February 21, 2017 Fourth Quarter and Full Year 2016 Financial Results Exhibit 99.3

February 21, 2017 1 Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • ability of SCE to recover its costs in a timely manner from its customers through regulated rates, including costs related to San Onofre and proposed spending on grid modernization; • decisions and other actions by the CPUC, the FERC, the NRC and other regulatory authorities, including the determinations of authorized rates of return or return on equity, approval of proposed spending on grid modernization, the outcome of San Onofre CPUC proceedings, and delays in regulatory actions; • risks associated with cost allocation, including the potential movement of costs to certain customers, caused by the ability of cities, counties and certain other public agencies to generate and/or purchase electricity for their local residents and businesses, along with other possible customer bypass or departure due to increased adoption of distributed energy resources or technological advancements in the generation, storage, transmission, distribution and use of electricity, and supported by public policy, government regulations and incentives; • risks inherent in the construction of SCE’s transmission and distribution infrastructure investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, power curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance of power delivery), and governmental approvals; • ability to obtain sufficient insurance, including insurance relating to SCE's nuclear facilities and wildfire-related liability, and to recover the costs of such insurance or in the absence of insurance the ability to recover uninsured losses; and • risks associated with the decommissioning of San Onofre, including those related to public opposition, permitting, governmental approvals, and cost overruns. Other important factors are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K, most recent Form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

February 21, 2017 2 Q4 2016 Q4 2015 Variance Basic Earnings Per Share (EPS)1,2 SCE $1.04 $(0.25) $1.29 EIX Parent & Other (0.02) 0.03 (0.05) Discontinued Operations 0.04 (0.02) 0.06 Basic EPS $1.06 $(0.24) $1.30 Less: Non-Core Items SCE3 $ − $(1.14) $1.14 EIX Parent & Other4 − 0.04 (0.04) Discontinued Operations5 0.04 (0.02) 0.06 Total Non-Core Items $0.04 $(1.12) $1.16 Core Earnings Per Share (EPS)1 SCE $1.04 $0.89 $0.15 EIX Parent & Other (0.02) (0.01) (0.01) Core EPS1 $1.02 $0.88 $0.14 Key SCE EPS Drivers Revenue6,7 $0.16 - CPUC – Escalation 0.09 - CPUC – GRC return on pole loading rate base (0.03) - CPUC – Other 0.09 - FERC revenue and other 0.01 Lower O&M 0.09 Higher depreciation (0.06) Higher net financing costs (0.05) Income Tax6,7 _ Other 0.01 - Property and other taxes (0.01) - Other income and expenses 0.02 Total core drivers $0.15 Non-core items3 1.14 Total $1.29 Fourth Quarter Earnings Summary Key EIX EPS Drivers EIX parent – Lower corporate expenses and other $0.02 EMG – Sold portfolio in 2015 and other (0.03) Total core drivers $(0.01) Non-core items4,5 0.02 Total $0.011. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Includes full year basic earnings impact of $0.09 due to the adoption of new accounting standards update on share-based payments ($0.05 of this benefit was attributable to prior quarters). See 2016 Retroactively Adjusted EPS by Quarter in Appendix for the impacts on basic and diluted earnings per share for each quarter of 2016 3. See SCE Core EPS Non-GAAP reconciliation in Appendix 4. Impact includes hypothetical liquidation at book value (HLBV) and sale of affordable housing portfolio 5. Impact primarily related to the resolution of tax issues and other impacts related to the EME bankruptcy settlement 6. Excludes income tax benefits for incremental tax repair deductions and pole loading program-based cost of removal of $0.27 7. Excludes San Onofre revenue of $0.02 which was offset by income taxes of $(0.02) Note: Diluted earnings were $1.05 and $(0.24) per share for the three months ended December 31, 2016 and 2015, respectively. See 2016 Retroactively Adjusted EPS by Quarter in Appendix for impacts related to the new accounting update

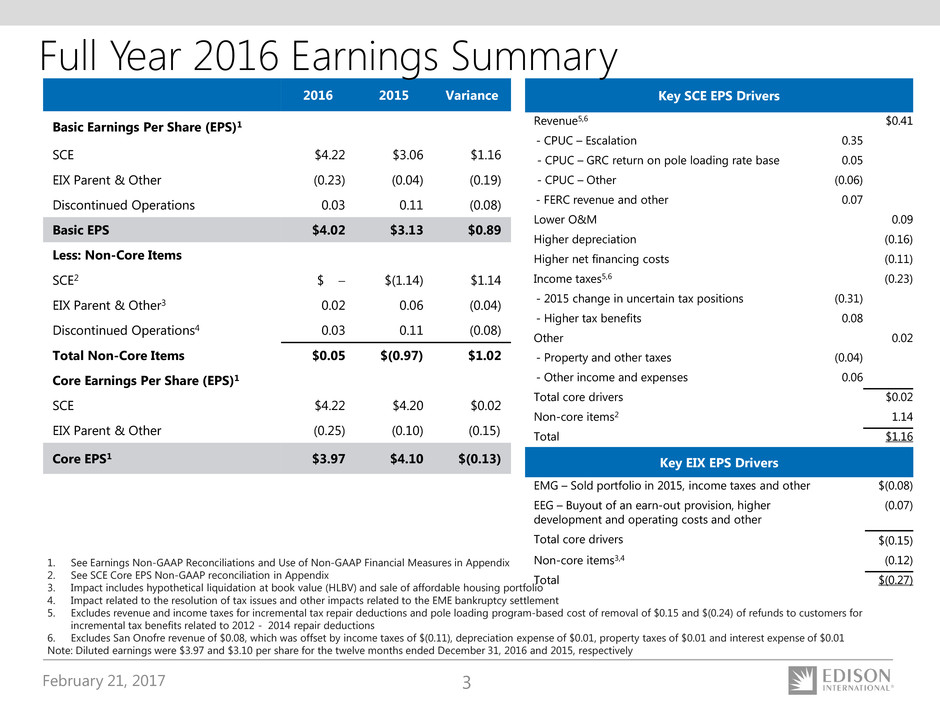

February 21, 2017 3 2016 2015 Variance Basic Earnings Per Share (EPS)1 SCE $4.22 $3.06 $1.16 EIX Parent & Other (0.23) (0.04) (0.19) Discontinued Operations 0.03 0.11 (0.08) Basic EPS $4.02 $3.13 $0.89 Less: Non-Core Items SCE2 $ − $(1.14) $1.14 EIX Parent & Other3 0.02 0.06 (0.04) Discontinued Operations4 0.03 0.11 (0.08) Total Non-Core Items $0.05 $(0.97) $1.02 Core Earnings Per Share (EPS)1 SCE $4.22 $4.20 $0.02 EIX Parent & Other (0.25) (0.10) (0.15) Core EPS1 $3.97 $4.10 $(0.13) Key SCE EPS Drivers Revenue5,6 $0.41 - CPUC – Escalation 0.35 - CPUC – GRC return on pole loading rate base 0.05 - CPUC – Other (0.06) - FERC revenue and other 0.07 Lower O&M 0.09 Higher depreciation (0.16) Higher net financing costs (0.11) Income taxes5,6 (0.23) - 2015 change in uncertain tax positions (0.31) - Higher tax benefits 0.08 Other 0.02 - Property and other taxes (0.04) - Other income and expenses 0.06 Total core drivers $0.02 Non-core items2 1.14 Total $1.16 Full Year 2016 Earnings Summary Key EIX EPS Drivers EMG – Sold portfolio in 2015, income taxes and other $(0.08) EEG – Buyout of an earn-out provision, higher development and operating costs and other (0.07) Total core drivers $(0.15) Non-core items3,4 (0.12) Total $(0.27) 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. See SCE Core EPS Non-GAAP reconciliation in Appendix 3. Impact includes hypothetical liquidation at book value (HLBV) and sale of affordable housing portfolio 4. Impact related to the resolution of tax issues and other impacts related to the EME bankruptcy settlement 5. Excludes revenue and income taxes for incremental tax repair deductions and pole loading program-based cost of removal of $0.15 and $(0.24) of refunds to customers for incremental tax benefits related to 2012 - 2014 repair deductions 6. Excludes San Onofre revenue of $0.08, which was offset by income taxes of $(0.11), depreciation expense of $0.01, property taxes of $0.01 and interest expense of $0.01 Note: Diluted earnings were $3.97 and $3.10 per share for the twelve months ended December 31, 2016 and 2015, respectively

February 21, 2017 4 $0.06 $0.01 November 2, 2016 Guidance Midpoint Additional FERC Rate Base Productivity & Financing Benefits Income Taxes & Other EIX Parent & Other 2016 Core EPS 2016 Core Earnings vs. Guidance Reconciliation Note: See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix SCE Total $3.91 SCE $4.18 EIX Parent & Other $(0.27) $0.02 ($0.03)• O&M and Financing Benefits $0.07 • Energy Efficiency Award ($0.01) SCE $4.22 Total $3.97 EIX Parent & Other $(0.25)

February 21, 2017 5 $4.05 $4.14 (0.25)0.34 SCE 2017 EPS from Rate Base Forecast SCE Variances EIX Parent & Other EIX 2017 Core EPS Midpoint Guidance • O&M and financing benefits - $0.31 • Energy efficiency - $0.03 2017 Core Earnings Per Share Guidance – Building from SCE Rate Base • SCE authorized rate base $26.2 billion • Energy efficiency earnings $0.03 per share • Authorized CPUC capital structure - 48% equity and 10.45% ROE • FERC ROE of 10.5% • No change in tax policy • 325.8 million common shares • MHI arbitration decision not included Legal costs are expensed as core as they are incurred SCE’s share of any award, if any, would first be used to recover the previously recorded expenses, and will be recorded as core Balance would be treated as non-core Key Assumptions Low Mid High SCE $4.39 EIX Parent & Other (0.25) EIX Basic EPS $4.04 $4.14 $4.24 Less: Non-Core Items - - - EIX Core EPS $4.04 $4.14 $4.24 • Holding Company - ($0.17) • Edison Energy Group - ($0.08) 2017 Earnings Per Share Guidance as of February 21, 2017 2017 EIX Earnings Per Share Guidance

February 21, 2017 6 SCE Capital Expenditure Forecast – Request Level Note: Forecasted capital spending includes CPUC, FERC and other spending. See Capital Expenditure/Rate Base Detailed Forecast for further information, including potential investment excluded in forecasts. 2021-2022 Delta reflects catch-up of prior forecast capital expenditures for delayed transmission projects. 2019 Delta reflects rounding difference in both periods ($ billions) $19.3 Billion Capital Program for 2017-2020 • Capital expenditure forecast incorporates GRC, FERC and non-GRC CPUC spending Grid modernization spending of $2.3 billion during four- year period 2017 traditional capital spending incorporates 2015 GRC decision and FERC spending Includes $289 million of non-GRC CPUC capital spending for grid modernization and mobile home pilot program and charge ready pilot in 2017 Excludes transportation electrification and Charge Ready Phase II • Authorized/Actual may differ from forecast Since the 2009 GRC, CPUC has approved 81%, 89%, and 92% of capital requested, respectively SCE has no prior approval experience on grid modernization capital spending and, therefore, prior results may not be predictive Forecasted FERC capital spending subject to timely receipt of permitting, licensing, and regulatory approvalsPrior Forecast $4.5 $5.0 $5.2 $4.9 N/A Delta ($0.3) — — $0.1 $0.2 $3.5 $4.2 $5.0 $5.1 $5.0 2016 (Actual) 2017 2018 2019 2020 2021-2022 Distribution Transmission Generation Traditional Capital Spending: Grid Modernization Capital Spending: Grid Modernization

February 21, 2017 7 SCE Rate Base Forecast – Request Level CPUC • Rate base based on request levels from 2018 GRC and 2018 positive true-up from authorized to forecast 2017 rate base FERC • FERC rate base is approximately 19% of SCE’s rate base by 2020; includes Construction Work in Progress (CWIP) • Incorporates latest FERC spending outlook Other • Excludes SONGS regulatory asset ($ billions) Note: Weighted-average year basis. 2016-2017 based on 2015 GRC decision. 2018-2020 CPUC based on 2018 GRC request, FERC based on latest forecast and current tax law, except “rate-base offset” for the 2015 GRC decision excluded because of write off of regulatory asset related to 2012-2014 incremental tax repairs. 2021-2022 Delta reflects catch-up of prior forecast rate base for delayed transmission projects 4-year CAGR of 8.6% Prior Forecast $26.4 $29.6 $32.4 $35.1 N/A Delta ($0.2) ($0.3) ($0.4) ($0.5) $0.5 $24.9 $26.2 $29.3 $32.0 $34.6 2016 (Authorized) 2017 2018 2019 2020 2021-2022 Traditional Grid Modernization

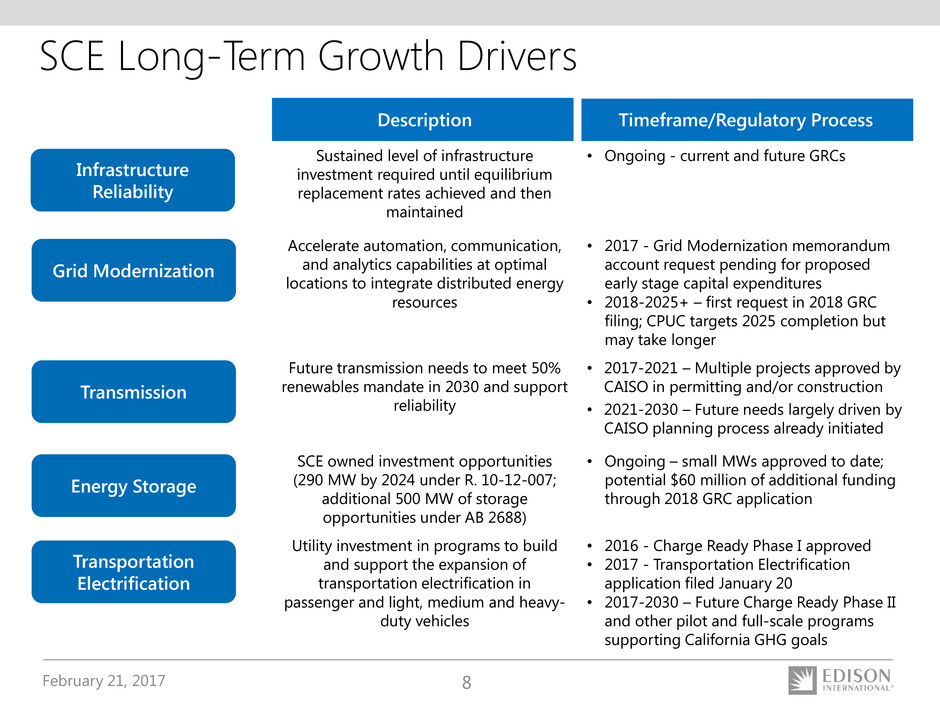

February 21, 2017 8 SCE Long-Term Growth Drivers Description Timeframe/Regulatory Process Sustained level of infrastructure investment required until equilibrium replacement rates achieved and then maintained • Ongoing - current and future GRCs Accelerate automation, communication, and analytics capabilities at optimal locations to integrate distributed energy resources • 2017 - Grid Modernization memorandum account request pending for proposed early stage capital expenditures • 2018-2025+ – first request in 2018 GRC filing; CPUC targets 2025 completion but may take longer Future transmission needs to meet 50% renewables mandate in 2030 and support reliability • 2017-2021 – Multiple projects approved by CAISO in permitting and/or construction • 2021-2030 – Future needs largely driven by CAISO planning process already initiated SCE owned investment opportunities (290 MW by 2024 under R. 10-12-007; additional 500 MW of storage opportunities under AB 2688) • Ongoing – small MWs approved to date; potential $60 million of additional funding through 2018 GRC application Utility investment in programs to build and support the expansion of transportation electrification in passenger and light, medium and heavy- duty vehicles • 2016 - Charge Ready Phase I approved • 2017 - Transportation Electrification application filed January 20 • 2017-2030 – Future Charge Ready Phase II and other pilot and full-scale programs supporting California GHG goals Infrastructure Reliability Grid Modernization Transportation Electrification Energy Storage Transmission

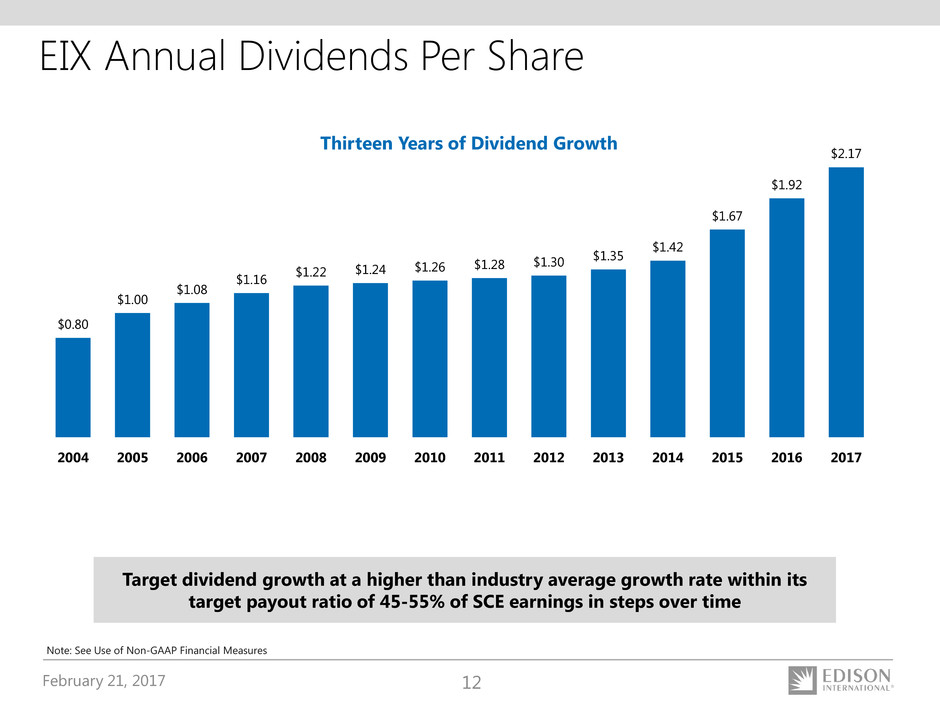

February 21, 2017 9 Other Finance Topics CPUC Cost of Capital Settlement • MOU reached February 6 among electric and gas utilities, TURN and ORA • CPUC approval requested on February 7 via a Petition for Modification of the prior decision 2017 FERC Formula Rate Filing • SCE plans to file its 2018 formula rate filing in Q4 2017 • Current settlement terms remain in effect (subject to adjustment) until new formula rate is approved 2017 SCE and Holding Company Financing Strategies • SCE balance sheet remains strong – 50.4% common equity vs. 48% requirement • Periodic SCE issuance of first mortgage bonds and preferred stock to support capital spending • Holding company $400 million debenture maturing this year to be refinanced • No need for equity issuance to support SCE capital program Continuing our Above-Average Dividend Growth Opportunity

February 21, 2017 10 3 4 5 6 7 10/1/12 10/1/13 10/1/14 10/1/15 10/1/16 10/1/17 10/1/18 10/1/19 R at e (% ) CPUC Cost of Capital CPUC Adjustment Mechanism Moody’s Baa Utility Index Spot Rate Moving Average (10/1/16 – 02/01/2017) = 4.60% 100 basis point +/- Deadband Starting Value – 5.00% Return on Equity (ROE) adjustment mechanism extended through 2019 • ROE adjustment based on 12-month average of Moody’s Baa utility bond rates, measured from October 1 to September 30 • If index exceeds 100 bps deadband from starting index value, authorized ROE changes by half the difference • Starting index value based on trailing 12 months of Moody’s Baa index as of September 30– 5.00% • Two year settlement awaiting CPUC approval ROE set at 10.30%; 2018 true-up of cost of debt/preferred CPUC Authorized Settlement Terms Capital Structure 2017 2018-2019 Common Equity 48% 10.45% 10.30% Preferred 9% 5.79% TBD Long-term Debt 43% 5.49% TBD Weighted Average Cost of Capital 7.90% TBD ROE fixed at 10.30%, for 2018 independent of trigger mechanism ROE fixed at 10.45%, for 2017 independent of trigger mechanism

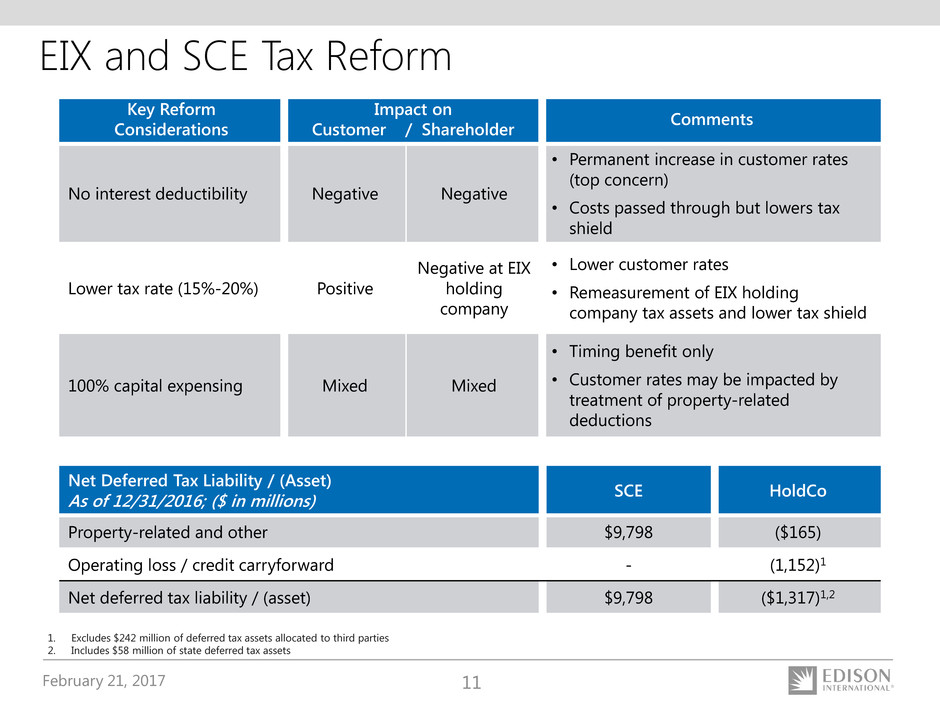

February 21, 2017 11 Key Reform Considerations Impact on Customer / Shareholder Comments No interest deductibility Negative Negative • Permanent increase in customer rates (top concern) • Costs passed through but lowers tax shield Lower tax rate (15%-20%) Positive Negative at EIX holding company • Lower customer rates • Remeasurement of EIX holding company tax assets and lower tax shield 100% capital expensing Mixed Mixed • Timing benefit only • Customer rates may be impacted by treatment of property-related deductions Net Deferred Tax Liability / (Asset) As of 12/31/2016; ($ in millions) SCE HoldCo Property-related and other $9,798 ($165) Operating loss / credit carryforward - (1,152)1 Net deferred tax liability / (asset) $9,798 ($1,317)1,2 1. Excludes $242 million of deferred tax assets allocated to third parties 2. Includes $58 million of state deferred tax assets EIX and SCE Tax Reform

February 21, 2017 12 EIX Annual Dividends Per Share $0.80 $1.00 $1.08 $1.16 $1.22 $1.24 $1.26 $1.28 $1.30 $1.35 $1.42 $1.67 $1.92 $2.17 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Note: See Use of Non-GAAP Financial Measures Thirteen Years of Dividend Growth Target dividend growth at a higher than industry average growth rate within its target payout ratio of 45-55% of SCE earnings in steps over time

February 21, 2017 13 Appendix

February 21, 2017 14 SCE Large Transmission Projects 1. CPUC approved 2. Presently under CPUC environmental review 3. Morongo Transmission holds an option to invest up to $400 million, or half of the estimated cost of the transmission facilities only, at the in-service date. If the option is exercised, SCE’s rate base would be offset by that amount 4. Total Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval. SCE regularly evaluates the cost and schedule based on permitting processes, given that SCE continues to see delays in securing project approvals FERC Cost of Capital 10.5% ROE in 2017: • Base ROE = 9.30% + CAISO participation + weighted average of individual project incentives • FERC Formula recovery mechanism in effect through December 31, 2017 • Application for 2018 FERC Formula recovery mechanism expected to be filed in Q4 of 2017 Summary of Large Transmission Projects Project Name Total Cost4 Remaining Investment In-Service Date West of Devers1,3 $1.1 billion $1.02 billion 2021 Mesa Substation1 $608 million $585 million 2020-2021 Alberhill System2 $397 million $361 million 2021 Riverside Transmission Reliability2 $233 million $228 million 2021 Eldorado-Lugo-Mohave Upgrade $269 million $264 million 2020

February 21, 2017 15 $6,305 — 1,977 1,915 334 — 4,226 2,079 (525) 64 1,618 507 1,111 113 $998 $5,180 4,266 913 — — — 5,179 1 (1) — — — — — $— $11,485 4,266 2,890 1,915 334 — 9,405 2,080 (526) 64 1,618 507 1,111 113 $998 (370) $1,368 SCE Results of Operations • Earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment • Cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject to reasonableness review or compliance with upfront standards Earning Activities Cost- Recovery Activities Total Consolidated 2016 Earning Activities Cost- Recovery Activities Total Consolidated 2015 Operating revenue Purchased power and fuel Operation and maintenance Depreciation, decommissioning and amortization Property and other taxes Impairment and other charges Total operating expenses Operating income Interest expense Other income and expenses Income before income taxes Income tax expense Net income Preferred and preference stock dividend requirements Net income available for common stock Less: Non-core earnings Core Earnings Note: See Use of Non-GAAP Financial Measures ($ millions) $6,504 — 1,939 1,998 351 — 4,288 2,216 (540) 79 1,755 256 1,499 123 $1,376 $5,326 4,527 798 — — — 5,325 1 (1) — — — — — $— $11,830 4,527 2,737 1,998 351 — 9,613 2,217 (541) 79 1,755 256 1,499 123 $1,376 — $1,376

February 21, 2017 16 2016 Retroactively Adjusted EPS by Quarter 20161 Q4 Q3 Q2 Q1 Earnings (loss) per share attributable to Edison International Continuing Operations SCE $4.22 $1.01 $1.34 $0.98 $0.90 Edison International Parent & Other (0.23) (0.04) (0.05) (0.11) (0.04) Discontinued Operations 0.03 0.04 − (0.01) − Edison International $4.02 $1.01 $1.29 $0.86 $0.86 Less: Non-Core Items SCE − − − − − Edison International Parent & Other 0.02 − − 0.01 0.01 Discontinued Operations 0.03 0.04 − (0.01) − Total Non-Core Items $0.05 $0.04 − − $0.01 Core Earnings (losses) SCE 4.22 1.01 1.34 0.98 0.90 Edison International Parent & Other (0.25) (0.04) (0.05) (0.12) (0.05) Edison International $3.97 $0.97 $1.29 $0.86 $0.85 1. As a result of rounding, the total of the four quarters does not always equal the amount for the year Note: Edison International and SCE adopted an accounting standard in the fourth quarter of 2016, effective January 1, 2016, which resulted in all of the tax effects related to share based payments being recorded through the income statement. Diluted EPS would have been, $1.00 for the fourth quarter of 2016, $1.27 for the third quarter of 2016, $0.85 for the second quarter of 2016 and $0.85 for the first quarter of 2016

February 21, 2017 17 Earnings Non-GAAP Reconciliations Note: See Use of Non-GAAP Financial Measures ($ millions) Reconciliation of EIX GAAP Earnings to EIX Core Earnings SCE EIX Parent & Other Discontinued Operations Basic Earnings Non-Core Items SCE EIX Parent & Other Discontinued Operations Total Non-Core Core Earnings SCE EIX Parent & Other Core Earnings $(80) 9 (8) $(79) $(370) 12 (8) $(366) $290 (3) $287 $339 (7) 13 $345 $ – – 13 $ 13 $339 (7) $332 Q4 2015 Q4 2016 Earnings Attributable to Edison International $998 (13) 35 $1,020 $(370) 19 35 $(316) $1,368 (32) $1,336 $1,376 (77) 12 $1,311 $ – 5 12 $17 $1,376 (82) $1,294 20152016

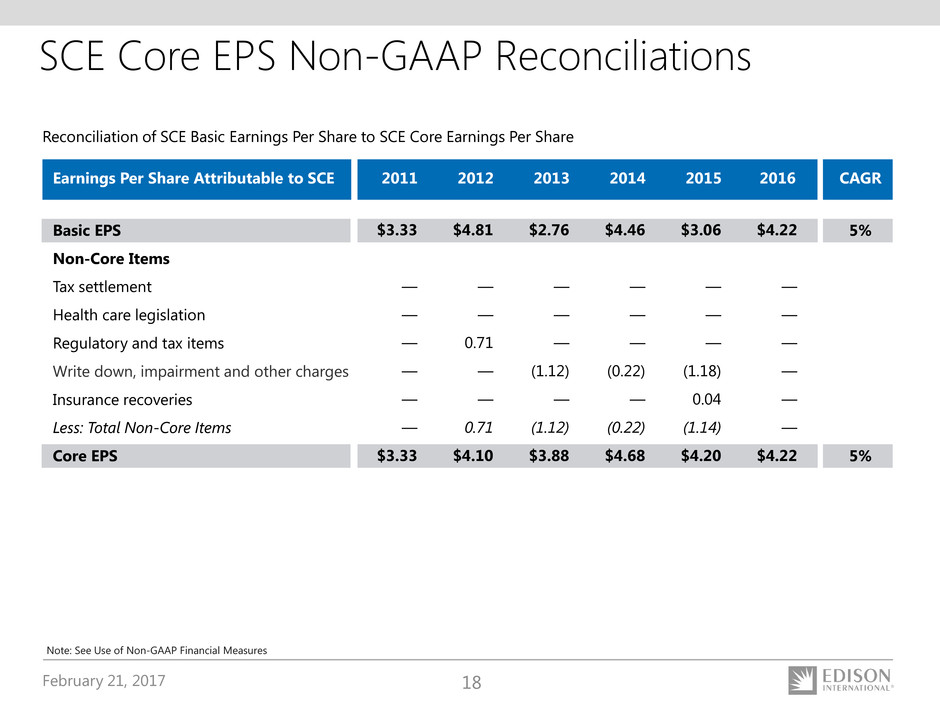

February 21, 2017 18 SCE Core EPS Non-GAAP Reconciliations Basic EPS Non-Core Items Tax settlement Health care legislation Regulatory and tax items Write down, impairment and other charges Insurance recoveries Less: Total Non-Core Items Core EPS Reconciliation of SCE Basic Earnings Per Share to SCE Core Earnings Per Share 5% 5% $3.33 — — — — — — $3.33 $4.81 — — 0.71 — — 0.71 $4.10 $2.76 — — — (1.12) — (1.12) $3.88 Note: See Use of Non-GAAP Financial Measures $4.46 — — — (0.22) — (0.22) $4.68 $3.06 — — — (1.18) 0.04 (1.14) $4.20 Earnings Per Share Attributable to SCE CAGR2011 2012 2013 2014 2015 $4.22 — — — — — — $4.22 2016

February 21, 2017 19 Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. EIX Investor Relations Contact Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Allison Bahen, Senior Manager (626) 302-5493 allison.bahen@edisonintl.com