UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission file number: 1-13888

GRAFTECH INTERNATIONAL LTD.

(Exact name of registrant as specified in its charter)

Delaware 27-2496053

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification Number)

982 Keynote Circle

Brooklyn Heights, Ohio 44131

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (216) 676-2000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | EAF | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer," “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of June 28, 2024 was $217.9 million, based on the closing price of the registrant’s common stock as reported on the New York Stock Exchange as of the last business day of the registrant’s most recently completed second quarter.

On February 7, 2025, 257,263,710 shares of our common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement (the “Proxy Statement”) to be filed with the Securities and Exchange Commission relative to the registrant’s 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this Report.

Table of Contents

| | | | | | | | |

| |

| |

| |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| |

| Item 5. | | |

| | |

| | |

| Item 6. | | |

| Item 7. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 7A. | | |

| Item 8. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| |

| |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| |

| |

| Item 15. | | |

| Item 16. | | |

| |

PART I

References herein to the “Company,” “GrafTech,” “we,” “our,” or “us” refer collectively to GrafTech International Ltd. and its subsidiaries.

Presentation of Financial, Market and Industry Data

We present our financial information on a consolidated basis. Unless otherwise noted, when we refer to dollars, we mean U.S. dollars.

Certain market and industry data included in this Annual Report on Form 10-K for the year ended December 31, 2024 (the “Annual Report” or “Report”) has been obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. We cannot guarantee the accuracy or completeness of this market and market share data and have not independently verified it. None of the sources has consented to the disclosure or use of data in this Annual Report. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in this Annual Report.

Cautionary Note Regarding Forward-Looking Statements

This Report may contain forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect our current views with respect to, among other things, financial projections, plans and objectives of management for future operations, future economic performance and short-term and long-term liquidity. Examples of forward-looking statements include, among others, statements we make regarding future estimated volume, pricing and revenue, anticipated levels of capital expenditures and cost of goods sold. You can identify these forward-looking statements by the use of forward-looking words such as “will,” “may,” “plan,” “estimate,” “project,” “believe,” “anticipate,” “expect,” “foresee,” “intend,” “should,” “would,” “could,” “target,” “goal,” “continue to,” “positioned to,” “are confident,” or the negative versions of those words or other comparable words. Any forward-looking statements contained in this Report are based upon our historical performance and on our current plans, estimates and expectations considering information currently available to us. The inclusion of this forward-looking information should not be regarded as a representation by us that the future plans, estimates, or expectations contemplated by us will be achieved. Our expectations and targets are not predictions of actual performance and historically our performance has deviated, often significantly, from our expectations and targets. These forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business, prospects, growth strategy and liquidity. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include, but are not limited to:

•our dependence on the global steel industry generally and the electric arc furnace (“EAF”) steel industry, in particular;

•the cyclical nature of our business and the selling prices of our products, which may continue to decline in the future, and may lead to prolonged periods of reduced profitability and net losses or adversely impact liquidity;

•the sensitivity of our business and operating results to economic conditions, including any recession, and the possibility others may not be able to fulfill their obligations to us in a timely fashion or at all;

•the possibility that we may be unable to implement our business strategies in an effective manner;

•the possibility that global graphite electrode overcapacity may adversely affect graphite electrode prices;

•the competitiveness of the graphite electrode industry;

•our dependence on the supply of raw materials, including decant oil and petroleum needle coke, and disruptions in supply chains for these materials;

•our primary reliance on one facility in Monterrey, Mexico for the manufacturing of connecting pins;

•the cost of electric power and natural gas, particularly in Europe;

•our manufacturing operations are subject to hazards;

•the legal, compliance, economic, social and political risks associated with our substantial operations in multiple countries;

•the possibility that fluctuation of foreign currency exchange rates could materially harm our financial results;

•the possibility that our results of operations could further deteriorate if our manufacturing operations were substantially disrupted for an extended period, including as a result of equipment failure, climate change, regulatory issues, natural disasters, public health crises, such as a global pandemic, political crises or other catastrophic events;

•the risks and uncertainties associated with litigation, arbitration, and like disputes, including disputes related to contractual commitments;

•our dependence on third parties for certain construction, maintenance, engineering, transportation, warehousing and logistics services;

•the possibility that we are subject to information technology systems failures, cybersecurity incidents, network disruptions and breaches of data security, including with respect to our third-party suppliers and business partners;

•the possibility that we are unable to recruit or retain key management and plant operating personnel or successfully negotiate with the representatives of our employees, including labor unions;

•the sensitivity of long-lived assets on our balance sheet to changes in the market;

•our dependence on protecting our intellectual property and the possibility that third parties may claim that our products or processes infringe their intellectual property rights;

•the impact of inflation and our ability to mitigate the effect on our costs;

•the impact of macroeconomic and geopolitical events on our business, results of operations, financial condition and cash flows, and the disruptions and inefficiencies in our supply chain that may occur as a result of such events;

•the possibility that the imposition of new or increase of existing custom duties and other tariffs in the countries in which we, our customers and our suppliers operate could adversely affect our operations;

•the possibility that our indebtedness could limit our financial and operating activities or that our cash flows may not be sufficient to service our indebtedness;

•past increases in benchmark interest rates and the fact that any future borrowings may subject us to interest rate risk;

•risks and uncertainties associated with our ability to access the capital and credit markets could adversely affect our results of operations, cash flows and financial condition;

•the possibility that disruptions in the capital and credit markets could adversely affect our customers and suppliers;

•the possibility that restrictive covenants in our financing agreements could restrict or limit our operations;

•changes in, or more stringent enforcement of, health, safety and environmental regulations applicable to our manufacturing operations and facilities; and

•our ability to continue to meet the New York Stock Exchange (“NYSE”) listing standards.

These factors should not be construed as exhaustive and should be read in conjunction with the Risk Factors and other cautionary statements that are included in this Report. The forward-looking statements made in this Report relate only to events as of the date on which the statements are made. Except as required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this Report that could cause actual results to differ before making an investment decision to purchase our common stock. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us.

For a more complete discussion of these and other factors, see “Risk Factors” in Part I of this Report and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II of this Report.

Item 1.Business

Introduction

GrafTech International Ltd., founded in 1886 and incorporated in Delaware, is a leading manufacturer of high-quality graphite electrode products essential to the production of EAF steel and other ferrous and non-ferrous metals. We believe that we have a competitive portfolio of low-cost ultra-high power (“UHP”) graphite electrode manufacturing facilities, with some of the highest capacity facilities in the world. We have graphite electrode manufacturing facilities in Calais, France; Pamplona, Spain; Monterrey, Mexico and St. Marys, Pennsylvania (idled in 2024). We are the only large-scale graphite electrode producer that is substantially vertically integrated into petroleum needle coke, our key raw material for graphite electrode manufacturing. This unique position provides us with competitive advantages in product quality and cost.

Our only reportable segment, Industrial Materials, is comprised of two major product categories: graphite electrodes and petroleum needle coke products. Our vision is to provide highly engineered graphite electrode products, services and solutions to EAF operators. Based on the high quality of our graphite electrodes, reliability of our petroleum needle coke supply and our excellent customer service, we believe that we are viewed as a preferred supplier to the global EAF steel producer market.

As of December 31, 2024, our stated production capacity was approximately 178 thousand metric tons (“MT”)1 through our primary manufacturing facilities in Calais, Pamplona and Monterrey. On February 14, 2024, the Company announced a cost rationalization and footprint optimization plan, in response to persistent softness in the commercial environment. This included an indefinite suspension of production activities at our St. Marys facility, with the exception of graphite electrode and pin machining. We also indefinitely idled certain assets within our remaining graphite electrode manufacturing footprint. As a result of these initiatives, our stated production capacity was reduced from approximately 202 thousand MT in 2023 to approximately 178 thousand MT1 in 2024.

Our principal executive offices are located at 982 Keynote Circle, Brooklyn Heights, Ohio 44131 and our telephone number is (216) 676‑2000. Our website address is www.graftech.com. Information on, or accessible through, our website is not part of this Annual Report. We have included our website address only as an inactive textual reference and do not intend it to be an active link to our website.

Products and Raw Materials

Graphite Electrodes

Graphite electrodes are an industrial consumable product used primarily in EAF steel production, one of the two primary methods of steel production and the steelmaking technology used by all “mini‑mills.” Electrodes act as conductors of electricity in the furnace, generating sufficient heat to melt scrap metal, iron ore-derived products or other raw materials used to produce steel or other metals. We estimate that, on average, the cost of graphite electrodes represents less than 5% of the total production cost of steel in a typical EAF, but they are essential to EAF steel production. Graphite electrodes are currently the only known commercially available products that have the high levels of electrical conductivity and the capability to sustain the high levels of heat generated in EAF steel production. As a result, EAF steel manufacturers require a reliable supply of high-quality graphite electrodes. Graphite electrodes are also used in steel refining ladle furnaces and in other processes, such as the production of titanium dioxide, stainless steel, silicon metals and other ferrous and non‑ferrous metals.

With the growth of EAF steel production, graphite electrode production has become focused on the manufacturing of UHP electrodes, which have low electrical resistivity and strong durability to maximize efficient use of electricity in the EAF and minimize electrode consumption. The production of UHP electrodes requires an extensive proprietary manufacturing process and material science knowledge, including the use of higher quality needle coke blends. We manufacture graphite electrodes ranging in size up to 31.5 inches (800 millimeters) in diameter, over 11 feet (3,400 millimeters) in length, and weighing as much as 5,900 pounds (2.6 MT). In 2024, we expanded our product offerings to include the addition of the 800-millimeter super-sized electrode to our portfolio to serve a small but growing segment of the UHP electrode market. We also manufacture corresponding sizes of graphite connecting pins, which are used by customers to connect and fasten graphite electrodes together in a column for use in an EAF. Prior to 2023, all of our connecting pin production was performed at our Monterrey, Mexico facility. However, in 2023, we added pin production capabilities at our Pamplona, Spain facility to provide

1 Production capacity reflects expected maximum production volume during the period through our Calais, Pamplona and Monterrey facilities depending on product mix and expected maintenance outage. Actual production may vary.

an alternative source, if needed, for this critical component. The Company continues to explore opportunities to increase its pin manufacturing capabilities. The total manufacturing time of a UHP graphite electrode and its associated connecting pin is, on average and except for special requests, approximately six months.

The size of the electrodes used in EAF steel production varies depending on the size of the furnace, the size of the furnace’s electric transformer and the planned productivity of the furnace. In a typical furnace using alternating electric current and operating at a typical number of production cycles per day, three UHP graphite electrodes are fully consumed (requiring the addition of new electrodes), on average, every eight to ten operating hours. UHP graphite electrodes are consumed at a rate of approximately 1.7 kilograms per MT of steel production, on average, in EAF facilities.

The actual rate of consumption and addition of electrodes for a particular furnace depends primarily on the efficiency and productivity of the furnace. Therefore, demand for graphite electrodes is directly related to the amount and efficiency of EAF steel production. EAF steel production requires significant heat (as high as 5,000° F) to melt the raw materials, primarily scrap metal, in the furnace. Heat is generated as electricity (as much as 150,000 amps) passes through the electrodes and creates an electric arc between the electrodes and the raw materials.

Graphite Electrode Industry - Supply and Demand Trends

Supply trends

We estimate that as of the end of 2024, the graphite electrode industry globally (excluding China) had nameplate capacity to produce approximately 786 thousand MT of graphite electrodes. The industry is fairly consolidated, with the five largest global (excluding China) producers in the industry, GrafTech, Resonac Holdings Corporation, HEG Limited, Tokai Carbon Co., Ltd. and Graphite India Limited, collectively, representing approximately 82% of global (excluding China) graphite electrode production capacity. As of December 31, 2024, our stated production capacity was approximately 178 thousand MT through our Calais, Pamplona and Monterrey facilities and represented approximately 23% of the global (excluding China) graphite electrode production capacity.

We believe that no new graphite electrode production facilities have been built outside of China for several years. In recent years, additional production capacity has been generated by optimization and debottlenecking of existing assets and limited brownfield expansion.

We primarily compete in the UHP segment of the graphite electrode market. We estimate that, as of the end of 2024, global (excluding China) UHP graphite electrode capacity was approximately 670 thousand MT, or approximately 85% of the global (excluding China) graphite electrode capacity.

Although graphite electrode production capacity within China exceeds that of the rest of the world combined, the production landscape in China is fragmented, and the quality of Chinese graphite electrodes varies greatly. We estimate that as of the end of 2024, total production capacity within China for the UHP segment of graphite electrodes was approximately 800 thousand MT. However, we believe that a significant portion of the UHP electrodes produced in China do not meet the quality standards needed to be exported for use in the most demanding EAF applications. In addition, the imposition of customs duties and other tariffs in key EAF steelmaking regions, including the United States and the European Union (“EU”), have further limited the quantity of graphite electrodes exported from China.

Demand trends

We estimate that annual global (excluding China) UHP graphite electrode demand has been approximately 660 thousand MT, on average, over the past three years. UHP graphite electrodes are primarily used in the EAF steelmaking process, and long-term global growth of EAF steel production has driven increased demand for graphite electrodes over time. EAF steelmaking has historically been the fastest-growing segment of the global steel market. According to data derived from World Steel Association (“WSA”) reporting, global (excluding China) EAF steel production grew at a 2%-3% compound annual growth rate from 2015 to 2023, the most recent year for which WSA has published such figures. This compares to a 1% compound annual growth rate for overall global (excluding China) steel production during this same period. As a result, the EAF method of steelmaking accounted for 50% of the global (excluding China) steel production in 2023, compared to 44% in 2015, with share growth in nearly every region.

EAF steelmaking is more energy efficient and is advantaged in terms of its environmental footprint, compared to steel produced through the basic oxygen furnace (“BOF”) steelmaking model. According to the Steel Manufacturers Association (“SMA”), EAF steelmaking produces 75% fewer carbon dioxide emissions compared to BOF steelmaking. Further, SMA notes that the EAF process is a sustainable model for recycling scrap-based raw materials into new steel, which is 100% (and infinitely) recyclable at the end of its useful life. In addition to these advantages, EAF steel producers benefit from their

flexibility in sourcing iron units, being able to make steel from either scrap or alternative sources of iron, such as direct reduced iron and hot briquetted iron, both made directly from iron ore.

Reflecting these and other competitive advantages, we believe EAF steel production will continue to grow at a faster rate than BOF steel production. Based on industry announcements of planned incremental EAF capacity additions and factoring in further production increases at existing EAF steel plants, we estimate this could result in global (excluding China) UHP graphite electrode demand growing at a compound annual growth rate of approximately 3% to 4% through 2029.

Petroleum Needle Coke

Petroleum needle coke, a crystalline form of carbon derived from decant oil, is the key raw material we use in the production of graphite electrodes. It is also a primary raw material utilized in the production of synthetic graphite used in anodes for lithium-ion batteries that power electric vehicles (“EV”).

Petroleum needle coke is produced through a manufacturing process very similar to a refinery. The production process converts decant oil, a byproduct of the gasoline refining process, into petroleum needle coke. Pitch needle coke, used principally by Chinese graphite electrode manufacturers, is made from coal tar pitch, a byproduct of coking metallurgical coal used in BOF steelmaking. For the production of our graphite electrodes, we prefer petroleum needle coke because of the meaningfully shorter bake and graphitizing time required, compared to graphite electrodes produced using pitch needle coke.

We are substantially vertically integrated into petroleum needle coke through our Seadrift facility (“Seadrift”), located in Port Lavaca, Texas, which provides the majority of our petroleum needle coke requirements used to produce our graphite electrodes and insulates us from rapid changes in the petroleum needle coke market. In addition, we believe the quality of Seadrift’s petroleum needle coke is superior for graphite electrode production compared to most of the petroleum needle coke available to our peers on the open market, allowing us to produce high-quality electrodes in a cost‑efficient manner. Seadrift sources all of its decant oil requirements from reputable U.S.-based suppliers. Seadrift has developed a well-diversified pool of suppliers, which we believe is sufficient to meet our needs.

Graphite electrode producers combine petroleum needle coke and/or pitch needle coke with binders and other ingredients to form graphite electrodes. Petroleum needle coke and pitch needle coke, relative to other varieties of coke, are distinguished by their needle-like structure and their quality, which is measured by the presence of impurities, principally sulfur, nitrogen and ash. Petroleum needle coke and pitch needle coke are typically low in these impurities. Additionally, the needle-like structure of petroleum and pitch needle coke creates expansion along the length of the electrode, rather than the width, which reduces the likelihood of fractures.

Petroleum Needle Coke Industry - Supply and Demand Trends

Supply Trends

We estimate that, as of the end of 2024, the petroleum needle coke industry globally (excluding China) had capacity to produce approximately 750 thousand MT of petroleum needle coke. The global (excluding China) industry is highly concentrated as it is comprised of four producers, Phillips 66, GrafTech (via Seadrift), Petrocokes Japan Ltd. (a subsidiary of Sumitomo Corporation) and ENEOS Holdings, Inc. Our Seadrift facility, with nameplate capacity to produce approximately 140 thousand MT of calcined petroleum needle coke, represents nearly one-fifth of the global (excluding China) production capacity.

Petroleum needle coke production capacity outside of China has remained relatively flat for many years due to the capital intensity, technical know-how and long permitting lead times required to build greenfield needle coke production facilities.

Chinese petroleum needle coke production is expected to grow significantly in the coming years, with a primary focus on serving the EV market, as China is currently the largest producer of EV batteries. Although this may provide sufficient capacity to meet global petroleum needle coke needs for the next several years, as demand from emerging non-Chinese EV battery producers continues to increase, we believe that regional supply-demand imbalances will occur, particularly in North America and Europe, in the coming years.

Demand Trends

We estimate that global (excluding China) needle coke demand for use in UHP graphite electrode production has been approximately 550 thousand MT, on average, over the past three years with the majority being petroleum needle coke. With demand for UHP graphite electrodes expected to increase at a compound annual growth rate of approximately 3% to 4%

through 2029 (see “Graphite Electrode” section above), we expect this to result in a similar increase in demand for needle coke used in graphite electrode production.

While the vast majority of petroleum needle coke produced globally (excluding China) is currently used in the production of graphite electrodes, its use in lithium-ion batteries for the EV market is expected to grow with the increased production of these vehicles. Most EVs rely on lithium-ion batteries as their key performance component, with graphite being the key material used for the carbon anode portion of the batteries. Although both natural and synthetic graphite are used in anodes for lithium-ion batteries, EV manufacturers prefer synthetic graphite, which is produced using needle coke, because of its advantages in terms of charging rate and capacity, providing batteries with longer driving ranges and longevity.

Based on Benchmark Mineral Intelligence estimates for growth in battery anodes, we estimate this could result in global needle coke demand for use in EV applications increasing at a 20% or more compound annual growth rate through 2029. While synthetic graphite can be produced from either petroleum needle coke or pitch needle coke, petroleum needle coke has superior characteristics for EV battery applications, as it does with graphite electrode applications. As a result, demand growth for petroleum needle coke for use in the EV market is expected to be higher than that of overall needle coke demand growth. As noted above, with North American and European EV manufacturers increasing focus on domestic sourcing of battery material needs, we believe that regional supply-demand imbalances will occur for petroleum needle coke in the coming years.

Contracts and Customers

Our customers include major steel producers and other ferrous and non-ferrous metal producers in Europe, the Middle East and Africa (collectively, “EMEA”), the Americas, and Asia-Pacific (“APAC”), which sell their products primarily into the automotive, construction, appliance, machinery, equipment and transportation industries.

We sell our products under short-term purchase agreements, multi-year purchase agreements and spot sales.

Our short-term agreements are either annual, semi-annual or quarterly. Because of the long production time, the book building process is largely concentrated in the fourth quarter of each year for the annual short-term agreements as well as for the semi-annual agreements related to the first half of the upcoming year. Spot purchase orders are entered into with deliveries usually starting three or more months later. The price of our short-term agreements is determined through contract negotiations with our customers and is influenced by the then-prevailing price on spot purchase orders as well as the anticipated supply-demand situation at the time of the planned deliveries. There is a lag between the time we negotiate prices for our short-term agreements and when our electrodes are delivered and recognized as revenue.

There is no widely accepted graphite electrode reference price. Pricing has historically been cyclical, reflecting the demand trends of the global EAF steelmaking industry and supply of graphite electrodes. Moreover, as petroleum needle coke represents a significant percentage of the raw material cost of graphite electrodes, graphite electrodes have typically been priced at a spread to petroleum needle coke. Over the period from 2005 to 2024, the average graphite electrode spread over petroleum needle coke was approximately $4,000 per MT, on an inflation-adjusted basis using constant 2024 dollars, although recent spreads have been narrower. In tight demand markets, this spread has increased, resulting in higher graphite electrode prices. Historically, between 2005 and 2024, our weighted-average realized price of graphite electrodes, excluding volume sold under our take-or-pay agreements with initial term of three-to-five years (“LTAs”), was approximately $6,000 per MT, on an inflation-adjusted basis using constant 2024 dollars.

Our LTAs were entered into between the end of 2017 and early 2019, which coincided with a period of elevated market prices for graphite electrodes. As graphite electrodes are an essential consumable in the EAF steel production process, the LTAs provided certainty of supply of reliable, high-quality graphite electrodes in a periodically volatile market. These LTAs have fixed prices and volumes. Within the contract, our customers are contractually bound to purchase the specified volume of product at the price under the contract. Sales from our LTAs represented 22%, 41% and 68% of our net sales in 2024, 2023 and 2022, respectively. Sales from LTAs represented 18% of our net sales in the fourth quarter of 2024 and we are substantially complete with these agreements.

As the substantial majority of our LTAs have expired, our mix of business has shifted towards short-term purchase agreements and spot purchase orders (“non-LTAs”). We will continue to offer multi-year agreements, also known as electrode supply agreements, as an important part of our commercialization strategy and value proposition. Our substantial vertical integration into petroleum needle coke supports our ability to offer contracts with varying durations, providing our customers with flexibility and surety of supply. However, we do not anticipate that multi-year agreements will make up the majority of our portfolio moving forward.

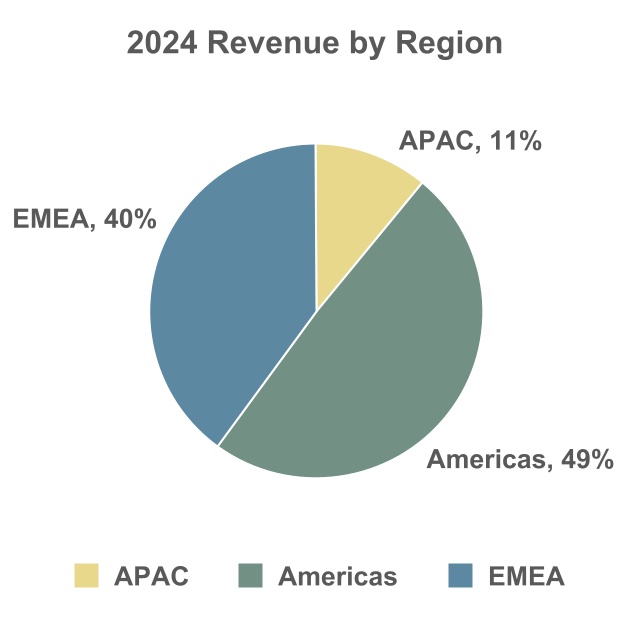

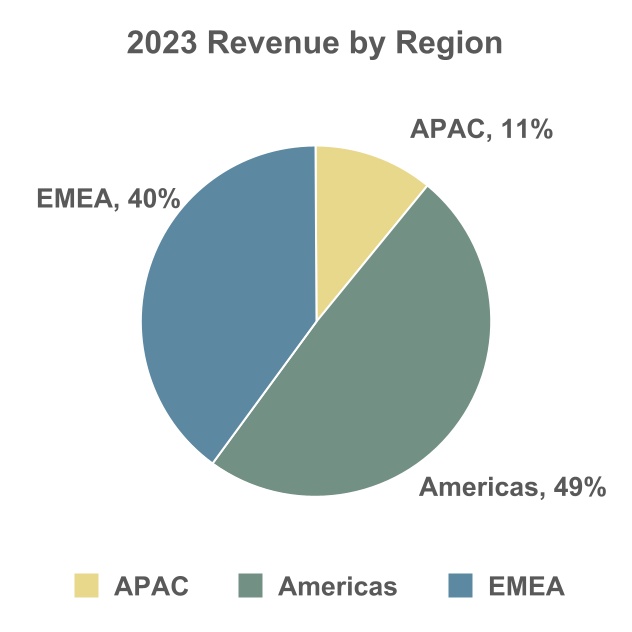

2024 Revenue and Production By Region

Approximately 90% of our graphite electrodes were purchased by EAF steel producers in 2024. The remaining portion is primarily used in various other ferrous and non-ferrous melting applications, fused materials, chemical processing, and alloy metals. We sell our products in every major geographic region globally. Sales of our products to buyers outside the United States accounted for approximately 68%, 67% and 73% of net sales in 2024, 2023 and 2022, respectively. Overall, in 2024, we generated 89% of our net sales from EMEA and the Americas.

The charts below show our revenue by region for 2024 and 2023:

Sales and Customer Service

We differentiate and sell the value of our graphite electrodes primarily based on product quality and performance, delivery reliability and customer technical service.

We have a large customer technical service organization, with supporting application engineering and scientific groups and approximately 30 engineers and specialists around the world serving in this area. We believe that we are one of the industry leaders in providing value-added technical services to our customers.

Our direct sales force currently operates from 13 sales offices located around the world. We sell our graphite electrodes primarily through our direct sales force, independent sales representatives, and distributors, all of whom are trained and experienced with our products.

We have customer technical service personnel based around the world to assist customers to maximize their production and minimize their costs. A portion of our engineers and technicians provide technical service and advice to key steel and other metals customers. These services relate to furnace applications and operation, as well as furnace upgrades to reduce energy consumption, improve raw material costs and increase output.

We believe we have a competitive advantage in offering customers ArchiTech® Furnace Productivity System 6.0 (“ArchiTech”), which is an advanced support and technical service platform in the graphite electrode industry. ArchiTech, which has been installed in customer furnaces worldwide, enables our engineers to work with our customers seamlessly to maximize the performance of their furnaces and provide real-time diagnostics and troubleshooting. The arc furnace monitoring system team is continuously listening to our customers’ needs and develops new functionalities for the ArchiTech environment.

Distribution

We deploy various demand management and inventory management techniques to seek to ensure that we can meet our customers’ delivery requirements while still maximizing the utilization of our production capacity. We can experience significant variation in our customers’ delivery requirements as their specific needs vary and change throughout the year. We

generally seek to maintain appropriate inventory levels, taking into account these factors as well as the significant differences in manufacturing cycle times for graphite electrode products and our customers’ products.

Finished products are usually stored at our manufacturing facilities. Limited quantities of some finished products are also stored at local warehouses around the world to meet customer needs.

Research and Development

We have over 135 years of experience in the research and development (“R&D”) of graphite- and carbon-based solutions. By focusing our management’s attention and R&D spending on the graphite electrode business, we have been able to improve the quality of our graphite electrodes, maintain our position as an industry leader and improve our relationships with strategic customers. Our focus on improving the quality of petroleum needle coke through R&D has led to our petroleum needle coke production at Seadrift being best-in-class for use in the manufacturing of highly durable UHP electrodes. Simultaneously, the R&D team helps to evaluate technology in adjacent markets where GrafTech may have technological advantages. We believe that the above strengths and capabilities provide us with a competitive advantage.

Intellectual Property

We believe that our intellectual property, consisting primarily of patents and proprietary know-how, provides us with competitive advantages and is important to our growth opportunities. Our intellectual property portfolio is extensive, with approximately 100 U.S. and foreign patents and pending patent applications.

We own, have the right to use or have obtained licenses for various trade names and trademarks used in our businesses. For example, the UCAR trademark is owned by Union Carbide Corporation (“Union Carbide”) (which was acquired by Dow Chemical Company) and is licensed to us on a worldwide, exclusive and royalty-free basis until January 2035. This particular license automatically renews for successive 10-year periods. It permits non-renewal by Union Carbide at the end of any renewal period upon five years notice of non-renewal.

We rely on patent, trademark, copyright and trade secret laws, as well as appropriate agreements to protect our intellectual property. Among other things, we seek to protect our proprietary know-how and information by requiring employees, consultants, strategic partners and others who have access to such proprietary information and know-how to enter into confidentiality or restricted use agreements.

Insurance

We maintain insurance against civil liabilities relating to personal injuries to third parties, for loss of or damage to property, for business interruptions, for directors and officers and for certain environmental matters, that provides coverage, subject to the applicable coverage limits, deductibles and retentions, and exclusions, that we believe is appropriate upon terms and conditions and for premiums that we consider fair and reasonable in the circumstances. There can be no assurance that we will not incur losses beyond the limits of or outside the coverage of our insurance.

Regulatory Matters

As a company with global operations, we are subject to the laws and regulations of the United States and the multiple foreign jurisdictions in which we operate or conduct business as well as the rules, reporting obligations and interpretations of all such requirements and obligations by various governing bodies, which may differ among jurisdictions. These include federal, state, local and foreign environmental laws and regulations, increasingly complex and changing laws and regulations enacted to protect business and personal data in the United States and other jurisdictions, including the EU’s General Data Protection Regulation (“GDPR”), anti-corruption laws, import/export controls, anti-competition laws, U.S. securities laws and a variety of regulations including work-related and community safety laws. We believe we operate in compliance in all material respects with applicable laws and regulations, and maintaining compliance with them is not expected to materially affect our capital expenditures, earnings and competitive position. Estimates of future costs for compliance with U.S. and foreign environmental protection laws and regulations, and for environmental liabilities, are necessarily imprecise due to numerous uncertainties, including the impact of potential new laws and regulations, the availability and application of new and diverse technologies, the extent of insurance coverage, the potential discovery of contaminated properties, or the identification of new hazardous substance disposal sites at which we may be a potentially responsible party (“PRP”) and, in the case of sites subject to the Comprehensive Environmental Response, Compensation and Liability Act and similar state and foreign laws, the final determination of remedial requirements and the ultimate allocation of costs among the PRPs. Subject to the inherent imprecision in estimating such future costs, but taking into consideration our experience to date regarding environmental matters of a similar nature and facts currently known, we estimate that our costs and capital expenditures (in each case, before adjustment for inflation) for environmental protection regulatory compliance programs and for remedial response actions will

not be material over the next several years. Furthermore, we establish accruals for environmental liabilities when it is probable that a liability has been or will be incurred, and the amount of the liability can be reasonably estimated. We adjust the accrual as new remedial actions or other commitments are made, as well as when new information becomes available that changes the prior estimates previously made and we believe our existing accruals are reasonable.

Human Capital Resources

Employment

As of December 31, 2024, we had 1,072 employees (excluding contractors), 629 of which were hourly employees. A total of 401 employees were in Mexico, 405 were in Europe, 230 were in the United States, 32 were in Brazil, three were in the Asia Pacific region and one was in the Middle East.

As of December 31, 2024, 647 employees, or approximately 60% of our worldwide employees, were covered by collective bargaining or similar agreements. We believe that, in general, our relationships with our employees’ unions are good and that we will be able to renew or extend our collective bargaining or similar agreements on reasonable terms as they expire. We have not had any material work stoppages or strikes initiated by our employees during the past year.

Health and Safety

The health and safety of our global team is a top priority and is a core value of the Company. Our comprehensive programs strive to achieve zero injuries and no harm done. Our total recordable incident rate in 2024 was 0.59 per 200,000 work hours, compared to 0.61 per 200,000 work hours in 2023. Our global Health, Safety and Environmental Protection (“HS&EP”) policy applies to all employees and governs our actions and decisions every day. We also have a Code of Conduct and Ethics for Suppliers and Contractors that includes HS&EP guidelines required for doing business with GrafTech. GrafTech’s focus on HS&EP is a top priority for all employees. We have built risk recognition into our HS&EP programs. From pre-job planning, safety walks and inspections, planned job observations, or training employees on health and safety best practices, we strive to identify and mitigate risks. In the spirit of continuous improvement, regular inspections, internal reviews and corporate audits are conducted to foster compliance with our high standards.

Diversity and Inclusion

Diversity and inclusion are foundational to our culture, and all employees are expected to uphold these values in their day-to-day work. Our recruitment policies and hiring practices support our diversity and inclusion objectives. At both the corporate and site levels, we assign responsibilities for upholding policies, procedures, and practices for diverse and inclusive hiring and talent management. GrafTech affirms its position as an Equal Opportunity Employer and is committed to recruiting, employing, and promoting qualified veterans and disabled individuals, and we aim to ensure our people have equal opportunities related to job promotions, compensation and benefits, and personal development.

Our global footprint lends itself to organic diversity, and our employee base has varied educational backgrounds and life experiences. We measure and track our diversity and intentional talent acquisition, retention, and development practices.

Compensation and Total Rewards

We aim to attract and retain top talent from a diverse pool of skilled workers by providing competitive compensation and benefit programs to help meet the needs of our employees. Our programs are designed to support the profitable growth of our business; attract, reward, and retain the talent we need to succeed; support the health and overall well-being of our employees; and reinforce a performance-based culture.

In addition to base compensation, we offer individual and group-based performance bonuses. Benefits packages include, depending on the country, medical, dental, prescription, vision, group life insurance, short- and long-term disability, paid vacation and holidays, and tuition reimbursement. The tuition reimbursement program, in particular, helps employees who want to continue their education or seek specialized job training, and illustrates our commitment to continued learning and focus on professional development.

Employee Engagement

Employee engagement is a priority at GrafTech because we believe that engaged employees help us provide high-quality products and services to our customers. We conducted our last employee engagement survey in October 2022.

Approximately 56% of full-time GrafTech employees participated in the October 2022 survey. The survey requested feedback from our employees on a variety of important topics, including safety, pay, communication and training.

Employee Training and Development

As committed stakeholders in the professional development of our employees, we look for opportunities to help employees grow, innovate, and impact our business and industry. Each role within our organization has a detailed job profile, including job-specific competencies. These profiles help us measure performance, and they work in conjunction with our performance management system, which enables employees to create individualized career and growth paths. The performance management system connects employees with job-specific professional development training and continuing education opportunities to help them progress along their career and growth path.

We conduct mid-year and annual performance reviews for all salaried employees to assess both individual job competencies and performance relative to GrafTech’s core competencies. During annual performance reviews, we discuss progress towards personal career goals, refine career aspirations, and connect employees with specific pathways to achievement. Employees are encouraged to work with their manager or human resources to further refine their career and growth paths at each annual review.

Available Information

We make available, free of charge, on or through our website, our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities and Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after we electronically file them with, or furnish them to, the U.S. Securities and Exchange Commission (“SEC”). We maintain our website at https://www.graftech.com. Information on, or accessible through, our website is not part of this Annual Report. We have included our website address only as an interactive textual reference and do not intend it to be an active link to our website.

Item 1A.Risk Factors

Our business, financial condition, results of operations, and cash flow can be affected by a number of factors, whether currently known or unknown, including but not limited to those described below. You should carefully read all of the information included in this Report and carefully consider, among other matters, the following risk factors, as well as any discussed under Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Although the risks are organized by headings, and each risk is discussed separately, many are interrelated. Moreover, the risks below are not the only risks we face and additional risks not currently known to us or that we presently deem immaterial may emerge or become material at any time. The occurrence of any of the following risks could materially and adversely affect our business, financial condition, results of operations, and cash flow, in which case, the market price of our securities could decline. You should not interpret the disclosure of any risk factor to imply that the risk has not already materialized.

Risks related to our business and industry

We are dependent on the global steel industry generally and the EAF steel industry in particular, which historically have been highly cyclical, and a downturn in these industries may materially adversely affect our business.

We sell our products primarily to the EAF steel production industry. The EAF steel production industry historically has been highly cyclical and is affected significantly by general economic conditions. As a result, we have experienced periods of significant net losses.

Significant customers for the steel industry include companies in the automotive, construction, appliance, machinery, equipment and transportation industries, which are industries that were negatively affected by the general economic downturn and the deterioration in financial markets, including severely restricted liquidity and credit availability, in the past.

Our customers, including major steel producers, have in the past experienced and may again experience downturns or financial distress that could adversely impact our ability to collect our accounts receivable on a timely basis or at all.

Pricing for graphite electrodes has historically been cyclical and the price of graphite electrodes may continue to decline in the future.

Pricing for graphite electrodes has historically been cyclical, reflecting the demand trends of the global EAF steelmaking industry and the supply of graphite electrodes. In addition, as petroleum needle coke reflects a significant

percentage of the raw material cost of graphite electrodes, graphite electrodes have historically been priced at a spread to petroleum needle coke, which in the past has increased in tight demand markets. Between 2005 and 2024, our weighted-average realized price of graphite electrodes for non-LTAs was approximately $6,000 per MT (on an inflation‑adjusted basis using constant 2024 dollars).

During the last demand trough in 2016, our weighted-average realized price of graphite electrodes for non-LTAs fell to approximately $3,000 per MT, on an inflation‑adjusted basis using constant 2024 dollars. Following the significant rationalization of graphite electrode production globally, the resumption of growth in EAF steel production, falling scrap prices, reductions in Chinese steel exports and constrained supply of needle coke, graphite electrode prices reached record highs in 2018.

Prices as of December 31, 2024 have receded from the highs of 2018, and the price of graphite electrodes may continue to decline in the future. Beginning in 2023 and continuing throughout 2024, spot prices began decreasing given the softer commercial environment. Spot prices for the year ended December 31, 2024 were approximately $4,200 per MT on a weighted-average basis. Our business, financial condition and operating results are being materially and adversely affected by the spot price of graphite electrodes as of December 31, 2024 and could be materially and adversely affected further to the extent prices for graphite electrodes continue to decline in the future, particularly as we implement our price increase initiative as described below.

We may be unable to realize the benefits of our initiative to increase prices on our products in certain of our regions and furthermore may lose market share in these regions as a result of this initiative, which could have a material adverse effect on our results of operations, cash flow, liquidity and financial condition.

In February 2025, we informed our customers of our intention to increase prices on volume that is not yet committed. This is just one initiative we expect to accelerate our path to profitability and support our ability to invest in our business for the long term. We operate in a highly competitive industry and, as a result, we may not be successful in raising or maintaining our existing prices. General economic, competitive or market-specific conditions may limit our ability to raise prices or otherwise impact our plans with respect to implementing price increases. In addition, we may lose customers who choose to source their graphite electrodes from a competitor who has not increased prices. If we are unable to successfully execute this initiative to increase prices, there may be material adverse effects on our market share, results of operations, cash flow, liquidity and financial condition.

Global graphite electrode overcapacity has adversely affected graphite electrode prices in the past, and is currently doing so now, which is negatively impacting our sales, margins and profitability.

Overcapacity in the graphite electrode industry has adversely affected pricing in the past, and is currently doing so now. Global graphite electrode production capacity that outpaces demand for graphite electrodes adversely affects the price of graphite electrodes. Excess production capacity is resulting in manufacturers producing and exporting electrodes at prices that are lower than prevailing domestic prices, and sometimes at or below their cost of production. Excessive imports into the Americas and EMEA, which markets collectively made up 89% of our net sales for the year ended December 31, 2024, can also exert downward pressure on graphite electrode prices, which negatively affects our sales, margins and profitability.

The graphite industry is highly competitive. Our market share, net sales or net income could decline due to vigorous price and other competition.

Competition in the graphite industry (other than, generally, with respect to new products) is based primarily on price, quality/performance, local presence, product portfolio, delivery reliability and customer service. Graphite electrodes, in particular, are subject to rigorous price competition. Competition with respect to new products is, and is expected to continue to be, based primarily on price, performance and cost effectiveness, customer service and product innovation. Competition could prevent implementation of price increases, including those described above, require price reductions or require increased spending on R&D, marketing and sales that could adversely affect us. In such a competitive market, changes in market conditions, including customer demand and technological development, as well as increased exports by Chinese EAF steel suppliers could adversely affect our competitiveness, sales and/or profitability.

We are dependent on the supply of petroleum needle coke. Our results of operations could deteriorate if disruptions in the supply of petroleum needle coke occur for an extended period.

Petroleum needle coke is our key raw material used in the production of graphite electrodes. At full operating levels, Seadrift provides a substantial portion of our petroleum needle coke requirements, with third party purchases making up the balance. A disruption in Seadrift’s production of petroleum needle coke could require us to obtain additional petroleum needle coke from third-party sources. There is no assurance that we would be able to obtain acceptable alternative sources on a cost-

effective or timely basis, or at all. An extended interruption of suitable needle coke for our operations could have a material adverse effect on our business, financial condition or operating results.

We rely primarily on one facility in Monterrey, Mexico for the manufacturing of connecting pins, a necessary component of our graphite electrodes. Our results of operations could deteriorate if this facility would become unable to provide us with the required volume of connecting pins.

We manufacture graphite connecting pins, which are used by customers to connect and fasten graphite electrodes together in a column for use in an EAF. For the past several years, all of our connecting pin production was performed at our Monterrey, Mexico facility. While we have added capability at our Pamplona, Spain facility, we primarily rely on one production location for this critical component. If our Monterrey, Mexico facility were to become unable to continue to provide us with connecting pins in required volumes, at suitable quality levels, or in a cost-effective manner, we would be required to shift production to our Pamplona, Spain facility or identify and obtain additional replacement manufacturing sources. There is no assurance that we would be able to obtain acceptable alternative sources on a cost-effective or timely basis, or at all. An extended interruption in the supply of connecting pins would result in the loss of sales, which could have a material adverse effect on our business, financial condition or operating results.

We are dependent on supplies of raw materials (in addition to petroleum needle coke). Our results of operations could deteriorate if those supplies increase in cost or are substantially disrupted for an extended period.

We purchase raw materials from a variety of sources. In many cases, we purchase them under short‑term contracts or on the spot market, in each case at fluctuating prices. The availability and price of raw materials may be subject to curtailment or change due to:

•limitations, which may be imposed under new legislation or regulation;

•suppliers’ allocations to meet demand from other purchasers during periods of shortage;

•interruptions or terminations in production by suppliers; and

•market and other events and conditions.

Petroleum and coal products, including decant oil and coal tar pitch, which are our principal raw materials other than petroleum needle coke, and energy, have been subject to significant price fluctuations. For example, Seadrift may not always be able to obtain an adequate quantity of suitable low‑sulfur decant oil for the manufacture of petroleum needle coke, and capital may not be available to install equipment to allow use of higher sulfur decant oil (which is more readily available in the United States) if supplies of low‑sulfur decant oil become more limited in the future. Further, low-sulfur emissions regulations adopted in 2020 by the International Maritime Organization have at times negatively affected pricing for low-sulfur decant oil and they may again in the future cause similar adverse impacts.

We have in the past entered into, and may continue in the future to enter into, derivative contracts and short‑duration fixed-rate purchase contracts to effectively fix a portion of our exposure to certain products. These hedging strategies may not be available or successful in eliminating our exposure. A substantial increase in raw material prices that cannot be mitigated or passed on to customers or a continued interruption in supply, particularly in the supply of decant oil, would have a material adverse effect on our business, financial condition, results of operations or cash flows. These hedges may be insufficient or ineffective in protecting against the impact of these fluctuations.

Our business and our customers are subject to market changes in the cost of electricity and natural gas that could adversely affect our business.

We are in an energy intensive industry that requires both natural gas and electricity in our manufacturing process. We primarily rely on third parties for the supply of our energy resources consumed in the manufacture of our products. The prices for third-party electricity and natural gas are subject to volatile market conditions, particularly in Europe. These market conditions often are affected by factors beyond our control and we may be unable to raise the price of our products to mitigate the effects of increased energy costs in our manufacturing processes. In addition, our customers are subject to these same market conditions.

Failure to retain our existing senior management team or the inability to attract and retain qualified personnel could hurt our business and inhibit our ability to operate and grow successfully.

Our success will continue to depend to a significant extent on the strength of our executive management team and the ability to recruit, hire and retain other key management and plant operating personnel, including factory and production workers

and other staff to support our growth and operational initiatives and replace those who retire or resign. Failure to retain our leadership team and workforce and to attract and retain other important management and technical personnel could place a constraint on our global growth and operational initiatives, possibly resulting in inefficient and ineffective management and operations, which would likely harm our revenues, operations and product development efforts and eventually result in a decrease in profitability.

Our operations are subject to hazards which could result in significant liability to us.

Our operations are subject to hazards associated with manufacturing and the related use, storage, transportation and disposal of raw materials, products and wastes. These hazards include explosions, fires, severe weather (including but not limited to hurricanes or other adverse weather that may be increasing as a result of climate change) and natural disasters, industrial accidents, mechanical failures, discharges or releases of toxic or hazardous substances or gases, transportation interruptions, human error and terrorist activities. These hazards can cause personal injury and loss of life, severe damage to or destruction of property and equipment as well as environmental damage, and may result in suspension of operations and the imposition of civil and criminal liabilities, including penalties and damage awards. While we believe our insurance policies are in accordance with customary industry practices, such insurance may not cover all risks associated with the hazards of our business and is subject to limitations, including deductibles and maximum liabilities covered. We may incur losses beyond the limits, or outside the coverage, of our insurance policies. In the future, we may not be able to obtain coverage at current levels, and our premiums may increase significantly on coverage that we maintain. Costs associated with unanticipated events in excess of our insurance coverage could have a material adverse effect on our business, competitive or financial position or our ongoing results of operations.

We are subject to a variety of legal, economic, social and political risks associated with our substantial operations in multiple countries, which could have a material adverse effect on our financial and business operations.

A substantial majority of our net sales are derived from sales outside the United States, and a majority of our operations and our property, plant and equipment and other long‑lived assets are located outside the United States. As a result, we are subject to risks associated with operating in multiple countries, including:

•currency fluctuations and devaluations in currency exchange rates, including impacts of transactions in various currencies, translation of various currencies into dollars for U.S. reporting and financial covenant compliance purposes, and impacts on results of operations due to the fact that the costs of our non‑U.S. operations are primarily incurred in local currencies while their products are primarily sold in dollars and euros;

•imposition of or increase in customs duties and other tariffs or the loss of the protection thereof;

•imposition of or increases in currency exchange controls, including imposition of or increases in limitations on conversion of various currencies into dollars, euros, or other currencies, making of intercompany loans by subsidiaries or remittance of dividends, interest or principal payments or other payments by subsidiaries;

•imposition of or increases in revenue, income or earnings taxes and withholdings and other taxes on remittances and other payments by subsidiaries;

•inflation, deflation and stagflation in any country in which we have a manufacturing facility;

•imposition of or increases in investment or trade restrictions by the United States or other jurisdictions or trade sanctions adopted by the United States;

•compliance with laws on anti-corruption, export controls, customs, sanctions, environmental and other laws governing our operations, including in challenging jurisdictions;

•inability to determine or satisfy legal requirements, effectively enforce contract or legal rights, including our rights under our LTAs and intellectual property rights, and obtain complete financial or other information under local legal, judicial, regulatory, disclosure and other systems; and

•nationalization or expropriation of assets, and other risks that could result from a change in government or government policy, or from other political, social or economic instability.

Any of these risks could have a material adverse effect on our business, financial condition, results of operations or cash flows, and we may not be able to mitigate these effects.

Our results of operations could deteriorate if our manufacturing operations were substantially disrupted for an extended period for any reason, including equipment failure, legal proceedings, climate change, natural disasters, public health crises, political crises or other catastrophic events.

Our manufacturing operations are subject to disruption due to equipment failure, extreme weather conditions, floods, hurricanes and tropical storms and similar events, major industrial accidents, including fires or explosions, cybersecurity incidents, strikes and lockouts, adoption of new laws or regulations, changes in interpretations of existing laws or regulations or changes in governmental enforcement policies, civil disruption, riots, terrorist attacks, war, public health crises and other events. These events may also impact the operations of one or more of our suppliers. For example, the potential physical impacts of climate change on our operations are uncertain and will likely be particular to the geographic circumstances. These physical impacts may include changes in rainfall and storm patterns, shortages of water or other natural resources, changing sea levels, changes in the frequency of natural or human induced disasters, including earthquakes, tsunamis, storms, hurricanes, floods, fires, droughts, tornadoes and other extreme weather events or conditions, and changing global average temperatures. For instance, our Seadrift facility in Texas and our Calais facility in France are located in geographic areas less than 50 feet above sea level. As a result, any future rising sea levels could have an adverse impact on their operations and on their suppliers. In the event manufacturing operations are substantially disrupted at one of our primary operating facilities, such as the September 2022 temporary suspension of our operations located in Monterrey, Mexico, we may not have the ability to increase production at our remaining operating facilities in order to compensate without considerable time and expense. To the extent any of these events occur, our business, financial condition and operating results could be materially and adversely affected.

Plant operational improvements may be delayed or may not achieve the expected benefits.

Our ability to complete future operational improvements may be delayed, interrupted or otherwise limited by the need to obtain environmental and other regulatory approvals, unexpected cost increases, financial constraints, availability of labor and materials, unforeseen hazards such as weather conditions, and other risks customarily associated with construction projects. Moreover, the costs of these activities could have a negative impact on our results of operations. In addition, these operational improvements may not achieve the expected benefits as a result of changes in market conditions, raw material shortages or other unforeseen contingencies.

We depend on third parties for certain construction, maintenance, engineering, transportation, warehousing and logistics services.

We contract with third parties for certain services relating to the design, construction and maintenance of various components of our production facilities and other systems. If these third parties fail to comply with their obligations, the facilities may not operate as intended, which may result in delays in the production of our products and materially adversely affect our ability to meet our production targets and satisfy customer requirements or we may be required to recognize impairment charges. In addition, production delays could cause us to miss deliveries and breach our contracts, which could damage our relationships with our customers and subject us to claims for damages under our contracts. Any of these events could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We also rely primarily on third parties for the transportation of the products we manufacture. In particular, a significant portion of the goods we manufacture are transported to different countries, which requires sophisticated warehousing, logistics and other resources. If any of the third parties that we use to transport products are unable to deliver the goods we manufacture in a timely manner, we may be unable to sell these products at full value or at all, which could cause us to miss deliveries and breach our contracts, which could damage our relationships with our customers and subject us to claims for damages under our contracts. Any of these events could have a material adverse effect on our business, financial condition, results of operations or cash flows.

We may be subject to information technology systems failures, cybersecurity incidents, network disruptions and breaches of data security, which could compromise our information and expose us to liability.

Our information technology systems are an important element for effectively operating our business. Information technology systems or processes, and the information technology systems or processes of our customers, our third-party business partners, our vendors or other parties that have been entrusted with our information, including risks associated with any failure to maintain or upgrade our systems, network disruptions and breaches of data security could disrupt our operations by impeding our processing of transactions, our ability to protect customer or company information or our financial reporting, leading to increased costs. It is possible that future technological developments could adversely affect the functionality of our computer systems and require further action and substantial funds to prevent or repair computer malfunctions. Our computer systems, including our back‑up systems, could be damaged or interrupted by power outages, computer and telecommunications failures, computer viruses, cybercrimes, internal or external security breaches, events such as fires, earthquakes, floods, tornadoes and hurricanes, errors by our employees, or other cybersecurity incidents. Cybersecurity incidents and similar attacks

vary in their form and can include the deployment of harmful malware or ransomware, denial-of-service attacks, and other attacks, which may affect business continuity and threaten the availability, confidentiality and integrity of our systems and information. Cybersecurity incidents can also include employee or personnel failures, fraud, phishing or other social engineering attempts or other methods to cause confidential information, payments, account access or access credentials, or other data to be transmitted to an unintended recipient. Cybersecurity threat actors also may attempt to exploit vulnerabilities in software that is commonly used by companies in cloud-based services and bundled software. Although we have taken steps to address these concerns by implementing network security, back‑up systems and internal control measures, these steps may be insufficient or ineffective. Security and/or privacy breaches, cybersecurity incidents, acts of vandalism or terror, misplaced, corrupted, altered or lost data, programming, and/or human error or other similar events with respect to our information technology systems or processes, or the information technology systems or processes of third-parties that have been entrusted with our information, could have a material adverse effect on our business strategy, financial condition, results of operations or cash flows, including major disruptions to business operations, loss of intellectual property, release of confidential information, alteration or corruption of data or systems, costs related to remediation or the payment of ransom, litigation, administrative, and civil or criminal investigations or actions, regulatory intervention and sanctions or fines, investigation and remediation costs and possible prolonged negative publicity.

If we are unable to successfully negotiate with the representatives of our employees, including labor unions, we may experience strikes and work stoppages.

We are party to collective bargaining agreements and similar agreements with our employees. As of December 31, 2024, 647 employees, or approximately 60% of our worldwide employees, were covered by collective bargaining or similar agreements. Although we believe that, in general, our relationships with our employees are good, we cannot predict the outcome of current and future negotiations and consultations with employee representatives, which could have a material adverse effect on our business. We may not succeed in renewing or extending these agreements on terms satisfactory to us. Although we have not had any material work stoppages or strikes initiated by our employees during the past decade, they may occur in the future during renewal or extension negotiations or otherwise. A material work stoppage, strike or other union dispute could adversely affect our business, financial condition, results of operations and cash flows.

Our ability to grow and compete effectively depends on protecting our intellectual property. Failure to protect our intellectual property could adversely affect our business.

We believe that our intellectual property, consisting primarily of patents and proprietary know‑how and information, is important to our growth. Our intellectual property portfolio is extensive, with approximately 100 U.S. and foreign patents and pending patent applications, which we believe is more than any of our major competitors in the businesses in which we operate. Failure to protect our intellectual property may result in the loss of the exclusive right to use our technologies. We rely on patent, trademark, copyright and trade secret laws and confidentiality and restricted-use agreements to protect our intellectual property. However, some of our intellectual property is not covered by any patent or patent application or any such agreement. Intellectual property protection does not protect against technological obsolescence due to developments by others or changes in customer needs.

Patents are subject to complex factual and legal considerations. Accordingly, the validity, scope and enforceability of any particular patent can be uncertain. Therefore, we cannot assure you that: