UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 28, 2024

OR

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number: 1-14092

THE BOSTON BEER COMPANY, INC.

(Exact name of registrant as specified in its charter)

| |

| |

Massachusetts | 04-3284048 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

\

One Design Center Place, Suite 850, Boston, Massachusetts

(Address of principal executive offices)

02210

(Zip Code)

(617) 368-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock. $0.01 par value | | SAM | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

|

|

|

|

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

|

|

|

|

Emerging growth company | ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Class A Common Stock ($0.01 par value) held by non-affiliates of the registrant totaled $2,737.76 million (based on the closing price of the Company’s Class A Common Stock on the New York Stock Exchange on June 28, 2024). All of the registrant’s Class B Common Stock ($0.01 par value) is held by an affiliate.

As of February 21, 2025 there were 9,175,801 shares outstanding of the Company’s Class A Common Stock ($0.01 par value) and 2,068,000 shares outstanding of the Company’s Class B Common Stock ($0.01 par value).

DOCUMENTS INCORPORATED BY REFERENCE

Certain parts of the registrant’s definitive Proxy Statement for its 2025 Annual Meeting to be held on May 14, 2025 are incorporated by reference into Part III of this report.

THE BOSTON BEER COMPANY, INC. AND SUBSIDIARIES

FORM 10-K

FOR THE PERIOD ENDED DECEMBER 28, 2024

PART I.

Item 1. Business

General

The Boston Beer Company, Inc. and certain subsidiaries (the “Company”) are engaged in the business of selling alcohol beverages throughout the United States and in selected international markets, under the trademarks “The Boston Beer Company®”, “Twisted Tea Brewing Company®”, “Hard Seltzer Beverage Company”, “Angry Orchard® Cider Company”, “Dogfish Head® Craft Brewery”, “Dogfish Head Distilling Co.”, “Angel City® Brewing Company”, “Coney Island® Brewing Company”, "Green Rebel Brewing Co.", “TeaPot Worldwide”, and “Sun Cruiser Beverage Co."

The Company produces alcohol beverages, including flavored malt beverages, hard seltzer, beer, hard cider, spirits based ready to drink beverages (“spirits RTDs”) and distilled spirits at Company-owned breweries and its cidery and under contract arrangements at other production facilities. The four primary Company-owned breweries are focused on production and research and development, including breweries located in Boston, Massachusetts (the “Boston Brewery”), Cincinnati, Ohio (the “Cincinnati Brewery”), Milton, Delaware (the “Milton Brewery”) and Breinigsville, Pennsylvania (the “Pennsylvania Brewery”). These breweries, with the exception of the Pennsylvania Brewery, have tap rooms for retail sales on site.

The Company also operates three smaller local breweries that are mainly focused on brewing and packaging beers for retail sales on site at tap rooms and gift shops, restaurant activities, developing innovative and traditional beers and in some cases, supporting draft and package accounts in the respective local market areas. These local breweries are located in Boston, Massachusetts (the “Samuel Adams Boston Downtown Tap Room”), Rehoboth, Delaware (“Dogfish Head Brewings and Eats”), Los Angeles, California (the “Angel City Brewery" and "Truly LA”), and Cincinnati, Ohio ("Cincinnati Tap Room").

In addition, the Company owns an apple orchard and cidery located in Walden, New York (the “Orchard” and “Cidery”), a restaurant in Rehoboth, Delaware (“Chesapeake & Maine”) and a boutique inn in Lewes, Delaware (the “Dogfish Inn”).

The Company sells its beverages in various packages. Sleek cans, standard cans and bottles are sold primarily for off-premise retailers, which include grocery stores, club stores, convenience stores, liquor stores, and other traditional and e-commerce retail outlets. Kegs are sold primarily for on-premise retailers, which include bars, restaurants, stadiums and other venues.

The Company’s principal executive offices are located at One Design Center Place, Suite 850, Boston, Massachusetts 02210, and its telephone number is (617) 368-5000.

Industry Background

Most of the Company’s products are sold through off-premise retailers and the Company estimates the size of its markets using third-party metrics from measured off-premise channels, which is standard in the United States beer industry.

The Company competes primarily in the United States in the combined Beyond beer and Traditional beer market (“US Beer Market”). Beyond beer includes flavored malt beverages, hard seltzer, hard cider, spirits RTDs and other emerging beverages. Traditional beer generally includes mass domestics, imports, domestic specialties and craft beer.

In measured off-premise channels in 2024, the US Beer Market increased 0.4% to $47.6 billion with Beyond beer increasing 4.4% to $10.3 billion and Traditional beer declining 0.7% to $37.3 billion. Beyond beer is 22% of the US Beer Market and the Company believes Beyond beer is positioned to continue to grow and gain share from Traditional beer.

Description of the Company’s Business

The Company was founded in 1984 as a craft brewery and competes in the craft beer category primarily with its Samuel Adams and Dogfish Head brands. The Company has a strong history of innovation and has internally developed brands outside of the craft beer category that are among the leaders in their respective categories. These brands include Twisted Tea, a flavored malt beverage introduced in 2001, Angry Orchard, a hard cider introduced in 2011, Truly Hard Seltzer, a hard seltzer introduced in 2016 and Sun Cruiser, a vodka spirits RTD introduced in 2024. In 2024, approximately 85% of the Company’s 2024 volume is in Beyond beer with the remainder in Traditional beer. The Company is the second largest supplier in Beyond beer at a 21% market share.

The Company’s business goal is to grow market share in the US Beer Market by creating and offering high quality alcohol beverages. With the support of a large, well-trained sales organization and world-class brewers, the Company strives to achieve this goal by offering consumer-responsive beverages, increasing brand availability and awareness through traditional media and digital advertising, point-of-sale, promotional programs, and drinker education and engagement.

The Company’s beverages are sold by the Company’s sales force to the same types of customers and drinkers in similar size quantities, at similar price points and through substantially the same channels of distribution. These beverages are manufactured using similar production processes, have comparable alcohol content and generally fall within the same regulatory environment.

The Company’s strategy is to create and offer a world-class variety of traditional and innovative alcohol beverages. The Company’s primary brands which include the Twisted Tea, Truly Hard Seltzer, Samuel Adams, Angry Orchard, Dogfish Head and Sun Cruiser brands are all available nationally. The Twisted Tea brand family has grown each year since the product was first introduced in 2001 and has established a loyal drinker following and has become the largest selling flavored malt beverage brand. In 2016, the Company began national distribution of the Truly Hard Seltzer brand and it maintained its place as one of the leading brands in the hard seltzer category in 2024. The Samuel Adams brand began in 1984 and the brand is recognized as one of the largest and most respected craft beer brands with a particular focus on lagers and seasonal beers. The Angry Orchard brand was launched in 2011 and since 2013, Angry Orchard has been the largest selling hard cider in the United States. The Dogfish Head brand began in 1995 and is recognized as one of the most innovative and respected craft beer and spirits brand with a particular focus on India Pale Ales (“IPAs”) and spirits RTDs. In addition to its primary brands, the Company has two local brands, Angel City® and Coney Island®, that primarily focus on local distribution.

The Company entered the market for spirits RTDs through its Dogfish Head brand in 2021 followed by its Truly spirits brands beginning in 2022 and Sun Cruiser in 2024. The Company discontinued its Truly spirits RTD brands in early 2025.

In 2021, the Company entered separate licensing agreements with PepsiCo, Inc. (“Pepsi”) and Jim Beam Brands Co. (“Jim Beam”) to develop, market and sell alcohol beverages. Beginning in 2022, the Company sold products under the brand names ‘Hard Mountain Dew’ under the Pepsi agreements and certain other brands under the Jim Beam agreements that have since been discontinued. Also, the Company collected royalties under the Jim Beam agreement on Jim Beam shipments of ‘Truly Vodka’ and ‘Twisted Tea Whiskey’. While the Company believes these agreements represent strategic opportunities to increase volume in the longer term, these combined brands represented approximately 2% of net revenue in 2023 and 2024, respectively.

Twisted Tea

The Company’s Twisted Tea products generally compete within the flavored malt beverage (“FMB”) category of Beyond beer. The FMB category is $4.6 billion in measured off-premise channels and comprises approximately 45% of Beyond beer and the FMB category grew in dollars approximately 20% in 2023 and 6% in 2024. This category is highly competitive due to, among other factors, the presence of large brewers and spirits companies in the category as well as many smaller national and regional competitors and a fast pace of product innovation.

The Company offers over ten styles of flavored malt beverages in the Twisted Tea brand family, most of which are available nationally in both the United States and Canada. Most styles are available in standard cans and some are available in 24 ounce cans and bottles. The majority of the promotional and distribution efforts for the Twisted Tea brand family are focused on Twisted Tea Original, Twisted Tea Half and Half and variety packs in various standard can packages. During 2023 and 2024, the Company increased its promotional efforts related to Twisted Tea Light, and in 2023 and 2024, the style grew significantly off a relatively small base.

In 2024, the Company launched in certain test markets, Twisted Tea Extreme, an 8% Alcohol By Volume ("ABV") flavored malt beverage in 2 styles, primarily sold in 24 ounce cans. Based on the results of the test markets, the Company anticipates launching Twisted Tea Extreme nationally during 2025.

Truly Hard Seltzer

The Company’s Truly Hard Seltzer brand generally competes within the hard seltzer category. This category grew rapidly in the early stages of its development and is highly competitive and includes large international and domestic competitors as well as many smaller national, regional and local hard seltzer companies. Beginning in the latter half of 2021 and continuing into 2023, the category saw sharp declines in volume. The Hard Seltzer category is $3.1 billion in measured off-premise channels and comprises approximately 30% of Beyond beer and the hard seltzer category declined in dollars approximately 16% in 2023 and 8% in 2024.

The Company offers over thirty styles of hard seltzer in the Truly Hard Seltzer brand family, most of which are available nationally in the United States. Most styles are available in sleek cans and some are available in 24 ounce cans. In 2024, the Company introduced Truly Unruly, an 8% ABV hard seltzer in a sleek can variety pack. In 2024, Truly Unruly was the top growth driver among higher ABV brands in the US Beer Market. The Company expects Truly Unruly to be a significant source of growth in 2025. The majority of the promotional and distribution efforts for the Truly brand family in 2024 were focused on sleek can variety packages which include, Truly Berry Mix Pack, Truly Party Pack, Truly Unruly Mix Pack, Truly Citrus Mix Pack, Truly Lemonade Seltzer Mix Pack and Truly Fruit Punch Mix Pack.

In early 2025, the Company anticipates launching nationally a new Truly Unruly Lemonade Mix Pack.

Samuel Adams and Dogfish Head Beers

The Company’s Samuel Adams and Dogfish Head beers generally compete within the craft beer and domestic specialty beer category. The craft beer category is $3.6 billion in measured off-premise channels and comprises approximately 10% of traditional beer and the craft beer category in dollars was approximately flat in 2023 and declined 2% in 2024. This category is highly competitive and includes large international and domestic competitors, as well as many smaller national, regional and local craft breweries.

The Company offers over twenty styles of beer in the Samuel Adams brand family and the brand is recognized for helping launch the craft beer industry. Samuel Adams Boston Lager® is the Company’s flagship beer that was introduced in 1984. The Samuel Adams Seasonal program of beers was originally introduced in the late 1980’s and includes various limited availability seasonal beers and variety packs. Samuel Adams American Light was introduced in 2024 and is made with high quality American ingredients and recently earned the title of Best Light Beer in America in the World Beer Awards.

Samuel Adams Just the Haze, a non-alcoholic hazy IPA, was released in early 2021 and Samuel Adams Golden, a non-alcoholic golden lager, was released in early 2023. The two Samuel Adams non-alcoholic beers combined in dollars grew 84% in 2023 and 27% in 2024 and represent 8% of the brands total.

The majority of the promotional and distribution efforts for the Samuel Adams brand family are focused on the Samuel Adams Seasonal program, Samuel Adams Boston Lager and Samuel Adams American Light. Most Samuel Adams beers are available nationally in various bottle, standard can, and keg packages.

The Samuel Adams brand also releases a variety of specialty package and draft beers brewed in limited quantities at its Samuel Adams Downtown Boston Tap Room, Samuel Adams Boston Brewery Tap Room, and Samuel Adams Cincinnati Brewery Tap Room.

The Company offers over twenty-five styles of beer in the Dogfish Head brand family. The Dogfish Head brand began in 1995 and it is recognized as an early leader in bringing culinary innovations to the U.S. craft beer market. The majority of the promotional and distribution efforts for the Dogfish Head brand family are focused on continually-hopped Dogfish Head 60 Minute and 90 Minute IPAs, along with seasonal variety packs. These styles are offered in various can, bottle and keg packages. The Dogfish Head brand also releases a variety of specialty package and draft beers brewed in limited quantities at its Dogfish Head Brewings and Eats and Milton Brewery tasting room locations. The Company does not own distribution rights to the Dogfish Head beer and distilled spirits brands outside of the United States and Canada.

Angry Orchard Hard Cider

The Company’s Angry Orchard ciders compete within the hard cider category. The hard cider category is $0.5 billion in measured off-premise channels and comprises approximately 5% of Beyond beer and the cider category in dollars increased 2% in 2023 and declined 2% in 2024. This category is small and highly competitive and the competition consists mostly of many small regional and local hard cider companies.

The Company offers over ten styles of hard cider in the Angry Orchard brand family, most of which are available nationally in the United States in various bottle, can, and keg packages. The majority of the promotional and distribution efforts for the Angry Orchard brand family are focused on Angry Orchard Crisp Apple. The Angry Orchard brand also releases a variety of specialty package and draft ciders fermented in limited quantities at its Company-owned Orchard and Cidery in Walden, New York.

Dogfish Head Spirit RTDs and Sun Cruiser

The Company’s Dogfish Head Canned Cocktails and Sun Cruiser brands compete in the spirits RTD category. The spirits RTD category is $1.3 billion in measured off-premise channels and comprises approximately 13% of Beyond beer and the spirits RTD category in dollars increased approximately 54% in 2023 and 24% in 2024. This category is highly competitive and includes large international and domestic competitors, as well as many small regional and local craft distilling companies.

The Dogfish Head brand began distilling spirits in 2002 and is considered one of the original craft distilleries. The Company offers over 15 styles of distilled spirits under the Dogfish Head brand in small quantities that are sold in limited markets. In 2021, the Company entered the market for spirits RTDs through its Dogfish Head brand. The Company currently offers over 7 styles of spirits RTDs under the Dogfish Head brand that are available in sleek can and sleek can variety packages.

The Sun Cruiser brand was launched in early 2024. The Company offers eight styles of vodka iced tea and lemonade RTDs in the Sun Cruiser brand family, that will be available nationally in the first half of 2025. All styles are available in sleek cans and some are available in 700 ml cans.

Product Innovations

The Company has a proven track record of innovation and building new brands and is committed to maintaining its position as a leading innovator. To that end, the Company continually tests new alcohol beverages and may sell them under various brand labels for evaluation of drinker interest. The Boston Brewery, the Milton Brewery and the Cidery, along with its other larger breweries and brewery tap rooms spend significant time ideating, testing and developing alcohol beverages for the Company’s potential future commercial development and evaluating ingredients and process improvements for existing beverages.

The Company’s most significant innovations in 2024 were the introduction of the Sun Cruiser brand, a new iced tea vodka based RTD, as well as the launch of Truly Unruly Mix Pack and Twisted Tea Extreme. Also, in 2024 the Company launched Samuel Adams American Light. In the first quarter of 2025, the Company is planning to launch Truly Unruly Lemonade Mix Pack, Sun Cruiser vodka based lemonade and Dogfish Head Grateful Dead Juicy Pale Ale. During the rest of 2025, the Company has plans to add new brands, new beverage styles and may reformulate existing styles of beverages.

In May 2021, the Company announced that it was establishing a subsidiary to serve as a dedicated research and innovation hub in the federally regulated market of Canada focused on non-alcoholic cannabis beverages. This subsidiary enables the Company to develop and pilot unique cannabis beverages, while cannabis regulations continue to evolve in the United States and worldwide. The Company began selling limited quantities of cannabis beverage products in Canada under the TeaPot brand during the second half of 2022. In late 2024, the Company began the launch of a new cannabis beverage brand of hand-crafted non-alcoholic cannabis cocktails named Emerald Hour. The Company currently does not have plans to produce or sell any cannabis products outside of Canada.

The Company continually evaluates the performance of its beverages and the rationalization of its product lines as a whole. Periodically, the Company discontinues certain styles and packages. For example, the Company discontinued Truly Margarita Style Variety Pack and Truly Tropical Variety Pack during the first half of 2024. Also late in 2024, the Company discontinued its Slingers and General Admission brands. In early 2025, Truly Vodka Soda and Truly Tequila Soda were discontinued. Certain styles or brands put on hiatus or discontinued in previous years may be produced for the Company’s variety packs or reintroduced.

Sales, Distribution, and Marketing

As dictated by the legal and regulatory environment, most all the Company’s sales are made to a network of over 300 wholesalers in the United States and to a network of foreign wholesalers, importers or other agencies (collectively referred to as “Distributors”). These Distributors, in turn, sell the products to retailers, such as grocery stores, club stores, convenience stores, liquor stores, bars, restaurants, stadiums and other traditional and e-commerce retail outlets, where the products are sold to drinkers, and in some limited circumstances to parties who act as sub-distributors. The Company sells its products predominantly in the United States, but also has markets in Canada, Mexico and other international markets.

With few exceptions, the Company’s products are not the primary brands in its Distributors’ portfolios. Thus, the Company, in addition to competing with other beverages for a share of the drinker’s business, competes with other beverage companies for a share of the Distributor’s attention, time and selling efforts. During 2024, the Company’s largest individual Distributor accounted for approximately 3% of the Company’s gross sales. The top three individual Distributors collectively accounted for approximately 7% of the Company’s gross sales. In some states and countries, the Company’s contracts with its Distributors may be affected by laws that restrict the enforcement of some contract terms, especially those related to the Company’s right to terminate the relationship.

Most of the Company’s products are shipped within days of packaging, resulting in limited finished goods at the Company’s breweries and third-party production facilities. The Company works with its distributors closely and has designed its internal supply chain systems and process to manage and maintain distributor inventories at between three and five weeks of sales on hand. These levels are designed to result in high customer service levels, limit distributor and retailer out of stocks and reduce the risk of inventory obsolescence.

During 2022, the Company produced and sourced materials for Truly Hard seltzer and some of its newer brands at the upper end of its projections to avoid out of stocks at retail. This led to improved customer service levels and significantly fewer out of stocks but resulted in write-offs of excess inventory at the Company’s breweries and warehouses. During 2023, the Company significantly improved its supply chain functions which led to reduced inventories internally and at distributors, while improving customer service levels and significantly reducing write-offs of excess inventory. During 2024, the Company’s distributor out of stocks improved significantly from prior years and were limited to some relatively minor out of stocks on its Truly brand during peak summer months. The Company continues to work on its supply chain improvement initiatives to better manage inventory and further reduce inventory obsolescence.

The Company believes distributor inventory as of December 28, 2024 and December 30, 2023 was at an appropriate level for each of its brands and averaged approximately four weeks on hand.

Boston Beer has a sales force of over 475 people, which the Company believes is one of the largest in the US Beer Market industry. The Company’s sales organization is designed to develop and strengthen relations at the Distributor, retailer and drinker levels by providing educational and promotional programs. The Company’s sales force has a high level of product knowledge and is trained in the details of the brewing and selling processes. Sales representatives typically carry samples of the Company’s beverages and other promotional materials to educate wholesale and retail buyers about the quality and taste of the Company’s products. The Company has developed strong relationships with its Distributors and retailers, many of which have benefited from the Company’s premium pricing strategy and growth.

The Company also engages in media campaigns, including television, digital and social media, radio, billboards, and print. These media efforts are complemented by participation in sponsorships, which currently include the United States Soccer Federation, Barstool Sports, the Boston Red Sox, and other professional sports teams, the Boston Marathon, local concert and festivals, and industry-related trade shows and promotional events at local establishments, to the extent permitted under local laws and regulations. The Company uses a wide array of point-of-sale items (banners, neon signs, umbrellas, glassware, display pieces, signs and menu stands) designed to stimulate impulse sales and continued awareness, where legal.

Packaging and Ingredients

Historically, the Company has been successful in obtaining sufficient quantities of the packaging materials and ingredients used in the production of its beverages. During 2020 and 2021, the Company experienced some supply chain constraints in packaging materials, primarily cans, that impacted the Company’s production schedules and increased can costs as a result of using a more expensive can supplier. The Company enters into limited-term supply agreements with certain vendors in order to receive preferential pricing. The Company maintains competitive sources for most packaging materials and ingredients. In 2024, certain flavorings, crowns and labels were each supplied by a single source; however, the Company believes that, given time to adjust, alternative suppliers are available. The most significant packaging and ingredients include:

Cans. Truly Hard Seltzer brand beverages are primarily packaged in sleek cans and Twisted Tea brand beverages are primarily packaged in standard cans. In 2024, approximately 79% of the Company’s total volume was packaged in cans and the Company expects that percentage to increase further in 2025. The demand for cans in the beverage industry significantly increased during 2020 and 2021 and there was a shortage of capacity, as can manufacturers adjusted their supply chains to keep up with the increased demand which had accelerated beginning in 2020 as alcohol consumption shifted from on-premise to off-premise. In 2021, as the Truly and the Twisted Tea brand families grew, the Company experienced supply shortages and these supply shortages impacted the Company’s production schedules and increased can costs as a result of using a more expensive can supplier. During 2022, 2023 and 2024 the Company did not have any significant disruptions in its can supply and the Company currently believes that it will have a sufficient supply of cans in 2025.

Flavorings and Fruit Juice. The Company’s beverages include many unique and proprietary flavors and combinations of flavors and most of these flavorings are single sourced. Truly Hard Seltzer and Twisted Tea brand beverages are particularly reliant on the use of flavorings and a variety of flavors as part of their appeal to drinkers. The Company is working closely with various flavoring and fruit juice suppliers to ensure it has an adequate supply and currently believes that it will have sufficient supply of flavorings and fruit juice in 2025.

Cardboard. The Company’s beverages are packaged primarily in cardboard wraps, carriers and cardboard shipping cases. Since 2020, the Company has not had any significant disruptions in its supply of cardboard and the Company currently believes that it will have a sufficient supply of cardboard wraps in 2025.

Glass. Some of the Company’s beverages are sold in glass bottles. Since 2020, the Company has not had any significant disruptions in its supply of glass and the Company currently believes that it will have a sufficient supply of glass in 2025.

Malt. The two-row varieties of barley used in the Company’s malt are mainly grown in the United States and Canada. The 2024 North American barley crop, which will support 2025 malt needs, was generally consistent with historical long-term averages with regard to both quality and quantity. The Company purchased most of the malt used in the production of its beers from four suppliers during 2024. The Company also believes that there are other malt suppliers available that are capable of supplying its needs.

Hops. The Company uses Noble hop varieties from Europe for many of its Samuel Adams beers and also uses hops grown in other areas of Europe, the United States, and New Zealand. Noble hops are grown in several specific areas in Germany and the Czech Republic that are recognized for growing hops with superior taste and aroma properties. The Company uses hops in various formats including T-90 hop pellets, T-45 hop pellets and CO2 Extract. The Company stores its hops in multiple cold storage warehouses to minimize the impact of a catastrophe at a single site.

The Company enters into purchase commitments with seven primary hop dealers, attempts to maintain a one to two-year supply of essential hop varieties on-hand in order to limit the risk of an unexpected reduction in supply, and procures hops needed for new beers, based on its best estimate of likely short-term demand. The Company classifies hops inventory in excess of two years of forecasted usage as other long term assets.

Variations to usage plans could result in hops shortages for specific beers or an excess of certain hops varieties.

Yeast. The Company uses multiple yeast strains for production of its beverages. While some strains are commercially available, other strains are proprietary. Since the proprietary strains cannot be replaced if destroyed, the Company protects these strains by storing multiple cultures of the same strain at different production locations and in several independent laboratories.

Apples. The Company uses special varieties and origins of apples in its hard ciders that it believes are important for their flavor profiles. In 2024, these apples were sourced primarily from Europe and the United States and include bittersweet apples from France and culinary apples from Italy, Washington State and New York. Purchases and commitments are denominated in Euros for European apples and US Dollars for American apples. There is limited availability of some of these apple varieties, and many outside factors, including weather conditions, growers rotating from apples to other crops, competitor demand, government regulation and legislation affecting agriculture could affect both price and supply.

Quality Assurance

The Company employs a quality assurance team and brewmasters to monitor the Company’s brewing operations and control the production of its beverages both at Company-owned breweries and at the third-party production facilities at which the Company’s products are produced. Extensive tests, tastings and evaluations are typically required to ensure that each batch of the Company’s beverages conforms to the Company’s standards. The Company has on-site quality control labs at each of the Company-owned breweries and supports the smaller tap rooms and local breweries with additional centralized lab services.

With the exception of certain specialty and distilled products, the Company includes a clearly legible “freshness” date on every bottle, can and keg of its beverages, in order to ensure that its drinkers enjoy only the freshest products. Boston Beer was the first American brewer to use this practice.

Production Strategy

The Company continues to pursue a production strategy that includes production at breweries owned by the Company and production facilities owned by others. The Company made capital investments in 2024 of approximately $76.8 million, most of which represented investments in breweries owned by the Company. These investments were made to drive efficiencies and cost reductions and support product innovation. Based on its current estimates of future volumes and mix, the Company expects to invest between $90 million and $110 million in 2025 to meet those estimates. The increase in 2025 estimated capital expenditures compared to 2024 is driven by an investment in our Pennsylvania Brewery infrastructure for wastewater treatment. Because actual capital investments are highly dependent on meeting demand, the actual amount spent may well be significantly different from the Company’s current expectations.

The Pennsylvania Brewery, the Cincinnati Brewery and the Milton Brewery produced most of the Company’s shipment volume from Company owned breweries during 2024. The Pennsylvania Brewery is the Company’s largest brewery.

Production and retail activities at the Company's local breweries and tap rooms are mainly for brewing and packaging beers for retail sales on site at tap rooms and gift shops, restaurant activities, developing innovative and traditional beers and in some cases supporting draft and package accounts in the respective local market areas.

The Cidery’s production is mainly for developing new types of innovative hard ciders and fermenting and packaging ciders for retail sales on site at the Cidery and supporting draft and package accounts in the local market area.

During each of the years ended December 28, 2024 and December 30, 2023, the Company produced approximately 74% of its domestic volume at Company-owned breweries. In the normal course of its business, the Company has historically entered into various production arrangements with other production companies. Pursuant to these arrangements, the Company generally supplies raw materials and packaging to those production companies and incurs conversion fees for labor at the time the liquid is produced and packaged. The Company has made up-front payments that were used for capital improvements at these third-party production facilities that it expenses over the period of the contracts.

The Company currently has production services agreements with subsidiaries of City Brewing Company, LLC (“City Brewing”). During 2024 and 2023, City Brewing supplied approximately 26% and 22%, respectively, of the Company’s annual domestic shipment volume. In accordance with the production services agreements, the Company has paid to City Brewing for capital improvements at its facilities and other pre-payments. These payments are being expensed over the terms of the agreements. Currently, certain of these production services agreements expire on December 31, 2025 and others on December 31, 2028. The Company has the contractual right to extend its agreements with City Brewing beyond the current termination dates on an annual basis through December 31, 2035. The remaining net book value of these third-party production prepayments is $14.5 million at December 28, 2024 of which $10.3 million is expected to be expensed to cost of goods sold during 2025 and the remainder thereafter.

These agreements include minimum capacity availability commitments by City Brewing and the Company is obligated to meet annual minimum volume commitments and is subject to contractual shortfall fees, if these annual minimum volume commitments are not met.

In January of 2024, the Company and City Brewing entered into a Loan and Security Agreement at which time payment of $20 million was made by the Company to City Brewing. Repayment of the note receivable plus an agreed investment return for a combined total of $22.4 million shall be repaid to the company subject to annual repayment limits. As of December 28, 2024, the balance of the note receivable is $16.7 million and the final maturity date is December 31, 2028.

In December of 2024 the Company entered into an amendment and restatement in its entirety of an existing production agreement with a third-party supplier, Rauch North America Inc ("Rauch"). This amendment and restatement adjusted the existing production agreement to better match the Company’s future capacity requirements and resulted in increased production flexibility and more favorable termination rights to the Company in exchange for a $26 million cash payment to Rauch which was paid on December 23, 2024. As a result of the payment, the Company recorded a pre-tax contract settlement expense of $26 million in the fourth quarter of 2024.

The amended and restated Rauch agreement includes quarterly minimum payments that generally total $4.1 million annually at zero volume and a termination fee of $5 million with 12 months written notice. The initial term of the agreement expires December 31, 2031 with provisions to extend.

At current production volume projections, the Company believes that it will fall short of its future annual volume commitments under the City Brewing and Rauch agreements and will incur shortfall fees. The Company expenses the shortfall fees during the contractual period when such fees are incurred as a component of cost of goods sold. During 2024 and 2023, the Company recorded $13.0 million and $9.5 million, respectively, in shortfall fees. At current volume projections, the Company anticipates that it will recognize approximately $30 million of shortfall fees in future years with $14 million forecasted to be expensed in 2025 and the remainder expected to be expensed primarily in 2026.

As of December 28, 2024, if volume for the remaining term of the production arrangements was zero, the total contractual shortfall and termination fees, with advance notice as specified in the related contractual agreements, would total approximately $37 million with $27 million due in 2025 and $10 million due in future years thereafter.

The Company has regular discussions with its third-party production suppliers related to its future capacity needs and the terms of its contracts. Changes to volume estimates, future amendments or cancellations of existing contracts could accelerate or change total shortfall fees expected to be incurred.

The Company currently expects that the percentage of total domestic production at third-party production facilities will be approximately 20% in 2025. The Company selects third-party production facilities with one or more of: (i) sleek can packaging and automated variety packaging capability and capacity; (ii) first-rate quality control capabilities throughout the process; and (iii) the capability of utilizing traditional brewing, fermenting and finishing methods. Under its production arrangements with third parties, the Company is charged a service fee based on units produced at each of the facilities.

The Company’s international business is primarily supplied by third-party production and packaging agreements and production under license at international locations.

While the Company believes that it has alternatives available to it, in the event that production at any of its current locations is interrupted, severe interruptions at the Pennsylvania Brewery, Cincinnati Brewery, or City Brewing facilities would be most problematic, especially in seasonal peak periods. In addition, the Company may not be able to maintain its current economics, if interruptions were to occur, and could face significant delays in starting up replacement production locations. Potential interruptions at production facilities include labor issues, governmental actions, quality issues, contractual disputes, machinery failures, operational shutdowns, or natural or other unavoidable catastrophes. The Company would work with available third-party production facilities to attempt to minimize any potential disruptions.

Competition

The US Beer Market is highly competitive due to large domestic and international brewers and a large number of smaller craft brewers and craft distilleries who distribute similar products that have similar pricing and target drinkers.

The two largest brewers in the United States, AB InBev and Molson Coors, participate actively in Beyond beer and Traditional beer, through numerous beers, flavored malt beverages, hard seltzers and spirit RTDs. Imported beers, such as Modelo Especial®, Corona®, Heineken®, and Stella Artois®, continue to compete aggressively in the United States and have gained market share over the last ten years. AB InBev, Molson Coors, Constellation Brands (owner of the United States Distribution rights to Modelo Especial and Corona) and Heineken may have substantially greater financial resources, marketing strength and distribution networks than the Company.

In addition, large non-alcoholic beverage companies including The Coca-Cola Company (“Coke"), Pepsi, Monster Beverage Corporation (“Monster”), and Arizona Beverage Company (“Arizona") have entered these markets directly or through licensing agreements with alcoholic beverage companies to develop alcohol versions of existing traditional non-alcohol brands. Coke has entered into agreements with Molson Coors to develop, market and sell Topo Chico brand Hard Seltzer, Simply Spiked Lemonade, and Peace Hard Tea. Coke also announced agreements with Constellation Brands to develop, market and sell FRESCA™ Mixed and with Brown Forman to develop, market and sell Jack Daniel's® Tennessee Whiskey and Coca-Cola®™ Ready-to-Drink Cocktail. As previously discussed, the Company has entered into an agreement with Pepsi to develop, market and sell Hard Mountain Dew, to take advantage of this trend. Pepsi also entered an agreement in late 2022 with FIFCO USA, a New York based brewery, to develop, market and sell Lipton Hard Iced Tea which launched during the first half of 2023. In addition, Monster acquired CaNarchy Craft Brewery Collective in early 2022 and launched the Beast Unleashed, a new brand of flavored malt beverages in early 2023 which includes Nasty Beast Hard Tea. Monster is planning to launch a new hard lemonade named Blind Lemon in early 2025. Arizona, after earlier development and launch in 2020 in Canadian markets, launched Arizona Hard Tea in the United States beginning in 2023.

The Company’s Twisted Tea beverages compete generally within the FMB category of Beyond beer. FMBs, such as Twisted Tea, Mike’s Hard Lemonade, Smirnoff Ice, Cayman Jack, Clubtails, Beast Unleashed, Bud Light Lime, Redd’s Apple Ale, Seagrams Escapes. As Twisted Tea has grown, more hard teas have been introduced by competitors. Some of these hard tea competitors currently include Arizona Hard Tea, Arnold Palmer Spiked, Nasty Beast Hard Tea, VooDoo Ranger Hard Charged Tea, Hoop Hard Tea, 2Hoots Hard Tea and Peace Hard Tea. As noted earlier, the FMB category is highly competitive due to, among other factors, the presence of large brewers and spirits companies in the category, the advertising of malt-based spirits brands in channels not available to the parent brands and a fast pace of product innovation.

The Company’s Truly Hard Seltzer beverages compete primarily within the hard seltzer category of Beyond beer. This category grew quickly from 2016 to 2021 and then declined in 2022, 2023 and 2024. The hard seltzer category is highly competitive and includes large international and domestic competitors. Hard seltzers are typically priced competitively with Traditional beer and Beyond beer and may compete for drinkers with beer, wine, spirits, or FMBs. Some of these competitors include Mark Anthony Brands under the brand name “White Claw” and "White Claw Surge."; ABInBev under “Bud Light Seltzer”, and Molson Coors under “Vizzy Hard Sparkling Water” and "Topo Chico".

The Company’s Truly brand also competes against a sub-category of Spirits RTDs that the Company and the alcohol industry at large categorize as Spirit Seltzer and Soda. The Spirit Seltzer and Soda sub-category generally consists of lower calorie and lower alcohol Spirits RTDs that are similar in flavor and taste to the hard seltzer category beverages but at a higher price. The leading brand in the Spirit Seltzer and Soda category is owned by E&J Gallo Winery under the brand name "High Noon” and other competitors in the category include ABInBev under “Nutrl Vodka Seltzer”, Mark Anthony under "White Claw Vodka Soda" and Molson Coors under "Topo Chico Spirited Can Cocktails".

The Company’s Samuel Adams and Dogfish Head beers compete primarily within the craft beer and domestic specialty beer category of Traditional beer. The Company expects competition and innovation among domestic craft brewers to remain strong. The Company estimates there are approximately 10,000 breweries in operation, up from approximately 1,500 operating breweries in 2009. Most of these new breweries are craft (small and independent) brewers.

In recent years, there have been numerous announcements of acquisitions of or investments in craft brewers by larger breweries and private equity and other investors. Most recently, during 2023 and 2024, in separate transactions AB InBev and Molson Coors sold some of these craft brands and breweries to Tilray Brands, Inc a global cannabis, craft beer, spirits beverage company.

The Company’s Angry Orchard product line competes within the hard cider category. As noted earlier, this category is small and highly competitive and the competitors include mostly small regional and local hard cider companies. Hard ciders are typically priced competitively with Traditional beer and Beyond beer and may compete for drinkers with beer, wine, spirits, or FMBs. Some of these competitors include "Bold Rock", "2 Towns" and “Blakes”.

The Company’s Dogfish Head Canned Cocktails and Sun Cruiser compete in the spirits RTDs category. This category is small and highly competitive and includes large international and domestic competitors, as well as many small regional and local distilling companies. Spirits RTDs are typically higher priced and may compete for drinkers with beer, wine, spirits, or FMBs. As discussed above, spirits RTDs consist of the sub-category of Spirit Seltzer and Soda. Dogfish Head Canned Cocktails generally competes in the other sub-category of spirits RTDs named Spirits-based Canned Cocktails. Beverages in the Spirits-based Canned Cocktails sub-category generally have more flavor and higher alcohol than spirits RTDs in the sub-category of Spirit Seltzer and Soda. Some of these Spirits-based Canned Cocktails competitors include; ABInBev under the brand name "Cutwater" and Diageo under the brand name "Crown Royal".

The Company’s products also compete with other alcoholic beverages for drinker attention and consumption and the pace of innovation in the categories in which the Company competes is increasing. In recent years, wine and spirits have been competing more directly with beers. The Company monitors such activity and attempts to develop strategies which benefit from the drinker’s interest in trading up, in order to position its beverages competitively with wine and spirits.

The Company competes with other beer and alcoholic beverage companies within a three-tier distribution system. The Company competes for a share of the Distributor’s attention, time and selling efforts. At retail, the Company competes for traditional retail shelf, cold box and tap space, as well as e-commerce placement. From a drinker perspective, competition exists for brand acceptance and loyalty. The principal factors of competition in the market for Traditional beer and Beyond beer occasions include product quality and taste, brand advertising and imagery, trade and drinker promotions, pricing, packaging and the development of innovative new products.

The Company distributes its products through independent Distributors who also distribute competitors’ products. Certain brewers have contracts with their Distributors that impose requirements on the Distributors that are intended to maximize the Distributors’ attention, time and selling efforts on that brewer’s products. These contracts generally result in increased competition among brewers as the contracts may affect the manner in which a Distributor allocates selling effort and investment to the brands included in its portfolio. The Company closely monitors these and other trends in its Distributor network and works to develop programs and tactics intended to best position its products in the market.

The Company has certain competitive advantages over other brewers and competitors, including a long history of awards for product quality, greater available resources and the ability to distribute and promote its products on a more cost-effective basis. Additionally, the Company believes it has competitive advantages over imported beers, including lower transportation costs, higher product quality, a lack of import charges and superior product freshness.

Regulation and Taxation

The alcoholic beverage industry is regulated by federal, state and local governments. These regulations govern the production, sale and distribution of alcoholic beverages, including permitting, licensing, marketing and advertising. To operate its production facilities, the Company must obtain and maintain numerous permits, licenses and approvals from various governmental agencies, including but not limited to, the Alcohol and Tobacco Tax and Trade Bureau (the “TTB”), the Food and Drug Administration, state alcohol regulatory agencies and state and federal environmental agencies.

Governmental entities may levy various taxes, license fees and other similar charges and may require bonds to ensure compliance with applicable laws and regulations. Beginning in 2018, as a result of the “Tax Cuts and Jobs Act”, the Company’s federal excise tax rate on hard seltzer and beer decreased from $18 to $16 per barrel on all barrels below 6 million barrels produced annually. The top tier rate on hard cider (with alcohol by volume of 8.5% or less) is $0.226 per gallon, on hard cider (with non-qualifying fermentable fruits) is $1.07 per gallon, on artificially carbonated wine (hard cider with high CO2 levels) is $3.30 per gallon, and on distilled spirits is $13.50 per proof gallon. States levy excise taxes at varying rates based on the type of beverage and alcohol content. Failure by the Company to comply with applicable federal, state or local laws and regulations could result in higher taxes, penalties, fees and suspension or revocation of permits, licenses or approvals. While there can be no assurance that any such regulatory action would not have a material adverse effect upon the Company or its operating results, the Company is not aware of any infraction affecting any of its licenses or permits that would materially impact its ability to continue its current operations.

Trademarks

The Company has obtained trademark registrations with the United States Patent and Trademark Office for over 400 trademarks, including Samuel Adams®, Sam Adams®, Twisted Tea®, Truly®, Truly Hard Seltzer®, Angry Orchard®, Dogfish Head®, Coney Island®, and Angel City Brewery®. It also has a number of common law trademarks. Several Company trademarks are also registered or have registrations pending in various foreign countries. The Company regards its trademarks as having substantial value and as being an important factor in the marketing of its products. The Company is not aware of any trademark infringements that could materially affect its current business or any prior claim to the trademarks that would prevent the Company from using such trademarks in its business. The Company’s policy is to pursue registration of its marks whenever appropriate and to oppose infringements of its marks through available enforcement options.

Environmental, Health, and Safety Regulations and Operating Considerations

We are committed to strong corporate governance, corporate responsibility, and the accountability of our Board and our Executive Leadership Team to our stockholders. This section provides a summary of the Board’s and management’s oversight of our strategies regarding our Environmental, Social, and Governance (ESG”) initiatives and selected highlights of the previous year’s accomplishments.

While formal ESG reporting began in our 2021 ESG Report, we began reporting on ESG initiatives starting in our 2019 Proxy Statement. While we’ve long believed that it’s important to provide accurate and transparent reporting on the impact that our Company has had on our people, our planet, and our communities, our commitment to sustainability has evolved significantly over the last several years, ushering in a new era of accountability in 2025. This shift reflects an increasing focus on transparency and meaningful progress. Since our inaugural ESG Report, we’ve built upon our strategy each year, strengthening our focus on transparency, progress, and responsible growth.

Among our key ESG achievements in 2024, we focused on establishing our sustainability goals and targets, which will be detailed in our forthcoming 2024 ESG report. This process involved extensive discussions with subject matter experts, collaborative workshops, and efforts to obtain Executive Leadership Team approval ahead of publication in 2025.

For additional information on our impact and ESG initiatives, the Company’s historical ESG reports are available in the sustainability section on our company website at www.bostonbeer.com/our-impact/sustainability. We anticipate that we will publish our 2024 ESG Report in the summer of 2025. In advance of the publication of that report, here is an early look at some of our ESG highlights from 2024.

2024 Environmental Highlights

•BBC advanced our commitment to sustainable packaging through two key initiatives:

•BBC advanced CO₂ recapturing systems across all three manufacturing locations. Most notably, at our Cincinnati brewery, we expanded CO₂ recovery capacity, reducing reliance on external sources and saving $30,000 weekly. The improved process captures CO₂ emissions from fermentation, filters and pressurizes the gas, and reuses it for carbonation and other operations. These energy-efficient advancements highlight our commitment to innovative solutions that drive both environmental and operational benefits.

•BBC committed to constructing a wastewater pre-treatment facility at our Samuel Adams Pennsylvania Brewery, which will reduce workloads for local wastewater treatment plants and capture biogas that will be used on site as an energy source, partially offsetting the need for fossil fuels.

•BBC Transportation Team improved truckload utilization by 2% in 2024 compared to 2023. Improving truck utilization allows Boston Beer to reduce the total number of trucks needed to ship our products and enable each truck to carry more products, thus reducing the overall emissions output of our transportation network.

2024 Social Highlights

•Creating and maintaining healthy and safe working environments is a critical part of our sustainability strategy. In 2024, we achieved an ambitious goal to reduce total injuries by 20% per location, with the ultimate target of achieving an injury-free workplace by 2030.

•As part of our Learning and Development team’s mission, we hold managers accountable for creating an environment that enhances coworker development. In 2024, we elevated manager development by launching a refreshed New Leader Experience course, a 2.5-day program providing essential leadership tools and training. We also introduced Moments that Matter training to empower all people leaders in handling key leadership moments effectively.

•We remain committed to fostering a diverse and inclusive workplace where all coworkers feel heard, valued, and respected. In 2024, we advanced this commitment by building participation and engagement within our seven coworker network groups, inclusive leadership development, bystander intervention training, and allyship programs.

•We remain committed to pay transparency by providing coworkers with insight into pay philosophy, administration, and job-specific pay ranges. In 2024, we refined our compensation strategy, expanded education for leaders and coworkers, enhanced manager training on compensation conversations, and engaged an independent third-party to analyze pay equity.

•In 2024, Boston Beer coworkers participated in 40 separate “Benevolence Days,” collectively volunteering more than 2,820 hours supporting 58 community partners and their mission-driven work.

•Building on 15 years of impact, our Samuel Adams Brewing the American Dream® program continued its mission in 2024 to empower entrepreneurs to thrive. By year’s end, the program had provided nearly 4,500 loans, totaling almost $113 million in funding. In collaboration with Accion Opportunity Fund, the nation’s largest nonprofit micro-lender, and a network of local nonprofit partners, the initiative empowers small business owners in the food, beverage, and brewing industries by offering access to capital, expert coaching, and opportunities to expand into new markets.

Human Capital Resources

As of December 28, 2024, the Company had 2,537 coworkers, of which 171 were represented by unions or similar organizations. The Company’s Executive Leadership Team (“ELT”) is comprised of the Company's CEO and seven of his direct reports who collectively have management responsibility for the Company's primary business areas, including but not limited to brewing, supply chain operations, sales, marketing, finance, legal, and people and culture. The Company’s Board of Directors and the ELT believe that succession planning, talent management, culture, and diversity, equity, and inclusion are critical to the Company’s continued success.

Succession Planning and Talent Management

The Company regularly reviews talent development and succession plans for each of its functional areas to identify and develop a pipeline of talent to maintain business operations. The Company understands the potential costs and risks of bringing in an outside executive officer in today’s environment, and that businesses are often – but not always – more successful in promoting internal candidates. Accordingly, the Board of Directors and the ELT make efforts to identify potential successors for those positions long in advance of any potential positional vacancies, perform skills gap analyses for those internal candidates, and provide training and exposure on those gap areas to those candidates in order to develop better potential successors. The Board of Directors is primarily responsible for succession planning for the CEO, but also participates in succession planning discussions for other executive officer positions. The Company believes that its culture, compensation structure, long-term equity program, and robust training and development program provide motivation for talented leaders to remain with the Company.

Other

The Company submitted the Section 12(a) CEO Certification to the New York Stock Exchange in accordance with the requirements of Section 303A of the NYSE Listed Company Manual. This Annual Report on Form 10-K contains at Exhibits 31.1 and 31.2 the certifications of the Chief Executive Officer and Chief Financial Officer, respectively, in accordance with the requirements of Section 302 of the Sarbanes-Oxley Act of 2002. The Company makes available free of charge copies of its Annual Report on Form 10-K, as well as other reports required to be filed by Section 13(a) or 15(d) of the Securities Exchange Act of 1934, on the Company’s investor relations website at www.bostonbeer.com, or upon written request to Investor Relations, The Boston Beer Company, Inc., One Design Center Place, Suite 850, Boston, Massachusetts 02210.

Item 1A. Risk Factors

In addition to the other information in this Annual Report on Form 10-K, the risks described below should be carefully considered before deciding to invest in shares of the Company’s Class A Common Stock. These are risks and uncertainties that management believes are most likely to be material and therefore are most important for an investor to consider. The Company’s business operations and results may also be adversely affected by additional risks and uncertainties not presently known to it, or which it currently deems immaterial, or which are similar to those faced by other companies in its industry or business in general. If any of the following risks or uncertainties actually occurs, the Company’s business, financial condition, results of operations or cash flows would likely suffer. In that event, the market price of the Company’s Class A Common Stock could decline.

Risks Associated with Our Industry

The Company faces substantial competition.

The Beyond beer and Traditional beer markets within the United States (“US Beer Market”) is highly competitive due to the participation of large domestic and international brewers and the large number of regional and local competitors, who distribute similar products that have similar pricing and target drinkers.

The two largest brewers in the United States, AB InBev and Molson Coors, participate actively in the US Beer Market, through numerous offerings including beers, flavored malt beverages, hard seltzers and spirit RTDs. Imported beers, such as Modelo Especial®, Corona®, Heineken®, and Stella Artois®, continue to compete aggressively in the United States and have gained market share over the last ten years. Constellation Brands (owner of the United States distribution rights to Modelo Especial and Corona) and Heineken may have substantially greater financial resources, marketing strength and distribution networks than the Company. The Company anticipates competition will remain strong as existing beverage companies continue adding more SKUs and styles. The potential for growth in the sales of flavored malt beverages, hard seltzers, domestic beers, imported beers and spirits RTDs is expected to increase the competition in the market for Beyond beer and Traditional beer occasions within the United States and, as a result, the Company may well face competitive pricing pressures and the demand for and market share of the Company’s products may fluctuate and possibly decline.

The Company’s products compete generally with other alcoholic beverages. The Company competes with other beer and beverage companies not only for drinker acceptance and loyalty, but also for traditional retail shelf, cold box and tap space, as well as e-commerce placement and for marketing focus by the Company’s distributors and their customers, all of which also distribute and sell other alcoholic beverage products. Many of the Company’s competitors, including AB InBev, Molson Coors, Constellation, Heineken and Mark Anthony Brands, have substantially greater financial resources, marketing strength and distribution networks than the Company. Moreover, the introduction of new products by competitors that compete directly with the Company’s products or that diminish the importance of the Company’s products to retailers or Distributors may have a material adverse effect on the Company’s business and financial results.

Several large non-alcoholic beverage companies including Coca-Cola Company (“Coke"), Pepsi, Monster Beverage Corporation (“Monster”) and Arizona Beverage Company ("Arizona") have entered the alcoholic beverage market directly or through licensing agreements with alcoholic beverage companies to develop alcohol versions of existing traditional non-alcohol brands. As previously discussed, the Company has entered into an agreement with Pepsi to develop, market and sell alcohol beverages which include Hard Mountain Dew, a flavored malt beverage, to take advantage of this trend.

Due to the increased leverage that the larger, alcohol and non-alcohol beverage companies may have in distribution and sales and marketing expenses, the costs to the Company of competing could increase. The potential also exists for these large competitors to increase their influence with their Distributors, making it difficult for smaller beverage companies to maintain their market presence or enter new markets. Also, consolidation in the industry could also reduce the contract brewing capacity that is available to the Company. These potential increases in the number and availability of competing brands, the costs to compete, reductions in contract brewing capacity and decreases in distribution support and opportunities may have a material adverse effect on the Company’s business and financial results.

Changes in public attitudes and drinker tastes could harm the Company’s business. Regulatory changes in response to public attitudes could adversely affect the Company’s business.

The alcoholic beverage industry has been the subject of considerable societal and political attention for several years, due to public concern over alcohol-related social problems, including driving under the influence, underage drinking and health consequences from the misuse of alcohol, including alcoholism. As an outgrowth of these concerns, the possibility exists that advertising by alcoholic beverage producers could be restricted, that additional cautionary labeling or packaging requirements might be imposed, that further restrictions on the sale of alcohol might be imposed or that there may be renewed efforts to impose increased excise or other taxes on beer sold in the United States.

The US Beer Market has experienced a decline in shipments over the last ten years. The Company believes that this decline is due to declining alcohol consumption per person in the population, health and wellness trends and increased competition from wine and spirits companies. If consumption of the Company’s products in general were to come into disfavor among domestic drinkers, or if the domestic alcohol beverage industry were subjected to significant additional societal pressure or governmental regulations, the Company’s business could be materially adversely affected.

Additionally, certain states are considering or have passed laws and regulations that allow the sale and distribution of cannabis. Currently, it is not possible to predict the impact of this on sales of alcohol, but it is possible that legal cannabis usage could adversely impact the demand for the Company’s products. The company has a cannabis-based beverage product in Canada and could be ready to produce that in the United States if the regulatory environment changes.

The Company is dependent on its distributors.

In the United States, where approximately 95% of its beverages are sold, the Company sells most of its alcohol beverages to independent beer Distributors for distribution to retailers and, ultimately, to drinkers. Although the Company currently has arrangements with over 300 Distributors, sustained growth will require it to maintain such relationships and possibly enter into agreements with additional Distributors. Changes in control or ownership within the current distribution network could lead to less support of the Company’s products.

Contributing to distribution risk is the fact that the Company’s distribution agreements are generally terminable by the Distributor on relatively short notice. While these distribution agreements contain provisions giving the Company enforcement and termination rights, some state laws prohibit the Company from exercising these contractual rights. The Company’s ability to maintain its existing distribution arrangements may be adversely affected by the fact that many of its Distributors are reliant on one of the major beer producers for a large percentage of their revenue and, therefore, they may be influenced by such producers. If the Company’s existing distribution agreements are terminated, it may not be able to enter into new distribution agreements on substantially similar terms, which may result in an increase in the costs of distribution.

No assurance can be given that the Company will be able to maintain its current distribution network or secure additional Distributors on terms not less favorable to the Company than its current arrangements.

Risks Related to the Company's Business and Operations

There is no assurance that the Company will grow its business in the future or that the Company can adapt to the challenges of the changing competitive environment.

Beginning in the second half of 2021, the market for hard seltzer products experienced decelerating growth trends, which contributed to the Company’s depletion volume decline of 5% in 2022, 6% in 2023 (5% decline on a 52-week comparable basis) and 2% in 2024. The slowdown in growth trends greatly impacted the Company's volume of production and shipments, as well as its volume projections for the future. The volume reduction also resulted in increased supply chain related costs. These costs include the destruction of excess inventory, provisions for excess and obsolete inventories, property, plant and equipment impairments, write-offs of third-party production prepayments and provisions for costs associated with the termination of various third-party production contracts.

The Company is targeting a percentage change in shipments and depletion volume of between down single digits to up single digits. The Company’s ability to meet these targets may be affected by an increasing number of competing beverages. The development of new products by the Company to meet these challenges may lead to reduced sales of the Company’s existing brands and there is no guarantee that these new product initiatives will generate stable long term volume. While the Company believes that a combination of innovation, new brand messaging and the use of traditional and social media, and increased investment in sales execution can lead to increased demand, there is no guarantee that the Company’s actions will be successful in maintaining the Company’s historical levels of profitability. Reduced sales, among other factors, could lead to lower brewery utilization, lower funds available to invest in brand support and reduced profitability, and these challenges may require a different mix and level of marketing investments to stabilize and grow volumes. A lower growth environment or periods of sales declines will present challenges for the Company to motivate and retain employees, maintain the current levels of distributor and retailer support of its brands, and fund its current brand investment levels. This could potentially lead to a review of long term organization and capacity needs. Currently, the Company believes it can meet its volume targets in 2025 and return to volume growth in future years, but there is no guarantee its efforts will be successful or profitable.

The Company’s inability to react to changes in demand could have a material adverse effect on the Company’s operations or financial results.

Historically, during periods of growth, the Company has faced challenges in meeting demand. The challenges were both production constraints, primarily resulting from canning and variety pack capacity limitations, and can supply constraints. During these periods of growth, the Company experienced increased inventory obsolescence, and operational, and freight costs, as it reacted. In response to these issues, the Company significantly increased its capacity and personnel to address these challenges.

With a decline in volume over the second half of 2021 through 2024, the Company incurred additional supply chain related costs associated with downsizing its production model to adjust to reduced demand. In recent years, the Company has been able to better match its supply chain to meet demand, but a sudden increase could result in a recurrence of challenges in meeting demand and a sudden decrease could result in other incremental costs. There can be no assurance that the Company will effectively address changing consumer demand or manage increasing product complexity, without experiencing similar issues in the future. Planning failures, operating inefficiencies, insufficient employee training, control deficiencies, or other similar issues could well have a material adverse effect on the Company’s business and financial results. Growth or decline in the Company’s revenues, changes in operating procedures, and increased complexity have required significant capital investment. The Company on an overall basis has yet to see any operating cost leverage from these investments and there is no guarantee that it will.

The Company remains reliant on third party-owned production facilities, particularly City Brewing Company, LLC, and its subsidiaries, to meet demand. The percentage of its domestic volume produced at Company owned breweries decreased from over 90% in 2017 to approximately 74% in 2024. The Company currently expects that the percentage of total domestic production at Company owned breweries in 2025 will be 80%. The Company expects its reliance on production at City Brewing Company, LLC to decline from approximately 26% of production in 2024 to approximately 20% of production in 2025.

The Company’s ability to grow and to meet potentially increasing consumer demand will be affected by:

•its ability to meet production goals and/or targets at the Company’s owned breweries and third party-owned production facilities;

•its ability to enter into new production contracts with third party-owned breweries on commercially acceptable terms;

•disruption or other operating performance issues at the Company’s owned breweries or limits on the availability of suitable production capacity at third party-owned production facilities;

•its ability to obtain sufficient quantities of certain packaging materials and ingredients, such as cans, flavorings, cardboard wraps and glass bottles from suppliers; and

•its ability to reduce risk of both over and under supply by improving and automating manual internal processes for demand and production planning.

If the Company were unable to increase supply to meet increased consumer demand for its products, the Company’s business and financial results could well be adversely affected. Alternatively, if there is a sudden decline in demand for the Company’s products, additional costs and inefficiencies could likely result from efforts to adjust the Company’s production model accordingly.

The Company’s advertising and promotional investments may affect the Company’s financial results but not be effective.

The Company has made and expects to continue to make, significant advertising and promotional expenditures to enhance its existing brands and promote new brands. These expenditures may adversely affect the Company’s results of operations in a particular quarter or even for the full year, and may not result in increased sales. Variations in the levels of advertising and promotional expenditures have in the past caused, and are expected in the future to continue to cause, variability in the Company’s quarterly results of operations. While the Company attempts to invest only in effective advertising and promotional activities, it is difficult to correlate such investments with sales results, and there is no guarantee that the Company’s expenditures will be effective in building brand equity or growing long term sales.

The Company is dependent on key packaging suppliers and an increase in packaging costs could harm the Company’s financial results.

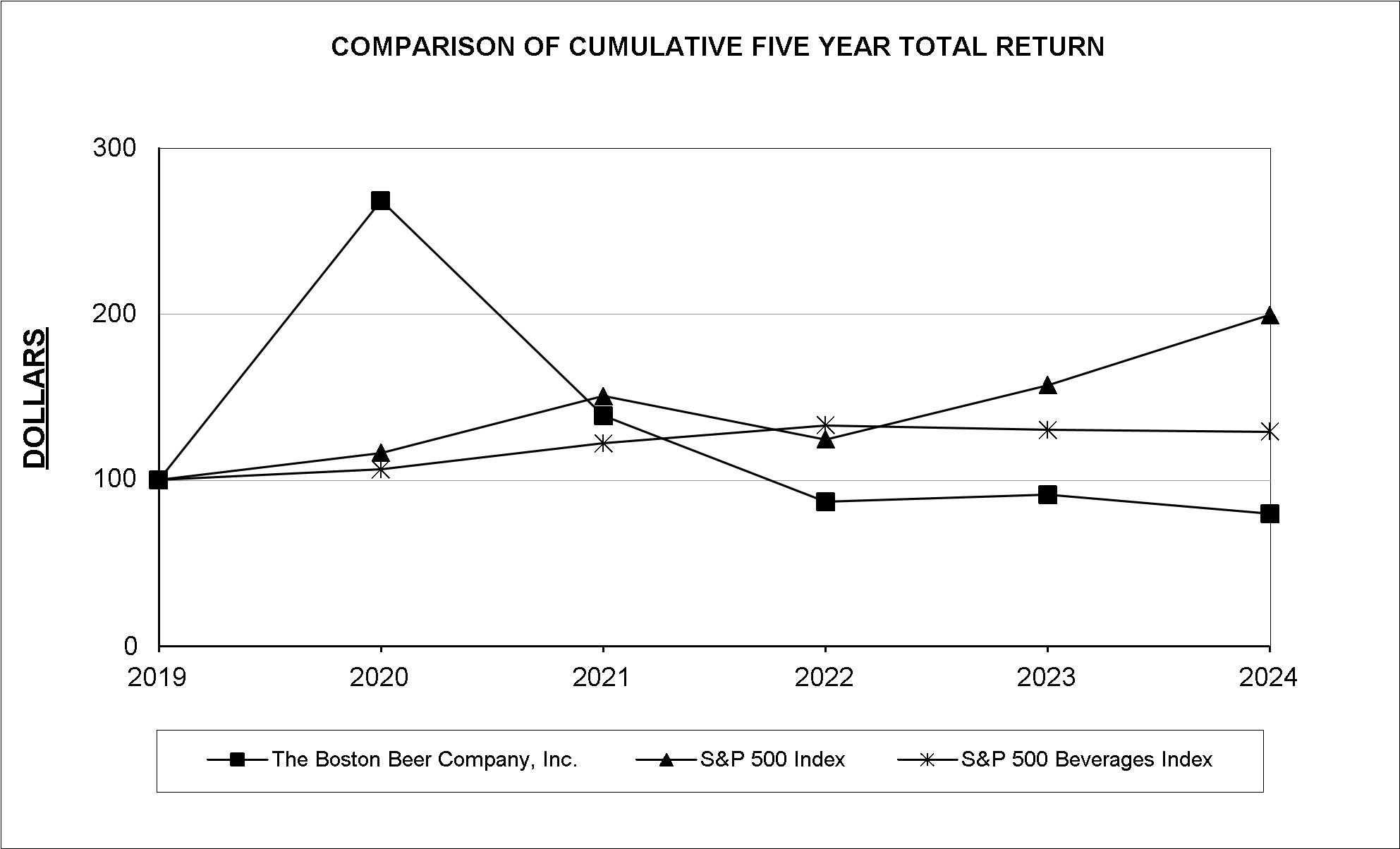

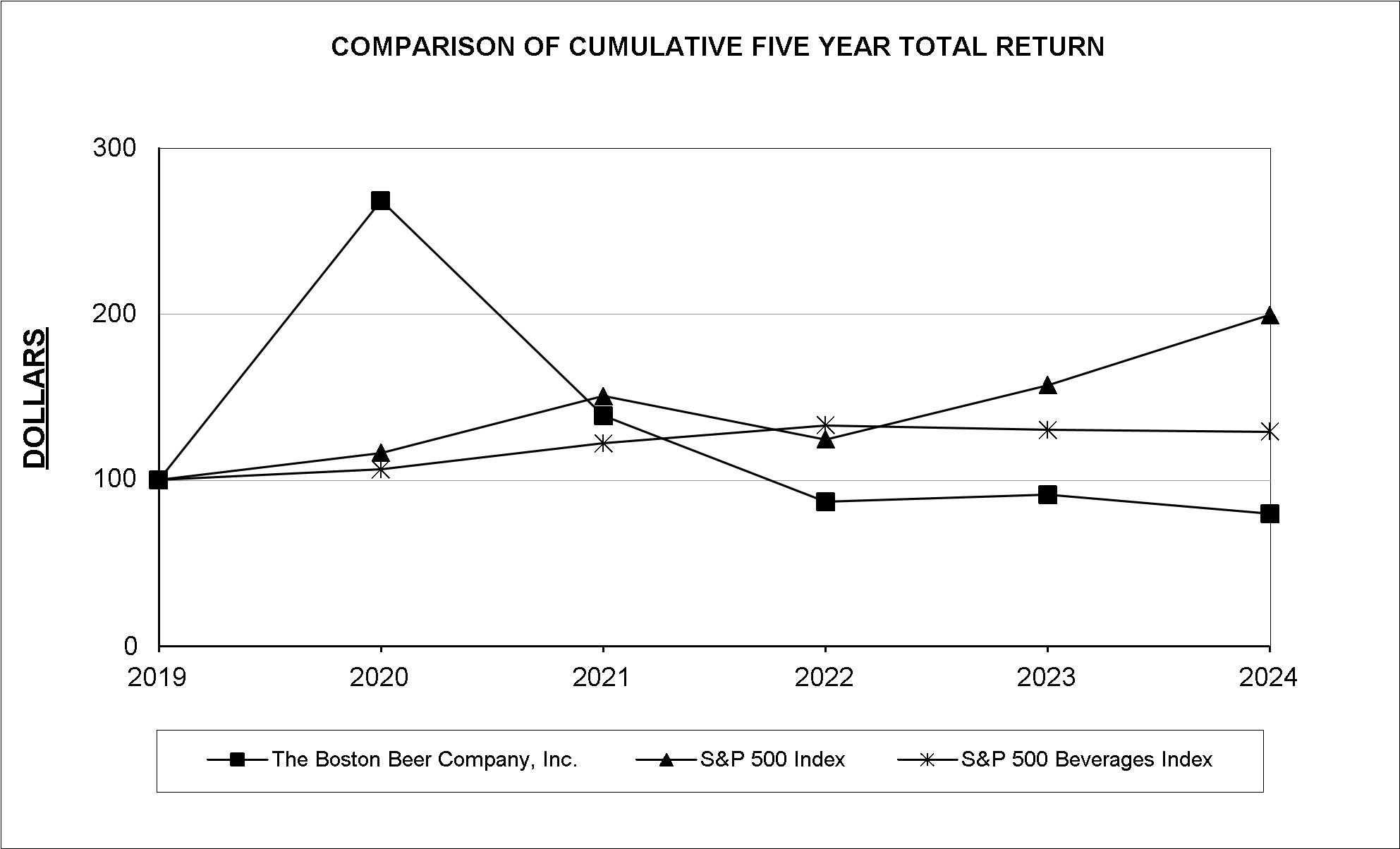

In 2020 and 2021, as the Truly and the Twisted brand families grew significantly and overall demand for cans increased, the Company experienced supply constraints for cans. These supply constraints impacted the Company’s production schedules and increased can cost by having to use a more expensive supplier.