Second Quarter 2010 Investor Presentation Exhibit 99.1 * * * * * * * * * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 2 Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995 This presentation, like many written and oral communications presented by New York Community Bancorp, Inc. and our authorized officers, may contain certain forward-looking statements regarding our prospective performance and strategies within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of said safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of the Company, are generally identified by use of the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “seek,” “strive,” “try,” or future or conditional verbs such as “will,” “would,” “should,” “could,” “may,” or similar expressions. Our ability to predict results or the actual effects of our plans or strategies is inherently uncertain. Accordingly, actual results may differ materially from anticipated results. There are a number of factors, many of which are beyond our control, that could cause actual conditions, events, or results to differ significantly from those described in the forward-looking statements. These factors include, but are not limited to: general economic conditions, either nationally or in some or all of the areas in which we and our customers conduct our respective businesses; conditions in the securities markets and real estate markets or the banking industry; changes in interest rates, which may affect our net income, prepayment penalty income, and other future cash flows, or the market value of our assets, including our investment securities; changes in deposit flows and wholesale borrowing facilities; changes in the demand for deposit, loan, and investment products and other financial services in the markets we serve; changes in our credit ratings or in our ability to access the capital markets; changes in our customer base or in the financial or operating performances of our customers’ businesses; changes in real estate values, which could impact the quality of the assets securing the loans in our portfolio; changes in the quality or composition of our loan or securities portfolios; changes in competitive pressures among financial institutions or from non- financial institutions; the ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we may acquire, including those acquired in the AmTrust Bank and Desert Hills Bank transactions, into our operations and our ability to realize related revenue synergies and cost savings within expected time frames; our use of derivatives to mitigate our interest rate exposure; our ability to retain key members of management; our timely development of new lines of business and competitive products or services in a changing environment, and the acceptance of such products or services by our customers; any breach in performance by the Community Bank under our loss sharing agreements with the FDIC; any interruption or breach of security resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems; any interruption in customer service due to circumstances beyond our control; potential exposure to unknown or contingent liabilities of companies we have acquired or target for acquisition, including those of AmTrust Bank and Desert Hills Bank; the outcome of pending or threatened litigation, or of other matters before regulatory agencies, whether currently existing or commencing in the future; changes in our estimates of future reserves based upon the periodic review thereof under relevant regulatory and accounting requirements; changes in our capital management policies, including those regarding business combinations, dividends, and share repurchases, among others; changes in legislation, regulation, policies, or administrative practices, whether by judicial, governmental, or legislative action, including, but not limited to, the effect of final rules amending Regulation E that prohibit financial institutions from assessing overdraft fees on ATM and one-time debit card transactions without a consumer’s affirmative consent, the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and other changes pertaining to banking, securities, taxation, rent regulation and housing, environmental protection, and insurance, and the ability to comply with such changes in a timely manner; additional FDIC special assessments or required assessment prepayments; changes in accounting principles, policies, practices, or guidelines; environmental conditions that exist or may exist on properties owned by, leased by, or mortgaged to the Company; operational issues stemming from, and/or capital spending necessitated by, the potential need to adapt to industry changes in information technology systems, on which we are highly dependent; the ability to keep pace with, and implement on a timely basis, technological changes; changes in the monetary and fiscal policies of the U.S. Government, including policies of the U.S. Department of the Treasury and the Board of Governors of the Federal Reserve System; war or terrorist activities; and other economic, competitive, governmental, regulatory, and geopolitical factors affecting our operations, pricing, and services. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to our Annual Report on Form 10-K for the year ended December 31, 2009, including the section entitled “Risk Factors,” on file with the U.S. Securities and Exchange Commission (the “SEC”). In addition, it should be noted that we routinely evaluate opportunities to expand through acquisition and frequently conduct due diligence activities in connection with such opportunities. As a result, acquisition discussions and, in some cases, negotiations, may take place at any time, and acquisitions involving cash, debt, or equity securities may occur. Furthermore, the timing and occurrence or non-occurrence of events may be subject to circumstances beyond our control. Readers are cautioned not to place undue reliance on the forward-looking statements contained herein, which speak only as of the date of this presentation. Except as required by applicable law or regulation, we undertake no obligation to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made. Forward-looking Statements and Associated Risk Factors |

New York Community Bancorp, Inc. Page 3 We rank among the top 25 bank holding companies in the U.S. (a) SNL Financial as of 7/29/10 With assets of $42.0 billion at 6/30/10, we are the 23rd largest bank holding company in the nation. (a) With deposits of $22.4 billion at 6/30/10 and 278 branches in Metro New York, New Jersey, Ohio, Florida, and Arizona, we rank 24th among the nation’s largest depositories. (a) We rank among the top three thrift depositories in eight attractive markets: Queens, Staten Island, and Long Island in New York; Essex County in New Jersey; Broward and Palm Beach Counties in Florida; greater Cleveland in Ohio; and greater Phoenix in Arizona. (a) With a portfolio of $16.8 billion at the end of June, we are a leading producer of multi- family loans in New York City. (a) With a market cap of $7.5 billion at 7/29/10, we rank 16th among the nation’s publicly traded banks and thrifts. (a) |

New York Community Bancorp, Inc. Page 4 We have a consistent business model that focuses on building value while building the Company. (a) SNL Financial as of 7/29/10 (b) Please see page 34 for a reconciliation of our GAAP and operating efficiency ratios. Our total return to shareholders increased at a CAGR of 33.8% from 11/23/93 to 7/29/10. Multi-family Lending $26.8 billion of multi-family loans originated since 2000, including $975 million in 1H 2010. Strong Credit Standards/ Superior Asset Quality Net charge-offs represented 0.10% of average loans in 1H 2010, as compared to 1.49% for the SNL Bank and Thrift Index. (a) Efficient Operation Our operating efficiency ratio has historically ranked in the top 3% of all banks and thrifts and was 36.56% in 2Q 2010. (a)(b) Growth through Acquisitions We completed ten acquisitions from 2000 to 2010, including our FDIC-assisted acquisitions of AmTrust Bank on December 4, 2009 and Desert Hills Bank on March 26th. |

2nd Quarter 2010 Performance Highlights * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 6 Our 2Q 2010 performance reflects the merits of our business model. (a) Please see page 36 for a reconciliation of our GAAP and operating earnings. (b) Please see page 34 for a reconciliation of our GAAP and operating efficiency ratios. (dollars in thousands, except per share data) |

New York Community Bancorp, Inc. Page 7 Our balance sheet was also enhanced in 2Q 2010. |

New York Community Bancorp, Inc. Page 8 Our asset quality measures continued to compare favorably with those of our industry as a whole. (a) SNL Financial as of 7/29/10 (b) Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest. (c) Non-performing loans exclude covered loans. (d) Non-performing assets exclude covered assets. |

New York Community Bancorp, Inc. Page 9 (a) Please see page 37 for a reconciliation of our GAAP and non-GAAP capital measures. Our capital strength reflects the growth of our earnings and our ability to access the capital markets. Our dividend has been a significant component of our total return to shareholders since our first year of public life. In July 2010, we declared our 26th consecutive quarterly cash dividend of $0.25 per share. |

Our Business Model: Growth through Acquisitions * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 11 We have completed 10 acquisitions since 2000. Note: The number of branches indicated reflects the number of branches in our current franchise that stemmed from each transaction. Transaction Type: Savings Bank Commercial Bank Branch FDIC |

New York Community Bancorp, Inc. Page 12 As a result of our acquisitions, we rank among the top 25 financial institutions in the nation. (in thousands) DEPOSITS Rank Company Total Deposits 1 Bank of America Corporation $974,467,000 2 JPMorgan Chase & Co. 887,805,000 3 Wells Fargo & Company 815,623,000 4 Citigroup Inc. 813,951,000 5 U.S. Bancorp 183,123,000 6 PNC Financial Services Group, Inc. 178,799,000 7 Bank of New York Mellon Corporation 143,667,000 8 SunTrust Banks, Inc. 118,668,103 9 Capital One Financial Corporation 117,331,000 10 BB&T Corporation 104,451,000 11 Regions Financial Corporation 96,250,000 12 State Street Corporation 95,743,000 13 Fifth Third Bancorp 82,115,000 14 KeyCorp 62,375,000 15 Northern Trust Corporation 57,952,100 16 M&T Bank Corporation 47,522,671 17 Zions Bancorporation 42,013,876 18 Huntington Bancshares Incorporated 39,848,507 19 Comerica Incorporated 39,780,000 20 Marshall & Ilsley Corporation 39,562,000 21 Popular, Inc. 27,114,000 22 Synovus Financial Corp. 26,257,563 23 Hudson City Bancorp, Inc. 25,168,465 24 New York Community Bancorp, Inc. 22,443,668 25 City National Corporation 17,972,913 ASSETS Rank Company Total Assets 1 Bank of America Corporation $2,363,878,000 2 JPMorgan Chase & Co. 2,014,019,000 3 Citigroup Inc. 1,937,656,000 4 Wells Fargo & Company 1,225,862,000 5 U.S. Bancorp 283,243,000 6 PNC Financial Services Group, Inc. 261,695,000 7 Bank of New York Mellon Corporation 235,693,000 8 Capital One Financial Corporation 197,489,000 9 SunTrust Banks, Inc. 170,668,470 10 State Street Corporation 162,075,000 11 BB&T Corporation 155,083,000 12 Regions Financial Corporation 135,340,000 13 Fifth Third Bancorp 112,025,000 14 KeyCorp 94,167,000 15 Northern Trust Corporation 80,048,900 16 M&T Bank Corporation 68,153,616 17 Hudson City Bancorp, Inc. 60,933,134 18 Comerica Incorporated 55,885,000 19 Marshall & Ilsley Corporation 53,904,000 20 Zions Bancorporation 52,147,295 21 Huntington Bancshares Incorporated 51,770,838 22 Popular, Inc. 42,444,000 23 New York Community Bancorp, Inc. 42,010,747 24 Synovus Financial Corp. 32,382,340 25 First Horizon National Corporation 26,254,226 Source: SNL Financial. Balance sheet data as of 6/30/10. Market data as of 7/29/10. MARKET CAPITALIZATION Rank Company Market Cap 1 JPMorgan Chase & Co. $159,866.9 2 Wells Fargo & Company 144,857.4 3 Bank of America Corporation 140,763.2 4 Citigroup Inc. 119,378.7 5 U.S. Bancorp 45,893.0 6 PNC Financial Services Group, Inc. 31,290.0 7 Bank of New York Mellon Corporation 30,666.7 8 State Street Corporation 19,565.7 9 Capital One Financial Corporation 19,186.6 10 BB&T Corporation 17,354.1 11 SunTrust Banks, Inc. 12,978.2 12 Northern Trust Corporation 11,496.9 13 M&T Bank Corporation 10,367.0 14 Fifth Third Bancorp 10,208.8 15 Regions Financial Corporation 9,281.8 16 New York Community Bancorp, Inc. 7,521.2 17 KeyCorp 7,431.6 18 Comerica Incorporated 6,839.3 19 Hudson City Bancorp, Inc. 6,582.6 20 People's United Financial, Inc. 5,133.3 21 Huntington Bancshares Incorporated 4,342.7 22 TFS Financial Corporation (MHC) 3,835.4 23 Zions Bancorporation 3,822.0 24 Marshall & Ilsley Corporation 3,719.6 25 Cullen/Frost Bankers, Inc. 3,374.3 |

New York Community Bancorp, Inc. Page 13 Largely reflecting our acquisition strategy, we currently have 278 locations in five states. Metro New York 158 Branches Ohio 29 Branches New Jersey 52 Branches Florida 25 Branches Arizona 14 Branches |

New York Community Bancorp, Inc. Page 14 FDIC-assisted transactions have enhanced our franchise, our balance sheet, and our earnings capacity. AmTrust Bank Desert Hills Bank Franchise Expansion: Added 29 branches in Ohio, 25 in Florida, and 11 in Arizona Added three more branches to our franchise in Arizona Improved Funding Mix: Provided deposits of $8.2 billion in December 2009 Provided deposits of approximately $375 million at 3/31/10 Enhanced Liquidity: Provided cash and cash equivalents of $4.0 billion, and $760.0 million of available-for-sale securities Provided cash and cash equivalents of $140.9 million Stronger Tangible Capital: Raised $864.9 million through a secondary common stock offering in December to capitalize the acquisition; resulted in a 27% linked-quarter increase in tangible book value per share Raised $28.9 million through our DRP to capitalize the acquisition, further enhancing our tangible book value per share Enhanced Earnings Capacity: Immediately beneficial to our 4Q 2009 earnings; contributed significantly to year- over-year earnings growth in 1H 2010 Expected to be incrementally accretive to 2010 earnings |

New York Community Bancorp, Inc. Page 15 (a) SNL Financial We have a meaningful share of deposits in several of the markets we serve. (a) |

New York Community Bancorp, Inc. Page 16 Total deposits: 33.4% CAGR Core deposits: 39.2% CAGR Demand deposits: 43.0% CAGR (in millions) CDs NOW, MMAs, and Savings Demand deposits Deposits Total Deposits: $12,168 $12,694 $13,236 $14,376 Our deposit growth has been largely acquisition- driven. $22,316 $1,086 $22,444 |

New York Community Bancorp, Inc. Page 17 (in millions) Non-Covered Loan Portfolio Multi-family CRE All Other Loans (includes loans held for sale) Covered Loan Portfolio Loans Outstanding Multi-family loans: 27.2% CAGR Total loans: 31.8% CAGR $1,611 $17,029 $19,653 Total Loans: $677 $6,332 $4,971 Total Originations (a) : $29,150 $3,130 $20,363 $4,853 While acquisitions have contributed to the growth of our loan portfolio, the bulk of our loan growth has been organic. $22,192 $5,881 $28,393 $4,280 (a) Originations of loans held for sale totaled $888 million in 2009 and $1.4 billion in 1H 2010. |

Our Business Model: Multi-family Loan Production * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 19 (in millions) Multi-family Loan Portfolio Multi-family loans have grown at a CAGR of 27.2% since 12/31/99. |

New York Community Bancorp, Inc. Page 20 (in millions) Commercial Real Estate Loan Portfolio Our commercial real estate loans feature the same structure as our multi-family loans. |

New York Community Bancorp, Inc. Page 21 (in millions) Mortgage Banking Production As a result of our acquisition of AmTrust’s mortgage banking operation, we have become a leading aggregator of Fannie Mae/Freddie Mac conforming one- to four-family residential loans. 1H 2010 Total: $3.44 billion |

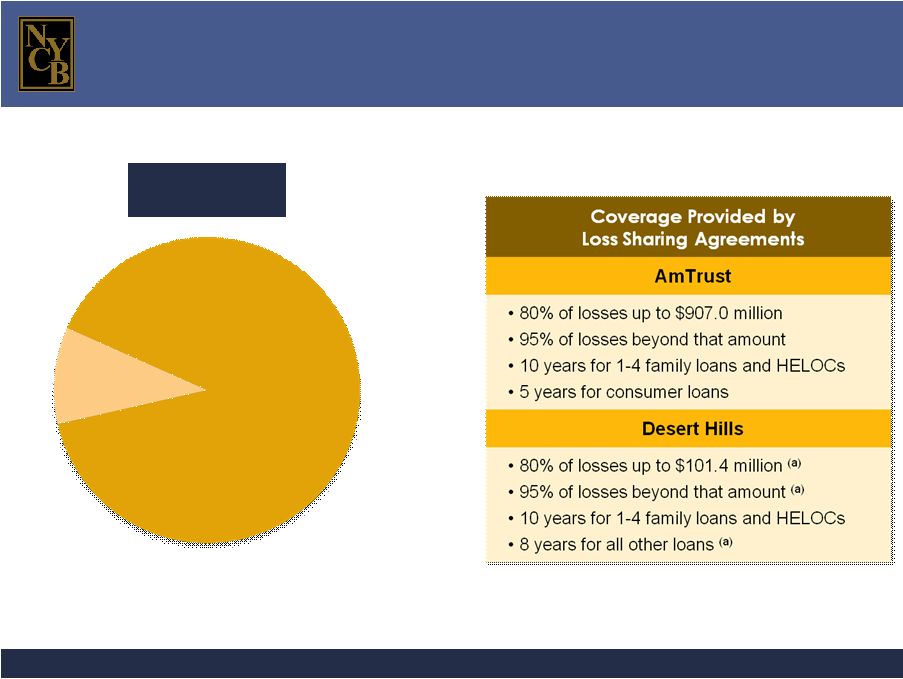

New York Community Bancorp, Inc. Page 22 All of the loans acquired in the AmTrust and Desert Hills acquisitions are covered by loss sharing agreements with the FDIC. (in millions) Total covered loans: $4.6 billion Covered Loans 6/30/10 1-4 Family $4,153.0 Other Loans $473.6 (a) Includes covered OREO as well as covered loans. Percent of total loans: 15.9% |

Our Business Model: Asset Quality * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 24 Net Charge-offs / Average Loans NYB Net Charge-offs: $22,000 $222,000 $458,000 $6.1 million $431,000 Both historically and currently, we have been distinguished by our low level of net charge-offs. $29.9 million NYB SNL Bank and Thrift Index (a) (a) SNL Financial as of 7/29/10 Last Credit Cycle Current Credit Cycle $28.9 million |

New York Community Bancorp, Inc. Page 25 The quality of our loan portfolio continues to exceed that of our industry, as it has in the past. (a) Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest. (b) Non-performing loans exclude covered loans. (c) SNL Financial as of 7/29/10 NYB SNL Bank and Thrift Index (c) Non-performing Loans / Total Loans (a) Last Credit Cycle Current Credit Cycle |

New York Community Bancorp, Inc. Page 26 (a) SNL Financial as of 7/29/10 Net Charge-offs / Average Loan Loss Allowance As in the past, our charge-offs represent a smaller percentage of our loan loss allowance compared to our industry peers. Last Credit Cycle Current Credit Cycle NYB SNL Bank and Thrift Index (a) |

New York Community Bancorp, Inc. Page 27 Historically and currently, few of our non-performing loans have resulted in charge-offs. At or for the 12 Months Ended December 31, At or for the 3 Months Ended Last Credit Cycle Current Credit Cycle 1990 1991 1992 2007 2008 2009 6/30/2010 NPLs / Total Loans (a)(b) 2.48% 2.10% 2.83% 0.11% 0.51% 2.04% 2.26% NCOs / Average Loans 0.00% 0.04% 0.07% 0.00% 0.03% 0.13% 0.07% Difference 248 bp 206 bp 276 bp 11 bp 48 bp 191 bp 219 bp (a) Non-performing loans are defined as non-accrual loans and loans 90 days or more past due but still accruing interest. (b) Non-performing loans exclude covered loans. |

New York Community Bancorp, Inc. Page 28 The quality of our assets reflects the nature of our multi-family lending niche and our strong underwriting standards. |

Our Business Model: Efficiency * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 30 Our operating efficiency ratio was 36.56% (a) in 2Q 2010, well below the SNL Bank and Thrift Index efficiency ratio of 59.75%. (b) (a) Please see pages 34 and 35 for a reconciliation of our GAAP and operating efficiency ratios. (b) SNL Financial as of 7/29/10 NYB (a) SNL Bank and Thrift Index (b) |

Total Return on Investment * * * * * * * * * * * * * * * * |

New York Community Bancorp, Inc. Page 32 Total Return on Investment NYB (b) CAGR since IPO = 33.8% (a) SNL Financial (b) Bloomberg As a result of nine stock splits in a span of 10 years, our charter shareholders have 2,700 shares of NYB stock for each 100 shares originally purchased. SNL Bank & Thrift Index (a) One-Year Total Return: 32.5% We are committed to building value for our investors. Y-T-D Total Return: 22.9% |

New York Community Bancorp, Inc. Page 33 8/3/2010 For More Information |

New York Community Bancorp, Inc. Page 34 For the Three Months Ended June 30, 2010 March 31, 2010 June 30, 2009 (dollars in thousands) GAAP Operating GAAP Operating GAAP Operating Total net interest income and non-interest income $374,614 $374,614 $349,628 $349,628 $199,874 $199,874 Adjustments: Loss on other-than-temporary impairment of securities -- -- -- -- -- 39,728 Gain on business acquisition -- (10,780) -- -- -- -- Adjusted total net interest income and non-interest income $374,614 $363,834 $349,628 $349,628 $199,874 $239,607 Operating expenses $133,488 $133,488 $128,855 $128,855 $101,927 $101,927 Adjustments: FDIC special assessment -- -- -- -- -- (13,952) Acquisition-related expenses -- (456) -- (2,682) -- -- Adjusted operating expenses $133,488 $133,032 $128,855 $126,173 $101,927 $ 87,975 Efficiency ratio 35.63% 36.56% 36.85% 36.09% 51.00% 36.72% Reconciliation of GAAP and Operating Efficiency Ratios The following table presents reconciliations of the Company’s GAAP and operating efficiency ratios for the three months ended June 30, 2010, March 31, 2010, and June 30, 2009: |

New York Community Bancorp, Inc. Page 35 Reconciliation of GAAP and Operating Efficiency Ratios The following table presents reconciliations of the Company’s GAAP and operating efficiency ratios for the years ended December 31, 2005, 2006, 2007, 2008, and 2009. For the Years Ended December 31, 2009 2008 2007 2006 2005 (dollars in thousands) GAAP Operating GAAP Operating GAAP Operating GAAP Operating GAAP Operating Total net interest income and non-interest income $1,062,964 $1,062,964 $691,024 $691,024 $727,622 $727,622 $650,556 $650,556 $693,068 $693,068 Adjustments: Gain on debt repurchases and exchange -- (10,054) -- -- -- -- -- -- -- -- Gain on AmTrust transaction -- (139,607) -- -- -- -- -- -- -- -- Gain on termination of servicing hedge -- (3,078) -- -- -- -- -- -- -- -- Visa-related gain -- -- -- (1,647) -- -- -- -- -- -- Net gain on sale of securities -- -- -- -- -- (1,888) -- -- -- -- Loss on mark-to-market of interest rate swaps -- -- -- -- -- -- -- 6,071 -- -- (Gain) loss on debt redemption -- -- -- (16,962) -- 1,848 -- 1,859 -- -- Loss on other-than-temporary impairment of securities -- 96,533 -- 104,317 -- 56,958 -- -- -- -- Balance sheet repositioning charge -- -- -- 39,647 -- -- -- -- -- -- Gain on sale of bank-owned property / branches -- -- -- -- -- (64,879) -- -- -- -- Adjusted total net interest income and non- interest income $1,062,964 $1,006,758 $691,024 $816,379 $727,622 $719,661 $650,556 $658,486 $693,068 $693,068 Operating expenses $384,003 $384,003 $320,818 $320,818 $299,575 $299,575 $256,362 $256,362 $236,621 $236,621 Adjustments: FDIC special assessment -- (14,753) -- -- -- -- -- -- -- -- Acquisition-related costs -- (5,185) -- -- -- -- -- -- -- -- Merger-related charge -- -- -- -- -- (2,245) -- (5,744) -- (36,588) VISA litigation charge -- -- -- (3,365) -- (1,000) -- -- -- -- Retirement charge -- -- -- -- -- -- -- (3,072) -- -- Adjusted operating expenses $384,003 $364,065 $320,818 $317,453 $299,575 $296,330 $256,362 $247,546 $236,621 $200,033 Efficiency ratio 36.13% 36.16% 46.43% 38.89% 41.17% 41.18% 39.41% 37.59% 34.14% 28.86% |

New York Community Bancorp, Inc. Page 36 The following table presents reconciliations of the Company’s GAAP and operating earnings for the three months ended June 30, 2010, March 31, 2010, and June 30, 2009: Reconciliation of GAAP and Operating Earnings For the Three Months Ended June 30, March 31, June 30, (in thousands, except per share data) 2010 2010 2009 GAAP Earnings $136,258 $124,149 $ 56,448 Adjustments to GAAP earnings: Loss on OTTI of securities -- -- 39,728 Gain on business acquisition (10,780) -- -- Acquisition-related expenses 456 2,682 -- FDIC special assessment -- -- 13,952 Income tax effect 4,008 (956) (21,075) Operating earnings $129,942 $125,875 $ 89,053 Diluted GAAP Earnings per Share $ 0.31 $0.29 $0.16 Adjustments to diluted GAAP earnings per share: Loss on OTTI of securities -- -- 0.07 Gain on business acquisition (0.01) -- -- Acquisition-related expenses -- -- -- FDIC special assessment -- -- 0.03 Diluted operating earnings per share $ 0.30 $0.29 $0.26 |

New York Community Bancorp, Inc. Page 37 Reconciliation of GAAP and Non-GAAP Capital Measures June 30, March 31, June 30, (dollars in thousands) 2010 2010 2009 Total stockholders’ equity $ 5,446,434 $ 5,413,461 $ 4,210,666 Less: Goodwill (2,436,327) (2,436,401) (2,436,401) Core deposit intangibles (93,226) (101,108) (76,617) Tangible stockholders’ equity $ 2,916,881 $ 2,875,952 $ 1,697,648 Total assets $42,010,747 $42,430,737 $32,860,123 Less: Goodwill (2,436,327) (2,436,401) (2,436,401) Core deposit intangibles (93,226) (101,108) (76,617) Tangible assets $39,481,194 $39,893,228 $30,347,105 Stockholders’ equity to total assets 12.96% 12.76% 12.81% Tangible stockholders’ equity to tangible assets 7.39% 7.21% 5.59% Tangible stockholders’ equity $2,916,881 $2,875,952 $1,697,648 Accumulated other comprehensive loss, net of tax 52,805 53,852 76,301 Adjusted tangible stockholders’ equity $2,969,686 $2,929,804 $1,773,949 Tangible assets $39,481,194 $39,893,228 $30,347,105 Accumulated other comprehensive loss, net of tax 52,805 53,852 76,301 Adjusted tangible assets $39,533,999 $39,947,080 $30,423,406 Adjusted tangible stockholders’ equity to adjusted tangible assets 7.51% 7.33% 5.83% The following table presents reconciliations of the Company’s stockholders’ equity, tangible stockholders’ equity, and adjusted tangible stockholders’ equity; total assets, tangible assets, and adjusted tangible assets; and the related capital measures at June 30, 2010, March 31, 2010, and June 30, 2009: |