Filed by The First Bancshares, Inc.

(Commission File No. 000-22507)

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Southwest Georgia Financial Corporation

(Commission File No. 001-120535)

Date: December 18, 2019

The following communication was provided to the employees of

Southwest Georgia Financial Corporation

* * *

December 18, 2019

2 This presentation contains “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995. In g eneral, forward - looking statements usually use words such as “may,” “believe,” “expect,” “anticipate,” “intend,” “will,” “should,” “plan,” “e sti mate,” “predict,” “continue” and “potential” or the negative of these terms or other comparable terminology, including statements related to th e e xpected timing of the closing of SGB being merged with and into FBMS (the “Merger”) under the terms of the Agreement and Plan of Merger by a nd between FBMS and SGB dated December 18, 2019 (the “Merger Agreement”), the expected returns and other benefits of the Merger, to shar eho lders, expected improvement in operating efficiency resulting from the Merger, estimated expense reductions resulting from the trans act ions and the timing of achievement of such reductions, the impact on and timing of the recovery of the impact on tangible book value, and the effect of the Merger on FBMS’s capital ratios. Forward - looking statements represent management’s beliefs, based upon information available at the time the statements are made, with regard to the matters addressed; they are not guarantees of future performance. Forward - looking statem ents are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results or financial co ndi tion to differ materially from those expressed in or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to (1) the risk that the cost savings an d any revenue synergies from the Merger may not be realized or take longer than anticipated to be realized, (2) disruption from the Merger wit h customers, suppliers, employee or other business partners relationships, (3) the occurrence of any event, change or other circumstances tha t could give rise to the termination of the Merger Agreement, (4) the risk of successful integration of SGB’s business into FBMS, (5) the failure to obtain the necessary approval by the shareholders of SGB, (6) the amount of the costs, fees, expenses and charges related to the Merger, (7 ) the ability by FBMS to obtain required governmental approvals of the Merger, (8) reputational risk and the reaction of each of the companies’ c ustomers, suppliers, employees or other business partners to the Merger, (9) the failure of the closing conditions in the Merger Agreement to be satisfied, or any unexpected delay in closing of the Merger, (10) the risk that the integration of SGB’s operations into the operations of FBM S will be materially delayed or will be more costly or difficult than expected, (11) the possibility that the Merger may be more expensive to complet e than anticipated, including as a result of unexpected factors or events, (12) the dilution caused by FBMS’s issuance of additional sh ares of its common stock in the Merger transaction, and (13) general competitive, economic, political and market conditions. Additional factors whi ch could affect the forward looking statements can be found in the cautionary language included under the headings “Management’s Discussion and A nal ysis of Financial Condition and Results of Operations” and “Risk Factors” in FBMS’s Annual Report on Form 10 - K for the year ended Decemb er 31, 2018, under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in SGB’s Annual Reports on Form 10 - K for the year ended December 31, 2018, and other documents subsequently filed by FBMS and SGB with the SEC. Consequently, no forward - looking statement can be guaranteed. Neither FBMS nor SGB undertakes any obligation to update or revis e any forward - looking statements, whether as a result of new information, future events or otherwise. For any forward - looking statemen ts made in this news release, the exhibits hereto or any related documents, FBMS and SGB claim protection of the safe harbor for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward Looking Statement

3 Additional Information about the Merger and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitati on of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed Merger, FBMS will file with the SEC a registration statement on Form S - 4 that will include a proxy statement of SGB and a prospectus of FBMS, as well as other relevant documents concerning the proposed transaction. WE URGE INVESTORS A ND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S - 4, THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S - 4 AN D ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INF ORMATION ABOUT FBMS, SGB AND THE PROPOSED MERGER. The proxy statement/prospectus will be sent to the shareholders of SGB seeking the r equ ired shareholder approval. Investors and security holders will be able to obtain free copies of the registration statement on Form S - 4 and the re lated proxy statement/prospectus, when filed, as well as other documents filed with the SEC by FBMS and SGB through the web site maintained by the SEC at www.s ec. gov. Documents filed with the SEC by FBMS will also be available free of charge by directing a written request to The First Bancshares, Inc., 6480 U.S. Hig hwa y 98 West, Hattiesburg, Mississippi 39402 Attn: Corporate Secretary, Chandra Kidd. FBMS’s telephone number is (601) 268 - 8998. Documents filed with the SEC by SGB w ill also be available free of charge by directing a written request to Southwest Georgia Financial Corporation, 25 Second Avenue, S. W., Moultrie, Georgia 317 68, Attn: EVP and Chief Administrative Officer, Donna Lott. SGB’s telephone number is (229) 985 - 1120. Participants in the Transaction FBMS, SGB and certain of their respective directors and executive officers may be deemed to be participants in the solicitati on of proxies from the shareholders of SGB in connection with the proposed transaction. Certain information regarding the interests of these participants and a desc rip tion of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus regarding the proposed trans act ion when it becomes available. Additional information about FBMS and its directors and officers may be found in the definitive proxy statement of FBMS relat ing to its 2019 Annual Meeting of Stockholders filed with the SEC on April 3, 2019. Additional information about SGB and its directors and officers may be foun d i n the definitive proxy statement of SGB relating to its 2019 Annual Meeting of Stockholders filed with the SEC on April 18, 2019. The definitive proxy statement ca n be obtained free of charge from the sources described above. About The First Bancshares, Inc. (“FBMS”) FBMS, headquartered in Hattiesburg, Mississippi, is the parent company of The First, A National Banking Association. Founded in 1996, the First has operations in Mississippi, Louisiana, Alabama, Florida and Georgia. FBMS’s stock is traded on NASDAQ Global Market under the symbol FBMS. I nformation is available on the Company’s website: www.thefirstbank.com . Additional Information about the Merger

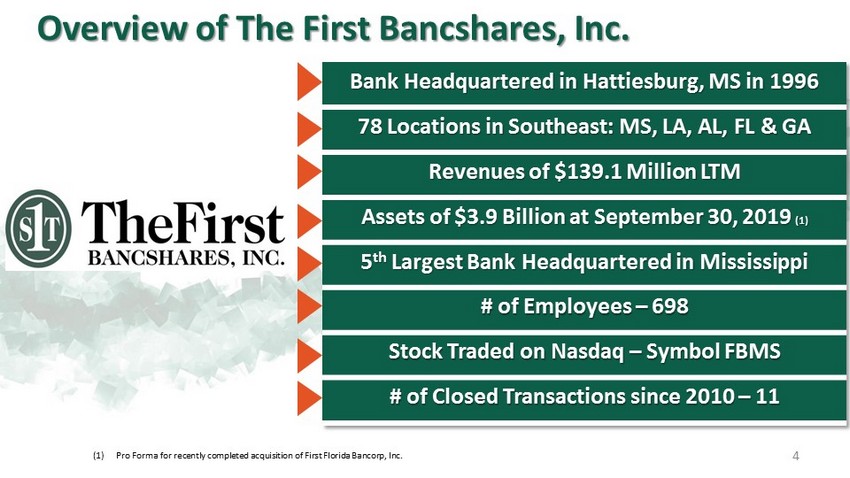

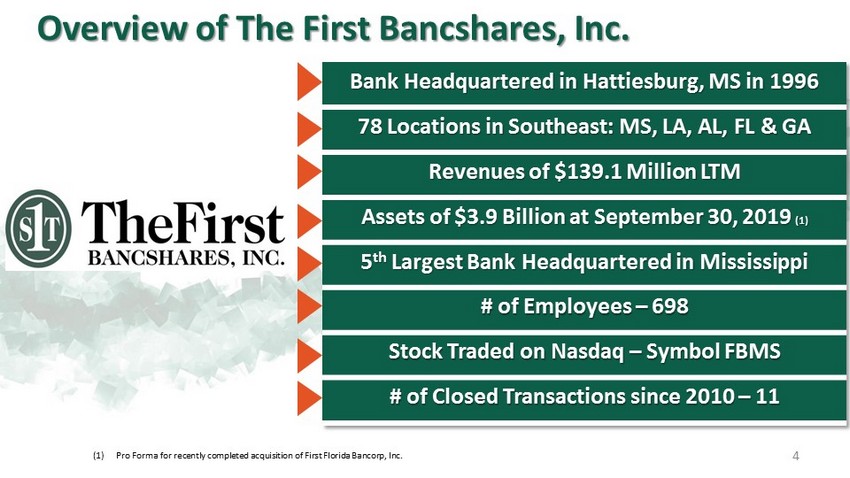

Overview of The First Bancshares, Inc. 4 Bank Headquartered in Hattiesburg, MS in 1996 78 Locations in Southeast: MS, LA, AL, FL & GA Revenues of $139.1 Million LTM Assets of $3.9 Billion at September 30, 2019 (1) 5 th Largest Bank Headquartered in Mississippi # of Employees – 698 Stock Traded on Nasdaq – Symbol FBMS # of Closed Transactions since 2010 – 11 (1) Pro Forma for recently completed acquisition of First Florida Bancorp, Inc.

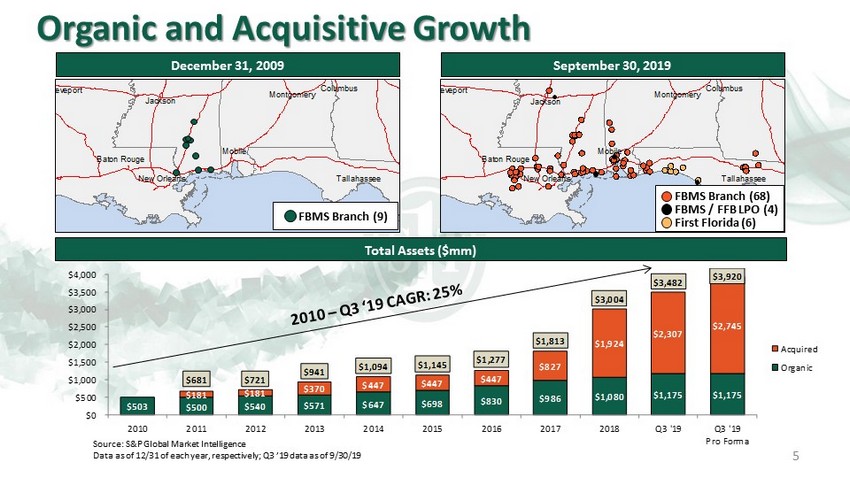

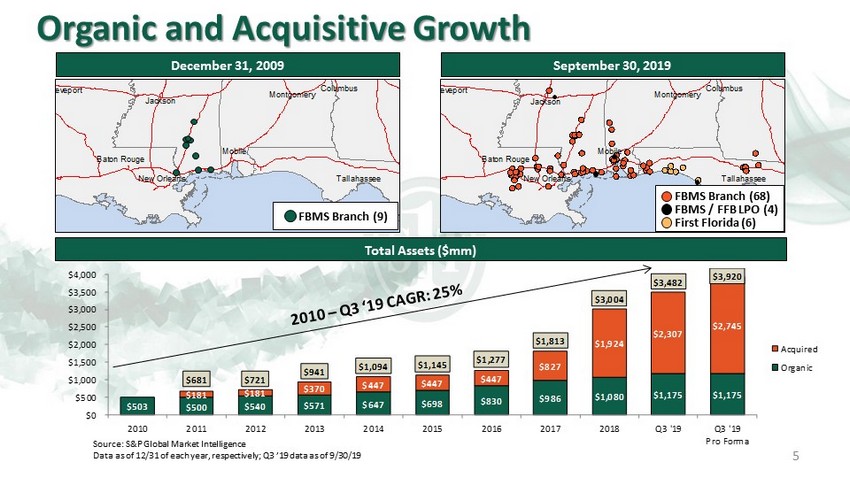

Mobile New Orleans Baton Rouge Jackson Tallahassee Montgomery Shreveport Columbus $503 $500 $540 $571 $647 $698 $830 $986 $1,080 $1,175 $1,175 $181 $181 $370 $447 $447 $447 $827 $1,924 $2,307 $2,745 $681 $721 $941 $1,094 $1,145 $1,277 $1,813 $3,004 $3,482 $3,920 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2010 2011 2012 2013 2014 2015 2016 2017 2018 Q3 '19 Q3 '19 Pro Forma Acquired Organic New Orleans Mobile Baton Rouge Jackson Tallahassee Montgomery Shreveport Columbus Organic and Acquisitive Growth 5 December 31, 2009 September 30 , 2019 Total Assets ($mm) Source: S&P Global Market Intelligence Data as of 12/31 of each year, respectively; Q3 ’19 data as of 9/30/19 FBMS Branch (9) FBMS Branch (68) FBMS / FFB LPO (4) First Florida (6)

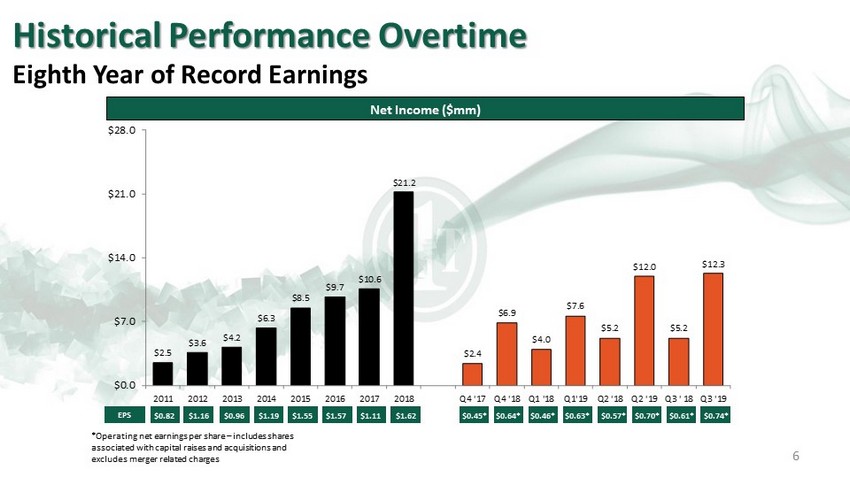

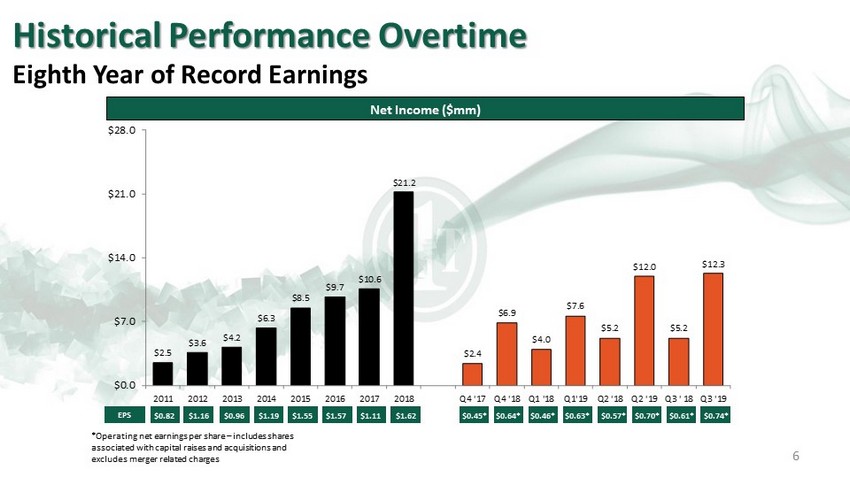

$2.5 $3.6 $4.2 $6.3 $8.5 $9.7 $10.6 $21.2 $2.4 $6.9 $4.0 $7.6 $5.2 $12.0 $5.2 $12.3 $0.0 $7.0 $14.0 $21.0 $28.0 2011 2012 2013 2014 2015 2016 2017 2018 Q4 '17 Q4 '18 Q1 '18 Q1'19 Q2 '18 Q2 '19 Q3 ' 18 Q3 '19 Historical Performance Overtime Eighth Year of Record Earnings *Operating net earnings per share – includes shares associated with capital raises and acquisitions and excludes merger related charges EPS Net Income ($mm) $0.82 6 $1.16 $0.96 $1.19 $1.55 $1.57 $0.96 $1.11 $1.62 $0.45* $0.64* $0.46* $0.61* $0.63* $0.57* $0.70* $0.74*

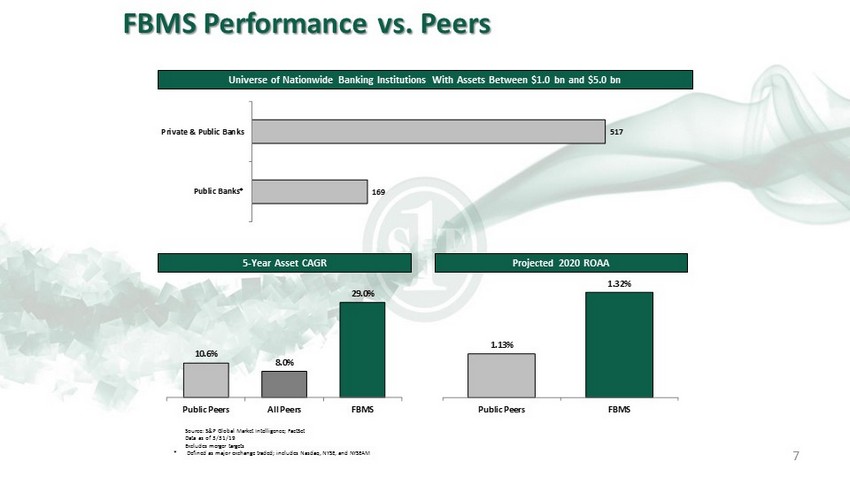

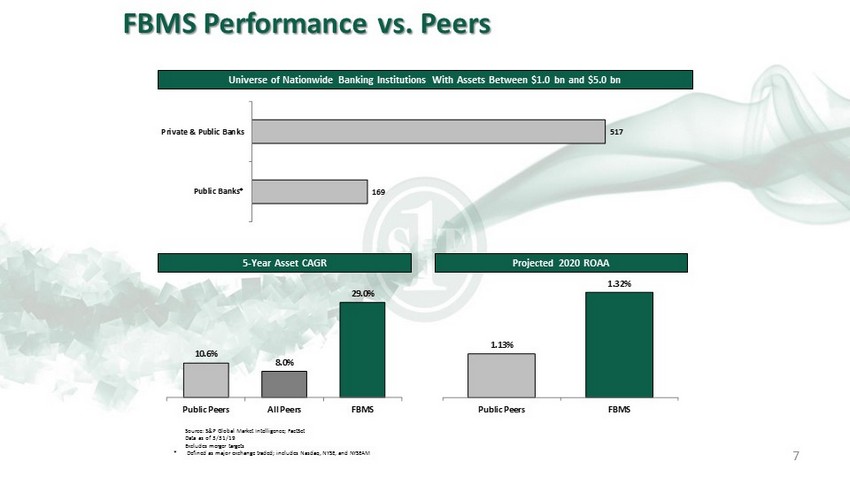

1.13% 1.32% Public Peers FBMS 10.6% 8.0% 29.0% Public Peers All Peers FBMS 169 517 Public Banks* Private & Public Banks 7 FBMS Performance vs. Peers Source: S&P Global Market Intelligence; FactSet Data as of 3/31/19 Excludes merger targets * Defined as major exchange traded; includes Nasdaq, NYSE, and NYSEAM 5 - Year Asset CAGR Projected 2020 ROAA Universe of Nationwide Banking Institutions With Assets Between $1.0 bn and $5.0 bn

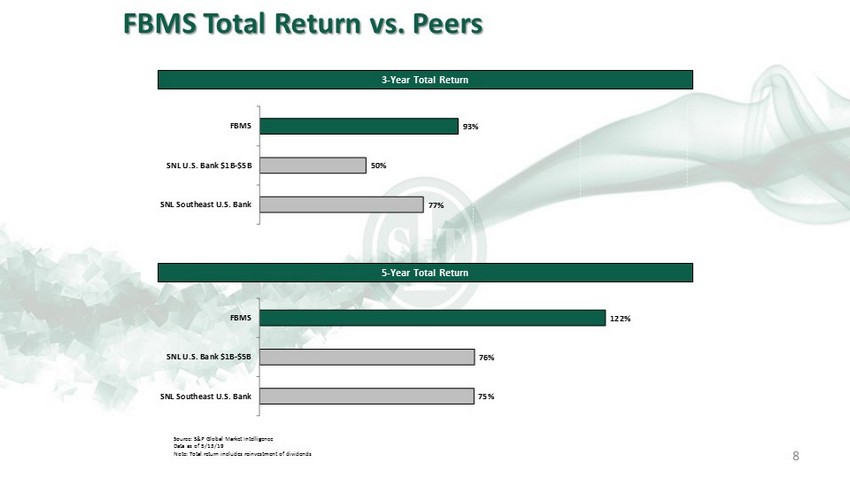

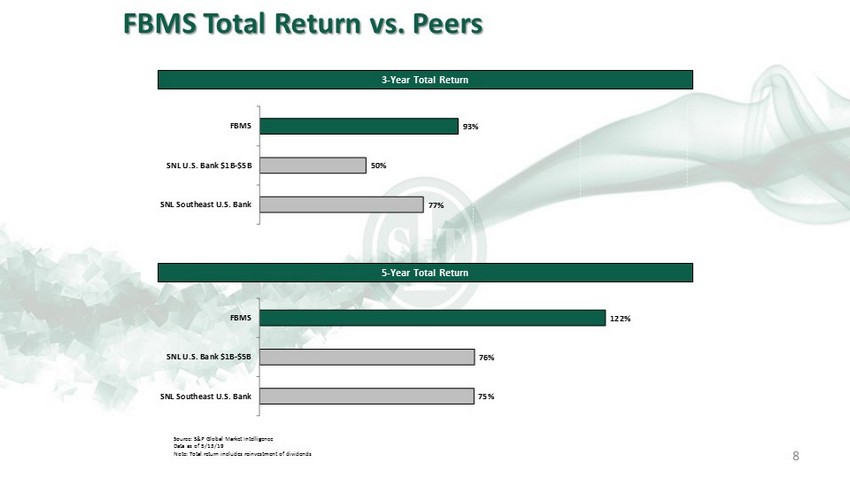

75% 76% 122% SNL Southeast U.S. Bank SNL U.S. Bank $1B-$5B FBMS 77% 50% 93% SNL Southeast U.S. Bank SNL U.S. Bank $1B-$5B FBMS 8 FBMS Total Return vs. Peers Source: S&P Global Market Intelligence Data as of 5/13/19 Note: Total return includes reinvestment of dividends 3 - Year Total Return 5 - Year Total Return

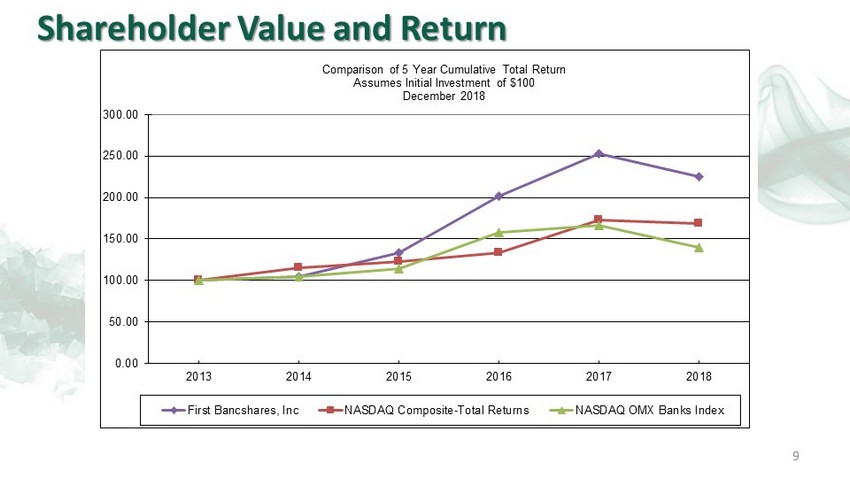

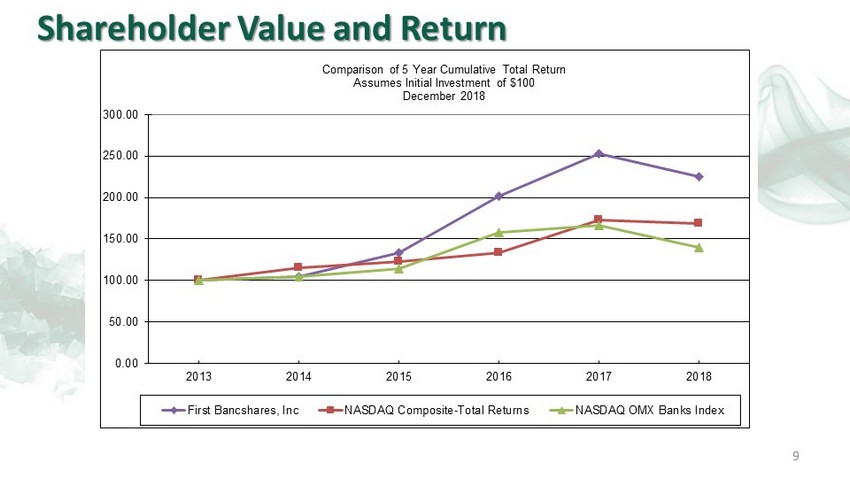

9 Shareholder Value and Return 0.00 50.00 100.00 150.00 200.00 250.00 300.00 2013 2014 2015 2016 2017 2018 Comparison of 5 Year Cumulative Total Return Assumes Initial Investment of $100 December 2018 First Bancshares, Inc NASDAQ Composite-Total Returns NASDAQ OMX Banks Index

A Division of The First, N.A.

AL FL GA LA MS Employees 752 Loans / Deposits 83% Loan Production Offices 4 Assets $4.5 Billion Loans $3.0 Billion Deposits $3.6 Billion Branches 82 (1) Pro forma for recently completed acquisition of First Florida Bancorp, Inc. and announced acquisition of SGB (2) Excludes purchase accounting adjustments Source: S&P Global Market Intelligence Our Pro Forma Company Pro Forma (1) FBMS Branch (74) SGB (8) FBMS LPO (4) Albany Hattiesburg Valdosta Panama City Beach Moultrie Pro Forma Loans by State (1)(2) Pro Forma Deposits by State (1)(2) Mississippi 26% Alabama 18% Louisiana 16% Florida 26% Georgia 14% Mississippi 29% Alabama 15% Louisiana 17% Florida 23% Georgia 16% Tallahassee Destin Pensacola New Orleans Baton Rouge Shreveport Jackson Huntsville Birmingham Montgomery Mobile Atlanta Columbus Jacksonville

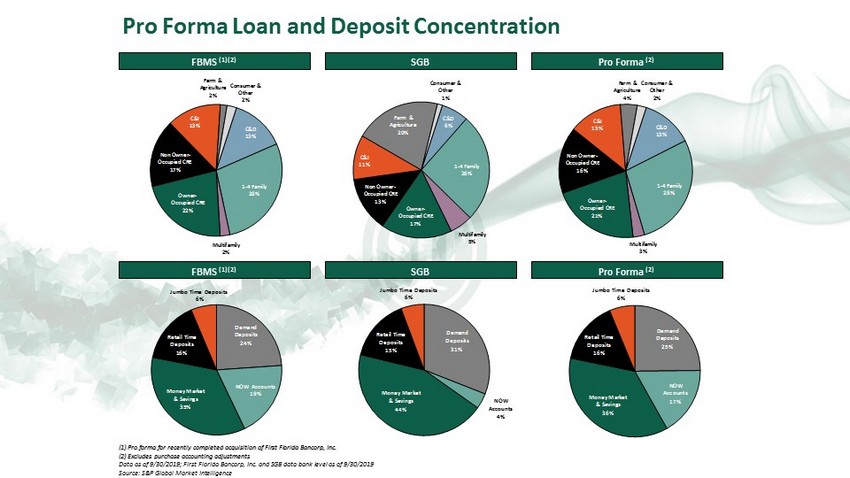

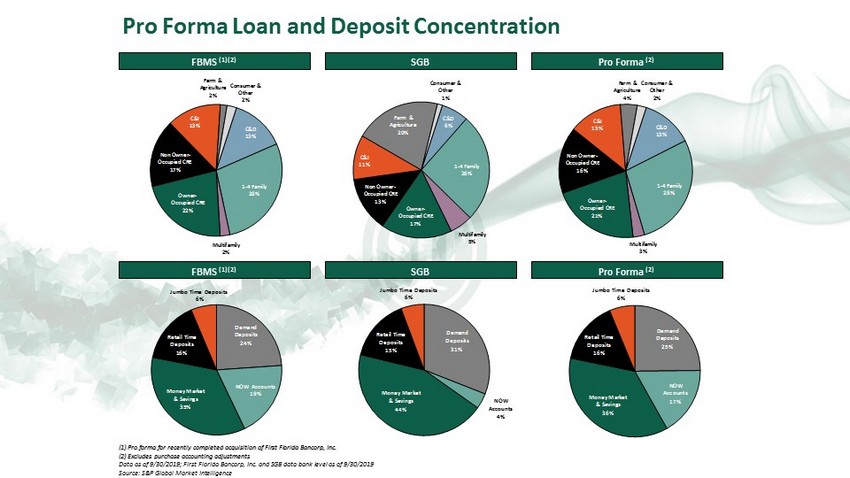

C&D 13% 1 - 4 Family 28% Multifamily 3% Owner - Occupied CRE 21% Non Owner - Occupied CRE 16% C&I 13% Farm & Agriculture 4% Consumer & Other 2% C&D 13% 1 - 4 Family 28% Multifamily 2% Owner - Occupied CRE 22% Non Owner - Occupied CRE 17% C&I 13% Farm & Agriculture 2% Consumer & Other 2% C&D 6% 1 - 4 Family 26% Multifamily 5% Owner - Occupied CRE 17% Non Owner - Occupied CRE 13% C&I 11% Farm & Agriculture 20% Consumer & Other 1% Demand Deposits 31% NOW Accounts 4% Money Market & Savings 44% Retail Time Deposits 15% Jumbo Time Deposits 6% Demand Deposits 25% NOW Accounts 17% Money Market & Savings 36% Retail Time Deposits 16% Jumbo Time Deposits 6% Demand Deposits 24% NOW Accounts 19% Money Market & Savings 35% Retail Time Deposits 16% Jumbo Time Deposits 6% (1) Pro forma for recently completed acquisition of First Florida Bancorp, Inc. (2) Excludes purchase accounting adjustments Data as of 9/30/2019; First Florida Bancorp, Inc. and SGB data bank level as of 9/30/2019 Source: S&P Global Market Intelligence Pro Forma Loan and Deposit Concentration SGB Pro Forma (2) SGB Pro Forma (2) FBMS (1)(2) FBMS (1)(2)

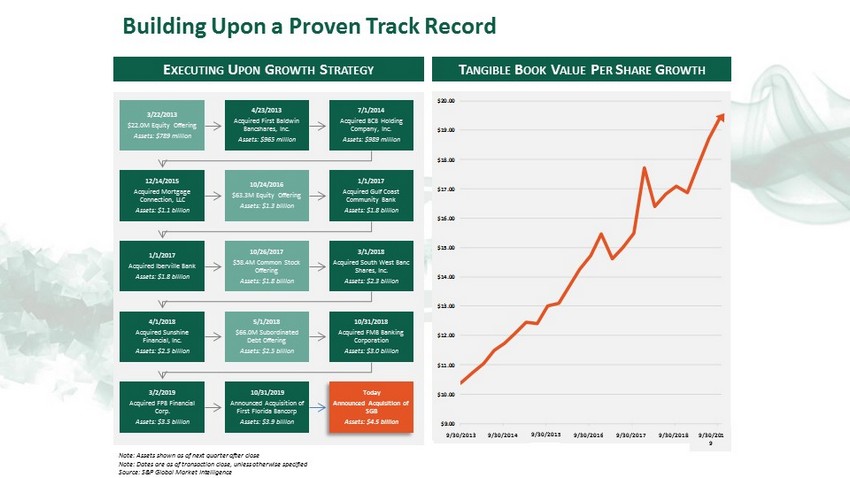

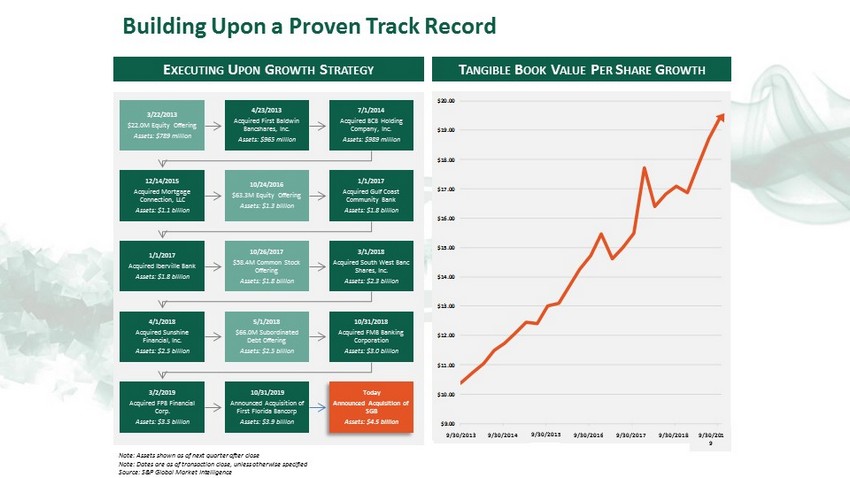

$9.00 $10.00 $11.00 $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 $18.00 $19.00 $20.00 9/1/2013 9/1/2014 9/1/2015 9/1/2016 9/1/2017 9/1/2018 9/1/2019 Note: Assets shown as of next quarter after close Note: Dates are as of transaction close, unless otherwise specified Source: S&P Global Market Intelligence Building Upon a Proven Track Record 3/22/2013 $22.0M Equity Offering Assets: $789 million 4/23/2013 Acquired First Baldwin Bancshares, Inc. Assets: $965 million 7/1/2014 Acquired BCB Holding Company, Inc. Assets: $989 million 12/14/2015 Acquired Mortgage Connection, LLC Assets: $1.1 billion 10/24/2016 $63.3M Equity Offering Assets: $1.3 billion 1/1/2017 Acquired Gulf Coast Community Bank Assets: $1.8 billion 1/1/2017 Acquired Iberville Bank Assets: $1.8 billion 10/26/2017 $58.4M Common Stock Offering Assets: $1.8 billion 3/1/2018 Acquired South West Banc Shares, Inc. Assets: $2.3 billion 4/1/2018 Acquired Sunshine Financial, Inc. Assets: $2.5 billion 5/1/2018 $66.0M Subordinated Debt Offering Assets: $2.5 billion 10/31/2018 Acquired FMB Banking Corporation Assets: $3.0 billion 3/2/2019 Acquired FPB Financial Corp. Assets: $3.5 billion 10/31/2019 Announced Acquisition of First Florida Bancorp Assets: $3.9 billion Today Announced Acquisition of SGB Assets: $4.5 billion E XECUTING U PON G ROWTH S TRATEGY T ANGIBLE B OOK V ALUE P ER S HARE G ROWTH 9/30/2013 9/30/2014 9/30/2015 9/30/2016 9/30/2017 9/30/2018 9/30/201 9

14