April 12, 2017 Edison Insights Series: California’s Climate Policies and Transportation Electrification Exhibit 99.2

April 12, 2017 2 Statements contained in this presentation about future performance, including, without limitation, operating results, capital expenditures, rate base growth, policy developments at the state and federal level, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results include, but are not limited to the: • decisions and other actions by the CPUC, the FERC and other regulatory authorities, including the determinations of authorized rates of return or return on equity, approval of proposed spending on grid modernization, transportation electrification, storage, transmission and other initiatives, and delays in regulatory actions; • risks associated with cost allocation, including the potential movement of costs to certain customers, caused by the ability of cities, counties and certain other public agencies to generate and/or purchase electricity for their local residents and businesses, along with other possible customer bypass or departure due to increased adoption of distributed energy resources or technological advancements in the generation, storage, transmission, distribution and use of electricity, and supported by public policy, government regulations and incentives; • risks inherent in the construction of SCE’s transmission and distribution infrastructure investment program, including those related to project site identification, public opposition, environmental mitigation, construction, permitting, power curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance of power delivery), and governmental approvals. Other important factors are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s (EIX) Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

April 12, 2017 3 Edison Insights Series Objectives • Series of conference calls and videos on key topics that underscore the EIX investor value proposition with an SCE focus • This call will address key policy drivers (legislation, regulation and key agencies) influencing California greenhouse gas (GHG) policies particularly important to investors • “Paint the picture” of how SCE’s grid and operating model will evolve as a key enabler of California GHG policies while identifying some of the likely conflicts and barriers as policies and technologies are adopted • Future series topics will include grid modernization and renewables and transmission planning plus others as appropriate Wires-Focused SCE Strategy • Infrastructure replacement – safety and reliability • Grid modernization – California’s low- carbon goals • Operational excellence Edison International Investor Value Drivers • Above average earnings growth opportunity driven by SCE rate base growth • Above average dividend growth opportunity Series and Call Objectives Supporting Our Value Proposition

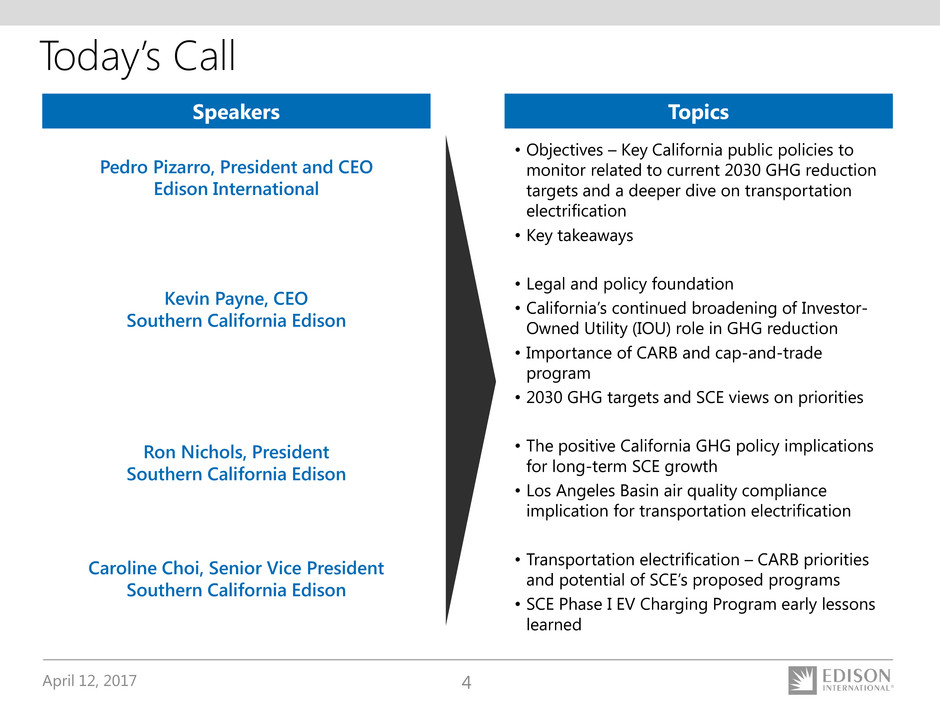

April 12, 2017 4 Today’s Call Speakers Topics Pedro Pizarro, President and CEO Edison International Kevin Payne, CEO Southern California Edison Ron Nichols, President Southern California Edison Caroline Choi, Senior Vice President Southern California Edison • Objectives – Key California public policies to monitor related to current 2030 GHG reduction targets and a deeper dive on transportation electrification • Key takeaways • Legal and policy foundation • California’s continued broadening of Investor- Owned Utility (IOU) role in GHG reduction • Importance of CARB and cap-and-trade program • 2030 GHG targets and SCE views on priorities • The positive California GHG policy implications for long-term SCE growth • Los Angeles Basin air quality compliance implication for transportation electrification • Transportation electrification – CARB priorities and potential of SCE’s proposed programs • SCE Phase I EV Charging Program early lessons learned

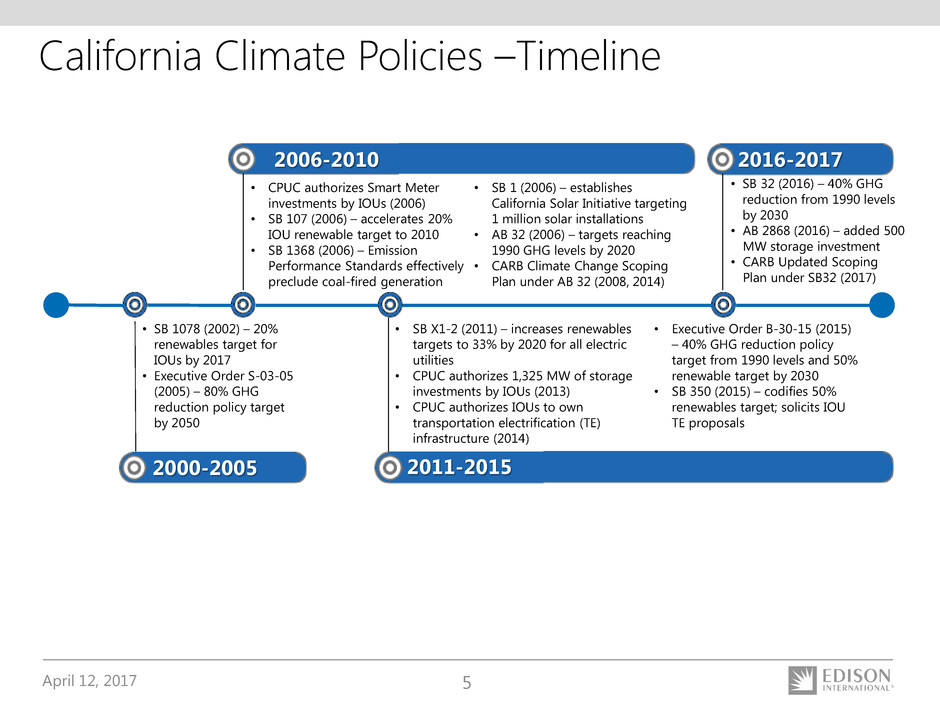

April 12, 2017 5 2016-2017 • SB X1-2 (2011) – increases renewables targets to 33% by 2020 for all electric utilities • CPUC authorizes 1,325 MW of storage investments by IOUs (2013) • CPUC authorizes IOUs to own transportation electrification (TE) infrastructure (2014) • CPUC authorizes Smart Meter investments by IOUs (2006) • SB 107 (2006) – accelerates 20% IOU renewable target to 2010 • SB 1368 (2006) – Emission Performance Standards effectively preclude coal-fired generation • SB 1 (2006) – establishes California Solar Initiative targeting 1 million solar installations • AB 32 (2006) – targets reaching 1990 GHG levels by 2020 • CARB Climate Change Scoping Plan under AB 32 (2008, 2014) • Executive Order B-30-15 (2015) – 40% GHG reduction policy target from 1990 levels and 50% renewable target by 2030 • SB 350 (2015) – codifies 50% renewables target; solicits IOU TE proposals 2011-20152000-2005 California Climate Policies –Timeline • SB 32 (2016) – 40% GHG reduction from 1990 levels by 2030 • AB 2868 (2016) – added 500 MW storage investment • CARB Updated Scoping Plan under SB32 (2017) • SB 1078 (2002) – 20% renewables target for IOUs by 2017 • Executive Order S-03-05 (2005) – 80% GHG reduction policy target by 2050 2006-2010

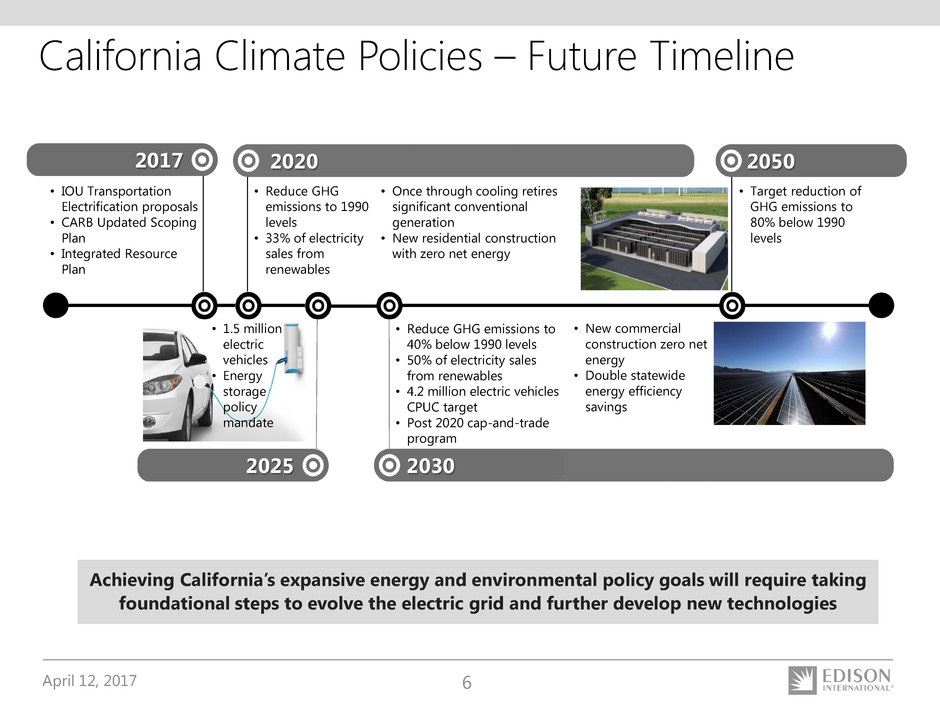

April 12, 2017 6 • Once through cooling retires significant conventional generation • New residential construction with zero net energy 2050 • Reduce GHG emissions to 40% below 1990 levels • 50% of electricity sales from renewables • 4.2 million electric vehicles CPUC target • Post 2020 cap-and-trade program • Target reduction of GHG emissions to 80% below 1990 levels • Reduce GHG emissions to 1990 levels • 33% of electricity sales from renewables • New commercial construction zero net energy • Double statewide energy efficiency savings 2030 2020 • 1.5 million electric vehicles • Energy storage policy mandate 2025 Achieving California’s expansive energy and environmental policy goals will require taking foundational steps to evolve the electric grid and further develop new technologies California Climate Policies – Future Timeline • IOU Transportation Electrification proposals • CARB Updated Scoping Plan • Integrated Resource Plan 2017

April 12, 2017 7 925 30 88 54 67 217 338 191 342 0 100 200 300 400 500 600 700 Proposed Scoping Plan Scenario Uncertainty Scenario G re en ho us e G as E m is si on s Re du ct io ns (M M TC O 2e ) CARB GHG Reduction Targets CARB Updated Scoping Plan – January 2017 First Scoping Plan Under AB 32 (2008, 2014) – Policy Framework for Economy Updated Scoping Plan (2017) – Key Elements • Post 2020 cap-and-trade program • 50% renewables and energy efficiency targets from SB 350 • Low Carbon Fuel Standard – reduce carbon intensity by 18% by 2030 • Mobile Source Strategy – put 4.2 million zero emission vehicles (ZEVs) on the road and increase ZEV buses, delivery and other trucks by 2030 • Sustainable Freight Strategy – deploy over 100,000 ZEV trucks and equipment by 2030 CARB’s Uncertainty Scenario Highlights Key Swing Factor Role of Cap-and-Trade Should Program Mandates Fall Short Source: CARB 2017 Climate Change Scoping Plan Update. The GHG reductions in the Plan’s Uncertainty Scenario represent uncertainty surrounding measure performance. CARB modeled assumptions around the ability of measures to achieve its full estimated potential GHG reductions as provided in the modeled scenario.

April 12, 2017 8 6% 10% 25% 22% 35% 2% CARB Updated Scoping Plan GHG Reductions Cap-and-trade effectiveness will be a key success factor in meeting CARB’s target emission reductions by sector 1990 Total: 431 MMTCO2e 2030 Proposed Total: 260 MMTCO2e Source: CARB 2017 Climate Change Scoping Plan Update. 2030 Forecast based on midpoint of CARB proposed Scoping Plan scenario ranges for targeted GHG reductions. 6% 10% 14% 21% 28% 5% 16% Cap-and-Trade Other Transportation Industrial Electric Power Residential and Commercial Agriculture

April 12, 2017 9 • A jurisdiction-wide cap is placed on GHG emissions; over time, this cap decreases • A compliance instrument is issued by the regulatory agency administering the policy for each ton of emissions (MTCO2e) allowed under the cap. There are two types: Allowances - lowers the cost impact to retail customers Offsets - credits from eligible projects that reduce GHG emissions (these occur outside of capped sectors; reforestation offsets are an example) • Compliance entities must hold a compliance instrument for every ton of GHG they emit Cap • Compliance instruments may be allocated or purchased, OR • Compliance entities can reduce emissions to avoid cost • Excess compliance instruments may be sold or “banked” for future use Trade Source: Environmental Defense Fund Cap-and-Trade Program Overview Cap-and-trade programs are designed to reduce emissions in the most cost-effective manner possible

April 12, 2017 10 Important Business and Policy Issues Lie Ahead CARB Scoping Plan Policy Issues Concerns/Interested Parties Reduce dependence on gasoline, diesel and natural gas Existing energy infrastructure may face declining sales and reduced infrastructure utilization Increased use of distributed generation and energy efficiency Unclear if electrification of transportation and other sectors will offset some of this load loss, but how much is to be determined Plan forecasts only minor incremental cost increases to society of 1-6% by 2030 due to forecast avoidance of societal damages from climate change Customers will see direct costs of plan from potential pass-through of higher cap-and-trade costs and higher gas and electric utility rates potentially mitigated to some extend by cap-and-trade allocations Requires continued development of moderately priced products and greater battery range for wider commercial acceptance Manufacturer product development costs and capital investment will be sizable for growing market to continue to increase customer base Requires significant development and commercial acceptance of new heavy-duty vehicle products Manufacturer product development costs and capital investment will be sizable for market that may be limited for some time to California, a few other states, and Europe especially at low oil prices Low Carbon Energy Changes in Electricity Use Heavy Duty Vehicle Products Consumer Cost Impacts Light Duty Vehicle Products

April 12, 2017 11 Unique SCE Insights • Only major California all-electric investor-owned utility • Most comprehensive transportation electrification proposals • Assessing SCE role in best achieving CARB Updated Scoping Plan 2030 GHG targets • Seeks to be actively engaged in legislative and regulatory proposals Renewables Customer Decisions Cost- Effective Solutions • Effective rate design that encourages customer adoption without unfair subsidies • Utility scale renewables plus transmission vs. distribution level renewables • Ability to procure lower cost out of state renewables • More customers will use distributed energy resources, energy efficiency, and fuel- switching • Companies targeting full use of green energy • Implications for grid modernization • Taking a view on low-cost approaches to GHG reductions • Engaging on technology developments • Enabling cap-and-trade as the preferred policy approach vs. less- flexible mandates Designing Around GHG and Renewables Targets Is Complicated Solar 26% Small Hydro 2% Geothermal 37% Wind 33% 2016 Preliminary Renewable Resources: 28.3% of SCE’s portfolio Biomass 2%

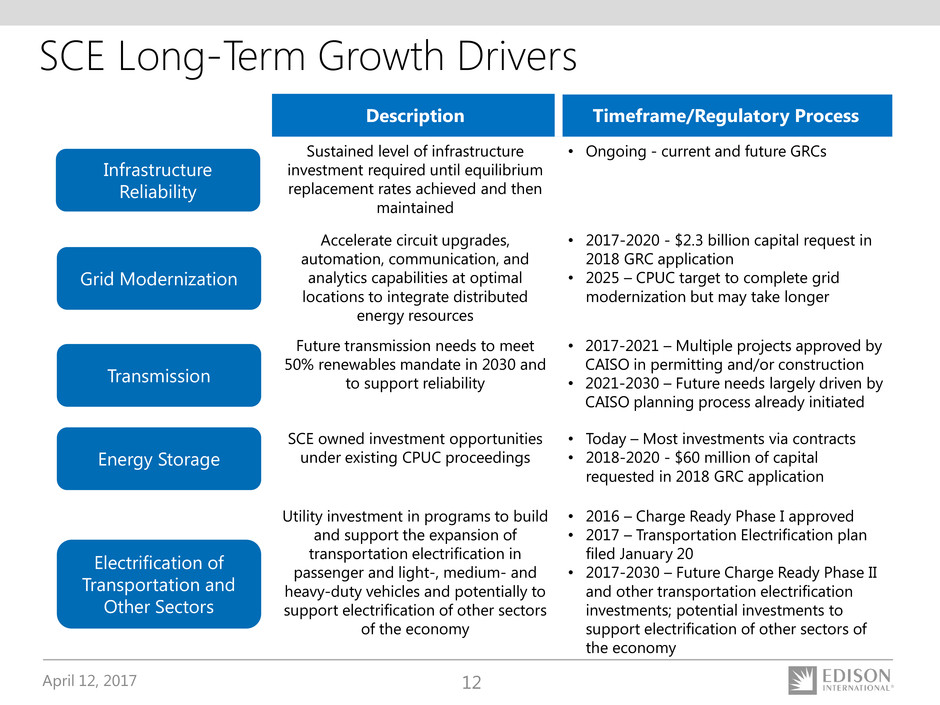

April 12, 2017 12 SCE Long-Term Growth Drivers Description Timeframe/Regulatory Process Sustained level of infrastructure investment required until equilibrium replacement rates achieved and then maintained • Ongoing - current and future GRCs Accelerate circuit upgrades, automation, communication, and analytics capabilities at optimal locations to integrate distributed energy resources • 2017-2020 - $2.3 billion capital request in 2018 GRC application • 2025 – CPUC target to complete grid modernization but may take longer Future transmission needs to meet 50% renewables mandate in 2030 and to support reliability • 2017-2021 – Multiple projects approved by CAISO in permitting and/or construction • 2021-2030 – Future needs largely driven by CAISO planning process already initiated SCE owned investment opportunities under existing CPUC proceedings • Today – Most investments via contracts • 2018-2020 - $60 million of capital requested in 2018 GRC application Utility investment in programs to build and support the expansion of transportation electrification in passenger and light-, medium- and heavy-duty vehicles and potentially to support electrification of other sectors of the economy • 2016 – Charge Ready Phase I approved • 2017 – Transportation Electrification plan filed January 20 • 2017-2030 – Future Charge Ready Phase II and other transportation electrification investments; potential investments to support electrification of other sectors of the economy Infrastructure Reliability Grid Modernization Electrification of Transportation and Other Sectors Energy Storage Transmission

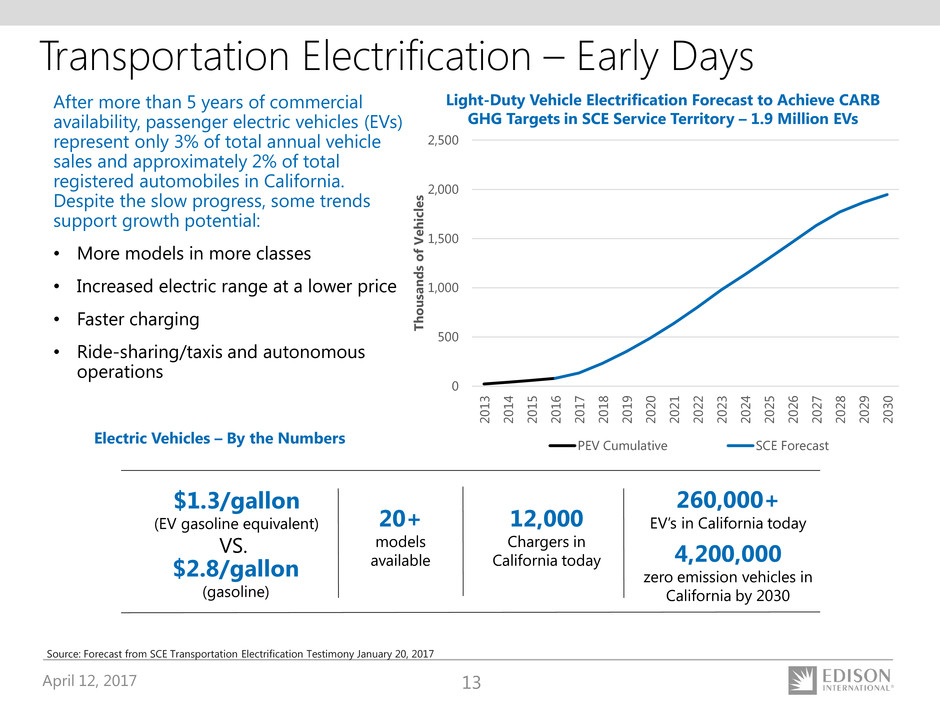

April 12, 2017 13 Transportation Electrification – Early Days After more than 5 years of commercial availability, passenger electric vehicles (EVs) represent only 3% of total annual vehicle sales and approximately 2% of total registered automobiles in California. Despite the slow progress, some trends support growth potential: • More models in more classes • Increased electric range at a lower price • Faster charging • Ride-sharing/taxis and autonomous operations Electric Vehicles – By the Numbers $1.3/gallon (EV gasoline equivalent) $2.8/gallon (gasoline) 20+ models available 12,000 Chargers in California today 260,000+ EV’s in California today 4,200,000 zero emission vehicles in California by 2030 VS. Source: Forecast from SCE Transportation Electrification Testimony January 20, 2017 Light-Duty Vehicle Electrification Forecast to Achieve CARB GHG Targets in SCE Service Territory – 1.9 Million EVs 0 500 1,000 1,500 2,000 2,500 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 20 25 20 26 20 27 20 28 20 29 20 30 Th o u sa n d s o f V eh ic le s PEV Cumulative SCE Forecast

April 12, 2017 14 Medium-Duty, Heavy-Duty and Non-Road Vehicles Contribute Significantly to NOx Emissions in SCE Territory Links to Conventional Pollutant Reductions Source: EPA National Emissions Inventory 2014 for counties in SCE territory. US DOT 2016 Non-Road & Ports category includes forklifts, yard tractors, cranes, and transport refrigeration units. • Transportation has an even greater impact on air quality than on GHG emissions in California – accounts for 80 percent of NOx and 95 percent of particulate emissions in the state • Meeting 2032 attainment deadlines for LA County and San Joaquin Valley will require even faster and greater adoption of TE and other low-emissions transportation technologies • Heavy-duty EVs reduce NOx up to 60 times more per kWh than renewables or energy efficiency • Light-duty EVs reduce NOx about 8 times more per kWh All Stationary Sources, 18% Other Mobile Sources, 6% Rail, 10% Light Duty, 24% Medium-Duty, Heavy-Duty and Non-Road, 42% Total NOx Emissions: 299,654 TON

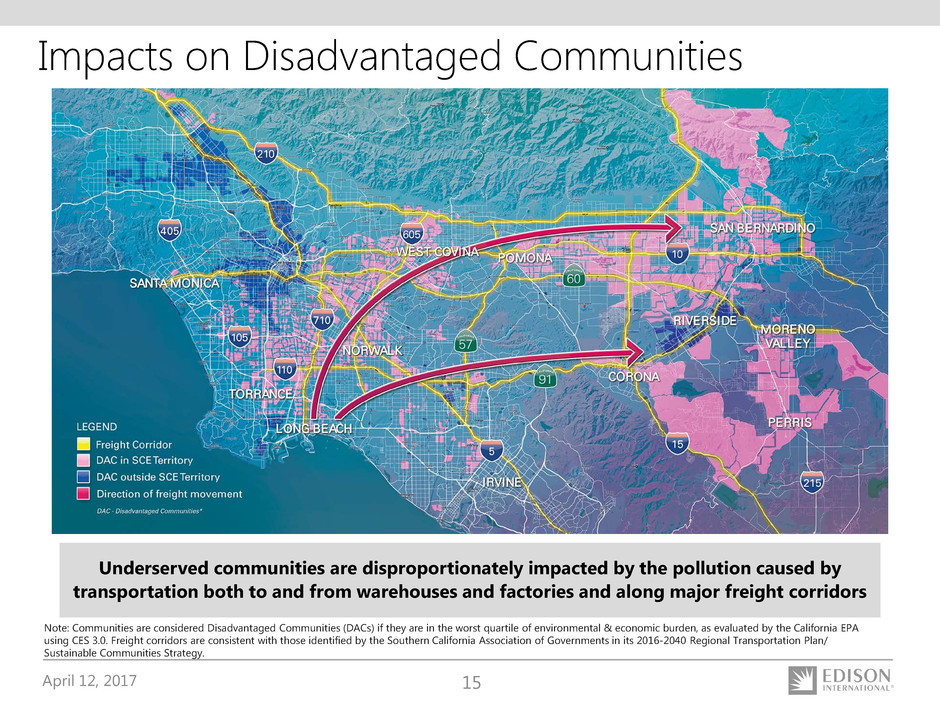

April 12, 2017 15 Impacts on Disadvantaged Communities Note: Communities are considered Disadvantaged Communities (DACs) if they are in the worst quartile of environmental & economic burden, as evaluated by the California EPA using CES 3.0. Freight corridors are consistent with those identified by the Southern California Association of Governments in its 2016-2040 Regional Transportation Plan/ Sustainable Communities Strategy. Underserved communities are disproportionately impacted by the pollution caused by transportation both to and from warehouses and factories and along major freight corridors

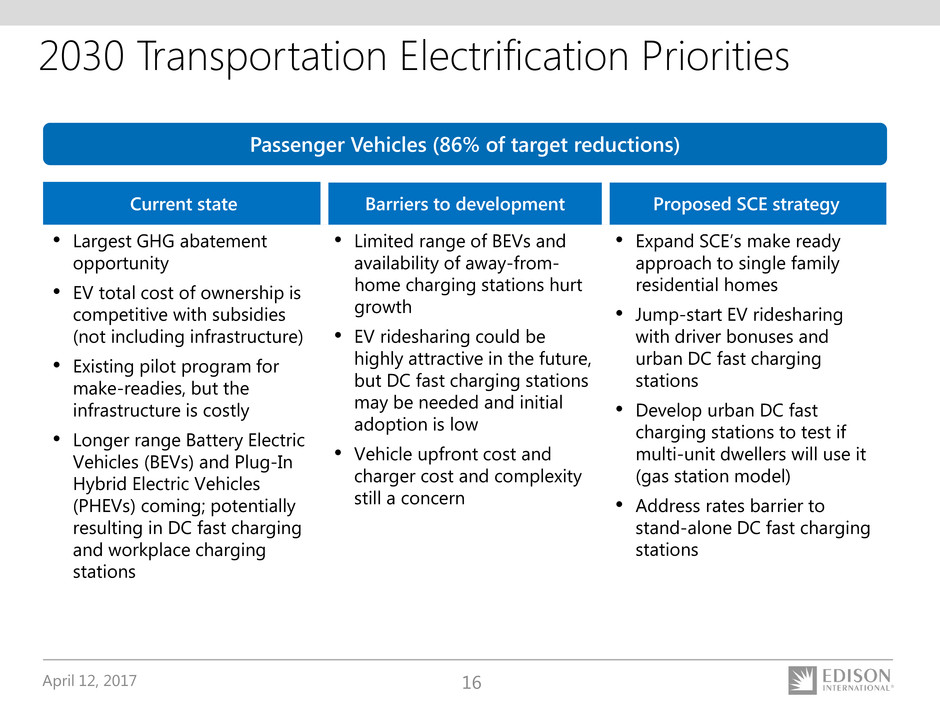

April 12, 2017 16 2030 Transportation Electrification Priorities Current state Barriers to development Proposed SCE strategy • Largest GHG abatement opportunity • EV total cost of ownership is competitive with subsidies (not including infrastructure) • Existing pilot program for make-readies, but the infrastructure is costly • Longer range Battery Electric Vehicles (BEVs) and Plug-In Hybrid Electric Vehicles (PHEVs) coming; potentially resulting in DC fast charging and workplace charging stations • Limited range of BEVs and availability of away-from- home charging stations hurt growth • EV ridesharing could be highly attractive in the future, but DC fast charging stations may be needed and initial adoption is low • Vehicle upfront cost and charger cost and complexity still a concern • Expand SCE’s make ready approach to single family residential homes • Jump-start EV ridesharing with driver bonuses and urban DC fast charging stations • Develop urban DC fast charging stations to test if multi-unit dwellers will use it (gas station model) • Address rates barrier to stand-alone DC fast charging stations Passenger Vehicles (86% of target reductions)

April 12, 2017 17 2030 Transportation Electrification Priorities Current state Barriers to development Proposed SCE strategy • Third-largest GHG abatement opportunity (SCE service area); largest air quality opportunity • Total cost of ownership of EVs alone has positive economic value (ex- infrastructure) • Charging infrastructure is a major cost • High demand charges are a disincentive to charging station development • Vehicle technology is nascent • Make-ready and charger infrastructure is costly, 21% of total cost • Large fleet charging is discouraged by rate structure • Expand SCE’s make-ready approach to other vehicle segments; assess cost to serve • Encourage large fleet charging by adjusting rate structure Light-duty vehicles (5% of target reductions)

April 12, 2017 18 2030 Transportation Electrification Priorities Current state Barriers to development Proposed SCE strategy • Air quality opportunity and small GHG opportunity • Electric rubber tire gantry cranes and yard tractors in Port of Long Beach terminals, and electric forklifts (warehouses) are ‘shovel- ready’ mature technologies • Make-ready infrastructure is costly, 21% of total cost • Large fleet charging is discouraged by rate structure • Expand SCE’s make-ready approach to other vehicle segments • Encourage large fleet charging by adjusting rate structure Port/other off-road (8% of target reductions)

April 12, 2017 19 2030 Transportation Electrification Priorities Current state Barriers to development Proposed SCE strategy • Significant contribution to reducing other criteria pollutants • Small GHG opportunity • Technology is at a very early stage • Not clear which of five different electric technologies is best to scale for region • Large fleet charging is discouraged by rate structure • Expand SCE’s make-ready approach to other vehicle segments • Support pilots of demonstration technologies leading to electrifying all freight in the LA Basin • Encourage large fleet charging by adjusting rate structure Heavy-duty trucks (2% of target reductions)

April 12, 2017 20 SCE Transportation Electrification Proposals • On January 20, 2017, SCE filed with the CPUC a wide-ranging plan to increase electrification of cars, buses, medium- and heavy-duty trucks and industrial vehicles and equipment SCE proposed 6 near-term, priority-review projects and 2 longer-term, standard-review programs for a total of $574 million of total costs (includes both O&M and capital expenditures) Proposal is not currently in capital expenditure and rate base forecasts • SCE’s Charge Ready Program experience and opportunity complements these proposals SCE 2017 Transportation Electrification Application Proposals Program Name Category Timeframe Estimated Total Cost1 Residential Make-Ready Rebate Incentive Pilot Near-term $4 EV Drive Rideshare Reward Incentive Pilot Near-term $4 Urban Direct Current Fast Charge Clusters Infrastructure Pilot Near-term $4 Electric Transit Bus Make-Ready Infrastructure Pilot Near-term $4 Port of Long Beach (POLB) ITS Terminal Yard Tractor Infrastructure Pilot Near-term $0.5 POLB Runner Tire Gantry Crane Electrification Infrastructure Pilot Near-term $3 Medium- and Heavy-Duty Vehicle Charging Infrastructure Program Long-term $554 New Commercial Electric Vehicle Rate Proposal Rate Design Program Long-term N/A 1. Estimated Total Cost in $millions of constant dollars

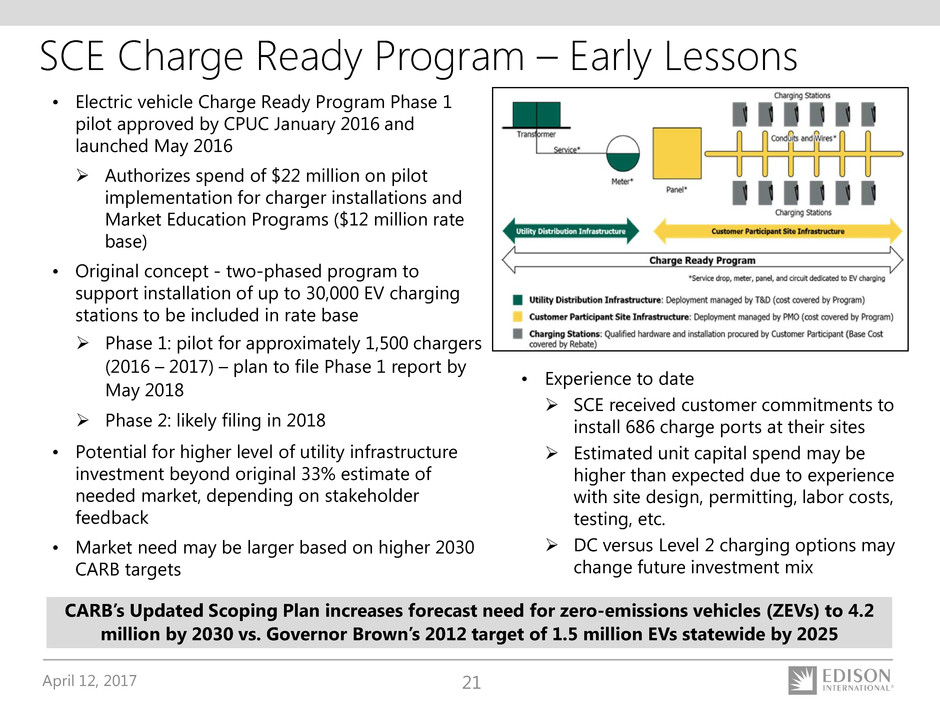

April 12, 2017 21 • Electric vehicle Charge Ready Program Phase 1 pilot approved by CPUC January 2016 and launched May 2016 Authorizes spend of $22 million on pilot implementation for charger installations and Market Education Programs ($12 million rate base) • Original concept - two-phased program to support installation of up to 30,000 EV charging stations to be included in rate base Phase 1: pilot for approximately 1,500 chargers (2016 – 2017) – plan to file Phase 1 report by May 2018 Phase 2: likely filing in 2018 • Potential for higher level of utility infrastructure investment beyond original 33% estimate of needed market, depending on stakeholder feedback • Market need may be larger based on higher 2030 CARB targets SCE Charge Ready Program – Early Lessons CARB’s Updated Scoping Plan increases forecast need for zero-emissions vehicles (ZEVs) to 4.2 million by 2030 vs. Governor Brown’s 2012 target of 1.5 million EVs statewide by 2025 • Experience to date SCE received customer commitments to install 686 charge ports at their sites Estimated unit capital spend may be higher than expected due to experience with site design, permitting, labor costs, testing, etc. DC versus Level 2 charging options may change future investment mix

April 12, 2017 22 Key Takeaways California is committed to climate change policies around GHG emissions reduction and increased air quality • Broad support from elected officials and population to continue climate change leadership • Legislative bills reflect interest in further GHG reduction commitments and expanded use of the electric grid as a key enabler SCE is uniquely positioned to help enable California’s climate policies • SCE is the only major California all-electric investor-owned utility • Integral player in enabling increased distributed energy resources and transportation electrification state goals • Supports the cap-and-trade program as a continued tool to meet policy targets SCE is already implementing the Charge Ready Program focused on long-dwell charging stations, but more work is needed to enable climate policy targets • SCE expects additional programs and expanded scope from existing programs and proposals to support current and proposed policy targets such as the transportation electrification application and Charge Ready Phase 2 • SCE long-term growth drivers include grid modernization, transmission, energy storage and transportation electrification opportunities and California may include additional electric utility roles in the future SCE is taking a leading role in developing the strategy to meet California’s GHG and criteria pollutant emissions reduction goals

April 12, 2017 23 Appendix

April 12, 2017 24 California Air Resources Board Part of the California Environmental Protection Agency; umbrella agency for SB 32 implementation; among its major goals are to provide safe, clean air to all Californians, and reduce California's emission of greenhouse gases California Public Utilities Commission Regulates privately owned electric, natural gas, telecommunications, water, railroad, rail transit, and passenger transportation companies. California Energy Commission The state's primary energy policy and planning agency; committed to reducing energy costs and environmental impacts of energy use - such as greenhouse gas emissions - while ensuring a safe, resilient, and reliable supply of energy. California Governor’s Office Under Governor Jerry Brown, California has established nation-leading targets to protect the environment and fight climate change. California State Legislature The California State Legislature introduces many energy and climate change bills and with the governor’s approval, are codified into state law. Key Organizations involved in CA’s Carbon Policy

April 12, 2017 25 SCE Transportation Electrification Approach • SCE currently supports EVs by providing a clean electric supply to fuel vehicles and a robust, modernized grid to improve reliability and quickly and easily integrate technologies that customers are adopting • Electric utilities like SCE are well suited to address barriers to EV adoption through charging infrastructure deployment, rate design, and collaboration among key stakeholders

April 12, 2017 26 For Further Information For those interested in further research into California’s carbon policies and transportation electrification initiatives most of interest to investors, the following resources are recommended: CARB Updated Scoping Plan California GHG-related Executive Orders SCE Grid Modernization White Paper SCE Transportation Electrification White Paper SCE Regulatory Highlights EIX Investor Relations Contact Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Allison Bahen, Senior Manager (626) 302-5493 allison.bahen@edisonintl.com