Superior Industries International, Inc.

Notes to Condensed Consolidated Financial Statements

September 30, 2018

(Unaudited)

Note 1 – Nature of Operations

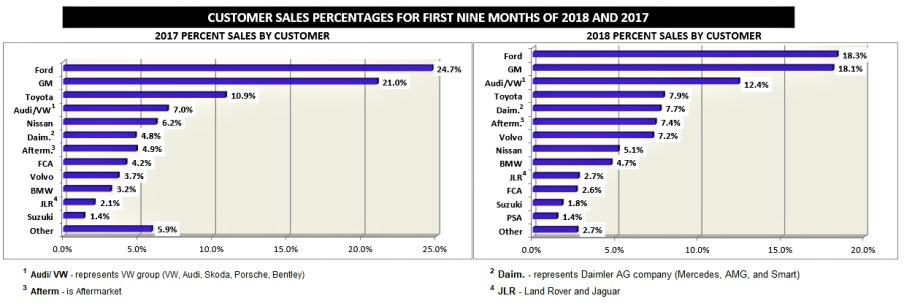

The principal business of Superior Industries International, Inc. (referred to herein as the “company” or “we,” “us” and “our”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers (“OEMs”) and aftermarket customers. We are one of the largest suppliers of cast aluminum wheels to the world’s leading automobile and light truck manufacturers, with manufacturing operations in the United States, Mexico, Germany and Poland. Our OEM aluminum wheels are sold primarily for factory installation, as either standard equipment or optional equipment, on vehicle models manufactured by Audi, BMW, Fiat Chrysler Automobiles N.V. (“FCA”), Ford, General Motors (“GM”), Jaguar-Land Rover,Mercedes-Benz, Mitsubishi, Nissan, Subaru, Toyota, Volkswagen, Volvo, Mazda, Peugot, and Suzuki. We sell aluminum wheels to the European aftermarket under the brands ATS, RIAL, ALUTEC and ANZIO. North America and Europe represent the principal markets for our products, but we have a global presence and influence with North American, European and Asian OEMs. With the acquisition of Uniwheels AG (referred to as “Uniwheels” or our “European operations”), on May 30, 2017, we diversified our customer base from predominately North American OEMs (e.g. Ford and GM) to a global customer base of OEMs (e.g. Audi andMercedes-Benz). As a result of the acquisition, we have determined that our North American and European operations should be treated as separate operating segments as further described in Note 7, “Business Segments.”

Note 2 – Presentation of Condensed Consolidated Financial Statements

Presentation

During interim periods, we follow the accounting policies set forth in our Annual Report on Form10-K for the fiscal year ended December 31, 2017 (the “2017 Annual Report on Form10-K”) and apply appropriate interim financial reporting standards for a fair presentation of our operating results and financial position in conformity with accounting principles generally accepted in the United States of America, as codified by the Financial Accounting Standards Board (“FASB”) in the Accounting Standards Codification (“ASC”) (referred to herein as “U.S. GAAP”). Users of financial information produced for interim periods in 2018 are encouraged to read this Quarterly Report on Form10-Q in conjunction with our consolidated financial statements and notes thereto filed with the Securities and Exchange Commission (“SEC”) in our 2017 Annual Report on Form10-K.

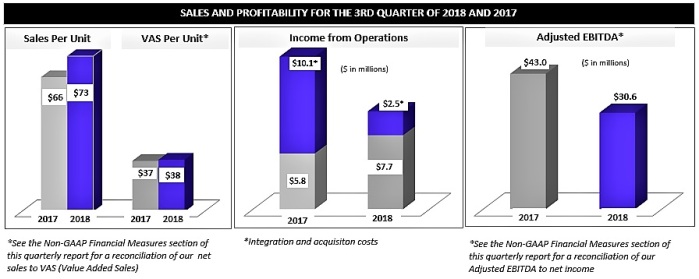

In the past, Superior used a4-4-5 convention for our fiscal quarters, which are thirteen-week periods (referred to as quarters) ending on the last Sunday of each calendar quarter. Therefore, the third quarter in 2017 started on June 26, 2017 and ended on October 1, 2017. Our European operations have historically reported on a calendar year basis, and, beginning on December 31, 2017, both our North American and European operations began reporting on a calendar fiscal year with each month ending on the last day of the calendar month. Thus, the third quarter of 2018 ended on September 30, 2018 and reflects one less calendar week of North America operations than the same period in 2017.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the SEC’s requirements for quarterly reports on Form10-Q and U.S. GAAP and, in our opinion, contain all adjustments, of a normal and recurring nature, which are necessary for a fair presentation of (i) the condensed consolidated statements of operations for the three and nine month periods ended September 30, 2018 and October 1, 2017, (ii) the condensed consolidated statements of comprehensive income for the three and nine month periods ended September 30, 2018 and October 1, 2017, (iii) the condensed consolidated balance sheets at September 30, 2018 and December 31, 2017, (iv) the condensed consolidated statements of cash flows for the nine month periods ended September 30, 2018 and October 1, 2017, and (v) the condensed consolidated statement of shareholders’ equity for the nine month period ended September 30, 2018. Superior acquired our European operations on May 30, 2017 and, as a result, our 2017 financial statements only include the period after the acquisition date. However, the accompanying unaudited condensed consolidated financial statements do not include all information and notes required by U.S. GAAP. The condensed consolidated balance sheet as of December 31, 2017, included in this report was derived from our 2017 audited financial statements, but does not include all disclosures required by U.S. GAAP.

6