UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

OR

o TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO .

Commission File Number 0-26068

____________________

(Exact name of registrant as specified in its charter)

|

| |

| DELAWARE | 95-4405754 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation organization) | Identification No.) |

| | |

| 520 NEWPORT CENTER DRIVE, | |

| NEWPORT BEACH, CA | 92660 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

Securities registered pursuant to Section 12(b) of the Act:

|

| |

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act: None

____________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act. Yes R No £

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes £ No R

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to filing requirements for the past 90 days. Yes R No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer R | | Accelerated filer £ |

Non-accelerated filer £ (Do not check if a smaller reporting company) | | Smaller reporting company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No R

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant on June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, computed by reference to the last sale price of the registrant’s common stock as reported by The Nasdaq Global Select Market on such date, was approximately $871,822,000. This computation assumes that all executive officers and directors are affiliates of the registrant. Such assumption should not be deemed conclusive for any other purpose.

As of February 25, 2015, 50,948,316 shares of common stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

In accordance with General Instruction G(3) to Form 10-K, portions of the registrant’s Definitive Proxy Statement on Schedule 14A for its Annual Meeting of Stockholders to be filed with the Commission within 120 days after the close of the fiscal year covered by this Annual Report on Form 10-K are incorporated by reference into Part III of this Annual Report on Form 10-K. Only those portions of the proxy statement that are specifically incorporated by reference herein shall constitute a part of this Annual Report on Form 10-K.

ACACIA RESEARCH CORPORATION

ANNUAL REPORT ON FORM 10-K

FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

|

| | |

| | | Page |

| PART I |

| | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | | |

| | | |

| PART II |

| | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | | |

| | | |

| PART III |

| | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | | |

| | | |

| PART IV |

| | | |

| Item 15. | | |

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

As used in this Annual Report on Form 10-K, “we,” “us” and “our” refer to Acacia Research Corporation and/or its wholly and majority-owned operating subsidiaries. All patent portfolio investments, development, licensing and enforcement activities are conducted solely by certain of our wholly owned operating subsidiaries.

This Annual Report on Form 10-K, or the annual report, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which include, without limitation, statements about our future business operations and results, our strategies and competition, and other forward-looking statements included in this annual report. Such statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “believe,” “estimate,” “anticipate,” “intend,” “continue,” or similar terms, variations of such terms or the negative of such terms. Such statements are based on management’s current expectations and are subject to a number of risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Such statements address future events and conditions concerning earnings, capital expenditures, litigation, competition, regulatory matters, stock price volatility, liquidity and capital resources and accounting matters. Actual results in each case could differ materially from those anticipated in such statements by reason of factors such as future economic conditions, legislative, regulatory and competitive developments in markets in which we and our subsidiaries operate, and other circumstances affecting anticipated revenues and costs, as more fully disclosed in our discussion of “Risk Factors” in Item 1A of Part I of this annual report. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. Additional factors that could cause such results to differ materially from those described in the forward-looking statements are set forth in connection with the forward-looking statements.

ITEM 1. BUSINESS

General

Our operating subsidiaries partner with inventors and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented inventions. We are an intermediary in the patent marketplace, bridging the gap between invention and application, facilitating efficiency and delivering monetary rewards to patent owners.

Our operating subsidiaries generate revenues and related cash flows from the granting of intellectual property rights for the use of patented technologies that our operating subsidiaries control or own. Our operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, where necessary, with the enforcement against unauthorized users of their patented technologies through the filing of patent infringement litigation. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to multiple patent portfolios, which include U.S. patents and certain foreign counterparts, covering technologies used in a wide variety of industries.

We are a leader in licensing and enforcing patented technologies and have established a proven track record of licensing success with over 1,430 license agreements executed to date, across 181 of our patent portfolio licensing and enforcement programs. To date, we have generated gross licensing revenue of approximately $1.1 billion, and have returned more than $665 million to our patent partners.

Other

We were originally incorporated in California in January 1993 and reincorporated in Delaware in December 1999. Our website address is www.acaciaresearch.com. Reference in this annual report to this website address does not constitute incorporation by reference of the information contained on the website. We make our filings with the Securities and Exchange Commission, or the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, other reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, and amendments to the foregoing reports, available free of charge on or through our website as soon as reasonably practicable after we file these reports with, or furnish such reports to, the SEC. In addition, we post the following information on our website:

| |

| • | our corporate code of conduct, our code of conduct for our board of directors and our fraud policy; |

| |

| • | charters for our audit committee, nominating and corporate governance committee, disclosure committee and compensation committee; and |

| |

| • | applicable dividend related tax forms. |

The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including us, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

Patent Licensing and Enforcement Business

Our operating subsidiaries invest in, license and enforce patented technologies. Our operating subsidiaries partner with inventors and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented inventions. We are an intermediary in the patent marketplace, bridging the gap between invention and application, facilitating efficiency and delivering monetary rewards to patent owners.

Our operating subsidiaries generate revenues and related cash flows from the granting of intellectual property rights for the use of patented technologies that our operating subsidiaries control or own. Our operating subsidiaries assist patent owners with the prosecution and development of their patent portfolios, the protection of their patented inventions from unauthorized use, the generation of licensing revenue from users of their patented technologies and, where necessary, with the enforcement against unauthorized users of their patented technologies through the filing of patent infringement litigation.

Refer to the section entitled “Patented Technologies” below for a partial summary of patent portfolios owned or controlled by certain of our operating subsidiaries.

Patents are an important asset class worldwide. Due to legislative and regulatory changes, licensing and enforcing patents has become increasingly difficult for patent holders, necessitating an experienced, well-capitalized, licensing partner. We focus solely on the patent marketplace, and have emerged as the leading outsource patent licensing and enforcement company for patent owners that have made the important choice to outsource their patent licensing and enforcement activities.

We are a leader in patent licensing and enforcement, and our operating subsidiaries have established a proven track record of licensing success with more than 1,430 license agreements executed to date. On a consolidated basis, to date, we have generated revenues from 181 of our patent portfolio licensing and enforcement programs. Our professional staff includes in-house patent attorneys, licensing executives, engineers and business development executives.

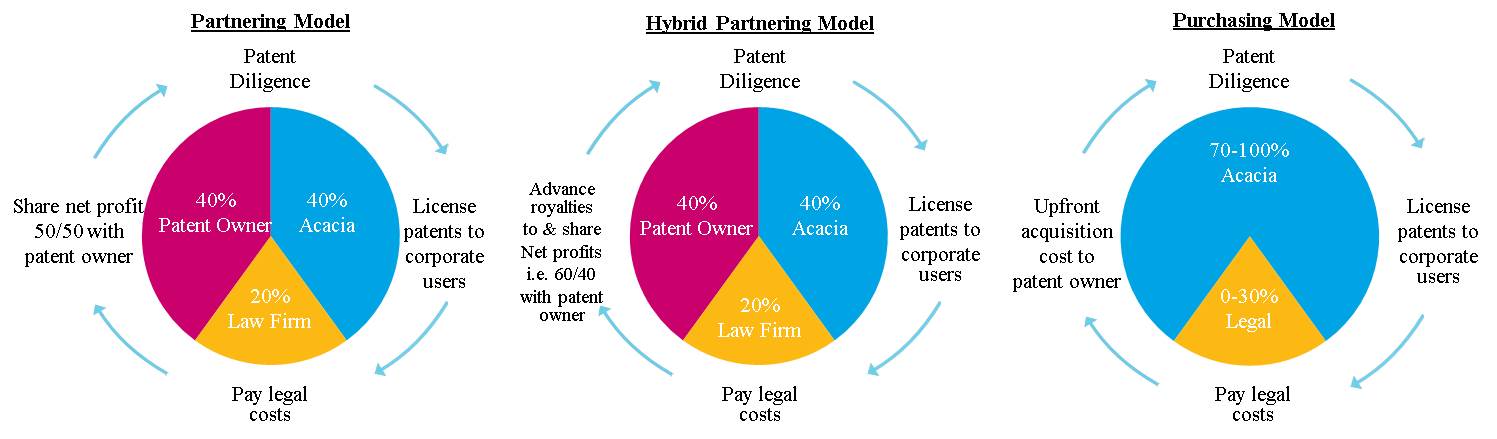

We partner with the disenfranchised patent owner, including individual inventors, universities, and large multi-national corporations in the technology, medical technology, energy, and industrial sectors. A disenfranchised patent owner owns patents that are being infringed by third-parties in connection with the design, manufacture, use, or distribution of products and/or services, but is not receiving fair compensation for the unauthorized use of his or her patented inventions by those third-parties. We strive to reward inventors and patent owners for their creative technological contributions. We also partner with patent owners, including individual inventors, universities, and domestic and multi-national corporations who may have limited internal resources and/or expertise to effectively address the unauthorized use of their patented technologies, and those that are seeking to effectively and efficiently monetize their portfolio of patented technologies on an outsourced basis. In a typical arrangement, our operating subsidiary will partner with a patent portfolio owner, acquiring rights in the patent portfolio or acquiring the patent portfolio outright, and in exchange, the original patent portfolio owner receives (i) a percentage of our operating subsidiary’s net recoveries from the licensing and enforcement of the patent portfolio, which we refer to as our Partnering Model, or (ii) an upfront payment for the purchase of the patent portfolio rights or the patent portfolio, which we refer to as our Purchasing Model, or (iii) a combination of the two, which we refer to as our Hybrid Partnering Model.

Under U.S. law, a patent owner has the right to exclude others from making, selling or using their patented invention. A third-party infringes a patent by making, offering for sale, selling, or using a patented invention without a license from the patent owner. Unfortunately, in the majority of cases, infringers are generally unwilling, at least initially, to negotiate or pay reasonable license fees for their unauthorized use of third-party patents and will typically fight any allegations of patent infringement. Inventors and/or patent holders without sufficient legal, financial and/or expert technical resources to bring and continue the pursuit of costly and complex patent infringement actions are often blatantly ignored.

As a result of the common reluctance of patent infringers to negotiate and ultimately take a patent license for the use of patented technologies without at least the threat of legal action, patent licensing and enforcement often begins with the filing of patent enforcement litigation. However, most patent infringement litigation settles out of court at amounts that are related to the strength of the patent and the value of the invention in the infringer’s products or services. We execute agreements that grant rights in our patents to users of our patented technologies. Our agreements can be negotiated without the filing of patent litigation, or negotiated in the shadow of ongoing patent litigation, depending on the specific facts and circumstances.

Patents are a complex and highly technical subject area. Our professionals actively seek to identify high-quality but undervalued patent portfolios in a variety of industries. We combine our legal expertise, technology expertise, and our extensive knowledge of, and experience in, the patent licensing ecosystem, to continually uncover important patent assets and bring needed proficiency to patent licensing and enforcement.

Our partnership with patent owners is the cornerstone of our operating subsidiaries’ corporate strategy. We assume all responsibility for advancing operational expenses while pursuing a patent licensing and enforcement program, and then share net licensing revenue with our patent partners as that program matures, on a pre-arranged and negotiated basis. We may also provide upfront capital to the patent owner as an advance against future licensing revenue. We are a principal in the licensing and enforcement effort, with our operating subsidiaries obtaining control of the rights in the patent portfolio, or control of the patent portfolio outright.

Business Model and Strategy - Overview

We have the flexibility to structure arrangements in a number of ways to address the needs and specific sets of circumstances presented by each of our unique patent partners, examples of which include the following:

Partnering Model:

| |

| • | 50/50 net profit sharing of revenue after legal costs and other licensing and enforcement costs. Profit sharing percentages can vary. |

| |

| • | Typical partners include major corporations, research labs and universities and individual inventors. |

| |

| • | Upon return of advanced costs, net profit revenue share with patent partner commences. |

Hybrid Partnering Model:

| |

| • | Hybrid Partnership with up-front capital infusion to our patent partners as an advance on future licensing revenue streams. |

| |

| • | Increases our total addressable market providing an advantage over competitors. |

| |

| • | Typical partners include major corporations seeking to effectively and efficiently monetize their patent portfolios. |

| |

| • | We maintain at least a 100% preferred rate of return until all deployed capital is returned. |

| |

| • | Upon return of capital infusion, net profit revenue share with patent partner commences. |

| |

| • | Target recovery of advanced capital in 18 months. |

Purchasing Model:

| |

| • | We invest in 100% of the patents for 100% of the profits, with no backed participation for the patent owner. |

| |

| • | Typical partners include distressed corporations and other corporations with limited success controlled by venture capitalists. |

| |

| • | Target recovery of advanced capital in 18 months. |

Key Elements of Business Strategy

Patent licensing and enforcement can be an effective and efficient way to maximize the profit potential of a patent. A patent license agreement grants a third-party user of an invention specific patent rights to the patented invention in exchange for patent license fees. Patent licensing is especially suitable for patents that are owned by the patent-disenfranchised. Patent disenfranchised owners of patents are those that have not successfully converted their patented invention into a profitable product or service, and therefore, are not generating revenues from their patented inventions. The patent-disenfranchised, for example, include owners of the following categories of patented inventions:

| |

| • | Inventions that were so far ahead of the technology curve that there is no existing ecosystem to support the patented products or services at the time they are introduced to market; |

| |

| • | Inventions that can only be deployed in very capital-intensive industries, such as semiconductor fabrication, energy, or medical sectors, but whose owners do not have sufficient amounts of capital to deploy; and |

| |

| • | Inventions that, for one reason or another, including the shifting of cost-effective manufacturing overseas, are no longer being practiced by the patent owner. |

Our patent licensing business provides patent holders with an opportunity to generate income from their patented inventions being practiced by third-parties without authorization. Our patent licensing and enforcement business strategy, conducted solely by our operating subsidiaries, includes three fundamental elements, as follows:

| |

| • | Patent Discovery - Discover potentially valuable patents or patent portfolios. |

| |

| • | Assessment of Economic Value - Work internally and with external experts to evaluate the use of the patented invention(s) in the relevant marketplace and assess a patents or patent portfolios’ expected economic value. |

| |

| • | Licensing and Enforcement - For unauthorized users of the patented invention, enter into license negotiations and, if necessary, litigation to monetize the patent based on its assessed value. |

Patent Discovery. The patent process breeds, encourages and sustains innovation and invention by granting a limited monopoly to the inventor in exchange for sharing the invention with the public. Certain technologies, including several of the technologies controlled by our operating subsidiaries, some of which are summarized below, become core technologies in the way products and services are manufactured, sold or delivered by companies across a wide array of industries. Our operating subsidiaries identify core, patented technologies that have been or are anticipated to be widely adopted by third-parties in connection with the manufacture, sale or use of products and services. Patent discovery occurs when we reach out to patent holders who may be disenfranchised, or when patent holders approach us seeking assistance with the monetization and enforcement of their patent portfolios.

Assessment of Economic Value. Subsequent to the patent discovery process, our executives work internally and/or with external industry experts in the specific technology field, to evaluate the patented invention and its adoption and implementation in the marketplace. There are several key factors to consider when analyzing a patent and determining a patent’s value: (1) Infringement, (2) Validity and (3) Enforceability.

| |

| • | Infringement. To determine infringement, we must first identify third-parties that are practicing the invention(s) covered by the patent without obtaining permission from the patent owner to do so. A key tool in determining whether or not a company is infringing a patent is a claim chart. A claim chart demonstrates how the manufacture, sale, or use of an existing product compares against the claims of the patent. |

| |

| • | Invalidity. The three main factors analyzed to determine invalidity are (1) anticipation, (2) obviousness, and (3) the existence of non-patentable subject matter. |

| |

| ◦ | Anticipation occurs when the claims of the patent are entirely revealed within a single piece of prior art. “Prior art” is a technical term that generally refers to an invention that existed prior to the grant of the patent being analyzed. |

| |

| ◦ | Even if the claims of the patent are not entirely revealed within a single piece of prior art, the patent may still be invalid if determined to be “obvious” under the law. “Obvious” essentially means that the |

differences between prior art and the patented invention are so slight such that they would have been obvious at the time of invention to one who is skilled in the subject matter being patented.

| |

| ◦ | Even if the patent lacks anticipation and obviousness, it may still be invalid if its subject matter is un-patentable by law. Un-patentable subject matter includes naturally occurring things, abstract concepts, or algorithms that perform an ordinary function. |

| |

| • | Enforceability. A myriad of factors are analyzed to determine whether or not a patent is enforceable, including whether or not there has been patent misuse, or whether or not there are antitrust violations associated with the patent. Due to the inherently complex nature of patent law, only a court or specific administrative body, such as the International Trade Commission, can make a decision whether a patent is infringed, valid and enforceable; however, we employ our wealth of expertise to make the best assessment possible given a specific fact pattern and set of circumstances. |

We estimate a patent’s economic value by evaluating the expected value of the license revenue stream based on past, present and future revenue of infringing products or services, and the risk that a court will disagree with our infringement, validity or enforcement assessments of the patent.

The processes and procedures employed in connection with the evaluation of a specific patent portfolio for future investment, licensing and enforcement are tailored and unique to each specific situation and can vary widely based on the specific facts and circumstances of a specific patent portfolio, such as the related technology, related industry and certain other factors. Some of the key components of our processes and procedures may include:

| |

| • | Utilizing our staff of in-house business development executives, patent attorneys, patent licensing executives, and technology engineers to conduct our tailored patent investment and evaluation processes and procedures. We may also leverage the expertise of external specialists and technology consultants. |

| |

| • | Identifying emerging growth areas where patented technologies will play a vital role in connection with the manufacture or sale of products and services. |

| |

| • | Identifying core, patented technologies that have been or are anticipated to be widely adopted by third-parties in connection with the manufacture or sale of products and services. |

| |

| • | Considering the impact of subtleties in the language of a patent, recorded interactions with the patent office, evaluating prior art and literature and considering the impact on the potential licensing and enforcement revenue that can be derived from a patent or patent portfolio. |

| |

| • | Evaluating the strength of a patent portfolio, including consideration of the types of claims and the number of claims potentially infringed by third-parties, and the results of any prior art searches or analysis, before the decision is made to allocate resources to a patent portfolio investment or an effective licensing and enforcement effort. |

| |

| • | Identifying and considering potential problem areas, if any, and determining whether potential problem areas can be overcome prior to acquiring a patent portfolio or launching an effective licensing program. |

| |

| • | Identifying potential infringers, industries within which the potential infringers exist, longevity of the patented technology, and a variety of other factors that directly impact the magnitude and potential success of a licensing and enforcement program. |

Licensing and Enforcement. The final step in the patent licensing and enforcement process is to monetize the patent by securing license agreements based on the patents estimated value. While we prefer to convince unauthorized users of our patented inventions of the value of the patented invention and secure a license agreement in a non-litigious manner, many infringers refuse to take such licenses even when confronted with substantial and persuasive evidence of infringement, validity, enforceability and significant economic value. As a result, often we must resort to litigation to demonstrate and prove infringement and ultimately induce infringers to take a license. We have found it effective to negotiate licenses concurrently with litigation due to the fact that litigation necessitates and facilitates an information exchange that helps both sides assess the value of a patent and make informed decisions. Also, litigation eventually leads to a court’s judgment. When a court agrees with our assessment of a patent, this judgment stops recalcitrant infringers from indefinitely profiting from the patent they are infringing.

Our operating subsidiaries engage highly competent and experienced patent lawyers to prosecute their patent portfolio litigation. It is imperative to be persistent and patient throughout the litigation process as it typically takes 18-36 months from the filing date of a lawsuit to yield a license agreement from a potential licensee. Often, it takes longer to secure a final court judgment.

Patent license negotiations and litigation initiated by our operating subsidiaries usually lead to serious and thoughtful discussions with the unauthorized users of the patented inventions. The result can be quite favorable with the user being granted rights under the patents for the patented invention in its products and services in exchange for financial remuneration. This remuneration is typically shared between our operating subsidiary and the patent holder.

Patent Prosecution. Concurrent with our patent litigation and licensing negotiation activities, we often assist patent holders with the acquisition of additional rights associated with their inventions both in the United States and across the globe. This is referred to as “continued prosecution,” and is done to further define the boundaries of an invention. It can also be effective to correct technical deficiencies discovered within a patent that may have been identified in the negotiation and litigation process. These deficiencies, if not appropriately addressed, can limit the value of patents that are otherwise infringed, valid, enforceable.

Our specialists, along with third-party experts that we engage, are trained and skilled in the areas of patent discovery, assessment of a patent or patent portfolios expected economic value, acquiring additional patent rights via continued patent prosecution, and patent licensing and enforcement. In applying our legal and technology expertise to high quality patent assets, we bridge the gap between invention and application, facilitating efficiency and delivering monetary rewards to the patent disenfranchised and other patent owners with whom we partner.

Patented Technologies

Currently, on a consolidated basis, our operating subsidiaries own or control the rights to patent portfolios with future patent expiration dates ranging from 2015 to approximately 2033, covering technologies used in a wide variety of industries, a sample of which includes the following:

|

| | |

| Operating Subsidiary | Industry | Description |

| 3 Degrees, LLC | Social Networking | Patents relate to professional and social media networking technology. |

| 3D Design Solutions, LLC | Software | Patents relating to Computer-Aided Design Technology. |

| Adaptix, Inc. | Telecommunications / Smartphones | Portfolio relates to air interface technology used in modern 4G wireless networks. The patents relate to both infrastructure and user equipment. |

| American Vehicular Sciences, LLC | Transportation And Automotive | Patents from Automotive Technologies International, or ATI and Intelligent Technologies International, or ITI, relating to numerous automotive safety, navigation and diagnostics technologies. |

| Body Science, LLC | Peripheral Vascular Devices | Patents relating to apparatus for use in wireless physiological monitoring. |

| Bonutti Skeletal Innovations, LLC | Orthopedic Implants And Sports Medicine Market | Issued and pending patents and applications in the orthopedic field covering, among other things, suture anchors, biologics, total knee replacements, total hip replacements, minimally invasive surgery, partial knee and hip replacement, spinal implants, and surgical instruments and methods of use. |

| Brandywine Communications Technologies, LLC | Communications | Patents related to Broadband Communications Technology. |

| Brilliant Optical Solutions, LLC | Semiconductor/MEMS | Patent relates to Core Fiber Optic Network Architectures. |

| Cell and Network Selection, LLC | Telecommunications / Smartphones | Patent family generally relates to LTE user equipment (phones, tablets, dongles). |

| Cellular Communications Equipment, LLC | Telecommunications / Smartphones | Portfolio covers Wireless Infrastructure and User Equipment Technology relating to second (2G), third (3G) and fourth (4G) generation wireless technologies and to air interface technology used in 2G, 3G and 4G wireless networks. |

| CeraMedic, LLC | Medical | U.S. patent plus foreign patent relating to Ceramic Hip Replacement technology. |

| Computer Software Protection, LLC | Software | Patent for Software Activation Technology, which generally relates to preventing software from running on unlicensed systems. |

| Data Engine Technologies, LLC | Software | Patent portfolio covering a wide range of Software Technology. |

| Delaware Display Group, LLC | Transportation And Automotive | Portfolio relates to certain display technologies used in smartphones, tablets, computers, HDTVs and other devices. |

| Dynamic 3D Geosolutions, LLC | Software | Patent related to Geological Interpretation and Modeling Technology. |

| Dynamic Transmissions Tech, LLC | Wireless Communications | Patent portfolios relating to on line collaboration, data networking, cellular communications and digital cameras. |

|

| | |

| Endotach, LLC | Peripheral Vascular Devices | Patents relating to stent grafts. |

| EVM Systems, LLC | Peripheral Vascular Devices | Patents and applications covering a series of medical instruments utilizing a slotted, shape memory tube. |

| GT Gaming, LLC | Internet/Ecommerce/Business Methods | Patent relating to Online Gaming Technology. |

| In-Depth Test, LLC | Semiconductor/MEMS | Patent portfolio relating to Semiconductor Testing Technology. |

| Industrial Print Technologies, LLC | Computers/Peripherals/Printers | Patent portfolio covering ink jet printer and ink jet printing technologies and other printer and printing technologies. |

| Innovative Display Technologies, LLC | Telecommunications / Smartphones | Portfolio generally relates to back-lighting for displays and the patented technology covers various improvements to LCD displays. |

| Labyrinth Optical Technologies, LLC | Communications | Patents relating to Optical Networking Technology. |

| Lambda Optical Solutions, LLC | Communications | Patents relating to Optical Switching Technology. |

| LifePort Sciences, LLC | Peripheral Vascular Devices | Multiple patents and applications relating to, among other things, stent grafts, stent graft delivery systems and stent placement procedures. |

| LifeScreen Sciences, LLC | Peripheral Vascular Devices | Portfolio consists of multiple patents and applications relating to, among other things, vena cava filters, embolic protection and associated delivery systems. |

| LifeShield Sciences, LLC | Peripheral Vascular Devices | Portfolio consists of multiple patents and applications relating to stent grafts, and stent graft delivery systems. |

| Light Transformation Technologies, LLC | Energy/Lighting | Patents relating to Improved Lighting Technology. |

| Mobile Enhancement Solutions, LLC | Telecommunications / Smartphones | This portfolio relates to enhanced mobile communications and covers many features found in smartphones today. |

| Nexus Display Technologies, LLC | Consumer Electronics | Patent portfolio relating to high speed digital display interface technology used in industry standards such as DisplayPort and DisplayPort-related technologies and also MIPI DSI.

|

| Online News Link, LLC | Internet/Ecommerce/Business Methods | Patents relate to embedded links in on-line newsletters. |

| Optimum Content Protection, LLC and Super Interconnect Technologies, LLC | Telecommunications / Smartphones | Portfolios relate to high speed circuit interconnect, display control technology and content security used in consumer electronics, PCs and mobile devices such as smartphones, tablets, and laptops. |

| Parthenon Unified Memory Architecture, LLC | Semiconductor | Patents relate to the use of shared memory in multimedia processing systems such as mobile phones, tablets and other consumer electronic devices. |

| Progressive Semiconductor Solutions, LLC | Semiconductor/MEMS | Patent portfolio covering Microprocessor and Memory Technology. |

| Promethean Insulation Technology, LLC | Energy/Lighting | Patent relates to insulation material used in building construction. |

| Saint Lawrence Communications, LLC | Wireless | Patents relating to Speech Codecs used in Wireless and Wireline Systems. |

| Signal Enhancement Technologies, LLC | Telecommunications / Smartphones | Portfolio covers radio frequency modulation technology used in mobile devices such as smartphones, tablets, and laptops from a major technology company. |

| Smartphone Technologies, LLC | Telecommunications / Smartphones | Portfolio includes patents from Palmsource and Geoworks, amongst others, that resulted from the merging of personal digital assistants and cell phones, a space in which Palm was the undisputed leader. Specifically, the patents are directed towards various interface and synchronization technologies which are used on modern smartphones today. |

| Super Resolution Technologies, LLC | Imaging And Diagnostics | Portfolio comprises U.S. and foreign patents relating to super resolution microscopy, also referred to as nanoscopy. |

| Unified Messaging Solutions, LLC | Communications | Patent for Messaging Technology. |

| Wireless Mobile Devices, LLC | Telecommunications / Smartphones | Portfolio includes patents that cover a wide range of wireless services such as Location Based Services technology and navigation that can be found on all smartphones today. |

Revenues for the periods presented include revenues generated from several of the portfolios summarized above and other technology patent portfolios owned or controlled by us. Refer to Item 7. “Management’s Discussion and Analysis of

Financial Condition and Results of Operations - Overview” for a summary of patent portfolios generating revenues for the applicable periods presented.

Competition

We expect to encounter increased competition in the area of patent portfolio investments and enforcement. This includes an increase in the number of competitors seeking to invest in the same or similar patents and technologies that we may seek to invest in. Non-practicing entities such as RPX, AST, Intellectual Ventures, Wi-LAN, Conversant, Round Rock Research LLC, IPvalue Management Inc., Vringo Inc. and Pendrell Corporation compete in acquiring rights to patents, and we expect more entities to enter the market.

We also compete with financial firms, corporate buyers and others acquiring IP. Many of these competitors may have more financial and human resources than our operating subsidiaries. As we become more successful, we may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently rely upon to generate future revenue.

Companies or other entities may develop competing technologies that offer better or less expensive alternatives to our patented technologies that we may invest in and license. Many potential competitors may have significantly greater resources than the resources that our operating subsidiaries possess. Such technological advances or entirely different approaches developed by one or more of our competitors could render certain of the technologies owned or controlled by our operating subsidiaries obsolete and/or uneconomical.

Employees

As of December 31, 2014, on a consolidated basis, we had 57 full-time employees. Neither we, nor any of our subsidiaries, are a party to any collective bargaining agreement. We consider our employee relations to be good.

ITEM 1A. RISK FACTORS

The following is a summary of certain risks we face in our business. They are not the only risks we face. Additional risks that we do not yet know of or that we currently believe are immaterial may also impair our business operations. If any of the following risks actually occur, our business, financial condition and results of operations could be materially adversely affected, and the trading price of our common stock could decline significantly. All patent portfolio investments, development, licensing and enforcement activities are conducted solely by certain of our wholly and majority-owned operating subsidiaries.

Risks Related to Our Business

We have a history of losses and may incur additional losses in the future.

We reported a net loss of $66.0 million and $56.4 million for the years ended December 31, 2014 and 2013 and net income of $59.5 million for the year ended December 31, 2012, and on a cumulative basis, we have sustained substantial losses since our inception. As of December 31, 2014, our accumulated deficit was $128.1 million. As of December 31, 2014, we had approximately $193.0 million in cash and cash equivalents and short-term investments and working capital of $172.8 million. We expect to continue incurring significant legal, marketing and general and administrative expenses in connection with our operations. As a result, we anticipate that we may incur losses in the future. We believe, however, that our current cash and cash equivalents and investments will be sufficient to finance our anticipated capital and operating requirements for at least the next twelve months.

If we encounter unforeseen difficulties with our business or operations in the future that require us to obtain additional working capital, and we cannot obtain additional working capital on favorable terms, or at all, our business may suffer.

Our consolidated cash and cash equivalents and short-term investments totaled $193.0 million and $256.7 million at December 31, 2014 and 2013, respectively. To date, we have relied primarily upon net cash flows from our operations and from the public and private sale of equity securities to generate the working capital needed to finance our operations.

We may encounter unforeseen difficulties with our business or operations in the future that may deplete our capital resources more rapidly than anticipated. As a result, we may be required to obtain additional working capital in the future through bank credit facilities, public or private debt or equity financings, or otherwise. If we are required to raise additional

working capital in the future, such financing may be unavailable to us on favorable terms, if at all, or may be dilutive to our existing stockholders. If we fail to obtain additional working capital, as and when needed, such failure could have a material adverse impact on our business, results of operations and financial condition.

Failure to effectively manage our growth could place strains on our managerial, operational and financial resources and could adversely affect our business and operating results.

Our growth has placed, and is expected to continue to place, a strain on our managerial, operational and financial resources and systems. Further, as our subsidiary companies’ businesses grow, we will be required to continue to manage multiple relationships. Any further growth by us or our subsidiary companies, or an increase in the number of our strategic relationships, may place additional strain on our managerial, operational and financial resources and systems. Although we may not grow as we expect, if we fail to manage our growth effectively or to develop and expand our managerial, operational and financial resources and systems, our business and financial results will be materially harmed.

Our future success depends on our ability to expand our organization to match the growth of our subsidiaries.

As our operating subsidiaries grow, the administrative demands upon us and our operating subsidiaries will grow, and our success will depend upon our ability to meet those demands. These demands include increased accounting, management, legal services, staff support, and general office services. We may need to hire additional qualified personnel to meet these demands, the cost and quality of which is dependent in part upon market factors outside of our control. Further, we will need to effectively manage the training and growth of our staff to maintain an efficient and effective workforce, and our failure to do so could adversely affect our business and operating results.

Potential patent portfolio investments may present risks, and we may be unable to achieve the financial or other goals intended at the time of any potential investment.

Our future growth depends, in part, on our ability to invest in patented technologies, patent portfolios, or companies holding such patented technologies and patent portfolios. Accordingly, we have engaged in patent portfolio investments to expand our patent portfolios and we intend to continue to explore such investments. Such investments are subject to numerous risks, including the following:

| |

| • | our inability to enter into a definitive agreement with respect to any potential patent portfolio investment, or if we are able to enter into such agreement, our inability to consummate the potential investment transaction; |

| |

| • | difficulty integrating the operations, technology and personnel of the acquired entity; |

| |

| • | our inability to achieve the anticipated financial and other benefits of the specific patent portfolio investment; |

| |

| • | our inability to retain key personnel from the acquired company, if necessary; |

| |

| • | difficulty in maintaining controls, procedures and policies during the transition and integration process; |

| |

| • | diversion of our management’s attention from other business concerns; and |

| |

| • | failure of our due diligence process to identify significant issues, including issues with respect to patented technologies and patent portfolios, and other legal and financial contingencies. |

If we are unable to manage these risks effectively as part of any patent portfolio investment, our business could be adversely affected.

Our revenues are unpredictable, and this may harm our financial condition.

From January 2005 to the present, our operating subsidiaries have executed our business strategy of partnering with inventors and patent owners, applying our legal and technology expertise to patent assets to unlock the financial value in their patented inventions. Currently, on a consolidated basis, our operating subsidiaries own or control the rights to multiple patent portfolios which include U.S. patents and certain foreign counterparts, covering technologies used in a wide variety of industries. These patent portfolio investments continue to expand and diversify our revenue generating opportunities. We believe that our cash and cash equivalents and short-term investment balances, anticipated cash flow from operations, proceeds from prior offerings of our common stock (refer to “Liquidity and Capital Resources” below) and other external sources of

available credit, will be sufficient to meet our cash requirements through at least March 2016 and for the foreseeable future. However, due to the nature of our licensing business and uncertainties regarding the amount and timing of the receipt of license and other fees from potential infringers, stemming primarily from uncertainties regarding the outcome of enforcement actions, rates of adoption of our patented technologies, the growth rates of our existing licensees and certain other factors, our revenues may vary significantly from quarter to quarter and period to period, which could make our business difficult to manage, adversely affect our business and operating results, cause our quarterly and periodic results to fall below market expectations and adversely affect the market price of our common stock.

Our operating subsidiaries depend upon relationships with others to provide technology-based opportunities that can develop into profitable royalty-bearing licenses, and if they are unable to maintain and generate new relationships, then they may not be able to sustain existing levels of revenue or increase revenue.

Neither we nor our operating subsidiaries invent new technologies or products; rather, we depend upon the identification and investment in new patents and inventions through our relationships with inventors, universities, research institutions, technology companies and others. If our operating subsidiaries are unable to maintain those relationships and to continue to grow new relationships, then they may not be able to identify new technology-based opportunities for sustainable revenue and growth.

Our current or future relationships may not provide the volume or quality of technologies necessary to sustain our business. In some cases, universities and other technology sources may compete against us as they seek to develop and commercialize technologies. Universities may receive financing for basic research in exchange for the exclusive right to commercialize resulting inventions. These and other strategies may reduce the number of technology sources and potential clients to whom we can market our services. If we are unable to maintain current relationships and sources of technology or to secure new relationships and sources of technology, such inability may have a material adverse effect on our operating results and financial condition.

The success of our operating subsidiaries depends in part upon their ability to retain the best legal counsel to represent them in patent enforcement litigation.

The success of our licensing business depends upon our operating subsidiaries’ ability to retain the best legal counsel to prosecute patent infringement litigation. As our operating subsidiaries’ patent enforcement actions increase, it will become more difficult to find the best legal counsel to handle all of our cases because many of the best law firms may have a conflict of interest that prevents their representation of our subsidiaries.

We spend a significant amount of our financial and management resources to pursue our current litigation matters. We believe that these litigation matters and others that we may in the future determine to pursue could continue for years and continue to consume significant financial and management resources. The counterparties to our litigation are sometimes large, well-financed companies with substantially greater resources than us. We cannot assure that any of our current or future litigation matters will result in a favorable outcome for us. In addition, in part due to the appeals process and other legal processes, even if we obtain favorable interim rulings or verdicts in particular litigation matters, they may not be predictive of the ultimate resolution of the dispute. Also, we cannot assure that we will not be exposed to claims or sanctions against us which may be costly or impossible for us to defend. Unfavorable or adverse outcomes may result in losses, exhaustion of financial resources or other adverse effects which could encumber our ability to develop and commercialize products.

In connection with any of our patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries or award attorney’s fees and/or expenses to a defendant(s), which could be material, and if required to be paid by us or our operating subsidiaries, could materially harm our operating results and our financial position.

Our operating subsidiaries, in certain circumstances, rely on representations, warranties and opinions made by third-parties that, if determined to be false or inaccurate, may expose us and our operating subsidiaries to certain material liabilities.

From time to time, our operating subsidiaries may rely upon representations and warranties made by third-parties from whom our operating subsidiaries acquired patents or the exclusive rights to license and enforce patents. We also may rely upon the opinions of purported experts. In certain instances, we may not have the opportunity to independently investigate and verify the facts upon which such representations, warranties, and opinions are made. By relying on these representations, warranties

and opinions, our operating subsidiaries may be exposed to liabilities in connection with the licensing and enforcement of certain patents and patent rights which could have a material adverse effect on our operating results and financial condition.

In connection with patent enforcement actions conducted by certain of our subsidiaries, a court may rule that we or our subsidiaries have violated certain statutory, regulatory, federal, local or governing rules or standards, which may expose us and our operating subsidiaries to certain material liabilities.

In connection with any of our patent enforcement actions, it is possible that a defendant may request and/or a court may rule that we have violated statutory authority, regulatory authority, federal rules, local court rules, or governing standards relating to the substantive or procedural aspects of such enforcement actions. In such event, a court may issue monetary sanctions against us or our operating subsidiaries or award attorney’s fees and/or expenses to a defendant(s), which could be material, and if we or our operating subsidiaries are required to pay such monetary sanctions, attorneys’ fees and/or expenses, such payment could materially harm our operating results and our financial position.

In connection with patent enforcement actions conducted by certain of our subsidiaries, a court may find the patents invalid, not infringed or unenforceable and/or the U.S. Patent and Trademark Office, or the USPTO, or other relevant patent office, may either invalidate the patents or materially narrow the scope of their claims during the course of a reexamination, opposition or other such proceeding.

Patent litigation is inherently risky and the outcome is uncertain. Some of the parties that we believe infringe on our patents are large and well-financed companies with substantially greater resources than ours. We believe that these parties would devote a substantial amount of resources in an attempt to avoid or limit a finding that they are liable for infringing on our patents or, in the event liability is found, to avoid or limit the amount of associated damages. In addition, there is a risk that these parties may file reexaminations or other proceedings with the USPTO or other government agencies in the United States or abroad in an attempt to invalidate, narrow the scope or render unenforceable the patents we own or control. If this were to occur, it may have a material adverse effect on the viability of our company and our operations.

In addition, it is difficult to predict the outcome of patent enforcement litigation at any level. In the United States, there is a higher rate of appeals in patent enforcement litigation than standard business litigation. The defendant to any case we bring, may file as many appeals as allowed by right, including to the first, second and/or final courts of appeal (in the United States those courts would be the Federal Circuit and Supreme Court, respectively). Such appeals are expensive and time-consuming, and the outcomes of such appeals are sometimes unpredictable, resulting in increased costs and reduced or delayed revenue.

Our licensing cycle is lengthy and costly, and our marketing, legal and sales efforts may be unsuccessful.

We expect our operating subsidiaries to incur significant marketing, legal and sales expenses prior to entering into license agreements and generating license revenues. We will also spend considerable resources educating prospective licensees on the benefits of a license arrangement with us. As such, we may incur significant losses in any particular period before any associated revenue stream begins.

If our efforts to educate prospective licensees on the benefits of a license arrangement are unsuccessful, we may need to pursue litigation or other enforcement action to protect our patent rights. We may also need to litigate to enforce the terms of our existing license agreements, protect our trade secrets, or determine the validity and scope of the proprietary rights of others. Enforcement proceedings are typically protracted and complex. The costs are typically substantial, and the outcomes are unpredictable. Enforcement actions will divert our managerial, technical, legal and financial resources from business operations.

Risks Related to Our Industry

Our exposure to uncontrollable outside influences, including new legislation, court rulings or actions by the United States Patent and Trademark Office, could adversely affect our licensing and enforcement business and results of operations.

Our licensing and enforcement business is subject to numerous risks from outside influences, including the following:

New legislation, regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease our revenue.

Our operating subsidiaries invest in patents with enforcement opportunities and spend a significant amount of resources to enforce those patents. If new legislation, regulations or rules are implemented by Congress, the USPTO or the courts that impact the patent application process, the patent enforcement process or the rights of patent holders, such changes could negatively affect our business. Recently, United States patent laws were amended with the enactment of the Leahy-Smith America Invents Act, or the America Invents Act, which took effect on March 16, 2013. The America Invents Act includes a number of significant changes to U.S. patent law. In general, the legislation attempts to address issues surrounding the enforceability of patents and the increase in patent litigation by, among other things, establishing new procedures for patent litigation. For example, the America Invents Act changes the way that parties may be joined in patent infringement actions, increasing the likelihood that such actions will need to be brought against individual allegedly-infringing parties by their respective individual actions or activities. In addition, the America Invents Act enacted a new inter-partes review process at the USPTO which can be, and often is, used by defendants, and other individuals and entities, to separately challenge the validity of any patent. At this time, it is not clear what, if any, overall impact the America Invents Act will have on the operation of our enforcement business. However, the America Invents Act and its implementation could increase the uncertainties and costs surrounding the enforcement of our patented technologies, which could have a material adverse effect on our business and financial condition.

The U.S. Department of Justice, or the DOJ, has conducted reviews of the patent system to evaluate the impact of patent assertion entities on industries in which those patents relate. It is possible that the findings and recommendations of the DOJ could impact the ability to effectively license and enforce standards-essential patents and could increase the uncertainties and costs surrounding the enforcement of any such patented technologies. Also, in 2014, the Federal Trade Commission, or FTC, initiated a study under Section 6(b) of the Federal Trade Commission Act to evaluate the patent assertion practice and market impact of Patent Assertion Entities, or PAEs. The FTC’s initial notice and request for public comment relating to the PAE study appeared in the Federal Register on October 3, 2013. Acacia Research Corporation received and responded to a request for information as part of this FTC study. It is expected that the results of the PAE study by the FTC will be provided to Congress and other agencies, such as the DOJ, who could take action, including legislative proposals, based on the results of the study.

Finally, new rules regarding the burden of proof in patent enforcement actions could significantly increase the cost of our enforcement actions, and new standards or limitations on liability for patent infringement could negatively impact our revenue derived from such enforcement actions. In addition, recent federal court decisions have lowered the threshold for obtaining attorneys’ fees in patent infringement cases and increased the level of deference given to a district court’s fee-shifting determination. These decisions may make it easier for district courts to shift a prevailing party’s attorneys' fees to a non-prevailing party if the district court believes that the case was weak or conducted in an abusive manner. As a result, defendants in patent infringement actions brought by non-practicing entities may elect not to settle because these decisions make it much easier for defendants to get attorneys’ fees.

Changes in patent law could adversely impact our business.

Patent laws may continue to change, and may alter the historically consistent protections afforded to owners of patent rights. Such changes may not be advantageous for us and may make it more difficult to obtain adequate patent protection to enforce our patents against infringing parties. Increased focus on the growing number of patent-related lawsuits may result in legislative changes which increase our costs and related risks of asserting patent enforcement actions. For instance, the United States Congress is considering a bill that would require, among other things, non-practicing entities that bring patent infringement lawsuits to pay legal costs of the defendants, if the lawsuits are unsuccessful and certain standards are not met.

Trial judges and juries often find it difficult to understand complex patent enforcement litigation, and as a result, we may need to appeal adverse decisions by lower courts in order to successfully enforce our patents.

It is difficult to predict the outcome of patent enforcement litigation at the trial level. It is often difficult for juries and trial judges to understand complex, patented technologies, and as a result, there is a higher rate of successful appeals in patent enforcement litigation than more standard business litigation. Such appeals are expensive and time consuming, resulting in increased costs and delayed revenue. Although we diligently pursue enforcement litigation, we cannot predict with significant reliability the decisions made by juries and trial courts.

More patent applications are filed each year resulting in longer delays in getting patents issued by the USPTO.

Certain of our operating subsidiaries hold and continue to invest in pending patents. We have identified a trend of increasing patent applications each year, which we believe is resulting in longer delays in obtaining approval of pending patent applications. The application delays could cause delays in recognizing revenue from these patents and could cause us to miss opportunities to license patents before other competing technologies are developed or introduced into the market.

Federal courts are becoming more crowded, and as a result, patent enforcement litigation is taking longer.

Our patent enforcement actions are almost exclusively prosecuted in federal court. Federal trial courts that hear our patent enforcement actions also hear criminal cases. Criminal cases always take priority over our actions. As a result, it is difficult to predict the length of time it will take to complete an enforcement action. Moreover, we believe there is a trend in increasing numbers of civil lawsuits and criminal proceedings before federal judges and, as a result, we believe that the risk of delays in our patent enforcement actions will have a greater effect on our business in the future unless this trend changes.

Any reductions in the funding of the USPTO could have an adverse impact on the cost of processing pending patent applications and the value of those pending patent applications.

The assets of our operating subsidiaries consist of patent portfolios, including pending patent applications before the USPTO. The value of our patent portfolios is dependent upon the issuance of patents in a timely manner, and any reductions in the funding of the USPTO could negatively impact the value of our assets. Further, reductions in funding from Congress could result in higher patent application filing and maintenance fees charged by the USPTO, causing an unexpected increase in our expenses.

Competition is intense in the industries in which our subsidiaries do business and as a result, we may not be able to grow or maintain our market share for our technologies and patents.

We expect to encounter competition in the area of patent portfolio investments and enforcement as the number of companies entering this market is increasing. This includes competitors seeking to invest in the same or similar patents and technologies that we may seek to invest in. Entities including RPX, AST, Intellectual Ventures, Wi-LAN, Conversant, Round Rock Research LLC, IPvalue Management Inc., Vringo Inc. and Pendrell Corporation compete in acquiring rights to patents, and we expect more entities to enter the market. As new technological advances occur, many of our patented technologies may become obsolete before they are completely monetized. If we are unable to replace obsolete technologies with more technologically advanced patented technologies, then this obsolescence could have a negative effect on our ability to generate future revenues.

Our licensing business also competes with venture capital firms and various industry leaders for patent licensing opportunities. Many of these competitors may have more financial and human resources than we do. As we become more successful, we may find more companies entering the market for similar technology opportunities, which may reduce our market share in one or more technology industries that we currently rely upon to generate future revenue.

Our patented technologies face uncertain market value.

Our operating subsidiaries have invested in patents and technologies that may be in the early stages of adoption in the commercial and consumer markets. Demand for some of these technologies is untested and is subject to fluctuation based upon the rate at which our licensees will adopt our patents and technologies in their products and services.

Further, significant judgment is required in connection with estimates of the recoverability of the carrying value of our intangible patent assets, including estimates of market values, estimates of the amount and timing of future cash flows, and estimates of other factors that are used to determine the fair value and recoverability of the respective patent asset values. Developments with respect to ongoing patent litigation, patent challenges and re-exams, legislative and judicial decisions and other factors outside of our control, may unfavorably impact the validity, applicability, and enforceability of our patent assets, and therefore, negatively impact the future value of our patent portfolios. If certain of these unfavorable events occur, our estimates or related projections may change materially in future periods, and future intangible asset impairment tests may result in material charges to earnings.

As patent enforcement litigation becomes more prevalent, it may become more difficult for us to voluntarily license our patents.

We believe that the more prevalent patent enforcement actions become, the more difficult it will be for us to voluntarily license our patents. As a result, we may need to increase the number of our patent enforcement actions to cause infringing companies to license the patent or pay damages for lost royalties. This may increase the risks associated with an investment in our company.

The markets served by our operating subsidiaries are subject to rapid technological change, and if our operating subsidiaries are unable to develop and invest in new technologies and patents, our ability to generate revenues could be substantially impaired.

The markets served by our operating subsidiaries and their licensees frequently undergo transitions in which products rapidly incorporate new features and performance standards on an industry-wide basis. Products for communications applications and high-speed computing applications, as well as other applications covered by our operating subsidiaries’ intellectual property, are based on continually evolving industry standards. In addition, the communications industry is intensely competitive and has been impacted by price erosion, rapid technological change, short product life cycles, cyclical market patterns and increasing foreign and domestic competition. Our ability to compete in the future will depend on our ability to identify and ensure compliance with evolving industry standards. This will require our continued efforts and success in acquiring new patent portfolios with licensing and enforcement opportunities. While we expect for the foreseeable future to have sufficient liquidity and capital resources to maintain the level of patent portfolio investments necessary to keep pace with these technological advances, various factors may require us to have greater liquidity and capital resources than we currently expect. If we are unable to invest in new patented technologies and patent portfolios, or to identify and ensure compliance with evolving industry standards, our ability to generate revenues could be substantially impaired and our business and financial condition could be materially harmed.

Uncertainty in global economic conditions could negatively affect our business, results of operations and financial condition.

Our revenue-generating opportunities depend on the use of our patented technologies by existing and prospective licensees, the overall demand for the products and services of our licensees, and on the overall economic and financial health of our licensees. Although economic conditions appear to be improving, recent uncertainties in global economic conditions have resulted in the tightening of the credit markets, a low level of liquidity in many financial markets, and extreme volatility in the credit, equity and fixed income markets. If economic conditions do not continue to improve, or if they further deteriorate, many of our licensees’ customers, which may rely on credit financing, may delay or reduce their purchases of our licensees’ products and services. In addition, the use or adoption of our patented technologies is often based on current and forecasted demand for our licensees’ products and services in the marketplace and may require companies to make significant initial commitments of capital and other resources. If negative conditions in the global credit markets delay or prevent our licensees’ and their customers’ access to credit, overall consumer spending on the products and services of our licensees may decrease and the adoption or use of our patented technologies may slow, respectively. Further, if the markets in which our licensees’ participate do not continue to improve, or deteriorate further, this could negatively impact our licensees’ long-term sales and revenue generation, margins and operating expenses, which could in turn have an adverse effect on our business, results of operations and financial condition.

In addition, we have significant patent-related intangible assets recorded on our consolidated balance sheets. We will continue to evaluate the recoverability of the carrying amount of our patent-related intangible assets on an ongoing basis, and we may incur substantial impairment charges, which would adversely affect our consolidated financial results. There can be no assurance that the outcome of such reviews in the future will not result in substantial impairment charges. Impairment assessment inherently involves judgment as to assumptions about expected future cash flows and the impact of market conditions on those assumptions. Future events and changing market conditions may impact our assumptions as to prices, costs, holding periods or other factors that may result in changes in our estimates of future cash flows. Although we believe the assumptions we used in testing for impairment are reasonable, significant changes in any one of our assumptions could produce a significantly different result.

Risks Related to Our Common Stock

The availability of shares for sale in the future could reduce the market price of our common stock.

In the future, we may issue securities to raise cash for operations and patent portfolio investments. We may also pay for interests in additional subsidiary companies by using shares of our common stock or a combination of cash and shares of our common stock. We may also issue securities convertible into our common stock. Any of these events may dilute stockholders’ ownership interests in our company and have an adverse impact on the price of our common stock.

In addition, sales of a substantial amount of our common stock in the public market, or the perception that these sales may occur, could reduce the market price of our common stock. This could also impair our ability to raise additional capital through the sale of our securities.

Delaware law and our charter documents contain provisions that could discourage or prevent a potential takeover of our company that might otherwise result in our stockholders receiving a premium over the market price of their shares.

Provisions of Delaware law and our certificate of incorporation and bylaws could make the acquisition of our company by means of a tender offer, proxy contest or otherwise, and the removal of incumbent officers and directors, more difficult. These provisions include:

| |

| • | Section 203 of the Delaware General Corporation Law, which prohibits a merger with a 15%-or-greater stockholder, such as a party that has completed a successful tender offer, until three years after that party became a 15%-or-greater stockholder; |

| |

| • | amendment of our bylaws by the stockholders requires a two-thirds approval of the outstanding shares; |

| |

| • | the authorization in our certificate of incorporation of undesignated preferred stock, which could be issued without stockholder approval in a manner designed to prevent or discourage a takeover; |

| |

| • | provisions in our bylaws eliminating stockholders’ rights to call a special meeting of stockholders, which could make it more difficult for stockholders to wage a proxy contest for control of our board of directors or to vote to repeal any of the anti-takeover provisions contained in our certificate of incorporation and bylaws; and |

| |

| • | the division of our board of directors into three classes with staggered terms for each class, which could make it more difficult for an outsider to gain control of our board of directors. |

Together, these provisions may make the removal of management more difficult and may discourage transactions that could otherwise involve payment of a premium over prevailing market prices for our common stock.

We may fail to meet market expectations because of fluctuations in quarterly operating results, which could cause the price of our common stock to decline.

Our reported revenues and operating results have fluctuated in the past and may continue to fluctuate significantly from quarter to quarter in the future. It is possible that in future periods, revenues could fall below the expectations of securities analysts or investors, which could cause the market price of our common stock to decline. The following are among the factors that could cause our operating results to fluctuate significantly from period to period:

| |

| • | the dollar amount of agreements executed in each period, which is primarily driven by the nature and characteristics of the technology being licensed and the magnitude of infringement associated with a specific licensee; |

| |

| • | the specific terms and conditions of agreements executed in each period and the periods of infringement contemplated by the respective payments; |

| |

| • | fluctuations in the total number of agreements executed; |

| |

| • | fluctuations in the sales results or other royalty-per-unit activities of our licensees that impact the calculation of license fees due; |

| |

| • | the timing of the receipt of periodic license fee payments and/or reports from licensees; |

| |

| • | fluctuations in the net number of active licensees period to period; |

| |

| • | costs related to investments, alliances, licenses and other efforts to expand our operations; |

| |

| • | the timing of payments under the terms of any customer or license agreements into which our operating subsidiaries may enter; |

| |

| • | expenses related to, and the timing and results of, patent filings and other enforcement proceedings relating to intellectual property rights, as more fully described in this section; and |

| |

| • | new litigation or developments in current litigation and the unpredictability of litigation results or settlements or appeals. |

Technology company stock prices are especially volatile, and this volatility may depress the price of our common stock.

The stock market has experienced significant price and volume fluctuations, and the market prices of technology companies have been highly volatile. We believe that various factors may cause the market price of our common stock to fluctuate, perhaps substantially, including, among others, the following:

| |