UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07319

Fidelity Covington Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Margaret Carey, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | June 30 |

Date of reporting period: | June 30, 2023 |

Item 1.

Reports to Stockholders

Contents

| Average Annual Total Returns | |||

Periods ended June 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Clean Energy ETF - NAV | 0.10% | -9.59% |

Fidelity® Clean Energy ETF - Market Price B | -0.25% | -10.23% |

| Fidelity Clean Energy Index℠ | 0.36% | -8.71% |

| MSCI ACWI (All Country World Index) Index | 16.97% | -0.17% |

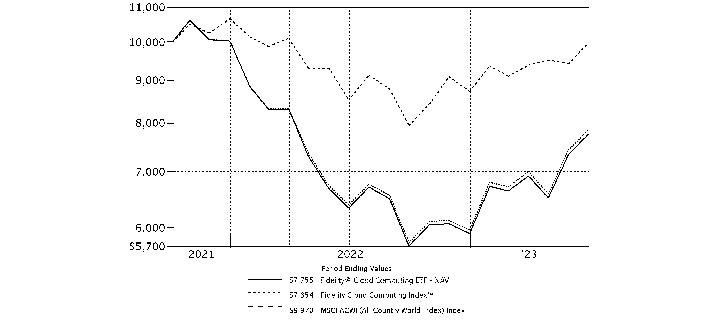

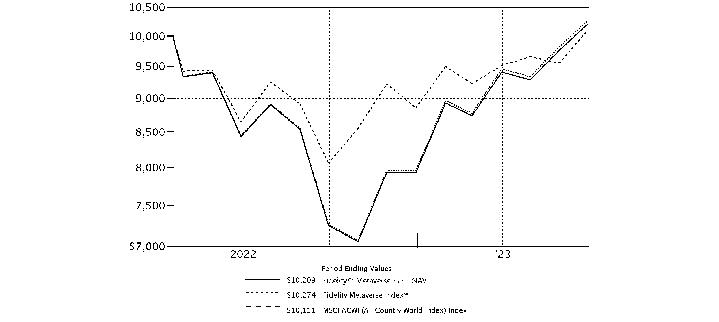

| $10,000 Over Life of Fund |

Let's say hypothetically that $10,000 was invested in Fidelity® Clean Energy ETF - NAV, on October 5, 2021, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Clean Energy Index℠ and MSCI ACWI (All Country World Index) Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Vestas Wind Systems A/S | 4.1 | |

| ORSTED A/S | 4.0 | |

| Enphase Energy, Inc. | 4.0 | |

| First Solar, Inc. | 3.7 | |

| Plug Power, Inc. | 3.0 | |

| Xinyi Solar Holdings Ltd. | 2.8 | |

| Northland Power, Inc. | 2.5 | |

| Shoals Technologies Group, Inc. | 2.4 | |

| Acciona SA | 2.4 | |

| EDP Renovaveis SA | 2.4 | |

| 31.3 | ||

| Market Sectors (% of Fund's net assets) | ||

| Utilities | 48.2 | |

| Industrials | 29.2 | |

| Information Technology | 21.2 | |

| Energy | 1.2 | |

Asset Allocation (% of Fund's net assets) |

|

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 99.8% | |||

| Shares | Value ($) | ||

| ENERGY - 1.2% | |||

| Oil, Gas & Consumable Fuels - 1.2% | |||

| Enviva, Inc. | 41,906 | 454,680 | |

| INDUSTRIALS - 29.2% | |||

| Commercial Services & Supplies - 1.6% | |||

| China Everbright International Ltd. | 1,618,000 | 637,983 | |

| Construction & Engineering - 2.7% | |||

| OX2 AB (a) | 73,523 | 496,221 | |

| Xinte Energy Co. Ltd. (H Shares) | 249,200 | 527,872 | |

| 1,024,093 | |||

| Electrical Equipment - 24.9% | |||

| Abalance Corp. | 6,700 | 495,541 | |

| Array Technologies, Inc. (a) | 36,789 | 831,431 | |

| Bloom Energy Corp. Class A (a) | 55,556 | 908,341 | |

| CS Wind Corp. | 11,495 | 752,870 | |

| Doosan Fuel Cell Co. Ltd. (a) | 24,404 | 531,548 | |

| Nordex SE (a) | 53,006 | 643,354 | |

| Plug Power, Inc. (a) | 110,880 | 1,152,043 | |

| Shoals Technologies Group, Inc. (a) | 36,988 | 945,413 | |

| Sunrun, Inc. (a) | 48,776 | 871,139 | |

| TPI Composites, Inc. (a) | 40,589 | 420,908 | |

| Vestas Wind Systems A/S (a) | 59,171 | 1,573,245 | |

| Xinjiang Goldwind Science & Technology Co. Ltd. (H Shares) | 651,800 | 446,643 | |

| 9,572,476 | |||

TOTAL INDUSTRIALS | 11,234,552 | ||

| INFORMATION TECHNOLOGY - 21.2% | |||

| Electronic Equipment, Instruments & Components - 1.8% | |||

| Landis+Gyr Group AG | 8,003 | 687,007 | |

| Semiconductors & Semiconductor Equipment - 19.4% | |||

| Canadian Solar, Inc. (a) | 17,924 | 693,480 | |

| Enphase Energy, Inc. (a) | 9,157 | 1,533,614 | |

| First Solar, Inc. (a) | 7,508 | 1,427,196 | |

| Flat Glass Group Co. Ltd. | 211,000 | 720,242 | |

| JinkoSolar Holdings Co. Ltd. ADR (a) | 16,143 | 716,426 | |

| Maxeon Solar Technologies Ltd. (a) | 18,742 | 527,775 | |

| SMA Solar Technology AG (a) | 6,418 | 783,528 | |

| Xinyi Solar Holdings Ltd. | 938,000 | 1,083,238 | |

| 7,485,499 | |||

TOTAL INFORMATION TECHNOLOGY | 8,172,506 | ||

| UTILITIES - 48.2% | |||

| Electric Utilities - 8.6% | |||

| Acciona SA | 5,503 | 932,986 | |

| ORSTED A/S (b) | 16,375 | 1,547,082 | |

| Verbund AG | 10,404 | 833,714 | |

| 3,313,782 | |||

| Independent Power and Renewable Electricity Producers - 39.6% | |||

| Atlantica Sustainable Infrastructure PLC | 27,202 | 637,615 | |

| Boralex, Inc. Class A | 27,551 | 751,003 | |

| Brookfield Renewable Corp. | 27,229 | 859,928 | |

| China Datang Corp. Renewable Power Co. Ltd. | 1,513,000 | 505,839 | |

| China Longyuan Power Grid Corp. Ltd. (H Shares) | 801,000 | 824,856 | |

| Clearway Energy, Inc. Class C | 26,255 | 749,843 | |

| Corp. ACCIONA Energias Renovables SA | 20,925 | 699,029 | |

| Drax Group PLC | 116,689 | 860,445 | |

| EDP Renovaveis SA | 45,770 | 913,562 | |

| Encavis AG | 43,698 | 716,310 | |

| Enlight Renewable Energy Ltd. (a) | 38,634 | 678,264 | |

| ERG SpA | 23,826 | 701,323 | |

| Innergex Renewable Energy, Inc. | 64,787 | 604,173 | |

| Neoen SA (b) | 24,121 | 763,164 | |

| Northland Power, Inc. | 45,879 | 957,972 | |

| Ormat Technologies, Inc. | 11,084 | 891,819 | |

| ReNew Energy Global PLC (a) | 81,174 | 444,834 | |

| RENOVA, Inc. (a) | 38,600 | 432,643 | |

| Solaria Energia y Medio Ambiente SA (a) | 43,303 | 663,536 | |

| Sunnova Energy International, Inc. (a) | 38,191 | 699,277 | |

| TransAlta Renewables, Inc. | 61,792 | 531,414 | |

| West Holdings Corp. | 21,600 | 372,715 | |

| 15,259,564 | |||

TOTAL UTILITIES | 18,573,346 | ||

| TOTAL COMMON STOCKS (Cost $43,100,424) | 38,435,084 | ||

| TOTAL INVESTMENT IN SECURITIES - 99.8% (Cost $43,100,424) | 38,435,084 |

NET OTHER ASSETS (LIABILITIES) - 0.2% | 68,784 |

| NET ASSETS - 100.0% | 38,503,868 |

| (a) | Non-income producing |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,310,246 or 6.0% of net assets. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | - | 3,930,285 | 3,930,285 | 996 | - | - | - | 0.0% |

| Total | - | 3,930,285 | 3,930,285 | 996 | - | - | - | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Energy | 454,680 | 454,680 | - | - |

Industrials | 11,234,552 | 11,234,552 | - | - |

Information Technology | 8,172,506 | 8,172,506 | - | - |

Utilities | 18,573,346 | 18,573,346 | - | - |

| Total Investments in Securities: | 38,435,084 | 38,435,084 | - | - |

| Statement of Assets and Liabilities | ||||

| June 30, 2023 | ||||

| Assets | ||||

Investment in securities, at value - See accompanying schedule Unaffiliated issuers (cost $43,100,424): | $ | 38,435,084 | ||

| Foreign currency held at value (cost $23,697) | 23,740 | |||

| Receivable for investments sold | 10,770 | |||

| Dividends receivable | 47,996 | |||

| Distributions receivable from Fidelity Central Funds | 99 | |||

Total assets | 38,517,689 | |||

| Liabilities | ||||

| Payable to custodian bank | $ | 1,221 | ||

| Accrued management fee | 12,600 | |||

| Total Liabilities | 13,821 | |||

| Net Assets | $ | 38,503,868 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 46,237,086 | ||

| Total accumulated earnings (loss) | (7,733,218) | |||

| Net Assets | $ | 38,503,868 | ||

Net Asset Value , offering price and redemption price per share ($38,503,868 ÷ 1,850,000 shares) | $ | 20.81 | ||

| Statement of Operations | ||||

Year ended June 30, 2023 | ||||

| Investment Income | ||||

| Dividends | $ | 471,225 | ||

| Income from Fidelity Central Funds | 996 | |||

| Income before foreign taxes withheld | $ | 472,221 | ||

| Less foreign taxes withheld | (54,132) | |||

| Total Income | 418,089 | |||

| Expenses | ||||

| Management fee | $ | 150,620 | ||

| Independent trustees' fees and expenses | 180 | |||

| Total expenses before reductions | 150,800 | |||

| Expense reductions | (127) | |||

| Total expenses after reductions | 150,673 | |||

| Net Investment income (loss) | 267,416 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Redemptions in-kind | 339,151 | |||

| Unaffiliated issuers | (2,068,472) | |||

| Foreign currency transactions | 407 | |||

| Total net realized gain (loss) | (1,728,914) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (194,650) | |||

| Assets and liabilities in foreign currencies | 4,558 | |||

| Total change in net unrealized appreciation (depreciation) | (190,092) | |||

| Net gain (loss) | (1,919,006) | |||

| Net increase (decrease) in net assets resulting from operations | $ | (1,651,590) | ||

| Statement of Changes in Net Assets | ||||

Year ended June 30, 2023 | For the period October 5, 2021 (commencement of operations) through June 30, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 267,416 | $ | 144,270 |

| Net realized gain (loss) | (1,728,914) | (1,012,499) | ||

| Change in net unrealized appreciation (depreciation) | (190,092) | (4,471,106) | ||

| Net increase (decrease) in net assets resulting from operations | (1,651,590) | (5,339,335) | ||

| Distributions to shareholders | (306,800) | (145,750) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 14,295,218 | 33,772,796 | ||

| Cost of shares redeemed | (2,120,671) | - | ||

Net increase (decrease) in net assets resulting from share transactions | 12,174,547 | 33,772,796 | ||

| Total increase (decrease) in net assets | 10,216,157 | 28,287,711 | ||

| Net Assets | ||||

| Beginning of period | 28,287,711 | - | ||

| End of period | $ | 38,503,868 | $ | 28,287,711 |

| Other Information | ||||

| Shares | ||||

| Sold | 600,000 | 1,350,000 | ||

| Redeemed | (100,000) | - | ||

| Net increase (decrease) | 500,000 | 1,350,000 | ||

| Fidelity® Clean Energy ETF |

| Years ended June 30, | 2023 | 2022 A | ||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 20.95 | $ | 25.12 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .15 | .15 | ||

| Net realized and unrealized gain (loss) | (.12) | (4.20) | ||

| Total from investment operations | .03 | (4.05) | ||

| Distributions from net investment income | (.17) | (.12) | ||

| Total distributions | (.17) | (.12) | ||

| Net asset value, end of period | $ | 20.81 | $ | 20.95 |

Total Return D,E,F | .10% | (16.12)% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | .39% | .39% I | ||

| Expenses net of fee waivers, if any | .39% | .39% I | ||

| Expenses net of all reductions | .39% | .39% I | ||

| Net investment income (loss) | .69% | .90% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 38,504 | $ | 28,288 |

Portfolio turnover rate J,K | 37% | 30% L |

| Average Annual Total Returns | |||

Periods ended June 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Cloud Computing ETF - NAV | 22.51% | -13.63% |

Fidelity® Cloud Computing ETF - Market Price B | 23.12% | -14.34% |

| Fidelity Cloud Computing Index℠ | 23.00% | -13.00% |

| MSCI ACWI (All Country World Index) Index | 16.97% | -0.17% |

| $10,000 Over Life of Fund |

Let's say hypothetically that $10,000 was invested in Fidelity® Cloud Computing ETF - NAV, on October 5, 2021, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Cloud Computing Index℠ and MSCI ACWI (All Country World Index) Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Oracle Corp. | 4.8 | |

| SAP SE | 4.5 | |

| Salesforce, Inc. | 4.3 | |

| ServiceNow, Inc. | 4.3 | |

| Equinix, Inc. | 3.7 | |

| Snowflake, Inc. | 3.3 | |

| MongoDB, Inc. Class A | 3.3 | |

| Workday, Inc. Class A | 3.2 | |

| Digital Realty Trust, Inc. | 2.9 | |

| VMware, Inc. Class A | 2.8 | |

| 37.1 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 93.3 | |

| Real Estate | 6.6 | |

Asset Allocation (% of Fund's net assets) |

|

Futures - 0.1% |

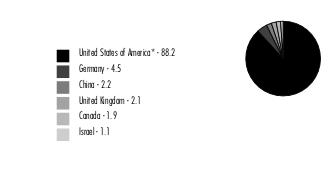

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 99.9% | |||

| Shares | Value ($) | ||

| INFORMATION TECHNOLOGY - 93.3% | |||

| IT Services - 11.4% | |||

| Digitalocean Holdings, Inc. (a) | 10,696 | 429,337 | |

| Fastly, Inc. Class A (a) | 23,689 | 373,576 | |

| Kingsoft Cloud Holdings Ltd. (a) | 794,000 | 325,235 | |

| MongoDB, Inc. Class A (a) | 2,940 | 1,208,311 | |

| Snowflake, Inc. (a) | 6,871 | 1,209,159 | |

| Twilio, Inc. Class A (a) | 10,690 | 680,098 | |

| 4,225,716 | |||

| Software - 69.1% | |||

| Alteryx, Inc. Class A (a) | 10,179 | 462,127 | |

| Atlassian Corp. PLC (a) | 5,331 | 894,595 | |

| Box, Inc. Class A (a) | 17,794 | 522,788 | |

| C3.ai, Inc. (a) | 13,097 | 477,124 | |

| CommVault Systems, Inc. (a) | 6,627 | 481,253 | |

| Confluent, Inc. (a) | 16,680 | 588,971 | |

| Datadog, Inc. Class A (a) | 9,555 | 940,021 | |

| Dropbox, Inc. Class A (a) | 25,146 | 670,644 | |

| Dynatrace, Inc. (a) | 13,711 | 705,705 | |

| Elastic NV (a) | 7,820 | 501,418 | |

| Five9, Inc. (a) | 7,958 | 656,137 | |

| GitLab, Inc. (a) | 11,560 | 590,832 | |

| HubSpot, Inc. (a) | 1,791 | 952,973 | |

| Informatica, Inc. (a) | 15,676 | 290,006 | |

| JFrog Ltd. (a) | 14,931 | 413,589 | |

| Kingdee International Software Group Co. Ltd. (a) | 363,500 | 486,114 | |

| LivePerson, Inc. (a) | 55,755 | 252,013 | |

| MicroStrategy, Inc. Class A (a) | 1,500 | 513,630 | |

| New Relic, Inc. (a) | 7,282 | 476,534 | |

| Nutanix, Inc. Class A (a) | 20,147 | 565,123 | |

| Open Text Corp. | 17,098 | 711,959 | |

| Oracle Corp. | 15,014 | 1,788,015 | |

| Pegasystems, Inc. | 8,287 | 408,549 | |

| Sage Group PLC | 66,539 | 782,329 | |

| Salesforce, Inc. (a) | 7,474 | 1,578,957 | |

| SAP SE | 12,067 | 1,647,480 | |

| ServiceNow, Inc. (a) | 2,795 | 1,570,706 | |

| SolarWinds, Inc. (a) | 25,656 | 263,231 | |

| Splunk, Inc. (a) | 7,664 | 813,074 | |

| Teradata Corp. (a) | 11,361 | 606,791 | |

| UiPath, Inc. Class A (a) | 32,647 | 540,961 | |

| Verint Systems, Inc. (a) | 11,702 | 410,272 | |

| VMware, Inc. Class A (a) | 7,169 | 1,030,114 | |

| Workday, Inc. Class A (a) | 5,170 | 1,167,851 | |

| Zoom Video Communications, Inc. Class A (a) | 11,421 | 775,257 | |

| 25,537,143 | |||

| Technology Hardware, Storage & Peripherals - 12.8% | |||

| Hewlett Packard Enterprise Co. | 57,374 | 963,883 | |

| NetApp, Inc. | 10,970 | 838,108 | |

| Pure Storage, Inc. Class A (a) | 19,725 | 726,275 | |

| Seagate Technology Holdings PLC | 11,746 | 726,725 | |

| Super Micro Computer, Inc. (a) | 3,026 | 754,231 | |

| Western Digital Corp. (a) | 18,821 | 713,881 | |

| 4,723,103 | |||

TOTAL INFORMATION TECHNOLOGY | 34,485,962 | ||

| REAL ESTATE - 6.6% | |||

| Equity Real Estate Investment Trusts (REITs) - 6.6% | |||

| Digital Realty Trust, Inc. | 9,399 | 1,070,264 | |

| Equinix, Inc. | 1,729 | 1,355,432 | |

| 2,425,696 | |||

| TOTAL COMMON STOCKS (Cost $37,125,287) | 36,911,658 | ||

| Money Market Funds - 0.1% | |||

| Shares | Value ($) | ||

Fidelity Cash Central Fund 5.14% (b) (Cost $13,981) | 13,979 | 13,981 | |

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $37,139,268) | 36,925,639 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | 11,909 |

| NET ASSETS - 100.0% | 36,937,548 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini NASDAQ 100 Index Contracts (United States) | 1 | Sep 2023 | 30,674 | 1,196 | 1,196 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.1% | |||||

| (a) | Non-income producing |

| (b) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | - | 1,690,166 | 1,676,185 | 641 | - | - | 13,981 | 0.0% |

| Total | - | 1,690,166 | 1,676,185 | 641 | - | - | 13,981 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Information Technology | 34,485,962 | 34,485,962 | - | - |

Real Estate | 2,425,696 | 2,425,696 | - | - |

| Money Market Funds | 13,981 | 13,981 | - | - |

| Total Investments in Securities: | 36,925,639 | 36,925,639 | - | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 1,196 | 1,196 | - | - |

| Total Assets | 1,196 | 1,196 | - | - |

| Total Derivative Instruments: | 1,196 | 1,196 | - | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Equity Risk | ||

Futures Contracts (a) | 1,196 | 0 |

| Total Equity Risk | 1,196 | 0 |

| Total Value of Derivatives | 1,196 | 0 |

| Statement of Assets and Liabilities | ||||

| June 30, 2023 | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $37,125,287) | $ | 36,911,658 | ||

Fidelity Central Funds (cost $13,981) | 13,981 | |||

| Total Investment in Securities (cost $37,139,268) | $ | 36,925,639 | ||

| Segregated cash with brokers for derivative instruments | 1,680 | |||

| Cash | 13,115 | |||

| Foreign currency held at value (cost $926) | 926 | |||

| Dividends receivable | 19,303 | |||

| Distributions receivable from Fidelity Central Funds | 146 | |||

| Receivable for daily variation margin on futures contracts | 474 | |||

| Other receivables | 3,800 | |||

Total assets | 36,965,083 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 16,915 | ||

| Accrued management fee | 10,620 | |||

| Total Liabilities | 27,535 | |||

| Net Assets | $ | 36,937,548 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 41,983,301 | ||

| Total accumulated earnings (loss) | (5,045,753) | |||

| Net Assets | $ | 36,937,548 | ||

Net Asset Value , offering price and redemption price per share ($36,937,548 ÷ 1,900,000 shares) | $ | 19.44 | ||

| Statement of Operations | ||||

Year ended June 30, 2023 | ||||

| Investment Income | ||||

| Dividends | $ | 140,919 | ||

| Income from Fidelity Central Funds | 641 | |||

| Total Income | 141,560 | |||

| Expenses | ||||

| Management fee | $ | 89,538 | ||

| Independent trustees' fees and expenses | 107 | |||

| Total expenses before reductions | 89,645 | |||

| Expense reductions | (185) | |||

| Total expenses after reductions | 89,460 | |||

| Net Investment income (loss) | 52,100 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (3,452,291) | |||

| Foreign currency transactions | (7,489) | |||

| Futures contracts | 6,228 | |||

| Total net realized gain (loss) | (3,453,552) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 8,600,221 | |||

| Assets and liabilities in foreign currencies | 173 | |||

| Futures contracts | 1,196 | |||

| Total change in net unrealized appreciation (depreciation) | 8,601,590 | |||

| Net gain (loss) | 5,148,038 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 5,200,138 | ||

| Statement of Changes in Net Assets | ||||

Year ended June 30, 2023 | For the period October 5, 2021 (commencement of operations) through June 30, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 52,100 | $ | 55,996 |

| Net realized gain (loss) | (3,453,552) | (1,531,664) | ||

| Change in net unrealized appreciation (depreciation) | 8,601,590 | (8,813,883) | ||

| Net increase (decrease) in net assets resulting from operations | 5,200,138 | (10,289,551) | ||

| Distributions to shareholders | (48,880) | (57,350) | ||

| Distributions to shareholders from tax return of capital | (14,820) | - | ||

| Total Distributions | (63,700) | (57,350) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 13,508,181 | 29,456,208 | ||

| Cost of shares redeemed | - | (816,378) | ||

Net increase (decrease) in net assets resulting from share transactions | 13,508,181 | 28,639,830 | ||

| Total increase (decrease) in net assets | 18,644,619 | 18,292,929 | ||

| Net Assets | ||||

| Beginning of period | 18,292,929 | - | ||

| End of period | $ | 36,937,548 | $ | 18,292,929 |

| Other Information | ||||

| Shares | ||||

| Sold | 750,000 | 1,200,000 | ||

| Redeemed | - | (50,000) | ||

| Net increase (decrease) | 750,000 | 1,150,000 | ||

| Fidelity® Cloud Computing ETF |

| Years ended June 30, | 2023 | 2022 A | ||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 15.91 | $ | 25.20 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .04 | .06 | ||

| Net realized and unrealized gain (loss) | 3.53 | (9.29) | ||

| Total from investment operations | 3.57 | (9.23) | ||

| Distributions from net investment income | (.03) | (.06) | ||

| Tax return of capital | (.01) | - | ||

| Total distributions | (.04) | (.06) | ||

| Net asset value, end of period | $ | 19.44 | $ | 15.91 |

Total Return D,E,F | 22.51% | (36.69)% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | .39% | .39% I | ||

| Expenses net of fee waivers, if any | .39% | .39% I | ||

| Expenses net of all reductions | .39% | .39% I | ||

| Net investment income (loss) | .23% | .41% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 36,938 | $ | 18,293 |

Portfolio turnover rate J,K | 38% | 31% L |

| Average Annual Total Returns | |||

Periods ended June 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Crypto Industry and Digital Payments ETF - NAV | 54.94% | -21.80% |

Fidelity® Crypto Industry and Digital Payments ETF - Market Price B | 56.21% | -15.03% |

| Fidelity Crypto Industry and Digital Payments Index℠ | 55.43% | -21.54% |

| MSCI ACWI (All Country World Index) Index | 16.97% | 0.92% |

| $10,000 Over Life of Fund |

Let's say hypothetically that $10,000 was invested in Fidelity® Crypto Industry and Digital Payments ETF - NAV, on April 19, 2022, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Crypto Industry and Digital Payments Index℠ and MSCI ACWI (All Country World Index) Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Coinbase Global, Inc. | 16.0 | |

| Marathon Digital Holdings, Inc. | 13.3 | |

| Riot Platforms, Inc. | 8.1 | |

| Hut 8 Mining Corp. | 5.8 | |

| Cleanspark, Inc. | 4.0 | |

| Applied Digital Corp. | 3.8 | |

| Bit Digital, Inc. | 3.5 | |

| HIVE Blockchain Technologies Ltd. | 3.1 | |

| Bitfarms Ltd. | 2.9 | |

| TeraWulf, Inc. | 2.5 | |

| 63.0 | ||

| Market Sectors (% of Fund's net assets) | ||

| Information Technology | 53.5 | |

| Financials | 46.5 | |

Asset Allocation (% of Fund's net assets) |

|

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 100.0% | |||

| Shares | Value ($) | ||

| FINANCIALS - 46.5% | |||

| Capital Markets - 19.8% | |||

| Bakkt Holdings, Inc. Class A (a) | 521,342 | 641,251 | |

| Coinbase Global, Inc. (a) | 81,380 | 5,822,738 | |

| Galaxy Digital Holdings Ltd. (a) | 177,912 | 770,403 | |

| 7,234,392 | |||

| Consumer Finance - 0.9% | |||

| Green Dot Corp. Class A (a) | 17,558 | 329,037 | |

| Financial Services - 25.8% | |||

| Cielo SA | 548,400 | 521,799 | |

| Dlocal Ltd. (a) | 41,828 | 510,511 | |

| Edenred SA | 8,126 | 543,808 | |

| FleetCor Technologies, Inc. (a) | 2,454 | 616,150 | |

| Flywire Corp. (a) | 16,675 | 517,592 | |

| Global Payments, Inc. | 5,660 | 557,623 | |

| GMO Payment Gateway, Inc. | 5,600 | 433,943 | |

| Marqeta, Inc. Class A (a) | 109,657 | 534,030 | |

| MasterCard, Inc. Class A | 1,508 | 593,096 | |

| Network International Holdings PLC (a)(b) | 89,887 | 438,370 | |

| Nexi SpA (a)(b) | 63,371 | 496,547 | |

| Nuvei Corp. (a)(b) | 12,709 | 375,678 | |

| Payoneer Global, Inc. (a) | 93,834 | 451,342 | |

| Shift4 Payments, Inc. (a) | 8,734 | 593,126 | |

| StoneCo Ltd. Class A (a) | 42,649 | 543,348 | |

| Visa, Inc. Class A | 2,470 | 586,576 | |

| WEX, Inc. (a) | 3,304 | 601,559 | |

| Worldline SA (a)(b) | 12,956 | 473,522 | |

| 9,388,620 | |||

TOTAL FINANCIALS | 16,952,049 | ||

| INFORMATION TECHNOLOGY - 53.5% | |||

| IT Services - 1.7% | |||

| Shopify, Inc. Class A (a) | 9,651 | 623,455 | |

| Software - 51.8% | |||

| Applied Digital Corp. (a) | 149,024 | 1,393,374 | |

| Bit Digital, Inc. (a) | 315,304 | 1,280,134 | |

| Bitfarms Ltd. (a) | 728,204 | 1,070,460 | |

| Cipher Mining, Inc. (a) | 301,587 | 862,539 | |

| Cleanspark, Inc. (a) | 337,880 | 1,449,505 | |

| HIVE Blockchain Technologies Ltd. (a) | 243,710 | 1,128,377 | |

| Hut 8 Mining Corp. (a) | 642,526 | 2,120,336 | |

| Iris Energy Ltd. (a) | 183,765 | 856,345 | |

| Marathon Digital Holdings, Inc. (a) | 349,393 | 4,842,587 | |

| Riot Platforms, Inc. (a) | 250,473 | 2,960,591 | |

| TeraWulf, Inc. (a) | 525,030 | 918,803 | |

| 18,883,051 | |||

TOTAL INFORMATION TECHNOLOGY | 19,506,506 | ||

| TOTAL COMMON STOCKS (Cost $27,558,125) | 36,458,555 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $27,558,125) | 36,458,555 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | 3,226 |

| NET ASSETS - 100.0% | 36,461,781 |

| (a) | Non-income producing |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $1,784,117 or 4.9% of net assets. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | - | 212,663 | 212,663 | 384 | - | - | - | 0.0% |

| Total | - | 212,663 | 212,663 | 384 | - | - | - | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Financials | 16,952,049 | 16,952,049 | - | - |

Information Technology | 19,506,506 | 19,506,506 | - | - |

| Total Investments in Securities: | 36,458,555 | 36,458,555 | - | - |

| Statement of Assets and Liabilities | ||||

| June 30, 2023 | ||||

| Assets | ||||

Investment in securities, at value - See accompanying schedule Unaffiliated issuers (cost $27,558,125): | $ | 36,458,555 | ||

| Cash | 585,233 | |||

| Foreign currency held at value (cost $2,496) | 2,483 | |||

| Distributions receivable from Fidelity Central Funds | 67 | |||

Total assets | 37,046,338 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 573,951 | ||

| Accrued management fee | 10,602 | |||

| Other payables and accrued expenses | 4 | |||

| Total Liabilities | 584,557 | |||

| Net Assets | $ | 36,461,781 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 31,924,647 | ||

| Total accumulated earnings (loss) | 4,537,134 | |||

| Net Assets | $ | 36,461,781 | ||

Net Asset Value , offering price and redemption price per share ($36,461,781 ÷ 1,900,000 shares) | $ | 19.19 | ||

| Statement of Operations | ||||

Year ended June 30, 2023 | ||||

| Investment Income | ||||

| Dividends | $ | 47,842 | ||

| Income from Fidelity Central Funds | 384 | |||

| Income before foreign taxes withheld | $ | 48,226 | ||

| Less foreign taxes withheld | (4,341) | |||

| Total Income | 43,885 | |||

| Expenses | ||||

| Management fee | $ | 87,834 | ||

| Independent trustees' fees and expenses | 90 | |||

| Total expenses before reductions | 87,924 | |||

| Expense reductions | (495) | |||

| Total expenses after reductions | 87,429 | |||

| Net Investment income (loss) | (43,544) | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Redemptions in-kind | (18,489) | |||

| Unaffiliated issuers | (3,443,187) | |||

| Foreign currency transactions | (258) | |||

| Futures contracts | 5,863 | |||

| Total net realized gain (loss) | (3,456,071) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 13,810,348 | |||

| Assets and liabilities in foreign currencies | 193 | |||

| Total change in net unrealized appreciation (depreciation) | 13,810,541 | |||

| Net gain (loss) | 10,354,470 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 10,310,926 | ||

| Statement of Changes in Net Assets | ||||

Year ended June 30, 2023 | For the period April 19, 2022 (commencement of operations) through June 30, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | (43,544) | $ | (5,137) |

| Net realized gain (loss) | (3,456,071) | (884,217) | ||

| Change in net unrealized appreciation (depreciation) | 13,810,541 | (4,910,077) | ||

| Net increase (decrease) in net assets resulting from operations | 10,310,926 | (5,799,431) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 14,414,125 | 18,803,995 | ||

| Cost of shares redeemed | (1,267,834) | - | ||

Net increase (decrease) in net assets resulting from share transactions | 13,146,291 | 18,803,995 | ||

| Total increase (decrease) in net assets | 23,457,217 | 13,004,564 | ||

| Net Assets | ||||

| Beginning of period | 13,004,564 | - | ||

| End of period | $ | 36,461,781 | $ | 13,004,564 |

| Other Information | ||||

| Shares | ||||

| Sold | 950,000 | 1,050,000 | ||

| Redeemed | (100,000) | - | ||

| Net increase (decrease) | 850,000 | 1,050,000 | ||

| Fidelity® Crypto Industry and Digital Payments ETF |

| Years ended June 30, | 2023 | 2022 A | ||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 12.39 | $ | 25.76 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | (.03) | (.01) | ||

| Net realized and unrealized gain (loss) | 6.83 | (13.36) | ||

| Total from investment operations | 6.80 | (13.37) | ||

| Net asset value, end of period | $ | 19.19 | $ | 12.39 |

Total Return D,E,F | 54.94% | (51.92)% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | .39% | .39% I | ||

| Expenses net of fee waivers, if any | .39% | .39% I | ||

| Expenses net of all reductions | .39% | .39% I | ||

| Net investment income (loss) | (.19)% | (.29)% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 36,462 | $ | 13,005 |

Portfolio turnover rate J,K | 55% | 28% L |

| Average Annual Total Returns | |||

Periods ended June 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Digital Health ETF - NAV | 5.98% | -13.07% |

Fidelity® Digital Health ETF - Market Price B | 6.39% | -13.61% |

| Fidelity Digital Health Index℠ | 6.34% | -12.63% |

| MSCI ACWI (All Country World Index) Index | 16.97% | -0.17% |

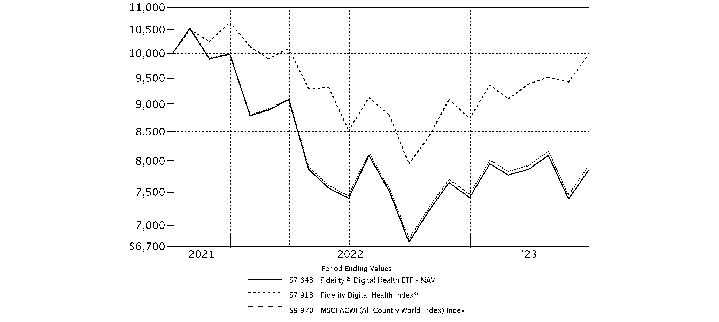

| $10,000 Over Life of Fund |

Let's say hypothetically that $10,000 was invested in Fidelity® Digital Health ETF - NAV, on October 5, 2021, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Digital Health Index℠ and MSCI ACWI (All Country World Index) Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Intuitive Surgical, Inc. | 4.8 | |

| DexCom, Inc. | 4.7 | |

| ResMed, Inc. | 4.3 | |

| Veeva Systems, Inc. Class A | 4.3 | |

| Insulet Corp. | 4.0 | |

| Sonova Holding AG | 3.5 | |

| Inspire Medical Systems, Inc. | 3.2 | |

| Fisher & Paykel Healthcare Corp. | 3.0 | |

| Cochlear Ltd. | 2.9 | |

| JD Health International, Inc. | 2.7 | |

| 37.4 | ||

| Market Sectors (% of Fund's net assets) | ||

| Health Care | 85.9 | |

| Consumer Staples | 7.7 | |

| Information Technology | 3.3 | |

| Industrials | 2.1 | |

| Consumer Discretionary | 1.0 | |

Asset Allocation (% of Fund's net assets) |

|

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 100.0% | |||

| Shares | Value ($) | ||

| CONSUMER DISCRETIONARY - 1.0% | |||

| Household Durables - 1.0% | |||

| Vuzix Corp. (a) | 18,992 | 96,859 | |

| CONSUMER STAPLES - 7.7% | |||

| Consumer Staples Distribution & Retail - 7.7% | |||

| Alibaba Health Information Technology Ltd. (a) | 322,000 | 193,530 | |

| DocMorris AG (a) | 3,205 | 139,786 | |

| JD Health International, Inc. (a)(b) | 42,200 | 266,288 | |

| Redcare Pharmacy NV (a)(b) | 1,552 | 160,586 | |

| 760,190 | |||

| HEALTH CARE - 85.9% | |||

| Biotechnology - 1.6% | |||

| Zealand Pharma A/S (a) | 4,337 | 155,436 | |

| Health Care Equipment & Supplies - 44.1% | |||

| Axonics Modulation Technologies, Inc. (a) | 3,836 | 193,603 | |

| Butterfly Network, Inc. Class A (a) | 41,314 | 95,022 | |

| Cochlear Ltd. | 1,902 | 290,018 | |

| Demant A/S (a) | 5,625 | 237,780 | |

| DexCom, Inc. (a) | 3,572 | 459,038 | |

| Fisher & Paykel Healthcare Corp. | 19,456 | 292,033 | |

| Inspire Medical Systems, Inc. (a) | 958 | 311,005 | |

| Insulet Corp. (a) | 1,374 | 396,179 | |

| Integra LifeSciences Holdings Corp. (a) | 5,149 | 211,778 | |

| Intuitive Surgical, Inc. (a) | 1,375 | 470,166 | |

| iRhythm Technologies, Inc. (a) | 1,898 | 197,999 | |

| Nevro Corp. (a) | 5,067 | 128,803 | |

| ResMed, Inc. | 1,954 | 426,949 | |

| Senseonics Holdings, Inc. (a) | 148,218 | 113,105 | |

| Sonova Holding AG | 1,284 | 341,864 | |

| Tandem Diabetes Care, Inc. (a) | 6,654 | 163,289 | |

| 4,328,631 | |||

| Health Care Providers & Services - 12.6% | |||

| Apollo Medical Holdings, Inc. (a) | 4,707 | 148,741 | |

| Cigna Group | 777 | 218,026 | |

| Corvel Corp. (a) | 872 | 168,732 | |

| Hims & Hers Health, Inc. (a) | 16,189 | 152,177 | |

| Premier, Inc. | 8,057 | 222,857 | |

| R1 RCM, Inc. | 11,206 | 206,751 | |

| Well Health Technologies Corp. (a) | 34,487 | 123,796 | |

| 1,241,080 | |||

| Health Care Technology - 27.6% | |||

| American Well Corp. (a) | 50,367 | 105,771 | |

| CompuGroup Medical AG | 2,960 | 145,580 | |

| Computer Programs & Systems, Inc. (a) | 4,027 | 99,427 | |

| Definitive Healthcare Corp. (a) | 9,887 | 108,757 | |

| Doximity, Inc. (a) | 6,917 | 235,316 | |

| Evolent Health, Inc. (a) | 6,555 | 198,617 | |

| Health Catalyst, Inc. (a) | 10,601 | 132,513 | |

| HealthStream, Inc. | 4,989 | 122,530 | |

| JMDC, Inc. | 3,600 | 142,072 | |

| Nextgen Healthcare, Inc. (a) | 8,472 | 137,416 | |

| Phreesia, Inc. (a) | 5,356 | 166,090 | |

| Pro Medicus Ltd. | 4,394 | 191,988 | |

| Teladoc Health, Inc. (a) | 9,252 | 234,261 | |

| Veeva Systems, Inc. Class A (a) | 2,149 | 424,922 | |

| Veradigm, Inc. (a) | 12,878 | 162,263 | |

| Yidu Tech, Inc. (a)(b) | 146,500 | 107,492 | |

| 2,715,015 | |||

TOTAL HEALTH CARE | 8,440,162 | ||

| INDUSTRIALS - 2.1% | |||

| Professional Services - 2.1% | |||

| Maximus, Inc. | 2,406 | 203,331 | |

| INFORMATION TECHNOLOGY - 3.3% | |||

| IT Services - 2.1% | |||

| Cognizant Technology Solutions Corp. Class A | 3,167 | 206,742 | |

| Software - 1.2% | |||

| EngageSmart, Inc. (a) | 6,137 | 117,155 | |

TOTAL INFORMATION TECHNOLOGY | 323,897 | ||

| TOTAL COMMON STOCKS (Cost $11,264,664) | 9,824,439 | ||

| TOTAL INVESTMENT IN SECURITIES - 100.0% (Cost $11,264,664) | 9,824,439 |

NET OTHER ASSETS (LIABILITIES) - 0.0% | 3,713 |

| NET ASSETS - 100.0% | 9,828,152 |

| (a) | Non-income producing |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $534,366 or 5.4% of net assets. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | - | 416,614 | 416,614 | 152 | - | - | - | 0.0% |

| Total | - | 416,614 | 416,614 | 152 | - | - | - | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Consumer Discretionary | 96,859 | 96,859 | - | - |

Consumer Staples | 760,190 | 760,190 | - | - |

Health Care | 8,440,162 | 8,440,162 | - | - |

Industrials | 203,331 | 203,331 | - | - |

Information Technology | 323,897 | 323,897 | - | - |

| Total Investments in Securities: | 9,824,439 | 9,824,439 | - | - |

| Statement of Assets and Liabilities | ||||

| June 30, 2023 | ||||

| Assets | ||||

Investment in securities, at value - See accompanying schedule Unaffiliated issuers (cost $11,264,664): | $ | 9,824,439 | ||

| Cash | 197 | |||

| Foreign currency held at value (cost $1,128) | 1,126 | |||

| Dividends receivable | 5,543 | |||

Total assets | 9,831,305 | |||

| Liabilities | ||||

| Accrued management fee | $ | 3,153 | ||

| Total Liabilities | 3,153 | |||

| Net Assets | $ | 9,828,152 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 12,747,754 | ||

| Total accumulated earnings (loss) | (2,919,602) | |||

| Net Assets | $ | 9,828,152 | ||

Net Asset Value , offering price and redemption price per share ($9,828,152 ÷ 500,000 shares) | $ | 19.66 | ||

| Statement of Operations | ||||

Year ended June 30, 2023 | ||||

| Investment Income | ||||

| Dividends | $ | 34,523 | ||

| Special dividends | 19,416 | |||

| Income from Fidelity Central Funds | 152 | |||

| Total Income | 54,091 | |||

| Expenses | ||||

| Management fee | $ | 37,437 | ||

| Independent trustees' fees and expenses | 49 | |||

| Total expenses before reductions | 37,486 | |||

| Expense reductions | (259) | |||

| Total expenses after reductions | 37,227 | |||

| Net Investment income (loss) | 16,864 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (1,145,622) | |||

| Foreign currency transactions | 9 | |||

| Total net realized gain (loss) | (1,145,613) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 1,683,678 | |||

| Assets and liabilities in foreign currencies | 35 | |||

| Total change in net unrealized appreciation (depreciation) | 1,683,713 | |||

| Net gain (loss) | 538,100 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 554,964 | ||

| Statement of Changes in Net Assets | ||||

Year ended June 30, 2023 | For the period October 5, 2021 (commencement of operations) through June 30, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 16,864 | $ | (3,322) |

| Net realized gain (loss) | (1,145,613) | (485,420) | ||

| Change in net unrealized appreciation (depreciation) | 1,683,713 | (3,123,941) | ||

| Net increase (decrease) in net assets resulting from operations | 554,964 | (3,612,683) | ||

| Distributions to shareholders | (15,500) | - | ||

| Share transactions | ||||

| Proceeds from sales of shares | - | 13,779,066 | ||

| Cost of shares redeemed | - | (877,695) | ||

Net increase (decrease) in net assets resulting from share transactions | - | 12,901,371 | ||

| Total increase (decrease) in net assets | 539,464 | 9,288,688 | ||

| Net Assets | ||||

| Beginning of period | 9,288,688 | - | ||

| End of period | $ | 9,828,152 | $ | 9,288,688 |

| Other Information | ||||

| Shares | ||||

| Sold | - | 550,000 | ||

| Redeemed | - | (50,000) | ||

| Net increase (decrease) | - | 500,000 | ||

| Fidelity® Digital Health ETF |

| Years ended June 30, | 2023 | 2022 A | ||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 18.58 | $ | 25.10 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .03 D | (.01) | ||

| Net realized and unrealized gain (loss) | 1.08 | (6.51) | ||

| Total from investment operations | 1.11 | (6.52) | ||

| Distributions from net investment income | (.03) | - | ||

| Total distributions | (.03) | - | ||

| Net asset value, end of period | $ | 19.66 | $ | 18.58 |

Total Return E,F,G | 5.98% | (25.99)% | ||

Ratios to Average Net Assets C,H,I | ||||

| Expenses before reductions | .39% | .39% J | ||

| Expenses net of fee waivers, if any | .39% | .39% J | ||

| Expenses net of all reductions | .39% | .39% J | ||

| Net investment income (loss) | .18% D | (.05)% J | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 9,828 | $ | 9,289 |

Portfolio turnover rate K | 36% | 48% L,M |

| Average Annual Total Returns | |||

Periods ended June 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Electric Vehicles and Future Transportation ETF - NAV | 7.36% | -14.59% |

Fidelity® Electric Vehicles and Future Transportation ETF - Market Price B | 7.30% | -15.33% |

| Fidelity Electric Vehicles and Future Transportation Index℠ | 7.89% | -13.67% |

| MSCI ACWI (All Country World Index) Index | 16.97% | -0.17% |

| $10,000 Over Life of Fund |

Let's say hypothetically that $10,000 was invested in Fidelity® Electric Vehicles and Future Transportation ETF - NAV, on October 5, 2021, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Electric Vehicles and Future Transportation Index℠ and MSCI ACWI (All Country World Index) Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Tesla, Inc. | 5.2 | |

| NXP Semiconductors NV | 3.8 | |

| Infineon Technologies AG | 3.7 | |

| Aptiv PLC | 3.4 | |

| ON Semiconductor Corp. | 3.4 | |

| Albemarle Corp. | 3.4 | |

| STMicroelectronics NV (Italy) | 3.2 | |

| Li Auto, Inc. Class A | 3.2 | |

| Samsung SDI Co. Ltd. | 3.1 | |

| NIO, Inc. sponsored ADR | 2.9 | |

| 35.3 | ||

| Market Sectors (% of Fund's net assets) | ||

| Consumer Discretionary | 38.7 | |

| Information Technology | 32.9 | |

| Industrials | 17.0 | |

| Materials | 11.3 | |

Asset Allocation (% of Fund's net assets) |

|

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 99.9% | |||

| Shares | Value ($) | ||

| CONSUMER DISCRETIONARY - 38.7% | |||

| Automobile Components - 15.5% | |||

| Aptiv PLC (a) | 18,269 | 1,865,082 | |

| Forvia (a) | 41,097 | 967,130 | |

| Gentex Corp. | 39,503 | 1,155,858 | |

| Lear Corp. | 8,817 | 1,265,680 | |

| Luminar Technologies, Inc. (a) | 96,495 | 663,886 | |

| Mobileye Global, Inc. | 14,641 | 562,507 | |

| Valeo SA | 48,084 | 1,029,783 | |

| Visteon Corp. (a) | 6,556 | 941,507 | |

| 8,451,433 | |||

| Automobiles - 19.9% | |||

| Li Auto, Inc. Class A (a) | 101,200 | 1,749,815 | |

| Lucid Group, Inc. Class A (a) | 140,500 | 968,045 | |

| NIO, Inc. sponsored ADR (a) | 166,015 | 1,608,685 | |

| Rivian Automotive, Inc. (a) | 77,858 | 1,297,114 | |

| Tesla, Inc. (a) | 10,719 | 2,805,915 | |

| XPeng, Inc. Class A (a) | 237,500 | 1,515,326 | |

| Yadea Group Holdings Ltd. (b) | 380,000 | 864,099 | |

| 10,808,999 | |||

| Household Durables - 2.6% | |||

| Garmin Ltd. | 13,755 | 1,434,509 | |

| Specialty Retail - 0.7% | |||

| EVgo, Inc. Class A (a) | 92,536 | 370,144 | |

TOTAL CONSUMER DISCRETIONARY | 21,065,085 | ||

| INDUSTRIALS - 17.0% | |||

| Electrical Equipment - 14.7% | |||

| Ballard Power Systems, Inc. (a) | 136,261 | 597,252 | |

| Blink Charging Co. (a) | 57,797 | 346,204 | |

| Bloom Energy Corp. Class A (a) | 55,272 | 903,697 | |

| ChargePoint Holdings, Inc. Class A (a) | 79,704 | 700,598 | |

| Doosan Fuel Cell Co. Ltd. (a) | 24,256 | 528,325 | |

| FuelCell Energy, Inc. (a) | 250,712 | 541,538 | |

| LG Energy Solution (a) | 3,406 | 1,429,452 | |

| Mabuchi Motor Co. Ltd. | 23,900 | 662,754 | |

| Plug Power, Inc. (a) | 110,308 | 1,146,100 | |

| Sensata Technologies, Inc. PLC | 25,202 | 1,133,838 | |

| 7,989,758 | |||

| Ground Transportation - 1.6% | |||

| Lyft, Inc. (a) | 87,615 | 840,228 | |

| Machinery - 0.7% | |||

| Blue Bird Corp. (a) | 16,998 | 382,115 | |

TOTAL INDUSTRIALS | 9,212,101 | ||

| INFORMATION TECHNOLOGY - 32.9% | |||

| Electronic Equipment, Instruments & Components - 3.1% | |||

| Samsung SDI Co. Ltd. | 3,274 | 1,662,282 | |

| Semiconductors & Semiconductor Equipment - 29.8% | |||

| Allegro MicroSystems LLC (a) | 17,781 | 802,634 | |

| Ambarella, Inc. (a) | 9,568 | 800,555 | |

| Himax Technologies, Inc. sponsored ADR | 69,409 | 468,511 | |

| indie Semiconductor, Inc. (a) | 47,153 | 443,238 | |

| Infineon Technologies AG | 49,431 | 2,037,716 | |

| Lattice Semiconductor Corp. (a) | 13,878 | 1,333,259 | |

| Lx Semicon Co. Ltd. | 5,754 | 496,949 | |

| NVIDIA Corp. | 2,431 | 1,028,362 | |

| NXP Semiconductors NV | 10,212 | 2,090,192 | |

| ON Semiconductor Corp. (a) | 19,591 | 1,852,917 | |

| Renesas Electronics Corp. (a) | 56,400 | 1,054,171 | |

| SiTime Corp. (a) | 5,892 | 695,079 | |

| Skyworks Solutions, Inc. | 12,405 | 1,373,109 | |

| STMicroelectronics NV (Italy) | 35,306 | 1,754,919 | |

| 16,231,611 | |||

TOTAL INFORMATION TECHNOLOGY | 17,893,893 | ||

| MATERIALS - 11.3% | |||

| Chemicals - 9.2% | |||

| Albemarle Corp. | 8,248 | 1,840,046 | |

| Ganfeng Lithium Group Co. Ltd. (H Shares) (b) | 122,480 | 798,654 | |

| Livent Corp. (a) | 39,079 | 1,071,937 | |

| SK IE Technology Co. Ltd. (a)(b) | 10,271 | 754,550 | |

| Tianqi Lithium Corp. (H Shares) | 77,000 | 535,991 | |

| 5,001,178 | |||

| Metals & Mining - 2.1% | |||

| Allkem Ltd. (a) | 107,634 | 1,147,778 | |

TOTAL MATERIALS | 6,148,956 | ||

| TOTAL COMMON STOCKS (Cost $58,461,337) | 54,320,035 | ||

| TOTAL INVESTMENT IN SECURITIES - 99.9% (Cost $58,461,337) | 54,320,035 |

NET OTHER ASSETS (LIABILITIES) - 0.1% | 75,349 |

| NET ASSETS - 100.0% | 54,395,384 |

| (a) | Non-income producing |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $2,417,303 or 4.4% of net assets. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | - | 2,474,687 | 2,474,687 | 273 | - | - | - | 0.0% |

| Total | - | 2,474,687 | 2,474,687 | 273 | - | - | - | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Consumer Discretionary | 21,065,085 | 21,065,085 | - | - |

Industrials | 9,212,101 | 9,212,101 | - | - |

Information Technology | 17,893,893 | 17,893,893 | - | - |

Materials | 6,148,956 | 6,148,956 | - | - |

| Total Investments in Securities: | 54,320,035 | 54,320,035 | - | - |

| Statement of Assets and Liabilities | ||||

| June 30, 2023 | ||||

| Assets | ||||

Investment in securities, at value - See accompanying schedule Unaffiliated issuers (cost $58,461,337): | $ | 54,320,035 | ||

| Cash | 15,788 | |||

| Foreign currency held at value (cost $1,393) | 1,394 | |||

| Dividends receivable | 75,281 | |||

Total assets | 54,412,498 | |||

| Liabilities | ||||

| Accrued management fee | $ | 17,114 | ||

| Total Liabilities | 17,114 | |||

| Net Assets | $ | 54,395,384 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 71,489,561 | ||

| Total accumulated earnings (loss) | (17,094,177) | |||

| Net Assets | $ | 54,395,384 | ||

Net Asset Value , offering price and redemption price per share ($54,395,384 ÷ 2,850,000 shares) | $ | 19.09 | ||

| Statement of Operations | ||||

Year ended June 30, 2023 | ||||

| Investment Income | ||||

| Dividends | $ | 315,221 | ||

| Income from Fidelity Central Funds | 273 | |||

| Income before foreign taxes withheld | $ | 315,494 | ||

| Less foreign taxes withheld | (18,776) | |||

| Total Income | 296,718 | |||

| Expenses | ||||

| Management fee | $ | 178,867 | ||

| Independent trustees' fees and expenses | 221 | |||

| Total expenses before reductions | 179,088 | |||

| Expense reductions | (95) | |||

| Total expenses after reductions | 178,993 | |||

| Net Investment income (loss) | 117,725 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (8,662,665) | |||

| Foreign currency transactions | (15,215) | |||

| Total net realized gain (loss) | (8,677,880) | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 12,015,537 | |||

| Assets and liabilities in foreign currencies | 204 | |||

| Total change in net unrealized appreciation (depreciation) | 12,015,741 | |||

| Net gain (loss) | 3,337,861 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 3,455,586 | ||

| Statement of Changes in Net Assets | ||||

Year ended June 30, 2023 | For the period October 5, 2021 (commencement of operations) through June 30, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 117,725 | $ | 67,784 |

| Net realized gain (loss) | (8,677,880) | (3,782,899) | ||

| Change in net unrealized appreciation (depreciation) | 12,015,741 | (16,156,923) | ||

| Net increase (decrease) in net assets resulting from operations | 3,455,586 | (19,872,038) | ||

| Distributions to shareholders | (119,850) | (64,350) | ||

| Share transactions | ||||

| Proceeds from sales of shares | 12,741,845 | 62,232,758 | ||

| Cost of shares redeemed | - | (3,978,567) | ||

Net increase (decrease) in net assets resulting from share transactions | 12,741,845 | 58,254,191 | ||

| Total increase (decrease) in net assets | 16,077,581 | 38,317,803 | ||

| Net Assets | ||||

| Beginning of period | 38,317,803 | - | ||

| End of period | $ | 54,395,384 | $ | 38,317,803 |

| Other Information | ||||

| Shares | ||||

| Sold | 700,000 | 2,300,000 | ||

| Redeemed | - | (150,000) | ||

| Net increase (decrease) | 700,000 | 2,150,000 | ||

| Fidelity® Electric Vehicles and Future Transportation ETF |

| Years ended June 30, | 2023 | 2022 A | ||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 17.82 | $ | 25.20 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .05 | .04 | ||

| Net realized and unrealized gain (loss) | 1.27 | (7.39) | ||

| Total from investment operations | 1.32 | (7.35) | ||

| Distributions from net investment income | (.05) | (.03) | ||

| Total distributions | (.05) | (.03) | ||

| Net asset value, end of period | $ | 19.09 | $ | 17.82 |

Total Return D,E,F | 7.36% | (29.15)% | ||

Ratios to Average Net Assets C,G,H | ||||

| Expenses before reductions | .39% | .39% I | ||

| Expenses net of fee waivers, if any | .39% | .39% I | ||

| Expenses net of all reductions | .39% | .39% I | ||

| Net investment income (loss) | .26% | .25% I | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 54,395 | $ | 38,318 |

Portfolio turnover rate J,K | 62% | 31% L |

| Average Annual Total Returns | |||

Periods ended June 30, 2023 | Past 1 year | Life of Fund A |

| Fidelity® Metaverse ETF - NAV | 21.06% | 1.75% |

Fidelity® Metaverse ETF - Market Price B | 21.49% | 6.14% |

| Fidelity Metaverse Index℠ | 21.68% | 2.28% |

| MSCI ACWI (All Country World Index) Index | 16.97% | 0.92% |

| $10,000 Over Life of Fund |

Let's say hypothetically that $10,000 was invested in Fidelity® Metaverse ETF - NAV, on April 19, 2022, when the fund started. The chart shows how the value of your investment would have changed, and also shows how the Fidelity Metaverse Index℠ and MSCI ACWI (All Country World Index) Index performed over the same period. |

|

Top Holdings (% of Fund's net assets) | ||

| Adobe, Inc. | 5.0 | |

| NVIDIA Corp. | 4.6 | |

| Meta Platforms, Inc. Class A | 4.6 | |

| Tencent Holdings Ltd. | 4.5 | |

| Samsung Electronics Co. Ltd. | 4.4 | |

| Alphabet, Inc. Class A | 4.2 | |

| Nintendo Co. Ltd. | 3.9 | |

| NetEase, Inc. | 3.6 | |

| Digital Realty Trust, Inc. | 3.4 | |

| Electronic Arts, Inc. | 3.3 | |

| 41.5 | ||

| Market Sectors (% of Fund's net assets) | ||

| Communication Services | 57.9 | |

| Information Technology | 36.9 | |

| Real Estate | 3.4 | |

| Consumer Discretionary | 1.4 | |

Asset Allocation (% of Fund's net assets) |

|

Futures - 0.2% |

Geographic Diversification (% of Fund's net assets) |

|

* Includes Short-Term investments and Net Other Assets (Liabilities). Percentages are adjusted for the effect of derivatives, if applicable. |

| Common Stocks - 99.6% | |||

| Shares | Value ($) | ||

| COMMUNICATION SERVICES - 57.9% | |||

| Entertainment - 38.3% | |||

| Capcom Co. Ltd. | 7,600 | 299,457 | |

| China Ruyi Holdings Ltd. (a) | 680,000 | 159,661 | |

| CMGE Technology Group Ltd. (a) | 442,000 | 98,704 | |

| Com2uS Corp. | 2,439 | 112,172 | |

| Electronic Arts, Inc. | 4,203 | 545,129 | |

| Embracer Group AB (a) | 85,438 | 213,253 | |

| GungHo Online Entertainment, Inc. | 8,500 | 166,136 | |

| Kakao Games Corp. (a) | 6,275 | 156,440 | |

| Koei Tecmo Holdings Co. Ltd. | 12,500 | 214,957 | |

| Konami Group Corp. | 5,400 | 280,994 | |

| KRAFTON, Inc. (a) | 2,002 | 295,974 | |

| NCSOFT Corp. | 1,075 | 240,675 | |

| Neowiz (a) | 3,456 | 103,078 | |

| NetEase, Inc. | 31,000 | 603,655 | |

| Netmarble Corp. (a)(b) | 4,093 | 152,519 | |

| Nexon Co. Ltd. | 16,900 | 321,198 | |

| Nexon Games Co. Ltd. (a) | 7,913 | 136,022 | |

| Nintendo Co. Ltd. | 14,400 | 651,778 | |

| Roblox Corp. (a) | 9,830 | 396,149 | |

| Square Enix Holdings Co. Ltd. | 5,800 | 268,381 | |

| Take-Two Interactive Software, Inc. (a) | 3,389 | 498,725 | |

| Ubisoft Entertainment SA (a) | 7,966 | 224,921 | |

| WeMade Entertainment Co. Ltd. | 4,118 | 122,041 | |

| XD, Inc. (a) | 53,800 | 135,245 | |

| 6,397,264 | |||

| Interactive Media & Services - 19.6% | |||

| Alphabet, Inc. Class A (a) | 5,871 | 702,759 | |

| Bumble, Inc. (a) | 11,870 | 199,179 | |

| Meta Platforms, Inc. Class A (a) | 2,665 | 764,802 | |

| NAVER Corp. | 3,075 | 426,600 | |

| Snap, Inc. Class A (a) | 34,980 | 414,163 | |

| Tencent Holdings Ltd. | 17,900 | 757,425 | |

| 3,264,928 | |||

TOTAL COMMUNICATION SERVICES | 9,662,192 | ||

| CONSUMER DISCRETIONARY - 1.4% | |||

| Household Durables - 0.7% | |||

| Vuzix Corp. (a) | 22,578 | 115,148 | |

| Leisure Products - 0.7% | |||

| Golfzon Co. Ltd. | 1,383 | 121,438 | |

TOTAL CONSUMER DISCRETIONARY | 236,586 | ||

| INFORMATION TECHNOLOGY - 36.9% | |||

| IT Services - 2.8% | |||

| GDS Holdings Ltd. Class A (a) | 142,300 | 194,295 | |

| NEXTDC Ltd. (a) | 32,787 | 274,554 | |

| 468,849 | |||

| Semiconductors & Semiconductor Equipment - 9.0% | |||

| ams-OSRAM AG (a) | 27,982 | 201,487 | |

| Cirrus Logic, Inc. (a) | 3,465 | 280,700 | |

| NVIDIA Corp. | 1,826 | 772,435 | |

| Synaptics, Inc. (a) | 2,966 | 253,237 | |

| 1,507,859 | |||

| Software - 18.3% | |||

| Adobe, Inc. (a) | 1,701 | 831,767 | |

| Bentley Systems, Inc. Class B | 7,208 | 390,890 | |

| Dassault Systemes SA | 11,773 | 521,801 | |

| Matterport, Inc. (a) | 49,401 | 155,613 | |

| Nemetschek SE | 3,422 | 256,261 | |

| PTC, Inc. (a) | 3,005 | 427,612 | |

| Unity Software, Inc. (a) | 10,771 | 467,677 | |

| 3,051,621 | |||

| Technology Hardware, Storage & Peripherals - 6.8% | |||

| Samsung Electronics Co. Ltd. | 13,541 | 741,973 | |

| Super Micro Computer, Inc. (a) | 1,595 | 397,554 | |

| 1,139,527 | |||

TOTAL INFORMATION TECHNOLOGY | 6,167,856 | ||

| REAL ESTATE - 3.4% | |||

| Equity Real Estate Investment Trusts (REITs) - 3.4% | |||

| Digital Realty Trust, Inc. | 4,956 | 564,340 | |

| TOTAL COMMON STOCKS (Cost $15,916,295) | 16,630,974 | ||

| Money Market Funds - 1.7% | |||

| Shares | Value ($) | ||

Fidelity Cash Central Fund 5.14% (c) (Cost $278,050) | 277,994 | 278,050 | |

| TOTAL INVESTMENT IN SECURITIES - 101.3% (Cost $16,194,345) | 16,909,024 |

NET OTHER ASSETS (LIABILITIES) - (1.3)% | (220,277) |

| NET ASSETS - 100.0% | 16,688,747 |

| Futures Contracts | |||||

Number of contracts | Expiration Date | Notional Amount ($) | Value ($) | Unrealized Appreciation/ (Depreciation) ($) | |

| Purchased | |||||

| Equity Index Contracts | |||||

| CME E-mini NASDAQ 100 Index Contracts (United States) | 1 | Sep 2023 | 30,674 | 1,311 | 1,311 |

| The notional amount of futures purchased as a percentage of Net Assets is 0.2% | |||||

| (a) | Non-income producing |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $152,519 or 0.9% of net assets. |

| (c) | Affiliated fund that is generally available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements, which are not covered by the Fund's Report of Independent Registered Public Accounting Firm, are available on the SEC's website or upon request. |

| Affiliate | Value, beginning of period ($) | Purchases ($) | Sales Proceeds ($) | Dividend Income ($) | Realized Gain (loss) ($) | Change in Unrealized appreciation (depreciation) ($) | Value, end of period ($) | % ownership, end of period |

| Fidelity Cash Central Fund 5.14% | - | 601,452 | 323,402 | 569 | - | - | 278,050 | 0.0% |

| Total | - | 601,452 | 323,402 | 569 | - | - | 278,050 | |

| Valuation Inputs at Reporting Date: | ||||

| Description | Total ($) | Level 1 ($) | Level 2 ($) | Level 3 ($) |

Investments in Securities: | ||||

| Equities: | ||||

Communication Services | 9,662,192 | 9,662,192 | - | - |

Consumer Discretionary | 236,586 | 236,586 | - | - |

Information Technology | 6,167,856 | 6,167,856 | - | - |

Real Estate | 564,340 | 564,340 | - | - |

| Money Market Funds | 278,050 | 278,050 | - | - |

| Total Investments in Securities: | 16,909,024 | 16,909,024 | - | - |

Derivative Instruments: | ||||

| Assets | ||||

Futures Contracts | 1,311 | 1,311 | - | - |

| Total Assets | 1,311 | 1,311 | - | - |

| Total Derivative Instruments: | 1,311 | 1,311 | - | - |

Primary Risk Exposure / Derivative Type | Value | |

| Asset ($) | Liability ($) | |

| Equity Risk | ||

Futures Contracts (a) | 1,311 | 0 |

| Total Equity Risk | 1,311 | 0 |

| Total Value of Derivatives | 1,311 | 0 |

| Statement of Assets and Liabilities | ||||

| June 30, 2023 | ||||

| Assets | ||||

| Investment in securities, at value - See accompanying schedule: | ||||

Unaffiliated issuers (cost $15,916,295) | $ | 16,630,974 | ||

Fidelity Central Funds (cost $278,050) | 278,050 | |||

| Total Investment in Securities (cost $16,194,345) | $ | 16,909,024 | ||

| Segregated cash with brokers for derivative instruments | 1,680 | |||

| Cash | 192 | |||

| Foreign currency held at value (cost $4,904) | 4,918 | |||

| Dividends receivable | 5,818 | |||

| Distributions receivable from Fidelity Central Funds | 102 | |||

| Receivable for daily variation margin on futures contracts | 474 | |||

Total assets | 16,922,208 | |||

| Liabilities | ||||

| Payable for investments purchased | $ | 228,390 | ||

| Accrued management fee | 5,071 | |||

| Total Liabilities | 233,461 | |||

| Net Assets | $ | 16,688,747 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 16,570,481 | ||

| Total accumulated earnings (loss) | 118,266 | |||

| Net Assets | $ | 16,688,747 | ||

Net Asset Value , offering price and redemption price per share ($16,688,747 ÷ 650,000 shares) | $ | 25.67 | ||

| Statement of Operations | ||||

Year ended June 30, 2023 | ||||

| Investment Income | ||||

| Dividends | $ | 86,936 | ||

| Non-Cash dividends | 35,300 | |||

| Income from Fidelity Central Funds | 569 | |||

| Income before foreign taxes withheld | $ | 122,805 | ||

| Less foreign taxes withheld | (8,283) | |||

| Total Income | 114,522 | |||

| Expenses | ||||

| Management fee | $ | 50,615 | ||

| Independent trustees' fees and expenses | 55 | |||

| Total expenses before reductions | 50,670 | |||

| Expense reductions | (282) | |||

| Total expenses after reductions | 50,388 | |||

| Net Investment income (loss) | 64,134 | |||

| Realized and Unrealized Gain (Loss) | ||||

| Net realized gain (loss) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | (414,949) | |||

| Redemptions in-kind | 968,649 | |||

| Foreign currency transactions | (4,020) | |||

| Futures contracts | 8,410 | |||

| Total net realized gain (loss) | 558,090 | |||

| Change in net unrealized appreciation (depreciation) on: | ||||

| Investment Securities: | ||||

| Unaffiliated issuers | 2,002,047 | |||

| Assets and liabilities in foreign currencies | 16 | |||

| Futures contracts | 1,634 | |||

| Total change in net unrealized appreciation (depreciation) | 2,003,697 | |||

| Net gain (loss) | 2,561,787 | |||

| Net increase (decrease) in net assets resulting from operations | $ | 2,625,921 | ||

| Statement of Changes in Net Assets | ||||

Year ended June 30, 2023 | For the period April 19, 2022 (commencement of operations) through June 30, 2022 | |||

| Increase (Decrease) in Net Assets | ||||

| Operations | ||||

| Net investment income (loss) | $ | 64,134 | $ | 214 |

| Net realized gain (loss) | 558,090 | (123,480) | ||

| Change in net unrealized appreciation (depreciation) | 2,003,697 | (1,287,738) | ||

| Net increase (decrease) in net assets resulting from operations | 2,625,921 | (1,411,004) | ||

| Distributions to shareholders | (70,500) | - | ||

| Share transactions | ||||

| Proceeds from sales of shares | 6,111,398 | 13,140,454 | ||

| Cost of shares redeemed | (2,636,047) | (1,071,475) | ||

Net increase (decrease) in net assets resulting from share transactions | 3,475,351 | 12,068,979 | ||

| Total increase (decrease) in net assets | 6,030,772 | 10,657,975 | ||

| Net Assets | ||||

| Beginning of period | 10,657,975 | - | ||

| End of period | $ | 16,688,747 | $ | 10,657,975 |

| Other Information | ||||

| Shares | ||||

| Sold | 250,000 | 550,000 | ||

| Redeemed | (100,000) | (50,000) | ||

| Net increase (decrease) | 150,000 | 500,000 | ||

| Fidelity® Metaverse ETF |

| Years ended June 30, | 2023 | 2022 A | ||

Selected Per-Share Data | ||||

| Net asset value, beginning of period | $ | 21.32 | $ | 25.28 |

| Income from Investment Operations | ||||

Net investment income (loss) B,C | .11 D | - E | ||

| Net realized and unrealized gain (loss) | 4.36 | (3.96) | ||

| Total from investment operations | 4.47 | (3.96) | ||

| Distributions from net investment income | (.12) | - | ||

| Total distributions | (.12) | - | ||

| Net asset value, end of period | $ | 25.67 | $ | 21.32 |

Total Return F,G,H | 21.06% | (15.67)% | ||

Ratios to Average Net Assets C,I,J | ||||

| Expenses before reductions | .39% | .39% K | ||

| Expenses net of fee waivers, if any | .39% | .39% K | ||

| Expenses net of all reductions | .39% | .39% K | ||

| Net investment income (loss) | .49% D | .01% K | ||

| Supplemental Data | ||||

| Net assets, end of period (000 omitted) | $ | 16,689 | $ | 10,658 |

Portfolio turnover rate L,M | 47% | 8% N |

| Fidelity Central Fund | Investment Manager | Investment Objective | Investment Practices | Expense Ratio A |

| Fidelity Money Market Central Funds | Fidelity Management & Research Company LLC (FMR) | Each fund seeks to obtain a high level of current income consistent with the preservation of capital and liquidity. | Short-term Investments | Less than .005% |

| Tax cost | Gross unrealized appreciation | Gross unrealized depreciation | Net unrealized appreciation (depreciation) | |

| Fidelity Clean Energy ETF | $43,435,173 | $3,307,362 | $(8,307,451) | $(5,000,089) |

| Fidelity Cloud Computing ETF | 37,502,705 | 3,590,022 | (4,167,088) | (577,066) |

Fidelity Crypto Industry and Digital Payments ETF | 27,815,659 | 10,198,630 | (1,555,734) | 8,642,896 |

| Fidelity Digital Health ETF | 11,296,611 | 901,285 | (2,373,457) | (1,472,172) |

Fidelity Electric Vehicles and Future Transportation ETF | 58,626,550 | 7,189,130 | (11,495,645) | (4,306,515) |

| Fidelity Metaverse ETF | 16,327,224 | 1,978,112 | (1,396,312) | 581,800 |

| Undistributed ordinary income | Capital loss carryforward | Net unrealized appreciation (depreciation) on securities and other investments | |

| Fidelity Clean Energy ETF | $- | $ (2,737,402) | $ (4,995,816) |

| Fidelity Cloud Computing ETF | - | (4,465,903) | (574,369) |

Fidelity Crypto Industry and Digital Payments ETF | 132,239 | (4,237,988) | 8,642,883 |

| Fidelity Digital Health ETF | - | (1,447,697) | (1,471,905) |

Fidelity Electric Vehicles and Future Transportation ETF | - | (12,775,795) | (4,304,638) |

| Fidelity Metaverse ETF | 7,324 | (470,880) | 581,821 |

| Short-term | Long-term | Total capital loss carryforward | |

| Fidelity Clean Energy ETF | $(1,596,374) | $(1,141,028) | $(2,737,402) |

| Fidelity Cloud Computing ETF | (1,589,073) | (2,876,830) | (4,465,903) |

Fidelity Crypto Industry and Digital Payments ETF | (3,656,444) | (581,544) | (4,237,988) |

| Fidelity Digital Health ETF | (435,575) | (1,012,122) | (1,447,697) |

Fidelity Electric Vehicles and Future Transportation ETF | (8,644,807) | (4,130,988) | (12,775,795) |

| Fidelity Metaverse ETF | (430,373) | (40,507) | (470,880) |

| Ordinary losses ($) | |

| Fidelity Cloud Computing ETF | (5,481) |

| Fidelity Electric Vehicles and Future Transportation ETF | (13,743) |

| June 30, 2023 | |||

| Ordinary Income | Tax Return of Capital | Total | |

| Fidelity Clean Energy ETF | $306,800 | $- | $306,800 |

| Fidelity Cloud Computing ETF | 48,880 | 14,820 | 63,700 |

Fidelity Crypto Industry and Digital Payments ETF | - | - | - |

| Fidelity Digital Health ETF | 15,500 | - | 15,500 |

Fidelity Electric Vehicles and Future Transportation ETF | 119,850 | - | 119,850 |

| Fidelity Metaverse ETF | 70,500 | - | 70,500 |

| June 30, 2022 | ||

| Ordinary Income | Total | |

| Fidelity Clean Energy ETF | $145,750 | $145,750 |

| Fidelity Cloud Computing ETF | 57,350 | 57,350 |

Fidelity Crypto Industry and Digital Payments ETF | - | - |

| Fidelity Digital Health ETF | - | - |

Fidelity Electric Vehicles and Future Transportation ETF | 64,350 | 64,350 |

| Fidelity Metaverse ETF | - | - |

| Equity Risk | Equity risk relates to the fluctuations in the value of financial instruments as a result of changes in market prices (other than those arising from interest rate risk or foreign exchange risk), whether caused by factors specific to an individual investment, its issuer, or all factors affecting all instruments traded in a market or market segment. |

| Purchases ($) | Sales ($) | |

| Fidelity Clean Energy ETF | 16,878,361 | 13,858,742 |

| Fidelity Cloud Computing ETF | 10,186,048 | 8,423,487 |

| Fidelity Crypto Industry and Digital Payments ETF | 12,101,096 | 11,898,376 |

| Fidelity Digital Health ETF | 3,766,416 | 3,427,444 |

| Fidelity Electric Vehicles and Future Transportation ETF | 30,192,485 | 27,931,323 |

| Fidelity Metaverse ETF | 9,272,755 | 5,930,846 |

| In-Kind Subscriptions ($) | In-Kind Redemptions ($) | |

| Fidelity Clean Energy ETF | 11,699,401 | 2,000,822 |

| Fidelity Cloud Computing ETF | 13,318,107 | - |

| Fidelity Crypto Industry and Digital Payments ETF | 14,161,087 | 1,241,384 |

| Fidelity Electric Vehicles and Future Transportation ETF | 10,392,464 | - |

| Fidelity Metaverse ETF | 2,937,457 | 2,615,739 |

| Fee Rate | |

| Fidelity Clean Energy ETF | .39% |

| Fidelity Cloud Computing ETF | .39% |

| Fidelity Crypto Industry and Digital Payments ETF | .39% |

| Fidelity Digital Health ETF | .39% |

Fidelity Electric Vehicles and Future Transportation ETF | .39% |

Fidelity Metaverse ETF | .39% |

| Amount ($) | |

| Fidelity Cloud Computing ETF | 6,267 |

| Custodian credits | |

| Fidelity Clean Energy ETF | $127 |

| Fidelity Cloud Computing ETF | 185 |

Fidelity Crypto Industry and Digital Payments ETF | 495 |

| Fidelity Digital Health ETF | 259 |

Fidelity Electric Vehicles and Future Transportation ETF | 95 |

| Fidelity Metaverse ETF | 282 |

| The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2023 to June 30, 2023). |

Annualized Expense Ratio- A | Beginning Account Value January 1, 2023 | Ending Account Value June 30, 2023 | Expenses Paid During Period- C January 1, 2023 to June 30, 2023 | |||||||

| Fidelity® Clean Energy ETF | .39% | |||||||||

| Actual | $ 1,000 | $ 964.00 | $ 1.90 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.86 | $ 1.96 | |||||||

| Fidelity® Cloud Computing ETF | .39% | |||||||||

| Actual | $ 1,000 | $ 1,313.20 | $ 2.24 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.86 | $ 1.96 | |||||||

| Fidelity® Crypto Industry and Digital Payments ETF | .39% | |||||||||

| Actual | $ 1,000 | $ 1,825.60 | $ 2.73 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.86 | $ 1.96 | |||||||

| Fidelity® Digital Health ETF | .39% | |||||||||

| Actual | $ 1,000 | $ 1,058.00 | $ 1.99 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.86 | $ 1.96 | |||||||

| Fidelity® Electric Vehicles and Future Transportation ETF | .39% | |||||||||

| Actual | $ 1,000 | $ 1,254.50 | $ 2.18 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.86 | $ 1.96 | |||||||

| Fidelity® Metaverse ETF | .39% | |||||||||

| Actual | $ 1,000 | $ 1,287.20 | $ 2.21 | |||||||

Hypothetical- B | $ 1,000 | $ 1,022.86 | $ 1.96 | |||||||

| Fidelity® Clean Energy ETF | |

| September 2022 | 20% |

| December 2022 | 20% |

| March 2023 | 10% |

| June 2023 | 10% |

| Fidelity® Cloud Computing ETF | |

| September 2022 | 100% |

| December 2022 | 100% |

| March 2023 | 42% |

| June 2023 | 42% |