QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14F-1

INFORMATION STATEMENT

Pursuant to Section 14(f) of

the Securities Exchange Act of 1934, as amended, and Rule 14f-1 thereunder.

TIPPERARY CORPORATION

(Exact name of registrant as specified in its charter)

TEXAS

(State or other jurisdiction

of incorporation) | | 1-7796

(Commission

File Number) | | 75-1236955

(IRS Employer

Identification No.) |

633 Seventeenth Street, Suite 1800

Denver, Colorado 80202

(Address of principal executive offices) (Zip Code)

303-293-9379

Registrant's telephone number, including area code

Approximate date of mailing: July 15, 2005

TIPPERARY CORPORATION

633 Seventeenth Street, Suite 1800

Denver, Colorado 80202

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE SECURITIES EXCHANGE ACT OF 1934,

AS AMENDED, AND RULE 14f-1 THEREUNDER

REPORT OF CHANGE IN MAJORITY DIRECTORS

July 15, 2005

This Information Statement is required by Section 14(f) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and Rule 14f-1 promulgated thereunder. Section 14(f) of the Exchange Act requires the mailing of this Information Statement to the shareholders of Tipperary Corporation, a Texas corporation ("Company"), not less than ten (10) days prior to a contemplated change in a majority of its directors otherwise than at a meeting of the Company's shareholders. This Information Statement is being furnished on or about July 15, 2005, to all of the holders of record as of the close of business on July 12, 2005 (the "Record Date"), of the common stock, $0.02 par value (the "Company Common Stock"), of the Company. As of such date, we had 41,360,994 shares of Company Common Stock issued and outstanding, for which shareholders are entitled to vote.

Please read this Information Statement carefully. It describes the terms of the proposed transactions among the Company, Santos International Holdings Pty Ltd., a company incorporated in the Australian Capital Territory, Australia ("Santos"), and Santos Acquisition Co., a Texas corporation and wholly owned subsidiary of Santos ("Merger Sub"), and the transactions between Slough Estates plc, a United Kingdom public limited company ("Slough"), together with its wholly owned subsidiary Slough Estates USA, Inc., a Delaware corporation and formerly the holder of approximately 54% of the Company Common Stock ("Slough USA"), and the effect thereof on the Company and its shareholders. This Information Statement also contains biographical and other information concerning the directors of the Company who were not serving the Company prior to the consummation of the transactions with Slough under the Amended IPA (defined below) but who will be serving the Company as a result of the consummation of the transactions with Slough under the Amended IPA (defined below).

The transactions giving rise to the change in the majority of the directors occurred on July 13, 2005 (see the subsection captioned "Change of Control" elsewhere in this Information Statement).

NO VOTE OR OTHER ACTION OF THE COMPANY'S SHAREHOLDERS IS REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. NO PROXIES OR CONSENTS ARE BEING SOLICITED AND YOU ARE REQUESTED NOT TO SEND TO THE COMPANY A PROXY OR CONSENT.

CHANGE OF CONTROL

On July 1, 2005, the Company and Santos announced the execution of an Agreement and Plan of Merger, dated as of July 1, 2005 (the "Original Merger Agreement"), by and among the Company, Santos, and Merger Sub. The Original Merger Agreement provides that, upon the terms and subject to the conditions set forth in the Original Merger Agreement, the Merger Sub will merge with and into the Company, with the Company continuing as the surviving corporation and a wholly-owned subsidiary of Santos (the "Merger").

Subject to the terms and conditions of the Original Merger Agreement, which has been approved by the Independent Board Committee of the Board of Directors of the Company and the Boards of Directors of both the Company and Santos, at the effective time and as a result of the Merger, each share of Company Common Stock issued and outstanding immediately prior to the effective time of the Merger, other than shares as to which appraisal rights are properly asserted under Texas law and shares owned by the Company, Santos or their respective wholly owned subsidiaries, would be converted into $7.41 cash.

The Company and Santos have made customary representations, warranties and covenants in the Original Merger Agreement, including, among others, covenants (i) that the Company will conduct its business in the ordinary course consistent with past practice during the interim period between the execution of the Original Merger Agreement and consummation of the Merger, (ii) not to engage in certain kinds of transactions during such period, (iii) that the Company will cause a shareholder meeting to be held by the Company to consider approval of the Merger and the other transactions contemplated by the Original Merger Agreement and (iv) that, subject to certain exceptions, the Company's Board of Directors will recommend adoption by its shareholders of the Original Merger Agreement. In addition, the Company made certain additional customary covenants, including, among others, covenants not to: (i) solicit proposals relating to alternative business combination transactions or (ii) subject to certain exceptions, enter into discussions concerning or provide confidential information in connection with any proposals for alternative business combination transactions.

The representations and warranties of each party set forth in the Original Merger Agreement have been made solely for the benefit of the other party to the Original Merger Agreement and such representations and warranties should not be relied on by any other person. In addition, such representations and warranties (i) have been qualified by a disclosure letter provided by the Company to Santos in connection with signing the Original Merger Agreement, (ii) will not survive consummation of the Merger and cannot be the basis for any claims under the Original Merger Agreement by the other party after termination of the Original Merger Agreement, except if willfully false as of the date of the Original Merger Agreement, (iii) are subject to materiality standards which may differ from what may be viewed as material by investors and (iv) were made only as of the date of the Original Merger Agreement or such other date as is specified in the Original Merger Agreement. The disclosure letter referred to above contains information (including information that has been included in the Company's prior public disclosures, as well as potential additional non-public information) that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Original Merger Agreement. Accordingly, you should not rely on the representations and warranties as characterizations of the actual state of facts, as they are modified in important part by the accompanying disclosure letter. Moreover, information concerning the subject matter of the representations and warranties may change after the date of execution of the Original Merger Agreement, which subsequent information may or may not be fully reflected in the Company's public disclosures.

Consummation of the Merger is subject to customary conditions, including (i) approval of the holders of the Company Common Stock, (ii) absence of any law or order prohibiting the completion of the Merger and (iii) certain other regulatory approvals. In addition, each party's obligation to

2

consummate the Merger is subject to certain other conditions, including (i) subject to certain exceptions, the accuracy of the representations and warranties of the other party and (ii) material compliance of the other party with its covenants.

Simultaneously with, and as a condition to, the execution of the Original Merger Agreement, Santos and Slough entered into an Interest Purchase Agreement dated as of July 1, 2005 (the "IPA"), providing for, among other things, the sale to Santos by Slough of all of the debt and equity interests held by Slough, Slough USA and Slough Trading Estates Limited, a United Kingdom limited company and a wholly-owned subsidiary of Slough ("STEL") (collectively, Slough, Slough USA and STEL are referred to as the "Slough Parties"), in the Company and its subsidiaries, and the procurement of a release of the Slough Parties from their guarantees of certain indebtedness of the Company (the "Slough Interests") simultaneously with the closing of the Merger contemplated under the Original Merger Agreement.

Total consideration for the transactions under the Original Merger Agreement and the IPA was fixed at approximately $466 million in cash.

On July 4, 2005, the Company and Santos entered into an Amended and Restated Agreement and Plan of Merger (the "Amended Merger Agreement"), which was approved on July 3, 2005, by the Independent Board Committee of the Board of Directors of the Company, and by the Boards of Directors of both the Company and Santos, amending the provisions of the Merger Agreement to increase the price paid for the Company Common Stock under the Merger from $7.41 to $7.43 per share, to provide that the materiality of representations and warranties by the Company will cease to be a condition to closing the Merger upon the closing of the transactions contemplated by the Amended IPA (defined below), which occurred on July 13, 2005.

On July 4, 2005, Santos and Slough entered into an Amended and Restated Interest Purchase Agreement (the "Amended IPA") to accelerate the acquisition by Santos of the Slough Interests from the date of closing of the Merger, to July 13, 2005. In recognition of the benefit to Slough of an accelerated closing date for purchase of the Slough Interest, Slough agreed to reduce the sale price for its Company Common Stock from $7.41 per share to $7.39 per share, provided that Santos increase the price to be paid to the remaining shareholders in the Merger from $7.41 to $7.43 per share.

The Amended Merger Agreement provides that from and after such closing under the Amended IPA, Santos may appoint a majority of the members of the Company's Board of Directors, subject to the satisfaction of applicable regulatory requirements. Santos is exercising its rights to appoint a majority of the members of the Board of Directors of the Company, which is the reason the Company is providing its shareholders with this Information Statement. Closing under the Amended IPA constituted a change of control of the Company because Santos acquired the Slough Parties' interests in the Company, including Slough USA's holdings of approximately 54% of the Company Common Stock. Pursuant to closing under the Amended IPA, the Company has a commitment from Santos to provide funds for working capital, board-approved capital expenditures and operations through April, 2006. At the closing of the Amended IPA, Douglas Kramer and Marshall D. Lees resigned from the Board of Directors of the Company, and John C. Ellice-Flint and Kathleen A. Hogenson were appointed to the Board of Directors of the Company to fill the vacancies created by such resignations. Both of Mr. Ellice-Flint and Ms. Hogenson are officers and/or directors of Santos and/or its affiliates.

Except as described above, the Amended Merger Agreement does not materially affect any other terms of the Original Merger Agreement, including the total consideration to be paid in the Merger and the acquisition of the Slough Interests, which remains at approximately $466 million.

In the event of a termination of the Amended Merger Agreement under certain circumstances, the Company may be required to pay Santos a termination fee as set forth in the Amended Merger Agreement.

3

The Original Merger Agreement was filed as Exhibit 10.37 to the Company's Current Report on Form 8-K filed on July 8, 2005, and is incorporated herein by reference. The Amended Merger Agreement was filed as Exhibit 10.38 to the Company's Current Report on Form 8-K filed on July 8, 2005, and is also incorporated herein by reference. The forgoing description of the Original Merger Agreement and the Amended Merger Agreement, and the transactions contemplated thereby, does not purport to be complete and is qualified in its entirety by reference to such documents.

In connection with the Merger, the Company will file a proxy statement and may file additional relevant documents with the Securities and Exchange Commission (the "SEC"). Shareholders are urged to read the proxy statement and any other relevant documents filed with the SEC regarding the proposed Merger because they may contain important information. Shareholders will be able to obtain a free copy of the proxy statement, as well as other filings containing information about the Company and Santos, without charge, at the SEC's Internet site (http://www.sec.gov). Copies of the proxy statement and the SEC filings that will be incorporated by reference in the proxy statement can also be obtained, without charge, by directing a request to the Company or Santos.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Except with respect to Santos, which acquired Slough's Company Common Stock on July 13, 2005, the following table sets forth information as of July 1, 2005, regarding the beneficial ownership by persons and entities known by the Company to beneficially own more than 5% of the outstanding Common Stock. Except as otherwise indicated, to the knowledge of the Company, each person or entity whose name appears below has sole voting and investment power over its respective shares of Common Stock.

Name and Address of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership

| | Percentage of Class

| |

|---|

Santos International Holdings Pty Ltd.(1)

Ground Floor, Santos House

91 King William Street

Adelaide 5000

South Australia, Australia | | 24,238,844 | (2) | 56.3 | % |

Wellington Management Company, LLP(3)

75 State Street

Boston, Massachusetts 02109 |

|

5,640,462 |

|

13.6 |

% |

Columbia Wanger Asset Management, L.P.(4)

227 West Monroe Street, Suite 3000

Chicago, Illinois 60606 |

|

2,611,712 |

|

6.3 |

% |

- (1)

- Santos International Holdings Pty Ltd. ("Santos") is a wholly owned subsidiary of Santos Limited ("SL"). The board of directors of SL ultimately exercises voting and dispositive power with regard to the shares of the Company's Common Stock. The principal office of SL is located at Ground Floor, Santos House, 91 King William Street, Adelaide 5000, South Australia, Australia.

- (2)

- Includes 1,700,000 shares covered by warrants, of which 500,000 shares are covered by warrants expiring on December 22, 2005 and exercisable at $3.00 per share and 1,200,000 shares are covered by warrants which expire December 23, 2009 and are exercisable at $2.00 per share.

- (3)

- This information is based on Schedule 13G filed with the United States Securities and Exchange Commission on February 14, 2005 by Wellington Management Company, LLP ("WMC"), parent company of Wellington Trust Company, NA ("WTC"). WTC is a bank as defined in Section 3(a)(6) of the Securities Exchange Act of 1934. WMC is an Investment Adviser registered under Section 203 of the Investment Advisers Act of 1940. WMC, in its capacity as investment adviser, has shared voting power for 5,640,462 shares and shared dispositive power for 5,739,462 shares. It may be deemed to beneficially own 5,739,462 shares which are held on record by clients of WMC.

- (4)

- This information is based on Schedule 13G/A filed with the United States Securities and Exchange Commission on February 11, 2004 by Columbia Wanger Asset Management, L.P. ("WAM"), WAM Acquisition GP, Inc., the general partner of WAM ("WAM GP") and Columbia Acorn Trust ("Columbia"). WAM is an Investment Adviser registered under Section 203 of the Investment Advisers Act of 1940; WAM GP is the General Partner of the Investment Adviser and Columbia is an Investment Company registered under Section 8 of the Investment Company Act. All shares are included in the shares beneficially owned by WAM and WAM GP with shared voting and dispositive power. Columbia claims beneficial ownership as to shared voting and dispositive power over 2,265,000 shares.

5

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Pursuant to closing under the Amended IPA on July 13, 2005, Santos acquired the Slough Parties' indebtedness owed by the Company to the Slough Parties. As of July 13, 2005, the Company owed Santos, our majority shareholder, $23.4 million as set forth in the following table:

Lender

| | Borrower

| | Loan

Initiated

| | USD

Current

Balance

| | Due

Date

| | Annual

Rate

| | Purpose

|

|---|

| Santos | | Company | | March

2003 | | $13.0 Million | | April

2012 | | 13.0 | % | General corporate |

Santos |

|

Company |

|

July

2002 |

|

$10.4 Million |

|

April

2006 |

|

6.8 |

% |

General corporate |

Slough, the parent company of Slough USA and STEL, guaranteed to June 9, 2009 recourse borrowings on the Company's Australian credit facility of $150.0 million AUD that closed in June 2004. As consideration for the guarantee, the Company pays 1% per annum on the daily outstanding balance of the debt guaranteed. During 2004, the Company paid guarantee fees of $425,000. Pursuant to closing under the Amended IPA on July 13, 2005, Santos replaced Slough as guarantor of such credit facility.

In March 2003, the Company entered into a credit facility agreement with STEL allowing the Company to borrow on an unsecured basis up to $8.5 million for the Company's U.S. operations. On September 3, 2004, the borrowing limit of this facility was amended to $13 million. The Company may repay the loan in whole or in part without prepayment penalties. STEL may demand repayment prior to the maturity date of April 2, 2012 provided that STEL gives 18-month notice. The Company is limited in taking on any additional third party indebtedness, either secured or unsecured, or conferring a priority payment in respect of any obligation without first obtaining written approval from STEL so long as the STEL indebtedness exists. In connection with this credit facility, the Company paid STEL arrangement fees of $40,000. The U.S. dollar value of the outstanding balance of this facility as of July 13, 2005, was $13 million. Santos acquired this indebtedness from STEL (and replaced STEL as a lender to the Company thereunder) pursuant to the closing of the transactions under the Amended IPA on July 13, 2005.

In 2002 and in 2005 through July 12, the Company borrowed $4 million and $6.4 million, respectively, from Slough USA which is evidenced by a note payable that bears interest at LIBOR plus 3.5% (6.8% as of July 1, 2005). The note is payable in full on April 30, 2006. Santos acquired this indebtedness from Slough USA (and replaced Slough USA as a lender to the Company thereunder) pursuant to the closing of the transactions under the Amended IPA on July 13, 2005.

During 2004, the Company paid Slough USA and STEL interest on the above loans of approximately $198,000 and $5.5 million, respectively. From January 1, 2005, through June 30, 2005, the Company paid Slough USA and STEL interest on the above loans of approximately $178,000 and $1,300,000, respectively.

Santos QNT Pty Ltd. (an affiliate of Santos, "Santos QNT") entered into a Letter Agreement dated July 9, 2004 and a Term Sheet, dated December 30, 2004, by and among Santos QNT, Tipperary Oil & Gas (Australia) Pty Ltd., a 90%-owned subsidiary of the Company ("TOGA"), and certain other unaffiliated parties to the Company's Comet Ridge joint venture, under which Santos QNT agreed to purchase from the other parties (including TOGA) coalseam gas during the period commencing on July 13, 2004 and concluding on September 30, 2006. The Letter Agreement was for mutually agreeable spot sales through July 13, 2005. The Term Sheet provides that Santos QNT will purchase a minimum of 7,200 and a maximum of 9,700 Mcf of gas per day. During 2004, the Company and its subsidiaries sold 0.8 bcf of coalseam gas for approximately $1.5 million to Santos QNT under the Letter Agreement. From January 1 to June 30, 2005, the Company and its subsidiaries sold 1.1 bcf of coalseam gas for approximately $2 million to Santos QNT under the Term Sheet and Letter Agreement. The Letter Agreement and Term Sheet were entered into prior to the date when Santos or any of its affiliates owned or had any rights to acquire voting securities of the Company or any of its affiliates, and represent negotiated, arms-length transactions entered into between unaffiliated parties.

6

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information as of July 13, 2005, regarding shares of the Company's Common Stock beneficially owned by each director, each Santos designee for director, each executive officer named in the table "Executive Compensation" below and by all executive officers and directors as a group. Except as otherwise indicated, to the knowledge of the Company, each person has sole voting and investment power over his or her respective shares of Common Stock. Options or warrants exercisable within 60 days of July 13, 2005 are included within the total beneficial ownership.

Title of Class

| | Name of

Beneficial Owner

| | Address of

Beneficial Owner

| | Total

Beneficial

Ownership

| | Options or

Warrants

Exercisable

Within

60 Days of

July 13, 2005

| | Percentage

of Class(1)

| |

|---|

| Common Stock—$.02 par value | | David L. Bradshaw | | 633 17th Street, Suite 1800

Denver, CO 80202 | | 755,028 | | 716,900 | | 1.8 | % |

| | | Kenneth L. Ancell | | 952 Echo Lane, Suite 375

Houston, TX 77024 | | 334,158 | | 325,000 | | * | |

| | | Eugene I. Davis | | Five Canoe Brook Drive

Livingston, NJ 07039 | | 90,000 | | 90,000 | | * | |

| | | Charles T. Maxwell | | 145 Mason Street

Greenwich, CT 06830 | | 135,000 | | 75,000 | | * | |

| | | D. Leroy Sample | | 20383 Wildcat Run Drive

Estero, FL 33928 | | 86,178 | | 75,000 | | * | |

| | | Jeff T. Obourn | | 633 17th Street, Suite 1800

Denver, CO 80202 | | 307,000 | | 210,000 | | * | |

| | | Joseph B. Feiten | | 633 17th Street, Suite 1800

Denver, CO 80202 | | 47,500 | | 47,500 | | * | |

| | | John C. Ellice-Flint(2) | | Ground Floor, Santos House

91 King William Street

Adelaide 5000

South Australia, Australia | | 0 | | 0 | | * | |

| | | Kathleen A. Hogenson(2) | | 10111 Richmond Avenue

Suite 500

Houston, Texas 77042 | | 0 | | 0 | | * | |

| | | Benjamin H. Bates(3) | | 10111 Richmond Avenue

Suite 500

Houston, Texas 77042 | | 0 | | 0 | | * | |

| | | Peter C. Wasow(3) | | Ground Floor, Santos House

91 King William Street

Adelaide 5000

South Australia, Australia | | 0 | | 0 | | * | |

| | | Andrew L. Winter(3) | | Ground Floor, Santos House

91 King William Street

Adelaide 5000

South Australia, Australia | | 0 | | 0 | | * | |

| | | Jonathon T. Young(3) | | Ground Floor, Santos House

91 King William Street

Adelaide 5000

South Australia, Australia | | 0 | | 0 | | * | |

| | | Executive officers and directors as a group, 11 in number (including nominees) | | | | 1,754,864 | | | | 4.2 | % |

- (1)

- Securities not outstanding but included in the beneficial ownership of each such person are deemed to be outstanding for the purpose of computing the percentage of outstanding securities owned by such person, but are not deemed to be outstanding for the purpose of computing the percentage of the class owned by any other person. An * designates less than 1%.

7

- (2)

- Mr. Ellice-Flint and Ms. Hogenson were appointed to the Board of Directors of the Company to fill the vacancies left by the resignations of Douglas Kramer and Marshall D. Lees. Such resignations and appointments were effective July 13, 2005.

- (3)

- Messrs. Bates, Wasow, Winter and Young will be appointed to the Board of Directors of the Company not less than ten (10) days following the later to occur of the filing of this Information Statement with the SEC or the mailing of this Information Statement to the shareholders of the Company.

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to us under Rule 16a-3(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") during the fiscal year ended December 31, 2004 and Forms 5 and amendments thereto furnished to us with respect to the fiscal year ended December 31, 2004, as well as any representation from a reporting person that no Form 5 is required, the Company is not aware of any person that failed to file on a timely basis, as disclosed in the aforementioned Forms, reports required by Section 16(a) of the Exchange Act during the fiscal year ended December 31, 2004.

COMMITTEES OF THE BOARD OF DIRECTORS

To assist it in carrying out its duties, the Board has delegated certain authority to four committees whose functions are described below:

Independent Board Committee

Members as at July 12, 2005: Eugene Davis, Charles T. Maxwell, D. Leroy Sample, Kenneth L. Ancell and David L. Bradshaw.

Number of Meetings through July 12, 2005: Seven.

Functions:

The Independent Board Committee was formed by the Board of Directors on January 11, 2005, following the announcement by Slough USA of its intention to sell its interest in the Company. Because Slough USA had two members appointed to the Board, to avoid conflicts of interest the Company created the Independent Board Committee to deal with all matters related to the proposed divestiture by Slough USA. The Board initially appointed non-management, non-employee members of the Board who were not affiliated with Slough USA or Slough: Eugene I. Davis, Charles T. Maxwell and D. Leroy Sample, with Mr. Davis being the Chairman. Messrs. Bradshaw and Ancell were subsequently appointed to the Committee on June 30, 2005. The Committee has all the powers necessary to instruct and direct the officers of the Corporation, and such other agents as it shall deem necessary, to carry out the decisions and recommendations of the Committee, including the power and authority to retain counsel and such other advisors as it deems necessary, including investment banking firms as well as other financial advisors, to represent the Company in respect of the divestiture of the Company Common Stock held by Slough. On February 11, 2005, the Independent Board Committee hired the investment banking firm Houlihan, Loukey, Howard & Zukin to advise the Independent Board Committee on matters related to the Slough divestiture.

Audit Committee

Members at December 31, 2003 and 2004: Directors Davis (Chair), Maxwell and Sample.

Number of Meetings in 2004: Six.

8

Functions:

- •

- Assists the Board in fulfilling its oversight responsibilities as they relate to the Company's accounting policies, internal controls, financial reporting practices and legal and regulatory compliance;

- •

- Hires the independent auditors;

- •

- Monitors the independence and performance of the Company's independent auditors and internal auditors;

- •

- Maintains, through regularly scheduled meetings, a line of communication between the Board and the Company's financial management, internal auditors and independent auditors; and

- •

- Oversees compliance with the Company's policies for conducting business, including ethical business standards.

The Audit Committee consists of three directors, each of whom meets the independence requirements of the American Stock Exchange ("AMEX"). The members of the committee are Eugene I. Davis, who serves as Chairman, Charles T. Maxwell and D. Leroy Sample. Mr. Sample has been determined by the Company's Board of Directors to be a financial expert pursuant to the Securities Act of 1933 and AMEX rules. This committee assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. The Board of Directors adopted an Audit Committee Charter on June 13, 2000 and subsequently amended and restated the Charter on March 19, 2004. The amended and restated Audit Committee Charter may be obtained by writing the Secretary of the Company at our address set forth above.

Compensation Committee

Members at December 31, 2003 and 2004: Directors Davis, Kramer (Chair) and Lees.

Number of Meetings in 2004: One.

Functions:

- •

- Assisting the Board in overseeing the management of the Company's human resources including:

- •

- compensation and benefits programs; and

- •

- CEO performance and compensation; and

- •

- executive development and succession and diversity efforts; and

- •

- Oversees the evaluation of management; and

- •

- Prepares the report of the Committee on executive compensation.

Following the resignation of Messrs. Kramer and Lees, Mr. Ellice-Flint and Ms. Hogenson have become members of the Compensation Committee.

Nominating Committee

Members at December 31, 2003 and 2004: Directors Bradshaw (Chair) and Lees.

Number of Meetings in 2004: One.

Functions:

- •

- Identifies individuals qualified to become board members, consistent with the criteria approved by the Board;

9

- •

- Recommends director nominees and individuals to fill vacant positions;

- •

- Assists the Board in interpreting the Company's Board Governance Guidelines, the Board's Principles of Conduct and any other similar governance documents adopted by the Board;

- •

- Oversees the evaluation of the Board and its committees; and

- •

- Generally oversees the governance of the Board.

Under AMEX rules, the Company is considered to be a "controlled" company due to Santos' majority ownership of the Company; prior to July 13, 2005, the Company was similarly considered to be a "controlled" company due to Slough's majority ownership of the Company. Although the Company is not required to maintain a Nominating Committee due to its "controlled" status, the Company has had a Nominating Committee since 1992. Mr. Bradshaw is employed by the Company as its President and Chief Executive Officer. Mr. Lees is not employed by the Company; however, he is an employee of Slough. Following the resignation of Mr. Lees, as described above, Mr. Ellice-Flint has become a member of the Nominating Committee. Mr. Ellice-Flint is not employed by the Company; however, he is an employee of Santos Limited, the parent of Santos.

This Committee will consider a candidate for director proposed by a stockholder. A candidate must be highly qualified in terms of business experience and be both willing and expressly interested in serving on the Board. A stockholder wishing to propose a candidate for the Committee's consideration should forward the candidate's name and information about the candidate's qualifications to Tipperary Corporation, Nominating Committee, 633 Seventeenth Street, Suite 1800, Denver, Colorado 80202, Attn: David L. Bradshaw, Chairman.

DIRECTORS MEETINGS AND ATTENDANCE

During the fiscal year ended December 31, 2004, there were three meetings of the Company's Board of Directors. All directors attended at least 75% of the board meetings and committee meetings on which such directors served.

COMPENSATION OF DIRECTORS

Directors who are officers or employees of the Company are not compensated for serving as directors or for attending meetings. The Company compensated its nonemployee, outside directors during the fiscal year ended December 31, 2004, at the rate of $8,000 annually and $1,000 for each board meeting attended, and during the fiscal year 2005 at the rate of $20,000 annually and $2,000 for each board meeting attended. Directors are not compensated for attendance at Board committee meetings. Directors designated by Santos and appointed to the Company's Board of Directors will not receive any compensation for serving as directors or attending meetings.

10

EXECUTIVE COMPENSATION

The table below presents the compensation awarded to, earned by, or paid to the Company's President and Chief Executive Officer, its Executive Vice President—Corporate Development, its Senior Vice President and its Chief Financial Officer, for the calendar years ended December 31, 2004 and 2003 and 2002. No other executive officer of the Company received total annual salary and bonus for any year in excess of $100,000.

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| |

| |

| |

| | Awards

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

| |

| | Securities

Underlying

Options &

Warrants

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other

Annual

Compensation(1)

| | All Other

Compensation(2)

|

|---|

David L. Bradshaw,

President & Chief Executive Officer | | 2004

2003

2002 | | $

$

$ | 274,064

271,025

242,333 | | $

$

$ | 80,000

100,000

60,000 | | $

| 84,000

—

— | |

40,000

— | | $

$

$ | 6,500

6,000

5,500 |

Kenneth L. Ancell

Executive Vice President—

Corporate Development |

|

2004

2003

2002 |

|

$

$

$ |

226,645

219,478

216,491 |

|

$

$

$ |

40,000

40,000

40,000 |

|

|

—

—

— |

|

—

10,000

— |

|

$

$

$ |

1,434

1,224

1,887 |

Jeff T. Obourn

Sr. Vice President |

|

2004

2003

2002 |

|

$

$

$ |

193,006

186,521

166,137 |

|

$

$

$ |

60,000

70,000

35,000 |

|

|

8,959

—

— |

|

—

20,000

— |

|

$

$

$ |

2,607

2,375

3,323 |

Joseph B. Feiten

Chief Financial Officer |

|

2004

2003 |

|

$

$ |

138,606

132,309 |

|

$

$ |

20,000

20,000 |

|

|

13,875

— |

|

—

5,000 |

|

$

$ |

1,460

1,300 |

- (1)

- The amounts listed represent the gain on the exercise of options exercised during 2004. The Company furnished other various benefits, the value of which are not reported in this column because the Company has concluded that the aggregate amount of these benefits is less than 10% of cash compensation paid.

- (2)

- Represents the Company's matching contribution to its Section 401(k) Retirement Savings Plan.

There were no stock warrants or options granted to executive officers during the year ended December 31, 2004.

The following table sets forth information with respect to stock warrants and option exercises during the fiscal year ended December 31, 2004, by the named executive officers and the value of such officer's unexercised stock options and warrants at December 31, 2004:

| | Aggregated Warrants and Option Exercises In Last Fiscal Year

And Fiscal Year-End Warrants and Option Values

|

|---|

| |

| |

| |

| |

| | Value of Unexercised

In-the-Money

Warrants and Options

at Fiscal Year End

|

|---|

| |

| |

| | Number of Unexercised

Warrants and Options Held at

Fiscal Year End

|

|---|

| | Shares

Acquired on

Exercise

| | Value Realized

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| David L. Bradshaw | | 80,000 | | $ | 84,000 | | 490,233 | | 26,667 | | $ | 1,187,683 | | $ | 48,267 |

| Kenneth L. Ancell | | — | | | — | | 268,333 | | 6,667 | | $ | 585,283 | | $ | 12,067 |

| Jeff T. Obourn | | 35,000 | | $ | 78,958 | | 171,667 | | 13,333 | | $ | 664,367 | | $ | 24,133 |

| Joseph B. Feiten | | 7,500 | | $ | 13,875 | | 10,833 | | 11,867 | | $ | 19,517 | | $ | 21,033 |

11

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The table below provides certain information as of December 31, 2004 with respect to compensation plans under which equity securities of the Company are authorized for issuance:

Plan category

| | Number of Securities

to Be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

| | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Securities

Remaining Available

for Future Issuance

Under Equity

Compensation Plans

|

|---|

| Equity compensation plans approved by security holders | | 293,500 | | $ | 3.68 | | 284,000 |

| Equity compensation plans not approved by security holders | | 1,201,900 | | $ | 2.49 | | — |

| | |

| | | | |

|

| Total | | 1,495,400 | | $ | 2.70 | | 284,000 |

| | |

| | | | |

|

At December 31, 2004, the Company had 284,000 options outstanding under two plans.

The 1987 Employee Stock Option Plan (the "1987 Plan") provided for option grants for a maximum of 383,000 shares. The 1987 Plan expired December 31, 1996. The 121,000 options outstanding as of December 31, 2004 under this plan have terms of ten years from the dates of grant ending no later than October 2006, an exercise price equal to the fair market value of the stock on the date of grant and qualify as incentive stock options as defined in the Internal Revenue Code of 1986 ("the Code"). These options remain in full force and effect pursuant to each option's terms.

The 1997 Long-Term Incentive Plan (the "1997 Plan") was adopted to replace the expired 1987 Plan. The 1997 Plan was amended in January 2000, to increase the shares of common stock issuable from 250,000 to 500,000 for a period expiring in 2007. The 163,000 options outstanding as of December 31, 2004 under the plan have terms of ten years from the dates of grant and an exercise price equal to the fair market value of the stock on the date of grant. The 1997 Plan provides that participants may be granted awards in the form of incentive stock options, non-qualified options as defined in the Code, stock appreciation rights, performance awards related to the Company's operations, or restricted stock. At December 31, 2004, a total of 293,500 shares were available for future grant.

At December 31, 2004, the Company had 3,191,900 warrants outstanding with directors, employees and non-employees. From time to time, the Company has offered warrants to directors and employees as an incentive to provide long-term service to the Company. The terms of each warrant are negotiated. Less frequently, the Company has offered warrants to consultants as part of their compensation agreements.

12

PERFORMANCE GRAPH

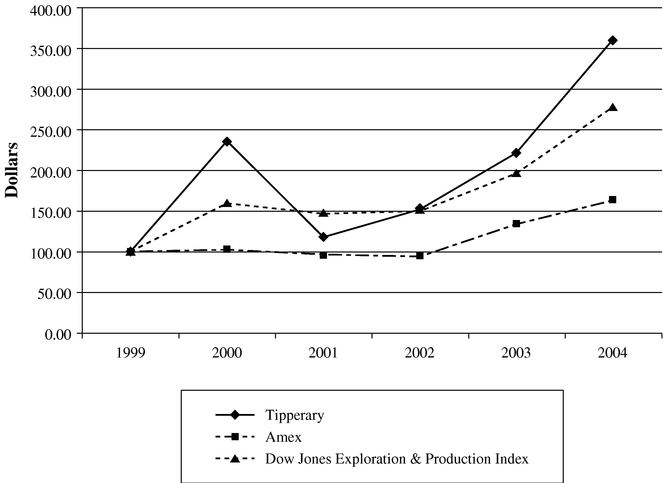

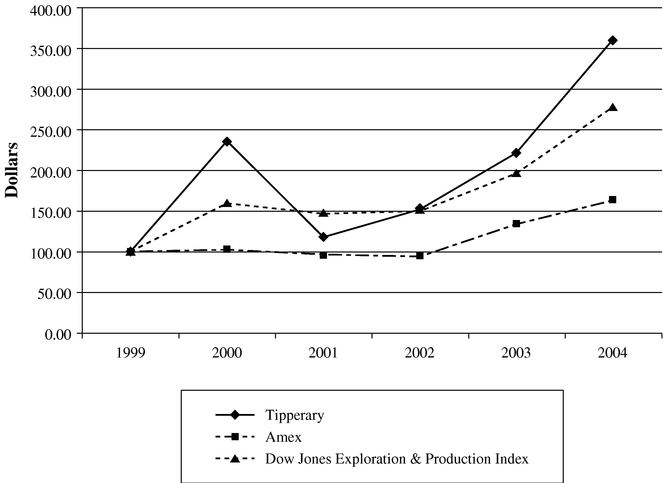

The following graph compares the annual percentage change in the Company's cumulative total shareholder return (stock price appreciation plus reinvested dividends) on Common Stock with the cumulative total return of the American Stock Exchange (AMEX) Composite Index and the Dow Jones Exploration & Production Index ("Peer Group Index") for the period from December 31, 1999 through December 31, 2004. The Peer Group Index includes 55 companies comparable with the Company. The graph assumes that the value of an investment in the Company's Common Stock and each index was $100 on December 31, 1999. Numerical comparisons are presented following the graph.

COMPARISON OF TOTAL RETURN

AMONG TIPPERARY CORPORATION,

PEER GROUP INDEX AND AMEX MARKET VALUE INDEX

13

ASSUMES $100 INVESTED ON DECEMBER 31, 1999

ASSUMES DIVIDENDS REINVESTED

YEAR ENDED DECEMBER 31, 2004

| | YEARS ENDED DECEMBER 31

|

|---|

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

|---|

| Tipperary | | 100.00 | | 236.36 | | 117.82 | | 152.00 | | 221.82 | | 361.45 |

| Amex Market Composite Index | | 100.00 | | 102.38 | | 96.66 | | 94.01 | | 133.83 | | 163.35 |

| Dow Jones Exploration & Production Index | | 100.00 | | 159.71 | | 146.63 | | 149.81 | | 196.34 | | 278.55 |

14

COMPENSATION COMMITTEE REPORT

The Compensation Committee, which is composed of three nonemployee directors, makes recommendations to the Board concerning the compensation of the Company's executive officers. At the end of each year, the Committee evaluates the Company's performance relative to its business plan and its peer group performance. Additionally, each executive officer's contribution to the Company's achievements during the year is evaluated.

The goal of the Compensation Committee is to ensure that the Company employs qualified, experienced executive officers whose financial interest is aligned with that of the shareholders. The Committee considers general industry practice, tax effects and other factors in structuring executive compensation awards. The following is a discussion of forms of compensation currently being utilized.

Base salaries for each of the Company's executive officers are determined by taking into consideration performance, length of tenure with the Company, compensation by industry competitors for comparable positions and career achievements. Salaries paid within the industry are weighted more heavily in setting base salary levels. In order to determine comparable salary levels paid within the industry, the Committee reviews various industry surveys and publicly filed information of its competitors.

In addition to their base salaries, the Company's executive officers may be awarded an annual bonus, depending on Company performance relative to its business plan and the Committee's assessment of the executive officer's personal contribution to such performance. Such performance may be measured by several criteria that are considered important to the Company's success. These criteria are not specifically weighted in the determination of whether to award an annual bonus to an executive officer, since the relative importance of such criteria may change from year to year and the relative responsibilities of each executive officer in the achievement of each of the objectives may differ. Examples of criteria considered are: quantity of oil and gas reserves added; finding cost of oil and gas reserves; control of lifting costs; efficiency of general and administrative expenses, management of exploration projects; and overall financial management.

The Company also utilizes stock warrants and options ("options") as an incentive for executive officers. The size of option grants is dependent on individual performance, level of responsibility and base salary and the number of shares covered by all outstanding options in relation to the total number of outstanding shares of Common Stock and Common Stock equivalents. Options are used in order to align the benefits received by the executive officers with the amount of appreciation realized by the stockholders. Options granted to current officers and directors have been at exercise prices not less than the fair market value of the stock on the date of the grant.

David L. Bradshaw was elected Chief Executive Officer on January 16, 1996. Mr. Bradshaw is currently employed by the Company under a two-year employment agreement entered into September 18, 2001, providing for, among other things, minimum compensation at the rate of $210,000. The agreement will renew automatically for additional two-year periods unless terminated under the terms of the agreement. Mr. Bradshaw's salary for 2002, 2003 and 2004 was $220,000, $250,000 and $255,000, respectively. During 2002, 2003 and 2004 he received bonuses of $60,000, $100,000 and $80,000, respectively. The Compensation Committee reviewed industry salary surveys and determined that Mr. Bradshaw's total cash compensation was comparable to similar positions with industry competitors and reasonable in view of his performance. In evaluating his performance during the last three years and using the above criteria, the Committee considered the significant increase in total proved reserves, the growth of gas sales in Australia, and the accumulation of several domestic exploration prospects. The Committee believes that the combination of stock and cash compensation paid to the chief executive officer is designed to closely align his interests with those of the

15

shareholders, and that his compensation is related directly to his performance as a person with considerable experience and ability in the oil and gas business.

Compensation Committee

as of March 1, 2005

Eugene I. Davis

Douglas Kramer, Chairman

Marshall D. Lees

EMPLOYMENT AGREEMENTS

On September 18, 2001, the Company entered into a two-year employment agreement with David L. Bradshaw for the position of Chairman, President and Chief Executive Officer, providing for, among other things, minimum compensation at the rate of $210,000 per year. In addition, Mr. Bradshaw may receive bonuses at times and in amounts to be determined by the Company's Compensation Committee based upon corporate and individual performance. The agreement will renew automatically for additional two-year periods unless terminated under the terms of the agreement. The employment agreement provides that in the event Mr. Bradshaw's employment is terminated by the Company without cause, other than as a result of death or disability, Mr. Bradshaw will be entitled to any unpaid compensation and bonus, if any, accrued through the date of termination, which shall be one year after notice is given, plus all compensation which accrues for one year following the termination date.

On October 17, 2002, the Company entered into a three-year employment agreement with Kenneth L. Ancell for the position of Executive Vice President—Corporate Development, providing for, among other things, minimum compensation at the rate of $195,000 per year. In addition, Mr. Ancell may receive a performance bonus equal to 20-25% of his basic compensation if he and the Company achieve such performance goals as may reasonably be set in the discretion of management of the Company. The employment agreement provides that in the event Mr. Ancell's employment is terminated by the Company without cause, other than as a result of death or disability, Mr. Ancell will be entitled to any unpaid compensation and bonus, if any, accrued through the date of termination, which requires 15 days notice, plus compensation which accrues for six months following the end of the employment term.

On January 17, 2002, the Company entered into a three-year employment agreement with Jeffrey T. Obourn for the position of Senior Vice President, providing for, among other things, minimum compensation at the rate of $150,000 per year. This agreement was extended for a period of one year on January 6, 2005. In addition, Mr. Obourn may receive bonuses at times and in amounts to be determined by the Company's Compensation Committee and upon approval of the Board of Directors based upon corporate and individual performance. The employment agreement provides that in the event Mr. Obourn's employment is terminated by the Company without cause, other than as a result of death or disability, Mr. Obourn will be entitled to any unpaid compensation and bonus, if any, accrued through the date of termination, which shall be one year after notice is given, plus compensation which accrues for one year following the termination date.

On April 25, 2005, the Company amended the employment agreements described above, and entered into Change in Control Severance Agreements with other key employees, to encourage the retention of certain key employees. The Company entered into Change in Control Severance Agreements with David L. Bradshaw ("Bradshaw"), Chairman, President and Chief Executive Officer, Jeffrey T. Obourn ("Obourn"), Senior Vice President, and Kenneth L. Ancell ("Ancell"), Executive Vice President—Corporate Development, amending each such officer's employment agreement to provide that upon a change in control of the Company, and the executive's termination without cause (as defined in the Employment Agreements) within twenty four (24) months for Bradshaw and eighteen (18) months for Obourn and Ancell following such change in control, the terminated executive will

16

receive the following benefits as severance in lieu of and not in addition to severance benefits set forth in the executive's Employment Agreement:

- •

- a lump-sum severance payment equal to two (2) times (Obourn and Ancell), or three (3) times (Bradshaw), the executive's annual Basic Compensation and the executive's average annual bonus (as measured by annual bonuses paid in 2003, 2004 and January 2005); and

- •

- medical, dental, life, and disability insurance coverage for twenty four (24) months following such termination at levels and a net cost comparable to that provided immediately prior to such termination; and

- •

- outplacement services.

The change in control severance benefits also become payable in the event of constructive termination of the executive within twenty four (24) months for Bradshaw and eighteen (18) months for Obourn and Ancell following such change in control. Constructive termination is defined as:

- •

- a reduction in the executive's basic compensation (unless such reduction is part of an overall Company reduction); or

- •

- the executive is removed from or denied participation in incentive or benefit plans; or

- •

- executive's target incentive benefits are reduced relative to other Company executives; or

- •

- executive is assigned duties or obligations inconsistent with his position with the Company; or

- •

- there is a material adverse change in the nature and scope of the executive's authority or working environment.

The Company also entered into a Change in Control Severance Agreement with Joseph Feiten, Chief Financial Officer, on substantially the same terms as the agreements with Obourn and Ancell. Other than the Change in Control Severance Agreement, Mr. Feiten does not have an employment agreement with the Company.

The Company also entered into Change in Control Severance Agreements with certain non-executive employees on substantially the same terms as the executive change in control severance agreements described above, but providing for one (1) times annual base compensation and average annual bonus upon termination of employment without cause within twelve (12) months following a change in control.

On June 3, 2005, the Company amended provisions of its Change in Control Severance Agreements in order to implement changes to the Company's Key Employee Retention Plan ("KERP"), and to adopt KERP benefits for other employees not previously covered by the Change in Control Severance Agreements. To encourage officers and employees to remain employed with the Company while Slough sold its interest in the Company and through any resulting merger process, the Company amended the employment agreements of Bradshaw, Obourn, and Ancell to provide that on September 30, 2005 each such person will receive a bonus equal to 35% of their annual base compensation, if they remain an officer of the Company through that date, or if they are terminated before September 30, 2005 without cause following a change of control they will receive the bonus amount upon such termination. Such bonuses approximate $235,000 in total.

The Company also amended its Change in Control Severance Agreements with Mr. Feiten, and several other employees of the Company and its Australian subsidiary Tipperary Oil and Gas (Australia) Pty Ltd, providing that on September 30, 2005, each such person will receive a bonus equal to 35% of their annual base compensation, if they remain an employee of the Company through that date, or if they are terminated before September 30, 2005 without cause following a change of control they will receive the bonus amount upon such termination. Such bonuses approximate $400,000 in total.

17

The Company also granted change-in-control severance benefits to certain employees not covered under the original Change in Control Severance Agreements, providing them with a payment of 35% of their base salary should such employees be terminated without cause within six months of a change in control and a payment of 35% of their base salary payable on September 30, 2005 should such employees remain employed with the company or its applicable affiliates through such date. These contingent severance benefits, if applicable, approximate $400,000 in total.

EXECUTIVE OFFICERS AND DIRECTORS

Following the expiration of the 10-day period beginning on the later of the date of the filing of this Information Statement with the SEC pursuant to Rule 14f-1 or the date of mailing of this Information Statement to the Company's shareholders, the Company's Board of Directors will be reconstituted and fixed at eleven directors. On that date, Messrs. Wasow, Young, Winter and Bates will be appointed to the Company's Board of Directors. The following discussion sets forth information regarding the Company's current executive officers and directors and the Company's proposed directors following the closing of the transactions under the Amended IPA, which occurred on July 13, 2005. There are currently no changes contemplated to the Company's executive officers between the closing of the transactions under the Amended IPA and the closing of the Merger. If any proposed director listed in the table below should become unavailable for any reason, which the Company does not anticipate, the directors will vote for a substitute nominee or nominees who may be designated by Santos prior to the date the new directors take office.

The Company has determined that three of the continuing directors listed below are "independent" as defined by the AMEX. Messrs. Bradshaw and Ancell are not independent since they are also employees of the Company. Mr. Ellice-Flint and Ms. Hogenson are also officers and directors of our majority shareholder, Santos, or its related affiliates.

The following sets forth information as of July 13, 2005, with respect to each continuing director:

David L. Bradshaw, 50, has been a director of the Company since January 23, 1990, and became President and Chief Executive Officer of the Company on January 16, 1996. Mr. Bradshaw, a certified public accountant, began his employment with the Company in January 1986, and has held various positions with the Company, including Chief Financial Officer and Chief Operating Officer, prior to his current position. Prior to joining the Company, Mr. Bradshaw was an officer and owner in a privately held oil and gas company.

Kenneth L. Ancell, 62, was elected to the Board of Directors on July 11, 1996, and became Executive Vice President—Corporate Development of the Company in 1999. For 17 years before joining the Company as an employee, Mr. Ancell was a petroleum engineer and a principal in a Houston-based consulting engineering firm. Prior to forming this consulting firm, Mr. Ancell was employed as a petroleum engineer by various energy companies developing coalseam gas projects. He has served as a senior project advisor for the United Nations coalseam gas project in China, and was a Distinguished Lecturer on coalseam gas reserves for the Society of Petroleum Engineers. Mr. Ancell has expertise in oil and gas recovery processes and more than 25 years of coalseam gas experience.

Eugene I. Davis, 50, was elected to the Board of Directors on September 2, 1992, and had served as independent legal counsel to the Company from 1984 until 1992. In 1999, he became Chairman and Chief Executive Officer of PIRINATE Consulting Group, L.L.C., a privately held consulting firm specializing in crisis and turn-around management, merger and acquisition consulting, hostile and friendly takeovers, proxy contests and strategic planning advisory services for public and private business entities. Mr. Davis was Chairman, Chief Executive Officer and President of RBX Industries, Inc. from August 2001 to December 2003, after having been appointed Chief Restructuring Officer in January 2001. From January 2000 through August 2001, Mr. Davis was Chairman and Chief Executive Officer of Murdock Communications Corp., a NASDAQ listed company. From May 1999

18

through June 2001, he was the Chief Executive Officer of SmarTalk Teleservices, Inc., which had filed a petition under Chapter 11 of the Federal Bankruptcy Code in March 1999. He was Chief Operating Officer of TotalTel USA Communications, Inc. in 1998. Both SmarTalk Teleservices, Inc. and TotalTel USA Communications, Inc. were NASDAQ listed companies. He is a director of Metals USA, Inc., and Knology, Inc., which are public companies, and Eagle Geophysical, Inc. In addition, he is a member of the Board of Advisors of PPM America Special Investment Funds. In 2004, he became a board member of Exide Technologies and chairman of the board of Atlas Air Worldwide Holdings, both of which are public companies.

John C. Ellice-Flint, 54, was appointed to the Board of Directors on July 13, 2005. Mr. Ellice-Flint is Managing Director of Santos Limited, a major publicly held Australian oil and gas exploration and production company. Mr. Ellice-Flint is also a director of Santos Limited. Mr. Ellice-Flint joined Santos Limited in 2000; prior to that time, he was Senior Vice President: Global Exploration and Technology for Unocal Corporation. Mr. Ellice-Flint has 32 years' experience in the international oil and gas industry. Mr. Ellice-Flint serves as an officer and/or director of various affiliates of Santos Limited.

Kathleen A. Hogenson, 45, was appointed to the Board of Directors on July 13, 2005. Ms. Hogenson is President and Chairman of Santos USA Corp., a wholly-owned affiliate of Santos Limited, with primary responsibility for upstream exploration and production growth in the United States. Ms. Hogenson is also a director of Santos Americas and Europe Corporation, which is also a wholly-owned affiliate of Santos Limited. Prior to 2001, Ms. Hogenson was Vice President of Exploration and Production Technology for Unocal Corporation.

Charles T. Maxwell, 73, has been a director of the Company since May 2000. Mr. Maxwell is senior energy analyst with Weeden & Co. L.P., Greenwich, CT, serving institutional clients in the US and abroad. He is also a director of Chesapeake Energy Corporation (CHK-NYSE), a prominent independent gas producer in the US Mid-Continent area. Mr. Maxwell was formerly vice chairman and senior energy strategist at Cyrus J. Lawrence, Inc., then a member firm of the New York Stock Exchange, where he worked for 29 years. Mr. Maxwell is a director of Lescarden, Inc., a publicly held biomedical products company founded in 1960 and is a director of American Distributed Generation, Inc., a privately held company founded in 2002 that makes and sells cogeneration systems to commercial firms.

D. Leroy Sample, 63, was elected to the Board of Directors on November 30, 2000. Mr. Sample was a business assurance partner in the international accounting firm of PricewaterhouseCoopers LLP in Chicago for 24 years until he retired in July 1999. He began his career with the firm in 1963. Mr. Sample is a certified public accountant.

Following the expiration of the 10-day period beginning on the later of the date of the filing of this Information Statement with the SEC pursuant to Rule 14f-1 or the date of mailing of this Information Statement to the Company's shareholders, the following persons will be appointed to the Company's Board of Directors:

Benjamin H. Bates, 55. Mr. Bates is Vice President of Strategic Development and a director of Santos USA Corp., a wholly-owned affiliate of Santos Limited, with primary responsibility for acquisitions, divestments and business development in the United States. Prior to 2003, Mr. Bates was Vice President of Projects for Randall & Dewey Inc., a privately held upstream oil and gas transaction advisory firm, with primary responsibility for project management and business development.

Peter C. Wasow, 46. Mr. Wasow is the Chief Financial Officer of Santos Limited, a position he has held since 2002. From 1994 to 2001, Mr. Wasow held various positions with BHP Limited, a diversified natural resources company, and its affiliates, most recently Vice President Finance with BHP Limited from 2000 to 2001, and Chief Financial Officer and Strategist with BHP Services from 1999 to 2000. Mr. Wasow serves as an officer and/or director of various affiliates of Santos Limited.

19

Andrew L. Winter, 43. Mr. Winter is the Group Executive Corporate Development of Santos Limited, a position he has held since 2002. From 1996 to 2002, Mr. Winter was Manager Commercial for Santos Limited.

Jonathon T. Young, 45. Mr. Young is the Executive Vice President—Operations of Santos Limited, a position he has held since 2004. From 2002 to 2004, Mr. Young was General Manager, Central Business Unit for Santos Limited. From 2000 to 2002, Mr. Young was General Manager, SA Business Unit for Santos Limited. Prior to joining Santos Limited in 2000, Mr. Young was the Chief Executive Officer of Mobil Ltd. India and he previously held positions with Mobil spanning 17 years.

In addition to information regarding Messrs. Bradshaw and Ancell set forth above, the following sets forth information with respect to the remainder of the Company's executive officers:

Jeff T. Obourn, 47, has been a Senior Vice President of the Company since January 16, 1996. He became employed as the Company's Vice President—Land on February 1, 1993. From 1987 to 1993, Mr. Obourn was President of Obourn Brothers, Inc., of Englewood, Colorado, an oil and gas land brokerage business.

Joseph B. Feiten, 52, a certified public accountant, has been the Company's Chief Financial Officer since June 10, 2002. In April 2002, Mr. Feiten returned to consulting to the oil and gas industry after having resigned from PricewaterhouseCoopers in June 2000 to become president of a privately-held company serving pediatricians and children's hospitals. After the merger of Price Waterhouse with Coopers in 1998, Mr. Feiten was the global director of training for the firm's Global Energy & Mining industry program. From 1991 to 1998, he was the director of Coopers & Lybrand's US oil and gas industry program.

There are no family relationships between or among the executive officers, the continuing directors and nominees to the Board of Directors of the Company. There are no arrangements or understandings between any of the directors or nominees or any other person pursuant to which any person was or is to be elected as a director or nominee, other than as discussed with respect to the Merger and the transactions contemplated under the Amended IPA.

LEGAL PROCEEDINGS

The Company is not aware of any legal proceedings in which Santos, any director, officer or any owner of record or beneficial owner of more than five percent of any class of the Company's voting securities, or any affiliate of Santos, or of any affiliate of any director, officer, affiliate of the Company or security holder, is a party adverse to the Company or has a material interest adverse to the Company.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

Because of the Company's small size, to date it has not developed formal processes by which shareholders may communicate directly with directors. Instead, the Company believes that its informal process by which any communication sent to the Board of Directors either generally or in care of a corporate officer, has served the shareholders' needs. In view of recently adopted SEC disclosure requirements related to this issue, the Board of Directors expects to review in the coming months whether more specific procedures are required. Until any other procedures are developed and posted on the Company's web site at www.tipperarycorp.com, any communication to the Board of Directors may be mailed to the Board, in care of the Secretary of the Company, at 633 Seventeenth Street, Suite 1800, Denver, Colorado 80202. Shareholders should clearly note on the mailing envelope that the letter is a "Shareholder-Board Communication." All such communications should identify the author as a shareholder and clearly state whether the intended recipients are all members of the board of directors

20

or just certain specified individual directors. The Secretary of the Company will make copies of all such communications and circulate them to the appropriate director or directors.

ADDITIONAL INFORMATION

Additional information about the Merger and related transactions is contained in the Company's Current Reports on Form 8-K filed on July 1, 2005 and July 8, 2005, pursuant to Section 13 of the Exchange Act. All of the Company's periodic reports and proxy and information statements may be inspected without charge at the public reference section of the SEC at Judiciary Plaza, 450 Fifth Street, N.W., Washington, D.C. 20549. Copies of this material also may be obtained from the SEC at prescribed rates. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding public companies that file reports with the SEC. Copies of the Company's filings may be obtained from the SEC's website at http://www.sec.gov.

Dated: July 13, 2005

| | | By order of the Board of Directors: |

|

|

By: |

/s/ DAVID L. BRADSHAW

David L. Bradshaw,

Chief Executive Officer and

Chairman of the Board |

21

QuickLinks

INFORMATION STATEMENT PURSUANT TO SECTION 14(f) OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED, AND RULE 14f-1 THEREUNDERREPORT OF CHANGE IN MAJORITY DIRECTORS July 15, 2005CHANGE OF CONTROLSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERSCERTAIN RELATIONSHIPS AND RELATED TRANSACTIONSSECURITY OWNERSHIP OF MANAGEMENTCOMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACTCOMMITTEES OF THE BOARD OF DIRECTORSDIRECTORS MEETINGS AND ATTENDANCECOMPENSATION OF DIRECTORSEXECUTIVE COMPENSATIONSUMMARY COMPENSATION TABLESECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANSPERFORMANCE GRAPHCOMPENSATION COMMITTEE REPORTEMPLOYMENT AGREEMENTSEXECUTIVE OFFICERS AND DIRECTORSLEGAL PROCEEDINGSSHAREHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORSADDITIONAL INFORMATION