UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to____________

Commission File No. 001-34220

__________________________

3D SYSTEMS CORPORATION

(Exact name of Registrant as Specified in its Charter)

__________________________

| | | | | |

| Delaware | 95-4431352 |

(State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

333 Three D Systems Circle

Rock Hill, South Carolina 29730

(Address of Principal Executive Offices and Zip Code)

(Registrant’s Telephone Number, Including Area Code): (803) 326-3900

_________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | DDD | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based-compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ☐ No ☒

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant on June 30, 2023 was $1,275,574,266. For purposes of this computation, it has been assumed that the shares beneficially held by directors and executive officers of the registrant were “held by affiliates.” This assumption is not to be deemed an admission by these persons that they are affiliates of the registrant.

The number of shares of the registrant's Common Stock outstanding as of August 5, 2024: 133,575,083.

3D SYSTEMS CORPORATION

Annual Report on Form 10-K

For the Year Ended December 31, 2023

TABLE OF CONTENTS

This Annual Report on Form 10-K (“Form 10-K”) contains forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Many of the forward-looking statements are located in Part II, Item 7 of this Form 10-K under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. In many cases, you can identify forward-looking statements by terms such as “believes,” “belief,” “expects,” “may,” “will,” “estimates,” “intends,” “anticipates,” or “plans” or the negative of these terms or other comparable terminology. Forward-looking statements are based upon management’s beliefs, assumptions and current expectations concerning future events and trends, using information currently available, and are necessarily subject to uncertainties, many of which are outside our control. Although we believe that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements are not, and should not be relied upon as a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. A number of important factors could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Factors that could cause such differences include, but are not limited to, those discussed in Part I, Item 1A of this Form 10-K under the heading “Risk Factors.” All subsequent written and oral forward-looking statements attributable to the Company or to individuals acting on our behalf are expressly qualified in their entirety by this discussion. The Company assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law.

PART I

Item 1. Business

General

3D Systems Corporation (“3D Systems” or the “Company” or “we,” "our" or “us”) markets our products and services through subsidiaries in North America and South America (collectively referred to as “Americas”), Europe and the Middle East (collectively referred to as “EMEA”) and Asia Pacific and Oceania (collectively referred to as “APAC”). We provide comprehensive 3D printing and digital manufacturing solutions, including 3D printers for plastics and metals, materials, software, and services, including maintenance, advanced manufacturing and applications engineering. Our solutions support advanced applications in two key industry verticals: Healthcare Solutions (which includes dental, medical devices, personalized health services and regenerative medicine) and Industrial Solutions (which includes aerospace, defense, transportation and general manufacturing). We have over 35 years of experience and expertise, which have proven vital to our development of an ecosystem and end-to-end digital workflow solutions that enable customers to optimize product designs, transform workflows, bring innovative products to market and drive new business models.

Business Strategy

Accelerating Additive Manufacturing Adoption

We partner with customers to enable them to adopt and scale additive manufacturing in their production environments. We believe that our additive manufacturing capabilities can help customers solve a number of design and manufacturing challenges – such as improved lead times, enhanced design freedom, part consolidation and the ability for mass customization. We believe that we have both the scale and the breadth of technologies, encompassing hardware platforms, materials and software, that our customers require for the successful implementation of additive manufacturing into their design and manufacturing processes. Using a strong application focus in each of our two business segments, our Applications Innovation Group integrates our printer hardware, materials, software and professional and technical services in unique combinations to solve a customer’s product need. Once complete, we can scale the process for the customer to a certain production level through our Advanced Manufacturing solutions, and, with increasing demand, we can enable a customer to continue scaling to high volumes within their own production facilities. This transfer of the workflow involves providing the printing systems, materials and software, along with the process definition and other technical expertise, that enables a seamless transfer of capability to the manufacturer. We expect the result of this approach to drive recurring revenue streams as customers adopt additive manufacturing solutions and consume materials to produce parts, utilize software to manage the print process and manufacturing operations, and make use of our service offerings for application development, maintenance and upgrades. Our proficiency in providing industry focused application and solution development for customers includes a number of internal assets and capabilities, including:

a.A full range of additive manufacturing hardware technologies and materials to address needs in metals and plastics (including biocompatible materials for medical use), wax and bioprinting

b.An Application Innovation Group that includes industry and technology application experts, customer innovation and advanced manufacturing centers and post-sale service and support

c.A software suite that enables end-to-end additive manufacturing including design, simulation, process management and manufacturing execution

d.Scale that includes significant and diverse experience in production parts and applications combined with a global reach to service our customers worldwide

During 2023 we made targeted investments and partnerships designed to broaden and enhance our product offering of 3D printing solutions and to expand addressable markets for our Industrial Solutions and Healthcare Solutions segments. Among these investments was the acquisition of Wematter AB (publ) (“Wematter”). Wematter is an affordable, turnkey, closed-loop selective laser sintering solution accessible for smaller manufacturing environments that addresses a wide range of applications including industrial, medical devices and equipment and academic markets. In addition, during 2023, we acquired a minority ownership interest in Theradaptive, Inc. (“Theradaptive”), a biopharmaceutical company focused on targeted regenerative therapeutics through a proprietary protein-engineering platform that can be used to coat implants and devices and to achieve hyper-local delivery for patients. In addition to our investment in Theradaptive, we entered into a partnership with Theradaptive to act as its exclusive 3D printing partner.

We believe that the above-described investments during 2023, will accelerate the adoption of additive manufacturing in our target industrial and healthcare end-markets and open up profitable future growth opportunities for our company. Realizing the full benefit of these growth-oriented initiatives will require us to make additional investments in operations and development activities during 2024 and beyond.

Investing in Regenerative Medicine

As an early and continuing innovator in additive manufacturing, we have significant experience in bringing this technology to new markets. Within our Healthcare Solutions segment, a portion of our business focuses on opportunities for additive manufacturing to be applied to regenerative medicine. To date, our efforts in the area of regenerative medicine have consisted primarily of pre-commercial bio-technology research and development ("R&D") in the areas described below.

Each year, end-stage organ failure kills millions of people, and the supply of donated organs is insufficient to meet the needs of patients seeking transplantation. Accordingly, our first area of focus is the use of additive manufacturing for human organ transplantation. In 2017, we entered into an arrangement that combined our 3D printing expertise and capabilities in human tissue engineering with the regenerative medicine and biotechnology expertise of a key strategic partner, with a long-term goal of developing the capability to 3D print lungs that will allow patients with end-stage lung disease to receive transplants that will enable them to enjoy long and active lives. In 2021, this program was expanded to also focus on developing the capability to print scaffolds for livers and kidneys, for which research continued through the start of 2024. Beginning in the first quarter of 2024, due to changes to our arrangement with and funding from our key strategic partner, the Company’s continuing organ program returned to focusing on developing the capability to print human lung scaffolds, for which the related R&D efforts will continue to be primarily funded by our key strategic partner. Given the loss of funding for research on kidney and livers from our key strategic partner, those programs were discontinued during the first quarter of 2024.

Our second area of focus involves utilizing our bio-printing technology to manufacture non-organ human tissue scaffolds for use in transplantation and surgical reconstruction applications (the "Tissue Program"). We believe that continued progress in this area could result in significantly improved health outcomes for patients, as well as open up attractive new growth markets and therapeutic applications for 3D printed, vascularized soft-tissue scaffolds. The Tissue Program is currently an internal R&D program that combines our 3D printing, materials, and bio-printing capabilities and expertise.

Our third area of focus seeks to utilize our bio-printing capabilities to design and manufacture 3D-printed vascularized “organs-on-chips” for use in drug development by pharmaceutical industry customers. Currently, drug development is an expensive and time-consuming process, and many drug therapies that appear promising during pre-clinical trials fail during human clinical trials. We believe that “organs-on-chips” can accelerate the drug development process and reduce the cost of pre-clinical drug testing, as well as reduce the pharmaceutical industry’s reliance on animal testing. During 2023, our wholly-owned biotech company, Systemic Bio, continued its R&D work in this area and entered into its first commercial contracts with pharmaceutical industry customers. We plan to continue to provide internal funding to support Systemic Bio during the early stages of its growth, including for product development and customer acquisition activities.

Products

We offer our customers a comprehensive range of 3D printers, materials, software, and digital design tools.

3D Printers and Materials

Our 3D printers transform digital data input generated by 3D design software, Computer Aided Design (“CAD”) software or other 3D design tools, into printed parts using several unique print engines that employ proprietary, additive layer by layer building processes with a variety of materials. As part of our solutions-oriented strategy, we offer a broad range of 3D printing technologies including Stereolithography (SLA), Selective Laser Sintering, Direct Metal Printing, MultiJet Printing, ColorJet Printing, polymer extrusion, and extrusion and SLA based bioprinting. Our printers utilize a wide range of materials, the majority of which are proprietary materials that we develop, blend, and market. Our comprehensive range of materials includes plastic, nylon, metal, composite, elastomeric, wax, polymeric dental materials and biocompatible materials. We augment and complement our portfolio of engineered materials with materials that we purchase or develop with third parties under private label and distribution arrangements.

We work closely with our customers to optimize the performance of our materials in their applications. Our expertise in materials science and formulation, combined with our processes, software and equipment, enables us to provide unique solutions and help our customers select the material that best meets their needs with optimal cost and performance results.

As part of our solutions approach, our currently offered printers, with the exception of direct metal printers and bioprinters, have built-in intelligence to make them integrated, closed systems. For these integrated printers, we furnish materials specifically designed for use in those printers, which are packaged in smart cartridges and utilize material delivery systems. These integrated materials are designed to enhance system functionality, productivity, reliability and materials' shelf life, in addition to providing our customers with a built-in quality management system and a fully integrated workflow solution.

Software and Related Products

We provide digital design tools, including software, scanners and haptic devices. We offer solutions for product design, simulation, mold and die design, 3D scan-to-print, reverse engineering, production machining, metrology, inspection and manufacturing workflows. These products are designed to enable a seamless workflow for customers and are marketed under brand names such as Geomagic®. We also offer 3D Sprint and 3DXpert, proprietary software to prepare and optimize CAD data and manage the additive manufacturing processes. These software products provide automated support building and placement, build platform management, print simulation and print queue management capabilities. The outcome is the ability to improve the quality of prints, optimize design structure, shorten design to manufacturing lead time and minimize manufacturing costs.

Since the acquisition of Oqton, Inc. ("Oqton") in 2021, we have also offered an intelligent, cloud-based MOS platform to customers that need to integrate a broad range of advanced manufacturing and automation technologies, including additive manufacturing (AM) solutions, in their production workflows. 3D System’s legacy stand-alone software applications are integrated into Oqton’s legacy MOS, so that we can offer our customers a complete cloud-based software solution to automate and control their entire digital manufacturing process from order to delivery.

Services

Maintenance and Training Services

We provide a variety of customer services, local application support and field support on a worldwide basis for our products, including installation of new printers at customers’ sites, maintenance agreements, periodic hardware upgrades and software updates. We also provide services to assist our customers and partners in developing new applications for our technologies to facilitate the use of our technology for specific applications, to train customers on the use of our printers and to maintain our printers at customers’ sites. We provide these services, spare parts and field support either directly or through a network of reseller partners. We employ customer-support sales engineers to support our worldwide customer base, and we seek to continue to strengthen and enhance our partner network and service offerings.

Our 3D printers are sold with a warranty period ranging from 90 days to one year. After the warranty period, we generally offer service contracts that enable our customers to continue service and maintenance coverage. These service contracts are offered with various levels of support and options, and are priced accordingly. One entitlement of our service contracts is our service engineers provide regularly scheduled preventive maintenance visits to customer sites. Additionally, we provide training to our partners to enable them to also perform these services. Another contract entitlement on select printer models is proactive remote troubleshooting capability through our 3DConnect Service IoT platform. From time to time, we also offer upgrade kits for certain of our printers that enable our existing customers to take advantage of new or enhanced printer capabilities. In some cases, we have discontinued upgrade support and maintenance agreements for certain of our older legacy printers.

Advanced Manufacturing

As part of our strategy to help customers adopt additive manufacturing, we offer advanced manufacturing services through facilities in the Americas and EMEA regions. These facilities supplement customer manufacturing environments by allowing them to test and ramp production using our solutions before transitioning production to their environment and also providing them with flexible manufacturing capacity on an as-needed basis. This allows us to provide application and production expertise and refine the production process as part of our solutions approach. As the process is validated and volumes ramp, customers may choose to move production to their facilities using equipment, materials, software and services that they purchase from us. These facilities operate under stringent quality systems and are also utilized by customers in regulated industries such as healthcare and aerospace & defense for sustained outsourced production of hundreds of thousands of parts per year.

Software Services

In addition to our software license products, we offer software maintenance and cloud-software subscriptions, which includes updates and support for our licensed software products. Our licensed software is sold with a maintenance service that generally covers a period of one year. After this initial period, we offer single and multi-year maintenance contracts that enable our customers to continue coverage. These software service contracts typically include free software updates and various levels of technical support. In addition, we offer Oqton's legacy MOS as a cloud based-manufacturing operating system designed to automate digital production workflows and to enable machine monitoring, end-to-end manufacturing visibility and production traceability. For our cloud subscription solutions, customer support and software updates are included as part of the solution.

Healthcare Solutions Services

As part of our precision healthcare solutions services, we provide surgical planning, modeling, prototyping and manufacturing services. We offer printing and finishing of medical and dental devices, anatomical models and surgical guides and tools, as well as modeling, design and planning services, including VSP™ surgical planning solutions.

Global Operations

We operate in the Americas, EMEA and APAC regions, and market our products and services in those areas as well as to other parts of the world.

In maintaining operations outside the United States (the “U.S.”), we expose our business to risks inherent in such operations, including currency exchange rate fluctuations. Information on foreign exchange risk appears in Part I, Item 1A, “Risk Factors,” Part II, Item 7A, “Quantitative and Qualitative Disclosures about Market Risk” and Part II, Item 8, “Financial Statements and Supplementary Data” of this Form 10-K.

Marketing and Customers

Our Go-to-Market strategy focuses on an integrated approach that is directed at providing comprehensive design to manufacturing solutions meeting the broad spectrum of our customer needs. We utilize a wide range of marketing tools to generate demand and create awareness for our products and services worldwide. Our marketing and communications teams support our demand generation activities by providing marketing campaigns, digital presence and outreach, and event and targeted vertical seminar engagements.

We promote and sell our solutions globally through a direct sales force, channel partners and, in certain geographies, appointed distributors. Our customer success organization includes sales professionals, application engineers, vertical specialists, and other support teams throughout the Americas, EMEA and APAC regions. These teams are responsible for providing complete service to our customers and channel partners from a technical consultation to the sale of our software, printer, and services products.

Our application engineers collaborate closely with our customers to solve complex design and additive manufacturing challenges, leveraging our technology, software, materials and services to develop advanced applications across our Healthcare Solutions and Industrial Solutions segments. Additionally, our Customer Innovation Centers provide access to the resources necessary to develop, validate, and commercialize customer applications.

We sell our software solutions, including our Oqton MOS software, through a dedicated software sales team. Our software may be sold to customers with 3D printing equipment from competitive equipment manufacturers and, in some cases, we resell our software through these manufacturers.

Our customers include major companies as well as small and midsize businesses in a broad range of industries, including medical, dental, automotive, aerospace, durable goods, government, defense, technology, jewelry, electronics, education, consumer goods, energy, biotechnology and others. For the years ended December 31, 2023, 2022, and 2021, one customer accounted for approximately 15%, 23% and 22% of our consolidated revenue, respectively. We expect to maintain our relationship with this customer.

Seasonality

Historically, our results of operations were subject to seasonal factors. Stronger demand for our products historically occurred in our fourth quarter primarily due to our customers’ capital expenditure budget cycles and our sales compensation incentive programs. Our first and third quarters historically were our weakest quarters for overall unit demand. The first quarter was typically a slow quarter for capital expenditures in general.

Production and Suppliers

In order to carry out the assembly and refurbishment of our 3D printer hardware, we utilize a combination of in-house operations and a limited outsourcing arrangement with a contract manufacturing company in Belgium from which we purchase finished printers pursuant to forecasts and customer orders that we supply. This supplier carries out quality control procedures on our printers prior to their shipment to customers and has responsibility for procuring the components and sub-assemblies either from us or third-party suppliers, which are sourced from a geographically diverse mix of countries. While the outsourced supplier of a small mix of our printers has responsibility for the supply chain and inventory of components for the printers they assemble, the components, parts and sub-assemblies that are used in our printers are generally available from several potential suppliers. During 2023, we continued our work to in-source the manufacturing of multiple printing platforms from contract manufacturing partners in order to realize improvements in production quality, cost efficiency, and inventory management, which resulted in the termination of outsourcing arrangements in the U.S. and Switzerland.

We produce materials at our facilities in Rock Hill, South Carolina, Marly, Switzerland and Soesterberg, Netherlands. We also have arrangements with third parties who blend certain materials according to our specifications that we sell under our own brand names, and we purchase certain complementary materials from third parties for resale to our customers.

Our equipment assembly and materials blending activities, advanced manufacturing services and certain R&D activities are subject to compliance with applicable federal, state and local provisions regulating the storage, use and discharge of materials into the environment. Our facilities engaged in such activities are subject to periodic compliance audits by applicable regulatory authorities. We believe that we are in compliance, in all material respects, with such regulations as currently in effect, and we expect continued compliance with them will not have a material adverse effect on our capital expenditures, results of operations or financial position.

As a company with global operations, we are subject to the laws of the U.S. and multiple foreign jurisdictions in which we operate and the rules and regulations of various governing bodies, which may differ among jurisdictions. Compliance with these laws, rules and regulations has not had, and is not expected to have, a material effect on our capital expenditures, results of operations or competitive position.

Research and Development

The 3D printing industry continues to experience rapid technological change and developments in hardware, software and materials. Consequently, we have ongoing R&D programs to develop new products and to enhance our portfolio of products and services, as well as to improve and expand the capabilities of our solutions. Our efforts are often augmented by development arrangements with research institutions, including universities, customers, suppliers, assembly and design firms, engineering companies, materials companies, governments and other partners.

We are also engaged in various R&D efforts related to regenerative medicine. These efforts include the application of 3D printing technologies to the development of transplantable organs and non-organ human applications. These efforts are expected to result in new products that we will market directly or in conjunction with development or channel partners.

In addition to our internally developed technology platforms, we have acquired products and technologies developed by others by acquiring business entities that held ownership rights to such products and technologies. In other instances, we have licensed or purchased the intellectual property rights of technologies developed by third parties through agreements that may obligate us to pay a license fee or royalty, typically based upon a dollar amount per unit or a percentage of the revenue generated by such products.

Intellectual Property

We regard our technology platforms and materials as proprietary and seek to protect them through copyrights, patents, trademarks and trade secrets. At December 31, 2023 and 2022 we held 1,381 and 1,358 patents worldwide, respectively. At December 31, 2023 and 2022, we had 350 and 360 pending patent applications worldwide, respectively. The principal issued patents covering aspects of our various technologies will expire at varying times through the year 2034.

In addition, we are a party to various licenses that have had the effect of broadening the range of the patents, patent applications and other intellectual property available to us.

We have also entered into licensing or cross-licensing arrangements with various companies in the U.S. and other countries that enable those companies to utilize our technologies in their products or that enable us to use their technologies in our products. Under certain of these licenses, we are entitled to receive, or we are obligated to pay, royalties for the sale of licensed products in the U.S. or in other countries. The amount of such royalties was not material to any of our annual results of operations or financial position for the three-year period ended December 31, 2023.

We believe that, while our patents and licenses provide us with a competitive advantage, our success also depends on our marketing, business development, applications know-how and ongoing R&D efforts. Accordingly, we believe the expiration of any of the patents, patent applications, or licenses discussed above would not be material to our business or financial position.

Competition

We compete with other suppliers of 3D printers, materials, software and healthcare solutions as well as with suppliers of conventional manufacturing solutions. We compete with these suppliers for customers as well as channel partners for certain of our products. Development of new technologies or techniques not encompassed by the patents that we own or license may result in additional future competition.

Our competitors operate both globally and regionally, and many of them have well-recognized brands and product lines.

We believe principal competitive factors include the functionality and breadth of our technology and materials, process and application know-how, total cost of operation of the solution, product reliability and the ability to provide a complete solution to meet customer needs. We believe that our future success depends on our ability to provide high-quality solutions, introduce new products and services to meet evolving customer needs and market opportunities, and to extend our technologies to new applications. Accordingly, our ongoing R&D programs are intended to enable us to continue technology advancement and develop innovative new solutions for the marketplace.

Sustainability

We deliver leading additive solutions for industrial and healthcare applications using innovative 3D printing technologies, powered by the expertise of our global team. Innovation is core to who we are and how we work. Our solutions enable our customers to meet key product needs and advance their business models. Looking to the future, sustainability will be an integral part of our innovation to address the evolving needs of our customers.

The effects of climate change and the heightened social, economic, and health challenges around the globe are transforming our business. We are considering these important topics as we design and execute our sustainability strategy. Our sustainability strategy is organized into four pillars: Empowering Innovation, Evolving the Future of Manufacturing, Advancing Customer Solutions, and Upholding Responsible Business Practices.

Empowering Innovation

We are focused on empowering innovation through our people to drive industry-leading solutions to maintain a competitive edge in additive manufacturing. We have instituted core talent strategies to prioritize the development of people, the diversity of talent to expand technology innovation, and the engagement of our global workforce. These strategies include investing in technical employee training and on-demand development resources, rewarding significant achievements in innovation, enabling cross-functional collaboration between our engineering, operations, and customer-facing teams, and creating opportunities for our diverse global workforce to connect.

Evolving the Future of Manufacturing

We offer a broad portfolio of additive manufacturing products and services and are evolving the future of manufacturing for our customers. Innovation and speed to market are critical for our customers, and leveraging additive manufacturing capabilities enables our customers to shorten their innovation cycle while reducing their environmental impact. Our products and customer solutions allow customers to optimize their supply chain to reduce lead times, enabling localized production to reduce logistics and transportation cost and environmental impact, advancing material design to address customer needs, and utilizing digitization for prototyping to reduce waste.

Advancing Customer Solutions

We provide solutions to empower our customers to address their evolving sustainability priorities. Our unique offerings of hardware, software, materials, and services provide application-specific solutions powered by the expertise of our global team of application engineers. We are maturing our product development activities to address our customers’ key environmental priorities, such as extending product lifespans, addressing material recyclability, and increasing energy and resource efficiency of our products and materials.

Upholding Responsible Business Practices

We believe we operate in a responsible and ethical manner and leverage corporate governance standards to operate with resiliency and sustain long-term value of our Company. We leverage this foundation to influence our sustainability strategy, including utilizing our governance structure for oversight of our sustainability program. We believe we operate responsible business practices across our sites with the goals of creating a safe, secure, healthy, and injury-free workplace, prioritizing product quality and safety in our design and manufacturing, and being responsible stewards of the environment by collecting and measuring environmental data to understand our carbon footprint.

Human Capital

At 3D Systems, our mission is to deliver leading additive solutions for industrial and healthcare applications. In support of this purpose, we are focused on empowering innovation through our people by sourcing top engineering and technology talent, advancing talent strategies to drive employee development and career progression, and seeking to ensure a safe and healthy work environment across our global sites.

As of December 31, 2023, we had 1,925 full-time and part-time employees, compared to 2,032 full-time and part-time employees as of December 31, 2022. We continue to evaluate our headcount needs as we streamline our organization and manage operating costs through our restructuring activities. Refer to the discussion of "Fiscal Year 2023 Restructuring Activities" in Part II, Item 7. "Management’s Discussion and Analysis of Financial Condition and Results of Operations," as well as Note 25 to our consolidated financial statements, for details regarding our previously announced and ongoing restructuring plan, which includes planned headcount reductions.

Our U.S. employees are not covered by collective bargaining agreements; however, some employees outside the U.S. are subject to local statutory employment and labor arrangements. We have not experienced any material work stoppages and believe that our relations with our employees are satisfactory.

Talent Management & Engagement

Our Company is advancing additive manufacturing through ongoing product innovation, and as such we recognize the importance of the retention, growth, and development of our employees – employees are necessary to achieving our long-term success. Our goal is to foster a workplace culture and employee experience that drives innovation with purpose, profitable growth, and delivers ‘extraordinary’ to our customers. To do so, we have established programs for acquiring strategic talent, developing our teams to build key capabilities and skills, and engaging, motivating, and retaining our employees to do their best work. We engage directly with employees to provide updates on our strategic priorities and Company progress, as well as solicit feedback through regular communications, global all-hands meetings, and business town hall updates. To address the evolving needs of our business, we perform strategic workforce and succession planning as well as ongoing evaluation of our organizational design, culture, and values.

Inclusion and Belonging

Employees span the Americas (56%), EMEA (35%), and APAC (9%) with approximately 44% of our employees located outside the U.S. This global representation promotes diversity of thought, experiences, culture, and backgrounds that enhances our ability to deliver innovative solutions to our customers, in support of our company value to ‘build great teams.’ We execute talent programs throughout the year in support of our commitment to maintain and engage our diverse workforce. Our talent sourcing activities focus on building our future talent pipeline and attracting top, diverse talent.

Throughout an employee’s career with 3D Systems, we are focused on fostering an engaged, inclusive, and purpose-driven culture through various company-wide programs. We are committed to fostering an environment where inclusion and belonging are central to how we work across our global teams and support employees with equitable opportunities to grow, contribute, develop, and thrive. Additionally, we extend our focus of inclusion within our local communities and strive to make a positive impact by serving our underserved populations through our 3D Gives Back volunteer program.

Compensation & Benefits

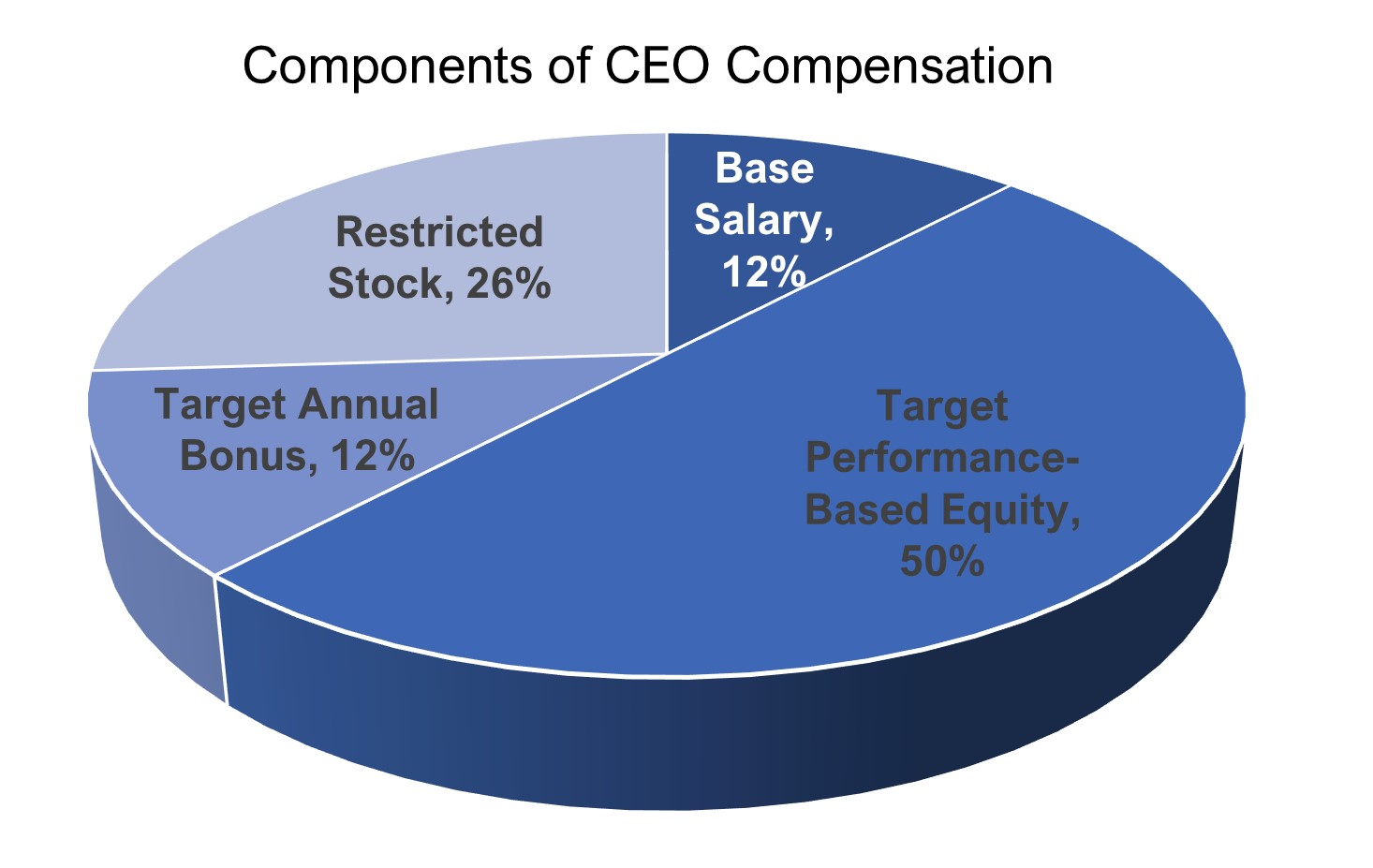

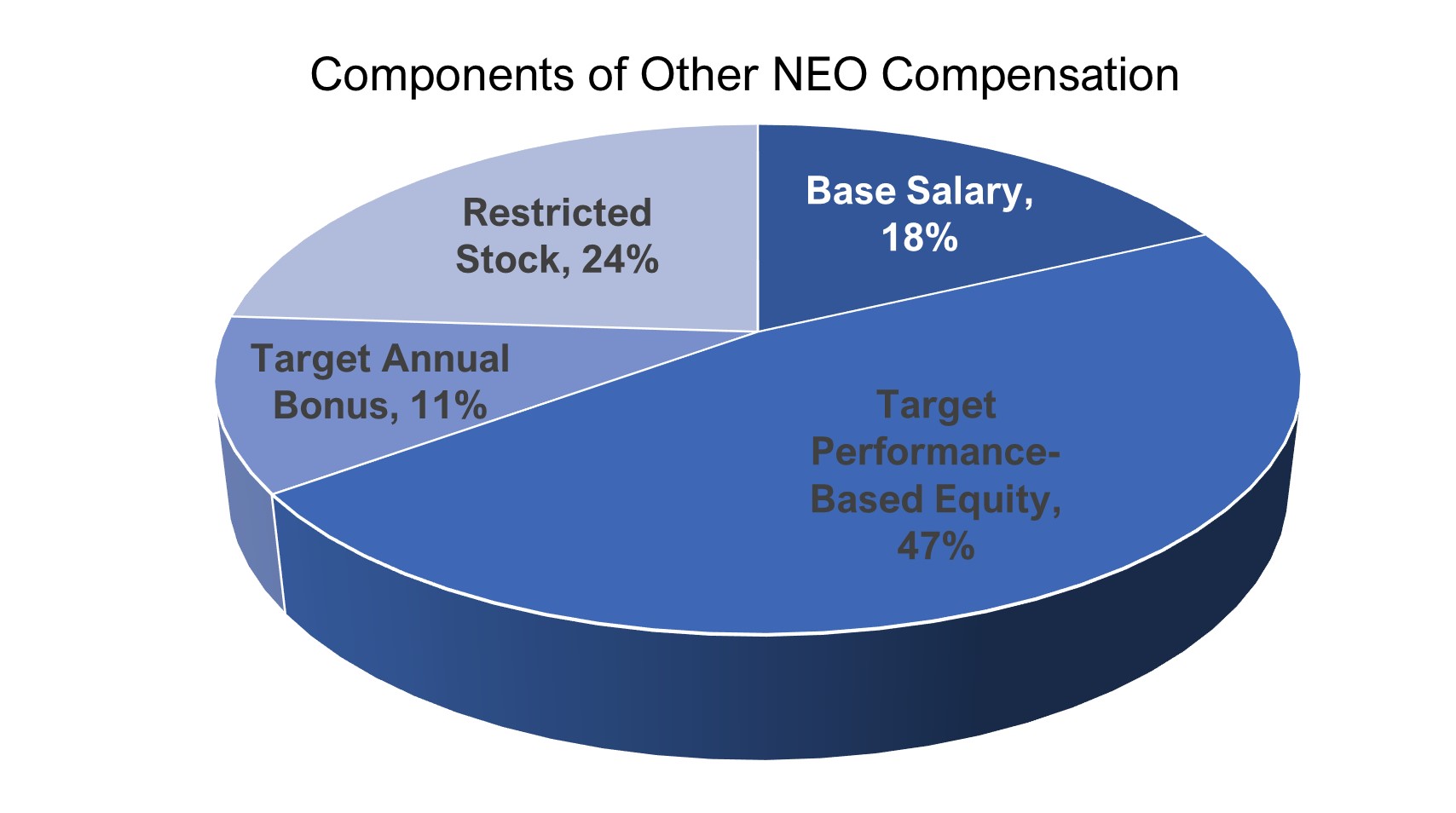

We design our compensation programs to be competitive and equitable to support employees in sharing in the success of 3D Systems. We tailor our compensation programs to attract and retain top talent to drive success in our current business priorities and emerging strategies. Additionally, we recognize that employees thrive when they have the resources to meet their needs and the time and support to succeed in their professional and personal lives. In support of this, we offer a wide variety of market competitive benefits to employees around the world. The Compensation Committee of the Board of Directors oversees the design of executive compensation and equity plans, which are designed to align executive pay to the delivery of long-term shareholder value.

Workplace Health & Safety

We are committed to creating a safe, secure, healthy, and injury-free work environment for our employees, customers, partners, and visitors. Our focus is on reducing significant safety risks and driving a strong safety culture through communication, awareness, and visible leadership. To assist in achieving this commitment, we provide substantial safety trainings and necessary equipment at all facilities, educating and encouraging our employees to proactively identify and eliminate unsafe actions and conditions. We have specific safety programs in place for those working in potentially high-hazard environments. We monitor injury and illness health and safety metrics across our organization to continually evaluate our safety programs to meet the needs of our teams.

Available Information

Refer to our website to learn more about our company culture, code of conduct, values, and sustainability initiatives. Our website address is www.3DSystems.com. The information contained on our website is neither a part of, nor incorporated by reference into, this Form 10-K or any other document that we file with or furnish to the Securities and Exchange Commission (“SEC”). We make available, free of charge through our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, amendments to those reports and other documents that we file with the SEC, as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC.

Many of our corporate governance materials, including our Code of Conduct, Code of Ethics for Senior Financial Executives and Directors, Corporate Governance Guidelines, current charters of each of the standing committees of the Board of Directors and our corporate charter documents and by-laws are available on our website.

Information about our Executive Officers

The information appearing in the table below sets forth the position or positions held by each of our executive officers and his or her age as of August 13, 2024. All of our executive officers serve at the pleasure of the Board of Directors. There are no family relationships among any of our executive officers or directors.

| | | | | |

| Name and Current Position | Age as of August 13, 2024 |

| Jeffrey A. Graves | 63 |

| President and Chief Executive Officer | |

| Jeffrey D. Creech | 61 |

| Executive Vice President and Chief Financial Officer | |

| Charles W. Hull | 85 |

| Executive Vice President and Chief Technology Officer for Regenerative Medicine | |

| Reji Puthenveetil | 56 |

| Executive Vice President, Additive Solutions and Chief Commercial Officer | |

| Phyllis Nordstrom | 46 |

| Executive Vice President, Chief People Officer and Chief Administrative Officer | |

| Joseph Zuiker | 60 |

| Executive Vice President, Engineering and Operations | |

| Andrew W. B. Wright | 55 |

| Senior Vice President, General Counsel and Secretary | |

Jeffrey A. Graves, President and Chief Executive Officer. Dr. Graves was appointed the Company’s President and Chief Executive Officer in May 2020. Prior to joining the Company, from 2012 to May 2020, Dr. Graves served as Chief Executive Officer, President and Director of MTS Systems Corporation, a global supplier of test, simulation, and measurement systems. From 2005 until 2012, Dr. Graves served as President and Chief Executive Officer of C&D Technologies, Inc., a technology company that produces and markets systems for the power conversion and storage of electrical power. Dr. Graves also held leadership roles with Kemet Corporation, an electronic component manufacturing company, as Chief Operating Officer from 2001 to 2003 and Chief Executive Officer from 2003 to 2005. Previously, he held a number of leadership and technical roles with General Electric, Rockwell Automation and Howmet Corporation. In addition to serving on the Company's Board of Directors, Dr. Graves serves on the board of directors of Integra Lifesciences Holdings Corporation.

Jeffrey D. Creech, Executive Vice President and Chief Financial Officer. Jeffrey D. Creech, Executive Vice President and Chief Financial Officer. Mr. Creech was appointed the Company’s Executive Vice President and Chief Financial officer in December 2023. Prior to joining the company, from 2022 to 2023, Mr. Creech was a Senior Director of The Finley Group, a niche consulting firm engaged primarily in the support, assistance, and remediation of companies in financial distress. Prior to joining the Finley Group, Mr. Creech was Chief Operating Officer and Chief Financial Officer at Nutramax Laboratories, a privately held manufacturer of human and animal health and dietary supplements, from April 2019 to November 2021, where his primary responsibilities included oversight of all financial and operational activities, human resources, and information technology. Prior to his tenure at Nutramax, from May 2017 to September 2018, Mr. Creech served as President of Springs Creative Products Group, a specialized textile operation, where his role included oversight, at an executive level, of most aspects of the Company’s operations.

Charles W. Hull, Executive Vice President, Chief Technology Officer for Regenerative Medicine. Mr. Hull is a founder of the Company and served as a member of our Board of Directors from 1993 to May 2022 when he was designated Director Emeritus. He has served as Chief Technology Officer since 1997, as Executive Vice President since 2000 and as Chief Technology Officer for Regenerative Medicine since 2021. Mr. Hull has also previously served in various other executive capacities at the Company since 1986, including Chief Executive Officer, Vice Chairman of the Board of Directors and President and Chief Operating Officer.

Reji Puthenveetil, Executive Vice President, Additive Solutions and Chief Commercial Officer. Mr. Puthenveetil has served as Executive Vice President, Additive Solutions and Chief Commercial Officer since January 2024. He previously served as Executive Vice President, Industrial Solutions since July 2020. In January 2024, Mr. Puthenveetil was appointed Executive Vice President, Additive Solutions. Prior to joining the Company, Mr. Puthenveetil spent 25 years as a management consultant for Group Newhouse helping companies, such as Lockheed Martin, Xcel Energy, Kia Motors, and Thales Group.

Phyllis Nordstrom, Executive Vice President, Chief People Officer and Chief Administrative Officer. Ms. Nordstrom has served as Executive Vice President, Chief People and Culture Officer and Chief Compliance Officer since August 2021. Effective December 2022, she was further appointed as the Company’s Chief Administrative Officer. Prior to joining 3D Systems, from May 2016 through July 2021, Ms. Nordstrom was Senior Vice President and Chief Risk & Compliance Officer at MTS Systems Corporation, where she was the leader of business ethics, corporate compliance, corporate sustainability, and internal audit and risk management. Over her 22-year career, Ms. Nordstrom has also held multiple leadership roles at PricewaterhouseCoopers, Target, and US Bank.

Joseph Zuiker, Executive Vice President, Engineering and Operations. Dr. Zuiker has served as Executive Vice President of Engineering and Operations since December 2022. Prior to joining 3D Systems, Dr. Zuiker served as Vice President of Engineering, Operations, and Order Fulfillment for MTS Systems Corporation where he worked from July 2017 until December 2022. Prior to joining MTS Systems, he was Senior Director of Technology for Halliburton Corporation’s Sperry Drilling from September 2011 to July 2016. Dr. Zuiker also worked for General Electric from December 1995 to August 2011 in various roles of increasing responsibility, including General Manager of GE Gasification Technology, General Manager of GE Hydro Technology, and Six Sigma Master Black Belt.

Andrew W. B. Wright, Senior Vice President, General Counsel and Secretary. Mr. Wright has served as Senior Vice President, General Counsel and Secretary since June 2024. Prior to joining 3D Systems, from November 2017 to June 2024, he was General Counsel and Secretary for Akoustis Technologies, Inc. Prior to joining Akoustis, from August 2013 to November 2017, he held Assistant General Counsel and Associate General Counsel roles at Toshiba Global Commerce Solutions, Inc. Prior to joining Toshiba Global Commerce Solutions, from January 1998 to August 2013, he held multiple roles of increasing responsibility within the IBM Corporation legal department supporting IBM Systems and Technology Group and IBM Software Group. Prior to joining IBM Corporation, from August 1994 to December 1997, Mr. Wright worked at Parker, Poe, Adams & Bernstein L.L.P.

Item 1A. Risk Factors

You should carefully read the following discussion of significant factors, events and uncertainties when evaluating our business and the forward-looking information contained in this Form 10-K. The events and consequences discussed in these risk factors could materially and adversely affect our business, operating results, liquidity and financial condition. While we believe we have identified and discussed below the key risk factors affecting our business, these risk factors do not identify all the risks we face, and there may be additional risks and uncertainties that we do not presently know or that we do not currently believe to be significant that may have a material adverse effect on our business, operating results, liquidity or financial condition in the future.

Operational & Financial Risk Factors

Current macro-economic trends have been adversely affecting, and could continue to adversely affect, our business, results of operations and financial condition due to their impact on the industries in which we and our customers operate, and due to the unknown speed, extent and nature of the reversal of those trends.

Certain global macro-economic trends have been adversely impacting the global economic environment and have contributed towards inflationary pressures on many goods, commodities and services globally. The high rates of inflation globally have caused governments and central banks to act to curb inflation, including by raising interest rates, which is intended to temper economic activity and which, if more powerful than intended, could trigger recessionary conditions in individual countries or regions, or globally. These macro-economic trends have been impacting our target markets and our results of operations. For example, rising interest rates, which are meant to slow down inflation, have been worsening credit/financing conditions for our customers and adversely impacting their ability to purchase our products.

While we believe that we are well-positioned to withstand the current adverse macro-economic trends, given our balance sheet (primarily due to our reserves of cash and cash equivalents) and our emphasis on operational efficiencies and execution, we continue to monitor the situation, assessing further implications for our operations, supply chain, liquidity, cash flow and customer orders, in an effort to mitigate potential new adverse consequences should they arise. However, there is no assurance that we will succeed at doing so.

Current or future downturns could also have a material adverse impact on our business partners’ stability and financial strength. Given the uncertainties associated with these trends in the current macro-economic environment, it is difficult to fully assess the magnitude of their effects on our, and our business partners’, business, financial condition and results of operations. The trends associated with the current economic environment may also have the effect of amplifying many of the other risks described herein.

The loss of, continued reduction or substantial decline in revenue from larger clients could have a material adverse effect on our revenues, profitability and liquidity.

We have experienced revenue concentration with a large customer that for the years ended December 31, 2023, 2022, and 2021 represented approximately 15%, 23% and 22% of our consolidated revenue, respectively. During the year ended December 31, 2023, the revenue recognized from this large customer declined approximately 41% as compared to the year ended December 31, 2022. Generally, our contracts do not contain guarantees of minimum duration, revenue levels, or profitability. This customer may terminate its contracts or may materially further reduce its requested levels of products or services at any time. The further loss of revenue from, deterioration of the financial condition of, or a significant change to the business of this customer could have a material adverse effect on our business, financial condition, and results of operations. Additionally, this concentration exposes us to concentrated credit risk, as a significant portion of our accounts receivable may be from a single customer. If we are unable to collect our receivables, or are required to take additional reserves, our results of operations and cash flow from operations will be adversely affected.

Changes in business conditions may cause goodwill and other intangible assets to become impaired.

Goodwill and other intangible assets are subject to an impairment test on an annual basis and when circumstances indicate that an impairment is more likely than not. Such circumstances include a significant adverse change in the business climate or a decision to dispose of a business or product line. We face some uncertainty in our business environment due to a variety of challenges, including changes in customer demand and a recent decline in our market capitalization as a result of a decrease in our stock price. While we recorded an impairment charge of $279.8 million related to our goodwill during 2023, we may experience additional unforeseen circumstances that adversely affect the value of our goodwill or intangible assets and trigger an evaluation of the amount of the recorded goodwill and intangible assets. Future write-offs of goodwill or other intangible assets as a result of an impairment in the business could materially adversely affect our results of operations and financial condition.

Our uneven sales cycle makes planning and inventory management difficult and future financial results less predictable.

Our quarterly sales often have reflected a pattern in which a disproportionate percentage of each quarter’s total sales occur towards the end of the quarter, in particular for sales of hardware and software products. This uneven sales pattern makes predicting net revenue, earnings, cash flow from operations and working capital for each financial period difficult, increases the risk of unanticipated variations in our quarterly results and financial condition and places pressure on our inventory management and logistics systems. If predicted demand is substantially greater than orders, there may be excess inventory. Alternatively, if orders substantially exceed predicted demand, we may not be able to fulfill all of the orders received in each quarter and such orders may be canceled. Furthermore, depending on when they occur in a quarter, developments such as an information systems failure, component pricing movements, component shortages or global logistics disruptions could adversely impact our inventory levels and results of operations in a manner that is disproportionate to the number of days in the quarter affected.

The variety of products that we sell could cause significant quarterly fluctuations in our gross profit margins, and those fluctuations in margins could cause fluctuations in operating income or loss and net income or loss.

We continuously work to expand and improve our products, materials and services offerings, geographic areas in which we operate and the distribution channels we use to reach various target product applications and customers. This variety of products, applications, channels and regions involves a range of gross profit margins that can cause substantial quarterly fluctuations in gross profit and gross profit margins depending upon the mix of product shipments from quarter to quarter. Additionally, the introduction of new products or services may further heighten quarterly fluctuations in gross profit and gross profit margins due to manufacturing ramp-up and start-up costs. We may experience significant quarterly fluctuations in gross profit margins or operating income or loss due to the impact of the mix of products, offerings, geographic areas and distribution channels we use to sell our products, materials and offerings from period to period.

Our products and services may experience quality problems from time to time that can result in decreased sales and operating margin, product returns, product liability, and warranty or other claims that could result in significant expenses and harm to our reputation.

We sell complex hardware and software products, materials and services that can contain undetected design and manufacturing defects or errors when first introduced or as enhancements are released that, despite testing, are not discovered until after the product has been installed and used by customers. Sophisticated software and applications, such as those sold by us, may contain “bugs” that can unexpectedly interfere with the software’s intended operation. Defects may also occur in components and products we purchase from third parties. There can be no assurance we will be able to detect and fix all defects in the hardware, software, materials and services we sell. Failure to do so could result in lost revenue, product returns, product liability, delayed market acceptance of those products and services, claims from distributors, end-users or others, increased end-user service and support costs, and significant warranty claims and other expenses to correct the defects. Additionally, such quality problems may result in a diversion of management time and attention and harm to our reputation.

We also sell end-use parts to customers in the aerospace, medical, and semiconductor industries and 3D printing systems to customers in the aerospace industry, which carry with them a greater potential for liability claims against us. In the case of end-use parts, our sales to customers in the aerospace, medical, and semiconductor industries, in particular, makes us more susceptible to product and other liability claims, which characterize operations in those industries. Sales of our 3D printing systems to customers in the aerospace industry similarly carry with them potential liability claims if the parts produced by those systems do not function properly. Any such claims that are not adequately covered by insurance or for which insurance is not available may adversely affect our results of operations and financial condition.

We depend on external vendors and suppliers for the components and spare parts for our 3D printers and for chemicals and packaging used in our materials. Supply and logistical disruptions occur periodically for many of our supply chain partners. If these relationships were to terminate or these or other disruptions, such as extreme weather events, worsen, our business could be disrupted while we locate alternative sources of supply and our expenses may increase.

We purchase components and sub-assemblies for our printers from third-party suppliers that we provide to our customers as spare parts. Additionally, we purchase raw chemicals and packaging that are used in our materials, as well as certain of those materials, from third-party suppliers.

While there are typically several potential suppliers of parts for our products, we currently choose to use only one or a limited number of suppliers for several of these items, including our lasers, materials and certain jetting components. Our reliance on a single or limited number of suppliers involves many risks, including, among others, the following:

•Potential shortages of some key components;

•Disruptions in the operations of these suppliers;

•Product performance shortfalls; and

•Reduced control over delivery schedules, assembly capabilities, quality and costs.

Increased occurrence of extreme weather events, increased temperature, and related disruptions may impact our ability to reliably procure key inputs from third-party suppliers, which could increase our costs and interrupt supply and adversely impact our business.

Periodic delays on the inbound supply chain at our partners and our own facilities have also created challenges. We continue to identify alternative solutions, but an inability to source from alternative suppliers in a timely manner could impact on our ability to fulfill demand.

While we believe that, if necessary, we can obtain all the components necessary for our spare parts and materials from other manufacturers, we require any new supplier to become “qualified” pursuant to our internal procedures, which could involve evaluation processes of varying durations. Our spare parts and raw chemicals used in our materials production are subject to various lead times. In addition, at any time, certain suppliers may decide to discontinue production of a part or raw material that we use, or may not have supplies available due to supplier business disruption. Any unanticipated change in the sources of our supplies, or unanticipated supply limitations, could increase production or related costs and consequently reduce margins.

If our forecasts exceed actual orders, we may hold large inventories of slow-moving or unusable parts, which could have an adverse effect on our cash flow, profitability and results of operations. Inversely, we may lose orders if our forecast is low and we are unable to meet demand. There is considerable uncertainty on the business impact from labor and supply limitations on our vendors, suppliers, and partners. If disruptions to global businesses continue or worsen it could have a material adverse effect on our financial condition and results of operations.

We are subject to environmental, health and safety laws and regulations related to our operations and the use of our systems and materials, including requirements imposed due to use of our products by our customers, which could subject us to compliance costs and/or potential liability in the event of non-compliance.

The export of our products internationally subjects us to environmental laws and regulations concerning the import and export of chemicals and hazardous substances such as the United States Toxic Substances Control Act, or TSCA, and the Registration, Evaluation, Authorization and Restriction of Chemical Substances, or REACH. These laws and regulations require the testing and registration of some chemicals that we ship along with, or that form a part of, our systems and other products. If we fail to comply with these or similar laws and regulations, we may be required to make significant expenditures to reformulate the chemicals that we use in our products and materials or incur costs to register such chemicals to gain and/or regain compliance. Additionally, we could be subject to significant fines or other civil and criminal penalties should we not achieve such compliance.

We are furthermore subject to extensive environmental, health and safety laws, regulations and permitting requirements in multiple jurisdictions due to our use of chemicals and production of waste materials as part of our operations and in connection with the operation of our systems by our customers. In certain cases, the required compliance with health or safety regulations is imposed by our customers themselves. These laws, regulations and requirements (which include the Directive on Waste Electrical and Electronic Equipment of the European Union (EU) and the EU Directive on Restriction of Use of Certain Hazardous Substances) govern, among other things, the generation, use, storage, registration, handling and disposal of chemicals and waste materials, the presence of specified substances in electrical products, the emission and discharge of hazardous materials into the ground, air or water, the cleanup of contaminated sites, including any contamination that results from spills due to our failure to properly dispose of chemicals and other waste materials and the health and safety of our employees. Under these laws, regulations and requirements, we could also be subject to liability for improper disposal of chemicals and waste materials, including those resulting from the use of our systems and accompanying materials by end-users. These or future laws and regulations could potentially require the expenditure of significant amounts for compliance and/or remediation. If our operations fail to comply with such laws or regulations, we may be subject to fines and other civil, administrative or criminal sanctions, including the revocation of permits and licenses necessary to continue our business activities. In addition, we may be required to pay damages or civil judgments in respect of third-party claims, including those relating to personal injury (including exposure to hazardous substances that we generate, use, store, handle, transport, manufacture or dispose of), property damage or contribution claims. Some environmental laws allow for strict, joint and several liabilities for remediation costs, regardless of fault. We may be identified as a potentially responsible party under such laws. If we fail to comply with any such regulations or are subject to related liability, such developments could have a material adverse effect on our business, financial condition and results of operations.

If we do not generate net cash flow from operations and if we are unable to raise additional capital, our financial condition could be adversely affected and we may not be able to execute our business strategy.

We cannot assure you that we will generate cash from operations or identify and secure other potential sources to fund future working capital needs and meet capital expenditure requirements.

If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring or incurring additional debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to obtain additional capital or refinance any indebtedness will depend on, among other things, the capital markets, our financial condition at such time and the terms and conditions of any such financing or indebtedness. We may not be able to engage in any of these activities or engage in these activities on desirable terms.

The lack of additional capital resulting from any inability to generate cash flow from operations or to raise equity or debt financing could force us to substantially curtail or cease operations and would, therefore, have an adverse effect on our business and financial condition. Furthermore, we cannot assure you that any necessary funds, if available, would be available on attractive terms or that they would not have a significantly dilutive effect on our existing stockholders. If our financial condition were to worsen and we become unable to attract additional equity or debt financing or enter into other strategic transactions, we would not be able to execute our business strategy and we could default on our debt obligations, become insolvent or be forced to declare bankruptcy.

Our business could be adversely impacted in the event of a failure of our information technology infrastructure or a successful cyber-attack.

We extensively rely on information technology systems and networks to operate our Company and meet our business objectives. Due to evolving cybersecurity threats, it has and will continue to be difficult to prevent, detect, mitigate, and remediate cybersecurity incidents. We experience cybersecurity threats, threats to our information technology infrastructure, and unauthorized attempts to gain access to our sensitive information. We face threats that vary from those common to most industries, to more advanced and persistent threats from highly organized adversaries who target us because of the products and services we provide. We also rely on information technology and third-party vendors to support our operations, including our secure processing of personal, confidential, sensitive, proprietary and other types of information. To date, risks from cybersecurity threats, including as a result of previous cybersecurity incidents, have not materially affected us, including our business strategy, results of operations, or financial condition, but we face ongoing risks from cybersecurity threats that may from time to time in the future cause material adverse impacts on our business strategy, results of operations, or financial condition. Despite ongoing efforts to continually improve our and our vendors’ ability to protect against cybersecurity threats and the implementation of various safeguards, including increasing our cyber insurance, regularly conducting company-wide cybersecurity awareness training, and establishing a dedicated team of personnel to address cyber-based threats, we may not be able to fully protect all information systems, and such incidents may lead to reputational harm, revenue and customer loss, and legal action, among other consequences.

We are subject to numerous laws, regulations, and contractual obligations designed to protect our regulated data, and that of our customers. These include complex and evolving laws, rules, regulations, and standards in many jurisdictions, as well as contractual obligations, relating to cybersecurity and data privacy. Such laws, rules, regulations, and standards pose increasingly complex compliance challenges and potential costs. Any loss of sensitive information and failure to comply with these requirements or other applicable laws and regulations in this area, could result in significant regulatory non-compliance exposure or other penalties and legal liabilities.

We may also need to expend additional resources to adapt our cybersecurity program to the evolving threat landscape and to investigate and remediate vulnerabilities or other identified risks. Given the persistence, sophistication, volume, and novelty of threats we face, we may not be successful in preventing or mitigating cybersecurity threats that could have a material adverse effect on us. The costs related to cybersecurity threats or other disruptions may also not be fully insured or indemnified by other means. Such events could result in the loss of competitive advantages derived from our R&D efforts or other intellectual property, which could result in early obsolescence of our products and services. The occurrence of any of these events could adversely affect our internal operations, the services we provide to our customers, impact our financial results and reputation, or result in litigation, fines, and penalties.

Servicing and/or refinancing our debt may require a significant amount of cash, and we may not have sufficient cash or the ability to raise the funds necessary to settle conversions of the 0% convertible senior notes due 2026 ("the Notes") in cash, repay the Notes at maturity, or repurchase the Notes as required following a fundamental change.

As of December 31, 2023, we had approximately $324.9 million outstanding of the Notes, which amount has been further reduced to $214.4 million in connection with the repurchase of $110.5 million of outstanding Notes on March 8, 2024. Our ability to service and/or refinance our remaining indebtedness, including the Notes, or to make cash payments in connection with any conversions of the Notes, depends on our future performance, which is subject to economic, financial, competitive, and other factors beyond our control. Our business may not generate cash flow from operations in the future sufficient to service our debt and make necessary capital expenditures. If we are unable to generate such cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt, or obtaining additional debt financing or equity capital on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations. In addition, any of our future debt agreements may contain restrictive covenants that may prohibit us from adopting any of these alternatives. The Company’s failure to file this Form 10-K and provide it to the trustee by April 1, 2024 represents a default under the terms of the Indenture. In addition, the Company’s failure to file its Form 10-Q for the three months ended March 31, 2024 and provide it to the trustee by May 30, 2024 represented an incremental default under the terms of the Indenture. These defaults will become an event of default under the terms of the Indenture if the Company fails to file this Form 10-K and its Form 10-Q for the three months ended March 31, 2024 prior to the end of the cure period provided for by the Indenture. Accordingly, our failure to comply with these or other covenants of the Indenture could result in an event of default which, if not cured or waived, could result in the acceleration of our debt or cause us to incur special interest payments. For further information regarding the non-compliance with the terms of the Indenture, refer to Note 26 to the consolidated financial statements included in Item 8 of this Form 10-K.

In the event the conditional conversion feature of the Notes is triggered, holders of Notes will be entitled to convert the Notes at any time during specified periods at their option. If one or more holders elect to convert their Notes, we would be required to settle any converted principal through the payment of cash, which could adversely affect our liquidity. In addition, even if holders do not elect to convert their Notes, we could be required under applicable accounting rules to reclassify all or a portion of the outstanding principal of the Notes as a current rather than long-term liability, which would result in a material reduction of our net working capital.

In addition, holders of the Notes have the right to require us to repurchase all or a portion of their Notes upon the occurrence of a fundamental change (as defined in the applicable indenture governing the Notes) at a repurchase price equal to 100% of the principal amount of the Notes to be repurchased. If the Notes have not previously been converted or repurchased, we will be required to repay such Notes in cash at maturity.

Our ability to make required cash payments in connection with conversions of the Notes, repurchase the Notes in the event of a fundamental change, or to repay or refinance the Notes at maturity will depend on market conditions and our future performance, which is subject to economic, financial, competitive, and other factors beyond our control. As a result, we may not have enough available cash or be able to obtain financing at the time we are required to repurchase or repay the Notes or pay cash with respect to Notes being converted.

Our operations and business performance could suffer if we are unable to attract and retain senior management or other key employees.

Our success depends largely on our ability to attract, hire, develop, and retain senior management and key employees, such as engineers, scientists, and other key skilled employees supporting our products and services.

Our senior management team is critical to the leadership of our business operations and the development and execution of our business strategy. When changes occur within senior management or within key employee roles, we are required to manage the continuity of our business, and typically incur incremental costs including search costs, relocation costs, and timing associated with onboarding and knowledge transfer. High demand exists for senior management and other key employees with experience in additive manufacturing and certain technical skills, and there can be no assurance that we will be able to attract and retain such talent. We experience intense competition for qualified talent.

While we aim to provide competitive compensation packages to attract and retain senior management and key employees and engage in regular succession planning for these positions, larger competitors with more resources available to them can make it difficult for us to successfully compete for key talent. If we cannot attract and retain sufficiently qualified talent, such as engineers, scientists, and other key technically skilled employees, or have an adequate succession plan in place, we may be unable to develop, commercialize, and sell new or existing products and services. Furthermore, increasing competition for critical technical skills in the regions surrounding our facilities could require us to pay more to hire and retain key employees, thereby increasing labor costs.

Business Strategy Risk Factors