Filed with the Securities and Exchange Commission on May 26, 2023

1933 Act Registration File No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

[ ] Pre-Effective Amendment No. ___

[ ] Post-Effective Amendment No. ___

(Check appropriate box or boxes.)

FPA FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

11601 WILSHIRE BOULEVARD, SUITE 1200

LOS ANGELES, CALIFORNIA 90025

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (310) 473-0225

J. RICHARD ATWOOD, PRESIDENT

FPA FUNDS TRUST

11601 WILSHIRE BOULEVARD, SUITE 1200

LOS ANGELES, CALIFORNIA 90025

(NAME AND ADDRESS OF AGENT FOR SERVICE)

COPY TO:

MARK D. PERLOW, ESQ.

DECHERT LLP

ONE BUSH STREET

SUITE 1600

SAN FRANCISCO, CA 94104

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective under the Securities Act of 1933, as amended.

It is proposed that this filing will become effective on the 30th day pursuant to Rule 488.

Title of Securities Being Registered:

FPA New Income Fund

FPA Queens Road Small Cap Value Fund – Investor Class, Advisor Class, and Institutional Class

FPA Queens Road Value Fund

FPA U.S. Core Equity Fund

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

FPA New Income, Inc.

FPA Queens Road Small Cap Value Fund

FPA Queens Road Value Fund

FPA U.S. Core Equity Fund, Inc.

11601 Wilshire Boulevard

Suite 1200

Los Angeles, California 90025

[ ], 2023

Dear Shareholder:

As an investor in one or more of the mutual funds listed below (each, a “Acquired Fund”), we are pleased to inform you of our plan to reorganize each Acquired Fund into a corresponding, newly created shell series (each, an “Acquiring Fund”) of FPA Funds Trust (the “Trust”), which will continue to be managed by First Pacific Advisors, LP (“FPA”):

| - | FPA New Income, Inc. | |

| - | FPA Queens Road Small Cap Value Fund, a series of Bragg Capital Trust | |

| - | FPA Queens Road Value Fund, a series of Bragg Capital Trust | |

| - | FPA U.S. Core Equity Fund, Inc. |

Each Acquired Fund and its corresponding Acquiring Fund have identical investment objectives, investment strategies and fundamental investment policies. Each Acquired Fund will exchange of all of its assets for the corresponding Acquiring Fund Shares and the assumption of all of the Acquired Fund liabilities (individually, a “Reorganization” and collectively, the “Reorganizations”). The Reorganizations will take place on or about [---, 2023] (“Closing Date”). Following the Reorganizations, the remaining organizational entity of each Acquired Fund will be wound down and liquidated. Each Reorganization will be conducted pursuant to an Agreement and Plan of Reorganization, a form of which is included as Appendix A to these materials. Each Reorganization is expected to be a tax-free reorganization under the U.S. Internal Revenue Code of 1986, as amended. In connection with the Reorganizations, shareholders of each Acquired Fund will receive shares of the corresponding Acquiring Fund equal in value to the number of shares of the Acquired Fund they own. Accordingly, a Reorganization will not dilute the value of your investment.

The Board of Trustees of each Acquired Fund, including all of the Independent Trustees (i.e., Trustees who are not “interested persons” of the Acquired Funds as that term is defined in the Investment Company Act of 1940), approved each Reorganization and determined, with respect to each Reorganization, that participation in the Reorganization is in the best interests of each Acquired Fund and that the interests of existing shareholders of the Acquired Fund would not be diluted as a result of the Reorganization. No shareholder vote is required to complete the Reorganizations. We are not asking you for a proxy and you are requested not to send us a proxy.

The accompanying Information Statement/Prospectus provides more information about the Reorganizations. Please carefully review the additional information provided in this document. If you have questions, please call 1-800-982-4372 (except from Alaska, Hawaii, Puerto Rico and U.S. Virgin Islands, where you may call collect (310) 473-0225).

Sincerely,

J. Richard Atwood

President

FPA New Income, Inc.

FPA Queens Road Small Cap Value Fund, a series of Bragg Capital Trust

FPA Queens Road Value Fund, a series of Bragg Capital Trust

FPA U.S. Core Equity Fund, Inc.

QUESTIONS AND ANSWERS

Shareholders should read this entire Information Statement/Prospectus carefully.

The following is a brief Q&A that will help explain the Reorganizations (as defined below), including the reasons for the Reorganizations. A more detailed discussion of the Reorganizations follows this section.

Q. What is happening? Why am I receiving an Information Statement/Prospectus?

A. You are receiving this Information Statement/Prospectus because you own shares in one or more of the following funds: FPA New Income, Inc., FPA Queens Road Value Fund, FPA Queens Road Small Cap Value Fund, and FPA U.S. Core Equity Fund, Inc. (each, an “Acquired Fund” and collectively, the “Acquired Funds”). Each Acquired Fund currently operates as an open-end mutual fund managed by First Pacific Advisors, LP (“FPA”). FPA has proposed, and the Board of Trustees of each Acquired Fund has approved, that each Acquired Fund be reorganized into a corresponding, newly created shell series (each, an “Acquiring Fund” and together with the Acquired Funds, the “Funds”) of FPA Funds Trust (the “Trust”) (each, a “Reorganization” and collectively, the “Reorganizations”). When completed, the Reorganizations will result in the consolidation of all six of the Funds into the Trust (which currently includes FPA Crescent Fund and FPA Flexible Fixed Income Fund). FPA believes that the proposed Reorganizations align with its longer-term strategic objectives and can bring meaningful benefits to Fund shareholders. To further these objectives, it is expected that FPA will recommend to the Boards that the Funds join the multi-series trust platform (the “Platform”) sponsored by Mutual Fund Administration Corporation (“MFAC”) and UMB Fund Services, Inc. (“UMB”) as a stand-alone trust to enhance the administrative services provided to the Funds, thereby engaging MFAC and UMB to provide fund administration services and UMB to provide the accounting and custody services currently performed by State Street Bank and Trust. The Funds would also engage Tait, Weller & Baker LLP as the Funds’ Independent Registered Public Accounting Firm to provide the audit and tax services currently performed by Ernst & Young LLP. Initially, the FPA Funds will be the only funds in the FPA Funds Trust. Some of the efficiencies of the Platform may be driven by adding non-FPA advised Funds to the Trust; there are currently no plans to do so, and the Trustees will determine when, and if, it is in the best interests of the Funds to add funds managed by other advisers to the Trust in the future. For example, adding other funds to the Trust may achieve cost savings and/or other benefits. FPA believes that the Reorganizations, combined with the Funds joining the Platform, will allow FPA to dedicate more time and resources to the management of the Funds’ portfolios by focusing more efficiently the time and resources spent on administrative activities. FPA also believes that the Reorganizations and joining the Platform can drive efficiencies for Funds and their service providers through standardization of workflow across all the Funds and other fund complexes using the Platform. FPA further believes that the efficiency and standardization of the Platform’s processes can reduce and help manage the risks of operational errors. FPA has indicated that no Fund will see an increase in its total net operating expenses as a result of the Reorganization or as a result of joining the Platform. In addition, FPA anticipates that each Fund may achieve some level of gross expense savings in the future; since most of those savings will serve to reduce a portion of FPA’s subsidies of certain Funds’ expenses, FPA believes that only FPA Queens Road Small Cap Value Fund and FPA U.S. Core Equity Fund, Inc. may experience future net operating expense savings.

Each Acquired Fund and its corresponding Acquiring Fund have identical investment objectives, investment strategies and fundamental investment policies. Following the Reorganizations, each Acquired Fund will be liquidated. The chart below lists the name of each Acquired Fund and its corresponding Acquiring Fund:

i

| Acquired Fund | Acquiring Fund

| |

| FPA New Income, Inc. | FPA New Income Fund | |

| FPA Queens Road Small Cap Value Fund | FPA Queens Road Small Cap Value Fund | |

| FPA Queens Road Value Fund | FPA Queens Road Value Fund | |

| FPA U.S. Core Equity Fund, Inc. | FPA U.S. Core Equity Fund |

Each Reorganization will be accomplished in accordance with its respective Agreement and Plan of Reorganization (each, a “Plan”). Each Plan provides for the transfer of all of the assets and liabilities of an Acquired Fund to its corresponding Acquiring Fund in exchange for shares of the corresponding Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the Acquired Fund. The Acquired fund will then immediately distribute to its shareholders the portion of shares of the Acquiring Fund to which each shareholder is entitled. The form of the Plan is contained in Appendix A.

If you remain a shareholder of an Acquired Fund on the Closing Date (as defined below) of its respective Reorganization, you will receive shares of the corresponding Acquiring Fund having the same value as your shares of the Acquired Fund on that date.

Q. Has the Board of Trustees of each Acquired Fund approved the Reorganizations?

A. Yes. The Board of Directors/Trustees of each Acquired Fund (collectively, the “Acquired Funds Boards”) approved its applicable Reorganization. The Acquired Funds’ Boards, including all of the Independent Trustees (i.e., Trustees who are not “interested persons” of the Acquired Funds as defined in the Investment Company Act of 1940 (the “1940 Act”)), determined that, for each Acquired Fund, the participation in the Reorganization is in the best interests of each Acquired Fund and that the interests of existing Acquired Fund’s shareholders will not be diluted as a result of the Reorganization.

Q. How will the Reorganizations affect me as a shareholder?

A. Once the Reorganization(s) are consummated, you will cease to be a shareholder of the Acquired Fund(s) and will become a shareholder of the Acquiring Fund(s). As described in more detail in the Information Statement/Prospectus, upon completion of the Reorganization(s), you will receive shares of the Acquiring Fund(s) having an aggregate NAV equal to the aggregate NAV of the shares of the corresponding Acquired Fund(s) you owned on the Closing Date of the Reorganization. Following the Reorganization, Shareholders of each Acquired Fund will receive the same class of shares of their corresponding Acquiring Fund.

Q. Am I being asked to vote on the Reorganizations?

A. No. Shareholders of the Acquired Funds are not required to approve the Reorganizations under state or federal law, the 1940 Act, or the organizational documents governing the Acquired Funds. We are not asking you for a proxy, and you are requested not to send us a proxy.

ii

Q. What effect will each Reorganizations have on me as an Acquired Fund shareholder?

A. Each Acquired Fund has identical investment objectives, investment strategies and fundamental investment policies as its corresponding Acquiring Fund. There will be no change in the Funds’ investment adviser and sub-adviser, as applicable. In addition, the portfolio managers responsible for the day-to-day portfolio management of the Acquired Funds will continue to be responsible for the day-to-day portfolio management of the Acquiring Funds. After the Reorganizations, it is expected that MFAC and UMB would replace State Street Bank and Trust to provide fund administration services and that UMB would replace State Street Bank and Trust to provide accounting and custody services. No changes in the level or quality of services that the Acquired Funds’ shareholders currently receive are expected as a result of the Reorganizations. The following table outlines the service providers for the Acquired Funds and the comparable service providers for the Acquiring Funds.

| Acquired Funds | Acquiring Funds | |

| Administrator | State Street Bank and Trust Company One Lincoln Street Boston, Massachusetts 02111 | Mutual Fund Administration, LLC 2220 E. Route 66, Suite 226 Glendora, California 91740

UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, Wisconsin 53212

|

| Distributor | UMB Distribution Services, LLC 235 West Galena Street Milwaukee, Wisconsin 53212 | Identical to Acquired Funds |

| Transfer Agent | UMB Fund Services, Inc. 235 W. Galena Street Milwaukee, Wisconsin 53212 | Identical to Acquired Funds |

| Independent Registered Public Accounting Firm | Ernst & Young LLP 725 South Figueroa Street Los Angeles, California 90017 | Tait, Weller & Baker LLP 50 S 16th Street, Suite 2900 Philadelphia, Pennsylvania 19102 |

| Custodian | State Street Bank and Trust Company One Lincoln Street Boston, Massachusetts 02111 | UMB Bank, n.a. 928 Grand Boulevard, 5th Floor Kansas City, Missouri 64106 |

Q. How do the fees and expenses of the Acquired Funds and the Acquiring Funds compare?

A. As shown in the table below, total annual fund operating expenses (after fee waivers and/or expense reimbursements) for each Acquiring Fund are expected to be the same as or lower than each share class of its corresponding Acquired Fund.

iii

| Fund | Total Annual Fund Operating Expenses Before Waivers | Total Annual Fund Operating Expenses After Waivers |

FPA New Income, Inc. (Acquired Fund)

| 0.59%

| 0.45%

|

FPA New Income Fund (Acquiring Fund) (Pro Forma)

| 0.58% | 0.45% |

| FPA Queens Road Small Cap Value Fund (Acquired Fund) | 1.00% for Investor Class 0.93% for Advisor Class 0.83% for Institutional Class

| 1.00% for Investor Class 0.93% for Advisor Class 0.83% for Institutional Class

|

| FPA Queens Road Small Cap Value Fund (Acquiring Fund) (Pro Forma) | 0.96% for Investor Class 0.90% for Advisor Class 0.79% for Institutional Class.

| 0.96% for Investor Class 0.90% for Advisor Class 0.79% for Institutional Class

|

FPA Queens Road Value Fund (Acquired Fund)

| 1.95%

| 0.65% |

FPA Queens Road Value Fund (Acquiring Fund) (Pro Forma)

| 1.51%.

| 0.65% |

FPA U.S. Core Equity Fund, Inc. (Acquired Fund)

| 1.44%

| 1.26% |

FPA U.S. Core Equity Fund (Acquiring Fund) (Pro Forma)

| 1.16% | 1.16% |

FPA has contractually agreed to limit each Acquiring Fund’s expenses at the same level that is currently in effect for each Acquired Fund for at least one year from the effective date of each Reorganization.

Q. Will I be subject to comparable risks as a shareholder of an Acquiring Fund?

A. Yes. As noted above, each Acquired Fund and its corresponding Acquiring Fund have identical investment objectives, investment strategies and fundamental investment policies. Therefore, the Acquiring Funds will be subject to the same investment risks as their corresponding Acquired Funds. The Funds’ principal risks are discussed in the section entitled “Description of Risks” and in Appendix B.

Q. Will the Acquired Funds or Acquiring Funds charge shareholders any sales charges (loads), commissions, or other similar fees in connection with the Reorganizations?

A. No. Neither the Acquired Funds nor the Acquiring Funds will charge shareholders any sales charges (loads), commissions, or other similar fees in connection with the Reorganizations.

iv

Q. When are the Reorganizations expected to occur?

A. FPA anticipates that the Reorganizations will take place on or about [ ], 2023 (the “Closing Date”): The Closing Date may be delayed. The Acquired Fund in which you hold shares will publicly disclose any changes to the applicable Closing Date. No Reorganization will be contingent on the occurrence of any other Reorganization.

Q. Who will pay the costs associated with the Reorganizations?

A. FPA will pay all costs associated with the Reorganizations (including the legal costs associated with the Reorganizations).

Q. Will the Reorganizations result in any federal tax liability to me?

A. The Reorganizations are intended to be treated as tax-free “reorganizations” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended, for federal income tax purposes. Accordingly, it is expected that neither you nor, in general, an Acquired Fund will recognize gain or loss as a direct result of the Reorganization of an Acquired Fund, and the holding period and aggregate tax basis for the Acquiring Fund shares that you receive will be the same as the holding period and aggregate tax basis of the Acquired Fund shares that you surrender in the Reorganization. You should consult your tax advisor regarding the effect, if any, of each Reorganization, in light of your individual circumstances.

Q. Whom do I contact for further information?

A. If you have questions, please call 1-800-982-4372, except from Alaska, Hawaii, Puerto Rico and U.S. Virgin Islands (where you may call collect (310) 473-0225).

Important additional information about the Reorganizations is set forth in the accompanying Information Statement/Prospectus. Please read it carefully.

v

INFORMATION STATEMENT/PROSPECTUS

Dated [ ], 2023

This Information Statement/Prospectus is being furnished to shareholders of FPA New Income, Inc., FPA Queens Road Small Cap Value Fund and FPA Queens Road Value Fund, and FPA U.S. Core Equity Fund, Inc. (each, an “Acquired Fund”, collectively, the “Acquired Fund Companies”) to inform them of a plan to reorganize each Acquired Fund into a corresponding series of FPA Funds Trust (the “Trust”), which will continue to be managed by FPA.

Each Acquired Fund will be reorganized into a newly created shell series (each, an “Acquiring Fund” and together with the Acquired Funds, the “Funds”) that is a series of the Trust, and each Acquired Fund will subsequently be liquidated (each such reorganization and liquidation, a “Reorganization”). The Reorganizations are set forth in the table below.

| Acquired Fund | Acquiring Fund | |

| FPA New Income, Inc. | FPA New Income Fund | |

| FPA Queens Road Small Cap Value Fund, a series of Bragg Capital Trust | FPA Queens Road Small Cap Value Fund | |

| FPA Queens Road Value Fund, a series of Bragg Capital Trust | FPA Queens Road Value Fund | |

| FPA U.S. Core Equity Fund, Inc. | FPA U.S. Core Equity Fund |

The Board of Directors of the FPA New Income, Inc., the Board of Directors for FPA U.S. Core Equity Fund, Inc. and the Board of Trustees of Bragg Capital Trust (collectively, the “Acquired Funds Boards”) approved the applicable Reorganization. The Acquired Funds’ Boards, including all of the Independent Trustees (i.e., Trustees or Directors who are not “interested persons” of the Acquired Funds as defined in the Investment Company Act of 1940 (the “1940 Act”)), determined that, for each Acquired Fund, participation in the Reorganization is in the best interests of each Acquired Fund and that the interests of existing Acquired Fund’s shareholders will not be diluted as a result of the Reorganization. Each Acquired Fund Board and the Board of Trustees of each Acquiring Fund (the “Acquiring Funds Board”) are comprised of the same individuals.

Each Reorganization will be accomplished in accordance with its respective Agreement and Plan of Reorganization (each, a “Plan”). Each Plan provides for the transfer of all of the assets and liabilities of an Acquired Fund to its corresponding Acquiring Fund in exchange for shares of the corresponding Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the Acquired Fund. The Acquired Fund will then immediately distribute to its shareholders the portion of shares of the Acquiring Fund to which each shareholder is entitled in complete liquidation of the Acquired Fund. A copy of the form of the Plan pertaining to the Reorganizations is included as Appendix A to this Information Statement/Prospectus.

1

For federal income tax purposes, each Reorganization is intended to be a tax-free transaction for the Acquired Fund, the Acquiring Fund, and the shareholders of the Acquired Fund. If you remain a shareholder of the Acquired Fund(s) on the Closing Date (as defined below) of a Reorganization, you will receive shares of the corresponding Acquiring Fund(s) that have the same value as your shares of the Acquired Fund(s) on that date.

THIS INFORMATION STATEMENT/PROSPECTUS IS FOR INFORMATION PURPOSES ONLY, AND YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO RECEIVING IT.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The Closing Date may be delayed. The Acquired Fund in which you hold shares will publicly disclose any changes to the applicable Closing Date.

The Reorganizations are anticipated to take place on or about [ ], 2023 (the “Closing Date”).

No Reorganization will be contingent on the occurrence of any other Reorganization.

This Information Statement/Prospectus, which you should read carefully and retain for future reference, sets forth concisely the information that you should know before investing. This Information Statement/Prospectus, which constitutes part of a Registration Statement filed by the Trust with the Securities and Exchange Commission (“SEC”) under the Securities Act of 1933, as amended, does not include certain information contained elsewhere in such Registration Statement. Reference is hereby made to the Registration Statement and to the exhibits and amendments thereto for further information with respect to the Acquiring Funds and the shares offered. Statements contained herein concerning the provisions of documents are necessarily summaries of such documents.

A statement of additional information relating to this Information Statement/Prospectus and the proposed Reorganizations (the “Statement of Additional Information”), dated [ ], 2023, is available upon request and without charge by contacting the Funds. This Statement of Additional Information also is incorporated herein by reference and is legally deemed to be part of this Information Statement/Prospectus.

The following additional materials are incorporated herein by reference and are legally deemed to be part of this Information Statement/Prospectus.

2

| • | The Acquired Fund's Semi-Annual Report to Shareholders dated March 31, 2023 for FPA New Income, Inc. filed with the SEC on May 25, 2023 (File No. 811-01735 (Accession No. 0001104659-23-064487). |

The Acquired Funds and Acquiring Funds can be reached by writing to UMB Distribution Services, LLC at 235 West Galena Street, Milwaukee, Wisconsin 53212, or by calling (310) 473-0225 or 1-800-982-4372 (except from Alaska, Hawaii, Puerto Rico and U.S. Virgin Islands).

The Acquired Funds’ prospectuses, statements of additional information, and Annual Reports and Semi-Annual Reports are available at the Funds’ website at https://fpa.com/funds.

You may request free copies of the Acquired Funds’ prospectuses and statements of additional information (including any supplement thereto), the Acquiring Funds’ prospectuses and statements of additional information and the Statement of Additional Information by calling (310) 473-0225 or 1-800-982-4372 (except from Alaska, Hawaii, Puerto Rico and U.S. Virgin Islands).

Because the Acquiring Funds have not yet commenced operations, no shareholder reports are available for them.

All available materials have been filed with the SEC.

Each Fund also files proxy materials, information statements, reports, and other information with the SEC in accordance with the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act. These materials can be obtained electronically from the EDGAR database on the SEC’s

3

Internet site (http://www.sec.gov) or, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov.

This Information Statement/Prospectus dated [ ], 2023, is expected to be mailed to shareholders of the Acquired Funds on or about [ ], 2023.

AN INVESTMENT IN THE FUNDS IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY. AN INVESTMENT IN THE FUNDS INVOLVES INVESTMENT RISK, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL.

AS FOR ALL FUNDS, THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

4

TABLE OF CONTENTS

| PAGE | ||

| SUMMARY | 6 | |

| What is happening to the Acquired Funds? | 6 | |

| How will the Reorganizations Work? | 6 | |

| Why are the Reorganizations happening and did the Board approve the Reorganization? | 7 | |

| How will the Reorganizations affect me? | 8 | |

| Who will pay the costs associated with the Reorganizations? | 8 | |

| What are the federal income tax consequences of the Reorganization? | 8 | |

| How do the Funds’ investment objectives, investment strategies and fundamental investment policies compare? | 8 | |

| What are the principal risks of an investment in the Acquiring Funds? | 8 | |

| How will the Reorganizations affect my fees and expenses? | 9 | |

| What are the distribution arrangements for the Funds? | 10 | |

| COMPARISON OF SOME IMPORTANT FEATURES OF THE FUNDS | 10 | |

| How do the performance records of the Funds compare? | 10 | |

| What are the fees and expenses of the Funds and what might they be after the Reorganization? | 15 | |

| Who manages the Funds and what are the management fees? | 23 | |

| How do the Funds’ investment objectives, investment strategies, risks and fundamental investment policies compare? | 28 | |

| What are the Funds’ arrangements for purchases, exchanges and redemptions? | 57 | |

| What are the Funds’ income and capital distribution policies? | 60 | |

| What are the Fund’s pricing and valuation arrangements? | 60 | |

| What are the fiscal years for the Funds? | 60 | |

| Where can I find more financial and performance information about the Funds? | 60 | |

| What about transactions through financial intermediaries? | 61 | |

| INFORMATION ABOUT THE REORGANIZATIONS | 61 | |

| Reasons for the Reorganizations | 61 | |

| INFORMATION ABOUT THE PLANS | 64 | |

| How will the Reorganizations be carried out? | 64 | |

| Who will pay the costs associated with the Reorganizations? | 64 | |

| What are the tax consequences of the Reorganizations? | 65 | |

| CAPITAL STRUCTURE AND SHAREHOLDER RIGHTS | 68 | |

| What are the capitalizations of the Funds? | 68 | |

| PRINCIPAL SHAREHOLDERS | 70 | |

| OTHER SERVICE PROVIDERS | 72 | |

| ADDITIONAL INFORMATION | 72 | |

| FINANCIAL HIGHLIGHTS | 73 | |

| APPENDIX A – FORM OF AGREEMENT AND PLAN OF REORGANIZATION | A-1 | |

| APPENDIX B – COMPARISON OF GOVERNING INSTRUMENTS | B-1 |

5

SUMMARY

This is only a summary of certain information contained in this Information Statement/Prospectus. Shareholders should carefully read the more complete information in the rest of this Information Statement/Prospectus, including the Plan relating to the Reorganizations, a form of which is attached to this Information Statement/Prospectus in Appendix A, and the applicable Acquiring Fund prospectus(es), which accompanies this Information Statement/Prospectus. For purposes of this Information Statement/Prospectus, the terms “shareholder”, “you”, and “your” refer to shareholders of the Acquired Funds. The Acquired Funds and Acquiring Funds are also referred to as the “Funds.”

What is happening to the Acquired Funds?

Each Acquired Fund currently operates as an open-end mutual fund. The Acquired Funds will be reorganized into a corresponding, newly-created shell Acquiring Fund. Each Acquired Fund and its corresponding Acquiring Fund have identical investment objectives, investment strategies and fundamental investment policies. Each reorganization of an Acquired Fund into its corresponding Acquiring Fund, along with the subsequent liquidation of each Acquired Fund, is referred to in this Information Statement/Prospectus as a “Reorganization,” and each Reorganization will be accomplished in accordance with an Agreement and Plan of Reorganization and Liquidation (a “Plan”). For reference purposes, the identification of each Reorganization, Acquired Fund and corresponding Acquiring Fund is listed in the chart below.

| Reorganizations | Acquired Fund | Acquiring Fund | ||

| FPA New Income Reorganization | FPA New Income, Inc. | FPA New Income Fund | ||

| FPA Queens Road Small Cap Value Reorganization | FPA Queens Road Small Cap Value Fund | FPA Queens Road Small Cap Value Fund | ||

| FPA Queens Road Value Reorganization | FPA Queens Road Value Fund | FPA Queens Road Value Fund | ||

| FPA U.S. Core Equity Reorganization | FPA U.S. Core Equity Fund, Inc. | FPA U.S. Core Equity Fund |

How will the Reorganizations work?

Each Plan provides for the transfer of all of the assets and liabilities of an Acquired Fund to its corresponding Acquiring Fund in exchange for shares of the corresponding Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate net asset value of the Acquired Fund. The Acquired Fund will then immediately distribute to its shareholders of the portion of shares of the Acquiring Fund to which each shareholder is entitled in complete liquidation of the Acquired Fund.

After shares of the Acquiring Fund are distributed to the Acquired Fund’s shareholders, the Acquired Fund will be completely liquidated and dissolved. As a result of a Reorganization, you will cease to be a shareholder of the Acquired Fund and will become a shareholder of the Acquiring Fund. This exchange will occur after the close of business on the Closing Date of the Reorganization, which is the specific date

6

on which the Reorganization takes place. The expected Closing Dates of each Reorganization is expected to occur on or about [ ], 2023.

The Closing Date may be delayed. The Acquired Fund in which you hold shares will publicly disclose any changes to the applicable Closing Date. No Reorganization will be contingent on the occurrence of any other Reorganization.

Why are the Reorganizations happening and did the Board approve the Reorganizations?

After consideration of all relevant factors, including the potential impact of the Reorganizations on the Acquired Funds’ shareholders, each Acquired Fund’s investment adviser, First Pacific Advisors, LP (“FPA”), proposed that each Acquired Fund be reorganized into its corresponding Acquiring Fund because of certain benefits associated with Trust, which FPA believes will better serve the interests of Acquired Fund shareholders. When completed, the Reorganizations will result in the consolidation of all six of the Funds into the Trust (which currently includes FPA Crescent Fund and FPA Flexible Fixed Income Fund). FPA believes that the proposed Reorganizations align with its longer-term strategic objectives and can bring meaningful benefits to Fund shareholders. To further these objectives, it is expected that FPA will recommend to the Boards that the Funds join the multi-series trust platform (the “Platform”) sponsored by Mutual Fund Administration Corporation (“MFAC”) and UMB Fund Services, Inc. (“UMB”) as a stand-alone trust to enhance the administrative services provided to the Funds, thereby engaging MFAC and UMB to provide fund administration services and UMB to provide the accounting and custody services currently performed by State Street Bank and Trust. The Funds would also engage Tait, Weller & Baker LLP as the Funds’ Independent Registered Public Accounting Firm to provide the audit and tax services currently performed by Ernst & Young LLP. Initially, the FPA Funds will be the only funds in the FPA Funds Trust. Some of the efficiencies of the Platform may be driven by adding non-FPA advised Funds to the Trust; there are currently no plans to do so, and the Trustees will determine when, and if, it is in the best interests of the Funds to add funds managed by other advisers to the Trust in the future. For example, adding other funds to the Trust may achieve cost savings and/or other benefits. FPA believes that the Reorganizations combined with the Funds joining the Platform will allow FPA to dedicate more time and resources to the management of the Funds’ portfolios by focusing more efficiently the time and resources spent on administrative activities. FPA also believes that the Reorganizations and joining the Platform can drive efficiencies for Funds and their service providers through standardization of workflow across all the Funds and other fund complexes using the Platform. FPA further believes that the efficiency and standardization of the Platform’s processes can reduce and help manage the risks of operational errors. FPA has indicated that no Fund will see an increase in its total net operating expenses as a result of the Reorganizations or as a result of joining the Platform. In addition, FPA anticipates that each Fund may achieve some level of gross expense savings in the future; since most of those savings will serve to reduce a portion of FPA’s subsidies of certain Funds’ expenses, FPA believes that only FPA Queens Road Small Cap Value Fund and FPA U.S. Core Equity Fund, Inc. may experience future net operating expense savings.

Each Acquired Fund and its corresponding Acquiring Fund have identical investment objectives, investment strategies and fundamental investment policies. FPA will continue as the investment adviser of each Acquiring Fund after the Reorganizations and no change in portfolio managers will result from the Reorganizations.

7

The Acquired Funds’ Boards, including all of the Acquired Funds’ Boards’ Trustees or Directors who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (together, the “Independent Trustees”), determined that, with respect to each Reorganization, participation in the Reorganization is in the best interests of each Acquired Fund and that the interests of the existing shareholders of the Acquired Fund will not be diluted as a result of the Reorganization. The Acquired Funds’ Boards made this determination based on various factors that are discussed in this Information Statement/Prospectus in the section entitled “Reasons for the Reorganizations.”

How will the Reorganizations affect me?

When your Reorganization is consummated, you will cease to be a shareholder of an Acquired Fund and will become a shareholder of the corresponding Acquiring Fund. As described in more detail above, upon completion of your Reorganization, you will receive shares of an Acquiring Fund having an aggregate NAV equal to the aggregate NAV of the shares of the Acquired Fund you owned on the Closing Date of the Reorganization.

Who will pay the costs associated with the Reorganizations?

FPA will pay all costs associated with the Reorganizations (including the legal costs associated with the Reorganizations).

What are the federal income tax consequences of the Reorganizations?

As a condition to the closing of each Reorganization, the Acquired Fund and the Acquiring Fund must receive an opinion of Dechert LLP (“Dechert”) to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither you nor, in general, an Acquired Fund will recognize gain or loss as a direct result of the Reorganization of an Acquired Fund, and the holding period and aggregate tax basis for the Acquiring Fund shares that you receive will be the same as the holding period and aggregate tax basis of the Acquired Fund shares that you surrender in the Reorganization. Prior to the consummation of a Reorganization, you may redeem your Acquired Fund shares, generally resulting in the recognition of gain or loss for U.S. federal income tax purposes based on the difference between your tax basis in the shares and the amount you receive for them.

You should consult your tax advisor regarding the effect, if any, of each Reorganization, in light of your individual circumstances. You should also consult your tax advisor about state and local tax consequences. For more information about the tax consequences of the Reorganizations, please see the section entitled “Information About the Plans—What are the tax consequences of the Reorganizations?”

How do the Funds’ investment objectives, investment strategies, risks, and fundamental investment policies compare?

Each Acquired Fund has identical investment objectives, investment strategies, risks, and fundamental investment policies as its corresponding Acquiring Fund. As with each Acquired Fund, each Acquiring

8

Fund’s investment objective is fundamental and cannot be changed without shareholder approval. Please see the section entitled “Comparison of Some Important Features of the Funds” for more information.

How will the Reorganizations affect my fees and expenses?

As shown in the table below, total annual fund operating expenses (after fee waivers and/or expense reimbursements) for each Acquiring Fund are expected to be the same as or lower than each share class of its corresponding Acquired Fund.

| Fund | Total Annual Fund Operating Expenses Before Waivers | Total Annual Fund Operating Expenses After Waivers |

FPA New Income, Inc. (Acquired Fund)

| 0.59%

| 0.45%

|

FPA New Income Fund (Acquiring Fund) (Pro Forma)

| 0.58% | 0.45% |

| FPA Queens Road Small Cap Value Fund (Acquired Fund) | 1.00% for Investor Class 0.93% for Advisor Class 0.83% for Institutional Class

| 1.00% for Investor Class 0.93% for Advisor Class 0.83% for Institutional Class

|

| FPA Queens Road Small Cap Value Fund (Acquiring Fund) (Pro Forma) | 0.96% for Investor Class 0.90% for Advisor Class 0.79% for Institutional Class.

| 0.96% for Investor Class 0.90% for Advisor Class 0.79% for Institutional Class

|

FPA Queens Road Value Fund (Acquired Fund)

| 1.95%

| 0.65% |

FPA Queens Road Value Fund (Acquiring Fund) (Pro Forma)

| 1.51%.

| 0.65% |

FPA U.S. Core Equity Fund, Inc. (Acquired Fund)

| 1.44%

| 1.26% |

FPA U.S. Core Equity Fund (Acquiring Fund) (Pro Forma)

| 1.16% | 1.16% |

FPA has contractually agreed to limit each Acquiring Fund’s expenses at the same level that is currently in effect for each Acquired Fund for at least one year from the effective date of each Reorganization.

A comparison of the fees and expenses of the Acquired Funds and Acquiring Funds is provided below under the heading, “What are the fees and expenses of the Funds and what might they be after the Reorganizations?”

9

What are the distribution arrangements for the Funds?

The Acquired Funds and Acquiring Funds are distributed by UMB Distribution Services, LLC (the “Distributor”), which serves as the principal underwriter for the shares of the Funds. The Distributor is registered with the SEC as a broker-dealer and is a member of the National Association of Securities Dealers. The Distributor’s principal address is 235 West Galena Street, Milwaukee, Wisconsin 53212.

COMPARISON OF SOME IMPORTANT FEATURES OF THE FUNDS

How do the performance records of the Funds compare?

Each Acquiring Fund is a newly created “shell” fund that has not yet commenced operations, and therefore, will have no performance history prior to the Reorganization. Each Acquiring Fund has been organized solely in connection with the Reorganization to acquire all of the assets and liabilities of its corresponding Acquired Fund and continue the business of the Acquired Fund. Therefore, after the Reorganization, the Acquired Fund will remain the “accounting survivor.” This means that the Acquiring Funds will continue to show the historical investment performance and returns of the Acquired Funds (even after liquidation of the Acquired Funds).

The following shows the historical performance of each Acquired Fund, as it is to be adopted by its corresponding Acquiring Fund.

10

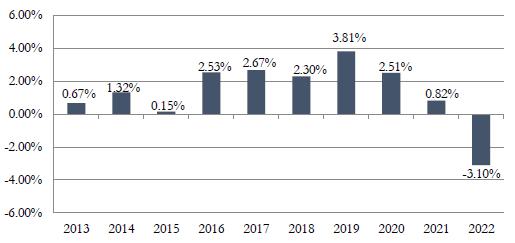

FPA New Income, Inc. (Acquired Fund)

Calendar Years Ended December 31

The total return for Acquired Fund shares from January 1, 2023 to March 31, 2023 was 2.02%.

The Acquired Fund’s highest/lowest quarterly results during this time period were:

| Highest | 2.66% | (Quarter ended 6/30/20) |

| Lowest | -1.74% | (Quarter ended 3/31/22) |

Average Annual Total Returns (for the periods ended December 31, 2022) | One Year | Five Years | Ten Years |

| Before Taxes | -3.10% | 1.24% | 1.35% |

| After Taxes on Distributions(1) | -3.92% | 0.32% | 0.28% |

| After Taxes on Distributions and Sale of Fund Shares(1) | -1.82% | 0.57% | 0.56% |

| Bloomberg Barclays U.S. Aggregate Bond Index | |||

| (reflects no deductions for fees, expenses or taxes) | -13.01% | 0.02% | 1.06% |

| CPI + 100 | 7.49% | 4.81% | 3.60% |

(1) After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend upon an investor’s tax situation and may differ from those shown. After-tax returns presented here are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

11

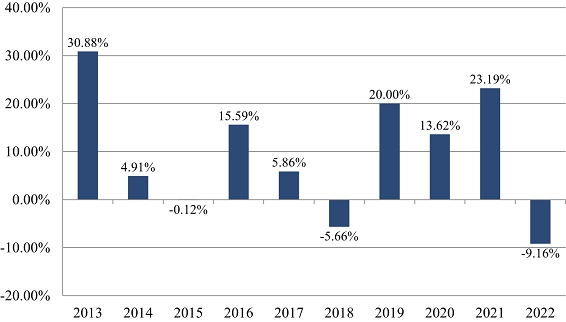

FPA Queens Road Small Cap Value Fund (Acquired Fund) – Investor Class

Calendar Years Ended December 31

The total return for Acquired Fund Investor Class shares from January 1, 2023 to March 31, 2023 was 0.70%.

The Acquired Fund’s highest/lowest quarterly results during this time period were:

| Highest | 24.75% | (Quarter ended 12/31/2020) |

| Lowest | -21.84% | (Quarter ended 03/31/2020) |

Average Annual Total Returns – Acquired Fund Investor Class (for the periods ended December 31, 2022) | One Year | Five Years | Ten Years |

| Investor Class – Return Before Taxes | (9.16)% | 7.56% | 9.22% |

| Investor Class – Return After Taxes on Distributions | (9.61)% | 6.63% | 8.41% |

| Investor Class – Return After Taxes on Distributions and Sale of Fund Shares(1) | (5.12)% | 5.74% | 7.37% |

| Advisor Class – Return Before Taxes | (9.17)% | -- | -- |

| Institutional Class – Return Before Taxes | (9.03)% | -- | -- |

| Benchmark: Russell 2000 Value Index | (14.48)% | 4.13% | 8.48% |

(1) After-tax returns are shown only for Investor Class shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. The after-tax returns are not relevant if you hold your Fund shares in tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRA”).

12

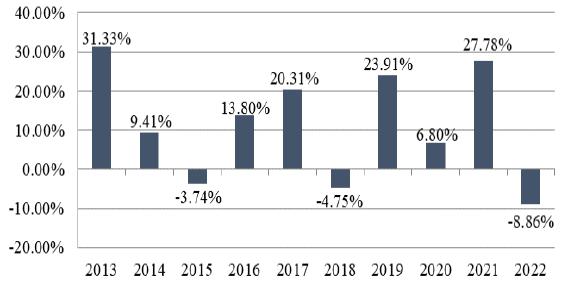

FPA Queens Road Value Fund (Acquired Fund)

Calendar Years Ended December 31

The total return for Acquired Fund shares from January 1, 2023 to March 31, 2023 was 1.20%.

The Acquired Fund’s highest/lowest quarterly results during this time period were:

| Highest | 15.04% | (Quarter ended 12/31/2022) |

| Lowest | -20.97 | (Quarter ended 03/31/2020) |

Average Annual Total Returns (for the periods ended December 31, 2022) | One Year | Five Years | Ten Years |

| Return Before Taxes | (8.86)% | 7.98% | 10.76% |

| Return After Taxes on Distributions | (9.45)% | 6.26% | 9.42% |

| Return After Taxes on Distributions and Sale of Fund Shares(1) | (4.83)% | 6.16% | 8.70% |

| Benchmark: S&P 500 Value Index | (5.22)% | 7.58% | 10.86% |

(1)After-tax returns are calculated using the highest historical individual federal marginal income tax rate and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. The after-tax returns are not relevant if you hold your Fund shares in tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRA”).

13

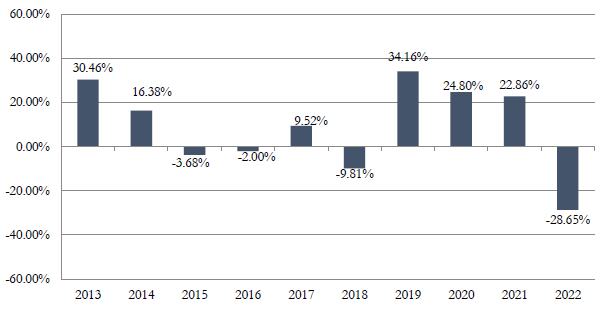

FPA U.S. Core Equity Fund, Inc. (Acquired Fund)

Calendar Years Ended December 31

The total return for Acquired Fund shares from January 1, 2023 to March 31, 2023 was 10.54%.

The Acquired Fund’s highest/lowest quarterly results during this time period were:

| Highest | 24.45% | (Quarter ended 6/30/2020) |

| Lowest | -18.92% | (Quarter ended 6/30/2022) |

Average Annual Total Returns (for the periods ended December 31, 2022) | One Year | Five Years | Ten Years |

| Before Taxes | -28.65% | 5.77% | 7.59% |

| After Taxes on Distributions(1) | -31.01% | 4.37% | 4.17% |

| After Taxes on Distributions and Sale of Fund Shares(1) | -15.26% | 4.62% | 5.49% |

| S&P 500 Index (reflects no deductions for fees, expenses, or taxes) | -18.11% | 9.42% | 12.56% |

(1) After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend upon an investor’s tax situation and may differ from those shown. After-tax returns presented here are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

14

What are the fees and expenses of the Funds and what might they be after the Reorganizations?

Shareholders of the Funds pay various fees and expenses, either directly or indirectly. The tables below show the fees and expenses that you would pay if you were to buy, hold and sell shares of each Fund. The fees and expenses in the tables appearing below are based on the expenses paid by each Acquired Fund as of September 30, 2022 for FPA New Income, Inc. (the end of its most recently completed fiscal year), May 31, 2022 for FPA Queens Road Small Cap Value Fund (the end of the its most recently completed fiscal year), May 31, 2022 for FPA Queens Road Value Fund (the end of its most recently completed fiscal year) and December 31, 2022 for FPA U.S. Core Equity Fund, Inc. (the end of its most recently completed fiscal year) and the anticipated expenses of each Acquiring Fund during their first year of operation.

The tables show the pro forma expenses of each combined Acquiring Fund after giving effect to the respective Reorganization, based on pro forma net assets as of September 30, 2022 for FPA New Income Fund, May 31, 2022 for FPA Queens Road Small Cap Value Fund and FPA Queens Road Value Fund, and December 31, 2022 for FPA U.S. Core Equity Fund. There is no separate pro forma combined column because the Acquiring Funds pro forma tables shows the fees and expenses that will apply going forward; the Acquiring Funds are not operational and do not currently have investment assets. Pro forma numbers are estimated in good faith and are hypothetical. Pro forma numbers do not reflect any potential liquidation of shareholders associated with the Reorganization.

15

FPA New Income, Inc. (Acquired Fund)/ FPA New Income Fund (Acquiring Fund)

Shareholder Fees (fees paid directly from your investment) | Acquired Fund | Acquiring Fund (Pro Forma) |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original sales price or redemption proceeds, as applicable) | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage | ||

| Management Fees | 0.50% | 0.50% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.09% | 0.08%(1) |

| Total Annual Fund Operating Expenses | 0.59% | 0.58% |

| Expense Reimbursement(2), (3) | (0.14)% | (0.13)% |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 0.45% | 0.45% |

| (1) | “Other Expenses” for the Acquiring Fund have been estimated for the current fiscal year. Actual expenses may differ from estimates. |

| (2) | The Acquired Fund’s adviser has contractually agreed to reimburse the Acquired Fund for Total Annual Fund Operating Expenses in excess of 0.45% of the average net assets of the Acquired Fund (excluding interest, taxes, brokerage fees and commissions payable by the Acquired Fund in connection with the purchase or sale of portfolio securities, and extraordinary expenses, including litigation expenses not incurred in the Acquired Fund’s ordinary course of business) through January 31, 2024. This agreement may only be terminated earlier by the Acquired Fund’s Board of Directors or upon termination of the advisory agreement. |

| (3) | The Acquiring Fund’s adviser has contractually agreed to reimburse the Acquiring Fund for Total Annual Fund Operating Expenses in excess of 0.45% of the average net assets of the Acquiring Fund (excluding interest, taxes, brokerage fees and commissions payable by the Acquiring Fund in connection with the purchase or sale of portfolio securities, and extraordinary expenses, including litigation expenses not incurred in the Acquiring Fund’s ordinary course of business) for a period of one year from the date of the Reorganization. This agreement may only be terminated earlier by the Acquiring Fund’s Board of Trustees upon termination of the advisory agreement. |

16

FPA Queens Road Small Cap Value Fund (Acquired Fund)/FPA Queens Road Small Cap Value Fund (Acquiring Fund) – Investor Class Shares

Shareholder Fees (fees paid directly from your investment) | Acquired Fund Investor Class | Acquiring Fund Investor Class (Pro Forma) |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of purchase price or redemption proceeds) | None | None |

| Maximum Sales Charge Load Imposed on Reinvested Dividends and other Distribution | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage | ||

| Management Fees | 0.66% | 0.66% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.34% | 0.30%(1) |

| Total Annual Fund Operating Expenses | 1.00% | 0.96% |

| Fee Waiver and Reimbursement(2), (3) | 0.00% | 0.00% |

| Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement | 1.00% | 0.96% |

| (1) | “Other Expenses” for the Acquiring Fund have been estimated for the current fiscal year. Actual expenses may differ from estimates. |

| (2) | The adviser has contractually agreed to waive its management fees and to make payments to limit Acquired Fund expenses, until February 21, 2024, so that the total annual operating expenses (excluding interest, taxes, brokerage fees and commissions payable by the Acquired Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquired Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business) of the Acquired Fund do not exceed 1.04% for Investor Class shares. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Acquired Fund in future years (within three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then-current expense limits. The expense limit agreement may be terminated only by the Acquired Fund’s Board of Trustees, upon written notice to the adviser. As of May 15, 2023, there were no outstanding amounts eligible for recoupment by the adviser. |

| (3) | The adviser has contractually agreed to waive its management fees and to make payments to limit Acquiring Fund expenses for a period of one year from the date of the Reorganization so that the total annual operating expenses (excluding interest, taxes, brokerage fees and commissions payable by the Acquiring Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquiring Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Acquiring Fund’s ordinary course of business) of the Acquiring Fund do not exceed 1.04% for Investor Class shares. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Acquiring Fund in future years (within three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then-current expense limits. The expense limit agreement may be terminated only by the Acquiring Fund’s Board of Trustees, upon written notice to the adviser. |

17

FPA Queens Road Small Cap Value Fund (Acquired Fund)/FPA Queens Road Small Cap Value Fund (Acquiring Fund) – Advisor Class Shares

Shareholder Fees (fees paid directly from your investment) | Acquired Fund Advisor Class | Acquiring Fund Advisor Class (Pro Forma) |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of purchase price or redemption proceeds) | None | None |

| Maximum Sales Charge Load Imposed on Reinvested Dividends and other Distribution | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage | ||

| Management Fees | 0.66% | 0.66% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.27% | 0.24%(1) |

| Total Annual Fund Operating Expenses | 0.93% | 0.90% |

| Fee Waiver and Reimbursement(2), (3) | 0.00% | 0.00% |

| Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement | 0.93% | 0.90% |

| (1) | “Other Expenses” for the Acquiring Fund have been estimated for the current fiscal year. Actual expenses may differ from estimates. |

| (2) | The adviser has contractually agreed to waive its management fees and to make payments to limit Acquired Fund expenses, until February 1, 2024, so that the total annual operating expenses (excluding interest, taxes, brokerage fees and commissions payable by the Acquired Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquired Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business) of the Acquired Fund do not exceed 0.99% for Advisor Class shares. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Acquired Fund in future years (within three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then current expense limits. The expense limit agreement may be terminated only by the Acquired Fund’s Board of Trustees, upon written notice to the adviser. As of May 15, 2023, there were no outstanding amounts eligible for recoupment by the adviser. |

| (3) | The adviser has contractually agreed to waive its management fees and to make payments to limit Acquiring Fund expenses for a period of one year from the date of the Reorganization so that the total annual operating expenses (excluding interest, taxes, brokerage fees and commissions payable by the Acquiring Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquiring Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Acquiring Fund’s ordinary course of business) of the Acquiring Fund do not exceed 0.99% for Advisor Class shares. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Acquiring Fund in future years (within three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then-current expense limits. The expense limit agreement may be terminated only by the Acquiring Fund’s Board of Trustees, upon written notice to the adviser. |

18

FPA Queens Road Small Cap Value Fund (Acquired Fund)/FPA Queens Road Small Cap Value Fund (Acquiring Fund) – Institutional Class Shares

Shareholder Fees (fees paid directly from your investment) | Acquired Fund Institutional | Acquiring Fund Institutional Class (Pro Forma) |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of purchase price or redemption proceeds) | None | None |

| Maximum Sales Charge Load Imposed on Reinvested Dividends and other Distribution | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage | ||

| Management Fees | 0.66% | 0.66% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.17% | 0.13%(1) |

| Total Annual Fund Operating Expenses | 0.83% | 0.79% |

| Fee Waiver and Reimbursement(2), (3) | 0.00% | 0.00% |

| Total Annual Fund Operating Expenses After Fee Waiver and Reimbursement | 0.83% | 0.79% |

| (1) | “Other Expenses” for the Acquiring Fund have been estimated for the current fiscal year. Actual expenses may differ from estimates. |

| (2) | The adviser has contractually agreed to waive its management fees and to make payments to limit Acquired Fund expenses, until February 1, 2024, so that the total annual operating expenses (excluding interest, taxes, brokerage fees and commissions payable by the Acquired Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquired Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business) of the Acquired Fund do not exceed 0.89%, for Institutional Class shares. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Acquired Fund in future years (within three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then current expense limits. The expense limit agreement may be terminated only by the Acquired Fund’s Board of Trustees, upon written notice to the adviser. As of May 15, 2023, there were no outstanding amounts eligible for recoupment by the adviser. |

| (3) | The adviser has contractually agreed to waive its management fees and to make payments to limit Acquiring Fund expenses for a period of one year from the date of the Reorganization so that the total annual operating expenses (excluding interest, taxes, brokerage fees and commissions payable by the Acquiring Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Acquiring Fund’s ordinary course of business) of the Acquiring Fund do not exceed 0.89% for Institutional Class shares. These fee waivers and expense reimbursements are subject to possible recoupment by the adviser from the Acquiring Fund in future years (within three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then current expense limits. The expense limit agreement may be terminated only by the Acquiring Fund’s Board of Trustees, upon written notice to the adviser. |

19

FPA Queens Road Value Fund (Acquired Fund)/FPA Queens Road Value Fund (Acquiring Fund)

Shareholder Fees (fees paid directly from your investment) | Acquired Fund | Acquiring Fund (Pro Forma) |

Maximum Sales Charge (Load) Imposed on purchases (as a percentage of offering price) | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of purchase price) | None | None |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends and other Distributions | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||

| Management Fees | 0.95% | 0.95% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 1.00% | 0.56%(1) |

| Total Annual Fund Operating Expenses | 1.95% | 1.51% |

| Fee Waiver and Reimbursement(2), (3) | (1.30)% | (0.86)% |

| Total Annual Fund Operating Expenses after Fee Waiver and Reimbursement | 0.65% | 0.65% |

| (1) | “Other Expenses” for the Acquiring Fund have been estimated for the current fiscal year. Actual expenses may differ from estimates. |

| (2) | The adviser has contractually agreed to reimburse the Acquired Fund for operating expenses in excess of 0.65% of average net assets of the Acquired Fund, excluding interest, taxes, brokerage fees and commissions payable by the Acquired Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquired Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Acquired Fund’s ordinary course of business, until October 31, 2023. These expense reimbursements are subject to possible recoupment by the adviser from the Acquired Fund in future years (within the three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then current expense limits. This agreement may be terminated only by the Acquired Fund’s Board of Trustees, upon written notice to the adviser. |

| (3) | The adviser has contractually agreed to reimburse the Acquiring Fund for operating expenses in excess of 0.65% of average net assets of the Acquiring Fund, excluding interest, taxes, brokerage fees and commissions payable by the Acquiring Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Acquiring Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Acquiring Fund’s ordinary course of business, for a period of one year from the date of the Reorganization. These expense reimbursements are subject to possible recoupment by the adviser from the Acquiring Fund in future years (within the three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then current expense limits. This agreement may be terminated only by the Acquiring Fund’s Board of Trustees, upon written notice to the adviser. The adviser is permitted to seek reimbursement from the Acquiring Fund, subject to certain limitations, of fees waived or payments made by the adviser to the Acquired Fund prior to the Reorganization for a period ending three years after the date of the waiver or payment. |

20

FPA U.S. Core Equity Fund, Inc. (Acquired Fund)/ FPA U.S. Core Equity Fund (Acquiring Fund)

Shareholder Fees (fees paid directly from your investment) | Acquired Fund | Acquiring Fund (Pro Forma) |

Maximum Sales Charge (Load) Imposed on purchases (as a percentage of offering price) | None | None |

Maximum Deferred Sales Charge (Load) (as a percentage of original sales price or redemption proceeds, as applicable) | None | None |

| Exchange Fee | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage | ||

| Management Fees(1), (2) | 0.75% | 0.75% |

| Distribution and/or Service (12b-1) Fees | None | None |

| Other Expenses | 0.69% | 0.41%(1) |

| Total Annual Fund Operating Expenses | 1.44% | 1.16% |

| Expense Reimbursement(2), (3) | 0.18% | 0.00% |

| Total Annual Fund Operating Expenses After Expense Reimbursement | 1.26% | 1.16% |

| (1) | “Other Expenses” for the Acquiring Fund have been estimated for the current fiscal year. Actual expenses may differ from estimates. |

| (2) | The Investment Advisory Agreement between the Acquired Fund and the Acquired Fund’s investment adviser, requires the adviser to reduce its investment management fee to the extent necessary to reimburse the Acquired Fund for any annual expenses (exclusive of interest, taxes, the cost of brokerage and research services, legal expenses related to portfolio securities, and extraordinary expenses such as litigation, merger, reorganization or recapitalization) in excess of 1.5% of the first $30 million and 1% of the remaining average net assets of the Acquired Fund for the year. This agreement is coterminous with the Investment Advisory Agreement which may be terminated by the Board, the vote of a majority of the Acquired Fund’s shareholders or the adviser. |

| (3) | The Investment Advisory Agreement between the Acquiring Fund and the Acquiring Fund’s investment adviser, requires the adviser to reduce its investment management fee to the extent necessary to reimburse the Acquiring Fund for any annual expenses (exclusive of interest, taxes, the cost of brokerage and research services, legal expenses related to portfolio securities, and extraordinary expenses such as litigation, merger, reorganization or recapitalization) in excess of 1.5% of the first $30 million and 1% of the remaining average net assets of the Acquiring Fund for the year. This agreement is coterminous with the Investment Advisory Agreement which may be terminated by the Board, the vote of a majority of the Acquiring Fund’s shareholders or the adviser. |

21

Example

The Examples below are intended to help you compare the cost of investing in each Acquired Fund with the cost of investing in the corresponding Acquiring Fund on a pro forma basis. The Example assumes that you invest $10,000 in a Fund and then redeem all of your shares at the end of each period. The Example also assumes that your investment has a 5% annual return, that each Fund’s Total Annual Fund Operating Expenses remain as stated in the previous table and that distributions are reinvested. The Example for the FPA New Income, Inc. (Acquired Fund)/FPA New Income Fund (Acquiring Fund) and FPA U.S. Core Equity Fund, Inc. (Acquired Fund)/FPA U.S. Core Equity Fund (Acquiring Fund) reflects the Fund’s contractual fee waiver and/or expense reimbursement only for the term of the contractual fee waiver and/or expense reimbursement. Although your actual costs may be higher or lower, based on these assumptions, your costs would be as follows, if you redeem your shares:

FPA New Income, Inc. (Acquired Fund)/ FPA New Income Fund (Acquiring Fund)

| One Year | Three Years | Five Years | Ten Years | |

| Acquired Fund | $46 | $175 | $315 | $725 |

| Acquiring Fund (Pro forma) | $46 | $173 | $311 | $713 |

FPA Queens Road Small Cap Value Fund (Acquired Fund)/FPA Queens Road Small Cap Value Fund (Acquiring Fund)

| One Year | Three Years | Five Years | Ten Years | |

| Acquired Fund – Investor Class Shares | $102 | $318 | $552 | $1,225 |

| Acquiring Fund – Investor Class Shares (Pro forma) | $98 | $306 | $531 | $1,178 |

| Acquired Fund – Advisor Class Shares | $95 | $296 | $515 | $1,143 |

| Acquiring Fund – Advisor Class Shares (Pro forma) | $92 | $287 | $498 | $1,108 |

Acquired Fund – Institutional Shares | $85 | $265 | $460 | $1,025 |

| Acquiring Fund – Institutional Shares (Pro forma) | $81 | $252 | $439 | $978 |

FPA Queens Road Value Fund (Acquired Fund)/FPA Queens Road Value Fund (Acquiring Fund)

| One Year | Three Years | Five Years | Ten Years | |

| Acquired Fund | $66 | $473 | $919 | $2,159 |

| Acquiring Fund (Pro forma) | $66 | $393 | $742 | $1,721 |

22

FPA U.S. Core Equity Fund, Inc. (Acquired Fund)/ FPA U.S. Core Equity Fund (Acquiring Fund)

| One Year | Three Years | Five Years | Ten Years | |

| Acquired Fund | $128 | $438 | $770 | $1,709 |

| Acquiring Fund (Pro forma) | $118 | $368 | $638 | $1,409 |

Who manages the Funds and what are the management fees?

Each Acquiring Fund is a series of Trust. The Trust is governed by a Board of Trustees, which is responsible for overseeing all business activities of the Acquiring Funds.

Investment Adviser

FPA is the investment adviser for each Acquiring Fund. Together with its predecessor organizations, FPA has been in the investment advisory business since 1954, and serves as the investment adviser for registered investment companies, including a closed-end fund and an exchange-traded fund, as well as institutional, sub-advised and private fund accounts. FPA is a registered investment adviser and is located 11601 Wilshire Boulevard, Suite 1200, Los Angeles, California 90025. As of March 31, 2023, FPA manages assets of approximately $24.3 billion.

Investment Management Fees and Fee Waivers for the Acquired Funds

Each Acquired Fund currently pays FPA an investment management fee based on a percentage of average daily net assets. The management fee for each Acquired Fund is as follows:

| Acquired Fund | Management Fee | ||

| FPA New Income, Inc. | 0.50% of the Fund’s daily net assets | ||

| FPA Queens Road Small Cap Value Fund | 0.75% of the Fund’s daily net assets up to $50 million; 0.65% of the Fund’s daily net assets in excess of $50 million | ||

| FPA Queens Road Value Fund | 0.95% of the Fund’s daily net assets | ||

| FPA U.S. Core Equity Fund, Inc. | 0.75% of the Fund’s daily net assets up to $50 million; 0.65% of the Fund’s daily net assets in excess of $50 million |

With respect to the FPA New Income, Inc., FPA has contractually agreed to reimburse expenses in excess of 0.45% of the average daily net assets of the Fund (excluding interest, taxes, brokerage fees and

23

commissions payable by the Fund in connection with the purchase or sale of portfolio securities, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business) through January 31, 2024.

With respect to the FPA Queens Small Cap Value Fund, FPA has contractually agreed to reimburse the Fund’s expenses in excess of 1.04% of average net assets of the Investor Class, 0.99% of average net assets of the Advisor Class, and 0.89% of average net assets of the Institutional Class, excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business, until October 31, 2023. These expense reimbursements are subject to possible recoupment by the adviser from the Fund in future years (within the three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then- current expense limits. This agreement may be terminated only by the Fund’s Board of Trustees upon written notice to FPA.

With respect to the FPA Queens Road Value Fund, FPA has contractually agreed to reimburse expenses in excess of 0.65% of average net assets of the Fund, excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business, until October 31, 2023. These expense reimbursements are subject to possible recoupment by the adviser from the Fund in future years (within the three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then- current expense limits. This agreement may be terminated only by the Fund’s Board of Trustees upon written notice to FPA.

With respect to FPA U.S. Core Equity Fund, Inc., the Investment Advisory Agreement requires FPA to reduce its investment management fee to the extent necessary to reimburse the Fund for any annual expenses (exclusive of interest, taxes, the cost of brokerage and research services, legal expenses related to portfolio securities, and extraordinary expenses such as litigation, merger, reorganization or recapitalization) in excess of 1.5% of the first $30 million and 1% of the remaining average net assets of the Fund for the year. This agreement is coterminous with the Investment Advisory Agreement, which may be terminated by the Fund's Board, the vote of a majority of the Fund’s shareholders or FPA.

During the twelve-month period ended September 30, 2022 for FPA New Income, Inc. (the end of the Fund’s most recently completed fiscal year), May 31, 2022 for FPA Queens Road Value Fund (the end of the Fund’s most recently completed fiscal year), May 31, 2022 for FPA Queens Road Small Cap Value Fund (the end of the Fund’s most recently completed fiscal year) and December 31, 2022 for FPA U.S. Core Equity Fund, Inc. (the end of the Fund’s most recently completed fiscal year), each Acquired Fund paid FPA the following effective management fees (net of any waivers):

| Acquired Fund | Effective Management Fee | ||

| FPA New Income, Inc. | 0.36% | ||

| FPA Queens Road Small Cap Value Fund | 0.66% |

24

| FPA Queens Road Value Fund | 0.00% | ||

| FPA U.S. Core Equity Fund, Inc. | 0.57% |

25

Investment Management Fees and Fee Waivers for the Acquiring Funds

Each Acquiring Fund will pay FPA an investment management fee based on a percentage of the Acquiring Fund’s average daily net assets. The management fee for each Acquiring Fund is as follows:

| Acquiring Fund | Management Fee | |||

| FPA New Income Fund | 0.50% of the Fund’s daily net assets

| |||

| FPA Queens Road Small Cap Value Fund | 0.75% of the Fund’s daily net assets up to $50 million; 0.65% of the Fund’s daily net assets in excess of $50 million

| |||

| FPA Queens Road Value Fund | 0.95% of the Fund’s daily net assets

| |||

| FPA U.S. Core Equity Fund | 0.75% of the Fund’s daily net assets up to $50 million; 0.65% of the Fund’s daily net assets in excess of $50 million |

With respect to the FPA New Income Fund, FPA has contractually agreed to reimburse expenses in excess of 0.45% of the average daily net assets of the Fund (excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business) for a period of one year from the date of the FPA New Income Reorganization.

With respect to the FPA Queens Small Cap Value Fund, FPA has contractually agreed to reimburse the Fund’s expenses in excess of 1.04% of average net assets of the Investor Class, 0.99% of average net assets of the Advisor Class, and 0.89% of average net assets of the Institutional Class, excluding interest, taxes, brokerage fees and commissions payable by the Fund in connection with the purchase or sale of portfolio securities, fees and expenses of other funds in which the Fund invests, and extraordinary expenses, including litigation expenses not incurred in the Fund’s ordinary course of business, for a period of one year from the date of the FPA Queens Road Small Cap Value Reorganization. These expense reimbursements are subject to possible recoupment by the adviser from the Fund in future years (within the three years from the date when the amount is waived or reimbursed) if such recoupment can be achieved within the lesser of the foregoing expense limits or the then- current expense limits. This agreement may be terminated only by the Fund’s Board of Trustees upon written notice to FPA. Note that the operating expenses for each of the Fund’s share classes are currently expected to be lower than these reimbursement levels.

With respect to the FPA Queens Road Value Fund, FPA has contractually agreed to reimburse expenses in excess of 0.65% of average net assets of the Fund, excluding interest, taxes, brokerage fees and

26