UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-475

A. O. Smith Corporation

(Exact name of registrant as specified in its charter)

Delaware

(State of Incorporation)

11270 West Park Place, Milwaukee, Wisconsin

(Address of Principal Executive Office)

39-0619790

(I.R.S. Employer Identification No.)

53224

(Zip Code)

(414) 359-4000

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Shares of Stock Outstanding January 31, 2025 | | Name of Each Exchange on

Which Registered |

Class A Common Stock

(par value $5.00 per share) | | None | | 25,870,069 | | Not listed |

Common Stock

(par value $1.00 per share) | | AOS | | 118,089,097 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ¨ No.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Emerging growth company | ☐ |

| | | | | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by a check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) ☐ Yes ☒ No

The aggregate market value of voting stock held by non-affiliates of the registrant was $66,240,083 for Class A Common Stock and $9,664,355,425 for Common Stock as of June 30, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | |

| 1. | Portions of the company’s definitive Proxy Statement for the 2025 Annual Meeting of Stockholders (to be filed with the Securities and Exchange Commission under Regulation 14A within 120 days after the end of the registrant’s fiscal year and, upon such filing, to be incorporated by reference in Part III). |

A. O. Smith Corporation

Index to Form 10-K

Year Ended December 31, 2024

PART 1

ITEM 1 – BUSINESS

As used in this annual report on Form 10-K, references to the “Company,” “A. O. Smith,” “AOS,” “we,” “us,” and “our” refer to A. O. Smith and its consolidated subsidiaries. The following discussion should be read in conjunction with our consolidated financial statements and notes thereto under “Item 8 Financial Statements and Supplementary Data” in this annual report on Form 10-K. Our company is comprised of two reporting segments: North America and Rest of World. Both segments manufacture and market comprehensive lines of residential and commercial gas and electric water heaters, boilers, heat pumps, tanks and water treatment products. Both segments primarily manufacture and market in their respective regions of the world. Our Rest of World segment is primarily comprised of China, Europe and India.

NORTH AMERICA

Sales in our North America segment accounted for approximately 77 percent of our total sales in 2024. This segment serves residential and commercial end markets with a broad range of products including:

Water heaters. Our residential and commercial water heaters primarily come in sizes ranging from 40 to 80 gallon models, however, we also offer sizes as low as 2.5 gallon (point-of-use) and as high as 2,500 gallon products with varying efficiency ranges. We offer electric, natural gas and liquid propane tank-type models as well as tankless (gas and electric), heat pump and solar tank units. Typical applications for our water heaters include residences, restaurants, hotels, office buildings, laundries, car washes, schools and small businesses.

Boilers. Our residential and commercial boilers range in size from 45,000 British Thermal Units (BTUs) to 6.0 million BTUs. Boilers are closed loop water heating systems used primarily for space heating or hydronic heating. Our boilers are primarily used in applications in commercial settings for hospitals, schools, hotels and other large commercial buildings while residential boilers are used in homes, apartments and condominiums.

Water treatment products. With the acquisition of Aquasana, Inc. (Aquasana) in 2016 we entered the water treatment market. We expanded our product offerings and geographic footprint with the acquisitions of Hague Quality Water International (Hague) in 2017, Water-Right, Inc. (Water-Right) in 2019, Master Water Conditioning Corporation (Master Water) in 2021, Atlantic Filter Corporation (Atlantic Filter) in 2022, Water Tec of Tucson, Inc (Water Tec) in 2023 and Impact Water Products (Impact) in 2024. Our water treatment products range from point-of-entry water softeners, solutions for problem well water, whole-home water filtration products and point-of-use carbon and reverse osmosis products. We also offer a comprehensive line of commercial water treatment and filtration products. Typical applications for our water treatment products include residences, restaurants, schools and offices.

Other. In our North America segment, we also manufacture expansion tanks, commercial solar water heating systems, swimming pool and spa heaters, related products and parts.

A significant portion of our North America sales is derived from the replacement of existing products.

We believe we are the largest manufacturer and marketer of water heaters in North America with a leading share in both the residential and commercial portions of the market. We expanded our presence in North America with our acquisition of Giant Factories, Inc. (Giant), a Canada-based manufacturer of residential and commercial water heaters, which we acquired in late 2021. In the commercial segments of the market for both water heating and space heating, we believe our comprehensive product lines and our high-efficiency products give us a competitive advantage. Our wholesale distribution channel, where we sell our products primarily under the A. O. Smith and State brands, includes approximately 900 independent wholesale plumbing distributors serving residential and commercial end markets. We also sell our residential water heaters through the retail and maintenance, repair and operations (MRO) channels. In the retail channel, our customers include four of the six largest national hardware and home center chains, including a long-standing exclusive relationship with Lowe’s where we sell A. O. Smith branded products.

Our Lochinvar brand is one of the leading residential and commercial boiler brands in North America. Approximately 45 percent of Lochinvar branded sales consist of residential and commercial water heaters while the remaining 55 percent of Lochinvar branded sales consist primarily of boilers and related parts. Our commercial boiler distribution channel is primarily comprised of manufacturer representative firms with the remainder of our Lochinvar branded products being distributed through wholesale channels.

In our water treatment business we sell through a variety of channels. We sell our A. O. Smith branded water treatment products primarily through our water quality, dealer network and Amazon. Our Aquasana branded products are primarily sold directly to consumers through e-commerce channels. Our water softener products and problem well water solutions, which

include the Hague, Water-Right, Master Water, Atlantic Filter, Impact, and Water Tec brands, are sold through water quality dealers and contractors. Our water softener products are also sold through home center retail chains.

Our energy-efficient product offerings continue to be a sales driver for our business. Our condensing commercial water heaters and boilers continue to be an option for commercial customers looking for high-efficiency water and space heating with a short payback period through energy savings. We offer residential heat pumps, condensing tank-type and tankless water heaters in North America, as well as other higher efficiency water heating solutions to round out our energy-efficient product offerings. We recently launched our newly designed ADAPT condensing gas tankless water heater and VERITUS air source commercial heat pump water heater to align with greenhouse gas emission reduction trends across the U.S.

We sell our products in highly competitive markets. We compete in each of our targeted market segments based on product design, reliability, quality of products and services, advanced technologies, energy efficiency, maintenance costs and price. Our principal water heating and boiler competitors in North America include Rheem, Bradford White, Rinnai, Aerco and Navien. Numerous other manufacturing companies also compete. Our principal water treatment competitors in the U.S. are Culligan, Kinetico, Pentair, Franklin Electric and Ecowater as well as numerous regional assemblers.

REST OF WORLD

Sales in our Rest of World segment accounted for approximately 23 percent of our total sales in 2024, a majority of which were in China. We have operated in China for nearly 30 years. In that time, we have established A. O. Smith brand recognition in the residential and commercial markets. We manufacture and market residential water heater and water treatment products, primarily incorporating reverse osmosis technology, and commercial dispensing water treatment products. The Chinese water heater market is predominantly comprised of electric wall-hung, gas tankless, combi-boiler, heat pump and solar water heaters. We believe we are one of the market leaders of water heaters and reverse osmosis water treatment products to the residential market in China in dollar terms. We also design and market kitchen products (range hoods, cooktops, steam ovens, and dishwashers) and connected product technology in China.

We sell our products in approximately 9,400 points of sale in China, of which approximately 4,400 are retail outlets in tier one through tier three cities and approximately 1,600 exclusively sell our products. We also sell our products through e-commerce channels. Our primary competitors in China in the water heater market segment are Haier/Casarte, Midea/COLMO, and Rinnai. Our principal competitors in the water treatment market are Angel, Haier/Casarte, Midea/COLMO, Truliva, and Xiaomi.

In 2008, we established a sales office in India and began importing products specifically designed for India. We began manufacturing water heaters in India in 2010 and water treatment products in 2015. In 2024, we expanded our product offerings and geographic footprint with the acquisition of Pureit, a Unilever PLC business. Pureit offers a broad range of residential water purification solutions in India and other South Asian markets. We continue to increase our product offerings and sales in this country, primarily through wholesale, e-commerce and retail channels. Our primary competitors in India are Racold, Bajaj and Havells in the water heater market and Eureka Forbes and Kent in the water treatment market.

We also sell water heaters in the European, Middle East, and Far East markets and water treatment products in Vietnam, all of which combined comprised less than 14 percent of total Rest of World sales in 2024.

RAW MATERIALS

Raw materials for our manufacturing operations, primarily consisting of steel, are generally available in adequate quantities. A portion of our customers are contractually obligated to accept price changes based on fluctuations in steel prices. There has been volatility in steel costs over the last several years. In addition tariffs could potentially increase volatility in steel and other input materials.

RESEARCH AND DEVELOPMENT

To improve our competitiveness by generating new products and processes, we conduct research and development at our Corporate Technology Center in Milwaukee, Wisconsin, our Global Engineering Center in Nanjing, China, and our operating locations. Our total expenditures for research and development in 2024, 2023 and 2022 were $101.7 million, $97.5 million and $89.0 million, respectively.

PATENTS AND TRADEMARKS

We invest, own and use in our businesses various trademarks, trade names, patents, trade secrets and licenses. We monitor our intellectual property for infringements. Although we believe our trademarks, trade names, patents, trade secrets, and licenses to constitute a valuable asset in the aggregate, we do not regard our business as being materially dependent on any

single trademark, trade name, patent, trade secret, license or any group of related such rights. Our trade name is important with respect to our products, particularly in China, India, and North America.

HUMAN CAPITAL

We employed approximately 12,700 employees as of December 31, 2024 with approximately 7,200 in North America and 5,500 in Rest of World. A small portion of our workforce in the U.S. is represented by a labor union, while outside the U.S., we have employees in certain countries that are represented by employee representative organizations, such as an employee association, union, or works council.

Our Guiding Principles and Values. The foundation of how we conduct business and interact with our employees is outlined in A. O. Smith Corporation’s Guiding Principles and our Statement of Values. These principles and values help to shape how we hire, train and treat our employees, emphasizing teamwork and promoting diversity in seeking our objectives. We believe that our Guiding Principles and Values shape the critical elements of our effort to attract, retain and develop talent. In 2024, we were named by Ethisphere on the list of the World’s Most Ethical Companies. The annual list recognizes global companies dedicated to integrity, sustainability, governance, and community with a commitment to ethical behavior, accountability, and driving positive change.

Culture and Employee Engagement. We conduct a Global Employee Engagement Survey on a biannual basis. This third party managed survey measures employees’ level of engagement against external norms and provides us with actionable feedback that drives improvement priorities. Participation in our most recent survey in 2024 was 93 percent, which we believe reflects our employees’ desire to share their perspectives and a commitment to continuous improvement. Survey results help shape action plans to further improve our culture and we will conduct the survey again in 2026.

Diversity and Inclusion. As reflected in our Guiding Principles, we strive to create a workplace where people from all backgrounds can thrive and achieve their fullest potential. Our commitment to this objective starts at the top with our Board of Directors, which is 40 percent diverse from either a gender or ethnic/racial perspective.

Compensation and Benefits. We provide what we believe is a robust total compensation program designed to be market-competitive and internally equitable to attract, retain, motivate and reward a high-performance workforce. Regular internal and external analysis is performed to ensure this market alignment. In addition to salaries, these programs, which vary by country, can include annual performance-based bonuses, stock-based compensation awards, retirement plans with employee matching opportunities, health benefits, health savings and flexible spending accounts, paid time off, family leave, and tuition assistance, among others.

Training and Development. We provide all employees with a wide range of professional development experiences, both formal and informal, to help them achieve their full potential. All of our salaried employees are given formal development plans. Some of the formal development programs that employees have access to include early-career leadership development programs, front-line leadership development programs, continuous improvement skill-building programs, core process technology councils and tuition reimbursement for degree programs or trade schools. To maintain our focus on career development all our salaried employees worldwide are required to have career conversations with their manager. Globally, all office and professional employees also have formal performance reviews and development plans with a focus on learning by doing. We expect our managers to work closely with their employees to ensure performance feedback and to conduct development discussions on a regular basis.

Safety. The safety of our people is always at the forefront of what we do. We provide safety training in our production facilities, designed to empower our employees with the knowledge and tools they need to make safe choices and mitigate risks. In addition to traditional training, we use standardized signage and visual management throughout our facilities. Since 1954, we have annually awarded the Lloyd B. Smith President's Safety Award, which acknowledges an A. O. Smith facility that demonstrates the most improvement over one year in the area of workplace safety.

BACKLOG

Due to the short-cycle nature of our businesses, our operations do not normally sustain significant backlogs.

GOVERNMENT REGULATIONS AND ENVIRONMENTAL MATTERS

Our operations, including the manufacture, packaging, labeling, storage, distribution, advertising and sale of our products, are subject to various federal, state, local and foreign laws and regulations. In the U.S., many of our products are regulated by the Department of Energy, the Consumer Product Safety Commission, and the Federal Trade Commission. State and local governments, through laws, regulations, and building codes, also regulate our water heating and water treatment products. Whether at the federal, state, or local level, these laws are intended to improve energy efficiency and product safety, and protect public health and the environment. In recent years, a number of states and local authorities have proposed or implemented bans on gas-fired products in new construction in an effort to address greenhouse gas emissions. Similar laws and regulations have been adopted by government authorities in other countries in which we manufacture, distribute, and sell our products. We offer a complete line of water and hydronic heating products, including electric-powered water heaters and boilers, and we believe that any reduction in fossil fuel-powered products would be counterbalanced by a corresponding increase in demand for our non-fossil fuel powered products. We are confident that our continued emphasis on product design and innovation, including energy efficiency, will keep us well positioned to deliver products demanded by customers, regardless of fuel source.

In addition, our operations are subject to federal, state and local environmental laws. We are subject to regulations of the U.S. Environmental Protection Agency and the Occupational Health and Safety Administration and their counterpart state agencies. Compliance with government regulations and environmental laws has not had and is not expected to have a material effect upon the capital expenditures, earnings, or competitive position of our company. See Item 3.

AVAILABLE INFORMATION

We maintain a website with the address www.aosmith.com. The information contained on our website is not included as a part of, or incorporated by reference into, this Annual Report on Form 10-K. We make available free of charge through our website our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports as soon as reasonably practical after we have electronically filed such material with, or furnished such material to, the Securities and Exchange Commission (SEC). All reports we file with the SEC are also available free of charge via EDGAR through the SEC’s website at www.sec.gov.

We are committed to sound corporate governance and have documented our corporate governance practices by adopting the A. O. Smith Corporate Governance Guidelines. The Corporate Governance Guidelines, Criteria for Selection of Directors, Financial Code of Ethics, the A. O. Smith Guiding Principles, as well as the charters for the Audit, Personnel and Compensation, Nominating and Governance and the Investment Policy Committees of the Board of Directors and other corporate governance materials, may be viewed on the Company’s website. Any waiver of or amendments to the Financial Code of Conduct or the A. O. Smith Guiding Principles would be posted on this website; to date there have been none. Copies of these documents will be sent to stockholders free of charge upon written request of the corporate secretary at the address shown on the cover page of this Annual Report on Form 10-K.

We are also committed to growing our business in a sustainable and socially responsible manner consistent with our Guiding Principles. This commitment has driven us to design, engineer and manufacture highly innovative and efficient products in an environmentally responsible manner that helps reduce energy consumption, conserve water and improve drinking water quality and public health. Consistent with this commitment, we issued our sustainability report biennially detailing our company’s historical and current efforts. We issued our fourth report, the 2024 sustainability report, in November 2024, documenting our environmental, social, and governance (ESG) activities over the past two years. This report details the positive impact of our highly efficient products, highlights our company’s commitment to employees and the communities in which we operate, reports on our progress toward our greenhouse gas emissions intensity reduction goal of 10 percent by 2025 (2019 baseline) and announced a new water goal to achieve an annual water savings of 40 million gallons by 2030 (2023 baseline). We have made significant progress toward our emission reduction goal and prevented over 560,000 metric tons of carbon emissions in 2023 through the sale of our high efficiency water heaters and boilers. Our ESG Scorecard (scorecard) reflecting our progress is available on our website. Our scorecard also provides information on our employee diversity, product stewardship, and recordable incident rate, among other items. Our Sustainability Report and scorecard are available on our website and not included as part of, or incorporated by reference into, this Annual Report on Form 10-K.

ITEM 1A – RISK FACTORS

In the ordinary course of our business, we face various strategic, operating, compliance and financial risks. These risks could have an impact on our business, financial condition, operating results and cash flows. The risks set forth below are not an exhaustive list of potential risks but reflect those that we believe to be material. You should carefully consider the risk factors set forth below and all other information contained in this Annual Report on Form 10-K, including the documents incorporated by reference, before making an investment decision regarding our common stock. If any of the events contemplated by the following risks were to actually occur, then our business, financial condition, or results of operations could be materially adversely affected. As a result, the trading price of our common stock could decline, and you may lose all or part of your investment.

Economic and Industry Risks

■The effects of global and regional economic conditions could have a material adverse effect on our business

A decline in economic activity, such as a recession or economic downturn, in the U.S., China, and other regions in the world in which we do business, could further adversely affect consumer confidence and spending patterns which could result in decreased demand for the products we sell, a delay in purchases, increased price competition, or slower adoption of energy-efficient water heaters and boilers, or high-quality water treatment products, which could negatively impact our profitability and cash flows. Such deterioration in economic conditions could arise from many factors or fears including public health crises, further deterioration in the property market, political instability or risk of government default. In addition, an increase in price levels generally or in particular industries, could result in a consumer shift away from the products we offer, including trading down to lower priced models, which could adversely affect our revenues and, at the same time, increase our costs. A deterioration in economic conditions also could negatively impact our vendors and customers, which could result in an increase in bad debt expense, customer and vendor bankruptcies, interruption or delay in supply of materials, or increased material prices, which could negatively impact our ability to distribute, market and sell our products and our financial condition, results of operations and cash flows.

■Import tariffs, taxes, customs duties and other trading regulations imposed by the U.S. government and retaliatory responses from other countries, could significantly increase the prices we pay for raw materials that are critical to our ability to manufacture our products

Import tariffs, taxes, customs duties and other trading regulations imposed by the U.S. government on foreign countries, or by foreign countries on the U.S., could significantly increase the prices we pay for raw materials that are critical to our ability to manufacture our products. And, we may be unable to find a domestic supplier to provide the necessary raw materials on an economical basis in the amounts we require. Also, the current U.S. administration has expressed a desire to impose substantial new or increased tariffs. Any widespread imposition of new or increased tariffs could increase the cost of and reduce the demand for our products and any cost increases will either require us to increase prices, foreclose our sales into impacted markets or negatively impact our profit margins. Any new or increased tariffs could also trigger retaliatory responses from other countries which may decrease the competitiveness of our products in foreign markets. New or increased tariffs could also negatively affect U.S. national or regional economies, which could negatively affect the demand for our products.

Unfavorable changes to import tariffs, taxes, customs duties and other trading regulations could have a material adverse effect on our financial condition, results of operations and cash flows.

■The occurrence or threat of extraordinary events, including natural disasters, political disruptions, terrorist attacks, public health issues, and acts of war, could significantly disrupt production, or impact consumer spending

As a global company with a large international footprint, we are subject to increased risk of damage or disruption to us and our employees, facilities, suppliers, distributors, or customers. Extraordinary events, including natural disasters, resulting from but not limited to climate change, political disruptions, terrorist attacks, public health issues and acts of war may disrupt our business and operations and impact our supply chain and access to necessary raw materials or could adversely affect the economy generally, resulting in a loss of sales and customers. Any of these disruptions or other extraordinary events outside of our control that impact our operations or the operations of our suppliers and key distributors could affect our business negatively, harming operating results.

Natural disasters and extreme weather conditions may disrupt the productivity of our facilities. For example, two of our manufacturing plants are located within a floodplain that has experienced past flooding events. We also have other manufacturing facilities located in hurricane and earthquake zones. We maintain insurance coverage and have taken steps to mitigate these physical risks related to natural disasters and extreme weather conditions. Although we have taken steps to

mitigate the risk of flooding, there is still the potential for natural disasters and extreme weather conditions to disrupt the productivity of our facilities.

Apart from the potential impact on our operations, these types of events also could negatively impact consumer spending in the impacted regions or depending on the severity, globally, which could materially and adversely affect our financial condition, results of operations and cash flows.

■Our business could be adversely impacted by changes in consumer purchasing behavior, consumer preferences, technological changes, and market trends

Consumer preferences for products and the methods in which they purchase products are constantly changing based on, among other factors, cost, performance, convenience, availability of government incentives, environmental and social concerns and perceptions. As consumer confidence changes, purchasing behavior may shift the product mix to lower priced models in the markets in which we participate or result in a shift to other distribution channels, for example e-commerce. Consumer preferences and broader trends, such as decarbonization and electrification efforts in response to climate change, may result in reduced demand for gas or fossil fuel-powered products and increased demand for higher efficiency products and/or more electric powered products. In addition, technologies are ever changing. Our ability to respond to these trends, timely transition our product portfolio, develop new and innovative products, and acquire and protect the necessary intellectual property rights is essential to our continued success, but cannot reasonably be assured. It is possible that we will not be able to develop new technologies, products or distribution channels, or do so on a timely basis, to align with consumer purchasing behavior and consumer preferences, which could materially and adversely affect our financial condition, results of operations and cash flows.

■Our operations could be adversely impacted by material and component price volatility, as well as supplier concentration

The market prices for certain materials and components we purchase, primarily steel, can be volatile. In recent years, we have also experienced inflation-related increases in our transportation and other costs. In addition tariffs could potentially increase volatility in steel and other input materials. Significant increases in the cost of any of the key materials and components we purchase would increase our cost of doing business and ultimately could lead to lower operating earnings if we are not able to recover these cost increases through price increases to our customers. Historically, there has been a lag in our ability to recover increased material costs from customers, and that lag, could negatively impact our profitability. In some cases, we are dependent on a limited number of suppliers for some of the raw materials and components we require in the manufacturing of our products. A significant disruption or termination of the supply from one of these suppliers could delay sales or increase costs which could result in a material adverse effect on our financial condition, results of operations and cash flows.

■Because we participate in markets that are highly competitive, our revenues and earnings could decline as we respond to competition

We sell all of our products in highly competitive and evolving markets. We compete in each of our targeted markets based on product design, reliability, quality of products and services, advanced technologies, product performance, maintenance costs and price. Some of our competitors may have greater financial, marketing, manufacturing, research and development and distribution resources than we have; others may invest little in technology or product development but compete on price and the rapid replication of features, benefits, and technologies, and some are increasingly expanding beyond their existing manufacturing or geographic footprints. New technologies and new competitors have developed and continue to develop in certain markets in which we participate, such as gas tankless and heat pump technologies in North America. While we design and manufacture these and other products, we cannot assure that our products will continue to compete successfully with those of our current competitors and new market participants and it is possible that we will not be able to retain our customer base or improve or maintain our profit margins on sales to our customers. There is also increasing use of data analytics, machine learning, and artificial intelligence software, which our competitors may be able to use more effectively or implement more successfully than we are able to do. Failure to adapt to the evolving competitive environment could materially and adversely affect our financial condition, results of operations and cash flows.

■Because approximately 21 percent of our sales in 2024 were attributable to China, adverse economic conditions or changes in consumer behavior in China could impact our business

Our third-party sales in China decreased six percent in local currency in 2024 compared to 2023. We derive a substantial portion of our sales in China from premium-tier products. Changes in consumer preferences and purchasing behaviors including preferences for e-commerce and manufacturer emphasis on brand ecosystems and connectivity, weakening consumer confidence and sentiment, as well as economic uncertainty, sociopolitical and demographic risks, availability of

government incentives, and increased competition from Chinese-based companies may prompt Chinese consumers to postpone purchases, choose lower-priced products or different alternatives, or lengthen the cycle of replacement purchases. Further deterioration in the Chinese economy may adversely affect our financial condition, results of operations and cash flows.

Business, Operational, and Strategic Risks

■We sell our products and operate outside the U.S., and to a lesser extent, rely on imports and exports, which may present additional risks to our business

Approximately 32 percent of our sales in 2024 were attributable to products sold outside of the U.S., primarily in China and Canada, and to a lesser extent in Europe and India. We also have operations and business relationships outside the U.S. that comprise a portion of our manufacturing, supply, and distribution. Approximately 5,000 of our 12,700 employees as of December 31, 2024 were located in China. At December 31, 2024, approximately $206 million of cash and marketable securities were held by our foreign subsidiaries, substantially all of which were located in China. International operations generally are subject to various risks, including: political, religious, and economic instability; local labor market conditions; new or increased tariffs or other trade restrictions, or changes to trade agreements; the impact of foreign government regulations, actions or policies; the effects of income taxes; governmental expropriation; the changes or imposition of statutory restrictions which prohibit repatriation of cash; the imposition or increases in withholding and other taxes on remittances and other payments by foreign subsidiaries; labor relations problems; the imposition of environmental or employment laws, or other restrictions or actions by foreign governments; and differences in business practices.

Unfavorable changes in the political, regulatory, or trade climate, diplomatic relations, or government policies, particularly in relation to countries where we have a presence, including Canada, China, India and Mexico, could have a material adverse effect on our financial condition, results of operations and cash flows or our ability to repatriate funds to the U.S.

■A material loss, cancellation, reduction, or delay in purchases by one or more of our largest customers could harm our business

Sales to our five largest customers represented approximately 42 percent of our sales in 2024. We expect that our customer concentration will continue for the foreseeable future. Our concentration of sales to a relatively small number of customers makes our relationships with each of these customers important to our business. We cannot assure that we will be able to retain our largest customers. Some of our customers may shift their purchases to our competitors in the future. Our customers may experience financial instability, affecting their ability to make or pay for future purchases. Further, a customer may be acquired by a customer of a competitor which could result in our loss of that customer. The loss of one or more of our largest customers, any material reduction or delay in sales to these customers, or our inability to successfully develop relationships with additional customers could have a material adverse effect on our financial position, results of operations and cash flows.

■A portion of our business could be adversely affected by a decline in North American new residential or commercial construction or a decline in replacement-related volume of water heaters and boilers, including a decline in demand for commercial spaces

Residential new construction activity in North America and industry-wide replacement-related volume of water heaters were flat in 2024 after growth in 2023. New residential housing starts in the U.S. are projected to be approximately flat in 2025. Commercial construction activity in North America grew in 2024, although at a slower rate than 2023. We believe that the significant majority of the markets we serve are for the replacement of existing products, and residential water heater replacement volume has been strong. In recent years, businesses and commercial spaces have experienced and may experience in the future, fluctuation in demand and in occupancy that may reduce demand for our products, and commercial sectors, such as the restaurant and hospitality industries in which we have customers, may experience long-term shifts in consumer behavior which could negatively impact demand or capacity and may not return to pre-pandemic levels. In addition, the acceptance of remote work arrangements could negatively impact demand for commercial construction. Changes in the replacement volume and in the construction market in North America could negatively affect us.

■An inability to adequately maintain our information systems and their security, as well as to protect data and other confidential information, could adversely affect our business and reputation

In the ordinary course of business, we utilize information systems for day-to-day operations, to collect and store sensitive data and information, including our proprietary and regulated business information and personally identifiable information of our customers, suppliers and business partners, as well as personally identifiable information about our employees. Our information systems are susceptible to outages due to system failures, cybersecurity threats, failures on the part of third-party information system providers, natural disasters, power loss, telecommunications failures, viruses, fraud, theft, malicious

actors or breaches of security. Like many companies, we, and some third parties upon which we rely, have experienced cybersecurity incidents and attacks on information technology networks and systems, products and services in the past but, to date, none have resulted in a material breach or had a material adverse impact on our financial condition, results of operations, or cash flows. We may experience such incidents and attacks in the future, potentially with increasing frequency from increasingly sophisticated cyber threats. In addition, remote work and remote access to our systems have increased in recent years, which may heighten these risks. Use of artificial intelligence software may also create risks from unintentional disclosure of proprietary, confidential, personal or otherwise sensitive information. Although we have a response plan in place in the event of a data breach and we have an active program to maintain and improve data security and address these risks and uncertainties by implementing and improving internal controls, security technologies, insurance programs, network and data center resiliency and recovery processes, a successful attack in the future could result in operations failure or breach of security that could lead to disruptions of our business activities and the loss or disclosure of both our and our customers’ financial, product and other confidential information and could result in regulatory actions, significant expense and litigation and have a material adverse effect on our financial condition, results of operations and cash flows and our reputation.

■Our international operations are subject to risks related to foreign currencies

We have a significant presence outside of the U.S., primarily in China and Canada and to a lesser extent Europe, Mexico, and India, and therefore, hold assets, including $119 million of cash and marketable securities denominated in Chinese renminbi, incur liabilities, earn revenues and pay expenses in a variety of currencies other than the U.S. dollar. The financial statements of our foreign subsidiaries are translated into U.S. dollars in our consolidated financial statements. Furthermore, typically our products are priced in foreign countries in local currencies. As a result, we are subject to risks associated with operating in foreign countries, including fluctuations in currency exchange rates and interest rates, or global exchange rate instability or volatility that strengthens the U.S. dollar against foreign currencies. An increase in the value of the U.S. dollar relative to the local currencies of our foreign markets, particularly in China, has negatively affected our sales, profitability, and cash and cash equivalents balances and could have such effects in the future. In 2024, the change in foreign currencies negatively impacted our sales and cash and cash equivalents by approximately $18 million and $7 million, respectively. In addition to currency translation risks, we incur a currency transaction risk whenever one of our subsidiaries enters into a purchase or sale transaction using a currency different from the operating subsidiaries’ functional currency. The majority of our foreign currency transaction risk results from sales of our products in Canada, a portion of which we manufacture in the U.S., and to a lesser extent from component purchases in Europe and India and payroll in Mexico. These risks may adversely impact our reported sales and profits in the future or negatively impact revenues and earnings translated from foreign currencies into U.S. dollars.

■Our business may be adversely impacted by product defects

Product defects can occur through our own product development, design and manufacturing processes or through our reliance on third parties for component design and manufacturing activities. We may incur various expenses related to product defects, including product warranty costs, product liability and recall or retrofit costs. While we maintain a reserve for product warranty costs based on certain estimates and our knowledge of current events and actions, our actual warranty costs may exceed our reserve, resulting in current period expenses and a need to increase our reserves for warranty charges. In addition, product defects and recalls may diminish the reputation of our brand. Further, our inability to cure a product defect could result in the failure of a product line or the temporary or permanent withdrawal from a product or market. Any of these events may have a material adverse impact on our financial condition, results of operations and cash flows.

■Potential acquisitions could use a significant portion of our capital and we may not successfully integrate future acquisitions or operate them profitably or achieve strategic objectives

We will continue to evaluate potential acquisitions, and we could use a significant portion of our available capital to fund future acquisitions. We may not be able to successfully integrate future acquired businesses or operate them profitably or accomplish our strategic objectives for those acquisitions. If we complete any future acquisitions in new geographies, our unfamiliarity with relevant regulations and market conditions may impact our ability to operate them profitably or achieve our strategic objectives for those acquisitions. Our level of indebtedness may increase in the future if we finance acquisitions with debt, which would cause us to incur additional interest expense and could increase our vulnerability to general adverse economic and industry conditions and limit our ability to service our debt or obtain additional financing. The impact of future acquisitions may have a material adverse effect on our financial condition, results of operations and cash flows.

Legal, Regulatory, and Governance Risks

■Changes in regulations or standards, such as those associated with climate change, could adversely affect our business

Our products are subject to a wide variety of statutory, regulatory, codes and industry standards and requirements related to, among other items, energy and water efficiency, environmental emissions, labeling and safety. For example, the Department of Energy (DOE) has adopted a new efficiency rule for commercial water heaters that will take effect in 2026 and for our residential water heaters that will take effect in 2029. In addition, new national drinking water standards regulating per- and poly-fluoroalkyl substances (PFAS), as well as lead, could affect the demand for our water filtration products. There are also a number of federal, foreign, state and local governments adopting laws, regulations and codes in response to climate change that require a transition to non-fossil fuel based sources of energy production as well as significantly reducing or eliminating the on-site combustion of fossil fuels in the building sector. We believe our products are currently efficient, safe and environment-friendly. However, a significant change to regulatory or code requirements that promotes a transition to alternative energy sources as a replacement for gas, or a significant shift in industry standards, could substantially increase manufacturing costs, capital expenditures, transportation costs and raw material costs, alter distribution channels, attract new competitors, impact the size and timing of demand for our products, affect the types of products we are able to offer or put us at a competitive disadvantage, any of which could harm our business and have a material adverse effect on our financial condition, results of operations and cash flow.

■We are subject to U.S. and global laws and regulations covering our domestic and international operations that could adversely affect our business and results of operations

Due to our global operations, we are subject to many laws governing international relations, including those that prohibit improper payments to government officials and restrict where we can do business, what information or products we can supply to certain countries and what information we can provide to a non-U.S. government, including but not limited to the Foreign Corrupt Practices Act and the U.S. Export Administration Act. Violations of these laws may result in criminal penalties or sanctions that could have a material adverse effect on our financial condition, results of operations and cash flows.

■Our sustainability commitments could result in additional costs, and our inability to achieve them could have an adverse impact on our reputation and performance

We periodically communicate our strategies, commitments and targets related to sustainability matters, including carbon emissions, water usage, and human rights, through the issuance of our sustainability report. Although we intend to meet these strategies, commitments and targets and are committed to advancing sustainable innovations in our industry, we may be unable to achieve them due to availability of resources, significant increases in operational costs, and technological changes. Failure to meet these sustainability requirements or targets could adversely impact our reputation as well as the demand for our products and adversely affect our business, financial condition and results of operations. In addition, standards and processes for measuring and reporting carbon emissions, water usage, and other sustainability metrics may change over time, result in inconsistent data, or result in significant revisions to our strategies, commitments and targets, or our ability to achieve them. Any scrutiny of our carbon emissions or other sustainability disclosures or our failure to achieve related strategies, commitments and targets could negatively impact our reputation or performance.

■Our results of operations may be negatively impacted by product liability lawsuits and claims

Our products expose us to potential product liability risks that are inherent in the design, manufacture, sale and use of our products. While we currently maintain what we believe to be suitable product liability insurance, we cannot be certain that we will be able to maintain this insurance on acceptable terms, that this insurance will provide adequate protection against potential liabilities or that our insurance providers will be able to ultimately pay all insured losses. In addition, we self-insure a portion of product liability claims. A series of successful claims against us could materially and adversely affect our reputation and our financial condition, results of operations and cash flows.

■We have significant goodwill and indefinite-lived intangible assets and an impairment of our goodwill or indefinite-lived intangible assets could cause a decline in our net worth

Our total assets include significant goodwill and indefinite-lived intangible assets. Our goodwill results from our acquisitions, representing the excess of the purchase prices we paid over the fair value of the net tangible and intangible assets we acquired. We assess whether there have been impairments in the value of our goodwill or indefinite-lived intangible assets during the fourth quarter of each calendar year or sooner if triggering events warrant. If future operating performance at our businesses does not meet expectations, we may be required to reflect non-cash charges to operating results for goodwill or indefinite-lived intangible asset impairments. The recognition of an impairment of a significant portion of goodwill or indefinite-lived intangible assets would negatively affect our results of operations and total capitalization, the effect of which could be material. A significant reduction in our stockholders’ equity due to an impairment of goodwill or indefinite-lived intangible assets may affect our ability to maintain the debt-to-capital ratio required under our existing debt arrangements. We have identified the valuation of goodwill and indefinite-lived intangible assets as a critical accounting policy. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies - Goodwill and Indefinite-lived Intangible Assets” included in Item 7 of this Annual Report on Form 10-K.

■Certain members of the founding family of our company and trusts for their benefit have the ability to influence all matters requiring stockholder approval

We have two classes of common equity: our Common Stock and our Class A Common Stock. The holders of Common Stock currently are entitled, as a class, to elect only one-third of our Board of Directors. The holders of Class A Common Stock are entitled, as a class, to elect the remaining directors. Certain members of the founding family of our company and trusts for their benefit (Smith Family) have entered into a voting trust agreement with respect to shares of our Class A Common Stock and shares of our Common Stock they own. As of December 31, 2024, through the voting trust, these members of the Smith Family own approximately 66.8 percent of the total voting power of our outstanding shares of Class A Common Stock and Common Stock, taken together as a single class, and approximately 96.9 percent of the voting power of the outstanding shares of our Class A Common Stock, as a separate class. Due to the differences in the voting rights between shares of our Common Stock (one-tenth of one vote per share) and shares of our Class A Common Stock (one vote per share), the Smith Family voting trust is in a position to control to a large extent the outcome of matters requiring a stockholder vote, including the adoption of amendments to our certificate of incorporation or bylaws or approval of transactions involving a change of control. This ownership position may increase if other members of the Smith Family enter into the voting trust agreement, and the voting power relating to this ownership position may increase if shares of our Class A Common Stock held by stockholders who are not parties to the voting trust agreement are converted into shares of our Common Stock. The voting trust agreement provides that, in the event one of the parties to the voting trust agreement wants to withdraw from the trust or transfer any of its shares of our Class A Common Stock, such shares of our Class A Common Stock are automatically exchanged for shares of our Common Stock held by the trust to the extent available in the trust. In addition, the trust will have the right to purchase the shares of our Class A Common Stock and our Common Stock proposed to be withdrawn or transferred from the trust. As a result, the Smith Family members that are parties to the voting trust agreement have the ability to maintain their collective voting rights in our company even if certain members of the Smith Family decide to transfer their shares.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

ITEM 1C – CYBERSECURITY

Cybersecurity Governance

We recognize the importance of maintaining the safety and security of our systems and data and have a holistic process for overseeing and managing cybersecurity and related risks. This process is supported by both our management and our Board of Directors.

Our Chief Information Officer (CIO) oversees our information systems and cybersecurity function and reports to our Chief Operating Officer (COO). She has over 30 years of experience in leading information systems management, strategy, and operational execution, including incident management, prevention, and response. Our Senior Director of Global Information Security (ISD) reports to our CIO and is responsible for the protection and defense of our networks and systems and managing cybersecurity risk. He has over 20 years of experience in managing cybersecurity and related risks, including threat identification, incident response, and defense strategies. Our CIO and ISD are supported by a direct and cross-functional team of professionals with broad experience and expertise in threat assessment and detection, mitigation technologies, training, incident response, and regulatory compliance.

Our Board of Directors is responsible for overseeing our enterprise risk management activities in general, which includes our management of information and cybersecurity risk. The full Board receives an update on our cyber risk management process and trends related to cybersecurity at least annually, or real-time if a material event occurs. The Audit Committee of the Board assists the full Board in its oversight of cybersecurity risks. As part of its oversight, the Audit Committee receives regular reports from management on information systems and security, including metrics and controls at each meeting, and other items at least annually including risk assessments, security software, incident response plans, and key updates to the cybersecurity program and its effectiveness.

We have also established a committee of our executive leadership team to consider cybersecurity risks and to consider mitigation strategies in managing the risk. Our CIO and ISD participate on this committee, which meets regularly. We have an established incident response plan led by our CIO and ISD to assess, respond, and report in the event of a cybersecurity incident. Depending on the nature and severity of the incident, the plan requires escalating notifications up to our CEO, Audit Committee and our Board.

Cybersecurity Risk Management

Our cybersecurity risk management program is integrated into our overall enterprise risk management program, and shares common methodologies, reporting channels and governance processes that apply across the enterprise risk management program consistent with other legal, compliance, strategic, operational, and financial risk areas. Our program is guided by cybersecurity frameworks, such as the National Institute of Standards and Technology Cybersecurity Framework (NIST CSF), although we also look to other standards to help us identify, assess, and manage cybersecurity risks relevant to our business.

The Company has a robust cybersecurity program to assess, identify and manage material risk from cybersecurity threats and to prevent, detect and respond to cybersecurity threats, including those associated with the use of third-party service providers. Our approach to cybersecurity risk management includes:

•Cybersecurity awareness training, including interactive simulations and tabletop exercises for our employees, incident response personnel, senior management, and our Board;

•Periodic risk assessments designed to help identify significant or potentially material cybersecurity risks to our critical systems, information, and our broader enterprise information technology (IT) environment;

•The use of external service providers, where appropriate, to assess, test or otherwise assist with aspects of our security controls;

•A multi-layered defense and continuous monitoring strategy employing various tools and testing, and incorporating lessons learned from our defense and monitoring efforts to help prevent future attacks;

•Regular testing by our Internal Audit function of controls related to our financial information systems; and

•Information security assessments conducted on third parties with whom we share sensitive electronic data against established cybersecurity frameworks;

While we have experienced cybersecurity incidents in the past, to-date none have materially affected the Company or our financial position, results of operations and/or cash flows. We continue to invest in cybersecurity and the resiliency of our networks, including our controls and processes, all of which are designed in an effort to protect our IT systems and infrastructure, and the information they contain. For more information regarding the risks we face from cybersecurity threats, please see Item 1A - Risk Factors.

ITEM 2 – PROPERTIES

Properties utilized by us at December 31, 2024 were as follows:

North America

In this segment, we have 23 manufacturing and assembly plants located in 13 states and two non-U.S. countries, of which 18 are owned directly by us or our subsidiaries and five are leased from outside parties. The terms of leases in effect at December 31, 2024, expire between 2025 and 2028.

Rest of World

In this segment, we have five manufacturing plants located in three non-U.S. countries, of which four are owned directly by us or our subsidiaries and one is leased from an outside party. The terms of the lease in effect at December 31, 2024, expire in 2035.

Corporate and General

We consider our plants and other physical properties to be suitable, adequate, and of sufficient productive capacity to meet the requirements of our business. Our manufacturing plants operate at varying levels of utilization depending on the type of operation and market conditions. The executive offices of the Company, which are leased, are located in Milwaukee, Wisconsin.

ITEM 3 – LEGAL PROCEEDINGS

We are involved in various unresolved legal actions, administrative proceedings and claims in the ordinary course of our business involving product liability, property damage, insurance coverage, exposure to asbestos and other substances, patents and environmental matters, including the disposal of hazardous waste. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss or recovery, we believe, based on past experience, adequate reserves and insurance availability, that these unresolved legal actions will not have a material effect on our financial position or results of operations. A more detailed discussion of certain of these matters appears in Note 16, “Commitments and Contingencies” of Notes to the Consolidated Financial Statements.

ITEM 4 – MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE COMPANY

Pursuant to General Instruction of G(3) of Form 10-K, the following is a list of our executive officers which is included as an unnumbered Item in Part I of this report in lieu of being included in our Proxy Statement for our 2025 Annual Meeting of Stockholders.

| | | | | | | | | | | | | | |

| Name (Age) | | Positions Held | | Period Position Was Held |

| Samuel M. Carver (55) | | Senior Vice President – Global Operations | | 2021 to Present |

| | | | |

| | Vice President – North America Manufacturing | | 2011 to 2021 |

| | | | |

| | Various A. O. Smith Management Positions | | 2006 to 2011 |

| | | | |

| Robert J. Heideman (58) | | Senior Vice President – Chief Technology Officer | | 2013 to Present |

| | | | |

| | Senior Vice President – Engineering & Technology | | 2011 to 2012 |

| | | | |

| | Various A. O. Smith Management Positions | | 2002 to 2011 |

| | | | |

| D. Samuel Karge (50) | | Senior Vice President | | 2018 to Present |

| | | | |

| | President – North America Water Treatment | | 2018 to Present |

| | | | |

| | Vice President, Sales and Marketing – Zurn Industries (water solutions manufacturer) | | 2016 to 2018 |

| | | | |

| Parag Kulkarni (57) | | Senior Vice President, International | | 2022 to Present |

| | | | |

| | President - A. O. Smith India Water Products Private Limited | | 2022 to Present |

| | | | |

| | Managing Director - A. O. Smith India Water Products Private Limited | | 2015 to 2022 |

| | | | |

| Charles T. Lauber (62) | | Executive Vice President and Chief Financial Officer | | 2019 to Present |

| | | | |

| | Senior Vice President, Strategy and Corporate Development | | 2013 to 2019 |

| | | | |

| | Senior Vice President – Chief Financial Officer – A. O. Smith Water Products Company | | 2006 to 2012 |

| | | | |

| | Various A. O. Smith Management Positions | | 1999 to 2006 |

| | | | |

| Stephen D. O'Brien (56) | | Senior Vice President | | 2024 to Present |

| | | | |

| | President and General Manager - North America Water Heating | | 2024 to Present |

| | | | |

| | Senior Vice President; President - Lochinvar, LLC | | 2022 to 2024 |

| | | | |

| | Chief Operating Officer – Lochinvar, LLC | | 2021 to 2022 |

| | | | |

| | Senior Vice President - Mitsubishi Electric Trane US (manufacturer of heating and air-conditioning systems) | | 2017 to 2021 |

| | | | |

| Jack Qiu (52) | | Senior Vice President | | 2020 to Present |

| | | | |

| | President - A. O. Smith China | | 2020 to Present |

| | | | |

| | Vice President - A. O. Smith China | | 2012 to 2020 |

| | | | |

| | Various A. O. Smith Management Positions | | 2003 to 2012 |

| | | | |

| S. Melissa Scheppele (62) | | Senior Vice President - Chief Information Officer | | 2020 to Present |

| | | | |

| | Vice President and Chief Information Officer - Triumph Group (aerospace and defense business) | | 2016 to 2020 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| Name (Age) | | Positions Held | | Period Position Was Held |

| Darrell W. Schuh (56) | | Senior Vice President | | 2024 to Present |

| | | | |

| | President - Lochinvar, LLC | | 2024 to Present |

| | | | |

| | Vice President and General Manager - APCOM and Water Systems | | 2017 to 2024 |

| | | | |

| | Vice President - Product Engineering | | 2012 to 2017 |

| | | | |

| Curtis E. Selby (57) | | Senior Vice President - Human Resources and Public Affairs | | 2024 to Present |

| | | | |

| | Chief Operating Officer - Board & Brush Creative Studio (painting workshops) | | 2015 to 2024 |

| | | | |

| | CHRO - Gardner Denver (manufacturer of compressors, blowers and vacuum pumps) | | 2014 to 2015 |

| | | | |

| | Vice President of International Human Resources - Regal Beloit (manufacturer of electric motors) | | 2011 to 2014 |

| | | | |

| | Vice President of Global Human Resources - A. O. Smith Electrical Products Company | | 2005 to 2011 |

| | | | |

| | Director of Human Resources - A. O. Smith Electrical Products Company | | 2001 to 2005 |

| | | | |

| Stephen M. Shafer (49) | | President and Chief Operating Officer | | 2024 to Present |

| | | | |

| | President - Automotive and Aerospace Solutions Division of 3M Company (manufacturer of specialized materials and products used in the manufacturing, maintenance and repair of vehicles and aircraft) | | 2020 to 2024 |

| | | | |

| | Senior Vice President and Chief Strategy Officer - 3M Company (manufacturer of building materials, adhesives, medical and home cleaning supplies) | | 2019 to 2020 |

| | | | |

| James F. Stern (62) | | Executive Vice President, General Counsel and Secretary | | 2007 to Present |

| | | | |

| | Partner – Foley & Lardner LLP (law firm) | | 1997 to 2007 |

| | | | |

| Kevin J. Wheeler (65) | | Chairman | | 2020 to Present |

| | | | |

| | Chief Executive Officer | | 2018 to Present |

| | | | |

| | President | | 2017 to 2024 |

| | | | |

| | President and Chief Operating Officer | | 2017 to 2018 |

| | | | |

| | Senior Vice President | | 2013 to 2017 |

| | | | |

| | President and General Manager – North America, India and Europe Water Heating | | 2013 to 2017 |

| | | | |

| | Various A. O. Smith Management Positions | | 1999 to 2013 |

| | | | |

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

(a)Market Information. Our Common Stock is listed on the New York Stock Exchange under the symbol AOS. Our Class A Common Stock is not listed. EQ Shareowner Services, P.O. Box 64874, St. Paul, Minnesota, 55164-0874 serves as the registrar, stock transfer agent and dividend reinvestment agent for our Common Stock and Class A Common Stock.

(b)Holders. As of January 31, 2025, the approximate number of stockholders of record of Common Stock and Class A Common Stock were 471 and 131, respectively. The actual number of stockholders is greater than this number of holders of record, and includes stockholders who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of stockholders of record also does not include stockholders whose shares may be held in trust by other entities.

(c)Dividends. Dividends declared on the common stock are shown in Note 11, “Stockholders' Equity” of Notes to the Consolidated Financial Statements appearing elsewhere herein.

(d)Stock Repurchases. In 2024, the Board of Directors approved adding 2,000,000 shares of Common Stock to an existing discretionary share repurchase authority. Under the share repurchase program, the Common Stock may be purchased through a combination of Rule 10b5-1 automatic trading plan and discretionary purchases in accordance with applicable securities laws. The number of shares purchased and the timing of the purchases will depend on a number of factors, including share price, trading volume and general market conditions, as well as working capital requirements, general business conditions and other factors, including alternative investment opportunities. The stock repurchase authorization remains effective until terminated by our Board of Directors which may occur at any time, subject to the parameters of any Rule 10b5-1 automatic trading plan that we may then have in effect. In 2024, we repurchased 3,755,337 shares at an average price of $81.43 per share and at a total cost of $305.8 million. As of December 31, 2024, there were 1,746,125 shares remaining on the existing repurchase authorization. On January 26 2025, the Board of Directors approved adding 5,000,000 shares of common stock to the existing discretionary share repurchase authority. Including the additional shares, we have 6,476,677 shares available for repurchase as of the date of the Board of Directors' approval. We intend to spend approximately $400 million to repurchase Common Stock in 2025 through a combination of 10b5-1 plans and open-market purchases.

(e)Performance Graph. The following information in this Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

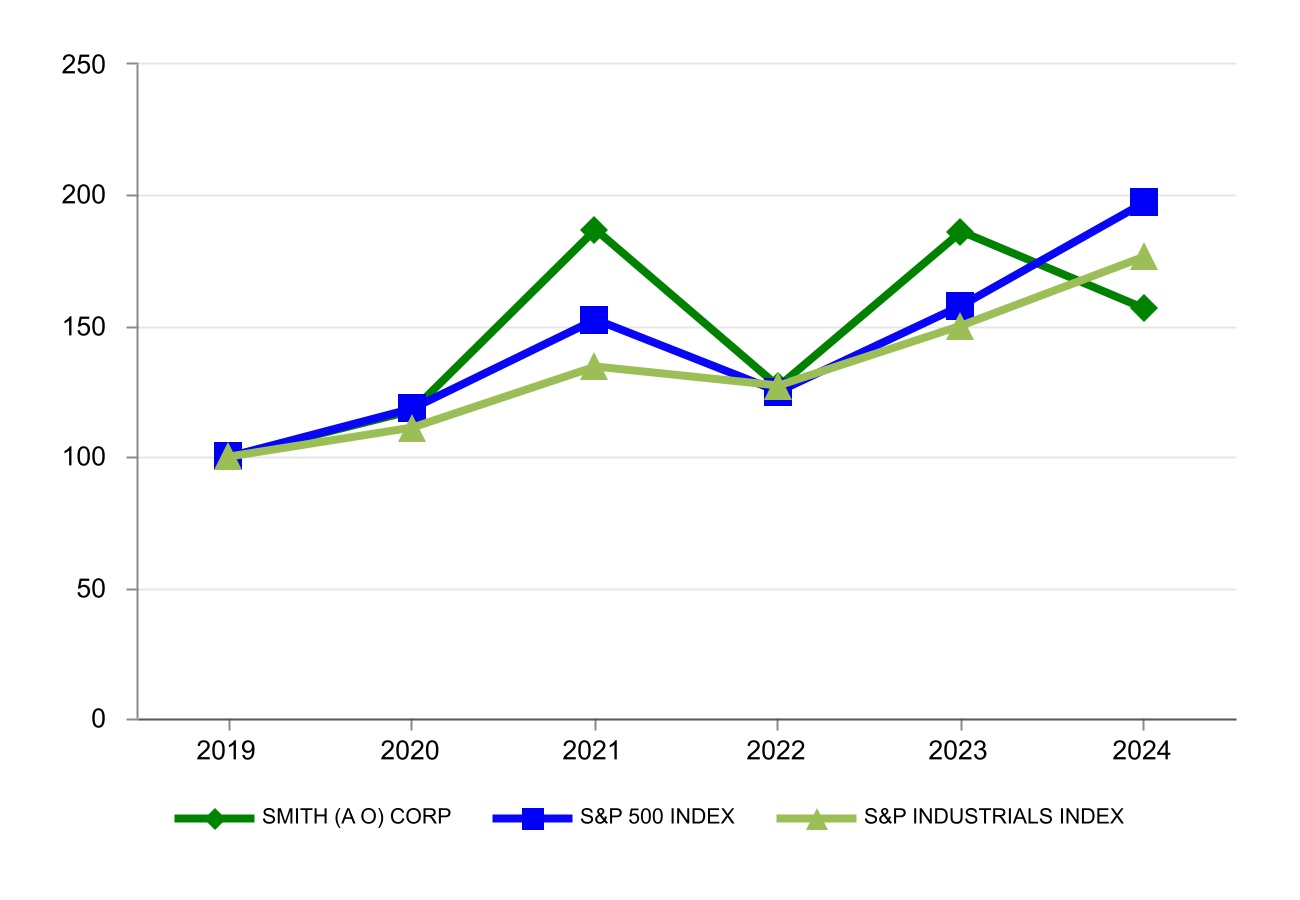

The graph below shows a five-year comparison of the cumulative shareholder return on our Common Stock with the cumulative total return of the Standard & Poor’s (S&P) 500 Index, S&P 500 Select Industrials Index, which are published indices.

Comparison of Five-Year Cumulative Total Return

From December 31, 2019 to December 31, 2024

Assumes $100 Invested with Reinvestment of Dividends

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Base

Period | | Indexed Returns |

| Company/Index | 12/31/19 | | 12/31/20 | | 12/31/21 | | 12/31/22 | | 12/31/23 | | 12/31/24 |

| A. O. Smith Corporation | 100.0 | | | 117.4 | | | 186.9 | | | 126.8 | | | 186.1 | | | 156.5 | |

| S&P 500 Index | 100.0 | | | 118.4 | | | 152.4 | | | 124.8 | | | 157.6 | | | 197.0 | |

| S&P 500 Select Industrial Index | 100.0 | | | 111.0 | | | 134.5 | | | 127.1 | | | 150.2 | | | 176.4 | |

ITEM 6 – SELECTED FINANCIAL DATA

Not applicable.

ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Our company is comprised of two reporting segments: North America and Rest of World. Our Rest of World segment is primarily comprised of China, Europe and India. Both segments manufacture and market comprehensive lines of residential and commercial gas, heat pump and electric water heaters, boilers, tanks, and water treatment products. Both segments primarily manufacture and market in their respective region of the world.

We continue to seek acquisitions that enable geographic growth, expand our core business, and establish adjacencies. On November 1, 2024, we acquired Pureit from Unilever for approximately $125 million, subject to customary adjustments. Pureit, a leading water purification business in South Asia, offers a broad range of residential water purification solutions and has annual sales of approximately USD $60 million. The acquisition fits squarely in our core capabilities and doubles our market penetration in the South Asia region. In the first quarter of 2024, we acquired Impact Water Products, a privately-held water treatment company. The acquisition supports our geographic expansion and growth strategy by expanding the West Coast presence of our water treatment business.

Also, we continue to look for opportunities to add to our existing product portfolio in high growth regions demonstrated by our previous introductions of kitchen products and connected product technologies in China. We also recently introduced our internally designed and manufactured gas tankless water heaters in North America. In addition, we are expanding our commercial water heater capacity in North America in preparation for the new efficiency rule for commercial water heaters that the Department of Energy (DOE) has adopted that will take effect in 2026.

In 2024, we recognized restructuring and impairment expenses of $17.6 million. In China, severance expenses of $11.3 million related to the right sizing of that business for current market conditions. The remaining $6.3 million related to the restructuring of our water treatment business in North America as a part of a profitability improvement strategy that prioritizes improving our cost structure and emphasizes our more profitable channels.

In our North America segment, we saw soft residential and commercial water heater order demand in the second half of 2024 after a strong first half of the year. We believe that a pre-buy ahead of our March 1st price increase pulled forward some demand into the first half of the year. We also believe our second half order demand was negatively impacted by our improved lead times. Those factors along with caution around softening of end market demand may have driven some customers to reduce their inventory levels. 2024 residential industry unit volumes were flat compared to the prior year and we project 2025 industry residential unit volumes will be flat as well. Proactive replacement has been above historical levels for the last several years and we project that will continue in 2025. We believe that new home construction remains in a deficit and will be flat compared to 2024. We anticipate that commercial water heater industry volumes will be approximately flat in 2025 after minimal growth in 2024 driven by growth in commercial electric water heaters greater than 55 gallons which was offset by lower shipments of commercial gas water heaters. We expect our boilers sales to grow between three and five percent in 2025 compared to 2024 as we continue to benefit from the transition to higher efficiency boilers. We anticipate sales of our North America water treatment products will be between $235 million and $245 million, a year-over-year decrease of approximately five percent as we de-emphasize certain channels and focus on our more profitable channels.

In our Rest of World segment, after sales growth of three percent in the first half of the year, our full-year 2024 third-party sales in China declined six percent due to a further weakening of consumer demand in the second half of the year. In 2025, we project our third-party sales in China to decrease between five to eight percent in local currency compared to 2024 as we expect consumer demand softness will persist in 2025.

Combining all of these factors, we expect our 2025 consolidated sales to be approximately flat to up two percent compared to 2024. Our guidance excludes the impacts from potential future acquisitions.

RESULTS OF OPERATIONS

In this section, we discuss the results of our operations for 2024 compared with 2023. We discuss our cash flows and current financial condition under “Liquidity and Capital Resources.” For a discussion related to 2023 compared with 2022, please refer to Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the Year Ended December 31, 2023, which was filed with the United States Securities and Exchange Commission (SEC) on February 13, 2024, and is available on the SEC's website at www.sec.gov.

| | | | | | | | | | | | | | | | | |

| Years Ended December 31, |

| (dollars in millions) | 2024 | | 2023 | | 2022 |

| Net sales | $ | 3,818.1 | | | $ | 3,852.8 | | | $ | 3,753.9 | |

| Cost of products sold | 2,362.0 | | | 2,368.0 | | | 2,424.3 | |

| Gross profit | 1,456.1 | | | 1,484.8 | | | 1,329.6 | |