As filed with the Securities and Exchange Commission on February 9, 2016

Securities Act File No. 333-208799

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. 1

Post-Effective Amendment No.

(Check appropriate box or boxes)

BLACKROCK LIQUIDITY FUNDS

(Exact Name of Registrant as Specified in the Charter)

100 Bellevue Parkway Wilmington, Delaware 19809

(Address of Principal Executive Offices)

Telephone Number: (302) 797-2000

(Area Code and Telephone Number)

Charles Park

BlackRock Advisors, LLC

55 East 52nd Street

New York, New York 10055

(Name and Address of Agent for Service)

Copies to:

| | |

John A. MacKinnon, Esq. Sidley Austin LLP 787 Seventh Avenue New York, New York 10019 | | Ben Archibald, Esq. BlackRock Advisors, LLC 55 East 52nd Street New York, New York 10055 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of securities being registered: Institutional Shares, Administration Shares, Dollar Shares, Cash Reserve Shares and Cash Management Shares of TempFund, each with no par value. Calculation of Registration Fee under the Securities Act of 1933: No filing fee is required because of reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement is organized as follows:

| 1. | Letter to Shareholders of each of BofA Cash Reserves and BofA Money Market Reserves, each a series of BofA Funds Series Trust |

| 2. | Questions and Answers for Shareholders of each of BofA Cash Reserves and BofA Money Market Reserves, each a series of BofA Funds Series Trust |

| 3. | Notice of Special Meeting of Shareholders of each of BofA Cash Reserves and BofA Money Market Reserves, each a series of BofA Funds Series Trust |

| 4. | Combined Prospectus/Proxy Statement regarding the proposed reorganizations of each of BofA Cash Reserves and BofA Money Market Reserves, each a series of BofA Funds Series Trust, with TempFund, a series of BlackRock Liquidity Funds |

| 5. | Statement of Additional Information regarding the proposed reorganizations of each of BofA Cash Reserves and BofA Money Market Reserves, each a series of BofA Funds Series Trust, with TempFund, a series of BlackRock Liquidity Funds |

| 6. | Appendix—Form of Proxy Card |

BOFA FUNDS SERIES TRUST

BofA Cash Reserves

BofA Money Market Reserves

100 Federal Street

Boston, Massachusetts 02110

(888) 331-0904 (individual investors)

(800) 353-0828 (for institutional investors)

February [•], 2016

Dear Shareholder:

You are cordially invited to attend a special meeting of shareholders (the “Special Meeting”) of each of BofA Cash Reserves (the “Cash Reserves Target Fund”) and BofA Money Market Reserves (the “Money Market Reserves Target Fund”; together with the Cash Reserves Target Fund, the “Target Funds” and each, a “Target Fund”), each a series of BofA Funds Series Trust (the “Target Trust”), which will be held on March 31, 2016 at 11:00 a.m., (Eastern time) at the offices of BofA Advisors, LLC (“BofA”) at 100 Federal Street, Boston, Massachusetts 02110. Before the Special Meeting, by way of this letter, I would like to provide you with additional background and ask for your vote on an important proposal affecting the Target Funds.

As you may know, BofA® Global Capital Management Group, LLC, the direct parent company of BofA, the investment adviser to the funds of the Target Trust (the “BofA Funds”), has entered into an agreement to transfer the investment management responsibilities of BofA to BlackRock, Inc. As a result of this transaction (the “Transaction”), it is being proposed that certain BofA Funds be reorganized into corresponding money market funds advised by BlackRock Advisors, LLC (“BlackRock”) or one of its investment advisory affiliates. The enclosed materials relate to the proposed Reorganizations of each Target Fund with the Acquiring Fund (as defined below). Shareholders of other BofA Funds are separately being asked to vote on the reorganization of their funds.

At the Special Meeting, shareholders will be asked to consider and act upon the proposals (the “Proposals”) set out below and to transact such other business as permitted by applicable law and as may properly come before the Special Meeting. The Proposals seek your approval of a series of transactions, which will result in you becoming a shareholder of TempFund (the “Acquiring Fund”), a series of BlackRock Liquidity Funds (the “Acquiring Trust”), a money market fund advised by BlackRock. The Acquiring Fund invests principally in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. The proposed transactions include a reorganization (each, a “Reorganization” and together, the “Reorganizations”) of each Target Fund with the Acquiring Fund. The Reorganizations are below and throughout the Combined Prospectus/Proxy Statement as Proposals 1a and 1b, with shareholders of Cash Reserves Target Fund being asked to vote on Proposal 1a and shareholders of Money Market Reserves Target Fund being asked to vote on Proposal 1b.

As noted above, it is being separately proposed that other BofA Funds be reorganized into corresponding money market funds advised by BlackRock or one of its investment advisory affiliates (the “Parallel Reorganizations”). Even if approved by shareholders of each Target Fund, neither Reorganization may occur unless each of the other Parallel Reorganizations is also approved. In the event a Parallel Reorganization is not approved, BofA® Global Capital Management Group, LLC and BlackRock will consider the facts and circumstances that exist at the time of closing of each Reorganization and determine whether each such Reorganization will still occur. If neither Reorganization occurs as contemplated in this Combined Prospectus/Proxy Statement, BofA will promptly notify shareholders of each Target Fund as to the status of the transaction. In such circumstances, the Target Board will examine alternatives to each such Reorganization in light of the best interests of shareholders.

If you are a shareholder of any other fund that is a party to a Parallel Reorganization, you will separately receive materials relating to that Parallel Reorganization.

After considering the fees and expenses, performance, investment objectives of the Acquiring Fund and the terms and conditions of each Reorganization, including the tax consequences, the Board of Trustees of the Target Trust recommends that you vote in favor of each Reorganization because it believes that the Reorganizations are in the best interests of each Target Fund and its shareholders.

Proposals 1a and 1b—Reorganizations

Proposal 1a: To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which the Acquiring Fund would acquire substantially all of the assets of, and assume certain stated liabilities of, the Cash Reserves Target Fund in exchange for shares of the Acquiring Fund to be distributed pro rata by the Cash Reserves Target Fund to its shareholders in complete liquidation and termination of the Cash Reserves Target Fund.

Proposal 1b: To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which Acquiring Fund would acquire substantially all of the assets of, and assume certain stated liabilities of, the Money Market Reserves Target Fund in exchange for shares of the Acquiring Fund to be distributed pro rata by the Money Market Reserves Target Fund to its shareholders in complete liquidation and termination of the Money Market Reserves Target Fund.

Please note that the Board of Trustees of the Target Trust believes that each Reorganization is in the best interests of each Target Fund, and unanimously recommends that you vote “FOR” Proposal 1a and/or 1b, as applicable.

I encourage you to carefully review the enclosed materials, which explain these proposals in more detail. As a shareholder, your vote is important, and we hope that you will respond today to ensure that your shares will be represented at the Special Meeting. You may vote using one of the methods below by following the instructions on your proxy card or voting instruction form(s):

| | • | | By touch-tone telephone; |

| | • | | By marking, signing, dating and returning the enclosed proxy card or voting instruction form(s) in the postage-paid envelope; or |

| | • | | In person at the Special Meeting. |

If you do not vote using one of these methods, you may be called by Computershare Fund Services, our proxy solicitor, to vote your shares.

If you are a holder of a Target Fund’s shares and plan to attend the Special Meeting, please note the following:

| | • | | If you plan to attend in person, you must show valid photographic identification, such as your driver’s license or passport. |

| | • | | If you hold your shares through a bank, broker or other nominee, and plan to attend the Special Meeting in person, you must show satisfactory proof of ownership of Target Fund shares, such as your voting instruction form (or a copy thereof) or a letter from your bank, broker or other nominee or broker’s statement indicating ownership as of the Record Date. |

| | • | | If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting. |

Even if you plan to attend the Special Meeting in person, please promptly follow the enclosed instructions to submit voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by marking, signing and dating each proxy card or voting instruction form you receive, and if received by mail, returning it in the accompanying postage-paid return envelope.

As always, we appreciate your support.

Sincerely,

Michael J. Pelzar

President and Chief Executive Officer

BofA Cash Reserves, a series of BofA Funds Series Trust

BofA Money Market Reserves, a series of BofA Funds Series Trust

100 Federal Street

Boston, Massachusetts 02110

(888) 331-0904 (individual investors)

(800) 353-0828 (for institutional investors)

|

| |

Please vote now. Your vote is important. |

| |

| To avoid the wasteful and unnecessary expense of further solicitation(s), we urge you to indicate your voting instructions on the enclosed proxy card or voting instruction form, date and sign it and return it promptly in the postage-paid envelope provided, or record your voting instructions by telephone or via the internet, no matter how large or small your holdings may be. If you submit a properly executed proxy but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” Proposal 1a and/or 1b, as applicable. If your shares are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the Special Meeting. |

QUESTIONS & ANSWERS

We recommend that you read the complete Combined Prospectus/Proxy Statement. For your convenience, we have provided a brief overview of the proposals to be voted on.

| Q: | Why is a shareholder meeting being held? |

| A: | You are a shareholder of the Cash Reserves Target Fund and/or the Money Market Reserves Target Fund. As a shareholder of a Target Fund, you are being asked to approve an Agreement and Plan of Reorganization (each, a “Reorganization Agreement”) between the Target Trust, on behalf of the applicable Target Fund, and the Acquiring Trust, on behalf of the Acquiring Fund, as set out in the table below: |

| | | | | | | | |

Target Funds | | Acquiring Fund | | Shareholders Entitled to Vote |

| BofA Cash Reserves (the “Cash Reserves Target Fund”) BofA Money Market Reserves (the “Money Market Reserves Target Fund”; together with the Cash Reserves Target Fund, the “Target Funds” and each, a “Target Fund”) | | each, a series of

BofA Funds

Series Trust (the

“Target Trust”),

a Delaware

statutory trust | | TempFund

(the

“Acquiring

Fund”) | | a series of BlackRock

Liquidity Funds (the

“Acquiring Trust”), a

Delaware statutory

trust | | Shareholders of each Target Fund as of the close of business on January 29, 2016 (the “Record Date”) |

Each Target Fund and the Acquiring Fund are each referred to as a “Fund” and collectively referred to as the “Funds.”

The Acquiring Fund, following completion of the Reorganizations (as defined below), may be referred to as the “Combined Fund.”

Each proposed reorganization seeks your approval of a series of transactions, which will result in you becoming a shareholder of the Acquiring Fund, a money market fund advised by BlackRock Advisors, LLC (“BlackRock”) that invests principally in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. The proposed transactions include a reorganization (each, a “Reorganization” and together, the “Reorganizations”) of each Target Fund with the Acquiring Fund. The Reorganizations are described herein and throughout the Combined Prospectus/Proxy Statement as Proposals 1a and 1b. It is also being separately proposed that other BofA Funds be reorganized into corresponding money market funds advised by BlackRock or one of its investment advisory affiliates (the “Parallel Reorganizations”). Even if approved by shareholders of each Target Fund, neither Reorganization may occur unless each Parallel Reorganization is also approved. In the event a Parallel Reorganization is not approved, BofA® Global Capital Management Group, LLC and BlackRock will consider the facts and circumstances that exist at the time of closing of each Reorganization and determine whether each such Reorganization will still occur. If neither Reorganization occurs as contemplated in this Combined Prospectus/Proxy Statement, BofA will promptly notify shareholders of each Target Fund as to the status of the transaction. In such circumstances, the Target Board will examine alternatives to each such Reorganization in light of the best interests of shareholders.

Each Fund pursues substantially similar investment objectives. Each Fund also employs similar investment strategies to achieve its respective investment objective. If both Reorganizations are approved and completed, and if each Parallel Reorganization is also approved and completed, you will become a shareholder of the Acquiring Fund, and each Target Fund will be dissolved and terminated as a series of the Target Trust. Please refer to the Combined Prospectus/Proxy Statement for a detailed explanation of the Reorganizations and for a more complete description of the Acquiring Fund.

THE REORGANIZATIONS

| Step 1: | Each Target Fund transfers substantially all of its assets to the Acquiring Fund in exchange for newly-issued shares of the Acquiring Fund and the assumption by the Acquiring Fund of certain stated liabilities of such Target Fund. |

| Step 2: | Newly-issued shares of the Acquiring Fund received by each Target Fund are distributed by such Target Fund to its shareholders in exchange for the shareholder’s Target Fund shares. |

| Step 3: | Each Target Fund is dissolved and terminated. |

| Q: | How does the Board of the Target Trust suggest that I vote? |

| A: | After careful consideration, the Board of Trustees of the Target Trust (the “Target Board”), including all of the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the Target Trust, have determined that each proposed Reorganization is in the best interests of the applicable Target Fund and its shareholders and, therefore, recommends that you cast your vote “FOR” each such proposed Reorganization. After considering the fees and expenses, performance, investment objective of the Acquiring Fund and the terms and conditions of each Reorganization, including the tax consequences, the Target Board recommends that you vote in favor of each Reorganization because it believes that the Reorganizations are in the best interests of each Target Fund and its shareholders. |

| Q: | In the Reorganizations, what class of shares of the Acquiring Fund will I receive? |

| A: | Shareholders of the Cash Reserves Target Fund will receive shares of the Acquiring Fund as follows: |

| | |

| If you own the following Target Fund Shares | | You will receive the following Acquiring Fund Shares |

Adviser Class Shares Capital Class Shares Daily Class Shares Institutional Class Shares Institutional Capital Shares Investor Class Shares Marsico Shares Investor II Class Shares Liquidity Class Shares Trust Class Shares | | Dollar Shares Institutional Shares Cash Management Shares Institutional Shares Institutional Shares Dollar Shares Dollar Shares Cash Reserve Shares Administration Shares Institutional Shares |

| | Shareholders of the Money Market Reserves Target Fund will receive shares of the Acquiring Fund as follows: |

| | |

| If you own the following Target Fund Shares | | You will receive the following Acquiring Fund Shares |

Adviser Class Shares Capital Class Shares Institutional Class Shares Institutional Capital Shares Liquidity Class Shares Trust Class Shares | | Dollar Shares Institutional Shares Institutional Shares Institutional Shares Administration Shares Institutional Shares |

| Q: | Will the number and value of the Acquiring Fund shares I receive in the Reorganizations equal the number and value of my Target Fund shares? |

| A: | Yes. The number and value of the Acquiring Fund shares you receive in the Reorganizations will equal the number and value of the Target Fund shares you hold immediately prior to the Reorganizations. |

ii

| Q: | Who will advise the Combined Fund once the Reorganizations are completed? |

| A: | The Acquiring Fund is advised by BlackRock, and the Combined Fund will continue to be advised by BlackRock once the Reorganizations are completed. BlackRock is an indirect wholly-owned subsidiary of BlackRock, Inc. |

| Q: | How will the Reorganizations affect Fund fees and expenses? |

| A: | Assuming the Reorganizations had each occurred on October 31, 2015, the Combined Fund would have (i) gross annual fund operating expenses for each of its share classes that are lower than those of each of the corresponding share classes of each Target Fund prior to the Reorganizations as of October 31, 2015, and (ii) net annual fund operating expenses for each of its share classes that are lower than those of the corresponding shares of each Target Fund prior to the Reorganizations as of October 31, 2015, after giving effect to all applicable contractual expense reimbursements (which exclude the effect of certain fees and expenses) that BlackRock has agreed to continue through March 1, 2017. |

| Q: | Will I have to pay any sales load, commission or other similar fee in connection with the applicable Reorganization? |

| A: | No, you will not have to pay any sales load, commission or other similar fee in connection with the applicable Reorganization. |

| Q: | What happens to my shares if the applicable Reorganization is approved? Will I have to take any action if such Reorganization is approved? |

| A: | If both Reorganizations are approved, your shares will automatically be converted into shares of the Acquiring Fund on the date of the completion of the applicable Reorganization. You will receive written confirmation that this change has taken place. No certificates for shares will be issued in connection with the Reorganizations. |

| Q: | What happens if the Reorganizations are not approved? |

| A. | If either Reorganization is not approved by shareholders of the applicable Target Fund, and/or if any other Parallel Reorganization is not approved, the Reorganizations may not occur, and the Target Board will consider other alternatives for each Target Fund, which alternatives may include liquidation of each such Target Fund. In the event a Parallel Reorganization is not approved, BofA® Global Capital Management Group, LLC and BlackRock will consider the facts and circumstances that exist at the time of closing of each Reorganization and determine whether each such Reorganization will still occur. If neither Reorganization occurs as contemplated in this Combined Prospectus/Proxy Statement, BofA will promptly notify shareholders of each Target Fund as to the status of the transaction. In such circumstances, the Target Board will examine alternatives to each such Reorganization in light of the best interests of shareholders. |

| Q: | Will the applicable Reorganization create a taxable event for me? |

| A: | Each Reorganization is expected to qualify as a tax-free “reorganization” under Section 368(a) of the Internal Revenue Code. In general, if a Reorganization so qualifies, (i) the applicable Target Fund will not recognize any gain or loss on the transfer of substantially all of its assets to the Acquiring Fund in exchange for (A) the assumption by the Acquiring Fund of certain stated liabilities of such Target Fund and (B) shares of the Acquiring Fund, and (ii) you will not recognize any gain or loss (A) upon receiving shares of the Acquiring Fund in connection with such Reorganization or (B) upon the dissolution and termination of such Target Fund. |

The portfolio managers of the Acquiring Fund have reviewed the portfolio holdings of each Target Fund and do not anticipate disposing of or requesting the disposition of any material portion of the holdings of each such Target Fund in preparation for, or as a result of, the Reorganizations. Consequently, no material transaction costs in restructuring the portfolio holdings of the Target Funds are anticipated to be incurred in

iii

connection with the Reorganizations. If there are any sales of portfolio assets, the tax impact of any such sales will depend on the difference between the price at which such portfolio assets are sold and the price at which such assets were bought by the applicable Target Fund. Any capital gains recognized in these sales on a net basis will be distributed to such Target Fund’s shareholders as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale, and such distributions will be taxable to shareholders. In addition, prior to the Reorganizations, each Target Fund will distribute to its shareholders all investment company taxable income and net realized capital gains not previously distributed to shareholders, and such distribution of investment company taxable income and net realized capital gains will be taxable to shareholders.

| Q: | What if I redeem my shares before the applicable Reorganization takes place? |

| A: | If you choose to redeem your shares before the applicable Reorganization takes place, such redemption is unlikely to result in recognition of a gain or loss for U.S. federal income tax purposes because of each Target Fund’s policy of maintaining a stable net asset value of $1.00 per share (although it is possible that it may not be able to do so). |

| Q: | As a shareholder of a Target Fund, will I be able to retain checking account redemption privileges? |

| A: | No. Shareholders of Capital Class Shares, Institutional Capital Shares, Trust Class Shares, Investor Class Shares, Investor II Class Shares, and Daily Class Shares of the Cash Reserves Target Fund and shareholders of Capital Class Shares, Institutional Capital Shares and Trust Class Shares of the Money Market Reserves Target Fund may establish a checking account using the BofA Funds’ free checkwriting service. Each check written must be for a minimum of $250. Target Fund shareholders may only use checks to make partial redemptions; a check may not be used to make a full redemption of the shares held in a Target Fund. Shareholders of the Combined Fund will not be able to use checkwriting to redeem shares after the Reorganizations because the Acquiring Fund does not offer such checkwriting privileges to its shareholders. However, shareholders of the Combined Fund will be able to submit redemption orders in respect of some or all of their Shares in the Combined Fund pursuant to the Combined Fund’s redemption policies. |

| Q: | Who will pay for the Reorganizations? |

| A: | The expenses associated with the Reorganizations will be borne by BlackRock and BofA and their respective affiliates. |

| Q: | How do I vote my shares? |

| A: | You may cast your vote by mail, phone or internet or in person at the special meeting of the Target Funds (“Special Meeting”). To vote by mail, please mark your vote on the enclosed proxy card(s) or voting instruction form and sign, date and return the card(s)/form in the postage-paid envelope provided. To vote by telephone or over the Internet, please have the proxy card(s) or voting instruction form(s) in hand and call the telephone number listed on the form(s) or go to the website address listed on the form(s) and follow the instructions. |

If you wish to vote in person at the Special Meeting, please complete each proxy card you receive and bring it to the Special Meeting. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting.

Whichever voting method you choose, please take the time to read the full text of the enclosed Combined Prospectus/Proxy Statement before you vote.

iv

| Q: | When will the Reorganizations occur? |

| A: | If approved by shareholders, each Reorganization is expected to occur during the 2nd quarter of 2016. The Reorganizations may not take place if either Reorganization is not approved by the applicable Target Fund’s shareholders and/or if any Parallel Reorganization is not approved. |

| Q: | Whom do I contact if I have questions? |

| A: | You can contact your financial advisor for further information. Direct shareholders may contact the applicable Target Fund at (888) 331-0904 for individual investors and (800) 353-0828 for institutional investors. You may also call Computershare Fund Services, our proxy solicitation firm, toll-free at (888) 916-1720. |

Important additional information about the proposals is set forth in the accompanying Combined Prospectus/Proxy Statement. Please read it carefully.

v

BOFA FUNDS SERIES TRUST

BofA Cash Reserves

BofA Money Market Reserves

100 Federal Street

Boston, Massachusetts 02110

(888) 331-0904 (individual investors)

(800) 353-0828 (for institutional investors)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 31, 2016

To the Shareholders of each of BofA Cash Reserves and BofA Money Market Reserves:

This is to notify you that a Special Meeting of Shareholders (the “Special Meeting”) of each of BofA Cash Reserves (the “Cash Reserves Target Fund”) and BofA Money Market Reserves (the “Money Market Reserves Target Fund”; together with the Cash Reserves Target Fund, the “Target Funds” and each, a “Target Fund”), each a series of BofA Funds Series Trust (the “Target Trust”), will be held on March 31, 2016 at 11:00 a.m., (Eastern time) at the offices of BofA Advisors, LLC (“BofA”) at 100 Federal Street, Boston, Massachusetts 02110.

At the Special Meeting, shareholders will be asked to consider and act upon the proposals (the “Proposals”) set out below and to transact such other business as permitted by applicable law and as may properly come before the Special Meeting. Each Proposal seeks your approval of a series of transactions, which will result in you becoming a shareholder of TempFund (the “Acquiring Fund”), a series of BlackRock Liquidity Funds (the “Acquiring Trust”), a money market fund advised by BlackRock Advisors, LLC (“BlackRock”). The proposed transactions include a reorganization (each, a “Reorganization”) of each Target Fund with the Acquiring Fund. The Reorganizations are described herein and throughout the Combined Prospectus/Proxy Statement as Proposals 1a and 1b, with shareholders of Cash Reserves Target Fund being asked to vote on Proposal 1a and shareholders of Money Market Reserves Target Fund being asked to vote on Proposal 1b. It is also being separately proposed that other BofA Funds, be reorganized into corresponding money market funds advised by BlackRock or one of its investment advisory affiliates (the “Parallel Reorganizations”). Neither Reorganization may occur unless each Parallel Reorganization is also approved. In the event a Parallel Reorganization is not approved, BofA® Global Capital Management Group, LLC and BlackRock will consider the facts and circumstances that exist at the time of closing of each Reorganization and determine whether each such Reorganization will still occur. If neither Reorganization occurs as contemplated in this Combined Prospectus/Proxy Statement, BofA will promptly notify shareholders of each Target Fund as to the status of the transaction. In such circumstances, the Target Board will examine alternatives to each such Reorganization in light of the best interests of shareholders.

After considering the fees and expenses, performance, investment objectives of the Acquiring Fund and the terms and conditions of each Reorganization, including the tax consequences, the Board of Trustees of the Target Trust recommends that you vote in favor of each Reorganization because it believes that each Reorganization is in the best interests of each Target Fund and its shareholders.

Proposal 1a and 1b—Reorganizations

Proposal 1a: To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which the Acquiring Fund would acquire substantially all of the assets of, and assume certain stated liabilities of, the Cash Reserves Target Fund in exchange for shares of the Acquiring Fund to be distributed pro rata by the Cash Reserves Target Fund to its shareholders in complete liquidation and termination of the Cash Reserves Target Fund.

Proposal 1b: To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which the Acquiring Fund would acquire substantially all of the assets of, and assume certain stated liabilities of, the Money Market Reserves Target Fund in exchange for shares of the Acquiring Fund to be distributed pro rata by the Money Market Reserves Target Fund to its shareholders in complete liquidation and termination of the Money Market Reserves Target Fund.

The Board of Trustees of the Target Trust has fixed the close of business on January 29, 2016 for determination of shareholders of each Target Fund entitled to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof (“Record Date”).

If you are a holder of a Target Fund’s shares and plan to attend the Special Meeting in person, in order to gain admission you must show valid photographic identification, such as your driver’s license or passport. If you hold your shares through a bank, broker or other nominee, and plan to attend the Special Meeting in person, in order to gain admission you must show valid photographic identification, such as your driver’s license or passport, and satisfactory proof of ownership of Target Fund shares, such as your voting instruction form (or a copy thereof) or a letter from your bank, broker or other nominee or broker’s statement indicating ownership as of the Record Date. If you hold your Target Fund shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Special Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Special Meeting. Even if you plan to attend the Special Meeting, please promptly follow the enclosed instructions to submit voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating each proxy card you receive, and if received by mail, returning it in the accompanying postage-paid return envelope.

For directions to the Special Meeting, please contact Computershare Fund Services, the firm assisting us in the solicitation of proxies, at (888) 916-1720.

The officers or trustees of the Target Trust named as proxies by shareholders may participate in the Special Meeting by remote communications, including, without limitation, by means of a conference telephone or similar communications equipment by means of which all persons participating in the Special Meeting can hear and be heard by each other, and the participation of such officers and directors in the Special Meeting pursuant to any such communications system shall constitute presence in person at the Special Meeting.

THE BOARD OF TRUSTEES OF EACH TARGET FUND UNANIMOUSLY RECOMMENDS THAT YOU CAST YOUR VOTE FOR PROPOSAL 1A AND/OR 1B, AS APPLICABLE.

PLEASE VOTE YOUR SHARES BY INDICATING YOUR VOTING INSTRUCTIONS ON THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM AND SIGN, DATE AND RETURN THE CARD/FORM IN THE POSTAGE-PAID ENVELOPE PROVIDED, OR BY RECORDING YOUR VOTING INSTRUCTIONS BY TELEPHONE OR VIA THE INTERNET.

IN ORDER TO AVOID THE ADDITIONAL EXPENSE OF FURTHER SOLICITATION, WE ASK THAT YOU MAIL YOUR SIGNED AND DATED PROXY CARD, VOTING INSTRUCTION FORM OR RECORD YOUR VOTING INSTRUCTIONS BY TELEPHONE OR VIA THE INTERNET PROMPTLY.

By Order of the Board of Trustees of the BofA Funds Series Trust,

//s/ Marina Belaya

Marina Belaya

Secretary

100 Federal Street

Boston, Massachusetts 02110

February [•], 2016

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on March 31, 2016. The Notice of Special Meeting of Shareholders, the Combined Prospectus/Proxy Statement and the form of proxy cards are available on the Internet at https://www.proxy-direct.com. On this website, you will be able to access the Notice of Special Meeting of Shareholders, the Combined Prospectus/Proxy Statement, the form of proxy cards and any amendments.

COMBINED PROSPECTUS/PROXY STATEMENT

BLACKROCK LIQUIDITY FUNDS

TempFund

100 Bellevue Parkway

Wilmington, Delaware 19809

(302) 797-2000

BOFA FUNDS SERIES TRUST

BofA Cash Reserves

BofA Money Market Reserves

100 Federal Street

Boston, Massachusetts 02110

(888) 331-0904 (individual investors)

(800) 353-0828 (for institutional investors)

This Combined Prospectus/Proxy Statement is furnished to you as a shareholder of BofA Cash Reserves (the “Cash Reserves Target Fund”) and/or BofA Money Market Reserves (the “Money Market Reserves Target Fund”; together with the Cash Reserves Target Fund, the “Target Funds” and each, a “Target Fund”), each a series of BofA Funds Series Trust, (the “Target Trust”).

A special meeting of shareholders of each Target Fund (the “Special Meeting”) will be held at the offices of BofA Advisors, LLC (“BofA”) at 100 Federal Street, Boston, Massachusetts 02110, on March 31, 2016 at 11:00 a.m. (Eastern time), to consider the items that are listed below and discussed in greater detail elsewhere in this Combined Prospectus/Proxy Statement. Shareholders of record of each Target Fund at the close of business on January 29, 2016 (the “Record Date”) are entitled to notice of, and to vote at, the Special Meeting or any adjournments or postponements thereof. This Combined Prospectus/Proxy Statement, proxy card or voting instruction form and accompanying Notice of Special Meeting of Shareholders were first sent or given to shareholders of each Target Fund on or about February [•], 2016. Shareholders should vote their shares by marking, signing, dating and returning the enclosed proxy card(s) or voting instruction form or by following one of the other methods for voting specified on the proxy card(s) or voting instruction form.

At the Special Meeting, shareholders will be asked to consider and act upon the proposals (the “Proposals”) set out below and to transact such other business as permitted by applicable law and as may properly come before the Special Meeting. Each Proposal seeks your approval of a series of transactions, which will result in you becoming a shareholder of TempFund (the “Acquiring Fund”), a series of BlackRock Liquidity Funds (the “Acquiring Trust”), a money market fund advised by BlackRock Advisors, LLC (“BlackRock”). The proposed transactions include a reorganization (each, a “Reorganization”) of each Target Fund with the Acquiring Fund. The Reorganizations are described herein and throughout the Combined Prospectus/Proxy Statement as Proposals 1a and 1b, with shareholders of Cash Reserves Target Fund being asked to vote on Proposal 1a and shareholders of Money Market Reserves Target Fund being asked to vote on Proposal 1b. It is also being separately proposed that other BofA Funds be reorganized into corresponding money market funds advised by BlackRock or one of its investment advisory affiliates (the “Parallel Reorganizations”). Neither Reorganization may occur unless each Parallel Reorganization is also approved. In the event a Parallel Reorganization is not approved, BofA® Global Capital Management Group, LLC and BlackRock will consider the facts and circumstances that exist at the time of closing of each Reorganization and determine whether each such Reorganization will still occur. If neither Reorganization occurs as contemplated in this Combined Prospectus/Proxy Statement, BofA will promptly notify

shareholders of each Target Fund as to the status of the transaction. In such circumstances, the Target Board will examine alternatives to each such Reorganization in light of the best interests of shareholders.

1. Proposals 1a and 1b—Reorganizations

Proposal 1a: To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which the Acquiring Fund would acquire substantially all of the assets of, and assume certain stated liabilities of, the Cash Reserves Target Fund in exchange for shares of the Acquiring Fund to be distributed pro rata by the Cash Reserves Target Fund to its shareholders in complete liquidation and termination of the Cash Reserves Target Fund.

Proposal 1b: To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which the Acquiring Fund would acquire substantially all of the assets of, and assume certain stated liabilities of, the Money Market Reserves Target Fund in exchange for shares of the Acquiring Fund to be distributed pro rata by the Money Market Reserves Target Fund to its shareholders in complete liquidation and termination of the Money Market Reserves Target Fund.

The Board of Trustees of the Target Trust (the “Board” or the “Target Board”) has approved the Reorganizations, pursuant to which each Target Fund, an open-end management investment company, would be reorganized into the Acquiring Fund. The Acquiring Fund pursues an investment objective that is substantially similar to the investment objective of each Target Fund. Each Target Fund has an investment objective to seek current income, consistent with capital preservation and maintenance of a high degree of liquidity. The Acquiring Fund has an investment objective to seek as high a level of current income as is consistent with liquidity and stability of principal. The Target Funds and the Acquiring Fund employ similar investment strategies, although each Fund, may employ certain differing investment strategies in seeking to achieve their respective objectives. For more information on each Fund’s investment strategies see “Summary—Investment Objectives and Principal Investment Strategies” below.

If the shareholders of each Target Fund approve the applicable Reorganization, and if each Parallel Reorganization is also approved, each Target Fund will transfer substantially all of its assets to the Acquiring Fund in exchange for Acquiring Fund shares and the assumption by the Acquiring Fund of certain stated liabilities of such Target Fund. Immediately thereafter, such Target Fund will distribute these shares of the Acquiring Fund to its shareholders. After distributing these shares, such Target Fund will be dissolved and terminated as a series of the Target Trust. When such Reorganization is complete, shareholders of such Target Fund will become shareholders of only the Acquiring Fund.

The aggregate net asset value of the Acquiring Fund shares received in the Reorganization by each Target Fund will equal the aggregate net asset value of the shares of such Target Fund held by shareholders of such Target Fund immediately prior to such Reorganization. As a result of such Reorganization, however, a shareholder’s interest will represent a smaller percentage of ownership in the combined fund (the “Combined Fund”) than such shareholder’s percentage of ownership in such Target Fund immediately prior to such Reorganization.

This Combined Prospectus/Proxy Statement sets forth concisely the information shareholders of each Target Fund should know before voting on the Reorganizations and constitutes an offering of shares of the Acquiring Fund being issued in the Reorganizations. Please read it carefully and retain it for future reference.

The following documents containing additional information about the Acquiring Fund and each Target Fund, each having been filed with the Securities and Exchange Commission (the “SEC”), are incorporated by reference into (legally considered to be part of) this Combined Prospectus/Proxy Statement:

| | 1. | the Statement of Additional Information dated February [•], 2016 (the “Reorganization SAI”), relating to this Combined Prospectus/Proxy Statement; |

ii

| | 2. | the Prospectuses relating to all applicable share classes of each Target Fund, dated January 1, 2016, as supplemented; |

| | 3. | the Statement of Additional Information relating to the Target Funds, dated January 1, 2016, as supplemented; |

| | 4. | the Annual Report to shareholders of each Target Fund for the fiscal year ended August 31, 2015; |

| | 5. | the Statement of Additional Information relating to the Acquiring Fund, dated February 27, 2015, as supplemented (the “Acquiring Fund SAI”); and |

| | 6. | the Annual Report to shareholders of the Acquiring Fund for the fiscal year ended October 31, 2015. |

The following document has been filed with the SEC, and is incorporated by reference into (legally considered to be part of) and also accompanies this Combined Prospectus/Proxy Statement:

| | 7. | the Prospectuses relating to Administration Shares, Cash Management Shares, Cash Reserve Shares, Dollar Shares and Institutional Shares of the Acquiring Fund dated February 27, 2015, as supplemented (collectively, the “Acquiring Fund Prospectus”). |

Except as otherwise described herein, the policies and procedures set forth under “Account Information” in the Acquiring Fund Prospectus will apply to the shares issued by the Acquiring Fund in connection with the Reorganization.

Copies of items 2 through 4 can be obtained on a website maintained by BofA at www.bofacapital.com. In addition, each Target Fund will furnish, without charge, a copy of any of the foregoing documents to any shareholder upon request. Any such request should be directed to BofA by calling (888) 331-0904 for individual investors or (800) 353-0828 for institutional investors or by writing to the applicable Target Fund at BofA Funds, c/o Boston Financial Data Services, Inc., P.O. Box 8723 (individual investors) or P.O. Box 8026 (institutional investors), Boston, MA 02266-8723. The foregoing documents are available on the EDGAR Database on the SEC’s website at www.sec.gov. The address of the principal executive offices of each Target Fund is BofA Funds, c/o Boston Financial Data Services, Inc., P.O. Box 8723 (individual investors) or P.O. Box 8026 (institutional investors), Boston, Massachusetts 02266-8723) and the telephone number is (888) 331-0904 for individual investors or (800) 353-0828 for institutional investors.

Copies of items 5 through 7 can be obtained on a website maintained by BlackRock, Inc. at www.blackrock.com/cash. In addition, the Acquiring Fund will furnish, without charge, a copy of any of the foregoing documents to any shareholder upon request. Any such request should be directed to BlackRock, Inc. by calling (800) 441-7450 or by writing to the Acquiring Fund at 100 Bellevue Parkway, Wilmington Delaware 19809. The foregoing documents are available on the EDGAR Database on the SEC’s website at www.sec.gov. The address of the principal executive offices of the Acquiring Fund is 100 Bellevue Parkway, Wilmington, Delaware 19809 and the telephone number is (302) 797-2000.

Each Fund is subject to the informational requirements of the Securities Act of 1933, Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith, files reports, proxy statements, proxy materials and other information with the SEC. Materials filed with the SEC can be reviewed and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549 or downloaded from the SEC’s website at www.sec.gov. Information on the operation of the SEC’s Public Reference Room may be obtained by calling the SEC at (202) 551- 8090. You may also request copies of these materials, upon payment at the prescribed rates of a duplicating fee, by electronic request to the SEC’s e-mail address (publicinfo@sec.gov) or by writing the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549-0102.

iii

The Board knows of no business other than that discussed above that will be presented for consideration at the Special Meeting. To the extent permitted by applicable law, if any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

No person has been authorized to give any information or make any representation not contained in this Combined Prospectus/Proxy Statement and, if so given or made, such information or representation must not be relied upon as having been authorized. This Combined Prospectus/Proxy Statement does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which, or to any person to whom, it is unlawful to make such offer or solicitation.

Neither the SEC nor any state regulator has approved or disapproved of these securities or passed upon the adequacy of this Combined Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

The date of this Combined Prospectus/Proxy Statement is February [•], 2016.

iv

TABLE OF CONTENTS

v

SUMMARY

The following is a summary of certain information contained elsewhere in this Combined Prospectus/Proxy Statement and is qualified in its entirety by reference to the more complete information contained herein. Shareholders should read the entire Combined Prospectus/Proxy Statement carefully.

Each of the Funds is a diversified, open-end management investment company registered with the Securities and Exchange Commission (“SEC”) and is a series of the management investment company specified below:

| | |

| BofA Cash Reserves (the “Cash Reserves Target Fund”); BofA Money Market Reserves (the “Money Market Reserves Target Fund”; together with the Cash Reserves Target Fund, the “Target Funds” and each, a “Target Fund”) | | each, a series of BofA Funds Series Trust (the “Target Trust”), a Delaware statutory trust |

| |

| TempFund (the “Acquiring Fund”) | | a series of BlackRock Liquidity Funds (the “Acquiring Trust”), a Delaware statutory trust |

The Target Funds and the Acquiring Fund are collectively referred to as the “Funds” and each, a “Fund.”

The Acquiring Fund, following completion of the Reorganizations, may be referred to as the “Combined Fund” in this Combined Prospectus/Proxy Statement.

Investment Objectives. The investment objective of the Target Funds and the Acquiring Fund are substantially similar. Each Target Fund has an investment objective to seek current income, consistent with capital preservation and maintenance of a high degree of liquidity. The Acquiring Fund has an investment objective to seek as high a level of current income as is consistent with liquidity and stability of principal. The investment objective of each of the Funds is non-fundamental, which means that it may be changed without approval of the respective Fund’s shareholders.

Advisers and Distributors. BlackRock Advisors, LLC (“BlackRock”) serves as the investment adviser of the Acquiring Fund. BofA Advisors, LLC (“BofA”) serves as the investment adviser of each Target Fund. Each of the Funds publicly offers its shares on a continuous basis. Shares of the Acquiring Fund may be purchased through the Acquiring Fund’s distributor, BlackRock Investments, LLC (“BRIL”), and numerous intermediaries. Shares of each Target Fund may be purchased through the Target Fund’s distributor, BofA Distributors, Inc. (“BofA Distributors”), and numerous intermediaries.

Investment Strategies. The principal strategies of the Target Funds and the Acquiring Fund are substantially similar, although there are some differences.

Each Fund is a money market fund managed pursuant to Rule 2a-7 under the 1940 Act. Each Fund seeks to achieve its investment objective by investing in a portfolio of securities maturing in 397 days or less (with certain exceptions) that will have a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less. Each Fund seeks to maintain a net asset value of $1.00 per share. Both Funds are subject to the quality, diversification, and other requirements of Rule 2a-7 under the 1940 Act.

Each Fund has adopted a strategy to invest in high quality money market instruments. Each Fund purchases only first-tier securities. Each Fund may depart from its principal investment strategies and take temporary defensive investment positions during adverse market conditions.

The securities in which each Fund may invest are generally similar. The Target Funds invest principally in short-term debt instruments of U.S. and foreign issuers, and such investments may include bank obligations

1

(including certificates of deposit and time deposits issued by domestic or foreign banks or their subsidiaries or branches), commercial paper, corporate bonds, extendible commercial notes, asset-backed securities, funding agreements, municipal securities, repurchase agreements and other high-quality, short-term obligations. The Acquiring Fund invests principally in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. In addition, the Acquiring Fund may also invest in mortgage- and asset-backed securities, short-term obligations issued by or on behalf of states, territories and possessions of the United States, the District of Columbia, and their respective authorities, agencies, instrumentalities and political subdivisions and derivative securities such as beneficial interests in municipal trust certificates and partnership trusts.

The Board of Trustees of the Target Trust (the “Board” or the “Target Board”), including all of the Trustees who are not “interested persons” (as defined in the 1940 Act) (the “Independent Trustees”), have approved each Reorganization.

Subject to approval by the Target Fund shareholders, each Reorganization provides for: (i) the transfer of substantially all of the assets of the applicable Target Fund to the Acquiring Fund in exchange for the assumption by the Acquiring Fund of certain stated liabilities of the Target Fund and newly-issued shares of the Acquiring Fund; (ii) the distribution of such shares of the Acquiring Fund by the Target Fund to its shareholders; and (iii) the dissolution and termination of the Target Fund as a series of the Target Trust.

If the Reorganizations are approved and completed, and if each Parallel Reorganization is also approved, shareholders of each Target Fund will receive the same number of shares of a corresponding class of the Acquiring Fund as the shares such shareholders own in the applicable Target Fund as follows:

| | |

If you own the following

Cash Reserves Target Fund Shares | | You will receive the following

Acquiring Fund Shares |

| Adviser Class Shares | | Dollar Shares |

| Capital Class Shares | | Institutional Shares |

| Daily Class Shares | | Cash Management Shares |

| Institutional Class Shares | | Institutional Shares |

| Institutional Capital Shares | | Institutional Shares |

| Investor Class Shares | | Dollar Shares |

| Marsico Shares | | Dollar Shares |

| Investor II Class Shares | | Cash Reserve Shares |

| Liquidity Class Shares | | Administration Shares |

| Trust Class Shares | | Institutional Shares |

| |

If you own the following

Money Market Reserves Target Fund Shares | | You will receive the following

Acquiring Fund Shares |

| Adviser Class Shares | | Dollar Shares |

| Capital Class Shares | | Institutional Shares |

| Institutional Class Shares | | Institutional Shares |

| Institutional Capital Shares | | Institutional Shares |

| Liquidity Class Shares | | Administration Shares |

| Trust Class Shares | | Institutional Shares |

The Acquiring Fund shares that shareholders of a Target Fund will receive in the applicable Reorganization will have the same aggregate net asset value as shares of such Target Fund that they owned immediately prior to such Reorganization.

Background and Reasons for the Proposed Reorganizations

Bank of America (the “Bank”), after a review of the nature and goals of its asset management business, determined to exit the proprietary side of its asset management business. BofA which serves as the investment

2

adviser to each series of the Target Trust (each, a “BofA Fund” and collectively, the “BofA Funds”), is a wholly-owned subsidiary of BofA Global Capital Management Group, LLC (“BACM”), which is an asset management division of the Bank. The Target Board received information from BofA and held discussions regarding potential options for the BofA Funds, including combining the BofA Funds with money market funds of another fund complex. After considering and evaluating several possible prominent and experienced money market fund managers, BofA recommended to the Target Board reorganizing the Target Funds into the Acquiring Fund managed by BlackRock or one of its advisory affiliates together with other BlackRock-advised Funds, the “BlackRock Funds”).

The Target Board discussed and considered matters relating to the Reorganization proposals at meetings held on September 25, October 1, November 13, December 4 and December 10, 2015. During the course of these meetings, the Target Board requested, received and discussed information from various parties, including from BACM, BofA and/or BlackRock, as applicable, regarding (i) the rationale for the Reorganizations and related proposals, as well as comparative data and information with respect to the BofA Funds and the BlackRock Funds; (ii) potential benefits and costs that may accrue to the Target Funds as a result of the Reorganizations; (iii) BlackRock’s personnel and affiliates; (iv) BlackRock’s investment philosophy and process; (v) BlackRock’s experience in providing investment advisory services to money market funds; (vi) BlackRock’s operational, legal and compliance capabilities and its financial conditions and resources; (vii) the services provided by, and BlackRock’s administration and oversight of, the BlackRock Funds’ third-party service providers; (viii) the key distribution channels and intermediary relationships for the BlackRock Funds; (ix) and the composition and governance of the BlackRock Funds’ boards of directors/trustees. The Target Board also received and considered information from counsel to the Independent Trustees regarding certain duties of the Target Board in connection with the Reorganizations and Parallel Reorganizations. During the course of the Target Board’s deliberations, the Independent Trustees were advised by and received assistance from their independent counsel, including in executive sessions.

At a meeting held on December 10, 2015 (the “Approval Meeting”), the Target Board, including all of the Independent Trustees, unanimously approved each Reorganization and authorized the Target Funds’ officers to solicit shareholder approval of the agreement and plan of reorganization (each, a “Plan of Reorganization”) applicable to each Reorganization. The Target Board determined that, based on an assumption that all of the facts and circumstances existing at the time of closing of each Reorganization are not materially different from those presented to the Target Board at the Approval Meeting, each Reorganization would be in the best interests of each Target Fund and that the interests of existing shareholders of each Target Fund would not be diluted as a result of each Target Fund’s Reorganization. The Target Board’s determinations were based on a comprehensive evaluation of the information provided to them. During the review, the Target Board did not identify any particular information or consideration that was all-important or controlling. Although the Trustees considered broader issues arising in the context of the combination of the cash asset management businesses of BACM and BlackRock, their determinations with respect to each of the Reorganizations and Parallel Reorganizations were made on a BofA Fund-by-BofA Fund basis.

Results of Process

In reaching its determinations with respect to the Reorganizations of the Target Funds into the Acquiring Fund, (for purposes of the remainder of this section the “Reorganization”), the Target Board considered a number of factors presented at the time of the Approval Meeting or at a prior meeting, including, but not limited to, the following:

| | • | | Fees and Expenses. The Target Board considered the contractual and actual management fees and other expenses paid or proposed to be paid by each Target Fund and the Acquiring Fund. Based on information provided to the Target Board, the Target Board noted, as described in this Combined Prospectus/Proxy Statement, that the Reorganization would result in similar contractual management fees. The Target Board also noted that the share classes of the Acquiring Fund have lower total annual |

3

| | net expenses (after any contractual waivers and/or reimbursements, but excluding voluntary expense waivers needed to maintain yield floors) than the corresponding share classes of each Target Fund. The Target Board also considered that the Acquiring Fund’s contractual waiver is in place through March 1, 2017. The Target Board also noted the greater potential for future operating efficiencies and economies of scale in a larger combined fund. The Target Board considered existing and historical yield floor waivers and noted that such yield floor waivers are voluntary and can be changed or removed at any time. |

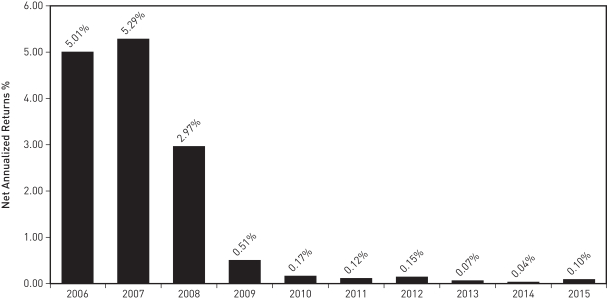

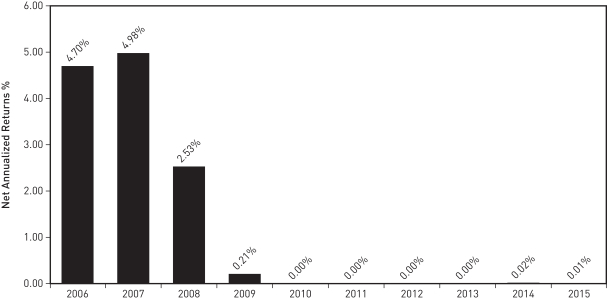

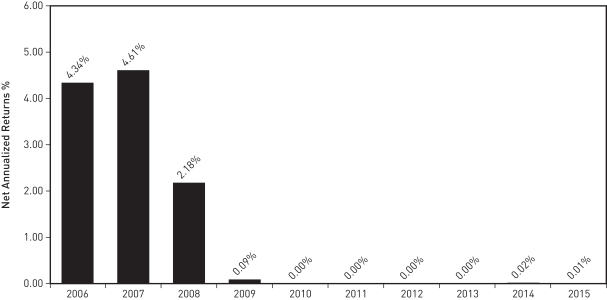

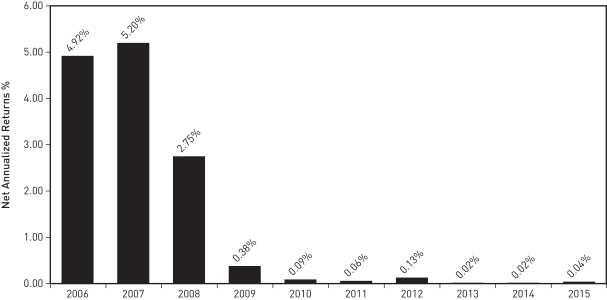

| | • | | Performance. The Target Board considered the relative performance and risk-profile of each Target Fund and those of the Acquiring Fund, while taking into account the impact of current market conditions on investment performance. The Target Board noted that the one-month, one-year, three-year and five-year gross performance record for the Acquiring Fund was better than, equal to, or in range of the corresponding performance of each Target Fund. With respect to performance net of fees, including, as applicable, yield floor waivers, the Target Board noted that the post-Reorganization net yield for the Acquiring Fund is expected to be higher than that of each Target Fund. The Target Board noted that, as discussed above, a yield floor waiver is voluntary and can be changed or removed at any time. The Target Board also noted other relevant factors in connection with its consideration of performance, including, among others, the relatively tight dispersion of performance data among money market funds, and the information it received from BlackRock and BofA relating to the emphasis on liquidity and principal preservation. |

| | • | | Continuity of Investment. The Target Board considered the investment objectives of each Target Fund and the Acquiring Fund. The Target Board noted that generally each Target Fund invests in similar securities to the securities invested in by the Acquiring Fund. The Target Board also noted that, to the extent shareholders of each Target Fund would acquire shares of a class of the Acquiring Fund with higher investment minimums, the shareholders of each Target Fund would be permitted to continue to invest in that share class without regard to such minimums. |

| | • | | Terms and Conditions of the Reorganization. The Target Board considered the terms and conditions of the Reorganization, including (1) that BofA, BlackRock and/or their respective affiliates, and not the Target Fund’s shareholders, will bear all expenses associated with the Reorganization, including but not limited to, shareholder solicitation costs, printing and mailing expenses, and legal, accounting and Target Board costs; (2) that the Plan of Reorganization includes provisions to address potential dilution; and (3) the compensation to be paid to BACM by BlackRock, Inc. at the time of the consummation of the Reorganization and for a period of time thereafter. |

| | • | | Tax Consequences. The Target Board considered that the Reorganization will be structured so as to be a tax-free reorganization for federal income tax purposes. The Target Board noted that no capital loss carry forward limitations and no significant dilution of capital loss carry forwards or built-in gains/losses are expected as a result of the Reorganization. |

| | • | | Fund Governance. The Target Board considered the committee structure of the board of directors/trustees of the Acquiring Fund. The Target Board also considered the experience and expertise of the directors/trustees of the Acquiring Fund. The Target Board noted that BlackRock, Inc. has contractually agreed to use its reasonable best efforts to assure that, following the close of the Reorganization, at least 75% of the board of directors/trustees of the Acquiring Fund would not be for a period of at least three years “interested persons” (as that term is defined in the 1940 Act) of BlackRock, Inc. or the Bank. |

| | • | | Dilution Considerations. The Target Board considered the market-based net asset values (“NAVs”) and amortized cost NAVs of each Target Fund and the Acquiring Fund. The Target Board considered whether the Reorganization would result in any greater dilution than a sale of each Target Fund’s shares (at $1 per share) in an ordinary course redemption by a shareholder. The Target Board also considered whether the Reorganization would materially affect a shareholder’s risk of breaking a dollar due to a decline in market-based NAV. |

4

| | • | | Other Considerations. The Target Board considered the pending regulatory changes to Rule 2a-7 under the 1940 Act and their potential effect on each Target Fund and its shareholders. The Target Board also considered the actions taken or to be taken by BlackRock to ensure that the Acquiring Fund complies in a timely manner with amendments to Rule 2a-7 under the 1940 Act. |

After consideration of the factors noted above, together with other factors and information considered to be relevant, the Target Board, including all of the Independent Trustees, unanimously approved the Reorganization, concluding that the Reorganization is in the best interest of each Target Fund and its shareholders and that, based on the assumption discussed above, the interests of existing shareholders of each Target Fund would not be diluted as a result of such Reorganization. This determination was made on the basis of each Trustee’s business judgment after consideration of all of the factors taken as a whole with respect to each Target Fund and its shareholders, although individual Trustees may have placed different weight on various factors and assigned different degrees of materiality to various factors.

The Target Board, including all of the Independent Trustees, unanimously recommends that you vote “FOR” Proposal 1a and/or 1b, as applicable.

Investment Objectives and Principal Investment Strategies

Comparison of the Target Funds and the Acquiring Fund

Investment Objectives. The investment objective of the Target Funds and the Acquiring Fund are substantially similar. Each Target Fund has an investment objective to seek current income, consistent with capital preservation and maintenance of a high degree of liquidity. The Acquiring Fund has an investment objective to seek as high a level of current income as is consistent with liquidity and stability of principal. The investment objective of each of the Funds is non-fundamental, which means that it may be changed without approval of the respective Fund’s shareholders.

Principal Investment Strategies. The Target Funds and the Acquiring Fund employ substantially similar principal investment strategies in seeking to achieve their respective objectives. The similarities and differences of the principal investment strategies of the Funds are described in the chart below.

| | |

Target Funds | | Acquiring Fund |

• Each Target Fund seeks to maintain a constant net asset value of $1.00 per share. | | • The Fund seeks to maintain a net asset value of $1.00 per share. |

| |

• Each Target Fund is a money market fund managed pursuant to Rule 2a-7 under the 1940 Act. The securities purchased by the Fund are subject to the quality, diversification, and other requirements of Rule 2a-7 and other rules of the SEC. | | • The Fund is a money market fund managed pursuant to Rule 2a-7 under the 1940 Act. The securities purchased by the Fund are subject to the quality, diversification, and other requirements of Rule 2a-7 and other rules of the SEC. |

| |

• Each Target Fund is subject to the maturity requirements of Rule 2a-7, which generally (i) require the Fund to maintain a dollar-weighted average portfolio maturity of 60 days or less and a dollar-weighted average life of 120 days or less and (ii) limits the remaining maturity of the Fund’s investments to 397 days or fewer. Rule 2a-7 permits the Fund to invest in securities with remaining maturities exceeding 397 days (with certain exceptions). | | • The Fund is subject to the maturity requirements of Rule 2a-7, which generally (i) require the Fund to maintain a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less and (ii) limits the remaining maturity of the Fund’s investments to 397 days or fewer. Rule 2a-7 permits the Fund to invest in securities with remaining maturities exceeding 397 days (with certain exceptions). |

5

| | |

Target Funds | | Acquiring Fund |

• Each Target Fund invests in high-quality money market instruments, including primarily short-term debt instruments of U.S. and foreign issuers. The Fund’s investments may include bank obligations (including certificates of deposit and time deposits issued by domestic or foreign banks or their subsidiaries or branches), commercial paper, corporate bonds, extendible commercial notes, asset-backed securities, funding agreements, municipal securities, repurchase agreements and other high-quality, short-term obligations. | | • The Fund invests in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. In addition, the Fund may also invest in mortgage- and asset-backed securities, short-term obligations issued by or on behalf of states, territories and possessions of the United States, the District of Columbia, and their respective authorities, agencies, instrumentalities and political subdivisions and derivative securities such as beneficial interests in municipal trust certificates and partnership trusts. |

| |

• Each Target Fund purchases only first-tier securities. | | • The securities purchased by the Fund will be first-tier securities. |

| |

• Each Target Fund may invest in securities that have fixed, floating or variable rates of interest. | | • The Fund may invest in variable and floating rate instruments and when-issued and delayed delivery securities. |

| |

• Each Target Fund may, from time to time, take temporary defensive investment positions that are inconsistent with the Fund’s principal investment strategies in attempting to respond to adverse market, economic, political or other conditions and factors, including holding a substantial portion of its total assets in uninvested cash. | | • During periods of unusual market conditions or during temporary defensive periods, the Fund may depart from its principal investment strategies. The Fund may hold uninvested cash reserves pending investment, during temporary defensive periods. |

Comparison. The principal strategies of the Target Funds and the Acquiring Fund are substantially similar, although there are some differences.

Each Fund is a money market fund managed pursuant to Rule 2a-7 under the 1940 Act. Each Fund seeks to achieve its investment objective by investing in a portfolio of securities maturing in 397 days or less (with certain exceptions) that will have a dollar-weighted average maturity of 60 days or less and a dollar-weighted average life of 120 days or less. Each Fund seeks to maintain a net asset value of $1.00 per share. Both Funds are subject to the quality, diversification, and other requirements of Rule 2a-7 under the 1940 Act.

Each Fund has adopted a strategy to invest in high quality money market instruments. Each Fund purchases only first-tier securities. Each Fund may depart from its principal investment strategies and take temporary defensive investment positions during adverse market conditions.

The securities in which each Fund may invest are generally similar. The Target Funds invest principally in short-term debt instruments of U.S. and foreign issuers, and such investments may include bank obligations (including certificates of deposit and time deposits issued by domestic or foreign banks or their subsidiaries or branches), commercial paper, corporate bonds, extendible commercial notes, asset-backed securities, funding agreements, municipal securities, repurchase agreements and other high-quality, short-term obligations. The Acquiring Fund invests principally in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. In addition, the Acquiring Fund may also invest in mortgage- and asset-backed securities, short-term obligations issued by or on behalf of states, territories and possessions of the United States, the District of Columbia, and their respective authorities, agencies, instrumentalities and political subdivisions and derivative securities such as beneficial interests in municipal trust certificates and partnership trusts.

6

Fees and Expenses

If the Reorganizations are approved and completed, holders of shares of each Target Fund will receive shares of the Acquiring Fund as follows:

| | |

If you own the following

Cash Reserves Target Fund Shares | | You will receive the following

Acquiring Fund Shares |

| Adviser Class Shares | | Dollar Shares |

| Capital Class Shares | | Institutional Shares |

| Daily Class Shares | | Cash Management Shares |

| Institutional Class Shares | | Institutional Shares |

| Institutional Capital Shares | | Institutional Shares |

| Investor Class Shares | | Dollar Shares |

| Marsico Shares | | Dollar Shares |

| Investor II Class Shares | | Cash Reserve Shares |

| Liquidity Class Shares | | Administration Shares |

| Trust Class Shares | | Institutional Shares |

| |

If you own the following

Money Market Reserves Target Fund Shares | | You will receive the following

Acquiring Fund Shares |

| Adviser Class Shares | | Dollar Shares |

| Capital Class Shares | | Institutional Shares |

| Institutional Class Shares | | Institutional Shares |

| Institutional Capital Shares | | Institutional Shares |

| Liquidity Class Shares | | Administration Shares |

| Trust Class Shares | | Institutional Shares |

7

Fee Tables as of October 31, 2015 (unaudited)

The fee tables below provide information about the fees and expenses attributable to: the Adviser Class Shares, Capital Class Shares, Daily Class Shares, Institutional Class Shares, Institutional Capital Shares, Investor Class Shares, Investor II Class Shares, Marsico Shares, Liquidity Class Shares and Trust Class Shares of the Cash Reserves Target Fund; the Adviser Class Shares, Capital Class Shares, Institutional Class Shares, Institutional Capital Shares, Liquidity Class Shares and Trust Class Shares of the Money Market Reserves Target Fund; and the Institutional Shares, Administration Shares, Dollar Shares, Cash Reserve Shares and Cash Management Shares of the Acquiring Fund, assuming each Reorganization had taken place on October 31, 2015, and the estimated pro forma fees and expenses attributable to the Institutional Shares, Administration Shares, Dollar Shares, Cash Reserve Shares and Cash Management Shares of the pro forma Combined Fund. The percentages presented in the fee tables are based on fees and expenses incurred during the 12-month period ended October 31, 2015. Future fees and expenses may be greater or less than those indicated below. For information concerning the net assets of each Fund as of October 31, 2015, see “Other Information—Capitalization.”

Fee Tables of BofA Cash Reserves (Target Fund), TempFund (Acquiring Fund) and the Pro Forma Combined Fund (as of October 31, 2015) (unaudited)

Target Fund Adviser Class Shares into Acquiring Fund Dollar Shares

| | | | | | |

| | | BofA Cash

Reserves

(Target Fund)(1)

Adviser Class

Shares | | TempFund

(Acquiring

Fund) Dollar

Shares | | Pro Forma

(Combined Fund:

TempFund)

Dollar

Shares(5) |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fee | | 0.25%(2) | | 0.18% | | 0.18% |

Distribution (12b-1) Fees | | None | | None | | None |

Other Expenses | | 0.27% | | 0.26% | | 0.26% |

Shareholder Servicing Fee | | 0.25% | | 0.25% | | 0.25% |

Miscellaneous/Other Expenses | | 0.02% | | 0.01% | | 0.01% |

Total Annual Fund Operating Expenses | | 0.52% | | 0.44% | | 0.44% |

Fee Waivers and/or Expense Reimbursements | | (0.07)%(2)(3) | | (0.01)%(4) | | (0.01)%(4) |

Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | | 0.45%(3) | | 0.43%(4) | | 0.43%(4) |

| (1) | Shareholders of Adviser Class Shares of the Cash Reserves Target Fund will receive Dollar Shares of the Acquiring Fund in connection with the Reorganization. |

| (2) | BofA has contractually agreed to limit management fees (investment advisory fees and administration fees) to an annual rate of 0.19% of average net assets through December 31, 2016. This fee and expense arrangement may only be modified or amended with the approval of all parties to such arrangement, including the Cash Reserves Target Fund (acting through the Target Board) and BofA. |

| (3) | BofA and/or some of the Cash Reserves Target Fund’s other service providers have contractually agreed to bear a portion of the Cash Reserves Target Fund’s expenses so that the Cash Reserves Target Fund’s ordinary operating expenses (excluding any acquired fund fees and expenses, distribution, shareholder servicing and/or shareholder administration fees, interest, taxes and extraordinary expenses, but including custodian charges relating to overdrafts, if any) do not exceed 0.20% of the Cash Reserves Target Fund’s average daily net assets through December 31, 2016. BofA and BofA Distributors are entitled to recover from the Cash Reserves Target Fund any fees waived and/or expenses reimbursed for a three year period following the date of such waiver and/or reimbursement if such recovery does not cause the Cash Reserves Target Fund’s total operating expenses to exceed the expense commitment in effect at the time the expenses to be recovered were incurred. This fee and expense arrangement may only be modified or amended with the approval of all parties to such arrangement, including the Cash Reserves Target Fund (acting through the Target Board) and BofA. |