UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the Fiscal Year Ended September 30, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 000-23554

StoneX Group Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 59-2921318 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

230 Park Ave, 10th Floor

New York, NY 10169

(Address of principal executive offices) (Zip Code)

(212) 485-3500

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | SNEX | | The Nasdaq Stock Market LLC |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large Accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of March 31, 2024, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $1,678.9 million.

As of November 22, 2024, there were 31,929,644 shares of the registrant’s common stock outstanding.

Document Incorporated by Reference

Certain portions of the definitive Proxy Statement for the Registrant’s Annual Meeting of Stockholders to be held on March 5, 2025 are incorporated by reference into Part III of this Annual Report on Form 10-K.

StoneX Group Inc.

Annual Report on Form 10-K for the Fiscal Year Ended September 30, 2024

Table of Contents

| | | | | | | | |

| | | Page |

| PART I | |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 1B. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| | |

| PART II | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| Item 7. | | |

| | |

| Item 7A. | | |

| | |

| Item 8. | | |

| | |

| Item 9. | | |

| | |

| Item 9A. | | |

| | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III | |

| | |

| Item 10. | | |

| | |

| Item 11. | | |

| | |

| Item 12. | | |

| | |

| Item 13. | | |

| | |

| Item 14. | | |

| | |

| | |

| PART IV | |

| | |

| Item 15. | | |

| | |

| Item 16. | | |

| | |

| | |

Throughout this document, unless the context otherwise requires, the terms “Company”, “we”, “us” and “our” refer to StoneX Group Inc. and its consolidated subsidiaries.

Cautionary Statement about Forward-Looking Statements

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business

Overview of Business and Strategy

We operate a global financial services network that connects companies, organizations, traders and investors to the global market ecosystem through a unique blend of digital platforms, end-to-end clearing and execution services, high touch service and deep expertise. We strive to be the one trusted partner to our clients, providing our network, product and services to allow them to pursue trading opportunities, manage their market risks, make investments and improve their business performance. Our businesses are supported by our global infrastructure of regulated operating subsidiaries, our advanced technology platforms and our team of more than 4,500 employees as of September 30, 2024. We believe our client-first approach differentiates us from large banking institutions, engenders trust and has enabled us to establish market leading positions in a number of complex fields in financial markets around the world.

We offer a vertically integrated product suite, beginning with high-touch and electronic access to nearly all major financial markets worldwide, as well as numerous liquidity venues. We deliver this access through the entire lifecycle of a trade, from deep market expertise and on-the-ground intelligence to best execution and finally post-trade clearing, custody and settlement services. We believe this is a unique product offering outside of the bulge bracket banks, which creates long-term relationships with our clients. Our business model has created a revenue stream that is diversified by asset class, client type and geography, earning commissions and spreads as clients execute transactions across our global network, monetizing non-trading client activity including interest and fee earnings on client balances as well as earning consulting and fees for our market intelligence and risk management services.

We currently serve more than 54,000 commercial, institutional, and payments clients, and over 400,000 self-directed/retail accounts located in more than 180 countries. Our clients include commercial entities, regional, national and introducing broker-dealers, asset managers, insurance companies, brokers, institutional and individual investors, professional traders, commercial and investment banks as well as government and non-governmental organizations (“NGOs”). We believe our clients value us for our attention to their needs, our expertise and flexibility, our global reach, our ability to provide access to liquidity in hard-to-reach markets and opportunities, and our status as a well-capitalized and regulatory-compliant organization.

We engage in direct sales efforts to seek new clients, with a strategy of extending our services to potential clients that are similar in size and operations to our existing client base. In executing this strategy, we intend to both target new geographic locations and expand the services offered in geographic locations in which we currently operate in an effort to increase our market share or where there is an unmet demand for our services. Through our mobile platforms and intranet websites, including StoneX.com, FOREX.com, and StoneXBullion.com we seek to attract and onboard new clients generated from digital marketing and brand advertising initiatives. We also pursue new clients through indirect channels, including our StoneX Marketing Partners affiliate program, StoneX.com/marketing partnerships; our relationships with introducing brokers, who solicit clients on our behalf; and white label partners, who offer our services to their clients under their own brand. In addition, we selectively pursue small- to medium-sized acquisitions, focusing primarily on targets that satisfy specified criteria, including client-centric organizations that enable us to increase market share in existing products, or which help us expand into new asset classes, client segments and geographies where we currently have a small or limited market presence.

We believe we are well positioned to capitalize on key trends impacting the financial services sector. Among others, these trends include the impact of increased regulation on banking institutions and other financial services providers; increased consolidation, especially of smaller sub-scale financial services providers and independent securities clearing firms; the growing importance and complexity of conducting secure cross-border transactions; and the demand among financial institutions to transact with well-capitalized counterparties.

We focus on mitigating exposure to market risk, ensuring adequate liquidity to maintain our daily operations and making non-interest expenses variable, to the greatest extent possible. Our strategy is to utilize a centralized and disciplined process for capital allocation, risk management and cost control, while delegating the execution of strategic objectives and day-to-day management to experienced individuals. This requires high quality managers, a clear communication of performance objectives and strong financial, operational and compliance controls. We believe this strategy will enable us to build a more scalable and significantly larger organization that embraces an entrepreneurial approach to business, supported and underpinned by strong centralized financial and compliance controls.

Available Information

Our internet address is www.stonex.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, statements of changes in beneficial ownership and press releases are available free of charge in the Investor Relations section of this website. Our website also includes information regarding our corporate governance, including our Code of Ethics, which governs our directors, officers and employees. The content of our website is not incorporated by reference into this report or any other filings with the Securities and Exchange Commission (“SEC”).

Capabilities

We connect our clients to global financial and physical markets and liquidity sources to enable them with efficient access to a broad array of financial and physical products through a combination of high-touch service and digital platforms in pursuit of their business objectives. Our financial network connects our clients to over 40 derivatives exchanges, 185 foreign exchange markets, most global securities exchanges and over 18,000 over-the-counter markets.

Execution

We provide trade execution services to our clients via both high-touch service and electronically through a wide variety of technology platforms that connect them to markets across the globe. Asset and product types include listed futures and options on futures, equities, mutual funds, ETFs, equity options, foreign currencies, corporate, government and municipal bonds and unit investment trusts.

Clearing

We provide competitive and efficient clearing on all major futures exchanges globally. One of our subsidiaries is one of the largest non-bank futures commission merchant (“FCM”) in the United States (“U.S.”) as measured by its $5.7 billion in required client segregated assets as of September 30, 2024 and our United Kingdom (“U.K.”) subsidiary is one of only seven Category One ring dealing members of the London Metals Exchange (the “LME”). In addition, we act as an independent full-service provider of clearing, custody, research and security-based lending products in the global securities markets. We provide multi-asset prime brokerage, outsourced trading and custody, as well as self-clearing and introduced clearing services for hedge funds, mutual funds and family offices. We provide prime brokerage services in major foreign currency pairs and swap transactions to institutional clients. Additionally, we provide clearing of foreign exchange transactions, as well as clearing of a wide range of over-the-counter (“OTC”) products.

OTC / Market-Making

We offer clients access to the OTC markets for a broad range of traded commodities, global securities, foreign currencies, contracts for difference (“CFD”) and interest rate products. For clients with commodity price and financial risk, our customized and tailored OTC structures help mitigate those risks by integrating the processes of product design, execution of the underlying components of the structured risk product, transaction reporting and valuation.

We provide market-making and execution in a variety of financial products including commodity derivatives, unlisted American Depository Receipts (“ADRs”) and Global Depository Receipts (“GDRs”), foreign ordinary shares, and foreign currencies. In addition, we are an institutional dealer in fixed income securities including U.S. Treasury, U.S. government agency, agency mortgage-backed, asset-backed, corporate, emerging market, convertible and high-yield securities.

Payments

We have built a scalable platform to provide end-to-end global payment solutions to banks and commercial businesses, as well as charities, NGOs and government organizations. We offer payments services in more than 140 currencies. In this business, we primarily act as a principal in buying and selling foreign currencies on a spot basis deriving revenue from the difference between the purchase and sale prices. Through our comprehensive platform and our commitment to client service, we provide simple and fast execution, delivering funds in any of these countries quickly through our global network of approximately 350 correspondent banking relationships.

Advisory Services

We provide value-added advisory services and high-touch trade execution across a variety of financial markets, including commodities, foreign currencies, interest rates, institutional asset management and independent wealth management. For commercial clients with exposure to commodities, foreign currencies and interest rates, we work through our proprietary Integrated Risk Management Program (“IRMP®”) to systematically identify and quantify their risks and then develop strategic plans to effectively manage these risks with a view to protecting their margins and ultimately improving their bottom lines.

We also participate in the underwriting and trading of agency mortgage-backed, commercial mortgage-backed, asset-backed and municipal securities as well as structured credit in domestic and international markets. Through our asset management activities, we leverage our specialist expertise in niche markets to provide institutional investors with tailored investment products. Through our independent wealth management business, we provide advisory services to the growing retail investor market.

Market Intelligence

Our Market Intelligence platform provides our clients with access to deep data and incisive commentary from our expert traders and analysts from across our global network. This platform focuses on providing local, actionable insights and detailed intelligence from every market we trade, through the lens of our professionals, who leverage first-hand knowledge and personal connections to deliver a unique advantage for our clients.

Physical Trading

We act as a principal to support the needs of our clients in a variety of physical commodities, primarily precious metals, as well as across the commodity complex, including renewable fuels, grains, oil seeds, cotton, coffee, cocoa, fats and oils and feed products. Through these activities, we have the ability to offer a simplified risk management approach to our commercial clients by embedding more complex hedging structures as part of each physical contract to provide clients with enhanced price risk mitigation. We also offer clients efficient off-take or supply services, as well as logistics management.

Operating Segments

Our business activities are managed through four operating segments, including Commercial, Institutional, Self-Directed/Retail, and Payments, as follows:

Commercial

The Commercial segment comprises the activities associated with the identification, management, hedging and monitoring of various commodity and financial risks faced by commercial entities in their business cycles, including risks related to interest rates, foreign exchange, agricultural commodities, energy and renewable fuels, industrial metals, precious metals, and other physical commodities.

We offer our commercial clients a comprehensive array of products and services, including risk management and hedging services, execution and clearing of exchange-traded and OTC products, voice brokerage, market intelligence and physical trading as well as commodity financing and logistics services. We believe our ability to provide these high-value-added products and services, differentiates us from our competitors and maximizes the opportunity to retain our clients.

Our risk management consulting services are designed to quantify and monitor commercial entities’ exposure to commodity and financial risk. Upon assessing this exposure, we develop a plan to control and hedge these risks with post-trade reporting against specific client objectives. Our clients are assisted in the execution of their hedging strategies through a wide range of products from listed exchange-traded futures and options to basic OTC instruments that offer greater flexibility, to structured OTC products designed for customized solutions and physical contracts.

Our execution and clearing services span virtually all traded commodity markets, with the largest concentrations in agricultural and energy commodities (consisting primarily of grains, energy and renewable fuels, coffee, sugar, cotton, and food service), as well as precious and base metals products. We also provide execution of foreign currency forwards and options and interest rate swaps as well as a wide range of structured product solutions to our commercial clients who are seeking cost-effective hedging strategies. Generally, our clients direct their own trading activity, and our risk management consultants do not have discretionary authority to transact trades on behalf of our clients.

We provide a full range of physical trading capabilities in precious metals markets providing our clients the ability to purchase physical gold and other precious metals, in multiple forms, and in denominations of their choice. In our precious metals activities, we act as a principal, committing our own capital to buy and sell precious metals on a spot and forward basis.

In addition, we act as a principal to facilitate physical commodity trading and provide marketing, procurement, logistics and price management services to clients across the commodity complex, including renewable fuels, grains, oil seeds, cotton,

coffee, cocoa, sugar, fats and oils and feed products. We selectively provide financing to commercial companies against physical inventories.

We generally mitigate the price risk associated with commodities held in inventory through the use of derivatives. We do not elect hedge accounting under accounting principles generally accepted in the United States of America (“U.S. GAAP”) in accounting for this price risk mitigation.

Within this segment we organize our marketing efforts into client industry product lines including agricultural, energy and renewable fuels, metals and various other commodities, servicing commercial producers, end users and intermediaries around the world.

Competitive Environment - Commercial Segment

Industry participants include producers/end-users, wholesalers and merchants, corporations, introducing brokers, grain elevators, merchandisers, importer/exporter and market intermediaries such as FCMs and swaps dealers, and liquidity venues such as commodity exchanges, financial exchanges and OTC markets. Commercial entities face a variety of risks, including risks related to commodity input pricing, supply chain management and inventory financing, interest rate changes, foreign exchange rate changes, and price and quantity volatility in their outputs. Market intermediaries facilitate the identification, management and hedging of commodity and financial risks on behalf of commercial entities by designing and executing hedging programs through the use of various hedging instruments, including futures and options traded on exchanges or plain vanilla and more complex structured products traded bi-laterally on the OTC markets. Commercial entities occasionally prefer to manage exposure to physical commodities through direct purchase and sale agreements for which they may utilize the services of physical commodity merchants.

The need for, and volume of, client hedging activity is driven by commodity supply and demand dynamics, quantity and quality of commodity production and consumption, both locally and globally, trading of various commodities, and economic and geopolitical factors. In addition, the price levels and price volatility of various commodities generally increase the need of commercial clients to hedge. FCMs, swaps dealers, physical commodity merchants and other intermediaries and service providers create value for commercial clients by managing risks across the clients’ operations, allowing them to focus on their core expertise. In addition, commercial clients often face financial risks such as interest rate and foreign exchange rate volatility, which these intermediaries help to mitigate. Physical commodity merchants serve clients by providing trading, hedging, inventory financing and logistics services.

Competitors in the Commercial segment include independent (non-bank) FCMs, FCMs affiliated with large commodity producers, global banks and independent and bank-owned swaps dealers. Although global banks represent the vast majority of client segregated assets, they tend to focus on larger clients. Independent, non-bank FCMs tend to focus on serving small- to mid-sized commercial clients where they face less competition from the global banks. Over the last 15 years since the financial crisis, global banks have increased the minimum size of clients they are willing to serve, in part due to decreasing profit margins often driven by regulation, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) in the United States and the revised Markets in Financial Instruments Directive (“MiFID II”) and accompanying regulation, Markets in Financial Instruments Regulation (“MiFIR”) in Europe. This has presented an opportunity for non-bank participants in this industry, such as us, to acquire small and mid-sized clients and increase market share.

We strive to increase market share and attract new clients that are underserved by the global banks, capitalizing on our position as one of few publicly listed mid-sized financial services companies offering our clients access to global futures and options products through our well-capitalized independent FCMs, structured OTC products through our swaps dealer as well as our physical commodity offerings. We have also taken advantage of opportunities to consolidate sub-scale competitors into our Commercial businesses.

Institutional

We provide institutional clients with a complete suite of equity trading services to help them find liquidity with best execution, consistent liquidity across a robust array of fixed income products, competitive and efficient clearing and execution in all major futures and securities exchanges globally, as well as prime brokerage in equities and major foreign currency pairs and swap transactions. In addition, we originate, structure and place debt instruments in the domestic and international capital markets. These instruments include agency mortgage-backed, commercial mortgage-backed, asset-backed and municipal securities, as well as structured credit.

Securities

We provide value-added solutions that facilitate cross-border trading in equity securities and believe our clients value our ability to manage complex transactions, including foreign exchange, utilizing our local understanding of market convention, liquidity and settlement protocols around the world. Our clients include U.S.-based regional and national broker-dealers and institutions investing or executing client transactions in international markets and foreign institutions seeking access to the U.S. securities markets. We make markets in more than 16,000 equities on the NYSE, NASDAQ, and various OTC markets, including ETFs and over 7,000 ADRs, GDRs and foreign securities making us one of the leading market makers in foreign securities. In addition, we make prices in more than 10,000 foreign equities listed on foreign exchanges. We are also a broker-dealer in Argentina, Brazil and in the U.K., where we are active in providing institutional executions in the local capital markets.

We act as an institutional dealer in fixed income securities, including U.S. Treasury, U.S. government agency, agency mortgage-backed and asset-backed securities, as well as investment grade, high yield, convertible and emerging market debt to a client base including asset managers, commercial bank trust and investment departments, broker-dealers and insurance companies.

We are an independent full-service provider to introducing broker-dealers (“IBD’s”) of clearing, custody, research, syndicated and security-based lending products and services, including a proprietary technology platform which offers efficient connectivity to ensure a positive client experience through the clearing and settlement process. We believe we are one of the leading mid-market clearers in the securities industry, with approximately 100 correspondent clearing relationships with over $31 billion in assets under management or administration as of September 30, 2024.

We operate an asset management business in which we earn fees, commissions and other revenues for management of third party assets and investment gains or losses on our investments in funds and proprietary accounts managed either by our investment managers or by independent investment managers.

Listed Derivatives

We provide competitive and efficient clearing and execution in all major futures exchanges globally. Through our platforms, client orders are accepted and directed to the appropriate exchange for execution. We then facilitate the clearing of clients’ transactions. Clearing involves the matching of clients’ trades with the exchange, the collection and management of client margin deposits to support the transactions, and the accounting and reporting of the transactions to clients.

As of September 30, 2024, our U.S. FCM held $5.7 billion in required client segregated assets, which makes us one the largest non-bank FCMs in the U.S., as measured by required client segregated assets. We seek to leverage our capabilities and capacity in clearing to financial institutions, institutional trading firms, professional traders and introducing brokers as well as offering facilities management or outsourcing solutions to other FCMs.

Foreign Exchange

We provide prime brokerage foreign exchange (“FX”) services to financial institutions and professional traders. We provide our clients with the full range of OTC products, including 24-hour a day execution of spot, forwards and options, as well as non-deliverable forwards in both liquid and exotic currencies.

Competitive Environment - Institutional Segment

The industry in which we provide services within our Institutional segment comprises activities associated with the trading of, and investment in, various financial assets, including equity and debt securities, commodities, foreign currencies, interest rates, and derivatives, both exchange-traded and OTC. This industry also includes various services provided to participants in the financial markets, which allow participants access to liquidity and execution venues, as well as clearing and settlement of transactions. Industry participants include institutional and retail investors, banks, insurance companies, fund managers, hedge funds, investment advisers, proprietary trading firms, commodity trading advisors and commodity pool operators, and foreign institutions and investors seeking access to U.S. markets, as well as various market intermediaries such as market makers, regional and national broker-dealers, independent broker-dealers, FCMs, and investment banks and liquidity venues, such as securities and derivatives exchanges and OTC marketplaces.

Trading and investing activity across asset classes is driven by growth in wealth and savings, investors’ asset allocation and diversification needs, including across geographies, and return objectives, risk management needs and the availability of speculative arbitrage opportunities. Volatility in asset prices generally drives increased trading activity and increased demand for execution and clearing services.

Broker-dealers, FCMs, investment banks and other intermediaries create value for institutional clients by facilitating client access to various financial markets, including securities and derivatives exchanges, proprietary sources of liquidity, OTC markets, other institutions and international markets. Market intermediaries can act as market-makers or principal traders that

facilitate client trading activity by matching orders internally. Market intermediaries can also act as agents that accept orders, direct them to the appropriate market and facilitate the clearing of client transactions, which involves matching client trades with the exchange, collecting and managing client margin deposits to support the transactions, and accounting and reporting these transactions to clients.

Certain market intermediaries, predominantly investment banks, also provide advisory services, securities underwriting, loan syndications, security-based lending products and services, custodial services, investment research products, asset management services and technology platforms for client connectivity.

Competitors in the securities and clearing and execution businesses include global banks, institutional broker-dealers, correspondent clearers, independent broker-dealers, clearing FCMs and market-makers. We compete to secure clients based on quality of execution and client service, global access and local market expertise, and the breadth of our product offerings.

Regulatory burdens for FCMs and broker-dealers have increased since the financial crisis, which has led to increased complexity and capital requirements that have disproportionately affected smaller firms, driving consolidation. We have benefited from these trends and expect them to continue, and we seek opportunities to participate in further industry consolidation.

Self-Directed/Retail

We provide our self-directed/retail clients around the world access to over 18,000 global financial markets, including spot foreign exchange and CFDs, which are investment products with returns linked to the performance of underlying assets, and both financial trading and physical investment in precious metals. In addition, our independent wealth management business offers a comprehensive product suite to retail investors in the United States.

Forex and CFDs

We are a provider of trading services and solutions in the global financial markets, including spot foreign exchange (“forex”) and CFDs. We offer CFDs on currencies, commodities, indices, individual equities, cryptocurrencies, bonds, options and interest rate products.

We seek to attract and support our clients through direct and indirect channels. Our primary direct channels for our retail forex and CFD business are our mobile platforms and internet websites, FOREX.com and Cityindex.com, which are available in multiple languages, including English, Chinese, Japanese, Spanish and Arabic. Our indirect channels include our relationships with introducing brokers, who solicit clients on our behalf, and white label partners, who offer our trading services to their clients under their own brand.

Our proprietary trading technology provides our clients with an enhanced client experience and multiple ways to trade and manage their accounts, tailored to their level of experience and preferred mode of access. In addition, we selectively offer third party trading tools that we believe complement our proprietary offerings. We believe that our proprietary trading technology is a significant competitive advantage because we have the ability to adapt quickly to our clients’ changing needs.

We have longstanding relationships with a large number of institutional liquidity providers, as well as access to multiple liquidity venues. They allow us to offer our clients superior liquidity and more competitive pricing with tighter bid/offer spreads than many of our competitors. In addition, we have developed a proprietary pricing engine that aggregates quotes from our liquidity sources to ensure that our prices accurately reflect current market price levels and allow us to provide our clients with fast, accurate trade execution.

We have proprietary technology to handle numerous aspects of account onboarding and client service, including the account opening and client verification process, fast online account funding and withdrawals with a wide variety of automated payment methods, and on-demand delivery of client information, such as account statements and other account-related reporting. We also offer account opening and funding functions on our mobile trading applications in order to provide a superior experience to the large number of clients who trade primarily through their mobile devices. Given the highly regulated and global nature of our business, these processes are customized to each regulatory jurisdiction in which we operate, and are further tailored to client needs and preferences in specific countries in order to make it easier for clients in these countries to open accounts with us and then to fund and trade in those accounts.

In connection with our self-directed/retail business, we look to acquire new clients as cost-efficiently as possible, primarily through online marketing efforts such as advertising on third-party websites, search engine marketing and affiliate marketing. Our experienced in-house marketing team creates highly targeted online campaigns tailored to experienced traders, as well as marketing programs and materials designed to support and educate newer traders. We use sophisticated tracking and measurement techniques to monitor the results of individual campaigns and continually work to optimize our overall marketing results.

We also work with introducing brokers in order to expand our client base. We work with a variety of different types of introducing brokers, ranging from small, specialized firms that specifically identify and solicit clients interested in forex and CFD trading, to larger, more established financial services firms.

Independent Wealth Management

Our independent broker/dealer, StoneX Securities Inc., member FINRA/SIPC, together with its affiliated SEC-registered investment advisor, StoneX Advisors Inc., provides an integrated platform of technology, comprehensive wealth management and investment services to registered representatives, investment advisor representatives and registered investment advisors nationwide. The firm supports more than 375 independent professionals with best-in-class service and products.

Self-Directed/Retail Precious Metals

Our physical self-directed/retail precious metals business is principally conducted within StoneX Bullion GmbH. Through our website Stonexbullion.com, we offer clients the ability to purchase physical gold and other precious metals, in multiple forms, including coins and bars, in denominations of their choice, to add to their investment portfolios.

Competitive Environment - Self-Directed/Retail

The market for our self-directed/retail services is rapidly evolving and highly competitive. Our competitors vary by region in terms of regulatory status, breadth of product offering, size and geographic scope of operations. In the self-directed/retail forex and CFD industry, we compete with both regulated firms focused on forex and CFDs, as well as with global multi-asset trading firms. In wealth management, our competitors vary from large integrated banks and on-line brokerage firms to smaller regional registered investment advisory firms, where competition is driven by reduced commission rates, continued development of online trading platforms and applications and client service.

Payments

We provide customized payment, technology and treasury services to banks and commercial businesses as well as charities, NGOs and government organizations. We provide transparent pricing and offer local currency payments services in more than 180 countries and 140 currencies, which we believe is more than any other payments solutions provider.

Our proprietary platforms allow our clients to connect to us digitally and seamlessly with customized solutions for each of our client groups that fit their specific needs.

We utilize the Society for Worldwide Interbank Financial Telecommunication (“SWIFT”) network as well as direct application programming interfaces (“APIs”) to service almost 100 financial institutions globally and connect them to our approximately 350 correspondent banks around the world enabling them to make local currency payments in a cost effective and secure manner.

Through our platforms and our commitment to client service, we believe we are able to provide simple and fast execution, ensuring delivery of funds in local currency to any of the countries we service quickly through our global network of correspondent banks. We primarily act as a principal in buying and selling foreign currencies on a spot basis and derive revenue from the difference between the purchase and sale prices.

We believe our clients value our ability to provide exchange rates that are significantly more competitive than those offered by large international banks, a competitive advantage that stems from our years of foreign exchange expertise focused on smaller, less liquid currencies.

Competitive Environment - Payments

Increasing globalization and growth of international trade, as well as the need of corporations, institutions and individuals to move money across borders efficiently, have driven growing activity in the payments industry. As the world becomes increasingly interconnected, corporations require the ability to cost-effectively exchange foreign currencies and to send and receive payments from clients and suppliers. NGOs also demand cross-border payment services as they attempt to bring funding, goods and services to their target geographies and recipients at the lowest possible cost. Even banks require lower cost implementation of foreign exchange transactions, as they are otherwise dependent on correspondent banks, which may subject such transactions to expensive and opaque pricing.

Volume growth in the payments market has been steady, driving revenue growth for cross-border payments providers. Increasingly, this volume growth comes from transactions to emerging economies, benefiting those few providers such as us who have a strong competitive position in those emerging economies and an extensive correspondent bank network that would be difficult to replicate. However, as reported in the Boston Consulting Group 2024 Global Payments Report, in recent years these rates of growth have slowed, with market participants shifting focus to unit economics, technological advances and addressing heightened regulatory scrutiny. While growth rates have slowed, the highest rates of growth through 2028 are

expected to be in Latin America, the Middle East and Africa, which we believe has potential to directly benefit our payments business.

The payments market has historically been dominated by large Organization for Economic Co-operation and Development (“OECD”) banks that provide G20 to non-G20 foreign exchange rates to clients. Such banks, however, are reliant on their correspondent banking network for foreign exchange rates, which often results in uncompetitive rates and a lack of transparency. These issues are further exacerbated by a lack of uniform regulation in the business-to-business (“B2B”) payments sector, with no coordinated regulatory framework, even among significant OECD countries.

We believe that the general lack of transparency in bank offerings in the payments market with regard to fees and exchange rates, the banks’ often more expensive services, as well as the lack of systematic regulation, have opened opportunities for competitors in this market. As a result, the fast-growing space has attracted significant investor interest. Independent providers have entered the market, leveraging technology to lower client acquisition costs and providing an enhanced client experience through online platforms. In the payments market, we believe we are one of those independent providers and disruptors offering significant value to our bank, corporate and NGO/charities clients, providing competitive and transparent payments solutions.

Subsequent Acquisitions

JBR Recovery Limited

On October 1, 2024, one of the Company’s subsidiaries, StoneX Metals Limited, acquired all the outstanding shares of JBR Recovery Limited (“JBR”), a recycling and refining business based in the UK. JBR is one of only two UK companies accredited for the supply of “Good Delivery” silver to the London Bullion Market. This acquisition extends our metals offering into sourcing and refining. The total purchase price is expected to be approximately $10 million.

Acquisitions during Fiscal Year 2024

Trust Advisory Group, Ltd.

On September 20, 2024, our subsidiary StoneX Advisors Inc. acquired all of the outstanding shares of Trust Advisory Group, Ltd. (“TAG”), a Massachusetts corporation. TAG is a FINRA and SIPC registered investment advisor offering a range of investing models to its customer base of mainly retail investors. The TAG acquisition reinforces the Company’s commitment to high-quality financial solutions and enhances its service reach into the Northeast.

Acquisitions during Fiscal Year 2023

Incomm S.A.S.

In February 2023, one of the Company’s subsidiaries, StoneX Commodity Solutions LLC acquired all of the outstanding shares of Incomm S.A.S. (“Incomm”), which is based in Colombia. Incomm specializes in supporting the import of grain and feed products for Colombian clients and is a proven resource in management of customs clearing, inventory management at destination ports and providing non-recourse trade finance for destination buyers via local Colombian banks.

Cotton Distributors Inc.

In October 2022, our wholly owned subsidiary, StoneX (Netherlands) B.V., acquired CDI-Societe Cotonniere De Distribution S.A (“CDI”), based in Switzerland. CDI operates a global cotton merchant business with a strong network of producers in Brazil and West Africa as well as buyers throughout Asia.

Regulation

Overview

Our business and the industries in which we operate are highly regulated. Our operating subsidiaries are regulated in a number of jurisdictions including the U.S., the U.K, Luxembourg, Germany, Cyprus, Argentina, Brazil, Dubai, Nigeria, Hong Kong, Singapore, Japan, Australia, Canada and the Cayman Islands. Government regulators and self-regulatory organizations oversee the conduct of our business in many ways, and a number perform regular examinations to monitor our compliance with applicable statutes, regulations and rules. These statutes, regulations and rules cover all aspects of our business, including:

•maintaining specified minimum amounts of capital and limiting withdrawals of funds from our regulated operating subsidiaries;

•the treatment of client assets, including custody, control, safekeeping and, in certain countries, segregation of our client funds and securities;

•the methods by which clients can fund accounts with us;

•sales and marketing activities, including our interaction with, and solicitation of, clients;

•disclosures to clients, including those related to product risks, self-dealing and material conflicts of interest;

•the collection, use, transfer and protection of client personal information;

•anti-money laundering practices;

•recordkeeping and reporting requirements; and

•continuing education and licensing requirements for our employees, and supervision of the conduct of directors, officers and employees.

In some jurisdictions in which we offer our products and services, we are not subject to regulation because there is no established regulatory regime that covers our products and services or due to the manner in which we offer our products and services. We consult with legal counsel in jurisdictions in which we operate on a regular basis, or where we have a material concentration of clients, as to whether we have the required authorizations, licenses or approvals or whether we may conduct our business cross-border with residents in that jurisdiction without obtaining local regulatory authorization, approval or consent. To the extent that we wish to serve clients in a jurisdiction in which we determine licensing or registration is required, we may also elect to direct such clients to a licensed white label or other partner, rather than pursuing licensing or registration ourselves.

Though we conduct our business in a manner which we believe complies with applicable local law, regulators may assert authority over activities that they deem to take place within the jurisdiction they regulate, and new laws, rules or regulations may be enacted that change the regulatory landscape and result in new, or clarify preexisting, registration or licensing requirements.

The primary responsibility for ensuring that we maintain compliance with all applicable regulatory requirements is vested in our legal and compliance departments. In addition, our legal and compliance departments are responsible for our ongoing training and education programs, supervision of our personnel required to be licensed by one or more of our regulators, review of sales, marketing and other communications and other related functions. Also where appropriate, our sales employees are licensed pursuant to applicable regulation.

Failure to comply with our regulatory requirements could result in a variety of sanctions, including, but not limited to, revocation of applicable licenses and registrations, restrictions or limitations on our ability to carry on our business, suspensions of individual employees and significant fines.

U.S. Regulation

The commodities industry in the U.S. is subject to extensive regulation under federal law. We are required to comply with a wide range of requirements imposed by the Commodity Futures Trading Commission (the “CFTC”) and the National Futures Association (the “NFA”). Similarly, the securities industry in the United States is subject to extensive regulation under federal and state securities laws. We must comply with a wide range of requirements imposed by the SEC, state securities commissions, the Municipal Securities Rulemaking Board (“MSRB”) and the Financial Industry Regulatory Authority (“FINRA”). These regulatory bodies safeguard the integrity of the financial markets and protect the interests of investors in these markets. They also impose minimum capital requirements on regulated entities.

In connection with our wealth management business, one of our subsidiaries, StoneX Advisors Inc., is registered with, and subject to oversight by, the SEC as an investment adviser. As such, in its relations with its advisory clients, StoneX Advisers Inc. is subject to the fiduciary and other obligations imposed on investment advisers under the Investment Advisers Act of 1940 and the rules and regulations promulgated thereunder, as well as various state securities laws. These laws and regulations include obligations relating to, among other things, custody and management of client assets, marketing activities, self-dealing and full disclosure of material conflicts of interest, and generally grant the SEC and other supervisory bodies administrative powers to address non-compliance.

The CFTC and NFA also regulate our forex, futures and swaps trading activities. Historically, the principal legislation covering our U.S. forex business was the Commodity Exchange Act, which provides for federal regulation of all commodities and futures trading activities. In recent years, as is the case of other companies in the financial services industry, our forex business has been subject to increasing regulatory oversight. The CFTC Reauthorization Act of 2019, which grants the CFTC express authority to regulate the retail forex industry, includes a series of additional rules which regulate various aspects of our business, including additional risk disclosures to retail forex clients, further limitations on sales and marketing materials and additional rules and interpretive notices regarding NFA mandated Information Systems Security Programs, including training and notification requirements for cybersecurity incidents.

In connection with our foreign-currency exchange risk management and payment solutions services business, one of our subsidiaries, StoneX Payment Services LTD., is registered as a money services business with the Financial Crimes Enforcement Network (“FinCEN”) and has 41 state money transmitter licenses and 8 license exemptions in the United States. Additionally, StoneX Payment Services LTD. is registered with the Financial Transactions and Reports Analysis Centre of Canada (“FINTRAC”) and holds a money transmitter license in Canada.

Net Capital Requirements

Many of our subsidiaries are regulated and subject to minimum and/or net capital requirements. All of our subsidiaries are in compliance with their capital regulatory requirements as of September 30, 2024. Additional information on our subsidiaries subject to significant net capital and minimum net capital requirements can be found in Note 21 to the Consolidated Financial Statements.

Segregated Client Assets

We maintain client segregated deposits from our clients relating to their trading of futures and options on futures on U.S. commodities exchanges, making us subject to CFTC regulation 1.20, which specifies that such funds must be held in segregation and not commingled with the firm’s own assets. We maintain acknowledgment letters from each depository at which we maintain client segregated deposits in which the depository acknowledges the nature of funds on deposit in the account. In addition, CFTC regulations require filing of a daily segregation calculation which compares the assets held in clients segregated depositories (“segregated assets”) to the firm’s total segregated assets held on deposit from clients (“segregated liabilities”). The amount of client segregated assets must be in excess of the segregated liabilities owed to clients and any shortfall in such assets must be immediately communicated to the CFTC.

In addition, we are subject to CFTC regulation 1.25, which governs the acceptable investment of client segregated assets. This regulation allows for the investment of client segregated assets in readily marketable instruments including U.S. Treasury securities, municipal securities, government sponsored enterprise securities, certificates of deposit, commercial paper and corporate notes or bonds which are guaranteed by the U.S. under the Temporary Liquidity Guarantee Program, interest in money market mutual funds, and repurchase transactions with unaffiliated entities in otherwise allowable securities. We predominately invest our client segregated assets in U.S. Treasury securities and interest-bearing bank deposits.

In addition, in our capacity as a securities clearing broker-dealer, we clear transactions for clients and certain proprietary accounts of broker-dealers (“PABs”). In accordance with Rule 15c3-3 of the Securities Exchange Act of 1934 (“Rule 15c3-3”), we maintain special reserve bank accounts (“SRBAs”) for the exclusive benefit of securities clients and PABs.

Secured Client Assets

We maintain client secured deposits from our clients relating to their trading of futures and options on futures traded on, or subject to the rules of, a foreign board of trade, making us subject to CFTC Regulation 30.7, which requires that such funds must be carried in separate accounts in an amount sufficient to satisfy all of our current obligations to clients trading foreign futures and foreign options on foreign commodity exchanges or boards of trade, which are designated as secured clients’ accounts.

Self-Directed/Retail Forex Client Assets

As a retail foreign exchange dealer (“RFED”) registered with the CFTC and member of NFA, we maintain deposits from clients relating to their trading of OTC foreign exchange contracts whereby we act as counterparty to client trading activity making us subject to CFTC regulation 5.8, which specifies that such funds must be held in designated accounts at qualifying institutions in the United States or money center countries as defined by CFTC regulation 1.49. In addition, CFTC regulations require filing of a daily retail forex obligation calculation which compares the assets held for clients with qualifying institutions (“retail forex assets”) to the firm’s total obligation to retail forex clients, also known as net liquidating value (“retail forex liabilities”). The amount of retail forex assets must be in excess of the retail forex liabilities owed to clients and any shortfall in such assets must be immediately communicated to the CFTC.

Dodd-Frank

Like other companies in the financial services industry, the Dodd-Frank Act provides for a number of significant provisions affecting our business. Notably, the Dodd-Frank Act requires the registration of swap dealers with the CFTC and provides framework for:

•swap data reporting and record keeping on counterparties and data repositories;

•centralized clearing for swaps, with limited exceptions for end-users;

•the requirement to execute swaps on regulated swap execution facilities;

•the imposition on swap dealers to exchange margin on uncleared swaps with counterparties; and

•the requirement to comply with capital rules.

We are a CFTC registered swap dealer, whose business is overseen by the NFA. The CFTC imposes rules over net capital requirements, as well as the exchange of initial margin between registered swap dealers and certain counterparties.

With respect to our retail OTC business, the Dodd-Frank Act includes:

•rules that require us to ensure that our clients residing in the United States have accounts open only with our U.S. registered NFA-member operating entity; and

•rules that essentially require all retail transactions in any commodity product other than a retail foreign currency transaction that is traded on a leveraged basis to be executed on an exchange, rather than OTC.

OFAC

The U.S. maintains various economic sanctions programs administered by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”). The OFAC administered sanctions take many forms, but generally prohibit or restrict trade and investment in and with sanctions targets, and in some cases require blocking of the target’s assets. Violations of any of the OFAC-administered sanctions are punishable by civil fines, criminal fines, and imprisonment. We believe that we have implemented, and that we maintain, appropriate internal practices, procedures and controls to enable us to comply with applicable OFAC requirements.

U.S. Patriot Act

We are subject to a variety of statutory and regulatory requirements concerning our relationships with clients and the review and monitoring of their transactions. Specifically, we are subject to the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA PATRIOT Act”), which requires that we maintain a comprehensive anti-money laundering (“AML”) program, a customer identification program (“CIP”), designate an AML compliance officer, provide specified employee training and conduct an annual independent audit of our AML program. The USA PATRIOT Act seeks to promote cooperation among financial institutions, regulators and law enforcement entities in identifying parties that may be involved in terrorism or money laundering. Anti-money laundering laws outside of the U.S. contain similar provisions. We believe that we have implemented, and that we maintain, appropriate internal practices, procedures and controls to enable us to comply with the provisions of the USA PATRIOT Act and other anti-money laundering laws.

FINCEN CDD Final Rule

Additionally, our US legal entities qualifying as covered financial institutions are subject to the Customer Due Diligence Rule (“the CDD Rule”), which clarifies and strengthens customer due diligence requirements. This applies to our U.S. broker dealer(s) in securities, FCMs, and introducing brokers in commodities. The CDD Rule requires these covered financial institutions to identify and verify the identity of the natural persons (known as beneficial owners) of legal entity customers who own, control, and profit from companies when those companies open accounts.

The CDD Rule has four core requirements. It requires covered financial institutions to establish and maintain written policies and procedures that are reasonably designed to:

•identify and verify the identity of customer;

•identify and verify the identity of the beneficial owners of companies opening accounts;

•understand the nature and purpose of customer relationships to develop customer risk profiles; and

•conduct ongoing monitoring to identify and report suspicious transactions and, on a risk basis, to maintain and update customer information.

With respect to the requirement to obtain beneficial ownership information, financial institutions will have to identify and verify the identity of any individual who owns 25 percent or more of a legal entity, and an individual who controls the legal entity. A Beneficial Ownership Form or an acceptable equivalent is also required. These requirements are applied to customers which meet the CDD Rule Criteria.

European and United Kingdom Regulation

The Financial Conduct Authority (“FCA”), the regulator of investment firms in the U.K., regulates our U.K. subsidiary as a Markets in Financial Instruments Directive (“MiFID”) investment firm under U.K. law. In Europe, our regulated subsidiaries are subject to E.U. regulation. Across the U.K. and E.U., the respective transpositions of the Market Abuse Regulation, and the General Data Protection Regulation, also apply.

Applicable regulations also impose regulatory capital, as well as conduct of business, governance, and other requirements on these entities. The client assets (“CASS”) rules in the FCA regulations include those that govern the handling of client money and other assets which, under certain circumstances must be segregated from the firm’s own assets.

CFD’s referencing cryptocurrencies

The FCA has adopted rules to ban the sale of CFDs referencing cryptocurrencies to retail consumers, which became effective in January 2021.

Client Money Rules

We are subject to the FCA’s Client Money rules, under which we are required to:

•maintain adequate segregation of client funds;

•maintain adequate records in order to identify appropriate client details;

•have adequate organizational arrangements in place to minimize the risk that client money may be paid for by the account of a client whose money has not yet been received by us;

•undertake daily internal and external client money reconciliations within an appropriate risk and control framework; and

•appoint an individual who is responsible for CASS oversight.

Anti-Money Laundering and Sanctions

As in the U.S., our U.K. and European entities are subject to statutory and regulatory requirements concerning relationships with customers and the review and monitoring of their transactions. Regulated firms in both the U.K. and in the European Union (“E.U.”) must have robust governance, effective risk procedures and adequate internal control mechanisms to manage the exposure to financial crime risk. The measures require the U.K. and E.U. entities to verify customer identity and understand the nature and purpose of the proposed relationship on the basis of documents, data or information obtained from a reliable and independent source; and review and monitor their customer’s transactions and activities to identify anything suspicious.

Our U.K. and E.U. entities take a risk-based approach and senior management are responsible for addressing these risks. There is a requirement to regularly identify and assess the exposure to financial crime risk and report to the governing body on the same. This enables the targeting of financial crime resources on the areas of greatest risk. Procedures in the U.K. and E.U. are based on guidance and requirements issued both at a national and supranational level.

The FCA and the financial supervisory authorities in the E.U. require our entities to have systems and controls in place to enable them to identify, assess, monitor and manage financial crime risk. Accordingly, we have implemented appropriate systems and controls which are proportionate to the nature, scale and complexity of our activities. We provide relevant training to our employees in relation to financial crime. As required, our Europe, Middle East and Africa (“EMEA”) Money Laundering Reporting Officer as well as the Money Laundering Reporting Officer appointed in respect of each of the entities in the E.U. provide regular reports on the operation and effectiveness of these systems and controls, including details of our regular assessments of the adequacy of these systems and controls to ensure their compliance with the local regulatory requirements.

Our financial crime systems and controls also include routine screening to identify where customers and others with whom we transact may be subject to financial sanctions, including measures initiated or adopted by inter alia the U.K. Treasury, E.U. or OFAC (as required in the U.S.).

EMIR

The E.U. European Market Infrastructure Regulation (Regulation (EU) 648/2012) (“EMIR”) imposes requirements on entities that enter into any form of derivative contract and applies directly to firms in the E.U. that trade derivatives and indirectly to non-E.U. firms that trade derivatives with E.U. firms. Accordingly, under these rules, we are required to:

•report all derivative contracts and their lifecycle events (concluded, modified and terminated) to which we are a party to a trade repository either by ourselves or through a third party;

•keep all records relating to concluding of derivative contracts and any subsequent modification for 5 years;

•comply with the risk management requirements for OTC bilateral derivatives, including portfolio reconciliation, portfolio compression, record keeping, dispute resolution and margining; and

•clear through central counterparties all OTC derivatives which will be subject to the mandatory clearing obligation.

MiFID

Where firms offer “execution only” services for certain financial instruments which are deemed “complex”, E.U. Markets in Financial Instruments Directive II (Directive 2014/65/EU) (“MiFID II”) requires firms to assess the appropriateness of those investments for retail clients. For this assessment, we are required to collect information about our existing and potential clients’ knowledge and experience with regard to specific products and services, including:

•the types of services, transactions and financial instruments with which the retail client is familiar;

•the nature, volume, and frequency of the retail client’s transactions in financial instruments and the period over which they have been carried out; and

•the level of education, and profession or relevant former profession of the retail client or potential retail client.

We are required to offer to a retail client or transact for them only those products that are deemed appropriate for their knowledge, experience and other circumstances. If the retail client demands a product that has been assessed as inappropriate for the retail client’s circumstances by us, we may either refuse to offer the product to the client or allow them access to the product but we are required to give the retail client a warning that the product may be inappropriate to its circumstances. We are not required to undertake this analysis for professional clients as we are entitled to assume that a professional client has the necessary knowledge and experience in order to understand the risks involved in relation to the particular products or services for which they have been classified as a professional client.

In addition to the requirements described above, MiFID II requires that:

•firms carry out an appropriateness assessment before providing an execution only service to retail clients;

•transparency is given to derivatives traded on regulated markets, multi-lateral trading facilities (“MTFs”), and organized trading facilities (“OTFs”);

•transactions are reported for those financial instruments traded on MTFs, OTFs, and those financial instruments where the underlying instrument is traded on a Trading Venue; and

•E.U. Member State regulators ban or restrict the marketing, distribution or sale of a financial instrument or types of financial practice where there is a threat to investor protection, the orderly functioning and integrity of markets or to financial stability. The European Banking Authority and the European Securities and Markets Authority have similar powers to impose a ban on an E.U.-wide basis or in relation to a particular E.U. Member State.

Packaged Retail and Insurance-based Investment Products

Our U.K. entities are required to comply with the PRIIPs Regulation in relation to packaged retail and insurance-based investment products (“PRIIPs”) that they manufacture, advise on or sell to retail clients. The FCA regards derivatives (including options, futures, and contracts for difference) as falling within the definition of a PRIIP. The regime requires us to provide retail clients with a standardized key information document (“KID”) in good time before any transaction in derivatives is concluded or for transactions concluded by distance communications, after the transaction has taken place, but only if it is not possible to provide the KID in advance and the client consents.

Payments Services Regulations 2017

The Payments Services Regulations 2017 (“PSRs”) implemented the second Payments Services Directive (“PSD II”) in the U.K, which contained the requirement for payment services firms to introduce strong customer authentication (“SCA”) on the payment platforms.

StoneX Financial Ltd put in place a comprehensive Brexit contingency plan to mitigate the risks associated with Brexit. This included the transfer of assets, services and clients to StoneX Financial Ltd’s subsidiary (StoneX Financial GmbH) and sister company (StoneX Financial Europe S.A.).

Similarly, the group has executed a plan to mitigate the risks associated with Brexit for retail clients including the establishment of a licensed entity in Cyprus, StoneX Europe Ltd.

U.K. Investment Firm Prudential Regime

StoneX Financial Ltd is subject to the rules under the U.K. Investment Firm Prudential Regime (“IFPR”) established for investment firms.

E.U. Conflict Minerals Regulation

We are subject to the E.U. Conflict Minerals Regulation (“CMR”), and in the U.K, the FCA has recognized the Global Precious Metals Code in the U.K. The CMR requires importers to conduct due diligence on their gold, tantalum, tin, and tungsten supply chains to identify minerals that may have originated from conflict zones. The new requirements are largely based on existing guidance issued by the Organisation for Cooperation and Development (“OECD”) which StoneX Financial Ltd already applies, as part of its policies and procedures. StoneX Financial Ltd is a full member of the London Bullion Market Association which sets out and oversees adherence to the principles to promote the integrity and effective functioning of the global precious metals market.

Irish Virtual Asset Service Provider (“VASP”) Regime and Forthcoming Markets in Crypto Assets Regulation

The European Union’s Fifth Anti-Money Laundering Directive (“5AMLD”) extended Anti-Money Laundering and Countering the Financing of Terrorism (“AML/CFT”) obligations to entities that provide certain services relating to virtual assets. This was transposed into Irish law by way of amendments to the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010 to 2021. This legislation requires all entities providing certain services in relation to virtual assets to undertake the process of registration as a VASP with the Central Bank of Ireland (“CBI”).

The E.U. Markets in Crypto Assets Regulation (“MiCA”) comes into force for Crypto-Asset Service Providers (“CASPs”) from the end of December 2024. Entities registered by the CBI and operating as VASPs by this date can take advantage of a 12-

month transition period within which they can continue operating while applying for authorization as a CASP. StoneX Digital International Limited, the Group’s Ireland-based digital assets entity, is in the closing stages of registration as a VASP with the CBI with a view to applying for authorization as a CASP in Ireland under MiCA. This VASP application comprised a comprehensive CBI review of the Firm’s financial crime systems and controls.

Other International Regulation

Our operating subsidiaries in jurisdictions outside of the U.S., U.K., and E.U. are registered with, or obtained a license from, local regulatory bodies that seek to protect clients by imposing requirements relating to capital adequacy and other matters.

Several of our foreign subsidiaries are subject to certain business rules, including those that govern the treatment of client money and other assets which under certain circumstances for certain classes of client must be segregated from the firm’s own assets.

Asia Pacific

In the Asia Pacific region, our subsidiaries operate under licenses and/or authority from various regulators. In Singapore, StoneX Financial Pte. Ltd. is regulated by the Monetary Authority of Singapore and is a Capital Markets Service Licensee (for dealing in capital market products), an Exempt Financial Adviser (for advising on investment products and issuing or promulgating analyses/ reports on investment products) and a Major Payments Institution (for cross-border money transfer service). In addition, in Singapore, StoneX APAC Pte. Ltd. is regulated as a Dealer under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism, and is authorized to act as a Spot Commodity Broker under the Commodity Trading Act 1992.

In Hong Kong, StoneX Financial (HK) Limited is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts. In Australia, StoneX Financial Pty Ltd is regulated by the Australian Securities and Investments Commission and holds an Australian Financial Service License to provide general financial product advice to retail and wholesale clients in derivatives and foreign exchange contracts, to provide general financial product advice to wholesale clients in securities, to deal and make a market for retail and wholesale clients in derivatives and foreign exchange contracts, and to deal and make a market for wholesale clients in securities. In Japan, StoneX Securities Co. Ltd. is regulated by the Financial Services Agency as a Type-I Financial Instruments Business and Securities-Related Business (Kanto Local Finance Bureau (FIBO) No.291).

The Monetary Authority of Singapore, Hong Kong Securities and Futures Commission, Australian Securities and Investments Commission, and Japan Financial Services Agency are members of the International Organization of Securities Commissions which promotes adherence to internationally recognized standards for securities regulation encompassing the key objectives of protecting investors, ensuring that markets are fair, efficient, and transparent, and reducing systematic risk.

Privacy and Data Protection

Our business is subject to rules and regulations adopted by state, federal and foreign governments, and regulatory organizations governing data privacy, including for example the California Consumer Privacy Act (“CCPA”) and the European General Data Protection Regulation (“GDPR”). Additional states, as well as foreign jurisdictions, have enacted or are proposing similar data protection regimes, resulting in a rapidly evolving landscape governing how we collect, use, transfer and protect personal data.

Exchange Memberships

Through our various operating subsidiaries, we are member of a number of exchanges, including the Chicago Mercantile Exchange, the Chicago Board of Trade, the New York Mercantile Exchange, COMEX, InterContinental Exchange, Inc., the Minneapolis Grain Exchange, the London Metal Exchange, ICE Europe Ltd, Eurex Exchange, Dubai Mercantile Exchange, Euronext Amsterdam, Euronext Paris, European Energy Exchange, B3 S.A., Bitnomial Exchange LLC, Norexco ASA, the Rosario Futures Exchange, ICE Futures Abu Dhabi, India International Bullion Exchange, Australian Securities Exchange, the Montreal Exchange, Small Exchange, Inc., Nodal Exchange and the Singapore Exchange. These exchanges impose their own requirements on a variety of matters, in some cases addressing capital adequacy, protection of client assets, record-keeping and reporting.

Failure to comply with our exchange membership requirements could result in a variety of consequences, including, but not limited to fines and revocation of memberships, which would limit on our ability to carry on our business with these exchanges.

Human Capital Management

We believe that our long-term success depends in large part on the quality and dedication of our people, as well as on empowering our employees to serve and engage our clients worldwide. At the direction of our Executive Committee and in furtherance of our business strategies as a whole, our global human resources leaders are responsible for developing and implementing our overall talent strategy. This includes the attraction, acquisition, development and engagement of talent to

deliver on our strategy and the design of employee compensation, incentive, wellbeing and benefits programs. We focus on the following factors in order to implement and develop our talent strategy:

•Employee Compensation and Incentives

•Evaluation of Employee Performance, Training and Talent Development

•Employee Health, Safety and Wellness

•Diversity

Employee Compensation and Incentives

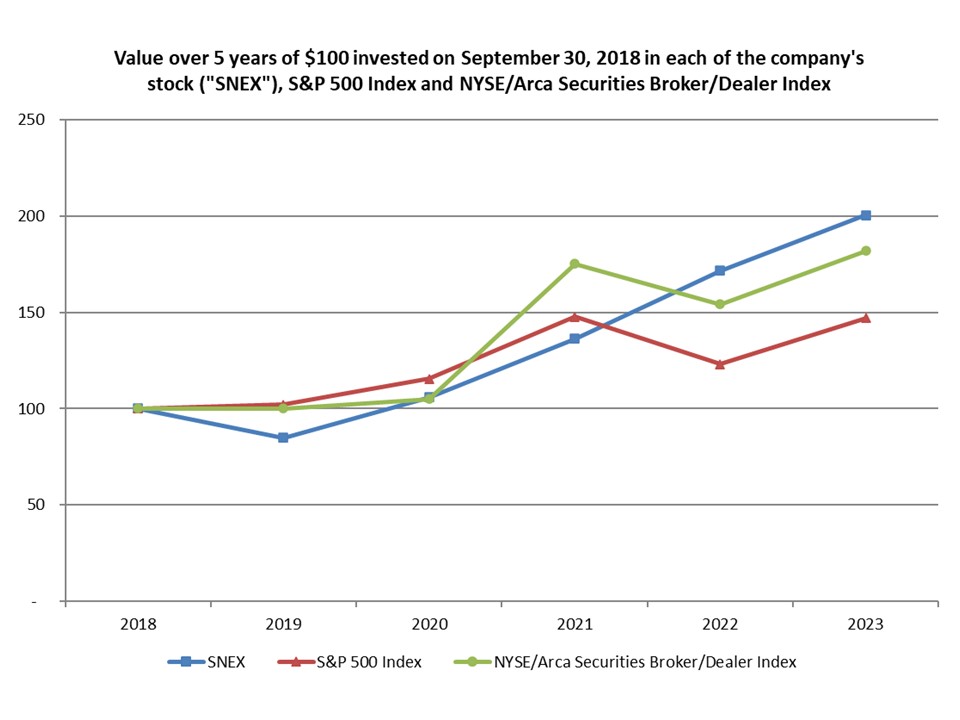

Ensuring that our employees are well-compensated and have the appropriate incentives in place to meet and exceed their potential is a central part of our talent strategy. Our entrepreneurial culture aligns pay with performance through various programs, including incentive-based compensation and performance-driven rewards. We grant options and restricted stock to our employees and also encourage our employees to acquire an ownership stake in our business by sponsoring restricted stock plans for directors, officers and employees. Furthermore, our Nominating & Governance Committee requires that directors and executive officers hold vested Company stock, promoting a strong sense of ownership and alignment with shareholder interests.