UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08228

The Timothy Plan

(Exact name of registrant as specified in charter)

The Timothy Plan

1055 Maitland Center Commons

Maitland, FL 32751

(Address of principal executive offices) (Zip code)

William Murphy

Huntington Asset Services, Inc.

2960 N. Meridian St, Ste 300.Indianapolis, IN 46208

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-846-7526

Date of fiscal year end: 12/31

Date of reporting period: 06/30/2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Registrant’s audited annual financial reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 are as follows:

SEMI-ANNUAL REPORT

June 30, 2011 (Unaudited)

TIMOTHY PLAN VARIABLE SERIES

Strategic Growth

Conservative Growth

Letter from the President

June 30, 2011

Arthur D. Ally

Dear Strategic Growth Variable and Conservative Growth Variable Shareholder,

The market recovery that began in mid-March, 2009 continued although it has been a rather choppy ride as of late. As you know, your Timothy Plan Variable Fund investment is a compilation of several of Timothy’s underlying funds and, as such, your performance is directly related to the performance of those underlying funds. Currently, our allocation into the underlying funds is as follows:

Conservative Growth Strategic Growth

| · | Large/Mid Cap Value Fund 15.0 % 20.0 % |

| · | Small Cap Value Fund 5.0 % 7.5 % |

| · | Large/Mid Cap Growth Fund 12.0 % 20.0 % |

| · | Aggressive Growth Fund 3.0 % 7.5 % |

| · | International Fund 10.0 % 25.0 % |

| · | High Yield Bond Fund 10.0 % 10.0 % |

| · | Defensive Strategies Fund 15.0% 10.0% |

| · | Fixed Income Fund 30.0 % |

The performance of these two funds is directly related to the performance of our underlying funds and, in our opinion, all of our underlying funds are managed by firms that we believe to be as good as, if not better than, the management of any mutual fund family in the industry.

There were many factors that played into the underlying funds’ performances. Even with the world-wide debt crisis, including our own U.S. debt crisis, a sluggish domestic economy, fears of inflation, and numerous other concerns creating a volatile market environment, the Funds provided investors positive returns in the first half of 2011.

All of our various managers still believe that the worst of the violent market is probably behind us. If they are right, as I believe they are, I expect the remainder of 2011 to continue to be a little unsettled, but also believe this year should produce mildly positive investment results. As you know, however, no one can guarantee future results. The one thing I can assure you is that every one of our managers continues to work very hard on your behalf.

As I have stated repeatedly in the past, the Timothy Plan is serious about our mission (to genuinely screen our investments and attempt to deliver competitive investment results) and our commitment to continuously pursue Kingdom Class quality in everything we do. Thank you for being part of the Timothy Plan family.

Sincerely,

Arthur D. Ally,

President

Timothy Plan Fund Performance [1]

Fund Profile | Conservative Growth Portfolio Variable Series

June 30, 2011 (Unaudited)

EXPENSE EXAMPLE (Unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of January 1, 2011, through June 30, 2011.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account | Ending Account | Expenses Paid | ||||||||||

| Value | Value | During Period* | ||||||||||

| 1/1/2011 through | ||||||||||||

| 1/1/2011 | 6/30/2011 | 6/30/2011 | ||||||||||

| Actual* | $ | 1,000.00 | $ | 1,043.88 | $ | 2.14 | ||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,022.70 | $ | 2.12 | ||||||

* Expenses are equal to the Fund’s annualized expense ratio of 0.42%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 181 days/365 days (to reflect the partial year period). The Fund’s ending account value in the first line in the table is based on its actual total return of 4.39% for the six-month period of January 1, 2011, to June 30, 2011.

| ** Assumes a 5% return before expenses. |

Timothy Plan Conservative Growth Portfolio Variable Series [2]

Schedule of Investments | Conservative Growth Portfolio Variable Series | |||||||

| As of June 30, 2011 - (Unaudited) | |||||||

MUTUAL FUNDS (A) - 99.90% | |||||||

| Number of Shares | Fair Value | ||||||

| 180,438 | Timothy Plan Aggressive Growth Fund* | $ | 1,243,221 | ||||

| 511,313 | Timothy Plan Defensive Strategies Fund | 6,043,725 | |||||

| 1,146,434 | Timothy Plan Fixed Income Fund | 11,957,308 | |||||

| 426,007 | Timothy Plan High Yield Bond Fund | 3,949,083 | |||||

| 473,187 | Timothy Plan International Fund | 4,074,140 | |||||

| 677,579 | Timothy Plan Large/Mid Cap Growth Fund* | 4,966,656 | |||||

| 432,818 | Timothy Plan Large/Mid Cap Value Fund | 6,124,369 | |||||

| 148,712 | Timothy Plan Small Cap Value Fund* | 2,059,661 | |||||

Total Mutual Funds (cost $34,112,275) | 40,418,163 | ||||||

| SHORT-TERM INVESTMENTS - 0.06% | |||||||

| Number of Shares | Fair Value | ||||||

| 24,690 | Fidelity Institutional Money Market Portfolio, 0.08% (B) | 24,690 | |||||

Total Short-Term Investments (cost $24,690) | 24,690 | ||||||

Total Investments (cost $34,136,965) - 99.96% | $ | 40,442,853 | |||||

| OTHER ASSETS LESS LIABILITIES - 0.04% | 15,030 | ||||||

| Net Assets - 100.00% | $ | 40,457,883 | |||||

| * Non-income producing securities. | |||||||

| (A) Affiliated Funds - Class A Shares. | |||||||

| (B) Variable rate security; the rate shown represents the yield at June 30, 2011. | |||||||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Conservative Growth Portfolio Variable Series [ 3 ]

Statement of Assets & Liabilities | Conservative Growth Portfolio Variable Series | |||

| As of June 30, 2011 - (Unaudited) | |||

| ASSETS | |||

Investments in Affiliated Securities at Fair Value (cost $34,112,275) [NOTE 1] | $ 40,418,163 | ||

Investments in Unaffiliated Securities at Fair Value (cost $24,690) | 24,690 | ||

| Receivables for: | |||

| Fund Shares Sold | 38,618 | ||

| Interest | 5 | ||

| Prepaid Expenses | 801 | ||

| Total Assets | 40,482,277 | ||

| LIABILITIES | |||

| Payable for Fund Shares Redeemed | $ 1,106 | ||

| Payable to Advisor | 3,302 | ||

| Accrued Expenses | 19,986 | ||

| Total Liabilities | 24,394 | ||

| Net Assets | $ 40,457,883 | ||

| SOURCES OF NET ASSETS | |||

| At June 30, 2011, Net Assets Consisted of: | |||

| Paid-in Capital | $ 39,826,938 | ||

| Accumulated Undistributed Net Investment Income (Loss) | 665,710 | ||

| Accumulated Net Realized Gain (Loss) on Investments | (6,340,653) | ||

| Net Unrealized Appreciation (Depreciation) in Value of Investments | 6,305,888 | ||

| Net Assets | $ 40,457,883 | ||

| Shares of Capital Stock Outstanding (No Par Value, Unlimited Shares Authorized) | 3,543,882 | ||

| Net Asset Value, Offering and Redemption Price Per Share ($40,457,883 / 3,543,882 Shares) | $ 11.42 | ||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Conservative Growth Portfolio Variable Series [ 4 ]

Statement of Operations | Conservative Growth Portfolio Variable Series | ||||

| For the Six Months Ended June 30, 2011 - (Unaudited) | ||||

| INVESTMENT INCOME | ||||

| Interest from Unaffiliated Funds | $ | 25 | ||

| Dividends from Affiliated Funds | 166,201 | |||

| Total Investment Income | 166,226 | |||

| EXPENSES | ||||

| Investment Advisory Fees [Note 3] | 20,544 | |||

| Fund Accounting , Transfer Agency and Administration Fees | 45,332 | |||

| Audit Fees | 10,076 | |||

| Custodian Fees | 5,125 | |||

| CCO Fees | 3,073 | |||

| Trustee Expense | 2,129 | |||

| Insurance Expense | 650 | |||

| Total Expenses | 86,929 | |||

| Net Investment Income (Loss) | 79,297 | |||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net Realized Gain (Loss) on Investments in Affiliated Funds | (25,636 | ) | ||

| Change in Unrealized Appreciation (Depreciation) of Investments | 1,746,718 | |||

| Net Realized and Unrealized Gain (Loss) on Investments | 1,721,082 | |||

| Increase (Decrease) in Net Assets Resulting from Operations | $ | 1,800,379 | ||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Conservative Growth Portfolio Variable Series [ 5 ]

Statements of Changes in Net Assets | Conservative Growth Portfolio Variable Series | ||||||||

| INCREASE (DECREASE) IN NET ASSETS | ||||||||

| Six months ended | Year ended | |||||||

| 6/30/11 (Unaudited) | 12/31/10 | |||||||

| Operations: | ||||||||

| Capital Gain Dividends from Affiliated Investments | $ | - | $ | 7,830 | ||||

| Net Investment Income (Loss) | 79,297 | 586,459 | ||||||

| Net Realized Gain (Loss) on Investments in Affiliated Funds | (25,636 | ) | (776,624 | ) | ||||

| Change in Unrealized Appreciation (Depreciation) of Investments | 1,746,718 | 5,082,151 | ||||||

| Net Increase (Decrease) in Net Assets (resulting from operations) | 1,800,379 | 4,899,816 | ||||||

| Distributions to Shareholders: | ||||||||

| Net Investment Income | - | (573,002 | ) | |||||

| Total Distributions to Shareholders | - | (573,002 | ) | |||||

| Capital Share Transactions: | ||||||||

| Proceeds from Shares Sold | 1,001,048 | 1,597,595 | ||||||

| Dividends Reinvested | - | 573,002 | ||||||

| Cost of Shares Redeemed | (5,515,904 | ) | (5,861,883 | ) | ||||

| Increase (Decrease) in Net Assets (resulting from capital share transactions) | (4,514,856 | ) | (3,691,286 | ) | ||||

| Total Increase (Decrease) in Net Assets | (2,714,477 | ) | 635,528 | |||||

| Net Assets: | ||||||||

| Beginning of period | 43,172,360 | 42,536,832 | ||||||

| End of period | $ | 40,457,883 | $ | 43,172,360 | ||||

| Accumulated Undistributed Net Investment Income | $ | 665,710 | $ | 586,413 | ||||

| Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

| Shares Sold | 88,904 | 156,611 | ||||||

| Shares Reinvested | - | 52,425 | ||||||

| Shares Redeemed | (491,739 | ) | (575,892 | ) | ||||

| Net Increase (Decrease) in Number of Shares Outstanding | (402,835 | ) | (366,856 | ) | ||||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Conservative Growth Portfolio Variable Series [ 5 ]

Financial Highlights | Conservative Growth Portfolio Variable Series | |||||||||||||

| The table below sets forth financial data for one share of capital stock outstanding throughout each period presented. | |||||||||||||

| Six months | |||||||||||||

| ended | Year | Year | Year | Year | Year | ||||||||

| 6/30/11 | ended | ended | ended | ended | ended | ||||||||

| (Unaudited) | 12/31/10 | 12/31/09 | 12/31/08 | 12/31/07 | 12/31/06 | ||||||||

| Per Share Operating Performance: | |||||||||||||

| Net Asset Value at Beginning of Period | $ 10.94 | $ 9.86 | $ 8.16 | $ 12.97 | $ 12.14 | $ 11.72 | |||||||

| Income from Investment Operations: | |||||||||||||

| Net Investment Income (Loss) | 0.04 | 0.14 | (A) | 0.12 | 0.22 | (A) | 0.30 | 0.35 | |||||

| Net Realized and Unrealized Gain (Loss) on Investments | 0.44 | 1.09 | 1.74 | (3.95) | 0.77 | 0.73 | |||||||

| Total from Investment Operations | 0.48 | 1.23 | 1.86 | (3.73) | 1.07 | 1.08 | |||||||

| Less Distributions: | |||||||||||||

| Dividends from Net Investment Income | - | (0.15) | (0.16) | (0.26) | - | (0.36) | |||||||

| Dividends from Realized Gains | - | - | - | (0.82) | (0.24) | (0.30) | |||||||

| Total Distributions | - | (0.15) | (0.16) | (1.08) | (0.24) | (0.66) | |||||||

| Net Asset Value at End of Period | $ 11.42 | $ 10.94 | $ 9.86 | $ 8.16 | $ 12.97 | $ 12.14 | |||||||

Total Return (B) | 4.39% | (E) | 12.45% | 22.80% | -28.59% | 8.82% | 9.16% | ||||||

| Ratios/Supplemental Data: | |||||||||||||

| Net Assets at End of Period (in 000s) | $ 40,458 | $ 43,172 | $ 42,537 | $ 32,454 | $ 38,205 | $ 26,723 | |||||||

Ratio of Expenses to Average Net Assets (C) | 0.42% | (F) | 0.41% | 0.50% | 0.64% | 0.64% | 0.72% | ||||||

Ratio of Net Investment Income (Loss) to Average Net Assets (C)(D) | 0.39% | (F) | 1.41% | 1.56% | 1.88% | 2.68% | 3.59% | ||||||

| Portfolio Turnover | 3.71% | (E) | 8.92% | 34.54% | 19.70% | 34.60% | 2.04% | ||||||

| (A) Net Investment Income was calculated using average shares method. | |||||||||||||

| (B) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. | |||||||||||||

| Total return would have been higher if certain expenses had not been recouped in the year in which the recoupment occurred. | |||||||||||||

| (C) These ratios exclude the impact of expenses of the underlying security holdings as represented in the schedule of investments. | |||||||||||||

| (D) Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. | |||||||||||||

| (E) Not annualized. | |||||||||||||

| (F) Annualized. | |||||||||||||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Conservative Growth Portfolio Variable Series [ 7 ]

Fund Profile | Strategic Growth Portfolio Variable Series

June 30, 2011 (Unaudited)

EXPENSE EXAMPLE (Unaudited):

As a shareholder of the Fund, you incur two types of costs: direct costs, such as wire fees and low balance fees; and indirect costs, including management fees, and other Fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund, and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of January 1, 2011, through June 30, 2011.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| Beginning Account | Ending Account | Expenses Paid | ||||||||||

| Value | Value | During Period* | ||||||||||

| 1/1/2011 through | ||||||||||||

| 1/1/2011 | 6/30/2011 | 6/30/2011 | ||||||||||

| Actual* | $ | 1,000.00 | $ | 1,056.08 | $ | 1.81 | ||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,023.04 | $ | 1.78 | ||||||

* Expenses are equal to the Fund’s annualized expense ratio of 0.35%, which is net of any expenses paid indirectly, multiplied by the average account value over the period, multiplied by 181 days/365 days (to reflect the partial year period). The Fund’s ending account value in the first line in the table is based on its actual total return of 5.61% for the six-month period of January 1, 2011, to June 30, 2011.

| ** Assumes a 5% return before expenses. |

Timothy Plan Strategic Growth Portfolio Variable Series [8]

Schedule of Investments | Strategic Growth Portfolio Variable Series | |||||||

| As of June 30, 2011 - (Unaudited) | |||||||

MUTUAL FUNDS (A) - 99.61% | |||||||

| Number of Shares | Fair Value | ||||||

| 255,757 | Timothy Plan Aggressive Growth Fund* | $ | 1,762,163 | ||||

| 194,333 | Timothy Plan Defensive Strategies Fund | 2,297,019 | |||||

| 239,130 | Timothy Plan High Yield Bond Fund | 2,216,735 | |||||

| 682,996 | Timothy Plan International Fund | 5,880,592 | |||||

| 637,242 | Timothy Plan Large/Mid Cap Growth Fund* | 4,670,986 | |||||

| 326,136 | Timothy Plan Large/Mid Cap Value Fund | 4,614,818 | |||||

| 125,992 | Timothy Plan Small Cap Value Fund* | 1,744,987 | |||||

Total Mutual Funds (cost $21,623,985) | 23,187,300 | ||||||

| SHORT-TERM INVESTMENTS - 0.42% | |||||||

| Number of Shares | Fair Value | ||||||

| 96,773 | Fidelity Institutional Money Market Portfolio, 0.08% (B) | 96,773 | |||||

Total Short-Term Investments (cost $96,773) | 96,773 | ||||||

Total Investments (cost $21,720,758) - 100.03% | $ | 23,284,073 | |||||

| LIABILITIES IN EXCESS OF OTHER ASSETS - (0.03)% | (6,562 | ) | |||||

| Net Assets - 100.00% | $ | 23,277,511 | |||||

| * Non-income producing securities. | |||||||

| (A) Affiliated Funds - Class A Shares. | |||||||

| (B) Variable rate security; the rate shown represents the yield at June 30, 2011. | |||||||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Strategic Growth Portfolio Variable Series [ 9 ]

Statement of Assets & Liabilities | Strategic Growth Portfolio Variable Series | ||||

| As of June 30, 2011 - (Unaudited) | ||||

| ASSETS | ||||

Investments in Affiliated Securities at Fair Value (cost $21,623,985) [NOTE 1] | $ | 23,187,300 | ||

Investments in Unaffiliated Securities at Fair Value (cost $96,773) | 96,773 | |||

| Receivables for: | ||||

| Fund Shares Sold | 3 | |||

| Interest | 13 | |||

| Prepaid Expenses | 445 | |||

| Total Assets | 23,284,534 | |||

| LIABILITIES | ||||

| Payable for Fund Shares Redeemed | $ | 1,289 | ||

| Payable to Advisor | 1,873 | |||

| Accrued Expenses | 3,861 | |||

| Total Liabilities | 7,023 | |||

| Net Assets | $ | 23,277,511 | ||

| SOURCES OF NET ASSETS | ||||

| At June 30, 2011, Net Assets Consisted of: | ||||

| Paid-in Capital | $ | 24,358,157 | ||

| Accumulated Undistributed Net Investment Income (Loss) | 101,405 | |||

| Accumulated Net Realized Gain (Loss) on Investments | (2,745,366 | ) | ||

| Net Unrealized Appreciation (Depreciation) in Value of Investments | 1,563,315 | |||

| Net Assets | $ | 23,277,511 | ||

| Shares of Capital Stock Outstanding (No Par Value, Unlimited Shares Authorized) | 2,332,167 | |||

| Net Asset Value, Offering and Redemption Price Per Share ($23,277,511 / 2,332,167 Shares) | $ | 9.98 | ||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Strategic Growth Portfolio Variable Series [ 10 ]

Statement of Operations | Strategic Growth Portfolio Variable Series | ||||

| For the Six Months Ended June 30, 2011 - (Unaudited) | ||||

| INVESTMENT INCOME | ||||

| Interest from Unaffiliated Funds | $ | 104 | ||

| Dividends from Affiliated Funds | 31,427 | |||

| Total Investment Income | 31,531 | |||

| EXPENSES | ||||

| Investment Advisory Fees [Note 3] | 11,115 | |||

| Fund Accounting, Transfer Agency and Administration Fees | 19,270 | |||

| Audit Fees | 4,174 | |||

| Custodian Fees | 2,269 | |||

| CCO Fees | 1,329 | |||

| Trustee Expense | 930 | |||

| Insurance Expense | 339 | |||

| Total Expenses | 39,426 | |||

| Net Investment Income (Loss) | (7,895 | ) | ||

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||||

| Net Realized Gain (Loss) on Investments in Affiliated Funds | 5,009 | |||

| Change in Unrealized Appreciation (Depreciation) of Investments | 1,142,599 | |||

| Net Realized and Unrealized Gain (Loss) on Investments | 1,147,608 | |||

| Increase (Decrease) in Net Assets Resulting from Operations | $ | 1,139,713 | ||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Strategic Growth Portfolio Variable Series [ 11 ]

Statements of Changes in Net Assets | Strategic Growth Portfolio Variable Series | ||||||||

| INCREASE (DECREASE) IN NET ASSETS | ||||||||

| Six months ended | ||||||||

| 6/30/11 (Unaudited) | Year ended 12/31/10 | |||||||

| Operations: | ||||||||

| Capital Gain Dividends from Affiliated Investments | $ | - | $ | 2,141 | ||||

| Net Investment Income (Loss) | (7,895 | ) | 109,392 | |||||

| Net Realized Gain (Loss) on Investments in Affiliated Funds | 5,009 | (730,711 | ) | |||||

| Change in Unrealized Appreciation (Depreciaton) of Investments | 1,142,599 | 3,092,458 | ||||||

| Net Increase (Decrease) in Net Assets (resulting from operations) | 1,139,713 | 2,473,280 | ||||||

| Distributions to Shareholders: | ||||||||

| Net Investment Income | - | (135,209 | ) | |||||

| Total Distributions to Shareholders | - | (135,209 | ) | |||||

| Capital Share Transactions: | ||||||||

| Proceeds from Shares Sold | 4,324,860 | 1,490,289 | ||||||

| Dividends Reinvested | - | 135,209 | ||||||

| Cost of Shares Redeemed | (1,277,072 | ) | (3,768,402 | ) | ||||

| Increase (Decrease) in Net Assets (resulting from capital share transactions) | 3,047,788 | (2,142,904 | ) | |||||

| Total Increase (Decrease) in Net Assets | 4,187,501 | 195,167 | ||||||

| Net Assets: | ||||||||

| Beginning of period | 19,090,010 | 18,894,843 | ||||||

| End of period | $ | 23,277,511 | $ | 19,090,010 | ||||

| Accumulated Undistributed Net Investment Income | $ | 101,405 | $ | 109,300 | ||||

| Shares of Capital Stock of the Fund Sold and Redeemed: | ||||||||

| Shares Sold | 440,804 | 171,124 | ||||||

| Shares Reinvested | - | 14,323 | ||||||

| Shares Redeemed | (129,472 | ) | (455,827 | ) | ||||

| Net Increase (Decrease) in Number of Shares Outstanding | 311,332 | (270,380 | ) | |||||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Strategic Growth Portfolio Variable Series [ 12 ]

Financial Highlights | Strategic Growth Portfolio Variable Series | |||||||||||||

| The table below sets forth financial data for one share of capital stock outstanding throughout each period presented. | |||||||||||||

| Six months | |||||||||||||

| ended | Year | Year | Year | Year | �� | Year | |||||||

| 6/30/11 | ended | ended | ended | ended | ended | ||||||||

| (Unaudited) | 12/31/10 | 12/31/09 | 12/31/08 | 12/31/07 | 12/31/06 | ||||||||

| Per Share Operating Performance: | |||||||||||||

| Net Asset Value at Beginning of Period | $ 9.45 | $ 8.25 | $ 6.41 | $ 12.83 | $ 12.07 | $ 11.64 | |||||||

| Income from Investment Operations: | |||||||||||||

| Net Investment Income (Loss) | (0.01) | 0.05 | (A) | 0.06 | 0.07 | (A) | 0.18 | 0.23 | |||||

| Net Realized and Unrealized Gain (Loss) on Investments | 0.54 | 1.22 | 1.83 | (5.19) | 1.04 | 0.91 | |||||||

| Total from Investment Operations | 0.53 | 1.27 | 1.89 | (5.12) | 1.22 | 1.14 | |||||||

| Less Distributions: | |||||||||||||

| Dividends from Net Investment Income | - | (0.07) | (0.05) | (0.15) | - | (0.23) | |||||||

| Dividends from Realized Gains | - | - | - | (1.15) | (0.46) | (0.48) | |||||||

| Total Distributions | - | (0.07) | (0.05) | (1.30) | (0.46) | (0.71) | |||||||

| Net Asset Value at End of Period | $ 9.98 | $ 9.45 | $ 8.25 | $ 6.41 | $ 12.83 | $ 12.07 | |||||||

Total Return (B) | 5.61% | (E) | 15.37% | 29.48% | -39.55% | 10.13% | 9.83% | ||||||

| Ratios/Supplemental Data: | |||||||||||||

| Net Assets at End of Period (in 000s) | $ 23,278 | $ 19,090 | $ 18,895 | $ 14,750 | $ 19,167 | $ 14,271 | |||||||

Ratio of Expenses to Average Net Assets (C) | 0.35% | (F) | 0.42% | 0.50% | 0.65% | 0.64% | 0.72% | ||||||

Ratio of Net Investment Income (Loss) to Average Net Assets (C)(D) | (0.07)% | (F) | 0.61% | 0.82% | 0.69% | 1.61% | 2.21% | ||||||

| Portfolio Turnover | 4.75% | (E) | 8.39% | 21.90% | 8.56% | 45.07% | 2.62% | ||||||

| (A) Net Investment Income was calculated using average shares method. | |||||||||||||

| (B) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. | |||||||||||||

| Total return would have been higher if certain expenses had not been recouped in the year in which the recoupment occurred. | |||||||||||||

| (C) These ratios exclude the impact of expenses of the underlying security holdings as represented in the schedule of investments. | |||||||||||||

| (D) Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. | |||||||||||||

| (E) Not annualized. | |||||||||||||

| (F) Annualized | |||||||||||||

The accompanying notes are an integral part of thsee financial statements.

Timothy Plan Strategic Growth Portfolio Variable Series [ 13 ]

Notes to Financial Statements

June 30, 2011 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

Note 1 | Significant Accounting Policies

The Timothy Plan Conservative Growth Portfolio Variable Series (“Conservative Growth Portfolio”) and the Timothy Plan Strategic Growth Portfolio Variable Series (“Strategic Growth Portfolio”) (individually the “Fund”, collectively the “Funds”) were organized as diversified series of The Timothy Plan (the “Trust”). The Trust is an open-ended investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated December 16, 1993 (the “Trust Agreement”). The Conservative Growth Portfolio’s primary objective is moderate long-term capital growth, with a secondary objective of current income only to the extent that the Timothy Funds in which the Conservative Growth Portfolio invests seek current income. The Strategic Growth Portfolio’s primary investment objective is medium to high levels of long-term capital growth, with a secondary objective of current income only to the extent that the Timothy Funds in which the Strategic Growth Portfolio invests seek current income. The Conservative Growth Portfolio seeks to achieve its investment objectives by investing primarily in the following Timothy Funds which are other series of the Trust: Small Cap Value Fund, Large/Mid Cap Value Fund, Large/Mid Cap Growth Fund, Fixed Income Fund, Aggressive Growth Fund, High Yield Bond Fund, International Fund and Defensive Strategies Fund. The Conservative Growth Portfolio also invests in the Fidelity Institutional Money Market Portfolio, an unaffiliated mutual fund. The Strategic Growth Portfolio seeks to achieve its investment objectives by investing primarily in the following Timothy Funds which are other series of the Trust: Small Cap Value Fund, Large/Mid Cap Value Fund, Large/Mid Cap Growth Fund, Aggressive Growth Fund, High Yield Bond Fund, International Fund and Defensive Strategies Fund. The Strategic Growth Portfolio also invests in the Fidelity Institutional Money Market Portfolio, an unaffiliated mutual fund. Each Fund is one of a series of Funds currently authorized by the Board of Trustees (the “Board”). Timothy Partners, Ltd., (“TPL” or the “Advisor”) is the Investment Advisor for the Funds.

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”) for investment companies.

| A. | SECURITY VALUATION AND FAIR VALUE MEASUREMENTS |

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Funds’ investments. These inputs are summarized in the three broad levels listed below.

| · | Level 1 – quoted prices in active markets for identical securities |

| · | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – significant unobservable inputs (including each Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Each Fund purchases Class A Shares of the Timothy Funds at net asset value without any sales charges. Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

The Board has delegated to the Advisor responsibility for determining the value of Fund portfolio securities under certain circumstances. Under such circumstances, the Advisor will use its best efforts to arrive at the fair value of a security held by each Fund under all reasonably ascertainable facts and circumstances. The Advisor must prepare a report for the Board not less than quarterly containing a complete listing of any securities for which fair value pricing was employed and detailing the specific reasons for such fair value pricing. The Board has adopted written policies and procedures to guide the Advisor with respect to the circumstances under which, and the methods to be used, fair value pricing is utilized.

Timothy Plan Notes [ 14 ]

Notes to Financial Statements

June 30, 2011 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

The following is a summary of the inputs used to value the Conservative Growth Portfolio’s investments as of June 30, 2011:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 - Quoted Prices in Active Markets | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Mutual Funds | $ | 40,418,163 | $ | - | $ | - | $ | 40,418,163 | ||||||||

| Short-Term Investments | 24,690 | - | - | 24,690 | ||||||||||||

| Total | $ | 40,442,853 | $ | - | $ | - | $ | 40,442,853 | ||||||||

The following is a summary of the inputs used to value the Strategic Growth Portfolio’s investments as of June 30, 2011:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 - Quoted Prices in Active Markets | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Mutual Funds | $ | 23,187,300 | $ | - | $ | - | $ | 23,187,300 | ||||||||

| Short-Term Investments | 96,773 | - | - | 96,773 | ||||||||||||

| Total | $ | 23,284,073 | $ | - | $ | - | $ | 23,284,073 | ||||||||

The Conservative Growth Portfolio and the Strategic Growth Portfolio did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. During the period ended June 30, 2011, there were no significant transfers between Levels 1 and 2. The Funds’ policy is to recognize transfers at the end of the period.

| B. | INVESTMENT INCOME AND SECURITIES TRANSACTIONS |

Security transactions are accounted for on the date the securities are purchased or sold (trade date). Cost is determined and gains and losses are based on the identified cost basis for both financial statement and federal income tax purposes. Dividend income is recognized on the ex-dividend date. Interest income and expenses are recognized on an accrual basis.

| C. | NET ASSET VALUE PER SHARE |

Net asset per share of the capital stock of each Fund is determined daily as of the close of trading on the New York Stock Exchange by dividing the value of its net assets by the number of Fund shares outstanding.

| D. | FEDERAL INCOME TAXES |

It is the policy of each Fund to continue to comply with all requirements under subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its shareholders. Each Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income or gains. Therefore, no federal income tax or excise provision is required.

As of June 30, 2011, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statements of operations. During the six months ended June 30, 2011, the Funds did not incur any interest or penalties. The Funds are not subject to examination by U.S. federal tax authorities for tax years before 2007 and are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially within the next twelve months.

| E. | USE OF ESTIMATES |

In preparing financial statements in conformity with GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| F. | DISTRIBUTIONS TO SHAREHOLDERS |

Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Funds.

Timothy Plan Notes [ 15 ]

Notes to Financial Statements

June 30, 2011 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

| G. | EXPENSES |

Expenses incurred by the Trust that do not relate to a specific Fund of the Trust are allocated to the individual Funds based on each Fund’s relative net assets or an appropriate basis (as determined by the Board).

Note 2 | Purchases and Sales of Securities

The following is a summary of the cost of purchases and proceeds from the sale of securities, other than short-term investments, for the six months ended June 30, 2011:

| Funds | Purchases | Sales | |||||||

| Conservative Growth Portfolio | $ | 1,551,200 | $ | 6,045,052 | |||||

| Strategic Growth Portfolio | $ | 3,994,438 | $ | 1,056,086 | |||||

Note 3 | Investment Management Fee and Other Transactions with Affiliates

Timothy Partners, Ltd. (“TPL”) is the Investment Advisor for the Funds pursuant to an Amended and Restated Investment Advisory Agreement (the “Agreement”) that was renewed by the Board on February 25, 2011. TPL supervises the investment of the assets of each Fund’s portfolio in accordance with the objectives, policies and restrictions of the Funds. Under the terms of the Agreement, TPL receives a fee, accrued daily and paid monthly, at an annual rate of 0.10% of the average daily net assets of each Fund. Total fees earned by TPL during the six months ended June 30, 2011 were $20,544 and $11,115 for the Conservative Growth Portfolio and the Strategic Growth Portfolio, respectively. The Conservative Growth Portfolio and the Strategic Growth Portfolio owed TPL $3,302 and $1,873, respectively, at June 30, 2011. An officer and trustee of the Funds is also an officer of the Advisor.

Note 4 | Control Ownership

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund under Section 2(a) 9 of the Investment Company Act of 1940. As of June 30, 2011, American United Life Insurance Co. (“AUL”) held for the benefit of others, in aggregate, approximately 93% of the Conservative Growth Portfolio and approximately 85% of the Strategic Growth Portfolio.

Note 5 | Unrealized Appreciation (Depreciation)

At June 30, 2011, the cost for federal income tax purposes and the composition of gross unrealized appreciation (depreciation) of investment securities is as follows:

Timothy Plan Notes [ 16 ]

Notes to Financial Statements

June 30, 2011 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

Note 6 | Distributions to Shareholders

There were no distributions paid during the six months ended June 30, 2011.

The tax characteristics of distributions paid during 2010 and 2009 were as follows:

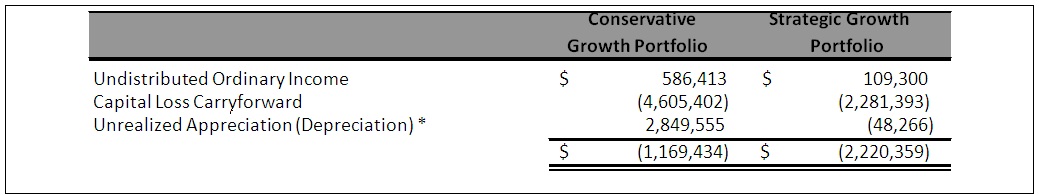

As of December 31, 2010, the components of distributable earnings (accumulated losses) on a tax basis were as follows:

| * The difference between book-basis and tax-basis unrealized depreciation is attributable to the tax deferral of wash sales losses in the amount of $1,509,045 and $464,867 for the Conservative Growth Portfolio and Strategic Growth Portfolio, respectively, and post-October losses in the amount of $200,570 and $4,115 for the Conservative Growth Portfolio and Strategic Growth Portfolio, respectively. |

Note 7 | Capital Loss Carryforwards

| At December 31, 2010, the following capital loss carryforwards are available to offset future capital gains. |

To the extent these loss carryforwards are used to offset future capital gains, it is probable that the amount, which is offset, will not be distributed to shareholders.

Note 8 | SUBSEQUENT EVENT

The Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted on December 22, 2010. The Act makes changes to several tax rules impacting the Funds. In general, the provisions of the Act will be effective for the Fund’s fiscal year ending December 31, 2011. Although the Act provides several benefits, including the unlimited carryover of future capital losses, there may be a greater likelihood that all or a portion of the Funds’ pre-enactment capital loss carryovers may expire without being utilized due to the fact that post-enactment capital losses get utilized before pre-enactment capital loss carryovers. Relevant information regarding the impact of the Act on the Funds, if any, will be contained within the “Federal Taxes” section of the financial statement notes for the fiscal year ending December 31, 2011.

Timothy Plan Notes [ 17 ]

Notes to Financial Statements

June 30, 2011 (Unaudited)

Conservative and Strategic Growth Portfolio Variable Series

Board Annual Approval/Renewals of Advisory and Sub-Advisory Agreements (Unaudited)

TIMOTHY PARTNERS, LTD

The continuance of the Investment Advisory Agreement (the “IA Agreement”) on behalf of each series of the Trust between the Trust and Timothy Partners, Ltd. (“TPL”) was last approved by the Board of Trustees (“the Board”), including a majority of the Trustees who are not interested persons of the Trust or any person who is a party to the Agreement, at an in-person meeting held on February 25, 2011. The Trust's Board considered the factors described below prior to approving the Agreement. The Trustees, including the Independent Trustees, noted the Advisor's experience in incorporating and implementing the unique, biblically-based management style that is a stated objective as set forth in the Funds' prospectus.

To further assist the Board in making its determination as to whether the IA Agreement should be renewed, the Board requested and received the following information: a description of TPL's business and any personnel changes, a description of the compensation received by TPL from the Funds, information relating to the Advisor's policies and procedures regarding best execution, trade allocation, soft dollars, code of ethics and insider trading, and a description of any material legal proceedings or securities enforcement proceedings regarding TPL or its personnel. In addition, the Board requested and received financial statements of TPL for its fiscal year ended December 31, 2010. The Board also received a report from TPL relating to the fees charged by TPL, both as an aggregate and in relation to fees charged by other advisors to similar funds. The materials prepared by TPL were provided to the Board in advance of the meeting. The Board considered the fees charged by TPL in light of the services provided to the Funds by TPL, the unique nature of the Funds and their moral screening requirements, which are maintained by TPL, and TPL's role as a manager of managers. After full and careful consideration, the Board, with the independent trustees separately concurring, agreed that the fees charged by TPL were fair and reasonable in light of the services provided to the Funds. The Board also discussed the nature, extent and quality of TPL's services to the Funds. In particular, the Board noted with approval TPL's commitment to maintaining certain targeted expense ratios for the Funds, its efforts in providing comprehensive and consistent moral screens to the investment managers, its efforts in maintaining appropriate oversight of the investment managers to each Fund, and its efforts to maintain ongoing regulatory compliance for the Funds. The Board also discussed TPL's current fee structure and whether such structure would allow the Funds to realize economies of scale as they grow. The Board next considered the investment performance of each Fund and the Advisor's performance in monitoring the investment managers of the underlying funds. The Board generally approved of each Fund's performance, noting that the Funds invested in a manner that did not rely exclusively on investment performance. Further, the Board noted with approval that the investment managers of each Fund did not succumb to style drift in their management of each Fund's assets, and that each Fund was committed to maintain its investment mandate, even if that meant under performance during periods when that style was out of favor. The Board noted with approval the Advisor's ongoing efforts to maintain such consistent investment discipline. The Board also noted with approval that the Advisor's business was devoted exclusively to serving the Funds, and that the Advisor did not realize any ancillary benefits or profits deriving from its relationship with the Funds. The Board further noted with approval the Advisor's past activities on monitoring the performance of the underlying Funds' various investment managers and the promptness and efficiency with which problems were brought to the Board's attention and responsible remedies offered and executed. After careful discussion and consideration, the Board, including the separate concurrence of the independent Trustees, unanimously cast an affirmative vote, and determined that the renewal of the IA Agreement for another one-year period would be in the best interests of the Funds' shareholders. In approving the renewal of the IA Agreement for an additional one year period, the Board did not place specific emphasis on any one factor discussed above, but considered all factors in equal light. Further, the Board had available and availed itself of the assistance of legal counsel at all times during its consideration of the IA Agreement renewal.

Timothy Plan Notes [18 ]

1055 Maitland Center Commons, #100

Maitland, Florida 32751

(800) TIM-PLAN

(800) 846-7526

Visit the Timothy Plan web site on the internet at:

www.timothyplan.com

This report is submitted for the general information of the shareholders of each Fund. It is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective Prospectus which includes the details regarding the Funds’ objectives, policies, expenses and other information.

Distributed by Timothy Partners, Ltd. Member FINRA

Item 2. Code of Ethics. NOT APPLICABLE – disclosed with annual report

Item 3. Audit Committee Financial Expert. NOT APPLICABLE- disclosed with annual report

Item 4. Principal Accountant Fees and Services. NOT APPLICABLE – disclosed with annual report

Item 5. Audit Committee of Listed Companies. NOT APPLICABLE – applies to listed companies only

Item 6. Schedule of Investments. NOT APPLICABLE – schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds. NOT APPLICABLE – applies to closed-end funds only

Item 8. Portfolio Managers of Closed-End Management Investment Companies. NOT APPLICABLE – applies to closed-end funds only

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. NOT APPLICABLE – applies to closed-end funds only

Item 10. Submission of Matters to a Vote of Security Holders. The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) Based on an evaluation of the registrant’s disclosure controls and procedures within 90 days, the disclosure controls and procedures are reasonably designed to ensure that the information required in filings on Forms N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not Applicable – filed with annual report

| (a)(2) | Certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes- Oxley Act of 2002 and required by Rule 30a-2under the Investment Company Act of 1940 are filed herewith. |

(a)(3) Not Applicable

| (b) | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Timothy Plan

| By | |

| /s/ Arthur D. Ally | |

| Arthur D. Ally, President | |

| Date | 8/4/11 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | |

| /s/ Arthur D. Ally | |

Arthur D. Ally, President & Treasurer | |

| Date | 8/4/11 |