UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2024

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-11692

Ethan Allen Interiors Inc.

(Exact name of registrant as specified in its charter)

Delaware | 06-1275288 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

25 Lake Avenue Ext., Danbury, Connecticut | 06811-5286 | |

(Address of principal executive offices) | (Zip Code) |

(203) 743-8000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading symbol | Name of exchange on which registered | ||||

Common stock, $0.01 par value | ETD | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

Based on the closing price as reported on the New York Stock Exchange on December 31, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant's common stock held by non-affiliates of the registrant on that date was $724 million.

The number of shares outstanding of the registrant’s common stock, $0.01 par value, as of August 16, 2024 was 25,423,374.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this Annual Report on Form 10-K is incorporated by reference to the registrant’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders, which will be filed with the Securities and Exchange Commission (“SEC”) not later than 120 days after June 30, 2024.

TABLE OF CONTENTS

| Cautionary Note Regarding Forward-Looking Statements | 4 | |

| PART I | ||

| Item 1. | Business | 5 |

| Information about our Executive Officers | 10 | |

| Item 1A. | Risk Factors | 11 |

| Item 1B. | Unresolved Staff Comments | 18 |

| Item 1C. | Cybersecurity | 18 |

| Item 2. | Properties | 19 |

| Item 3. | Legal Proceedings | 20 |

| Item 4. | Mine Safety Disclosures | 20 |

| PART II | ||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 21 |

| Item 6. | [Reserved] | 22 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 22 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 35 |

| Item 8. | Financial Statements and Supplementary Data | 36 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 70 |

| Item 9A. | Controls and Procedures | 70 |

| Item 9B. | Other Information | 70 |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 70 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 71 |

| Item 11. | Executive Compensation | 71 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 71 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 72 |

| Item 14. | Principal Accountant Fees and Services | 72 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 73 |

| Item 16. | Form 10-K Summary | 74 |

| Signatures | 75 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain statements which may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally, forward-looking statements include information concerning current expectations, projections or trends relating to results of operations, financial results, financial condition, strategic objectives and plans, expenses, dividends, share repurchases, liquidity, use of cash and cash requirements, borrowing capacity, investments, future economic performance, and our business and industry. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These forward-looking statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “continue,” “may,” “will,” “short-term,” “target,” “outlook,” “forecast,” “future,” “strategy,” “opportunity,” “would,” “guidance,” “non-recurring,” “one-time,” “unusual,” “should,” “likely,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

Forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that are expected. Ethan Allen Interiors Inc. and its subsidiaries (the “Company”) derive many of its forward-looking statements from operating budgets and forecasts, which are based upon many detailed assumptions. While the Company believes that its assumptions are reasonable, it cautions that it is very difficult to predict the impact of known factors and it is impossible for the Company to anticipate all factors that could affect actual results and matters that are identified as “short term,” “non-recurring,” “unusual,” “one-time,” or other words and terms of similar meaning may in fact recur in one or more future financial reporting periods. Important factors that could cause actual results to differ materially from the Company’s expectations, or cautionary statements, are disclosed in Item 1A, Risk Factors, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and elsewhere in this Annual Report on Form 10-K. All forward-looking statements attributable to the Company, or persons acting on its behalf, are expressly qualified in their entirety by these cautionary statements, as well as other cautionary statements. A reader should evaluate all forward-looking statements made in this Annual Report on Form 10-K in the context of these risks and uncertainties. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. Many of these factors are beyond our ability to control or predict.

The forward-looking statements included in this Annual Report on Form 10-K are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as otherwise required by law.

PART I

ITEM 1. BUSINESS

Overview

Ethan Allen Interiors Inc., through its wholly-owned subsidiary, Ethan Allen Global, Inc., and Ethan Allen Global, Inc.’s subsidiaries (collectively, “we,” “us,” “our,” “Ethan Allen” or the “Company”), is a leading interior design company, manufacturer and retailer in the home furnishings marketplace. We are a global luxury home fashion brand that is vertically integrated from product design through home delivery, which offers our customers stylish product offerings, artisanal quality, and personalized service. We are known for the quality and craftsmanship of our products as well as for the exceptional personal service from design to delivery, and for our commitment to social responsibility and sustainable operations. Our strong network of entrepreneurial leaders and interior designers provide complimentary interior design service to our clients and sell a full range of home furnishing products through a retail network of design centers located throughout the United States and abroad as well as online at ethanallen.com.

Ethan Allen design centers represent a mix of locations operated by independent licensees and Company-operated locations. At June 30, 2024, the Company operates 142 retail design centers with 138 located in the United States and four in Canada. Our 45 independently operated design centers are located in the United States, Asia, the Middle East and Europe. We manufacture approximately 75% of our furniture in our North American manufacturing plants and have been recognized for product quality and craftsmanship since we were founded in 1932. At June 30, 2024, we own and operate ten manufacturing facilities, including four manufacturing plants, one sawmill, one rough mill and one kiln dry lumberyard in the United States, two manufacturing plants in Mexico and one manufacturing plant in Honduras. We also partner with suppliers located in Europe, Asia, and other countries to produce and import various products that support our business.

Business Strategy

We strive to deliver value to our shareholders through the execution of our strategic initiatives focused on the concept of constant reinvention. Ethan Allen has a distinct vision of classic American style with a modern perspective, which we believe differentiates us from our competitors. Our business model is to maintain continued focus on (i) providing relevant product offerings, (ii) capitalizing on the professional and personal service offered to our clients by our interior design professionals, (iii) leveraging the benefits of our vertical integration including a strong manufacturing presence in North America, (iv) regularly investing in new technologies across all aspects of our vertically integrated business, (v) maintaining a strong logistics network, (vi) communicating our messages with strong marketing campaigns, and (vii) utilizing our website, ethanallen.com, as a key marketing tool to drive traffic to our retail design centers.

We aim to position Ethan Allen as a premier interior design destination and a preferred brand offering products of superior style, quality, and value to clients with a comprehensive solution for their home furnishing and interior design needs. We operate our business with an entrepreneurial attitude, staying focused on long-term growth, and treating our employees, vendors, and clients with dignity and respect, which we believe are important amidst the constant changes taking place in the world.

For the second year in a row Ethan Allen was named to Newsweek’s list of America’s Best Retailers, including the #1 retailer of Premium Furniture. The assessment and rankings were the result of an independent survey of more than 7,000 customers who have shopped at retail stores in person in the past three years and based on the likelihood of recommendation and the evaluation of products, customer service, atmosphere, accessibility and store layout.

Product

By harnessing the expertise of skilled artisans within our North American facilities, we manufacture 75% of the furniture we offer. Every product bears the distinctive quality of the Ethan Allen brand. Meticulously hand-guided stitching dress our upholstery frames and our case goods wood furniture is crafted from premium lumber and veneers, which are individually finished and customized. Our commitment to using leading construction techniques is evident, including using mortise and tenon joinery and four-corner glued dovetail joinery for drawers. These elements are part of Ethan Allen's identity, solidifying our reputation for quality and style in home furnishings.

Our vertically integrated approach empowers us to seamlessly introduce new products, oversee design specifications, and uphold consistent levels of excellence across all product lines. Alongside our seven manufacturing facilities in the United States, we possess two upholstery manufacturing plants in Mexico and a case goods manufacturing facility in Honduras. We selectively outsource the remaining 25% of our products, primarily from Asia. Our sourcing partners must adhere to our quality standards, specifications and social responsibility. If any of these suppliers experience financial or other difficulties, we believe we have alternative sources of supply to prevent temporary disruptions in our imported product flow. We believe our strategic investments in manufacturing facilities and the sourcing from foreign and domestic suppliers positions us to accommodate future growth while retaining control over costs, quality and customer service.

Projection

Our design centers are interior design destinations, with technology-driven projections and dedicated workstations that foster collaboration between designers and clients. When clients enter, they see a gallery showroom with a certain number of room projections depending on the design center’s square footage. Touchscreens located throughout the sales floor enable clients to browse at their own pace or with a designer’s guidance. In-store presentations often take place at freestanding designer workstations that are equipped with large flat-panel touchscreen displays to share floorplans and 3D renderings. These workstations also provide space for designers to showcase samples. The overall structure of each location equips designers with the tools they need to create personalized presentations for each client, while also giving clients the sense that what they need to realize their design vision is at their fingertips.

During fiscal 2024, new state-of-the-art design centers were opened in The Villages, FL, Avon, OH, New York, NY, Albuquerque, NM and Louisville, KY that showcase the Company’s unique vision of American style while combining complimentary interior design services with technology. We plan to further expand our retail design center footprint in fiscal 2025 through the addition of new design centers. We ended the fiscal 2024 year with 172 retail design centers in North America, including 142 Company-operated and 30 independently owned and operated locations as well as 15 additional design centers outside North America.

Combining Technology with Personal Service

Our unique combination of personal service and technology enhances the clients’ Ethan Allen experience, including the use of virtual design appointment capabilities at ethanallen.com. We leverage EA inHome®, an augmented reality mobile app, which empowers clients to preview Ethan Allen products in their homes, at scale, in a wide-variety of fabrics and finishes. With the 3D Room Planner, our designers generate both 2D floor plans and immersive 4K, realistic 3D walk-throughs of the interior designs they create. In addition, our website offers a virtual design center, which enables clients to access our home furnishings while either co-browsing live with a designer or browsing on their own, at their own pace. Clients can view items in 3D, read product details, share, and save item lists, and utilize augmented reality views in their homes, either via a QR code on their desktop or directly when browsing on a mobile device. With so much of our product customizable, we encourage our customers to get personalized help from our interior design professionals either in person or through virtual chat. The recent implementation of a state-of-the-art fabric-to-frame configurator empowers designers to visualize nearly 1,000 fabrics and a wide range of construction options on upholstered frames. This cutting-edge addition to our technology stack offers clients a real-time preview of what their custom upholstery will look like. All of these technologies have been pivotal to our ability to serve clients and provide even more ways for us to collaborate and create a timely and exceptional experience.

Marketing

Ethan Allen’s marketing emphasizes our core brand values of quality and craftsmanship, combining personal service with technology, and a commitment to social responsibility. We amplify those values through our dynamic brand story built around a core projection and philosophy: Classics with a Modern Perspective. By adopting a fresh, ever-evolving creative approach, using digital marketing to drive traffic to our retail locations, we continue to broaden our reach and enhance desirability and visibility. Our combination of creative and analytics-driven strategies enables us to secure both new and repeat client traffic to our design centers and to our website at ethanallen.com. Our creative messaging is relevant and aspirational and conveyed through a variety of media, including digital marketing that includes social media and email marketing campaigns, plus direct mail, TV and radio. Additionally, grassroots marketing efforts led by our local design center teams further drive interest in our product offerings. Taken together, these strategies help ensure that we are continuing to add to our client base while maintaining existing relationships.

E-Commerce

We consider our website an extension of our retail design centers and not a separate segment of our business. Recent improvements to our ethanallen.com website include enhanced search capabilities, expanded live chat services, online appointment booking capability, and product listing and display page enhancements. Most clients will use the internet for inspiration and as a start to their shopping process to view products and prices. With so much of our product customizable, we encourage our website customers to get personalized help from our interior design professionals either in person or by chatting online. We believe this complimentary direct contact creates a competitive advantage through our excellent personal service.

Raw Materials and Supply Chain

The principal raw materials we use in manufacturing are lumber, logs, veneers, plywood, hardware, glue, finishing materials, glass, steel, fabrics, leather, frames, foam and filling material. The various types of wood used in our products include soft maple, wormy maple, red oak, prima vera, birch, rubber wood and cherry. These raw materials used for manufacturing are for cover (primarily fabrics and leather), polyester batting and polyurethane foam for cushioning and padding, lumber and plywood for frames, steel for motion mechanisms and various other metal components for fabrication of product.

Our raw materials are purchased both domestically and outside the United States. We have no significant long-term supply contracts and believe we have sufficient alternate sources of supply to prevent significant long-term disruption to our operations. Appropriate amounts of inventory are typically stocked to maintain adequate production levels. We believe that our sources of supply for these materials are sufficient and that we are not dependent on any one supplier. Our vertically integrated structure, whereby we manufacture approximately 75% of the furniture we sell, leaves Ethan Allen with reduced exposure to any one particular country on the remaining 25% of products that are imported. We enter into standard purchase agreements with foreign and domestic suppliers to source selected products. The terms of these arrangements are customary for the industry and do not contain any long-term contractual obligations on our behalf. We believe we maintain good relationships with our suppliers.

Segments

We have strategically aligned our business into two reportable segments: wholesale and retail. Our operating segments are aligned with how the Company, including our chief executive officer (defined as our chief operating decision maker), manages the business. These two segments represent strategic business areas of our vertically integrated enterprise that operate separately and provide their own distinctive services. This vertical structure enables us to offer home furnishings while better controlling quality and cost. We evaluate the performance of our respective segments based upon net sales and operating income. Intersegment transactions result, primarily, from the wholesale sale of inventory to the retail segment, including the related profit margin. Financial information, including sales, operating income and long-lived assets related to our segments are disclosed in Note 20, Segment Information, of the notes to our consolidated financial statements included under Item 8 of this Annual Report on Form 10-K.

Seasonality

We believe that the demand for home furnishings generally reflects sensitivity to overall economic conditions, including consumer confidence, discretionary spending, housing starts, sales of new and existing homes, housing values, interest and inflationary rates, the level of mortgage refinancing, retail trends and unemployment rates. In a typical year, we schedule production to maintain consistent manufacturing activity throughout the year. We typically shut down our domestic plants for one week at the beginning of each fiscal year to perform routine maintenance. Historically no one particular fiscal quarter contributes more than 28% of annual net sales volume, thus limiting our exposure to seasonality. Our sales volume and production schedules were impacted by the pandemic and thus did not follow the aforementioned historical trends. As a result of heightened post-pandemic demand during fiscal years 2021 and 2022, significant backlog was built. During fiscal 2023, our wholesale and retail business sales volumes began trending to more historical levels and at June 30, 2024, backlogs were near pre-pandemic levels.

Backlog

We define backlog as any written order received that has not yet been delivered. Our wholesale backlog consists of written orders received from our retail network of independently operated design centers, Company-operated design centers, and contract business customers that have not yet been delivered. Our retail backlog is undelivered written orders associated with end retail customers. Our backlog fluctuates based on the timing of net orders booked, manufacturing production, the timing of imported product receipts, the timing and volume of shipments, and the timing of various promotional events. Historically, the size of our backlog at a given time varies and may not be indicative of our future sales, and therefore, we do not rely entirely on backlogs to predict future sales. At June 30, 2024 our wholesale backlog was $53.5 million, down 27.7% from a year ago and nearing pre-pandemic levels.

Distribution and Logistics

We distribute our products through three national distribution centers, owned by the Company and strategically located in North Carolina and Virginia. These distribution centers provide efficient and effective cross-dock operations to receive and ship Ethan Allen product from our manufacturing facilities and third-party suppliers to our retail network of Company and independently operated retail home delivery centers. Retail home delivery centers prepare products for delivery into clients’ homes. At June 30, 2024, our Company-operated retail design centers were supported by 17 Company-operated retail home delivery centers and five home delivery centers operated by third parties. We utilize independent carriers to ship our products. Our practice has been to sell our products at the same delivered cost to all Company and independently operated design centers throughout the United States, regardless of their shipping point. This policy creates pricing credibility with our wholesale customers while providing our retail segment the opportunity to achieve more consistent margins by removing fluctuations attributable to the cost of shipping.

Human Capital Management

We operate our business with an entrepreneurial attitude, staying focused on long-term growth, and treating our employees, vendors, and clients with dignity and respect. At June 30, 2024, our employee count totaled 3,404, with 2,376 employees in our wholesale segment and 1,028 in our retail segment. The majority of our employees are employed on a full-time basis and none of our employees are represented by unions or collective bargaining agreements. In managing our business, we focus on a number of key human capital objectives, which are rooted in our core values and include the following.

Culture and Values

Our employees are vital to our success and are one of the main reasons we continue to perform well. Since our founding, we have aimed to build a collaborative culture that emphasizes treating people with dignity and respect while offering employees a variety of opportunities and experiences. We believe our employees have an entrepreneurial spirit, a passion for style, a drive for excellence, and creativity that has fostered a culture that embraces integrity, diversity, innovation and inclusion of people from all backgrounds. We continue to maintain and enforce our policy prohibiting discrimination and harassment in our workplace.

Ethan Allen is dedicated to upholding the highest ethical standards in all aspects of our business operations. The Company’s Code of Conduct provides a clear and thorough ethics standard for all employees, officers, and directors with respect to interactions with clients, vendors, and other employees. Ethan Allen provides multiple avenues through which to report inappropriate behavior, including a confidential whistleblower hotline.

Diversity and Inclusion

Diversity and inclusion are part of our core values, as we recognize that our employees’ unique backgrounds, experiences and perspectives enable us to create and deliver high-quality products and provide outstanding service to meet the needs of our client base and the communities we serve. We believe in creating and fostering a workplace in which all our employees feel valued, included and empowered to do their best work and contribute their ideas and perspectives. We are committed to recruiting and retaining diverse talent so that our workforce better reflects the communities in which we live and work. Our diversity initiatives include developing impactful practices to advance our Company’s diversity and inclusion policies, supporting diversity awareness across our organization, maintaining an inclusive environment free from discrimination or harassment of any kind, and continuing to offer our employees equal employment opportunities based solely on merit and qualifications. The Company participates in various surveys, which we use as benchmarking tools on corporate policies, practices and benefits, as a commitment to build a diverse and inclusive workforce mirroring the diversity of our clients and the communities we serve. Aligning with our purpose and values, we work every day to support the advancement of women, promoting them to leadership positions throughout our enterprise. We are proud to report that as of June 30, 2024, 71% of our retail division leaders and 67% of our Company-wide leaders are women.

Health and Safety

Ethan Allen is committed to protecting the health and safety of our employees. We have safety programs in place for our employees to receive the proper training and education to ensure they are able to work in a safe environment each day. In addition, we have partnered with local communities in some of our North American manufacturing workshops to provide transportation to and from work and offer daily low-cost meals. In coordination with national healthcare systems for our manufacturing facilities outside of the United States, we provide on-site medical clinics staffed by a doctor and a team of experienced nurses, who also provide a pharmacy to prescribe over-the-counter medications. This commitment and focus enables us to run our business operations without sacrificing the safety of our employees and customers.

A Culture of Social Responsibility

Throughout our history, philanthropy has been a core value to Ethan Allen. We strive to develop exceptional programs based on partnerships where employees feel a sense of connection and pride in their communities and our mission is to enhance the quality of life in the communities in which we work and live. During fiscal 2024, and for the fifth year in a row, the Mexican Center for Corporate Philanthropy and the Alliance for Corporate Social Responsibility recognized Ethan Allen’s upholstery manufacturing operations in Silao, as “Environmentally and Socially Responsible” for our ongoing commitment to socially responsible management.

Compensation and Other Benefits

Our compensation programs are designed to attract, retain and motivate team members to achieve strong results. We benchmark our compensation practices and benefits programs against those of comparable industries and in the geographic areas where our facilities are located. We believe that our compensation and employee benefits are competitive and allow us to attract and retain skilled labor. Certain of the benefits we offer include access to healthcare plans, financial and physical wellness programs, paid time off, parental leave and retirement benefits, including a 401(k) plan with Company matching contributions.

Competition

The home furnishings industry is a highly fragmented and competitive business. There has been increased competition from both internet only retailers and those with a brick-and-mortar presence. We compete with numerous individual retail home furnishing stores as well as national and regional chains. We believe the home furnishings industry competes primarily on the basis of product styling and quality, personal service, prompt delivery, product availability and price. We further believe that we are well-positioned to compete on the basis of each of these factors and that, more specifically under our vertical integration structure, our complimentary interior design service, direct manufacturing, a logistics network including white glove delivery service and relevant product offerings, create a competitive advantage. We also believe that we differentiate ourselves further with the caliber of our interior design professionals, who combine personal service with technology.

Sustainability

Ethan Allen’s view of sustainability and protecting the environment has been a cornerstone of our mission statement. We are committed to sustainable business practices that incorporate social, environmental, health and safety programs into our global manufacturing, distribution, home delivery and retail design centers.

Our environmental initiatives include but are not limited to:

● | Use of responsibly harvested Appalachian woods, including the establishment of a wood sourcing policy and the sourcing of reclaimed/recycled wood; we are proud that Ethan Allen reports more than 25% of its wood furniture sold is from materials sourced from reclaimed/recycled wood |

● | Use of finishes that are low in both volatile organic compounds and hazardous air pollutants |

● | Eliminate the use of heavy metals and hydrochlorofluorocarbons in all packaging; our mattresses and custom upholstery use foam made without harmful chemicals and substances |

● | Convert, where and when reasonably feasible, to becoming per- and polyfluoroalkyl substances (“PFAS”) free throughout all our products including area rugs, broadloom, draperies and fabrics |

● | Invest in machinery and technology to cut down the landfill waste we generate by packaging our furniture with custom-sized plastic wrap and cartons to reduce excess packaging waste |

● | Continually review and investigate ways to reduce our carbon footprint and greenhouse gas emissions |

The Company requires its sourcing facilities that manufacture Ethan Allen branded products to implement a labor compliance program and meet or exceed the standards established for preventing child labor, involuntary labor, coercion and harassment, discrimination, and restrictions to freedom of association. These facilities are also required to provide a safe and healthy environment in all workspaces, compliance with all local wage and hour laws and regulations, compliance with all applicable environmental laws and regulations, and are required to authorize Ethan Allen or its designated agents (including third-party auditing companies) to engage in monitoring activities to confirm compliance.

Intellectual Property

We currently hold, or have registration applications pending for, trademarks, service marks and copyrights for the Ethan Allen name, logos and designs in a broad range of classes for both products and services in the United States and in many foreign countries. We also have registered, or have applications pending, for certain of our slogans utilized in connection with promoting brand awareness, retail sales and other services and certain collection names. In addition, we have registered and maintain the internet domain name of ethanallen.com. We view such trademarks, logos, service marks and domain names as valuable assets and have an ongoing program to diligently monitor and defend, through appropriate action, against their unauthorized use. The Company regularly reviews the necessity for renewal as registrations expire.

Corporate Contact Information

Ethan Allen Interiors Inc. is a Delaware corporation with its principal executive office located in Danbury, Connecticut.

● | Founded in 1932 and Incorporated in Delaware in 1989 |

● | Mailing address of the Company’s headquarters: 25 Lake Avenue Ext., Danbury, Connecticut 06811-5286 |

● | Telephone number: +1 (203) 743-8000 |

● | Website address: ethanallen.com |

Information about our Executive Officers

Listed below are the names, ages and positions of our current executive officers and, if they had not held those positions for the past five years, their former positions during that period with Ethan Allen or other companies. This information is presented as of August 23, 2024, the date of this Annual Report on Form 10-K.

M. Farooq Kathwari*, age 80

● | Chairman of the Board, President and Chief Executive Officer since 1988 |

Amy Franks, age 50

● | Executive Vice President, Retail Division since August 2024 |

● | Executive Vice President, Retail Network and Business Development from December 2021 to August 2024 |

● | Senior Vice President, Retail from March 2021 to December 2021 |

● | Previously held senior retail leadership position at Bassett Furniture Industries, Inc. from 2019 to 2021 |

● | Prior to joining Bassett in 2019, she was Vice President, Retail at Ethan Allen from 2013 to 2019 |

Matthew J. McNulty, age 45

● | Senior Vice President, Chief Financial Officer and Treasurer since December 2021 |

● | Vice President, Finance and Treasurer from February 2020 to December 2021 |

● | Joined the Company in February 2019 as Vice President, Corporate Controller |

Rebecca L. Thompson, age 52

● | Senior Vice President, Merchandising and Product Development since October 2023 |

● | Vice President, Merchandising and Product Development from September 2022 to October 2023 |

● | Senior Director of Accents from March 2021 to September 2022 |

● | Joined the Company in October 2019 as Director of Wall Decor |

* Mr. Kathwari is the sole executive officer of the Company who operates under a written employment agreement.

Available Information

Information contained in our Investor Relations section of our website at https://ir.ethanallen.com is not part of this Annual Report on Form 10-K. Information that we furnish or file with the SEC, including our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K or exhibits included in these reports are available for download, free of charge, on our Investor Relations website soon after such reports are filed with or furnished to the SEC. Our SEC filings, including exhibits filed therewith, are also available free of charge through the SEC’s website at www.sec.gov.

Additionally, we broadcast live our quarterly earnings calls via the News & Events section of our Investor Relations website. We also provide notifications of news or announcements regarding our financial performance, including SEC filings, press and earnings releases, and investor events as part of our Investor Relations website. The contents of this website section are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document the Company files with the SEC and any reference to this section of our website is intended to be inactive textual references only.

Additional Information

Additional information with respect to the Company’s business is included within the following pages and is incorporated herein by reference:

Page | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 |

Quantitative and Qualitative Disclosures about Market Risk | 35 |

Note 1 to Consolidated Financial Statements entitled Organization and Nature of Business | 44 |

Note 20 to Consolidated Financial Statements entitled Segment Information | 65 |

ITEM 1A. RISK FACTORS

The following risks could materially and adversely affect our business, financial condition, cash flows, results of operations and the trading price of our common stock could decline. These risk factors do not identify all risks that we face; our operations could also be affected by factors that are not presently known to us or that we currently consider to be immaterial to our operations. Investors should also refer to the other information set forth in this Annual Report on Form 10-K, including Management’s Discussion and Analysis of Financial Condition and Results of Operations and our financial statements including the related notes. Investors should carefully consider all risks, including those disclosed, before making an investment decision.

Home Furnishings Industry Risks

Declines in certain economic conditions, which impact consumer confidence and consumer spending, could negatively impact our sales, results of operations and liquidity.

Historically, the home furnishings industry has been subject to cyclical variations in the general economy and to uncertainty regarding future economic prospects. Should current economic conditions weaken, the current rate of housing starts further decline, or elevated inflation persist, consumer confidence and demand for home furnishings could deteriorate which has in the past and could in the future adversely affect our business through its impact on the performance of our Company-operated design centers, as well as on our independent licensees and the ability of a number of them to meet their obligations to us. Our principal products are consumer goods that may be considered discretionary purchases. Economic downturns and prolonged negative conditions in the economy have in the past and could in the future affect consumer spending habits by decreasing the overall demand for discretionary items, including home furnishings. Factors influencing consumer spending include general economic and financial market conditions, consumer disposable income, fuel prices, recession and fears of recession, United States government default or shutdown or the risk of such default or shutdown, unemployment, war and fears of war, availability of consumer credit, consumer debt levels, conditions in the housing market, increased interest rates, sales tax rates and rate increases, inflation, civil disturbances and terrorist activities, consumer confidence in future economic and political conditions, natural disasters and inclement weather and consumer perceptions of personal well‑being and security, including health epidemics or pandemics.

Other financial or operational difficulties due to competition may result in a decrease in our sales, earnings and liquidity.

The residential home furnishings industry is highly competitive and fragmented. We currently compete with many other manufacturers and retailers, including online retailers, some of which offer widely advertised products, and others, several of which are large retail dealers offering their own store-branded products. Competition in the residential home furnishings industry is based on quality, style of products, perceived value, price, service to the customer, promotional activities, and advertising. The highly competitive nature of the industry means we are constantly subject to the risk of losing market share, which would likely decrease our future sales, earnings and liquidity.

A significant shift in consumer preference toward purchasing products online could have a materially adverse impact on our sales and operating margin.

A majority of our business relies on physical design centers that merchandise and sell our products and a significant shift in consumer preference towards exclusively purchasing products online could have a materially adverse impact on our sales and operating margin. We are attempting to meet consumers where they prefer to shop by expanding our online capabilities and improving the user experience at ethanallen.com including our virtual design center.

Evolving technologies are altering the manner in which the Company and its competitors communicate and transact with customers. Adoption of new technology and related changes in customer behavior present a specific risk in the event we are unable to successfully execute our technology plans or adjust them over time if needed.

Risks Related to our Brand and Product Offerings

Inability to maintain and enhance our brand may materially adversely impact our business.

Maintaining and enhancing our brand is critical to our ability to expand our base of customers and may require us to make substantial investments. Our advertising campaigns utilize direct mail, digital, newspapers, magazines, television, and radio to maintain and enhance our existing brand equity. We cannot provide assurance that our advertising and other efforts to promote and maintain awareness of our brand will not require us to incur substantial costs. If these efforts are unsuccessful or we incur substantial costs in connection with these efforts, our business, operating results and financial condition could be materially adversely affected.

Failure to successfully anticipate or respond to changes in consumer tastes and trends in a timely manner could materially adversely impact our business, operating results and financial condition.

Sales of our products are dependent upon consumer acceptance of our product designs, styles, quality and price. We continuously monitor changes in home design trends through attendance at trade shows, industry events, internal and external marketing research, and regular communication with our retailers and design professionals who provide valuable input on consumer tendencies. However, as with many retailers, our business is susceptible to changes in consumer tastes and trends. Such tastes and trends can change rapidly and any delay or failure to anticipate or respond to changing consumer tastes and trends in a timely manner could materially adversely impact our business and operating results.

We may not be able to maintain our current design center locations at current costs. We may also fail to successfully select and secure design center locations.

Our design centers are typically located in busy urban settings as freestanding destinations or as part of suburban shopping malls, depending upon the real estate opportunities in a particular market. Our business competes with other retailers and as a result, our success may be affected by our ability to renew current design center leases and to select and secure appropriate retail locations for existing and future design centers.

We have potential exposure to market risk related to conditions in the commercial real estate market. At June 30, 2024, there were 142 Company-operated retail design centers averaging approximately 13,800 square feet in size per location. Of these 142 properties, we own 49 and lease 93. Our retail segment real estate holdings could suffer significant impairment in value if we are forced to close design centers and sell or lease the related properties during periods of weakness in certain markets. We are also exposed to risk related to conditions in the commercial real estate rental market with respect to the right-of-use assets we carry on our balance sheet for leased design centers and retail service centers. At June 30, 2024, the unamortized balance of such right-of-use assets totaled $114.2 million. Should we have to close or abandon one of these leased locations, we could incur additional impairment charges if rental market conditions do not support a fair value for the right of use asset in excess of carrying value.

Supply Chain Risks

Disruptions of our supply chain and supply chain management could have a material adverse effect on our operating and financial results.

Disruption of the Company’s supply chain capabilities due to trade restrictions, political instability, severe weather, natural disasters, public health crises, terrorism, product recalls, global unrest, war, labor supply or stoppages, the financial and/or operational instability of key suppliers and carriers, or other reasons could impair the Company’s ability to distribute its products. To the extent we are unable to mitigate the likelihood or potential impact of such events, there could be a material adverse effect on our operating and financial results.

For example, the COVID-19 pandemic, resulted in supply chain challenges for the entire home furnishings industry, including the Company. While the pandemic-era disruptions have subsided, if in the future there are transportation delays, increases on shipping containers, more extensive travel restrictions, closures or disruptions of businesses and facilities or social, economic, political or labor instability in the affected areas, as a result of pandemics or otherwise, it could impact either our or our suppliers’ operations and have a material adverse effect on our consolidated results of operations.

Fluctuations in the price, availability and quality of raw materials and imported finished goods could result in increased costs and cause production delays which could result in a decline in sales, either of which could materially adversely impact our earnings.

In manufacturing furniture we use various types of logs, lumber, fabrics, plywood, frames, leathers, finishing materials, foam, steel and other raw materials. Fluctuations in the price, availability and quality of raw materials could result in increased costs or a delay in manufacturing our products, which in turn could result in a delay in delivering products to our customers. Although we have instituted measures to ensure our supply chain remains open to us, higher raw material prices and costs of sourced products could have an adverse effect on our future margins. While we strive to maintain a number of sources for our raw materials, decreased availability on raw materials may create additional pricing and availability pressures.

Imported finished goods represent approximately 25% of our consolidated sales. The prices paid for these imported products include inbound freight. Elevated ocean freight container rates may be impacted by container supply and elevated demand. To the extent that we experience incremental costs in any of these areas, we may increase our selling prices to offset the impact. However, increases in selling prices may not fully mitigate the impact of the cost increases which would adversely impact operating income. Furthermore, supply chain disruptions could materially adversely impact our manufacturing production and fulfillment of backlog.

Manufacturing Risks

Competition from overseas manufacturers and domestic retailers may materially adversely affect our business, operating results or financial condition.

Our wholesale business segment is involved in the development of our brand, which encompasses the design, manufacture, sourcing, sales and distribution of our home furnishings products, and competes with other United States and foreign manufacturers. Our retail network sells home furnishings to consumers through a network of independently operated and Company-operated design centers, and competes against a diverse group of retailers ranging from specialty stores to traditional home furnishings and department stores, any of which may operate locally, regionally, nationally or globally, as well as over the internet. We also compete with these and other retailers for retail locations as well as for qualified design professionals and management personnel. Such competition could adversely affect our future financial performance.

Industry globalization has led to increased competitive pressures brought about by the increasing volume of imported finished goods and components, particularly for case good products, and the development of manufacturing capabilities in other countries, specifically within Asia. In addition, because many foreign manufacturers are able to maintain lower production costs, including the cost of labor and overhead, imported product may be capable of being sold at a lower price to consumers, which, in turn, could lead to some measure of further industry‐wide price deflation.

We cannot provide assurance that we will be able to establish or maintain relationships with sufficient or appropriate manufacturers, whether foreign or domestic, to supply us with selected case goods, upholstery and home accent items to enable us to maintain our competitive advantage. In addition, the emergence of foreign manufacturers has served to broaden the competitive landscape. Some of these competitors produce products not manufactured by us and may have greater financial resources available to them or lower costs of operating. This competition could materially adversely affect our future financial performance.

Our number of manufacturing sites may increase our exposure to business disruptions and could result in higher costs.

We have a limited number of manufacturing sites within our case goods and upholstery operations. Our upholstery operations consist of three upholstery plants in North Carolina and two plants in Mexico. Our case goods operations is supported by two manufacturing plants in Vermont and Honduras and one sawmill, one rough mill and one kiln dry lumberyard. If any of our manufacturing sites experience significant business interruption, our ability to manufacture or deliver our products in a timely manner would likely be impacted. For example, in July 2023, our wood furniture manufacturing operations located in Orleans, Vermont sustained damage from flooding, which resulted in losses of $2.2 million, net of insurance recoveries and grant proceeds, and a temporary work stoppage for many Vermont associates and a disruption and delay of shipments. Fewer locations have also resulted in longer distances for delivery and could result in higher costs to transport products if fuel costs significantly increase.

Environmental, Health and Safety Risks

Our current and former manufacturing and retail operations and products are subject to environmental, health and safety requirements.

We use and generate hazardous substances in our manufacturing operations. In addition, the manufacturing properties on which we currently operate and those on which we have ceased operations are and have been used for industrial purposes. Our manufacturing operations and, to a lesser extent, our retail operations involve risk of personal injury or death. We are subject to environmental, health and safety laws and regulations relating to our products, current and former properties and our current operations. These laws and regulations provide for substantial fines and criminal sanctions for violations and sometimes require the installation of costly pollution control or safety equipment, or costly changes in operations to limit pollution or decrease the likelihood of injuries. In addition, we may become subject to potentially material liabilities for the investigation and cleanup of contaminated properties and to claims alleging personal injury or property damage resulting from exposure to or releases of hazardous substances or personal injury because of an unsafe workplace. In addition, noncompliance with, or stricter enforcement of, existing laws and regulations, adoption of more stringent new laws and regulations, discovery of previously unknown contamination or imposition of new or increased requirements could require us to incur costs or become the basis of new or increased liabilities that could be material.

Product recalls or product safety concerns could materially adversely affect our sales and operating results.

If the Company's merchandise offerings do not meet applicable safety standards or consumers' expectations regarding safety, the Company could experience decreased sales, increased costs and/or be exposed to legal and reputational risk. Although we require that all of our vendors comply with applicable product safety laws and regulations, we are dependent on them to ensure that the products we buy comply with all safety standards. Events that give rise to actual, potential or perceived product safety concerns could expose the Company to government enforcement action and/or private litigation. Reputational damage caused by real or perceived product safety concerns or product recalls could negatively affect the Company's business and results of operations.

We may incur significant increased costs and become subject to additional potential liabilities under environmental and other laws and regulations aimed at combating climate change.

We believe it is likely that the increased focus by the United States and other governmental authorities on climate change and other environmental matters will lead to enhanced regulation in these areas, which could also result in increased compliance costs and subject us to additional potential liabilities. The extent of these costs and risks is difficult to predict and will depend in large part on the extent of new regulations and the ways in which those regulations are enforced. We operate manufacturing facilities in multiple regions across the globe, and the impact of additional regulations in this area is likely to vary by region. It is possible the costs we incur to comply with any such new regulations and implementation of our own sustainability goals could be material.

Our practices and future disclosures related to Environmental, Social and Governance (“ESG”) matters may expose us to numerous risks, including risks to our reputation and stock price.

There has been an increased focus on ESG practices within the general markets. Our efforts to accomplish and accurately report on ESG matters present numerous operational, reputational, financial, legal, and other risks, any of which could have a material negative impact, including on our reputation, stock price and results of operation. We could also incur additional costs and require additional resources to implement various ESG initiatives and to monitor and track performance with respect to such initiatives.

The standards for tracking and reporting on ESG matters are relatively new and continue to evolve. In March 2024, the SEC finalized new rules that would require public companies to include extensive climate-related disclosures in their SEC filings, which the SEC voluntarily stayed in April 2024 pending completion of a judicial review that is currently pending in the U.S. Court of Appeals for the Eighth Circuit. While we continue to assess the materiality of climate-related topics to our operations, we could incur substantial additional compliance costs to the extent these or similar rules are implemented and we determine such topics are material. Collecting, measuring, and reporting ESG information and metrics can be difficult and time consuming. Our current selected disclosure framework or standards may need to be changed from time to time, including as a result of new rules, which may result in a lack of consistent or meaningful comparative data from period to period. In addition, our interpretation of reporting frameworks, standards or rules may differ from those of others and such frameworks, standards or rules may change over time, any of which could result in significant revisions to our goals or reported progress in achieving such goals.

Our ability to achieve any ESG-related objective is subject to numerous risks, many of which are outside of our control, including the availability and cost of low-or non-carbon-based energy sources and technologies, evolving regulatory requirements affecting ESG standards or disclosures, the availability of vendors and suppliers that can meet our sustainability, diversity and other standards, and the availability of raw materials that meet and further sustainability objectives. If our ESG practices do not meet evolving standards, then our reputation, our ability to attract or retain employees and our competitiveness, could be negatively impacted. Furthermore, if our competitors’ ESG performance is perceived to be better than ours, potential or current customers and investors may elect to do business with our competitors instead, and our ability to attract or retain employees could be negatively impacted. Our failure, or perceived failure to pursue or fulfill ESG objectives or to satisfy various reporting standards could also expose us to government enforcement actions and litigation.

Technology and Data Security Risks

We rely extensively on information technology systems to process transactions, summarize results, and manage our business and that of certain independent retailers. Disruptions in both our primary and back-up systems could adversely affect our business and operating results.

Our primary and back-up information technology systems are subject to damage or interruption from power outages, computer and telecommunications failures, viruses, phishing attempts, cyberattacks, malware and ransomware attacks, security breaches, severe weather, natural disasters, and errors by employees or third-party contractors. Though losses arising from some of these issues may be covered by insurance, interruptions of our critical business information technology systems or failure of our back-up systems could result in longer production times or negatively impact customers resulting in damage to our reputation and a reduction in sales. If our critical information technology systems or back-up systems were damaged or ceased to function properly, we might have to make a significant investment to repair or replace them.

Further, information systems of our suppliers or service providers may be vulnerable to attacks by hackers and other security breaches, including computer viruses and malware, through the internet, email attachments and persons with access to these information systems. If our suppliers or service providers were to experience a system disruption, attack or security breach that impacts a critical function, it could result in disruptions in our supply chain, the loss of sales and customers, potential liability for damages to our customers, reputational damage and incremental costs, which could adversely affect our business, results of operations and profitability.

Successful cyberattacks and the failure to maintain adequate cybersecurity systems and procedures could materially harm our operations.

Cyberattacks designed to gain access to and extract sensitive information or otherwise affect or compromise the confidentially, integrity, and availability of information, including phishing attempts, denial of service attacks, and malware or ransomware incidents, have occurred over the last several years at a number of major global companies and have resulted in, among other things, the unauthorized release of confidential information, system failures including material business disruptions, and negative brand and reputational impacts. Despite widespread recognition of the cyberattack threat and improved data protection methods, cyberattacks on organizations continue to be sophisticated, persistent, and ever-changing, making it difficult to prevent and detect these attacks. Additionally, we rely on third-party service providers to execute certain business processes and maintain certain information technology systems and infrastructure, and we supply such third-party providers with the personal information required for those services.

Cyberattacks are becoming more sophisticated, and in some cases have caused significant harm. Computer hackers and others routinely attempt to breach the security of technology products, services and systems, and to fraudulently induce employees, customers, or others to disclose information or unwittingly provide access to systems or data. We operate many aspects of our business through server and web‐based technologies, and store various types of data on such servers or with third parties who in turn store it on servers and in the cloud. Any disruption to the internet or to the Company's or its service providers' global technology infrastructure, including malware, insecure coding, “Acts of God,” attempts to penetrate networks, data theft or loss and human error, could have adverse effects on the Company's operations.

A cyberattack of our systems or networks that impairs our information technology systems could disrupt our business operations and result in loss of service to customers. We believe we have a comprehensive cybersecurity program designed to protect and preserve the integrity of our information technology systems. We expect to continue to experience attempted cyberattacks of our IT systems or networks, through malware, ransomware, computer viruses, phishing attempts, social engineering and other means of unauthorized access; however, none of the attempted cyberattacks has had a material impact on our operations or financial condition to date. If a computer security breach or cyberattack affects our systems or results in the unauthorized release of proprietary or personally identifiable information, our reputation could be materially damaged, our customer confidence could be diminished, and our operations, including technical support for our devices, could be impaired. We would also be exposed to litigation and potential liability, which could have a material adverse effect on our business, results of operations, cash flows and financial condition. Moreover, the costs to eliminate or alleviate network security problems, bugs, viruses, worms, malicious software programs and security vulnerabilities could be significant, and our efforts to address these problems may not be successful, resulting potentially in the theft, loss, destruction or corruption of information we store electronically, as well as unexpected interruptions, delays or cessation of service, any of which could cause harm to our business operations.

Where necessary and applicable, we have enabled certain employees to arrange for a hybrid work approach. Although we continue to implement strong physical and cybersecurity measures to ensure that our business operations remain functional and to ensure uninterrupted service to our customers, our systems and our operations remain vulnerable to cyberattacks and other disruptions due to the fact that certain employees work remotely and we cannot guarantee that our mitigation efforts will be effective.

Loss, corruption and misappropriation of data and information relating to customers could materially adversely affect our operations.

We have access to customer information in the ordinary course of business. If a significant data breach occurred, the loss, disclosure or misappropriation of our business information may adversely affect our reputation, customer confidence may be diminished, or we may be subject to legal claims, or legal proceedings, including regulatory investigations and actions, which may lead to regulatory enforcement actions against us, and may materially adversely affect our business, operating results and financial condition.

Legal and Regulatory Risks

Global and local economic uncertainty may materially adversely affect our manufacturing operations or sources of merchandise and international operations.

Economic uncertainty, as well as other variations in global economic conditions such as fuel costs, wage and benefit inflation, and currency fluctuations, may cause inconsistent and unpredictable consumer spending habits, while increasing our own input costs. These risks resulting from global and local economic uncertainty could also severely disrupt our manufacturing operations, which could have a material adverse effect on our financial performance. We import approximately 25% of our merchandise from outside of the United States as well as operate manufacturing plants in Mexico and Honduras and retail design centers in Canada. As a result, our ability to obtain adequate supplies or to control our costs may be adversely affected by events affecting international commerce and businesses located outside the United States, including natural disasters, public health crises, changes in international trade including tariffs, central bank actions, changes in the relationship of the U.S. dollar versus other currencies, labor availability and cost, and other domestic governmental policies and the countries from which we import our merchandise or in which we operate facilities.

Changes in the United States trade and tax policy could materially adversely affect our business and results of operations.

Changes in the political environment in the United States may require us to modify our current business practices. We are subject to risks relating to increased tariffs on United States imports, and other changes affecting imports, as we manufacture components and finished goods in Mexico and Honduras and purchase components and finished goods manufactured in foreign countries. We may not be able to fully or substantially mitigate the impact of tariffs, pass price increases on to our customers, or secure adequate alternative sources of products or materials. The tariffs, along with any additional tariffs or retaliatory trade restrictions implemented by other countries, could negatively impact customer sales, including potential delays in product received from our vendors, our cost of goods sold and results of operations.

Our business may be materially adversely affected by changes to tax policies.

Changes in United States or international income tax laws and regulations may have a material adverse effect on our business in the future or require us to modify our current business practices. In the ordinary course of business, we are subject to tax examinations by various governmental tax authorities. The global and diverse nature of our business means that there could be additional examinations by governmental tax authorities and the resolution of ongoing and other probable audits, which could impose a future risk to the results of our business.

Human Capital Risk

Our business is dependent on certain key personnel; if we lose key personnel or are unable to hire additional qualified personnel, our business may be harmed.

The success of our business depends upon our ability to retain continued service of certain key personnel, including our Chairman of the Board, President and Chief Executive Officer, M. Farooq Kathwari, whose employment agreement was amended on July 30, 2024, extending his term for an additional two years, ending June 30, 2027. We face risks related to loss of any key personnel and we also face risks related to any changes that may occur in key senior leadership executive positions. Any disruption in the services of our key personnel could make it more difficult to successfully operate our business and achieve our business goals and could adversely affect our results of operation and financial condition. These changes could also increase the volatility of our stock price.

The market for qualified employees and personnel in the retail and manufacturing industries is highly competitive. Our success depends upon our ability to attract, retain and motivate qualified artisans, professional and clerical employees and upon the continued contributions of these individuals. We cannot provide assurance that we will be successful in attracting and retaining qualified personnel. A shortage of qualified personnel may require us to enhance our wage and benefits package in order to compete effectively in the hiring and retention of qualified employees. This could have a material adverse effect on our business, operating results and financial condition.

Labor challenges could have a material adverse effect on our business and results of operations.

In our current operating environment, due in part to macroeconomic factors, we continue to experience various labor challenges, including, for example significant competition for skilled manufacturing and production employees; pressure to increase wages as a result of inflationary pressures, and at times, a shortage of qualified full-time labor. Outside suppliers that we rely on have also experienced similar labor challenges. The future success of our operations depends on our ability, and the ability of third parties on which we rely, to identify, recruit, develop and retain qualified and talented individuals in order to supply and deliver our products. A prolonged shortage or inability to retain qualified labor could decrease our ability to effectively produce and meet customer demand and efficiently operate our facilities, which could negatively impact our business and have a material adverse effect on our results of operations. Higher wages to attract new and retain existing employees, as well as higher costs to purchase services from third parties, could negatively impact our results of operations.

Financial Risks

Our total assets include substantial amounts of long-lived assets. Changes to estimates or projections used to assess the fair value of these assets, financial results that are lower than current estimates at certain design center locations or determinations to close underperforming locations may cause us to incur future impairment charges, negatively affecting our financial results.

We make certain accounting estimates and projections with regards to individual design center operations as well as overall Company performance in connection with our impairment analysis for long-lived assets in accordance with applicable accounting guidance. An impairment charge may be required if the impairment analysis indicates that the carrying value of an asset exceeds the sum of the expected undiscounted cash flows of the asset. The projection of future cash flows used in this analysis requires the use of judgment and a number of estimates and projections of future operating results, including sales growth rates. If actual results differ from Company estimates, additional charges for asset impairments may be required in the future. If impairment charges are significant, our financial results could be negatively affected.

Access to consumer credit could be interrupted as a result of conditions outside of our control, which could reduce sales and profitability.

Our ability to continue to access consumer credit for our customers could be negatively affected by conditions outside our control. If capital market conditions have a material negative change, there is a risk that our business partner that issues our private label credit card program may not be able to fulfill its obligations under that agreement. In addition, the tightening of credit markets as well as increased borrowing rates has in the past and may in the future restrict the ability and willingness of customers to make purchases.

We are subject to self-insurance risks.

We are self-insured for our health benefits and maintain per employee stop loss coverage; however, we retain the insurable risk at an aggregate level. Therefore, unforeseen or significant losses in excess of our insured limits could have a material adverse effect on the Company’s financial condition and operating results.

General Risk Factors

Failure to protect our intellectual property could materially adversely affect us.

We believe that our copyrights, trademarks, service marks, trade secrets, and all of our other intellectual property are important to our success. We rely on patent, trademark, copyright and trade secret laws, and confidentiality and restricted use agreements, to protect our intellectual property and may seek licenses to intellectual property of others. Some of our intellectual property is not covered by any patent, trademark, or copyright or any applications for the same. We cannot provide assurance that agreements designed to protect our intellectual property will not be breached, that we will have adequate remedies for any such breach, or that the efforts we take to protect our proprietary rights will be sufficient or effective. Any significant impairment of our intellectual property rights or failure to obtain licenses of intellectual property from third parties could harm our business or our ability to compete. Moreover, we cannot provide assurance that the use of our technology or proprietary know‐how or information does not infringe the intellectual property rights of others. If we have to litigate to protect or defend any of our rights, such litigation could result in significant expense.

Our operations present hazards and risks which may not be fully covered by insurance, if insured.

As protection against operational hazards and risks, we maintain business insurance against many, but not all, potential losses or liabilities arising from such risks. We may incur costs in repairing any damage beyond our applicable insurance coverage. Uninsured losses and liabilities from operating risks could reduce the funds available to us for capital and investment spending and could have a material adverse impact on the results of operations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 1C. CYBERSECURITY

Cybersecurity Risk Management and Strategy

We have policies, procedures and processes in place to identify, assess and monitor material risks from cybersecurity threats. These plans are part of our overall enterprise risk management strategy and are part of our operating procedures, internal controls, and information systems. Cybersecurity risks include, among other things, fraud, extortion, harm to employees or customers, violation of privacy or security laws and other litigation and legal risks, and reputational risks. We have developed and implemented a cybersecurity framework intended to assess, identify and manage risks from threats to the security of our information, systems, and network using a risk-based approach. The framework is informed in part by the National Institute of Standards and Technology (“NIST”) Cybersecurity Framework, although this does not imply that we meet all technical standards, specifications or requirements under the NIST.

Our key cybersecurity processes include the following:

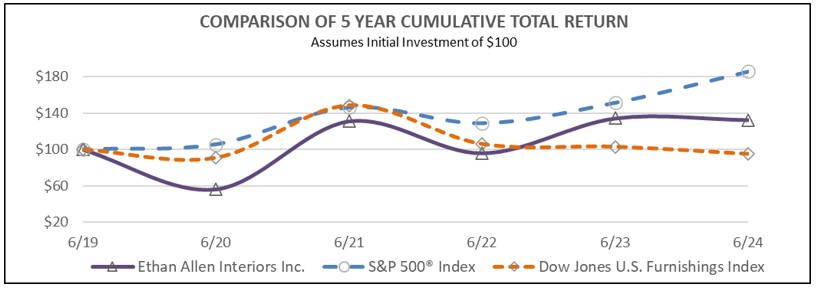

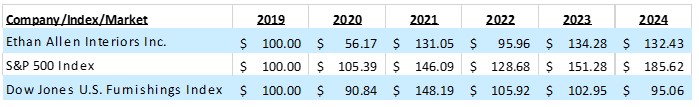

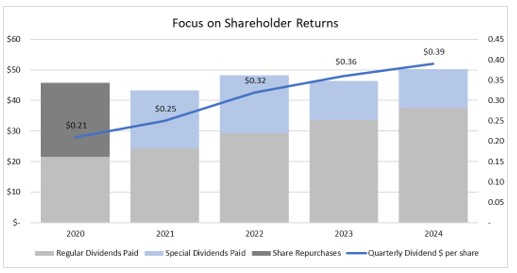

● | Risk-based controls for information systems and information on our networks: We seek to maintain an information technology infrastructure that implements physical, administrative and technical controls that are calibrated based on risk and designed to protect the confidentiality, integrity and availability of our information systems and information stored on our networks, including customer and employee information. |