UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the fiscal year ended December 31, 2010

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

for the transition period from to

Commission file number 0-24517

ORTHOVITA, INC.

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 23-2694857 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

77 Great Valley Parkway Malvern, Pennsylvania | | 19355 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (610) 640-1775

Securities registered pursuant to Section 12(b) of the Act:

| | |

(Title of class) | | (Name of Exchange on which Registered) |

| Common Stock, par value $.01 per share | | Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in the definitive proxy statement incorporated by reference in Part III of this annual report on Form 10-K or any amendment to this annual report on Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The approximate aggregate market value of Common Stock held by non-affiliates of the registrant was $112,844,072 as of June 30, 2010 (For purposes of determining this amount only, the registrant has defined affiliates as including (a) the executive officers of the registrant as of June 30, 2010, (b) all directors of the registrant as of June 30, 2010 and (c) each shareholder that informed the registrant that as of June 30, 2010 it was the beneficial owner of 10% or more of the outstanding common stock of the registrant).

As of March 3, 2011, there were 76,895,151 shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the registrant’s Proxy Statement relating to the 2010 Annual Meeting of Shareholders (to be filed within 120 days after the end of the year covered by this annual report on Form 10-K) are incorporated into Part III of this annual report on Form 10-K by reference.

TABLE OF CONTENTS

PART I

In addition to historical facts or statements of current conditions, our disclosure and analysis in this Form 10-K contain some forward-looking statements. See the discussion of forward-looking statements in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operation” included in this Form 10-K.

Unless the context indicates otherwise, the terms Orthovita, Company, we, us or our herein refer to Orthovita, Inc. and, where appropriate, one or more of our subsidiaries.

GENERAL DEVELOPMENT OF OUR BUSINESS

We are a specialty spine and orthopedic company with a portfolio of orthobiologic and biosurgery products. Our products are based on novel and unique proprietary biomaterials that have innovative mechanisms of action in the body.

Our orthobiologic platform includes products for the fusion, regeneration and fixation of human bone. Our orthobiologic products are based on our proprietary Vitoss™ Bone Graft Substitute technology and include the Imbibe™ Bone Marrow Aspiration System used with Vitoss. Vitoss is the market-leading synthetic bone graft in the United States. Several of our Vitoss products incorporate our proprietary bioactive ceramic glass technology which accelerates bone healing. Our orthobiologic products also include our Cortoss™ Bone Augmentation Material and the Aliquot™ Delivery System used with Cortoss, both of which were first available for sale in the U.S. in July 2009. Cortoss is an advanced synthetic biomaterial that hardens to mimic weight-bearing, cortical bone following injection into spinal vertebrae. Cortoss is the first clinically-proven, injectable alternative to polymethylmethacrylate (PMMA) bone cement cleared by the U.S. Food and Drug Administration (FDA) for the treatment of vertebral compression fractures, an often extremely painful condition that occurs in patients with osteoporosis and cancer. In addition to extensive clinical data showing statistically significant improvements in pain relief (at three months following implantation) and function (at twenty-four months following implantation) from the use of Cortoss in comparison to PMMA, we believe that Cortoss has significant ease-of-use advantages over current vertebral augmentation technology.

Our biosurgery products include Vitagel™ Surgical Hemostat, Vitasure™ Absorbable Hemostat, and the CellPaker™ Plasma Collection System used in conjunction with Vitagel, and other accessories and delivery products that complement our Vitagel product. These products incorporate advanced biosurgical materials to help control bleeding during surgeries.

We have historically expanded our product portfolio through internal product development efforts, co-development efforts with strategic partners and the in-licensing of products. We internally developed our Vitoss and Cortoss materials and maintain an ongoing internal research and development program. In addition, we worked with Kensey Nash Corporation (Kensey) to co-develop and commercialize certain Vitoss Foam products, and we have acquired rights from third parties to market Vitagel and Vitasure. We continue to pursue in-licensing, co-development and other opportunities to acquire complementary products and technologies to broaden our product offerings and further leverage our sales force.

Other Sales and Corporate Information

In the U.S., we market and sell our products through a hybrid sales and distribution network of direct sales representatives and independent distributors. As of December 31, 2010, we had 79 direct sales representatives (DSRs), 5 associate sales representatives who support our DSRs, and arrangements with 75 independent distributors and sales agents that we utilize to market and sell our products in the U.S. Of these distributors and agents, 72 were non-stocking and 3 were stocking distributors. We continue to strengthen our hybrid distribution network by optimizing the number of DSRs and adding distributors or sales agents in those territories or markets where we do not have adequate coverage. Outside the U.S., we primarily utilize a network of independent stocking distributors to market our products, although we market these products through a direct sales force in the United Kingdom.

Information regarding our product sales by geographic markets for 2010, 2009, and 2008 is included in note 14 (Product Sales) to the consolidated financial statements included in this report.

We market our products for only the indication(s) or use(s) that have received regulatory approval or clearance.

We incorporated in Pennsylvania in 1992 and maintain a branch operation in Belgium, as well as a wholly-owned subsidiary in the United Kingdom, and a wholly-owned subsidiary incorporated in Delaware to hold certain intangible properties.

Our principal executive offices are located at 77 Great Valley Parkway, Malvern, Pennsylvania 19355, and our telephone number is (610) 640-1775. We maintain a website at www.orthovita.com and make available free of charge on this website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or

1

furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file these materials with, or furnish them to, the U.S. Securities and Exchange Commission. The reference to our website is intended to be an inactive textual reference only.

OUR PRODUCTS

As further discussed below under the caption “GOVERNMENT REGULATION,” our products and product candidates are subject to extensive regulation as medical devices by the FDA, regulatory authorities in Europe and regulatory authorities in other jurisdictions. Product approval or clearance applications for our products must be supported by valid scientific evidence, and may require clinical trial data, to demonstrate the safety and effectiveness of the products.

Our existing orthobiologic and biosurgery products, as well as select product development projects, are described below.

Orthobiologic Products: Vitoss and Cortoss and Related Delivery Systems and Accessories; Select Product Development Projects

A. Vitoss Bone Graft Substitute

| | |

Vitoss Blocks and Morsels | | FDA 510(k) cleared December 2000 Approved in European Union July 2000 |

| |

Vitoss Micro and Macro Morsels | | FDA 510(k) cleared December 2000 Approved in European Union July 2003 |

| |

Vitoss Standard and Micro Canisters | | FDA 510(k) cleared November 2003 Approved in European Union July 2003 |

| |

Vitoss Foam Product Platform, including: | | FDA 510(k) cleared December 2003 Approved in European Union May 2005 |

| |

Vitoss Foam Strips and Cylinders Vitoss Foam Flow Vitoss Foam Shapes Vitoss Foam Pack | | |

| |

Vitoss Bioactive Foam Strips | | FDA 510(k) cleared September 2007 Approved in European Union October 2009 |

| |

Vitoss Bioactive Foam Pack | | FDA 510(k) cleared June 2008 Approved in European Union October 2009 |

| |

Vitoss Bioactive Foam-2X | | FDA 510(k) cleared December 2010 |

| |

Vitoss BA Bimodal | | FDA 510(k) cleared February 2011 |

Vitoss is a high-porous resorbable beta-tricalcium phosphate bone graft substitute used to help the body guide the three-dimensional regeneration of the patient’s own bone. We launched Vitoss in the U.S. and the European Union (EU) in 2001. Vitoss can soak and hold its own volume in blood and bone marrow aspirate due to its high-porosity, and has been shown to perform well in an array of applications in the spine, extremities and pelvis, such as spinal grafting and the treatment of bone defects due to trauma, degenerative disease and tumors, including posterolateral spine fusion procedures. Vitoss integrates well into existing bone and allows for bone in-growth and maturation. Vitoss, the Vitoss Foam products, the Vitoss Bioactive Foam products, Vitoss Bioactive Foam-2X and Vitoss BA Bimodal are covered by certain issued patents and/or patent applications in and outside of the United States.

Since the initial U.S. regulatory clearance and subsequent Vitoss product launch in mid-2001, we have developed and are developing a number of new Vitoss-based products and related devices that are designed to expand the market for our Vitoss products by broadening the range of surgical indications and by addressing additional surgeon preferences and clinical needs. In 2003, we entered into a development, manufacturing and supply agreement with Kensey, leading to the development and launch of the Vitoss Foam product platform. The Vitoss Foam products combine our base Vitoss technology with Kensey’s proprietary resorbable biomaterials to produce a wide array of pliant, flexible, flowable and compression resistant bone graft materials. The Vitoss Foam products have the ability to retain biological fluids such as blood and bone marrow aspirate in pliable and compression resistant forms. These forms can be designed into specific shapes and material characteristics to meet a surgeon’s need for handling and delivery in a variety of surgical approaches and applications. We launched another iteration of the Vitoss Foam product line called Vitoss Bioactive Foam in the United States in 2008 and in the European Union in 2009. In addition to our proprietary Vitoss beta-tricalcium phosphate bone graft substitute and Kensey’s proprietary resorbable biomaterials, Vitoss Bioactive Foam products also contain our proprietary combeite bioactive glass to advance bone healing.

2

In February 2011, we launched in the United States a new iteration of our Vitoss Foam product line called Vitoss Bioactive Foam-2X. As compared to prior Vitoss Bioactive Foam products, Vitoss Bioactive Foam-2X has the same structure and porosity but contains increased levels of bioactive glass. In addition, we expect to launch in the United States in approximately one year another product iteration called Vitoss BA Bimodal.

Bone Defect Grafting. Injury or trauma to the bone, degenerative conditions, disease and aging all affect the health and viability of the human skeleton. These conditions often result in the need for the repair of bone defects through a bone grafting procedure. We estimate that over two million bone grafting procedures on a worldwide basis are performed each year in the spine, extremities and pelvis. Bone grafting material is either (i) autograft material, which is often obtained or harvested from the iliac crest region of the patient’s own hip, (ii) allograft material, which is obtained from a cadaver, or (iii) synthetically derived materials that provide one or more components of either bone-like scaffold (such as Vitoss), cells or signals (such as bone morphogenic proteins). Vitoss has been used in bone grafting procedures as a bone graft substitute to provide a synthetic scaffold in a variety of applications, including those of the extremities, spine and pelvis. When used with the patient’s bone marrow, Vitoss provides all components of scaffold, cells and signals required to aid in the growth of new bone.

As a synthetic beta-tricalcium phosphate material, our Vitoss material has advantages over both autograft and allograft materials. For example, a harvest of autograft material involves an additional surgical procedure that extends surgical time, adding to costs and increasing blood loss and patient risk of infection or adverse reaction from the additional time under anesthesia. In addition, harvesting bone for autograft sometimes causes protracted pain that may necessitate additional medical care after the surgical procedure. Disadvantages of allograft bone include the possibility of disease transmission, antigenic response and quality variability from donor to donor. Using Vitoss instead of autograft or allograft material avoids these potential complications.

Spinal Fusion and Grafting. Many patients affected by severe back pain due to degeneration of one or more discs are often treated with spinal surgical procedures. We estimate that each year approximately 460,000 spinal fusion procedures are performed in the United States. In cases where the patient has advanced disc degeneration or spinal instability, a fusion procedure can involve a surgical incision in the patient’s back or abdomen to access and remove the affected disc material. To provide initial stability and support of the surrounding vertebrae, the resulting defect is filled with a structural implant made of either titanium, shaped bone derived from a human cadaver, or a synthetic material known as polyetheretherketone (PEEK). Adjunctively, these procedures may require the use of bone grafting material to repair defects and facilitate the fusion of two bony elements. We believe the use of Vitoss provides a clinically proven alternative to patient- or cadaver-derived tissues and may be preferable for both patients and their surgeons for its efficacy and safety.

Trauma. Physical trauma such as falls and accidents can result in bone fracture or damage. Fractures of broken bones are often realigned with hardware, such as plates, rods and screws. Once the hardware has been used to recreate the skeletal anatomy and to provide the stability of the bony structure, there are often defects or voids in the bone which remain. Those voids may require the use of bone graft material. The goal of bone grafting in trauma applications is to rapidly heal the damaged bone. Approximately 300,000 trauma-related bone graft repairs are performed annually on a worldwide basis. Autograft, cadaver allograft, as well as synthetic scaffolds like Vitoss, are used for trauma-related bone graft repairs.

Dental, Periodontal, Oral and Cranio-Maxillofacial. In August 2002, we entered into a supply agreement with BioMimetic Therapeutics, Inc. for our proprietary Vitomatrix™ particulate synthetic scaffold biomaterial, which is produced in the same process used to manufacture Vitoss. In January 2008, in connection with the sale of its dental business to Luitpold Pharmaceuticals, Inc., BioMimetic assigned its rights and obligations under the supply agreement to Luitpold with our consent. The supply agreement with Luitpold terminated in March 2010, and we do not expect to sell Vitomatrix as a raw material in the future. In October 2010, we received clearance from the FDA to market Vitomatrix as a standalone product in certain dental procedures. We are seeking to identify potential commercial partners to distribute Vitomatrix or to license the underlying technology.

B. Bone Marrow Aspiration System with Imbibe Needles and Syringes used with Vitoss

| | |

Bone Marrow Aspiration Needle | | FDA 510(k) cleared June 2005 |

| |

Bone Marrow Aspiration Syringe | | FDA 510(k)s cleared September 2001 and March 2003 Approved in European Union September 2004 |

The disposable Imbibe devices provide spine and orthopedic surgeons with a simple method for harvesting a patient’s own bone marrow, mixing it with Vitoss, and delivering the mixture to the bone graft site. We believe Imbibe, when used together with Vitoss, provides greater flexibility and options for surgeons. Imbibe is covered by a U.S.-issued patent.

3

C. Cervical Interbody Fusion Device in Development Phase

We are currently developing a cervical interbody fusion device incorporating our proprietary bioactive glass with polyetheretherketone (PEEK). While we expect to seek regulatory clearance for this device in the United States by filing a 510(k) application for this device by the end of the first quarter of 2011, we are not certain whether the regulatory pathway for this device will entail a 510(k) as opposed to a premarket approval (PMA) application, or whether clinical trials will be required. See “GOVERNMENT REGULATION” below for additional information on U.S. regulatory requirements for the introduction of a new device into the market. There can be no assurance that we can obtain regulatory clearance for this device or the timing of any such clearance.

D. Cortoss Bone Augmentation Material

| | |

Cortoss Bone Augmentation Material | | FDA 510(k) cleared June 2009 for vertebral augmentation Approved in European Union January 2003 for vertebral augmentation Approved in European Union October 2001 for screw augmentation |

Cortoss is a polymer composite which mimics the mechanical characteristics of human bone that has been cleared by the FDA and approved in the EU under the CE mark process. For patients with poor bone healing, as seen in osteoporotic patients, Cortoss may be used in a number of surgical procedures to quickly provide structural stability and reinforcement of the bones after surgery. The surgeon’s goal is to repair the patient’s bone and enhance the patient’s mobility as quickly as possible since prolonged bed rest or inactivity may result in decreased overall health for older or osteoporotic patients. Cortoss’ simple mix-on-demand delivery system design allows for minimum waste and maximum ease of use and flexibility for the surgeon. Cortoss is an injectable material that is delivered through a pre-filled, unit dose, disposable cartridge. Delivery of Cortoss to the surgical site may be started and stopped for a prolonged period of time throughout the surgical procedure as polymerization is initiated only when Cortoss is expressed through its static mix-tip. The polymerization is a self-setting reaction that causes Cortoss to harden within minutes. Cortoss provides two stages of fixation: immediate mechanical interlock into porous bone, followed by intimate bone apposition over time along the contours of its surface. Cortoss is covered by several patents issued in the U.S. and other countries, and other U.S. and non-U.S. patent applications are pending.

Cortoss received regulatory clearance in the U.S. and EU for use in the treatment of vertebral compression fractures (VCFs) of the spine, and may be used in vertebroplasty as well as kyphoplasty procedures. Cortoss also has regulatory approval in the EU for use in screw augmentation. We are in the process of seeking regulatory clearance in the U.S. for the use of Cortoss in cranioplasty, a surgical procedure to repair a defect or deformity of the skull. There can be no assurance that we can obtain regulatory clearance for Cortoss in the use of cranioplasty or the timing of any such clearance.

We have sold Cortoss in Europe since December 2001. We launched Cortoss in the U.S. in the second half of 2009 shortly after its clearance by the FDA for use in vertebral augmentation procedures. We believe that the U.S. launch of Cortoss has been negatively affected by several factors, including two small studies published inThe New England Journal of Medicinein August 2009 that questioned the effectiveness of vertebroplasty, the uncertainty created by the pending reimbursement review of vertebral augmentation procedures by a few of Medicare’s local contractors, and the issuance of clinical practice guidelines in September 2010 by the American Academy of Orthopedic Surgeons (AAOS) that did not support the use of vertebroplasty to treat vertebral compression fractures. While these studies did not evaluate or discuss Cortoss and no reimbursement decisions have yet been announced, we believe that the publication of the studies, the ongoing reimbursement review and the AAOS guidelines have resulted in a notable decrease in the number of vertebroplasty procedures nationwide. We also believe that a recent shift for vertebral augmentation procedures from the hospital in-patient to out-patient settings has adversely affected our launch of Cortoss in the U. S. because the historic call pattern of our sales force is within the in-patient setting. The economic pressure causing this shift was exacerbated during 2009 and 2010 following the imposition of significant fines by the U.S. government on a number of hospitals that treated patients with vertebral compression fractures in the in-patient setting when these patients could have been treated more cost-effectively in the out-patient setting. As a result of these pressures, as well as negative overall economic conditions and health care reform initiatives to reduce costs, we believe the number of vertebral augmentation procedures performed by spine surgeons and neurosurgeons, our primary target audience, has decreased, and a greater number of procedures are being performed in an out-patient setting by interventional radiologists and neuroradiologists, which is a new target physician group for us. We believe that these factors have resulted in U.S. Cortoss sales that are significantly below our initial expectations for the launch of this product. We expect that the vertebral augmentation market will continue to face economic and other pressures at least in the near-term.

Vertebral Augmentation of VCFs. Vertebral augmentation of VCFs is a procedure for repairing fractured vertebrae that can be performed on a hospital in-patient or out-patient basis or in ambulatory surgery centers, clinics and physician offices. We estimate there are approximately 700,000 patients in the U.S. with VCFs caused by osteoporotic bone or bone cancer resulting in severe pain

4

and immobility. Of these, we believe approximately 150,000 fractures are treated annually using vertebroplasty or kyphoplasty techniques. The traditional treatments, e.g., bed rest, bracing, narcotics or anesthetic injections, may not address the underlying fracture. Vertebral augmentation of VCFs has been reported to provide early pain relief in up to 90% of osteoporotic patients. Early relief of pain provided by vertebral augmentation of VCFs enables patients to maintain better functional capacity. Functional capacity, in turn, is believed to be directly related to the ability to live independently and unassisted. We are not aware of any product that has received FDA approval or a CE mark for use in this procedure on the basis of prospective, controlled clinical data. However, since 2004, several versions of PMMA bone cement have been cleared by the FDA under the 510(k) process. Results from our pivotal clinical data comparing Cortoss to PMMA in vertebral augmentation showed statistically significant improvements for Cortoss patients in pain relief (at three months following implantation) and function (at 24 months following implantation). Results from this study further indicated that Cortoss patients treated at one vertebral level with no previous fracture had a lower incidence of subsequent adjacent level fracture. In addition, the material properties of Cortoss described below result in the following advantages over PMMA:

| | • | | Flow characteristics and fill patterns that enhance procedural safety and control; |

| | • | | The ability to be mixed on demand with no time constraints in the pre-injection phase and delivered on a start-stop basis, thereby enhancing ease of use; |

| | • | | Mechanical properties more closely resembling cortical bone; |

| | • | | A lower temperature setting that reduces the risk of tissue necrosis associated with PMMA; and |

| | • | | The absence of volatile, free unreacted methylmethacrylate monomer released into the patient’s body. Although documented complications of monomer released from PMMA may be rare, they are severe adverse events when they occur. |

For the foregoing reasons, we believe that Cortoss has meaningful clinical benefits over PMMA in the treatment of VCFs.

Screw Augmentation. Screw augmentation is a procedure for securing the fixation of bone screws used in patients with weak bone caused by osteoporosis. Cortoss may be used in those procedures where the screws “strip” or fail to hold the integrity of the internal fixation construct due to poor bone quality, as is often the case with osteoporotic bone. Where screws fail to hold, current treatment options include: (i) replacing the screw with a screw of larger diameter, which may further weaken the bone and is not always possible because of the size of the screw holes and/or the bone, or (ii) augmenting the screws with PMMA bone cement, which is cumbersome and time consuming. PMMA must be manually mixed and transferred into a syringe for application. After mixing, there is only a small time window in which the PMMA can be used before it sets, making it difficult to augment more than one screw at a time. Additionally, PMMA bone cement is not approved in either Europe or the U.S. for pedicle, trauma or hip fracture screw augmentation. We believe the use of Cortoss to anchor the screw in a quick and efficient way enables the full function of the screw to be restored. We market Cortoss for use in screw augmentation outside of the U.S. only where we have obtained regulatory approval for this indication.

E. Aliquot Delivery System

Our Aliquot Delivery System is a coaxial system of catheter and syringe dispenser designed specifically to directly deliver our Cortoss material in vertebroplasty procedures. We launched the Aliquot system in the U.S. concurrently with the launch of Cortoss in the second half of 2009. The Aliquot Delivery System is exempt from 510(k) clearance. During the second quarter of 2002, we received CE mark approval from our notified body for certain Aliquot kit configurations.

The U.S. launch of Aliquot was negatively impacted by the same factors mentioned above for Cortoss. Further, prior to and following the U.S. launch of Cortoss and Aliquot and in anticipation of significant product demand, we acquired a significant inventory quantities of Aliquot from third party suppliers with requisite long manufacturing lead times. As a result, during the fourth quarter of 2010, we recorded a $3.5 million inventory charge primarily for Aliquot inventory that either was expected to expire prior to sale or was not expected to be sold based on our current projections of product demand. For additional information, see the risk factor entitled, “If our current products are not commercially successful, our operating results will be impaired and our viability will be jeopardized” under Item 1A. “RISK FACTORS.”

We are currently developing a suite of cavity creation devices that are designed to expand the use of Cortoss in the treatment of vertebral compression fractures for physicians who prefer kyphoplasty over vertebroplasty. We plan to launch the first such device, an Aliquot directional bone tamp, in the second quarter of 2011. This device is intended to create preferential flow channels in existing spinal bone structure prior to a vertebral augmentation procedure. These channels can provide directional filling of bone cement. In addition, we are currently seeking regulatory clearance in the United States for an Aliquot inflatable bone tamp designed for balloon-assisted vertebroplasty with Cortoss bone cement. There can be no assurance that we can obtain regulatory clearance for this device or the timing of any such clearance.

5

Biosugery Products: Vitagel and Vitasure and Related Components and Accessories

A. Vitagel Surgical Hemostat and Accessories

| | |

Vitagel Surgical Hemostat | | PMA approved, distribution rights initially obtained June 2004 Approved in European Union July 2007 (See GOVERNMENT REGULATION below) |

| |

CellPaker Plasma Collection System | | PMA approved, distribution rights initially obtained June 2004 Approved in European Union July 2007 (See GOVERNMENT REGULATION below) |

| |

Malleable Extended Applicator | | PMA approved, distribution rights obtained June 2004 Approved in European Union July 2007 (See GOVERNMENT REGULATION below) |

| |

Laparoscopic Extended Applicator | | PMA approved, U.S. distribution rights obtained June 2004 Approved in European Union July 2007 (See GOVERNMENT REGULATION below) |

| |

Vitagel Spray Set | | FDA 510(k) cleared October 2005 Approved in European Union July 2007 |

Vitagel is an FDA-approved, CE-marked composite liquid hemostat that combines the biomaterials bovine thrombin and bovine collagen with the patient’s autologous plasma. When applied to the surgical site, Vitagel creates a safe adherent matrix and an impermeable barrier to blood flow, and its unique microfibrillar collagen component facilitates healing. Vitagel has been marketed to general surgeons and is applicable in the spine, hip and knee replacement surgery markets, where bleeding is a significant complication for many routine surgeries. After obtaining the right to sell Vitagel and CellPaker from a third party, we commenced sales of the products in the U.S. in 2005 through our existing orthopedics and spine-based sales channel, utilizing the same marketing strategy that we use for all of our Vitoss-related products. This strategy provides our sales network additional functional biomaterial products to offer to customers. During the first half of 2006, we launched the Vitagel Spray Set in the U.S. We obtained the CE mark for Vitagel, CellPaker and related accessories in July 2007 and launched these products in the European Union in the first quarter of 2008. Vitagel and CellPaker are covered by U.S. and non-U.S. issued patents owned by the licensor of the products.

B. Vitasure Absorbable Hemostat

| | |

Vitasure Absorbable Hemostat | | PMA approved, distribution rights initially obtained April 2008 Approved in European Union September 2002 (See GOVERNMENT REGULATION below) |

Vitasure is an FDA-approved, CE-marked, plant-based hemostat product that can be deployed quickly throughout surgery. Through proprietary microporous polysaccharide hemosphere technology, Vitasure acts as a molecular sieve to quickly extract fluids from blood, creating an osmotic action that causes the Vitasure particles to swell and concentrate serum proteins, platelets, and other elements on the surface. The Vitasure particles and their coating of compacted cells then create a matrix for the formation of a tenacious fibrin clot. We originally obtained the right to distribute Vitasure in the U.S. and certain other territories for orthopedic and spine applications in 2008 from Medafor, Inc. We launched the Vitasure product in the U.S. in 2008 and in certain non-U.S. territories in January 2009. Vitasure is covered by U.S. and non-U.S. issued patents owned by Medafor and its licensor.

STRATEGIC PARTNERSHIPS

Kensey - Vitoss Foam

In March 2003, we entered into an agreement with Kensey to jointly develop and commercialize certain orthobiologic products based upon our Vitoss platform. The new products developed under this agreement are based on our internally developed, proprietary Vitoss bone graft substitute material in combination with proprietary resorbable Kensey biomaterials. To date, the products covered by the Kensey agreement for which we have received 510(k) clearance from the FDA are our Vitoss Foam, Vitoss Bioactive Foam, Vitoss Bioactive Foam-2X and Vitoss BA Bimodal products.

Kensey has the exclusive right to manufacture any approved or cleared products that were jointly developed under the agreement, and we market and sell these products worldwide. Following the regulatory approval or clearance of each new product, we have obligations under the agreement to pay Kensey for manufacturing the product and make royalty payments to Kensey based on the net sales of the product. These rights and obligations extend until at least February 2024 for our Vitoss Bioactive Foam, Vitoss

6

Bioactive Foam-2X and Vitoss BA Bimodal products, and until February 2014 for our other products under the Vitoss Foam product platform.

Approximately 67% of our product sales during 2010 were from products based upon our Vitoss Foam platform covered by the Kensey agreement, including Vitoss Bioactive Foam.

Angiotech – Vitagel and CellPaker

We have the right to distribute Vitagel and CellPaker pursuant to a license agreement with Angiotech Pharmaceuticals (U.S.), Inc. (which we refer to collectively with its affiliates and parent company Angiotech Pharmaceuticals, Inc. as Angiotech). We paid Angiotech $9.0 million in 2006 to eliminate any further obligations to pay royalties on our sales of Vitagel and CellPaker under the license agreement.

Under the license agreement, we have exclusive rights to manufacture, market and sell Vitagel products throughout the world for orthopedic indications, and non-exclusive rights to manufacture, market and sell CellPaker products throughout the world for all indications through July 31, 2017. Additionally, under the license agreement, Angiotech has an option for co-exclusive rights outside the orthopedic field which, if exercised, would permit Angiotech to manufacture, market and sell an Angiotech-branded Vitagel product throughout the world. Until Angiotech elects to exercise its option for co-exclusive rights, we have exclusive rights to manufacture, market and sell Vitagel outside of the orthopedic field throughout the world. If Angiotech elects to exercise its option, we would then have co-exclusive rights to manufacture, market and sell Vitagel outside of the orthopedic field throughout the world.

We currently manufacture Vitagel at our facilities in Malvern, Pennsylvania and manufacture CellPaker at our subcontractor’s facility.

On January 28, 2011 Angiotech voluntarily commenced proceedings under theCompanies’ Creditors Arrangement Act (the “CCAA” and such proceedings, the “CCAA Proceedings”), obtaining an Initial Order from the Supreme Court of British Columbia (the “Canadian Court”), inIn re Angiotech Pharmaceuticals, Inc.,et al. In connection with the CCAA Proceedings, Angiotech filed a voluntary petition under chapter 15 of title 11 of the United States Code on January 30, 2011 (the “Chapter 15 Cases” and together with the CCAA Proceedings, the “Proceedings”) in the United States Bankruptcy Court for the District of Delaware (the “U.S. Court”) inIn re Angiotech Pharmaceuticals, Inc. According to Angiotech, the purpose of the Chapter 15 Cases is to obtain recognition and enforcement in the United States of certain relief granted in the CCAA Proceedings, and to obtain U.S. Court assistance to the Canadian Court in effectuating a proposed recapitalization of the Company. We do not believe that the Proceedings will have any effect on the validity of our license from Angiotech.

Medafor - Vitasure

After obtaining certain non-exclusive rights from Medafor, Inc. to distribute Vitasure Absorbable Hemostat pursuant to a distribution agreement, we launched the product in the third quarter of 2008. Our territory under the agreement currently consists of the United States, Australia, Belgium, Germany, Ireland, the Netherlands, South Africa and the United Kingdom. The agreement with Medafor extends through the end of 2013.

SIGNIFICANT CONTRACTUAL OBLIGATIONS

See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operation” of this report for a discussion of significant contractual arrangements relating to (i) our senior secured note facility, (ii) our leases, (iii) our joint product development and commercialization arrangement with Kensey and (iv) product development milestone and related payments.

RESEARCH AND PRODUCT DEVELOPMENT

We employ the disciplines of composite engineering, polymer science, biologics processing, solution chemistry and nanoparticulate ceramic glass science to create our orthobiologic and biosurgery materials technology platforms. We then utilize technologies developed, co-developed or licensed by us to commercialize orthobiologic and biosurgery products for orthopedic and surgical applications. Patents have been issued and additional patent applications have been filed to protect our key developments. See “PATENTS AND PROPRIETARY INTELLECTUAL PROPERTY” below for additional information. We incurred approximately $5.2 million, $6.8 million, and $6.7 million in research and development expenses in 2010, 2009 and 2008, respectively.

7

We continue to develop new products under certain of our approved product platforms. In the near-term, we may seek to bring Vitoss, Cortoss, Vitagel and/or Imbibe product line extensions to market in the U.S. through the 510(k) or PMA regulatory process (see “GOVERNMENT REGULATION” below). As discussed above under OUR PRODUCTS, we are developing a suite of cavity creation devices for the vertebral compression fracture market, as well as a cervical interbody fusion device. We also intend to seek in the near term regulatory clearance in the United States for new indications of use for our existing Cortoss product, including cranioplasty.

In the long-term, we will continue to exploit our biomaterials expertise and manufacturing capacity to develop additional biomaterials for alternative indications related or unrelated to spine and orthopedic uses. Additionally we may utilize our knowledge of the spine and orthopedic markets to identify and develop products that may be unrelated to our biomaterials expertise.

PATENTS AND PROPRIETARY INTELLECTUAL PROPERTY

Our strategy is to seek protection for our product technologies and manufacturing methods through the use of U.S. and non-U.S. patents. We have filed or intend to file applications as appropriate for patents covering our technologies, products and processes. As of March 1, 2011, certain of the products that we have developed or market are covered by one or more of our 24 issued U.S. patents, 20 pending U.S. patent applications and numerous counterparts of certain of these patents and pending patent applications outside the U.S., including Canada, Europe, Mexico, Israel and Japan. Our issued patents are set to expire between 2015 and 2024. Key patents covering Vitoss, Vitoss Foam, Cortoss, Vitagel and Vitasure are set to expire in 2017, 2024, 2022, 2017 and 2019, respectively.

MANUFACTURING AND PRODUCT SUPPLY

The manufacture of our products is subject to regulation and periodic inspection by various regulatory bodies for compliance with current FDA Quality System Regulations, the EU Medical Devices Directive, International Organization for Standardization (ISO) 9000 Series standards, ISO 13485/European Norm (EN) 13485 and equivalent requirements.

In-House Manufacturing. Our 25,800-square foot Vitoss, Vitagel and Cortoss manufacturing facilities that produce our commercial products are leased through July 2017 and are certified as meeting the requirements of ISO 9001 and ISO/EN 13485. These facilities are subject to inspection by the FDA for compliance with FDA device manufacture requirements. We believe our existing manufacturing facilities have the capacity to meet our commercial needs through at least 2013.

In October 2009, we completed renovations at our leased space to establish a 4,000-square foot facility to process collagen used as a raw material in the manufacture of Vitagel. This facility is leased through 2017. During 2010, we received FDA approval for our new collagen processing facility and fully transitioned the processing of collagen for Vitagel in-house. As part of the establishment of our collagen processing facility, in September 2008 we acquired collagen production equipment and a non-exclusive, perpetual, royalty-free, irrevocable license to certain collagen production process technology and know-how from Allergan, Inc. The license rights are limited to certain uses, including those related to the processing and production of collagen for surgical hemostats such as Vitagel.

Third Party Manufacturers. We are manufacturing CellPaker and Aliquot through outside third party contract manufacturers. Our Vitoss is converted to Vitoss Foam and Vitoss Bioactive Foam by our development partner Kensey under a long-term supply agreement. We purchase Vitasure from Medafor, which uses third party manufacturers to make this product. Our and Medafor’s third party manufacturers are regulated by government agencies and are required to be EN 13485 certified or otherwise meet our quality system requirements (See “GOVERNMENT REGULATION” below).

Raw Materials Supply. Our ability to manufacture our products is dependent on a limited number of specialty suppliers of certain raw materials. We have various supply agreements with third parties for raw materials used in products we manufacture.

We have a supply agreement with Kensey for bovine collagen used in our Vitoss Foam, Vitoss Bioactive Foam and Vitoss Bioactive Foam-2X product lines.

A key raw material for manufacturing Vitagel is processed collagen that is derived from bovine hides. During 2010, we entered into a supply agreement to obtain bovine hides, which we process at our new collagen processing facility described above. This supplier of bovine hides is a sole source supplier. See the risk factor entitled, “We are dependent on a limited number of specialty suppliers of certain raw materials, and our business and financial results could be harmed if a specialty supplier no longer provides materials to us,” under Item 1A. “RISK FACTORS.”

We do not have supply agreements for all raw materials. The failure of any supplier to continue to provide us with materials at a price or quality acceptable to us, or at all, or our inability to find an alternative supplier with acceptable prices and quality, would have a material adverse effect on our ability to manufacture our products.

8

SALES AND MARKETING

In the U.S, we have a field sales network consisting of direct sales representatives and independent stocking and non-stocking distributors and agents who market our products. We continually seek to strengthen our hybrid sales and distribution network by optimizing the number of direct sales representatives and adding distributors or sales agents in those territories or markets where we do not have adequate coverage. Outside the U.S., we primarily utilize a network of independent stocking distributors to market our products, although we sell these products through a direct sales force in the United Kingdom.

COMPETITION

Extensive research efforts and rapid technological change characterize the market for products in the orthopedic, spine and orthobiologic and biosurgery markets. We face intense competition from medical device and biomedical technology companies. Our products could be rendered noncompetitive or obsolete by competitors’ technological advances. We may be unable to respond to technological advances through the development and introduction of new products. Moreover, many of our existing and potential competitors have substantially greater financial, marketing, sales, distribution, manufacturing and technological resources than we do. These competitors may also be in the process of seeking FDA or other regulatory approvals, or patent protection, for new products. Our competitors could, therefore, commercialize new competing products in advance of our products. We cannot guarantee that we will be able to compete successfully against current or future competitors or that competition will not have a material adverse effect on our business, financial condition and results of operations.

We believe Vitoss faces competition from numerous synthetic products, bone morphogenic proteins (BMPs), stem cell-based products and cadaver-based products, such as demineralized bone matrix (DBM) products, currently on the market that may be used for the same indications as our products, as well as from other products and technologies that may enter the market in the future. Moreover, we believe that pressure generated by current economic conditions and health care reform has resulted in hospitals becoming more proactive at controlling costs for medical devices. These efforts increase competition on a pricing level among bone graft products.

Cortoss received regulatory clearance in the U.S. in June 2009 for use in the vertebral augmentation of VCFs and received the CE mark several years ago for use in vertebral augmentation of VCFs and in screw augmentation. Cortoss faces competition from the several PMMA bone cement products that have been 510(k) cleared by the FDA since 2004 for this indication. Outside the U.S., Cortoss is facing competition from several other PMMA bone cement products that have received the CE mark since 2004 for this indication. We believe that Cortoss offers advantages over PMMA bone cement in terms of its simple mix-on-demand delivery system design, which allows for minimum waste and maximum ease of use and flexibility for the surgeon.

Vitagel is approved by the FDA as a surgical hemostat where bleeding may be a significant complication for many routine surgeries. As such, Vitagel can be marketed broadly to general surgeons and is applicable in the spine, hip and knee replacement surgery markets. Vitagel faces competition from several established surgical hemostat products marketed by other companies with substantially greater resources than us. However, we believe Vitagel offers unique advantages in comparison to these other products due to Vitagel’s ability to facilitate healing through its collagen component, as well as its use of the patient’s autologous plasma instead of pooled donated human plasma as is the case with the leading products in the market. In 2008, recombinant human thrombin was approved for sale in the U.S. We believe that recombinant human thrombin will be positioned as an improvement to bovine-derived thrombin, a raw material in our Vitagel product, which could adversely affect our sales of Vitagel. It is too early to estimate the effect of this new technology on our Vitagel product. If management believes this effect to be material and adverse to our Vitagel sales, we will consider alternative formulations of Vitagel and the regulatory approvals that may be required for any such alternative formulations.

Vitasure competes with several thrombin products and surgical hemostats on the basis of its safety profile and pricing.

We may also face pricing and competitive pressure as a result of the growing number of physician-owned distributors operating in the spine and orthopedic markets, as discussed below in Item 1A. RISK FACTORS under the risk factor entitled, “If we cannot keep up with technological changes and marketing initiatives of competitors, or if we are unable to effectively compete with the growing number of physician-owned distributors, sales of our products may be harmed.”

GOVERNMENT REGULATION

In order to market our products, we must apply for, be granted and maintain all necessary regulatory approvals, clearances and certifications. In addition, we must comply with all regulatory requirements in each applicable jurisdiction. The section entitled “OUR PRODUCTS” above details the regulatory approvals, clearances and certifications currently in place for our products.

The following discussion summarizes the material regulatory requirements applicable to our products.

9

United States

The medical devices that we manufacture and market, or intend to market, are subject to extensive regulation by the FDA. Pursuant to the Federal Food, Drug and Cosmetic Act (FFD&C Act) and the regulations promulgated thereunder, the FDA regulates the clinical testing, manufacture, labeling, distribution and promotion of medical devices. Noncompliance with applicable requirements can result in, among other things, fines, injunctions, civil penalties, recall or seizure of products, total or partial suspension of production, failure of the government to grant premarket clearance or premarket approval for devices, withdrawal of marketing approvals/clearances and criminal prosecution.

In the U.S., medical devices are classified into one of three classes (Class I, II or III) on the basis of the controls deemed necessary by the FDA to reasonably assure their safety and effectiveness. Under FDA regulations, Class I devices, the least regulated category, are subject to general controls and Class II devices are subject to general and special controls. Generally, Class III devices are those that must receive premarket approval by the FDA to ensure their safety and effectiveness.

Before we can introduce a new device into the market, we must generally obtain market clearance through a 510(k) notification or premarket approval through a premarket approval (PMA) application. A 510(k) clearance will be granted if the submitted information establishes that the proposed device is “substantially equivalent” to a legally marketed Class I or II medical device, or to a Class III medical device for which the FDA has not required a PMA. The FDA may determine that a proposed device is not substantially equivalent to a legally marketed device or that additional information or data are needed before a substantial equivalence determination can be made. A request for additional data may require that clinical studies be performed to establish the device’s “substantial equivalence.”

Commercial distribution of a device for which a 510(k) notification is required can begin only after the FDA issues a letter finding the device to be “substantially equivalent” to a predicate device. Pursuant to the FFD&C Act, the FDA must make a determination with respect to a 510(k) submission within 90 days of its receipt. The FDA may, and often does, extend this time frame by requesting additional data or information.

A “not substantially equivalent” determination, or a request for additional information, could delay or prevent the market introduction of new products for which we file such notifications. For any of our products that are cleared through the 510(k) process, modifications or enhancements that could significantly affect the safety or efficacy of the device or that constitute a major change to the intended use of the device will require new 510(k) submissions. The FDA has implemented a policy under which certain device modifications may be submitted as a “Special 510(k),” which will require only a 30-day review. Special 510(k)s are limited to those device modifications that do not affect the intended use or alter the fundamental scientific technology of the device and for which substantial equivalence can be demonstrated through design controls.

We must file a PMA if our proposed device is not substantially equivalent to a legally marketed Class I or Class II device, or if it is a Class III pre-amendment device (on the market since prior to May 28, 1976) for which FDA has called for PMAs. A PMA must be supported by valid scientific evidence that typically includes extensive data, including pre-clinical and clinical trial data, to demonstrate the safety and effectiveness of the device, as well as extensive manufacturing information.

FDA review of a PMA generally takes one to two years from the date the PMA is accepted for filing, but may take significantly longer. The review time is often significantly extended should the FDA ask for more information or clarification of information already provided in the submission.

During the PMA review period, an advisory committee, typically a panel of clinicians, will likely be convened to review and evaluate the application and provide recommendations to the FDA as to whether the device should be approved. The FDA is not bound by the recommendations of the advisory panel. Toward the end of the PMA review process, the FDA generally will conduct an inspection of the manufacturer’s facilities to ensure that they comply with Quality System Regulation (QSR) requirements.

If the FDA’s evaluations of both the PMA and the manufacturing facilities are favorable, the FDA will either issue an approval letter or an “approvable letter,” which usually contains a number of conditions that must be met in order to secure final approval of the PMA. When, and if, those conditions have been fulfilled to the satisfaction of the FDA, the agency will issue an approval letter, authorizing commercial marketing of the device for certain indications. If the FDA’s evaluation of the PMA or manufacturing facilities is not favorable, the FDA will deny approval of the PMA or issue a “not approvable letter.” The FDA may also determine that additional clinical trials are necessary, in which case PMA approval may be delayed up to several years while additional clinical trials are conducted and submitted as an amendment to the PMA. The PMA process can be expensive, uncertain and lengthy, and a number of devices for which other companies have sought FDA approval have never been approved for marketing.

Modifications to a device that is the subject of an approved PMA (including modifications to its labeling, raw material components or manufacturing process) may require approval by the FDA in the form of a PMA supplement or new PMA. Supplements to a PMA often require the submission of the same type of information required for an initial PMA, except that the

10

supplement is generally limited to that information needed to support the proposed change from the product covered by the original PMA.

If clinical trials of a device are required in connection with either a 510(k) notification or a PMA and the device presents a “significant risk,” we will be required to file an investigational device exemption (IDE) application prior to commencing clinical trials. The IDE application must be supported by data, typically including the results of animal and laboratory testing. If the IDE application is reviewed and approved by the FDA and one or more appropriate Institutional Review Boards (IRBs), clinical trials may begin at a specific number of investigational sites with a specific number of patients, as approved by the FDA. If the device presents a “non-significant risk” to the patient, we may begin the clinical trials after obtaining approval for the study by one or more appropriate IRBs. For “significant risk” devices, we must submit an IDE supplement to the FDA and receive approval from the FDA before we, or our investigator, may make a change to the investigational plan that may affect its scientific soundness or the rights, safety or welfare of human subjects. IRB approval may be required for changes in the investigational plan for both non-significant risk and significant risk devices.

Any products manufactured or distributed by us pursuant to FDA clearances or approvals are subject to extensive regulation by the FDA, including reporting and record keeping requirements. Device manufacturers are required to register their establishments and list their devices with the FDA and certain state agencies, and are subject to periodic inspections by the FDA and certain state agencies. The FFD&C Act requires devices to be manufactured in accordance with QSR requirements that impose certain procedural and documentation requirements upon us with respect to manufacturing and quality assurance activities. Medical devices are also subject to post-market reporting requirements for deaths or serious injuries when the device may have caused or contributed to the death or serious injury, and for certain device malfunctions that would be likely to cause or contribute to a death or serious injury if the malfunction were to recur. If safety or efficacy problems occur after the product reaches the market, the FDA may impose severe limitations on the use of any approved or cleared product.

Our labeling and promotion activities are subject to scrutiny by the FDA and, in certain instances, by the Federal Trade Commission. The FDA actively enforces regulations prohibiting marketing of products for unapproved or uncleared uses. We, as well as our products, are also subject to a variety of state laws and regulations in those states or localities where our products are or will be marketed. Any applicable state or local regulations may hinder our ability to market our products in those states or localities. We are also subject to numerous federal, state and local laws relating to such matters as safe working conditions, manufacturing practices, environmental protection, fire hazard control and disposal of hazardous or potentially hazardous substances. There can be no assurance that we will not be required to incur significant costs to comply with such laws and regulations now or in the future or that such laws or regulations will not have a material adverse effect upon our ability to do business. Noncompliance with applicable requirements can result in, among other things, fines, injunctions, civil penalties, recall or seizure of products, total or partial suspension of production, failure of the government to grant the pre-market clearance or premarket approval for devices, withdrawal of marketing approvals, clearances and criminal prosecution.

In August 2010, the FDA issued two comprehensive evaluations containing recommendation to change its regulatory review of medical devices. One report focused on ways to strengthen and clarify the premarket review or 510(k) process for medical devices that do not need to undergo a full premarket approval review. The other report evaluated FDA’s use of science in decision-making. These reports were prepared and issued in response to concerns raised both inside and outside of the FDA about whether the current 510(k) program achieves its goals of making safe and effective devices available to the public while fostering innovation. Concerns about the program have centered on whether it allows devices to enter the market without sufficient safety and effectiveness evidence and whether a lack of predictability, consistency, and transparency is hindering device development.

Following issue of these reports, FDA solicited public feedback on the content and subsequently developed a plan containing 25 actions it intends to implement during 2011 to improve the 510(k) process. Key actions include: 1) Streamlining the “de novo” review process for certain innovative, lower-risk medical devices; 2) Clarifying when clinical data should be submitted in a premarket submission, guidance that will increase the efficiency and transparency of the review process; and 3) Establishing a new Center Science Council of senior FDA experts to assure timely and consistent science-based decision making. FDA seeks to implement more changes after obtaining additional feedback from the public and the Institute of Medicine. These changes to the 510(k) program may significantly alter the review process for our products, and may increase the amount of pre-clinical and clinical data required to obtain product clearances and approvals.

European Union

In order to sell our products within the EU, we are required to achieve compliance with the requirements of the EU Medical Devices Directive, or MDD, and affix a CE mark on our products to attest such compliance. To achieve this, our products must meet the “essential requirements” defined under the MDD relating to safety and performance. Some of our products, such as Vitoss Foam,

11

Vitoss Bioactive Foam and Vitagel, contain materials of animal origin (i.e., bovine collagen and/or bovine thrombin). Demonstrated compliance with the EU Animal Tissue Directive is also required in order to sell these products in the EU.

In addition to demonstrating compliance with these European Directives, we must successfully undergo a verification of our regulatory compliance by an independent notified body referred to as a conformity assessment. The nature of the conformity assessment will depend on the regulatory class of our products. Under European law, our products, other than Imbibe and Aliquot (which are Class I-sterile and Class II-A, respectively), are likely to be in Class III. In the case of Class III products, we must (as a result of the regulatory structure which we have elected to follow) establish and maintain a complete quality system for design and manufacture as described in Annex II of the MDD and demonstrated by compliance with EN 13485:2003. We are certified as meeting the requirements of ISO 9001 and ISO/EN 13485. Our notified body has audited our quality system and determined that it meets the requirements of the MDD. In addition, the notified body must certify the specific design of each device in Class III, IIa and IIb. As part of the design certification process, the notified body must also verify that the products comply with the essential requirements of the MDD. In order to comply with these requirements, we must, among other things, complete a risk analysis and evaluation of the clinical data to demonstrate the product’s conformity with the essential requirements. This clinical evaluation may include a literature review for the subject device, or another comparable device. In the absence of adequate clinical information about the product, we may be required to conduct a clinical investigation for the product.

The clinical data presented by us must provide evidence that the products meet the performance specifications claimed by us, provide sufficient evidence of adequate assessment of unwanted side effects and demonstrate that the benefits to the patient outweigh the risks associated with the device. We are subject to continued surveillance by the notified body and are required to report any serious adverse incidents to the appropriate authorities of the European Union member states. The certification of the notified body is valid for a maximum of five years but may be extended by application for additional five year periods. We also are required to comply with additional national requirements that are outside of the scope of the MDD. There can be no assurance that we will not be required to incur significant costs to comply with such laws and regulations now or in the future or that such laws or regulations will not have a material adverse effect upon our ability to do business.

THIRD PARTY REIMBURSEMENT; HEALTH CARE REFORM

Successful sales of our products in the U.S. and other markets will depend on the availability of adequate coverage and reimbursement from third party payers relative to our products. In the U.S., health care providers, such as hospitals and physicians that purchase or utilize our products for treatment of their patients, generally rely on independent third party payers, such as private insurance companies or HMOs, and governmental payers, such as Medicare and Medicaid, to reimburse all or part of the costs and fees associated with the provision of items and services using our products. Physicians, hospitals, and other health care providers may not purchase our products if they do not receive satisfactory reimbursement from these payers for the cost of procedures using our products.

Each payer has its own process and standards for determining whether it will cover and reimburse a procedure or particular product. Private payers often follow the lead of the governmental payers in rendering coverage and reimbursement determinations. Therefore, achieving favorable Medicare coverage and reimbursement is usually a significant issue for successful introduction of a new product. Medicare is a federally funded program managed by the Centers for Medicare and Medicaid Services (CMS), through local contractors that administer coverage and reimbursement for certain health care items and services furnished to the elderly and disabled. Medicaid is an insurance program for the poor that is both federally and state funded and managed by each state. The federal government sets general guidelines for Medicaid and each state creates specific regulations that govern its individual program.

Medicare provides, among other things, health care benefits that cover, within prescribed limits, the major costs of most medically necessary care for such individuals, subject to certain deductibles and co-payments. The Medicare program has established, and continues to establish, standards and guidelines for the coverage and reimbursement of certain procedures, equipment, supplies and other items and services. Generally, in order to be covered and reimbursed by Medicare, a health care item or service furnished to a Medicare beneficiary must be included in a statutory benefit category, must not be excluded from coverage by statute, and must be reasonable and necessary for the diagnosis or treatment of an illness or injury or to improve the functioning of a malformed body part. Medicare’s coverage decisions can be made on a nationwide basis or at the local contractor level, and coverage of an item or service can be reconsidered at any time. Several of Medicare’s contractors have policies governing coverage of our products or procedures using our products, including vertebroplasty and kyphoplasty. In July 2008, CMS identified vertebroplasty and kyphoplasty, procedures for which our Cortoss product is cleared, as one of twenty potential national coverage determination topics. Although CMS has not taken further action nationally since that time, the use of vertebroplasty and kyphoplasty is currently under a coverage review by a few of Medicare’s local contractors. We expect these local contractors will issue their coverage determinations in 2011.

The methodology for determining (1) the coverage status of our products; and (2) the amount of Medicare reimbursement for our products varies based upon, among other factors, the setting in which a Medicare beneficiary received health care items and services. Acute care hospitals are generally reimbursed by Medicare for in-patient operating costs based upon prospectively determined rates. Under the in-patient Prospective Payment System (PPS), acute care hospitals receive a predetermined payment rate

12

based upon the Medicare Severity Diagnosis-Related Group, or MS-DRG, into which each Medicare beneficiary stay is assigned, regardless of the actual cost of the services provided. These payment rates are adjusted for geographic variations in costs, medical education payments, and adjustments for hospitals that serve a disproportionate share of low-income patients. In some cases, hospitals also may receive adjustments for use of certain new technologies. Certain additional or “outlier” payments may be made to a hospital for cases involving unusually high costs. Accordingly, acute care hospitals generally do not receive direct Medicare reimbursement under the in-patient PPS for the distinct costs incurred in purchasing our products. Rather, reimbursement for these costs is deemed to be included within the MS-DRG-based payments made to hospitals for the services furnished to Medicare-eligible in-patients in which our products are utilized. Because in-patient PPS payments are based on predetermined rates and may be less than a hospital’s actual costs in furnishing care, acute care hospitals have incentives to lower their in-patient operating costs by utilizing equipment, devices and supplies, including those sold by us, that will reduce the length of in-patient stays, decrease labor or otherwise lower their costs. Our product revenue could be affected negatively if acute care hospitals discontinue product use due to insufficient reimbursement, or if other treatment options are perceived to be more cost-effective. Similarly, some states reimburse certain health care providers for in-patient services under their Medicaid programs by using prospective rates for diagnosis-related groups of illnesses.

Medicare also reimburses most hospital out-patient services on a prospective payment basis, subject to certain adjustments, exceptions, and limitations. Under the Medicare hospital out-patient PPS, services are grouped based on clinical and cost similarity into ambulatory payment classifications (APCs). All services in an APC have the same rate, intended to cover the equipment, supplies, and labor used to perform the service. Unlike the in-patient PPS, if a patient receives multiple services, the hospital will receive reimbursement through multiple APCs. Similar to the in-patient PPS, this system provides hospitals with an incentive to select equipment and supplies that reduce the costs of treating a patient. Therefore, health care providers may refuse to use our products if coverage or reimbursement is inadequate.

Any changes in federal legislation, regulations and policy affecting Medicare coverage and reimbursement relative to our products could have a material effect on our results of operations. Changes in the health care industry in the United States and elsewhere also could adversely affect the demand for our products as well as the way in which we conduct our business. Significantly, the Patient Protection and Affordable Care Act (PPACA) enacted into federal law in 2010 requires most individuals to have health insurance, establishes new regulations on health plans, creates insurance pooling mechanisms, and requires other expanded public health care measures. PPACA will also reduce Medicare spending on services provided by hospitals and other providers and establishes a new 2.3 percent tax on the sale after December 31, 2012 of a taxable medical device by the manufacturer, producer, or importer.

Inadequate coverage or reimbursement by private insurance companies and government programs could significantly reduce usage of our products. In addition, an increasing emphasis on managed care in the U.S. has placed, and we believe will continue to place, greater pressure on medical device pricing. Such pressures could have a material adverse effect on our ability to sell our products profitably. Failure by hospitals and other users of our products to obtain favorable coverage or reimbursement from third party payers or changes in governmental and private third party payers’ policies toward coverage or reimbursement for procedures employing our products could reduce demand for our products.

The European Union has not established a uniform process to govern the pricing and reimbursement of medical devices. Consequently, the individual EU member states operate various combinations of centrally financed health care systems and private health insurance systems. The relative importance of government and private systems varies from country to country. The choice of devices is subject to constraints imposed by the availability of funds within the purchasing institution and by hospital and authority priorities and procedures. Medical devices are most commonly sold to hospitals or health care facilities at a price set by negotiation between the buyer and the seller. A contract to purchase products may result from an individual initiative or as a result of a competitive bidding process. In either case, the purchaser pays the supplier, and payment terms vary widely throughout the EU. Failure to obtain favorable negotiated prices with hospitals or health care facilities could adversely affect sales of our products.

HEALTH CARE FRAUD AND ABUSE LAWS

We are subject to various federal and state laws pertaining to health care fraud and abuse, including anti-kickback laws and false claims laws. Similar regulations have been adopted by EU member states. Violations of these laws are punishable by criminal, civil and/or administrative sanctions, including, in some instances, fines, imprisonment, and exclusion from participation in federal, state and national health care programs, including Medicare, Medicaid and veterans’ health programs. Because of the far-reaching nature of these laws, there can be no assurance that the occurrence of one or more violations of these laws would not result in a material adverse effect on our business, financial condition and results of operations.

Anti-Kickback Laws. Our operations are subject to federal and state anti-kickback laws. The federal anti-kickback law prohibits entities such as us from knowingly and willfully offering, paying, soliciting or receiving any form of remuneration (including any kickback, bribe or rebate) in return for the referral of items or services for which payment may be made under a federal health care

13

program, or in return for the recommendation, arrangement, purchase, lease or order of items or services for which payment may be made under a federal health care program. The definition of remuneration has been broadly interpreted to include anything of value, including for example gifts, discounts, the furnishing of supplies or equipment, payments of cash and waivers of payments. Several courts have interpreted the statute’s intent requirement to mean that if any one purpose of an arrangement involving remuneration is to induce referrals or otherwise generate business involving goods or services reimbursed in whole or in part under federal health care programs, the statute has been violated. Violation of the federal anti-kickback law is a felony, punishable by criminal fines and imprisonment for up to five years or both. In addition, the Department of Health and Human Services may impose civil penalties and exclude violators from participation in federal health care programs such as Medicare and Medicaid. Exclusion of a manufacturer would preclude any federal health care program from paying for its products. In addition, enforcement officials have argued (and some courts have agreed) that kickback arrangements can provide the basis for an action under the Federal False Claims Act, which is discussed below.

Government officials have focused recent enforcement efforts on, among other things, the sales and marketing activities of health care companies, and recently have brought cases against individuals or entities with personnel who allegedly offered unlawful inducements to potential or existing customers in an attempt to procure their business. Settlements of these cases by health care companies have involved significant fines and/or penalties and in some instances criminal pleas.

Many states have adopted similar prohibitions against payments intended to induce referrals of products or services paid by Medicaid or other third party payers.

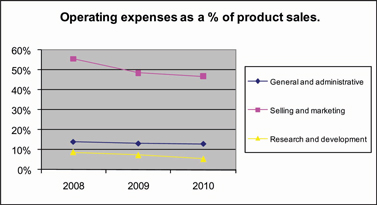

False Claims. The federal False Claims Act imposes civil and criminal liability on individuals or entities who submit (or cause the submission of) false or fraudulent claims for payment to the government. Violations of the federal False Claims Act may result in penalties equal to three times the damages which the government sustained, an assessment of between $5,500 and $11,000 per claim, civil monetary penalties and exclusion from participation in the Medicare and Medicaid programs.