Exhibit 99.1

2015 ANNUAL REPORT

Reimagine Your Business

| | |

| | The Best-Run Businesses Run SAP® |

Key Facts

PERFORMANCE SUMMARY

| | | | | | | | | | | | |

€ millions, unless otherwise stated | | 2015 | | | 2014 | | | D in % | |

| Revenues | | | | | | | | | | | | |

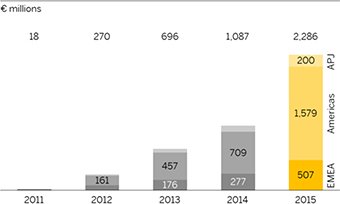

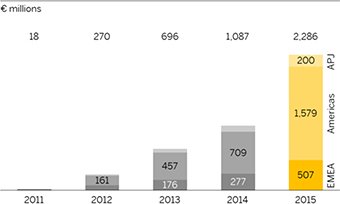

Cloud subscriptions and support (IFRS) | | | 2,286 | | | | 1,087 | | | | 110 | |

Cloud subscriptions and support (non-IFRS) | | | 2,296 | | | | 1,101 | | | | 109 | |

Software licenses and support (IFRS) | | | 14,928 | | | | 13,228 | | | | 13 | |

Software licenses and support (non-IFRS) | | | 14,930 | | | | 13,233 | | | | 13 | |

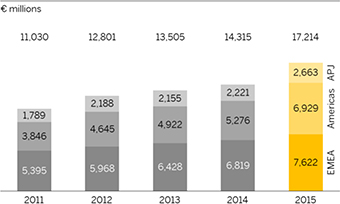

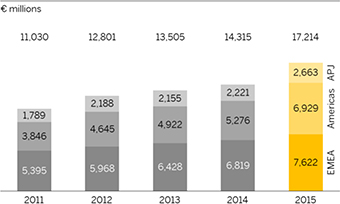

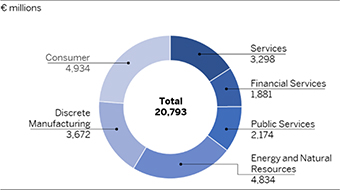

Cloud and software (IFRS) | | | 17,214 | | | | 14,315 | | | | 20 | |

Cloud and software (non-IFRS) | | | 17,226 | | | | 14,334 | | | | 20 | |

Services (IFRS = non-IFRS) | | | 3,579 | | | | 3,245 | | | | 10 | |

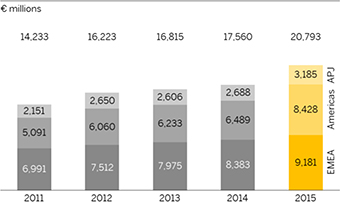

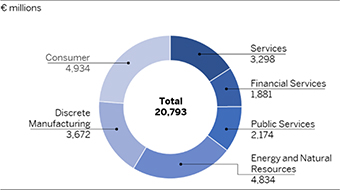

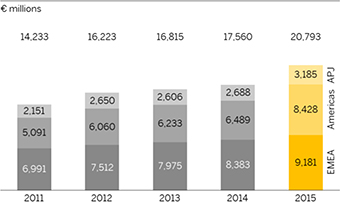

Total revenue (IFRS) | | | 20,793 | | | | 17,560 | | | | 18 | |

Total revenue (non-IFRS) | | | 20,805 | | | | 17,580 | | | | 18 | |

Applications, Technology & Services Segment revenue | | | 19,126 | | | | 16,871 | | | | 13 | |

SAP Business Network Segment revenue | | | 1,614 | | | | 644 | | | | 150 | |

| | | |

| Operating expenses | | | | | | | | | | | | |

Cost of cloud subscriptions and support (IFRS) | | | 1,022 | | | | 481 | | | | 112 | |

Cost of cloud subscriptions and support (non-IFRS) | | | 789 | | | | 393 | | | | 101 | |

Cost of software licenses and support (IFRS) | | | 2,291 | | | | 2,076 | | | | 10 | |

Cost of software licenses and support (non-IFRS) | | | 2,008 | | | | 1,818 | | | | 10 | |

Cost of cloud and software (IFRS) | | | 3,313 | | | | 2,557 | | | | 30 | |

Cost of cloud and software (non-IFRS) | | | 2,797 | | | | 2,211 | | | | 27 | |

Cost of services (IFRS) | | | 3,313 | | | | 2,716 | | | | 22 | |

Cost of services (non-IFRS) | | | 3,133 | | | | 2,590 | | | | 21 | |

Total cost of revenue (IFRS) | | | 6,626 | | | | 5,272 | | | | 26 | |

Total cost of revenue (non-IFRS) | | | 5,930 | | | | 4,801 | | | | 24 | |

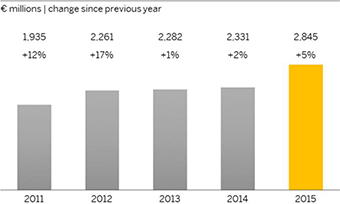

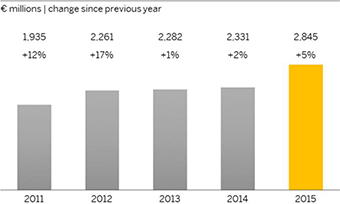

Research and development (IFRS) | | | 2,845 | | | | 2,331 | | | | 22 | |

| | | |

| Profits and Margins | | | | | | | | | | | | |

Cloud subscriptions and support margin (as a percentage of corresponding revenue, IFRS) | | | 55.3 | | | | 55.8 | | | | -1 | |

Cloud subscriptions and support margin (as a percentage of corresponding revenue, non-IFRS) | | | 65.6 | | | | 64.3 | | | | 2 | |

Cloud and software margin (as a percentage of corresponding revenue, IFRS) | | | 80.8 | | | | 82.1 | | | | -2 | |

Cloud and software margin (as a percentage of corresponding revenue, non-IFRS) | | | 83.8 | | | | 84.6 | | | | -1 | |

Services margin (as a percentage of corresponding revenue, IFRS) | | | 7.4 | | | | 16.3 | | | | -54 | |

Services margin (as a percentage of corresponding revenue, non-IFRS) | | | 12.5 | | | | 20.2 | | | | -38 | |

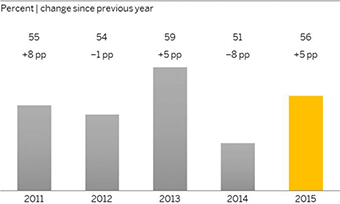

Total gross margin (as a percentage of total revenue, IFRS) | | | 68.1 | | | | 70.0 | | | | -3 | |

| | | | | | | | | | | | |

€ millions, unless otherwise stated | | 2015 | | | 2014 | | | D in % | |

Total gross margin (as a percentage of total revenue, non-IFRS) | | | 71.5 | | | | 72.7 | | | | -2 | |

Applications, Technology & Services Segment gross margin (as a percentage of corresponding revenue, IFRS) | | | 72 | | | | 73 | | | | -1 | |

SAP Business Network Segment gross margin (as a percentage of corresponding revenue, IFRS) | | | 67 | | | | 66 | | | | 1 | |

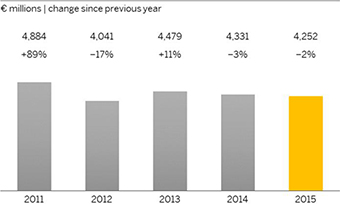

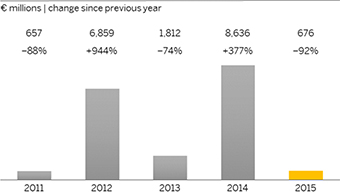

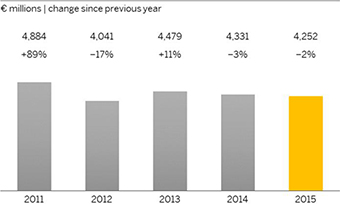

Operating profit (IFRS) | | | 4,252 | | | | 4,331 | | | | -2 | |

Operating profit (non-IFRS) | | | 6,348 | | | | 5,638 | | | | 13 | |

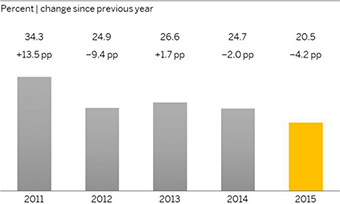

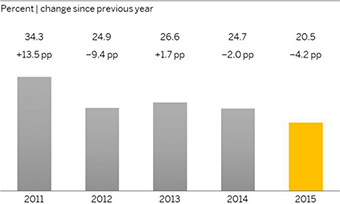

Operating margin (as a percentage of total revenue, IFRS) | | | 20.5 | | | | 24.7 | | | | -17 | |

Operating margin (as a percentage of total revenue, non-IFRS) | | | 30.5 | | | | 32.1 | | | | -5 | |

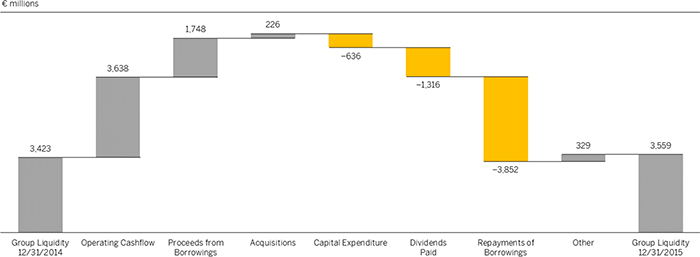

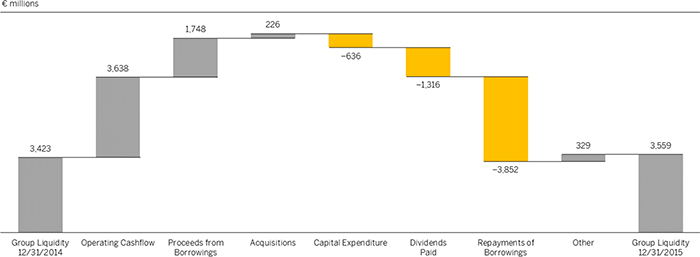

Free cash flow | | | 3,001 | | | | 2,762 | | | | 9 | |

Net liquidity | | | -5,615 | | | | -7,670 | | | | -27 | |

Days’ sales outstanding (DSO, in days) | | | 71 | | | | 65 | | | | 9 | |

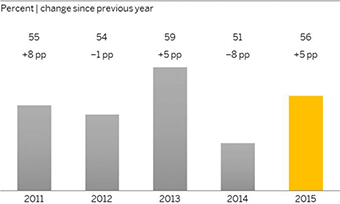

Equity ratio (total equity as a percentage of total assets) | | | 56 | | | | 51 | | | | 11 | |

| | | |

| Key SAP Stock Facts | | | | | | | | | | | | |

Issued shares1)(in millions) | | | 1,229 | | | | 1,229 | | | | 0 | |

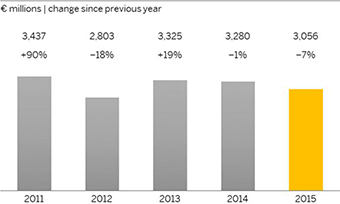

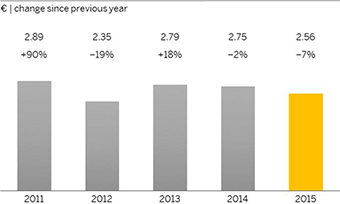

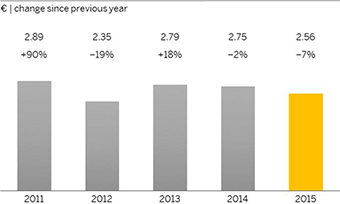

Earnings per share, basic (in €) | | | 2.56 | | | | 2.75 | | | | -7 | |

Dividend per share2)(in €) | | | 1.15 | | | | 1.10 | | | | 5 | |

SAP share price1)(in €) | | | 73.38 | | | | 58.26 | | | | 26 | |

Market capitalization1)(in € billions) | | | 90.18 | | | | 71.60 | | | | 26 | |

| | | |

| Employees and personnel expenses | | | | | | | | | | | | |

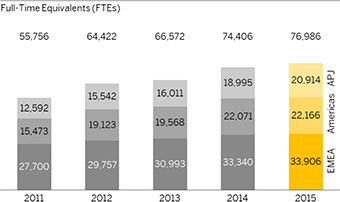

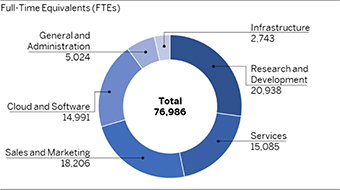

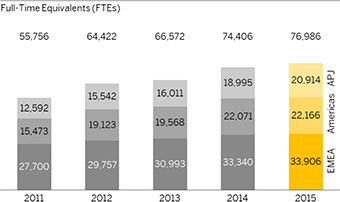

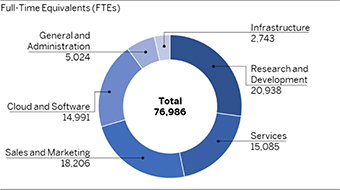

Number of employees1),3) | | | 76,986 | | | | 74,406 | | | | 3 | |

Personnel expenses per employee – excluding share-based payments (in € thousands) | | | 126 | | | | 111 | | | | 13 | |

Women working at SAP (as a percentage) | | | 31 | | | | 31 | | | | 0 | |

Women in management1)(total, as a percentage of total number of employees) | | | 23.6 | | | | 21.3 | | | | 11 | |

Employee Engagement Index (as a percentage) | | | 81 | | | | 79 | | | | 3 | |

Business Health Culture Index4)(as a percentage) | | | 75 | | | | 72 | | | | 4 | |

Employee retention (as a percentage) | | | 91.8 | | | | 93.5 | | | | -2 | |

| | | |

| Customer | | | | | | | | | | | | |

Customer Net Promoter Score5)(as a percentage) | | | 22.4 | | | | 19.1 | | | | 17 | |

| | | |

| Environment | | | | | | | | | | | | |

Net Greenhouse gas emissions (in kilotons) | | | 455 | | | | 500 | | | | -9 | |

Greenhouse gas emissions per employee3)(in tons) | | | 6.0 | | | | 7.3 | | | | -18 | |

Total energy consumption (in GWh) | | | 965 | | | | 920 | | | | 5 | |

Energy consumed per employee3)(in kWh) | | | 12,500 | | | | 13,400 | | | | -7 | |

Data center energy consumed (in GWh) | | | 249 | | | | 179 | | | | 39 | |

Renewable energy sourced (as a percentage) | | | 100 | | | | 100 | | | | 0 | |

| 1) | Numbers based on year-end. |

| 2) | 2015 numbers are based on the proposed dividend for 2015 and on 2015 closing level of treasury stock. |

| 3) | Full-time equivalents. |

| 4) | The BHCI score for 2014 was recalculated from 70% to 72% based on two updated questions in the people survey concerning work-life balance. |

| 5) | The 2015 Customer NPS is not fully comparable to the prior year’s score. |

Contents

2

Letter from the CEO

Dear Stakeholders,

I’m honored to present the SAP Integrated Report 2015.

Six years ago, we charted a bold new course for SAP. We set a vision to help the world run better and improve people’s lives. We designed a strategy to transform SAP into THE cloud company powered by SAP HANA. We redoubled our focus on helping businesses grow and prosper in 25 distinctly different industries.

2010 was the year we started on this journey. 2015 was the year we proved it is the right one for the stakeholders of SAP – a course that is worthy of the rich traditions of market leadership that date back to our five original innovators and their audacious dream for a better way.

The history of SAP was especially meaningful last year as we mourned the loss of Klaus Tschira. More than four decades ago, Hasso Plattner, Dietmar Hopp, Claus Wellenreuther, Hans-Werner Hector and Klaus founded SAP by innovating a new way for businesses to run better. In honoring Klaus’s memory, we are reminded that we stand on the shoulders of giants. As part of the SAP family, we have a solemn obligation to constantly push the boundaries of what’s possible; to be curious and courageous; and to never tire of rising beyond the highest expectations for what our company can achieve. Those five partners set a course 44 years ago; we continue to follow it to this day.

THE BACKDROP: A FAST-CHANGING DIGITAL ECONOMY

In the spirit of design thinking and innovation, the mission of SAP is always driven by the state of the world.

| | |

| To Our StakeholdersLetter from the CEO | | 4 |

The theme of the 2016 World Economic Forum in Davos, Switzerland, said it all: we live and work in the midst of the “Fourth Industrial Revolution.” The world is changing faster today than ever. By 2020, 21 billion devices will be connected in the Internet of Things (IoT). Thriving economies like China are investing in digital technologies to deliver efficiency and accelerate growth. Industry lines are blurring as legacy businesses invent new business models to strengthen their long-term prospects.

In each and every example, yesterday’s technologies are not keeping pace with tomorrow’s opportunities.

SAP customers no longer compete in a business-to-business economy. It’s now a consumer-to-business economy that is generating unprecedented quantities of structured and unstructured information. In this era, individual consumers expect businesses to deliver relevant, personalized experiences to them – wherever they are, whenever they want. Businesses that rise to this expectation will win. Those that can’t, or choose not to, will lose.

As we have done many times in our history, SAP delivered a fundamentally new architecture engineered for a new economy. With SAP HANA, SAP is able to break with a 45+ old tradition: enterprise systems based on three data pillars – master data, transactional data and aggregations of transactional data – were the foundation for all these years. The real time management of aggregated data was the cornerstone of the system, enabling users to have instant insights along predefined hierarchies. Any change of these aggregations required programming and painful data restructuring. This new architecture is based on the assumption that all reports, statutory or analytical, key figures, prediction, simulation and optimization are a mapping between millions to billions of data and presentations of a few hundred characters.

This makes it possible to achieve transformative technology and business outcomes:

| ¡ | | Data entry transaction can run in parallel without database locking |

| ¡ | | Much higher transactional performance and much lower data footprint |

| ¡ | | Monitoring of social media data and IoT data in combination with marketing initiatives |

| ¡ | | Analysis of point of sales data for signals and trends in real time |

| ¡ | | Predictive analytics for forecasting new planning applications with more intelligence and speed |

| ¡ | | New applications for simulation and optimization |

| ¡ | | Real-time monitoring of company’s performance in a Digital Boardroom |

| ¡ | | A new multi-channel approach to customer engagement and commerce |

We have paved the way to bring simplicity into every aspect of enterprise computing – from the legacy IT stack to new, context-aware applications. As a trusted innovator, we have moved beyond the limitations of the past into a period of limitless possibilities for the digital, inter-connected future of the world.

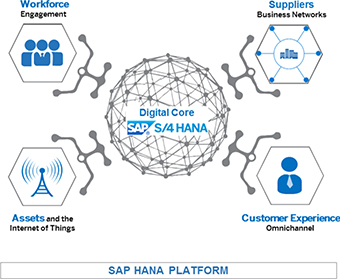

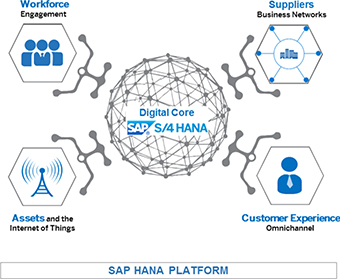

HOW WE ARE LEADING: COMPLETENESS OF VISION

From the database to core applications, to the cloud and to business networks, SAP’s offerings are truly end-to-end.

The database

We engineered our entire software portfolio for the SAP HANA platform, the only true in-memory column store database in the marketplace. In just a few short years, nearly 10,000 customers and startup companies chose to innovate on SAP HANA, momentum that continued to accelerate in 2015 with the release of SAP HANA Vora. The in-memory revolution is real and SAP is several years ahead of our competition.

The core applications

With this massive new processing power, we turned our attention to SAP’s flagship suite of core business applications for finance and logistics. In February 2015, we made history by unveiling SAP S/4HANA, our next-generation suite engineered specifically to realize unprecedented functionality increases made possible by SAP HANA. SAP S/4HANA is delivering 25x higher transactional performance, nearly 13x reductions in data footprint and dramatically simplified application code, to name only a few. In less than one year, more than 2,700 customers adopted SAP S/4HANA, beginning a once-in-decades innovation cycle and proving that enterprise resource planning (ERP) has shifted from a system of record to a system of innovation. It took SAP R/3 two years to take off; SAP S/4HANA is already off to a much faster start.

The cloud

Whether for human capital management, customer engagement or to run an entire enterprise, SAP is excelling in the cloud. Because many companies want faster innovation cycles and time to value, we focused on choice of consumption as a major priority for SAP. Today, customers can run SAP software in a multitenant public cloud, their own private cloud, or with the SAP HANA Enterprise Cloud service. Our SAP SuccessFactors solutions, for example, combined with SAP Fieldglass solutions, are best-in-class applications to manage a total workforce, including temporary workers. Anchored by SAP Hybris solutions, our customer engagement and commerce solutions go way beyond the administrative functions of traditional customer relationship management (CRM). Altogether, SAP now reaches more than 95 million cloud users, more than any other company in enterprise software.

| | |

| To Our StakeholdersLetter from the CEO | | 5 |

Another critical piece of our cloud story is our Platform-as-a-Service, the SAP HANA Cloud Platform (HCP). HCP is a standards based, open platform that allows customers to easily extend and integrate any and all SAP applications (cloud and on-premise) including SAP S/4HANA, SAP SuccessFactors and business networks. Thousands of our customers are using HCP to maximize their investment in SAP applications and simultaneously empower their developers with the power of in-memory computing to build and deploy next-generation digital applications.

The business networks

Finally, we recognized that businesses would need to think about partnerships in an entirely new way. Whether procuring materials or hiring new workers, digital connections would need to be made more seamless than ever before. For a longstanding challenge like business travel and expense management, we needed a network approach that allows multiple businesses to collaborate for the ultimate benefit of the end user. With SAP Ariba, SAP Fieldglass, and Concur solutions, our business network companies are best-in-class and focused on extending the walls of a digital enterprise. These companies are magnets for other businesses in their respective categories – building new ecosystems to develop applications and create new value streams.

CEOs of large businesses and small businesses alike have made it clear: narrowly focused IT solutions have made things more complicated. They need full alignment between the supply chain and the demand chain. They need to run businesses based on live data and have the agility to make fast decisions. They need an intuitive user experience that empowers every employee and unleashes their unique abilities.

SAP is committed to delivering on these expectations.

SAP IS A PROFITABLE GROWTH COMPANY

The proof of our successful strategy lies in our 2015 achievements.

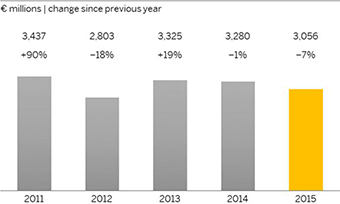

Non-IFRS total revenue for SAP was €20.8 billion, a 12% CAGR since we started in 2010. Even during the transformation of our company, our full-year non-IFRS operating profit was €6.35 billion, a 10% CAGR since 2010. Very few companies can claim this rate of growth on both the top and the bottom line. In addition, as SAP’s percentage of more predictable revenues increase, we are aggressively managing this transformation to protect our margin profile and ensure continued shareholder value.

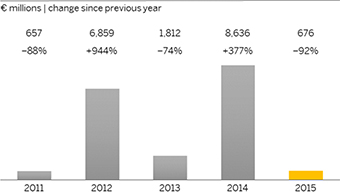

In virtually every financial metric, 2015 was a record year. We grew our full-year non-IFRS cloud subscription and support revenue by 109%. Our full-year non-IFRS cloud and software revenue increased by 20%. Our fourth quarter was SAP’s best quarter ever, with all regions performing at record levels, despite continued uncertainty in many geographic markets.

Our core business has been accelerated by the fast adoption of SAP S/4HANA and the transformative business outcomes it is already enabling. Our cloud applications – led by the momentum of the SAP SuccessFactors Employee Central – are soaring. Our business network companies are shaping the future of commerce and growing in triple digits.

Through our direct-to-consumer business unit, SAP Digital, more than 50,000 transactions in 32 countries were processed in 2015 alone. We see this volume only accelerating as SAP develops even more offerings that can be bought and used with little or no human interaction, such as SAP Lumira and SAP Anywhere.

According to our employee survey, we finished the year with a 10-year high in employee engagement (81%), along with increases in leadership trust and work-life balance, including employee health. We also remained committed to our high standards for reducing carbon emissions and introduced new programs to support employees battling cancer. We continued our focus on building great careers for the people of SAP, whether they come to us direct from university or as experienced professionals. Our University Alliance program has momentum everywhere in the world, building on the 2,400+ university partnerships we already have and opening new doors in places like China, Russia and the Middle East. Our Autism at Work program continued as a role model for the world, proving that there is no limit to what any person can achieve when they are given the opportunity to share their unique talents.

On the world stage we acted with purpose as a true global market leader. We engaged with policy makers to forge a compromise on data sharing standards and joined the United Nations in setting clear benchmarks for a more sustainable planet. With the We Are Family Foundation, we gave brilliant young innovators the chance to be heard at TedxTeen. Through the unprecedented #One4 project, we stood with the refugees who escaped warzones in search of a more peaceful and promising future.

For SAP, doing well has always been about enabling us to do good. We’ve never been more committed to doing both.

THE ROAD AHEAD

The only constant in technology is change. With breakthroughs such as SAP HANA and SAP S/4HANA only just scratching the surface of their full potential, SAP is strongly positioned to shape the future.

Businesses are hungry for growth and looking to the Internet of Things, robotics, artificial intelligence, and context-rich applications. Smart cities and connected manufacturing are making it possible to deliver mass personalization at scale for end consumers. Industries like healthcare are about to experience wide-scale disruption as technology finally converges around a common vision for personalized medicine. Healthcare, in particular, is a vivid illustration of SAP’s long-term growth potential. The American Society of Clinical Oncology

| | |

| To Our StakeholdersLetter from the CEO | | 6 |

(ASCO) and the National Center for Tumor Diseases (NCT) in Germany are already transforming the treatment and effort to cure cancer with SAP HANA. The raw computing power of SAP HANA means that doctors can rely on genome sequencing at a fraction of the time and cost. It also means that data from diagnostic procedures and clinical trials can be aggregated and searched for powerful insights about how to treat specific tumors.

SAP is charging into this future with optimism. We’ll continue leading the reinvention of business technology as we look to help solve the world’s greatest challenges because we see them as our greatest opportunities.

IN SUMMARY

Over the past six years, whether you measure us on the basis of our customer satisfaction, extraordinary top line growth, dramatic expansion of operating profit, the successful management of our business model transformation, or our consistent commitment to corporate citizenship, SAP has never been in a stronger position. Our 77,000 colleagues are firmly united in purpose to serve the more than 300,000 customers who have placed their trust in SAP. Together with our open partner ecosystem, we are reshaping every sector of the modern economy in nearly every country.

This integrated report seeks to expand on this story in vivid detail. It also reflects our commitment to unprecedented transparency. We believe that our stakeholders deserve to understand the market conditions, strategy and software that will power SAP to deliver on our short, mid, and long-term expectations. We also believe that the full measure of a great business is not just in its financial results, but also in its social responsibility. That’s why we include metrics like environmental impact and diversity alongside revenue and operating income – to give you the full picture of an ambitious, successful, and sustainable company.

SAP’s vision is to help the world run better and improve people’s lives. We’re passionate in service to this enduring purpose. We also know that vision isn’t just what we see – it’s what we feel and how we make other people feel. Whether you rely on SAP as a customer, invest in us as a shareholder, work for us as an employee, or partner with us in the ecosystem, we work every day to make you feel proud of our success and confident in our future. We will never lose our sense of urgency. We’ll always be driven to rise even higher and to earn the privilege of following in the footsteps of our founders. Indeed, we aspire to leave footprints of our own for others to follow.

Thank you for your interest in and support of SAP.

Bill McDermott

Chief Executive Officer

| | |

| To Our StakeholdersLetter from the CEO | | 7 |

Global Managing Board

Bill McDermott

CEO and Member of the Executive Board

Luka Mucic

Member of the Executive Board

Chief Financial Officer and Chief Operating Officer

Robert Enslin

Member of the Executive Board

President, Global Customer Operations

Bernd Leukert

Member of the Executive Board Products & Innovation

| | |

| To Our StakeholdersGlobal Managing Board | | 8 |

Gerhard Oswald

Member of the Executive Board

Product Quality & Enablement

Steve Singh

Member of the Global Managing Board, CEO of Concur

Technologies, and Head of Business Network Group

Quentin Clark

Member of the Global Managing Board

Chief Business Officer

Ingrid-Helen Arnold

Member of the Global Managing Board

Chief Information Officer and Chief Process Officer

Michael Kleinemeier

Member of the Executive Board

Global Service & Support

Stefan Ries

Member of the Global Managing Board

Chief Human Resources Officer

| | |

| To Our StakeholdersGlobal Managing Board | | 9 |

Investor Relations

| ¡ | | SAP stock increased 26% in 2015. |

| ¡ | | The market capitalization of SAP exceeded US$97 billion at the end of 2015. |

| ¡ | | Recommended dividend payout is €1.15 per share. |

In 2015, our conversations with the financial community were highly focused on the soaring adoption of SAP S/4HANA, our strategy in business networks and the powerful combination of our rapidly expanding cloud business and our growing core business. Investors were keen to understand SAP’s position to capture the tremendous growth opportunities in the market.

SAP’s stock increased 26% in 2015 outperforming major indices such as the DAX. The market capitalization of SAP exceeded US$97 billion at the end of 2015. SAP is number 57 among the top 100 most valuable companies in the world.

PROVIDING TRANSPARENCY FOR INVESTORS

Investor Relations Team and Senior Management at SAP Held More Than 360 Meetings

In over 360 one-on-one meetings held during investor road shows worldwide, in virtual format over Telepresence or video conference, and at investor events, senior management at SAP and the Investor Relations (IR) team answered inquiries from institutional investors and analysts about SAP’s business strategy. We also held telephone conferences and analyst meetings when we published our quarterly results. In addition, we continued our dialog with the debt investor community through regular calls on SAP’s financial performance.

SAP Capital Markets Day at the New York Stock Exchange

A particular highlight of our global Investor Relations program in 2015 was the Capital Markets Day in conjunction with the SAP S/4HANA product launch held at the New York Stock Exchange. At the Capital Markets Day, our customers BASF, Shell, and UnderAmour spoke about their relationship with SAP. In addition, our events for investors and financial analysts at the CeBIT fair in Hanover, Germany, and the SAPPHIRE NOW conference in Orlando, Florida, in the United States, were key elements of our IR program. SAP engages in regular dialog with social responsible investors (SRIs), providing insight into SAP’s environmental, social, and corporate governance policies. SAP also speaks at various retail shareholder events.

Communication Across Multiple Channels

We provide a wide range of information for investors about SAP and SAP stock online, including social media information on the SAP Investor Relations Twitter feed @sapinvestor, the quarterly SAP INVESTOR magazine, which investors can subscribe to free of charge, and a text message service. Shareholders can reach the IR team directly through a hotline and e-mail at investor@sap.com. We also publish an overview of the latest analyst assessments in collaboration with Vara Research. All key investor events at which members of our Global Managing Board speak are broadcast live on the Internet, and we post the presentation materials on the investor relations area of our public Web site.

REWARDING OUR INVESTORS – DIVIDEND PAYOUT OF €1.15 PER SHARE

We believe our shareholders should benefit appropriately from the profit the Company made in 2015. In recent years, the payout has always been greater than 35% of profit after tax. We aim to continue our policy to pay a dividend totaling more than 35% of profit after tax in the future.

The Executive Board and the Supervisory Board will recommend to the Annual General Meeting of Shareholders that the total dividend will be increased by 5% to €1.15 per share (2014: €1.10). Based on this recommendation, the overall dividend payout ratio (which here means total distributed dividend as a percentage of profit) would be 45% (2014: 40%).

| | |

| To Our StakeholdersInvestor Relations | | 10 |

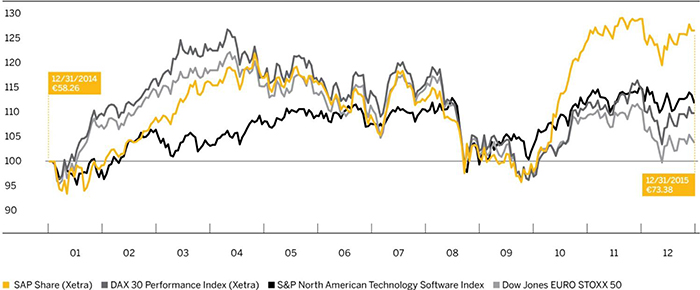

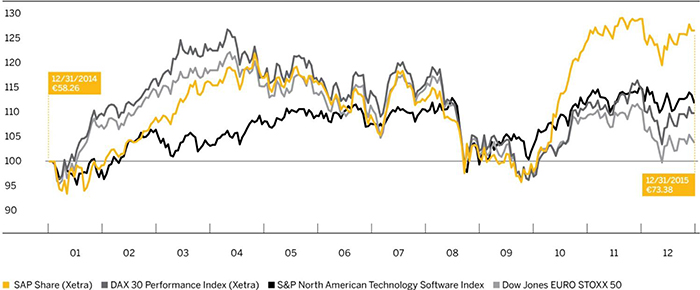

SAP Stock in Comparison to DAX 30, Dow Jones EURO STOXX 50, and S&P North American Technology Software Index

December 31, 2014 (=100%) to December 31, 2015

Percent

STOCK DEVELOPMENT AND COMPARISON TO PEER INDICES

Key Facts About SAP Stock/SAP ADRs

| | | | |

| Listings | | | | |

Germany | | | Berlin, Frankfurt, Stuttgart | |

United States (ADRs) | | | New York Stock Exchange | |

| IDs and symbols | | | | |

WKN/ISIN | | | 716460/DE0007164600 | |

NYSE (ADRs) | | | 803054204 (CUSIP) | |

Reuters | | | SAPG.F or .DE | |

Bloomberg | | | SAP GR | |

| Weight (%) in indexes at 12/31/2015 | | | | |

DAX 30 | | | 7.80 | |

Prime All Share | | | 5.78 | |

CDAX | | | 6.07 | |

HDAX | | | 6.20 | |

Dow Jones STOXX 50 | | | 2.02 | |

Dow Jones EURO STOXX 50 | | | 3.33 | |

A Volatile Year on Stock Markets Worldwide

Stock markets were volatile in 2015. The Greek debt crisis, fears over China’s economy, the decision of the Federal Reserve to delay plans to increase interest rates, the migrant crisis, terror attacks, and falling oil prices negatively impacted share prices worldwide. A third loan program for Greece and the European Central Bank’s commitment to its expansionary monetary policy lifted the markets and caused stocks to rally at the beginning and end of the year.

SAP Stock Outperforms the Indexes from the Second Quarter

Our stock reached its lowest price for the year on January 9, when it traded at €54.53. It recovered after the announcement of our preliminary results for full-year 2014 before fluctuating in its low range following the announcement of further results, outlook guidance, and medium-term targets for 2015. However, on February 12 it passed the €60 mark. The European Central

Bank’s loose monetary policy and its announcement of a bond purchase program at the end of January buoyed the markets. This helped lift the DAX 30, which crossed the 12,000 point level on March 12. Successful participation at the CeBIT trade fair and the Company’s proposal to increase the dividend also boosted the price of SAP stock.

The stock markets continued their climb in early April. On April 10, the DAX reached 12,374.73 points, an all-time high, and SAP stock surpassed €69. Shortly after, fears that Greece might leave the euro area weighed on stock markets for a time. After we published our first-quarter results on April 21, the price of SAP stock climbed to €68.94, and then to €70.72 on April 27, exceeding its record closing price from March 7, 2000. During the remainder of the second quarter, the price of SAP stock moved broadly in sympathy with general sentiment, which was disturbed by the crisis in Greece, weak economic data from the United States, and a strong euro.

| | |

| To Our StakeholdersInvestor Relations | | 11 |

The outcome of Greece’s referendum and China’s stock market crash weighed on markets in early July. After we announced our

second-quarter results on July 21, SAP stock fell to €67.80 in a weak market environment. The negative sentiment continued into August and dragged our stock down to below the €60 mark on August 21. In the second half of September, the Federal Reserve delayed its plans to raise interest rates, which unsettled investors primarily in Europe. The DAX moved back below the 10,000-point mark. The Volkswagen crisis also weighed on market sentiment, and, on September 24, SAP stock slipped to €55.89, its lowest point of the quarter.

At the start of October, hopes of a further central bank stimulus package temporarily lifted market sentiment. SAP stock also benefited from strong third-quarter results. After we presented our results, SAP stock rose to €66.50, while the DAX fell slightly. On October 27, our stock again passed the €70 mark and, on November 20, reached €74.85, its highest value for the year and an all-time high. In the first half of December, market sentiment was cautious following weak economic data from China and a strong euro before improving after the Federal Reserve raised interest rates. SAP stock ended the year at €73.38.

CAPITAL STOCK UNCHANGED

SAP’s capital stock as at December 31, 2015, was €1,228,504,232 (2014: €1,228,504,232). It is issued as 1,228,504,232 no-par shares, each with an attribute value of €1 in relation to capital stock.

SHAREHOLDER STRUCTURE

The proportion of our stock in free float increased again slightly in 2015. Applying the definition accepted on the Frankfurt Stock Exchange, which excludes treasury stock from the free float, as at December 31, 2015, the free float stood at 77.5% (December 31, 2014: 75.7%). In January 2016, approximately 20% (January 2015: 22%) of the stock was under the control of SAP founders Hasso Plattner, Dietmar Hopp, the Klaus Tschira community of heirs, and their trusts and holding companies.

Institutions in Ireland and the United Kingdom represented the largest regional group of shareholders, holding 17% of the stock in January 2016 (January 2015: 15%). Institutions in North America held around 16% of the stock in January 2016 (January 2015: 16%), followed by continental European investors outside Germany, who held approximately 14% in January 2016 (January 2015: 14%). Institutions in Germany held 8% (January 2015: 7%) and investors from the rest of the world held 2% (January 2015: 3%) of the stock in January 2015. Of these institutional investors, 10% were classified as socially responsible investors (SRIs) in January 2016 (January 2015: 10%). Private or unidentified investors held 18% (January 2015: 19%) in January 2016. Also as of January 2016, SAP held 2.5% (January 2015: 2.7%) of the stock in treasury.

Return on SAP Common Stock – WKN 716460/ISIN DE007164600

| | | | | | | | | | | | |

Percent, unless otherwise stated | | | | | | | | | |

| Initial investment €10,000 | | | | | | | | | | | | |

| Date of investment | | | 38,717 | | | | 40,543 | | | | 42,004 | |

| Period of investment | | | 10 years | | | | 5 years | | | | 1 year | |

| Value at 12/31/20151)(in €) | | | 22,317 | | | | 21,002 | | | | 12,798 | |

| Average annual return | | | 8.4 | | | | 16.0 | | | | 28.0 | |

| Performance comparators | | | | | | | | | | | | |

DAX 30 Performance – total return index | | | 7.1 | | | | 9.2 | | | | 9.6 | |

REX General Bond – total return index | | | 4.1 | | | | 4.0 | | | | 0.5 | |

S&P 500 Composite – total return index | | | 8.2 | | | | 17.4 | | | | 12.9 | |

S&P North American Technology Software Index | | | 11.4 | | | | 17.8 | | | | 25.3 | |

| 1) | Assuming all dividends were reinvested |

| | |

| To Our StakeholdersInvestor Relations | | 12 |

Return on SAP ADRs – 803054204 (CUSIP)

| | | | | | | | | | | | |

Percent, unless otherwise stated | | | | | | | | | |

| Initial investment €10,000 | | | | | | | | | | | | |

| Date of investment | | | 38,717 | | | | 40,543 | | | | 42,004 | |

| Period of investment | | | 10 years | | | | 5 years | | | | 1 year | |

| Value at 12/31/20151)(in US$) | | | 19,918 | | | | 16,870 | | | | 11,561 | |

| Average annual return | | | 7.1 | | | | 11.0 | | | | 15.6 | |

| Performance comparators | | | | | | | | | | | | |

S&P 500 Composite – total return index | | | 7.3 | | | | 12.6 | | | | 1.4 | |

| 1) | Assuming all dividends were reinvested |

Source: Datastream

| | |

| To Our StakeholdersInvestor Relations | | 13 |

Corporate Governance Report

We are a global company with an international shareholder base, so we need sound governance. Good corporate governance means managing the Company accountably and transparently to secure long-term value. We believe our shareholders, business partners, employees, and the financial markets reward good corporate governance with the increased trust they place in our Company.

CORPORATE GOVERNANCE PRINCIPLES AT SAP

SAP is an international firm with European roots, having the legal form of a European company (Societas Europaea, or SE). Being an SE headquartered in Germany, we are now subject to European and German law for SEs while remaining subject to German stock corporation law. Major characteristics of our governance structure remain in place since the conversion, notably our two-tier board comprising a Supervisory Board and an Executive Board, and parity for workforce representatives on the Supervisory Board. Because SAP SE is listed on a German stock exchange, our corporate governance is still based on the German Corporate Governance Code (the “Code” in this report). Every year, as required by the German Stock Corporation Act, section 161, the Executive Board and Supervisory Board issue a declaration stating whether SAP has implemented and is following the Code’s recommendations, and identifying any recommendations that the Company has not followed – with a full explanation of why it has not done so. Our latest section 161 declaration, published on October 29, 2015, is on the SAP Web site along with our declarations from previous years and links to the current and previous editions of the Code. As our 2015 declaration shows, we currently follow all but seven of the 102 recommendations and all of the suggestions in the current Code.

Since SAP is also listed in the United States, we comply with the rules that apply to non-U.S. companies listed on the New York Stock Exchange (NYSE). These include the requirements, as they apply to foreign private issuers, of the NYSE Corporate Governance Standards, the U.S. Sarbanes-Oxley Act of 2002, and the U.S. Securities and Exchange Commission (SEC).

CORPORATE GOVERNANCE STATEMENT

On February 24, 2016, the Executive Board published a corporate governance statement for 2015 as required by the German Commercial Code, section 289a. The statement is on the SAP Web site. It comprises the current declaration pursuant to the German Stock Corporation Act, section 161, certain details of our corporate governance practices, and an account of how the Executive Board and the Supervisory Board work, who serves on which Supervisory Board committees, and how those committees work. It also sets out the targets for the percentage of women on the Executive Board and the two management levels below Executive Board level.

EXECUTIVE BOARD

The Executive Board currently has six members. It is solely responsible for managing the Company. It has a duty to exercise its management powers in the interest of the Company and in pursuit of the sustained growth of corporate value. It discusses and agrees its strategy for the Company with the Supervisory Board, ensures compliance with the requirements of the law throughout the Group, and maintains effective risk management structures and internal risk controls. There is information about each member’s portfolio of responsibilities on the SAP Web site.

GLOBAL MANAGING BOARD

The Global Managing Board helps the Executive Board with its work. It currently comprises all of the Executive Board and four other global managers who play a part in directing large sections of the business. These additional members are appointed by the Executive Board with the Supervisory Board’s consent. The Global Managing Board has a coordinating function, advises the Executive Board, and helps it make decisions, but the Executive Board retains overall responsibility for everything the Company does. The Global Managing Board will be dissolved on March 31, 2016. Two of its members were appointed by the Supervisory Board to the Executive Board with effect from April 1, 2016.

SUPERVISORY BOARD

The size and composition of the Supervisory Board are governed not by the German Codetermination Act (which does not apply, because we are a European company) but by the Articles of Incorporation and the SAP SE Employee Involvement Agreement. Both documents are available on the SAP Web site.

| | |

| To Our StakeholdersCorporate Governance Report | | 14 |

The Supervisory Board has 18 members who, in equal numbers, represent the shareholders and the employees. It appoints, monitors, and advises the Executive Board. The Executive Board involves the Supervisory Board in decisions on matters of fundamental importance for the Company. The Supervisory Board has reserved to itself the approval of certain transactions of fundamental importance, as set out in the Articles of Incorporation and detailed in the Supervisory Board’s list of reserved categories of transactions. The Executive Board regularly provides the Supervisory Board with full and timely reports on all material matters of strategy, business planning, and performance, including any deviations of actual business performance from plan, risks, risk management, and corporate compliance. We provide our shareholders with in-depth information about how the Executive Board and the Supervisory Board work, how the committees are composed, and how these committees work, in our corporate governance statement. For more information about the joint work of the Executive Board and the Supervisory Board and about the work of the Supervisory Board and its committees in 2015, see theReport from the Supervisory Board.

COMPOSITION OF THE SUPERVISORY BOARD

The Supervisory Board members as a group possess the knowledge, ability, and expert experience required to properly perform its duties in our global IT company. At least one independent member has financial reporting and auditing expertise. The Supervisory Board has defined the following objectives for its own composition:

| ¡ | | There should never be fewer than three people from the international stage on the shareholder representatives’ side of the Supervisory Board. |

| ¡ | | No employee, consultant, or director of a significant SAP competitor should be a Supervisory Board member. |

| ¡ | | At least five shareholder representatives on the Supervisory Board should be independent members in the meaning of section 5.4.2 of the Code. |

| ¡ | | No member of the Supervisory Board should be older than 75 years. |

We believe the current composition of the Supervisory Board fulfills all of these objectives. There is information about each member, the committees, and who serves on which committee, on the SAP Web site.

INDEPENDENCE OF THE SUPERVISORY BOARD

We believe a sufficient degree of independence of our Supervisory Board members is essential for effective and responsible corporate management and control. Our Supervisory Board has a defined objective for its composition regarding the minimum number of independent members on the shareholder representative side, as recommended in the Code, section 5.4.1, paragraph 2. The objective is five such members. At its meeting on October 8, 2015, the Supervisory Board determined that all of its shareholder representative members are independent in the meaning of the Code, section 5.4.2 and that the number of independent members is sufficient in the meaning of that section. The Audit Committee is chaired by Erhard Schipporeit, who for many years was the chief financial officer of a DAX company that is also listed on a U.S. stock exchange and therefore qualifies as an independent financial expert in the meaning of the German Stock Corporation Act, section 100 (5).

DIVERSITY IN THE COMPANY

Starting 2016, a fixed gender quota of 30% applies for new appointments to the Supervisory Board of SAP SE pursuant to the law on the equal participation of men and women in leadership positions (German Equal Leadership Opportunities for Women Act). As such, the Supervisory Board’s previous voluntary objective for the composition of the Supervisory Board, based on an earlier Code recommendation, no longer applies. There are currently two women on the shareholder representatives’ side of the Supervisory Board and two women on the employee representatives’ side. The fixed quota applies to future appointments to the Supervisory Board; the current members of the Supervisory Board remain unaffected until the end of their term.

The Executive Board currently has six male members. Pursuant to the above Act, the Supervisory Board adopted by resolution at its meeting on March 19, 2015, a target of one for the number of Executive Board seats to be held by women by June 30, 2017.

The first and second management levels below the Executive Board are the Global Executive Team (GET, without the Global Managing Board) and the Senior Executive Team (SET), respectively. In accordance with the requirements of the Act, the Executive Board resolved on September 30, 2015, that the percentage of positions held by women on the first two management levels below the Executive Board should remain unchanged at 23% and 17%, respectively, to June 30, 2017.

The Executive Board continues to follow the recommendation in the Code that executive boards should generally have regard to diversity when appointing people to leadership positions, and in particular to employ appropriate numbers of women in such positions. In support of this, we maintain a diversity policy for company leadership appointments. SAP has set itself a target of increasing the overall percentage of positions in leadership held by women to 25% by 2017. It goes without saying that ability is still the primary selection criterion for any position at SAP. Globally, the percentage of leadership positions held by women at the end of 2015 was 23.6%.

| | |

| To Our StakeholdersCorporate Governance Report | | 15 |

CODE OF BUSINESS CONDUCT

SAP’s corporate governance includes our Code of Business Conduct for employees and members of the Executive Board. The Code of Business Conduct expresses the high standards that we require from our employees and Executive Board members and sets out the main principles that guide our business conduct toward customers, business partners, and shareholders. We see our Code of Business Conduct as the standard for our dealings involving customers, business partners, vendors, shareholders, and competitors. By following our Code of Business Conduct, we demonstrate a commitment against all forms of unfair competitive practice, corruption, and misrepresentation. Our global compliance organization monitors worldwide compliance with the Code of Business Conduct and other policies applying within the Group. It regularly reviews these internal policies, revises them if necessary, and delivers related employee training.

APPLYING INTERNATIONAL CORPORATE GOVERNANCE STANDARDS

SAP is a NYSE-listed company and we are therefore subject to certain U.S. financial legislation (including the Sarbanes-Oxley Act of 2002, among others) and to the applicable SEC and NYSE regulations. Besides implementing the requirements of the U.S. Sarbanes-Oxley Act, section 404, and other Sarbanes-Oxley Act requirements, including conducting an annual audit of our internal control over financial reporting, we comply with those of the corporate governance standards codified in the NYSE Listed Company Manual, section 303A, which bind foreign private issuers. The section 303A standards that apply to SAP include the requirement to have an audit committee composed of members who are independent in the meaning of the Sarbanes-Oxley Act, and related reporting requirements. Erhard Schipporeit, the chairperson of the Audit Committee, is an audit committee financial expert in the meaning of the Sarbanes-Oxley Act.

ANNUAL GENERAL MEETING OF SHAREHOLDERS

Our shareholders exercise their rights, such as the rights to put questions to the management and to vote, at the Annual General Meeting of Shareholders. Shareholders and the public are able to watch a live broadcast of the entire Annual General Meeting of Shareholders on the Internet. They can vote their shares at the Meeting or instruct a proxy of their choice or one of the proxies provided for that purpose by SAP. Alternatively, they can participate online or vote by mail. The invitation to the Annual General Meeting of Shareholders includes full details and instructions. Every shareholder can access all of the paperwork on the SAP Web site in good time for the meeting.

TRANSPARENCY, COMMUNICATION, AND SERVICE FOR SHAREHOLDERS

Our shareholders can obtain full and timely information about SAP on our Web site and can access current and historical Company data. Among other information, we post all of our financial reports, all relevant news about the Company’s governing bodies and their corporate governance documentation, information requiring ad hoc (current) disclosure, press releases, and news of notifiable directors’ dealings.

FINANCIAL ACCOUNTING, RISK MANAGEMENT, AND INTERNAL CONTROL

We prepare the SAP SE financial statements in accordance with the German Commercial Code and our consolidated financial statements in accordance with International Financial Reporting Standards (IFRSs). We prepare a management report, as required by the German Commercial Code, and the Form 20-F annual report in accordance with SEC requirements. The Executive Board is responsible for financial accounting. The Supervisory Board approves the SAP SE financial statements, the consolidated financial statements, and the combined management report. The SAP SE financial statements, the consolidated financial statements, and the combined management report are audited by KPMG AG Wirtschafts-prüfungsgesellschaft, the auditor elected for that purpose by the Annual General Meeting of Shareholders.

In addition to our annual financial statements, we also prepare interim reports for the first, second, and third quarters. Our quarterly reports comply with the German Securities Trading Act and are submitted to the Audit Committee of the Supervisory Board before they are published.

In German stock corporation and commercial law, there are special requirements for internal risk management that apply to SAP. To meet them, our global risk management system supports risk planning, identification, analysis, handling, and minimization. We maintain standard documentation of all our internal control structures, especially those that affect financial reporting, and continually evaluate their effectiveness. As a company listed on the NYSE, we instruct our auditor, KPMG, to conduct an annual audit of our internal control over financial reporting in accordance with the requirements of the U.S. Sarbanes-Oxley Act of 2002, section 404. The audit as of December 31, 2015, confirmed that our internal control is effective. In compliance with the reporting requirements in the German Commercial Code, sections 289 (5) and 315 (2)(5), the combined SAP SE and SAP Group management report contains full information about the principal features of the internal controls and risk management structure applying to SAP’s consolidated financial reporting.

EXECUTIVE BOARD AND SUPERVISORY BOARD SHAREHOLDINGS

Section 6.3, sentence 2, of the Code recommends that all directors’ shareholdings be reported in a corporate governance report, broken down by executive board and supervisory board memberships if the entire holdings exceed 1% of the shares issued by the Company. In fulfillment of this recommendation, see theCompensation Report in our combined management report for 2015, which contains the recommended information.

| | |

| To Our StakeholdersCorporate Governance Report | | 16 |

Report from the Supervisory Board

Dear Shareholders,

In 2015, as every year, the Supervisory Board continuously discharged all of the duties imposed on it by the law and by the Company’s Articles of Incorporation. We were consulted by the Executive Board throughout the year and kept the global management of the Company under continued observation and scrutiny for legal compliance, adherence to proper accounting principles, business focus, and efficiency. We agreed the Company’s strategy with the Executive Board and regularly discussed with the Executive Board the Company’s progress toward executing it. We were directly involved when the Executive Board made any decision of fundamental importance to SAP.

We received regular, full, and timely reports, both in writing and from Executive Board members in person. They kept us up to date on the Company’s strategy, plans, business performance, risks, risk management, compliance (in other words, adherence to laws, to the Company’s Articles of Incorporation, and to internal policies), and transactions of special significance for SAP. The Executive Board advised us when business deviated from plan or target, and why.

The content and scope of the Executive Board’s reports to us fully met our requirements for them. Whenever we asked for more information than was in the reports, the Executive Board gave us it. In particular, the Executive Board came to Supervisory Board meetings for discussion and to answer our questions. We questioned and probed the Executive Board to satisfy ourselves that the information it gave us was plausible. Section 11 (6) in the Articles of Incorporation lists certain transactions for which management must seek prior supervisory board approval. The Supervisory Board established a list of such transactions and other categories of transactions for which the Executive Board must obtain the Supervisory Board’s consent, in accordance with the German SE Implementation Act, section 19. The Supervisory Board carefully considered all transactions in the listed categories and discussed them with the Executive Board, focusing on the benefits, potential risks, and other effects of each transaction. The Supervisory Board agreed to all transactions for which its consent was sought by the Executive Board.

The Executive Board also kept the chairperson of the Supervisory Board fully informed between meetings of the Supervisory Board and its committees. In particular, the CEO met regularly with the chairperson of the Supervisory Board to discuss SAP’s strategy, planning, the Company’s business performance, risks, risk management, compliance, and other key topics and decisions. The CEO informed the Supervisory Board chairperson without delay of all important events that were significant for assessing SAP’s position and progress or for the management and governance of the Company.

SUPERVISORY BOARD MEETINGS AND RESOLUTIONS

In 2015, the Supervisory Board of SAP SE held four ordinary meetings and four extraordinary meetings at which we deliberated and resolved on all matters of relevance to the Company. We also adopted two resolutions by correspondence vote. It is customary practice at our meetings that the Executive Board withdraws while we deliberate on items that pertain to the Executive Board or require discussion among Supervisory Board members alone. This happened at three of our ordinary meetings in 2015. The Supervisory Board addressed the following key topics during the year:

SAP Business Network and Cloud Business

After dealing extensively with a number of major SAP acquisitions in 2013 and 2014, the Supervisory Board and the Finance and Investment Committee discussed the development and integration of the acquired entities on numerous occasions in 2015. The SAP Business Network segment, which combines the activities of the acquired Ariba, Concur, Fieldglass businesses, and the integration of these companies into the SAP Group, were key topics notably at the Supervisory Board meeting on February 12 and at the Finance and Investment Committee meetings in February, July, and December. Likewise in our line of focus were the development of the cloud business, and the cloud strategy. We explored these topics regularly, particularly in connection with the Executive Board’s business reports and in the course of Technology and Strategy Committee meetings.

| | |

| To Our StakeholdersReport from the Supervisory Board | | 17 |

Executive Board Compensation

Prompted by, among other things, the unexpectedly strong growth in SAP’s cloud business and the pending discontinuation of the RSU Milestone Plan 2015 at the end of the year, the Supervisory Board made a number of decisions about Executive Board compensation. Compensation was on the agenda of the ordinary Supervisory Board meetings in February, July, and October, and of the General and Compensation Committee meetings.

At our ordinary Supervisory Board meeting on February 12, we received and discussed the recommendations of the General and Compensation Committee concerning Executive Board compensation for 2014. Exercising our discretionary powers under the terms of the short-term incentive (STI) plan 2014, we first determined performance against the defined targets. We also looked at target achievement within the so-called performance period for the 2014 tranche of the RSU Milestone Plan 2015. Introduced in 2012, the RSU Milestone Plan 2015 is a long-term variable compensation element for SAP SE Executive Board members in which the members are granted a number of virtual shares (called restricted share units, or RSUs) for a given year (or “tranche”); the quantity of RSUs ultimately allocable for a plan tranche depends on SAP’s operating profit performance in the year it is allocated. In light of the unexpectedly strong growth in cloud business and its effects on SAP’s revenue development, the Supervisory Board resolved a number of amendments to the RSU Milestone Plan 2015 to preserve its fair and equitable nature.

We also deliberated on Executive Board compensation for 2015 in the February meeting. We identified the key performance indicators (KPIs) and set the target numbers for each KPI in the STI 2015 plan and their relative weightings. We revised the revenue and operating profit performance targets for the 2015 tranche of the RSU Milestone Plan 2015 to take account of the effects of the aforementioned cloud growth on the Company’s sales and profit planning. We adopted a resolution on Executive Board members’ individual allocation of rights under the RSU Milestone Plan 2015 (2015 tranche). The Supervisory Board, as required, evaluated the appropriateness of the Executive Board members’ compensation for 2015, and in each case found it to be appropriate in terms of amount, structure, objective criteria, and for each member’s responsibilities and tasks.

On July 9, we deliberated on the new model for Executive Board compensation for 2016, which had been prepared and discussed by the General and Compensation Committee at several meetings on account of the pending discontinuation of the RSU Milestone Plan 2015. Ahead of the meeting, we had received a legal opinion from Allen & Overy and a certificate from Ernst & Young on the compensation’s appropriateness. On this basis, we resolved to adopt the new Long-Term Incentive (LTI) Plan 2016 and agreed that the amount and structure of the Executive Board’s compensation for 2016 was appropriate. For more information about the LTI Plan 2016 and other elements of the compensation package for Executive Board members, see theCompensation Report.

Other matters addressed at our meetings in 2015 included:

Meeting in February

The compensation issues discussed at our February meeting are covered in the preceding section. In view of the retroactive changes to the Executive Board compensation as described, we also resolved in our February meeting to update the Company’s declaration of implementation of the German Corporate Governance Code (the “Code”) pursuant to the German Stock Corporation Act, section 161, by filing jointly with the Executive Board a precautionary declaration of deviation from the recommendation contained in section 4.2.3 (second paragraph, eighth sentence) of the Code.

The Executive Board gave us an overview of business in 2014 and presented other management information, such as SAP’s revenue growth in the individual business areas, regions, and product fields. It also explained SAP’s current market position and growth plan for the next five years. We discussed in detail the annual plan for 2015 as presented to us by the Executive Board, and we decided to vote on the 2015 capital expenditure budget and liquidity plan in a subsequent extraordinary Supervisory Board meeting. In addition, the Executive Board updated us on the status and lessons learned from the “Simplify & Optimize” personnel restructuring project launched in 2014/2015.

Extraordinary Meeting in February

The Supervisory Board held an extraordinary meeting on February 23 in which it continued its discussion from the preceding ordinary meeting and approved the annual plan and budget for 2015.

Meeting in March (Meeting to Discuss the Financial Statements)

At its March 19 meeting, the Supervisory Board turned its attention to SAP SE’s 2014 financial statements and the consolidated financial statements, the audits conducted by KPMG AG Wirtschaftsprüfungsgesellschaft (KPMG), and the Executive Board’s proposed resolution on the appropriation of retained earnings for 2014. The Audit Committee reported on all matters for which it is responsible in connection with the financial statements and the consolidated financial statements for 2014, particularly on the form and scope of its examination of the documents relating to the financial statements, and recommended that we approve them. The auditor attended the meeting and reported in detail on the audit and its findings for each of the focus areas the Audit Committee had selected. The auditor also related the discussions on those matters at the two preceding meetings of the Audit Committee. The auditor then discussed the results of the audit with the Supervisory Board and answered our questions. The Supervisory Board approved the audit. There were no findings from our own examination, so

| | |

| To Our StakeholdersReport from the Supervisory Board | | 18 |

we gave our consent to the SAP SE and consolidated financial statements for 2014. We checked and endorsed the Executive Board’s proposal to appropriate retained earnings in accordance with the Audit Committee’s recommendation. There were also a number of corporate governance matters on the meeting agenda. We discussed the impact of Germany’s new gender quota law and set a target for the percentage of women on SAP’s Executive Board. We decided on the resolutions we would propose for the agenda of the Annual General Meeting of Shareholders in May 2015. Among them was our recommendation to the shareholders concerning the auditor to elect for 2015; our recommendation followed that of the Audit Committee to us.

The Executive Board reported on its forecast for the first quarter of 2015 and offered insights into the implementation of the end-to-end delivery model, using the example of cloud-based human capital management (HCM) software. This delivery model is based on a standardized concept for the management and organization of all activities in the product lifecycle, from product development to sales to service and support services. Finally, it gave us an update on the status of the SAP ONE Service program restructuring designed to merge the services and support areas into a single organization.

Extraordinary Meeting in May

Elections for new employee representatives on the Supervisory Board were held in the spring of 2015 in accordance with the terms of the SAP SE Employee Involvement Agreement that was concluded on March 10, 2014, in the course of SAP’s conversion to an SE. Among other things, the SAP SE Employee Involvement Agreement governs the codetermination of employees on the Supervisory Board. The term of office of the elected employee representatives began after the Annual General Meeting of Shareholders on May 20, 2015. As a result, the Supervisory Board held an extraordinary meeting immediately following the Annual General Meeting. After welcoming the new members, the Supervisory Board chairperson introduced Gesche Joost, who was to be appointed as Hartmut Mehdorn’s successor to the Supervisory Board through application to the court. We then elected the new employee representative members to the various committees. Margret Klein-Magar was elected deputy chairperson of the Supervisory Board by circular correspondence vote following in-depth discussion of all proposed candidates during the meeting.

Meeting in July

At our ordinary meeting on July 9, we discussed in detail the directors’ and officers’ group liability insurance policies that we take out from year to year, and approved an increase in the insurance limit. We resolved to revise the list of transactions for which the Executive Board must obtain the Supervisory Board’s consent, in accordance with the German SE Implementation Act, section 19. We confirmed the appointment of Quentin Clark to the Global Managing Board. The Supervisory Board also resolved the appointments of new members to the committees, which became necessary following Hartmut Mehdorn’s departure from and Gesche Joost’s appointment to the Supervisory Board.

The Executive Board then gave us an account of business in the second quarter of 2015 and performance in the first half-year. Members of the Executive Board told us about second-quarter growth in cloud, about the SAP Business Network segment’s performance, and about SAP’s competitive situation. We also received updates on the Global Service & Support board area, the market launch of SAP S/4HANA, and the Company’s “Run Simple” campaign.

Extraordinary Meeting in September

In early July, we learned of Bill McDermott’s serious accident. The Supervisory Board chairperson thereafter maintained close regular contact with the CEO to check on his recovery. Having already advised by telephone during a break at the ordinary meeting on July 9 that he had been released from hospital, Bill McDermott joined our extraordinary meeting on September 10 personally to report in more detail about his accident, the injuries he suffered, and his recovery process. We were relieved to hear that despite the severe consequences of the accident, he now felt strong again and was able to continue devoting all of his energy to his work as CEO.

Meeting in October

At our ordinary meeting on October 8, we resolved, on the recommendation of the General and Compensation Committee, to appoint Michael Kleinemeier to the Executive Board effective on November 1, 2015, and we agreed the terms and conditions of his compensation.

The Executive Board reported on business in the third quarter, using the new SAP Digital Boardroom solution to present the data and detailed views on multiple interactive computer screens. The SAP Digital Boardroom is an innovative, analytical software solution that allows analysts to generate impressive graphics for all business area metrics in real time. The “Global Consolidation of Intellectual Property Rights” (IP Rights) project for Group-wide bundling of SAP’s IP rights was also presented to us. We consented to this project and its related planned measures. In agreement with the Executive Board, the Supervisory Board also adopted, for regular publication in October 2015, the annual declaration of implementation of the Code pursuant to the German Stock Corporation Act, section 161. The Supervisory Board determined that it has a sufficient number of independent members. Some Supervisory Board members currently have business dealings with SAP or hold senior positions or material equity in companies that currently have business dealings with SAP, or had done so in the course of the year. SAP’s business dealings with these persons or companies are or were at arm’s length. In our view, especially given the limited scope and materiality of those dealings, they did not affect the independence of the Supervisory Board members concerned and do not give rise to any substantial and

| | |

| To Our StakeholdersReport from the Supervisory Board | | 19 |

not merely temporary conflict of interest in the meaning of the Code. The Supervisory Board conducted its regular investigation into the efficiency of its own work. We then looked at the budget plan for the upcoming fiscal year and the Executive Board updated us on SAP’s current marketing strategy.

Extraordinary Meeting in December

At the extraordinary meeting on December 11, which was held in the form of a telephone conference, we discussed with the Executive Board the status of the budget planning for 2016, which the Executive Board explained to us in detail. The final adoption of the budget will occur, as is customary, at the February meeting of the new year.

THE WORK OF THE SUPERVISORY BOARD COMITTEES

The committees made a key contribution to the work of the Supervisory Board and reported on their work to us, including their preparatory work on the relevant agenda items of the full Supervisory Board. The following committees were in place in 2015 before the term of office of the newly elected employee representatives began:

| ¡ | | General and Compensation Committee: Hasso Plattner (chairperson), Panagiotis Bissiritsas, Wilhelm Haarmann, Jim Hagemann Snabe, Lars Lamadé, Bernard Liautaud, Margret Klein-Magar, Christiane Kuntz-Mayr |

| ¡ | | Audit Committee: Erhard Schipporeit (chairperson), Steffen Leskovar, Stefan Schulz, Klaus Wucherer |

| ¡ | | Finance and Investment Committee: Wilhelm Haarmann (chairperson), Panagiotis Bissiritsas, Hartmut Mehdorn, Kurt Reiner, Mario Rosa-Bian, Jim Hagemann Snabe |

| ¡ | | Technology and Strategy Committee: Hasso Plattner (chairperson), Stefan Schulz (deputy chairperson), Pekka Ala-Pietilä, Anja Feldmann, Steffen Leskovar, Bernard Liautaud, Margret Klein-Magar, Kurt Reiner |

| ¡ | | People and Organization Committee: Hasso Plattner (chairperson), Catherine Bordelon, Anja Feldmann, Wilhelm Haarmann, Christiane Kuntz-Mayr, Lars Lamadé, Hartmut Mehdorn, Mario Rosa-Bian |

| ¡ | | Nomination Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Bernard Liautaud |

| ¡ | | Special Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Wilhelm Haarmann, Margret Klein-Magar, Lars Lamadé, Erhard Schipporeit |

In the course of the election of new employee representatives to the Supervisory Board, we reconstituted the committees after the Annual General Meeting of Shareholders on May 20, 2015, as detailed below. The membership of the committees subsequently changed once more in July 2015 following the departure of Hartmut Mehdorn from and appointment of Gesche Joost to the Supervisory Board. Hartmut Mehdorn was succeeded by Pekka Ala-Pietilä on the Finance and Investment Committee, and by Gesche Joost on the People and Organization Committee. In addition, Gesche Joost and Panagiotis Bissiritsas joined theTechnology and StrategyCommittee, increasing the number of members on that committee from eight to 10.

| ¡ | | General and Compensation Committee: Hasso Plattner (chairperson), Wilhelm Haarmann, Andreas Hahn, Margret Klein-Magar, Lars Lamadé, Bernard Liautaud, Sebastian Sick, Jim Hagemann Snabe |

| ¡ | | Audit Committee: Erhard Schipporeit (chairperson), Panagiotis Bissiritsas, Martin Duffek, Klaus Wucherer |

| ¡ | | Finance and Investment Committee: Wilhelm Haarmann (chairperson), Pekka Ala-Pietilä (from July 9, 2015), Panagiotis Bissiritsas, Margret Klein-Magar, Sebastian Sick, Jim Hagemann Snabe |

| ¡ | | Technology and Strategy Committee: Hasso Plattner (chairperson), Christine Regitz (deputy chairperson), Pekka Ala-Pietilä, Panagiotis Bissiritsas (from July 9, 2015), Anja Feldmann, Andreas Hahn, Gesche Joost (from July 9, 2015), Margret Klein-Magar, Bernard Liautaud, Pierre Thiollet |

| ¡ | | People and Organization Committee: Hasso Plattner (chairperson), Martin Duffek, Anja Feldmann, Wilhelm Haarmann, Gesche Joost (from July 9, 2015), Lars Lamadé, Christine Regitz, Robert Schuschnig-Fowler |

| ¡ | | Nomination Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Bernard Liautaud |

| ¡ | | Special Committee: Hasso Plattner (chairperson), Pekka Ala-Pietilä, Wilhelm Haarmann, Lars Lamadé, Erhard Schipporeit, Sebastian Sick |

Each of the committees was active in 2015 except the Special Committee and the Nomination Committee.

For more information about the Supervisory Board committees and their duties, see SAP’s corporate governance statement pursuant to the German Commercial Code, section 289a, published on SAP’s Web site at: http://www.sap.com/investor.

In 2015, the committees focused on the following topics:

| ¡ | | TheGeneral and Compensation Committee held six regular meetings. It prepared and recommended the Supervisory Board’s resolutions, notably those on Executive Board compensation described above. It worked on the new model for Executive Board compensation for 2016 and frequently deliberated on Global Managing Board members’ compensation. It reviewed the annual report it receives from the capital market compliance officer and gave its approval for Bill McDermott to accept a seat on the supervisory board of a U.S. company. At its first meeting in March, the Committee prepared the Supervisory Board’s resolutions regarding the target for the percentage of women on the Executive Board. In a second meeting in March, the Committee received a report from the corporate governance officer and, in preparation for the upcoming Supervisory Board meeting, discussed the Government Commission for the German Corporate Governance Code’s proposed changes to the Code recommendations. At its October |

| | |

| To Our StakeholdersReport from the Supervisory Board | | 20 |

meeting, the Committee discussed the Company’s implementation of the Code recommendations and prepared the Supervisory Board’s decisions with respect to the submission of the declaration of implementation of the Code and ascertaining the independence of Supervisory Board members. It also prepared the Supervisory Board’s decision concerning Michael Kleinemeier’s appointment to the Executive Board. The Committee also discussed succession planning for the Executive Board and the Global Managing Board.

| ¡ | | TheFinance and Investment Committee held five physical meetings in 2015, one of which was a joint meeting with the Technology and Strategy Committee. At its January 27 meeting, representatives from Sapphire Ventures presented detailed information about the investment activities of the three SAP venture capital funds. The Committee discussed SAP’s process for mergers and acquisitions (M&A) and was given a comparison of standards with those of other IT companies. It learned about the standard clauses SAP uses in acquisition contracts, probed the tax treatment of past M&A transactions, and received a status report regarding the 2014 acquisition of SeeWhy, a leader in cloud solutions for behavior-based marketing. The annual report on SAP’s acquisitions was the focus of the meeting on February 11, during which the Committee discussed at length the employee feedback regarding past acquisitions. On July 8, the Finance and Investment Committee held a joint meeting with the Technology and Strategy Committee. Matters discussed included a comprehensive analysis of the major acquisitions in the past three years, SAP’s strategic alignment, and an overview of product developments in the field of analytics and the Internet of Things. When it met in October, the Committee focused solely on the global project to consolidate SAP SE’s IP rights. Focus topics at the December 16 meeting were an overview of the acquisition scene in Europe including startups, the acquisition of the HR software company Multiposting, and the adoption of the Committee’s rules of procedure. The Committee was also given a status update on the IP rights consolidation project, notably as regards the final legal and tax analysis. The Executive Board explained the principles of goodwill recognition, as well the results of the impairment test performed on the recognized goodwill in accordance with the relevant IFRS regulations. The Committee’s aim was to be able to better consider the subsequent accounting for goodwill arising from acquisitions when monitoring SAP’s acquisition activities in the future. |

| ¡ | | TheAudit Committee held four meetings at which members attended in person (“physical meetings”) and four telephone conference meetings. The telephone conference meetings were all ahead of the publication of interim reports for each quarter. At these meetings, the Committee primarily deliberated on the course of business over the quarter concerned, the process by which the quarterly financial reports were prepared, the interim report to be published, and insights gained from the auditor’s quarterly review of selected software agreements. The physical meetings in February and March concentrated on the SAP SE and consolidated financial reports for 2014 and the reporting process, the internal control structure for financial reporting, the most important accounting methods, and the audit. At the February meeting, the Committee also discussed the German Financial Reporting Enforcement Panel’s criteria and the internal audit service’s report for the previous year, organization and processes, and audit plan for 2015. At its meeting in March, the Committee did preparatory work on the Supervisory Board’s recommendations to the Annual General Meeting of Shareholders concerning the election of an auditor and the appropriation of retained earnings and discussed the Company’s compliance system. When it met in July, the Committee discussed the audit focus and fees with the auditor, dealt with the internal audit service’s work in the first half of the year and audit planning for the second half-year, and reviewed the Company’s internal controls. At its October meeting, the Committee discussed the report from the chief compliance officer and other compliance system matters and came to the conclusion that the compliance system was effective. |

The auditor attended all physical meetings and telephone conference meetings of the Audit Committee and reported in depth on its audit work and on its quarterly reviews of selected software agreements.

| ¡ | | TheTechnology and Strategy Committee held four meetings in 2015, one of which was a joint meeting with the Finance and Investment Committee. It discussed the key technology trends in the software industry in the years to come and SAP’s corporate and product strategies. At the Committee’s February 11 meeting, the Executive Board presented an overview of market development in 2014 and explained what it would mean for SAP’s business in 2015. Key topics included the strategic road map for SAP S/4HANA, its deployment in the cloud, and its market launch. When the Committee met on March 18, it discussed SAP HANA Cloud Platform and SAP HANA Enterprise Cloud. As reported in the Finance and Investment Committee section above, the Technology and Strategy Committee held a joint meeting with the Finance and Investment Committee on July 8. On October 7, the Committee engaged in detailed discussions about SAP’s user experience (UX) strategy, in other words, the planned measures to improve the user-friendliness of SAP software, taking a particular look at SAP Fiori UX and past successes. It also analyzed and discussed the outlook for the SAP Business Network segment. |

| ¡ | | ThePeople and Organization Committee held two meetings in 2015. In June, it was given an update on the current status of training and personal and professional development at SAP, with detailed information on the various training programs in each board area. The Committee also examined the current state of succession planning for the managers. The second meeting took place on September 10, at which the Committee reviewed the learning offerings available through SAP Development University, SAP’s internal academy for the professional training of its developers. In addition, the Committee discussed SAP’s collaboration with academia to promote young talents in a digitalized working world. |

| | |

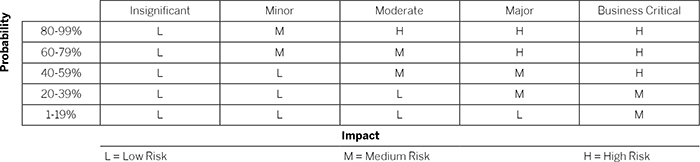

| To Our StakeholdersReport from the Supervisory Board | | 21 |