UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

or

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-7259

Southwest Airlines Co.

(Exact name of registrant as specified in its charter)

| | |

| Texas | | 74-1563240 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| P.O. Box 36611 | | 75235-1611 |

Dallas, Texas (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(214) 792-4000

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Stock ($1.00 par value) | | New York Stock Exchange, Inc. |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $9,550,216,553, computed by reference to the closing sale price of the common stock on the New York Stock Exchange on June 30, 2008, the last trading day of the registrant’s most recently completed second fiscal quarter.

Number of shares of common stock outstanding as of the close of business on January 28, 2009: 740,146,494 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Company’s Annual Meeting of Shareholders to be held May 20, 2009, are incorporated into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

i

PART I

Overview

Southwest Airlines Co. is a major passenger airline that provides scheduled air transportation in the United States. Based on the most recent data available from the U.S. Department of Transportation (“DOT”), Southwest is the largest air carrier in the United States, as measured by the number of originating passengers boarded and the number of scheduled domestic departures. Southwest commenced Customer Service on June 18, 1971, with three Boeing 737 aircraft serving three Texas cities — Dallas, Houston, and San Antonio. As of December 31, 2008, Southwest operated 537 Boeing 737 aircraft and provided service to 64 cities in 32 states throughout the United States. In 2008, Southwest announced that it would be commencing service to Minneapolis-St. Paul in March 2009. In addition, Southwest has received initial approval to acquire 14 take-off and landing slots at New York’s LaGuardia airport from the former ATA Airlines, Inc., which filed for bankruptcy protection in April 2008.

Southwest focuses principally on point-to-point, rather than hub-and-spoke, service, providing its markets with frequent, conveniently timed flights and low fares. As of December 31, 2008, Southwest served 438 nonstop city pairs. Historically, Southwest served predominantly short-haul routes, with high frequencies. In recent years, Southwest has complemented this service with more medium to long-haul routes, including transcontinental service.

Southwest has a low cost structure, enabling it to charge low fares. Adjusted for stage length, Southwest has lower unit costs, on average, than most major network carriers. Southwest’s low cost advantage is facilitated by reliance upon a single aircraft type, an operationally efficient route structure, and highly productive Employees.

Fuel Price Impact

Fuel prices can have a significant impact on Southwest’s profitability. During 2008, the cost of fuel fluctuated greatly, as the price of a barrel of crude oil soared from near $100 in January 2008 to almost $150 in July 2008, then plummeted to below $35 at one point during the fourth quarter of 2008. The table below shows Southwest’s average cost of jet fuel, netof hedging gains and including fuel taxes, over the past five years and during each quarter of 2008:

| | | | | | | | | |

Year | | Cost*

(Millions) | | Average

Cost

Per

Gallon* | | Percent of

Operating

Expenses* | |

2004 | | $ | 1,106 | | $ | .92 | | 18.1 | % |

2005 | | $ | 1,470 | | $ | 1.13 | | 21.4 | % |

2006 | | $ | 2,284 | | $ | 1.64 | | 28.0 | % |

2007 | | $ | 2,690 | | $ | 1.80 | | 29.7 | % |

2008 | | $ | 3,713 | | $ | 2.44 | | 35.1 | % |

First Quarter 2008 | | $ | 800 | | $ | 2.13 | | 32.8 | % |

Second Quarter 2008 | | $ | 944 | | $ | 2.42 | | 35.5 | % |

Third Quarter 2008 | | $ | 1,051 | | $ | 2.73 | | 37.5 | % |

Fourth Quarter 2008 | | $ | 918 | | $ | 2.49 | | 34.5 | % |

| * | Southwest reclassified fuel sales and excise taxes for the years 2004 through 2007 from “Other operating expenses” to “Fuel and oil expense” in order to conform to the current year presentation. Average fuel cost per gallon figures, as well as the percent of operating expenses, have also been recalculated based on the restated information. |

Volatile fuel costs, coupled with a continued domestic economic downturn, had a significant impact on Southwest and the airline industry generally during 2008. The dramatically higher fuel prices during most of the year led to significant industry-wide capacity reductions. Southwest’s fuel hedges during this time enabled it to weather fuel price increases, contributing to cash savings of almost $1.3 billion during 2008; however, the recent significant decline in fuel prices led to Southwest’s decision to significantly reduce its net fuel hedge position in place for 2009 and beyond. Southwest’s fuel hedging activities are discussed in more detail below under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Regulation

The airline industry is heavily regulated, especially by the federal government. Examples of regulations impacting Southwest and/or the industry include:

Economic and Operational Regulation

| | • | | Aviation Taxes. The statutory authority for the federal government to collect aviation |

1

| | taxes, which are used, in part, to finance the nation’s airport and air traffic control systems, and the authority of the Federal Aviation Administration (“FAA”) to expend those funds must be periodically reauthorized by the U.S. Congress. This authority was scheduled to expire on September 30, 2008. However, Congress has approved a temporary extension of this authority through March 31, 2009. Similar temporary extensions or a reauthorization for a fixed term are expected to occur in 2009. Other proposals that could be considered by Congress in connection with the FAA reauthorization legislation include: (i) the imposition of new, or changes to, aviation-specific taxes; (ii) an increase in the amount of airport passenger facility charges; and (iii) the adoption of new unfunded mandates on commercial airlines such as new environmental, consumer, and labor standards, any of which could have an impact on Southwest’s operations. |

| | • | | U.S. Department of Transportation. The DOT has significant regulatory jurisdiction over passenger airlines. To provide passenger transportation in the United States, a domestic airline is required to hold a Certificate of Public Convenience and Necessity issued by the DOT. A certificate is unlimited in duration and generally permits Southwest to operate among any points within the United States and its territories and possessions. Additional DOT authority, in the form of a certificate or exemption from certificate requirements, is required for a U.S. airline to serve foreign destinations either with its own aircraft or via codesharing with another airline. The DOT may revoke a certificate, in whole or in part, for intentional failure to comply with federal aviation statutes, regulations, orders, or the terms of the certificate itself. The DOT also has jurisdiction over certain economic and consumer protection matters such as airline codesharing, advertising, denied boarding compensation, baggage liability, and access for persons with disabilities. The DOT may impose civil penalties on air carriers for violations of its regulations in these areas. |

| | • | | Wright Amendment. The International Air Transportation Competition Act of 1979, asamended (the “IATC Act”), imposed restrictions on the provision of air transportation to and from Dallas Love Field. The applicable portion of the IATC Act, commonly known as the “Wright Amendment,” impacted Southwest’s scheduled service by prohibiting the carrying of nonstop and through passengers on commercial flights between Dallas Love Field and all states outside of Texas, with the exception of the following states (the “Wright Amendment States”): Alabama, Arkansas, Kansas, Louisiana, Mississippi, Missouri, New Mexico, and Oklahoma. In addition, the Wright Amendment only permitted an airline to offer flights between Dallas Love Field and the Wright Amendment States to the extent the airline did not offer or provide any through service or ticketing with another air carrier at Dallas Love Field and did not market service to or from Dallas Love Field and any point outside of a Wright Amendment State. In other words, a Customer could not purchase a single ticket between Dallas Love Field and any destination other than a Wright Amendment State. The Wright Amendment did not restrict flights operated with aircraft having 56 or fewer passenger seats, nor did it restrict Southwest’s intrastate Texas flights or its air service to or from points other than Dallas Love Field. |

In 2006, Southwest entered into an agreement with the City of Dallas, the City of Fort Worth, American Airlines, Inc., and the DFW International Airport Board. Pursuant to this agreement, the five parties sought enactment of legislation to amend the IATC Act. Congress responded by passing the Wright Amendment Reform Act of 2006 (the “Reform Act”). The Reform Act immediately repealed through service and ticketing restrictions, thereby allowing the purchase of a single ticket between Dallas Love Field and any U.S. destination (while still requiring the Customer to make a stop in a Wright Amendment State), and reduced the maximum number of gates available for commercial air service at Dallas Love Field from 32 to 20. Southwest currently uses 15 gates at Dallas Love Field. Pursuant to the Reform Act and local agreements with the City of Dallas with respect to gates, Southwest can expand scheduled service from

2

Dallas Love Field and currently intends to do so. The Reform Act also provides for substantial repeal of the remainder of the Wright Amendment in 2014.

Safety and Health Regulation

Southwest and its third-party maintenance providers are subject to the jurisdiction of the FAA with respect to Southwest’s aircraft maintenance and operations, including equipment, ground facilities, dispatch, communications, flight training personnel, and other matters affecting air safety. To ensure compliance with its regulations, the FAA requires airlines to obtain, and Southwest has obtained, operating, airworthiness, and other certificates. These certificates are subject to suspension or revocation for cause. In addition, pursuant to FAA regulations, Southwest has established, and the FAA has approved, Southwest’s operations specifications and a maintenance program for Southwest’s aircraft, ranging from frequent routine inspections to major overhauls. The FAA, acting through its own powers or through the appropriate U.S. Attorney, also has the power to bring proceedings for the imposition and collection of fines for violation of the Federal Aviation Regulations.

Southwest is subject to various other federal, state, and local laws and regulations relating to occupational safety and health, including Occupational Safety and Health Administration and Food and Drug Administration regulations.

Security Regulation

Following the terrorist attacks on September 11, 2001, Congress enacted the Aviation and Transportation Security Act (the “Aviation Security Act”). The Aviation Security Act established the Transportation Security Administration (the “TSA”), a division of the U.S. Department of Homeland Security that is responsible for certain civil aviation security matters. The Aviation Security Act also mandated, among other things, improved flight deck security, increased deployment of federal air marshals onboard flights, improved airport perimeter access security, airline crew security training, enhanced security screening of passengers, baggage, cargo, mail, employees, and vendors, enhanced training and qualifications of security screening personnel, additional provision of passenger data toU.S. Customs and Border Protection, and enhanced background checks. Under the Aviation Security Act, substantially all security screeners at airports are federal employees, and significant other elements of airline and airport security are overseen and performed by federal employees, including federal security managers, federal law enforcement officers, and federal air marshals.

Enhanced security measures have impacted Southwest’s business. In particular, they have had a significant impact on the airport experience for passengers. For example, in the third quarter of 2006, the TSA mandated new security measures in response to a terrorist plot uncovered by authorities in London. These rules, which primarily regulate the types of liquid items that can be carried onboard aircraft, have had a negative impact on air travel, especially on shorthaul routes and with business travelers. Although the TSA is expected to eventually lift its restrictions on liquids, Southwest is not able to predict the ongoing impact, if any, that these security changes will have on passenger revenues, both in the shortterm and the longterm, or that new restrictions will not be put in place. Southwest has made significant investments to address the impact of these types of regulations, including investments in facilities, equipment, and technology to process Customers efficiently and restore the airport experience. Southwest’s Automated Boarding Passes and self service kiosks have reduced the number of lines in which a Customer must wait and, during 2008, Southwest introduced priority security lane access for its Business Select and Rapid Reward A-List Customers at select airports. In addition, Southwest’s gate readers at all of its airports have improved the boarding reconciliation process. Southwest also offers baggage checkin through self service kiosks at certain airport locations, as well as Internet checkin and transfer boarding passes at the time of checkin.

Enhanced security measures have also impacted Southwest’s business through the imposition of security fees on Southwest’s Customers and on Southwest. Under the Aviation Security Act, funding for passenger security is provided in part by a $2.50 per enplanement security fee, subject to a maximum of $5.00 per one-way trip. The Aviation Security Act also allows the TSA to assess an Aviation Security Infrastructure Fee (“ASIF”) on each airline. Southwest’s ASIF liability was originally set at $24

3

million per year. Effective in 2005, the TSA unilaterally increased the amount to $50 million. Southwest and 22 other airlines are joined in litigation presently pending in the U.S. Court of Appeals against the TSA to challenge that increase, and a ruling is expected during 2009.

Environmental Regulation

The Airport Noise and Capacity Act of 1990 gives airport operators the right, under certain circumstances, to implement local noise abatement programs, so long as they do not unreasonably interfere with interstate or foreign commerce or the national air transportation system. Some airports have established airport restrictions to limit noise, including restrictions on aircraft types to be used, and limits on the number of hourly or daily operations or the time of operations. These types of restrictions can cause curtailments in service or increases in operating costs and could limit the ability of Southwest to expand its operations at the affected airports.

Southwest is subject to various other federal, state, and local laws and regulations relating to the protection of the environment, including the discharge or disposal of materials such as chemicals, hazardous waste, and aircraft deicing fluid. Further regulatory developments pertaining to such things as control of engine exhaust emissions from ground support equipment and prevention of leaks from underground aircraft fueling systems could increase operating costs in the airline industry. Southwest does not believe, however, that presently pending environmental regulatory developments will have a material impact on Southwest’s capital expenditures or otherwise adversely affect its operations, operating costs, or competitive position. However, legislation has been introduced in the U.S. Congress to regulate so-called “green house gas emissions.” The legislation could impose additional costs or restrictions on all transportation-related activities, the impact of which is presently unpredictable. Additionally, in conjunction with airport authorities, other airlines, and state and local environmental regulatory agencies, Southwest, as a normal course of business, undertakes voluntary investigation or remediation of soil or groundwater contamination at several airport sites. Southwest does not believe that any environmental liability associated with these airport sites will have a material adverse effect on Southwest’s operations, costs, or profitability, norhas it experienced any such liability in the past that has had a material adverse effect on its operations, costs, or profitability.

Southwest has appointed a “Green Team” to target areas of environmental improvement in all aspects of Southwest’s business, while at the same time remaining true to Southwest’s low cost philosophy. As part of this initiative, during 2008, Southwest published an Environmental Report describing Southwest’s strategies to reduce greenhouse gas emissions and addressing other environmental matters such as waste management and recycling.

Regulation of Customer Service Practices

From time to time, the airline industry has been faced with possible legislation dealing with certain Customer Service practices. As a compromise with Congress, the industry, working with the Air Transport Association, has responded by adopting and filing with the DOT written plans disclosing commitments to improve performance. Southwest Airlines’ Customer Service Commitment is a comprehensive plan that embodies the Mission Statement of Southwest Airlines: dedication to the highest quality of Customer Service delivered with a sense of warmth, friendliness, individual pride, and Southwest Spirit. The Customer Service Commitment can be reviewed by clicking on “About Southwest” atwww.southwest.com. The DOT and Congress monitor the industry’s plans, and there can be no assurance that legislation or regulations will not be proposed in the future to regulate airline Customer Service practices.

Operating Strategies and Marketing

During 2008, Southwest continued to implement and promote initiatives designed to enhance Customer Service and improve future revenues. Southwest’s general operating strategies and specific offerings and related initiatives are discussed below.

General Operating Strategies

Southwest focuses principally on point-to-point service, rather than the hub-and-spoke service provided by most major U.S. airlines. The “hub-and-spoke” system concentrates most of an airline’s operations at a limited number of hub cities and serves most other destinations in the system by

4

providing one-stop or connecting service through the hub. Point-to-point service allows for more direct nonstop routing than the hub and spoke system, minimizing connections, delays, and total trip time. As a result, approximately 78 percent of Southwest’s Customers fly nonstop. Southwest’s average aircraft trip stage length in 2008 was 636 miles with an average duration of approximately 1.8 hours, as compared to an average aircraft trip stage length of 629 miles and an average duration of approximately 1.8 hours in 2007. Point-to-point service also enables Southwest to provide its markets with frequent, conveniently timed flights and low fares. Examples of markets offering frequent daily flights are: Dallas Love Field to Houston Hobby, 30 weekday roundtrips; Phoenix to Las Vegas, 17 weekday roundtrips; and Los Angeles International to Oakland, 18 weekday roundtrips. Southwest complements these high-frequency shorthaul routes with longhaul nonstop service between markets such as Phoenix and Tampa Bay, Las Vegas and Orlando, Nashville and Oakland, and San Diego and Baltimore. During 2008, Southwest’s schedule optimization capabilities allowed it to reduce flight frequency on less profitable routes and reallocate capacity to potentially more rewarding markets.

Southwest serves many conveniently located secondary or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Baltimore-Washington International, Burbank, Manchester, Oakland, San Jose, Providence, Ft. Lauderdale/Hollywood, and Long Island Islip airports, which are typically less congested than other airlines’ hub airports. This operating strategy enables Southwest to achieve high asset utilization because aircraft can be scheduled to minimize the amount of time they are on the ground. This in turn reduces the number of aircraft and gate facilities that would otherwise be required. Southwest is also able to simplify scheduling, maintenance, flight operations, and training activities by operating only one aircraft type, the Boeing 737. All of these strategies enhance Southwest’s ability to sustain high Employee productivity and reliable ontime performance.

Fare Structure and No Hidden Fees Marketing Campaign

Southwest employs a relatively simple fare structure, featuring low, unrestricted, unlimited, everyday coach fares, as well as even lower faresavailable on a restricted basis. As of January 13, 2009, Southwest’s highest non-codeshare, one-way unrestricted walkup fare offered was $503 for its longest flights. Substantially lower walkup fares are generally available on Southwest’s short and medium haul flights. Since November 2007, Southwest’s fares have been bundled into three major fare columns: “Business Select,” “Anytime,” and “Wanna Get Away,” with the goal of making it easier for Customers to choose the fare they want. Southwest’s “Business Select” offering was developed to increase options and improve productivity for the business traveler. Customers who purchase the Business Select fare are allowed to be among the first Customers to board the aircraft. They also receive extra Rapid Rewards frequent flyer credit for the flight and a free drink. Southwest’s “Business Select” program contributed approximately $73 million in revenues during 2008.

During 2008, in response to skyrocketing fuel prices, virtually all other U.S. airlines began charging additional fees for items such as first or second checked bags, seat selection, fuel surcharges, snacks, curb-side checkin, and telephone reservations. In response, Southwest adopted a No Hidden Fees marketing campaign to highlight Southwest’s prioritization of high value Customer Service. As part of the campaign, Southwest launched radio, print, television, and billboard advertisements to promote Southwest’s point of differentiation.

Enhanced Boarding Method and Updated Gate Design and Priority Security Lane

During fourth quarter 2007, Southwest introduced an enhanced boarding method, which was designed to significantly reduce the time a Customer spends standing in line at the gate. The enhanced boarding process automatically reserves a place for a Customer in the Customer’s boarding group at the time of check-in by assigning a specific position number within the A, B, or C boarding group. Customers then board the aircraft in that numerical order. The enhanced boarding method also allows for future enhancements, such as product customization and additional incentives for business and leisure travelers.

During 2008, Southwest completed modification of substantially all of its gate areas with columns and signage that facilitate the new boarding process. The “extreme gate makeover” was also designed to

5

improve the airport experience for all of Southwest’s Customers by including (i) a business focused area with padded seats, tables with power outlets, power stations with stools, and a flat screen television for news programming; and (ii) a family area with smaller tables and chairs, “kid friendly” programming on a flat screen television, and power stations for charging electrical devices. In addition, during 2008, Southwest introduced priority security lane access for its Business Select and Rapid Reward A-List Customers at select airports.

Rapid Rewards Frequent Flyer Program

Southwest’s frequent flyer program, Rapid Rewards, is based on trips flown rather than mileage. Rapid Rewards Customers earn a credit for each one-way trip flown or two credits for each roundtrip flown. Rapid Rewards Customers can also earn credits by using the services of non-airline partners, which include car rental agencies, hotels, and credit card partners, including Southwest Airlines Rapid Rewards Visa Card®. During 2008, Southwest introduced a new dining program for Rapid Rewards Members that enables them to earn Rapid Rewards credits when dining at more than 9,000 restaurants, bars, and clubs across the United States and Canada.

Rapid Rewards offers different types of travel award opportunities (“Award Tickets”). Rapid Rewards Members who accumulate 16 credits within 24 consecutive months are awarded a Standard Award, which is valid for one free roundtrip award to any destination available on Southwest. Rapid Rewards Members who fly at least 32 qualifying one-way flights within a 12-month period also receive reserved boarding privileges for an entire year. When these Customers purchase travel at least 36 hours prior to flight time, they receive the best boarding pass number available (generally, an “A” boarding pass). Customers on this “A-List” are also automatically checked in for their flight in advance of departure. Southwest also offers a “Freedom Award,” which allows Rapid Rewards Members the opportunity to convert two Standard Awards into a Freedom Award, which is free of seat restrictions except for a limited number of “Black-out” dates around major holidays. Southwest also offers a Rapid Rewards Companion Pass, which is granted for accumulating 100 credits within a consecutive twelve-month period. The Companion Pass offers unlimited free roundtrip travel, to any destinationavailable on Southwest, for a designated companion of the qualifying Rapid Rewards Member. For the designated companion to use this pass, the Rapid Rewards Member must purchase a ticket or use a Standard Award. Additionally, the Rapid Rewards Member and designated companion must travel together on the same flight. Standard Awards and Companion Passes are automatically generated when earned by the Customer rather than allowing the Customer to bank credits indefinitely. Award Tickets are valid for 12 months after issuance and are subject to seat restrictions. Companion Passes have no seat restrictions or “Black out” dates.

Southwest also sells credits to business partners, including credit card companies, hotels, and car rental agencies. These credits may be redeemed for Award Tickets having the same program characteristics as those earned by flying.

Customers redeemed approximately 2.8 million, 2.8 million, and 2.7 million, Award Tickets during 2008, 2007, and 2006, respectively. The amount of free travel award usage as a percentage of total Southwest revenue passengers carried was 6.4 percent in 2008, 6.2 percent in 2007, and 6.4 percent in 2006. The number of fully earned Award Tickets and partially earned awards outstanding at December 31, 2008 was approximately 10.4 million, of which approximately 78 percent were partially earned awards. The number of fully earned Award Tickets and partially earned awards outstanding at December 31, 2007 was approximately 11.6 million, of which approximately 81 percent were partially earned awards. However, due to the expected expiration of a portion of credits making up partial awards, not all of them will eventually turn into useable Award Tickets. In addition, not all Award Tickets will be redeemed for future travel. Since the inception of Rapid Rewards in 1987, approximately 16 percent of all fully earned Award Tickets have expired without being used. The number of Companion Passes outstanding at December 31, 2008 and 2007 was approximately 67,000 and 65,000, respectively. Southwest currently estimates that an average of three to four trips will be redeemed per outstanding Companion Pass.

Southwest accounts for its Rapid Rewards program obligations by recording, at the time an award is earned, a liability for the estimated incremental cost of the use of flight awards Southwest expects to be redeemed. The estimated

6

incremental cost includes direct passenger costs such as fuel, food, and other operational costs, but does not include any contribution to overhead or profit. Revenue from the sale of credits to business partners and associated with future travel is deferred and recognized when the ultimate free travel award is flown or the credits expire unused. The liability for free travel awards earned but not used at December 31, 2008 and 2007 was not material to Southwest’s business.

Cashless Cabin

During 2008, Southwest introduced “Cashless Cabin” for the purchase of food and beverages without cash. All Southwest aircraft are now equipped with handheld devices that enable Flight Attendants to accept credit and debit cards onboard the aircraft, and cash is no longer accepted. Cashless Cabin is intended to enhance Customer Service by appealing to the increasing number of Customers traveling without cash and increasing efficiencies. In addition, it allows for ancillary revenues through an increased offering of food and beverage services.

Southwest.com; GDS Participation and Corporate Travel Account Efforts

Southwest was the first major airline to introduce a Ticketless travel option, eliminating the need to print and then process a paper ticket altogether, and the first to offer Ticketless travel through Southwest’s web site atwww.southwest.com. For the year ended December 31, 2008, more than 89 percent of Southwest’s Customers chose the Ticketless travel option, and nearly 78 percent of Southwest’s passenger revenues came through its web site (including SWABiz revenues), which has become a vital part of Southwest’s distribution strategy.

Southwest continues to explore selling tickets through channels in addition to its own reservation system, web site, and the Sabre System and is also continuing its efforts to provide travel agent and professional travel manager partners with increased and cost effective access to its fares and inventory. Southwest is party to an agreement with Travelport’s Galileo, which includes Worldspan, another of Travelport’s global distribution systems, pursuant to which Southwest intends that all of its published fares and inventory, with the exception of Southwest’s exclusive web fares, will eventually beavailable to Galileo-connected travel agencies in North America.

RNP

In support of the FAA’s Roadmap for Performance-Based Navigation, Southwest has made a commitment to invest $175 million over the next several years to implement Required Navigation Performance (“RNP”) procedures at the airports it serves. RNP is one of the cornerstones for the FAA’s Next Generation Air Traffic Control System and combines GPS (Global Positioning System), the capabilities of advanced aircraft avionics, and new flight procedures for the purpose of achieving safer, more efficient, and environmentally friendly flight operations. RNP procedures are designed to reduce fuel consumption, improve safety, and minimize emissions and noise, while simultaneously taking advantage of the high-performance characteristics that exist in an airline’s fleet. Southwest, the FAA, and an aviation consulting firm have been working together to gain Air Traffic Control support of RNP to train Southwest’s pilots on RNP, equip Southwest’s entire fleet to be RNP capable, and produce RNP charted procedures. In January 2009, Southwest activated autothrottles and VNAV (vertical navigation) on its aircraft for the first time in Southwest history, representing the first step in Southwest’s automation transformation. VNAV is also expected to provide more nearterm benefits such as significant savings in fuel costs and reductions in fuel emissions.

Codesharing

In 2008, Southwest announced its intention to enter into codeshare relationships with two different airlines — Canadian carrier WestJet and Mexican carrier Volaris. The Company and WestJet currently intend to announce codeshare flight schedules and additional features regarding the relationship by late 2009. The Company and Volaris currently intend to announce codeshare flight schedules and additional features regarding the relationship by early 2010. Certain details of these alliances are subject to approvals by both the U.S. and Canadian/Mexican governments. The Company is also continuing to consider codeshare opportunities with other carriers, both domestic and international. Southwest originally implemented codesharing in domestic operations in 2005 with ATA Airlines. Southwest’s codeshare arrangement with ATA terminated during 2008 as a result of ATA’s bankruptcy.

7

Management Information Systems

Southwest continues to invest in technology to support its initiatives and its ongoing operations. During 2008, Southwest implemented a system to replace its point of sale application in the stations and its refunds system in the back office. Additionally, Southwest has purchased technology that will replace its ticketless system and revenue accounting system. The new systems are designed to, among other things, enhance data flow and thereby increase Southwest’s operational efficiencies and Customer Service capabilities. Southwest is also working to replace its back office accounting systems, payroll system, and human resource information system, with a goal of completion sometime in late 2009 or early 2010.

Competition

The airline industry is highly competitive. Southwest believes the principal competitive factors in the industry are:

| | • | | Frequency and convenience of scheduling; |

| | • | | Frequent flyer benefits; and |

| | • | | Efficiency and productivity, including effective selection and use of aircraft. |

Southwest currently competes with other airlines on almost all of its routes. Some of these airlines have larger fleets than Southwest and some may have wider name recognition in certain markets. In addition, some major U.S. airlines have established extensive marketing or codesharing alliances. These alliances enable these carriers to expand their destinations and marketing opportunities. Airlines that do not fly exclusively domestically are less exposed to domestic economic conditions and may be able to offset less profitable domestic fares with more profitable international fares. As discussed above, Southwest continues to address this competitive factor through its international codeshare efforts.

Southwest is also subject to varying degrees of competition from surface transportation and may have more exposure to this form of competition than airlines with longer average stage lengths. Surfacecompetition can be more significant during economic downturns when consumers cut back on discretionary spending.

The competitive landscape for airlines continues to change. Following the terrorist attacks on September 11, 2001, the airline industry as a whole incurred substantial losses through 2005. Many carriers reduced capacity, grounded their most inefficient aircraft, cut back on unprofitable service, and furloughed employees. Significant increases in the cost of fuel through most of 2008 have continued to exacerbate industry challenges. As discussed above, during 2008, many carriers reduced capacity to cope with the spike in fuel costs. In addition, a number of carriers have sought relief from financial obligations in bankruptcy. During 2008 alone, the following airlines filed for bankruptcy: Frontier Airlines, Inc., Aloha Airlines, ATA Airlines, Skybus Airlines Inc., Eos Airlines, Inc., and Champion Air. All but Frontier also discontinued operations. Other airlines that have filed and emerged from bankruptcy in recent years include UAL Corporation, the parent of United Airlines, US Airways, Northwest Airlines Corporation, the parent of Northwest Airlines, and Delta Air Lines. In some cases, this has led to industry consolidation. For example, US Airways and America West Airlines merged in September 2005, and Delta and Northwest merged in 2008. Reorganization in bankruptcy, and even the threat of bankruptcy, has allowed carriers to decrease operating costs through renegotiated labor, supply, and financing contracts. As a result, differentials in cost structures between traditional hub-and-spoke carriers and low cost carriers have significantly diminished. In addition, distressed carriers may price for cash flow to remain in business, which can cause a reduction in pricing in the industry generally. Southwest has nonetheless continued to maintain its cost advantage, improve Employee productivity, and provide outstanding Service to its Customers. Southwest cannot, however, predict the timing or extent of any further airline bankruptcies or consolidation or their impact (either positive or negative) on Southwest’s operations or results of operations.

Insurance

Southwest carries insurance of types customary in the airline industry and at amounts deemed adequate to protect Southwest and its property and to comply both with federal regulations and certain of Southwest’s credit and lease agreements. The policies principally provide coverage for public and

8

passenger liability, property damage, cargo and baggage liability, loss or damage to aircraft, engines, and spare parts, and workers’ compensation.

Following the terrorist attacks of September 11, 2001, commercial aviation insurers significantly increased the premiums and reduced the amount of war-risk coverage available to commercial carriers. Through the 2003 Emergency Wartime Supplemental Appropriations Act, the federal government has continued to provide supplemental, first-party, war-risk insurance coverage to commercial carriers for renewable 60-day periods, at substantially lower premiums than prevailing commercial rates and for levels of coverage not available in the commercial market. The government-provided supplemental coverage from the Wartime Act is currently set to expire on March 31, 2009. Although another extension beyond this date is expected, if such coverage is notextended by the government, Southwest could incur substantially higher insurance costs or unavailability of adequate coverage in future periods.

Seasonality

Southwest’s business is somewhat seasonal. Quarterly operating income and, to a lesser extent, revenues have historically tended to be lower in the first quarter (January 1 — March 31) and fourth quarter (October 1 — December 31).

Employees

At December 31, 2008, Southwest had 35,499 active fulltime equivalent Employees, consisting of 15,483 flight, 2,528 maintenance, 12,365 ground, Customer, and fleet service, and 5,123 management, accounting, marketing, and clerical personnel.

The Railway Labor Act (“RLA”) establishes the right of airline employees to organize and bargain collectively. As of December 31, 2008, approximately 77 percent of Southwest’s employees were represented by labor unions, all of which are under ten different collective-bargaining agreements. Under the RLA, collective-bargaining agreements between an airline and a labor union generally do not expire, but instead becomes amendable as of an agreed date. By the amendable date, if either party wishes to modify the terms of the agreement, it must notify the other party in the manner required by the RLA and/or described in the agreement. After receipt of such notice, the parties must meet for direct negotiations. If no agreement is reached, either party may request the National Mediation Board (the “NMB”) to appoint a federal mediator. If no agreement is reached in mediation, the NMB may determine that an impasse exists and offer binding arbitration to the parties. If either party rejects binding arbitration, a 30-day “cooling off ” period begins. At the end of this 30-day period, the parties may engage in “self-help,” unless a Presidential Emergency Board (“PEB”) is established to investigate and report on the dispute. The appointment of a PEB maintains the “status quo” for an additional 60 days. If the parties do not reach agreement during this period, the parties may then engage in “self-help.” “Self-help” includes, among other things, a strike by the union or the airline’s imposition of any or all of its proposed amendments and the hiring of new employees to replace any striking workers. The following table sets forth Southwest’s Employee groups and status of the collective bargaining agreements:

| | | | |

Employee Group | | Representatives | | Status of Agreement |

Pilots | | Southwest Airlines Pilots’ Association (“SWAPA”) | | Currently in negotiations |

Flight Attendants | | Transportation Workers of America, AFL-CIO (“TWU 556”) | | Currently in negotiations |

Ramp, Operations, Provisioning, Freight Agents | | Transportation Workers of America, AFL-CIO, Local 555 (“TWU 555”) | | Currently in mediation |

Customer Service Agents, Reservations Agents | | International Association of Machinists and Aerospace Workers, AFL-CIO (“IAM”) | | Currently in negotiations |

Stock Clerks | | International Brotherhood of Teamsters, Local 19 (“IBT Local 19”) | | Currently in negotiations |

Mechanics | | Aircraft Mechanics Fraternal Association (“AMFA”) | | Agreement (ratified January 29, 2009) Amendable August 2012 |

Aircraft Appearance Technicians | | AMFA | | Amendable February 2009 |

9

| | | | |

Employee Group | | Representatives | | Status of Agreement |

Dispatchers | | Transportation Workers of America, AFL-CIO, Local 550 (“TWU 550”) | | Amendable November 2009 |

Flight Simulator Technicians | | International Brotherhood of Teamsters (“IBT”) | | Amendable October 2011 |

Flight Crew Training Instructors | | Southwest Airlines Professional Instructor’s Association (“SWAPIA”) | | Amendable December 2012 |

Additional Information About Southwest

Southwest was incorporated in Texas in 1967. The following documents are available free of charge through Southwest’s website,www.southwest.com:Southwest’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports that are filed with or furnished to the Securities and Exchange Commission (“SEC”) pursuant to Sections 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. These materials are made available through Southwest’s website as soon as reasonablypracticable after they are electronically filed with, or furnished to, the SEC.

The certifications of Southwest’s Chief Executive Officer and Chief Financial Officer required under Section 302 of the Sarbanes-Oxley Act have been filed as Exhibits 31.1 and 31.2 to this report. Additionally, in 2008 Southwest’s Chief Executive Officer certified to the New York Stock Exchange (“NYSE”) that he was not aware of any violation by Southwest of the NYSE’s corporate governance listing standards.

DISCLOSURE REGARDING FORWARD-LOOKING INFORMATION

Some statements in this Form 10-K (or otherwise made by Southwest or on Southwest’s behalf from time to time in other reports, filings with the SEC, news releases, conferences, Internet postings, or otherwise) that are not historical facts may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on, and include statements about, Southwest’s estimates, expectations, beliefs, intentions, or strategies for the future, and the assumptions underlying these forward-looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” and similar expressions. While management believes that these forward-looking statements are reasonable as and when made, forward-looking statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed in or indicated by Southwest’s forward-looking statements or from historical experience or Southwest’s present expectations. Factors that could cause these differences include, but are not limited to, those set forth below under “Risk Factors.”

Caution should be taken not to place undue reliance on Southwest’s forward-looking statements, which represent Southwest’s views only as of the date this report is filed. Southwest undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Southwest’s business is heavily impacted by the price and availability of aircraft fuel. Continued volatility in fuel costs and/or significant disruptions in the supply of fuel could adversely affect Southwest’s results of operations.

Airlines are inherently dependent upon energy to operate and can therefore be significantly impactedby changes in the prices of jet fuel. The cost of jet fuel, which generally has been at historically high levels over the last three years, is largely unpredictable, as is evidenced by the recent plunge in market jet fuel prices. Even a small change in fuel prices, with no other changes, can drive profitability sharply in one direction or the other. Jet fuel and oil consumed for fiscal 2008 and 2007 represented approximately 35 percent and 30 percent of

10

Southwest’s operating expenses, respectively, and, for 2008, constituted the largest expense incurred by Southwest. As a result, fuel costs have factored significantly into Southwest’s growth decisions.

Fuel availability can also affect fuel prices and is impacted by political and economic factors beyond Southwest’s control. Therefore, although Southwest does not currently anticipate a significant reduction in fuel availability, future availability is difficult to predict. Fuel availability can be impacted by factors such as dependency on foreign imports of crude oil and the potential for hostilities or other conflicts in oil producing areas, limited refining capacity, and the possibility of changes in governmental policies on jet fuel production, transportation, and marketing. Significant disruptions in the supply of jet fuel could adversely affect Southwest’s results of operations.

Southwest’s profitability is impacted in part by its ability to adjust fares in reaction to fuel price volatility. Southwest’s ability to increase fares can be limited by factors such as Southwest’s low fares reputation, the percentage of its Customer base that purchases travel for leisure purposes, and the competitive nature of the airline industry generally. Fare increases are even more difficult to achieve in uncertain economic environments, as low fares are often used to stimulate demand. Additionally, Southwest has historically entered into fuel derivative contracts to protect against rising fuel costs. These contracts produced cash settlement gains of $1.3 billion (on a cash basis, before profitsharing and income taxes) for the full year 2008. In response to the recent drop in energy prices, Southwest significantly reduced its net fuel hedge position in place for 2009 and beyond and is therefore less protected against future increases.

Changes in Southwest’s overall fuel hedging strategy, the ability of the commodities used in fuel hedging (principally crude oil, heating oil, and unleaded gasoline) to qualify for special hedge accounting, and the effectiveness of Southwest’s fuel hedges pursuant to highly complex accounting rules, are all significant factors impacting Southwest’s results of operations. Southwest’s fuel hedging arrangements are discussed in more detail under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 10 to the Consolidated Financial Statements.

The airline industry is particularly sensitive to changes in economic condition; continued negative economic conditions would likely continue to negatively impact Southwest’s results of operations and its ability to obtain financing on acceptable terms.

Southwest’s operations and the airline industry in general are particularly sensitive to changes in economic conditions. Unfavorable general economic conditions, such as higher unemployment rates, a constrained credit market, housing-related pressures, and increased business operating costs can reduce spending for both leisure and business travel. Unfavorable economic conditions can also impact Southwest’s ability to raise fares to counteract increased fuel, labor, and other costs. Demand for air travel waned during the fourth quarter of 2008, which Southwest believes can be primarily attributed to the crisis experienced in worldwide credit markets and the domestic recessionary environment that became evident during the year. Therefore, a continued economic recessionary environment would likely continue to negatively impact Southwest’s results of operations. Southwest continues to be cautious of current domestic economic conditions, as recessionary fears have continued to proliferate.

Factors such as continued unfavorable economic conditions, a significant decline in demand for air travel, or continued instability of the credit and capital markets could result in future pressure on credit ratings, which could trigger credit rating provisions in Southwest’s credit card transaction processing agreements, outstanding debt agreements, and some hedging counterparty agreements (as discussed in more detail in “Item 7A. Quantitative and Qualitative Disclosures About Market Risk”). These factors could also negatively impact (a) Southwest’s ability to obtain financing on acceptable terms, (b) Southwest’s liquidity generally, and (c) the availability and cost of insurance.

Southwest’s business is labor intensive; Southwest could be adversely affected if it were unable to maintain satisfactory relations with its Employees or its Employees’ Representatives.

While the airline business is labor intensive and the Company’s results are subject to variations in labor-related job actions, Southwest has historically maintained positive relationships with its Employees and its Employee’s Representatives. Salaries, wages,

11

and benefits represented 32 percent of the Company’s operating expenses for the year ended December 31, 2008. In addition, as of December 31, 2008, approximately 77 percent of the Company’s Employees were represented for collective bargaining purposes by labor unions. As discussed above in “Item 1. Business – Employees,” the Company is currently in discussions with several Employee Representatives. Employment-related issues that may impact the Company’s results of operations, some of which are negotiated items, include hiring/retention rates, pay rates, outsourcing costs, work rules, and health care costs.

Southwest’s inability to timely and effectively implement its revenue initiatives could adversely affect its results of operations.

Southwest has implemented and intends to continue to implement revenue initiatives that are designed to help offset increasing costs and improve Customer Service. The timely and effective implementation of these initiatives has involved, and will continue to involve, significant investments by the Company of time and money and could be impacted by (i) Southwest’s ability to timely and effectively implement, transition, and maintain related information technology systems and infrastructure; (ii) the timing of Southwest’s investment of incremental operating expenses and capital expenditures for these purposes, while balancing the need to effectively control operating expenses; and (iii) Southwest’s dependence on third parties to assist with implementation. Because Southwest has limited experience with some of its strategic initiatives, it cannot ensure the timing of their implementation or that they will be successful or profitable either over the short or long term.

Southwest is increasingly reliant on technology to operate its business and continues to implement substantial changes to its information systems; any failure or disruption in Southwest’s information systems could adversely impact the Company’s operations.

Southwest’s operations have become increasingly dependant on the use of sophisticated technology and systems, including those used for its point of sale, ticketing, revenue accounting, payroll, and financial reporting areas. Systems and technology are also crucial to the timely and effective implementation of Southwest’s revenue initiatives.As discussed above under “Business – Operating Strategies and Marketing – Management Information Systems,” Southwest has multiple technology projects underway, many of which are reliant upon third party performance for timely and effective completion. Any issues with transitioning to upgraded or replacement systems, or any material failure, inadequacy, interruption, or security failure of these systems, could materially impact Southwest’s ability to effectively operate its business.

The airline industry is affected by many conditions that are beyond its control.

Southwest’s business and the airline industry in general are also impacted by other conditions that are largely outside of Southwest’s control, including, among others:

| | • | | Actual or threatened war, terrorist attacks, and political instability; |

| | • | | Changes in consumer preferences, perceptions, spending patterns, or demographic trends; |

| | • | | Actual or potential disruptions in the air traffic control system; |

| | • | | Increases in costs of safety, security, and environmental measures; and |

| | • | | Weather and natural disasters. |

Because expenses of a flight do not vary significantly with the number of passengers carried, a relatively small change in the number of passengers can have a disproportionate effect on an airline’s operating and financial results. Therefore, any general reduction in airline passenger traffic as a result of any of these factors could adversely affect Southwest’s results of operations. In addition, when the airline industry shrinks, as it did during 2008, airport operating costs are essentially unchanged and must be shared by the remaining operating carriers, which can therefore increase Southwest’s costs.

The airline industry faces on-going security concerns and related cost burdens; further threatened or actual terrorist attacks, or other hostilities, could significantly harm the Company’s industry and its business.

The attacks of September 11, 2001, and resulting aftermath materially impacted air travel and

12

the results of operations for Southwest and the airline industry generally. The Department of Homeland Security and the TSA have implemented numerous security measures that affect airline operations and costs. Substantially all security screeners at airports are now federal employees, and significant other elements of airline and airport security are now overseen and performed by federal employees, including federal security managers, federal law enforcement officers, and federal air marshals. Enhanced security procedures, including enhanced security screening of passengers, baggage, cargo, mail, employees, and vendors, introduced at airports since the terrorist attacks of September 11 have increased costs to airlines and have from time to time impacted demand for air travel.

Additional terrorist attacks, even if not made directly on the airline industry, or the fear of such attacks or other hostilities (including elevated national threat warnings or selective cancellation or redirection of flights due to terror threats) could have a further significant negative impact on Southwest and the airline industry. Additional international hostilities could potentially have a material adverse impact on the Company’s results of operations.

Airport capacity constraints and air traffic control inefficiencies could limit the Company’s growth; changes in or additional governmental regulation could increase the Company’s operating costs or otherwise limit the Company’s ability to conduct business.

Almost all commercial service airports are owned and/or operated by units of local or state government. Airlines are largely dependent on these governmental entities to provide adequate airport facilities and capacity at an affordable cost. Similarly, the federal government singularly controls all U.S. airspace, and airlines are completely dependent on the FAA to operate that airspace in a safe, efficient, and affordable manner. As discussed above under “Business — Regulation,” airlines are also subject to other extensive regulatory requirements. These requirements often impose substantial costs on airlines. The Company’s results of operations may be affected by changes in law and future actions taken by governmental agencies having jurisdiction over its operations, including, but not limited to:

| | • | | Increases in airport rates and charges; |

| | • | | Limitations on airport gate capacity or other use of airport facilities; |

| | • | | Changes in the law that affect the services that can be offered by airlines in particular markets and at particular airports; |

| | • | | Restrictions on competitive practices; |

| | • | | The adoption of statutes or regulations that impact customer service standards, including security standards; and |

| | • | | The adoption of more restrictive locally-imposed noise regulations. |

The airline industry is intensely competitive.

As discussed in more detail above under “Business — Competition,��� the airline industry is extremely competitive. Southwest’s competitors include other major domestic airlines, as well as regional and new entrant airlines, and other forms of transportation, including rail and private automobiles. Southwest’s revenues are sensitive to the actions of other carriers in capacity, pricing, scheduling, codesharing, and promotions.

Southwest’s low cost structure is one of its primary competitive advantages, and many factors could affect the Company’s ability to control its costs.

Southwest’s low cost structure has historically been one of its primary competitive advantages; however, it has limited control over many of its fixed costs. For example, Southwest’s ability to adjust compensation and benefit costs is limited by the terms of its collective bargaining agreements. Other factors that can impact Southwest’s ability to control costs include the price and availability of jet fuel, aircraft airframe or engine repairs, regulatory requirements, and ability to access capital or financing at competitive rates. Given, in particular, the recent volatility in fuel prices and the number of pending labor negotiations, Southwest cannot guarantee that it will be able to maintain its current level of low cost advantage. In addition, a key contributor to Southwest’s low cost structure is its use of a single aircraft type, the Boeing 737. Although Southwest is able to purchase some of these aircraft from parties other than Boeing, most of its purchases are direct from Boeing. Therefore, if

13

Southwest were unable to acquire additional aircraft from Boeing, or Boeing were unable or unwilling to provide adequate support for its products, Southwest’s operations could be adversely impacted. In addition, Southwest’s dependence on a single aircraft type could result in downtime for part or all of its fleet if mechanical or regulatory issues relating to the Boeing 737 aircraft type were to arise. However, given the Company’s years of experience with the Boeing 737 aircraft type and its longterm relationship with Boeing, the Company believes the advantages of operating a single fleet type outweigh the risks of its single aircraft strategy.

As discussed above under “Item 1. Business-Insurance,” Southwest carries insurance of types customary in the airline industry and is also provided supplemental, first-party, war-risk insurance coverage by the federal government at substantially lower premiums than prevailing commercial rates. If the supplemental coverage is not extended,Southwest could incur substantially higher insurance costs. In addition, in the event of an accident involving Southwest aircraft, Southwest could be responsible for costs in excess of its related insurance coverage, which costs could be substantial. Any aircraft accident, even if fully insured, could also have a material adverse effect on the public’s perception of Southwest.

| Item 1B. Unresolved | Staff Comments |

None.

Aircraft

Southwest operated a total of 537 Boeing 737 aircraft as of December 31, 2008, of which 82 and 9 were under operating and capital leases, respectively. The remaining 446 aircraft were owned.

The following table details information on the 537 aircraft in the Company’s fleet as of December 31, 2008:

| | | | | | | | | | |

737 Type | | Seats | | Average Age

(Yrs) | | Number of

Aircraft | | Number

Owned | | Number

Leased |

-300 | | 137 | | 17.4 | | 185 | | 112 | | 73 |

-500 | | 122 | | 17.7 | | 25 | | 16 | | 9 |

-700 | | 137 | | 5.3 | | 327 | | 318 | | 9 |

| | | | | | | | | | |

Totals | | | | 10.1 | | 537 | | 446 | | 91 |

| | | | | | | | | | |

In total, at January 22, 2009, the Company had firm orders, options and purchase rights for the purchase of Boeing 737 aircraft as follows:

Firm Orders, Options and Purchase Rights for Boeing 737-700 Aircraft

| | | | | | | | |

| | | The Boeing Company | | |

Delivery Year | | Firm Orders | | Options | | Purchase Rights | | Total |

2009 | | 13 | | — | | — | | 13 |

2010 | | 10 | | — | | — | | 10 |

2011 | | 10 | | 10 | | — | | 20 |

2012 | | 13 | | 10 | | — | | 23 |

2013 | | 19 | | 4 | | — | | 23 |

2014 | | 13 | | 7 | | — | | 20 |

2015 | | 14 | | 3 | | — | | 17 |

2016 | | 12 | | 11 | | — | | 23 |

2017 | | — | | 17 | | — | | 17 |

Through 2018 | | — | | — | | 54 | | 54 |

| | | | | | | | |

Total | | 104 | | 62 | | 54 | | 220 |

| | | | | | | | |

14

Ground Facilities and Services

Southwest leases terminal passenger service facilities at each of the airports it serves, to which it has made various leasehold improvements. The Company leases the land and structures on a long-term basis for its maintenance centers (located at Dallas Love Field, Houston Hobby, Phoenix Sky Harbor, and Chicago Midway), its flight training center at Dallas Love Field (which houses seven 737 simulators), and its corporate headquarters, also located at Dallas Love Field. During 2008, the City of Dallas approved the Love Field Modernization Program, an estimated $519 million project to provide Dallas Love Field with modern, convenient facilities. Southwest is managing the project, and construction is expected to commence during the summer of 2009, with completion scheduled for October 2014. As of December 31, 2008, the Company operated six reservation centers. The reservation centers located in Chicago, Albuquerque, and Oklahoma City occupy leased space. The Company owns its Houston, Phoenix, and San Antonio reservation centers.

The Company performs substantially all line maintenance on its aircraft and provides ground support services at most of the airports it serves. However, the Company has arrangements with certain aircraft maintenance firms for major component inspections and repairs for its airframes and engines, which comprise the majority of the Company’s annual aircraft maintenance costs.

On March 6, 2008, the FAA notified Southwest that it was seeking to fine Southwest approximately $10 million in connection with an incident concerning the Company’s potential non-compliance with an airworthiness directive. The Company is currently in settlement discussions with the FAA.

In connection with the above incident, during the first quarter and early second quarter of 2008, the Company was named as a defendant in two putative class actions on behalf of persons who purchased air travel from the Company while the Company was allegedly in violation of FAA safety regulations. Claims alleged by the plaintiffs in these two putativeclass actions include breach of contract, breach of warranty, fraud/misrepresentation, unjust enrichment, and negligent and reckless operation of an aircraft. The Company believes that the class action lawsuits are without merit and intends to vigorously defend itself. Also in connection with the above incident, during the first quarter and early second quarter of 2008, the Company received four letters from Shareholders demanding the Company commence an action on behalf of the Company against members of its Board of Directors and any other allegedly culpable parties for damages resulting from an alleged breach of fiduciary duties owed by them to the Company. In August 2008, Carbon County Employees Retirement System and Mark Cristello filed a related Shareholder derivative action in Texas state court naming certain directors and officers of the Company as individual defendants and the Company as a nominal defendant. The derivative action claims breach of fiduciary duty and seeks recovery by the Company of alleged monetary damages sustained as a result of the purported breach of fiduciary duty, as well as costs of the action. A Special Committee appointed by the Independent Directors of the Company is currently evaluating the Shareholder demands.

The Company is subject to various legal proceedings and claims arising in the ordinary course of business, including, but not limited to, examinations by the Internal Revenue Service (IRS). The IRS regularly examines the Company’s federal income tax returns and, in the course of those examinations, proposes adjustments to the Company’s federal income tax liability reported on such returns. It is the Company’s practice to vigorously contest those proposed adjustments that it deems lacking merit. The Company’s management does not expect the outcome in any of its currently ongoing legal proceedings or the outcome of any proposed adjustments presented to date by the IRS, individually or collectively, will have a material adverse effect on the Company’s financial condition, results of operations, or cash flows.

| Item 4. | Submission of Matters to a Vote of Security Holders |

None to be reported.

15

EXECUTIVE OFFICERS OF THE REGISTRANT

The following information regarding the Company’s executive officers is as of January 1, 2009.

| | | | |

Name | | Position | | Age |

Gary C. Kelly | | Chairman of the Board, President, & Chief Executive Officer | | 53 |

| | |

Robert E. Jordan | | Executive Vice President Strategy & Planning | | 48 |

| | |

Ron Ricks | | Executive Vice President Corporate Services & Corporate Secretary | | 59 |

| | |

Michael G. Van de Ven | | Executive Vice President & Chief Operating Officer | | 47 |

| | |

Davis S. Ridley | | Senior Vice President Marketing & Revenue Management | | 55 |

| | |

Laura H. Wright | | Senior Vice President Finance & Chief Financial Officer | | 48 |

Set forth below is a description of the background of each of Southwest’s executive officers.

Gary C. Kellyhas served as Southwest’s Chairman of the Board since May 2008, as its President since July 2008, and as its Chief Executive Officer since July 2004. Mr. Kelly also served as Southwest’s Executive Vice President & Chief Financial Officer from June 2001 to July 2004 and as its Vice President Finance & Chief Financial Officer from 1989 to 2001. Mr. Kelly joined Southwest in 1986 as its Controller.

Robert E. Jordanhas served as Southwest’s Executive Vice President Strategy & Planning since May 2008. Mr. Jordan also served as Southwest’s Executive Vice President Strategy & Technology from September 2006 to May 2008, Senior Vice President Enterprise Spend Management from August 2004 to September 2006, and Vice President Technology from October 2002 to August 2004.

Ron Rickshas served as Southwest’s Executive Vice President Corporate Services & Corporate Secretary since May 2008. Mr. Ricks also served as Southwest’s Executive Vice President Law, Airports, & Public Affairs from September 2006 to May 2008 and Senior Vice President Law, Airports, & Public Affairs from August 2004 until September 2006. Prior to 2004, Mr. Ricks served as Vice President Governmental Affairs for Southwest.

Michael G. Van de Venhas served as Southwest’s Executive Vice President & Chief Operating Officer since May 2008. Mr. Van de Ven also served as Southwest’s Chief of Operations from September 2006 to May 2008, Executive Vice President Aircraft Operations from November 2005 through August 2006, Senior Vice President Planning from August 2004 to November 2005, and Vice President Financial Planning & Analysis from June 2001 to August 2004.

Davis S. Ridleyhas served as Southwest’s Senior Vice President Marketing & Revenue Management since May 2008. Mr. Ridley also served as Southwest’s Senior Vice President Marketing from November 2007 to May 2008. Prior to such time, Mr. Ridley served as Southwest’s Senior Vice President People & Leadership Development from August 2004 to January 2006 and as its Vice President Ground Operations from May 1998 to August 2004. Mr. Ridley served as a consultant for the Company from January 2006 to November 2007.

Laura H. Wrighthas served as Southwest’s Senior Vice President Finance & Chief Financial Officer since July 2004. Ms. Wright also served as Southwest’s Vice President Finance & Treasurer from June 2001 to July 2004 and as its Treasurer from August 1998 to June 2001.

16

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

Southwest’s common stock is listed on the New York Stock Exchange and is traded under the symbol “LUV.” The following table shows, for the periods indicated, the high and low sales prices per share of Southwest’s common stock, as reported on the NYSE Composite Tape, and the cash dividends per share paid on Southwest’s common stock.

| | | | | | | | | |

Period | | Dividend | | High | | Low |

2008 | | | | | | | | | |

| | | |

1st Quarter | | $ | 0.00450 | | $ | 13.10 | | $ | 11.02 |

2nd Quarter | | | 0.00450 | | | 14.89 | | | 11.75 |

3rd Quarter | | | 0.00450 | | | 16.77 | | | 12.68 |

4th Quarter | | | 0.00450 | | | 14.97 | | | 7.05 |

| | | |

2007 | | | | | | | | | |

| | | |

1st Quarter | | $ | 0.00450 | | $ | 16.58 | | $ | 14.50 |

2nd Quarter | | | 0.00450 | | | 15.90 | | | 14.03 |

3rd Quarter | | | 0.00450 | | | 16.96 | | | 14.21 |

4th Quarter | | | 0.00450 | | | 15.06 | | | 12.12 |

Southwest currently intends to continue paying quarterly dividends for the foreseeable future; however, Southwest’s Board of Directors may change the timing, amount, and payment of dividends on the basis of results of operations, financial condition, cash requirements, future prospects, and other factors deemed relevant by the Board. As of January 28, 2009, there were 10,624 holders of record of Southwest’s common stock.

17

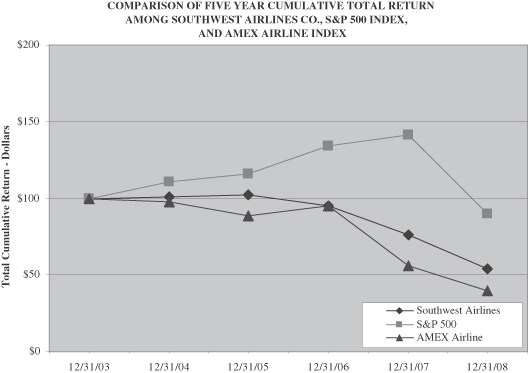

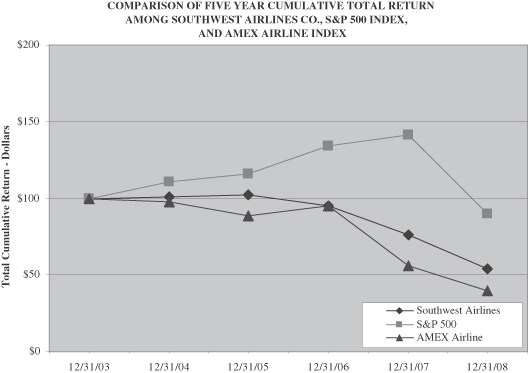

Stock Performance Graph

The following Performance Graph and related information shall not be deemed “soliciting material” or “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that Southwest specifically incorporates it by reference into such filing.

The following graph compares the cumulative total Shareholder return on Southwest’s common stock over the five-year period ended December 31, 2008, with the cumulative total return during such period of the Standard and Poor’s 500 Stock Index and the AMEX Airline Index. The comparison assumes $100 was invested on December 31, 2003, in Southwest common stock and in each of the foregoing indices and assumes reinvestment of dividends. The stock performance shown on the graph below represents historical stock performance and is not necessarily indicative of future stock price performance.

| | | | | | | | | | | | | | | | | | |

| | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 | | 12/31/08 |

Southwest Airlines Co. | | $ | 100 | | $ | 101 | | $ | 102 | | $ | 95 | | $ | 76 | | $ | 54 |

S&P 500 | | $ | 100 | | $ | 111 | | $ | 116 | | $ | 134 | | $ | 142 | | $ | 90 |

AMEX Airline | | $ | 100 | | $ | 98 | | $ | 89 | | $ | 95 | | $ | 56 | | $ | 40 |

18

| Item 6. | Selected Financial Data |

The following financial information for the five years ended December 31, 2008, has been derived from the Company’s Consolidated Financial Statements. This information should be read in conjunction with the Consolidated Financial Statements and related notes thereto included elsewhere herein.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | (in millions, except per share amounts) | |

Financial Data: | | | | | | | | | | | | | | | | | | | | |

Operating revenues | | $ | 11,023 | | | $ | 9,861 | | | $ | 9,086 | | | $ | 7,584 | | | $ | 6,530 | |

Operating expenses | | | 10,574 | | | | 9,070 | | | | 8,152 | | | | 6,859 | | | | 6,126 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 449 | | | | 791 | | | | 934 | | | | 725 | | | | 404 | |

Other expenses (income) net | | | 171 | | | | (267 | ) | | | 144 | | | | (54 | ) | | | 65 | |

| | | | | | | | | | | | | | | | | | | | |

Income before taxes | | | 278 | | | | 1,058 | | | | 790 | | | | 779 | | | | 339 | |

Provision for income taxes | | | 100 | | | | 413 | | | | 291 | | | | 295 | | | | 124 | |

| | | | | | | | | | | | | | | | | | | | |

Net Income | | $ | 178 | | | $ | 645 | | | $ | 499 | | | $ | 484 | | | $ | 215 | |

| | | | | | | | | | | | | | | | | | | | |

Net income per share, basic | | $ | .24 | | | $ | .85 | | | $ | .63 | | | $ | .61 | | | $ | .27 | |

Net income per share, diluted | | $ | .24 | | | $ | .84 | | | $ | .61 | | | $ | .60 | | | $ | .27 | |

Cash dividends per common share | | $ | .0180 | | | $ | .0180 | | | $ | .0180 | | | $ | .0180 | | | $ | .0180 | |

Total assets at period-end | | $ | 14,308 | | | $ | 16,772 | | | $ | 13,460 | | | $ | 14,003 | | | $ | 11,137 | |

Long-term obligations at period-end | | $ | 3,498 | | | $ | 2,050 | | | $ | 1,567 | | | $ | 1,394 | | | $ | 1,700 | |

Stockholders’ equity at period-end | | $ | 4,953 | | | $ | 6,941 | | | $ | 6,449 | | | $ | 6,675 | | | $ | 5,527 | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Revenue passengers carried | | | 88,529,234 | | | | 88,713,472 | | | | 83,814,823 | | | | 77,693,875 | | | | 70,902,773 | |

Enplaned passengers | | | 101,920,598 | | | | 101,910,809 | | | | 96,276,907 | | | | 88,379,900 | | | | 81,066,038 | |

Revenue passenger miles (RPMs) (000s) | | | 73,491,687 | | | | 72,318,812 | | | | 67,691,289 | | | | 60,223,100 | | | | 53,418,353 | |

Available seat miles (ASMs) (000s) | | | 103,271,343 | | | | 99,635,967 | | | | 92,663,023 | | | | 85,172,795 | | | | 76,861,296 | |

Load factor(1) | | | 71.2 | % | | | 72.6 | % | | | 73.1 | % | | | 70.7 | % | | | 69.5 | % |

Average length of passenger haul (miles) | | | 830 | | | | 815 | | | | 808 | | | | 775 | | | | 753 | |

Average aircraft stage length (miles) | | | 636 | | | | 629 | | | | 622 | | | | 607 | | | | 576 | |

Trips flown | | | 1,191,151 | | | | 1,160,699 | | | | 1,092,331 | | | | 1,028,639 | | | | 981,591 | |