canadian portion is categorized as a Group 2 pipeline, and as such, its tolls are regulated by the CER on a complaint basis.

We have an effective 27.6% interest in the Bakken Pipeline System, which connects the Bakken Basin in North Dakota to markets in eastern Petroleum Administration for Defense Districts (PADD) II and the US Gulf Coast. The Bakken Pipeline System consists of the Dakota Access Pipeline from the Bakken area in North Dakota to Patoka, Illinois, and the Energy Transfer Crude Oil Pipeline from Patoka, Illinois to Nederland, Texas. Current capacity is approximately 750 kbpd of crude oil with the potential to be expanded through additional pumping horsepower. The Bakken Pipeline System is anchored by long-term throughput commitments from a number of producers.

Feeder Pipelines and Other includes a number of liquids storage assets and pipeline systems in Canada and the US.

Key assets included in Feeder Pipelines and Other are the Hardisty Contract Terminal and Hardisty Storage Caverns located near Hardisty, Alberta, a key crude oil pipeline hub in western Canada and the Southern Access Extension (SAX) Pipeline which originates in Flanagan, Illinois and delivers to Patoka, Illinois. We have an effective 65% interest in the 300 kbpd SAX pipeline. The majority of the SAX Pipeline's capacity is commercially secured under long-term take-or-pay contracts with shippers.

Feeder Pipelines and Other also includes Patoka Storage, the Toledo pipeline system and the Norman Wells (NW) System. Patoka Storage is comprised of four storage tanks with 480 thousand barrels of shell capacity located in Patoka, Illinois. The 180 kbpd Toledo pipeline system connects with the Lakehead System and delivers to Ohio and Michigan. The 45 kbpd NW System transports crude oil from Norman Wells in the Northwest Territories to Zama, Alberta and has a cost-of-service rate structure based on established terms with shippers.

CRUDE OIL MARKETING

The Liquids Pipelines segment also includes the Crude Oil Marketing business in Canada and the US, which provides physical commodity marketing and logistical services to North American refiners, producers, and other customers. The business is primarily focused on servicing customers across the value chain and capturing value from quality, time, and location price differentials when opportunities arise. To execute these strategies, the Crude Oil Marketing business transports and stores on both Enbridge-owned and third-party assets using a combination of contracted pipeline, storage, railcar, and truck capacity agreements.

COMPETITION

Competition for our liquids pipelines network comes primarily from infrastructure or logistics alternatives (e.g., rail or trucking) that transport liquid hydrocarbons from production basins in which we operate to markets in Canada, the US and internationally. Competition from existing pipelines, such as the recently completed Trans Mountain Pipeline expansion, is based primarily on access to supply, end use markets, the cost of transportation, contract structure and the quality and reliability of service. Additionally, volatile crude price differentials and insufficient pipeline capacity on either our or competitors' pipelines can make transportation of crude oil by rail competitive, particularly to markets not currently served by pipelines.

We believe that our liquids pipelines systems will continue to provide competitive and attractive options to producers in the Western Canadian Sedimentary Basin (WCSB), North Dakota, and the Permian Basin, due to our market access, competitive tolls and flexibility through our multiple delivery and storage points. We also employ long-term agreements with shippers, which mitigates competition risk by ensuring consistent supply to our liquids pipelines network. We have a proven track record of successfully executing projects to meet the needs of our customers.

Earnings from our Crude Oil Marketing business are primarily generated from arbitrage opportunities which, by their nature, can be replicated by competitors. An increase in market participants entering into similar arbitrage strategies could have an impact on our earnings. Efforts to mitigate competition risk include diversification of the marketing business by transacting at the majority of major hubs in North America and establishing long-term relationships with clients and pipelines.

SUPPLY AND DEMAND

We have an established and successful history of being the largest transporter of crude oil to the US, the world’s largest market for crude oil. We expect US demand for Canadian crude oil production will support the use of our infrastructure for the foreseeable future.

Under most base case forecasts, demand is expected to grow into the next decade, primarily driven by emerging economies in regions outside the Organization for Economic Cooperation and Development (OECD), such as India and broader Southeast Asia. In North America, demand growth for transportation fuels is expected to slow down over time due to vehicle fuel efficiency improvement and rising adoption of electric vehicles.

The Organization of Petroleum Exporting Countries is expected to continue to balance markets and manage prices with production quotas despite accelerated developments of offshore production in both Brazil and Guyana and continued growth from Canada and the US. In the US, growth will likely be driven by the Permian Basin, a large and cost competitive light crude oil resource base. In addition, heavy crude oil growth is expected from the WCSB as additional egress availability will likely support expansion of existing projects and some potential new greenfield facilities.

Our Mainline System was effectively fully utilized in 2024 delivering 3.1 mmbpd. Refinery demand in the upper Midwest PADD II market has been strong. On the US Gulf Coast, lower supply of heavy crude from Latin America and the Middle East continues to drive increased demand for Canadian heavy crude. Many of the refineries connected to the Mainline System are complex and competitive in the global context.

The anticipated combination of long-term demand growth in non-OECD nations, domestic demand contraction over time, and continued production growth in the Permian Basin and WCSB, highlights the importance of our strategic asset footprint and reinforces the need for additional export-oriented infrastructure. We believe that we are well positioned to meet these evolving supply and demand fundamentals through expansion of system capacity for incremental access to the US Gulf Coast, and through further development of our EIEC in Corpus Christi, including the full integration and optimization of the Flint Hills marine docks and land acquired in October 2024.

Opposition to fossil fuel development in conjunction with evolving consumer preferences and new technologies could underpin energy transition scenarios impacting long-term supply and demand of crude oil. We continue to closely monitor the evolution of all of these factors to be able to proactively adapt our business to help meet our customers’ and society’s energy needs.

These supply and demand dynamics are evolving, as the current political climate in Canada and the US continues to shift, including as a result of changes in governments and trade relations. We continue to monitor these developments together with their impact on our business.

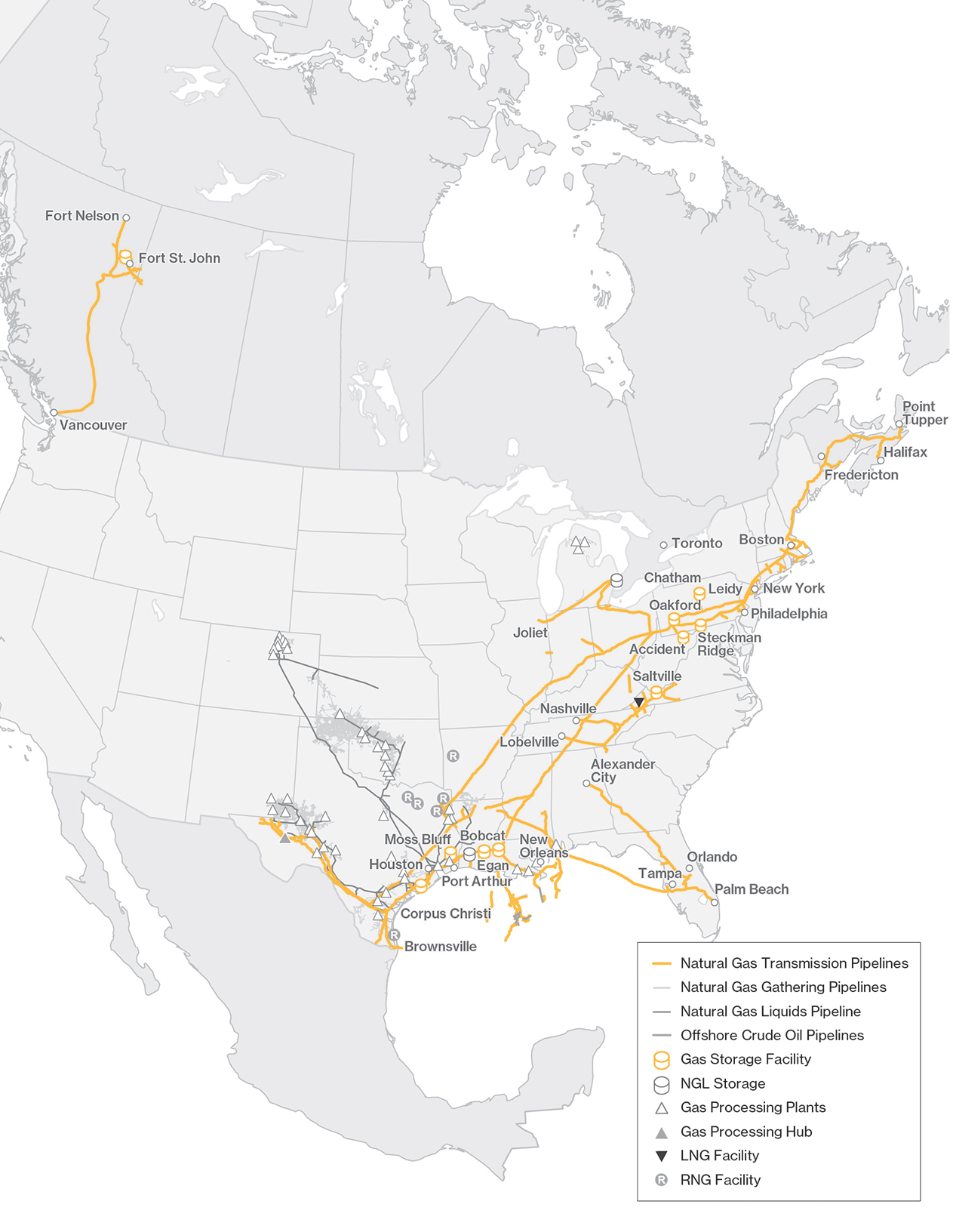

GAS TRANSMISSION

Gas Transmission consists of our investments in natural gas pipelines and gathering and processing facilities in Canada and the US, including US Gas Transmission, Canadian Gas Transmission, US Midstream and Other assets.

US GAS TRANSMISSION

US Gas Transmission includes ownership interests in Texas Eastern Transmission, LP (Texas Eastern), Algonquin Gas Transmission, LLC (Algonquin), Maritimes & Northeast (M&N) (US and Canada), East Tennessee Natural Gas, LLC (East Tennessee), Gulfstream Natural Gas System, L.L.C. (Gulfstream), Sabal Trail Transmission, LLC (Sabal Trail), NEXUS Gas Transmission, LLC (NEXUS), Valley Crossing Pipeline, LLC (Valley Crossing), Southeast Supply Header, LLC (SESH), Vector Pipeline L.P. (Vector), Whistler Parent, LLC (Whistler Parent JV), Delaware Basin Residue, LLC (DBR) and certain other gas pipeline and storage assets. The US Gas Transmission business primarily provides transmission and storage of natural gas through interstate pipeline systems for customers in various regions of the northeastern, southern and midwestern US.

The Texas Eastern interstate natural gas transmission system extends from supply and demand centers in the Gulf Coast region of Texas and Louisiana to supply and demand centers in Ohio, Pennsylvania, New Jersey and New York. Texas Eastern's onshore system has a peak day capacity of 12.0 billion cubic feet per day (bcf/d) of natural gas on approximately 13,745 kilometers (8,541 miles) of pipeline and associated compressor stations. Texas Eastern is also connected to five affiliated storage facilities that are partially or wholly-owned by other entities within the US Gas Transmission business, including the Tres Palacios Holdings LLC (Tres Palacios) storage facility that we acquired on April 3, 2023.

The Algonquin interstate natural gas transmission system connects with Texas Eastern’s facilities in New Jersey and extends through New Jersey, New York, Connecticut, Rhode Island and Massachusetts where it connects to M&N US. The system has a peak day capacity of 3.1 bcf/d of natural gas on approximately 1,817 kilometers (1,129 miles) of pipeline with associated compressor stations.

M&N US has a peak day capacity of 0.8 bcf/d of natural gas on approximately 552 kilometers (343 miles) of mainline interstate natural gas transmission system, including associated compressor stations, which extends from northeastern Massachusetts to the border of Canada near Baileyville, Maine. M&N Canada has a peak day capacity of 0.5 bcf/d on approximately 885 kilometers (550 miles) of interprovincial natural gas transmission mainline system that extends from Goldboro, Nova Scotia to the US border near Baileyville, Maine. We have a 78% interest in M&N US and M&N Canada.

East Tennessee’s interstate natural gas transmission system has a peak day capacity of 1.9 bcf/d of natural gas, crosses Texas Eastern’s system at two locations in Tennessee and consists of two mainline systems totaling approximately 2,449 kilometers (1,522 miles) of pipeline in Tennessee, Georgia, North Carolina and Virginia, with associated compressor stations. East Tennessee has an LNG storage facility in Tennessee and also connects to the Saltville storage facilities in Virginia.

Valley Crossing is an approximately 285 kilometer (177 mile) intrastate natural gas transmission system, with associated compressor stations. The pipeline infrastructure is located in Texas and provides market access of up to 2.6 bcf/d of design capacity to the Comisión Federal de Electricidad, Mexico’s state-owned utility.

Vector is an approximately 560 kilometer (348 mile) pipeline travelling between Joliet, Illinois in the Chicago area and Ontario. Vector can deliver 1.7 bcf/d of natural gas, of which 455 million cubic feet per day (mmcf/d) is leased to NEXUS. We have a 60% interest in Vector.

Gulfstream is an approximately 1,199 kilometer (745 mile) interstate natural gas transmission system with associated compressor stations. Gulfstream has a peak day capacity of 1.4 bcf/d of natural gas from Mississippi, Alabama, Louisiana and Texas, crossing the Gulf Coast to markets in central and southern Florida. We have a 50% interest in Gulfstream.

Sabal Trail is an approximately 832 kilometer (517 mile) interstate pipeline that provides firm natural gas transportation. Facilities include a pipeline, laterals and various compressor stations. The pipeline infrastructure is located in Alabama, Georgia and Florida, and adds approximately 1.0 bcf/d of capacity enabling the access of onshore gas supplies. We have a 50% interest in Sabal Trail.

NEXUS is an approximately 414 kilometer (257 mile) interstate natural gas transmission system with associated compressor stations. NEXUS transports natural gas from our Texas Eastern system in Ohio to our Vector interstate pipeline in Michigan, with peak day capacity of 1.4 bcf/d. Through its interconnect with Vector, NEXUS provides a connection to Dawn Hub, the largest integrated underground storage facility in Canada and one of the largest in North America, located in southwestern Ontario adjacent to the Greater Toronto Area. We have a 50% interest in NEXUS.

SESH is an approximately 462 kilometer (287 mile) interstate natural gas transmission system with associated compressor stations. SESH extends from the Perryville Hub in northeastern Louisiana where the shale gas production of eastern Texas, northern Louisiana and Arkansas, along with conventional production, is reached from six major interconnections. SESH extends to Alabama, interconnecting with 14 major north-south pipelines and three high-deliverability storage facilities and has a peak day capacity of 1.1 bcf/d of natural gas. We have a 50% interest in SESH.

The Whistler Parent JV holds a 100% interest in Whistler Pipeline, LLC (Whistler), a 450 mile intrastate pipeline with associated compressor stations that extends from the Permian Basin to Agua Dulce, Texas with a capacity of 2.5 bcf/d, a 70% interest in ADCC Pipeline, LLC (ADCC), a 40 mile pipeline that extends from Agua Dulce, Texas to Cheniere Energy’s Corpus Christi LNG export facility with a capacity of 1.7 bcf/d, and a 50% interest in Waha Gas Storage, LLC, a 2.0 bcf gas storage cavern facility connecting to key Permian egress pipelines including Whistler. We have a 19% interest in the Whistler Parent JV.

DBR holds a 100% interest in Agua Blanca, LLC, Waha Connector, LLC, and Gateway Pipeline, LLC, a combined network of pipelines that connects Permian supply to Whistler and other pipelines transporting natural gas from the Permian Basin to downstream markets, and the remaining 50% interest in Waha Gas Storage, LLC not held by Whistler Parent JV. We have a 15% interest in DBR.

Transmission and storage services are generally provided under firm agreements where customers reserve capacity in pipelines and storage facilities. The vast majority of these agreements provide for fixed reservation charges that are paid monthly regardless of the actual volumes transported on the pipelines, plus a small variable component that is based on volumes transported, injected or withdrawn, which is intended to recover variable costs.

Interruptible transmission and storage services are also available where customers can use capacity if it exists at the time of the request and are generally at a higher toll than long-term contracted rates. Interruptible revenues depend on the amount of volumes transported or stored and the associated rates for this service. Storage operations also provide a variety of other value-added services including natural gas parking, loaning and balancing services to meet customers’ needs.

CANADIAN GAS TRANSMISSION

Canadian Gas Transmission is comprised of Westcoast Energy Inc.’s (Westcoast) British Columbia (BC) Pipeline, and other minor midstream gas gathering pipelines. It also includes the Aitken Creek Gas Storage facility, located in BC, Canada, which we acquired on November 1, 2023.

The BC Pipeline provides natural gas transmission services, transporting processed natural gas from facilities located primarily in northeastern BC to markets in BC and the US Pacific Northwest. It has a peak day capacity of 3.6 bcf/d of natural gas on approximately 2,950 kilometers (1,833 miles) of transmission pipeline in BC and Alberta, as well as associated mainline compressor stations. BC Pipeline is regulated by the CER under cost-of-service regulation.

The majority of transportation services provided by Canadian Gas Transmission are under firm agreements, which provide for fixed reservation charges that are paid monthly regardless of actual volumes transported on the pipeline, plus a small variable component that is based on volumes transported to recover variable costs. Canadian Gas Transmission also provides interruptible transmission services where customers can use capacity if it is available at the time of request. Payments under these services are based on volumes transported.

US MIDSTREAM

US Midstream includes a 13.2% effective economic interest in DCP Midstream, LP (DCP). Prior to August 17, 2022, we had a 28.3% effective economic interest in DCP. DCP is a joint venture, with a diversified portfolio of assets, engaged in the business of gathering, compressing, treating, processing, transporting, storing and selling natural gas; producing, fractionating, transporting, storing and selling NGL; and recovering and selling condensate. DCP owns and operates more than 32 plants and approximately 86,016 kilometers (53,448 miles) of natural gas and NGL pipelines, with operations in nine states across major producing regions.

OTHER