Nicholas Financial, Inc. (NASDAQ: NICK) Annual General Shareholders Meeting – August 30, 2022, Charlotte, NC Exhibit 99.1

FORWARD LOOKING STATEMENTS The statements contained in this Presentation that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 31E of the Securities Exchange Act of 1934, including statements regarding the Company’s expectations, hopes, beliefs, intentions, or strategies regarding the future. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. All forward-looking statements included in this document are based on information available to the Company on the date hereof and the Company assumes no obligation to update any such forward-looking statement. Prospective investors should also consult the risks described from time to time in the Company’s Reports on Forms 10-K, 10-Q and 8-K and Annual Reports to Shareholders.

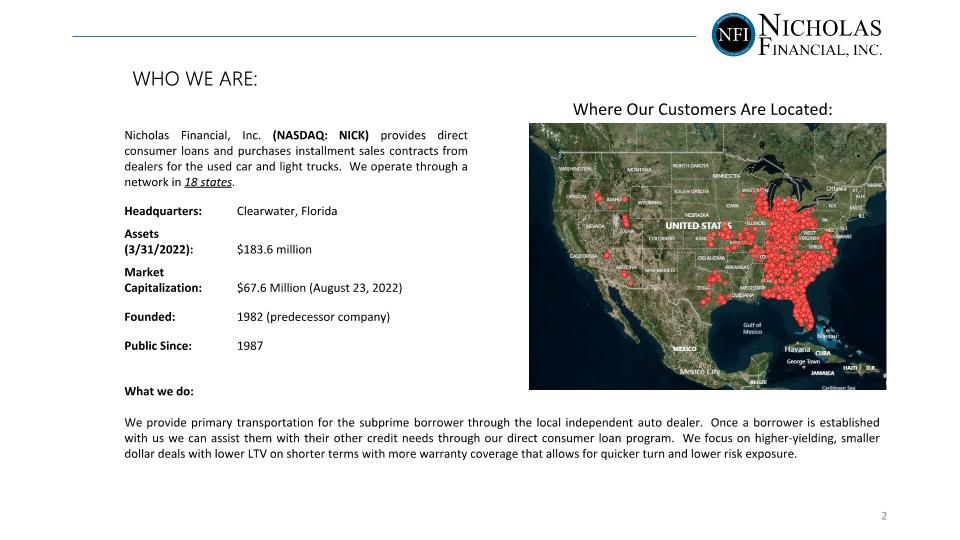

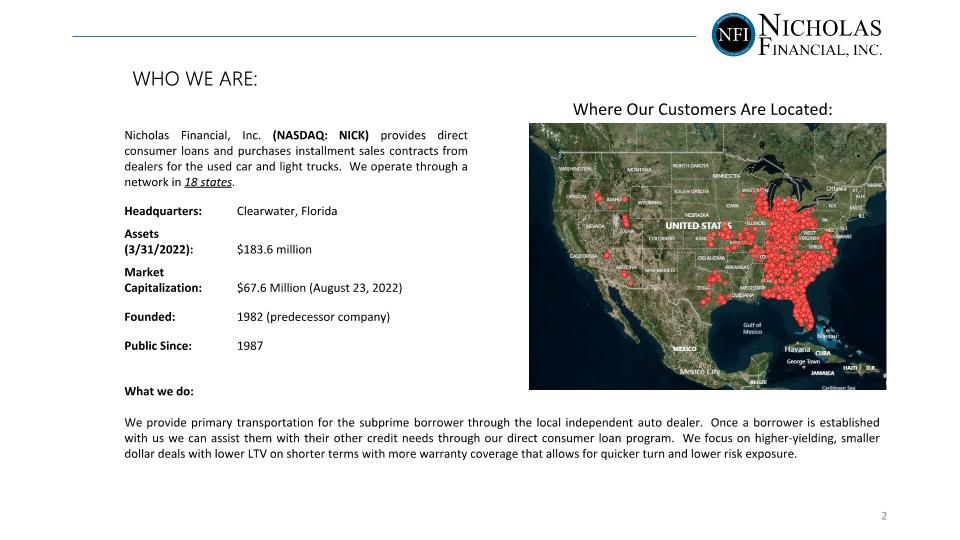

WHO WE ARE: Nicholas Financial, Inc. (NASDAQ: NICK) provides direct consumer loans and purchases installment sales contracts from dealers for the used car and light trucks. We operate through a network in 18 states. Headquarters: Clearwater, Florida Assets (3/31/2022): $183.6 million Market Capitalization: $67.6 Million (August 23, 2022) Founded: 1982 (predecessor company) Public Since: 1987 What we do: We provide primary transportation for the subprime borrower through the local independent auto dealer. Once a borrower is established with us we can assist them with their other credit needs through our direct consumer loan program. We focus on higher-yielding, smaller dollar deals with lower LTV on shorter terms with more warranty coverage that allows for quicker turn and lower risk exposure. Where Our Customers Are Located:

Material Investment in Personnel Training and Development Continual Reinvestment in Technology and Digital Enhancements Increased Focus on Direct Loan Program Proliferation and Strengthening of Proven Business Model Refinance main credit facility Highlights of Fiscal Year 2022: Existing locations Expansion

Fiscal Year Q1-FY23 Contracts Originations

Cost savings reorganization plan – July 2022 We recently consolidated the following branch locations to reduce operating expenses and become more efficient: Ocala, FL Melbourne, FL Columbia, SC Salt Lake City, UT Boise, ID Detroit, MI Louisville, KY South Florida Grand Rapids, MI Houston, TX Milwaukee, WI We also stopped all expansion efforts in Texas. We will continue remote originations and servicing efforts in exited markets from the remaining branches.

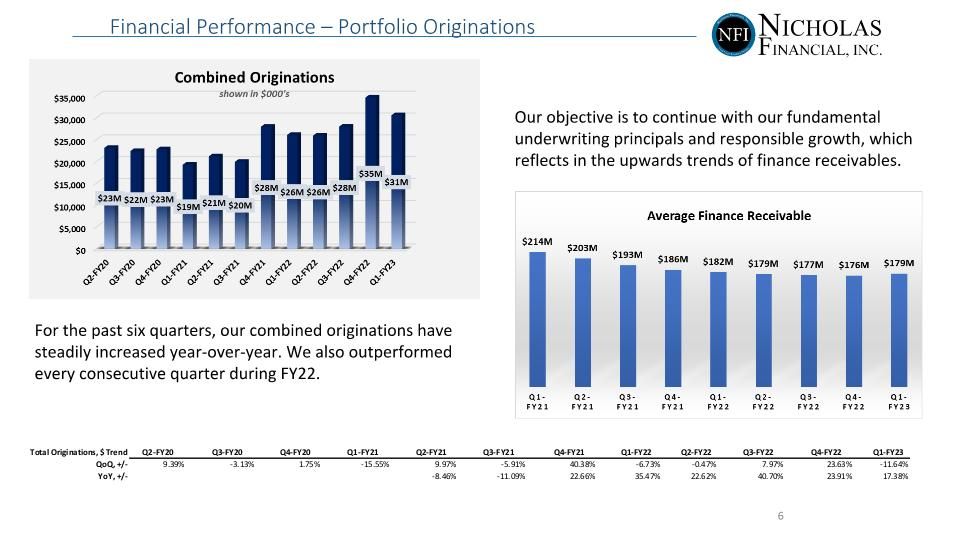

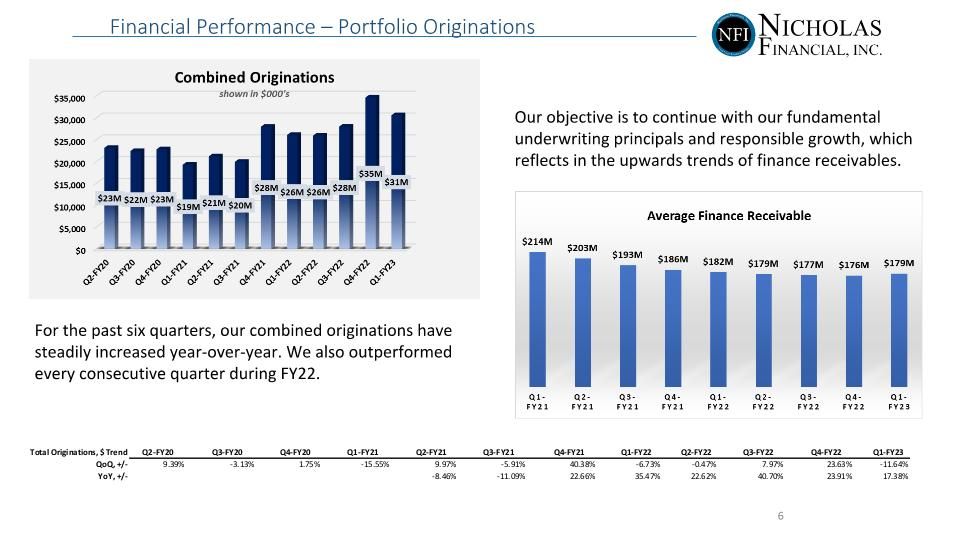

Financial Performance – Portfolio Originations For the past six quarters, our combined originations have steadily increased year-over-year. We also outperformed every consecutive quarter during FY22. Our objective is to continue with our fundamental underwriting principals and responsible growth, which reflects in the upwards trends of finance receivables. $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 $0 Q2-FY20 Q3-FY20 Q4-FY20 Q1-FY21 Q2-FY21 Q3-FY21 Q4-FY21 Q1-FY22 Q2-FY22 Q3-FY22 Q4-FY22 Q1-FY23 $214M $203M $193M $186M $182M $179M $177M $176M $179M Q1-FY21 Q2-FY21 Q3-FY21 Q4-FY21 Q1-FY22 Q2-FY22 Q3-FY22 Q4-FY22 Q1-FY23 Total Origination, $ Trend Q2-FY20 Q3-FY20 Q4-FY20 Q1-FY21 Q2-FY21 Q3-FY21 Q4-FY21 Q1-FY22 Q2-FY22 Q3-FY22 Q4-FY22 Q1-FY23 QoQ, +/- 9.39% -3.13% 1.75% -15.55% 9.97% -5.91% 40.38% -6.73% -0.47% 7.97% 23.63% -11.64% YoY, +/- -8.46% -11.09% 22.66% 35.47% 22.62% 40.70% 23.91% 17.38%

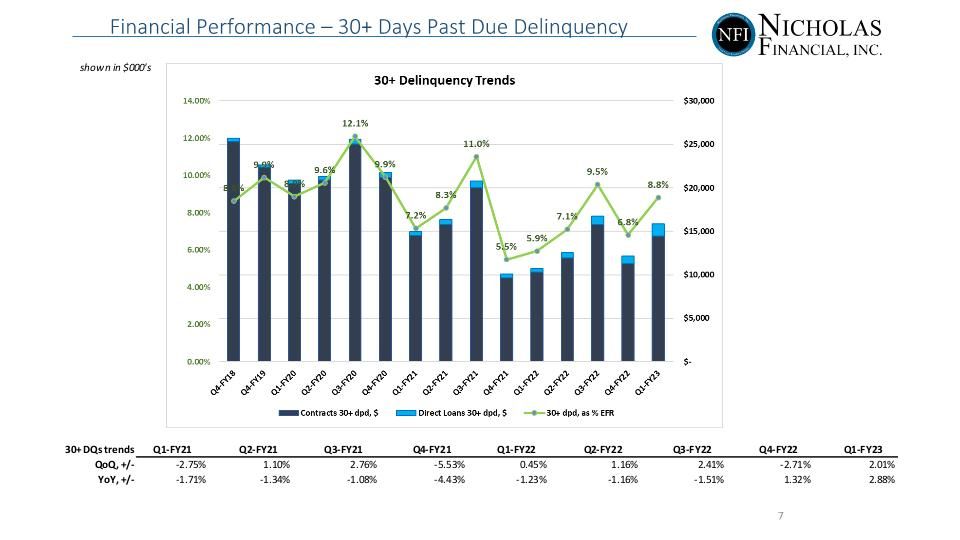

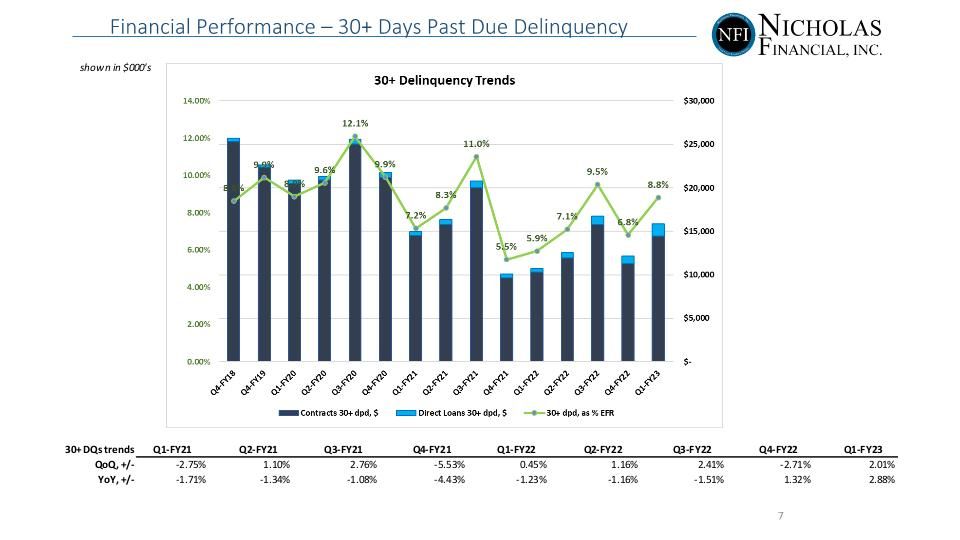

Financial Performance – 30+ Days Past Due Delinquency 30+ DQs trends Q1-FY21 Q2-FY21 Q3-FY21 Q4-FY21 Q1-FY22 Q2-FY22 Q3-FY22 Q4-FY22 Q1-FY23 QoQ, +/- -2.75% 1.10% 2.76% -5.53% 0.45% 1.16% 2.41% -2.71% 2.01% YoY, +/- -1.71% -1.34% -1.08% -4.43% -1.23% -1.16% -1.51% 1.32% 2.88%

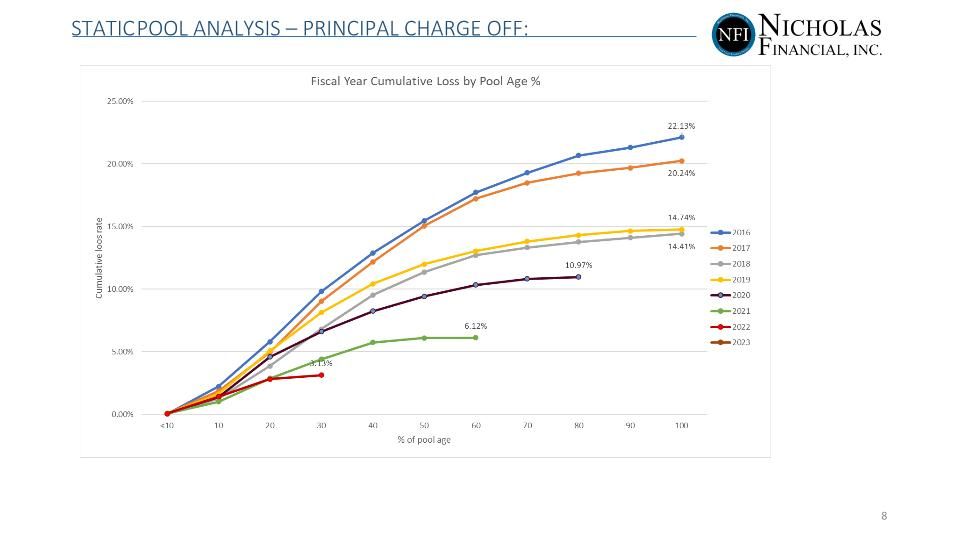

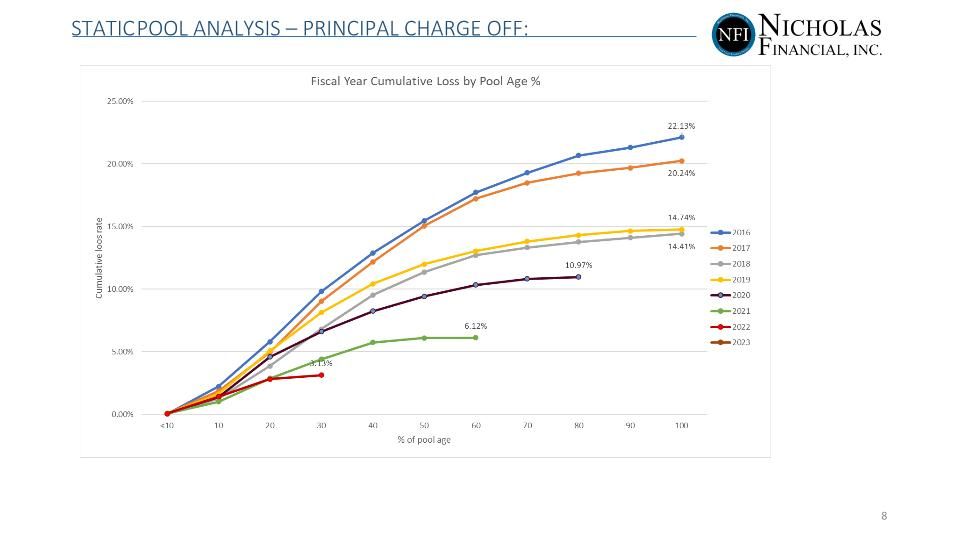

STATIC POOL ANALYSIS – PRINCIPAL CHARGE OFF:

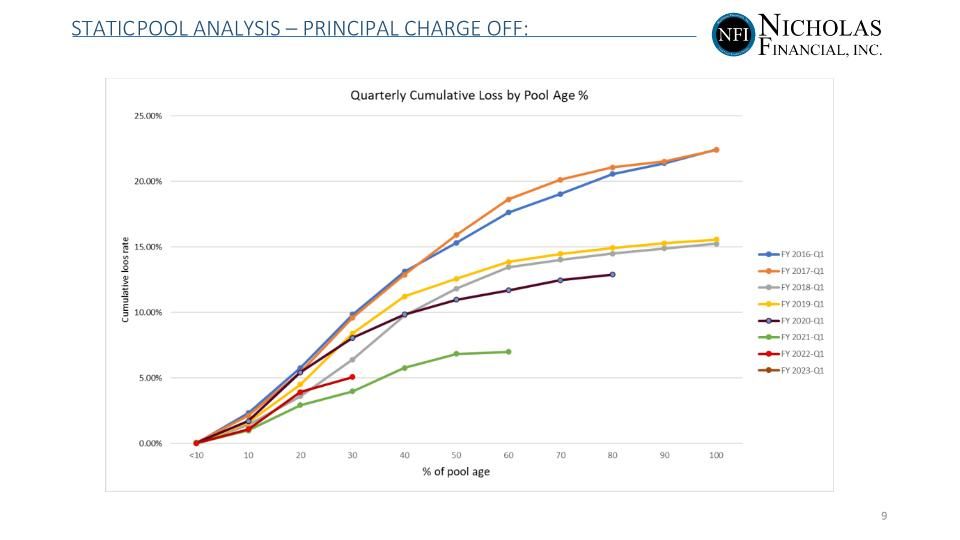

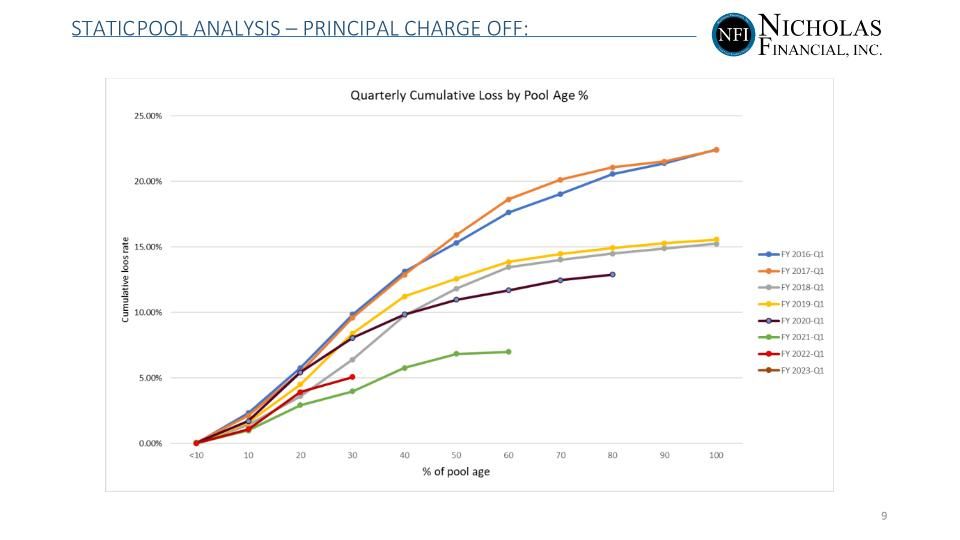

STATIC POOL ANALYSIS – PRINCIPAL CHARGE OFF:

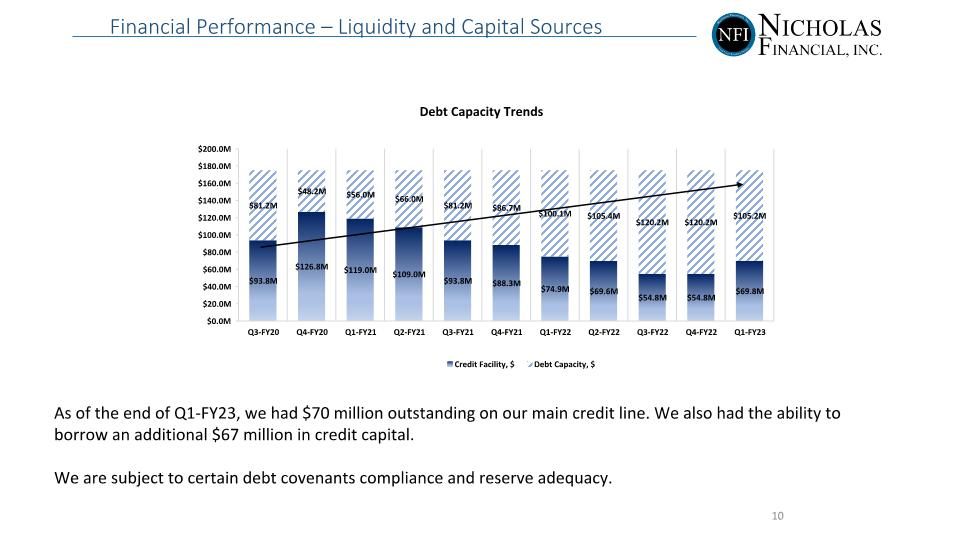

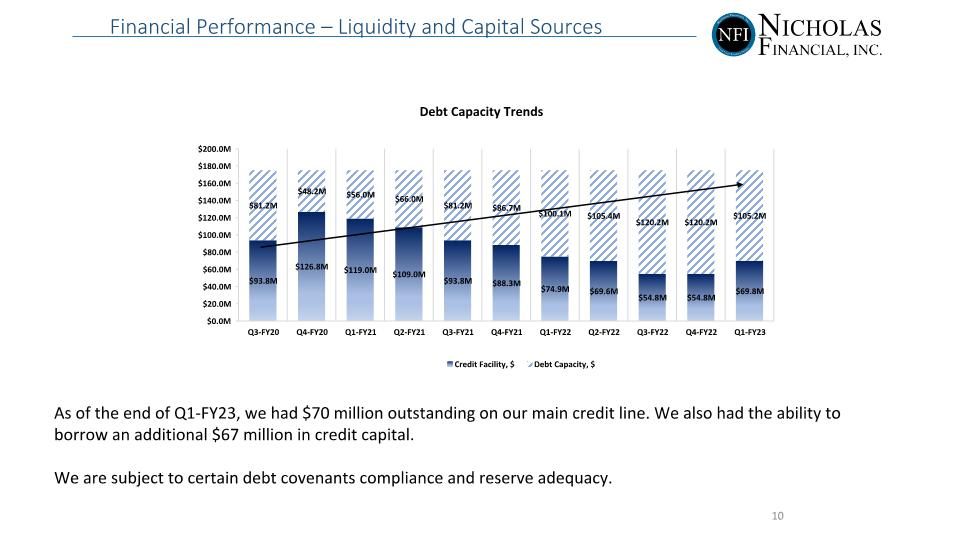

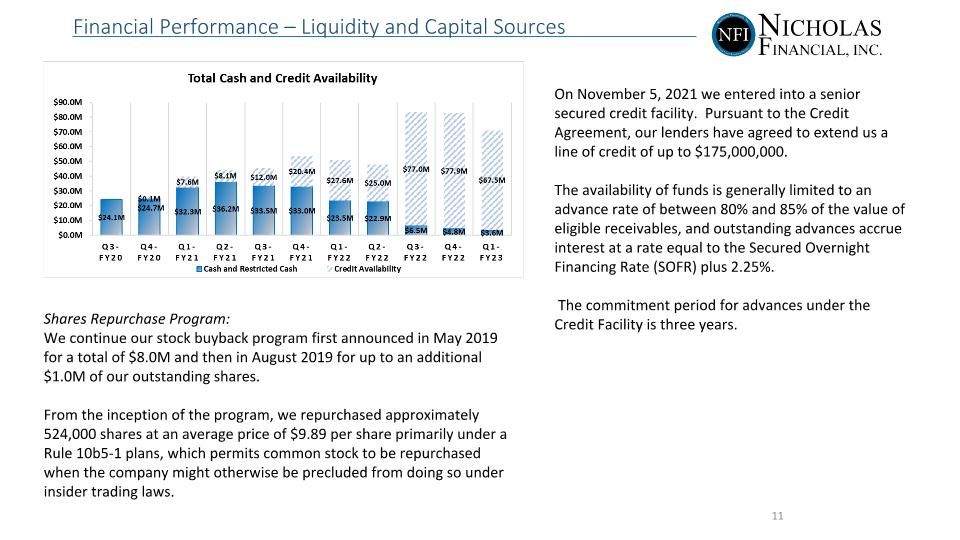

Financial Performance – Liquidity and Capital Sources As of the end of Q1-FY23, we had $70 million outstanding on our main credit line. We also had the ability to borrow an additional $67 million in credit capital. We are subject to certain debt covenants compliance and reserve adequacy.

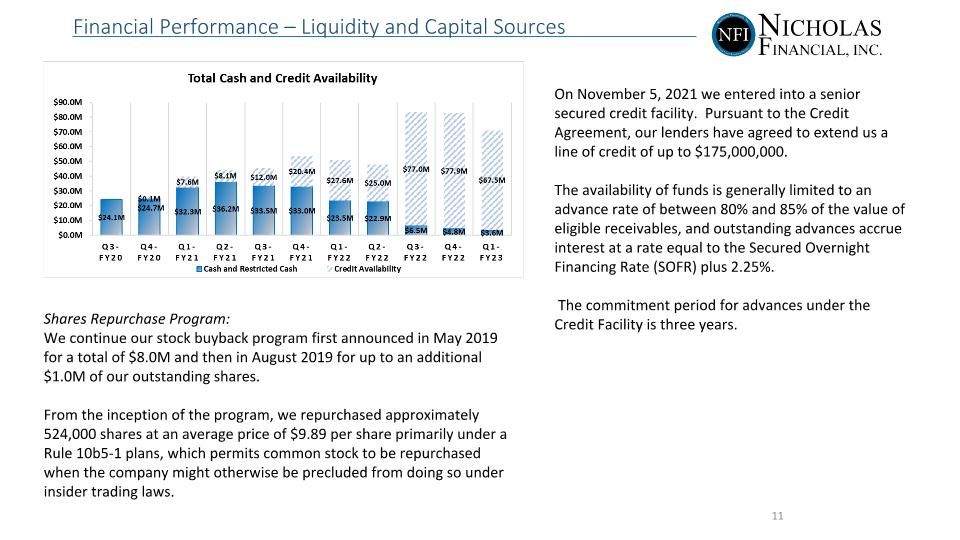

Financial Performance – Liquidity and Capital Sources On November 5, 2021 we entered into a senior secured credit facility. Pursuant to the Credit Agreement, our lenders have agreed to extend us a line of credit of up to $175,000,000. The availability of funds is generally limited to an advance rate of between 80% and 85% of the value of eligible receivables, and outstanding advances accrue interest at a rate equal to the Secured Overnight Financing Rate (SOFR) plus 2.25%. The commitment period for advances under the Credit Facility is three years. Shares Repurchase Program: We continue our stock buyback program first announced in May 2019 for a total of $8.0M and then in August 2019 for up to an additional $1.0M of our outstanding shares. From the inception of the program, we repurchased approximately 524,000 shares at an average price of $9.89 per share primarily under a Rule 10b5-1 plans, which permits common stock to be repurchased when the company might otherwise be precluded from doing so under insider trading laws.

Q&A