Exhibit 99.2

Impact Through Innovation

Half-Year Report

January - June 2017

| | | | |

| Half-Year Report January – June 2017 | | | 1 | |

Table of Contents

| | | | |

| Half-Year Report January – June 2017 | | | 2 | |

Introductory Notes

This half-year group report meets the requirements of German Accounting Standard No. 16 “Half-yearly Financial Reporting” (GAS 16). We prepared the financial data in the Half-Year Report section for SAP SE and its subsidiaries in accordance with International Financial Reporting Standards (IFRS). In doing so, we observed the IFRS both as issued by the International Accounting Standards Board (IASB) and as endorsed by the European Union (EU). This does not apply to numbers expressly identified asnon-IFRS. For additional IFRS andnon-IFRS information, see the Supplementary Financial Information section.

This half-year group report complies with the legal requirements in accordance with the German Securities Trading Act (Wertpapierhandelsgesetz, WpHG) for a half-year financial report, and comprises the consolidated half-year management report, consolidated half-year financial statements, and the responsibility statement in accordance with the German Securities Trading Act, section 37w (2).

This half-year financial report updates our consolidated financial statements 2016, presents significant events and transactions of the first half of 2017, and updates the forward-looking information contained in our Management Report 2016. This half-year financial report only includes half-year numbers, our quarterly numbers are available in the Quarterly Statement. Both the 2016 consolidated financial statements and the 2016 management report are part of our Integrated Report 2016, which is available at www.sapintegratedreport.com.

All of the information in this half-year group report is unaudited. This means the information has been subject neither to any audit nor to any review by an independent auditor.

| | | | |

| Half-Year Report January – June 2017 | | | 3 | |

Consolidated Half-Year Management Report

Strategy and Business Model

We did not change our strategy or our business model in the first half of 2017. For a detailed description, see our Integrated Report 2016.

Products, Research and Development, and Services

In the first six months of 2017, we continued to innovate in every aspect of our customers’ businesses and launched several innovations to grow and win in the market. This chapter outlines the major enhancements we made to our software portfolio in the first half year 2017. For a detailed overall description, see the Products, Research & Development, and Services section in our Integrated Report 2016 (www.sapintegratedreport.com).

SAP Leonardo empowers companies to digitally transform at scale

SAP Leonardo is a Digital Innovation System that was announced at SAPPHIRE NOW in May. It brings together SAP’s experience, deep process and industry knowledge with software capabilities such as IoT, Blockchain, Machine Learning, Big Data and Analytics on the SAP Cloud Platform. SAP Leonardo starts with a specific business problem, applies Design Thinking to define the desired solution, and then uses SAP Leonardo Innovation Services with rapid prototyping to quickly make that solution a reality.

SAP Cloud Platform

SAP Cloud Platform is anend-to-end digital multi-cloud enterprise platform running in SAP data centers as well as on Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform. It gives our customers the choice as to where their data resides, and the ability to massively scale. It is the underlying platform and technical foundation for SAP Leonardo. Beyond the service layer, it continues to offer many additional features with a focus on being an open platform. It makes use of open-source standards to provide support for more programming languages, as well as support for Hadoop and Spark for our Big Data Services, and providing a basis for seamless integration through the SAP API Business Hub. The SAP App Center went live in May 2017 with 1,350 solutions from more than 800 partners. This marketplace enables customers to discover, try, and buy solutions built on SAP Cloud Platform.

IoT and Digital Supply Chain

Our IoT & Digital Supply Chain solutions support the vision to “Intelligently Connect People, Things, and Businesses”. The goal is to enable our customers to achieve higher levels of automation and productivity, and to create new business models. SAP Internet of Things provides solutions toon-board, configure, and manage almost any kind of remote device, using a broad variety of protocols. Devices or other assets can also be represented and monitored as a digital model, otherwise known as a ‘Digital Twin’. SAP IoT services allow data to be processed either on the devices at the edge of your network, or on SAP Cloud Platform. SAP IoT in combination with 3D printing, advanced logistics, and our fully integrated digital supply chain solutions, enableson-demand manufacturing and streamlined supply chains, to deliver products to market more quickly and cost-effectively. SAP Connected Goods connects, monitors, and controls a large number of customer-facing mass market devices such as beverage coolers, coffee makers, vending machines, construction tools, or healthcare equipment.

Machine Learning

The SAP Leonardo Machine Learning Foundation provides a variety of functional and business machine-learning services to make enterprise applications intelligent. We have many examples of these services being utilized across the SAP portfolio, and the number is growing rapidly. For example, SAP Cash Application deployed in SAP S/4HANA can accurately match payments to invoices, while SAP Resume Matching helps recruiters to match resumes with job positions. We also have stand-alone applications for specific use cases, such as SAP Brand Impact to accurately track brand exposure in videos and SAP Fraud Management to more accurately identify fraud in business. In addition, SAP Machine Learning services have also been made available to our customers and partners through the SAP API Business Hub.

Blockchain

SAP Cloud Platform blockchain services enable business application developers to build transactional applications. These applications are used by multiple participants and establish trust and transparency while streamlining business processes. SAP helps customers implement industry and line of business process extensions by leveraging blockchain capabilities integrated into SAP solutions.

Advanced Analytics

Business Intelligence systems are rapidly evolving, becoming more intelligent, with insights delivered in greater context, and with new

| | | | |

| Half-Year Report January – June 2017 | | | 4 | |

ways to interact with the software, including spoken form. New features in our SAP Analytics Cloud solution are creating a new standard for working with data at the intersection of BI, planning, predictive and machine learning. Analytics Cloud Smart Insights, Guided Machine Discovery, and regression visualization support help both business and data scientist users understand driving factors and context. Mobile is a significant element in this version of SAP Analytics Cloud, allowing customers to consume analytics in a responsive, native mobile layout with support for collaboration and notifications. To provide customers with smooth transitions to the cloud, enhanced hybrid capabilities are available, including SAP Analytics Hub, which consolidates content fromon-premise and cloud analytics solutions in a single portal.

SAP HANA: Enabling Business with a Digital Data Foundation

SAP HANA remains the foundation for digital transformation, and itsin-memory database technology is the enabler for the digital business. The simplified SAP HANA architecture drives accelerated machine learning, with greater accuracy and faster learning cycles. SAP HANA continues to evolve with new innovations. For example, SAP HANA can now deliver earth observation analysis to drive greater spatial analytics. The SAP HANA Express Edition, a free version of SAP HANA designed to run on a laptop, has now been downloaded over 20,600 times. It is also available on the Google Marketplace, thus opening up the SAP HANA community to even morenon-SAP developers.

Applications

SAP S/4HANA

SAP S/4HANA Cloud, SAP’s public cloud ERP solution, which now includes Finance for Large Enterprises and Demand-Driven Manufacturing, is focused on delivering greater autonomy and intelligence to ERP by leveraging the next-generation of intelligent technologies. SAP S/4HANA Cloud is an ERP solution that offers a rich library of APIs that can be used to extend applications and to enable processes to run across different systems.

Many SAP customers also like to work in a hybrid mode, where optimized core processes run on premise, and differentiating applications run in the cloud, for example on SAP Cloud Platform, while being seamlessly integrated back into the core. We provide customers with a road map to support their digital transformation journey. The SAP Transformation Navigator tool facilitates the customers’ move from their current landscape to one that is based on SAP S/4HANA – and has received excellent feedback from hundreds of mapping sessions.

Innovating for LoBs and Industries

Customer Engagement and Commerce (CEC)

In March 2017, SAP extended its customer engagement and commerce cloud suite with the availability of the SAP Hybris Revenue Cloud solution. With this solution, customers can connect to SAP S/4HANA for a single view, providing flexible, simplified reporting and improved automation to better track and manage the health of customer relationships and their overall business.

In early 2017, SAP strengthened its portfolio by acquiring Abakus. The combined power of Abakus and our SAP Hybris Marketing solution which enables chief marketing officers and chief financial officers to better understand the contributions and effectiveness of their digital marketing investments.

Connecting Companies Through Business Networks

In 2017, SAP Ariba unveiled and went live with innovations that help businesses achieve efficient, intelligent connections and frictionless transactions across the entiresource-to-settle process. These innovations include the following:

| – | | Cognitive procurement applications – Leveraging SAP Leonardo and other machine learning technologies, the applications will bring intelligence from procurement data together with predictive insights to improve decision making across supplier management, contracts, and sourcing activities. |

| – | | SAP Ariba Spot Buy – A digital marketplace for industrial goods and services that delivers a consumer-like shopping experience. |

| – | | Guided buying – A contextual buying experience that automatically leads employees to the goods and services they need to do their jobs and execute purchases in compliance with company policies. |

| – | | Open platform – Ariba Network offers an open technical interface (API) capability that allows partners to add functionality and extend solutions for all industries and business needs. |

In the first half of 2017, SAP Fieldglass made the following innovations available:

| – | | SAP Fieldglass Flex, a talent management system for external workers designed for themid-market |

| – | | SAP Fieldglass Live Insights, a machine learning-powered industry benchmarking and simulation solution created in partnership with the SAP Data Network, which enables executives to benchmark, plan, predict, and simulate business scenarios using anonymized and aggregated data. |

Employees and Social Performance

Our employees play a pivotal role in helping our customers succeed in the new digital economy. Our employees empower our customers to Run Simple and work more innovatively. At the same time, our employees enable SAP to fulfill its strategy to be the most innovative cloud company powered by SAP HANA. For a detailed description of our employee strategy, see the employees and social investments section in our Integrated Report 2016 (www.sapintegratedreport.com).

An important factor in our long-term success is our ability to attract and retain talented employees. At the end of the first half year of 2017, the employee retention rate was 94.3% (compared to 92.6% at the end of the first half year of 2016). We define employee

| | | | |

| Half-Year Report January – June 2017 | | | 5 | |

retention rate as the ratio between the average number of employees less voluntary employee departures (fluctuation) and the average number of employees (in full-time equivalents) in the last 12 months.

One of SAP’s overallnon-financial goals is fostering a diverse workforce, specifically increasing the number of women in management. At the end of the first half year of 2017, 25.0% of all management positions at SAP were held by women, compared to 24.1% at the end of June 2016. Thus SAP will reach its target to increase the share of women in management to 25% by the end of 2017.

On June 30, 2017, we had 87,114 full-time equivalent (FTE) employees worldwide (June 30, 2016: 79,962; December 31, 2016: 84,183). Those headcount numbers included 19,375 FTEs based in Germany (June 30, 2016: 18,176), and 18,368 FTEs based in the United States (June 30, 2016: 16,780).

Environmental Performance: Energy and Emissions

Over the past several years, we have worked to better understand the connections between our energy consumption, its related cost, and the resulting environmental impact. Today we measure and address our energy usage throughout SAP, as well as our greenhouse gas (GHG) emissions across our entire value chain. We have calculated that over the last three years, energy efficiency initiatives have contributed to a cumulative cost avoidance of €148 million, compared to abusiness-as-usual extrapolation, €35 million of which were avoided this year.

Our goal is to reduce the greenhouse gas emissions from our operations to levels of the year 2000 by 2020. We also recently announced the target to become carbon neutral by 2025. SAP’s GHG emissions for the first half year of 2017 totaled 155 kilotons of CO2compared to 215 kilotons in the first half year of 2016. This decrease is primarily due to an increased purchase of CO2 offsets to compensate for a significant portion of our business flights, as well as an overall decrease in business flights.

To gain insight into our efficiency as we grow, we also measure our emissions per employee and per euro of revenue. At the end of the first half year of 2017, our GHG emissions (in tons) per employee was 3.6 (compared to 5.0 at the end of the first half year of 2016) and our GHG emissions (in grams) per euro revenue was 13.5 (compared to 18.8 at the end of the first half year of 2016) (rolling four quarters).

In recognition of the exemplary actions SAP has taken to embed sustainability across its business worldwide, SAP has been included in various ratings and rankings. In the first half year of 2017, SAP has been awarded the exclusive 2017 Top Employer certification in Belgium, Canada, China, France, Israel, Italy, Mexico, Netherlands, Russia, Saudi Arabia, South Africa, Spain, Turkey, United Kingdom, and the United States. Furthermore, the Company has also been certified as a regional Top Employer in Europe, the Middle East, and North America.

Organization and Changes in Management

Steve Singh, the Executive Board member responsible for Business Networks and Applications, left SAP on April 30, 2017.

The Supervisory Board decided to expand the responsibilities of the Executive Board members Robert Enslin and Bernd Leukert as of May 1, 2017. Further, the Supervisory Board appointed AdaireFox-Martin and Jennifer Morgan to the Executive Board effective May 1, 2017. They assume global responsibility for SAP’s sales organization.

| | | | |

| Half-Year Report January – June 2017 | | | 6 | |

Financial Performance:

Review and Analysis

Economy and the Market

Global Economic Trends

In its latest economic bulletin, the European Central Bank (ECB) concludes that the global economy continued its positive momentum in the first half of 2017 despite an initial decline in global gross domestic product (GDP) in the first quarter. The ongoing economic recovery stimulated emerging market economies and boosted global trade, it finds.

In the Europe, Middle East, and Africa (EMEA) region, euro area activity increased in the first half of the year. According to the analysts, this economic boom in the euro area was increasingly resilient and by midyear had broadened across sectors and countries. Consumer and investment spending was likewise strong in the Central and Eastern European countries, the ECB writes, with GDP growth even rebounding sharply in Russia.

In the Americas region, GDP growth in the United States slowed, which the ECB attributes primarily to weaker consumer spending and a marked decline in inventory investment spending. Brazil, on the other hand, was able to rise out of its recession during the reporting period, it says.

Looking at the Asia Pacific Japan (APJ) region, the ECB reports that while GDP growth in China waned despite optimistic short-term indicators, economic activity in India continued its upswing. The Japanese economy, meanwhile, continued to benefit from Japan’s low interest rate policy and expanded slightly, the ECB says.

The IT Market

According to Gartner, a market research firm, “The U.K. election and continuing Brexit uncertainty did shock the currency markets, and the British pound has declined; however, this did not translate into a disruption in the global IT market.” “Taking out the impact of exchange rate movements, the […] constant-currency growth for 2017 is unchanged at 3.3%.”2)

“Enterprise software is the fastest-growing segment in 2017, with 5,5% growth in 2017”1), says Gartner. “Globally, the enterprise software market will grow by 8.6% in 2017, reaching $392 billion in constant dollars, an increase of 1.3% over the 1Q17 forecast.”2)

“Overall, IT spending results vary greatly by region. The largest region for total IT spend in 2017 remains North America, with $1.21 trillion. However, the fastest-growing region is emerging Asia/Pacific, with 2017 constant-currency growth of 8.9% (revised up 0.9% from the 1Q17 update). The next-best region for growth is Greater China, with 2017 constant-currency growth of 5.1%, down 1.2% from 1Q17. The remaining regions are facing anemic growth rates between 3.9% and 0.3%.”2)

The Western European IT market in the Europe, Middle-East, and Africa (EMEA) region, grew from 1.2% (2016) to 1.7% (2017) on ayear-on-year basis, whereas the Eastern European IT market declined from 2.8% to 0.3% (see table in paragraph “Expected Developments and Opportunities”: “Trends in the IT Market – IT SpendingYear-on-Year”, created by SAP based on Gartner Market Databook, 2Q17 Update). According to the same table, software spending grew significantly faster than all other submarkets throughout the region.

The Americas region likewise recorded higher growth rates in IT spending than the previous year as can be seen in the table mentioned above. According to the same table, software spending even outperformed IT spending as a whole.

In the Asia Pacific Japan (APJ) region, software spending grew much faster than all other submarkets in the IT industry as well, documented in the table mentioned above.

Sources:

1) Gartner Forecast Analysis: IT Spending, Worldwide, 1Q17 Update, 16 May 2017.

2) Gartner Forecast Alert IT Spending, Worldwide, 2Q17 Update, 7 July 2017.

The Gartner Report(s) described herein, (the “Gartner Report(s)”) represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this Half-Year Report) and the opinions expressed in the Gartner Report(s) are subject to change without notice.

Impact on SAP

SAP had a strong performance in the EMEA region with cloud and software revenue increasing 9% (IFRS). Cloud subscriptions and support revenue grew 48% (IFRS) with an especially strong quarter in Germany and Russia. SAP also had double-digit software revenue growth in Germany and MENA (Middle East and North Africa) and triple-digit software revenue growth in Russia.

The Company had solid growth in the Americas region with cloud and software revenue growing by 8% (IFRS) and cloud subscriptions and support revenue increasing by 20% (IFRS). In North America, Canada had double-digit growth in software revenue. In Latin America Mexico and Chile were highlights with double-digit software revenue growth.

In the APJ region, SAP had an exceptional performance in both cloud and software revenue and cloud subscriptions and support revenue. Cloud and software revenue was up 13% (IFRS) with cloud subscriptions and support revenue growing by 52% (IFRS). Greater China3 was very strong in cloud subscriptions and support revenue while Japan and Australia both had strong double-digit growth in software revenue.

| | | | |

| Half-Year Report January – June 2017 | | | 7 | |

Key Figures – SAP Group in the First Half Year of 2017 (IFRS)

| | | | | | | | | | | | | | | | |

€ millions, unless otherwise stated | | Q1–Q2

2017 | | | Q1–Q2 2016 | | | D | | | D in % | |

Cloud subscriptions and support | | | 1,837 | | | | 1,397 | | | | 440 | | | | 31 | |

Software licenses | | | 1,781 | | | | 1,649 | | | | 132 | | | | 8 | |

Software support | | | 5,467 | | | | 5,162 | | | | 305 | | | | 6 | |

Cloud and software | | | 9,085 | | | | 8,208 | | | | 876 | | | | 11 | |

Total revenue | | | 11,066 | | | | 9,964 | | | | 1,102 | | | | 11 | |

Operating expense | | | –9,467 | | | | –7,882 | | | | –1,585 | | | | 20 | |

Operating profit | | | 1,599 | | | | 2,082 | | | | –482 | | | | –23 | |

Operating margin (in %) | | | 14.5 | | | | 20.9 | | | | –6.4pp | | | | NA | |

Profit after tax | | | 1,197 | | | | 1,382 | | | | –186 | | | | –13 | |

Effective tax rate (in %) | | | 24.1 | | | | 26.7 | | | | –2.7pp | | | | NA | |

Earnings per share, basic (in €) | | | 0.99 | | | | 1.16 | | | | –0.17 | | | | –14 | |

| | | | | | | | | | | | | | | | |

Deferred cloud subscriptions and support revenue (June 30) | | | 1,293 | | | | 1,003 | | | | 290 | | | | 29 | |

Operating Results in the First Half Year of 2017 (IFRS)

Orders

The total number of completed transactions foron-premise software in the first half year of 2017 remained stable at 27.5 thousand (first half year of 2016: 27.4 thousand). The average value of software orders received foron-premise software increased 3% compared to the year before. Of all our software orders received in the first half year of 2017, 29% were attributable to deals worth more than €5 million (first half year of 2016: 25%), while 42% were attributable to deals worth less than €1 million (first half year of 2016: 42%).

Revenue

Our revenue from cloud subscriptions and support was €1,837 million (first half year of 2016: €1,397 million), an increase of 31% compared to the same period in 2016, with the cloud revenue growth rates remaining stable on a high level.

In the first half year of 2017, software licenses revenue was €1,781 million (first half year of 2016: €1,649 million), an increase of 8% compared to the same period in 2016. Noteworthy is the successful software license business in both quarters with increases of 13% (first quarter of 2017) and 5% (second quarter of 2017).

Total revenue was €11,066 million (first half year of 2016: €9,964 million), an increase of 11% compared to the same period in 2016.

Operating Expense

In the first half year of 2017, our operating expense increased by 20% to €9,467 million (first half year of 2016: €7,882 million). The increase in expenses was driven by an increase in share-based compensation expenses. The increase in share based compensation expenses reflects the strong increase in SAP’s share price and high participation rates in SAP’s global employee share based-compensation programs. The increase in restructuring related expenses is caused by a newly launched restructuring program in the Digital Business Services (DBS) board area.

Operating Profit and Operating Margin

In the first half year of 2017, mainly as a result of the aforementioned expense increases, operating profit decreased 23% compared with the same period in the previous year to €1,599 million (first half year of 2016: €2,082 million). Our operating margin decreased by 6.4 percentage points to 14.5% (first half year of 2016: 20.9%).

Profit After Tax and Earnings per Share

In the first half year of 2017, profit after tax was €1,197 million (first half year of 2016: €1,382 million), a decrease of 13%. Basic earnings per share was €0.99 (first half year of 2016: €1.16), a decrease of 14%.

The effective tax rate in the first half of 2017 was 24.1% (first half of 2016: 26.7%). The year-over-year decrease in the effective tax rate mainly resulted from changes in taxes for prior years and changes in the regional allocation of income.

| | | | |

| Half-Year Report January – June 2017 | | | 8 | |

Performance Against Our Outlook for 2017(Non-IFRS)

In this section, all discussion of the contribution to target achievement is based exclusively onnon-IFRS measures. However, the discussion of operating results refers to IFRS figures only, so those figures are not expressly identified as IFRS figures.

We present, discuss, and explain the reconciliation from IFRS measures tonon-IFRS measures in the Supplementary Financial Information section.

Guidance for 2017(Non-IFRS)

For our guidance based onnon-IFRS numbers, see the Operational Targets for 2017(non-IFRS) section in this consolidated half-year management report.

Key Figures – SAP Group in the First Half Year of 2017(Non-IFRS)

| | | | | | | | | | | | | | | | |

| | | Non-IFRS | |

| € millions, unless otherwise stated | | Q1–Q2

2017 | | | Q1–Q2 2016 | | | D in % | | | D in %

(Constant Currency) | |

Cloud subscriptions and support | | | 1,837 | | | | 1,399 | | | | 31 | | | | 28 | |

Software licenses | | | 1,781 | | | | 1,651 | | | | 8 | | | | 6 | |

Software support | | | 5,467 | | | | 5,163 | | | | 6 | | | | 4 | |

Cloud and software | | | 9,085 | | | | 8,212 | | | | 11 | | | | 8 | |

Total revenue | | | 11,067 | | | | 9,967 | | | | 11 | | | | 9 | |

Operating expense | | | –8,299 | | | | –7,348 | | | | 13 | | | | 11 | |

Operating profit | | | 2,768 | | | | 2,620 | | | | 6 | | | | 3 | |

Operating margin (in %) | | | 25.0 | | | | 26.3 | | | | –1.3pp | | | | –1.4pp | |

Profit after tax | | | 2,006 | | | | 1,742 | | | | 15 | | | | NA | |

Effective tax rate (in %) | | | 26.9 | | | | 28.1 | | | | –1.3pp | | | | NA | |

Earnings per share, basic (in €) | | | 1.67 | | | | 1.46 | | | | 14 | | | | NA | |

Performance in the First Half Year of 2017(Non-IFRS)

In the first half year of 2017, our revenue from cloud subscriptions and support(non-IFRS) was €1,837 million (first half year of 2016: €1,399 million), an increase of 31% (28% at constant currencies) compared to the same period in 2016. In the first half year 2017, our cloud subscriptions and support margin decreased by 1.8 percentage points to 63% (first half year of 2016: 65%).

New cloud bookings increased 39% in the first half year of 2017 to €555 million (first half year of 2016: €400 million).

In the first half year of 2017, cloud and software revenue(non-IFRS) was €9,085 million (first half year of 2016: €8,212 million), an increase of 11%. On a constant currency basis, the increase was 8%. This increase was mainly driven by a strongon-premise software business in both quarters of 2017.

Total revenue(non-IFRS) in the same period was €11,067 million (first half year of 2016: €9,967 million), an increase of 11%. On a constant currency basis, the increase was 9%.

Operating expense(non-IFRS) in the first half year of 2017 was €8,299 million (first half year of 2016: €7,348 million), an increase of 13%. On a constant currency basis, the increase was 11%. This increase reflects ongoing investments into our cloud infrastructure to increase operational efficiency and performance. In addition, we have higher personnel expenses from adding over 7,000 full-time employees or a 9% increase compared to the prior year period, to drive organic innovation and strengthen the sales function.

Operating profit(non-IFRS) was €2,768 million (first half year of 2016: €2,620 million), an increase of 6%. On a constant currency basis, the increase was 3%.

Operating margin(non-IFRS) in the first half year of 2017 was 25.0%, a decrease of 1.3 percentage points (first half year of 2016: 26.3%). Operating margin(non-IFRS) on a constant currency basis was 24.9%, a decrease of 1.4 percentage points.

In the first half year of 2017, profit after tax(non-IFRS) was €2,006 million (first half year of 2016: €1,742 million), an increase of 15%. Basic earnings per share(non-IFRS) was €1.67 (first half year of 2016: €1.46), an increase of 14%.

The effective tax rate(non-IFRS) in the first half of 2017 was 26.9% (first half of 2016: 28.1%). The year-over-year decrease in the effective tax rate mainly resulted from changes in taxes for prior years.

| | | | |

| Half-Year Report January – June 2017 | | | 9 | |

Segment Information

Applications, Technology & Services Segment

| | | | | | | | | | | | | | | | | | | | |

| € millions, unless otherwise stated | | Q1–Q2 2017 | | | Q1–Q2 2016 | | | D in % | | | D in % | |

| | | Actual Currency | | | Constant Currency | | | Actual Currency | | | Actual Currency | | | Constant Currency | |

Cloud subscriptions and support revenue – SaaS/PaaS1) | | | 728 | | | | 710 | | | | 527 | | | | 38 | | | | 35 | |

Cloud subscriptions and support gross margin – SaaS/PaaS1) (in %) | | | 59 | | | | 59 | | | | 64 | | | | –5pp | | | | –4pp | |

Cloud subscriptions and support revenue – IaaS2) | | | 158 | | | | 155 | | | | 89 | | | | 76 | | | | 73 | |

Cloud subscriptions and support gross margin – IaaS2) (in %) | | | 10 | | | | 10 | | | | –14 | | | | 24pp | | | | 24pp | |

Cloud subscriptions and support revenue | | | 885 | | | | 865 | | | | 616 | | | | 44 | | | | 40 | |

Cloud subscriptions and support margin (in %) | | | 50 | | | | 50 | | | | 52 | | | | –2pp | | | | –2pp | |

Segment revenue | | | 9,772 | | | | 9,566 | | | | 8,973 | | | | 9 | | | | 7 | |

Gross margin (in %) | | | 71 | | | | 71 | | | | 71 | | | | –0pp | | | | –0pp | |

Segment profit | | | 3,387 | | | | 3,297 | | | | 3,295 | | | | 3 | | | | 0 | |

Segment margin (in %) | | | 35 | | | | 34 | | | | 37 | | | | –2pp | | | | –2pp | |

1) Software as a Service/Platform as a Service

2) Infrastructure as a Service

The Applications, Technology & Services segment recorded strong growth in our cloud subscriptions and support revenue and growth in software licenses and support revenue as well as in services revenue in the first half year of 2017. The SaaS/PaaS business in this segment grew by 35% at constant currency basis driven by an ongoing strong demand in our cloud solutions. The IaaS business even grew by 73% at constant currency basis year over year.

As a result of our ongoing efforts to further improve our offerings and invest in our cloud infrastructure, our SaaS/PaaS gross margin showed a decline of 4 percentage points at constant currencies compared to the first half of 2016. This could not be fully offset by the positive development of the IaaS gross margin. The operative optimization and efficiency gains in our IaaS offerings led to a gross margin improvement of 24 percentage points. As a result, the overall cloud subscription and support gross margin dropped 2 percentage points to 50%.

The services gross margin continued its upward trend which was driven by completion of previous investment projects.

| | | | |

| Half-Year Report January – June 2017 | | | 10 | |

SAP Business Network Segment

| | | | | | | | | | | | | | | | | | | | |

| € millions, unless otherwise stated | | Q1–Q2 2017 | | | Q1–Q2 2016 | | | D in % | | | D in % | |

| | | Actual Currency | | | Constant Currency | | | Actual Currency | | | Actual Currency | | | Constant Currency | |

Cloud subscriptions and support revenue – SaaS/PaaS1) | | | 925 | | | | 899 | | | | 761 | | | | 22 | | | | 18 | |

Cloud subscriptions and support gross margin – SaaS/PaaS1) (in %) | | | 77 | | | | 77 | | | | 76 | | | | 1pp | | | | 1pp | |

Cloud subscriptions and support revenue | | | 925 | | | | 899 | | | | 761 | | | | 22 | | | | 18 | |

Cloud subscriptions and support margin (in %) | | | 77 | | | | 77 | | | | 76 | | | | 1pp | | | | 1pp | |

Segment revenue | | | 1,138 | | | | 1,107 | | | | 919 | | | | 24 | | | | 21 | |

Gross margin (in %) | | | 68 | | | | 68 | | | | 67 | | | | 0pp | | | | 0pp | |

Segment profit | | | 189 | | | | 181 | | | | 160 | | | | 18 | | | | 13 | |

Segment margin (in %) | | | 17 | | | | 16 | | | | 17 | | | | –1pp | | | | –1pp | |

1) Software as a Service/Platform as a Service

2) Infrastructure as a Service

Our improved operational efficiency resulted in improved cloud subscriptions and support gross margin in the SAP Business Network segment. In the first half of 2017, segment revenue growth was 21% at constant currencies.

Over the past 12 months, approximately 2.8 million connected companies traded nearly $1 trillion of commerce on the SAP Ariba network, more than 49 million end users processed travel and expenses effortlessly with Concur, and customers managed over 3.5 million contingent workers in more than 140 countries with the SAP Fieldglass platform.

At the beginning of 2017, we started to break down our cloud subscriptions and support revenue to provide transparency in our performance in the cloud delivery models. A reconciliation is provided for cloud revenues and cloud gross margins by delivery model from the amounts presented in the segment reporting to the group-wide amounts.

For more information about our segments, see the Notes to the Consolidated Half-Year Financial Statements section, Note (15).

Reconciliation of Cloud Subscription Revenues and Margins

| | | | | | | | | | | | | | | | | | | | | | |

| € millions, unless otherwise stated | | | | Q1–Q2 2017 | | | Q1–Q2 2016 | | | D in % | | | D in % | |

| | | | | Actual

Currency | | | Constant

Currency | | | Actual

Currency | | | Actual Currency | | | Constant Currency | |

Cloud subscriptions and support revenue – SaaS/PaaS1) | | SAP Business Network segment | | | 925 | | | | 899 | | | | 761 | | | | 22 | | | | 18 | |

| | Other | | | 755 | | | | 737 | | | | 548 | | | | 38 | | | | 35 | |

| | Total | | | 1,680 | | | | 1,636 | | | | 1,309 | | | | 28 | | | | 25 | |

Cloud subscriptions and support revenue – IaaS2) | | | | | 158 | | | | 155 | | | | 89 | | | | 76 | | | | 73 | |

Cloud subscriptions and support revenue | | | | | 1,837 | | | | 1,791 | | | | 1,399 | | | | 31 | | | | 28 | |

Cloud subscriptions and support gross margin – SaaS/PaaS1) (in %) | | SAP Business Network segment | | | 77 | | | | 77 | | | | 76 | | | | 1pp | | | | 1pp | |

| | Other | | | 58 | | | | 59 | | | | 64 | | | | –5pp | | | | –5pp | |

| | Total | | | 69 | | | | 69 | | | | 71 | | | | –2pp | | | | –2pp | |

Cloud subscriptions and support gross margin – IaaS2) (in %) | | | | | 10 | | | | 10 | | | | –14 | | | | 24pp | | | | 24pp | |

Cloud subscriptions and support gross margin (in %) | | | | | 63 | | | | 64 | | | | 65 | | | | –2pp | | | | –2pp | |

1) Software as a Service/Platform as a Service

2) Infrastructure as a Service

| | | | |

| Half-Year Report January – June 2017 | | | 11 | |

Finances and Assets (IFRS)

Cash Flow

| | | | | | | | | | | | |

| € millions | | Q1–Q2 2017 | | | Q1–Q2 2016 | | | D | |

Net cash flows from operating activities | | | 3,514 | | | | 2,921 | | | | +20% | |

Capital expenditure | | | –610 | | | | –406 | | | | +51% | |

Free cash flow | | | 2,903 | | | | 2,516 | | | | +15% | |

Free cash flow (as a percentage of total revenue) | | | 26 | | | | 25 | | | | +1pp | |

Free cash flow (as a percentage of profit after tax) | | | 243 | | | | 182 | | | | +61pp | |

Days’ sales outstanding (DSO, in days) | | | 72 | | | | 73 | | | | –1 | |

€3,514 million was our highest-ever operating cash flow for the first half of a year. The increase resulted mainly from an improved working capital management, which is also reflected in a year-over-year decrease of DSO. Furthermore, we had reduced payments for restructuring plans and income tax.

The expansion of our data centers as well as consolidation of our cloud infrastructure and technology platforms underlying our cloud solution portfolio are a key component of our investments in 2017 and led to higher cash outflows in the first half of 2017.

We calculate free cash flow as net cash flows from operating activities minus purchases of intangible assets and property, plant, and equipment without acquisitions (capital expenditure). DSO for receivables is defined as the average number of days from the raised invoice to the cash receipt from the customer.

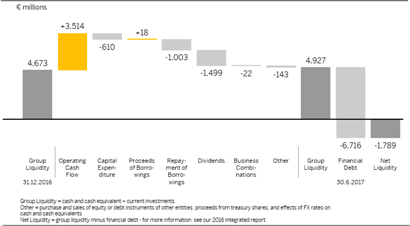

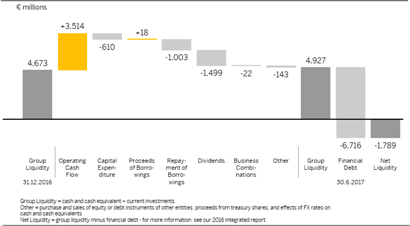

Group Liquidity

| | | | |

| Half-Year Report January – June 2017 | | | 12 | |

Liquidity and Financial Position

| | | | | | | | | | | | |

€ millions | | 30.6.2017 | | | 31.12.2016 | | | D | |

Cash and cash equivalents | | | 4,236 | | | | 3,702 | | | | +534 | |

Current investments | | | 691 | | | | 971 | | | | –279 | |

Group liquidity | | | 4,927 | | | | 4,673 | | | | +254 | |

Financial debt | | | –6,716 | | | | –7,826 | | | | +1,109 | |

Net liquidity | | | –1,789 | | | | –3,153 | | | | +1,364 | |

Goodwill | | | 21,949 | | | | 23,311 | | | | –1,362 | |

Total assets | | | 42,900 | | | | 44,277 | | | | –1,376 | |

Total equity | | | 24,525 | | | | 26,397 | | | | –1,872 | |

Equity ratio (total equity as a percentage of total assets) | | | 57 | | | | 60 | | | | –2pp | |

Competitive Intangibles

The resources that are the basis for our current as well as future success do not appear in the Consolidated Statements of Financial Position. This is apparent from a comparison of the market capitalization of SAP SE (based on all outstanding shares), which was €112 billion at the end of June 2017, with the carrying amount of our equity. The market capitalization of our equity is nearly five times higher than the carrying amount.

Some of the most important competitive intangibles that influence our market value include: customer capital, our employees and their knowledge and skills, our ecosystem of partners, software we developed ourselves, our ability to innovate, the brands we have built up – in particular, the SAP brand itself – and our organization.

SAP was recognized as the world’s 21nd most valuable brand in the 2017 BrandZ Top 100 Most Valuable Global Brands ranking. SAP’s brand value is now estimated at US$45 billion, an increase of 16% in brand value for SAP year over year.

Risk Management and Risks

We have comprehensive risk-management structures in place that are intended to enable us to recognize and analyze risks early and to take the appropriate action. For changes in our legal liability risks since our last Integrated Report, see Note (12) in the Notes to the Consolidated Half-Year Financial Statements. The other risk factors remain largely unchanged since 2016, and are discussed more fully in our Integrated Report 2016 and in our Annual Report on Form20-F for 2016. We do not believe the risks we have identified jeopardize our ability to continue as a going concern.

Expected Developments and Opportunities

Future Trends in the Global Economy

In its current report, the European Central Bank (ECB) predicts that the global economy will continue to accelerate in 2017 and 2018, yet still remain below itspre-crisis pace. It believes that advanced economies will see moderate expansion spurred on by continued accommodative monetary and fiscal policies, and that economic activity among commodity-exporting countries will strengthen slightly. Nevertheless, the global outlook might still be suffering from negative impacts of low commodity prices, the continued readjustment of the Chinese economy, as well as political and economic uncertainties in the United States.

In the Europe, Middle-East, and Africa (EMEA) region, the ECB anticipates stronger-than-initially-projected growth thanks to better profitability of businesses and very low interest rates, which support investment activities in the euro-area. Furthermore, it expects the Central and Eastern European countries will continue to benefit from strong consumer and enterprise investment going forward. The experts further believe that Russia in particular will benefit and expect a growth in 2017 for the first time after the recession period.

With regards to the Americas region, the ECB observes still high uncertainties about future political and economic development plans of the new administration in the United States. Brazil, meanwhile, will continue its economic recovery as the year progresses, though ongoing political uncertainties and fiscal consolidation needs could weigh on the medium-term outlook there.

In the Asia Pacific Japan (APJ) region, the analysts expect the Chinese and Indian economies will continue expanding at a robust pace. Economic expansion is also expected to continue in Japan, but only on the level of the prior year. Supported by the country’s low interest rate policy, looser financial conditions, and a slight increase in exports the investment activities in Japan may improve, however the overall economic momentum in Japan is expected to remain weak. The ECB experts further estimate the Chinese GDP will slow down and that investment activities will decrease. This mainly caused by a reduction of capacity.

| | | | |

| Half-Year Report January – June 2017 | | | 13 | |

Economic Trends – Year-Over-Year GDP Growth

| | | | | | | | | | | | |

| % | | 2016e | | | 2017p | | | 2018p | |

World | | | 3.1 | | | | 3.5 | | | | 3.6 | |

Advanced economies | | | 1.7 | | | | 2.0 | | | | 2.0 | |

Developing and emerging economies | | | 4.1 | | | | 4.5 | | | | 4.8 | |

Europe, the Middle East, and Africa (EMEA) | | | | | | | | | | | | |

Euro area | | | 1.7 | | | | 1.7 | | | | 1.6 | |

Germany | | | 1.8 | | | | 1.6 | | | | 1.5 | |

Central and Eastern Europe | | | 3.0 | | | | 3.0 | | | | 3.3 | |

Middle East and North Africa | | | 3.9 | | | | 2.6 | | | | 3.4 | |

Sub- Saharan Africa | | | 1.4 | | | | 2.6 | | | | 3.5 | |

Americas | | | | | | | | | | | | |

United States | | | 1.6 | | | | 2.3 | | | | 2.5 | |

Canada | | | 1.4 | | | | 1.9 | | | | 2.0 | |

Central and South America, Caribbean | | | –0.1 | | | | 1.1 | | | | 2.0 | |

Asia-Pacific-Japan (APJ) | | | | | | | | | | | | |

Japan | | | 1.0 | | | | 1.2 | | | | 0.6 | |

Asian developing economies | | | 6.4 | | | | 6.4 | | | | 6.4 | |

China | | | 6.7 | | | | 6.6 | | | | 6.2 | |

e = estimate; p = projection

Source: International Monetary Fonds, World Economic Outlook April 2017, Gaining Momentum?, as of 18. April 2017

(http://www.imf.org/~/media/Files/Publications/WEO/2017/April/pdf/text.ashx?la=en), S. 20.

IT Market: The Outlook

Gartner, a market research firm, announced that “through 2021, we expect the [enterprise software] market to grow at an 8.5% CAGR in constant currency – […] an increase of 1.3% over the 1Q17 forecast.”2)

According to Gartner, “public cloud will become one of the main deployment platforms because enterprises see it as an agile and cost-effective option for some workloads.”1) “Through 2021, the penetration of cloud automation and service support tools by North American organizations will reach 18% and 40%, respectively, driven by the need for more agile application release cycles that support digital business. As software applications allow more organizations to derive revenue from digital business channels, there will be a stronger need to automate and release new applications and functionality.”1)

Within the Europe, Middle-East, and Africa (EMEA) region, the table below shows that IT spending in Western European countries is expected to grow 1.7% in 2017 and 2.3% in 2018, whereas Western European software spending will increase considerably by 7.2% (2017) and 7.5% (2018).

According to the table below, IT spending in the Americas region is projected to expand by 3.9% (2017) and by 3.1% (2018) in Northern America and 1.3% (2017) and 2.3% (2018) in Latin America, software spending even considerably faster.

IT spending in the Asia Pacific Japan (APJ) region is expected to expand by 3.7% (2017)/2.8% (2018) (Mature Asia/Pacific without Japan) and 8.9% (2017)/6.9% (2018) (Emerging Asia/Pacific without China) (see table below). IT spending in Greater China is expected to grow 5.1% in 2017 and 5.4% in 2018 (see table below). Software spending is expected to expand significantly faster throughout the region as can be seen from the table below.

Sources:

1) Gartner Forecast Analysis: IT Spending, Worldwide, 1Q17 Update, 16 May 2017.

2) Gartner Forecast Alert IT Spending, Worldwide, 2Q17 Update, 7 July 2017.

The Gartner Report(s) described herein, (the “Gartner Report(s)”) represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Report speaks as of its original publication date (and not as of the date of this Half Year Report) and the opinions expressed in the Gartner Report(s) are subject to change without notice.

Trends in the IT Market – IT Spending Year-Over-Year

| | | | | | | | | | | | |

| % | | 2016e | | | 2017p | | | 2018p | |

| | | |

World | | | | | | | | | | | | |

| | | |

Total IT | | | 2.0 | | | | 3.3 | | | | 3.3 | |

| | | |

Software | | | 6.5 | | | | 8.6 | | | | 8.6 | |

| | | |

Services | | | 4.1 | | | | 4.3 | | | | 4.5 | |

| | | |

Western Europe | | | | | | | | | | | | |

| | | |

Total IT | | | 1.2 | | | | 1.7 | | | | 2.3 | |

| | | |

Software | | | 5.9 | | | | 7.2 | | | | 7.5 | |

| | | |

Services | | | 2.7 | | | | 3.2 | | | | 3.8 | |

| | | |

Eastern Europe | | | | | | | | | | | | |

| | | |

Total IT | | | 2.8 | | | | 0.3 | | | | 3.6 | |

| | | |

Software | | | 9.1 | | | | 11.3 | | | | 11.1 | |

| | | |

Services | | | 1.4 | | | | 3.6 | | | | 3.9 | |

| | | |

Eurasia | | | | | | | | | | | | |

| | | |

Total IT | | | 5.1 | | | | 1.8 | | | | 1.7 | |

| | | |

Software | | | 5.0 | | | | 9.2 | | | | 9.9 | |

| | | |

Services | | | –0.9 | | | | 1.3 | | | | 1.9 | |

| | | |

Middle East and North Africa | | | | | | | | | | | | |

| | | |

Total IT | | | 0.5 | | | | 1.4 | | | | 2.8 | |

| | | |

Software | | | 7.9 | | | | 12.1 | | | | 11.5 | |

| | | |

Services | | | 2.2 | | | | 4.7 | | | | 3.9 | |

| | | |

Sub-Saharan Africa | | | | | | | | | | | | |

| | | |

Total IT | | | 4.1 | | | | 5.1 | | | | 5.3 | |

| | | |

Software | | | 10.6 | | | | 12.7 | | | | 12.1 | |

| | | |

Services | | | 11.5 | | | | 5.6 | | | | 5.2 | |

| | | | |

| Half-Year Report January – June 2017 | | | 14 | |

| | | | | | | | | | | | |

North America | | | | | | | | | | | | |

| | | |

Total IT | | | 2.4 | | | | 3.9 | | | | 3.1 | |

| | | |

Software | | | 6.8 | | | | 8.5 | | | | 8.2 | |

| | | |

Services | | | 5.7 | | | | 5.2 | | | | 5.2 | |

| | | |

Latin America | | | | | | | | | | | | |

| | | |

Total IT | | | 0.5 | | | | 1.3 | | | | 2.3 | |

| | | |

Software | | | 8.0 | | | | 10.6 | | | | 10.6 | |

| | | |

Services | | | 3.8 | | | | 5.6 | | | | 5.8 | |

| | | |

Mature Asia/Pacific (w/o Japan) | | | | | | | | | | | | |

| | | |

Total IT | | | –1.1 | | | | 3.7 | | | | 2.8 | |

| | | |

Software | | | 7.6 | | | | 11.2 | | | | 10.8 | |

| | | |

Services | | | 0.9 | | | | 2.6 | | | | 2.4 | |

| | | |

Emerging Asia/Pacific (w/o China) | | | | | | | | | | | | |

| | | |

Total IT | | | 5.0 | | | | 8.9 | | | | 6.9 | |

| | | |

Software | | | 8.3 | | | | 12.3 | | | | 12.2 | |

| | | |

Services | | | 7.7 | | | | 9.6 | | | | 9.8 | |

| | | |

Japan | | | | | | | | | | | | |

| | | |

Total IT | | | –0.5 | | | | 2.0 | | | | 1.6 | |

| | | |

Software | | | 2.0 | | | | 6.9 | | | | 6.6 | |

| | | |

Services | | | 1.3 | | | | 1.9 | | | | 1.7 | |

| | | |

Greater China (China/ Taiwan/ Hong Kong) | | | | | | | | | | | | |

| | | |

Total IT | | | 4.5 | | | | 5.1 | | | | 5.4 | |

| | | |

Software | | | 7.9 | | | | 11.4 | | | | 11.8 | |

| | | |

Services | | | 11.0 | | | | 9.3 | | | | 9.5 | |

e = estimate, p = projection

Table created by SAP based on Gartner Market Databook, 2Q17 Update—July 2017, Table2-1 “RegionalEnd-User Spending on IT Products and Services in Constant U.S. Dollars, 2015–2021 (Millions of Dollars)”.

Impact on SAP

SAP expects to outperform the global economy and the IT industry again in 2017 in terms of revenue growth.

With continued strong results, we are validating our strategy of innovating across our core and cloud offerings, to help our customers become true digital enterprises. Our innovation cycle for SAP S/4HANA is well underway and the completeness of our vision in the cloud continues to distinguish SAP from both legacy players and providers of cloud-based point solutions.

On this basis, we consider ourselves well-prepared for the future and expect profitable growth beyond 2017 as well. Balanced in terms of regions as well as industries, we remain well-positioned with our product offering to offset individual fluctuations in the global economy and IT market.

A comparison of our business outlook with forecasts for the global economy and IT industry shows that we can be successful even in a tough economic environment and increased geopolitical uncertainty, and will further strengthen our position as the market leader of enterprise application software. Furthermore, we are able to generate growth that few other IT companies can match – in three aspects: in revenue from our core and cloud businesses, and in operating profit.

Operational Targets for 2017(Non-IFRS)

Revenue and Operating Profit Outlook

The Company is raising its outlook for the full year 2017:

| – | | Based on the continued strong momentum in SAP’s cloud business, the Company expects full year 2017non-IFRS cloud subscriptions and support revenue to be in a range of €3.8 billion to €4.0 billion at constant currencies (2016: €2.99 billion). The upper end of this range represents a growth rate of 34% at constant currencies. |

| – | | Due to increasing adoption of S/4HANA and our Digital Business Platform the Company now expects full year 2017non-IFRS cloud & software revenue to increase by 6.5% to 8.5% at constant currencies (2016: €18.43 billion). |

| – | | The Company now expects full year 2017non-IFRS total revenue in a range of €23.3 billion to €23.7 billion at constant currencies (2016: €22.07 billion). |

| – | | The Company expects full-year 2017non-IFRS operating profit to be in a range of €6.8 billion to €7.0 billion at constant currencies (2016: €6.63 billion). |

While the Company’s full-year 2017 business outlook is at constant currencies, actual currency reported figures are expected to continue to be impacted by exchange rate fluctuations. If exchange rates remain at the June 2017 average level for the rest of the year, we expectnon-IFRS cloud and software revenue andnon-IFRS operating profit growth rates to experience a currency headwind in a range of-2 to 0pp in Q3 2017(-1 to +1pp for the full year 2017).

We expect thatnon-IFRS total revenue will continue to depend largely on the revenue from cloud and software. However, the revenue growth we expect from this is below the outlook provided fornon-IFRS cloud subscriptions and support revenue. We expect our software license revenue in 2017 to be at approximately the same level as in 2016.

We continuously strive for profit expansion in all our reportable segments leading to a SAP Group profit expansion as outlined in the given 2017 outlook. For SAP’s managed-cloud offerings, we expect a positive gross margin result in 2017 according to outlined long-term 2020 planning:

The following table shows the estimates of the items that represent the differences between our IFRS financial measures and ournon-IFRS financial measures.

| | | | |

| Half-Year Report January – June 2017 | | | 15 | |

Non-IFRS Measures

| | | | | | | | | | | | |

| € millions | | Estimated

Amounts for Full Year

2017 | | | Q1–Q2 2017 | | | Q1–Q2 2016 | |

Revenue adjustments | | | <20 | | | | 0 | | | | 4 | |

Acquisition related charges | | | 610 to 640 | | | | 309 | | | | 336 | |

Share-based payment expenses | | | 900 to 1,150 | | | | 618 | | | | 177 | |

Restructuring1) | | | 200 to 250 | | | | 242 | | | | 22 | |

1) reflects our expectations for restructuring activities in our services and support business

The Company expects a full-year 2017 effective tax rate (IFRS) of 26.0% to 27.0% (2016: 25.3%) and an effective tax rate(non-IFRS) of 27.0% to 28.0% (2016: 26.8%).

Goals for Liquidity, Finance, and Investments

On June 30, 2017, we had a negative net liquidity. We believe that our liquid assets combined with our undrawn credit facilities are sufficient to meet our operating financing needs in the second half of 2017 as well and, together with expected cash flows from operations, will support debt repayments and our currently planned capital expenditure requirements over the near term and medium term.

In 2017, we expect a positive development of our operating cash flow. Furthermore, we repaid Eurobonds totaling €1 billion in April 2017 and intend to repay U.S. private placements totaling US$443 million in October and November 2017.

After evaluating the expected cash flow development for the second half of 2017, and consistent with the company’s capital allocation priorities, SAP has decided on a share buyback of up to €500 million in 2017. The share buyback will start shortly and will be executed in several tranches.

Our planned capital expenditures for 2017 and 2018, other than from business combinations, mainly comprise the construction activities described in the Assets (IFRS) section of our Integrated Report 2016. We expect investments from these activities of approximately €380 million in 2017 (an increase of 25% compared to the previous year), and approximately €350 million in 2018. These investments can be covered in full by operating cash flow.

Premises on Which Our Outlook Is Based

In preparing our outlook, we have taken into account all events known to us at the time we prepared this report that could influence SAP’s business going forward.

Among the premises on which this outlook is based are those presented concerning economic development and the assumption that there will be no major acquisitions in 2017 and 2018.

Non-Financial Goals 2017

SAP has already achieved its objective of 25% women in management by the end of 2017. We have now extended our commitment to increase the percentage of women in management to 30% by the end of 2022.

For a detailed description of ourNon-Financial Goals 2017, see our Integrated Report 2016.

Medium-Term Prospects

We did not change our medium-term prospects in the first half of 2017. For a detailed description, see our Integrated Report 2016.

Opportunities

We have comprehensive opportunity-management structures in place that are intended to enable us to recognize and analyze opportunities early and to take the appropriate action. The opportunities remain largely unchanged since 2016, and are discussed more fully in our Integrated Report 2016.

Events After the Reporting Period

Media reports have raised questions surrounding contracts and third-party business practices in South Africa. SAP embodies an unwavering commitment to maintain the highest standards of integrity and transparency across its business. SAP has initiated an independent investigation spearheaded by a multinational law firm and overseen by Executive Board Member AdaireFox-Martin to vigorously review contracts awarded by SAP South Africa.

For further information about events after the reporting period, see the Notes to the Consolidated Half-Year Financial Statements section,Note (17).

| | | | |

| Half-Year Report January – June 2017 | | | 16 | |

Consolidated Half-Year Financial Statements – IFRS

| | | | |

| Half-Year Report January – June 2017 | | | 17 | |

Consolidated Income Statements of SAP Group (IFRS) – Half Year

| | | | | | | | | | | | | | |

| € millions, unless otherwise stated | | | | Q1–Q2 2017 | | | Q1–Q2 2016 | | | D in % | |

| | | | |

Cloud subscriptions and support | | | | | 1,837 | | | | 1,397 | | | | 31 | |

| | | | |

Software licenses | | | | | 1,781 | | | | 1,649 | | | | 8 | |

| | | | |

Software support | | | | | 5,467 | | | | 5,162 | | | | 6 | |

| | | | |

Software licenses and support | | | | | 7,248 | | | | 6,811 | | | | 6 | |

| | | | |

Cloud and software | | | | | 9,085 | | | | 8,208 | | | | 11 | |

| | | | |

Services | | | | | 1,981 | | | | 1,755 | | | | 13 | |

| | | | |

Total revenue | | | | | 11,066 | | | | 9,964 | | | | 11 | |

| | | | |

| | | | | | | | | | | | | | | |

| | | | |

Cost of cloud subscriptions and support | | | | | –793 | | | | –603 | | | | 31 | |

| | | | |

Cost of software licenses and support | | | | | –1,134 | | | | –1,007 | | | | 13 | |

| | | | |

Cost of cloud and software | | | | | –1,927 | | | | –1,610 | | | | 20 | |

| | | | |

Cost of services | | | | | –1,628 | | | | –1,506 | | | | 8 | |

| | | | |

Total cost of revenue | | | | | –3,555 | | | | –3,116 | | | | 14 | |

| | | | |

Gross profit | | | | | 7,512 | | | | 6,848 | | | | 10 | |

| | | | |

Research and development | | | | | –1,694 | | | | –1,419 | | | | 19 | |

| | | | |

Sales and marketing | | | | | –3,415 | | | | –2,865 | | | | 19 | |

| | | | |

General and administration | | | | | –569 | | | | –460 | | | | 24 | |

| | | | |

Restructuring | | (5) | | | –242 | | | | –22 | | | | >100 | |

| | | | |

Other operating income/expense, net | | | | | 8 | | | | –1 | | | | <-100 | |

| | | | |

Total operating expenses | | | | | –9,467 | | | | –7,882 | | | | 20 | |

| | | | |

Operating profit | | | | | 1,599 | | | | 2,082 | | | | –23 | |

| | | | |

| | | | | | | | | | | | | | | |

| | | | |

Othernon-operating income/expense, net | | | | | –10 | | | | –136 | | | | –93 | |

| | | | |

Finance income | | | | | 143 | | | | 73 | | | | 94 | |

| | | | |

Finance costs | | | | | –156 | | | | –132 | | | | 18 | |

| | | | |

Financial income, net | | | | | –13 | | | | –59 | | | | –78 | |

| | | | |

Profit before tax | | | | | 1,576 | | | | 1,887 | | | | –16 | |

| | | | |

| | | | | | | | | | | | | | | |

| | | | |

Income tax expense | | | | | –379 | | | | –504 | | | | –25 | |

| | | | |

Profit after tax | | | | | 1,197 | | | | 1,382 | | | | –13 | |

| | | | |

Attributable to owners of parent | | | | | 1,189 | | | | 1,388 | | | | –14 | |

| | | | |

Attributable tonon-controlling interests | | | | | 7 | | | | –5 | | | | <-100 | |

| | | | |

| | | | | | | | | | | | | | | |

| | | | |

Earnings per share, basic (in €)1) | | | | | 0.99 | | | | 1.16 | | | | –14 | |

| | | | |

Earnings per share, diluted (in €)1) | | | | | 0.99 | | | | 1.16 | | | | –14 | |

1) For the six months ended June 30, 2017 and 2016, the weighted average number of shares was 1,199 million (diluted 1,199 million) and 1,198 million (diluted: 1,199 million), respectively (treasury stock excluded).

Due to rounding, numbers may not add up precisely.

| | | | |

| Half-Year Report January – June 2017 | | | 18 | |

Consolidated Statements of Comprehensive Income of SAP Group (IFRS) – Half-Year

| | | | | | | | |

| € millions | | Q1–Q2 2017 | | | Q1–Q2 2016 | |

| | |

Profit after tax | | | 1,197 | | | | 1,382 | |

Items that will not be reclassified to profit or loss | | | | | | | | |

Remeasurements on defined benefit pension plans, before tax | | | 12 | | | | 3 | |

Income tax relating to remeasurements on defined benefit pension plans | | | –2 | | | | 0 | |

Remeasurements on defined benefit pension plans, net of tax | | | 10 | | | | 3 | |

Other comprehensive income for items that will not be reclassified to profit or loss, net of tax | | | 10 | | | | 3 | |

Items that will be reclassified subsequently to profit or loss | | | | | | | | |

Gains (losses) on exchange differences on translation, before tax | | | –1,635 | | | | –182 | |

Reclassification adjustments on exchange differences on translation, before tax | | | 0 | | | | –1 | |

Exchange differences, before tax | | | –1,635 | | | | –183 | |

Income tax relating to exchange differences on translation | | | –3 | | | | –26 | |

Exchange differences, net of tax | | | –1,637 | | | | –210 | |

Gains (losses) on remeasuringavailable-for-sale financial assets, before tax | | | 107 | | | | –132 | |

Reclassification adjustments onavailable-for-sale financial assets, before tax | | | –35 | | | | –14 | |

Available-for-sale financial assets, before tax | | | 72 | | | | –145 | |

Income tax relating toavailable-for-sale financial assets | | | 0 | | | | 1 | |

Available-for-sale financial assets, net of tax | | | 72 | | | | –144 | |

Gains (losses) on cash flow hedges, before tax | | | 42 | | | | –19 | |

Reclassification adjustments on cash flow hedges, before tax | | | 0 | | | | –6 | |

Cash flow hedges, before tax | | | 43 | | | | –25 | |

Income tax relating to cash flow hedges | | | –11 | | | | 7 | |

Cash flow hedges, net of tax | | | 31 | | | | –18 | |

Other comprehensive income for items that will be reclassified to profit or loss, net of tax | | | –1,534 | | | | –372 | |

Other comprehensive income, net of tax | | | –1,524 | | | | –369 | |

Total comprehensive income | | | –327 | | | | 1,013 | |

Attributable to owners of parent | | | –334 | | | | 1,019 | |

Attributable tonon-controlling interests | | | 7 | | | | –5 | |

Due to rounding, numbers may not add up precisely.

| | | | |

| Half-Year Report January – June 2017 | | | 19 | |

Consolidated Statements of Financial Position of SAP Group (IFRS)

| | | | | | | | | | | | |

as at June 30, 2017 and December 31, 2016 | |

€ millions | | | | | | 2017 | | | 2016 | |

Cash and cash equivalents | | | | | | | 4,236 | | | | 3,702 | |

Other financial assets | | | | | | | 868 | | | | 1,124 | |

Trade and other receivables | | (8) | | | | | 5,408 | | | | 5,924 | |

Othernon-financial assets | | | | | | | 751 | | | | 581 | |

Tax assets | | | | | | | 375 | | | | 233 | |

Total current assets | | | | | | | 11,638 | | | | 11,564 | |

Goodwill | | | | | | | 21,949 | | | | 23,311 | |

Intangible assets | | | | | | | 3,273 | | | | 3,786 | |

Property, plant, and equipment | | | | | | | 2,719 | | | | 2,580 | |

Other financial assets | | | | | | | 1,497 | | | | 1,358 | |

Trade and other receivables | | (8) | | | | | 117 | | | | 126 | |

Othernon-financial assets | | | | | | | 557 | | | | 532 | |

Tax assets | | | | | | | 441 | | | | 450 | |

Deferred tax assets | | | | | | | 710 | | | | 571 | |

Totalnon-current assets | | | | | | | 31,263 | | | | 32,713 | |

Total assets | | | | | | | 42,900 | | | | 44,277 | |

| | | | | | | | | | |

€ millions | | | | | | 2017 | | | 2016 | |

Trade and other payables | | | | | | | 1,142 | | | | 1,281 | |

Tax liabilities | | | | | | | 288 | | | | 316 | |

Financial liabilities | | (9) | | | | | 863 | | | | 1,813 | |

Othernon-financial liabilities | | | | | | | 2,758 | | | | 3,699 | |

Provisions | | | | | | | 369 | | | | 183 | |

Deferred income | | (10) | | | | | 4,898 | | | | 2,383 | |

Total current liabilities | | | | | | | 10,318 | | | | 9,674 | |

Trade and other payables | | | | | | | 124 | | | | 127 | |

Tax liabilities | | | | | | | 436 | | | | 365 | |

Financial liabilities | | (9) | | | | | 6,260 | | | | 6,481 | |

Othernon-financial liabilities | | | | | | | 545 | | | | 461 | |

Provisions | | | | | | | 235 | | | | 217 | |

Deferred tax liabilities | | | | | | | 380 | | | | 411 | |

Deferred income | | (10) | | | | | 78 | | | | 143 | |

Totalnon-current liabilities | | | | | | | 8,058 | | | | 8,205 | |

Total liabilities | | | | | | | 18,376 | | | | 17,880 | |

Issued capital | | | | | | | 1,229 | | | | 1,229 | |

Share premium | | | | | | | 565 | | | | 599 | |

Retained earnings | | | | | | | 22,004 | | | | 22,302 | |

Other components of equity | | | | | | | 1,812 | | | | 3,346 | |

Treasury shares | | | | | | | –1,091 | | | | –1,099 | |

Equity attributable to owners of parent | | | | | | | 24,518 | | | | 26,376 | |

| | | | | | | | | | | | |

Non-controlling interests | | | | | | | 7 | | | | 21 | |

Total equity | | (11) | | | | | 24,525 | | | | 26,397 | |

Total equity and liabilities | | | | | | | 42,900 | | | | 44,277 | |

Due to rounding, numbers may not add up precisely.

| | | | |

| Half-Year Report January – June 2017 | | | 20 | |

Consolidated Statements of Changes in Equity of SAP Group (IFRS)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

€ millions | | Equity Attributable to Owners of Parent | | | Non- Controlling

Interests | | | Total

Equity | |

| | | Issued

Capital | | | Share

Premium | | | Retained

Earnings | | | Other

Components of

Equity | | | Treasury

Shares | | | Total | | | |

January 1, 2016 | | | 1,229 | | | | 558 | | | | 20,044 | | | | 2,561 | | | | –1,124 | | | | 23,267 | | | | 28 | | | | 23,295 | |

Profit after tax | | | | | | | | | | | 1,388 | | | | | | | | | | | | 1,388 | | | | –5 | | | | 1,382 | |

Other comprehensive income | | | | | | | | | | | 3 | | | | –372 | | | | | | | | –369 | | | | | | | | –369 | |

Comprehensive income | | | | | | | | | | | 1,391 | | | | –372 | | | | | | | | 1,019 | | | | –5 | | | | 1,013 | |

Share-based payments | | | | | | | 14 | | | | | | | | | | | | | | | | 14 | | | | | | | | 14 | |

Dividends | | | | | | | | | | | –1,378 | | | | | | | | | | | | –1,378 | | | | | | | | –1,378 | |

Reissuance of treasury shares under share-based payments | | | | | | | 9 | | | | | | | | | | | | 10 | | | | 18 | | | | | | | | 18 | |

Other changes | | | | | | | | | | | –2 | | | | | | | | | | | | –2 | | | | 3 | | | | 1 | |

June 30, 2016 | | | 1,229 | | | | 580 | | | | 20,054 | | | | 2,189 | | | | –1,114 | | | | 22,938 | | | | 26 | | | | 22,963 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

January 1, 2017 | | | 1,229 | | | | 599 | | | | 22,302 | | | | 3,346 | | | | –1,099 | | | | 26,376 | | | | 21 | | | | 26,397 | |

Profit after tax | | | | | | | | | | | 1,189 | | | | | | | | | | | | 1,189 | | | | 7 | | | | 1,197 | |

Other comprehensive income | | | | | | | | | | | 10 | | | | –1,534 | | | | | | | | –1,524 | | | | | | | | –1,524 | |

Comprehensive income | | | | | | | | | | | 1,199 | | | | –1,534 | | | | | | | | –335 | | | | 7 | | | | –327 | |

Share-based payments | | | | | | | –47 | | | | | | | | | | | | | | | | –47 | | | | | | | | –47 | |

Dividends | | | | | | | | | | | –1,499 | | | | | | | | | | | | –1,499 | | | | –23 | | | | –1,522 | |

Reissuance of treasury shares under share-based payments | | | | | | | 13 | | | | | | | | | | | | 8 | | | | 22 | | | | | | | | 22 | |

Other changes | | | | | | | | | | | 1 | | | | | | | | | | | | 1 | | | | 1 | | | | 2 | |

June 30, 2017 | | | 1,229 | | | | 565 | | | | 22,004 | | | | 1,812 | | | | –1,091 | | | | 24,518 | | | | 7 | | | | 24,525 | |

Due to rounding, numbers may not add up precisely.

| | | | |

| Half-Year Report January – June 2017 | | | 21 | |

Consolidated Statements of Cash Flows of SAP Group (IFRS)

| | | | | | | | |

€ millions | | Q1–Q2 2017 | | | Q1–Q2 2016 | |

Profit after tax | | | 1,197 | | | | 1,382 | |

Adjustments to reconcile profit after tax to net cash flows from operating activities: | | | | | | | | |

Depreciation and amortization | | | 642 | | | | 615 | |

Income tax expense | | | 379 | | | | 504 | |

Financial income, net | | | 13 | | | | 59 | |

Decrease/increase in sales and bad debt allowances on trade receivables | | | –4 | | | | 60 | |

Other adjustments fornon-cash items | | | –28 | | | | 12 | |

Decrease/increase in trade and other receivables | | | 303 | | | | 114 | |

Decrease/increase in other assets | | | –312 | | | | –309 | |

Decrease/increase in trade payables, provisions, and other liabilities | | | –634 | | | | –1,165 | |

Decrease/increase in deferred income | | | 2,722 | | | | 2,493 | |

Interest paid | | | –125 | | | | –120 | |

Interest received | | | 41 | | | | 36 | |

Income tax paid, net of refunds | | | –680 | | | | –760 | |

Net cash flows from operating activities | | | 3,514 | | | | 2,921 | |

Business combinations, net of cash and cash equivalents acquired | | | –22 | | | | –16 | |

Purchase of intangible assets or property, plant, and equipment | | | –610 | | | | –406 | |

Proceeds from sales of intangible assets or property, plant, and equipment | | | 47 | | | | 33 | |

Purchase of equity or debt instruments of other entities | | | –1,843 | | | | –320 | |

Proceeds from sales of equity or debt instruments of other entities | | | 2,064 | | | | 308 | |

Net cash flows from investing activities | | | –365 | | | | –401 | |

Dividends paid | | | –1,499 | | | | –1,378 | |

Dividends paid onnon-controlling interests | | | –23 | | | | 0 | |

Proceeds from reissuance of treasury shares | | | 0 | | | | 15 | |

Proceeds from borrowings | | | 18 | | | | 1 | |

Repayments of borrowings | | | –1,003 | | | | –544 | |

Transactions withnon-controlling interests | | | 0 | | | | 3 | |

Net cash flows from financing activities | | | –2,506 | | | | –1,902 | |

Effect of foreign currency rates on cash and cash equivalents | | | –108 | | | | 177 | |

Net decrease/increase in cash and cash equivalents | | | 534 | | | | 796 | |

Cash and cash equivalents at the beginning of the period | | | 3,702 | | | | 3,411 | |

Cash and cash equivalents at the end of the period | | | 4,236 | | | | 4,206 | |

Due to rounding, numbers may not add up precisely.

| | | | |

| Half-Year Report January – June 2017 | | | 22 | |

Notes to the Consolidated Half-Year Financial Statements

(1) General Information About Consolidated Half-Year Financial Statements

The accompanying Consolidated Half-Year Financial Statements of SAP SE and its subsidiaries (collectively, “we,” “us,” “our,” “SAP,” “Group,” and “Company”) have been prepared in accordance with the International Financial Reporting Standards (IFRS) and in particular in compliance with International Accounting Standard (IAS) 34. The designation IFRS includes all standards issued by the International Accounting Standards Board (IASB) and related interpretations issued by the IFRS Interpretations Committee (IFRS IC). The variances between the applicable IFRS standards as issued by the IASB and the standards as used by the European Union are not relevant to these financial statements.

Certain information and disclosures normally included in the notes to annual financial statements prepared in accordance with IFRS have been condensed or omitted. We believe that the disclosures made are adequate and that the information gives a true and fair view.

Our business activities are influenced by certain seasonal effects. Historically, our overall revenue tends to be highest in the fourth quarter. Interim results are therefore not necessarily indicative of results for a full year.

Amounts reported in previous years have been reclassified as appropriate to conform to the presentation in this half-year report.

These unaudited condensed Consolidated Half-Year Financial Statements should be read in conjunction with SAP’s audited Consolidated IFRS Financial Statements for the Year Ended December 31, 2016, included in our Integrated Report 2016 and our Annual Report on Form20-F for 2016.

Due to rounding, numbers presented throughout these Consolidated Half-Year Financial Statements may not add up precisely to the totals we provide and percentages may not precisely reflect the absolute figures.

(2) Scope of Consolidation

Our changes in the scope of consolidation in the first half of 2017 were not material to our Consolidated Financial Statements.

For more information about our business combinations and the effect on our Consolidated Financial Statements, see Note (4) and our Integrated Report 2016.

(3) Summary of Significant Accounting Policies

These Consolidated Half-Year Financial Statements were prepared based on the same accounting policies as those applied and described in the Consolidated Financial Statements as at December 31, 2016. Our significant accounting policies are summarized in the Notes to the Consolidated Financial Statements.

In the Notes to our Consolidated Financial Statements for 2016, we disclosed, for new accounting standards that have been issued but not yet been adopted by us, our expectations regarding the timing of and our approaches to adopt these standards and known or reasonably estimable information on the possible impact that the adoption will have on our financial statements. The following provides updates to these disclosures and should be read in conjunction with these disclosures:

| – | IFRS 15 will be adopted with the effective date as of January 1, 2018. We intend to apply IFRS 15 retrospectively and recognize the cumulative effect of the initial application of the standard as an adjustment to the opening balance of retained earnings on the effective date. We plan to apply IFRS 15 retrospectively only to contracts that are not completed as at January 1, 2018. The application of this practical expedient will have an effect on the opening balance sheet under IFRS 15 as well as on the revenues recorded after the date of transition. We are still evaluating whether we will use the practical expedient related to contract modifications that happened before the date of initial application of IFRS 15. If we elect to apply this practical expedient, we would reflect the aggregate effect of all modifications when identifying performance obligations, determining the transaction price and allocating the transaction price. |

The comparison of our intended futureIFRS 15-based accounting policies versus our current accounting policies has led to several

| | | | |

| Half-Year Report January – June 2017 | | | 23 | |

potential policy differences, which we continue to evaluate as described in Note (3e) of our Consolidated Financial Statements for the financial year 2016. Based on our analysis to date, we tentatively do not expect a material impact of the adoption of IFRS 15 on our reported revenue. This estimate is based on several assumptions, including assumptions regarding the extent to which IFRS 15 influences our future business andgo-to-market practices. Particularly this influence is difficult to predict.

Under IFRS 15 we will capitalize higher amounts of cost to obtain a contract and will amortize these capitalized amounts over a longer period than under our current policies. Our analysis of the impact of this change is ongoing. Thus, the impact of this change on our expenses and on our Consolidated Statement of Financial Position is currently neither known nor reasonably estimable.

We will continue with our process and further assess the IFRS 15 impacts during the second half of 2017.

| – | We will adopt IFRS 9 per its effective date of January 1, 2018. We plan to use the exceptions from full retrospective application and thus recognize the effect of the initial application as an adjustment to the opening balance of retained earnings. |

Currently, we are in the process of finalizing the analysis of the contractual cash flow characteristics of all our debt investments, loans, and other financial receivables. Based on the current state of our analysis, we tentatively believe that we can continue the current classification for the majority of such financial assets and do, therefore, not expect a material impact from changes in classification and subsequent measurement. We have not yet made a final decision whether we classify our equity investments as fair value through other comprehensive income or fair value through profit or loss. Consequently, the possible impact of IFRS 9 on our accounting for our equity investments is currently neither known nor reasonably estimable.