Item 1. Report to Stockholders:

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940:

What makes Putnam different?

In 1830, Massachusetts Supreme Judicial Court Justice Samuel Putnam established The Prudent Man Rule, a legal foundation for responsible money management.

THE PRUDENT MAN RULE

All that can be required of a trustee to invest is that he shall conduct himself faithfully and exercise a sound discretion. He is to observe how men of prudence, discretion, and intelligence manage their own affairs, not in regard to speculation, but in regard to the permanent disposition of their funds, considering the probable income, as well as the probable safety of the capital to be invested.

A time-honored tradition in money management

Since 1937, our values have been rooted in a profound sense of responsibility for the money entrusted to us.

A prudent approach to investing

We use a research-driven team approach to seek consistent, dependable, superior investment results over time, although there is no guarantee a fund will meet its objectives.

Funds for every investment goal

We offer a broad range of mutual funds and other financial products so investors and their advisors can build diversified portfolios.

A commitment to doing what’s right for investors

We have stringent investor protections and provide a wealth of information about the Putnam funds.

Industry-leading service

We help investors, along with their financial advisors, make informed investment decisions with confidence.

| Putnam Managed High Yield Trust 11| 30| 05 Semiannual Report |

| Message from the Trustees | 2 |

| About the fund | 4 |

| Report from the fund managers | 7 |

| Performance | 12 |

| Your fund’s management | 14 |

| Terms and definitions | 17 |

| Trustee approval of management contract | 18 |

| Other information for shareholders | 25 |

| Financial statements | 27 |

| Shareholder meeting results | 55 |

| Cover photograph: © Richard H. Johnson |

| Message from the Trustees |

Dear Fellow Shareholder

During the course of 2005, U.S. and global economies proved resilient in the face of some emerging challenges. Higher energy prices, mounting inflationary pressures, and damage caused by an unusually active hurricane season appeared at times to pose a risk to corporate earnings, raising investors’ concerns. The Federal Reserve Board’s program of interest-rate increases remained in effect throughout the year, as well. Nevertheless, in recent months the financial markets have demonstrated trends consistent with an expanding economy -- relative weakness for bonds and relative strength for stocks. With many companies appearing likely to deliver strong earnings, our teams are working to identify investment opportunities while remaining cognizant of the risks posed by higher energy prices in the winter months, as well as the possibility of continued increases in interest rates in 2006.

In our view, the professional research, diversification, and active management that mutual funds provide continue to make them an intelligent choice for investors. We want you to know that Putnam Investments’ management team, under the leadership of Chief Executive Officer Ed Haldeman, continues to focus on investment performance and remains committed to putting the interests of shareholders first. Also, in keeping with these goals, we have redesigned and expanded our shareholder reports to make it easier for you to learn more about your fund. Furthermore, on page 18 we provide information about the 2005 approval by the Trustees of your fund’s management contract with Putnam.

2

In the following pages, members of your fund’s management team discuss the fund’s performance and strategies, and their outlook for the months ahead. We thank you for your support of the Putnam funds throughout 2005 and wish you a happy and prosperous 2006.

| Putnam Managed High Yield Trust: a disciplined approach to seeking income and capital growth |

Relative to most types of fixed-income investments, high-yield bonds are more dependent on the performance of issuing companies than on interest rates. For this reason, distinguishing between opportunities and pitfalls requires a rigorous investment process. With Putnam Managed High Yield Trust, this process is highlighted by exhaustive research, investment diversification, and timely portfolio adjustments.

Because of the risks of high-yield bond investing, in-depth credit research is essential. The fund’s research team -- more than 20 professionals, including analysts who specialize by industry -- visits with the management of issuing companies and analyzes each company’s prospects. The team then compares this information, along with each bond’s independent credit rating, to the bond’s stated yield before deciding whether it is an appropriate investment for the fund.

The fund’s portfolio typically consists of a broad range of industries and companies. Holdings are diversified across industry sectors and among bonds with differing credit ratings. While the fund invests primarily in the bonds of U.S. companies, its diversified approach allows it to include foreign bonds as well. Among these securities, investments in emerging-market bonds may be used to enhance the fund’s appreciation potential. Although diversifi-cation does not ensure a profit or protect against a loss and it is possible to lose money in a diversified portfolio, the fund’s diversification can help reduce the volatility that typically comes with higher-risk investments.

As the bond markets shift over time, the fund’s management looks for ways to capitalize on developments that affect fixed-income securities in general and high-yield bonds in particular. For example, when credit spreads

| High-yield bonds have historically offered greater return potential than investment-grade bonds. |

are wide and expected to tighten, the fund may pursue the higher income potential offered by lower-quality issues. On the other hand, when credit spreads are narrow -- that is, when the difference in yield between higher- and lower-rated bonds of comparable maturities is small -- the fund may shift its emphasis to higher-quality high-yield bonds.

Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses. Additional risks may be associated with emerging-market securities, including illiquidity and volatility.

| How do closed-end funds differ from open-end funds? |

More assets at work While open-end funds must maintain a cash position to meet redemptions, closed-end funds have no such requirement and can keep more of their assets invested in the market.

Traded like stocks Closed-end fund shares are traded on stock exchanges, and their market prices fluctuate in response to supply and demand, among other factors.

Market price vs. net asset value Like an open-end fund’s net asset value (NAV) per share, the NAV of a closed-end fund share is equal to the current value of the fund’s assets, minus its liabilities, divided by the number of shares outstanding. However, when buying or selling closed-end fund shares, the price you pay or receive is the market price. Market price reflects current market supply and demand and may be higher or lower than the NAV.

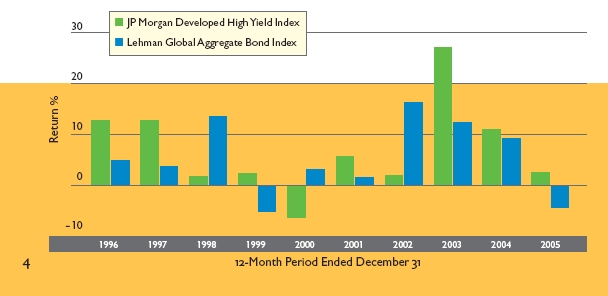

In general, the performance of high-yield bonds tends to be less dependent on interest rates than that of higher-rated bonds. Over the past 10 years, the JP Morgan Developed High Yield Index (the fund’s benchmark) largely outperformed the Lehman Global Aggregate Bond Index (which is made up of a variety of investment-grade bonds), particularly when corporate stocks were rallying.

The JP Morgan Developed High Yield Index is an unmanaged index of high-yield fixed-income securities of developed markets. The Lehman Global Aggregate Bond Index is an unmanaged index of global investment-grade fixed-income securities. You cannot invest directly in an index.

5

Putnam Managed High Yield Trust seeks high current income and, as a secondary objective, to the extent consistent with high current income, capital growth, by investing in corporate high-yield bonds. The fund is designed for investors seeking higher fixed-income returns who are willing to accept the added risks of investing in below-investment-grade bonds.

| Highlights |

- For the six months ended November 30, 2005, Putnam Managed High Yield Trust returned 3.34% at net asset value (NAV) and 0.56% at market price.

- The fund’s benchmark, the JP Morgan Developed High Yield Index, returned 2.52%.

- The average return for the fund’s Lipper category, High Current Yield Funds (closed-end), was 3.68%.

- Additional fund performance, comparative performance, and Lipper data can be found in the performance section beginning on page 12.

| Performance |

It is important to note that a fund’s performance at market price may differ from its results at NAV. Although market price performance generally reflects investment results, it may also be influenced by several other factors, including changes in investor perceptions of the fund or its investment advisor, market conditions, fluctuations in supply and demand for the fund’s shares, and changes in fund distributions.

| Total return for periods ended 11/30/05 |

Since the fund’s inception (6/25/93), average annual return is 6.18% at NAV and 4.30% at market price.

| Average annual return | Cumulative return | |||

| NAV | Market price | NAV | Market price | |

| 10 years | 5.63% | 3.71% | 72.85% | 43.98% |

| 5 years | 7.86 | 5.23 | 45.96 | 29.02 |

| 3 years | 13.20 | 4.62 | 45.07 | 14.50 |

| 1 year | 4.45 | -0.76 | 4.45 | -0.76 |

| 6 months | -- | -- | 3.34 | 0.56 |

Data is historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes.

6

| Report from the fund managers |

The period in review

During the six months ended November 30, 2005, Putnam Managed High Yield Trust outperformed its benchmark, the JP Morgan Developed High Yield Index, based on results at net asset value (NAV). This outperformance was due primarily to successful security selection; in addition to positioning the fund to benefit from the strength of numerous holdings, we believe we also added value by underweighting or entirely avoiding some of the period’s weakest performers. Your fund also benefited from a small position in emerging-market bonds held earlier in the period; although this position was sold before the end of the period, we believe it contributed to the fund’s relative outperformance. The fund’s results at NAV were slightly behind the average for its Lipper peer group, but comparisons in this category can be misleading because the peer group contains only six funds, some of which use leverage to boost returns.

| Market overview |

In the months leading up to the semian-nual period covered by this report, high-yield bonds had struggled due to concerns that record-high energy prices might spark more broad-based infla-tion. Investors feared that the Federal Reserve Board (the Fed) might abandon its measured tightening policy and begin raising short-term interest rates more aggressively. In addition, market participants sought to come to terms with the credit-rating downgrades of General Motors and Ford bonds, and the automakers’ subsequent entry into the high-yield market. However, these fears subsided during the semiannual period. The high-yield bond market has assimilated these large issuers smoothly and recovered to post positive returns for the period.

Overall, high-yield bonds continued to benefit from consistently solid corporate business fundamentals and steady consolidation activity. Several high-yield companies were acquired by investment-grade firms, resulting in upgrades of their credit ratings. The Fed continued to boost short-term interest rates steadily, hiking the federal funds rate four times, bringing it to 4.00% by period-end. These moves

7

didn’t lead to substantial increases in yields for longer-term bonds, but created a bit of a headwind for the high-yield market in the early fall. However, high-yield bonds enjoyed stronger performance in November due to additional demand generated by solid inflows of assets into high-yield mutual funds. The default rate within the high-yield market remained near historical lows, and the yield spread -- or advantage --offered by high-yield bonds over Treasury bonds with comparable maturities ended the period below historical averages, indicating generally favorable sentiment toward the asset class, although spreads ended the period wider than they were at the beginning of 2005.

Strategy overview

We continued to upgrade the credit quality of the portfolio during the period, moving away from the lower-quality bonds we had emphasized during the past two years. This shift was based on our belief that the Fed’s continued tightening of short-term interest rates would start to curtail economic growth. We also felt that narrow yield spreads -- i.e., a smaller difference between yields on higher-quality and lower-quality bonds of comparable maturities -- meant high-yield bond investors were not being compensated enough for the added risk of owning lower-quality bonds.

In comparison to the benchmark, the fund carried an overweighted stake in energy, where we focused on small and

| Market sector performance | |

These indexes provide an overview of performance in different market sectors for the | |

| six months ended 11/30/05. | |

| Bonds | |

| JP Morgan Developed High Yield Index (high-yield corporate bond markets) | 2.52% |

| Lehman Aggregate Bond Index (broad bond market) | -0.48% |

| Lehman GNMA Index (Government National Mortgage Association bonds) | 0.11% |

| Lehman Municipal Bond Index (tax-exempt bonds) | 0.37% |

| Equities | |

| S&P 500 Index (broad stock market) | 5.88% |

| Russell 2000 Index (small-company stocks) | 10.47% |

| MSCI EAFE Index (international stocks) | 11.23% |

8

midsize exploration and production companies that we considered were well- positioned to profit from higher oil and gas prices. We underweighted transportation issues, avoiding Delta Airlines and Northwest Airlines, both of which declared bankruptcy during the period. We also underweighted the automotive industry, particularly auto suppliers whose fates are heavily dependent on the big three U.S. auto producers, and who were adversely affected by higher operating costs. In addition, we underweighted paper and forest products. We considered these bonds unattractively priced and we believed that some firms were facing weakening business prospects. As noted earlier, the fund carried a small stake in emerging-market debt for part of the period, and sold it when the bonds reached our price targets.

Your fund’s holdings

During the semiannual period, your fund’s performance was helped by several factors. The sector-weighting decisions just described -- overweighting energy; underweighting transportation and paper and forest products; and keeping a small stake in emerging markets -- all buoyed performance. The fund’s strong showing relative to its benchmark is mainly due to our underweighting or not owning certain index components that suffered price declines during the period. These laggards included electric energy merchant

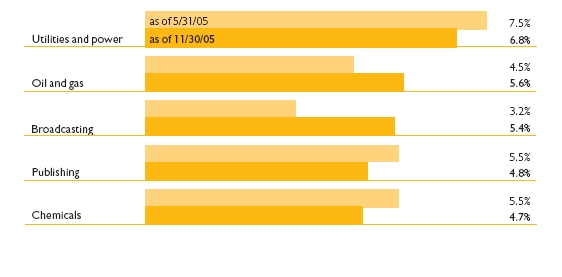

| Comparison of top industry weightings This chart shows how the fund’s top weightings have changed over the last six months. Weightings are shown as a percentage of net assets. Holdings will vary over time. |

9

Calpine, which appeared headed toward bankruptcy due to heavy indebtedness and rising prices for the natural gas the firm uses for power generation. The fund also benefited from underweighting Ford and General Motors, which, after enjoying a short rally upon entering the high-yield market, underperformed over the six-month period due to relatively weak business fundamentals. Television broadcaster Paxson Communications, on the other hand, made a substantial, positive contribution to performance. The prices for Paxson’s bonds improved because its management team offered the market more clarity about the firm’s ownership structure and corporate strategy going forward.

On the downside, the fund’s performance relative to its benchmark index was held back by our underweighting of bonds issued by electric energy merchant Mirant and rural/suburban wireless telecommunications services provider Dobson Communications. Both of these companies’ bonds recovered from depressed price levels during the period. Mirant’s bonds rallied as the company emerged from bankruptcy, but we chose to not purchase any because we found Mirant’s credit profile unappealing. Similarly, Dobson’s bonds rallied when the company posted better-than-expected revenues from roaming charges that bolstered its financial health, but we missed out on the rebound due to credit concerns.

Top holdings

This table shows the fund’s top holdings, and the percentage of the fund’s net assets that each comprised, as of 11/30/05. The fund’s holdings will change over time.

| Holding (percent of fund’s net assets) | Coupon (%) and maturity date | Industry |

| General Motors Acceptance Corp. (0.8%) | 8%, 2031 | Automotive |

| Ford Motor Credit Corp. (0.8%) | 7.875%, 2010 | Automotive |

| DirecTV Holdings, LLC (0.8%) | 6.375%, 2015 | Broadcasting |

| CCH I, LLC (0.7%) | 11%, 2015 | Cable television |

| Whiting Petroleum Corp. (0.7%) | 7%, 2014 | Oil and gas |

| Novelis, Inc. 144A (0.6%) | 7.5%, 2015 | Metals |

| Qwest Communications International, Inc. (0.6%) | 8%, 2014 | Regional Bells |

| CanWest Media, Inc. (Canada) (0.6%) | 8%, 2012 | Publishing |

| Legrand SA (France) (0.6%) | 8.5%, 2025 | Manufacturing |

| Qwest Corp. (0.6%) | 8.875%, 2012 | Regional Bells |

10

Fund holding Milacron, maker of plastic injection molding equipment, declined during the period, dampening performance. Bonds issued by the company fell as investors worried that its customers -- facing high plastic resin prices -- might choose to defer buying new equipment from Milacron.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy, and may vary in the future.

| The outlook for your fund |

The following commentary reflects anticipated developments that could affect your fund over the next six months, as well as your management team’s plans for responding to them.

At this time, we believe corporate business fundamentals are generally positive, driven by a strong U.S. economy, healthy capital markets, merger-and-acquisitions activity, credit upgrades, and low default rates. Defaults may rise from current lows during the next 12 months, but we do not anticipate that any increase will be dramatic. In terms of valuations, yield spreads between high-yield bonds and Treasuries are currently narrower than the historical average, indicating that high-yield bond valuations may be relatively high -- although historically, spreads have been at similar levels during extended periods of low default rates. As for technicals (issues related to the supply of and demand for high-yield bonds that help drive the market), demand and new-issue supply have both waned, leading us to a neutral outlook in this area. Overall, we feel that, after such a run-up in the recent past, any positive returns for high-yield bonds will largely be generated by their regular interest payments. We intend to follow a relatively defensive approach, particularly regarding credit quality, as we believe it is the most prudent choice in this environment.

The views expressed in this report are exclusively those of Putnam Management. They are not meant as investment advice.

Lower-rated bonds may offer higher yields in return for more risk. Mutual funds that invest in bonds are subject to certain risks, including interest-rate risk, credit risk, and inflation risk. As interest rates rise, the prices of bonds fall. Long-term bonds are more exposed to interest-rate risk than short-term bonds. Unlike bonds, bond funds have ongoing fees and expenses.

The fund’s shares trade on a stock exchange at market prices, which may be higher or lower than the fund’s net asset value.

11

| Your fund’s performance |

This section shows your fund’s performance during the first half of its fiscal year, which ended November 30, 2005. In accordance with regulatory requirements for mutual funds, we also include performance for the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represents past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

| Fund performance | ||||

| Total return and comparative index results for periods ended 11/30/05 | ||||

| Lipper High | ||||

| JP Morgan | Current Yield | |||

| Developed | Funds | |||

| Market | High-Yield | (closed-end) | ||

| NAV | price | Index* | category average† | |

| Annual average | ||||

| Life of fund | ||||

| (since 6/25/93) | 6.18% | 4.30% | -- | 6.82% |

| 10 years | 72.85 | 43.98 | 96.39% | 84.24 |

| Annual average | 5.63 | 3.71 | 6.98 | 6.17 |

| 5 years | 45.96 | 29.02 | 58.22 | 48.97 |

| Annual average | 7.86 | 5.23 | 9.61 | 8.22 |

| 3 years | 45.07 | 14.50 | 45.78 | 46.32 |

| Annual average | 13.20 | 4.62 | 13.39 | 13.52 |

| 1 year | 4.45 | -0.76 | 3.28 | 4.90 |

| 6 months | 3.34 | 0.56 | 2.52 | 3.68 |

Performance assumes reinvestment of distributions and does not account for taxes.

Index and Lipper results should be compared to fund performance at net asset value. Lipper calculations for reinvested dividends may differ from actual performance.

* This index began operations on 12/31/94.

+ Over the 6-month and 1-, 3-, 5-, and 10-year periods ended 11/30/05, there were 6, 6, 4, 4, and 4 funds, respectively, in this Lipper category.

12

| Fund price and distribution information | ||

For the six-month period ended 11/30/05 | ||

| Distributions (number) | 6 | |

| Income | $0.294 | |

| Capital gains | -- | |

| Total | $0.294 | |

| Share value: | NAV | Market price |

| 5/31/05 | $9.04 | $7.97 |

| 11/30/05 | 9.01 | 7.73 |

| Current yield (end of period) | ||

| Current dividend rate1 | 6.53% | 7.61% |

| 1 | Most recent distribution, excluding capital gains, annualized and divided by NAV or market price at end of period. | ||

| Fund performance for most recent calendar quarter | |||

Total return for periods ended 12/31/05 | |||

| NAV | Market price | ||

| Annual average | |||

| Life of fund (since 6/25/93) | 6.21% | 4.62% | |

| 10 years | 71.43 | 50.28 | |

| Annual average | 5.54 | 4.16 | |

| 5 years | 45.52 | 21.71 | |

| Annual average | 7.79 | 4.01 | |

| 3 years | 45.76 | 21.60 | |

| Annual average | 13.38 | 6.74 | |

| 1 year | 3.97 | 3.00 | |

| 6 months | 2.61 | 1.18 | |

13

| Your fund’s management |

Your fund is managed by the members of the Putnam Core Fixed-Income High-Yield Team. Paul Scanlon is the Portfolio Leader. Norman Boucher, Geoffrey Kelley, and Robert Salvin are Portfolio Members of your fund. The Portfolio Leader and Portfolio Members coordinate the team’s management of the fund.

For a complete listing of the members of the Putnam Core Fixed-Income High-Yield Team, including those who are not Portfolio Leaders or Portfolio Members of your fund, visit Putnam’s Individual Investor Web site at www.putnam.com.

Fund ownership by the Portfolio Leader and Portfolio Members

The table below shows how much the fund’s current Portfolio Leader and Portfolio Members have invested in the fund (in dollar ranges). Information shown is as of November 30, 2005, and November 30, 2004.

| $1 - | $10,001 - | $50,001 - | $100,001 - | $500,001 - | $1,000,001 | |||

| Year | $0 | $10,000 | $50,000 | $100,000 | $500,000 | $1,000,000 | and over | |

| Paul Scanlon | 2005 | * | ||||||

| Portfolio Leader | 2004 | * | ||||||

| Norman Boucher | 2005 | * | ||||||

| Portfolio Member | N/A | |||||||

| Geoffrey Kelley | 2005 | * | ||||||

| Portfolio Member | N/A | |||||||

| Robert Salvin | 2005 | * | ||||||

| Portfolio Member | N/A | |||||||

N/A indicates the individual was not a Portfolio Leader or Portfolio Member as of 11/30/04.

14

| Fund manager compensation |

The total 2004 fund manager compensation that is attributable to your fund is approximately $30,000. This amount includes a portion of 2004 compensation paid by Putnam Management to the fund managers listed in this section for their portfolio management responsibilities, calculated based on the fund assets they manage taken as a percentage of the total assets they manage. The compensation amount also includes a portion of the 2004 compensation paid to the Group Chief Investment Officer of the fund’s broader investment category for his oversight responsibilities, calculated based on the fund assets he oversees taken as a percentage of the total assets he oversees. This amount does not include compensation of other personnel involved in research, trading, administration, systems, compliance, or fund operations; nor does it include non-compensation costs. These percentages are determined as of the fund’s fiscal period-end. For personnel who joined Putnam Management during or after 2004, the calculation reflects annualized 2004 compensation or an estimate of 2005 compensation, as applicable.

Other Putnam funds managed by the Portfolio Leader and Portfolio Members

Paul Scanlon is also a Portfolio Leader of Putnam Floating Rate Income Fund, Putnam High Yield Advantage Fund, and Putnam High Yield Trust. He is also a Portfolio Member of Putnam Diversified Income Trust, Putnam Master Intermediate Income Trust, and Putnam Premier Income Trust.

Norman Boucher is also a Portfolio Member of Putnam High Yield Advantage Fund and Putnam High Yield Trust.

Geoffrey Kelley is also a Portfolio Member of Putnam High Yield Advantage Fund and Putnam High Yield Trust.

Robert Salvin is also a Portfolio Member of Putnam High Income Securities Fund, Putnam High Yield Advantage Fund, and Putnam High Yield Trust.

Paul Scanlon, Norman Boucher, Geoffrey Kelley, and Robert Salvin may also manage other accounts and variable trust funds advised by Putnam Management or an affiliate.

Changes in your fund’s Portfolio Leader and Portfolio Members

During the year ended November 30, 2005, Paul Scanlon became Portfolio Leader and Geoffrey Kelley and Robert Salvin became Portfolio Members of your fund, while Portfolio Member Norman Boucher rejoined your fund’s management team. These changes followed the departure of Portfolio Leader Stephen Peacher and Portfolio Member Rosemary Thomsen from your fund’s management team.

15

Fund ownership by Putnam’s Executive Board

The table below shows how much the members of Putnam’s Executive Board have invested in the fund (in dollar ranges). Information shown is as of November 30, 2005, and November 30, 2004.

| $1 - | $10,001 - | $50,001- | $100,001 | ||||

| Year | $0 | $10,000 | $50,000 | $100,000 | and over | ||

| Philippe Bibi | 2005 | * | |||||

| Chief Technology Officer | 2004 | * | |||||

| Joshua Brooks | 2005 | * | |||||

| Deputy Head of Investments | N/A | ||||||

| William Connolly | 2005 | * | |||||

| Head of Retail Management | N/A | ||||||

| Kevin Cronin | 2005 | * | |||||

| Head of Investments | 2004 | * | |||||

| Charles Haldeman, Jr. | 2005 | * | |||||

| President and CEO | 2004 | * | |||||

| Amrit Kanwal | 2005 | * | |||||

| Chief Financial Officer | 2004 | * | |||||

| Steven Krichmar | 2005 | * | |||||

| Chief of Operations | 2004 | * | |||||

| Francis McNamara, III | 2005 | * | |||||

| General Counsel | 2004 | * | |||||

| Richard Robie, III | 2005 | * | |||||

| Chief Administrative Officer | 2004 | * | |||||

| Edward Shadek | 2005 | * | |||||

| Deputy Head of Investments | N/A | ||||||

| Sandra Whiston | 2005 | * | |||||

| Head of Institutional Management | N/A | ||||||

N/A indicates the individual was not a member of Putnam's Executive Board as of 11/30/04.

16

| Terms and definitions |

| Important terms |

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV) is the value of all your fund’s assets, minus any liabilities, divided by the number of outstanding shares.

Market price is the current trading price of one share of the fund. Market prices are set by transactions between buyers and sellers on exchanges such as the American Stock Exchange and the New York Stock Exchange.

| Comparative indexes |

JP Morgan Developed High Yield Index is an unmanaged index of high-yield fixed-income securities issued in developed countries.

Lehman Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

Lehman Global Aggregate Bond Index is an unmanaged index of global investment-grade fixed-income securities.

Lehman GNMA Index is an unmanaged index of Government National Mortgage Association bonds.

Lehman Municipal Bond Index is an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Morgan Stanley Capital International (MSCI) EAFE Index is an unmanaged index of equity securities from developed countries in Western Europe, the Far East, and Australasia.

Russell 2000 Index is an unmanaged index of the 2,000 smallest companies in the Russell 3000 Index.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

Lipper is a third-party industry-ranking entity that ranks mutual funds. Lipper rankings are based on total return at net asset value and do not reflect sales charges. Funds are ranked among other funds with similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

17

| Trustee approval of management contract |

| General conclusions |

The Board of Trustees of the Putnam funds oversees the management of each fund and, as required by law, determines annually whether to approve the continuance of your fund’s management contract and administrative services contract with Putnam Management and its sub-management contract with Putnam Management’s affiliate, Putnam Investments Limited (“PIL”). In this regard, the Board of Trustees, with the assistance of its Contract Committee consisting solely of Trustees who are not “interested persons” (as such term is defined in the Investment Company Act of 1940, as amended) of the Putnam funds (the “Independent Trustees”), requests and evaluates all information it deems reasonably necessary under the circumstances. Over the course of several months beginning in March and ending in June 2005, the Contract Committee met five times to consider the information provided by Putnam Management and other information developed with the assistance of the Board’s independent counsel and independent staff. The Contract Committee reviewed and discussed key aspects of this information with all of the Independent Trustees. Upon completion of this review, the Contract Committee recommended and the Independent Trustees approved the continuance of your fund’s management contract, administrative services contract and sub-management contract, effective July 1, 2005. Because PIL is an affiliate of Putnam Management and Putnam Management remains fully responsible for all services provided by PIL, the Trustees have not evaluated PIL as a separate entity and all subsequent references to Putnam Management below should be deemed to include reference to PIL as necessary or appropriate in the context.

This approval was based on the following conclusions:

- That the fee schedule currently in effect for your fund, subject to certain changes noted below, represents reasonable compensation in light of the nature and quality of the services being provided to the fund, the fees paid by competitive funds and the costs incurred by Putnam Management in providing such services, and

- That such fee schedule represents an appropriate sharing between fund shareholders and Putnam Management of such economies of scale as may exist in the management of the fund at current asset levels.

These conclusions were based on a comprehensive consideration of all information provided to the Trustees and were not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations and how the Trustees considered these factors are described below, although individual Trustees may have evaluated the information presented differently, giving different weights to various factors. It is also important to recognize that the fee arrangements for your fund and the other Putnam funds are the result of many years of review and discussion between the Independent Trustees and Putnam Management, that certain aspects of such arrangements may receive greater scrutiny in some years than others, and that the Trustees’ conclusions may be based, in part, on their consideration of these same arrangements in prior years.

18

| Model fee schedules and categories; total expenses |

The Trustees’ review of the management fees and total expenses of the Putnam funds focused on three major themes:

- Consistency. The Trustees, working in cooperation with Putnam Management, have devel- oped and implemented a series of model fee schedules for the Putnam funds designed to ensure that each fund’s management fee is consistent with the fees for similar funds in the Putnam family of funds and compares favorably with fees paid by competitive funds spon- sored by other investment advisors. Under this approach, each Putnam fund is assigned to one of several fee categories based on a combination of factors, including competitive fees and perceived difficulty of management, and a common fee schedule is implemented for all funds in a given fee category. The Trustees reviewed the model fee schedule currently in effect for the Putnam funds, including fee levels and breakpoints, and the assignment of your fund to a particular fee category under this structure. (“Breakpoints” refer to reductions in fee rates that apply to additional assets once specified asset levels are reached.)

Since their inception, Putnam’s closed-end funds have generally had management fees that are higher than those of Putnam’s open-end funds pursuing comparable investment strategies. These differences ranged from five to 20 basis points. The Trustees have reexamined this matter and recommended that these differences be conformed to a uniform five basis points. Under the new fee schedule, the fund pays a quarterly management fee to Putnam Management calculated at the annual rates set out below:

| 0.55% of the first $500 million of the fund’s average weekly assets (as described below under “Approval of Amended and Restated Management Contract in July 2005”); 0.45% of the next $500 million; 0.40% of the next $500 million; 0.35% of the next $5 billion; 0.325% of the next $5 billion; 0.305% of the next $5 billion; 0.29% of the next $5 billion; 0.28% of the next $5 billion; 0.27% of the next $5 billion; 0.26% of the next $5 billion; 0.25% of the next $5 billion; 0.24% of the next $5 billion; 0.23% of the next $5 billion; and 0.22% thereafter. |

19

Your fund’s separate administrative services contract provides for quarterly payment of fees to Putnam Management equal to a percentage of the average of weekly determinations of the net asset value of the fund as calculated at the annual rates set out below:

| 0.20% of the first $500 million of the fund’s average net assets; |

| 0.17% of the next $500 million; |

| 0.16% of the next $500 million; and |

| 0.15% of the excess over $1.5 billion. |

The administrative services contract may be amended to provide for payment of fees to Putnam Management on the basis of average weekly assets without shareholder approval.

Based on net asset levels as of June 30, 2005, and without taking into account any leverage your fund may incur for investment purposes, the new management fee schedule for your fund will not change the management fees, as a percentage of the fund’s net assets, currently paid by common shareholders. The Trustees approved the new fee schedules for the funds effective as of January 1, 2006, in order to provide Putnam Management an opportunity to accommodate the impact on revenues in its budget process for the coming year.

- Competitiveness. The Trustees also reviewed comparative fee and expense information for competitive funds, which indicated that, in a custom peer group of competitive funds selected by Lipper Inc., your fund ranked in the 50th percentile in management fees and in the first percentile in total expenses as of December 31, 2004 (the first percentile being the least expensive funds and the 100th percentile being the most expensive funds). The Trustees expressed their intention to monitor this information closely to ensure that fees and expenses of the Putnam funds continue to meet evolving competitive standards.

- Economies of scale. The Trustees concluded that the fee schedule currently in effect for your fund, subject to the changes noted above, represents an appropriate sharing of economies of scale at current asset levels. The Trustees examined the existing breakpoint structure of the Putnam funds’ management fees in light of competitive industry practices. The Trustees consid- ered various possible modifications to the Putnam funds’ current breakpoint structure, but ultimately concluded that the current breakpoint structure continues to serve the interests of fund shareholders. Accordingly, the Trustees continue to believe that the fee schedules currently in effect for the funds, subject to the changes noted above, represent an appropriate sharing of economies of scale at current asset levels.

In connection with their review of the management and administrative services fees and total expenses of the Putnam funds, the Trustees also reviewed the costs of the services to be provided and profits to be realized by Putnam Management and its affiliates from the relationship with the funds. This information included trends in revenues, expenses and profitability of Putnam Management and its affiliates relating to the investment management and distribution services provided to the funds. In this regard, the Trustees also reviewed an analysis of Putnam Management’s revenues, expenses and profitability with respect to the funds’ management contracts, allocated on a fund-by-fund basis.

20

| Investment performance |

The quality of the investment process provided by Putnam Management represented a major factor in the Trustees’ evaluation of the quality of services provided by Putnam Management under your fund’s management contract. The Trustees were assisted in their review of the funds’ investment process and performance by the work of the Investment Oversight Committees of the Trustees, which meet on a regular monthly basis with the funds’ portfolio teams throughout the year. The Trustees concluded that Putnam Management generally provides a high-quality investment process -- as measured by the experience and skills of the individuals assigned to the management of fund portfolios, the resources made available to such personnel, and in general the ability of Putnam Management to attract and retain high-quality personnel -- but also recognize that this does not guarantee favorable investment results for every fund in every time period. The Trustees considered the investment performance of each fund over multiple time periods and considered information comparing the fund’s performance with various benchmarks and with the performance of competitive funds. The Trustees noted the satisfactory investment performance of many Putnam funds. They also noted the disappointing investment performance of certain funds in recent years and continued to discuss with senior management of Putnam Management the factors contributing to such underperformance and actions being taken to improve performance. The Trustees recognized that, in recent years, Putnam Management has made significant changes in its investment personnel and processes and in the fund product line to address areas of underperformance. The Trustees indicated their intention to continue to monitor performance trends to assess the effectiveness of these changes and to evaluate whether additional remedial changes are warranted.

In the case of your fund, the Trustees considered that your fund’s common share performance at net asset value was in the following percentiles of its Lipper Inc. peer group for the one-, three-and five-year periods ended December 31, 2004 (the first percentile being the best-performing funds and the 100th percentile being the worst-performing funds):

| One-year period | Three-year period | Five-year period |

| 56th | 40th | 40th |

(Because of the passage of time, these performance results may differ from the performance results for more recent periods shown elsewhere in this report.)

As a general matter, the Trustees believe that cooperative efforts between the Trustees and Putnam Management represent the most effective way to address investment performance problems. The Trustees believe that investors in the Putnam funds have, in effect, placed their trust in the Putnam organization, under the oversight of the funds’ Trustees, to make appropriate decisions regarding the management of the funds. Based on the responsiveness of Putnam Management in the recent past to Trustee concerns about investment performance, the Trustees believe that it is preferable to seek change within Putnam Management to address performance shortcomings. In the Trustees’

21

view, the alternative of terminating a management contract and engaging a new investment advisor for an underperforming fund would entail significant disruptions and would not provide any greater assurance of improved investment performance.

Brokerage and soft-dollar allocations; other benefits

The Trustees considered various potential benefits that Putnam Management may receive in connection with the services it provides under the management contract with your fund. These include principally benefits related to brokerage and soft-dollar allocations, whereby a portion of the commissions paid by a fund for brokerage is earmarked to pay for research services that may be utilized by a fund’s investment advisor, subject to the obligation to seek best execution. The Trustees believe that soft-dollar credits and other potential benefits associated with the allocation of fund brokerage, which pertains mainly to funds investing in equity securities, represent assets of the funds that should be used for the benefit of fund shareholders. This area has been marked by significant change in recent years. In July 2003, acting upon the Contract Committee’s recommendation, the Trustees directed that allocations of brokerage to reward firms that sell fund shares be discontinued no later than December 31, 2003. In addition, commencing in 2004, the allocation of brokerage commissions by Putnam Management to acquire research services from third-party service providers has been significantly reduced, and continues at a modest level only to acquire research that is customarily not available for cash. The Trustees will continue to monitor the allocation of the funds’ brokerage to ensure that the principle of “best price and execution” remains paramount in the portfolio trading process.

The Trustees’ annual review of your fund’s management contract and administrative services contract also included the review of your fund’s custodian and investor servicing agreements with Putnam Fiduciary Trust Company, which provide benefits to affiliates of Putnam Management.

Comparison of retail and institutional fee schedules

The information examined by the Trustees as part of their annual contract review has included for many years information regarding fees charged by Putnam Management and its affiliates to institutional clients such as defined benefit pension plans, college endowments, etc. This information included comparison of such fees with fees charged to the funds, as well as a detailed assessment of the differences in the services provided to these two types of clients. The Trustees observed, in this regard, that the differences in fee rates between institutional clients and the mutual funds are by no means uniform when examined by individual asset sectors, suggesting that differences in the pricing of investment management services to these types of clients reflect to a substantial degree historical competitive forces operating in separate market places. The Trustees considered the fact that fee rates across all asset sectors are higher on average for mutual funds than for institutional clients, as well as the differences between the

22

services that Putnam Management provides to the Putnam funds and those that it provides to institutional clients of the firm, but have not relied on such comparisons to any significant extent in concluding that the management fees paid by your fund are reasonable.

Approval of amended and restated management contract in July 2005

In July 2005, the Trustees, including the Independent Trustees of your fund, approved an amendment to your fund’s management contract to take into account investment leverage in calculating management fees. The Trustees, including a majority of the Independent Trustees, have concluded that it would be in the best interest of your fund and its common shareholders to compensate Putnam Management on the basis of its “average weekly assets,” rather than its net assets. “Average weekly assets” is defined as the difference (as measured on a weekly basis) between the fund’s total assets (including assets attributable to leverage for investment purposes) and its total liabilities (excluding liabilities attributable to leverage for investment purposes). This formulation effectively allows for Putnam Management to receive management fees on leveraged assets. As a fundamental investment restriction prohibits the fund from issuing preferred shares, for all practical purposes the only form of investment leverage available would be borrowing. In the course of their evaluation, the Trustees considered the benefit to your fund from the additional investment management services that Putnam Management would perform in connection with a leveraged investment strategy, as well as the amount of compensation Putnam Management would receive under the proposed fee structure.

The Trustees noted that the amendment would align the fee arrangements for your fund more closely with those of other closed-end Putnam funds that currently engage in leverage for investment purposes. Furthermore, the Trustees were advised by Putnam Management that it is a customary and widespread practice in the closed-end fund industry to structure leveraged products in a manner that compensates advisors for their management of the assets acquired through leverage.

In evaluating the incentives and potential conflicts of interest created by an average weekly assets-based fee, the Trustees considered that the asset coverage restrictions under the 1940 Act, as well as other legal requirements, limit the extent to which a manager can expose a fund to additional risk through leverage. Furthermore, the Trustees considered the advantages of a management fee reduction mechanism that is included in the amended contract, which reduces the management fee dollar for dollar (subject to a specified maximum reduction) where the costs of carrying investment leverage outweigh the benefits (in terms of net income and short-term capital gains) to common shareholders from managing additional investment assets. In the event that your fund actually engages in leverage, the Trustees will have the opportunity, through regular reports from Putnam Management prepared in connection with the fee reduction mechanism described above, to continue monitoring the conflict of interest between Putnam Management and your fund.

23

Shareholders of your fund approved the amended and restated management contract at a meeting on December 6, 2005 (which was an adjournment of the fund’s annual meeting convened on October 28, 2005).

The Trustees also approved conforming changes to the sub-management contract between Putnam Management and PIL with respect to your fund, to provide for PIL’s fee to be calculated on the basis of the fund’s average weekly assets. The fee paid under the sub-management contract is paid by Putnam Management and not by your fund. Under the circumstances, the changes to the sub-management contract did not require shareholder approval.

24

| Other information for shareholders |

Important notice regarding share repurchase program

In October 2005, the Trustees of your fund authorized Putnam Investments to implement a repurchase program on behalf of your fund, which would allow your fund to repurchase up to 5% of its outstanding shares over the 12 months following the announcement.

Notice regarding 2006 annual shareholder meeting

The 2006 annual meeting of shareholders of your fund is currently expected to be held in June 2006, rather than in October, as was stated in the proxy statement for the 2005 annual meeting. Accordingly, shareholder proposals to be included in the proxy statement for the 2006 meeting must be received by your fund on or before February 28, 2006. Shareholders who wish to make a proposal at the 2006 annual meeting -- other than one that will be included in the fund’s proxy materials -- should notify the fund no later than April 26, 2006. Shareholders who wish to propose one or more nominees for election as Trustees, or to make a proposal fixing the number of Trustees, at the 2006 annual meeting must provide written notice to the fund (including all required information) so that such notice is received in good order by the fund no earlier than April 15, 2006, and no later than May 15, 2006. Notices of any such proposals should be addressed to the Clerk of your fund at One Post Office Square, Boston, Massachusetts 02109.

Important notice regarding delivery of shareholder documents

In accordance with SEC regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

25

| Proxy voting |

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2005, are available on the Putnam Individual Investor Web site, www.putnam.com/individual, and on the SEC’s Web site, www.sec.gov. If you have questions about finding forms on the SEC’s Web site, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

| Fund portfolio holdings |

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Shareholders may obtain the fund’s Forms N-Q on the SEC’s Web site at www.sec.gov. In addition, the fund’s Forms N-Q may be reviewed and copied at the SEC’s public reference room in Washington, D.C. You may call the SEC at 1-800-SEC-0330 for information about the SEC’s Web site or the operation of the public reference room.

26

| Financial statements |

| A guide to financial statements |

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and noninvestment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings -- from dividends and interest income - -- and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings - -- as well as any unrealized gains or losses over the period -- is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlight table also includes the current reporting period. For open-end funds, a separate table is provided for each share class.

27

| The fund’s portfolio 11/30/05 (Unaudited) | ||||

| CORPORATE BONDS AND NOTES (90.1%)* | ||||

| Principal amount | Value | |||

| Advertising and Marketing Services (0.3%) | ||||

| Affinion Group, Inc. 144A company guaranty 10 1/8s, 2013 | $ | 140,000 | $ | 132,650 |

| Lamar Media Corp. company guaranty 7 1/4s, 2013 | 100,000 | 103,000 | ||

| 235,650 | ||||

| Automotive (3.8%) | ||||

| Dana Corp. notes 10 1/8s, 2010 | 30,000 | 27,300 | ||

| Dana Corp. notes 9s, 2011 | 165,000 | 135,300 | ||

| Dura Operating Corp. company guaranty Ser. B, 8 5/8s,2012 | 93,000 | 77,190 | ||

| Ford Motor Co. notes 7.45s, 2031 | 255,000 | 179,775 | ||

| Ford Motor Credit Corp. bonds 7 3/8s, 2011 | 270,000 | 245,309 | ||

| Ford Motor Credit Corp. notes 7 7/8s, 2010 | 550,000 | 515,461 | ||

| Ford Motor Credit Corp. notes 7 3/8s, 2009 | 75,000 | 68,942 | ||

| General Motors Acceptance Corp. bonds 8s, 2031 | 545,000 | 534,443 | ||

| General Motors Acceptance Corp. notes 5 1/8s, 2008 | 100,000 | 89,656 | ||

| Meritor Automotive, Inc. notes 6.8s, 2009 | 115,000 | 105,225 | ||

| Tenneco Automotive, Inc. company guaranty 8 5/8s, 2014 | 100,000 | 93,375 | ||

| Tenneco Automotive, Inc. sec. notes Ser. B, 10 1/4s, 2013 | 210,000 | 229,425 | ||

| TRW Automotive, Inc. sr. notes 9 3/8s, 2013 | 90,000 | 96,975 | ||

| TRW Automotive, Inc. sr. sub. notes 11s, 2013 | 145,000 | 162,038 | ||

| 2,560,414 | ||||

| Basic Materials (10.2%) | ||||

| AK Steel Corp. company guaranty 7 7/8s, 2009 | 120,000 | 114,600 | ||

| Almatis Investment Holdings S.a.r.l. sr. notes 11s, | ||||

| 2013 (Luxembourg) ‡‡ | 179,869 | 192,910 | ||

| ALROSA Finance SA 144A company guaranty 8 7/8s, | ||||

| 2014 (Luxembourg) | 125,000 | 143,438 | ||

| BCP Crystal US Holdings Corp. sr. sub. notes 9 5/8s, 2014 | 130,000 | 144,138 | ||

| Century Aluminum Co. company guaranty 7 1/2s, 2014 | 60,000 | 57,900 | ||

| Chaparral Steel Co. 144A sr. unsecd. notes 10s, 2013 | 210,000 | 223,125 | ||

| Chesapeake Corp. sr. sub. notes 7s, 2014 | EUR | 185,000 | 213,389 | |

| Cognis Holding GmbH & Co. 144A | ||||

| sr. notes 9 1/2s, 2014 (Germany) | EUR | 210,000 | 265,867 | |

| Compass Minerals Group, Inc. company guaranty 10s, 2011 | $ | 130,000 | 140,400 | |

| Compass Minerals International, Inc. sr. disc. | ||||

| notes stepped-coupon Ser. B, zero % (12s, 6/1/08),2013 †† | 50,000 | 43,250 | ||

| Compass Minerals International, Inc. sr. notes stepped-coupon | ||||

| zero % (12 3/4s, 12/15/07), 2012 †† | 235,000 | 209,150 | ||

| Crystal US Holdings, LLC sr. disc. notes stepped-coupon | ||||

| Ser. A, zero % (10s, 10/1/09), 2014 †† | 80,000 | 56,800 | ||

| Equistar Chemicals, LP/Equistar Funding Corp. company | ||||

| guaranty 10 1/8s, 2008 | 290,000 | 316,100 | ||

| Georgia-Pacific Corp. company guaranty 9 3/8s, 2013 | 130,000 | 145,763 | ||

| Georgia-Pacific Corp. debs. 9 1/2s, 2011 | 120,000 | 127,950 | ||

| Gerdau Ameristeel Corp. sr. notes 10 3/8s, 2011 (Canada) | 175,000 | 192,500 | ||

| Gibraltar Industries, Inc. 144A sr. sub. notes 8s, 2015 | 75,000 | 75,563 | ||

28

| CORPORATE BONDS AND NOTES (90.1%)* continued | |||||

| Principal amount | Value | ||||

| Basic Materials continued | |||||

| Hercules, Inc. company guaranty 6 3/4s, 2029 | $ | 140,000 | $ | 135,625 | |

| Huntsman Advanced Materials, LLC sec. FRN 11.82s, 2008 | 8,000 | 8,400 | |||

| Huntsman Advanced Materials, LLC sec. notes 11s, 2010 | 40,000 | 45,700 | |||

| Huntsman, LLC company guaranty 11 5/8s, 2010 | 78,000 | 88,628 | |||

| Huntsman, LLC company guaranty 11 1/2s, 2012 | 40,000 | 45,500 | |||

| Innophos, Inc. 144A sr. sub. notes 9 5/8s, 2014 | 325,000 | 326,625 | |||

| Ispat Inland ULC sec. notes 9 3/4s, 2014 | 230,000 | 259,325 | |||

| Jefferson Smurfit Corp. company guaranty 8 1/4s, 2012 | 5,000 | 4,850 | |||

| Jefferson Smurfit Corp. company guaranty 7 1/2s, 2013 | 10,000 | 9,225 | |||

| JSG Holding PLC 144A sr. notes 11 1/2s, 2015 (Ireland) ‡‡ | EUR | 107,810 | 114,378 | ||

| Lyondell Chemical Co. bonds 11 1/8s, 2012 | $ | 10,000 | 11,250 | ||

| Lyondell Chemical Co. company guaranty 10 1/2s, 2013 | 130,000 | 147,713 | |||

| Lyondell Chemical Co. company guaranty 9 1/2s, 2008 | 100,000 | 104,750 | |||

| Lyondell Chemical Co. notes Ser. A, 9 5/8s, 2007 | 50,000 | 52,375 | |||

| MDP Acquisitions PLC sr. notes 9 5/8s, 2012 (Ireland) | 245,000 | 242,550 | |||

| MDP Acquisitions PLC sr. notes Ser. EUR, | |||||

| 10 1/8s, 2012 (Ireland) | EUR | 5,000 | 6,289 | ||

| Metals USA, Inc. 144A sec. notes 11 1/8s, 2015 | $ | 90,000 | 92,025 | ||

| Nalco Co. sr. sub. notes 9s, 2013 | EUR | 65,000 | 83,020 | ||

| Nalco Co. sr. sub. notes 8 7/8s, 2013 | $ | 190,000 | 197,125 | ||

| Nell AF S.a.r.l. 144A sr. notes 8 3/8s, 2015 (Luxembourg) | 105,000 | 102,900 | |||

| NewPage Corp. sec. notes 10s, 2012 | 120,000 | 118,200 | |||

| Norske Skog Canada, Ltd. sr. notes 7 3/8s, 2014 (Canada) | 75,000 | 67,875 | |||

| Novelis, Inc. 144A sr. notes 7 1/2s, 2015 | 460,000 | 430,100 | |||

| PCI Chemicals Canada sec. sr. notes 10s, 2008 (Canada) | 31,547 | 33,085 | |||

| PQ Corp. 144A company guaranty 7 1/2s, 2013 | 45,000 | 41,400 | |||

| Pregis Corp. 144A company guaranty 12 3/8s, 2013 | 140,000 | 136,500 | |||

| Rockwood Specialties Group, Inc. company | |||||

| guaranty 7 5/8s, 2014 | 235,000 | 284,775 | |||

| SGL Carbon Luxembourg SA 144A | |||||

| sr. notes 8 1/2s, 2012 (Luxembourg) | EUR | 50,000 | 64,451 | ||

| Steel Dynamics, Inc. company guaranty 9 1/2s, 2009 | $ | 110,000 | 115,913 | ||

| Sterling Chemicals, Inc. sec. notes 10s, 2007 ‡‡ | 27,275 | 26,184 | |||

| Stone Container Corp. sr. notes 9 3/4s, 2011 | 70,000 | 71,400 | |||

| Stone Container Corp. sr. notes 8 3/8s, 2012 | 140,000 | 136,500 | |||

| Stone Container Finance company guaranty 7 3/8s, | |||||

| 2014 (Canada) | 215,000 | 196,188 | |||

| Tembec Industries, Inc. company guaranty 8 1/2s, | |||||

| 2011 (Canada) | 18,000 | 10,800 | |||

| Tembec Industries, Inc. company guaranty 7 3/4s, | |||||

| 2012 (Canada) | 25,000 | 14,750 | |||

| Ucar Finance, Inc. company guaranty 10 1/4s, 2012 | 90,000 | 94,950 | |||

| United States Steel Corp. sr. notes 9 3/4s, 2010 | 214,000 | 232,458 | |||

| Wheeling-Pittsburgh Steel Corp. sr. notes 6s, 2010 ‡‡ | 7,588 | 6,070 | |||

| Wheeling-Pittsburgh Steel Corp. sr. notes 5s, 2011 ‡‡ | 14,328 | 11,642 | |||

| WHX Corp. sr. notes 10 1/2s, 2005 (In default) (F) † **** | 40,000 | 4 | |||

| 6,834,341 | |||||

29

| CORPORATE BONDS AND NOTES (90.1%)* continued | ||||

| Principal amount | Value | |||

| Beverage (0.1%) | ||||

| Constellation Brands, Inc. company guaranty Ser. B, 8s, 2008 | $ | 45,000 | $ | 47,025 |

| Constellation Brands, Inc. sr. sub. notes Ser. B, 8 1/8s, 2012 | 45,000 | 46,800 | ||

| 93,825 | ||||

| Broadcasting (5.0%) | ||||

| British Sky Broadcasting PLC company guaranty 6 7/8s, | ||||

| 2009 (United Kingdom) | 210,000 | 219,793 | ||

| DirecTV Holdings, LLC company guaranty 6 3/8s, 2015 | 520,000 | 510,250 | ||

| DirecTV Holdings, LLC sr. notes 8 3/8s, 2013 | 194,000 | 210,490 | ||

| Diva Systems Corp. sr. disc. notes Ser. B, 12 5/8s, | ||||

| 2008 (In default) † | 440,000 | 550 | ||

| Echostar DBS Corp. company guaranty 6 5/8s, 2014 | 165,000 | 159,225 | ||

| Echostar DBS Corp. sr. notes 6 3/8s, 2011 | 380,000 | 367,612 | ||

| Emmis Communications Corp. sr. notes FRN 10.364s, 2012 | 95,000 | 95,119 | ||

| Granite Broadcasting Corp. sec. notes 9 3/4s, 2010 | 255,000 | 237,150 | ||

| Gray Television, Inc. company guaranty 9 1/4s, 2011 | 105,000 | 112,481 | ||

| LIN Television Corp. sr. sub. notes 6 1/2s, 2013 | 125,000 | 119,688 | ||

| LIN Television Corp. 144A sr. sub. notes 6 1/2s, 2013 | 155,000 | 148,413 | ||

| Paxson Communications Corp. company guaranty 10 3/4s, 2008 | 320,000 | 328,800 | ||

| Rainbow National Services, LLC 144A sr. notes 8 3/4s, 2012 | 155,000 | 163,525 | ||

| Rainbow National Services, LLC 144A sr. sub. debs. 10 3/8s, 2014 | 150,000 | 163,500 | ||

| Sinclair Broadcast Group, Inc. company guaranty 8 3/4s, 2011 | 60,000 | 63,450 | ||

| Sirius Satellite Radio, Inc. 144A sr. notes 9 5/8s, 2013 | 140,000 | 136,850 | ||

| Young Broadcasting, Inc. company guaranty 10s, 2011 | 301,000 | 282,940 | ||

| Young Broadcasting, Inc. sr. sub. notes 8 3/4s, 2014 | 65,000 | 57,038 | ||

| 3,376,874 | ||||

| Building Materials (1.6%) | ||||

| Associated Materials, Inc. company guaranty 9 3/4s, 2012 | 100,000 | 94,000 | ||

| Building Materials Corp. company guaranty 8s, 2008 | 60,000 | 60,225 | ||

| Goodman Global Holding Co., Inc. 144A | ||||

| sr. notes 6.41s, 2012 | 90,000 | 89,100 | ||

| Goodman Global Holding Co., Inc. 144A | ||||

| sr. sub. notes 7 7/8s, 2012 | 130,000 | 122,200 | ||

| NTK Holdings, Inc. sr. disc. notes zero %, 2014 | 105,000 | 63,525 | ||

| Owens Corning bonds 7 1/2s, 2018 (In default) † | 5,000 | 4,125 | ||

| Owens Corning notes 7 1/2s, 2005 (In default) † **** | 120,000 | 97,500 | ||

| Texas Industries, Inc. 144A sr. notes 7 1/4s, 2013 | 225,000 | 232,875 | ||

| THL Buildco, Inc. (Nortek Holdings, Inc.) | ||||

| sr. sub. notes 8 1/2s, 2014 | 350,000 | 336,000 | ||

| 1,099,550 | ||||

| Cable Television (2.9%) | ||||

| Adelphia Communications Corp. sr. notes 10 7/8s, | ||||

| 2010 (In default) † | 20,000 | 11,900 | ||

| Adelphia Communications Corp. sr. notes 10 1/4s, | ||||

| 2011 (In default) † | 90,000 | 57,600 | ||

| Adelphia Communications Corp. sr. notes 10 1/4s, | ||||

| 2006 (In default) † | 5,000 | 2,975 | ||

30

| CORPORATE BONDS AND NOTES (90.1%)* continued | |||||

| Principal amount | Value | ||||

| Cable Television continued | |||||

| Adelphia Communications Corp. sr. notes 9 3/8s, | |||||

| 2009 (In default) † | $ | 5,000 | $ | 3,075 | |

| Adelphia Communications Corp. sr. notes Ser. B, | |||||

| 9 7/8s, 2007 (In default) † | 40,000 | 24,200 | |||

| Atlantic Broadband Finance, LLC company | |||||

| guaranty 9 3/8s, 2014 | 255,000 | 230,775 | |||

| Cablevision Systems Corp. sr. notes Ser. B, 8s, 2012 | 195,000 | 186,225 | |||

| CCH I Holdings, LLC 144A company guaranty 11 1/8s, 2014 | 119,000 | 75,565 | |||

| CCH I Holdings, LLC 144A company guaranty 10s, 2014 | 87,000 | 53,505 | |||

| CCH I Holdings, LLC 144A company guaranty | |||||

| stepped-coupon zero % (12 1/8s, 1/15/07), 2015 †† | 35,000 | 18,025 | |||

| CCH I Holdings, LLC 144A company guaranty | |||||

| stepped-coupon zero % (11 3/4s, 5/15/06), 2014 †† | 5,000 | 3,025 | |||

| CCH I, LLC 144A secd. notes 11s, 2015 | 582,000 | 499,065 | |||

| CSC Holdings, Inc. debs. 7 5/8s, 2018 | 45,000 | 42,750 | |||

| CSC Holdings, Inc. sr. notes Ser. B, 7 5/8s, 2011 | 80,000 | 79,600 | |||

| CSC Holdings, Inc. 144A sr. notes 6 3/4s, 2012 | 155,000 | 147,250 | |||

| Kabel Deutscheland GmbH 144A company | |||||

| guaranty 10 5/8s, 2014 (Germany) | 270,000 | 290,250 | |||

| Quebecor Media, Inc. sr. disc. notes stepped-coupon | |||||

| zero % (13 3/4s, 7/15/06), 2011 (Canada) †† | 30,000 | 30,750 | |||

| Quebecor Media, Inc. sr. notes 11 1/8s, 2011 (Canada) | 155,000 | 167,788 | |||

| 1,924,323 | |||||

| Capital Goods (9.3%) | |||||

| AEP Industries, Inc. sr. unsub. 7 7/8s, 2013 | 65,000 | 63,284 | |||

| Aero Invest 1 SA 144A company guaranty FRN | |||||

| 10.634s, 2015 (Luxembourg) ‡‡ | EUR | 285,294 | 340,508 | ||

| Allied Waste North America, Inc. company | |||||

| guaranty Ser. B, 8 1/2s, 2008 | $ | 240,000 | 252,000 | ||

| Amsted Industries, Inc. 144A sr. notes 10 1/4s, 2011 | 320,000 | 346,000 | |||

| Argo-Tech Corp. company guaranty 9 1/4s, 2011 | 125,000 | 129,063 | |||

| BE Aerospace, Inc. sr. notes 8 1/2s, 2010 | 240,000 | 256,800 | |||

| Blount, Inc. sr. sub. notes 8 7/8s, 2012 | 125,000 | 129,688 | |||

| Bombardier, Inc. 144A notes 6 3/4s, 2012 (Canada) | 100,000 | 92,000 | |||

| Browning-Ferris Industries, Inc. debs. 7.4s, 2035 | 80,000 | 70,400 | |||

| Browning-Ferris Industries, Inc. sr. notes 6 3/8s, 2008 | 145,000 | 144,456 | |||

| Crown Americas, LLC/Crown Americas Capital Corp. 144A | |||||

| sr. notes 7 5/8s, 2013 | 255,000 | 261,375 | |||

| Decrane Aircraft Holdings Co. company guaranty | |||||

| zero %, 2008 (acquired 7/23/04, cost $156,000) ‡ | 476,000 | 228,480 | |||

| Earle M. Jorgensen Co. sec. notes 9 3/4s, 2012 | 250,000 | 266,250 | |||

| Hexcel Corp. sr. sub. notes 6 3/4s, 2015 | 45,000 | 43,425 | |||

| Invensys PLC notes 9 7/8s, 2011 (United Kingdom) | 15,000 | 14,700 | |||

| Jacuzzi Brands, Inc. sec. notes 9 5/8s, 2010 | 30,000 | 31,950 | |||

| L-3 Communications Corp. company guaranty 6 1/8s, 2013 | 325,000 | 317,688 | |||

| L-3 Communications Corp. 144A sr. sub. notes 6 3/8s, 2015 | 165,000 | 162,525 | |||

| Legrand SA debs. 8 1/2s, 2025 (France) | 310,000 | 372,000 | |||

31

| CORPORATE BONDS AND NOTES (90.1%)* continued | |||||

| Principal amount | Value | ||||

| Capital Goods continued | |||||

| Manitowoc Co., Inc. (The) company guaranty 10 1/2s, 2012 | $ | 91,000 | $ | 101,238 | |

| Manitowoc Co., Inc. (The) company guaranty 10 3/8s, 2011 | EUR | 25,000 | 31,842 | ||

| Manitowoc Co., Inc. (The) sr. notes 7 1/8s, 2013 | $ | 290,000 | 298,700 | ||

| Milacron Escrow Corp. sec. notes 11 1/2s, 2011 | 240,000 | 206,400 | |||

| Mueller Group, Inc. sr. sub. notes 10s, 2012 | 175,000 | 184,625 | |||

| Mueller Holdings, Inc. disc. notes stepped-coupon | |||||

| zero % (14 3/4s, 4/15/09), 2014 †† | 105,000 | 79,013 | |||

| Owens-Brockway Glass company guaranty 8 1/4s, 2013 | 180,000 | 185,850 | |||

| Owens-Brockway Glass company guaranty 7 3/4s, 2011 | 40,000 | 41,600 | |||

| Owens-Brockway Glass sr. sec. notes 8 3/4s, 2012 | 155,000 | 167,400 | |||

| Owens-Illinois, Inc. debs. 7.8s, 2018 | 100,000 | 98,500 | |||

| Polypore, Inc. sr. sub. notes 8 3/4s, 2012 | 110,000 | 98,450 | |||

| Ray Acquisition sr. notes 9 3/8s, 2015 (France) | EUR | 210,000 | 257,079 | ||

| Siebe PLC 144A sr. unsub. 6 1/2s, 2010 (United Kingdom) | $ | 210,000 | 180,600 | ||

| Solo Cup Co. sr. sub. notes 8 1/2s, 2014 | 130,000 | 117,813 | |||

| TD Funding Corp. company guaranty 8 3/8s, 2011 | 145,000 | 150,075 | |||

| Tekni-Plex, Inc. 144A sec. notes 10 7/8s, 2012 | 240,000 | 261,600 | |||

| Terex Corp. company guaranty 9 1/4s, 2011 | 35,000 | 37,450 | |||

| Terex Corp. company guaranty 7 3/8s, 2014 | 18,000 | 17,955 | |||

| Terex Corp. company guaranty Ser. B, 10 3/8s, 2011 | 190,000 | 202,588 | |||

| 6,241,370 | |||||

| Communication Services (5.8%) | |||||

| Alamosa Delaware, Inc. company guaranty 12s, 2009 | 50,000 | 54,875 | |||

| Alamosa Delaware, Inc. company guaranty 11s, 2010 | 60,000 | 68,100 | |||

| Alamosa Delaware, Inc. sr. notes 8 1/2s, 2012 | 35,000 | 38,150 | |||

| American Cellular Corp. company guaranty 9 1/2s, 2009 | 35,000 | 37,975 | |||

| American Cellular Corp. sr. notes Ser. B, 10s, 2011 | 320,000 | 346,400 | |||

| American Tower Corp. sr. notes 7 1/2s, 2012 | 65,000 | 67,763 | |||

| American Towers, Inc. company guaranty 7 1/4s, 2011 | 125,000 | 130,313 | |||

| Asia Global Crossing, Ltd. sr. notes 13 3/8s, 2010 | |||||

| (Bermuda) (In default) † | 96,207 | 4,089 | |||

| Centennial Cellular Operating Co., LLC company | |||||

| guaranty 10 1/8s, 2013 | 75,000 | 83,625 | |||

| Cincinnati Bell Telephone Co. company guaranty 6.3s, 2028 | 25,000 | 22,500 | |||

| Cincinnati Bell, Inc. company guaranty 7s, 2015 | 60,000 | 57,900 | |||

| Cincinnati Bell, Inc. sr. sub. notes 8 3/8s, 2014 | 55,000 | 53,900 | |||

| Cincinnati Bell, Inc. sr. sub. notes 7 1/4s, 2023 | 70,000 | 67,025 | |||

| Citizens Communications Co. notes 9 1/4s, 2011 | 185,000 | 202,113 | |||

| Citizens Communications Co. sr. notes 6 1/4s, 2013 | 160,000 | 154,000 | |||

| Dobson Communications Corp. 144A sr. notes FRN 8.4s, 2012 | 60,000 | 59,100 | |||

| Eircom Funding company guaranty Ser. US$, 8 1/4s, | |||||

| 2013 (Ireland) | 45,000 | 48,713 | |||

| Globix Corp. company guaranty 11s, 2008 ‡‡ | 23,008 | 21,800 | |||

| Horizon PCS, Inc. company guaranty 11 3/8s, 2012 | 30,000 | 34,575 | |||

| Inmarsat Finance PLC company guaranty 7 5/8s, 2012 | |||||

| (United Kingdom) | 114,000 | 115,995 | |||

| Inmarsat Finance PLC company guaranty stepped-coupon | |||||

| zero % (10 3/8s, 10/15/08), 2012 (United Kingdom) †† | 175,000 | 142,625 | |||

32

| CORPORATE BONDS AND NOTES (90.1%)* continued | |||

| Principal amount | Value | ||

| Communication Services continued | |||

| Intelsat Bermuda, Ltd. 144A sr. notes 8 5/8s, 2015 (Bermuda) $ | 160,000 | $ | 160,400 |

| Intelsat Bermuda, Ltd. 144A sr. notes 8 1/4s, 2013 (Bermuda) | 75,000 | 75,000 | |

| iPCS, Inc. sr. notes 11 1/2s, 2012 | 55,000 | 63,388 | |

| IWO Holdings, Inc. sec. FRN 7.9s, 2012 | 20,000 | 20,700 | |

| Madison River Capital Corp. sr. notes 13 1/4s, 2010 | 51,000 | 54,315 | |

| Nextel Communications, Inc. sr. notes Ser. E, 6 7/8s, 2013 | 5,000 | 5,201 | |

| Nextel Partners, Inc. sr. notes 8 1/8s, 2011 | 225,000 | 239,625 | |

| Qwest Communications International, Inc. company | |||

| guaranty 8s, 2014 | 410,000 | 414,100 | |

| Qwest Corp. notes 8 7/8s, 2012 | 330,000 | 370,425 | |

| Qwest Corp. 144A sr. notes 7 5/8s, 2015 | 115,000 | 122,331 | |

| Rogers Cantel, Inc. debs. 9 3/4s, 2016 (Canada) | 50,000 | 60,063 | |

| Rogers Wireless Communications, Inc. sec. | |||

| notes 9 5/8s, 2011 (Canada) | 40,000 | 46,000 | |

| Rural Cellular Corp. sr. notes 9 7/8s, 2010 | 120,000 | 125,550 | |

| Rural Cellular Corp. sr. sub. notes 9 3/4s, 2010 | 30,000 | 30,000 | |

| Rural Cellular Corp. 144A sr. sub. notes FRN 10.041s, 2012 | 40,000 | 39,600 | |

| SBA Communications Corp. sr. notes 8 1/2s, 2012 | 36,000 | 39,960 | |

| SBA Telecommunications, Inc./SBA Communications Corp. | |||

| sr. disc. notes stepped-coupon zero % (9 3/4s, | |||

| 12/15/07), 2011 †† | 36,000 | 32,940 | |

| Syniverse Technologies, Inc. 144A | |||

| sr. sub. notes 7 3/4s, 2013 | 60,000 | 60,975 | |

| U S West, Inc. debs. 7 1/4s, 2025 | 55,000 | 54,588 | |

| Valor Telecommunications Enterprises, LLC/Finance Corp. | |||

| company guaranty 7 3/4s, 2015 | 60,000 | 58,800 | |

| 3,885,497 | |||

| Consumer (0.8%) | |||

| Jostens IH Corp. company guaranty 7 5/8s, 2012 | 245,000 | 243,163 | |

| Samsonite Corp. sr. sub. notes 8 7/8s, 2011 | 260,000 | 265,850 | |

| 509,013 | |||

| Consumer Goods (2.0%) | |||

| Church & Dwight Co., Inc. company guaranty 6s, 2012 | 105,000 | 103,425 | |

| Elizabeth Arden, Inc. company guaranty 7 3/4s, 2014 | 120,000 | 120,300 | |

| Playtex Products, Inc. company guaranty 9 3/8s, 2011 | 190,000 | 200,213 | |

| Playtex Products, Inc. sec. notes 8s, 2011 | 140,000 | 148,400 | |

| Prestige Brands, Inc. sr. sub. notes 9 1/4s, 2012 | 259,000 | 255,115 | |

| Remington Arms Co., Inc. company guaranty 10 1/2s, 2011 | 125,000 | 108,750 | |

| Scotts Co. (The) sr. sub. notes 6 5/8s, 2013 | 45,000 | 45,450 | |

| Spectrum Brands, Inc. company guaranty 7 3/8s, 2015 | 335,000 | 289,775 | |

| Spectrum Brands, Inc. sr. sub. notes 8 1/2s, 2013 | 55,000 | 49,844 | |

| 1,321,272 | |||

33

| CORPORATE BONDS AND NOTES (90.1%)* continued | ||||

| Principal amount | Value | |||

| Consumer Services (0.6%) | ||||

| Brand Services, Inc. company guaranty 12s, 2012 | $ | 350,000 | $ | 367,500 |

| United Rentals NA, Inc. company guaranty 6 1/2s, 2012 | 45,000 | 43,313 | ||

| United Rentals NA, Inc. sr. sub. notes 7 3/4s, 2013 | 18,000 | 17,325 | ||

| 428,138 | ||||

| Energy (7.9%) | ||||

| Arch Western Finance, LLC sr. notes 6 3/4s, 2013 | 270,000 | 272,700 | ||

| Bluewater Finance, Ltd. company guaranty 10 1/4s, | ||||

| 2012 (Cayman Islands) | 70,000 | 74,725 | ||

| Chaparral Energy, Inc. 144A sr. notes 8 1/2s, 2015 | 110,000 | 112,200 | ||

| CHC Helicopter Corp. sr. sub. notes 7 3/8s, 2014 (Canada) | 185,000 | 186,388 | ||

| Chesapeake Energy Corp. company guaranty 7 3/4s, 2015 | 45,000 | 47,588 | ||

| Chesapeake Energy Corp. sr. notes 7 1/2s, 2013 | 210,000 | 221,550 | ||

| Chesapeake Energy Corp. sr. notes 7s, 2014 | 60,000 | 62,100 | ||

| Compton Petroleum Corp. 144A sr. notes 7 5/8s, | ||||

| 2013 (Canada) | 145,000 | 147,175 | ||

| Comstock Resources, Inc. sr. notes 6 7/8s, 2012 | 95,000 | 94,050 | ||

| Delta Petroleum Corp. company guaranty 7s, 2015 | 365,000 | 339,450 | ||

| Dresser-Rand Group, Inc. 144A sr. sub. notes 7 5/8s, 2014 | 22,000 | 22,495 | ||

| Encore Acquisition Co. sr. sub. notes 6 1/4s, 2014 | 45,000 | 42,863 | ||

| Encore Acquisition Co. sr. sub. notes 6s, 2015 | 152,000 | 139,840 | ||

| Exco Resources, Inc. company guaranty 7 1/4s, 2011 | 175,000 | 177,188 | ||

| Forest Oil Corp. company guaranty 7 3/4s, 2014 | 70,000 | 73,500 | ||

| Forest Oil Corp. sr. notes 8s, 2011 | 145,000 | 159,500 | ||

| Forest Oil Corp. sr. notes 8s, 2008 | 35,000 | 36,750 | ||

| Hanover Compressor Co. sr. notes 9s, 2014 | 70,000 | 75,950 | ||

| Hanover Compressor Co. sr. notes 8 5/8s, 2010 | 40,000 | 42,100 | ||

| Hanover Compressor Co. sub. notes zero %, 2007 | 95,000 | 84,550 | ||

| Hanover Equipment Trust sec. notes Ser. B, 8 3/4s, 2011 | 30,000 | 31,650 | ||

| Harvest Operations Corp. sr. notes 7 7/8s, 2011 (Canada) | 275,000 | 273,625 | ||

| Inergy, LP/Inergy Finance Corp. sr. notes 6 7/8s, 2014 | 275,000 | 259,875 | ||

| KCS Energy, Inc. sr. notes 7 1/8s, 2012 | 65,000 | 65,000 | ||