Filed Pursuant to Rule 424(b)(2)

Registration number: 333-283053

Registration number: 333-283053-01

PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED NOVEMBER 7, 2024

$5,500,000,000

Chevron U.S.A. Inc.

$750,000,000 4.405% Notes Due 2027

$750,000,000 Floating Rate Notes Due 2027

$1,000,000,000 4.475% Notes Due 2028

$500,000,000 Floating Rate Notes Due 2028

$1,100,000,000 4.687% Notes Due 2030

$650,000,000 4.819% Notes Due 2032

$750,000,000 4.980% Notes Due 2035

Fully and unconditionally guaranteed by

Chevron Corporation

Chevron U.S.A. Inc. (exclusive of its subsidiaries, the ”Issuer” or “CUSA”) is offering $1,500,000,000 aggregate principal amount of notes due 2027 (the “2027 notes”), $1,500,000,000 aggregate principal amount of notes due 2028 (the “2028 notes”), $1,100,000,000 aggregate principal amount of notes due 2030 (the “2030 notes”), $650,000,000 aggregate principal amount of notes due 2032 (the “2032 notes”), and $750,000,000 aggregate principal amount of notes due 2035 (the “2035 notes”).

The Issuer will issue the 2027 notes in two series, a single series with a fixed interest rate, which are referred to as the “2027 fixed rate notes,” and a single series with a floating interest rate, which are referred to as the “2027 floating rate notes.” The 2028 notes will be issued in two series, a single series with a fixed interest rate, which are referred to as the “2028 fixed rate notes,” and a single series with a floating interest rate, which are referred to as the “2028 floating rate notes.” The 2030 notes will be issued in a single series with a fixed interest rate. The 2032 notes will be issued in a single series with a fixed interest rate. The 2035 notes will be issued in a single series with a fixed interest rate. The 2027 fixed rate notes the 2028 fixed rate notes the 2030 fixed rate notes, the 2032 fixed rate notes and the 2035 fixed rate notes are collectively referred to as the “fixed rate notes,” and the 2027 floating rate notes and the 2028 floating rate notes are referred to as the “floating rate notes.” The fixed rate notes and the floating rate notes are collectively referred to as the “notes.”

The obligations under the notes will be fully and unconditionally guaranteed by Chevron Corporation, the parent company of the Issuer (exclusive of its subsidiaries, the “Guarantor”), on an unsecured and unsubordinated basis and will rank equally to any other unsecured and unsubordinated indebtedness of the Guarantor that is currently outstanding or that the Guarantor may issue in the future.

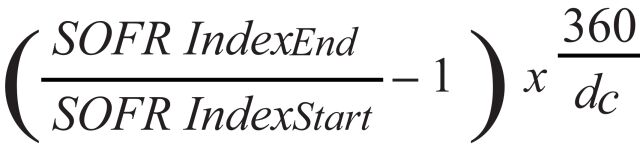

The 2027 notes will mature on February 26, 2027, the 2028 notes will mature on February 26, 2028, the 2030 notes will mature on April 15, 2030, the 2032 notes will mature on April 15, 2032, and the 2035 notes will mature on April 15, 2035. The Issuer will pay interest on the 2027 fixed rate notes and the 2028 fixed rate notes on February 26 and August 26 of each year starting on August 26, 2025, and interest on the 2030 fixed rate notes the 2032 fixed rate notes and the 2035 fixed rate notes on April 15 and October 15 of each year starting on October 15, 2025. The Issuer will pay interest on the 2027 floating rate notes and 2028 floating rate notes on February 26, May 26, August 26 and November 26 of each year starting on May 27, 2025. The 2027 floating rate notes will bear interest at a floating rate equal to Compounded SOFR (as defined herein) plus 0.36%, and the 2028 floating rate notes will bear interest at a floating rate equal to Compounded SOFR plus 0.47%, each subject to the provisions set forth under “Description of the Notes—Interest—Floating Rate Notes”; provided, however, that the minimum interest rate on the floating rate notes shall not be less than 0.000%. The Issuer will have the right to redeem the fixed rate notes in whole or in part at any time prior to maturity at the redemption prices described in this prospectus supplement. The floating rate notes will not be redeemable prior to maturity.

| | | | | | | | | | | | |

| | | Price to

Public(1) | | | Underwriting

Discount | | | Proceeds Before

Expenses to

the Issuer | |

Per 2027 Fixed Rate Note | | | 100.000 | % | | | 0.110 | % | | | 99.890 | % |

Total | | $ | 750,000,000 | | | $ | 825,000 | | | $ | 749,175,000 | |

Per 2027 Floating Rate Note | | | 100.000 | % | | | 0.110 | % | | | 99.890 | % |

Total | | $ | 750,000,000 | | | $ | 825,000 | | | $ | 749,175,000 | |

Per 2028 Fixed Rate Note | | | 100.000 | % | | | 0.140 | % | | | 99.860 | % |

Total | | $ | 1,000,000,000 | | | $ | 1,400,000 | | | $ | 998,600,000 | |

Per 2028 Floating Rate Note | | | 100.000 | % | | | 0.140 | % | | | 99.860 | % |

Total | | $ | 500,000,000 | | | $ | 700,000 | | | $ | 499,300,000 | |

Per 2030 Note | | | 99.991 | % | | | 0.150 | % | | | 99.841 | % |

Total | | $ | 1,099,901,000 | | | $ | 1,650,000 | | | $ | 1,098,251,000 | |

Per 2032 Note | | | 99.990 | % | | | 0.170 | % | | | 99.820 | % |

Total | | $ | 649,935,000 | | | $ | 1,105,000 | | | $ | 648,830,000 | |

Per 2035 Note | | | 99.990 | % | | | 0.200 | % | | | 99.790 | % |

Total | | $ | 749,925,000 | | | $ | 1,500,000 | | | $ | 748,425,000 | |

| (1) | Plus accrued interest, if any, from February 26, 2025. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus supplement or the accompanying prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

Investing in the notes involves risks. See “Item 1A. Risk Factors” in Chevron Corporation’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 21, 2025, which is incorporated by reference herein, and the “Risk Factors” section on page S-3 for a discussion of factors you should consider carefully before investing in the notes.

The underwriters have agreed to purchase each series of notes on a firm commitment basis. It is expected that delivery of each series of notes will be made through the facilities of The Depository Trust Company, including its participants Clearstream Banking, société anonyme, or Euroclear Bank S.A./N.V., as operator of the Euroclear System, against payment in New York, New York on or about February 26, 2025.

Joint Book-Running Managers

| | | | |

| Barclays | | BofA Securities | | J.P. Morgan |

| | | | | | | | | | |

| | | | | |

| Citigroup | | Goldman Sachs & Co. LLC | | HSBC | | Morgan Stanley | | MUFG | | Standard Chartered Bank |

Co-Managers

| | | | | | | | |

| Mizuho | | Scotiabank | | Deutsche Bank Securities | | SMBC Nikko | | Loop Capital Markets |

| | | | |

Santander | | BBVA | | IMI – Intesa Sanpaolo | | Standard Bank | | US Bancorp |

The date of this prospectus supplement is February 24, 2025.