UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

ANNUAL REPORT

PURSUANT TO SECTIONS 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2017

OR

|

| |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

COMMISSION FILE 1-5224

STANLEY BLACK & DECKER, INC.

(Exact Name Of Registrant As Specified In Its Charter)

|

| | |

| Connecticut | | 06-0548860 |

(State Or Other Jurisdiction Of Incorporation Or Organization) | | (I.R.S. Employer Identification Number) |

1000 Stanley Drive New Britain, Connecticut | | 06053 |

| (Address Of Principal Executive Offices) | | (Zip Code) |

860-225-5111

(Registrant’s Telephone Number)

Securities Registered Pursuant To Section 12(b) Of The Act:

|

| | |

| Title Of Each Class | | Name Of Each Exchange On Which Registered |

| Common Stock-$2.50 Par Value per Share | | New York Stock Exchange |

Securities Registered Pursuant To Section 12(g) Of The Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act of 1933.

Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | |

| Large accelerated filer | þ | | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | ¨ |

| | | | Emerging growth company | ¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2).

Yes ¨ No þ

As of June 30, 2017, the aggregate market values of voting common equity held by non-affiliates of the registrant was $21.6 billion based on the New York Stock Exchange closing price for such shares on that date. On February 22, 2018, the registrant had 154,111,483 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed pursuant to Regulation 14A within 120 days after the end of the registrant’s fiscal year are incorporated by reference in Part III of the Annual Report on Form 10-K.

TABLE OF CONTENTS

|

| | | |

| | | | |

| |

| ITEM 1. | | | |

| ITEM 1A. | | | |

| ITEM 1B. | | | |

| ITEM 2. | | | |

| ITEM 3. | | | |

| ITEM 4. | | | |

| | | | |

| |

| ITEM 5. | | | |

| ITEM 6. | | | |

| ITEM 7. | | | |

| ITEM 7A. | | | |

| ITEM 8. | | | |

| ITEM 9. | | | |

| ITEM 9A. | | | |

| ITEM 9B. | | | |

| | | | |

| |

| ITEM 10. | | | |

| ITEM 11. | | | |

| ITEM 12. | | | |

| ITEM 13. | | | |

| ITEM 14. | | | |

| | | | |

| |

| ITEM 15. | | | |

| ITEM 16. | | | |

| SIGNATURES | | | |

| EX-10.16.b | | | |

| EX-10.25 | | | |

| EX-10.26 | | | |

| EX-12 | | | |

| EX-21 | | | |

| EX-23 | | | |

| EX-24 | | | |

| EX-31.1.a | | | |

| EX-31.1.b | | | |

| EX-32.1 | | | |

| EX-32.2 | | | |

FORM 10-K

PART I

ITEM 1. BUSINESS

General

Stanley Black & Decker, Inc. ("the Company") was founded 175 years ago, in 1843, by Frederick T. Stanley and incorporated in Connecticut in 1852. In March 2010, the Company completed a merger ("the Merger") with The Black & Decker Corporation (“Black & Decker”), a company founded by S. Duncan Black and Alonzo G. Decker and incorporated in Maryland in 1910. At that time, the Company changed its name from The Stanley Works ("Stanley") to Stanley Black & Decker, Inc.

The Company is a diversified global provider of hand tools, power tools and related accessories, engineered fastening systems and products, services and equipment for oil & gas and infrastructure applications, commercial electronic security and monitoring systems, healthcare solutions, and mechanical access solutions (primarily automatic doors), with 2017 consolidated annual revenues of $12.7 billion. Approximately 54% of the Company’s 2017 revenues were generated in the United States, with the remainder largely from Europe (22%), emerging markets (14%) and Canada (5%).

The Company continues to pursue a growth and acquisition strategy that involves industry, geographic and customer diversification to foster sustainable revenue, earnings and cash flow growth. The Company remains focused on organic growth, including increasing its presence in emerging markets, and leveraging the Stanley Fulfillment System ("SFS 2.0"), which focuses on digital excellence, commercial excellence, breakthrough innovation, core SFS operating principles, and functional transformation. In addition, the Company continues to make strides towards achieving its 22/22 Vision of reaching $22 billion in revenue by 2022 while expanding the margin rate, by becoming known as one of the world’s leading innovators, delivering top-quartile financial performance and elevating its commitment to social responsibility.

Execution of the above strategy has already resulted in approximately $8.9 billion of acquisitions since 2002 (excluding the Black & Decker merger and pending acquisition of the Nelson Fastener Systems industrial business, as discussed below), which was enabled by strong cash flow generation and increased debt capacity. This strategy is further exemplified by the Company's March 2017 acquisitions of the Tools business of Newell Brands ("Newell Tools") for approximately $1.84 billion and the Craftsman® brand from Sears Holdings Corporation ("Sears Holdings") for an estimated cash purchase price of approximately $900 million on a discounted basis. The Newell Tools acquisition, which includes the industrial cutting, hand tool and power tool accessory brands Irwin® and Lenox®, enhances the Company’s position within the global tools & storage industry and broadens the Company’s product offerings and solutions to customers and end users, particularly within power tool accessories. The Craftsman acquisition provides the Company with the rights to develop, manufacture and sell Craftsman®-branded products in non-Sears Holdings channels. Furthermore, on December 22, 2017, the Company reached an agreement to purchase the industrial business of Nelson Fastener Systems ("Nelson") from the Doncasters Group, which excludes Nelson's automotive stud welding business, for approximately $440 million in cash. This acquisition is complementary to the Company's product offerings, enhances its presence in the general industrial end markets and expands its portfolio of highly engineered fastening solutions. This transaction, which is subject to customary closing conditions including regulatory approval, is expected to close in the first half of 2018. Refer to Note E, Acquisitions, of the Notes to Consolidated Financial Statements in Item 8 for further discussion.

In February 2017, the Company completed the sale of the majority of its mechanical security businesses, which included the commercial hardware brands of Best Access, phi Precision and GMT, for net proceeds of approximately $717 million. This sale allowed the Company to deploy capital in a more accretive and growth-oriented manner. The Company has also divested several smaller businesses in recent years that did not fit into its long-term strategic objectives. Refer to Note T, Divestitures, of the Notes to Consolidated Financial Statements in Item 8 for further discussion.

At December 30, 2017, the Company employed 57,765 people worldwide. The Company’s principal executive office is located at 1000 Stanley Drive, New Britain, Connecticut 06053 and its telephone number is (860) 225-5111.

Description of the Business

The Company’s operations are classified into three reportable business segments, which also represent its operating segments: Tools & Storage, Industrial and Security. All segments have significant international operations and are exposed to translational and transactional impacts from fluctuations in foreign currency exchange rates.

Additional information regarding the Company’s business segments and geographic areas is incorporated herein by reference to the material captioned “Business Segment Results” in Item 7 and Note P, Business Segments and Geographic Areas, of the Notes to Consolidated Financial Statements in Item 8.

Tools & Storage

The Tools & Storage segment is comprised of the Power Tools and Equipment ("PTE") and Hand Tools, Accessories & Storage ("HTAS") businesses. The segment sells its products to professional end users, distributors, retail consumers and industrial customers in a wide variety of industries and geographies. The majority of sales are distributed through retailers, including home centers, mass merchants, hardware stores, and retail lumber yards, as well as third-party distributors and a direct sales force. Annual revenues in the Tools & Storage segment were $8.9 billion in 2017, representing 70% of the Company’s total revenues.

The PTE business includes both professional and consumer products. Professional products include professional grade corded and cordless electric power tools and equipment including drills, impact wrenches and drivers, grinders, saws, routers and sanders, as well as pneumatic tools and fasteners including nail guns, nails, staplers and staples, concrete and masonry anchors. Consumer products include corded and cordless electric power tools sold primarily under the BLACK+DECKER® brand, lawn and garden products, including hedge trimmers, string trimmers, lawn mowers, edgers and related accessories, and home products such as hand-held vacuums, paint tools and cleaning appliances.

The HTAS business sells hand tools, power tool accessories and storage products. Hand tools include measuring, leveling and layout tools, planes, hammers, demolition tools, clamps, vises, knives, saws, chisels and industrial and automotive tools. Power tool accessories include drill bits, screwdriver bits, router bits, abrasives, saw blades and threading products. Storage products include tool boxes, sawhorses, medical cabinets and engineered storage solution products.

Industrial

The Industrial segment is comprised of the Engineered Fastening and Infrastructure businesses. Annual revenues in the Industrial segment were $1.9 billion in 2017, representing 15% of the Company’s total revenues.

The Engineered Fastening business primarily sells engineered fastening products and systems designed for specific applications. The product lines include blind rivets and tools, blind inserts and tools, drawn arc weld studs and systems, engineered plastic and mechanical fasteners, self-piercing riveting systems and precision nut running systems, micro fasteners, and high-strength structural fasteners. The business sells to customers in the automotive, manufacturing, electronics, and aerospace industries, amongst others, and its products are distributed through direct sales forces and, to a lesser extent, third-party distributors.

The Infrastructure business consists of the Oil & Gas and Hydraulics businesses. The Oil & Gas business sells and rents custom pipe handling, joint welding and coating equipment used in the construction of large and small diameter pipelines, and provides pipeline inspection services. The Hydraulics business sells hydraulic tools and accessories. The Infrastructure businesses sell to the oil and natural gas pipeline industry and other industrial customers. The products and services are primarily distributed through a direct sales force and, to a lesser extent, third-party distributors.

Security

The Security segment is comprised of the Convergent Security Solutions ("CSS") and Mechanical Access Solutions ("MAS") businesses. Annual revenues in the Security segment were $1.9 billion in 2017, representing 15% of the Company’s total revenues.

The CSS business designs, supplies and installs commercial electronic security systems and provides electronic security services, including alarm monitoring, video surveillance, fire alarm monitoring, systems integration and system maintenance. Purchasers of these systems typically contract for ongoing security systems monitoring and maintenance at the time of initial equipment installation. The business also sells healthcare solutions, which include asset tracking, infant protection, pediatric protection, patient protection, wander management, fall management, and emergency call products. The CSS business sells to consumers, retailers, educational, financial and healthcare institutions, as well as commercial, governmental and industrial customers. The MAS business primarily sells automatic doors to commercial customers. Products for both businesses are sold predominantly on a direct sales basis.

Other Information

Competition

The Company competes on the basis of its reputation for product quality, its well-known brands, its commitment to customer service, strong customer relationships, the breadth of its product lines and its innovative products and customer value propositions.

The Company encounters active competition in the Tools & Storage and Industrial segments from both larger and smaller companies that offer the same or similar products and services. Certain large customers offer private label brands (“house brands”) that compete across a wider spectrum of the Company’s Tools & Storage segment product offerings. Competition in the Security segment is generally fragmented via both large international players and regional companies. Competition tends to be based primarily on price, the quality of service and comprehensiveness of the services offered to the customers.

Major Customers

A significant portion of the Company’s Tools & Storage products are sold to home centers and mass merchants in the U.S. and Europe. A consolidation of retailers both in North America and abroad has occurred over time. While this consolidation and the domestic and international expansion of these large retailers have provided the Company with opportunities for growth, the increasing size and importance of individual customers creates a certain degree of exposure to potential sales volume loss. One customer, Lowe's, accounted for 11.7% of the Company's consolidated sales in 2017. No other customer exceeded 10% of consolidated sales in 2017, 2016 or 2015.

Working Capital

The Company continues to practice the five operating principles encompassed by Core SFS, one component of the SFS 2.0 operating system, which work in concert: sales and operations planning ("S&OP"), operational lean, complexity reduction, global supply management, and order-to-cash excellence. The Company develops standardized business processes and system platforms to reduce costs and provide scalability. Core SFS is instrumental in the reduction of working capital as evidenced by the 51% improvement in the Company's working capital turns from 5.9 at the end of 2010 (directly after the Black & Decker merger) to 8.9 at the end of 2017. Excluding the 2017 acquisitions and divestitures, working capital turns were consistent with the record in the prior year of 10.6 turns. The continued efforts to deploy Core SFS across the entire Company and increase working capital turns have created significant opportunities to generate incremental free cash flow (defined as cash flow from operations less capital and software expenditures). The Company plans to continue leveraging Core SFS to generate ongoing improvements, both in the existing business and future acquisitions, in working capital turns, cycle times, complexity reduction and customer service levels, with a long-term goal of sustaining 10+ working capital turns.

Raw Materials

The Company’s products are manufactured using ferrous and non-ferrous metals including, but not limited to, steel, zinc, copper, brass, aluminum and nickel as well as resins. The Company also purchases components such as batteries, motors, and electronic components to use in manufacturing and assembly operations along with resin-based molded parts. The raw materials required are procured globally and generally available from multiple sources at competitive prices. As part of the Company's Enterprise Risk Management, the Company has implemented a supplier risk mitigation strategy in order to identify and address any potential supply disruption associated with commodities, components, finished goods and critical services. The Company does not anticipate difficulties in obtaining supplies for any raw materials or energy used in its production processes.

Backlog

Due to short order cycles and rapid inventory turnover primarily in the Company's Tools & Storage segment, backlog is generally not considered a significant indicator of future performance. At February 3, 2018, the Company had approximately $929 million in unfilled orders, which mainly relate to the Engineered Fastening and Security businesses. Substantially all of these orders are reasonably expected to be filled within the current fiscal year. As of February 4, 2017 and February 6, 2016 unfilled orders amounted to $838 million and $783 million, respectively.

Patents and Trademarks

No business segment is solely dependent, to any significant degree, on patents, licenses, franchises or concessions, and the loss of one or several of these patents, licenses, franchises or concessions would not have a material adverse effect on any of the Company's businesses. The Company owns numerous patents, none of which individually is material to the Company's operations as a whole. These patents expire at various times over the next 20 years. The Company holds licenses, franchises

and concessions, none of which individually or in the aggregate are material to the Company's operations as a whole. These licenses, franchises and concessions vary in duration, but generally run from one to 40 years.

The Company has numerous trademarks that are used in its businesses worldwide. In the Tools & Storage segment, significant trademarks include STANLEY®, BLACK+DECKER®, DEWALT®, FLEXVOLT®, Irwin®, Lenox®, Craftsman®, Porter-Cable®, BOSTITCH®, FatMax®, Powers®, Guaranteed Tough®, Innerspace®, Mac Tools®, Proto®, Vidmar®, Facom®, USAG™, DIYZ®, Lista®, and the yellow & black color scheme for power tools and accessories. Significant trademarks in the Industrial segment include STANLEY®, CRC®, LaBounty®, Dubuis®, AeroScout®, Cribmaster®, Expert®, SIDCHROME™, POP®, Warren®, GRIPCO®, Avdel®, HeliCoil®, MasterFix®, Tucker®, NPR®, Dodge®, and Spiralock®. The Security segment includes significant trademarks such as STANLEY®, Blick™, HSM®, Sargent & Greenleaf®, S&G®, SONITROL®, Stanley Access Technologies™, AeroScout®, Hugs®, WanderGuard®, Roam Alert®, MyCall®, Arial® and Bed-Check®. The terms of these trademarks typically vary from 10 to 20 years, with most trademarks being renewable indefinitely for like terms.

Environmental Regulations

The Company is subject to various environmental laws and regulations in the U.S. and foreign countries where it has operations. In the normal course of business, the Company is involved in various legal proceedings relating to environmental issues. The Company’s policy is to accrue environmental investigatory and remediation costs for identified sites when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated. In the event that no amount in the range of probable loss is considered most likely, the minimum loss in the range is accrued. The amount of liability recorded is based on an evaluation of currently available facts with respect to each individual site and includes such factors as existing technology, presently enacted laws and regulations, and prior experience in remediation of contaminated sites. The liabilities recorded do not take into account any claims for recoveries from insurance or third parties. As assessments and remediation progress at individual sites, the amounts recorded are reviewed periodically and adjusted to reflect additional technical and legal information that becomes available. As of December 30, 2017 and December 31, 2016, the Company had reserves of $176.1 million and $160.9 million, respectively, for remediation activities associated with Company-owned properties, as well as for Superfund sites, for losses that are probable and estimable. Of the 2017 amount, $22.5 million is classified as current and $153.6 million as long-term, which is expected to be paid over the estimated remediation period. As of December 30, 2017, the Company has recorded $12.2 million in other assets related to funding by the Environmental Protection Agency ("EPA") and monies received have been placed in trust in accordance with the Consent Decree associated with the West Coast Loading Corporation ("WCLC") proceedings, as further discussed in Note S, Contingencies, of the Notes to Consolidated Financial Statements in Item 8. Accordingly, the Company's cash obligation as of December 30, 2017 associated with the aforementioned remediation activities is $163.9 million. The range of environmental remediation costs that is reasonably possible is $143.4 million to $277.1 million, which is subject to change in the near term. The Company may be liable for environmental remediation of sites it no longer owns. Liabilities have been recorded on those sites in accordance with policy.

The amount recorded for identified contingent liabilities is based on estimates. Amounts recorded are reviewed periodically and adjusted to reflect additional technical and legal information that becomes available. Actual costs to be incurred in future periods may vary from the estimates, given the inherent uncertainties in evaluating certain exposures. Subject to the imprecision in estimating future contingent liability costs, the Company does not expect that any sum it may have to pay in connection with these matters in excess of the amounts recorded will have a materially adverse effect on its financial position, results of operations or liquidity. Additional information regarding environmental matters is available in Note S, Contingencies, of the Notes to Consolidated Financial Statements in Item 8.

Employees

At December 30, 2017, the Company had 57,765 employees, 16,055 of whom are employed in the U.S. Employees in the U.S. totaling 1,237 are covered by collective bargaining agreements negotiated with 27 different local labor unions who are, in turn, affiliated with approximately 6 different international labor unions. The majority of the Company’s hourly-paid and weekly-paid employees outside the U.S. are not covered by collective bargaining agreements. The Company’s labor agreements in the U.S. expire between 2018 and 2021. There have been no significant interruptions of the Company’s operations in recent years due to labor disputes. The Company believes that its relationship with its employees is good.

Research and Development Costs

Research and development costs, which are classified in SG&A, were $252.3 million, $204.4 million and $188.0 million for fiscal years 2017, 2016 and 2015, respectively. The increase in 2017 reflects the Company's continued focus on growth investments and its commitment to the SFS 2.0 Breakthrough Innovation initiative.

Available Information

The Company’s website is located at http://www.stanleyblackanddecker.com. This URL is intended to be an inactive textual reference only. It is not intended to be an active hyperlink to the Company's website. The information on the Company's website is not, and is not intended to be, part of this Form 10-K and is not incorporated into this report by reference. The Company makes its Forms 10-K, 10-Q, 8-K and amendments to each available free of charge on its website as soon as reasonably practicable after filing them with, or furnishing them to, the U.S. Securities and Exchange Commission. Also available on the Company's website is the Company's Code of Ethics for CEO and Senior Financial Officers.

ITEM 1A. RISK FACTORS

The Company’s business, operations and financial condition are subject to various risks and uncertainties. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K, including those risks set forth under the heading entitled "Cautionary Statements Under the Private Securities Litigation Reform Act of 1995," and in other documents that the Company files with the U.S. Securities and Exchange Commission ("SEC"), before making any investment decision with respect to its securities. If any of the risks or uncertainties actually occur or develop, the Company’s business, financial condition, results of operations and future growth prospects could change. Under these circumstances, the trading prices of the Company’s securities could decline, and you could lose all or part of your investment in the Company’s securities.

Changes in customer preferences, the inability to maintain mutually beneficial relationships with large customers, inventory reductions by customers, and the inability to penetrate new channels of distribution could adversely affect the Company’s business.

The Company has certain significant customers, particularly home centers and major retailers. The two largest customers comprised approximately 21% of net sales, with U.S. and international mass merchants and home centers collectively comprising approximately 29% of net sales. The loss or material reduction of business, the lack of success of sales initiatives, or changes in customer preferences or loyalties, for the Company’s products related to any such significant customer could have a material adverse impact on the Company’s results of operations and cash flows. In addition, the Company’s major customers are volume purchasers, a few of which are much larger than the Company and have strong bargaining power with suppliers. This limits the ability to recover cost increases through higher selling prices. Furthermore, unanticipated inventory adjustments by these customers can have a negative impact on net sales.

If customers in the Convergent Security Solutions ("CSS") business are dissatisfied with services and switch to competitive services, or disconnect for other reasons such as preference for digital technology products or other technology enhancements not then offered by CSS, the Company's attrition rates may increase. In periods of increasing attrition rates, recurring revenue and results of operations may be materially adversely affected. The risk is more pronounced in times of economic uncertainty, as customers may reduce amounts spent on the products and services the Company provides.

In times of tough economic conditions, the Company has experienced significant distributor inventory corrections reflecting de-stocking of the supply chain associated with difficult credit markets. Such distributor de-stocking exacerbated sales volume declines pertaining to weak end user demand and the broader economic recession. The Company’s results may be adversely impacted in future periods by such customer inventory adjustments. Further, the inability to continue to penetrate new channels of distribution may have a negative impact on the Company’s future results.

The Company faces active global competition and if it does not compete effectively, its business may suffer.

The Company faces active competition and resulting pricing pressures. The Company’s products compete on the basis of, among other things, its reputation for product quality, its well-known brands, price, innovation and customer service capabilities. The Company competes with both larger and smaller companies that offer the same or similar products and services or that produce different products appropriate for the same uses. These companies are often located in countries such as China, Taiwan and India where labor and other production costs are substantially lower than in the U.S., Canada and Western Europe. Also, certain large customers offer house brands that compete with some of the Company’s product offerings as a lower-cost alternative. To remain profitable and defend market share, the Company must maintain a competitive cost structure, develop new products and services, lead product innovation, respond to competitor innovations and enhance its existing products in a timely manner. The Company may not be able to compete effectively on all of these fronts and with all of its competitors, and the failure to do so could have a material adverse effect on its sales and profit margins.

Core SFS is a continuous operational improvement process applied to many aspects of the Company’s business such as procurement, quality in manufacturing, maximizing customer fill rates, integrating acquisitions and other key business

processes. In the event the Company is not successful in effectively applying the Core SFS principles to its key business processes, including those of acquired businesses, its ability to compete and future earnings could be adversely affected.

In addition, the Company may have to reduce prices on its products and services, or make other concessions, to stay competitive and retain market share. Price reductions taken by the Company in response to customer and competitive pressures, as well as price reductions and promotional actions taken to drive demand that may not result in anticipated sales levels, could also negatively impact its business. The Company engages in restructuring actions, sometimes entailing shifts of production to low-cost countries, as part of its efforts to maintain a competitive cost structure. If the Company does not execute restructuring actions well, its ability to meet customer demand may decline, or earnings may otherwise be adversely impacted. Similarly, if such efforts to reform the cost structure are delayed relative to competitors or other market factors, the Company may lose market share and profits.

Customer consolidation could have a material adverse effect on the Company’s business.

A significant portion of the Company’s products are sold through home centers and mass merchant distribution channels in the U.S. and Europe. A consolidation of retailers in both North America and abroad has occurred over time and the increasing size and importance of individual customers creates risk of exposure to potential volume loss. The loss of certain larger home centers as customers would have a material adverse effect on the Company’s business until either such customers were replaced or the Company made the necessary adjustments to compensate for the loss of business.

Low demand for new products and the inability to develop and introduce new products at favorable margins could adversely impact the Company’s performance and prospects for future growth.

The Company’s competitive advantage is due in part to its ability to develop and introduce new products in a timely manner at favorable margins. The uncertainties associated with developing and introducing new products, such as market demand and costs of development and production may impede the successful development and introduction of new products on a consistent basis. Introduction of new technology may result in higher costs to the Company than that of the technology replaced. That increase in costs, which may continue indefinitely or until increased demand and greater availability in the sources of the new technology drive down its cost, could adversely affect the Company’s results of operations. Market acceptance of the new products introduced in recent years and scheduled for introduction in future years may not meet sales expectations due to various factors, such as the failure to accurately predict market demand, end-user preferences, and evolving industry standards. Moreover, the ultimate success and profitability of the new products may depend on the Company’s ability to resolve technical and technological challenges in a timely and cost-effective manner, and to achieve manufacturing efficiencies. The Company’s investments in productive capacity and commitments to fund advertising and product promotions in connection with these new products could erode profits if those expectations are not met.

The Company’s brands are important assets of its businesses and violation of its trademark rights by imitators, or the failure of its licensees or vendors to comply with the Company’s product quality, manufacturing requirements, marketing standards, and other requirements could negatively impact revenues and brand reputation.

The Company’s trademarks have a reputation for quality and value and are important to the Company's success and competitive position. Unauthorized use of the Company’s trademark rights may not only erode sales of the Company’s products, but may also cause significant damage to its brand name and reputation, interfere with its ability to effectively represent the Company to its customers, contractors, suppliers, and/or licensees, and increase litigation costs. Similarly, failure by licensees or vendors to adhere to the Company’s standards of quality and other contractual requirements could result in loss of revenue, increased litigation, and/or damage to the Company’s reputation and business. There can be no assurance that the Company’s ongoing efforts to protect its brand and trademark rights and ensure compliance with its licensing and vendor agreements will prevent all violations.

Successful sales and marketing efforts depend on the Company’s ability to recruit and retain qualified employees.

The success of the Company’s efforts to grow its business depends on the contributions and abilities of key executives, its sales force and other personnel, including the ability of its sales force to adapt to any changes made in the sales organization and achieve adequate customer coverage. The Company must therefore continue to recruit, retain and motivate management, sales and other personnel sufficiently to maintain its current business and support its projected growth. A shortage of these key employees might jeopardize the Company’s ability to implement its growth strategy.

The Company has significant operations outside of the United States, which are subject to political, economic and other risks inherent in operating outside of the United States.

The Company generates a significant portion of its total revenue outside of the United States. Business operations outside of the United States are subject to political, economic and other risks inherent in operating in certain countries, such as:

| |

| • | the difficulty of enforcing agreements and protecting assets through legal systems outside the U.S.; |

| |

| • | managing widespread operations and enforcing internal policies and procedures such as compliance with U.S. and foreign anti-bribery and anti-corruption regulations; |

| |

| • | trade protection measures and import or export licensing requirements; |

| |

| • | the application of certain labor regulations outside of the United States, including data privacy; |

| |

| • | compliance with a wide variety of non-U.S. laws and regulations; |

| |

| • | changes in the general political and economic conditions in the countries where the Company operates, particularly in emerging markets; |

| |

| • | the threat of nationalization and expropriation; |

| |

| • | increased costs and risks of doing business in a wide variety of jurisdictions; |

| |

| • | government controls limiting importation of goods; |

| |

| • | government controls limiting payments to suppliers for imported goods; |

| |

| • | limitations on repatriation of earnings; and |

| |

| • | exposure to wage, price and capital controls. |

Changes in the political or economic environments in the countries in which the Company operates could have a material adverse effect on its financial condition, results of operations or cash flows.

The Company’s business is subject to risks associated with sourcing and manufacturing overseas.

The Company imports large quantities of finished goods, component parts and raw materials. Substantially all of its import operations are subject to customs requirements and to tariffs and quotas set by governments through mutual agreements, bilateral actions or, in some cases unilateral action. In addition, the countries in which the Company’s products and materials are manufactured or imported from (including importation into the U.S. of our products manufactured overseas) may from time to time impose additional quotas, duties, tariffs or other restrictions on its imports (including restrictions on manufacturing operations) or adversely modify existing restrictions. Furthermore, imported products and materials may be subject to future tariffs or other trade measures in the U.S. Imports are also subject to unpredictable foreign currency variation which may increase the Company’s cost of goods sold. Adverse changes in these import costs and restrictions, or the Company’s suppliers’ failure to comply with customs regulations or similar laws, could harm the Company’s business.

The Company’s operations are also subject to the effects of international trade agreements and regulations such as the North American Free Trade Agreement, and the activities and regulations of the World Trade Organization. Although these trade agreements generally have positive effects on trade liberalization, sourcing flexibility and cost of goods by reducing or eliminating the duties and/or quotas assessed on products manufactured in a particular country, trade agreements can also impose requirements that adversely affect the Company’s business, such as setting quotas on products that may be imported from a particular country into key markets including the U.S. or the European Union, or making it easier for other companies to compete, by eliminating restrictions on products from countries where the Company’s competitors source products.

The Company’s ability to import products in a timely and cost-effective manner may also be affected by conditions at ports or issues that otherwise affect transportation and warehousing providers, such as port and shipping capacity, labor disputes, severe weather or increased homeland security requirements in the U.S. and other countries. These issues could delay importation of products or require the Company to locate alternative ports or warehousing providers to avoid disruption to customers. These alternatives may not be available on short notice or could result in higher transit costs, which could have an adverse impact on the Company’s business and financial condition.

The Company’s success depends on its ability to improve productivity and streamline operations to control or reduce costs.

The Company is committed to continuous productivity improvement and evaluating opportunities to reduce fixed costs, simplify or improve processes, and eliminate excess capacity. The Company has undertaken restructuring actions, the savings of which may be mitigated by many factors, including economic weakness, competitive pressures, and decisions to increase costs in areas such as sales promotion or research and development above levels that were otherwise assumed. Failure to achieve, or delays in achieving, projected levels of efficiencies and cost savings from such measures, or unanticipated inefficiencies resulting from manufacturing and administrative reorganization actions in progress or contemplated, would adversely affect the Company’s results.

The performance of the Company may suffer from business disruptions or other costs associated with information technology, cyber attacks, system implementations, data privacy, or catastrophic losses affecting distribution centers and other infrastructure.

The Company relies heavily on computer systems to manage and operate its businesses, and record and process transactions. Computer systems are important to production planning, customer service and order fulfillment among other business-critical processes. Consistent and efficient operation of the computer hardware and software systems is imperative to the successful sales and earnings performance of the various businesses in many countries.

Despite efforts to prevent such situations, insurance policies and loss control and risk management practices that partially mitigate these risks, the Company’s systems may be affected by damage or interruption from, among other causes, power outages, system failures or computer viruses. Computer hardware and storage equipment that is integral to efficient operations, such as e-mail, telephone and other functionality, is concentrated in certain physical locations in the various continents in which the Company operates. Additionally, the Company relies on software applications and enterprise cloud storage systems and cloud computing services provided by third-party vendors, and our business may be adversely affected by service disruptions or security breaches in such third-party systems.

Security threats and sophisticated computer crime pose a potential risk to the security of the Company’s information technology systems, cloud storage systems, networks, services and assets, as well as the confidentiality and integrity of the Company’s customers' data. If the Company suffers a loss or disclosure of business or stakeholder information due to security breaches, including as a result of human error and technological failures, and business continuity plans do not effectively address these issues on a timely basis, the Company may suffer interruptions in its ability to manage operations as well as reputational, competitive or business harm, which may adversely impact the Company’s results of operations and financial condition.

In addition, the Company is in the process of system conversions to SAP as well as other applications to provide a common platform across most of its businesses. There can be no assurances that expected expense synergies will be achieved or that there will not be delays to the expected timing of such synergies. It is possible the costs to complete the system conversions may exceed current expectations, and that significant costs may be incurred that will require immediate expense recognition as opposed to capitalization. The risk of disruption to key operations is increased when complex system changes such as SAP conversions are undertaken. If systems fail to function effectively, or become damaged, operational delays may ensue and the Company may be forced to make significant expenditures to remedy such issues. Any significant disruption in the Company’s computer operations could have a material adverse impact on its business and results.

The Company’s operations are significantly dependent on infrastructure, notably certain distribution centers and security alarm monitoring facilities, which are concentrated in various geographic locations. If any of these were to experience a catastrophic loss, such as a fire, earthquake, hurricane, or flood, it could disrupt operations, delay production, shipments and revenue and result in large expenses to repair or replace the facility. The Company maintains business interruption insurance, but it may not fully protect the Company against all adverse effects that could result from significant disruptions.

The Company is also subject to U.S. and international data privacy and cybersecurity laws and regulations, which may impose fines and penalties for noncompliance and may have an adverse effect on the Company's operations. For example, the European Union’s General Data Protection Regulation (the “GDPR”), which becomes effective in May 2018, extends the scope of the EU data protection law to all companies processing data of EU residents, regardless of the company's location, and imposes significant new requirements on how the Company collects, processes and transfers personal data.

Unforeseen events, including war, terrorism and other international conflicts and public health issues, whether occurring in the United States or abroad, could disrupt the Company's operations, disrupt the operations of its suppliers or customers, or result in political or economic instability. These events could reduce demand for the Company's products and make it difficult or impossible to manufacture products, deliver products to customers, or receive materials from suppliers.

The Company’s results of operations could be negatively impacted by inflationary or deflationary economic conditions which could affect the ability to obtain raw materials, component parts, freight, energy, labor and sourced finished goods in a timely and cost-effective manner.

The Company’s products are manufactured using both ferrous and non-ferrous metals including, but not limited to, steel, zinc, copper, brass, aluminum, and nickel. Additionally, the Company uses other commodity-based materials for components and packaging including, but not limited to, plastics, resins, wood and corrugated products. The Company’s cost base also reflects significant elements for freight, energy and labor. The Company also sources certain finished goods directly from vendors. If the Company is unable to mitigate any inflationary increases through various customer pricing actions and cost reduction initiatives, its profitability may be adversely affected.

Conversely, in the event there is deflation, the Company may experience pressure from its customers to reduce prices, and there can be no assurance that the Company would be able to reduce its cost base (through negotiations with suppliers or other measures) to offset any such price concessions which could adversely impact results of operations and cash flows.

Further, as a result of inflationary or deflationary economic conditions, the Company believes it is possible that a limited number of suppliers may either cease operations or require additional financial assistance from the Company in order to fulfill their obligations. In a limited number of circumstances, the magnitude of the Company’s purchases of certain items is of such significance that a change in established supply relationships with suppliers or increase in the costs of purchased raw materials, component parts or finished goods could result in manufacturing interruptions, delays, inefficiencies or an inability to market products. Changes in value-added tax rebates, currently available to the Company or to its suppliers, could also increase the costs of the Company’s manufactured products as well as purchased products and components and could adversely affect the Company’s results.

In addition, many of the Company’s products incorporate battery technology. As other industries begin to adopt similar battery technology for use in their products, the increased demand could place capacity constraints on the Company’s supply chain. In addition, increased demand for battery technology may also increase the costs to the Company for both the battery cells as well as the underlying raw materials. If the Company is unable to mitigate any possible supply constraints or related increased costs, its profitably and financial results could be negatively impacted.

Uncertainty about the financial stability of economies outside the U.S. could have a significant adverse effect on the Company's business, results of operations and financial condition.

The Company generates approximately 46% of its revenues from outside the U.S., including 22% of its revenues from Europe and 14% from various emerging market countries. Each of the Company’s segments generates sales from these marketplaces. While the Company believes any downturn in the European or emerging marketplaces might be offset to some degree by the relative stability in North America, the Company’s future growth, profitability and financial liquidity could be affected, in several ways, including but not limited to the following:

| |

| • | depressed consumer and business confidence may decrease demand for products and services; |

| |

| • | customers may implement cost-reduction initiatives or delay purchases to address inventory levels; |

| |

| • | significant declines of foreign currency values in countries where the Company operates could impact both the revenue growth and overall profitability in those geographies; |

| |

| • | a slowing or contracting Chinese economy could reduce China’s consumption and negatively impact the Company’s sales in that region, as well as globally; |

| |

| • | a devaluation of foreign currencies could have an effect on the credit worthiness (as well as the availability of funds) of customers in those regions impacting the collectability of receivables; |

| |

| • | a devaluation of foreign currencies could have an adverse effect on the value of financial assets of the Company in the effected countries; |

| |

| • | the impact of an event (individual country default, Brexit, or break up of the Euro) could have an adverse impact on the global credit markets and global liquidity potentially impacting the Company’s ability to access these credit markets and to raise capital. |

The Company is exposed to market risk from changes in foreign currency exchange rates which could negatively impact profitability.

The Company manufactures and sells its products in many countries throughout the world. As a result, there is exposure to foreign currency risk as the Company enters into transactions and makes investments denominated in multiple currencies. The Company’s predominant currency exposures are related to the Euro, Canadian Dollar, British Pound, Australian Dollar, Brazilian Real, Argentine Peso, Chinese Renminbi (“RMB”) and the Taiwan Dollar. In preparing its financial statements, for foreign operations with functional currencies other than the U.S. dollar, asset and liability accounts are translated at current exchange rates, while income and expenses are translated using average exchange rates. With respect to the effects on translated earnings, if the U.S. dollar strengthens relative to local currencies, the Company’s earnings could be negatively impacted. In 2017, translational and transactional foreign currency fluctuations negatively impacted pre-tax earnings by approximately $12.4 million and diluted earnings per share by approximately $0.07. The translational and transactional impacts will vary over time and may be more material in the future. Although the Company utilizes risk management tools, including hedging, as it deems appropriate, to mitigate a portion of potential market fluctuations in foreign currencies, there can be no assurance that such measures will result in all market fluctuation exposure being eliminated. The Company generally does not hedge the translation of its non-U.S. dollar earnings in foreign subsidiaries, but may choose to do so in certain instances.

The Company sources many products from China and other low-cost countries for resale in other regions. To the extent the RMB or other currencies appreciate, the Company may experience cost increases on such purchases. The Company may not be successful at implementing customer pricing or other actions in an effort to mitigate the related cost increases and thus its profitability may be adversely impacted.

The Company has incurred, and may incur in the future, significant indebtedness, or issue additional equity securities, in connection with mergers or acquisitions which may impact the manner in which it conducts business or the Company’s access to external sources of liquidity. The potential issuance of such securities may limit the Company’s ability to implement elements of its growth strategy and may have a dilutive effect on earnings.

As described in Note H, Long-Term Debt and Financing Arrangements, of the Notes to Consolidated Financial Statements in Item 8, the Company has a five-year $1.75 billion committed credit facility and a 364-day $1.25 billion committed credit facility. No amounts were outstanding against either of these facilities at December 30, 2017.

The instruments and agreements governing certain of the Company’s current indebtedness contain requirements or restrictive covenants that include, among other things:

| |

| • | a limitation on creating liens on certain property of the Company and its subsidiaries; |

| |

| • | a restriction on entering into certain sale-leaseback transactions; |

| |

| • | customary events of default. If an event of default occurs and is continuing, the Company might be required to repay all amounts outstanding under the respective instrument or agreement; and |

| |

| • | maintenance of a specified financial ratio. The Company has an interest coverage covenant that must be maintained to permit continued access to its committed revolving credit facilities. The interest coverage ratio tested for covenant compliance compares adjusted Earnings Before Interest, Taxes, Depreciation and Amortization to adjusted Interest Expense (“adjusted EBITDA”/”adjusted Interest Expense”); such adjustments to interest or EBITDA include, but are not limited to, removal of non-cash interest expense and stock-based compensation expense. The interest coverage ratio must not be less than 3.5 times and is computed quarterly, on a rolling twelve months (last twelve months) basis. Under this covenant definition, the interest coverage ratio was 10 times EBITDA or higher in each of the 2017 quarterly measurement periods. Management does not believe it is reasonably likely the Company will breach this covenant. Failure to maintain this ratio could adversely affect further access to liquidity. |

Future instruments and agreements governing indebtedness may impose other restrictive conditions or covenants. Such covenants could restrict the Company in the manner in which it conducts business and operations as well as in the pursuit of its growth and repositioning strategies.

The Company is exposed to counterparty risk in its hedging arrangements.

From time to time, the Company enters into arrangements with financial institutions to hedge exposure to fluctuations in currency and interest rates, including forward contracts, options and swap agreements. The failure of one or more counterparties to the Company’s hedging arrangements to fulfill their obligations could adversely affect the Company’s results of operations.

Tight capital and credit markets or the failure to maintain credit ratings could adversely affect the Company by limiting the Company’s ability to borrow or otherwise access liquidity.

The Company’s long-term growth plans are dependent on, among other things, the availability of funding to support corporate initiatives and complete appropriate acquisitions and the ability to increase sales of existing product lines. While the Company has not encountered financing difficulties to date, the capital and credit markets have experienced extreme volatility and disruption in the past and may again in the future. Market conditions could make it more difficult for the Company to borrow or otherwise obtain the cash required for significant new corporate initiatives and acquisitions. In addition, there could be a number of follow-on effects from a credit crisis on the Company’s businesses, including insolvency of key suppliers resulting in product delays; inability of customers to obtain credit to finance purchases of the Company’s products and services and/or customer insolvencies.

In addition, the major rating agencies regularly evaluate the Company for purposes of assigning credit ratings. The Company’s ability to access the credit markets, and the cost of these borrowings, is affected by the strength of its credit ratings and current market conditions. Failure to maintain credit ratings that are acceptable to investors may adversely affect the cost and other terms upon which the Company is able to obtain financing, as well as its access to the capital markets.

The Company’s acquisitions, as well as general business reorganizations, may result in significant costs and certain risks for its business and operations.

In 2017, the Company completed the acquisitions of Newell Tools and the Craftsman brand, as well as a number of other smaller acquisitions. In addition, the Company recently reached an agreement to purchase the Nelson Fastener Systems industrial business, which is expected to close in the first half of 2018, and may make additional acquisitions in the future.

Acquisitions involve a number of risks, including:

| |

| • | the failure to identify the most suitable candidates for acquisitions; |

| |

| • | the ability to identify and close on appropriate acquisition opportunities within desired time frames at reasonable cost; |

| |

| • | the anticipated additional revenues from the acquired companies do not materialize, despite extensive due diligence; |

| |

| • | the possibility that the acquired companies will not be successfully integrated or that anticipated cost savings, synergies, or other benefits will not be realized; |

| |

| • | the acquired businesses will lose market acceptance or profitability; |

| |

| • | the diversion of Company management’s attention and other resources; |

| |

| • | the incurrence of unexpected costs and liabilities, including those associated with undisclosed pre-closing regulatory violations by the acquired business; and |

| |

| • | the loss of key personnel and clients or customers of acquired companies. |

In addition, the success of the Company’s long-term growth and repositioning strategy will depend in part on successful general reorganization including its ability to:

| |

| • | combine businesses and operations; |

| |

| • | integrate departments, systems and procedures; and |

| |

| • | obtain cost savings and other efficiencies from such reorganizations, including the Company's functional transformation initiative. |

Failure to effectively consummate or manage the pending acquisition and any future acquisitions or general business reorganizations, and mitigate the related risks, may adversely affect the Company’s existing businesses and harm its operational results due to large write-offs, significant restructuring costs, contingent liabilities, substantial depreciation, adverse tax or other consequences. The Company cannot ensure that such integrations and reorganizations will be successfully completed or that all of the planned synergies and other benefits will be realized.

Expansion of the Company's activity in emerging markets may result in risks due to differences in business practices and cultures.

The Company's growth plans include efforts to increase revenue from emerging markets through both organic growth and acquisitions. Local business practices in these regions may not comply with U.S. laws, local laws or other laws applicable to the Company. When investigating potential acquisitions, the Company seeks to identify historical practices of target companies that would create liability or other exposures for the Company were they to continue post-completion or as a successor to the target. Where such practices are discovered, the Company assesses the risk to determine whether it is prepared to proceed with the transaction. In assessing the risk, the Company looks at, among other factors, the nature of the violation, the potential liability, including any fines or penalties that might be incurred, the ability to avoid, minimize or obtain indemnity for the risks, and the likelihood that the Company would be able to ensure that any such practices are discontinued following completion of the acquisition through implementation of its own policies and procedures. Due diligence and risk assessment are, however, imperfect processes, and it is possible that the Company will not discover problematic practices until after completion, or that the Company will underestimate the risks associated with historical activities. Should that occur, the Company may incur fees, fines, penalties, injury to its reputation or other damage that could negatively impact the Company's earnings.

Significant judgment and certain estimates are required in determining the Company’s worldwide provision for income taxes. Future tax law changes and audit results may materially increase the Company’s prospective income tax expense.

The Company is subject to income taxation in the U.S. as well as numerous foreign jurisdictions. Significant judgment is required in determining the Company’s worldwide income tax provision and accordingly there are many transactions and computations for which the final income tax determination is uncertain. The Company considers many factors when evaluating and estimating its tax positions and tax benefits, which may require periodic adjustments and which may not accurately anticipate actual outcomes. The Company periodically assesses its liabilities and contingencies for all tax years still subject to audit based on the most currently available information, which involves inherent uncertainty. The Company is routinely audited by income tax authorities in many tax jurisdictions. Although management believes the recorded tax estimates are reasonable, the ultimate outcome of any audit (or related litigation) could differ materially from amounts reflected in the Company’s income tax accruals. Additionally, the global income tax provision can be materially impacted due to foreign currency fluctuations against the U.S. dollar since a significant amount of the Company’s earnings are generated outside the United States. Lastly, it is possible that future income tax legislation may be enacted that could have a material impact on the Company’s worldwide income tax provision beginning with the period that such legislation becomes enacted.

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Act”). The Act makes broad and complex changes to the U.S. tax code, including, but not limited to, (1) reducing the U.S. federal corporate tax rate from 35 percent to 21 percent; (2) requiring companies to pay a one-time transition tax on certain unrepatriated earnings of foreign subsidiaries; (3) generally eliminating U.S. federal income taxes on dividends from foreign subsidiaries; (4) requiring a tax on global intangible low-taxed income (“GILTI”) which is a current inclusion in U.S. federal taxable income of certain earnings of controlled foreign corporations; (5) eliminating the corporate alternative minimum tax ("AMT") and changing how existing AMT credits can be realized; (6) creating the base erosion anti-abuse tax ("BEAT"); (7) creating a new limitation on deductible interest expense; and (8) changing rules related to uses and limitations of net operating loss carryforwards created in tax years beginning after December 31, 2017.

Pursuant to Staff Accounting Bulletin No. 118 (“SAB 118”) issued by the SEC in December 2017, issuers are permitted up to one year from the enactment of the Act to complete the accounting for the income tax effects of the Act. See Note A, Significant Accounting Policies, of the Notes to Consolidated Financial Statements in Item 8, for further information about SAB 118. As of December 30, 2017, the Company has not completed its accounting for the tax effects of the enactment of the Act; however, in certain cases, as described in Note Q, Income Taxes, of the Notes to Consolidated Financial Statements in Item 8, the Company has made a reasonable estimate of the effects on its existing deferred tax balances and the one-time transition tax. In other cases, the Company has not been able to make a reasonable estimate and continues to account for those items based on existing accounting guidance under Accounting Standards Codification ("ASC") 740, Income Taxes, and the provisions of the tax laws that were in effect immediately prior to enactment. During the fourth quarter of 2017, a provisional net charge of $23.6 million was recognized for the items the Company was able to reasonably estimate, which has been included as a component of income taxes on continuing operations. The final impacts of the Act may be materially different from current estimates, which are based on management’s preliminarily analysis of currently available information. In all cases, estimates of the impact of the Act may be updated to account for changes in interpretations of the Act, any legislative action to address questions that arise because of the Act, and any changes in accounting standards for income taxes or related interpretations in response to the Act. The Company will continue to examine the impact that the Act may have on its operations in future periods. Notwithstanding the reduction in the corporate income tax rate, the overall net impact of the legislation remains uncertain and could adversely impact the Company's results of operations or financial condition.

The Company’s failure to continue to successfully avoid, manage, defend, litigate and accrue for claims and litigation could negatively impact its results of operations or cash flows.

The Company is exposed to and becomes involved in various litigation matters arising out of the ordinary routine conduct of its business, including, from time to time, actual or threatened litigation relating to such items as commercial transactions, product liability, workers compensation, the Company’s distributors and franchisees, intellectual property claims and regulatory actions.

In addition, the Company is subject to environmental laws in each jurisdiction in which business is conducted. Some of the Company’s products incorporate substances that are regulated in some jurisdictions in which it conducts manufacturing operations. The Company could be subject to liability if it does not comply with these regulations. In addition, the Company is currently, and may in the future be held responsible for remedial investigations and clean-up costs resulting from the discharge of hazardous substances into the environment, including sites that have never been owned or operated by the Company but at which it has been identified as a potentially responsible party under federal and state environmental laws and regulations. Changes in environmental and other laws and regulations in both domestic and foreign jurisdictions could adversely affect the Company’s operations due to increased costs of compliance and potential liability for non-compliance.

The Company manufactures products, configures and installs security systems and performs various services that create exposure to product and professional liability claims and litigation. If such products, systems and services are not properly manufactured, configured, installed, designed or delivered, personal injuries, property damage or business interruption could result, which could subject the Company to claims for damages. The costs associated with defending product liability claims and payment of damages could be substantial. The Company’s reputation could also be adversely affected by such claims, whether or not successful.

There can be no assurance that the Company will be able to continue to successfully avoid, manage and defend such matters. In addition, given the inherent uncertainties in evaluating certain exposures, actual costs to be incurred in future periods may vary from the Company’s estimates for such contingent liabilities.

The Company’s products could be recalled.

The Consumer Product Safety Commission or other applicable regulatory bodies may require the recall, repair or replacement of the Company’s products if those products are found not to be in compliance with applicable standards or regulations. A recall could increase costs and adversely impact the Company’s reputation.

The Company is exposed to credit risk on its accounts receivable.

The Company’s outstanding trade receivables are not generally covered by collateral or credit insurance. While the Company has procedures to monitor and limit exposure to credit risk on its trade and non-trade receivables, there can be no assurance such procedures will effectively limit its credit risk and avoid losses, which could have an adverse effect on the Company’s financial condition and operating results.

If the Company were required to write-down all or part of its goodwill, indefinite-lived trade names, or other definite-lived intangible assets, its net income and net worth could be materially adversely affected.

As a result of the Black and Decker merger and other acquisitions, the Company has $8.8 billion of goodwill, $2.2 billion of indefinite-lived trade names and $1.3 billion of net definite-lived intangible assets at December 30, 2017. The Company is required to periodically, at least annually, determine if its goodwill or indefinite-lived trade names have become impaired, in which case it would write down the impaired portion of the asset. The definite-lived intangible assets, including customer relationships, are amortized over their estimated useful lives and are evaluated for impairment when appropriate. Impairment of intangible assets may be triggered by developments outside of the Company’s control, such as worsening economic conditions, technological change, intensified competition or other factors resulting in deleterious consequences.

If the investments in employee benefit plans do not perform as expected, the Company may have to contribute additional amounts to these plans, which would otherwise be available to cover operating expenses or other business purposes.

The Company sponsors pension and other post-retirement defined benefit plans. The Company’s defined benefit plan assets are currently invested in equity securities, government and corporate bonds and other fixed income securities, money market instruments and insurance contracts. The Company’s funding policy is generally to contribute amounts determined annually on an actuarial basis to provide for current and future benefits in accordance with applicable law which require, among other things, that the Company make cash contributions to under-funded pension plans. During 2017, the Company made cash contributions to its defined benefit plans of $67 million and it expects to contribute $41 million to its defined benefit plans in 2018.

There can be no assurance that the value of the defined benefit plan assets, or the investment returns on those plan assets, will be sufficient in the future. It is therefore possible that the Company may be required to make higher cash contributions to the plans in future years which would reduce the cash available for other business purposes, and that the Company will have to recognize a significant pension liability adjustment which would decrease the net assets of the Company and result in higher expense in future years. The fair value of the defined benefit plan assets at December 30, 2017 was $2.213 billion.

Risks associated with hostilities involving North Korea.

The Company has a number of key suppliers in South Korea. Escalation of hostilities with North Korea and/or military action in the region could cause disruptions in the Company's supply chain which could, in turn, cause product shortages, delays in delivery and/or increases in the Company's cost incurred to produce and deliver products to its customers.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

As of December 30, 2017, the Company and its subsidiaries owned or leased significant facilities used for manufacturing, distribution and sales offices in 19 states and 18 foreign countries. The Company leases its corporate headquarters in New Britain, Connecticut. The Company has 84 other facilities that are larger than 100,000 square feet, as follows:

|

| | | | | |

| | Owned | | Leased | | Total |

| Tools & Storage | 42 | | 16 | | 58 |

| Industrial | 13 | | 5 | | 18 |

| Security | 2 | | 2 | | 4 |

| Corporate | 2 | | 2 | | 4 |

| Total | 59 | | 25 | | 84 |

The combined size of these facilities is approximately 22 million square feet. The buildings are in good condition, suitable for their intended use, adequate to support the Company’s operations, and generally fully utilized.

ITEM 3. LEGAL PROCEEDINGS

In the normal course of business, the Company is involved in various lawsuits and claims, including product liability, environmental and distributor claims, and administrative proceedings. The Company does not expect that the resolution of these matters will have a materially adverse effect on the Company’s consolidated financial position, results of operations or liquidity.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is listed and traded on the New York Stock Exchange, Inc. (“NYSE”) under the abbreviated ticker symbol “SWK”, and is a component of the Standard & Poor’s (“S&P”) 500 Composite Stock Price Index. The Company’s high and low quarterly stock prices on the NYSE for the years ended December 30, 2017 and December 31, 2016 follow:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2017 | | 2016 |

| | | High | | Low | | Dividend Per Common Share | | High | | Low | | Dividend Per Common Share |

| QUARTER: | | | | | | | | | | | | |

| First | | $ | 132.87 |

| | $ | 115.75 |

| | $ | 0.58 |

| | $ | 106.64 |

| | $ | 90.14 |

| | $ | 0.55 |

|

| Second | | $ | 143.05 |

| | $ | 130.57 |

| | $ | 0.58 |

| | $ | 115.05 |

| | $ | 104.24 |

| | $ | 0.55 |

|

| Third | | $ | 152.30 |

| | $ | 137.07 |

| | $ | 0.63 |

| | $ | 124.46 |

| | $ | 111.40 |

| | $ | 0.58 |

|

| Fourth | | $ | 170.03 |

| | $ | 154.53 |

| | $ | 0.63 |

| | $ | 125.78 |

| | $ | 113.49 |

| | $ | 0.58 |

|

| Total | | | | | | $ | 2.42 |

| | | | | | $ | 2.26 |

|

As of February 1, 2018, there were 9,976 holders of record of the Company’s common stock. Information required by Item 201(d) of Regulation S-K concerning securities authorized for issuance under equity compensation plans can be found under Item 12 of this Annual Report on Form 10-K.

Issuer Purchases of Equity Securities

The following table provides information about the Company’s purchases of equity securities that are registered by the Company pursuant to Section 12 of the Exchange Act for the three months ended December 30, 2017:

|

| | | | | | | | | | | | | |

| 2017 | | (a) Total Number Of Shares Purchased | | Average Price Paid Per Share | | Total Number Of Shares Purchased As Part Of A Publicly Announced Plan or Program | | (b) Maximum Number Of Shares That May Yet Be Purchased Under The Program |

| October 1 - November 4 | | 2,943 |

| | $ | 160.34 |

| | — |

| | 15,000,000 |

|

| November 5 - December 2 | | 18,516 |

| | $ | 168.24 |

| | — |

| | 15,000,000 |

|

| December 3 - December 30 | | 52,653 |

| | $ | 169.58 |

| | — |

| | 15,000,000 |

|

| Total | | 74,112 |

| | $ | 168.88 |

| | — |

| | 15,000,000 |

|

| |

| (a) | The shares of common stock in this column were deemed surrendered to the Company by participants in various benefit plans of the Company to satisfy the participants’ taxes related to vesting or delivery of time-vesting restricted share units under those plans. |

| |

| (b) | On July 20, 2017, the Board of Directors approved a new repurchase program for up to 15.0 million shares of the Company’s common stock and terminated its previously approved repurchase program. As of December 30, 2017, the authorized shares available for repurchase under the new repurchase program totaled 15.0 million shares. The currently authorized shares available for repurchase do not include approximately 3.6 million shares reserved and authorized for purchase under the Company’s previously approved repurchase program relating to a forward share purchase contract entered into in March 2015. Refer to Note J, Capital Stock, of the Notes to Consolidated Financial Statements in Item 8 for further discussion. |

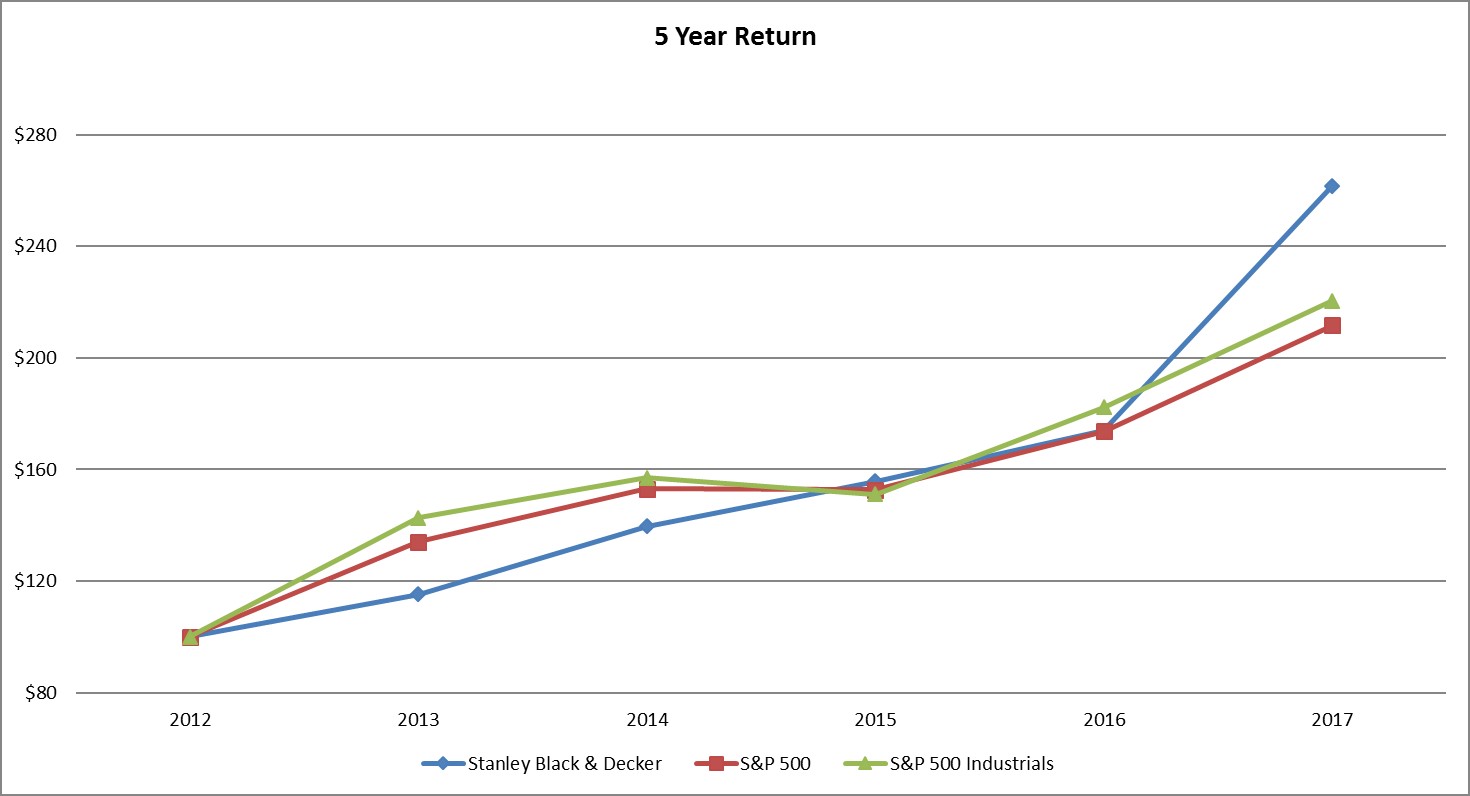

Stock Performance Graph