- AWH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Aspira Women's Health (AWH) DEF 14ADefinitive proxy

Filed: 29 Mar 24, 7:14pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ý Filed by a Party other than the Registrant | |||

Check the appropriate box: | |||

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

ý | Definitive Proxy Statement | ||

| Definitive Additional Materials | ||

| Soliciting Material under §240.14a-12 | ||

Aspira Women’s Health Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply): | |

ý | No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

ASPIRA WOMEN’S HEALTH INC.

12117 Bee Caves Road, Building III, Suite 100

Austin, Texas 78738

(512) 519-0400

______________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 13, 2024

______________________

Dear Stockholder:

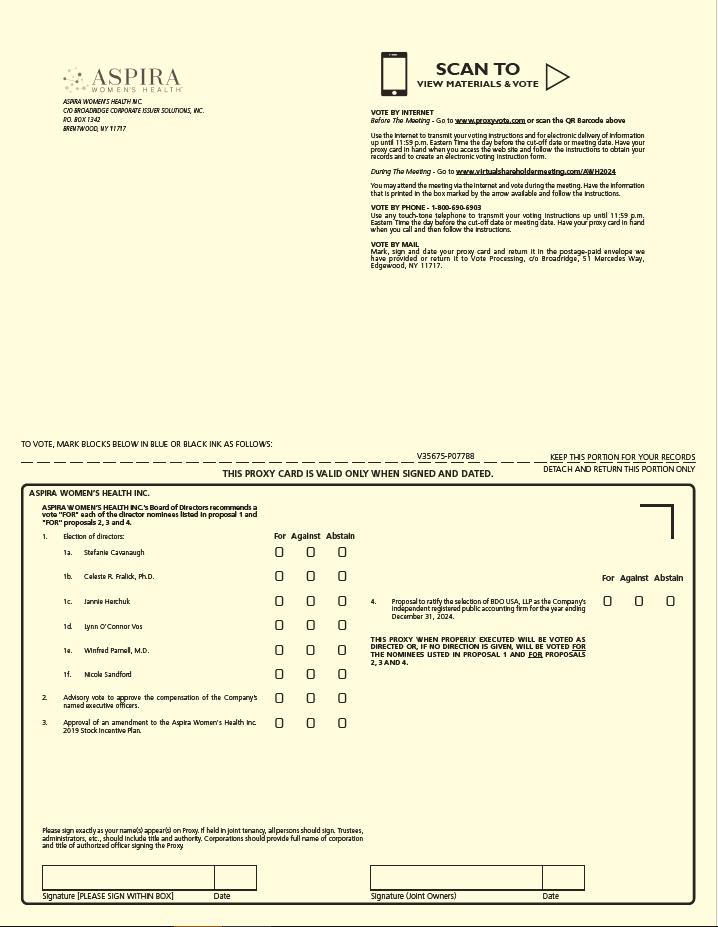

NOTICE IS HEREBY GIVEN that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Aspira Women’s Health Inc., a Delaware corporation (the “Company”), will be held on Monday, May 13, 2024 at 12:00 p.m. (Eastern Time). This year’s Annual Meeting will be conducted online via live webcast at www.virtualshareholdermeeting.com/AWH2024.

The Annual Meeting will be held for the following purposes:

1.To elect as directors the six nominees named in the proxy statement to serve for a one-year term expiring at the 2025 annual meeting of stockholders and until their successors are elected and qualified (Proposal 1);

2.To hold an advisory vote to approve the compensation of the Company’s Named Executive Officers as disclosed in the proxy statement (Proposal 2);

3.To approve an amendment to the Aspira Women’s Health Inc. 2019 Stock Incentive Plan (the “2019 Plan”) (Proposal 3);

4.To ratify the selection of BDO USA, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2024 (Proposal 4); and

5.To transact such other business as properly may be brought before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

The Board of Directors of the Company has fixed the close of business on March 18, 2024 as the record date for determining the stockholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. A complete list of the stockholders entitled to vote at the Annual Meeting, as well as during the ten days prior to the Annual Meeting, will be available for examination by any stockholder for any purpose germane to the Annual Meeting during the Annual Meeting at www.virtualshareholdermeeting.com/AWH2024 or by contacting the Corporate Secretary at (415) 650-7377 in order to arrange a viewing of the list during ordinary business hours, at our principal place of business, during the period of ten days prior to the Annual Meeting.

YOUR VOTE IS IMPORTANT. IN ORDER TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, YOU ARE URGED TO VOTE BY INTERNET OR TELEPHONE TODAY OR REQUEST A PROXY CARD TO SIGN, DATE AND RETURN BY MAIL AS SOON AS POSSIBLE.

All stockholders are cordially invited to attend the Annual Meeting virtually. Even if you plan to virtually attend the Annual Meeting, you are urged to vote by Internet, telephone or request a proxy card to sign, date and return by mail in order to ensure your representation at the Annual Meeting. Any stockholder attending the Annual Meeting may change his or her vote and vote online even if that stockholder has voted previously.

Austin, Texas | By Order of the Board of Directors /s/ Nicole Sandford___________ Nicole Sandford |

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 13, 2024

The proxy statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 will be available at www.aspirawh.com or www.proxyvote.com.

___________________

TABLE OF CONTENTS

___________________

ASPIRA WOMEN’S HEALTH INC.

12117 Bee Caves Road, Building III, Suite 100

Austin, Texas 78738

___________________

PROXY STATEMENT

___________________

Annual Meeting of Stockholders to be Held on May 13, 2024

General

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Aspira Women’s Health Inc., a Delaware corporation (“Aspira,” the “Company,” “we,” “us” or “our”), for use at our 2024 annual meeting of stockholders (the “Annual Meeting”) to be held on Monday, May 13, 2024 at 12 p.m. (Eastern Time). The Annual Meeting will be conducted online via live webcast at www.virtualshareholdermeeting.com/AWH2024. Our principal executive offices are located at 12117 Bee Caves Road, Building III, Suite 100, Austin, Texas 78738, and our telephone number is (512) 519-0400.

Electronic Delivery of Proxy Materials

In accordance with U.S. Securities and Exchange Commission (the “SEC”) rules and regulations, instead of mailing a printed copy of our proxy materials to each stockholder of record or beneficial owner, we are furnishing our proxy materials, which include this proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023 (“Annual Report”), to our stockholders over the Internet unless otherwise instructed by the stockholder. On or about March 28, 2024, we mailed out our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access our proxy materials, including this proxy statement and our Annual Report, to vote at the Annual Meeting, and to request printed copies of the proxy materials. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in this Proxy Statement and 2023 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Internet Notice Stockholders may request to receive all future materials in printed form by mail or electronically by e-mail by following the instructions contained in the Internet Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings.

Attending the Virtual Annual Meeting

This year’s Annual Meeting will be a completely virtual meeting, which will be conducted online via live webcast. You will not be able to attend the Annual Meeting in person. You are entitled to participate in the Annual Meeting if you owned shares of our common stock as of the close of business on March 18, 2024.

You will be able to attend the Annual Meeting online and submit your questions and vote during the meeting by visiting www.virtualshareholdermeeting.com/AWH2024. You will need the 16-digit control number included on your Internet Notice or proxy registration confirmation email to participate in the Annual Meeting. If you own shares as a beneficial owner through a broker, bank or nominee and your Internet Notice or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit control number indicated on the Internet Notice or voting instruction form. Otherwise, stockholders who hold their shares in street name should contact the broker, bank or nominee that holds their shares (preferably at least five days before the Annual Meeting) for instructions on how to participate in and vote during the Annual Meeting.

If you do not have your control number, you may still attend the Annual Meeting as a guest (non-stockholder) but you will not have the option to ask questions or vote your shares electronically at the Annual Meeting.

The Annual Meeting webcast will begin promptly at noon Eastern Time, on May 13, 2023. Online access will begin at 11:45 a.m., Eastern Time, and we encourage you to access the meeting prior to the start time. You will not be able to attend the Annual Meeting if you do not have Internet access.

Even if you plan to participate in the Annual Meeting online, we recommend that you also vote in advance by proxy as described further in “Voting” on page 2 so that your vote will be counted if you later decide not to participate in the Annual Meeting.

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties while accessing the virtual meeting during the check-in or meeting time, a technical assistance phone number will be made available on the virtual meeting registration page 15 minutes prior to the start time of the meeting.

Record Date; Outstanding Shares

Only stockholders of record at the close of business on March 18, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, there were 12,344,104 shares of our common stock issued and outstanding and entitled to vote.

Stockholder of Record: Shares of Common Stock Registered in Your Name

If on March 18, 2024, your shares of common stock were registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., then you are a stockholder of record. As a stockholder of record, you may vote online at the virtual Annual Meeting or vote by proxy. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote by proxy over telephone, through the internet or, if you receive a printed proxy card, by mail, by completing, dating and signing the proxy card and promptly mailing it in the postage-paid envelope provide, to ensure your vote is counted.

Beneficial Owner: Shares of Common Stock Registered in the Name of a Broker or Bank

If on March 18, 2024, your shares of common stock were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. You will receive instructions from the brokerage firm, bank, dealer or other organization that holds your shares, which you must follow in order for your shares to be voted.

Revocability of Proxies

Any proxy given by a stockholder of record pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to us at our principal executive offices (12117 Bee Caves Road, Building III, Suite 100, Austin, Texas 78738, Attention: Investor Relations) either a written notice of revocation, properly submitting a duly executed proxy (via the Internet, telephone, or by returning a proxy card) bearing a later date, or by virtually attending the Annual Meeting and voting electronically. Attendance at the Annual Meeting will not, by itself, revoke a proxy. For shares held in street name by beneficial owners, you will need to follow the directions provided to you by your broker, bank, trustee, or other nominee that holds your shares to change your vote.

Solicitation of Proxies

This solicitation of proxies is made by us and all related costs will be borne by us. In addition, we will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of our directors, officers and employees, without additional compensation, personally or by electronic or regular mail, telephone or facsimile.

Voting

Each share of common stock outstanding on the Record Date is entitled to one vote for each director to be elected and one vote on each other matter to be voted on. Stockholders do not have cumulative voting rights.

Voting in Advance of the Annual Meeting

Stockholders of record may vote their shares in advance of the Annual Meeting by Internet, telephone or, if you received printed proxy materials by mail.

By Internet: You may vote your shares by Internet as instructed on the Internet Notice (you will need the control number printed on your Internet Notice or proxy registration confirmation email) . The Internet procedures are designed to authenticate your identity, to allow you to vote your shares, and confirm that your instructions have been properly recorded.

By Telephone: You may vote your shares by telephone as instructed on your Internet Notice.

By Mail: You may vote your shares by mail if you request a paper proxy card. If you receive multiple proxy cards, you should sign and date each proxy card you receive. When a proxy card is properly dated, executed and returned, the shares represented by such proxy card will be voted at the Annual Meeting in accordance with the instructions of the stockholder as set forth on the proxy card. If you return a signed and dated proxy card or otherwise vote with no specific instructions, the shares will be voted in accordance with the Board’s recommendation, as follows:

“FOR” the election of each director nominee named herein (Proposal 1);

“FOR” the approval of the compensation of our Named Executive Officers (Proposal 2);

“FOR” the approval of the amendment to the 2019 Plan (Proposal 3);

“FOR” the ratification of the selection of BDO USA, LLP as our independent registered public accounting firm for the year ending December 31, 2024 (Proposal 4).

In addition, shares will be voted at the discretion of the individuals designated as proxies on the proxy card on such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

If you are a beneficial owner of shares in “street name”, you should have received an Internet Notice containing voting instructions from that organization rather than from us. You must follow these instructions for your bank, broker or other stockholder of record to vote your shares per your instructions.

Voting During the Annual Meeting

If you are a stockholder of record, you may vote by accessing the webcast online at www.virtualshareholdermeeting.com/AWH2024, having the 16-digit control number included on your Internet Notice (or proxy registration confirmation email) available, and following the instructions. If you own shares as a beneficial owner through a broker, bank or nominee and your Internet Notice or voting instruction form indicates that you may vote those shares through the www.proxyvote.com website, then you may access, participate in, and vote at the Annual Meeting with the 16-digit control number indicated on that Internet Notice or voting instruction form. Otherwise, stockholders who hold their shares in street name and do not have a 16-digit control number, must contact the broker, bank or nominee that holds their shares (preferably at least five days before the Annual Meeting) for instructions on how to participate and vote during the Annual Meeting.

Quorum; Required Votes; Abstentions; Broker Non-Votes

Quorum

Holders of a majority of the outstanding stock entitled to vote at the Annual Meeting, must be present, in person or represented by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. If the shares present, in person or represented by proxy, at the Annual Meeting do not constitute the required quorum, the meeting may be adjourned to a subsequent date by any officer entitled to preside at or to act as secretary of such meeting regardless of the presence of a quorum. Stockholders attending the Annual Meeting via webcast are deemed to be present “in person.” When shares are properly voted in accordance with the procedures above, such shares are counted in determining whether a quorum exists, even if the shares are voted “ABSTAIN.” Broker non-votes (as defined below) are also counted for purposes of determining a quorum.

Required Votes

The proposal to elect directors (Proposal 1) in an uncontested election requires the affirmative vote of a majority of the votes properly cast (meaning the number of shares voted “for” a nominee must exceed the number of shares voted “against” such nominee) with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” such nominee’s election.

The proposals to approve the compensation of our Named Executive Officers (Proposal 2), to approve the amendment to the 2019 Plan (Proposal 3) and to ratify the selection of BDO USA, LLP as our independent registered public accounting firm (Proposal 4) each require the affirmative vote of a majority of the votes properly cast for such matter (i.e., if the number of votes properly cast “for” such matter exceeds the number of votes properly cast “against” such matter) with “abstentions” and “broker non-votes” not counted as a vote cast either “for” or “against” such matter.

Abstentions

Shares voted “ABSTAIN” from the proposals to elect directors (Proposal 1), to approve the compensation of our Named Executive Officers (Proposal 2), to approve the amendment to the 2019 Plan (Proposal 3) and to ratify the selection of BDO USA, LLP as our independent registered public accounting firm (Proposal 4) will have no effect on the outcome of the votes.

Broker Non-Votes

If a stockholder is the beneficial owner of shares held in “street name” through a broker, bank or nominee, the broker, bank or nominee is required to vote your shares in accordance with your instructions. You should direct any such organization on how to vote the shares held in your account. Under applicable stock exchange rules, the broker, bank or nominee is not permitted to vote on the stockholder’s behalf on certain matters that are not “routine,” unless the stockholder provides specific instructions on how to vote the shares. Broker non-votes occur when your broker submits a proxy for the Annual Meeting with respect to “routine” matters but does not vote on “non-routine” matters because you did not provide voting instructions on those matters. Proposals 1, 2 and 3 are considered to be “non-routine” under NYSE rules and we therefore expect broker non-votes to exist only in connection with these proposals.

The proposal to ratify the selection of BDO USA, LLP as our independent registered public accounting firm (Proposal 4) is considered a routine matter, and the broker, bank or nominee is allowed to vote the shares held in street name, without receiving specific instructions from stockholders on how to vote the shares on that proposal. Each other proposal to be voted on at the Annual Meeting is expected to be a non-routine matter, and the broker, bank or nominee may not vote your shares on these proposals without your instructions and these shares will not be counted as having been voted on the applicable proposal. Accordingly, we urge you to instruct your broker, bank, or other nominee to ensure that your vote will be counted.

Postponement or Adjournment of the Annual Meeting

Your proxy may be voted at the postponed or adjourned Annual Meeting. You will still be able to change your proxy until it is voted.

Any adjournment of the Annual Meeting can be accessed at the same website listed above and you may vote at any postponement or adjournment using the control number.

Results of the Annual Meeting

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Householding of Proxy Materials

Some banks, brokers and other nominee registered holders may be “householding” our proxy materials. This means that only one copy of the Internet Notice may have been sent to multiple stockholders in your household. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If you would like to request a copy of the material(s) for this and/or future stockholder meetings, you may (1) visit www.proxyvote.com, (2) call 1-800-579-1639 or (3) send an email to sendmaterial@proxyvote.com. If sending an email, please include your 16-digit control number in the subject line. If you want to receive separate copies in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee, or you may contact us at the above address or telephone number.

Submission of Stockholder Proposals for the 2025 Annual Meeting

In order to be eligible for inclusion in the Company’s proxy statement for the 2025 annual meeting of stockholders (the “2025 Annual Meeting”), stockholder proposals must comply with Rule 14a-8(e) promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and any other applicable rules. Rule 14a-8 requires that stockholder proposals be delivered to our principal executive offices no later than 120 days before the one-year anniversary of the release date of the previous year’s annual meeting proxy statement. Accordingly, if you wish to submit a proposal to be considered for inclusion in the proxy statement for our 2025 Annual Meeting, you must submit the proposal in writing to Aspira Women’s Health Inc., 12117 Bee Caves Road, Building III, Suite 100, Austin, Texas 78738, Attention: Corporate Secretary. We must receive the proposal by November 29, 2024 in order to consider it for inclusion in the proxy statement for our 2025 Annual Meeting.

Alternatively, in accordance with the “advance notice” provisions of our Bylaws, stockholders seeking to present a stockholder proposal or director nomination at our 2025 Annual Meeting of Stockholders, without having it included in the 2025 Proxy Statement, must comply with the advance notice requirements set forth in our Bylaws, including that the stockholder gives timely notice of the proposal or nomination in writing and in proper form to our secretary at our principal executive offices. To be timely, a stockholder’s notice must be received by the Secretary at our principal executive offices not earlier than 5:00 p.m. ET on the 120th day, nor later than 5:00 p.m. ET on the 90th day, before the first anniversary of the 2024 Annual Meeting of Stockholders, unless the date of the 2025 Annual Meeting of Stockholders is advanced by more than 30 days from the anniversary of the 2024 Annual Meeting of Stockholders. For our 2025 Annual Meeting of Stockholders, this means that any such proposal or nomination must be submitted no earlier than January 13, 2025, and no later than February 12, 2025. If the date of the 2025 Annual Meeting of Stockholders is advanced by more than 30 days or delayed by more than 60 days from the anniversary of the 2024 Annual Meeting of Stockholders, the stockholder must submit any such proposal or nomination on or before the later of 5:00 p.m. ET on the 90th day prior to the 2025 Annual Meeting of Stockholders, or the 10th day following the day on which we first make public announcement of the date of the 2025 Annual Meeting of Stockholders

Our Bylaws contain provisions regarding information that must be set forth in a stockholder’s notice or otherwise provided in connection with stockholder proposals and director nominations. In addition to satisfying the foregoing requirements under our Bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than management’s nominees must provide notice that sets forth in their notice any additional information required by Rule 14a-19(b) under the Exchange Act.

YOUR VOTE IS EXTREMELY IMPORTANT, NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN. PLEASE VOTE BY INTERNET OR TELEPHONE TODAY OR REQUEST A PROXY CARD TO SIGN, DATE AND RETURN BY MAIL AS SOON AS POSSIBLE.

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors (the “Board”) currently consists of six members, all of whom have been re-nominated for election at the Annual Meeting. Valerie Palmieri and Veronica G.H. Jordan, Ph.D. each resigned as a director effective as of March 1, 2023 and December 21, 2023, respectively. On June 1, 2023, the Board appointed Winfred Parnell, M.D. as a director.

If elected by our stockholders, each of the six nominees named below will serve for a one-year term expiring at our 2025 annual meeting of stockholders. Each director will hold office until his or her successor has been elected and qualified or until the director’s earlier resignation or removal. Stockholders may not vote for more than six nominees.

In evaluating the suitability of individual Board members, our Nominating and Corporate Governance Committee takes into account many factors such as general understanding of various business disciplines (e.g., marketing or finance), understanding of the Company’s business environment, educational and professional background, judgment, integrity, ability to make independent analytical inquiries and willingness to devote adequate time to Board duties. The Board evaluates each individual in the context of the Board as a whole with the objective of retaining a group with diverse and relevant experience that can best perpetuate the Company’s success and represent stockholder interests through sound judgment.

Nominees for Director

Information regarding the nominees for the Board of Directors is set forth below. The Company has no reason to believe that the nominees would be unable or unwilling to serve as a director if elected. However, in the event that any of the nominees is unable to or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the Board to fill the vacancy, or alternatively, the Board may leave a vacancy on the Board or reduce the size of the Board.

All of the Company’s incumbent directors have previously been elected by our stockholders, other than Dr. Winfred Parnell, M.D., who was appointed by our Board in June 2023. Our Nominating and Governance Committee identifies candidates for director nominees in consultation with management, through the use of search firms or other advisers, or through such other methods as our Nominating and Governance Committee deems to be helpful to identify candidates. Our Board, upon the recommendation of the Nominating and Governance Committee selected Dr. Parnell as a director nominee in recognition of his extensive experience in the medical industry. Our Board expects Dr. Parnell to provide meaningful perspectives on a wide range of matters, including with respect to our strategic priorities and valuable industry insights. Dr. Parnell was identified as a potential director nominee by a professional search firm engaged by management.

Name | Age | Position with Aspira | Director Since |

Stefanie Cavanaugh(1)(2) | 59 | Director | May 2023 |

Celeste R. Fralick, Ph.D.(3) | 68 | Director | February 2022 |

Jannie Herchuk(4) | 61 | Chair of the Board of Directors | May 2023 |

Lynn O' Connor Vos(2)(5)(6) | 68 | Director | May 2023 |

Winfred Parnell, M.D.(5)(6) | 71 | Director | June 2023 |

Nicole Sandford | 53 | President, Chief Executive Officer and Director | February 2021 |

(1)Chair of the Compensation Committee

(2)Member of the Audit Committee

(3)Chair of the Nominating and Governance Committee

(4)Chair of the Audit Committee

(5)Member of the Compensation Committee

(6)Member of the Nominating and Governance Committee

Stefanie Cavanaugh has been a senior financial executive for healthcare companies for over 30 years. Ms. Cavanaugh has served as Chief Financial Officer of Giving Home Health Care, an at-home healthcare services company, since August 2022. Before her tenure at Giving Home Health Care, Ms. Cavanaugh was the Chief Financial Officer of Apollo Endosurgery, a publicly traded medical technology company, from February 2015 to January 2022. After completing Apollo’s IPO via a reverse merger, she worked closely with the Board and CEO to develop guidance and investor communications raising over $170 million in debt and equity financing to support Apollo’s strategic and organizational objectives. Ms. Cavanaugh began her career as an auditor at Ernst & Young after earning her B.B.A. in Accounting and Finance at the University of Texas at Austin. Ms. Cavanaugh is a licensed CPA in the state of Texas.

Our Board has determined that based upon Ms. Cavanaugh’s extensive financial expertise and leadership and her extensive experience in the medical industry, she has the qualifications and skills to serve as a member of our Board.

Celeste R. Fralick, Ph.D. has served as Chief Technology & Data Officer, Technology Design of Choir Power since February 2023. Additionally, since 2018, Dr. Fralick has served as Chief Data Officer of Innovatio HealthDesign, a privately held health predictive analytics company. Previously, from 2017 to 2022, Dr. Fralick served as Chief Data Scientist at McAfee, a cybersecurity company, which was spun-off from Intel Corporation in 2017. Prior to her position at McAfee, Dr. Fralick served as Principal Engineer and Chief Technology Officer at Intel from 2015 to 2017. She has also served as Managing Principal at Prukinje Science and Technology, LLC, a privately held data analytics consulting business, from 2019 to 2022. Dr. Fralick earned a B.Sc. in Microbiology and Chemistry from Texas Tech University and a Ph.D. in Bioengineering from Arizona State University.

Our Board has determined that based upon Dr. Fralick’s extensive executive-level leadership and management experience in technology and health sciences, she has the qualifications and skills to serve as a member of our Board.

Jannie Herchuk retired from Deloitte & Touche LLP in 2022 after nearly 40 years of audit experience. Ms. Herchuk served on the Deloitte LLP board of directors and led strategic initiatives and practices. As the audit partner for some of the firm’s most important healthcare and life sciences companies, Ms. Herchuk oversaw her client's preparation of financial statements and led audit engagements for public and private companies. Ms. Herchuk has routinely attended client board and audit committee meetings throughout her career. Ms. Herchuck received her B.B.A. in Accounting from Texas A&M University and is a licensed CPA in the state of Texas.

Our Board has determined that based upon Ms. Herchuk’s extensive industry experience and financial accounting, SEC reporting, internal controls, and auditing expertise, she qualifies to serve as a member of our Board.

Lynn O’Connor Vos has served as president of VosHealth LLC, a healthcare consultancy firm since November 2022. From August 2021 until February 2022, she served as chief executive officer of Modular Medical, a development state insulin pump company. Prior, served as the president and chief executive officer of the Muscular Dystrophy Association, the leader of genetic/neuromuscular and ALS research, patient care and advocacy from October 2017 to November 2020. Previously, she spent almost 30 years as CEO of Greyhealth Group (and its predecessor company), where she built a global healthcare communications firm and worked on launches for clients across the pharmaceutical, biotech, surgical, and diagnostic sectors. .Lynn currently serves on the boards of OptimizeRX and Modular Medical. She previously served on the board of nTelos, prior to the sale to Shentel, and on the boards of several WPP investment portfolio companies. She has significant nonprofit board experience with The Jed Foundation, Multiple Myeloma Research Foundation (MMRF), Healthcare Businesswomen’s Association (HBA) and a trustee of The Windward School and the YMCA of the City of New York. Lynn was named the Woman of the Year by the Healthcare Businesswomen’s Association in 2005. She was also a member of the Kraft Precision Medicine Accelerator at Harvard Business School focused on innovation and improving outcomes in oncology and rare diseases. She earned a B.S. in Nursing from Alfred University.

Our Board has determined that based upon Ms. O’Connor Vos’s extensive experience in the healthcare industry, including relevant experience as a current and prior director and as an executive officer, she has the qualifications and skills to serve as a member of our Board.

Winfred Parnell is a board-certified physician in obstetrics and gynecologic care bringing more than 20 years of board experience and expertise in strategic planning, governance, cultural transformation, regulatory & compliance, quality of care, and crisis management. Dr. Parnell was a founding partner of Carlos & Parnell, M.D., P.A., an obstetrics and gynecology practice in Dallas, TX. Dr. Parnell serves on the board of private equity-backed SCA Pharm, one of the largest compounding pharmacies in the country. Dr. Parnell is a graduate of Florida A&M University and received his MD from the University of Florida College of Medicine. He completed his internship and residency training at Parkland Hospital in Dallas, TX and holds an Executive Certificate in Non-Profit Governance.

Our Board has determined that based upon Dr. Parnell’s extensive experience in gynecologic care and as a current and prior director, he has the qualifications and skills to serve as a member of our Board.

Nicole Sandford has served as our President and Chief Executive Officer since March 2022. Ms. Sandford brings more than three decades of executive and leadership experience to the role as an innovator, business leader and sought-after advisor to CEOs and Boards on strategy, operations, human capital, governance, and risk. Prior to joining the company, Ms. Sandford was the executive Vice President of Ellig Group, a boutique human capital and strategy consultancy. Before that she spent over 27 years with global consultancy, Deloitte, where she launched new ventures, transformed underperforming practices, and led mature businesses including the firm’s flagship Regulatory and Operational Risk practice. She started her career with Deloitte as an auditor specializing in high-growth global companies in the technology, healthcare and industrial sectors and advising on complex transactions including mergers and acquisitions, financings, and securities offerings. Ms. Sandford is a member of the Advisory Board for Ellig Group and

an Emeritus Member of the Weinberg Center at the University of Delaware and the patient representative for the Greenwich Hospital Breast Cancer Accreditation Committee. She was previously the Board Chair of Girl Scouts of Connecticut, and Board Member of the Stamford Public Education Foundation. Ms. Sandford received her B.B.A in Accounting from Niagara University.

Our Board has determined that based upon Ms. Sandford’s extensive financial expertise and experience in leadership, including relevant experience as our President and Chief Executive Officer, she has the qualifications and skills to serve as a member of our Board.

Independence of the Board of Directors

As required under the Nasdaq listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the Board.

The Board has affirmatively determined, after considering all relevant facts and circumstances, that each of Stefanie Cavanaugh, Celeste R. Fralick, Jannie Herchuk, Lynn O’Connor Vos and Winfred Parnell is an independent director, as the term is currently defined under Nasdaq Listing Rule 5605(a)(2). Nicole Sandford is not an independent director because she currently serves as our President and Chief Executive Officer.

In addition, Robert Auerbach Ruby Sharma and Veronica G.H. Jordan, Ph.D., each of whom served as a director in 2023, were independent directors during their service in 2023. Valerie Palmieri was not an independent director because she served as our Executive Chair and prior to that as our President and Chief Executive Officer.

Board Leadership Structure

The Board believes that separation of the positions of the Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Board believes that having an independent Chair creates an environment that is more conducive to the Board’s objective evaluation and oversight of management’s performance, increasing management accountability, and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders, including with respect to evaluating whether steps management is taking to manage risks are appropriate for the Company. Our Chair of the Board, Jannie Herchuk’s responsibility is to ensure that our Board functions properly and to work with our Chief Executive Officer to set the Board’s agenda. Accordingly, she has substantial ability to shape the work of the Board. We expect her to facilitate communications among our directors and between the Board and senior management. While Ms. Herchuk provides independent leadership, she also works closely with our Chief Executive Officer to ensure that our directors receive the information that they need to perform their responsibilities, including discussing and providing critical review of the matters that come before the Board and assessing management’s performance. As a result, we believe that such separation can enhance the effectiveness of our Board as a whole. We believe that the leadership structure of our Board is appropriate and enhances its ability to effectively carry out its roles and responsibilities on behalf of our stockholders.

Role of the Board in Risk Oversight

The Board is involved in oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the Board, and particularly the Audit Committee and Nominating and Governance Committee, but the full Board has retained responsibility for general oversight of risks.

The Board satisfies this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers and department heads responsible for oversight of particular risks within the Company.

With respect to cybersecurity, the Audit Committee works closely with and receives updates from management at least annually on matters related to cybersecurity. Employees receive cybersecurity training at least annually. The Company maintains cyber liability insurance coverage.

With respect to human capital-related risk exposures, the Compensation Committee works closely with management on matters related to significant compensation and equity decisions.

The Audit Committee reviews and assesses corporate responsibility matters, including environmental and social risks.

Meetings of the Board of Directors

Our Board establishes overall policies and standards and reviews the performance of management. The Board held eleven meetings in 2023. Each director, other than Ruby Sharma attended 75% or more of the aggregate number of meetings of the Board and the committees on which he or she served that were held during the period for which he or she was a director. Applicable Nasdaq listing standards require that the independent directors meet at least twice a year, and perhaps more frequently from time to time in executive session. In 2023, our independent directors met in regularly scheduled executive sessions at which only independent directors were present. It is our policy to request that all Board members attend the annual meeting of stockholders. We held our most recent annual meeting of stockholders on May 9, 2023 and all members of the Board standing for re-election attended the meeting.

Audit Committee

The Audit Committee of the Board was established by the Board to oversee our corporate accounting and financial reporting processes, systems of internal control over financial reporting and the quality and integrity of our financial statements and reports. In addition, the Audit Committee oversees the qualification, independence and performance of our independent registered public accounting firm. The Audit Committee also recommends to the Board the appointment of our independent registered public accounting firm.

The Audit Committee is currently composed of three directors: Ms. Herchuk (Chair), Ms. Cavanaugh and Ms. O’Connor Vos. The Audit Committee is governed by a written charter adopted by the Board. The Audit Committee charter can be found in the Investor Overview & Financial Information section of our website at www.aspirawh.com. The Audit Committee met eight times in 2023. The Board has determined that all members of our Audit Committee are independent pursuant to applicable Nasdaq and SEC requirements. The Board has also determined that Ms.Herchuk qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. In making the determination that Ms. Herchuk qualifies as an “audit committee financial expert,” the Board made a qualitative assessment of Ms. Herchuk’s level of knowledge and experience based on a number of factors, including her education as well as her experience as an audit partner.

The following Audit Committee Report shall not be deemed to be “soliciting material,” deemed “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act. Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act or the Exchange Act that might incorporate by reference future filings, including this proxy statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into any such filings.

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the system of internal financial controls. Management has represented to the Audit Committee that the Company’s consolidated financial statements for the fiscal year ended December 31, 2023 were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the audited financial statements of the Company with management of the Company and BDO USA, LLP (“BDO”), the Company’s independent registered public accounting firm, which audited the Company’s consolidated financial statements for the fiscal year ended December 31, 2023. In addition, the Audit Committee has discussed with BDO the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301 (Communications with Audit Committees) and the SEC. The Audit Committee has also received from BDO the written disclosures and the letter required by the applicable requirements of the PCAOB regarding BDO’s communications with the Audit Committee concerning independence and has discussed with BDO the firm’s independence from the Company and its management. Based on the foregoing, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for filing with the SEC.

Respectfully Submitted by:

Members of the Audit Committee

Jannie Herchuk, Chair

Stefanie Cavanaugh

Lynn O’Connor Vos

Compensation Committee

The Compensation Committee of the Board acts on behalf of the Board to review, adopt and oversee our compensation strategy, policies, plans and programs. The Compensation Committee approves, or recommends for approval, the compensation (i.e., salary, bonus and stock-based compensation grants) and other terms of employment or service of our Chief Executive Officer and other executive officers and administers the 2019 Plan. The Compensation Committee also reviews and recommends for the Board’s approval the compensation for members of the Board. The Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. The Compensation Committee may form and delegate authority to subcommittees when appropriate. Any such subcommittee, to the extent provided in the resolutions of the Compensation Committee and to the extent not limited by applicable law, will have and may exercise all the powers and authority of the Compensation Committee.

Our executive officers recommend to the Compensation Committee of the Board business performance targets and objectives and provide background information about the Company’s underlying strategic objectives. Our Chief Executive Officer generally makes recommendations to the Compensation Committee regarding salary increases for other executive officers during the

regular merit increase process. Our executive officers are not present or involved in deliberations concerning their own compensation.

The Compensation Committee is currently composed of three directors: Ms. Cavanaugh (Chair), Ms. O’Connor Vos and Dr. Parnell. The Board has determined that the members of our Compensation Committee are independent pursuant to applicable Nasdaq and SEC requirements. The Compensation Committee has adopted a written charter that can be found in the Investor Overview & Financial Information section of our website at www.aspirawh.com. The Compensation Committee met six times in 2023.

The Compensation Committee retained Arnosti Consulting, Inc., (“Arnosti”), as its independent compensation consultant during 2023. The Compensation Committee requested that Arnosti assist in evaluating the efficacy of our existing compensation strategy and practices for executives. As part of its engagement, our compensation committee requested that Arnosti develop a group of peer companies to use as a reference in making compensation decisions, evaluating current pay practices and considering different compensation programs and best practices. The Company has engaged Pearl Meyer & Partners, LLC to assist in evaluating our compensation strategy and practices for directors and executives in 2024.

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for identifying individuals qualified to serve as members of the Board, recommending to the Board nominees for election as our directors, and providing oversight with respect to corporate governance and ethical conduct.

Our Nominating and Governance Committee currently consists of Dr. Fralick (Chair) Ms. O’Connor Vos and Dr. Parnell. The Board has determined that the members of our Nominating and Governance Committee are independent pursuant to applicable Nasdaq listing standards. The Nominating and Governance Committee has adopted a written charter that can be found in the Investor Overview & Financial Information section of our website at www.aspirawh.com. The Nominating and Governance Committee met five times in 2023.

The information below describes the criteria and process that the Nominating and Governance Committee uses to evaluate candidates for selection to the Board.

Board Membership Criteria

The Nominating and Governance Committee is responsible for assessing the appropriate balance of experience, skills and characteristics required of directors. Nominees for director are selected on the basis of depth and breadth of experience, knowledge, integrity, ability to make independent analytical inquiries, understanding of our business environment, the willingness to devote adequate time to Board duties, the interplay of the candidate’s experience and skills with those of other Board members, and the extent to which the candidate would be a desirable addition to the Board and any committees of the Board. Although there is no specific policy regarding diversity in identifying director nominees, both the Nominating and Governance Committee and the Board seek the talents and backgrounds that would be most helpful to us in selecting director nominees. In particular, the Nominating and Governance Committee, when recommending director candidates to the full Board for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience.

Process for Identifying and Evaluating Nominees

The Nominating and Governance Committee initiates the process for identifying and evaluating nominees to the Board by identifying a slate of candidates who meet the criteria for selection as nominees and have the specific qualities or skills being sought based on input from members of the Board, management and, if the Nominating and Governance Committee deems appropriate, a third-party search firm. Candidates are evaluated by the Nominating and Governance Committee on the basis of the factors described above under “Board Membership Criteria.” With respect to candidates for initial election to the Board, the Nominating and Governance Committee also reviews biographical information and qualifications and checks the candidates’ references. Qualified candidates are interviewed by at least one member of the Nominating and Governance Committee. Serious candidates meet, either in person or by telephone, with all members of the Nominating and Governance Committee and as many other members of the Board as practicable.

Using the input from interviews and other information obtained, the Nominating and Governance Committee evaluates which of the prospective candidates is qualified to serve as a director and whether the committee should recommend that the Board nominate, or elect to fill a vacancy with, a prospective candidate. Candidates recommended by the Nominating and Governance Committee are presented to the Board for selection as nominees to be presented for the approval of the stockholders or for election to fill a vacancy.

The Nominating and Governance Committee and/or the Board will consider nominees for director who are recommended by our stockholders, provided that written notice of any such recommendation is received by our Corporate Secretary within the timeframe established by our Bylaws with respect to director nominations by stockholders (see “Information About the Annual

Meeting and Voting–Submission of Stockholder Proposals for the 2025 Annual Meeting”). All candidates for directors, including those who have been properly recommended or nominated by a stockholder, are evaluated using the criteria and process described above.

Board Diversity Matrix

The following matrix is provided in accordance with applicable Nasdaq listing requirements and includes all director nominees, assuming the election of such nominees at the Annual Meeting.

Board Diversity Matrix (As of May 13, 2024) | ||||

Total Number of Directors | 6 | |||

Female | Male | Non-Binary | Did Not Disclose Gender | |

Part I: Gender Identity | ||||

Directors | 5 | 1 | - | - |

Part II: Demographic Background | ||||

African American or Black | - | 1 | - | - |

Alaskan Native or Native American | - | - | - | - |

Asian | - | - | - | - |

Hispanic or Latinx | - | - | - | - |

Native Hawaiian or Pacific Islander | - | - | - | - |

White | 5 | - | - | - |

Two or More Races or Ethnicities | - | - | - | - |

LGBTQ+ | - | |||

Did Not Disclose Demographic Background | - | |||

Board Diversity Matrix (As of May 9, 2023) | ||||

Total Number of Directors | 6 | |||

Female | Male | Non-Binary | Did Not Disclose Gender | |

Part I: Gender Identity | ||||

Directors | 6 | - | - | - |

Part II: Demographic Background | ||||

African American or Black | - | - | - | - |

Alaskan Native or Native American | - | - | - | - |

Asian | - | - | - | - |

Hispanic or Latinx | - | - | - | - |

Native Hawaiian or Pacific Islander | - | - | - | - |

White | 6 | - | - | - |

Two or More Races or Ethnicities | - | - | - | - |

LGBTQ+ | - | |||

Did Not Disclose Demographic Background | - | |||

Prohibition on Hedging

Under out Insider Trading Policy, all directors, employees, consultants and contractors of the Company, together with their respective family members, are prohibited from entering into hedging or monetization transactions or similar arrangements with respect to the Company’s common stock, including the purchase or sale of puts or calls or the use of any other derivative instruments.

Dodd-Frank Clawback Policy

As a public company, if we are required to restate our financial results due to our material noncompliance with any financial reporting requirements under the federal securities laws as a result of misconduct, the Chief Executive Officer and Chief

Financial Officer may be legally required to reimburse our Company for any bonus or other incentive-based or equity-based compensation they receive in accordance with the provisions of section 304 of the Sarbanes-Oxley Act of 2002, as amended. Additionally, we have implemented a Dodd-Frank Act-compliant clawback policy, as required by SEC rules.Code of Ethics

We have adopted the Aspira Women’s Health Inc. Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all of our officers, directors, employees, agents, contractors, and consultants. The Code of Ethics is available in the Investor Overview & Financial Information section of our website at www.aspirawh.com. We intend to disclose on our website any waiver of, or amendment to, the Code of Ethics as required by applicable SEC and Nasdaq requirements.

Stockholder Communications

Our stockholders may communicate directly with the Board of Directors or individual directors in writing, addressed to:

Board of Directors

c/o Corporate Secretary

Aspira Women’s Health Inc.

12117 Bee Caves Road, Building III, Suite 100

Austin, Texas 78738

The Corporate Secretary will review each stockholder communication. The Corporate Secretary will forward to the entire Board (or to members of a committee thereof, if the communication relates to a subject matter clearly within that committee’s area of responsibility) or to any individual director, as applicable, each communication, except those that constitute spam, junk mail, mass mailings, customer complaints or inquiries, job inquiries, surveys, business solicitations or advertisements, or patently offensive or otherwise inappropriate material.

Our director compensation program is designed both to attract qualified non-employee directors and to fairly compensate them for their substantial responsibilities and time commitment. Periodically, the Compensation Committee reviews and determines the adequacy of the compensation program for non-employee directors and, based upon the results of its review, the Compensation Committee may make recommendations regarding the compensation program for non-employee directors to the Board. Directors are eligible to elect a mix of restricted stock units (“RSUs”), stock option awards and cash awards. For 2023, the Compensation Committee engaged Arnosti to assist in the review of director compensation. Based on the independent review, and after considering the recommendation of the Compensation Committee, the Board increased the annual equity retainer from $72,500 to $87,500 for the Chair of the Board and increased the annual equity retainer for the other outside directors from $55,000 to $70,000. In addition, the Board approved the addition of a cash retainer for the Chair of the Board of $35,000 and a cash retainer for the other outside directors of $28,000. Such changes were effective as of January 1, 2023. The 2023 non-employee director compensation program consisted of the following:

Director Retainer | ||||

Equity Awards (1)(2) | Cash | |||

Chairperson | $ | 175,000 | $ | 35,000 |

Other Outside Directors | 140,000 | 28,000 | ||

Chair of the Audit Committee | 15,000 | - | ||

Other Audit Committee Members | 7,500 | - | ||

Chair of the Compensation Committee | 12,000 | - | ||

Other Compensation Committee Members | 6,000 | - | ||

Chair of the Nomination and Governance Committee | 6,000 | - | ||

Other Nomination and Governance Committee Members | 4,000 | - | ||

(1)Directors have the ability to elect their equity retainer either in RSUs or in a combination of RSUs and options. RSUs and stock option awards granted to non-employee directors generally vest over a one-year period, 25% on April 1, 25% on June 1, 25% on September 1 and 25% on December 1 of each year, subject to their continued service through the applicable vesting date and prorated for partial periods of service.

(2)Ms. Cavanaugh, Dr. Fralick, Ms. O’Connor-Vos and Dr. Parnell elected to receive 100% of their equity retainers in RSUs for 2023. Dr. Auerbach, Ms. Herchuk, Dr. Jordan and Ms Sharma elected to receive 50% of their equity retainers in RSUs and 50% of their equity retainers in stock options for 2023.

2023 Director Compensation Table

The table below presents the compensation earned by our non-employee directors for the year ended December 31, 2023. Ms. Sandford did not receive any additional compensation for her service on the Board during 2023. Please see the “2023 Summary Compensation Table” for a summary of the compensation received by Ms. Sandford for her service as our Chief Executive Officer during 2023.

Name | Fees Earned or Paid in Cash | Stock Awards (1)(2) | Option Awards(1)(3) | Total | ||||

Robert Auerbach, M.D.(4) | $ | 10,381 | $ | 29,398 | $ | 29,398 | $ | 69,177 |

Stefanie Cavanaugh (5) | $ | 18,182 | $ | 95,774 | $ | — | $ | 113,956 |

Celeste Fralick, Ph.D. | $ | 28,000 | $ | 150,000 | $ | — | $ | 178,000 |

Jannie Herchuk (6) | $ | 18,182 | $ | 50,322 | $ | 50,322 | $ | 118,826 |

Veronica G.H. Jordan, Ph.D.(7) | $ | 33,869 | $ | 94,421 | $ | 94,421 | $ | 222,711 |

Ellen O'Connor-Vos (8) | $ | 18,182 | $ | 97,397 | $ | — | $ | 115,579 |

Winfred Parnell, M.D. (9) | $ | 16,417 | $ | 84,427 | $ | — | $ | 100,844 |

Ruby Sharma(10) | $ | 9,896 | $ | 28,098 | $ | 28,098 | $ | 66,092 |

(1) Reflects the grant date fair value, calculated in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“ASC Topic 718”), of RSUs and options granted in fiscal year 2023 by the Company under its 2019 Stock Incentive Plan. In 2023, a price and target value was fixed in February 2023 when the trailing average price per share of our common stock was $8.490 per share and in June 2023 when the trailing average price per share of our common stock was $3.346. For additional information regarding the assumptions made in calculating these amounts, see Note 9, Employee Share Based Compensation and Benefit Plans, to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

(2)As of December 31, 2023, each individual who served as a non-employee director during 2023 held outstanding RSUs as follows: Dr. Auerbach – 0; Ms. Cavanaugh – 0; Dr. Fralick – 0; Ms. Herchuk – 5,838; Dr. Jordan – 0; Ms. O’Connor-Vos – 0; Dr. Parnell – 10,848 and Ms. Sharma – 0.

(3)As of December 31, 2023, each individual who served as a non-employee director during 2023 held outstanding stock options to purchase an equal number of shares of Company common stock as follows: Dr. Auerbach – 0; Ms. Cavanaugh – 0; Dr. Fralick – 0; Ms. Herchuk – 23,493; Dr. Jordan – 41,003; Ms. O’Connor-Vos – 0; Dr. Parnell – 0 –and Ms. Sharma – 0.

(4)Dr. Auerbach resigned from the Board, effective May 9, 2023.

(5)Ms. Cavanaugh was elected to the Board, effective May 9, 2023.

(6)Ms. Herchuk was elected to the Board, effective May 9, 2023.

(7)Dr. Jordan resigned from the Board, effective December 21, 2023.

(8)Ms. O’Connor-Vos was elected to the Board, effective May 9, 2023.

(9)Dr. Parnell was appointed to the Board, effective June 1, 2023.

(10)Ms. Sharma resigned from the Board, effective May 9, 2023.

MANAGEMENT

Set forth below is a list of our executive officers as of March 18, 2024:

Name | Age | Positions |

Nicole Sandford | 53 | President and Chief Executive Officer |

Torsten Hombeck | 54 | Chief Financial Officer |

Minh Merchant | 51 | General Counsel & Secretary |

Biographical information about Ms. Sandford can be found under “Director Biographies and Qualifications.”

Dr. Torsten Hombeck, Ph.D. joined Aspira Women’s Health on June 15, 2023 as Chief Financial Officer. Prior to joining Aspira, Dr. Hombeck served as Chief Financial Officer of Akari Therapeutics from July 2020 until June 2023. Dr. Hombeck’s previous positions include Chief Commercial and Strategy Officer and Managing Director at Promethera Biosciences, and Co-Chief Executive Officer and Chief Business Officer at Cytonet where he played an integral role in its acquisition by Promethera. Dr. Hombeck also served as Chief Financial Officer at both Agennix and GPC Biotech. Dr. Hombeck holds a Masters in Business Administration and a Ph.D. in Finance from the European Business School University of Business and Law, Oestrich-Winkel, Germany.

Minh Merchant joined Aspira in January 2022 as our General Counsel and Secretary. From March 2020 to November 2021, Ms. Merchant served as General Counsel, Corporate Secretary and Corporate Compliance Officer at Genome Medical Inc., a private tele-genomics company. From September 2016 to March 2020, she served as Associate General Counsel, Global Director of Litigation & Human Resources at Myriad Genetics. Ms. Merchant began her corporate career at McKesson Corporation, a Fortune 500 company, where she served as Chief Counsel after almost one decade in private legal practice. Ms. Merchant graduated from UCLA School of Law where she was the Joseph Drown Fellow. Ms. Merchant has served as President of the Vietnamese American Bar Association of Northern California and was the inaugural co-chair of the National Conference of Vietnamese American Attorneys in 2008.

EXECUTIVE COMPENSATION

The following individuals who served as executive officers of the Company during 2023 were our “Named Executive Officers” for 2023:

Name | Positions |

Nicole Sandford(1) | President and Chief Executive Officer |

Torsten Hombeck, Ph.D.(2) | Senior Vice President and Chief Financial Officer |

Minh Merchant(3) | General Counsel and Corporate Secretary |

Valerie Palmieri(4) | Former Executive Chair of the Board, President and Chief Executive Officer |

Ryan Phan, Ph.D.(5) | Former Chief Scientific and Operating Officer |

(1)Ms. Sandford served as our President and Chief Executive Officer beginning effective March 1, 2022 and the amount reported in 2022 reflects the portion of her annual base salary eared in 2022 from such date.

(2)Dr. Hombeck commenced employment as our Chief Financial officer on June 15, 2023 and the amount reported reflects the portion of his annual base salary earned in 2023 from such date.

(3)Ms. Merchant joined the Company as our General Counsel and Secretary effective January 4, 2022 and the amount reported in 2022 reflects the portion of her annual base salary earned in 2022 from such date.

(4)Ms. Palmieri’s employment terminated with the Company effective March 1, 2023 and the amount reported in 2023 reflects the portion of her annual base salary earned in 2023 through such date.

(5)Dr. Phan joined the Company as our Chief Scientific and Operating Officer on July 5, 2022 and the amount reported reflects the portion of his annual base salary earned in 2022 from such date. Dr. Phan resigned from the Company effective September 15, 2023 and the amount reported reflects the portion of his annual base salary earned in 2023 through such date. Dr. Phan continues to serve the Company as its consultant.

2023 Summary Compensation Table

The compensation earned by the Named Executive Officers for the years ended December 31, 2023 and December 31, 2022 was as follows:

Name and Principal Position | Year | Salary | Bonus | Stock | Option | Non-Equity Incentive Plan(2) | All Other | Total | ||||||||||

Nicole Sandford | 2023 | $ | 500,000 | $ | - | $ | - | $ | 392,074 | $ | 112,500 | $ | 31,016(3) | $ | 1,035,590 | |||

President, Chief Executive Officer | 2022 | $ | 416,667 | $ | - | $ | 24,000 | $ | 63,845 | $ | 99,251(4) | $ | 493 | $ | 604,256 | |||

Torsten Hombeck | ||||||||||||||||||

Chief Financial Officer | 2023 | $ | 177,500 | $ | - | $ | 97,500(5) | $ | 42,762(12) | $ | 37,000 | $ | 10,900(6) | $ | 365,662 | |||

Minh Merchant | 2023 | $ | 325,000 | $ | 50,000(7) | $ | 32,500(5) | $ | 96,595 | $ | 48,750 | $ | 9,656(3) | $ | 562,501 | |||

General Counsel & Secretary | 2022 | $ | 322,708 | $ | - | $ | - | $ | 104,550 | $ | 31,200(4) | $ | 625 | $ | 459,083 | |||

Valerie Palmieri | 2023 | $ | 74,423 | $ | - | $ | - | $ | 251,038(13) | $ | - | $ | 60,803(8) | $ | 386,264 | |||

Former Executive Chair of the Board, President and Chief Executive Officer | 2022 | $ | 450,000 | $ | - | $ | - | $ | - | $ | 202,500 | $ | 682 | $ | 653,182 | |||

2021 | $ | 439,231 | $ | - | $ | - | $ | 2,117,250 | $ | 135,000 | $ | 682 | $ | 2,692,163 | ||||

Ryan Phan | 2023 | $ | 320,192 | $ | 50,000(7) | $ | - | $ | 112,689 | $ | - | $ | 50,000(9) | $ | 532,881 | |||

Chief Scientific and Operating Officer | 2022 | $ | 221,826 | $ | - | $ | - | $ | 80,200 | $ | 101,251(10) | $ | 50,287(11) | $ | 453,564 | |||

(1)Represents RSU and option awards granted to the Named Executive Officers. The amounts reported in this column are valued based on the aggregate grant date fair value computed in accordance with ASC Topic 718. For additional information regarding the assumptions made in calculating these amounts, see Note 9, Employee Share Based Compensation and Benefit Plans, to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

(2)Amount represents annual incentive bonus earned for 2023 and 2022.

(3)Represents payment of withholding on behalf of executive.

(4)Represents restricted stock units granted to Ms. Sandford and Ms. Merchant in lieu of cash for their annual incentive bonus for 2022.

(5)Represents restricted stock units awarded to Dr. Hombeck and Ms. Merchant for retention. 50% of the restricted stock units will vest on March 31, 2024, and 50% of the restricted stock units will vest on June 30, 2024 subject to their remaining with the Company through the vest dates.

(6)Represents cash paid to Mr. Hombeck for consulting prior to his joining the Company.

(7)Represents retention cash bonuses paid to Ms. Merchant and Dr. Phan. Under the terms of the retention agreement, the Named Executive Officer would have to repay the Company if he or she resigned prior to December 31, 2023.As consideration for his consulting agreement, Dr. Phan’s repayment was waived.

(8)Represents severance payments to Ms. Palmieri of $2,342 and a paid time off payout of $58,461.

(9)Represents cash paid to Dr. Phan for consulting after his departure from the Company.

(10)Represents payments for the 2022 bonus incentive plan to Dr. Phan, including $50,000 cash and $51,251 in restricted stock units awarded in lieu of cash.

(11)Represents $50,000 cash paid for consulting prior to his joining the Company and Company paid insurance premiums of $287.

(12)Includes aggregate grant value of $14,281 related to 6,667 performance options granted to Dr. Hombeck in 2023, which reflected the then-probable achievement of the performance conditions as of the date of grant. Assuming maximum achievement of the performance goals, the grant date fair value of such options would be $14,281.

(13)Represents the incremental fair value generated by the modification of Ms. Palmieri’s options to extend their applicable post-termination exercise period, pursuant to the terms of her Separation Agreement dated February 28, 2023, computed in accordance with ASC 718.

2023 Outstanding Equity Awards at Fiscal Year-End

The outstanding equity awards held by the Named Executive Officers as of December 31, 2023 were as follows:

Option Awards | Stock Awards | ||||||||||||||

Name | Number of Securities Underlying Unexercised Options - Exercisable | Number of Securities Underlying Unexercised Options – Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options | Option Exercise Price | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested | Vest Commencement Date | |||||||

Nicole Sandford | 333 | — | — | $ 15.75 | 3/1/2032 | 3/1/2022 | |||||||||

1,667 | 4,999 | — | $ 15.60 | 3/31/2032(1) | 3/31/2022 | ||||||||||

333 | — | — | $ 15.75 | 4/1/2032 | 4/1/2022 | ||||||||||

333 | — | — | $ 10.50 | 5/2/2032 | 5/2/2022 | ||||||||||

333 | — | — | $ 8.40 | 6/1/2032 | 6/1/2022 | ||||||||||

333 | — | — | $ 10.95 | 7/1/2032 | 4/1/2022 | ||||||||||

333 | — | — | $ 12.00 | 8/1/2032 | 8/1/2022 | ||||||||||

333 | — | — | $ 7.95 | 9/1/2032 | 9/1/2022 | ||||||||||

333 | — | — | $ 5.70 | 10/3/2032 | 10/1/2022 | ||||||||||

333 | — | — | $ 5.85 | 11/1/2032 | 11/1/2022 | ||||||||||

333 | — | — | $ 5.70 | 12/1/2032 | 12/1/2022 | ||||||||||

333 | — | — | $ 4.80 | 1/1/12033 | 1/1/2023 | ||||||||||

333 | — | — | $ 7.65 | 2/1/2033 | 2/1/2023 | ||||||||||

— | 33,332 | — | $ 8.55 | 2/9/2033(2) | 2/9/2023 | ||||||||||

— | 16,666 | — | $ 8.55 | 2/9/2033(3) | 2/9/2023 | ||||||||||

— | 20,000 | — | $ 3.75 | 8/29/2033(3) | 8/29/2023 | ||||||||||

— | 40,000 | — | $ 3.25 | 11/17/2033(2) | 11/17/2023 | ||||||||||

Torsten Hombeck | — | 13,334 | — | $ 2.40 | 7/25/2033(2) | 7/25/2023 | |||||||||

30,000 | $ 97,500.00 | 11/17/2023(4) | |||||||||||||

— | — | 6,667 | $ 3.20 | 12/5/2033(5) | 12/5/2023 | ||||||||||

Minh Merchant | 2,500 | 7,500 | — | $ 16.20 | 1/28/2032(1) | 1/4/2022 | |||||||||

— | 6,666 | — | $ 8.70 | 2/8/2033(3) | 2/8/2023 | ||||||||||

— | 13,333 | — | $ 8.70 | 2/8/2033(2) | 2/8/2023 | ||||||||||

10,000 | $ 32,500.00 | 11/17/2023(4) | |||||||||||||

Valerie Palmieri | 11,666 | — | — | $ 23.25 | 10/22/2024 | 10/22/2014 | |||||||||

26,666 | — | — | $ 29.25 | 1/2/2025 | 1/2/2015 | ||||||||||

30,000 | — | — | $ 23.55 | 3/16/2026 | 3/16/2016 | ||||||||||

6,666 | — | — | $ 13.35 | 11/7/2026 | 11/7/2016 | ||||||||||

29,999 | — | — | $ 32.10 | 3/22/2027 | 3/22/2017 | ||||||||||

29,999 | — | — | $ 16.65 | 4/13/2028 | 4/13/2018 | ||||||||||

8,333 | — | — | $ 7.05 | 1/8/2029 | 1/8/2019 | ||||||||||

22,500 | — | — | $ 19.35 | 3/26/2029 | 3/26/2019 | ||||||||||

12,000 | — | — | $ 12.30 | 2/12/2030 | 2/12/2020 | ||||||||||

16,666 | — | — | $ 10.20 | 3/19/2030 | 3/19/2020 | ||||||||||

7,500 | — | — | $ 111.00 | 3/19/2031 | 3/19/2021 | ||||||||||

Ryan Phan | 8,335 | 4,998 | — | $ 11.55 | 7/5/2032(6) | 7/5/2022 | |||||||||

— | 13,333 | — | $ 8.70 | 2/8/2033(2) | 2/8/2023 | ||||||||||

6,666 | — | — | $ 8.70 | 2/8/2033 | 2/8/2023 | ||||||||||

— | 3,332 | — | $ 8.70 | 2/8/2033(3) | 2/8/2023 | ||||||||||

____________________

(1)Stock options vest in four equal annual installments beginning one year following the vesting commencement date.

(2)Stock options vest in three equal annual installments beginning one year following the vesting commencement date.

(3)Stock options vest 100% after one year following the grant date.

(4)Represents restricted stock units which will vest 50% on March 31, 2024 and 50% on June 30, 2024.

(5)Represents stock options which will vest upon attainment of performance goals in 2023 and 2024. The estimates used and maximum grant date fair value are described in the “2023 Summary Compensation Table”. The measurement date for the performance goals is June 17, 2024.

(6)Stock options vest in eight equal quarterly installments beginning on October 1, 2022.

Narrative Disclosure to Summary Compensation Table

Compensation Program Overview

Base Salaries. Executive salaries are determined based on the data from our comparator group, an evaluation of each officer’s individual performance throughout the year, level of responsibility, overall salary structure, budget guidelines and assessment of our financial condition. We believe that this approach allows us to remain competitive in the market. The Compensation Committee normally reviews and adjusts as appropriate the base salaries for the Named Executive Officers in the first half of each calendar year. No changes were made to the base salaries to the Named Executive Officers for 2024.

Annual Base Salary | |

Nicole Sandford | $500,000 |

Torsten Hombeck, Ph.D. | $325,000 |

Minh Merchant | $325,000 |

Annual Incentive Bonuses. Consistent with our objectives to tie a significant portion of the Named Executive Officers’ total compensation to our performance, all Named Executive Officers have a target bonus of a fixed percentage of their base salary. At the beginning of each fiscal year, the Compensation Committee establishes performance measures and goals. These are formulated into specific metrics on which to measure performance and attainment of goals during the year. The Compensation Committee generally establishes the individual payout targets for each Named Executive Officer based on the executive’s position, level of responsibility and a review of the peer group. The Compensation Committee typically assigns weightings to the various performance goals to provide a balanced approach to the various factors applied to determining bonus amounts. For 2023, these measures and goals were designed to be challenging yet achievable with strong management performance. In February 2024, the Compensation Committee determined that the performance goals had been 30% achieved for each Named Executive Officer. These bonus payments are expected to be made in April. On March 20, 2024, the employment agreement for Torsten Hombeck was amended to add eligibility for a bonus of up to $50,00 upon the closing of one or more equity or debt financing transactions that result in a total aggregate net proceeds to the Company of $3,000,000 or more prior to March 31, 2025. The bonus will increase to $100,000 upon the aggregates closing of one or more equity, debt or other financing transactions that result in total net proceeds to the Company of $5,000,000 or more prior to March 31, 2025.

Equity Incentive Compensation. The equity component of our executive compensation program is designed to fulfill our performance alignment and retention objectives. In general, Named Executive Officers receive incentive stock option grants at the time of hire. Annually thereafter, they receive additional equity-based compensation as recommended by the Compensation Committee. Equity-based compensation is based on individual performance and contributions toward the achievement of our business objectives, as well as overall Company performance. The number of underlying shares that may be purchased pursuant to the stock options granted to each Named Executive Officer varies based on the executive’s position and responsibilities. The Compensation Committee granted equity-based compensation to the Named Executive Officers during the year ended December 31, 2023 in the form of stock options and RSUs, as described above in the Summary Compensation Table.

Executive Employment Agreements

Nicole Sandford

Effective March 1, 2023, the Company and Nicole Sandford entered into an amended and restated employment agreement (the “Sandford Agreement”). Pursuant to the Sandford Agreement, the Company pays Ms. Sandford an annual base salary of $500,000. In addition, Ms. Sandford is eligible for a bonus of up to 75% of her salary, based on achievement of reasonable Company goals to be defined by the Board.