UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 3, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-33642

Masimo Corporation

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 33-0368882 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

| |

| 40 Parker Irvine, California | | 92618 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(949) 297-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class: | | Name of each exchange on which registered: |

Common Stock, par value $0.001 | | The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of the common stock on June 27, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, as reported on the NASDAQ Global Market, was approximately $1.72 billion.

At February 13, 2009, the registrant had 57,394,949 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K incorporate information by reference from the registrant’s proxy statement for the registrant’s 2009 Annual Meeting of Stockholders to be filed with the Securities and Exchange Commission within 120 days after the close of the fiscal year covered by this annual report.

MASIMO CORPORATION

FISCAL YEAR 2008 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or Form 10-K, contains “forward-looking statements” that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially and adversely from those expressed or implied by such forward-looking statements. The forward-looking statements are contained principally in Item 1—“Business,” Item 1.A—“Risk Factors” and Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations” but appear through the Form 10-K. Examples of forward-looking statements include, but are not limited to any projection or expectation of earnings, revenue or other financial items; the plans, strategies and objectives of management for future operations; factors that may affect our operating results; our success in pending litigation; new products or services; the demand for our products; our ability to consummate acquisitions and successfully integrate them into our operations; future capital expenditures; effects of current or future economic conditions or performance; industry trends and other matters that do not relate strictly to historical facts or statements of assumptions underlying any of the foregoing. These statements are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “ongoing,” “opportunity,” “plan,” “potential,” “predicts,” “seek,” “should,” “will,” or “would,” and similar expressions and variations or negatives of these words. These forward-looking statements are based on the expectations, estimates, projections, beliefs and assumptions of our management based on information currently available to management, all of which is subject to change. Such forward-looking statements are subject to risks, uncertainties and other factors that are difficult to predict and could cause our actual results and the timing of certain events to differ materially and adversely from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed under Item 1.A. “Risk Factors” in this Form 10-K. Furthermore, such forward-looking statements speak only as of the date of this Form 10-K. We undertake no obligation to update or revise publicly any forward-looking statements to reflect events or circumstances after the date of such statements for any reason, except as otherwise required by law.

PART I

Overview

We are a global medical technology company that develops, manufactures and markets noninvasive patient monitoring products that improve patient care. We were incorporated in California in May 1989 and reincorporated in Delaware in May 1996. We invented Masimo Signal Extraction Technology, or Masimo SET, which provides the capabilities of measure-through motion and low perfusion pulse oximetry to address the primary limitations of conventional pulse oximetry. Pulse oximetry is the noninvasive measurement of the oxygen saturation level of arterial blood, or the blood that delivers oxygen to the body’s tissues, and pulse rate. Our Masimo SET platform has addressed many of the previous technology limitations and has been referred to by several industry sources as the gold standard in pulse oximetry. The benefits of Masimo SET have been validated in over 100 independent clinical and laboratory studies. During fiscal 2008, we generated product revenue of $258.9 million and we increased our revenue at a compound annual growth rate, or CAGR, of approximately 34.0% for the three years ended January 3, 2009.

We develop, manufacture and market a family of noninvasive blood constituent patient monitoring solutions that consists of a monitor or circuit board and our proprietary single-patient use and reusable sensors and cables. In addition, we offer remote-alarm/monitoring solutions, such as the Masimo Patient SafetyNet. Our solutions and related products are based upon our proprietary Masimo SET algorithms. This software-based technology is incorporated into a variety of product platforms depending on our customers’ specifications. We sell our products to end-users through our direct sales force and certain distributors, and some of our products to our original equipment manufacturer, or OEM, partners, for incorporation into their products. We estimate that the worldwide installed base of our pulse oximeters and OEM monitors that incorporate Masimo SET was approximately 567,000 units as of January 3, 2009. Our installed base is the primary driver for the recurring sales of our sensors, most notably, single-patient adhesive sensors. Based on industry reports, we estimate that the worldwide pulse oximetry market was over $1.0 billion, as of January 3, 2009, the largest component of which was the sale of sensors.

Our strategy is to utilize the reliability and accuracy of our Masimo SET platform, along with our Patient SafetyNet solutions, to facilitate the expansion of our pulse oximetry products into areas beyond critical care settings, including the general care areas of the hospital. Additionally, we have developed products that noninvasively monitor parameters beyond arterial blood oxygen saturation level and pulse rate, which create new market opportunities in both the critical care and non-critical care settings. In 2005, we launched our Masimo Rainbow SET platform utilizing licensed Rainbow technology, which we believe includes the first devices cleared by the U.S. Food and Drug Administration, or FDA, to noninvasively measure select noninvasive blood parameters that previously required invasive procedures. In 2005, we launched carboxyhemoglobin, allowing measurement of carbon monoxide levels in the blood. In 2006, we launched methemoglobin, allowing for the measurement of a dangerous condition known as methemoglobinemia, which occurs as a reaction to some common drugs used in hospitals and in out patient procedures. In 2007, we launched Plethysmographic Variability Index, or PVI. Independent clinical studies have demonstrated that PVI can predict fluid responsiveness in surgical and intensive care patients. In May 2008, we received FDA approval for our most recent Rainbow measurement, total hemoglobin. Total hemoglobin is defined as the oxygen-carrying component of red blood cells, and is one of the

1

most frequent invasive laboratory measurements in the world, often measured as part of a complete blood count. We believe that the use of products incorporating Rainbow technology will become widely adopted for the noninvasive monitoring of these parameters. We also believe that we will develop and introduce additional parameters in the future based on our proprietary technology platforms.

Our technology is supported by a substantial intellectual property portfolio that we have built through internal development and, to a lesser extent, acquisitions and license agreements. As of January 3, 2009, we had 513 issued and pending patents worldwide. We have exclusively licensed from our development partner, Masimo Laboratories, Inc., or Masimo Labs, the right to incorporate Rainbow technology into our products intended to be used by professional caregivers, including, but not limited to, hospital caregivers and emergency medical services, or EMS, facility caregivers. On January 17, 2006, we settled a patent litigation dispute with Nellcor Puritan Bennett, Inc., a division of Tyco Healthcare (currently Covidien Ltd.). Under the terms of the settlement, Nellcor has agreed to discontinue the sale of its products found to infringe our patents and will pay us royalties at least through March 14, 2011 on the U.S. sales of its pulse oximetry products.

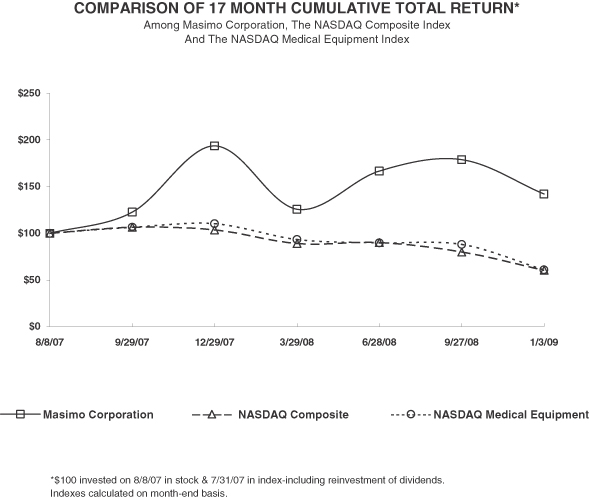

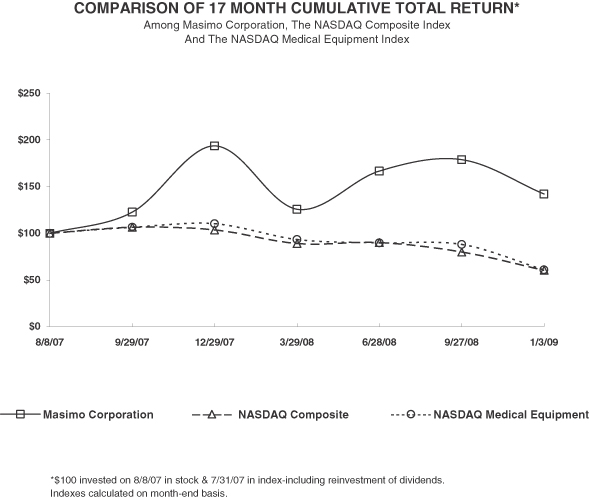

On August 13, 2007, we completed our initial public offering, or IPO, of common stock in which a total of 13,704,120 shares were sold, comprised of 10,416,626 shares sold by selling stockholders, 1,500,000 shares sold by us at the initial closing and 1,787,494 shares sold by us pursuant to the underwriters’ full exercise of their over-allotment option, at an issue price of $17.00 per share. We raised a total of $55.9 million in gross proceeds from the IPO, or approximately $47.8 million in net proceeds after deducting underwriting discounts and commissions of $3.9 million and estimated other offering costs of approximately $4.2 million. Upon the closing of the IPO, all shares of convertible preferred stock outstanding automatically converted into an aggregate of 34,612,503 shares of common stock. The consolidated financial statements as of and for the period ended December 29, 2007, including share and per share amounts, include the effects of the offering since it was completed prior to December 29, 2007.

Industry Background

Pulse oximetry has gained widespread clinical acceptance as a standard patient vital sign measurement because it can give clinicians an early warning of low arterial blood oxygen saturation levels, known as hypoxemia. Early detection is critical because hypoxemia can lead to a lack of oxygen in the body’s tissues, which can result in brain damage or death in a matter of minutes. Pulse oximeters are currently used primarily in critical care settings, including emergency departments, surgery, recovery rooms, intensive care units, or ICUs, and emergency medical services, or EMS market.

In addition, clinicians use pulse oximeters to estimate whether there is too much oxygen in the blood, a condition called hyperoxemia. In premature babies, hyperoxemia can lead to permanent eye damage or blindness. By ensuring that oxygen saturation levels in babies remain under 96%, clinicians believe they can lower the incidence of hyperoxemia. Hyperoxemia can also cause problems for adults, such as increased risk of postoperative infection and tissue damage. In adults, to prevent hyperoxemia, clinicians use pulse oximeters to administer the minimum level of oxygen necessary to maintain normal saturation levels.

Pulse oximeters use sensors attached to an extremity, typically the fingertip. These sensors contain two light emitting diodes, or LEDs, that in a transmittance sensor transmit red and infrared light from one side of the extremity through the tissue to a photodetector on the other side of the extremity. The photodetector in the sensor measures the amount of red and infrared light absorbed by the tissue. A microprocessor then analyzes the changes in light-absorption to provide a continuous, real-time measurement of the amount of oxygen in the patient’s arterial blood. Pulse oximeters typically give audio and visual alerts, or alarms, when the patient’s arterial blood oxygen saturation level or pulse rate falls outside of a designated range. As a result, clinicians are able to immediately initiate treatment to prevent the serious clinical consequences of hypoxemia and hyperoxemia.

Limitations of Conventional Pulse Oximetry

Conventional pulse oximetry is subject to technological limitations that reduce its effectiveness and the quality of patient care. In particular, when using conventional pulse oximetry, arterial blood signal recognition can be distorted by motion artifact, or patient movement, and low perfusion, or low arterial blood flow. Motion artifact can cause conventional pulse oximeters to inaccurately measure the arterial blood oxygen saturation level due mainly to the movement and recognition of venous blood. Venous blood, which is partially depleted of oxygen, may cause falsely low oxygen saturation readings. Low perfusion can also cause the failure of the conventional pulse oximeter to obtain an accurate measurement. Conventional pulse oximeters cannot distinguish oxygenated hemoglobin, or the component of red blood cells that carries oxygen, from dyshemoglobin, which is hemoglobin that is incapable of carrying oxygen. In addition, conventional pulse oximetry readings can also be impacted by bright light and electrical interference from the presence of electrical surgical equipment. Independent, published research shows that conventional pulse oximeters are subject to operating limitations, including:

| | • | | inaccurate measurements, which can lead to the non-detection of a hypoxemic event or improper and unnecessary treatment; |

2

| | • | | false alarms, which occur when the pulse oximeter falsely indicates a drop in the arterial blood oxygen saturation level which can lead to improper therapy, the inefficient use of clinical resources as clinicians respond to false alarms, or the non-detection of a true alarm if clinicians become desensitized to frequently occurring false alarms; and |

| | • | | signal drop-outs, which is the loss of a real-time signal as the monitor attempts to find or distinguish the pulse, which can lead to the non-detection of hypoxemic events. |

Published independent research shows that over 70% of the alarms were false outside the operating room using conventional pulse oximetry. In addition, in the operating room, conventional pulse oximeters failed to give measurements at all due to weak physiological signals, or low perfusion, in approximately 9% of all cases studied. Manufacturers of conventional pulse oximeters have attempted to address some of these limitations, with varying degrees of success. Some devices have attempted to minimize the effects of motion artifact by repeating the last measurement before motion artifact is detected, until a new, clean signal is detected and a new measurement can be displayed, known as freezing values. Other devices have averaged the signal over a longer period of time, known as long-averaging, in an attempt to reduce the effect of brief periods of motion. These solutions, commonly referred to as alarm management techniques, mask the limitations of conventional pulse oximetry. Several published studies have demonstrated that some of these alarm management techniques have actually contributed to increased occurrences of undetected true alarms, or events where hypoxemia occurs, but is not detected by the pulse oximeter.

Conventional pulse oximetry technology also has several practical limitations. Because the technology cannot consistently measure oxygen saturation levels of arterial blood in the presence of motion artifact or low perfusion, the technology is not sufficiently robust to allow for its use in non-critical care settings of the hospital, such as general care areas, where the hospital staff-to-patient ratio is significantly lower. In order for pulse oximetry to become a standard patient monitor in these settings, these limitations must be overcome.

In addition, conventional pulse oximeters cannot distinguish oxygenated hemoglobin, or the component of red blood cells that carries oxygen, from dyshemoglobin, which is hemoglobin that is incapable of carrying oxygen. The most prevalent forms of dyshemoglobins are carboxyhemoglobin and methemoglobin. As a result of these dyshemoglobins, pulse oximeters will report falsely high oxygen levels when they are present in the blood. Although currently there are lab-based tests that detect dyshemoglobins, they are invasive and do not provide immediate or continuous results.

Pulse Oximetry Market Opportunity

The pulse oximetry market consists of pulse oximeters and consumables, including single-patient use and reusable sensors, cables and other pulse oximetry accessories that are primarily sold to the hospital and EMS markets. According to a Frost & Sullivan report dated March 2004, it was estimated that U.S. pulse oximetrysensor market would increase to $622 million by 2010. According to a Frost & Sullivan report dated December 2008, it is estimated that the U.S. pulse oximetryequipment market would increase to $265 million by 2010. Based on these estimates, the total U.S. pulse oximetry market will be $887 million in 2010, with between 6% and 8% CAGR. Frost & Sullivan expects the growth in the U.S. pulse oximetry market to be driven by:

| | • | | ongoing adoption of low perfusion, motion-tolerant technology; |

| | • | | aggressive awareness campaigns; |

| | • | | rising patient acuity, or severity of illnesses, which increases the need for monitoring in the intermediate and sub-acute settings; |

| | • | | expansion of the market for pulse oximetry monitoring to the general surgical floor; |

| | • | | greater efficiencies for the health care worker through increased reliability, improved detection algorithms and the ability to reject false alarms; and |

| | • | | adoption of pulse oximetry outside the hospital and in the faster growing alternate care market. |

Based on this Frost & Sullivan estimate for the U.S. market and other available estimates for markets outside the U.S., we estimate that the worldwide pulse oximetry market will be more than $1.0 billion in 2010. According to the December 2008 Frost & Sullivan report, Masimo and Nellcor each comprised 37.4% of the total U.S. pulse oximetry monitoring equipment market in 2008. According to January 2009 market research report from iData, Masimo and Nellcor had 43.5% and 38.3% respectively of the U.S. pulse oximetry monitoring equipment market. We believe we will continue to grow our U.S. market share amount as more hospitals convert to Masimo technology.

New Market Opportunities for Masimo SET

General Floor Monitoring Expansion

We believe there are opportunities to expand the market for pulse oximetry by applying Masimo SET’s proven benefits from critical care settings to non-critical care settings, as well as settings outside of the hospital. It is currently estimated that over 86% of all U.S.

3

hospital beds are located in non-critical care areas, where continuous monitoring is not widely used. A study published in July 2004, byHealthGrades showed that approximately 264,000 hospital deaths over a three-year period were attributable to patient safety incidents, or generally preventable patient events in non-critical care areas. The study concluded that the failure to timely diagnose and treat patients accounted for over 70% of those deaths, suggesting that improved patient monitoring in non-critical care settings can alert clinicians of patient distress and help to improve patient care. As presented at the Society for Technology in Anesthesia in 2009, a recent study by Dartmouth-Hitchcock Medical Center demonstrated a measurable cost advantage with Patient SafetyNet’s ability to assist clinicians in the identification of the onset of patient distress earlier, contributing to decreases in patient costs on the general care floor.

The American Hospital Association estimated that there were approximately 947,000 staffed beds in all U.S.-registered hospitals in 2004. In 2000, approximately 87% of all hospital beds in the United States were located in non-critical care settings according to a study published in the Journal of Critical Care Medicine, which suggests a non-critical care market potential of approximately 820,000 beds in the U.S. alone. While some of these non-critical care beds have some form of monitoring capabilities today, we believe that approximately 15% of the 820,000 beds in the U.S. alone could become continuous monitoring beds. We believe that Masimo SET’s ability to dramatically minimize false alarms due to patient motion while maximizing the sensitivity of pulse oximeters to report true alarms will allow hospitals to reliably and continuously monitor their patients in the general floors.

Alternate Care

According to the June 2007 Frost & Sullivan report, the fastest growing portion of the U.S. pulse oximetry equipment market is in the alternate care market. We believe that Masimo SET technology offers significant advantages in some segments of this market, including home care and sleep diagnostics. The proven ability of Masimo SET to dramatically reduce false alarms and increase true event detection enables clinicians to make more reliable diagnoses of those who need oxygen therapy and Continuous Positive Airway Pressure, or CPAP, and we plan to leverage the opportunity and expand our presence in this market.

New Market Opportunities for Masimo Rainbow SET

There are opportunities to expand the market for patient monitoring by enabling the measurement of additional blood constituents beyond arterial blood oxygen saturation level and pulse rate by measuring total hemoglobin, carboxyhemoglobin and methemoglobin.

Total Hemoglobin (SpHb®)

In May 2008, we received clearance from the FDA for our total hemoglobin monitoring technology and in September 2008, we began shipping, in a limited market release, these monitors and sensors. Hemoglobin is the part of a red blood cell that carries oxygen to the body and therefore a measurement of total hemoglobin is an indicator of the oxygen carrying capacity of the blood. Because of its clinical importance, hemoglobin is one of the most commonly ordered lab diagnostic tests in the hospital and physician office. Each year in the United States, over 400 million invasive hemoglobin tests are performed, which require multiple steps including collecting the patient’s blood sample, and most often transferring the sample to the lab, analyzing the sample and documenting the results and reporting the results to the ordering clinician.

According to a 2007 study published inSurgery, unnecessary blood transfusions in a surgical setting account for between 9 - 44% of all transfusion costs. Bleeding during surgery may require a blood transfusion, which increases the length of hospital stays and the associated healthcare costs. The decision to transfuse often requires the physician to either make an educated guess or wait for lab results to confirm that it is necessary. Our Rainbow SET technology can provide noninvasive and continuous hemoglobin measurements to the clinician, typically within 90 seconds after placing our Rainbow sensor on a patient’s finger.

We believe that the ability to measure total hemoglobin on a noninvasive, immediate and continuous basis will, enable clinicians in surgery, ICU, emergency department, and other hospital settings to make earlier and better treatment decisions, including the detection of bleeding earlier and the decision of whether or not to transfuse, thus potentially decreasing costs. Because of the significant clinical and cost advantages of measuring total hemoglobin noninvasively and continuously, we believe that a large number of hospitals will adopt Masimo Rainbow SET technology because of our total hemoglobin measurement.

A significant portion of invasive hemoglobin measurements are made outside of hospital settings, in the physician office to aid diagnosis and treatment, and in the blood donation market to qualify potential donors for eligibility to donate blood. We believe that a significant number of the estimated 200,000 U.S. physician offices and estimated 15 million annual U.S. blood donations would be aided by the noninvasive and immediate assessment of hemoglobin. While we believe that these market opportunities will eventually become significant, we do not expect any expansion into these specific markets until 2010.

Carboxyhemoglobin (SpCO®)

Carbon monoxide is a colorless, odorless and tasteless gas that is undetectable by humans and is often unknowingly inhaled from combustion fumes, or during fires by victims and first responders. Carbon monoxide poisoning is the leading cause of accidental

4

poisoning death in the U.S., responsible for up to 50,000 emergency department visits and 500 unintentional deaths annually. Carbon monoxide poisoning, which involves carbon monoxide binding with hemoglobin cells, thereby preventing them from carrying oxygen, can cause severe neurological damage, permanent heart damage or death in a matter of minutes. Quick diagnosis and treatment of carbon monoxide poisoning is critical in saving lives and preventing long-term damage, but the condition is often misdiagnosed because symptoms are similar to the flu.

Masimo’s ability to noninvasively detect carbon monoxide has allowed clinicians and emergency professionals to identify carbon monoxide poisoning earlier, allowing faster triage and earlier intervention and treatment. A recent study in the emergency department using Masimo Rainbow SET carbon monoxide monitoring identified 60% more carbon monoxide poisoning cases than the conventional approach, and estimated that as many as 11,000 carbon monoxide poisoning cases per year in the U.S. were being missed with the conventional approach. Several leading emergency first responder associations, including the National Association of Emergency Medical Technicians, the National Association of EMS Educators and the International Association of Fire Fighters, have in the past 18 months issued recommendations to noninvasively screen for carbon monoxide poisoning when exposure is suspected or when an individual presents with symptoms of such poisoning. In addition the National Fire Protection Association, or NFPA, included carbon monoxide screening by Pulse CO-Oximetry as part of a new national healthcare standard for firefighters potentially exposed to carbon monoxide poisoning. NFPA’s consensus codes and standards serve as the worldwide authoritative source on fire prevention and public safety.

In addition, the United Kingdom House of Commons All Party Parliamentary Gas Safety Group, in a newly-published report aimed at increasing the awareness of carbon monoxide poisoning among medical professionals, and recommends noninvasive carbon monoxide testing for Emergency Department and EMS providers as a way to improve the country’s rate of detection and diagnosis of carbon monoxide poisoning. For the preparation of this report, the United Kingdom Group used Masimo Rainbow SET Rad-57 devices for 12 months and reported successful cases with the Rad-57 devices. In the U.S., Medicare recently approved a Current Procedural Terminology, or CPT, code and pricing for carboxyhemoglobin, enabling hospitals that perform testing to recoup their costs, in addition to the clinical benefits they receive.

We believe that the first opportunity for noninvasive blood carbon monoxide monitoring is in the EMS and emergency department settings. In the U.S. alone, there are approximately 30,000 fire departments / EMS locations and 5,000 hospitals that would benefit from noninvasive carbon monoxide testing. We believe other opportunities exist for Carboxyhemoglobin monitoring, including the pre-operative setting.

Methemoglobin (SpMet®)

Commonly prescribed drugs can introduce methemoglobin into the blood and cause methemoglobinemia. Some of the 30 drugs that are known to cause methemoglobinemia are benzocaine, a local anesthetic, which is routinely used in procedures ranging from endoscopy to surgery; inhaled nitric oxide, routinely used in the Neonatal Intensive Care Unit; nitroglycerin used to treat cardiac patients and dapsone, used to treat infections for immune deficient patients, such as HIV patients. Methemoglobinemia reduces the amount of oxygen bound to hemoglobin for delivery to tissues and forces normal hemoglobin to bind more tightly to oxygen, releasing less oxygen to the tissues. Methemoglobinemia is often unrecognized or diagnosed late, increasing risk to the patient.

According to a study published by researchers at Johns Hopkins University in September 2004, there were 414 cases, or 19% of all patients reviewed, of acquired methemoglobinemia, at two hospitals over a 28-month period. The methemoglobinemia resulted in one fatality and three near-fatalities. Warnings, cautions and alerts regarding the clinical significance and prevalence of methemoglobinemia have been generated by the FDA, Veterans Administration, Institute for Safe Medication Practices, and the National Academy of Clinical Biochemistry. The American Academy of Pediatrics recommends monitoring methemoglobin levels in infants who receive nitric oxide therapy. In the U.S., Medicare recently approved a CPT code and pricing for our methemoglobin monitoring, enabling hospitals who perform testing to recoup their costs, in addition to the clinical benefits they receive.

We believe the initial opportunity for methemoglobin monitoring is in outpatient procedure labs in hospitals, such as esophageal echocardiography and gastrointestinal labs where use of caines, such as benzocaine, is prevalent, monitoring HIV patients who receive dapsone, as well as monitoring neonates who receive inspired nitric oxide in the neonatal intensive care units.

Plethysmograph Variability Index (PVI®)

Plethysmograph Variability Index, or PVI, is a noninvasive measurement that quantifies changes in the plethysmographic waveform over the respiration cycle. PVI may help optimize fluid status, a critical factor during surgery and in intensive care. Traditional methods such as invasive pressure monitoring often fail to predict fluid responsiveness, and newer methods are also invasive and costly. PVI has been shown by one research group to predict fluid responsiveness in surgical and intensive care patients. Optimizing fluid status has been shown to improve patient outcomes in previously published studies, so we believe that PVI will be helpful in patient management as well.

We believe the primary opportunity for PVI monitoring is in surgery and intensive care in hospitals, but it is also possible that future studies may reveal application in identifying dehydration or in optimizing fluid in cardiac conditions such as heart failure.

5

Future Parameters

We believe that our core signal processing and sensor technologies are widely applicable and expect to develop and launch future applications utilizing our proprietary technology platforms.

In the second half of 2009, we expect to introduce, in limited market release, a noninvasive and continuous respiration rate parameter based on acoustic monitoring SET. Respiration rate is defined as the number of breaths per minute, and changes in respiration rate provide an early warning sign of deterioration in patient condition. Current methods to monitor respiration rate include end tidal CO2 monitoring, which requires a special tube inserted in the patient’s nose, and impedance monitoring, which is considered cumbersome to the clinician and patient and unreliable. Masimo’s noninvasive respiration rate parameter will be available in our Masimo Rainbow SET platforms such as Radical-7 and Rad 87 bedside monitoring devices, with the launch of MX-3 Board, slated for release in the second half of fiscal 2009. These devices will be deployed through an acoustic respiration sensor on the patient’s neck and connected to the bedside monitor with a special cable. Should the respiration rate change or stop, an alarm will be displayed on the device and in addition, can be sent to the Masimo Patent SafetyNet system, which can notify the attending clinician or nurse of the condition, directly on the monitor or remotely via a pager. We believe this noninvasive measurement will become a key and important measurement in both critical care and general floor environments.

The Masimo Solution

Our innovative and proprietary technologies and products are designed to overcome the primary limitations of conventional pulse oximetry, which involve maintaining accuracy in the presence of motion artifact and weak signal-to-noise situations. Our Masimo SET platform, which became available to hospitals in the United States in 1998, is the basis of our pulse oximetry products and we believe represented the first significant technological advancement in pulse oximetry since its introduction in the early 1980s. In addition, our products’ benefits have been validated in over 100 independent clinical and laboratory studies.

Masimo SET utilizes five signal processing algorithms, four of which are proprietary, in parallel, to deliver high precision, sensitivity and specificity in the measurement of arterial blood oxygen saturation levels. Sensitivity is the ability to detect true events and specificity is the ability to reject false alarms. One of our proprietary processing algorithms, Discrete Saturation Transform, separates signal from noise in real-time through the use of adaptive filtering, and an iterative sampling technique that tests each possible saturation value for validity. Masimo SET signal processing can therefore identify the venous blood and other noise, isolate them, and extract the arterial signal.

To complement our Masimo SET platform, we have developed a wide range of proprietary single-patient use and reusable sensors, cables and other accessories designed specifically to work with Masimo SET software and hardware. Although our technology platforms operate solely with our proprietary sensor lines, our sensors have the capability to work with certain competitive pulse oximetry monitors through the use of adapter cables. Our neonatal adhesive sensors have been clinically proven to exhibit greater durability compared to competitive sensors.

In 2005, we introduced our Masimo Rainbow SET platform, leveraging our Masimo SET technology and incorporating licensed Rainbow technology to enable reliable, real-time monitoring of additional parameters beyond arterial blood oxygen saturation and pulse rate. The Masimo Rainbow SET platform has the unique ability to distinguish oxygenated hemoglobins from certain dyshemoglobins, hemoglobin incapable of transporting oxygen, and allows for the rapid, noninvasive monitoring of total hemoglobin, carboxyhemoglobin, methemoglobin and PVI, which we refer to as Pulse CO-Oximetry. Along with the release of our Rainbow SET Pulse CO-Oximetry products, we have developed multi-wavelength sensors that have the ability to monitor multiple parameters with a single sensor. We believe that the use of Masimo Rainbow SET Pulse CO-Oximetry products will become widely adopted for the noninvasive monitoring of these parameters.

Additionally, we market our Patient SafetyNet and RadNet remote-alarm and monitoring systems for use with our Masimo SET pulse oximeters and Rainbow SET Pulse CO-Oximeters. These systems currently allow wireless and remote monitoring of the oxygen saturation and pulse rate of up to 40 patients simultaneously, and may facilitate the expansion of our products into areas beyond the critical care settings, such as the general care areas. We believe that the superior performance of the Masimo SET platform coupled with reliable, cost effective, and easy to use wireless remote monitoring will allow hospitals to create continuous surveillance solutions on general care floors where patients are at risk of avoidable adverse events and where direct patient observation by skilled clinicians is cost prohibitive.

Benefits of Our Products and Technology

We believe that our technology and products offer several key benefits, including:

| | • | | Accurate, Real-Time Measurement. We believe that the Masimo SET platform has the ability to provide more accurate measurements with fewer missed events and false alarms than other pulse oximeters in the market place. Many of the top hospitals in the United States, including four of the top five, according to “U.S. News and World Reports Honor Roll” for |

6

| | 2008, made Masimo SET their primary pulse oximetry platform. We believe Masimo Rainbow SET will allow noninvasive measurement of previously invasive parameters, such as total hemoglobin. |

| | • | | Increased Quality of Patient Care. We believe that the proven accuracy and reliability of Masimo SET pulse oximetry allows for better clinical decisions, leading to fewer medical errors and better patient care. We believe that the noninvasive monitoring of carboxyhemoglobin will improve the quality of care based on the number of emergency room visits reported for carbon monoxide poisoning. We believe the noninvasive monitoring of methemoglobin will also improve patient care based on reported drug interactions that increase methemoglobin levels in the blood. We believe wireless remote-alarm and monitoring on the general care floor will reduce avoidable adverse events through earlier detection and intervention. We believe Masimo Rainbow SET will allow earlier and better clinical decisions in a variety of care areas. |

| | • | | Reduced Cost of Care. Several independent studies have shown that hospitals can reduce their costs as a result of using Masimo SET products. We believe that factors contributing to lower costs include a reduction in sensor usage as a result of more durable sensors, fewer invasive arterial blood gas procedures needed, less oxygen administration and a reduction in length of stay as the result of weaning patients off of ventilators more quickly. In addition, we expect that the noninvasive monitoring of carboxyhemoglobin and methemoglobin will help reduce the cost of care by reducing the need for invasive blood tests and limiting the costs from complications caused by incorrect diagnoses. We believe early detection of avoidable adverse events will contribute to lower length of stay because such events will be treated earlier before patients decompensate to critical levels. We believe earlier and better clinical decisions from Masimo Rainbow SET will allow for more cost-effective care and in some cases reimbursable procedures for hospitals and non-hospital providers. |

| | • | | Masimo SET Platform Allows for Expansion into Non-Critical Care Settings. We believe the ability of Masimo SET products to provide reliable monitoring with fewer false alarms has expanded and will continue to expand the use of pulse oximetry into other settings where patient motion and false alarms have historically prevented its use. Since the introduction of Masimo SET, we believe that pulse oximetry has become a standard of care in the EMS market. In addition, hospitals and other care centers can reduce their costs by moving less critically ill patients from the ICU to the general care areas where these patients can be continuously and accurately monitored in a more cost-effective manner. Many patients in the general care areas are at risk of dying due to inadequate oxygenation. To mitigate this risk, patients in the general care areas need to be continuously monitored. Our Patient SafetyNet and RadNet systems enable the Masimo SET and Rainbow SET platforms to wirelessly and remotely monitor patients in the general care areas of the hospital that are not under the constant supervision of clinicians. |

| | • | | Upgradeable Rainbow Platform for the Monitoring of Additional Parameters. Products with our new MX circuit board contain our Masimo SET pulse oximetry technology as well as circuitry to support Rainbow parameters. At the time of purchase, or at any time in the future, our customers and our OEMs’ customers will have the option of purchasing a software parameter, which will allow the customer to expand their patient monitoring systems to monitor additional parameters with a cost-effective solution. |

Our Strategy

Since inception, our mission has been to develop noninvasive blood constituent patient monitoring solutions that improve patient outcomes and reduce the cost of patient care. We intend to continue to grow our business and to improve our market position by pursuing the following strategies:

| | • | | Continue to Expand Our Market Share in Pulse Oximetry. We grew our product revenue from $107.6 million in 2005 to $258.9 million in 2008, representing a three year CAGR of approximately 34.0%. This growth can be attributed to the increased access to pulse oximetry customers through our agreements with group purchasing organizations, or GPOs, and our increased relationships with OEM partners, the expansion of our direct sales force, and strong, independent clinical evidence that demonstrates the benefits of our technology. We supplement our direct sales with sales through our distributors. Direct and distributor sales increased to approximately $201.1 million, or 77.7%, of product revenue in 2008, from $69.1 million, or 64.2%, of product revenue in 2005. |

| | • | | Expand the Pulse Oximetry Market to Other Patient Care Settings. We believe the ability to continuously and accurately monitor patients outside of critical care settings, including the general care areas of the hospital, are currently unmet medical needs and have the potential to significantly improve patient care and increase the size of the pulse oximetry market. We believe the ability of Masimo SET to accurately monitor and address the limitations of conventional pulse oximetry has enabled, and will continue to enable, us to expand into non-critical care settings and thus significantly expand the market for our products. To further support our expansion into the general care areas, we market two wireless floor monitoring solutions, Patient SafetyNet and RadNet, that currently enable continuous monitoring of up to 40 patients’ oxygen saturation and pulse rate with one system, utilizing our Masimo SET or Masimo Rainbow SET platform. |

7

| | • | | Expand the use of Rainbow SET Pulse CO-Oximetry in the Hospital Setting. We believe the noninvasive measurement of total hemoglobin, carboxyhemoglobin, methemoglobin, PVI, and future parameters will provide an excellent opportunity to leverage existing customer relationships into new streams of revenue, directly and through a greater ability to convert non-Masimo hospitals to Masimo hospitals due to our expanded measurement capabilities. |

| | • | | Expand the use of Rainbow SET in the Non-Hospital Setting.We believe the noninvasive measurement of hemoglobin creates a significant opportunity in markets such as the physician office and blood donation centers, and noninvasive carboxyhemoglobin in the Fire/EMS market. By 2010, we expect to introduce a new handheld product called the Pronto into the Physician Office. The Pronto will allow non-hospital users to simply and quickly measure hemoglobin, one of the most common invasive laboratory measurements. We believe that the ability to noninvasively measure total hemoglobin will greatly facilitate the efficiency with which physicians will be able to quickly determine total hemoglobin levels of their patients, by reducing invasive blood draws, labeling, sending to the lab, waiting for the lab results, and communicating these results to the patient (usually the next day). |

| | • | | Utilize Our Customer Base and OEM Relationships to Market Our Masimo Rainbow SET Pulse CO-Oximetry Products Incorporating Licensed Rainbow Technology. We sold our first Masimo Rainbow SET Pulse CO-Oximetry products in September 2005. We are currently selling our Rainbow SET products through our direct sales force and distributors. In addition, we plan to sell our MX circuit boards in our own pulse oximeters and to our OEM partners, equipped with circuitry to support Rainbow SET Pulse CO-Oximetry parameters which can be activated at time of sale or through a subsequent software upgrade. We believe that the clinical need of these measurements along with our installed customer base will help drive the adoption of our Rainbow SET Pulse CO-Oximetry products. |

| | • | | Continue to Innovate and Maintain Our Technology Leadership Position. We invented and pioneered what we believe is the first pulse oximeter to accurately measure arterial blood oxygen saturation level and pulse rate in the presence of motion artifact and low perfusion. In addition, through our license of Rainbow technology from Masimo Labs, we launched our Rainbow SET Pulse CO-Oximetry platform that enabled what we believe are the first FDA-cleared noninvasive monitoring of carboxyhemoglobin and methemoglobin in the blood. We also developed PVI. We plan to continue to innovate and develop new technologies and products internally and through our collaboration with Masimo Labs, for the noninvasive monitoring of other parameters. |

Our future growth strategy is also closely tied to our focus on international expansion opportunities. Historically, we have generated between 75% to 80% of our revenues in the United States. Since 2006, we have been aggressively expanding our sales and marketing presence in Europe, Japan, Canada, Latin America and the rest of Asia. We have accomplished this through both additional staffing and by adding or expanding sales offices in many of these territories. During the fourth quarter of 2008, we established a new international business structure designed to better serve and support our growing international business. By centralizing our international operations, including sales management, marketing, customer support, planning, logistics and administrative functions, we believe it will be able to develop a more efficient and scalable international organization—capable of being even more responsive to the business needs of its international customers—all under one centralized management structure. As a result of these investments and focus on our international operations, we believe that our international product revenues, as a percent of total product revenues, will continue to increase.

Our Products

We develop, manufacture and market a patient monitoring solution that incorporates a monitor or circuit board and sensors including both proprietary single-patient use and reusable sensors and cables. In addition, we offer remote-alarm/monitoring solutions and software.

The following chart summarizes our principal product components and principal markets and methods of distribution:

| | | | |

Product Components | | Description | | Markets and Methods of Distribution |

Patient Monitoring Solutions: | | | | |

Circuit Boards (e.g. MX-1) | | • Signal processing apparatus for all Masimo SET and licensed Masimo Rainbow SET technology platforms | | Incorporated into our proprietary pulse oximeters and sold to OEM partners who incorporate our circuit boards into their patient monitoring systems |

| | |

Pulse CO-Oximeters/Monitors and Pulse Oximeters (e.g Radical-7) | | • Bedside and handheld monitoring devices that incorporate Masimo SET with and without licensed Masimo Rainbow SET technology | | Sold directly to end-users and through distributors and in some cases to our OEM partners who sell to end-users |

8

| | | | |

Product Components | | Description | | Markets and Methods of Distribution |

| | |

Sensors (e.g. Rainbow and Non-Rainbow Sensors) | | • Extensive line of both single-patient use and reusable sensors • Patient cables, as well as adapter cables that enable the use of our sensors on certain competitive monitors | | Sold directly to end-users and through distributors and to OEM partners who sell to end-users |

| | |

Remote Alarm and Monitoring Solutions (e.g. Patient Safety Net) | | • Network-linked wired or wireless, multiple patient floor monitoring solutions • Standalone wireless alarm notification solutions | | Sold directly to end-users |

| | |

| Software (e.g. SpHb, SpCO, SpMet, PVI) | | • Rainbow parameters and other proprietary features sold to installed monitors | | Sold directly to end-users and through OEM partners who sell to end-users |

Circuit Boards

Masimo SET MS Circuit Boards. Our Masimo SET MS circuit boards perform all signal processing and other pulse oximetry functions incorporating the Masimo SET platform. Our MS circuit boards are included in our proprietary monitors for direct sale or sold to our OEM partners for incorporation into their monitors. Once incorporated into a pulse oximeter, the MS circuit boards perform all data acquisition processing and report the pulse oximetry levels to the host monitor. The circuit boards and related software interface directly with our proprietary sensors to calculate arterial blood oxygen saturation level and pulse rate. Our latest generation boards include the MS-2003, MS-2011 and MS-2013. Our older generation boards, including the MS-1, MS-3, MS-5, MS-7, MS-11 and MS-13 circuit boards, which all vary in size and power consumption, have been made obsolete and are being transitioned out of our MS OEM Board family.

Masimo Rainbow SET MX Circuit Boards. Our next-generation circuit board is the foundation for our Masimo Rainbow SET Pulse CO-Oximetry platform, utilizing technology licensed from Masimo Labs. The MX circuit boards measure arterial blood oxygen saturation levels and pulse rate, and have the circuitry to enable the measurement of total hemoglobin, oxygen content, carboxyhemoglobin, methemoglobin, PVI and potentially other parameters. Customers can choose to buy additional parameters beyond arterial blood oxygen saturation levels and pulse rate at the time of sale or at any time in the future through a field-installed software upgrade. As additional parameters are developed, each new parameter may be available as a software upgrade to the existing system.

Pulse CO-Oximeters/Monitors and Pulse Oximeters

Radical-7. We believe that the Radical-7 pulse CO-Oximeter is the most advanced and versatile oximetry monitor available. The Radical-7 incorporates the MX circuit board, which enables all Rainbow SET parameters, and offers three-in-one capability to be used as:

| | • | | a standalone device for bedside monitoring; |

| | • | | a detachable, battery-operated handheld unit for easy portable monitoring; and |

| | • | | a monitor interface via SatShare, proprietary technology allowing our products to work with certain competitor products, to upgrade existing conventional multi-parameter patient monitors to Masimo SET while displaying Rainbow parameters on the Radical-7 itself. |

Radical-7 is a fully-equipped standalone pulse CO-Oximeter with a detachable module, which functions as a battery-operated, handheld monitor. The handheld module can be connected with any other Radical-7 base station, which allows Radical-7 to stay with the patient, enabling continuous and reliable arterial blood oxygen saturation and blood constituent monitoring such as total hemoglobin as patients are transported within the hospital. For example, Radical-7 can continuously monitor a patient from the ambulatory environment, to the emergency room, to the operating room, to the general floor, and on until the patient is discharged. Radical-7 delivers the accuracy and reliability of Masimo Rainbow SET with multi-functionality, ease of use and a convenient upgrade path for existing monitors.

Our SatShare technology enables a conventional monitor to upgrade to Masimo SET through a simple cable connection from the back of Radical-7 to the sensor input port of the conventional monitor. No software upgrades or new modules are necessary for the upgrade,

9

which can be completed in minutes. SatShare allows hospitals to standardize the technology and sensors used throughout the hospital while allowing them to gain more accurate monitoring capabilities and additional multi-functionality in a cost-effective manner. This has facilitated many hospital-wide conversions of previously installed competitor monitors to Masimo SET. In addition, Masimo Rainbow SET parameters such as total hemoglobin are available to clinicians on the Radical-7 itself while the device is being used in SatShare mode.

Rad-87. The Rad-87, which also contains Masimo Rainbow SET technology, is a compact, lightweight and easy-to-use device designed specifically for use in less acute settings than the Radical-7. The Rad-87 is available with a built-in bi-directional wireless radio for use as part of the Masimo Patient SafetyNet remote monitoring and clinician notification system. We began shipping the Rad-87 in July 2008.

Pronto. The Pronto is a handheld spot-check device, using Masimo Rainbow SET technology, specifically designed to noninvasively provide total hemoglobin levels in a physician office, clinic, or blood donation setting. Additionally, the device provides arterial oxygen saturation and pulse rate readings. The Pronto does not provide continuous monitoring. We received FDA clearance for the Pronto in December 2008 and expect to begin shipping the product, under a limited market release program, in the first half of 2009.

Rad-8. The Rad-8 is a bedside pulse oximeter featuring Masimo SET (but without Rainbow capability) with a low cost design and streamlined feature set, allowing it to be offered at a lower price point than the Radical-7 or Rad-87.

Rad-5. In addition to the bedside monitors, we have developed handheld pulse oximeters using Masimo SET. Our Rad-5 and Rad-5v handheld oximeters were the first dedicated handhelds with Masimo SET.

Rad-57. The Rad-57 is a fully featured handheld pulse CO-Oximeter that provides continuous, noninvasive measurement of carboxyhemoglobin and methemoglobin in addition to oxygen saturation, pulse rate, perfusion and index. Its rugged and lightweight design makes it applicable for use in hospital and field settings, specifically for fire departments and EMS units.

Sensors

Sensors and Cables. We have developed one of the broadest lines of single-patient use and reusable sensors and cables. Masimo SET sensors are uniquely designed to reduce interference from physiological and non-physiological noise. Our proprietary technology platforms operate only with our proprietary sensor lines. However, through the use of adapter cables, we can connect our sensors to certain competitive pulse oximetry monitors. We sell our sensors and cables to end-users through our direct sales force and our distributors and OEM partners.

Our single-patient use sensors offer several advantages over reusable sensors, including improved performance, cleanliness, increased comfort and greater reliability. In addition, our LNOP single-patient use sensors offer several advantages over competitive disposable sensors, including a more durable tape material that is less likely to tear and an adhesive that can be easily rejuvenated with an alcohol swab. As a result, the sensor can be moved and reapplied multiple times during a patient’s stay. Our LNOP single-patient neonatal adhesive sensors have been shown in independent, published studies to last approximately twice as long as the market-leading disposable sensor. Our reusable sensors, which include ear and forehead sensors, are primarily used for short-term hospital stays and spot checks. We currently sell over 40 different sensors for adults, children, infants and pre-term infants.

SofTouch Sensors. We have developed SofTouch sensors, designed with less adhesive or no adhesive at all for compromised skin conditions. These include single-patient sensors for babies and multi-site reusable sensors for pediatrics and adults.

Trauma and Newborn Sensors. We believe we were the first to develop two specialty sensor lines, specifically designed for trauma and resuscitation situations, as well as for newborns. These sensors contain an identifier which automatically sets the oximeter to monitor with maximum sensitivity and the shortest-averaging mode and allows for quick application, even in wet and slippery environments.

Blue Sensors. In 2005, we introduced what we believe to be the first FDA-cleared sensor to accurately monitor arterial blood oxygen saturation levels in cyanotic infants and children with abnormally low oxygen saturation levels.

Masimo Rainbow SET Sensors. We believe we were the first to develop proprietary, multi-wavelength sensors for use with our Rainbow SET Pulse CO-Oximetry products. As opposed to traditional sensors that only have the capability to monitor arterial blood oxygen saturation levels and pulse rate, our Rainbow sensors can also monitor carboxyhemoglobin, methemoglobin and total hemoglobin. Our licensed Rainbow SET sensors are the only sensors that are compatible with our licensed Rainbow SET products.

Remote-Alarm and Monitoring Solutions

Patient SafetyNet. Patient SafetyNet is a remote monitoring and clinician notification system. It instantly routes bedside-generated alarms through a server to a qualified clinician’s handheld paging device in real-time. Each system can support up to 40 bedside monitors and can either be integrated into a hospital’s existing IT infrastructure or operate as a stand-alone wireless network.

10

RadNet. RadNet enables Masimo SET and Rainbow SET monitors with a wired or wireless monitoring system to provide continuous, centralized monitoring of remotely located patients, with the ability to monitor up to 40 patients per system.

PPO+. PPO+, or Personal Pulse Oximeter, is a patient-wearable pulse oximeter and electrocardiogram, or ECG, monitor that can wirelessly transmit patients’ arterial blood oxygen saturation level, pulse rate and ECG to the RadNet. PPO+ is ideally suited for monitoring ambulatory patients in the general care areas, emergency department, emergency department waiting room and any other area where the patient is ambulatory.

Both RadNet and PPO+ are OEM products from Welch Allyn.

Software.

All of our monitors, including Radical-7 and certain future OEM products, which incorporate the MX board, will allow purchases of software for Rainbow parameters as well as other future parameters or features that can be field installed.

Geographic information

We are a global company with a geographically diverse market presence. See Note 14 to our consolidated financial statements for financial information relating to the geographic areas in which we currently engage in business.

Sales and Marketing

As of January 3, 2009, we had 324 employees in sales and marketing in the United States and abroad, including 138 sales representatives. We expect to continue to increase our worldwide sales and sales support organizations as we continue to expand our presence throughout both the United States and throughout the world including Europe, the Middle East, Japan, Asia, Latin America, Canada and Australia. We currently sell all of our products both directly to hospitals and the EMS market via our sales force, and certain distributors.

Our direct and distributor revenue accounted for approximately 77.7% of our total product revenue in 2008. The primary focus of our sales representatives is to facilitate the conversion of competitor accounts to our Masimo SET pulse oximetry products. In addition to sales representatives, we employ clinical specialists to work with our sales representatives to educate end-users on the benefits of Masimo SET and assist with the introduction and implementation of our technology and products to their sites. Our sales and marketing strategy for pulse oximetry has been and will continue to be focused on building end-user awareness of the clinical and cost-saving benefits of our Masimo SET platform. More recently, we have expanded this communication and educational role to include our Masimo Rainbow SET Pulse CO-Oximetry products, including total hemoglobin, carboxyhemoglobin, methemoglobin and PVI. For the year ended January 3, 2009, Owens & Minor, one of our distributors, represented 11.6% of our total revenue and was the only customer that represented 10% or more of our revenue for the year ended January 3, 2009. Importantly, distributors such as Owens & Minor take and fulfill orders from our direct customers, many of whom have signed long-term sensor agreements with us. As a result, in the event a specific distributor is unable to fulfill these orders, the orders will be redirected to other distributors or fulfilled directly by us.

Additionally, we sell certain of our products through our OEM partners who both incorporate our boards into their monitors and resell our sensors to their customers’ installed base of Masimo SET products. Our OEM agreements allow us to expand the availability of Masimo SET through the sales and distribution channels of each OEM partner. To facilitate clinician awareness of Masimo SET installations, all of our OEM partners have agreed to place the Masimo SET logo prominently on their instruments. As of January 3, 2009, we had agreements with 53 OEM partners whom we believe accounted for over 90% of worldwide shipments of pulse oximeters incorporated into multi-parameter monitors. As of January 3, 2009, our OEM partners had collectively launched a total of approximately 127 patient monitoring products worldwide incorporating Masimo SET.

In order to facilitate our direct sales to hospitals, we have signed contracts with companies that we believe to be the six largest GPOs, based on the total volume of negotiated purchases. In return for the GPOs to put our products on contract, we have agreed to pay the GPOs a percentage of our revenue from their member hospitals. In 2008 and 2007, revenue from the sale of our pulse oximetry products to hospitals that are associated with GPOs amounted to $132.1 million and $101.0 million, respectively.

Our marketing efforts are designed to build end-user awareness through advertising, direct mail and trade shows. In addition, we distribute published clinical studies, sponsor accredited educational seminars for doctors, nurses, biomedical engineers, and respiratory therapists and conduct clinical evaluations. We expect to increase the size of our sales and marketing force worldwide during 2009, as we continue to establish and expand our sales channels on a global basis.

11

Competition

The medical device industry is highly competitive and many of our competitors have substantially greater financial, technical, marketing and other resources than we do. While we regard any company that sells pulse oximeters as a potential customer, we also recognize that the companies selling pulse oximeters on an OEM basis and/or pulse oximetry sensors are also potential competitors. Our primary competitor, Covidien Ltd. (formerly Tyco Healthcare) and its subsidiary Nellcor Puritan Bennett, Inc., currently hold a substantial share of the pulse oximetry market. Covidien sells its own brand of Nellcor pulse oximeters to end-users, sells pulse oximetry modules to other monitoring companies on an OEM basis and licenses, to certain OEMs, the right to make their pulse oximetry platforms compatible with Nellcor sensors. Although Nellcor is still a competitor of ours, in 2006 we settled a patent infringement case against them following an appellate ruling which found that Nellcor had infringed three of our patents. See “—Nellcor Patent Litigation Settlement” in Item 7—“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We face substantial competition from larger medical device companies, including companies that develop products that compete with our proprietary Masimo SET. We believe that a number of companies have announced products which claim to offer measure-through motion accuracy. Based on those announcements and our investigations, we further believe that many of these products include technology that infringes our intellectual property rights. We have settled claims against some of these companies and intend to vigorously enforce and protect our proprietary rights with respect to the others whom we believe are infringing our technology. On February 3, 2009, we filed a patent infringement suit against Phillips Electronics North America Corporation and Philips Medizin Systeme Böblingen Gmbh, which are affiliates of Philips Medical Systems, one of our OEM partners. Some of the remaining companies, including GE Medical Systems and Mindray Medical International Ltd., are also currently OEM partners of ours.

We believe that the principal competitive factors in the market for pulse oximetry products include:

| | • | | accurate monitoring during both patient motion and low perfusion; |

| | • | | ability to introduce other clinically beneficial parameters related to oxygenation and respiration, such as carboxyhemoglobin and methemoglobin; |

| | • | | sales and marketing capability; |

| | • | | access to hospitals which are members of GPOs; |

| | • | | access to OEM partners; and |

Masimo Laboratories, Inc.

Masimo Laboratories, Inc., or Masimo Labs, is an independent entity spun-off from us to our stockholders in 1998. Joe E. Kiani and Jack Lasersohn, members of our board of directors, are also members of the board of directors of Masimo Labs. Joe E. Kiani, our Chairman and Chief Executive Officer, is also the Chairman and Chief Executive Officer of Masimo Labs.

We have a cross-licensing agreement with Masimo Labs for certain technologies. The following table outlines our rights under the Cross-Licensing Agreement relating to specific end user markets and the related technology applications of specific parameters.

| | | | |

| | | End User Markets |

Parameters | | Professional Caregiver and EMS | | Patient and Pharmacist |

Vital Signs(1) | | Masimo (owns) | | Masimo Labs (non-exclusive license) |

Non-Vital Signs(2) | | Masimo (exclusive license) | | Masimo Labs (owns) |

(1) | Vital Signs parameters include SpO2, peripheral venous oxygen saturation, mixed venous oxygen saturation, fetal oximetry, sudden infant death syndrome, ECG, blood pressure (noninvasive blood pressure, invasive blood pressure and continuous non- invasive blood pressure), temperature, respiration rate, CO2, pulse rate, cardiac output, EEG, perfusion index, depth of anesthesia, cerebral oximetry, tissue oximetry and/or EMG, and associated features derived from these parameters, such as 3-D alarms, Pleth Variability Index and other features. |

(2) | Non-Vital Signs parameters include the body fluid constituents other than vital signs parameters and include, but are not limited to, carbon monoxide, methemoglobin, blood glucose, total hemoglobin and bilirubin. |

Our License to Masimo Labs. We granted Masimo Labs an exclusive, perpetual and worldwide license, with sublicense rights, to use all Masimo SET owned by us for the measurement of non-vital signs parameters and to develop and sell devices incorporating Masimo SET for monitoring non-vital signs parameters in the Labs Market. We also granted Masimo Labs a non-exclusive, perpetual

12

and worldwide license, with sublicense rights, to use Masimo SET for the measurement of vital signs in the Labs Market. In exchange, Masimo Labs pays us a 10% royalty on the amount of vital signs sensors and accessories sold by Masimo Labs.

The Labs Market is defined as any product market in which a product is intended to be used by a patient or pharmacist rather than a professional medical caregiver regardless of the particular location of the sale, including sales to doctors, hospitals, EMS professionals or otherwise, provided the product is intended to be recommended, or resold, for use by the patient or pharmacist.

Masimo Labs’ License to Us. We exclusively licensed from Masimo Labs the right to make and distribute products in the Masimo Market that utilize Rainbow technology for the measurement of carbon monoxide, methemoglobin, fractional arterial oxygen saturation, and total hemoglobin, which includes hematocrit. To date, we have developed and commercially released devices that measure carbon monoxide and methemoglobin using licensed Rainbow technology. We also have the option to obtain the exclusive license to make and distribute products in the Masimo Market that utilize Rainbow technology for the measurement of other non-vital signs parameters, including blood glucose. These licenses are exclusive until the later of 20 years from the grant of the applicable license or the expiration of the last patent included in the Rainbow technology related to the applicable parameter.

The Masimo Market is defined as those product markets where the product is intended to be used by a professional medical caregiver, including hospital caregivers, surgicenter caregivers, paramedic vehicle caregivers, doctor’s offices caregivers, EMS facility caregivers and vehicles where emergency medical services are provided.

Our license to Rainbow technology for these parameters in these markets is exclusive on the condition that we continue to pay Masimo Labs royalties on our products incorporating Rainbow technology, subject to certain minimum unit and aggregate royalty thresholds, and that we use commercially reasonable efforts to develop or market products incorporating the licensed Rainbow technology. The royalty is up to 10% of the Rainbow royalty base, which includes handhelds, tabletop and multi-parameter devices. Handheld products incorporating Rainbow technology will carry a 10% royalty rate. For other products, only the proportional amount attributable for that portion of our products used to measure non-vital signs parameters, sensors and accessories, rather than for measuring vital signs parameters, will be included in the 10% Rainbow royalty base. For multi-parameter devices, the Rainbow royalty base will include the percentage of the revenue based on the number of Rainbow-enabled parameters. Beginning in 2009, for hospital contracts where we place equipment and enter into a sensor contract, we will pay a royalty to Masimo Labs on the total sensor contract revenue based on the ratio of Rainbow enabled devices to total devices.

We are also subject to certain specific annual minimum aggregate royalty payments. The minimum aggregate royalty payment is $4.0 million for the 2009 fiscal year and $5.0 million per year thereafter.

From its inception in 1998 through January 3, 2009, we have agreed to pay Masimo Labs $22.1 million for both exclusive options and minimum royalty payments. We have 180 days after proof of feasibility to exercise the above-referenced option to obtain a license to the remaining non-vital signs parameters, including carbon monoxide, methemoglobin, total hemoglobin and bilirubin, for an additional $500,000 each, and blood glucose, for an additional $2.5 million.

Change in Control. The Cross-Licensing Agreement provides that, upon a change in control:

| | • | | if the surviving or acquiring entity ceases to use “Masimo” as a company name and trademark, all rights to the “Masimo” trademark will be assigned to Masimo Labs; |

| | • | | the option to license technology developed by Masimo Labs for use in blood glucose monitoring will be deemed automatically exercised and a $2.5 million license fee for this technology will become immediately payable to Masimo Labs; |

| | • | | per product minimum royalties, to the extent less than the annual minimums, will be payable to Masimo Labs; and |

| | • | | the minimum aggregate annual royalties for all licensed Rainbow parameters payable to Masimo Labs will increase to $10.0 million in the 2009 fiscal year and $15.0 million in each following year until the exclusive period of the agreement ends, plus up to $2.0 million per other Rainbow parameters. |

A change in control includes any of the following with respect to us or Masimo Labs:

| | • | | the sale of all or substantially all of either party’s assets to a non-affiliated third party; |

| | • | | the acquisition by a non-affiliated third party of 50% or more of the voting power of either party; |

| | • | | Joe E. Kiani, our Chief Executive Officer and the Chief Executive Officer of Masimo Labs, resigns or is terminated from his position with either party; and |

| | • | | the merger or consolidation of either party with a non-affiliated third party. |

Ownership of Improvements. Any improvements to Masimo SET or Rainbow technology made by Masimo Labs, by us, or jointly by Masimo Labs with us or with any third party that relates to non-vital signs monitoring, and any new technology acquired by Masimo

13

Labs, is and will be owned by Masimo Labs. Any improvements to the Masimo SET platform or Rainbow technology made by Masimo Labs, by us, or jointly by Masimo Labs with us or with any third party that relates to vital signs monitoring, and any new technology acquired by us, is and will be owned by us. However, in either case, any improvements to the technology, excluding acquired technology, will be assigned to the other party and be subject to the terms of the licenses granted under the Cross-Licensing Agreement. Any new non-vital signs monitoring technology utilizing Masimo SET that we develop will be owned by Masimo Labs and will be subject to the same license and option fees as if it had been developed by Masimo Labs. Also, we will not be reimbursed by Masimo Labs for our expenses relating to the development of any such technology.

Masimo Labs Services Agreement. We have also entered into a services agreement, or the Services Agreement, with Masimo Labs. Under this Services Agreement, we provide Masimo Labs with engineering services and accordingly charge Masimo Labs for these direct salary and payroll related expenses. In addition, at the end of each quarter, we charge Masimo Labs for its share of accounting, human resources, legal, facility and equipment costs, which we collectively refer to as indirect expenses. From its inception in 1998 through January 3, 2009, Masimo Labs has incurred approximately $17.4 million in both direct and indirect expenses. We expect Masimo Labs to continue to engage us for these services. However, pursuant to the Services Agreement, Masimo Labs may terminate the agreement by providing us 30 days notice, while we may terminate with 180 days notice to Masimo Labs.

Research and Product Development

We believe that ongoing research and development efforts are essential to our success. As of January 3, 2009, including Masimo Labs, we employed 136 engineers and engineering support staff. We expect to increase the size of our research and development staff during 2009. Our research and development efforts focus primarily on continuing to enhance our technical expertise in pulse oximetry, enabling the noninvasive monitoring of other parameters and developing remote-alarm and monitoring solutions.

Although we and Masimo Labs each have separate research and development projects, we collaborate with Masimo Labs on multiple research and development activities related to Rainbow technology and other technologies. Under the Cross-Licensing Agreement, the parties have agreed to allocate proprietary ownership of technology developed by either party based on the functionality of the technology. We will have proprietary rights to all technology related to the noninvasive measurement of vital signs parameters, and Masimo Labs will have proprietary ownership of all technology related to the noninvasive measurement of non-vital signs parameters. In addition, under our Services Agreement with Masimo Labs, we provide Masimo Labs with professional and management support services, including human resources, legal and accounting services. In January 2007, Masimo Labs realigned its development efforts and, as of January 3, 2009, it had nine full-time engineers supporting its development efforts.