UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2007

o TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES ACT OF 1934

For the transition period from ________to__________

Commission file number 0-22904

PARKERVISION, INC.

(Exact name of registrant as specified in its charter)

| | 59-2971472 |

| (State of Incorporation) | | (I.R.S. Employer ID No.) |

7915 Baymeadows Way, Suite 400

Jacksonville, Florida 32256

(904) 737-1367

(Address of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $.01 PAR VALUE

COMMON STOCK RIGHTS

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K x.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

As of June 29, 2007, the aggregate market value of the Issuer's Common Stock, $.01 par value, held by non-affiliates of the Issuer was approximately $255,997,286 (based upon $11.95 share closing price on that date, as reported by The Nasdaq Global Market).

As of March 6, 2008, 26,495,691 shares of the Issuer's Common Stock were outstanding.

Table of Contents

| Forward Looking Statements | 4 |

| | | |

| PART I | | |

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 8 |

| Item 1B. | Unresolved Staff Comments | 11 |

| Item 2. | Properties | 11 |

| Item 3. | Legal Proceedings | 11 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 11 |

| | | |

| PART II | | |

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 |

| Item 6. | Selected Financial Data | 13 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 21 |

| Item 8. | Consolidated Financial Statements and Supplementary Data | 22 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 46 |

| Item 9A. | Controls and Procedures | 46 |

| Item 9B. | Other Information | 47 |

| | | |

| PART III | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 47 |

| Item 11. | Executive Compensation | 49 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 60 |

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 62 |

| Item 14. | Principal Accountant Fees and Services | 63 |

| | | |

| PART IV | | |

| Item 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 63 |

| | | |

| SIGNATURES | 68 |

| | | |

| SCHEDULES | 69 |

| | | |

| INDEX TO EXHIBITS | 70 |

Forward-Looking Statements

We believe that it is important to communicate our future expectations to our shareholders and to the public. This report contains forward-looking statements, including, in particular, statements about our future plans, objectives and expectations under the headings “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. When used in this Form 10-K and in future filings by ParkerVision, Inc., with the Securities and Exchange Commission, the words or phrases “will likely result”, “management expects”, “we expect”, “will continue”, “is anticipated”, “estimated” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Readers are cautioned not to place undue reliance on such forward-looking statements, each of which speaks only as of the date made. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical earnings and those presently anticipated or projected. Examples of such risks and uncertainties include the timely development and commercial acceptance of new products and technologies, reliance on key business and sales relationships, and reliance on our intellectual property. We have no obligation to publicly release the results of any revisions which may be made to any forward-looking statements to reflect anticipated events or circumstances occurring after the date of such statements.

PART I

Item 1. Business

ParkerVision, Inc. (the “Company” or “we”) was incorporated under the laws of the state of Florida on August 22, 1989. We are in the business of designing, developing and licensing our proprietary d2p™ and d2d™ wireless radio frequency (“RF”) technologies for use in semiconductor circuits for wireless radio applications. Our primary business strategy is to license our technologies to chip suppliers and/or mobile handset manufacturers for the incorporation of our technologies into mobile handsets. In addition, we have, from time to time, explored licensing and other opportunities outside the cellular industry to the extent that the applications are synergistic with our current development efforts.

Recent Developments

Initial Customer Agreements

In 2007, we entered into agreements for the incorporation of our technologies into RF products.

In May 2007, we executed an Engineering Services Agreement and a Licensing Agreement with ITT Corporation (“ITT”) for the design and use of our d2p technology in applications worldwide. Under the agreements, we will be paid royalties on a per unit basis for products sold by ITT that incorporate our d2p technology. We are also providing engineering consulting and design services to ITT on a time and materials basis, as requested, for the development of products using our technology.

In December 2007, we entered into a Licensing and Engineering Services Agreement with a mobile handset chip supplier for the design and use of our d2p and d2d technologies in chipsets initially targeted for the 3G mobile handset market worldwide. Under the terms of the agreement, we will be paid royalties on a per unit basis for chipsets sold which incorporate one or both of our RF technologies.

Sale of Equity Securities to Fund Operations

On March 5, 2008, we completed the sale of an aggregate of 1,240,199 shares of our common stock to a limited number of domestic institutional and other investors in a private placement transaction pursuant to an offering exemption under the Securities Act of 1933. Such shares represent 4.7% of our outstanding common stock on an after-issued basis. 1,110,999 shares were sold at a price of $7.50 per share, and 129,200 shares were sold to Mr. Jeffrey Parker, our chief executive officer and chairman, at $7.74 per share. The net proceeds from this transaction of approximately $9 million will be used for general working capital purposes. We will register the common stock issued in the private offering for re-offer and re-sale by the investors.

General Development of Business

From 2003 through June of 2005, we manufactured and sold branded wireless networking products that incorporated our d2d technology. Our product sales were primarily through retail and internet retail distribution channels. All of our product revenues through 2005 were generated from these retail products. In June 2005, we exited our manufacturing and retail sales activities in pursuit of our longer-term business strategy of establishing relationships with original equipment manufacturers (“OEMs”) for the incorporation of our technology into their products. Our decision to exit the retail activities was precipitated by advances in our wireless technology resulting in increased interest from OEM prospects, specifically in the mobile handset market. We determined that the investment required to increase brand awareness, introduce new product offerings, and expand the distribution channel for retail products, would detract from our ability to capitalize on OEM opportunities.

As of December 31, 2005, we had substantially completed our retail exit activities. Those activities included the sale of our remaining finished product inventories, including those reclaimed from our retail and distribution channel partners, and liquidation of our remaining raw materials inventory, our manufacturing and prototype assets and other property and equipment utilized in the retail business.

In the second half of 2005, we began educating prospective customers about the benefits of our technologies, with a focus on our d2p transmit technology. In 2006, we completed our first d2p integrated circuit (“IC”) which embodied many of the advancements of our technology and enabled us to begin demonstrating partially integrated prototypes. Throughout 2006 and 2007, we continued to further advance our prototype ICs while cultivating potential customer relationships. Our sales-related activities in 2006 and 2007 included prototype demonstrations of our increasingly integrated d2p platform, support of in-depth technical due-diligence by prospective customers, analysis of prospective customer product plans, delivery of initial proposals and terms, and, ultimately, negotiations of proposed business relationships.

Our initial target customer base was limited to top tier mobile handset manufacturers. However, in 2006 and increasingly in 2007, mobile handset manufacturers were shifting RF innovation and developments to their chipset providers. Accordingly, we expanded our target customer base to include not only the mobile handset manufacturers, but also their component suppliers. In addition, we expanded our market awareness campaign to include network providers who are significant influencers to the OEMs in the mobile handset industry.

Although our primary target market is the mobile handset industry, we have explored potential relationships outside this target market to the extent that the requirements of the prospective customers are in concert with the needs of our primary target market. This exploration resulted in our first license agreement, with ITT Corporation in May 2007.

To date, we have generated no royalty revenue from licensing of our wireless RF technologies. Our ability to generate revenues sufficient to offset costs is subject to our ability to successfully support our customers in completing their initial product designs incorporating our technologies and expand our market opportunities through additional product offerings with our current customers and/or the addition of new customers such that we are able to secure a reasonable share of the market.

We believe our technology has substantial advantages over competing technologies, especially in the third generation, or 3G, mobile handset market and generations that are likely to evolve beyond 3G, such as 4G mobile handset standards and applications. Current industry studies indicate that over 0.5 billion 3G handsets are expected to ship in the year 2009, which represents approximately 40 percent of the total mobile handset market.

Technology and Products

Our wireless technologies, collectively referred to as Energy Signal Processing or ESP™, represent unique, proprietary methods for processing RF waveforms in wireless applications. The technology applies to the

transmit (baseband data to an RF carrier signal) and receive (RF carrier signal to baseband data) functions of a radio transceiver. The transmit portion of the technology is called Direct2Power™, or d2p, and enables the transformation of a digital baseband signal to an RF carrier waveform, at the desired power output level, in a single unified operation. The receiver portion of the technology is called Direct2Data™, or d2d, and enables the direct conversion of an RF carrier to baseband data signal. Although our primary sales efforts have been focused on commercialization of our d2p technology solutions, our first customer in the mobile handset industry has licensed both the d2p and d2d solutions.

We have completed several engineering prototypes of our d2p-based ICs targeted at mobile handset applications. These ICs were produced using a Silicon Germanium (“SiGe”) process through a fabrication relationship with IBM Microelectronics (“IBM”). These ICs are utilized to verify that our technology can be highly integrated in silicon and to demonstrate the benefits of the technology to OEM target customers. The portion of the IC that embodies the core RF technology has been highly integrated in prototype ICs. We anticipate that OEM customers will engage us to customize the implementation of the core technology based on their specific interface and product requirements. Our current prototypes support multi-band (meaning multiple frequencies) and multi-mode (meaning multiple cellular standards and corresponding modulation formats) functionality. Our ICs support multiple bands of cellular and PCS frequencies and support the current and emerging cellular standards including GSM/EDGE, CDMA, W-CDMA, and HSUPA. We are also able to demonstrate 802.16e WiMax standards using PCS frequencies with our current ICs.

Our d2d (receiver) technology was first introduced in the form of transceiver ICs for the wireless local area networking (“WLAN”) market in 2002. In 2003, we began marketing ICs to OEMs and original design manufacturers (“ODM”s) who manufacture and sell WLAN products or application modules that incorporate WLAN capabilities. In order to mitigate the barriers to entry in the WLAN marketplace, we also initiated a business strategy of developing our own d2d-based WLAN products for marketing to end-users.

From 2003 to 2005, we produced WLAN products for retail distribution. In June 2005, we ceased production and development efforts for our WLAN end-user products and exited our retail business activities in order to focus exclusively on OEM opportunities, particularly with regard to our transmit technology implementation which we believe has broad adoption potential in the mobile handset market.

Our unique technologies process the RF waveform in a more optimal manner than existing technologies, thereby allowing OEMs to create handsets that have extended battery life, more easily incorporate multiple air interface standards and frequencies in smaller form factors, and reduce manufacturing costs. Our technologies provide such attractive benefits, in part, because of the unique integrated circuit architecture which enables efficient digital circuit processing, eliminating many of the limitations of legacy analog processing.

Marketing and Sales

Our marketing and sales activities are currently focused on developing and capitalizing on relationships in the mobile handset industry. Although we believe our direct customers are likely to be the chipset suppliers in this industry, we continue to cultivate our relationships with the mobile handset manufacturers who are significant influencers to their chipset suppliers.

Our sales and sales support activities include prototype demonstrations of both semi-integrated and highly integrated circuits that showcase the benefits of the technology; support of detailed technology due-diligence discussions and testing; analysis of potential customer product roadmaps and integration alternatives; and negotiations of specific terms of potential business relationships.

We believe the sales cycle, from the initial customer meeting to the consummation of a business arrangement, is generally 18-24 months. The length of the sales cycle is a result of many factors, including the unique nature of our technology; intense technology evaluation and due-diligence required based on the complex nature of radio frequency technology, in general, and the cellular specifications, in particular; our lack of tenure in the cellular industry; and the variety of licensing implementations and integration decisions that

must be evaluated by the customer in order to assess the specific value proposition for their needs. We believe the sales cycle will be significantly shortened as our technologies gain adoption in this market.

We executed our first two customer contracts in 2007. We believe additional customer design wins will occur and, furthermore, we believe that the rate of adoption of our technology will increase as we move toward completion of products with our existing customers. Future sales may be influenced by the terms negotiated with our customers and our ability to expand internal resources to support multiple customers.

Competition

We operate in a highly competitive industry against companies with substantially greater financial, technical, and sales and marketing resources. Our technologies, which are currently being marketed in the mobile handset industry, face competition from incumbent providers of transceivers and power amplifiers including companies such as RF Microdevices, Anadigics, Skyworks, ST Microelectronics, Qualcomm, and Freescale, among others. Each of our competitors, however, also has the potential of becoming a licensee of our technologies. We also compete against RF engineering groups within the research and development organizations of our target customers. To date, we are unaware of any competing or emerging RF technologies that provide all the simultaneous benefits that our technology enables.

We believe we can gain adoption, and therefore compete, based on the performance and cost advantages enabled by our unique circuit architecture, as supported by a solid and defensible intellectual property portfolio. Our intellectual property offering is capable of being compliant with mobile standards-based 3G requirements and can accept the same baseband data input as traditional or future offerings. In addition, we believe the improved power efficiencies enabled by our technology provide a solution to an existing problem in applications for 3G standards and beyond that the mobile handset industry is seeking to solve.

Production and Supply

Our current business strategy is focused on licensing our intellectual property. As a result, we expect that production capacity risk will shift to our customers. We currently have a fabrication relationship with IBM for the production of our prototype ICs on a SiGe process. We believe IBM has sufficient capacity to meet our foreseeable needs. In addition, our ICs can be produced using different materials and processes, if necessary, to satisfy capacity requirements and/or customer preferences.

Patents and Trademarks

We consider our intellectual property, including patents, patent applications, trademarks, and trade secrets to be significant to our competitive positioning. We have a program to file applications for and obtain patents, copyrights, and trademarks in the United States and in selected foreign countries where we believe filing for such protection is appropriate to establish and maintain our proprietary rights in our technology and products. As of December 31, 2007, we have obtained 59 U.S. and 54 foreign patents related to our RF technologies and have 98 patent applications pending in the United States and other countries. Our patents have been issuing at a rate of approximately four to six new patents each quarter. Since December 31, 2007, we have been granted four additional U.S patents and one additional foreign patent. We estimate the economic lives of our patents to be fifteen to twenty years.

Research and Development

For the years ended December 31, 2007, 2006 and 2005, we spent approximately $10.7 million, $9.5 million, and $10.3 million, respectively, on company-sponsored research and development activities. Our research and development efforts have been devoted to the development and advancement of RF technologies, including the development of prototype ICs for proof of concept purposes.

Employees

As of December 31, 2007, we had 53 full-time employees, of which 32 are employed in engineering research and development, 9 in sales and marketing, and 12 in executive management, finance and administration. Our employees are not represented by a labor union. We consider our employee relations satisfactory.

Available Information and Access to Reports

We file our annual report on Form 10-K and quarterly reports on Forms 10-Q, including amendments, as well as our proxy and other reports electronically with the Securities and Exchange Commission (“SEC”). The SEC maintains an Internet site (http://www.sec.gov) where these reports may be obtained at no charge. Copies of any materials filed with the SEC may also be obtained from the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the SEC Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Copies of these reports may also be obtained via the Company’s website (http://www.parkervision.com) via the link “SEC filings”. This provides a direct link to our reports on the SEC Internet site. We will provide copies of this annual report on Form 10-K and the quarterly reports on Forms 10-Q, including amendments, filed during the current fiscal year upon written request to Investor Relations, 7915 Baymeadows Way, Suite 400, Jacksonville, Florida, 32256. These reports will be provided at no charge. In addition, exhibits may be obtained at a cost of $.25 per page plus $5.00 postage and handling.

Item 1A. Risk Factors

In addition to other information in this Annual Report on Form 10-K, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements.

We have had a history of losses which may ultimately compromise our ability to implement our business plan and continue in operation.

We have had losses in each year since our inception in 1989, and continue to have an accumulated deficit which, at December 31, 2007, was $167.6 million. The net loss for 2007 was $18.2 million. To date, our technologies and products have not produced revenues sufficient to cover operating, research and development and overhead costs. We also will continue to make expenditures on marketing, research and development, pursuit of patent protection for our intellectual property and operational costs for fulfillment of any contracts that we achieve for the sale of our products or technologies. We expect that our revenues in the near term will not bring the company to profitability. If we are not able to generate sufficient revenues or we have insufficient capital resources, we will not be able to implement our business plan and investors will suffer a loss in their investment. This may result in a change in our business strategies.

We expect to need additional capital in the future, which if we are unable to raise will result in our not being able to implement our business plan as currently formulated.

Because we have had net losses and, to date, have not generated positive cash flow from operations, we have funded our operating losses from the sale of equity securities from time to time and the sale of our video division in 2004. We anticipate that our business plan will continue to require significant expenditures for research and development, patent protection, sales and marketing and general operations. Our current capital resources, including cash and cash equivalents at December 31, 2007 of $13.4 million and the net proceeds of our March 5, 2008 private placement transaction of approximately $9 million, are expected to sustain operations through the first quarter of 2009, if not longer. Thereafter, unless we increase revenues to a level that they cover operating expenses or we reduce costs, we will require additional capital to fund these expenses. Financing, if any, may be in the form of loans or additional sales of equity securities. A loan or the sale of preferred stock may result in the imposition of operational limitations and other covenants and payment obligations, any of which may be burdensome to us. The sale of equity securities will result in dilution to the current stockholders’ ownership. The long-term continuation of our business plan is dependent upon the generation of sufficient revenues from the sale of our products, additional funding or reducing

expenses or a combination of the foregoing. The failure to generate sufficient revenues, raise capital or reduce expenses could have a material adverse effect on our ability to achieve our long-term business objectives.

Our industry is subject to rapid technological changes which if we are unable to match or surpass, will result in a loss of competitive advantage and market opportunity.

Because of the rapid technological development that regularly occurs in the microelectronics industry, we must continually devote substantial resources to developing and improving our technology and introducing new product offerings. For example, in fiscal years 2007 and 2006, we spent approximately $10.7 million and $9.5 million, respectively, on research and development, and we expect to continue to spend a significant amount in this area in the future. These efforts and expenditures are necessary to establish and increase market share and, ultimately, to grow revenues. If another company offers better products or our product development lags, a competitive position or market window opportunity may be lost, and therefore our revenues or revenue potential may be adversely affected.

If our products are not commercially accepted, our developmental investment will be lost and our future business continuation will be impaired.

There can be no assurance that our research and development will produce commercially viable technologies and products. If existing or new technologies and products are not commercially accepted, the funds expended will not be recoverable, and our competitive and financial position will be adversely affected. In addition, perception of our business prospects will be impaired with an adverse impact on our ability to do business and to attract capital and employees.

If our patents and intellectual property do not provide us with the anticipated market protections and competitive position, our business and prospects will be impaired.

We rely on our intellectual property, including patents and patent applications, to provide competitive advantage and protect us from theft of our intellectual property. We believe that many of our patents are for entirely new technologies. If the patents are not issued or issued patents are later shown not to be as broad as currently believed, or are otherwise challenged such that some or all of the protection is lost, we will suffer adverse effects from the loss of competitive advantage and our ability to offer unique products and technologies. In addition, there would be an adverse impact on our financial condition and business prospects.

If we cannot demonstrate that our technologies and products can compete in the marketplace and are better than current competitive solutions, then we will not be able to generate the sales we need to continue our business and our prospects will be impaired.

We expect to face competition from chip suppliers such as RF MicroDevices, Anadigics, Skyworks, ST Microelectronics, Qualcomm, and Freescale, among others. Our technology may also face competition from other emerging approaches or new technological advances which are under development and have not yet emerged. If our technologies and products are not established in the market place as improvements over current, traditional chip solutions in wireless communications, our business prospects and financial condition will be adversely affected.

We rely, in large part, on key business and sales relationships for the successful commercialization of our products, which if not developed or maintained, will have an adverse impact on achieving market awareness and acceptance and will result in a loss of business opportunity.

To achieve a wide market awareness and acceptance of our products, as part of our business strategy, we will attempt to enter into a variety of business relationships with other companies which will incorporate our intellectual property into their products and/or market products based on our technologies. The successful commercialization of our products will depend in part on our ability to meet obligations under contracts with respect to the products and related development requirements. The failure of the business relationships will limit the commercialization of our products which will have an adverse impact on our business development and our ability to generate revenues and recover development expenses.

We rely, in large part, on the ability of key customers to successfully develop and sell products incorporating our technologies, the failure of which will have an adverse impact on our business opportunities.

The successful commercialization of our products will depend, in part, on the success and timing of our customer’s product development and sales activities which may be impacted by factors outside of our control. Delays in or failure of our customers’ product development or sales activities will hinder the commercialization of our products which will have an adverse impact on our ability to generate revenues and recover development expenses.

We are highly dependent on Mr. Jeffrey Parker as our chief executive officer whose services, if lost, would have an adverse impact on our leadership, industry perception, and investor perception about our future.

Because of Mr. Parker’s position in the company and the respect he has garnered in both the industry in which we operate and the investment community, the loss of the services of Mr. Parker might be seen as an impediment to the execution of our business plan. If Mr. Parker were no longer available to the company, investors may experience an adverse impact on their investment. We do not currently have an employment agreement with Mr. Parker. We maintain key-employee life insurance for our benefit on Mr. Parker.

If we are unable to attract or retain highly skilled employees we will not be able to execute our research and development plans or provide the highly technical services that our products require.

Our business is very specialized, and therefore it is dependent on having skilled and specialized employees to conduct our research, development and customer support activities. The inability to obtain or retain these specialized employees will have an adverse impact on our business development because customers will not obtain the information or services expected which may prevent us from successfully implementing our current business plans.

The outstanding options and warrants may affect the market price and liquidity of the common stock.

At December 31, 2007, we had 25,182,892 shares of common stock outstanding and had 5,789,926 exercisable options and warrants for the purchase of shares of common stock, assuming no terminations or forfeitures of such options and warrants. On December 31, 2008 and 2009, respectively, there will be 5,593,646 and 5,631,169 currently exercisable options and warrants (assuming no new grants, exercises, terminations or forfeitures). All of the underlying common stock of these securities is registered for sale to the holder or for public resale by the holder. The amount of common stock available for the sales may have an adverse impact on our ability to raise capital and may affect the price and liquidity of the common stock in the public market. In addition, the issuance of these shares of common stock will have a dilutive effect on current stockholders’ ownership.

Provisions in the certificate of incorporation and by-laws could have effects that conflict with the interest of stockholders.

Some provisions in our certificate of incorporation and by-laws could make it more difficult for a third party to acquire control. For example, the board of directors has the ability to issue preferred stock without stockholder approval, and there are pre-notification provisions for director nominations and submissions of proposals from stockholders to a vote by all the stockholders under the by-laws. Florida law also has anti-takeover provisions in its corporate statute.

We have a shareholder protection rights plan that may delay or discourage someone from making an offer to purchase the company without prior consultation with the board of directors and management which may conflict with the interests of some of the stockholders.

On November 17, 2005, the board of directors adopted a shareholder protection rights plan which called for the issuance, on November 29, 2005, as a dividend, rights to acquire fractional shares of preferred stock. The rights are attached to the shares of common stock and transfer with them. In the future the rights may become exchangeable for shares of preferred stock with various provisions that may discourage a takeover bid. Additionally, the rights have what are known as “flip-in” and “flip-over” provisions that could make any acquisition of the company more costly. The principal objective of the plan is to cause someone interested in acquiring the company to negotiate with the board of directors rather than launch an unsolicited bid. This

plan may limit, prevent, or discourage a takeover offer that some stockholders may find more advantageous than a negotiated transaction. A negotiated transaction may not be in the best interests of the stockholders.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties

Our headquarters are located in a 14,000 square foot leased facility in Jacksonville, Florida. We have an additional leased facility in Lake Mary, Florida primarily for engineering design activities. We believe our properties are in good condition and suitable for the conduct of our business.

Refer to “Lease Commitments” in Note 11 to the Consolidated Financial Statements included in Item 8 for information regarding our outstanding lease obligations.

Item 3. Legal Proceedings

We are subject to legal proceedings and claims arising in the ordinary course of business. Based upon the advice of outside legal counsel, we believe that the final disposition of such matters will not have a material adverse effect on our financial position, results of operations or liquidity.

Item 4. Submission of Matters to a Vote of Security Holders

None.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is traded under the symbol PRKR on the Nasdaq Global Market ("Nasdaq"), which is the principal market for the common stock. Listed below is the range of the high and low bid prices of the common stock for the last three fiscal years, as reported by Nasdaq. The amounts represent inter-dealer quotations without adjustment for retail markups, markdowns or commissions and do not necessarily represent the prices of actual transactions.

| | | 2007 | | 2006 | | 2005 | |

| | | High | | Low | | High | | Low | | High | | Low | |

1st Quarter | | $ | 13.98 | | $ | 9.28 | | $ | 10.91 | | $ | 7.61 | | $ | 13.27 | | $ | 6.61 | |

2nd Quarter | | | 13.75 | | | 10.15 | | | 12.00 | | | 9.02 | | | 8.50 | | | 3.70 | |

3rd Quarter | | | 16.00 | | | 10.94 | | | 9.63 | | | 5.30 | | | 10.24 | | | 4.72 | |

4th Quarter | | | 17.20 | | | 7.00 | | | 11.98 | | | 6.53 | | | 9.50 | | | 4.85 | |

Holders

As of February 25, 2008, there were 164 holders of record. We believe there are approximately 3,500 beneficial holders of our common stock.

Dividends

To date, we have not paid any dividends on our common stock. The payment of dividends in the future is at the discretion of the board of directors and will depend upon our ability to generate earnings, our capital requirements and financial condition, and other relevant factors. We do not intend to declare any dividends in the foreseeable future, but instead intend to retain all earnings, if any, for use in the business.

Sales of Unregistered Securities

On November 15, 2007, we granted 63,750 options to purchase common stock to officers and other employees that vest over three years and 2,281 options to an employee that were immediately vested. The options have an exercise price of $10.36 per share, expire seven years from the grant date and are exempt from registration under section 4(2). We will not receive any consideration for the options until the recipient exercises the option.

Issuer Repurchase of Equity Securities

None.

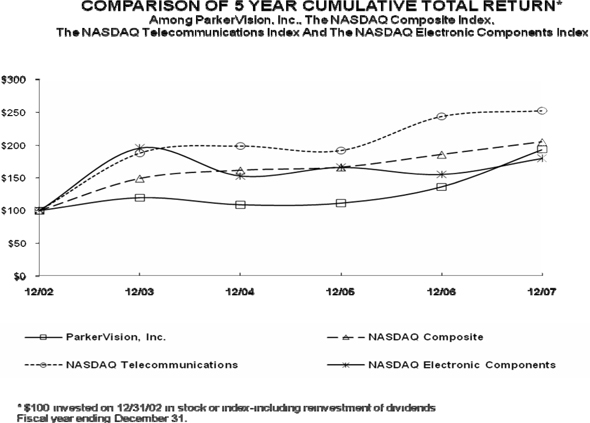

Performance Graph

The following graph shows a five-year comparison of cumulative total shareholder returns for our company, the Nasdaq U.S. Stock Market Index, the Nasdaq Electronic Components Index and Nasdaq Telecommunications Index for the five years ending December 31, 2007. The total shareholder returns assumes the investment on December 31, 2002 of $100 in our common stock, the Nasdaq U.S. Stock Market Index, the Nasdaq Electronic Components Index, and Nasdaq Telecommunications Index at the beginning of the period, with immediate reinvestment of all dividends.

Item 6. Selected Financial Data

The following table sets forth our consolidated financial data as of the dates and for the periods indicated. The data has been derived from our audited consolidated financial statements. The selected financial data should be read in conjunction with our consolidated financial statements and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. The selected financial data for the statements of operations for December 31, 2004 and December 31, 2003 has been restated to reflect the effects of discontinued operations.

| | | For the years ended December 31, | |

| (in thousands, except per share amounts) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | |

| Revenues, net | | $ | 284 | | $ | 0 | | $ | 996 | | $ | 441 | | $ | 23 | |

| Gross margin | | | 32 | | | 0 | | | (2,041 | ) | | (2,854 | ) | | (7 | ) |

| Operating expenses | | | 19,122 | | | 16,866 | | | 21,362 | | | 19,951 | | | 19,104 | |

| Interest and other income | | | 876 | | | 1,051 | | | 304 | | | 217 | | | 476 | |

| Loss from continuing operations | | | (18,213 | ) | | (15,816 | ) | | (23,099 | ) | | (22,588 | ) | | (18,635 | ) |

| Gain (loss) from discontinued operations | | | 0 | | | 0 | | | 0 | | | 7,773 | | | (3,380 | ) |

| Net loss | | | (18,213 | ) | | (15,816 | ) | | (23,099 | ) | | (14,815 | ) | | (22,015 | ) |

| | | | | | | | | | | | | | | | | |

| Basic and diluted net loss per common share | | | | | | | | | | | | | | | | |

| Continuing operations | | | (0.74 | ) | | (0.68 | ) | | (1.14 | ) | | (1.25 | ) | | (1.21 | ) |

| Discontinued operations | | | n/a | | | n/a | | | n/a | | | 0.43 | | | (0.22 | ) |

| Total basic and diluted net loss per common share | | | (0.74 | ) | | (0.68 | ) | | (1.14 | ) | | (0.82 | ) | | (1.43 | ) |

| | | | | | | | | | | | | | | | | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | |

| Total assets | | $ | 26,577 | | $ | 26,675 | | $ | 23,832 | | $ | 28,081 | | $ | 42,483 | |

| Shareholders’ equity | | | 24,414 | | | 25,183 | | | 22,400 | | | 24,758 | | | 39,399 | |

| Working capital | | | 12,611 | | | 13,313 | | | 10,833 | | | 10,471 | | | 23,225 | |

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Executive Overview

We are in the business of designing, developing and licensing our proprietary d2p and d2d wireless radio frequency (“RF”) technologies for use in semiconductor circuits for wireless radio applications. Our primary business strategy is to license our technologies to chip suppliers and/or mobile handset manufacturers for the incorporation of our technologies into mobile handsets. In addition, we have, from time to time, explored licensing and other opportunities outside the cellular industry to the extent that the applications are synergistic with our current development efforts.

In 2007, we entered into the first agreements for the incorporation of our technologies into RF products. In May 2007, we executed an Engineering Services Agreement and a Licensing Agreement with ITT for the design and use of our d2p technology in applications worldwide. Under the agreements, we will be paid royalties on a per unit basis for products sold by ITT that incorporate our d2p technology. We are also providing engineering consulting and design services to ITT on a time and materials basis, as requested, for the development of products using our technology.

In December 2007, we entered into a Licensing and Engineering Services Agreement with a mobile handset chip supplier for the design and use of our d2p and d2d technologies in chipsets initially targeted for the 3G mobile handset market worldwide. Under the terms of the agreement, we will be paid royalties on a per unit

basis for chipsets sold which incorporate one or both of our RF technologies.

To date, we have generated no royalty revenue from licensing of our wireless RF technologies and only limited revenue from engineering design services. Our ability to generate revenues sufficient to offset costs is subject to our ability to successfully support our customers in completing their initial product designs incorporating our technologies and expand our market opportunities through additional product offerings with our current customers and/or the addition of new customers. Although design cycles will vary from customer to customer, we believe the timeframe from consummation of the business arrangement to recognition of royalty revenue from product shipments will range from 12-24 months.

We believe our technology has substantial advantages over competing technologies, especially in the third generation, or 3G, mobile handset market and generations that are likely to evolve beyond 3G, such as 4G mobile handset standards and applications. We have made significant investments in developing our technologies and products, the returns on which are dependent upon the generation of future revenues for realization. Since we have not yet generated revenues sufficient to offset our operating expenses, we have used the proceeds largely from the sale of equity securities to fund our operations.

We intend to continue to use our working capital to support future marketing, sales, research and development and general operations. No assurance can be given that such expenditures will result in revenues, new products, or technological advances or that we have adequate capital to complete our products or gain market acceptance before requiring additional capital.

Exit from Retail Business Activities

In June 2005, we exited our manufacturing and retail sales activities in pursuit of our longer-term business strategy of establishing relationships with original equipment manufacturers (“OEMs”) for the incorporation of our technology into their products. Our decision to exit the retail activities was precipitated by advances in our wireless technology resulting in increased interest from OEM prospects, specifically in the mobile handset market. We determined that the investment required to increase brand awareness, introduce new product offerings, and expand the distribution channel for retail products, would detract from our ability to capitalize on OEM opportunities.

Exiting the retail business resulted in charges to our 2005 operating results of approximately $4.7 million. As of December 31, 2005, we had substantially completed our retail exit activities. Those activities included the sale of our remaining finished product inventories, including those reclaimed from our retail and distribution channel partners, and liquidation of our remaining raw materials inventory, our manufacturing and prototype assets and other property and equipment utilized in the retail business.

Critical Accounting Policies

We believe that the following are the critical accounting policies affecting the preparation of our consolidated financial statements:

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. The more significant estimates made by management include the volatility, risk-free interest rate, forfeiture rate and estimated lives of share-based awards used in the estimate of the fair market value of share-based compensation, the assessment of recoverability of long-lived assets and amortization period for intangible and long-lived assets, and the valuation allowance for deferred taxes. Actual results could differ from the estimates made. Management periodically evaluates estimates used in the preparation of the consolidated financial statements for continued reasonableness. Appropriate adjustments, if any, to the estimates used are made prospectively based upon such periodic evaluation.

Intangible Assets

Patents, copyrights and other intangible assets are amortized using the straight-line method over their estimated period of benefit, ranging from three to twenty years. Management evaluates the recoverability of intangible assets periodically and takes into account events or circumstances that warrant revised estimates of useful lives or that indicate impairment exists.

Accounting for Stock Based Compensation

Effective January 1, 2006, we adopted the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 123R, “Share-Based Payment,” (“FAS 123R”) which establishes accounting for equity instruments exchanged for employee services. Under the provisions of FAS 123R, share-based compensation cost is measured at the grant date, based on the calculated fair value of the award, and is recognized as an expense on a straight-line basis over the employee’s requisite service period (generally the vesting period of the equity grant). In March 2005, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 107 (“SAB 107”) relating to FAS 123R. We have applied the provisions of SAB 107 in our adoption of FAS 123R.

Prior to January 1, 2006, we accounted for share-based compensation to employees in accordance with Accounting Principles Board Opinion (“APB”) No. 25, “Accounting for Stock Issued to Employees,” and related interpretations. We also followed the disclosure requirements of SFAS No. 123, “Accounting for Stock-Based Compensation”, as amended by SFAS 148, “Accounting for Stock-Based Compensation - Transition and Disclosure”. We elected to adopt the modified prospective transition method as provided by FAS 123R and, accordingly, financial statement amounts for the prior periods have not been retroactively adjusted to reflect the fair value method of expensing share-based compensation. Under the modified prospective method, share-based expense recognized after adoption includes: (a) share-based expense for all awards granted prior to, but not yet vested as of January 1, 2006, based on the grant date fair value estimated in accordance with the original provisions of SFAS No. 123, as amended by SFAS 148 and (b) share-based expense for all awards granted or modified subsequent to January 1, 2006, based on the grant-date fair value estimated in accordance with the provisions of FAS 123R. Further, as required under FAS123R, we estimate forfeitures for options granted which are not expected to vest. Changes in these inputs and assumptions can materially affect the measure of estimated fair value of our stock-based compensation expense.

In November 2005, the FASB issued FASB Staff Position (“FSP”) FAS No. 123R-3, Transition Election Related to Accounting for the Tax Effects of Share-Based Payment Awards, (“FSP FAS 123R-3”). FSP FAS 123R-3 provides a practical exception when a company transitions to the accounting requirements in FAS123R. FAS123R requires a company to calculate the pool of excess tax benefits available to absorb tax deficiencies recognized subsequent to adopting FAS123R (termed the “APIC Pool”), assuming the company had been following the recognition provisions prescribed by SFAS No. 123. We have elected to use the shortcut method under FSP FAS 123R-3 to calculate our APIC Pool.

Revenue Recognition

We account for service revenue under the provisions of Staff Accounting Bulletin No. 104 (“SAB 104”), “Revenue Recognition in Financial Statements” and AICPA Statement of Position No. 81-1 (“SOP 81-1”), “Accounting for Performance of Construction-Type and Certain Production-Type Contracts.” Under the provisions of SAB 104 and SOP 81-1, we recognize revenue when there is persuasive evidence of an arrangement, services have been rendered, the fee is fixed or determinable, and collection of the resulting receivable is reasonably assured. We use the percentage-of-completion method of accounting for cost reimbursement-type contracts which specify a certain billable fee amount. Revenues are recognized as costs are incurred assuming that collection is reasonably assured. Our cost of sales includes the direct labor costs of engineering staff providing services under these contracts, as well as indirect costs including depreciation and amortization and allocated facilities costs.

Revenue from product sales is generally recognized at the time the product is shipped, provided that

persuasive evidence of an arrangement exists, title and risk of loss has transferred to the customer, the sales price is fixed or determinable and collection of the receivable is reasonably assured. We did not recognize any product revenue in 2007 or 2006. Our 2005 product revenue relates primarily to products sold through retail distribution channels, with limited sales direct to end users through our own website and direct value added resellers.

Income Taxes

The provision for income taxes is based on loss before taxes as reported in the accompanying consolidated statements of operations. Deferred tax assets and liabilities are recognized for the expected future tax consequences of events that have been included in the financial statements or tax returns. Deferred tax assets and liabilities are determined based on differences between the financial statement carrying amounts and the tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. Valuation allowances are established to reduce deferred tax assets when, based on available objective evidence, it is more likely than not that the benefit of such assets will not be realized.

In addition, we adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes - an Interpretation of FASB Statement No. 109”, (“FIN 48”) on January 1, 2007, as more fully discussed in Note 7 to the consolidated financial statements.

Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board issued Statement of Financial Accounting Standard No. 157, “Fair Value Measurements” (“SFAS 157”). This statement defines fair value as used in numerous accounting pronouncements, establishes a framework for measuring fair value in generally accepted accounting principles (“GAAP”) and expands disclosure related to the use of fair value measures in financial statements. SFAS 157 does not expand the use of fair value measures in financial statements, but standardizes its definition and guidance in GAAP. SFAS 157 is effective for fiscal years beginning after November 15, 2008 for nonfinancial assets and liabilities. We will adopt the provisions of SFAS 157 on January 1, 2009. We have evaluated SFAS 157 and do not anticipate that it will have an impact on our financial statements when adopted.

In February 2007, the Financial Accounting Standards Board issued Statement of Financial Accounting Standard No. 159, “Fair Value Option for Financial Assets and Financial Liabilities” (“SFAS 159”). This statement permits entities to elect to measure many financial instruments and certain other items at fair value and also amends SFAS 115, “Accounting for Certain Investments in Debt and Equity Securities”. SFAS 159 is effective for fiscal years beginning after November 15, 2007. We will adopt the provisions of SFAS 159 on January 1, 2008. We have evaluated SFAS 159 and do not anticipate that it will have an impact on our financial statements when adopted.

Results of Operations for Each of the Years Ended December 31, 2007, 2006 and 2005

Revenues

Revenue for the year ended December 31, 2007 of approximately $284,000 represented revenue from services provided to ITT under the engineering services agreement entered into in May 2007. These services included analysis and evaluation of architectural design alternatives for incorporation of our d2p technology into RF circuits based on various product specifications provided by ITT.

ITT is utilizing that information to establish their product development plans for incorporation of the d2p technology. We anticipate that ITT will select a product development program that utilizes their internal resources, as needed, to design circuits based on our existing commercial prototype designs. As such, we currently do not anticipate any significant engineering services revenue from ITT during their initial product design cycle. We believe utilization of our commercial prototype designs will enable a faster product launch for ITT than would be expected if they had selected a program that involved a fully customized d2p design. We also continue to be engaged with ITT in reviewing various longer term product applications for our technology.

Based on the established royalty rates and other contract terms, as well as our understanding of ITT’s product plans, we currently estimate that we will achieve cumulative royalties under our agreement with ITT of approximately $25 million.

We also anticipate that royalties from our mobile handset chip customer will range from approximately $5 million to $10 million in the first full year of shipments depending upon the customer’s product mix and unit volume as well as the timing of incorporation of the d2d receiver technology into products. We also believe the opportunity exists to significantly expand our royalty revenue from this customer based on the expected growth of the market in which their products are targeted, additional product applications for our technology which are contemplated in the agreement and our customer’s ability to capture greater share of market for their products. We believe the initial ICs incorporating our technology will be completed in late 2008. We will collect royalties upon the sale of chipsets by our customer to the mobile handset providers who will then incorporate the chipset into mobile products.

We believe we will achieve additional design wins in the mobile handset market which will expand our future revenue opportunities both for royalties and engineering services.

We had no revenues for the year ended December 31, 2006 and our 2005 product revenue of approximately $996,000 represented revenue from sales of wireless consumer products through retail channels. Revenue for the period ended December 31, 2005 was net of an allowance (recovery) for sales returns of approximately $(80,000). Gross revenue was also reduced for price protection programs, customer rebates and cooperative marketing costs deemed to be sales incentives under Emerging Issues Task Force, (EITF) Issue 01-09, to derive net revenue. Revenue for the year ended December 31, 2005 included cooperative marketing costs of approximately $30,000.

Gross Margin

The gross margins for products and services for the years ended December 31, 2007 and 2005 were as follows:

| | | 2007 | | 2005 | |

| Engineering services | | $ | 32,361 | | $ | 0 | |

| Products | | | 0 | | | (2,040,823 | ) |

| Total | | $ | 32,361 | | $ | (2,040,823 | ) |

Our gross margin in 2007 is approximately 11% of service revenue and represents margin on services provided to ITT. Cost of sales for engineering services includes the direct labor costs of engineering staff, as well as depreciation, amortization and allocated facilities costs. Indirect costs are generally allocated to cost of sales based on a percentage of the labor hours incurred for customer design support. Allocated indirect costs represent approximately 38-40% of the total cost of sales. We expect that future margin on engineering services will vary based on the experience level of the engineers providing services, the operating costs of the research and development organization as a whole, and the number of service agreements over which the indirect costs are allocated.

Our product margin in 2005 reflects a write down of inventory to net realizable value of approximately $2.3 million. This write down was a result of our exit from retail activities in the second quarter of 2005, resulting in a mark down of remaining product inventory to estimated wholesale values.

Research and Development Expenses

Our research and development expenses increased by approximately $1.2 million, or 12%, from 2006 to 2007, and decreased by approximately $0.8 million, or 7% from 2005 to 2006.

The increase in research and development expenses from 2006 to 2007 was primarily due to increases in personnel costs, design consulting fees, equipment rental, and prototype chip production costs, offset

somewhat by decreases in depreciation expense. Personnel and related costs increased approximately $640,000 due to the addition of personnel, compensation increases for existing engineering staff and increases in performance bonuses earned in 2007 over 2006. Outside engineering design consulting increased approximately $550,000 from 2006 to 2007 due to increased use of outside design services to supplement in-house engineering resources, offset by the expiration of a stock-based consulting agreement which reduced stock-based compensation expense. Equipment rental expense increased approximately $90,000 from 2006 to 2007 due to increased rental of test and development equipment under operating leases allowing a reduction in capital expenditures for required equipment. Prototype chip production costs increased approximately $70,000 from 2006 to 2007. We maintain a fairly regular cycle of prototype chip runs; however, the fabrication costs vary based on the materials specified and the number of variants requested on each run. These increases were somewhat offset by a decrease in depreciation expense of approximately $80,000 from 2006 to 2007 as certain engineering assets became fully depreciated.

The decrease in research and development expenses from 2005 to 2006 was a result of cost reductions following the 2005 retail exit including a reduction in retail product development personnel and related costs of approximately $1.8 million and a reduction in depreciation and amortization of retail related assets of approximately $0.9 million. These decreases were offset by increases in expenses for the use of outside design firms of approximately $1.0 million, increases in employee stock compensation expense due the adoption of “FAS123R” of approximately $0.7 million, and increases in prototype costs of approximately $220,000 stemming from increases in the number of prototype chip production runs.

The markets for our products and technologies are characterized by rapidly changing technology, evolving industry standards and frequent new product introductions. Our ability to successfully develop and introduce, on a timely basis, new and enhanced products and technologies will be a significant factor in our ability to grow and remain competitive. Although the percentage of revenues invested in our research and development programs may vary from period to period, we are committed to continue investing in our technology development. We anticipate that we will use a substantial portion of our working capital for research and development activities in 2008.

Marketing and Selling Expenses

Marketing and selling expenses increased by approximately $0.6 million or 27%, from 2006 to 2007 and decreased by approximately $1.0 million, or 33%, from 2005 to 2006.

The increase in marketing and selling expenses from 2006 to 2007 was primarily due to increases in personnel costs, outside consulting and other professional fees and employee stock-based compensation expense. Personnel costs increased approximately $230,000 due to increases in personnel late in 2006, compensation increases for existing employees and increases in performance bonuses earned from 2006 to 2007. Outside consulting and other professional fees increased approximately $280,000 from 2006 to 2007 due to the use of consultants for expansion of network carrier and other potential customer relationships and legal fees incurred in relation to initial licensing agreements. Employee related stock-based compensation expense increased approximately $60,000 due to additional stock based awards for sales and marketing employees.

The decrease in marketing and selling expenses from 2005 to 2006 was primarily due to cost reductions in personnel and related costs of approximately $670,000 and reduced retail promotional costs of approximately $540,000 following the 2005 exit from retail business activities. These cost reductions were partially offset by an increase in employee stock compensation expense of approximately $320,000 following the adoption of “FAS123R.”

We are committed to continuing our investment in marketing and selling efforts in order to continue to increase market awareness and penetration of our products and technologies, although we do not anticipate any significant increases in overall sales and marketing expenses in 2008.

General and Administrative Expenses

General and administrative expenses consist primarily of executive, finance and administrative personnel costs and costs incurred for insurance, shareholder relations and outside professional services. Our general and administrative expenses increased by approximately $0.5 million, or 9%, from 2006 to 2007 and decreased by approximately $0.8 million or 13% from 2005 to 2006.

The increase in general and administrative expenses from 2006 to 2007 is due to increases in personnel costs and employee stock-based compensation, offset partially by decreases in insurance costs. Personnel costs increased approximately $340,000 from 2006 to 2007 primarily due to an increase of approximately $290,000 in performance bonuses earned in 2007 over 2006. These bonuses were largely paid through the issuance of stock awards to our chief executive officer and chief financial officer in early 2008. Employee stock-based compensation expense increased approximately $250,000 from 2006 to 2007 due largely to the fair value expense related to long term incentive awards for our executive officers in 2006 and 2007. The cost of our directors’ and officers’ liability insurance decreased by approximately $110,000 from 2006 to 2007 due to general market conditions. In addition, consulting and other professional fees, including stock-based consulting fees, decreased approximately $50,000 from 2006 to 2007. This decrease is primarily the result of increases in accounting and consulting fees related to our financial accounting system conversion in 2007 offset by a decrease in stock-based consulting fees primarily from a consulting agreement that expired in 2006.

The reduction in general and administrative costs from 2005 to 2006 is due to a reduction in personnel costs of approximately $470,000 stemming from staff reductions as well as the movement of certain senior management personnel to different areas of supervision. We had a reduction in bad debt expense of approximately $140,000 following the exit from retail, a reduction in share-based consulting fees of approximately $680,000, and a reduction in professional fees of approximately $310,000 from both legal and accounting fees. These reductions were partially offset by increases in employee and director stock compensation expense of approximately $860,000 following the adoption of “FAS123R.”

Impairment Loss and Loss (Gain) on Disposal of Equipment

For the years ended December 31, 2007 and 2006, we recognized an insignificant loss and gain, respectively, on the loss and/or disposal of assets.

For 2005, we recognized impairment charges on certain long-lived assets related to the exit of our retail activities. These charges include impairment of prepaid license fees of approximately $660,000, impairment of other intangible assets of approximately $580,000 and impairment of fixed assets, primarily the manufacturing and prototype facility assets, of approximately $630,000.

Interest Income and Other

Interest income and other consist of interest earned on our investments, net gains recognized on the sale of investments, and other miscellaneous income and expense. Interest income and other decreased approximately $0.2 million from 2006 to 2007 and increased approximately $0.7 million from 2005 to 2006. The decrease in interest income and other from 2006 to 2007 is primarily due to a reduction in miscellaneous income of approximately $110,000. The increase in interest and other income from 2005 to 2006 is primarily due to higher interest rates and higher average cash balances in 2006.

Loss and Loss per Common Share

Our net loss increased by approximately $2.4 million or $0.06 per common share from 2006 to 2007, and decreased by approximately $7.3 million or $0.46 per common share from 2005 to 2006. The increase in net loss from 2006 to 2007 is primarily due to a $2.3 million or 13% increase in operating expenses. The decrease in net loss from 2005 to 2006 is primarily due to a $4.5 million decrease in operating expenses from 2005 to 2006 as a result of our exit from retail business activities in 2005, as well as the $2.3 million

inventory impairment charge incurred in 2005.

Liquidity and Capital Resources

At December 31, 2007, we had working capital of approximately $12.6 million including approximately $13.4 million in cash and cash equivalents. For the year ended December 31, 2007, our cash and cash equivalents increased by $0.2 million. This increase is a result of approximately $8.4 million in proceeds from a February 2007 sale of equity securities and approximately $6.7 million received from the exercise of approximately 800,000 options and warrants in 2007, offset by the use of approximately $13.5 million in cash for operating activities and approximately $1.4 million for the purchase of property and equipment and for payment of patent costs in 2007.

For the year ended December 31, 2006, our cash and cash equivalents increased approximately $3.0 million as a result of $16.2 million in proceeds from the sale of equity securities, $0.2 million received from the exercise of options and warrants, and $0.3 million in proceeds from the maturity of investments, offset by $11.4 million of cash used for operations and an additional $2.4 million used for the purchase of property and equipment and for payment of patent costs.

For the year ended December 31, 2005, our cash and cash equivalents increased approximately $3.8 million as a result of $20.1 million in proceeds from the sale of equity securities, $0.4 million received from the exercise of options and warrants, and $1.0 million in proceeds from the maturity of investments, offset by $15.7 million of cash used for operations and an additional $2.0 million used for the purchase of property and equipment and for payment of patent costs.

At December 31, 2007, we were not subject to any significant commitments to make additional capital expenditures.

Our future business plans call for continued investment in sales, marketing, customer support and product development for our technologies and products. Our ability to generate revenues sufficient to offset costs is subject to our ability to successfully support our customers in completing their initial product designs incorporating our technologies and our ability to expand our market opportunities through additional product offerings with our current customers and/or the addition of new customers such that we are able to secure a reasonable share of the market. We do not expect that revenue for 2008 will be sufficient to cover our operational expenses for 2008. The expected continued losses and use of cash will continue to be funded from available working capital.

On March 5, 2008, we completed the sale of 1,240,199 shares of common stock in a private placement transaction for net proceeds of approximately $9.0 million. We plan to use these proceeds, together with the $13.4 million in cash and cash equivalents at December 31, 2007, to fund our future business plans. We believe that our current capital resources together with the proceeds of the March 2008 equity financing will be sufficient to support our liquidity requirements at least through the first quarter of 2009. The long-term continuation of our business plans is dependent upon generation of sufficient revenues from our technologies to offset expenses. In the event that we do not generate sufficient revenues, we will be required to obtain additional funding through public or private financing and/or reduce certain discretionary spending. Management believes certain operating costs could be reduced if working capital decreases significantly and additional funding is not available. In addition, we currently have no outstanding long-term debt obligations. Failure to generate sufficient revenues, raise additional capital and/or reduce certain discretionary spending could have a material adverse effect on our ability to achieve our intended long-term business objectives.

Off-Balance Sheet Transactions, Arrangements and Other Relationships; Contractual Obligations

As of December 31, 2007, we have outstanding warrants to purchase 1,814,528 shares of common stock that were issued in connection with the sale of equity securities in various private placement transactions in 2000, 2001, 2005 and 2006. These warrants have exercise prices ranging from $8.50 to $56.66 per share with a weighted average exercise price of $31.27 and a weighted average remaining contractual life of 3.4 years.

The estimated fair value of these warrants at their date of issuance of $17,492,097 is included in shareholders’ equity in our consolidated balance sheets. During the year ended December 31, 2007, warrants to purchase 641,208 shares of common stock were exercised at a weighted average exercise price of $8.64, resulting in proceeds of approximately $5.5 million. Refer to “Non Plan Options/Warrants” in Note 8 to the consolidated financial statements included in Item 8 for information regarding the outstanding warrants.

Our contractual obligations and commercial commitments at December 31, 2007 were as follows (see “Lease Commitments” in Note 11 to the consolidated financial statements included in Item 8):

| | | Payments due by period | |

Contractual Obligations: | | | Total | | | 1 year or less | | | 2-3 years | | | 4 - 5 years | | | After 5 years | |

| Operating leases | | $ | 1,979,000 | | $ | 650,000 | | $ | 1,087,000 | | $ | 242,000 | | $ | 0 | |

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

None.

Item 8. Consolidated Financial Statements and Supplementary Data

Index to Consolidated Financial Statements

| | Page |

| | |

| REPORT OF INDEPENDENT REGISTERED CERTIFIED PUBLIC ACCOUNTING FIRM | 23 |

| | |

| CONSOLIDATED FINANCIAL STATEMENTS: | |

| | |

| Consolidated Balance Sheets - December 31, 2007 and 2006 | 25 |

| | |

| Consolidated Statements of Operations - for the years ended December 31, 2007, 2006 and 2005 | 26 |

| | |

| Consolidated Statements of Shareholders’ Equity - for the years ended December 31, 2007, 2006 and 2005 | 27 |

| | |

| Consolidated Statements of Cash Flows - for the years ended December 31, 2007, 2006 and 2005 | 29 |

| | |

| Notes to Consolidated Financial Statements - December 31, 2007, 2006 and 2005 | 30 |

| | |

| FINANCIAL STATEMENT SCHEDULE: | |

| | |

Schedule II – Valuation and Qualifying Accounts | 69 |

| | |

| Schedules other than those listed have been omitted since they are either not required, not applicable or the information is otherwise included. | |

Report of Independent Registered Certified Public Accounting Firm

To the Board of Directors and Shareholders of ParkerVision, Inc.:

In our opinion, the consolidated financial statements listed in the accompanying index present fairly, in all material respects, the financial position of ParkerVision, Inc. and its subsidiary at December 31, 2007 and December 31, 2006, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2007 in conformity with accounting principles generally accepted in the United States of America. In addition, in our opinion, the financial statement schedule listed in the accompanying index presents fairly, in all material respects, the information set forth therein when read in conjunction with the related consolidated financial statements. Also in our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2007, based on criteria established in Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). The Company’s management is responsible for these financial statements and financial statement schedule, for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in Management’s Report on Internal Control over Financial Reporting included under Item 9A. Our responsibility is to express opinions on these financial statements, on the financial statement schedule, and on the Company’s internal control over financial reporting based on our integrated audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement and whether effective internal control over financial reporting was maintained in all material respects. Our audits of the financial statements included examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our audit of internal control over financial reporting included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audits also included performing such other procedures as we considered necessary in the circumstances. We believe that our audits provide a reasonable basis for our opinions.

As discussed in Note 7 to the consolidated financial statements, the Company changed the manner in which it accounts uncertain tax positions in 2007. As discussed in Note 8 to the consolidated financial statements, the Company changed the manner in which it accounts for share-based compensation in 2006.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the