UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the fiscal year ended December 31, 2017

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934.

For the transition period from to

Commission file number: 000-26408

WAYSIDE TECHNOLOGY GROUP, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware | | 13-3136104 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification Number) |

| | |

4 Industrial Way West, Suite 300 Eatontown, NJ | | 07724 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (732) 389-0932

Securities registered pursuant to section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.01 per share | | The NASDAQ Global Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or other information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | Accelerated filer ☒ | Non-accelerated filer ☐ | Smaller reporting company ☐ |

| | (Do not check if a

smaller reporting company) | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the Common Stock held by non-affiliates of the Registrant computed by reference to the closing sale price for the Registrant’s Common Stock as of June 30, 2017, which was the last business day of the Registrant’s most recently completed second fiscal quarter, as reported on The NASDAQ Global Market, was approximately $76,651,368 (In determining the market value of the Common Stock held by any non-affiliates, shares of Common Stock of the Registrant beneficially owned by directors, officers and holders of more than 10% of the outstanding shares of Common Stock of the Registrant have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes).

The number of shares outstanding of the Registrant’s Common Stock as of February 27, 2018 was 4,504,203 shares.

Documents Incorporated by Reference: Portions of the Registrant’s definitive Proxy Statement for its 2018 Annual Meeting of Stockholders to be filed on or before May 1, 2018 are incorporated by reference into Part III of this Report.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” within the meaning of Section 21E of the Exchange Act. Statements in this report regarding future events or conditions, including but not limited to statements regarding industry prospects and the Company’s expected financial position, business and financing plans, are forward-looking statements.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. We strongly urge current and prospective investors to carefully consider the cautionary statements and risks contained in this report, particularly the risks described under “Item 1A. Risk Factors” herein. Such risks include, but are not limited to, the continued acceptance of the Company’s distribution channel by vendors and customers, the timely availability and acceptance of new products, contribution of key vendor relationships and support programs, as well as factors that affect the software industry generally.

The Company operates in a rapidly changing business, and new risk factors emerge from time to time. Management cannot predict every risk factor, nor can it assess the impact, if any, of all such risk factors on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statements.

Accordingly, forward-looking statements should not be relied upon as a prediction of actual results and readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

The statements concerning future sales, future gross profit margin and future selling and administrative expenses are forward looking statements involving certain risks and uncertainties such as availability of products, product mix, pricing pressures, market conditions and other factors, which could result in a fluctuation of sales below recent experience.

PART I

Item 1 Business

General

Wayside Technology Group, Inc. and Subsidiaries (the “Company,” “us,” “we,” or “our”) is an information technology (“IT”) channel company. The Company operates through two reportable operating segments. The “Lifeboat Distribution” segment distributes technical software and hardware to corporate resellers, value added resellers (VARs), consultants and systems integrators worldwide. The “TechXtend” segment is a value-added reseller of software, hardware and services for corporations, government organizations and academic institutions in the USA and Canada. We offer an extensive line of products from leading publishers of software and tools for virtualization/cloud computing, security, networking, storage and infrastructure management, application lifecycle management and other technically sophisticated domains as well as computer hardware.

The Company was incorporated in Delaware in 1982. Our Common Stock is listed on The NASDAQ Global Market under the symbol “WSTG”. Our main web site address is www.waysidetechnology.com, and the other web sites maintained by our business include www.lifeboatdistribution.com, and www.techxtend.com. Reference to these “uniform resource locators” or “URLs” is made as an inactive textual reference for informational purposes only. Information on our web sites should not be considered filed with the Securities and Exchange Commission, and is not, and should not be deemed to be, a part of this report.

In our Lifeboat segment, we distribute technology products from software developers, publishers or equipment manufacturers to resellers, and system integrators worldwide. We purchase software, maintenance/service agreements, networking/storage/security equipment and complementary products from our vendors and sell them to our reseller customers. Generally, a vendor authorizes a limited of number of companies to act as distributors of their product and sell to resellers of their product. Our reseller customers include value-added resellers, or VARs, corporate resellers, government resellers, system integrators, direct marketers, and national IT superstores. We combine our core strengths in customer service, marketing, distribution, credit and billing to allow our customers to achieve greater efficiencies in time to market in the IT channel in a cost effective manner.

Our Lifeboat Distribution business is characterized by low gross profit as a percentage of revenue, or gross margin, and price competition. In our Lifeboat segment, we are highly dependent on the end-market demand for the products we sell, and on our partners’ strategic initiatives and business models. This end-market demand is influenced by many factors including the introduction of new products, replacement and renewal cycles for existing products, competitive products, overall economic growth and general business activity. A difficult and challenging economic environment may also lead to consolidation or decline in the industry and increased price-based competition.

We also provide comprehensive IT solutions directly to end users through our TechXtend segment. Products in this segment are acquired directly from equipment manufacturers, software developers or distributors and sold to end users. We provide customer service, billing, sales and marketing support in this segment and also provide extended payment terms to facilitate sales.

Products

An essential part of our ongoing operations and growth plans is the continued recruitment of software publishers for which we become authorized distributors of their products. The Company offers a wide variety of technology products from a broad range of publishers and manufacturers, such as Bluebeam Software, Dell/Dell Software, erwin, Flexera Software, Hewlett Packard, Infragistics, Intel Software, Lenovo, Micro Focus Microsoft, Mindjet, Samsung, SmartBear Software, SolarWinds, Sophos, StorageCraft Technology, TechSmith, Unitrends, Veeam Software and VMware. On a continuous basis, we screen new products for inclusion in our direct sales portfolio, and web sites based on their features, quality, price, profit margins and warranties, as well as on current sales trends. The

Company predominantly sells software, software subscriptions, and maintenance. Sales of hardware and peripherals represented 7%, 10%, and 10% of our overall net sales in 2017, 2016 and 2015, respectively.

Marketing and Distribution

We market products through creative marketing communications, including our web sites, local and on-line seminars, webinars, and social media. We also use direct e-mail and printed material to introduce new products and upgrades, to cross-sell products to current customers, and to educate and inform existing and potential customers. We believe that our blend of electronic and traditional marketing and selling programs are important marketing vehicles for software publishers and manufacturers. These programs provide a cost-effective and service-oriented means to market and sell and fulfill software products and meet the needs of users.

The Company had two customers that each accounted for more than 10% of total sales for 2017. For the year ended December 31, 2017, Software House International Corporation (“SHI”), and CDW Corporation (“CDW”) accounted for 23.0%, and 19.4%, respectively, of consolidated net sales and, as of December 31, 2017, 15.1% and 28.6%, respectively, of total net accounts receivable. For the year ended December 31, 2016, Software House International Corporation (“SHI”), and CDW Corporation (“CDW”) accounted for 19.6%, and 17.9%, respectively, of consolidated net sales, and, as of December 31, 2016, 13.3%, and 23.2%, respectively, of total net accounts receivable. For the year ended December 31, 2015, SHI, and CDW Corporation accounted for 19.0%, and 17.9%, respectively, of consolidated net sales. Our top five customers accounted for 52%, 48%, and 52% of consolidated net sales in 2017, 2016 and 2015, respectively. The Company generally ships products within 48 hours of confirming a customer’s order. This results in minimum backlog in the business.

Sales to customers in Canada represented 7%, 7%, and 6% of our consolidated revenue in 2017, 2016, and 2015, respectively. Sales in Europe and the rest of the world represented 6%, 6%, and 6% of our consolidated revenue in 2017, 2016, and 2015, respectively. For geographic financial information, please refer to Note 9 in the Notes to our Consolidated Financial Statements.

Customer Support

We believe that providing a high level of customer service is necessary to compete effectively, and is essential to continued sales and revenue growth. Our account representatives assist our customers with all aspects of purchasing decisions, order processing, and inquiries on order status, product pricing and availability. The account representatives are trained to answer all basic questions about the features and functionality of products.

Purchasing and Fulfillment

The Company’s success is dependent, in part, upon the ability of its suppliers to develop and market products that meet the changing requirements of the marketplace. The Company believes it enjoys good relationships with its vendors. The Company and its principal vendors have cooperated frequently in product introductions and in other marketing programs. As is customary in the industry, the Company has no long-term supply contracts with any of its suppliers. Substantially all of the Company’s contracts with its vendors are terminable upon 30 days’ notice or less. Moreover, the manner in which software products are distributed and sold is changing, and new methods of distribution and sale may emerge or expand. Software publishers have sold, and may intensify their efforts to sell, their products directly to end-users. The Company’s business and results of operations may be adversely affected if the terms and conditions of the Company’s authorizations with its vendors were to be significantly modified or if certain products become unavailable to the Company.

We believe that effective purchasing from a diverse vendor base is a key element of our business strategy. For the year ended December 31, 2017, Sophos and Solarwinds accounted for 26.4% and 14.7%, respectively of our consolidated purchases. For the year ended December 31, 2016, Sophos and Solarwinds accounted for 23.1% and 10.8%, respectively, of our consolidated purchases. For the year ended December 31, 2015, Sophos was the only individual vendor from whom our purchases exceeded 10% of our total purchases and accounted for 24.2% of our total

purchases. The loss of a key vendor or group of vendors could disrupt our product availability and otherwise have an adverse effect on the Company.

In 2017, 2016 and 2015 the Company purchased approximately 96% of its products directly from manufacturers and publishers and the balance from multiple distributors. Most suppliers or distributors will “drop ship” products directly to the customers, which reduces physical handling by the Company. Inventory management techniques, such as “drop shipping” allow the Company to offer a greater range of products without increased inventory requirements or associated risk.

Inventory levels may vary from period to period, due in part to increases or decreases in sales levels, the Company’s practice of making large-volume purchases when it deems the terms of such purchases to be attractive, and the addition of new suppliers and products. Moreover, the Company’s order fulfillment and inventory control systems allow the Company to order certain products just in time for next day shipping. The Company promotes the use of electronic data interchange (“EDI”) with its suppliers and customers, which helps reduce overhead and the use of paper in the ordering process. Although brand names and individual products are important to our business, we believe that competitive sources of supply are available for substantially all of the product categories we carry.

The Company operates a distribution facility in Eatontown, New Jersey.

Competition

The software market is highly competitive and characterized by aggressive pricing practices by both software distributors and resellers. This has resulted in declining gross margins as a percentage of sales, which the Company expects to continue. The Company faces competition from a wide variety of sources competing principally on the basis of price, product availability, customer service and technical support. In the Lifeboat Distribution segment, we compete against much larger broad-line distributors, as well as specialty distributors and, in some cases, the direct sales teams of the vendors we represent, who also sell directly to the end-customers. In the TechXtend segment, we compete against vendors who sell directly to customers, as well as software resellers, superstores, e-commerce vendors, and other direct marketers of software and hardware products. In both segments, some of our competitors are significantly larger and have substantially greater resources than the Company.

There can be no assurance that the Company can compete effectively against existing competitors or new competitors that may enter the market or that it can generate profit margins which represent a fair return to the Company. An increase in the amount of competition faced by the Company, or its failure to compete effectively against its competitors, could have a material adverse effect on the Company’s business, financial condition and results of operations.

The Company competes with other distributors and resellers to become an authorized distributor or reseller of products from software developers and publishers. It also competes with distributors and resellers to attract prospective buyers, and to source new products from software developers and publishers, and to market its current product line to customers. The Company believes that its ability to offer software developers and IT professionals easy access to a wide selection of the desired IT products at reasonable prices with prompt delivery and high customer service levels, along with its good relationships with vendors and suppliers, allows it to compete effectively. The Company competes to gain distribution rights for new products primarily on the basis of its reputation for successfully bringing new products to market and the strength of and quality of its relationships with software publishers.

The market for the software products we sell is characterized by rapid changes in technology, user requirements, and customer specifications. The manner in which software products are distributed and sold is changing, and new methods of distribution and sale may emerge or expand. Software developers and publishers have sold, and may intensify their efforts to sell, their products directly to end-users. The continuing evolution of the Internet as a platform in which to conduct e-commerce business transactions has both lowered the barriers for competition and broadened customer access to products and information, increasing competition and reducing prices. From time to time, certain software developers and publishers have instituted programs for the direct sale of large order quantities of software to certain major corporate accounts. These types of programs may continue to be developed and used by

various developers and publishers. While some software developers and publishers currently sell new releases or upgrades directly to end users, they have not attempted to completely bypass the distribution and reseller channels. There can be no assurances, however, that software developers and publishers will continue using distributors and resellers to the same extent they currently do. Future efforts by software developers and publishers to bypass third-party sales channels could materially and adversely affect the Company’s business operations and financial conditions.

In addition, resellers and publishers may attempt to increase the volume of software products distributed electronically through ESD (Electronic Software Distribution) technology, through subscription services, and through on-line shopping services. Any of these competitive programs, if successful, could have a material adverse effect on the Company’s business, results of operations and financial condition. For a description of additional risks relating to competition in our industry, please refer to “Item 1.A. Risk Factors”: “We rely on our suppliers for product availability, marketing funds, purchasing incentives and competitive products to sell”, and “The IT products and services industry is intensely competitive and actions of competitors, including manufacturers of products we sell, can negatively affect our business.”

Management Information Systems

The Company operates management information systems on Windows 2008 and Windows 2012 platforms that allow for centralized management of key functions, including inventory, accounts receivable, purchasing, sales and distribution. We are dependent on the accuracy and proper utilization of our information technology systems, including our telephone, websites, e-mail and fax systems.

The management information systems allow the Company to monitor sales trends, provide real-time product availability and order status information, track direct marketing campaign performance and to make marketing event driven purchasing decisions. In addition to the main system, the Company has systems of networked personal computers, as well as microcomputer-based desktop publishing systems, which facilitate data sharing and provide an automated office environment.

The Company recognizes the need to continually upgrade its management information systems to most effectively manage its operations and customer database. In that regard, the Company anticipates that it will, from time to time, require software and hardware upgrades for its present management information systems.

Trademarks

The Company conducts its business under various trademarks and service marks including Lifeboat Distribution, TechXtend and International Software Partners. The Company protects these trademarks and service marks and believes that they have significant value to us and are important factors in our marketing programs.

Employees

As of December 31, 2017, Wayside Technology Group, Inc. and its subsidiaries had 138 full-time employees and 2 part-time employees. The Company is not a party to any collective bargaining agreements with its employees, has experienced no work stoppages and considers its relationships with its employees to be satisfactory.

Executive Officers of the Company

Set forth below are the name, age, present title, principal occupation and certain biographical information for our executive officers as of February 1, 2018 all of whom have been appointed by and serve at the discretion of the Board of Directors of the Company (the “Board of Directors”).

| | | | |

Name | | Age | | Position |

Simon F. Nynens | | 46 | | Chairman, President and Chief Executive Officer |

Dale Foster | | 54 | | Executive Vice President |

Michael Vesey | | 55 | | Vice President and Chief Financial Officer |

Kevin Scull | | 52 | | Vice President and Chief Accounting Officer |

Vito Legrottaglie | | 53 | | VP of Operations and Chief Information Officer |

Brian Gilbertson | | 57 | | VP and General Manager of Lifeboat Distribution |

Charles Bass | | 53 | | VP New Business Development |

Simon F. Nynens was appointed President and Chief Executive Officer in January 2006. Mr. Nynens also serves on the Board of Directors and was named Chairman in June 2006. He previously held the position of Executive Vice President and Chief Financial Officer (June 2004 - January 2006) and Vice President and Chief Financial Officer (January 2002 - June 2004). Prior to January 2002, Mr. Nynens served as the Vice President and Chief Operating Officer of the Company’s European operations.

Dale Foster was appointed Executive Vice President in January 2018. Mr. Foster Previously served as Executive Director and General Manager of Promark Technology Inc. from November 2012 until he joined the Company. Prior to that he served as President and CEO of Promark prior to its acquisition by Ingram Micro.

Michael Vesey was appointed Vice President and Chief Financial Officer in October 2016. He served as Vice President of SEC Reporting for OTG Management, Inc., from January to September 2016. Prior to that, Mr. Vesey served as Senior Vice President and Chief Financial Officer from 2011 to 2015, and Vice President Corporate Controller from 2006 to 2011, for Majesco Entertainment Company, a NASDAQ listed publisher and distributor of interactive entertainment software. Mr. Vesey is a certified public accountant and holds a Master of Finance degree from Penn State University. He began his career with the accounting firm KPMG.

Kevin Scull was appointed to the position of Vice President and Chief Accounting Officer in February 2015, after having served as the Vice President and Interim Chief Financial Officer since February 2014. He previously held the position of Vice President and Chief Accounting Officer from January 2006 to August 2012, after having served as Corporate Controller of the company since January 2003. Prior to joining Wayside Technology Group, Inc., Mr. Scull worked for Niksun Inc. as Accounting Manager from January 2001to January 2003 and, prior to that, he worked for Telcordia Inc. from December 2000 to January 2001, as Manager of Accounting Policies.

Vito Legrottaglie was appointed to the position of Vice President and Chief Information Officer in February 2015, after having served as Vice President of Operations and Information Systems since April 2007. Mr. Legrottaglie rejoined the company in February 2003 having previously served as director of Information Systems and then vice president of Information Systems from 1996-2000. Mr. Legrottaglie has also held the positions of chief technology officer at Swell Commerce Incorporated, vice president of Operations for The Wine Enthusiast Companies, and director of Information Systems at Barnes and Noble.

Brian Gilbertson was appointed Vice President and General Manager of Lifeboat Distribution (“Lifeboat”), a subsidiary of Wayside Technology Group, Inc., in May 2016. Mr. Gilbertson joined Lifeboat in 2015 as Vice President, Business Development. Since 2003, Mr. Gilbertson has held leadership positions in distribution and high-tech vendor companies. Prior to joining Lifeboat, Mr. Gilbertson served as the Senior Director for Arrow Enterprise Computing Solutions from November 2006 to February 2015. While at Arrow, Mr. Gilbertson had responsibility for the P&L,

development and execution of strategic direction, and day to day operations. Prior to Arrow, he served as the Director of Sales for Alternative Technology July 2003 to November 2006.

Charles Bass was appointed Vice President New Business Development, in January 2018. Mr. Bass previously served as Vice President Worldwide Channel Sales at Blue Medora since October 2016 until he joined the Company. From August 2015 to October 2016 he served as Vice President Worldwide sales for Tegile Inc., and from November 2010 to August 2015 he served as Vice President, Alliances, Marketing and Western Sales for Promark Technology Inc.

Available Information

Under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company is required to file annual, quarterly and current reports, proxy and information statements and other information with the SEC. You may read and copy any document we file with the SEC at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. The SEC maintains a web site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The Company files electronically with the SEC. The Company makes available, free of charge, through its internet web site, its reports on Forms 10-K, 10-Q and 8-K, and amendments to those reports, as soon as reasonably practicable after they are filed with the SEC. The following address for the Company’s web site includes a hyperlink to those reports under “Financials/SEC Filings”: http://www.waysidetechnology.com.

In December 2017, we adopted a Code of Ethical Conduct. The full text of the Code of Ethical Conduct, which applies to all employees, officers and directors of the Company, including our Chief Executive Officer and Chief Financial Officer, is available at our web site, http://www.waysidetechnology.com, under “Governance.” The Company intends to disclose any amendment to, or waiver from, a provision of the Code of Ethical Conduct that applies to its Chief Executive Officer or Chief Financial Officer on its web site under “Investor Information.”

Reference to the “uniform resource locators” or “URLs” contained in this section is made as an inactive textual reference for informational purposes only. Information on our web sites should not be considered filed with the Securities and Exchange Commission, and is not, and should not be deemed to be part of this report.

Item 1A. Risk Factors

Investors should carefully consider the risk factors set forth below as well as the other information contained in this report. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not currently known to us or those currently viewed by us to be immaterial may also materially and adversely affect our business, financial condition or results of operations.

Changes in the information technology industry and/or economic environment may reduce demand for the products and services we sell. Our results of operations are influenced by a variety of factors, including the condition of the IT industry, general economic conditions, shifts in demand for, or availability of, computer products and software and IT services and industry introductions of new products, upgrades or methods of distribution. The information technology products industry is characterized by abrupt changes in technology, rapid changes in customer preferences, short product life cycles and evolving industry standards. Net sales can be dependent on demand for specific product categories, and any change in demand for or supply of such products could have a material adverse effect on our net sales, and/or cause us to record write-downs of obsolete inventory, if we fail to react in a timely manner to such changes.

We rely on our suppliers for product availability, marketing funds, purchasing incentives and competitive products to sell. We acquire products for resale both directly from manufacturers and indirectly from distributors. The loss of a supplier could cause a disruption in the availability of products. Additionally, there is no assurance that as manufacturers continue to or increasingly sell directly to end users and through the distribution channel, that they will not limit or curtail the availability of their products to distributors/resellers like us. For example, resellers and publishers may attempt to increase the volume of software products distributed electronically through ESD (Electronic Software

Distribution) technology, through subscription services, and through on-line shopping services, and correspondingly, decrease the volume of products sold through us. Our inability to obtain a sufficient quantity of products, or an allocation of products from a manufacturer in a way that favors one of our competitors, or competing distribution channels, relative to us, could cause us to be unable to fill clients’ orders in a timely manner, or at all, which could have a material adverse effect on our business, results of operations and financial condition. We also rely on our suppliers to provide funds for us to market their products, including through our on-line marketing efforts, and to provide purchasing incentives to us. If any of the suppliers that have historically provided these benefits to us decides to reduce such benefits, our expenses would increase, adversely affecting our results of operations.

General economic weakness may reduce our revenues and profits. Generally, economic downturns, may cause some of our current and potential customers to delay or reduce technology purchases, resulting in longer sales cycles, slower adoption of new technologies and increased price competition. We may, therefore, experience a greater decline in demand for the products we sell, resulting in increased competition and pressure to reduce the cost of operations. Any benefits from cost reductions may take longer to realize and may not fully mitigate the impact of the reduced demand. In addition, weak financial and credit markets heighten the risk of customer bankruptcies and create a corresponding delay in collecting receivables from those customers and may also affect our vendors’ ability to supply products, which could disrupt our operations. The realization of any or all of these risks could have a material adverse effect on our business, results of operations and financial condition.

We depend on having creditworthy customers to avoid an adverse impact to our operating results and financial condition. We may require sufficient amounts of debt and/or equity capital to fund our transactions as we provide larger extended payment terms to certain of our customers. If the credit quality of our customer base materially decreases, or if we experience a material increase in our credit losses, we may find it difficult to continue to obtain the required capital for our business, and our operating results and financial condition may be harmed. In addition to the impact on our ability to attract capital, a material increase in our delinquency and default experience would itself have a material adverse effect on our business, operating results and financial condition. Furthermore, if any of our customers to whom we provide larger extended payment terms go elsewhere for financing, such loss of revenue could have a material adverse effect on our business, operating results and financial condition.

The IT products and services industry is intensely competitive and actions of competitors, including manufacturers of products we sell, can negatively affect our business. Competition has been based primarily on price, product availability, speed of delivery, credit availability and quality and breadth of product lines and, increasingly, also is based on the ability to tailor specific solutions to client needs. We compete with manufacturers, including manufacturers of products we sell, as well as a large number and wide variety of marketers and resellers of IT products and services. In addition, manufacturers are increasing the volume of software products they distribute electronically directly to end-users and in the future, will likely pay lower referral fees for sales of certain software licensing agreements sold by us. Generally, pricing is very aggressive in the industry, and we expect pricing pressures to continue. There can be no assurance that we will be able to negotiate prices as favorable as those negotiated by our competitors or that we will be able to offset the effects of price reductions with an increase in the number of clients, higher net sales, cost reductions, or greater sales of services, which service sales typically at higher gross margins, or otherwise. Price reductions by our competitors that we either cannot or choose not to match could result in an erosion of our market share and/or reduced sales or, to the extent we match such reductions, could result in reduced operating margins, any of which could have a material adverse effect on our business, results of operations and financial condition.

We operate on narrow margins. We operate in a very competitive business environment. Like other companies in the technology distribution industry, the Company’s business is continually under pricing pressure and characterized by narrow gross and operating margins. These narrow margins magnify the impact on the Company’s operating results attributed to variations in sales and operating costs and place a premium on our ability to leverage our infrastructure. Future gross and operating margins may be adversely affected by changes in product mix, vendor pricing actions and competitive and economic pressures. In addition, failure to attract new sources of business from expansion of products or services or entry into new markets may adversely affect future gross and operating margins.

If we lose several of our larger customers our earnings may be affected. Meeting our customers’ needs quickly and fairly is critical to our business success. Our contracts for the provision of products are generally non-

exclusive agreements that are terminable by either party upon 30 days’ notice. In addition, our agreements with these larger customers do not provide for minimum purchase commitments. The loss of several of our large customers, the failure of such customers to pay their accounts receivable on a timely basis, or a material reduction in the amount of purchases made by such customers could have a material adverse effect on our business, financial position, results of operations and cash flows. Additionally, anything that negatively impacts our customer relations also can negatively impact our operating results.

Disruptions in our information technology and voice and data networks could affect our ability to service our clients and cause us to incur additional expenses. We believe that our success to date has been, and future results of operations likely will be, dependent in large part upon our ability to provide prompt and efficient service to clients. Our ability to provide such services is dependent largely on the accuracy, quality and utilization of the information generated by our IT systems, which affect our ability to manage our sales, client service, distribution, inventories and accounting systems and the reliability of our voice and data networks.

Failure to adequately maintain the security of our electronic and other confidential information could materially adversely affect our financial condition and results of operations. We are dependent upon automated information technology processes. Privacy, security, and compliance concerns have continued to increase as technology has evolved to facilitate commerce and as cross-border commerce increases. As part of our normal business activities, we collect and store certain confidential information, including personal information of employees and information about partners and clients which may be entitled to protection under a number of regulatory regimes. In the course of normal and customary business practice, we may share some of this information with vendors who assist us with certain aspects of our business. Moreover, the success of our operations depends upon the secure transmission of confidential and personal data over public networks, including the use of cashless payments. Any failure on the part of us or our vendors to maintain the security of data we are required to protect, including via the penetration of our network security and the misappropriation of confidential and personal information, could result in business disruption, damage to our reputation, financial obligations to third parties, fines, penalties, regulatory proceedings and private litigation with potentially large costs, and also result in deterioration in our employees’, partners’ and clients’ confidence in us and other competitive disadvantages, and thus could have a material adverse impact on our business, financial condition and results of operations. During 2017 and 2016 we did not have any cybersecurity breaches.

We depend on certain key personnel. Our future success will be largely dependent on the efforts of key management personnel for strategic and operational guidance as well as relationships with our key vendors and customers. We also believe that our future success will be largely dependent on our continued ability to attract and retain highly qualified management, sales, service, finance and technical personnel. We cannot assure you that we will be able to attract and retain such personnel. Further, we make a significant investment in the training of our sales account executives. Our inability to retain such personnel or to train them either rapidly enough to meet our expanding needs or in an effective manner for quickly changing market conditions could cause a decrease in the overall quality and efficiency of our sales staff, which could have a material adverse effect on our business, results of operations and financial condition.

Risks related to our common stock. The exercise of options or any other issuance of shares by us may dilute your ownership of our Common Stock. Our Common Stock is thinly traded, which may be exacerbated by our repurchases of our Common Stock. As a result of the thin trading market for our stock, its market price may fluctuate significantly more than the stock market as a whole or of the stock prices of similar companies. Without a larger float, our common stock will be less liquid than the stock of companies with broader public ownership, and, as a result, the trading prices for our Common Stock may be more volatile. Among other things, trading of a relatively small volume of our Common Stock may have a greater impact on the trading price of our stock than would be the case if our public float were larger.

Our common stock is listed on The NASDAQ Global Market, and we therefore are subject to continued listing requirements, including requirements with respect to the market value and number of publicly-held shares, number of stockholders, minimum bid price, number of market makers and either (i) stockholders’ equity or (ii) total market value of stock, total assets and total revenues. If we fail to satisfy one or more of the requirements, we may be delisted from The NASDAQ Global Market. If we do not qualify for listing on The NASDAQ Capital Market, and if we are not able

to list our common stock on another exchange, our common stock could be quoted on the OTC Bulletin Board or on the “pink sheets”. As a result, we could face significant adverse consequences including, among others, a limited availability of market quotations for our securities and a decreased ability to issue additional securities or obtain additional financing in the future.

If the Company fails to maintain an effective system of internal controls or discovers material weaknesses in its internal controls over financial reporting, it may not be able to report its financial results accurately or timely or detect fraud, which could have a material adverse effect on its business. An effective internal control environment is necessary for the Company to produce reliable financial reports and is an important part of its effort to prevent financial fraud. The Company is required to annually evaluate the effectiveness of the design and operation of its internal controls over financial reporting. Based on these evaluations, the Company may conclude that enhancements, modifications, or changes to internal controls are necessary or desirable. During 2017, the Company determined it had a material weakness in its internal controls as is reported in Item 9a., Controls and Procedures. While management evaluates the effectiveness of the Company's internal controls on a regular basis, these controls may not always be effective. There are inherent limitations on the effectiveness of internal controls, including collusion, management override, and failure in human judgment. In addition, control procedures are designed to reduce rather than eliminate financial statement risk. If the Company fails to maintain an effective system of internal controls, or if management or the Company's independent registered public accounting firm discovers material weaknesses in the Company's internal controls, it may be unable to produce reliable financial reports or prevent fraud, which could have a material adverse effect on the Company's business. In addition, the Company may be subject to sanctions or investigation by regulatory authorities, such as the SEC or the NASDAQ. Any such actions could result in an adverse reaction in the financial markets due to a loss of confidence in the reliability of the Company's financial statements, which could cause the market price of its common stock to decline or limit the Company's access to capital.

We have identified a material weakness in our internal control over financial reporting which could, if not remediated, result in material misstatements in our financial statements. As described under Item 9a., Controls and Procedures, we have identified a material weakness in the Company’s internal control. Under standards established by the Public Company Accounting Oversight Board, a material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis.

We have initiated remediation measures, but these new and enhanced controls have not operated for a sufficient amount of time to conclude that the material weakness has been remediated. To implement these remediation measures, we may need to commit additional resources, hire additional staff, and provide additional management oversight. These activities may divert management’s attention from other business concerns, which could have a material adverse effect on our business, financial condition, results of operations, and cash flows. Further, if our remediation measures are insufficient to address the material weakness, or if additional material weaknesses or significant deficiencies in our internal control over financial reporting are discovered or occur in the future, our consolidated financial statements may contain material misstatements, and we could be required to restate our financial results. In addition, if we are unable to successfully remediate this material weakness and if we are unable to produce accurate and timely financial statements, our stock price may be adversely affected and we may be unable to maintain compliance with applicable stock exchange listing requirements.

The Company may be subject to intellectual property rights claims, which are costly to defend, could require payment of damages or licensing fees and could limit the company's ability to use certain technologies in the future. Certain of the Company's products and services include intellectual property owned primarily by the company's

third- party suppliers. Substantial litigation and threats of litigation regarding intellectual property rights exist in the software and some service industries. From time to time, third parties (including certain companies in the business of acquiring patents not for the purpose of developing technology but with the intention of aggressively seeking licensing revenue from purported infringers) may assert patent, copyright and/or other intellectual property rights to technologies that are important to the company's business. In some cases, depending on the nature of the claim, the company may be able to seek indemnification from its suppliers for itself and its customers against such claims, but there is no assurance

that it will be successful in obtaining such indemnification or that the company is fully protected against such claims. Any infringement claim brought against the company, regardless of the duration, outcome, or size of damage award, could:

| · | | result in substantial cost to the company; |

| · | | divert management's attention and resources; |

| · | | be time consuming to defend; |

| · | | result in substantial damage awards; or |

| · | | cause product shipment delays. |

Additionally, if an infringement claim is successful the company may be required to pay damages or seek royalty or license arrangements, which may not be available on commercially reasonable terms. The payment of any such damages or royalties may significantly increase the company's operating expenses and harm the company's operating results and financial condition. Also, royalty or license arrangements may not be available at all. The company may have to stop selling certain products or using technologies, which could affect the company's ability to compete effectively.

Item 1B. Unresolved Staff Comments

Not applicable.

Item 2. Properties

The Company leases approximately 20,000 square feet of space in Eatontown, New Jersey for its corporate headquarters under a lease expiring in March 2027. Total annual rent expense for these premises is approximately $420,000. The Company also leases 7,800 square feet of warehouse space in Eatontown, New Jersey under a lease expiring in October 2020. Total annual rent expense is approximately $44,000. The Company also leases 2,800 square feet of office space in Mesa, Arizona under a lease expiring in August 2018. Total annual rent expense is approximately $55,000. Additionally, the Company leases approximately 3,700 square feet of office and warehouse space in Mississauga, Canada, under a lease which expires in November 30, 2019. Total annual rent expense for these premises is approximately $30,000. The Company also leases office space in Amsterdam, Netherlands under a lease which expires June 30, 2018, at an annual rent of approximately $34,000. We believe that each of the properties is in good operating condition and such properties are adequate for the operation of the Company’s business as currently conducted.

Item 3. Legal Proceedings

There are no material legal proceedings to which the Company or any of its subsidiaries is a party or of which any of their property is the subject.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Shares of our Common Stock, par value $0.01, trade on The NASDAQ Global Market under the symbol “WSTG”. Following is the range of low and high closing sales prices for our Common Stock as reported on The NASDAQ Global Market.

| | | | | | | |

| | High | | Low | |

2017: | | | | | | | |

First Quarter | | $ | 18.85 | | $ | 16.60 | |

Second Quarter | | $ | 20.95 | | $ | 18.25 | |

Third Quarter | | $ | 19.35 | | $ | 13.35 | |

Fourth Quarter | | $ | 17.10 | | $ | 13.40 | |

| | | | | | | |

2016: | | | | | | | |

First Quarter | | $ | 19.38 | | $ | 15.98 | |

Second Quarter | | $ | 18.94 | | $ | 16.50 | |

Third Quarter | | $ | 18.50 | | $ | 16.76 | |

Fourth Quarter | | $ | 18.87 | | $ | 16.70 | |

Securities Authorized For Issuance Under Equity Compensation Plans

The following table sets forth information, as of December 31, 2017, regarding securities authorized for issuance upon the exercise of stock options and vesting of restricted stock under all of the Company’s equity compensation plans.

| | | | | | | | |

| | (a) | | (b) | | | |

| | Number of Securities to | | Weighted | | (c) | |

| | be Issued Upon Exercise | | Average | | Number of Securities Remaining Available | |

| | of Outstanding Options | | Exercise Price | | for Future Issuance Under Equity | |

| | and Vesting of Stock | | of Outstanding | | Compensation Plans (Excluding Securities | |

Plan Category | | Awards | | Options | | Reflected in Column (a)) | |

Equity Compensation Plans Approved by Stockholders (1) | | 161,818 | | $ | 15.98 | | 245,846 | |

Total | | 161,818 | | $ | 15.98 | | 245,846 | |

| (1) | | Includes the 2006 Plan and the 2012 Plan. For plan details, please refer to Note 6 in the Notes to our Consolidated Financial Statements. |

In each of 2017 and 2016, we declared quarterly dividends totaling $0.68 per share, respectively, on our Common Stock. There can be no assurance that we will continue to pay comparable cash dividends in the future.

During 2017, the Company granted a total of 87,076 shares of Restricted Stock to officers, and employees. These shares of Restricted Stock vest over time up to twenty equal quarterly installments. In 2017, 22,694 shares of Restricted Stock were forfeited as a result of officers and employees terminating employment with the Company.

During 2016, the Company granted a total of 171,252 shares of Restricted Stock to officers, employees and directors. These shares of Restricted Stock vest over time up to twenty equal quarterly installments. In 2016, 7,167 shares of Restricted Stock were forfeited as a result of directors and employees terminating employment with the Company.

The share issuances in all of the above transactions were not registered under the Securities Act of 1933, as amended (the “Securities Act”). The issuances were exempt from registration pursuant to Section 4(2) of the Securities

Act and/or Regulation D thereunder, as they were transactions by the issuer that did not involve public offerings of securities and/or involved issuances to accredited investors.

As of February 12, 2018, there were approximately 112 record holders of our Common Stock. This figure does not include an estimate of the number of beneficial holders whose shares are held of record by brokerage firms and clearing agencies.

During the fourth quarter of 2017, we repurchased shares of our Common Stock as follows:

| | | | | | | | | | | | | |

| | | | | | | | | | | | Maximum | |

| | | | | | | | | | | | Number of | |

| | | | | | | Total Number | | | | | Shares That | |

| | | | | | | of Shares | | | | | May Yet Be | |

| | | | | | | Purchased as | | | | | Purchased | |

| | Total | | Average | | Part of Publicly | | Average | | Under the | |

| | Number | | Price Paid | | Announced | | Price Paid | | Plans or | |

| | of Shares | | Per Share | | Plans or | | Per Share | | Programs | |

Period | | Purchased | | (2) | | Programs | | (3) | | (4)(5) | |

| | | | | | | | | | | | | |

October 1, 2017- October 31, 2017 | | 500 | | $ | 13.70 | | 500 | | $ | 13.70 | | 547,488 | |

November 1, 2017- November 30, 2017 | | 7,577 | (1) | $ | 14.05 | | — | | $ | — | | 547,488 | |

December 1, 2017- December 31, 2017 | | — | | $ | — | | — | | $ | — | | 547,488 | |

Total | | 8,077 | | $ | 14.03 | | 500 | | $ | 13.70 | | 547,488 | |

| (1) | | Includes 7,577 shares surrendered to the Company by employees to satisfy individual tax withholding obligations upon vesting of previously issued shares of Restricted Stock. These shares are not included in the Common Stock repurchase program referred to in footnote (4) below. |

| (2) | | Average price paid per share reflects the closing price of the Company’s Common Stock on the business date the shares were surrendered by the employee stockholder to satisfy individual tax withholding obligations upon vesting of Restricted Stock or the price of the Common Stock paid on the open market purchase, as applicable. |

| (3) | | Average price paid per share reflects the price of the Company’s Common Stock purchased on the open market. |

| (4) | | On December 3, 2014, the Board of Directors of the Company approved an increase of 500,000 shares of Common Stock to the number of shares of Common Stock available for repurchase under its repurchase plans. The Company expects to purchase shares of its Common Stock from time to time in the market or otherwise subject to market conditions. The Common Stock repurchase program does not have an expiration date. |

| (5) | | On July 27, 2016, the Board of Directors of the Company approved, and on September 1, 2016, the Company entered a written purchase plan intended to comply with the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Plan”). The Plan involved purchases of shares of the Company’s Common Stock commencing September 1, 2016, and was in effect until February 28, 2017. Pursuant to the Plan, the Company’s broker could affect purchases of up to an aggregate of 325,000 shares of Common Stock. |

| (6) | | On February 2, 2017, the Board of Directors of the Company approved, and on March 1, 2017, the Company entered a written purchase plan intended to comply with the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Plan”). The Plan involved purchases of shares of the Company’s Common Stock commencing March 1, 2017, and was in effect until September 30, 2017. Pursuant to the Plan, the Company’s broker could affect purchases of up to an aggregate of 600,000 shares of Common Stock. |

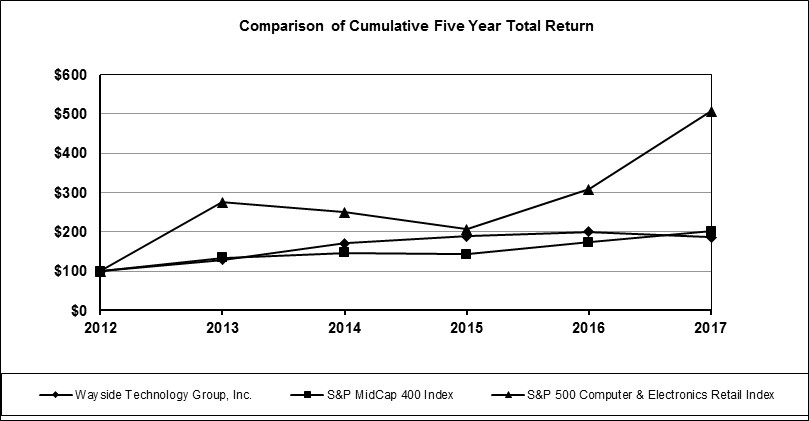

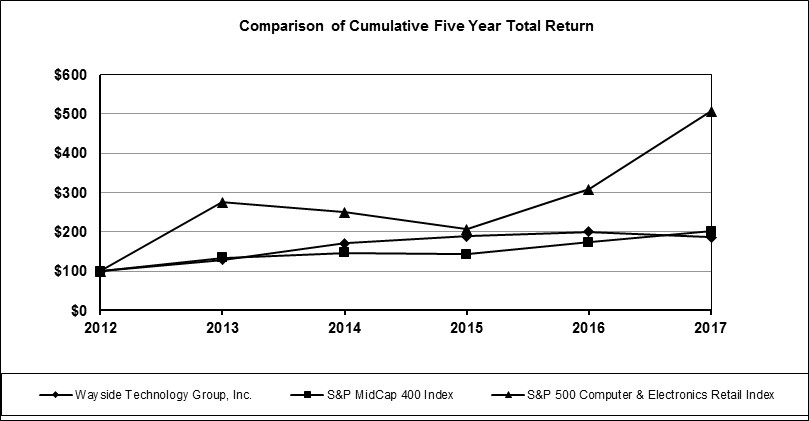

STOCK PRICE PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on the Company’s Common Stock with the cumulative total return of the S&P Midcap 400 Index and the S&P 500 Computer and Electronics Retail Index for the period commencing December 31, 2012 and ending December 31, 2017, assuming $100 was invested on December 31, 2012 and the reinvestment of dividends.

| | | | | | | | | | | | | |

| | Base | | INDEXED RETURNS | |

| | Period | | Year ended | |

Company / Index | | Dec-12 | | Dec-13 | | Dec-14 | | Dec-15 | | Dec-16 | | Dec-17 | |

Wayside Technology Group, Inc. | | 100 | | 128.45 | | 170.47 | | 188.66 | | 200.02 | | 185.85 | |

S&P MidCap 400 Index | | 100 | | 133.50 | | 146.54 | | 143.35 | | 173.08 | | 201.20 | |

S&P 500 Computer & Electronics Retail Index | | 100 | | 275.33 | | 250.14 | | 206.62 | | 307.61 | | 505.99 | |

Item 6. Selected Financial Data

The following tables set forth, for the periods indicated, selected consolidated financial and other data for Wayside Technology Group, Inc. and its Subsidiaries. You should read the selected consolidated financial and other data below in conjunction with our consolidated financial statements and the related notes in Part II, Item 8, and with “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this Form 10-K.

Year Ended December 31,

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | |

| | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | |

Net sales- (1) | | $ | 449,379 | | $ | 418,131 | | $ | 382,090 | | $ | 340,758 | | $ | 300,390 | |

Cost of sales | | | 422,303 | | | 390,800 | | | 355,517 | | | 315,948 | | | 276,035 | |

Gross profit | | | 27,076 | | | 27,331 | | | 26,573 | | | 24,810 | | | 24,355 | |

Selling, general and | | | | | | | | | | | | | | | | |

administrative expenses | | | 19,263 | | | 18,715 | | | 18,063 | | | 16,513 | | | 15,505 | |

Income from operations | | | 7,813 | | | 8,616 | | | 8,510 | | | 8,297 | | | 8,850 | |

Other income, net | | | 740 | | | 317 | | | 348 | | | 461 | | | 562 | |

Income before provision for income taxes | | | 8,553 | | | 8,933 | | | 8,858 | | | 8,758 | | | 9,412 | |

Provision for income taxes | | | 3,491 | | | 3,032 | | | 3,028 | | | 2,998 | | | 3,019 | |

Net income | | $ | 5,062 | | $ | 5,901 | | $ | 5,830 | | $ | 5,760 | | $ | 6,393 | |

Net income per common share - (2) | | | | | | | | | | | | | | | | |

Basic | | $ | 1.13 | | $ | 1.25 | | $ | 1.22 | | $ | 1.20 | | $ | 1.37 | |

Diluted | | $ | 1.13 | | $ | 1.25 | | $ | 1.22 | | $ | 1.20 | | $ | 1.37 | |

Weighted average common | | | | | | | | | | | | | | | | |

shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 4,299 | | | 4,503 | | | 4,634 | | | 4,661 | | | 4,454 | |

Diluted | | | 4,299 | | | 4,503 | | | 4,634 | | | 4,661 | | | 4,454 | |

| | | | | | | | | | | | | | | | |

| (1) | | See Note 2 to the consolidated financial statements in Part II, Item 8 of this Form 10K, for information related to the anticipated impact on revenue from the adoption of ASC 606 – Revenue From Contracts With Customers, effective January 1, 2018. |

| (2) | | Reflects restated net income per common share as discussed further in Note 1 to the consolidated financial statements in Part II, Item 8 of this Form 10K. |

.

December 31,

(Amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | |

| | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 5,530 | | $ | 13,524 | | $ | 23,823 | | $ | 23,124 | | $ | 19,609 | |

Working capital | | | 29,078 | | | 24,477 | | | 30,568 | | | 31,161 | | | 24,016 | |

Total assets | | | 102,725 | | | 113,698 | | | 94,082 | | | 94,981 | | | 94,760 | |

Total stockholders’ equity | | | 38,712 | | | 37,611 | | | 38,659 | | | 39,567 | | | 34,721 | |

| | | | | | | | | | | | | | | | |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following management’s discussion and analysis of the Company’s financial condition and results of operations should be read in conjunction with the Company’s Consolidated Financial Statements and the Notes thereto. This discussion and analysis contains, in addition to historical information, forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and uncertainties, including those set forth under the heading “Risk Factors” and elsewhere in this report.

Overview

Our Company is an IT channel company, primarily selling software and other third-party IT products and services through two reportable operating segments. Through our “Lifeboat Distribution” segment we sell products and services to corporate resellers, value added resellers (VARs), consultants and systems integrators worldwide, who in turn sell these products to end users. Through our “TechXtend Segment” we act as a value-added reseller, selling computer software and hardware developed by others and provide technical services directly to end user customers in the USA and Canada. We offer an extensive line of products from leading publishers of software and tools for virtualization/cloud computing, security, networking, storage and infrastructure management, application lifecycle management and other technically sophisticated domains as well as computer hardware. We market these products through creative marketing communications, including our web sites, local and on-line seminars, webinars, social media, direct e-mail, and printed materials.

The Company has subsidiaries in the United States, Canada and the Netherlands, through which its sales are made.

Factors Influencing Our Financial Results

We derive the majority of our net sales though the sale of third-party software licenses, maintenance and service agreements. In our Lifeboat distribution segment, sales are impacted by the number of product lines we distribute, and sales penetration of those products into the reseller channel, product lifecycle competitive, and demand characteristics of the products which we are authorized to distribute. In our TechXtend segment sales are generally driven by sales force effectiveness and success in providing superior customer service, competitive pricing, and flexible payment solutions to our customers. Our sales are also impacted by external factors such as levels of IT spending and customer demand for products we distribute.

We sell in a competitive environment where gross product margins have historically declined due to competition and changes in product mix towards products where no delivery of a physical product is required. To date, we have been able to implement cost efficiencies such as the use of drop shipments, electronic ordering (“EDI”) and other capabilities to be able to operate our business profitably as gross margins have declined.

Selling general and administrative expenses are comprised mainly of employee salaries, commissions and other employee related expenses, facility costs, costs to maintain our IT infrastructure, public company compliance costs and professional fees. We monitor our level of accounts payable, inventory turnover and accounts receivable turnover which are measures of how efficiently we utilize capital in our business.

The Company’s sales, gross profit and results of operations have fluctuated and are expected to continue to fluctuate on a quarterly basis as a result of a number of factors, including but not limited to: the condition of the software industry in general, shifts in demand for software products, pricing, level of extended payment terms sales transactions, industry shipments of new software products or upgrades, fluctuations in merchandise returns, adverse weather conditions that affect response, distribution or shipping, shifts in the timing of holidays and changes in the Company’s product offerings. The Company’s operating expenditures are based on sales forecasts. If sales do not meet expectations in any given quarter, operating results may be materially adversely affected.

Dividend Policy and Share Repurchase Program. Historically we have sought to return value to investors through the payment of quarterly dividends and share repurchases. Total dividends paid and shares repurchased were $3.1 and $3.0 million for the year ended December 31, 2017, respectively, and $3.2 million and $5.4 million for the year ended December 31, 2016, respectively. The payment of future dividends is at the discretion of our Board of Directors and dependent on results of operations, projected capital requirements and other factors the Board of Directors may find relevant.

Stock Volatility. The technology sector of the United States stock markets is subject to substantial volatility. Numerous conditions which impact the technology sector or the stock market in general or the Company in particular, whether or not such events relate to or reflect upon the Company’s operating performance, could adversely affect the market price of the Company’s Common Stock. Furthermore, fluctuations in the Company’s operating results, announcements regarding litigation, the loss of a significant vendor or customer, increased competition, reduced vendor incentives and trade credit, higher operating expenses, and other developments, could have a significant impact on the market price of our Common Stock.

Financial Overview

Net sales increased 7%, or $31.2 million, to $449.4 million for the year ended December 31, 2017, compared to $418.1 million for the same period in 2016. Gross profit decreased 1%, or $0.3 million, to $27.1 million for the year ended December 31, 2017, compared to $27.3 million in the prior year. Selling, general and administrative (“SG&A”) expenses increased 3%, or $0.5 million, to $19.3 million for the year ended December 31, 2017, compared to $18.7 million in the prior year. Net income decreased 14%, or $0.8 million, to $5.1 million for the year ended December 31, 2017, compared to $5.9 million in the prior year. Weighted Average diluted shares outstanding decreased by 4.5% from the prior year, primarily due to the Company’s share buyback program. Income per share diluted decreased 10.3% to $1.13 for the year ended December 31, 2017, compared to $1.25 for the same period in 2016.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of the Company’s financial condition and results of operations are based upon the Company’s consolidated financial statements that have been prepared in accordance with US GAAP. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. Revenues from the sales of hardware products, software products, licenses, maintenance and subscription agreements are recognized on a gross basis upon delivery or fulfillment, with the selling price to the customer recorded as sales and the acquisition cost of the product recorded as cost of sales.

On an on-going basis, the Company evaluates its estimates, including those related to product returns, bad debts, inventories, investments, intangible assets, income taxes, stock-based compensation, contingencies and litigation.

The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

The Company believes the following critical accounting policies used in the preparation of its consolidated financial statements affect its more significant judgments and estimates.

Allowance for Accounts Receivable

The Company maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers to make required payments. Management determines the estimate of the allowance for uncollectible accounts receivable by considering a number of factors, including: historical experience, aging of the accounts receivable, and specific information obtained by the Company on the financial condition and the current creditworthiness of its

customers. If the financial condition of the Company’s customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required. At the time of sale, we record an estimate for sales returns based on historical experience. If actual sales returns are greater than estimated by management, additional expense may be incurred.

Accounts Receivable – Long Term

The Company’s accounts receivable long-term are discounted to their present value at prevailing market rates at the time of sale. In doing so, the Company considers competitive market rates and other relevant factors.

Inventory Allowances

The Company writes down its inventory for estimated obsolescence or unmarketable inventory equal to the difference between the cost of inventory and the estimated market value based upon assumptions about future demand and market conditions. If actual market conditions are less favorable than those projected by management, additional inventory write-offs may be required.

Income Taxes

The Company has considered future taxable income and ongoing prudent and feasible tax planning strategies in assessing the need for the valuation allowance related to deferred tax assets. In the event the Company were to determine that it would not be able to realize all or part of its net deferred tax assets in the future, an adjustment to the deferred tax assets would be charged to income in the period such determination was made.

Share-Based Payments

Under the fair value recognition provision, stock-based compensation cost is measured at the grant date based on the fair value of the award and is recognized as expense on a straight-line basis over the requisite service period. We make certain assumptions in order to value and expense our various share-based payment awards. In connection with our restricted stock programs we record the forfeitures when they occur. We review our valuation assumptions periodically and, as a result, we may change our valuation assumptions used to value stock based awards granted in future periods. Such changes may lead to a significant change in the expense we recognize in connection with share-based payments.

Recently Issued Accounting Pronouncements

In May 2014, the Financial Accounting Standards Board (“FASB”) issued guidance for revenue recognition for contracts, superseding the previous revenue recognition requirements, along with most existing industry-specific guidance. In March, April, May and December 2016, the FASB issued additional updates to the new accounting standard which provide supplemental adoption guidance and clarifications. The guidance requires an entity to review contracts in five steps: 1) identify the contract, 2) identify performance obligations, 3) determine the transaction price, 4) allocate the transaction price, and 5) recognize revenue in order to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The new standard will also result in enhanced disclosures regarding the nature, amount, timing and uncertainty of revenue arising from contracts with customers.

The guidance permits two methods of adoption: retrospectively to each prior reporting period presented (full retrospective method), or retrospectively with the cumulative effect of initially applying the guidance recognized at the date of initial application (the cumulative catch-up transition method). The new standard will be effective for the Company beginning January 1, 2018, and early adoption as of January 1, 2017 is permitted.

The Company elected to adopt the standard effective January 1, 2018 using the full retrospective method, which will require the Company to recast our historical financial information for the years 2017 and 2016 to be consistent with the standard. The most significant impact of adopting the standard relates to the determination of whether the Company is acting as a principal or an agent in the sale of third party security software and software that is highly interdependent

with support, as well as maintenance, support and other services. Historically, under the transfer of risk and rewards model of revenue recognition, the Company has accounted for primarily all of its sales on a gross basis. The new guidance requires the Company to identify performance obligations and assess transfer of control. While assessing its performance obligations for sales of security software and software subscriptions that are highly interdependent with support, the Company determined that the vendor has ongoing performance obligations with the end customer that are not separately identifiable from the software itself. The Company also determined that the vendor has ongoing performance obligation for sales of certain third-party maintenance, support and service contracts. In these instances, under the new guidance, the Company has determined that it does not have control and is acting as an agent in the sale. When acting as an agent in a transaction, the Company accounts for sales on a net basis, with the vendor cost associated with the sale recognized as a reduction of revenue. The change from gross sale to net reporting has no impact on gross profit, net income or cash flows.

The adoption of the standard is expected to result in a reduction of reported revenue of $288.8 million, $253.5 million and $218.4 million for 2017, 2016 and 2015, respectively, had the standard been adopted at the earliest period presented. The adoption is not expected to have any impact on income from operations or the Company’s balance sheet. For additional information on the expected impact to reported results please see note 2 of the consolidated financial statements in Part II of this Annual Report on Form 10-K.

In July 2015, the FASB issued Accounting Standards Update No. 2015-11, "Simplifying the Measurement of Inventory (Topic 330)", ("ASU 2015-11"). Topic 330, Inventory, currently requires an entity to measure inventory at the lower of cost or market, with market value represented by replacement cost, net realizable value or net realizable value less a normal profit margin. The amendments in ASU 2015-11 require an entity to measure inventory at the lower of cost or net realizable value. ASU 2015-11 is effective for reporting periods beginning after December 15, 2016. We adopted ASU 2015-11 during the quarter ended March 31, 2017 and it did not have a material impact on our consolidated financial statements.

In March 2016, the FASB issued Accounting Standards Update ("ASU") 2016-09, Improvements to Employee Share-Based Payment Accounting ("ASU 2016-09"). ASU 2016-09 simplifies several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities and classification on the statement of cash flows. This ASU is effective for fiscal years, and interim periods within those years, beginning after December 15, 2016. Effective January 1, 2017, the Company adopted the provisions of ASU 2016-09 related to the recognition of excess tax benefits in the income statement and classification in the statement of cash flows on a prospective basis and the prior periods were not retrospectively adjusted. The Company has elected to account for forfeitures of share-based awards when they occur in determining compensation cost to be recognized each period. The adoption of ASU 2016-09 did not have a material impact on our consolidated financial statements.