20 4 ANNUAL REPORT

2024 LETTER TO SHAREHOLDERS Dear Shareholders, I would like to start by saying ‘congratulations’ to the Daktronics team for an amazing year! We began and finished fiscal 2024 strong, demonstrating the increased power of our more profitable business model resulting from the operating improvements we’ve made over the past few years. We achieved record revenue and solid expansion in operating profitability and cash flow generation. Fiscal 2024 was a year of terrific accomplishment, as we executed on a number of strategies and made progress toward our long-term objectives. Some highlights of our year: • We refinanced the company to ensure we have the resources available to serve our customers and build long-term value for our shareholders. • We executed consistently to incrementally raise the base profitability of the business by allocating resources to growing business segments and the most profitable projects. • We generated substantially higher cash flow through our increased profitability and our management of working capital, and through efforts such as reduction in inventory levels post-supply chain correction. • On the product front, we continued to innovate to maintain our technology leadership, as seen in releases like additional narrow pixel pitch product lines used primarily in indoor applications. • With respect to our end market penetration, our teams deepened our relationships with AV integrators in new customer areas to reach growing markets. As an example, we delivered displays to a number of military sites this past year. • We laid essential groundwork for our digital transformation strategy, making progress in our services systems areas and investing in enterprise performance management software. • In our facilities, we further optimized our operations in manufacturing and site fulfillment processes, as we returned to serving customers within market lead-times. These accomplishments serve as evidence of the success of the actions taken over the last 18 months to capture and leverage lessons learned from challenging business conditions to improve our customers' experiences, to increase our profitability, and to optimize working capital levels. The results also testify to the resiliency and strength of Daktronics teams to execute our strategy of capturing demand in diverse markets and creating differentiation by innovating across technology platforms. We are not done with our efforts to enhance the returns that our business can deliver. Building on our accomplishments in fiscal 2024, we are implementing a set of initiatives in fiscal 2025 to continue to drive future revenue growth and returns on invested capital. Our fiscal 2025 priorities include: 1. Taking the next steps in our digital transformation to enhance our internal systems. These include modernizing our field service systems, enterprise performance management tools, and automating quoting and sales processes. Our digital transformation will provide greater insights into our business and end markets, allowing us to continue to guide our investments to our most profitable business segments and to pursue growth through expanding our share of these customers’ spend. 2. Focused actions to further penetrate our addressable market through innovation, allocating resources and capital to our most profitable opportunities, and adding professional services, control systems and other content to drive recurring revenue, ensuring we are driving returns as we help our customers achieve success on their investment in our offerings. 3. We are taking steps in parallel to lower our overall costs to operate the business and increase market competitiveness. This includes increasing the flexibility of our capacity and our plant manufacturing allocation and utilization, adjusting our production and capabilities to smoothly manage order flow, and boost operational effectiveness. With these initiatives, we will continue to advance many existing elements of our strategy and our competitive differentiation, including our premium value proposition, our U.S. design, fulfillment, and high-touch services, our key investments in control systems, and our unique culture of life-time service to our customers. All actions support our commitment to maximize our return on capital and consistently earn returns above our cost of capital. Reece A. Kurtenbach Chairman of the Board President and Chief Executive Officer

(This page has been left blank intentionally.)

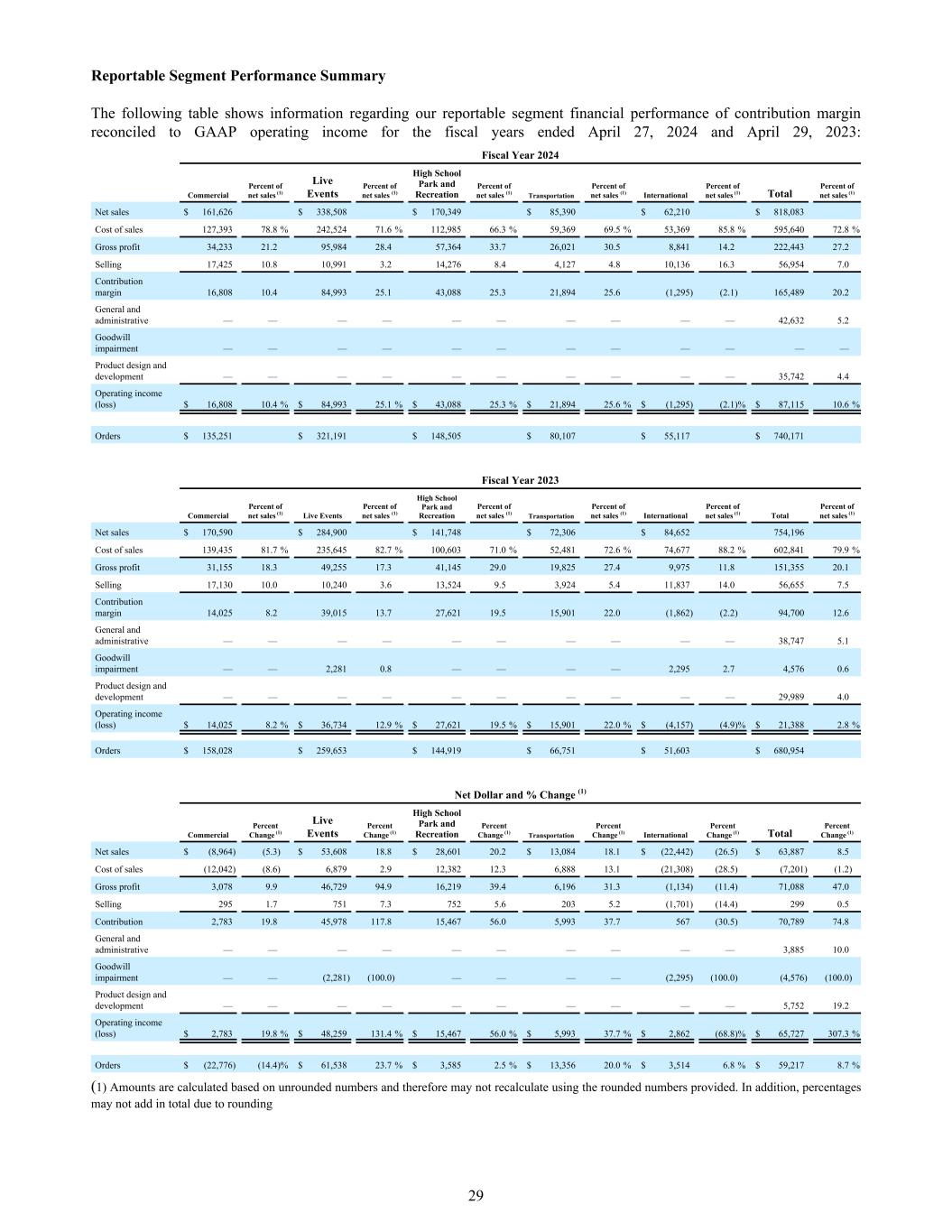

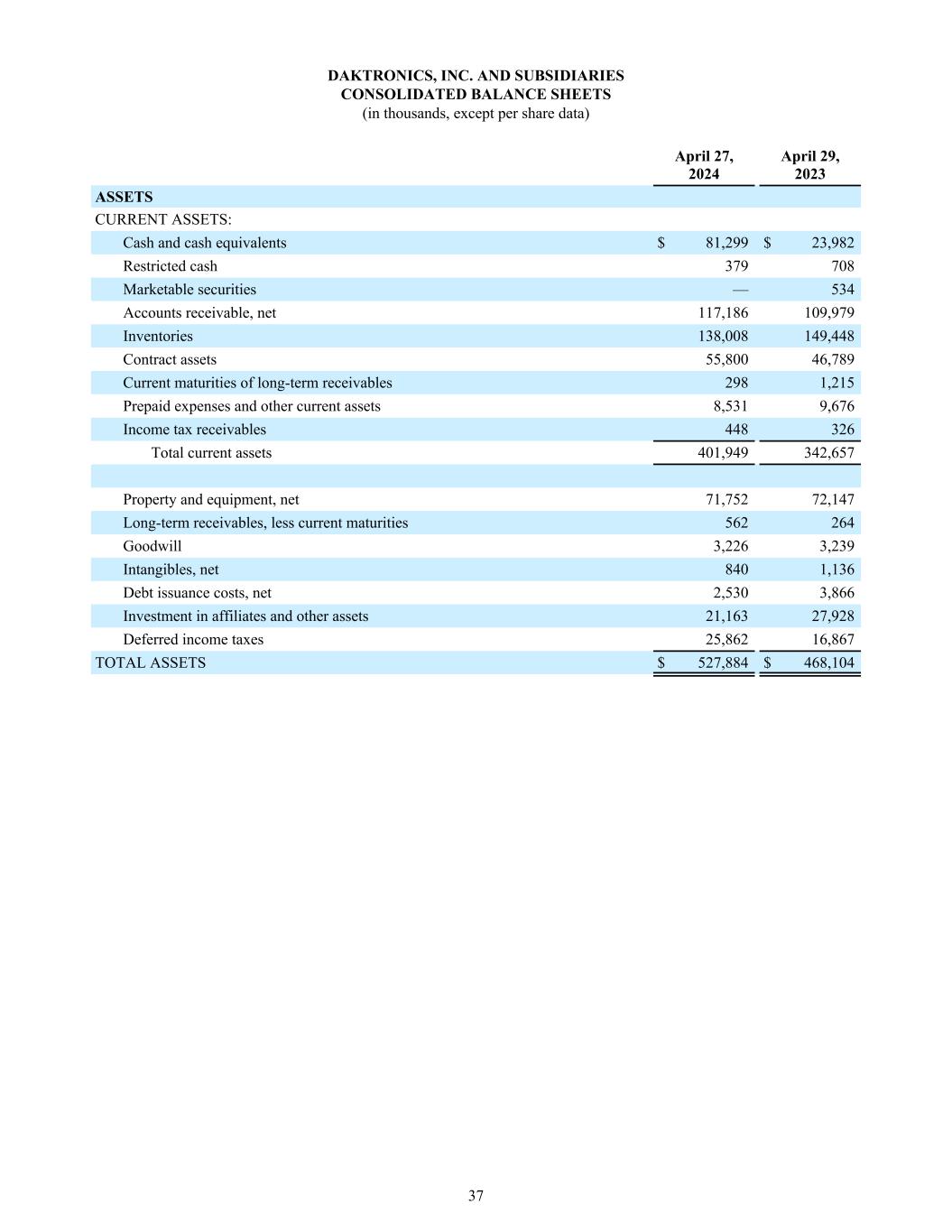

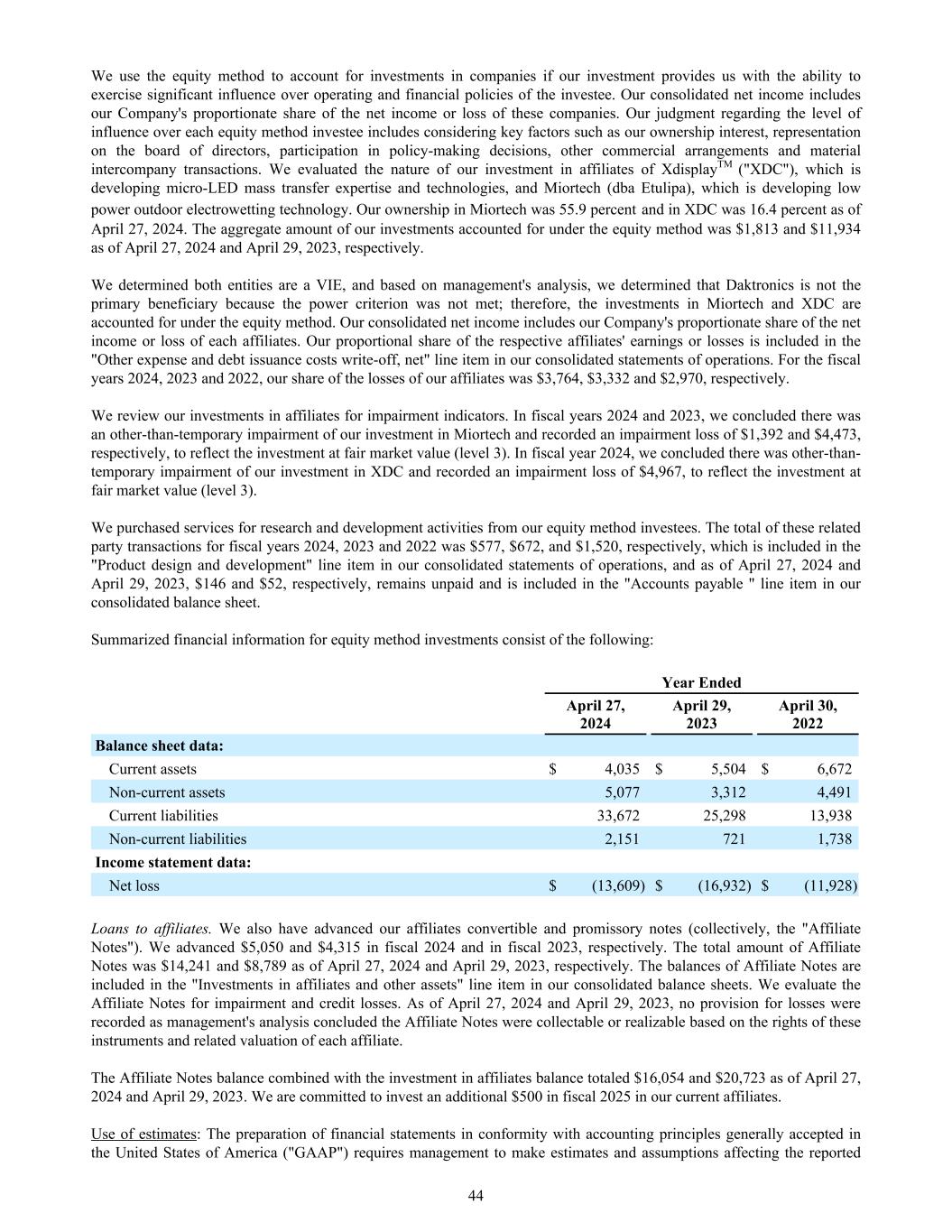

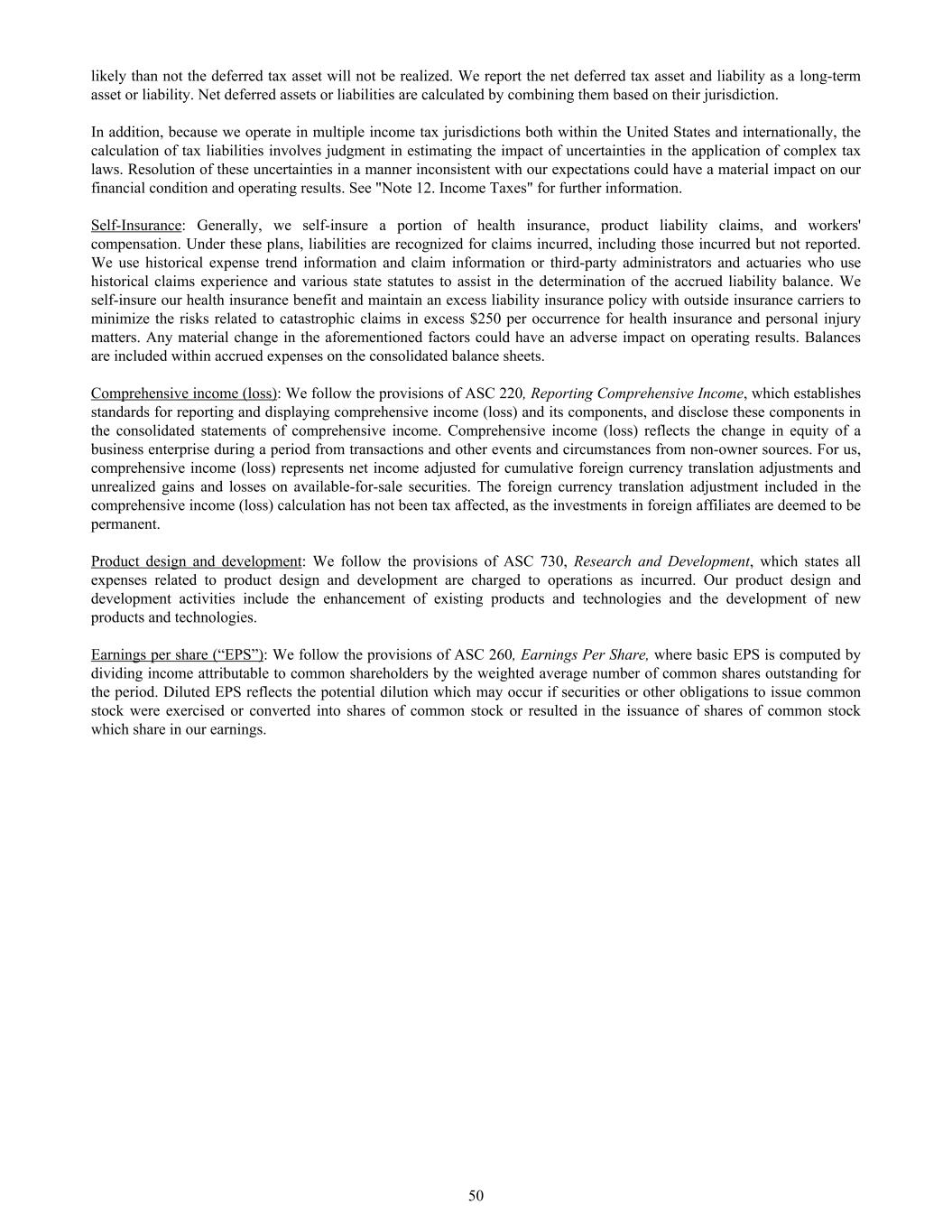

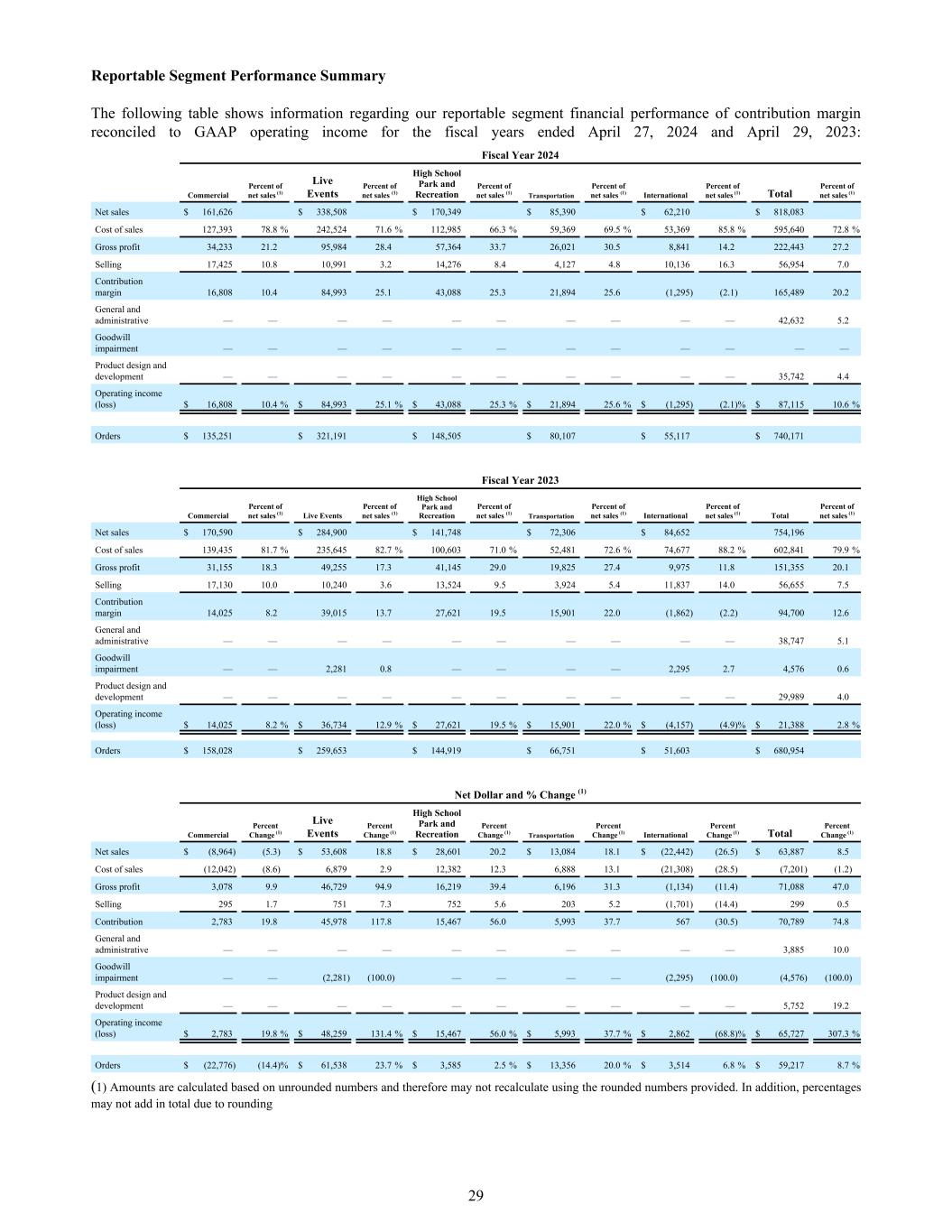

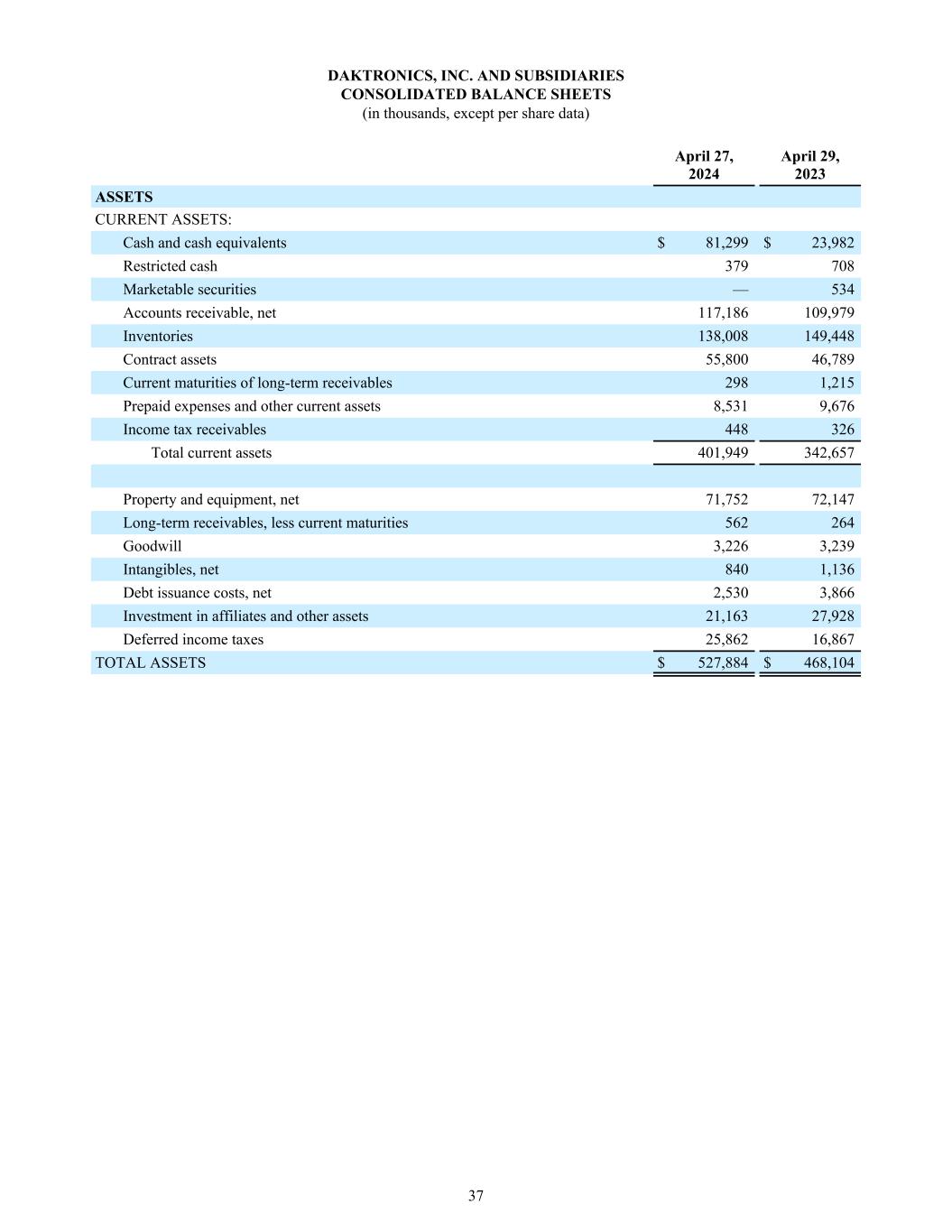

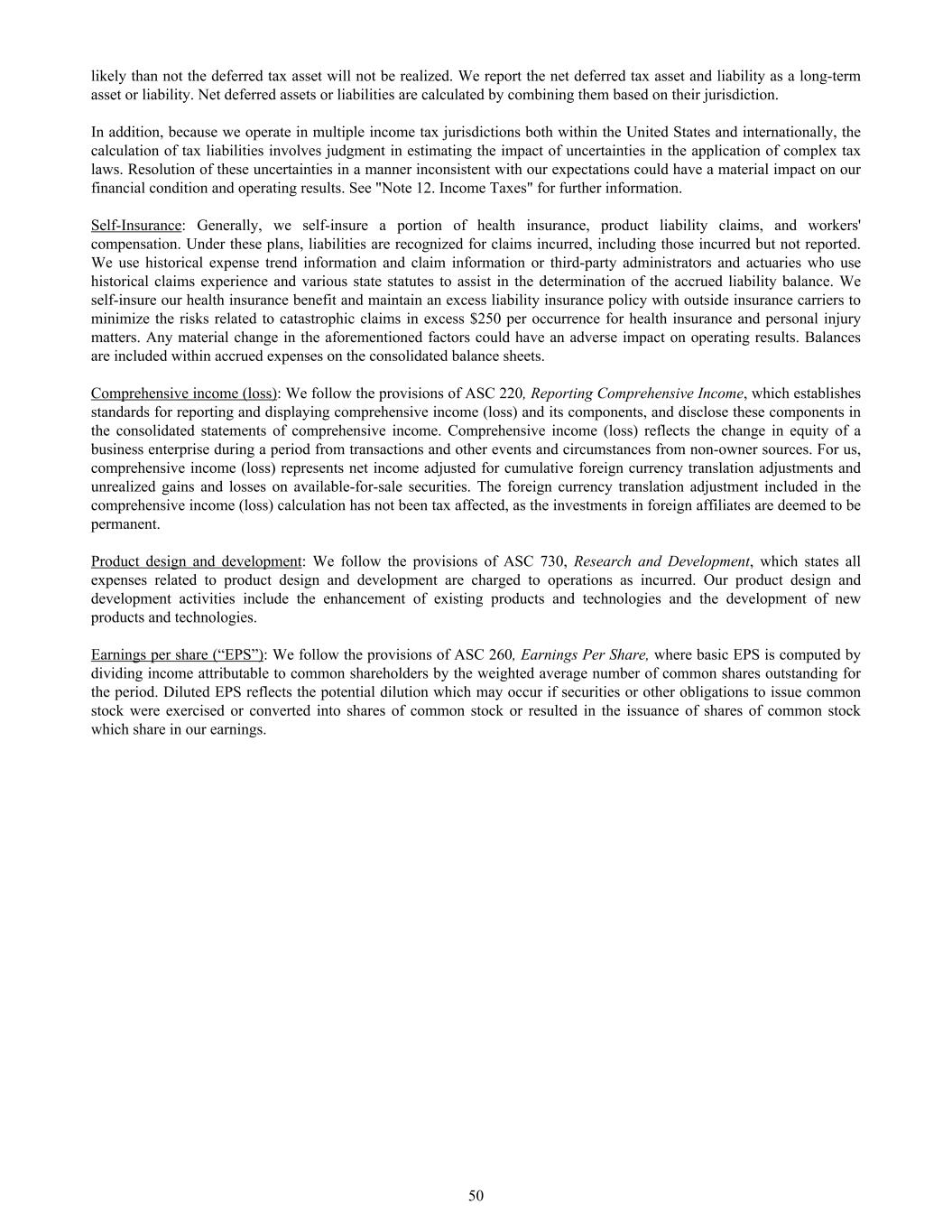

FINANCIAL HIGHLIGHTS Daktronics, Inc. and its subsidiaries are an industry leader in designing and manufacturing electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial and transportation applications. We serve our customers by providing the highest quality standard display products as well as custom-designed and integrated systems. We offer a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. We are recognized as a technical leader with the capabilities to design, market, manufacture, install and service complete integrated systems displaying real-time data, graphics, animation and video. We engage in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services and customer service and support. Our business is organized into five business units: Commercial, Live Events, High School Park and Recreation, Transportation, and International. Our customers value our products for their customer and fan experience, and the ability to generate revenues and inform their audiences. Our products have been installed in venues from grade school gyms to premier sports facilities, destination sites and in over 100 countries throughout the world. We serve our customers through a network of offices in the United States, Canada, Europe, and the Asia-Pacific Region. We employ 2,734 full-time and part-time employees. Our engineering capabilities are second to none in the industry and we are committed to on-going product development to find new applications for our products and expand the markets we serve. Daktronics stock is traded on The Nasdaq Global Select Market under the symbol DAKT. (Dollars in thousands, except per share and share price data.) FY2020 FY2021 FY2022 FY2023 FY2024 Net sales $ 608,932 $ 482,033 $ 610,970 $ 754,196 $ 818,083 Gross profit 138,700 120,583 116,697 151,355 222,443 Operating expenses 138,867 103,475 112,651 129,967 135,328 Operating income (loss) (167) 17,108 4,046 21,388 87,115 Net income (loss) 491 10,926 592 6,802 34,621 Gross profit percentage 22.8 % 25.0 % 19.1 % 20.1 % 27.2 % Operating margin percentage — % 3.5 % 0.7 % 2.8 % 10.6 % Weighted average diluted shares outstanding 45,316 45,202 45,326 45,521 46,543 Diluted earnings (loss) per share 0.01 0.24 0.01 0.15 0.74 Cash dividend per share 0.20 — — — — Working capital $ 106,037 $ 118,383 $ 103,876 $ 132,494 $ 209,653 Total assets 372,651 375,164 $ 440,876 468,104 527,884 Shareholders' equity 176,980 193,554 $ 191,564 200,878 238,792 Product Backlog 212,000 251,000 472,000 400,737 316,905 Product design and development expense $ 37,772 $ 26,846 $ 29,013 $ 29,989 $ 35,742 Capital expenditures 18,091 7,891 20,376 25,385 16,980 Depreciation and amortization expense 17,718 17,077 15,394 16,993 19,291 Cash flow from operations 10,808 66,212 (27,035) 15,024 63,241 Regular dividend per share 0.20 — — — — Employees as of year-end: Full-time 2,395 1,981 2,246 2,441 2,520 Part-time and students 276 136 231 293 311 Stock price during fiscal year: High $ 7.91 $ 7.22 $ 7.20 $ 5.80 $ 12.17 Low 4.16 3.79 3.35 1.75 4.77 Stock price at fiscal year-end 4.45 6.17 3.35 4.81 9.29

(This page has been left blank intentionally.)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended April 27, 2024 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period From ___ to ___. Commission File Number: 001-38747 Daktronics, Inc. (Exact Name of Registrant as Specified in Its Charter) South Dakota 46-0306862 (State or Other Jurisdiction of Incorporation or Organization) (I.R.S. Employer Identification No.) 201 Daktronics Drive Brookings, SD 57006 (Address of Principal Executive Offices) (Zip Code) (605) 692-0200 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, No Par Value DAKT Nasdaq Global Select Market Preferred Stock Purchase Rights DAKT Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ Indicate by check mark whether any of those errors corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐ Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ☒ The aggregate market value of the registrant's common stock held by non-affiliates at October 28, 2023 (which is the last business day of the Registrant’s most recently completed second quarter), computed by reference to the closing sales price of the Registrant’s common stock on The Nasdaq Global Select Market on such date, was approximately $445,961,756. For purposes of determining this number, individual shareholders holding more than 10 percent of the Registrant’s outstanding common stock are considered affiliates. This number is provided only for the purpose of this Annual Report on Form 10-K and does not represent an admission by either the Registrant or any such person as to the status of such person. The number of shares of the Registrant’s common stock outstanding as of June 3, 2024 was 46,296,377. Auditor Name: Deloitte & Touche LLP Location: Minneapolis, Minnesota Auditor Firm ID: PCAOB No. 34

DAKTRONICS, INC. AND SUBSIDIARIES FORM 10-K FOR THE FISCAL YEAR ENDED April 27, 2024 Table of Contents Page SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS 1 PART I 1 ITEM 1. BUSINESS 1 ITEM 1A. RISK FACTORS 8 ITEM 1B. UNRESOLVED STAFF COMMENTS 21 ITEM 1C. CYBERSECURITY 21 ITEM 2. PROPERTIES 22 ITEM 3. LEGAL PROCEEDINGS 23 ITEM 4. MINE SAFETY DISCLOSURES 23 PART II 23 ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES 23 ITEM 6. [Reserved.] 24 ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS 24 ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK 33 ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA 35 ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE 77 ITEM 9A. CONTROLS AND PROCEDURES 77 ITEM 9B. OTHER INFORMATION 79 ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS 79 PART III 81 ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE 81 ITEM 11. EXECUTIVE COMPENSATION 81 ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS 81 ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE 82 ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES 82 PART IV 83 ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES 83 ITEM 16 FORM 10-K SUMMARY 83 SIGNATURES 87

(This page has been left blank intentionally.)

SPECIAL NOTE REGARDING FORWARD–LOOKING STATEMENTS This Annual Report on Form 10-K (including exhibits and any information incorporated by reference herein) (the "Form 10-K" or the "Report") contains both historical and forward-looking statements that involve risks, uncertainties and assumptions. The statements contained in this Report that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21B of the Securities Exchange Act of 1934, as amended, including statements regarding our expectations, beliefs, intentions and strategies for the future. These statements appear in a number of places in this Report and include all statements that are not historical statements of fact regarding the intent, belief or current expectations with respect to, among other things: (i.) our competition; (ii.) our financing plans and ability to maintain adequate liquidity; (iii.) trends affecting our financial condition or results of operations; (iv.) our growth and operating strategies; (v.) the declaration and payment of dividends; (vi.) the timing and magnitude of future contracts; (vii.) raw material shortages and lead times and supply chain disruptions; (viii.) fluctuations in margins; (ix.) the seasonality of our business; (x.) the introduction of new products and technology; (xi.) the amount and frequency of warranty claims; (xii.) our ability to manage the impact that new or adjusted tariffs may have on the cost of raw materials and components and our ability to sell product internationally; (xiii.) the resolution of litigation contingencies; (xiv.) the timing and magnitude of any acquisitions or dispositions; (xv.) the impact of governmental laws, regulations, and orders, including as a result of the COVID-19 pandemic caused by the coronavirus; (xvi) disruptions to our business caused by geopolitical events, military actions, work stoppages, natural disasters, or international health emergencies, such as the COVID-19 pandemic; (xvii) uncertainties related to market conditions and entry into financing transactions; (xviii) the Company’s potential need to seek additional strategic alternatives, including seeking additional debt or equity capital or other strategic transactions and/or measures; (xix) our financing plans and ability to maintain adequate liquidity; (xx) the Company’s ability to increase cash flow to support the Company’s operating activities and fund its obligations and working capital needs; (xxi) our ability to obtain additional financing on terms favorable to us, or at all; (xxii) any future goodwill impairment charges; and (xxiii) the valuation of investment in and advances to affiliates. The words “may,” “would,” “could,” “should,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend,” “plan” and similar expressions and variations thereof are intended to identify forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, many of which are beyond our ability to control, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors discussed herein, including those discussed in the section of this Form 10-K entitled “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and those factors discussed in detail in our other filings with the Securities and Exchange Commission. PART I. Item 1. BUSINESS Business Overview Daktronics, Inc. and its subsidiaries (the “Company”, “Daktronics”, “we”, “our”, or “us”) are industry leaders in designing and manufacturing electronic scoreboards, programmable display systems and large screen video displays for sporting, commercial and transportation applications. We serve our customers by providing high quality standard display products as well as custom-designed and integrated systems. We offer a complete line of products, from small scoreboards and electronic displays to large multimillion-dollar video display systems as well as related control, timing, and sound systems. We are recognized as a technical leader with the capabilities to design, market, manufacture, install and service complete integrated systems displaying real-time data, graphics, animation and video. We engage in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. We were founded in 1968 by Drs. Aelred Kurtenbach and Duane Sander, professors of electrical engineering at South Dakota State University in Brookings, South Dakota. The Company began with the design and manufacture of electronic voting systems for state legislatures. In 1971, Daktronics developed the patented Matside® wrestling scoreboard, the first product in the Company's growing and evolving line. In 1994, Daktronics became a publicly-traded company and invested in display technologies and new markets. We have continued these investments and have supported our long-term customer relationships to grow from a small company operating out of a garage to a world leader in the display industry. We currently employ 2,831 people globally. We are headquartered at 201 Daktronics Dr., Brookings, SD 57006, telephone 605-692-4200. Our Internet address is https://www.daktronics.com. 1

Available Information Our annual, quarterly and current reports and any amendments to those reports are freely available in the "Investor Relations" section of our website. We post each of these documents on our website as soon as reasonably practicable after it is electronically filed with the Securities and Exchange Commission (the "SEC"). These reports and other reports, proxy statements, and electronic filings are also found on the SEC’s website at www.sec.gov. Information contained on our website is not deemed to be incorporated by reference into this Report or filed with the SEC. Reportable Segments We focus our sales and marketing efforts on markets, geographical regions and products. Our five business segments consist of four domestic business units and the International business unit. The four domestic business units consist of Commercial, Live Events, High School Park and Recreation, and Transportation, all of which include the geographic territories of the United States and Canada. Financial information concerning these segments is set forth in this Form 10-K in "Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations" and "Note 3. Segment Reporting" of the Notes to our Consolidated Financial Statements included in this Form 10-K. Industry Background Over the years, our products have evolved significantly from scoreboards and matrix displays with related software applications to complex, integrated visual display systems which include full color video with text and graphics displays located on a local or remote network that are tied together through sophisticated control systems. In the mid-1990's, as light emitting diodes (“LEDs”) became available in red, blue and green colors with outdoor brightness, we pioneered the development of full color LED video displays capable of replicating trillions of colors, thereby producing large format video systems with excellent color, brightness, energy efficiency and lifetime. Due to our foundation of developing scoring and graphics display systems, we were able to add video capabilities so we could meet all our customers' large format display needs in a complete, integrated system. This has proven to be a key factor in Daktronics becoming a leader in large electronic displays. LED technologies continue to evolve and advance, creating new high-resolution and micro-LED display options of all shapes and sizes. Today, the industry continues development in both the construct of the micro-LED and production methods of micro-LED display panels using mass-transfer technology. Integrated visual display systems are increasingly used across a variety of vertical markets including: media/advertising, stadiums/venues, hospitality/leisure, transportation, military and government, broadcast, control room, corporate and education, and retail. Generally, these vertical markets use systems to collaboratively communicate, inform, entertain, and advertise to various sized audiences. Advances in technologies and the decrease in costs of systems have opened up and increased the market's size. Description of Business We are engaged in a full range of activities: marketing and sales, engineering and product design and development, manufacturing, technical contracting, professional services, and customer service and support. Each of those activities is described below: Marketing and Sales. Our sales force is comprised of direct sales staff and resellers, including AV integrators, located throughout the world supporting all customer types in both sales and service. We primarily use a direct sales force for large integrated display system sales in professional sports, colleges and universities, and commercial spectacular projects. We also use our direct sales force to sell to out-of-home advertising companies, to transportation system operators, and to certain high school park and recreation customers. The majority of our products sold by resellers are standard catalog products such as video boards and dynamic message systems and increasingly include indoor micro-LED configurable display systems. We also utilize resellers outside North America for large integrated system sales where we do not have a direct sales presence. We support our resellers through direct mail/email advertising, social media campaigns, trade journal advertising, product and installation training, trade show exhibitions, and accessibility to our regional sales or service teams and demonstration equipment. Engineering and Product Design and Development. The large format electronic display industry is characterized by ongoing product innovations and developments in technology and complementary services. To remain competitive, we have a tradition of applying engineering resources throughout our business to anticipate and respond rapidly to the system needs in the marketplace. We employ and contract with engineers and technicians in the areas of mechanical and electrical 2

design; applications engineering; software design; quality design; and customer and product support. Product managers assigned to each product family assist our sales staff in training and implementing product improvements which ensures each product is designed for maximum reliability and serviceability. We employ and contract with process engineers to assist in quality and reliability processing in our product design testing and manufacturing areas. We also make selected investments in and contract with affiliated companies to support and advance technologies and capabilities for our product lines and solutions. Manufacturing. The majority of our products are manufactured in the United States, specifically in South Dakota and Minnesota. We also have manufacturing facilities in China and Ireland. We perform component manufacturing, system manufacturing (metal fabrication, electronic assembly, sub-assembly and final assembly) and testing in-house for most of our products to control quality, improve response time and maximize cost-effectiveness. Given the cyclical nature of some parts of our business and dispersed sales geography, we balance and maintain our ability to manufacture the same products across our plants so we can efficiently utilize our capacity and reduce costs. A key strategy of ours is to increase standardization and commonality of parts and manufacturing processes across product lines through the use of product platforms to increase efficiencies. Other strategies include supplier management programs and lean manufacturing techniques. For more details on our facilities, see "Part II, Item 2. Properties". Technical Contracting. We serve as a technical contractor for larger display system installations requiring custom designs and innovative product solutions. The purchase of display systems typically involves competitive proposals. As part of our response to a proposal request, we may suggest additional products or features to assist the prospective customer in analyzing the optimal type of display system. We usually include site preparation and installation services related to the display system in our proposal. In these cases, we serve as a contractor and may retain subcontractors for electrical, steel and installation labor. We have developed relationships with many subcontractors throughout the United States and the world, which is an advantage for us in bidding and delivering on these projects. We are licensed as a general contractor in many jurisdictions. Professional Services. To assist our clients' ability to engage, inform and entertain their audiences, we provide professional services including event support, event production curriculum, content creation, product maintenance, marketing assistance, training on hardware and software, control room design, and continuing technical support training for operators. Customer Service and Support. We offer limited warranties on our products, ranging from one to 10 years, against failure due to defective parts or workmanship. In addition, we offer service agreements of various scopes. To serve our customers, we provide help-desk access, parts repair and replacement, display monitoring and on-site support. Our technical help desk has experienced technicians who are on-call 24 hours a day to support events and sites. Our field service personnel and third-party service partners are trained to provide on-site support. We use third-party service partners to allow us to respond to the changes in volume of service requests during our seasonal peaks. Products and Technologies The two principal components of our systems are the display and the control system, which manages the operation of the display. We produce displays varying in complexity, size and resolution. The physical dimensions of a display depend on the size of the viewing area, the distance from the viewer to the display, and the amount and type of information to be displayed. The control system is comprised of various combinations of computer hardware, video processing hardware and software products designed to compile information provided by the operator and other integrated sources to display information, graphics, video or animation on the displays. We customize our products according to the design specifications of the customer and the conditions of the environment in which our products function. Our products are comprised of the following product families: • Video displays/video walls • Scoreboards and timing systems • LED Message displays and signs • ITS (intelligent transportation systems) dynamic message signs • Mass Transit displays • Sound systems • Digital billboards • Digital street furniture • Digit and price displays 3

• Indoor dynamic messaging systems and indoor liquid crystal display ("LCD") signs • Software and controllers including Venus® Control Suite, Show Control Studio and Show Control Live Each of these product families is described below: Video Displays/Video Walls. These displays are comprised of a large number of full-color pixels capable of showing various levels of video feeds, pre-rendered graphics and animated content with Real Time Data capabilities. These displays include red, green and blue LEDs arranged in various combinations to form pixels. The electronic circuitry, which controls the pixels, allows for variances in the relative brightness of each LED to provide a full color spectrum, thereby displaying video images in striking, vibrant colors. Variables in video displays include the spacing of the pixels (pixel pitch), the resolution of the displays (number of pixels), the brightness of the displays (nits), the number of discrete colors the display is able to produce (color depth), the viewing angles, and the LED technology. We offer a broad range of indoor and outdoor LED video displays with these varying features. Examples of offerings include centerhung displays, landmark displays, video walls, ribbon board displays, hanging banners, roadside displays, digital billboards, corporate office entrance displays, conference room displays, control room displays, and video displays designed for arenas, stadiums, retail stores, restaurants, malls, transportation hubs and other similar indoor facilities. Video displays provide content to serve as a revenue generation source through advertising or as an information and communication medium (such as scoring, statistics, wayfinding, advertising, and control center information), or to provide interior design elements to create luxurious space to feature digital art. The control components for video displays in live event applications include our Show Control Software Suite, proprietary digital media players and video processors. These control components provide advanced capabilities for the display of live video and real-time content on our displays. The Show Control Software Suite can operate an entire network of displays within a venue from a single, intuitive control interface. Its features allow users to instantly deliver media clips, camera feeds, and streaming information to any display in a venue. Scoreboards and Timing Systems. Our line of scoreboards and timing products include indoor and outdoor scoreboards for many different sports, digit displays, scoring and timing controllers, statistics software and other related products. Indoor and outdoor systems range in complexity from small scoreboards to larger systems incorporating scoring, timing, video, message centers, advertising panels and control software. We offer a variety of controllers complementing our scoreboards and displays. These controllers vary in complexity from the All Sport® 100, a handheld controller for portable scoreboards, to the All Sport® Pro, designed for more sophisticated scoring systems and allowing for more user-defined options. As a key component of an integrated system, we market sports statistics and results software under the DakStats® trademark. The software allows the entry and display of sports statistics and other information. It is one of the leading applications of its type in collegiate and high school sports. LED Message Displays and Signs. The Galaxy® product line is a family of full-matrix displays, available in both indoor and outdoor models and controlled with the Venus® Control Suite. Galaxy® displays are full color or monochrome with varying pixel spacing depending on color, size and viewing distance. Galaxy® displays can display text, graphics and animation, as well as prerecorded video clips. They are used primarily to convey information and on-premises advertising to consumers. The Venus® Control Suite software is used to control the creation of messages and graphic sequences for uploading to the Galaxy® displays. This software is designed to be user friendly and applicable to all general advertising or message applications. It can be used to control a single message display or can scale up to provide a secure, cloud-based control center for large networks of message displays. ITS Dynamic Message Signs ("DMS"). DMS products include a wide range of LED displays for road management applications. The Vanguard® family of dynamic message displays is typically used to direct traffic and inform motorists. These displays are used over freeways, on arterial roads, near bridges, at toll booths and in other locations. We have also developed a Vanguard® control system for these displays to help transportation agencies manage large networks of displays. 4

Mass Transit Displays. Our Mass Transit products include a wide range of LCD and LED display solutions for public transportation applications. Installations often involve a network of displays located on railway platforms, at bus stations, or on concourses within a transportation hub to guide travelers to their intended destination. Sound Systems. Our sound systems include both standard and custom options. Standard systems are designed to meet the needs of a variety of indoor and outdoor sports venues based on the size and configuration of the facility. Custom indoor and outdoor systems are tailored for larger venues and venues with unique seating configurations and are often integrated into an overall venue solution for scoring, timing, message display and/or video capability. Digital Billboards. Our line of digital billboards offers a unique display solution for the Out-of-Home (“OOH”) advertising industry. The products are used to display images which change at regular intervals. These systems include many features unique to the outdoor advertising market, such as our patented mounting system, self-adjusting brightness, optimized energy consumption, and enhanced network security. Digital street furniture. Our LED street furniture features some of the brightest imagery in the industry and is built to withstand full-sun conditions. Our line of digital street furniture engages people with advertising content at eye level as they walk through campuses, cityscapes, and malls. This design enhances the message and complements surrounding architecture. These street furniture displays are our most flexible solution for digital OOH campaigns. Digit and Price Displays. This product line includes our DataTime® and Fuelight™ displays. The DataTime® product line consists of outdoor time and temperature displays which use a remote sensor for temperature data. Fuelight™ digit displays are specifically designed for the petroleum industry, offering high visibility and quick fuel price updates using the Fuelink™ control software. Indoor Dynamic Messaging Systems and LCD screens. Our ADFLOW DMS™ systems include indoor networked solutions for retailers, convenience stores and other businesses. These solutions, using either LED or LCD technologies, allow customers to broadcast advertising campaigns and other information through the software, media players and visual hardware. Software and Controllers including Venus® Control Suite. The Venus® Control Suite is our platform for scheduled control capability. It can be used in any application where the intended message is created in advance and scheduled to play at a predetermined time. It is available in an on-premise or hosted cloud-based configuration and is capable of supporting a single display or scaling to support many displays. For applications that require both scheduled content and live video or real time content, a control solution can combine the capabilities of Venus® Control Suite with the capabilities of the Show Control Software Suite to create a powerful solution that enables customers to easily manage content on their displays. Content includes media, scoring, statistics, timing, advertising, way-finding information, playback loops and entertainment type visualizations. Our Show Control Suite is an easy-to-use and powerful integrated solution to achieve a dynamic, seamless and fully immersive game-day production. Show Control Studio offers products designed for display control, while Show Control Live is designed for video production. Raw Materials Materials used in the production of our video display and control systems are sourced from around the world. Examples of the materials we use in production include LEDs, integrated circuits, printed circuit boards, power supplies, plastics, aluminum, and steel. We source some of our materials from a single-source or a limited number of suppliers due to the proprietary nature of the materials. The loss of a key supplier, part unavailability, tariff changes, price changes, war, transportation disruptions, or other geopolitical impacts to trade or transport, or defects in the supplied material or component could have an adverse impact on our business and operations. Our sourcing group is responsible to maintain and implement strategies to mitigate these evolving risks. Periodically, we enter into pricing agreements or purchasing contracts under which we agree to purchase a minimum amount of product in exchange for guaranteed price terms over the length of the contract, which generally does not exceed one year. We sometimes prepay for future supply. Intellectual Property We own or hold licenses to use numerous patents, copyrights, and trademarks on a global basis. Our policy is to protect our competitive position by filing United States and international patent applications to protect technology and improvements 5

that we consider important to the development of our business. This will allow us to pursue infringement claims against competitors for protection due to patent violations. Although we own a number of patents and possess rights under others to which we attach importance, we do not believe that our business as a whole is materially dependent upon any such patents or rights. We also own a number of trademarks that we believe are important in connection with the identification of our products and associated goodwill with customers, but no part of our business materially depends on such trademarks. We also rely on nondisclosure agreements with our employees and agents to protect our intellectual property. Despite these intellectual property protections, there can be no assurance a competitor will not copy the functions or features of our products. Seasonality Our net sales and profitability historically have fluctuated due to the impact of uniquely configured orders, such as display systems for professional sports facilities, colleges and universities, and spectacular projects in the commercial area, as well as the seasonality of the sports market. Uniquely configured orders can include several displays, controllers, and subcontracted structure builds, each of which can occur on varied schedules per the customer's needs. Our third fiscal quarter sales and profit levels are lighter than other quarters due to the seasonality of our sports business, construction cycles, and the reduced number of production days due to holidays in the quarter. Our gross margins tend to fluctuate more on uniquely configured orders than on limited configured orders. Uniquely configured orders involving competitive bidding and substantial subcontracting work for product installation generally have lower gross margins. Although we follow the over-time method of recognizing revenues for uniquely configured orders, we nevertheless have experienced fluctuations in operating results and expect our future results of operations will be subject to similar fluctuations. Working Capital For information regarding working capital items, see “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations-Liquidity and Capital Resources” in this Form 10-K. Customers We have a large and diverse worldwide customer base, ranging from local main street business owners, out-of-home companies, governmental agencies, and schools, colleges, and universities, to the owners and operators of premier professional sports arenas. Our customers are important to us, and we strive to serve them over the long-term to earn their future business. The loss of one or more customers could have an adverse effect on us. See "Note 3. Segment Reporting" of the Notes to our Consolidated Financial Statements included in this Form 10-K for our primary markets and customers of each business unit. Product Order Backlog Backlog represents the dollar value of orders for integrated electronic display systems and related products and services which are expected to be recognized in net sales in the future. Orders are contractually binding purchase commitments from customers. Orders are included in backlog when we are in receipt of an executed contract and any required deposits or security and have not yet been recognized into net sales. Certain orders for which we have received binding letters of intent or contracts will not be included in backlog until all required contractual documents and deposits are received. Orders and backlog are not metrics defined by accounting principles generally accepted in the United States of America ("GAAP"), and our methodology for determining orders and backlog may vary from the methodology used by other companies in determining their orders and backlog amounts. Order and backlog levels provide management and investors additional details surrounding the results of our business activities in the marketplace and highlight fluctuations caused by seasonality and multi-million dollar projects. Management uses orders to evaluate market share and performance in the competitive environment. Management uses backlog information for capacity and resource planning. Order fulfillment timing is dependent on customer schedules, supply chain conditions, and our capacity availability. We believe order information is useful to investors because it provides an indication of our market share and future revenues. Our product order backlog as of April 27, 2024 was $316.9 million as compared to $400.7 million as of April 29, 2023. The decrease in backlog, to more historical levels, is a result of fulfilling orders at a greater pace in fiscal 2024 as supply 6

chain conditions stabilized and production lead times improved, utilizing our increased capacity, and order pace returning to more normalized rates. We expect to fulfill the backlog as of April 27, 2024 within the next 24 months. The timing of backlog fulfillment may be impacted by project delays resulting from customer site conditions, which are outside our control. Government and Other Regulation In the United States and other countries, various laws, regulations and ordinances related to our products and controllers restrict the installation of outdoor signs and displays, particularly in the commercial and transportation markets. These laws and regulations impose greater restrictions on electronic displays versus non-electronic displays due to alleged concerns over aesthetics or driver safety. Globally, our products are also subject to various regulations and standards including electromagnetic interference, electromagnetic compatibility, electrical safety, and flammability standards. We design and have our products tested for these regulations; however, these factors may prevent or inhibit us from selling products to some prospective customers in certain geographies. Our manufacturing facilities and products comply with industry specific requirements, including environmental rules and regulations and safety standards. These requirements include quality, manufacturing process controls, manufacturing documentation, supplier certification of raw materials, and various safety tests. Our production processes require the storage, use and disposal of a variety of hazardous chemicals under applicable laws. Our global supply chain and sales distribution channels subject us to various trade compliance regulations. These requirements can include certification of country of origin, classification within the various tariff codes and trade agreements; compliance with other specific product or country import/export regulations; and payment of certain import or export tariffs, duties, or taxes. Our obligations to conduct site work, including installations or repair, require us to comply with environmental rules and regulation, wage requirements, and safety standards. Often, certain contracts require us to have accident prevention programs that provide for frequent and regular inspection of the jobsites, materials, and equipment by competent persons. Our global operations subject us to various laws and regulations, including laws and regulations relating to tax compliance, anti-corruption, data privacy, cybersecurity, governance, climate, and disclosure reporting. These requirements vary and can involve matters and processes such as using resources for related expertise and information systems, records management, policy creation and maintenance, data protection programs, compliance filings, control design and testing, and continued training of employees. We are subject to regulations restricting the movement and interaction of people and business operations. Countries and states and/or localities in the United States can issue lock down orders impacting the availability of employees, third parties, suppliers, customers, and other services we need to operate our business. We believe we are in material compliance with government and other regulatory requirements. Competition We encounter a wide variety of competitors that vary by product, geographic area, and business unit. Our competitors include both domestic and foreign companies which range in size and product offerings. Our competitors may develop lower-cost or lower-featured products, may be willing to charge lower prices to increase their market share, or include different service and controller offerings. Some competitors have more capital, governmental funding, supply chain access, and other resources, which may allow them to take advantage of acquisition opportunities or adapt more quickly to changes in customer requirements. Other competitors use sponsorships as a way to win business at a particular location or market. In addition, our products compete with other forms of advertising, such as television, print media, digital and mobile, and fixed display signs. We believe that our ability to compete depends upon customer centric product and service quality and features, technical expertise, service breadth, and cost-effective solutions. 7

Research and Development Our experience in engineering, process design, and product and service design and development capabilities and investments made in affiliates are very important factors in continuing to develop, produce, and offer the most up-to-date digital displays and control system solutions desired by the market. We invest in our development and our affiliates to increase differentiated product platforms, advance our software architecture and offerings, support customer requirements, advance new competitive narrow pixel and micro-electronic technologies, and advance sustainable technologies and related products. During fiscal 2024, our design teams focused on investing in product design and development to improve our video technology over a wide range of pixel pitches and sustainable technologies for both indoor and outdoor applications and to advance micro-LED devices and placement processes. These new or improved technologies are focused on varied pixel density for image quality and use, expanded product line offerings for our various markets and geographies, improved quality and reliability, and improved cost points. Employees and Human Capital Resource Management Our core values of Honest, Helpful and Humble support our commitment to diversity, equity and inclusion, which leads to our vision of every person at Daktronics being able to contribute their best every day. We seek to recruit, retain, and develop our existing and future workforce for decades-long engagements to build long-term mutual prosperity. We facilitate company-wide teams to inspire a more inclusive culture and achieve company goals through teamwork. We encourage each employee to proactively and continuously build self-awareness, understanding of aspects of diversity, and openness to others’ experiences and perspectives. We also foster and encourage self development and a continuous learning environment to build talent. The safety and well-being of our team are a top priority, and we believe each and every team member plays an essential role in creating a safe and healthy workplace. We provide training for safety measures on the job site and in our facilities. We provide our employees and their families with access to a variety of health programs, including benefits that support their physical and mental health. As of April 27, 2024, we employed approximately 2,520 full-time employees and 311 part-time and temporary employees. Of these employees, approximately 1,149 were in manufacturing, 482 were in sales and marketing, 570 were in customer service, 387 were in engineering, and 243 were in general and administrative. None of our employees are represented by a collective bargaining agreement. We believe employee relations are good. Item 1A. RISK FACTORS Investing in our common stock involves risk. You should carefully consider the risks and uncertainties described below, together with all of the other information set forth in this Annual Report on Form 10-K and documents incorporated by reference herein, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making a decision to invest in our common stock. The risks and uncertainties described below may not be the only ones we face. If any of the risks actually occur, our business, operating results, and financial condition could be materially and adversely affected. In that event, the market price of our common stock could decline, and you could lose part or all of your investment. Macroeconomic Risks Our business is sensitive to global economic conditions, including recessions, inflation, and interest rate fluctuations. Weakened global economic or recessionary conditions may adversely affect our industry, business and results of operations. Our overall performance depends in part on worldwide economic conditions. The United States and other key international economies have experienced downturns and recessions from time to time during which economic activity was impacted by falling demand for a variety of goods and services; restricted credit; poor liquidity; reduced corporate profitability; volatility in credit, equity and foreign exchange markets; increased unemployment; bankruptcies; and overall uncertainty with respect to the economy. These conditions affect consumer and entertainment spending and could adversely affect our 8

customers’ ability or willingness to purchase our products, delay prospective customers’ purchasing decisions, reduce the value of their contracts, or affect attrition rates, all of which could adversely affect our operating results. These demand fluctuations and various factors may reduce our ability to effectively utilize our capacity and impact our results of operations. We rely on global supply chains, and inflationary pressures can increase our input costs faster than our ability to raise prices. These could eliminate our ability to sell our products or receive parts and components through our global supply chains. The rate of interest we pay on our asset-based lending facility with JPMorgan Chase Bank, N.A. is correlated to the Standard Overnight Fund Rate (SOFR), which is determined by governmental policy decisions. Increases in SOFR will increase the rate of any extended borrowing on this facility. Geopolitical issues, conflicts, governmental actions and other global events could adversely affect our results of operations and financial condition. Our business is subject to global political issues and conflicts and governmental actions. Such factors can create trade restrictions, increase tariff costs, increase prices for raw materials and components used in our products, increase the cost of sales, decrease demand for our products, or have other implications on our business operations. These impacts could reduce profitability and could have a material adverse effect on our results of operations and financial condition if they escalate into geographies in which we do business, manufacture our products, or obtain raw materials and components for production. For example, during calendar 2024, national elections are occurring in countries accounting for 49 percent of the people of the world, including the United States, which could cause changing governmental actions and policies; the Israeli- Palestinian conflict; the continuing conflict arising from the invasion of Ukraine by Russia; or tensions among Taiwan, China, the United States or other countries, could adversely impact macroeconomic conditions, give rise to regional instability, and result in heightened economic tariffs, sanctions and import-export restrictions from the United States and the international community in a manner that adversely affects our Company, including to the extent that any such actions cause material business interruptions or restrict our ability in these regions to conduct business with certain suppliers or vendors. Additionally, such conflict or sanctions may significantly devalue various global currencies and have a negative impact on economies in geographies in which we do business. We face risks related to actual or threatened health epidemics and other outbreaks, which have had and could have a material adverse effect on our operations, liquidity, financial conditions, and financial results. A serious global pandemic can adversely impact, shock and weaken the global economy. These impacts can amplify other risk factors and could have a material impact on our operations, liquidity, financial conditions, and financial results. Our business, operations, and financial results were impacted by the COVID-19 pandemic. Impacts on our business include, but are not limited to: • Inability to meet our customers' demand due to disruptions in our manufacturing caused by delays and disruptions in obtaining certain raw material and other manufacturing components and because of restrictions affecting our ability to conduct work at sites during shutdowns; • Rapid increases in raw material, components, and personnel related costs and expenses; and • Rapid declines and increases in demand for our products. Unexpected events, including natural disasters, weather events, war, terrorist acts, and pandemics, may increase our cost of doing business or disrupt our operations. We operate manufacturing operations in three locations in the United States - Brookings, South Dakota, Sioux Falls, South Dakota, and Redwood Falls, Minnesota, and we have production facilities in Ireland and China. Unexpected events could result in damage to, and a complete or partial closure of, one or more of our manufacturing facilities, which could make it difficult to supply our customers with product and provide our employees with work, thereby adversely affecting our business, operating results or financial condition. 9

The occurrence of one or more unexpected events in the United States or in other countries in which we operate may disrupt our operations and the operations of our customers and suppliers. Such events could create additional uncertainties, forcing customers to reduce, delay, or cancel already planned projects or cause our suppliers not to perform, resulting in parts and component shortages. Risks Related to Our Business and Industry We depend on a single-source or a limited number of suppliers for our raw materials and components from countries around the world. The loss, an interruption, or a material change in our business relationships with our suppliers or in global supply chain conditions has had and could continue to cause a disruption in our supply chains and a substantial increase in the costs of such raw materials and components. Geopolitical tensions can impact our ability to obtain key materials and components. Such changes have and could continue to result in extended lead times or supply changes, which could disrupt or delay our scheduled product deliveries to our end user customers and may result in the loss of sales and end user customers and cause harm to our sales, financial condition, and results of operations. The performance and financial condition of a supplier may cause us to alter our business terms, cease doing business with a particular supplier, or change our sourcing practices. Our suppliers are subject to the fluctuations in global economic cycles and conditions and other business risk factors which may impact their ability to operate their businesses. Our supply chain includes materials that are sourced or packaged directly or indirectly through suppliers in Taiwan or China. Geopolitical tensions and shipping disruptions can impact our suppliers ability to deliver components and raw materials. An interruption from our suppliers of raw materials or components could affect our ability to manufacture our products until a new source of supply is located and, therefore, could have a material adverse effect on our business, financial condition or results of operations. Our suppliers may need to allocate available supply, and we may not be able to obtain parts needed for production. Qualifying new suppliers to compensate for such shortages may be time-consuming and costly and may increase the likelihood of errors in design or production. In order to reduce manufacturing lead times and plan for adequate component supply, from time to time we may issue purchase orders or prepay for components and products that are non-cancelable and non-returnable. In addition, we may purchase components and products that have extended lead teams to ensure adequate supply to support long-term customer demand and mitigate the impact of supply disruptions. If we are unable to use all of the components we have purchased, we may have excess inventory or obsolescence, or increased inventory or carrying costs, which could have an adverse impact on our results of operation or financial condition. We operate in highly competitive markets and face significant competition and pricing pressures. If we are unable to keep up with the rapidly changing product developments and new technologies or if we cannot compete effectively, we could lose market share and orders, which would negatively impact our results of operations. The electronic display industry is characterized by ongoing product improvement, innovations and development. We compete against products produced in foreign countries and the United States. Our competitors may develop lower-cost or lower-featured products, may be willing to charge lower prices to increase their market share, or market new and unique product, service and controller offerings. Some competitors have more capital and other resources, which may allow them to take advantage of acquisition opportunities or adapt more quickly to changes in customer requirements. Other competitors use sponsorships as a way to win business at a particular location or market. In addition, our products compete with other forms of advertising, such as television, print media, digital and mobile, and fixed display signs. To remain competitive, we must anticipate and respond quickly to provide products and services that meet our customers’ needs, enhance our existing products, introduce new products and features, and continue to price our products competitively. We may be unable to protect our intellectual property rights effectively, or we may infringe upon the intellectual property rights of others, either of which may have a material adverse effect on our operating results and financial condition. We rely on a variety of intellectual property rights we use in our products and services. We may not be able to successfully preserve our intellectual property rights in the future, and these rights could be invalidated, circumvented or challenged. In particular, the laws of certain countries in which our products are sold do not protect our products and intellectual property rights to the same extent as the laws of the United States. If litigation is necessary in the future to enforce our intellectual 10

property rights, to protect our trade secrets, or to determine the validity and scope of the proprietary rights of others, such litigation could result in substantial costs and diversion of resources even if we ultimately prevail. In addition, intellectual property rights of others also have an impact on our ability to offer some of our products and services for specific uses or at competitive prices. Competitors' patents or other intellectual property may limit our ability to offer products or services to our customers. Any infringement or claimed infringement by us of the intellectual property rights of others could result in litigation and adversely affect our ability to continue to provide, or could increase the cost of providing, products and services, even if we are successful in defending against any such claim. If we fail to timely and effectively obtain shipments of raw materials and components from our suppliers or to send shipments of our manufactured product to our customers, our business and operating results could be adversely affected. We cannot control all of the various factors that might affect our suppliers' timely and effective delivery of raw materials and components to our manufacturing facilities or the availability of freight capacity for us to deliver products to our customers. In addition to increased costs, these factors could delay delivery of products, which may result in the assessment of liquidated damages or other contractual damages that could negatively impact our profits. Our utilization of a complex supply chain for raw material and component imports and the global distribution of our products makes us vulnerable to many risks, including, among other things, shortages or delays because of work restrictions for various reasons like pandemic restrictions; supply chain implications due to war or other geopolitical impacts on supply chains; risks of damage, destruction or confiscation of products while in transit to and from our manufacturing facilities; organized labor strikes and work stoppages, such as labor disputes or related employee worker unavailability, that could disrupt operations at ports-of-entry; transportation and other delays in shipments as a result of heightened security screening and inspection processes or other port-of-entry limitations or restrictions; unexpected or significant port congestion; lack of freight availability; and freight cost increases. In addition, we may be required to arrange for products to be delivered through airfreight, which is significantly more expensive than standard shipping by sea. We may not be able to obtain sufficient freight capacity on a timely basis and, therefore, may not be able to timely receive shipments of raw materials and components or deliver products to customers. Cost inflation in, and shortages of, raw materials, components, and related transportation and tariff costs can have a significant impact on our price competitiveness and/or ability to produce our products, which have caused and could continue to cause harm to our sales, financial condition and results of operations. Cost inflation and shortages of any raw materials and components used to manufacture our products have and may continue to occur due to various factors, such as worldwide demand, natural disasters, logistic disruptions, war and other conflicts, and trade regulations. Electronic and other components and materials used in our products are sometimes in short supply, which may impact our ability to meet customer demand. Transportation costs and availability can fluctuate due to fluctuations in oil prices and other social, economic, and geopolitical factors. If we experience shortages or increases in the prices we pay for raw materials and components and are unable to pass on those increases to our customers or are unable to manufacture our products at all or on a timely basis, it could negatively affect our business, financial condition or results of operations as such conditions have in the past. In addition to increased costs, these factors could delay delivery of products, which may result in the assessment of liquidated damages or other contractual damages that could negatively impact our profits. Trade disruptions and trade policies between countries could make us subject to additional regulatory costs and challenges, affect global economic and market conditions, and contribute to volatility in foreign exchange markets, which we may be unable to effectively manage through our foreign exchange risk management program. We monitor for these types of situations and evaluate ways to minimize these impacts through vendor negotiations, alternative sources, and potential price adjustments. 11

We may fail to continue to attract, develop and retain personnel throughout our business areas, which could negatively impact our operating results. We depend on qualified employees, including experienced and skilled technical personnel, to design, market, fulfill, and serve our customers. Qualified employees can be in high demand and limited in availability. Our future success and operating results will also depend upon our ability to attract, train, motivate and retain qualified personnel to maintain and grow capacity. Although we intend to continue to provide competitive compensation packages to attract and retain qualified personnel, market conditions for pay levels and availability may negatively impact our operations. We depend on third parties to complete some of our contracts. Depending on a contract's scope of work, we may hire third-party subcontractors to perform on-site installation and service-related activities, hire manufacturers of structures or elements of structures related to on-site installations, hire contract manufacturers for certain product lines, or purchase specialty non-display related system elements from other companies. If we are unable to hire qualified subcontractors, find qualified manufacturers for on-site elements, find qualified contract manufacturers, or purchase specialty non-display system elements, our ability to successfully complete a project could be impaired. If we are not able to locate qualified third party subcontractors or manufacturers, the amount we are required to pay may exceed what we have estimated, and we may suffer losses on these contracts. If the subcontractor or manufacturer fails to perform, we may be required to source these services to other third parties on a delayed basis or on less favorable terms, which could impact contract profitability. There is a risk that we may have disputes with our subcontractors relating to, among other things, the quality and timeliness of work performed, customer concerns about the subcontractor, or faulty workmanship, resulting in claims against us for failure to meet required project specifications and negatively impacting our financial condition and results of operations. These third parties are subject to fluctuations in global economic cycles and conditions and other business risk factors which may adversely impact their ability to operate their businesses. The performance and financial condition of the third parties may cause us to alter our business terms or to cease doing business with a particular third party or change our sourcing practices. We may not be able to utilize our capacity efficiently or accurately plan our capacity requirements, which may negatively affect our business and operating results. We increase and decrease our production and services capacity and the overhead supporting order fulfillment based on anticipated market demand. Market demand, however, has not always developed as expected or remained at a consistent level. These underutilization and overbooking capacity risks can potentially decrease our profitability and result in the impairment of certain assets. The following factors are among those that could complicate capacity planning for market demand: • changes in the demand for and mix of products that our customers buy; • our ability to scale down or to add and train our manufacturing and services staff in advance of demand changes; • the market’s pace of technological change; • variability in our manufacturing or services productivity; • long lead times for and availability of raw materials and components used in production; • our ability to engage qualified third parties; • geography of the order and related shipping methods; and • long lead times for our plant and equipment expenditures. Our results of operations on a quarterly and annual basis have and are likely to continue to fluctuate and be substantially affected by the size and timing of large contract order awards. Customer demand and the timing and size of large contracts create volatility in supply chain planning and capacity requirements to fulfill orders. Awards of large contracts and their timing and amounts are difficult to predict, may not be repeatable, and are outside of our control. Market demand has not always developed as expected or remained at a consistent level. Adjusting supply chain material planning and production and services capacity to meet this varied demand can increase costs. Large contracts or customer awards include projects for college and professional sports facilities 12

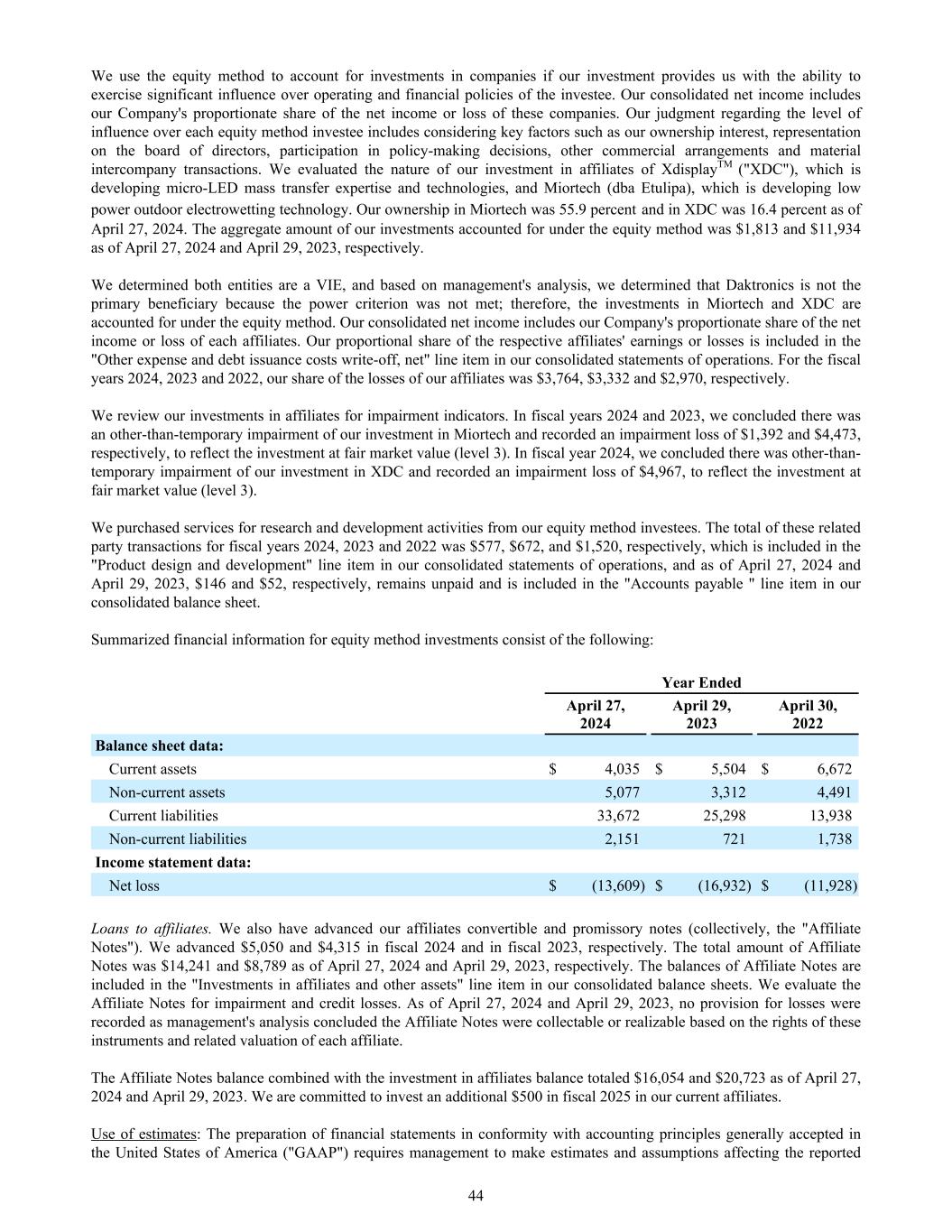

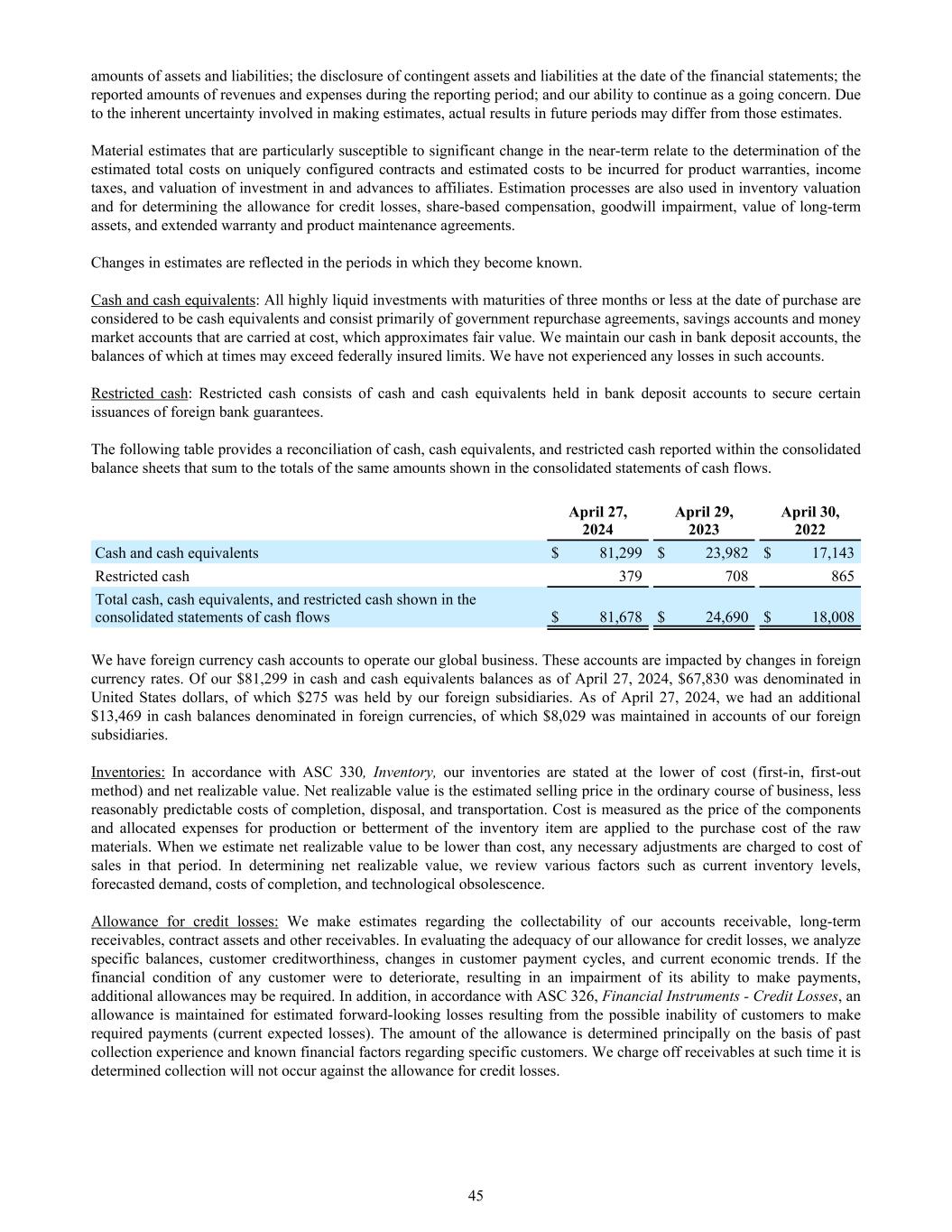

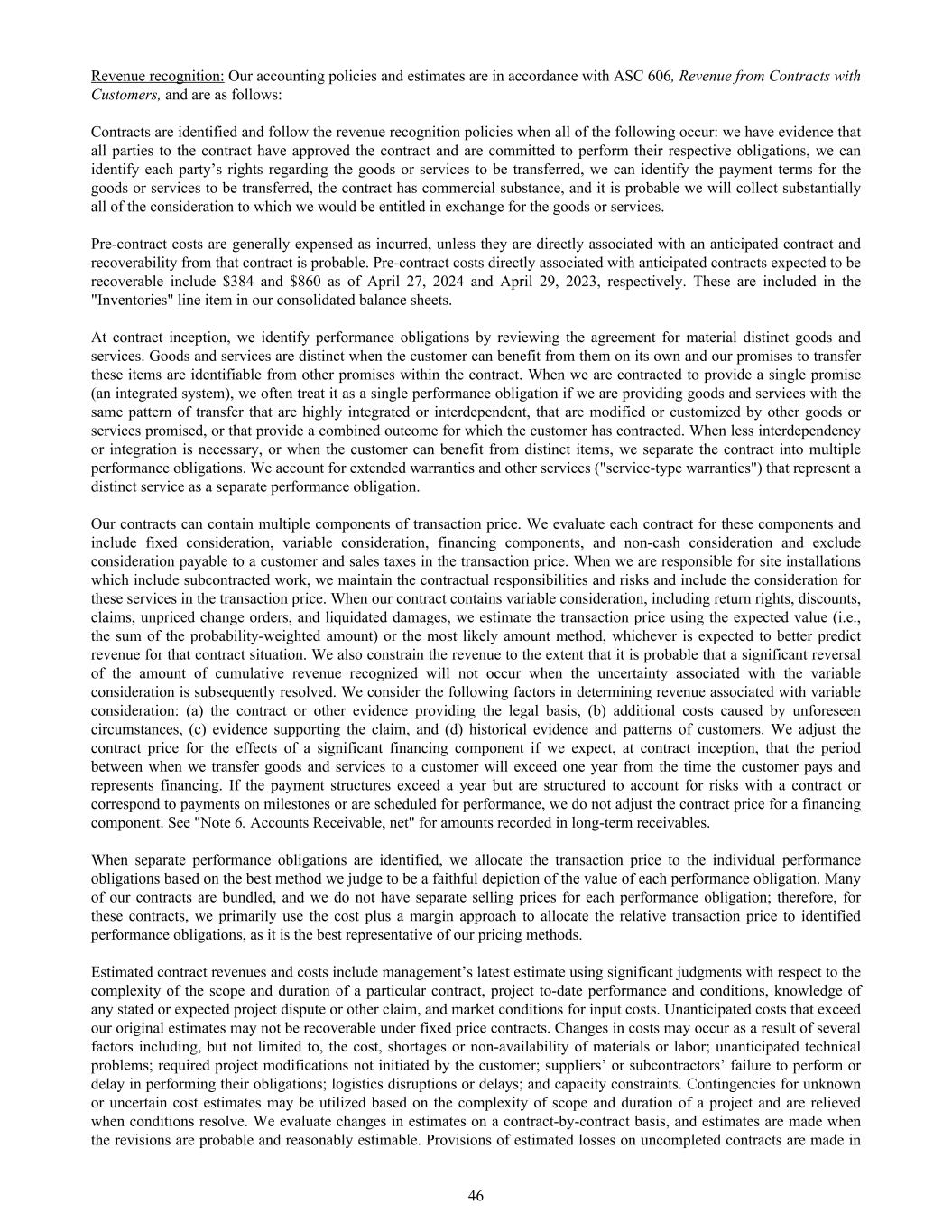

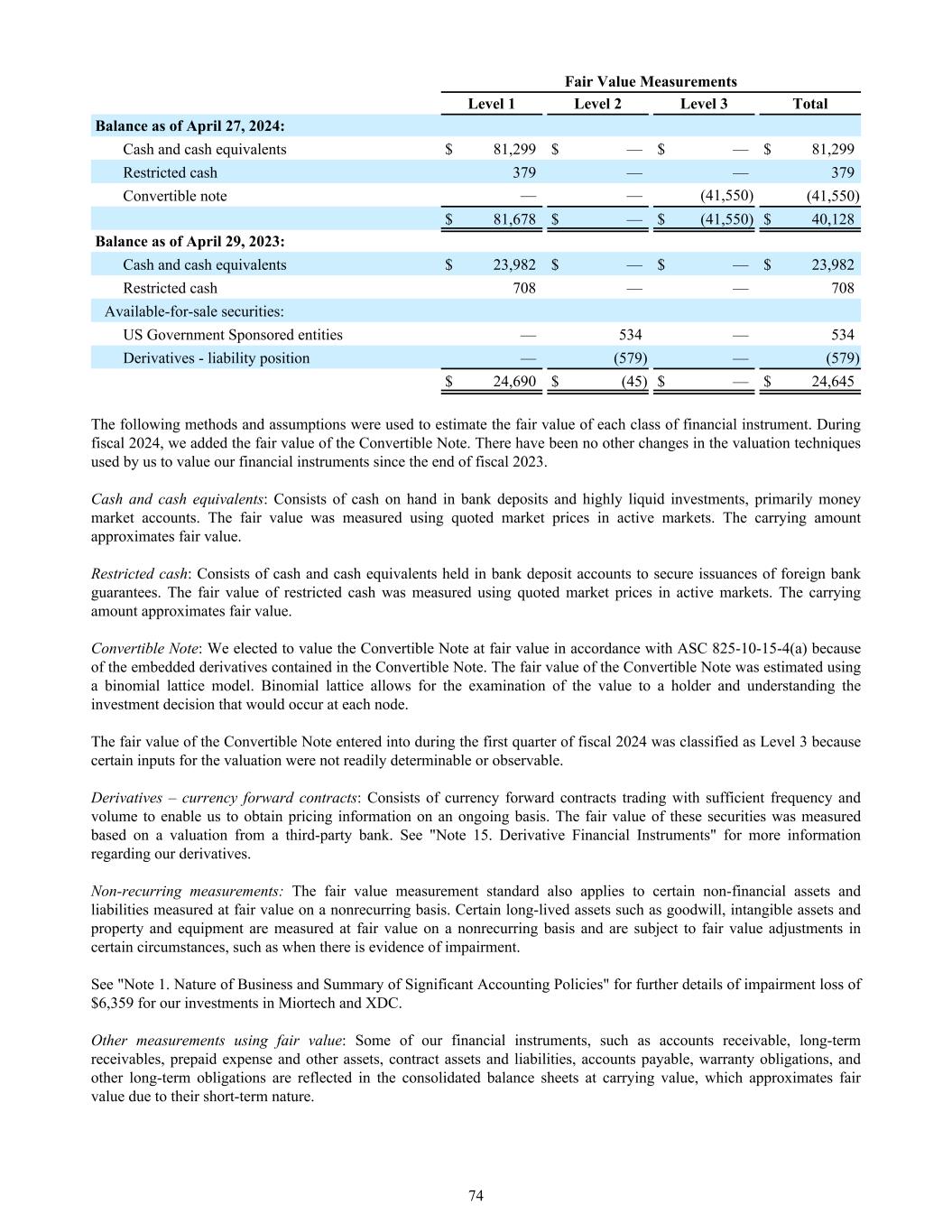

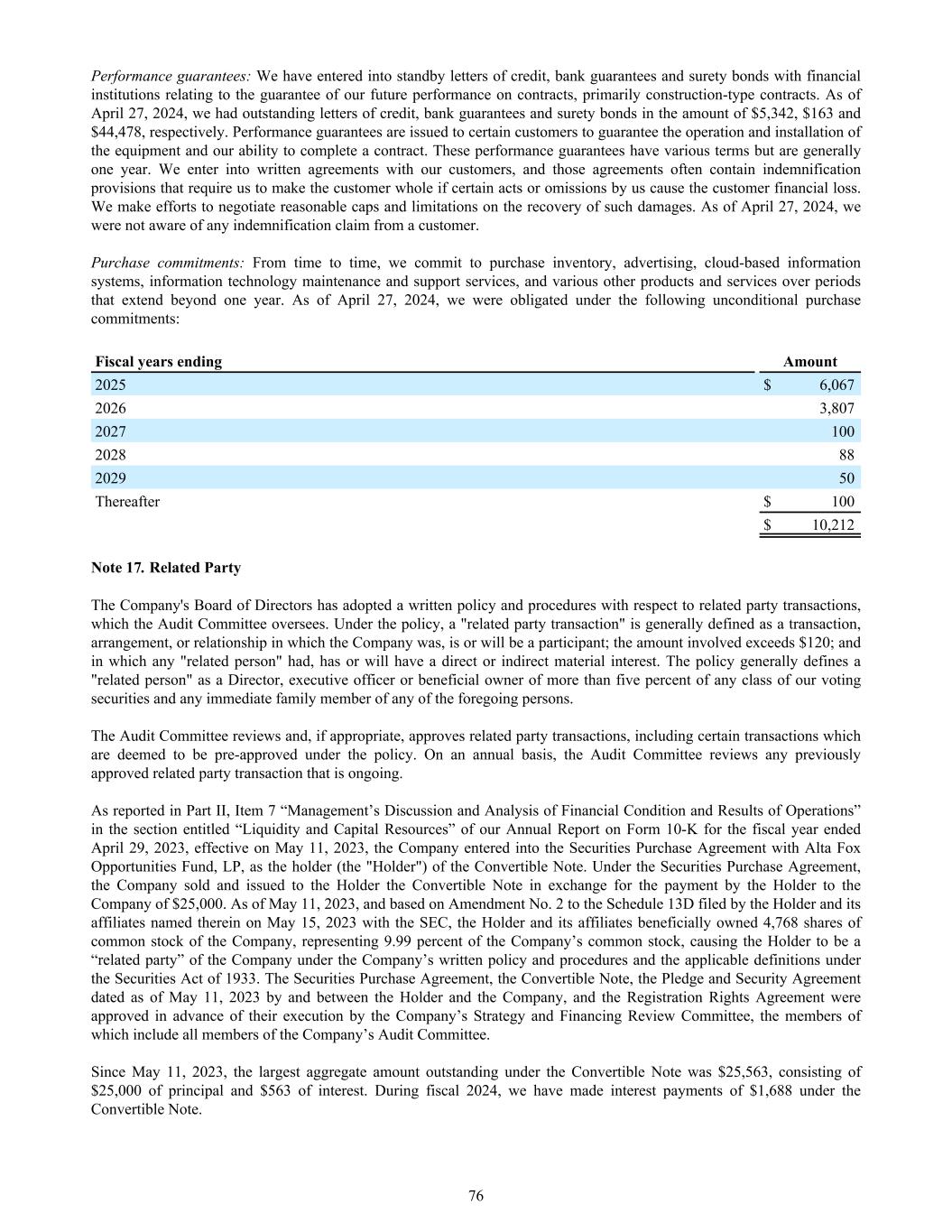

markets, the OOH niche, the transportation market, and the large spectacular niche. These projects can have short delivery time frames. Some factors that may cause our operating results to vary due to timing and size of the awards include: • the timing of orders and related deliveries, including delays or cancellations of orders; • our ability to obtain raw materials and components timely and at reasonable prices; • our ability to adjust and utilize production and services capacity; • our ability to engage third parties to support production and fulfillment; • new product introductions; • variations in product mix; and • customer financial wherewithal and the related economic conditions impacting their business. Operating results in one or more quarters of a fiscal year may not be indicative of future operating results. We enter into fixed-price contracts, which could reduce our profits if actual costs exceed estimated costs. Because of the complexity of many of our client contracts, accurately estimating the cost, scope and duration of a particular contract can be a difficult task. Unanticipated costs that exceed our original estimates may not be recoverable under fixed price contracts. Unanticipated cost increases may occur as a result of several factors including, but not limited to: increases in the cost, shortages or non-availability of materials or labor; unanticipated technical problems; required project modifications not initiated by the customer; suppliers’ or subcontractors’ failure to perform or delay in performing their obligations; logistics disruptions or delays; and capacity constraints. In addition to increased costs, these factors could delay delivery of products, which may result in the assessment of liquidated damages or other contractual damages which would negatively impact our profits. We evaluate changes in estimates on a contract-by-contract basis and disclose significant changes, if material, in the Notes to Consolidated Financial Statements. The cumulative catch-up method is used to account for revisions in estimates. Backlog may not be indicative of future revenue or profitability. Many of our products have long sales, delivery and acceptance cycles. In addition, our backlog is subject to order cancellations and delays. Orders normally contain cancellation provisions to permit our recovery of costs expended as well as a pro-rata portion of the profit. If projects are delayed, revenue recognition can occur over longer periods of time, and projects may remain in backlog for extended periods of time. If we receive relatively large orders in any given quarter, fluctuations in the levels of the quarterly backlog can result because the backlog may reach levels which may not be sustained in subsequent quarters. Unanticipated events resulting in credit losses to us could have a material adverse impact on our financial results. Significant portions of our sales are to customers who place large orders for custom products. We closely monitor the creditworthiness of our customers and have not, to date, experienced significant credit losses. We mitigate our exposure to credit risk, to some extent, by requiring deposits, payments prior to shipment, progress payments, payment bonds and letters of credit. However, because some of our exposure to credit losses is outside of our control, unanticipated events resulting in credit losses could have a material adverse impact on our operating results. Our actual results could differ from the estimates and assumptions we make to prepare our financial statements, which could have a material impact on our financial condition and results of operations. In connection with the preparation of our financial statements, including the Consolidated Financial Statements included in this Form 10-K, our management is required under GAAP to make estimates and assumptions based on historical experience and other factors. Our most critical accounting estimates are described in "Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" in this Form 10-K. These estimates and assumptions affect the timing and amount of net sales, costs, and profits or losses in applying the principles to contracts with customers under over time method of recording revenue using the cost-to-cost input method; credit losses for accounts receivables and contract assets; the valuation of inventory; estimated amounts for warranty and product maintenance agreement costs; the calculation of the fair value of our notes payable; the calculation and valuation of our investments and deferred tax assets; the valuation of our investment in affiliates or unconsolidated subsidiaries; fair value estimates used in goodwill and long-term assets testing; estimating the impact of uncertainties in the application of complex tax laws; and calculating share-based compensation expense. Although we believe these estimates and 13