- MBNKP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Medallion Bank (MBNKP) CORRESPCorrespondence with SEC

Filed: 24 Apr 12, 12:00am

| 1875 K Street, N.W. Washington, DC 20006-1238

Tel: 202 303 1000 Fax: 202 303 2000 |

April 24, 2012

VIA EDGAR

Division of Investment Management

Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Attn: | Mr. James E. O’Connor | |

| Ms. Christina DiAngelo | ||

| Re: | Medallion Financial Corp. | |

| Pre-Effective Amendment No. 1 filed on the date hereof to the | ||

| Registration Statement on Form N-2 | ||

| File Nos.: 333-178644 and 814-00188 | ||

Dear Mr. O’Connor and Ms. DiAngelo:

On behalf of Medallion Financial Corp. (the “Company”), we are responding to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) pertaining to the Registration Statement on Form N-2, filed on December 20, 2011 (the “Initial Registration Statement”), contained in the letter dated January 19, 2012 (the “Initial Comment Letter”), the telephone comments delivered to the Company on February 27, 2012, March 6, 2012 and April 23, 2012 (the “Telephone Comments”) and the email comments delivered to the Company on February 29, 2012 (the “Email Comments”) (collectively, the “Comment Letter”).

We are submitting this response letter in connection with the filing of Pre-Effective Amendment No. 1 to the Company’s Registration Statement on Form N-2 (the “Revised Registration Statement”). The Revised Registration Statement is being filed in order to respond to the Comment Letter, to make such other changes as the Company deems appropriate, and to file additional exhibits to the Registration Statement. To facilitate your review, we have set out each of your comments below with our corresponding response and have numbered the items to correspond to the Comment Letter.

As discussed with the Staff, the Company is requesting, via separate correspondence, acceleration of effectiveness of the Revised Registration Statement of an effective date to April 24, 2012.

* * * * *

NEW YORK WASHINGTON, DC PARIS LONDON MILAN ROME FRANKFURT BRUSSELS

INITIAL COMMENT LETTER

Cover Pages

Comment 1: Please revise the first sentence of the bolded fifth paragraph (“Investing in our securities involves a high degree of risk”) to indicate that, as stated on pages 22 and 24 of the prospectus, such investments are “highly speculative.”

Response: The Company has made the requested revision to the Revised Registration Statement.

Comment 2: Immediately before the sentence with the cross reference required by Item 1.1.j., please include the following statement in the same bold face type:

The securities in which the Fund invests will not be rated by any rating agency. If they were, they would be rated as below investment grade or “junk.” Indebtedness of below investment grade quality has predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal.

Response: The Company has included the following disclosure in bold face type in the Revised Registration Statement:

The securities in which we invest will not be rated by any rating agency. If they were, all of them could be rated as below investment grade or “junk.” Indebtedness of below investment grade quality has predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal.

Comment 3: If the Fund intends to seek shareholder approval at its upcoming annual meeting to offer its securities below NAV, as required under Section 63(2) of the 1940 Act, this intention should be disclosed in the second paragraph on the cover and, where appropriate, in the prospectus.

Response: The Company does not intend to seek shareholder approval at its upcoming annual meeting to offer its securities below NAV.

Comment 4: Please add a statement to the paragraph immediately preceding the “Table of Contents” noting that the prospectus will be amended to reflect material changes.

Response: The Company has included the following sentence to the paragraph immediately preceding the “Table of Contents:” “We will update this prospectus and any supplements to reflect any material changes.”

Comment 5: Please add the statement required by Rule 481(e) under the 1933 Act with respect to the dealer prospectus delivery requirement.

Response: The Company has made the requested addition to the back cover of the Revised Registration Statement.

2

Comment 6: Please inform us how the Fund will account for the offering expenses related to shares being registered.

Response: The Company intends to deduct offering expenses from amounts raised in any potential offering in accordance with U.S. Generally Accepted Accounting Principles.

Prospectus Summary

Comment 1: Throughout the prospectus, please update all financial information to a more recent date than September 30, 2011 (December 31st, if possible).

Response: The Company has updated financial information in the Revised Registration Statement as of December 31, 2011.

Comment 2: We note that 62% of the Fund’s portfolio is comprised of fixed-rate medallion loans. Please disclose, where appropriate, the portfolio’s interest rate risk.

Response: The Company has made the requested addition of interest rate risk under the subsection titled “Interest Rate Sensitivity” on pages 3-4 of the Revised Registration Statement.

Comment 3: The disclosure in the “Overview” subsection, on page 1, states that “[t]otal assets under our management, which includes assets serviced for third party investors and managed by unconsolidated portfolio companies, were approximately $1.11 billion as of September 30, 2011….” Please clarify the meaning of the term “assets serviced for third party investors and managed by unconsolidated portfolio companies.” “Total assets under our management” should include only the value of the loans made by the Fund, its equity investments, and the value of its investments in Medallion Bank and any other unconsolidated subsidiaries.

Response: The Company has clarified the disclosure to state that “[t]otal assets under our management and the management of our unconsolidated wholly-owned subsidiaries, which includes assets serviced for third party investors, were approximately $1.14 billion as of December 31, 2011….”

Comment 4: At the end of the “Strategy” subsection, on page 1, please include the following or similar disclosure:

Investments in our portfolio companies are not rated by any of the public ratings agencies, but if they were rated they would be rated below “investment grade.” Our portfolio companies may have limited access to capital, higher funding costs, abrupt business cycles, and intense competition. These factors could impair their cash flow or result in other events, such as bankruptcy, that could limit their ability to repay their obligations to us and may materially adversely affect the return on, or the recovery of, our investments in their businesses.

Response: The Company has included the following disclosure in the Revised Registration Statement.

3

Investments in our portfolio companies are not rated by any of the public ratings agencies, but if they were, all of them could be rated below “investment grade.” Our portfolio companies may have limited access to capital, higher funding costs, abrupt business cycles, and intense competition. These factors could impair their cash flow or result in other events, such as bankruptcy, that could limit their ability to repay their obligations to us and may materially adversely affect the return on, or the recovery of, our investments in their businesses.

Comment 5: The disclosure in the “Commercial Loans” subsection, on page 2, states: “We plan to continue to expand our commercial loan activities to develop a more diverse borrower base and a wider geographic area of coverage, as well as to expand our targeted industries.” Please precede this statement about the Fund’s plans with specific information about the Fund’s current “commercial loan activities.” To what extent is the portfolio currently concentrated by geography and industry? What is the average asset size of the companies invested in by the Fund?

Response: The Company has disclosed the following requested additional information about the Company’s current commercial loan activities in the Revised Registration Statement: “We focus our marketing efforts on the manufacturing, wholesale trade, administrative and support services and accommodation and food services industries with the portfolio concentrated in the manufacturing industry. The majority of our commercial borrowers are located in the New York metropolitan area, the Midwest region and Florida.” Instead of disclosing the average asset size of the companies invested in by the Company, which may greatly vary, the Company has provided the following informative disclosure: “The commercial loans originated by our SBIC subsidiaries are made to qualifying small businesses as defined by applicable SBA regulations and all of our commercial loans are made to eligible portfolio companies.”

Comment 6: In the same subsection, on page 3, please clarify the difference between the “asset-based loans” made by the Medallion Business Credit division and the “secured mezzanine loans” made by Medallion Capital, Inc. We note that the paragraph titled “Secured Mezzanine Loans,” states that Medallion Capital, Inc., makes “senior and subordinated loans.” Please clarify this apparent inconsistency between the text of the paragraph and its title.

Response: The Company has revised the statement to state “we originate primarily secured mezzanine loans to businesses” to correct the inconsistency between the text of the paragraph and its title.

Comment 7: The paragraph titled “Secured Mezzanine Loans,” states that “we originate both senior and subordinated loans to businesses in a variety of industries, including radio and television stations, airport food service operations and various manufacturing concerns.” Please disclose the nature of the secured interests that the Fund takes in its secured commercial loans.

Response: The Company has included the following in the Revised Registration Statement to describe the nature of the secured interests that the Company takes in its secured commercial loans: “These mezzanine loans are primarily secured by a second position on all assets of the businesses and generally range in amounts from $1,000,000 to $5,000,000.”

4

Comment 8: The disclosure in the paragraph titled “Other Secured Commercial Loans” states that “[w]e originate other commercial loans that are not concentrated in any particular industry.” Which entity originates these loans? Other than that they are “generally fixed-rate,” how do these loans differ from the loans described in the previous two paragraphs of the disclosure? Does this statement imply that the other commercial loans originated by the Fund are concentrated?

Response: The Company has revised the statement as follows: “[w]e originate, primarily through our subsidiary, Freshstart Venture Capital Corp., or Freshstart, other commercial loans that are focused on food service, real estate, dry cleaner and laundromat businesses, which are typically located within 200 miles of New York City. These commercial loans are generally secured by all of the assets of the businesses and are generally personally guaranteed by the principals. Frequently, we receive assignments of lease from our borrowers.”

Comment 9: In the subsection, “Consumer Loans,” on page 3, please clarify that, although Medallion Bank does make loans for the purchase of “recreational vehicles, boats, motorcycles and horse trailers,” to the extent required by FDIC diversification requirements, its principal function is medallion loan financing. Please confirm to us that the “consumer loans” are not qualifying assets for purposes of Section 2(a)(46) of the 1940 Act.

Response: Medallion Bank is an unconsolidated, wholly-owned portfolio investment of the Company. Therefore, the consumer loans originated by Medallion Bank are not consolidated onto the financial statements of the Company; rather, the Company carries its investment in Medallion Bank on the Company’s financial statements. While Medallion Bank maintains a significant medallion loan portfolio, the Company believes Medallion Bank may engage in any permissible banking activity. The Company believes its investment in Medallion Bank is not a qualifying asset for purposes of Section 2(a)(46) of the 1940 Act. If the Company were to make consumer loans, it believes those would also not be qualifying assets for purposes of Section 2(a)(46).

Comment 10: The “Sources of Funds” subsection, on page 3, states that “[w]e have historically funded our lending operations primarily through credit facilities with bank syndicates and, to a lesser degree, through fixed-rate, senior secured notes and long-term subordinated debentures issued to or guaranteed by the Small Business Administration, or the SBA.”

a) It appears from the “Notes to the Financial Statements,” on page F-7, that the Fund has four consolidated subsidiaries that are sources of its funding. Three of the four are SBICs: (1) Medallion Funding LLC, which is the primary taxicab medallion lending company; (2) Medallion Capital, Inc., which conducts a mezzanine financing business; and (3) Freshstart Venture Capital Corp., which originates and services taxicab medallion and commercial loans. A fourth controlled subsidiary, Medallion Financing Trust I, which is not an SBIC, issues unsecured preferred securities. The sources and relative amounts and percentages of all funding for the Fund’s operations need to be clarified in the prospectus. In addition to Medallion Funding LLC, are any of the subsidiaries registered as business development companies?

Response: The Company respectfully believes the disclosure it has provided on pages 41-42 and pages 49-52 of the Revised Registration Statement provide detailed information regarding the sources

5

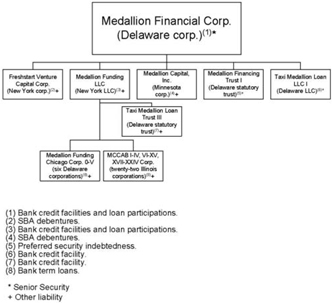

and details of the funding for the Company’s operations. Freshstart Venture Capital Corp. and Medallion Capital, Inc. are registered as business development companies. The Company supplementally provides the Staff with a chart outlining the sources of funding for the Company’s operations. Please see Exhibit A to this letter below.

b) Medallion Funding LLC, has a wholly-owned financing subsidiary, Taxi Medallion Loan Trust III (“Trust”). Loans originated by Medallion Funding are transferred to the Trust, which the Trust pays for with borrowings secured by the loans. Please address in your response letter the following issues raised by the Trust:

1) Please explain why Medallion Funding LLC, through the Trust, has borrowed using bank loans, given that the SBA offers fixed rate, low cost 10-year loans to SBICs.

Response: Although SBA debentures currently represent a relatively inexpensive funding source, historical interest rates on issued debentures have been at significantly higher rates. At most times, private capital available to Medallion Funding has represented a lower cost of funds than SBA debentures. Even in the current market, Medallion Funding’s cost of funds through the Trust is approximately Libor + 95 basis points, lower than SBA debentures being issued today.

2) Please clarify the effect of the guarantee provided by Medallion Funding LLC. It does not appear, based on the guarantee, that the Trust is a bankruptcy remote entity whose obligations are secured solely by the portfolio loans its holds?

Response: The guarantee provided by Medallion Funding is a limited guaranty not to exceed the least of (x) 5% of the aggregate net principal balance of the loans included in the collateral at the time of an event of default, (y) 5% of the maximum facility amount and (z) 10% of the aggregate outstanding principal balance of the advances at the time of an event of default. The Company has been advised by outside counsel that the structure of the Trust meets the requirements of a bankruptcy remote entity.

3) Please clarify whether the Trust’s creditors have a claim on the assets of Medallion Funding LLC and the Fund. It appears that they do, based on the guarantee provided by Medallion Funding LLC.

Response: Please see the response to Comment 10(b)(2) above.

4) Please clarify whether the Trust is consolidated or the transfer of loans to the Trust is structured and accounted for as a “true sale.”

Response: Although the Trust is a bankruptcy remote entity, Medallion Funding consolidates the Trust’s assets and liabilities for accounting and reporting purposes. The Company treats the Trust as part of Medallion Funding for all Commission and SBA regulatory purposes, including asset coverage.

5) Do the loans transferred to the Trust remain on the consolidated balance sheet of the Fund and its subsidiaries? If not, what is the accounting justification for not consolidating them?

6

Response: The loans transferred to the Trust are consolidated for accounting and reporting purposes, as is any outstanding indebtedness.

c) Please clarify the following issues with respect to the Fund’s SBICs:

1) Please identify all of the Fund’s subsidiaries that are SBICs.

Response: The Company has three SBIC subsidiaries, Medallion Funding LLC, Freshstart Venture Capital Corp. and Medallion Capital, Inc. (the “SBIC Subsidiaries”).

2) Are the assets and liabilities of all of the SBICs included on the Fund’s consolidated balance sheet?

Response: Yes, all of the assets and liabilities of the SBIC Subsidiaries are included on the Company’s consolidated balance sheet.

3) Please clarify whether the liabilities of the direct and indirect consolidated subsidiaries, including the Trust’s, are included in the calculation of the Fund’s asset coverage.

Response: All of the assets and liabilities of the Company’s consolidated subsidiaries are included in the calculation of the Company’s asset coverage.

4) Assuming that Section 18(k) of the 1940 Act exempts the indebtedness of the SBICs, including the Trust’s, from treatment as senior securities under Sections 18(a) and 61(a) of the 1940 Act, do you agree that their indebtedness is a liability of the Fund for purposes of the asset coverage calculation under 18(h) of the 1940 Act?

Response: The Company treats indebtedness incurred by the SBIC subsidiaries as “other liabilities” of the Company for purposes of the asset coverage calculation.

5) If so, what is the effect on the Company’s asset coverage of including the indebtedness of the SBICs, including the Trust’s, on the Company’s consolidated balance sheet?

Response: The liabilities of the Trust are included in the Company’s asset coverage calculations and the Company believes it maintains the coverage required by the 1940 Act.

d) Please inform us whether the SBA, or any other authority, limits the leveraging that the Fund’s SBICs and the Trust can take. Is the Trust’s debt or the Trust’s debt guaranteed by Medallion Funding LLC included when determining compliance with such limits? If so, please explain to us what those limits are and how the Fund’s SBICs and the Trust are in compliance with the applicable limits on their leveraging.

Response: SBICs that have issued SBA debentures (“Leveraged Licensees”) are subject to the leverage limitations set forth in 13 CFR 107.1150. This section specifies the SBA debenture limits SBA will approve for Leveraged Licensees, currently $150 million for any single Leveraged Licensee and $225 million for any two or more Leveraged Licensees under common control. In addition, any

7

other secured private leverage of a Leveraged Licensee must be pre-approved by SBA pursuant to 13 CFR 107.550. We are unaware of any Leveraged Licensee that has been granted approval to issue any additional secured leverage and have been advised that SBA’s policy is to decline approval for private secured leverage for any Leveraged Licensee.

For SBICs that have not issued SBA debentures, such as Medallion Funding, SBA does not restrict the amount of private leverage available to the entity. Nonetheless, because the Company considers all of the Trust leverage to be “other liabilities” when calculating its asset coverage requirements, the Company’s ability to obtain leverage is limited by Sections 18 and 61 under the 1940 Act. All of the Company’s SBIC Subsidiaries are in compliance with applicable SBA leverage and capital requirements.

e) Please inform us about how the Fund calculates asset coverage and determines compliance with Sections 18(a) and 61(a) of the 1940 Act on a consolidated basis.

Response: The Company calculates asset coverage and determines compliance with Sections 18(a) and 61(a) of the 1940 Act as follows:

The Company, as a BDC, and Medallion Funding, Freshstart and Medallion Capital (together, the “Investment Company Subsidiaries”) are exempt under Section 6(f) of the 1940 Act from many of the requirements of the 1940 Act. Section 61 of the 1940 Act, however, requires a BDC to comply with Section 18 of the 1940 Act to the same extent as if the BDC were a registered closed-end investment company, subject to certain modifications. In relevant part and as modified by Section 61, Section 18(a)(1)(A) of the 1940 Act effectively provides that a BDC may not issue a “senior security” that represents indebtedness unless, immediately after such issuance, the BDC will have an “asset coverage” of at least 200%. Section 18(a)(2)(A) provides for the same asset coverage requirement for any senior security that is stock.

The term “senior securities” is generally interpreted broadly by the Commission and its staff to include any bond, debenture, note, or similar obligation or instrument constituting a security and evidencing indebtedness, and any stock of a class having priority over any other class as to distribution of assets or payment of dividends. A senior security representing indebtedness is any senior security other than stock.

The Company’s Exemptive Orders

The Company calculates its “asset coverage” on both an unconsolidated and a consolidated basis in accordance with Section 18 as modified under (i) the Application by Medallion Funding Corp., SEC Rel. No. IC-16253 (Feb. 5, 1988), granted by Commission Order,In the Matter of Medallion Funding Corp., SEC Rel. No. IC-16296 (Mar. 1, 1988) (the “1988 Order”) and (ii) the Application by Medallion Financial Corp., SEC Rel. No. IC-21915 (Apr. 24, 1996), granted by Commission order,In the Matter of Medallion Financial Corp., SEC Rel. No. IC-21969 (May 21, 1996) (the “1996 Order”). The 1988 Order was primarily designed to facilitate the use of a company structure by the Company; the 1996 Order clarified how certain debentures held by the SBA should be treated by the Company for purposes of the asset coverage test.

8

Under the 1988 Order, the Company and the Investment Company Subsidiaries obtained certain exemptive relief from Sections 8(b), 12(d)(1), 12(e), 17(a), 17(d), 18(a), 18(c), 30(b) and 30(d) of the 1940 Act and Rules 8b-16, 17d-1, 30b1-1 and 30d-1 thereunder. In relevant part, the Company and each Investment Company Subsidiary represented that it would not issue any senior securities unless the Company, on an individual basis, and the Company and its subsidiaries, on a consolidated basis, met the asset coverage requirements under Section 18(a) of the 1940 Act. In calculating the Company’s asset coverage on a consolidated basis, the 1988 Order permits the following to not be treated as senior securities issued by the Company but to be treated as indebtedness not represented by senior securities:

| • | Any SBA preferred stock interest in Medallion Funding. |

| • | Any borrowings by the Investment Company Subsidiaries. |

| • | Any guarantees by the Company of any borrowings of the Investment Company Subsidiaries, so long as at least 90% of the total assets of the Company on a consolidated basis are represented by the Company’s investments in the Investment Company Subsidiaries, or in securities similar to those in which those entities invest. |

Under the 1996 Order, the Company and certain other parties obtained exemptive relief from Sections 12(d), 17(a), 17(d), 18(a) and 57(a) of the 1940 Act and Rule 17d-1 thereunder. The Company made essentially the same representations, and agreed to the same conditions, in the 1996 Order as under the 1988 Order with respect to the issuance of senior securities, although no reference was made to guarantees by the Company and the 90% requirement discussed above.

Under both the 1988 Order and the 1996 Order, the Company represented that it would calculate asset coverage on both an individual and consolidated basis in accordance with Section 18 of the 1940 Act.

The Company’s Asset Coverage on a Consolidated Basis

Under the terms of the 1988 and 1996 Orders, the Company must calculate its asset coverage on a consolidated basis. For purposes of Section 18, on a consolidated basis, the Company has not issued any stock other than its common stock, but does have outstanding senior securities represented by indebtedness. In calculating its asset coverage for indebtedness on a consolidated basis, the Company follows the guidelines below:

| • | Any debt issued directly by the Company, such as the Company’s loan with Sterling National Bank, is treated as senior security. |

| • | Any margin loans, to the extent “covered” in accordance with Commission guidance, are treated as a liability not deemed a senior security. The Company covers its margin loans by segregating on its books cash or marketable securities in an amount equal to the margin liability, as marked to market on a daily basis. |

9

| • | Guarantees, if any, issued by the Company would generally be senior securities except (1) guarantees issued on any borrowings of the Investment Company Subsidiaries, provided the conditions set out in the 1988 Order are met, and (2) guarantees meeting the requirements of Section 61(a)(4) of the 1940 Act. |

| • | Per the 1988 and 1996 Orders, any borrowings by any of the Investment Company Subsidiaries, including any SBA debentures, are treated as a liability but not a senior security. |

| • | Any preferred stock interest held by the SBA is treated as a liability of the Company, but not a senior security. |

| • | Indebtedness under the $200 million line of credit between Taxi Medallion Loan Trust III and an affiliate of DZ Bank is treated as a liability of the Company but not a senior security. This position is based primarily on the fact that neither the Company nor any Investment Company Subsidiary is the issuer of the indebtedness, and DZ Bank does not have priority to any assets of the Company or any Investment Company Subsidiary, but, except for the limited guarantee provided by Medallion Funding discussed above, is limited in recourse solely to the Trust. |

| • | When the Company consolidated Medallion Bank, Certificates of Deposit issued by Medallion Bank were treated as liabilities of the Company but not senior securities. The CDs essentially represent borrowings by Medallion Bank from its depositors for which Medallion Bank issues promissory notes paying a certain rate of interest. Medallion Bank was the sole issuer of the CDs, and the CDs were solely the obligations of Medallion Bank, were FDIC insured, and were subject to regulation by the FDIC and Utah state banking regulators. Following deconsolidation of Medallion Bank, the Company treats CDs issued by Medallion Bank solely as obligations of a portfolio investment. |

Applying the guidelines to the asset coverage test with respect to the Company’s financials as of December 31, 2011, the Company’s asset coverage on a consolidated basis is calculated as follows:

Total Assets ($537,030,579) – Total Liabilities other than Senior Security Debt ($272,969,700) / Senior Security Debt ($92,556,774) = approximately 285.3%.

f) Please provide, where appropriate in the prospectus, a chart that identifies and shows the purpose, and relationship to the Fund, of every subsidiary of the Fund.

Response: The Company has provided the requested chart identifying each majority-owned subsidiary of the Company and the purpose and relationship to the Company on pages 10-11 and 51-58 of the Revised Registration Statement with a cross-reference to those sections on page 2.

Comment 11: At the end of the subsection “Determination of Net Asset Value,” on page 3, please add the following information, which also appears in the prospectus on page 19:

Because such valuations, and particularly valuations of private securities and private companies, are inherently uncertain, the valuations may fluctuate over short periods of time and may be based on estimates. As a result, our determinations of fair value

10

may differ materially from the values that would have been used if a ready market for these investments existed. Our net asset value could be adversely affected if our determinations regarding the fair value of our investments were materially higher than the values that we ultimately realize upon the disposal of such securities.

Response: The Company has made the requested addition to page 4 of the Revised Registration Statement.

Available Information, page 4

Comment: Please disclose the 1933 Act file number of the current “registration statement on Form N-2.”

Response: The Company has made the requested addition to the Revised Registration Statement.

Fees and Expenses, page 5

Comment 1: Please revise footnote 3 to state that the calculation of “average net assets attributable to common stock” is based on an estimate of the Fund’s average net assets for the current fiscal year, taking into account the net proceeds from offerings of common shares expected to be received by the Fund in the current fiscal year.

Response: The Company has revised footnote 3 to state: “ ‘Average net assets attributable to common stock’ are estimated for the current fiscal year, taking into account the anticipated net proceeds from offerings of common stock, which are based on the average total shareholder’s equity of $166,738,000 for the fiscal year ended December 31, 2011.”

Comment 2: At the end of the line item “Operating Expenses,” please add the parenthetical phrase “(estimated for the current fiscal year).” Please also delete footnote 4.

Response: The Company has revised footnote 4 to state: “ ‘Operating Expenses’ are estimated for the current fiscal year, which are based on the annualized operating expenses for the fiscal year ended December 31, 2011.”

Comment 3: Please revise the first sentence of footnote 6 to state that the “Interest Payments on Borrowed Funds” are estimated for the current fiscal year. Please confirm to us that this figure includes the interest on the Fund’s preferred shares currently outstanding and expected to be issued in the current fiscal year.

Response: The Company has revised footnote 6 to state: “ ‘Interest Payments on Borrowed Funds’ are estimated for the current fiscal year, which are based on the annualized interest expense for the fiscal year ended December 31, 2011.” The Company currently does not have any preferred shares outstanding and does not expect to issue any preferred shares in the current fiscal year.

Comment 4: Please provide an “Acquired Fund Fees and Expenses” line item if it is expected that any of the Fund’s assets will be invested in an “acquired fund,” including a money market fund, and the indirect expenses of such an investment are expected to be equal to, or greater than, one basis point. See Instruction 10 to Item 3.1. of Form N-2.

11

Response: The Company does not expect to materially invest in any “acquired fund” that would require disclosure of “Acquired Fund Fees and Expenses” in the Fees and Expenses table.

Comment 5: Please delete the last sentence of footnote 7. It is irrelevant and could be confusing to investors.

Response: The Company has made the requested deletion to the Revised Registration Statement.

Example, page 5

Comment 1: In the first paragraph of the Example, please delete the statement: “we have assumed we would have no leverage.” Replace it with a statement that the Example assumes that the Fund’s annual expenses, including leverage, would remain the same each year. See Instruction 11 to Item 3.1. of Form N-2.

Response: The Company has deleted the requested statement and replace it with the following: “we have assumed that the annual expenses, including leverage, would remain the same each year at the levels set forth in the table above.”

Comment 2: The first paragraph also states that the Example will be restated to reflect the sales load “[i]n the event that shares to which this prospectus relates are sold to or through underwriters….” Please add that, as disclosed elsewhere in the prospectus, shares may be sold by agents and dealers, as well as underwriters.

Response: The Company has made the requested additions to the Revised Registration Statement.

Comment 3: The second paragraph of the Example states that “[t]his illustration assumes that we will not realize any capital gains computed net of all realized capital losses and unrealized capital depreciation in any of the indicated time periods.” There is no disclosure in the prospectus about a performance fee based on realized capital gains. Please explain what appears to be a reference to such a performance fee. Please also inform us whether the managers are exempt from registration under Section 203 of the Investment Advisors Act of 1940.

Response: The Company does not charge a performance fee and has removed the statement “[t]his illustration assumes that we will not realize any capital gains computed net of all realized capital losses and unrealized capital depreciation in any of the indicated time periods.” As disclosed on page 6 of the Revised Registration Statement, the Company does not have an investment adviser and is internally managed by the Company’s executive officers under the supervision of the Board of Directors.

Selected Condensed Consolidated Financial Data, page 7

Comment: If possible, please present all financial information as of the end of the calendar year.

12

Response: The Company has presented financial information in the Revised Registration Statement as of December 31, 2011.

Use of Proceeds, page 10

Comment 1: Please state the interest rate and maturity of the debt to be paid off with the net proceeds of the offering. See instruction 2 to Item 7.1 of form N-2.

Response: As required by Item 7.1, the Company has disclosed the principal purposes for the use of net proceeds, which may include reducing the Company’s debt under its revolving facilities. Since the Company currently does not intend to use the net proceeds to discharge any particular debt of the Company, the Company is unable to provide specific information about the interest rate and maturity of the indebtedness.

Comment 2: Please confirm that the Fund will invest the proceeds of the current offering within the time limits provided for a business development company in “Guide 1” of the “Guidelines for Form N-2.”

Response: Confirmed. As disclosed in the Revised Registration Statement on page 12, the Company anticipates that substantially all of the net proceeds from this offering will be used within two years of receipt of the applicable funds or as otherwise required pursuant to applicable law.

Dividends, page 10

Comment: Please inform us whether the Fund intends to report a distribution yield. If the Fund intends to report a distribution yield at any point prior to finalizing its tax figures, it should disclose the components of the distribution yield. In addition, any reports containing distribution yields should be accompanied by the SEC total return and/or yield and the Fund should also disclose that the distribution yield does not represent its performance.

Response: The Company does not intend to report a distribution yield.

Consumer lending by Medallion Bank…, page 13

Comment: Please clarify who is referred to by the phrase “consumers that have blemishes on their credit reports.” Are these the principal loan customers of Medallion Bank?

Response: The principal loan customers for Medallion Bank’s consumer loan portfolio primarily consist of borrowers with FICO scores at the lower end of prime or just below prime. However, more than 25% of the portfolio consists of borrowers with prime FICO scores. The typical borrower has experienced a credit blemish (late or missed payment) at some point in the past but is on the path of credit recovery. Importantly, all borrowers are current at loan origination with all payments and have demonstrated an ability to repay the loan. Due to the ongoing economic downturn, the board of Medallion Bank determined it would be prudent to tighten its credit standards to require a higher minimum FICO score to qualify for a loan and the average FICO score of a consumer borrower has risen from 605 to approximately 670.

13

We operate in a highly regulated environment…, page 13

Comment: The disclosure states that “we rely upon several exemptive orders from the SEC permitting us to consolidate our financial reporting and operate our business as presently conducted.” Please identify to us the specific exemptive orders referred to by this statement.

Response: The Company relies on the following exemptive orders from the SEC: SEC Rel. No. IC-16296 (Mar. 1, 1988), SEC Rel. No. IC-21969 (May 21, 1996), SEC Rel. No. IC-22417 (Dec. 23, 1996), SEC Rel. No. IC-24390 (Apr. 12, 2000), SEC Rel. No. IC-27955 (Aug. 27, 2007), SEC Rel. No. IC-29258 (Apr. 26, 2010).

Federal and state law may discourage certain acquisitions of our common stock…, page 14

Comment 1: The disclosure states that “we are an ‘insured depository institution’ within the meaning of the Change in Bank Control Act.…” Regardless of whether this statement is technically correct for purposes of the “Change in Bank Control Act,” it has potential to mislead investors with respect to the very significant risks of investing in the Fund. Please revise the disclosure to eliminate any possible misapprehension on the part of investors that their investments in the Fund are insured deposits.

Response: The Company has included disclosure to clarify that investment in the Company is not guaranteed by the FDIC and is subject to loss.

Comment 2: The FDIC is authorized to conduct examinations of Utah industrial loan companies and their holding companies. See Section 10(b) of the Federal Deposit Insurance Act (12 U.S.C. Section 1820 (B)). Please inform us when Medallion Bank was last examined and furnish us with the results of that examination. Please also inform us whether the Fund is eligible for the exemption from the Bank Holding Company Act in 12 U.S.C. Section 1841(c)(2).

Response: Both the FDIC and the Utah Department of Financial Institutions examine Medallion Bank on an annual basis. The last examination was a joint examination conducted by the FDIC and the Utah Department of Financial Institutions for the period ended March 31, 2011. The FDIC’s examination report is confidential, and we believe we are prohibited from furnishing the results of the examination pursuant to Part 309 of the Federal Deposit Insurance Corporation Rules and Regulations and Section 7-1-809 of the Utah Code. Generally, an industrial bank will not be a Bank Holding Company Act (BHCA) bank as long as it satisfies at least one of the following conditions: (1) the institution does not accept demand deposits, (2) the institution’s total assets are less than $100,000,000, or (3) control of the institution has not been acquired by any company after August 10, 1987. Medallion Bank does not accept demand deposits and is therefore not a “bank” under the BHCA. A company controlling an institution that is not a BHCA bank is not required to register as a bank holding company with the Federal Reserve Board and, therefore, is not subject to regulation and supervision by the Federal Reserve Board.

Comment 3: Please disclose the limitations imposed by federal and state law on the amount of dividends payable by Medallion Bank. If the restrictions on the dividends payable by Medallion Bank could affect the Fund’s qualification as a “regulated investment company,” please disclose this risk.

14

Response: Per a 2003 FDIC order entered into as a condition for obtaining FDIC insurance, Medallion Bank was prohibited from paying out dividends during the three years following entry of the order. That provision of the order has since expired. In addition, during Medallion Bank’s participation in the TARP program, the amount of dividends payable by Medallion Bank were limited. Medallion Bank has since exited the TARP program. Therefore, the Company does not believe there are any applicable restrictions on the ability of Medallion Bank to pay dividends unique to Medallion Bank that could affect the Company’s qualification as a “regulated investment company.”

If our primary investments are deemed not to be qualifying assets…, page 15

Comment: The disclosure states that “[o]ur investment in Medallion Bank may constitute a non-qualifying asset. As of September 30, 2011, up to 27% of our total assets were invested in non-qualifying assets.” We note that the value of the assets of Medallion Bank is continuing to grow at a double digit compound annual rate. The disclosure also states that “if such proactive measures are ineffective and our primary investments are deemed not to be qualifying assets, we could be deemed in violation of the 1940 Act….” How often has the Fund had to take “proactive steps” at the end of a quarter to maintain compliance with section 55(a) of the 1940 Act?

Response: Over the course of any quarter, including towards the end of a quarter, the Company may engage in prudent cash management activities in the ordinary course, but it has not engaged in any activities solely to maintain compliance with any particular regulatory requirement.

We may have difficulty paying our required distributions…, page 17

Comment: The disclosure states that “we will include in taxable income certain amounts that we have not yet received in cash, such as original issue discount, which may arise if we receive warrants in connection with the origination of a loan or possibly in other circumstances, or contractual payment-in-kind interest….”

a) Please disclose how much of the Fund’s current income is attributable to original issue discount (“OID.”)

Response: None of the Company’s current income is attributable to original issue discount. In the event the Company recognizes OID income, the Company will disclose such amounts.

b) Disclose whether the Fund has a policy limiting its ability to invest in instruments with OID, including payment-in-kind (“PIK”) loans.

Response: The Company does not have a policy limiting its ability to invest in instruments with OID.

c) In the Schedule of Investments, on pages 66 and F-36, and wherever appropriate in the financial statements, please disclose the amount of PIK interest payable on each loan and the amount of OID attributable to each warrant.

15

Response: The Company has made the requested addition to the Consolidated Summary Schedule of Investments beginning on page F-36, identifying any loans with PIK interest payable and the amount of interest income capitalized into the outstanding investment balance.

d) If the Fund’s OID investments will be significant, please provide summary risk disclosure about the fact that such investments will require the Fund to pay incentive fees and taxes on accrued income that will not be collectible until maturity of the instrument and, ultimately, may not be collected.

Response: As noted above, none of the Company’s current income is attributable to OID. In the event the Company expects to recognize a material amount of OID income, the Company would provide the requested summary risk disclosure.

We depend on cash flow from our subsidiaries to make dividend payments…, page 18

Comment: Please clarify the meaning of the statement that “as a condition of its approval by its regulators, Medallion Bank is required to maintain a 15% capital ratio.” Please identify the “approval” and the “regulators” referred to. In addition, this statement seems inconsistent with the disclosure in the subsequent subsection, “Medallion Bank’s use of brokered deposit sources… may not be available…,” which states that “[i]f the capital levels at Medallion Bank fall below the “well-capitalized” level… the cost of attracting deposits from the brokered deposit market could increase significantly…” Currently, an insured depository institution is classified as “well capitalized” by the FDIC if its risk-based capital ratio is 10% or higher. Please revise the disclosure to clarify whether the bank could continue to take operate and take deposits if its capital ratio were to fall below the level “required by the FDIC.”

Response: As a condition to receipt of FDIC insurance, Medallion Bank entered into a capital maintenance agreement with the FDIC obligating it to maintain a 15% leverage ratio (Tier 1 capital to total assets). This is significantly higher than the 5% minimum leverage ratio to be considered “well capitalized” under FDIC regulations. This leverage ratio is calculated differently than a risk-based capital ratio for purposes of determining if a bank is “well capitalized.” In the event Medallion Bank failed to maintain a 15% leverage ratio, we believe the FDIC could require Medallion Bank to undertake corrective action to increase capital above 15%. In the event Medallion Bank failed to remain “well capitalized” with a leverage ratio of 10% or higher, it is possible the cost of funding through brokered CDs might become prohibitively expensive. The Company has revised the statement on page 21 of the Revised Registration Statement to state: “as a condition to receipt of FDIC insurance, Medallion Bank entered into a capital maintenance agreement with the FDIC requiring it to maintain a 15% leverage ratio (Tier 1 capital to total assets). Medallion Bank may be restricted from declaring and paying dividends if doing so were to cause it to fall below a 15% leverage ratio.”

Medallion Bank’s use of brokered deposit sources for its deposit-gathering activities may not be available when needed, page 18

Comment: Please define the term, “brokered deposits.” In addition, please discuss the risks to the banks of being reliant on what is considered in the banking industry to be “hot money” that is an unstable source of deposits.

16

Response: The Company has disclosed the following requested additional information defining the term, “brokered deposits:” “Medallion Bank’s brokered deposits consist of deposits raised through the brokered deposit market rather than through retail branches.”

Use of the brokered CD market is recognized by Medallion Bank’s regulators as the primary method for industrial banks to raise all or substantially all of their deposits. The brokered deposits are obtained through brokered deposit desks of brokers approved by Medallion Bank, including Wells Fargo, Citibank, UBS and Morgan Stanley. Brokered deposits desks typically deliver Medallion Bank a rate sheet at the beginning of the week indicating pricing on brokered deposits for various maturities. Medallion Bank will purchase deposits for maturities that correspond to its business needs at the prices quoted by the trading desks. The brokered deposits provide stable funding for Medallion Bank because it is able to purchase deposits at maturities matching its business needs rather than relying on core deposits that may be withdrawn unexpectedly. The brokered deposits raised by Medallion Bank are not related to “hot money” as the rates offered are quoted to Medallion Bank and generally available in the marketplace.

Our investment portfolio is… recorded at fair value as determined in good faith by our management and approved by our Board of Directors…, page 19

Comment 1: The disclosure states that “[u]nder the 1940 Act, we are required to carry our portfolio investments at market value or, if there is no readily available market value, at fair value as determined by our management and approved by our Board of Directors.” Please revise this statement to make clear that it is the responsibility of the Fund’s Board of Directors to fair value the Fund’s investments. See Section 2(a)(41)(B) of the 1940 Act.

Response: The Company has revised the disclosure to clarify that it is the responsibility of the Company’s Board of Directors to value investments in the portfolio.

Comment 2: With respect to the disclosure about the “written guidelines approved by our Board of Directors,” please also clarify that it is the obligation of the Board to “regularly review the appropriateness and accuracy of the method used in valuing securities, and make any necessary adjustments” (Release No. IC-26299; “Compliance Programs of Investment Companies and Investment Advisers,” (December 17, 2003)).

Response: The Company has revised the disclosure to clarify that the Board of Directors regularly reviews the appropriateness and accuracy of the method used in valuing the Company’s investments and makes any necessary adjustments.

Comment 3: Explain to us how the value of the Fund’s investment in Medallion Bank is calculated? How are the assets valued? Are values ascribed to the Utah industrial loan charter and a core deposit intangible?

Response: In determining the fair value of Medallion Bank, the Company typically reviews multiple factors relating specifically to the loans, including the financial condition of the borrower base, the adequacy of the collateral underlying the loans, individual credit risks, historical loss experience and the relationships between current and projected market rates and portfolio rates of

17

interests and maturities. The Company also considers more general factors relevant to its investment in Medallion Bank, including the level of Medallion Bank’s earnings, book value, franchise value, restrictions on Medallion Bank’s operations, restrictions in its charter (including transferability), comparable sales and valuations of other similar industrial banks, if available, as well as additional factors that the Company determines as relevant from time-to-time. Some of the salient points that the Company considers are:

| • | The industrial bank charter is a unique license. Industrial banks are more limited in their activities than commercial banks. For example, industrial banks (like Medallion Bank) with assets in excess of $100 million cannot offer transaction accounts, such as checking accounts, which are among the lowest cost and hence most profitable source of funds for most commercial banks. Medallion Bank is not a full-service bank, and its activities are limited to three main product lines (medallion, commercial, and consumer) and an immaterial amount of other loans. Medallion Bank has no retail locations, no core deposits, does not provide residential mortgages, and does not provide credit cards. Given these limitations, as well as the others described below, the Company does not believe a commercial bank provides a reasonable comparison to the value of Medallion Bank. |

| • | For the past several years, either the FDIC or the Dodd-Frank Act has implemented a moratorium on granting new industrial bank charters or approving transfers of existing charters or industrial bank charter transfers to certain commercial firms (companies whose gross revenues are primarily derived from non-financial activities). Because of this restriction, Medallion Bank has been a completely illiquid asset, limiting the value of Medallion Bank beyond its book value. |

| • | Per a 2003 FDIC order, Medallion Bank has been prohibited from (i) entering any new lines of business without prior approval from the FDIC, and (ii) growing the medallion portfolio in excess of certain capital ratios, in effect requiring Medallion Bank to diversify its assets. Furthermore, as a condition to receipt of FDIC insurance, Medallion Bank entered into a capital maintenance agreement with the FDIC requiring it to maintain a 15% leverage ratio (Tier 1 capital to total assets). The Company believes this restriction is higher than required of peer banks and further limits the value of the Company’s investment in Medallion Bank. |

| • | There are only a limited number of approved industrial bank charters in Utah, and the Company believes there are approximately 50 industrial banks nationwide. As a result, there is little market evidence of values independently derived through market trades or company sales. |

| • | There is significant uncertainty in the regulatory environment relating to industrial banks through the passage of the Dodd-Frank Act, which imposes a moratorium on new industrial bank charters and industrial bank transfers to certain commercial firms before 2013. Previously, federal legislation has been proposed that could have impaired Medallion Bank’s operating flexibility and hence the value of Medallion Bank. The proposed legislation would have (i) provided more regulatory oversight over Medallion Bank’s parent and affiliates, (ii) limited the Company’s ability to either sell Medallion Bank, or change its ownership group, and (iii) if Medallion Bank was chartered after September 30, 2003, restrict the development of new business ventures. |

18

| • | The market valuation of the Company for the past several years, as reflected by its stock price, has approximated its book value. The Company believes when investors value the Company, they also indirectly place a value on Medallion Bank as it is a large component of the Company, with similar assets. Unlike many other publicly traded business development companies which trade at a more substantial premium to book value, the market currently places a value on the entire Company at close to its book value. This has generally been the case for as long as Medallion Bank has been in existence. |

| • | Medallion Bank’s primary value to the Company is derived from its ability to lower the price at which the Company obtains funds for making investments in its portfolio companies and its earnings which cannot be duplicated by any other current or foreseen investment opportunity. Replacing this stream would be very difficult. As a result, the Company does not have any current intention to dispose of its investment in Medallion Bank. |

| • | When Medallion Bank acquired the RV/marine portfolio, it was viewed purely as a portfolio acquisition, not the acquisition of an ongoing origination platform or business. Prior to Medallion Bank’s acquisition of the RV/marine portfolio, the seller, in fact, had not underwritten any new loans in almost two years. Accordingly, Medallion Bank acquired an aging portfolio. |

| • | All of the medallion loans and commercial loans originated by Medallion Bank are referred to Medallion Bank by the Company. The Company maintains the entire origination and servicing platform for these loans and reserves the right to no longer refer loans to Medallion Bank without notice. Because the Company typically services all of these loans, Medallion Bank does not have direct contact with these borrowers or an appropriate platform to conduct this business. |

| • | Because origination, ongoing contact and relationship control exist outside Medallion Bank, we do not believe that the medallion and commercial loan portfolios create any enterprise or relationship premium for Medallion Bank. Much the same can be said for the RV/marine portfolio, which is currently referred to Medallion Bank by third parties who have the transactional contact with the borrowers. Servicing of this portfolio is managed by a third party unrelated to the Company or Medallion Bank. |

| • | On an annual basis, the Company obtains a report from an independent third-party valuation expert that reviews the methodology utilized by the Company to determine the fair value of Medallion Bank and opines on the reasonableness of such methodology. In issuing its opinion, the third-party valuation expert closely reviews both the methodology and the sources of information used by the Company in implementing that methodology, including, among others: (i) certain publicly available financial statements and other business and financial information of the Company and Medallion Bank; (ii) certain internal financial statements and other financial and operating data concerning Medallion Bank and the Company; and (iii) correspondence from the FDIC to Medallion Bank. A copy of the report pertaining to the period ended December 31, 2011 has been supplementally provided to the Staff. |

| • | The Company’s independent registered public accounting firm, WeiserMazars LLP, issued an unqualified opinion for the audit of the Company’s financial statements as of December 31, 2011 in |

19

which the financial statements reflect the historically reported fair values for Medallion Bank as approved by the Company’s Board of Directors determined pursuant to the valuation process described above. In connection with the audit of the Company’s financial statements and audit of the Company’s internal controls over financial reporting, WeiserMazars LLP typically verifies the facts and circumstances the Company relies upon in determining the fair value of Medallion Bank. For example, the auditors have verified that no new industrial bank charters have been issued and no industrial bank charters have been transferred. |

We have enhanced our disclosure related to the process for determining the fair value of Medallion Bank. See, e.g., pages 22, 32, 42-43, 50, 53 and 69 of the Revised Registration Statement.

Acquisitions may lead to difficulties that could adversely affect our operations, page 20

Comment: Please disclose whether the Fund currently intends to make any “corporate acquisitions.”

Response: The Company does not currently contemplate making any corporate acquisitions but regularly reviews acquisition opportunities. The Company will disclose in any prospectus or prospectus supplement related to an offering of securities whether the proceeds of such offering will be used towards any corporate acquisition.

Our Board of Directors may change our operating policies and strategies without prior notice or shareholder approval.., page 21

Comment: Please disclose how much notice, if any, shareholders will be given of the Board’s decision to change the Fund’s operating policies or strategies.

Response: The Company has disclosed on page 24 of the Revised Registration Statement that the Board of Directors may change the Company’s operating policies and strategies without prior notice or shareholder approval.

Changes in taxicab industry regulations that result in the issuance of additional medallions… could lead to a decrease in the value of our medallion loan collateral, page 21

Comment: Please update the disclosure to reflect the fact that the legislation described as “enacted” by the New York State legislature has now been signed by Governor Cuomo. The new law, according to press reports, would created as many as 2,000 additional “yellow cab” medallions and 18,000 “livery” medallions. Please revise the disclosure to address the following issues with respect to the new law. How has the value of the existing New York City medallions been affected? Have the valuations of the medallion loans made by the Fund been affected by a reduction in the value of the collateral? On the other hand, will the Fund and Medallion Bank benefit from an expansion of lending opportunities in New York City? Does the recent action of the New York legislature heighten the political risk that the number of medallions could be increased in other cities?

Response: Currently, the status of the legislation is in flux and we do not believe the impact is yet known. An amendment to the legislation was enacted on February 17, 2012. In addition, a judicial

20

decision rendered on December 23, 2011 requires any future medallion issuances by the city to comply with the Americans with Disabilities Act. The Company does not believe the legislation as passed complies with the judicial decision and that further changes will be required. Accordingly, the Company has no estimated time table for when any additional medallions might be issued. There have been no reductions to the values of the medallions and the Company has not experienced any material changes to its portfolio. The Company does not believe the recent action in New York heightens the political risk in other markets because the New York legislation is designed to address taxi service outside of Manhattan which is an issue unique to the New York market.

We may allocate the net proceeds from this offering in ways with which you may not agree, page 25

Comment: Please clarify the meaning of the statement that “[w]e use allocate the net proceeds from this offering in ways with which you may not agree or for purposes other than those contemplated at the time of the offering.” This statement implies that the advisor may use strategies or make investments not disclosed by the prospectus.

Response: The Company has revised the statement as follows: “[w]e . . . may use the net proceeds from this offering in ways with which you may not agree.”

Management’s Discussion and Analysis of Financial Condition and Results of operations, page 27

Comment 1: The disclosure states that “[t]o take advantage of this low cost of funds, we refer a portion of our taxicab medallion and commercial loans to Medallion Bank, which then originates these loans. We earn referral fees for these activities.” However, in a “Talking Points” memorandum submitted to the staff in December, 2006, you described the lending process as follows: “[m]edallion loans and commercial loans that are financed by Medallion Bank reflect Medallion Bank as the lender but are originated and serviced by the same departments at Medallion Financial as when such loans are financed from other financing sources in the Medallion family.” Please explain the apparent inconsistency in the two descriptions of the origination process. Please explain exactly how the Fund is able “to take advantage of [Medallion Bank’s] low cost of funds.” What factors determine which loans are “referred” to Medallion Bank?

Response: The Company respectfully does not believe these statements are inconsistent. Medallion Bank does not maintain any taxi medallion or commercial underwriting or servicing staff. It relies on the Company’s underwriters and servicers to provide it with new medallion and commercial loan origination opportunities and to service those loan portfolios. When a proposed loan is referred by the underwriters to Medallion Bank, that loan is reviewed by Medallion Bank’s credit committee. If Medallion Bank accepts the loan, Medallion Bank will close the loan on its own paper. Medallion and commercial loans that are financed by Medallion Bank reflect Medallion Bank as the lender. The Company refers a mix of loans to Medallion Bank taking into account many factors, including the potential yield and profitability to Medallion Bank, concentration limits, the market in which the loan is located, etc. Because of Medallion Bank’s low cost of funds, it may have the opportunity to originate a loan that another one of the Company’s lending entities would not find sufficiently profitable.

21

Comment 2: Please correct an apparent typo in the financial information on page 30. The yield on the medallion loans in the Medallion Bank’s portfolio is shown as 17.77% (compared to a weighted average yield on the medallion loans in the Fund’s portfolio of 5.59%). The disclosure on page 32, however, states that the weighted average gross yield of the managed consumer loan portfolio was 17.77% at September 30, 2011, indicating a likelihood that the yields on Medallion Bank’s medallion loans and consumer loans, on page 30, have been transposed.

Response: The Company has corrected the financial information on page 34 of the Revised Registration Statement as the financial information for certain periods for “Consumer loans” and “Medallion loans” were transposed. The financial information has been updated as of December 31, 2011.

Comment 3: Please disclose how the FDIC restricts the amount of medallion loans that Medallion Bank may finance. Please discuss whether the combination of the FDIC’s diversification requirements and the 30% limit on non-qualifying assets imposed by Section 55(a) of the 1940 Act have combined to restrict the future growth of Medallion Bank.

Response: The Company has included the following requested disclosure on pages 32 and 57 of the Revised Registration Statement: “[t]he FDIC restricts the amount of taxicab medallion loans that Medallion Bank may finance to three times Tier 1 capital.” The Company does not believe the FDIC diversification requirement is directly related to the fair value of the Company’s investment in Medallion Bank.

Management, page 69

Comment 1: Please revise the tables, on page 69, to conform to the requirements of Item 18(1) of Form N-2. Please also list any other directorships held by the Directors during the past five years, as required by Item 18(6)(b) of Form N-2.

Response: The Company has revised the tables to conform to the requirements of Item 18(1) of Form N-2 and provided disclosure of other directorships held by each director during the past five years.

Comment 2: Please revise the disclosure, on page 75, to disclose the specific characteristics or circumstances of the Fund that make its leadership structure appropriate. See Item 18(5)(a) of Form N-2.

Response: The Company has supplemented the disclosure of the board leadership structure of the Company on page 77 of the Revised Registration Statement in accordance with Item 18(5)(a) of Form N-2 as follows:

Alvin Murstein serves as both the Chief Executive Officer and Chairman of the Board of Directors. Mr. Murstein is an “interested person” under the 1940 Act. The Board

22

of Directors believes that this leadership structure is appropriate because Mr. Murstein’s service as both the Chief Executive Officer and Chairman of the Board of Directors is in the best interest of our company and our shareholders. Mr. Murstein possesses detailed and in-depth specialized knowledge of the taxicab medallion loan business, opportunities and challenges facing our company and is thus best positioned to develop agendas that ensure that the Board of Director’s time and attention are focused on the most critical matters. His combined role enables greater efficiency regarding management of the company, provides for decisive leadership, ensures clear accountability, and enhances our ability to communicate our message and strategy clearly and consistently to our shareholders, employees and customers. Because of the ease of communication arising from the relatively small size of the Board of Directors and the small number of independent directors, the Board of Directors has determined not to designate a lead independent director.

Executive Compensation, page 77

Comment 1: Please put the tables, currently on pages 87-92, at the front of this section.

Response: The Company has moved the tables to the front of the section.

Comment 2: Please inform us whether the Fund intends to request exemptions from Sections 23(a), 23(b) and 63 of the 1940 Act and, under Sections 57(a)(4) and 57(i) of the 1940 Act and Rule 17d-1 under the 1940 Act, authorizing joint transactions otherwise prohibited by Section 57(a)(4) of the 1940 Act. Such exemptive relief, we note, was granted in 2009 permitting the Company to issue a limited number of shares of its restricted common stock, as part of the compensation packages for its officers and employees described on page 85.

Response: The Company currently does not intend to request exemptions from Sections 23(a), 23(b) and 63 of the 1940 Act and, under Sections 57(a)(4) and 57(i) of the 1940 Act and Rule 17d-1 under the 1940 Act, authorizing joint transactions otherwise prohibited by Section 57(a)(4) of the 1940 Act. The Company has requested an exemption from Section 61(a)(3)(B) of the 1940 Act from the Commission to approve a stock option plan for non-employee directors and the grant of certain stock options of which the initial application was filed in June 2009 and subsequently amended in June 2010 and May 2011.

Other

Comment 1: In future filings please include a cover letter that describes the purpose of the filing and provides the address and direct telephone number of a representative of the Fund to whom the staff may direct questions and comments about the filing.

Response: The Company will include the requested cover letter in this filing and future filings.

Comment 2: Does the prospectus describe all of the fundamental policies of the Fund with respect to any of the activities listed in Item 17.2. of Form N-2 and any other policy that the Fund deems fundamental? Does the Fund reserve freedom of action with respect to any of these activities?

23

Response: The Company has supplemented the disclosure of its policies on page 108 of the Revised Registration Statement as follows:

We may invest up to 100% of our assets in securities acquired directly from issuers in privately negotiated transactions. With respect to such securities, we may, for the purpose of public resale, be deemed an “underwriter” as that term is defined in the Securities Act of 1933. Similarly, in connection with an acquisition, we may acquire rights to require the issuers of acquired securities or their affiliates to repurchase them under certain circumstances. We also do not intend to acquire securities issued by any investment company that exceed the limits imposed by the 1940 Act. Under these limits, we generally cannot acquire more than 3% of the voting stock of any registered investment company, invest more than 5% of the value of our total assets in the securities of one investment company or invest more than 10% of the value of our total assets in the securities of more than one investment company. Certain of these limits are not applicable to our investments in our wholly-owned SBIC subsidiaries. With regard to that portion of our portfolio invested in securities issued by investment companies, it should be noted that such investments might subject our stockholders to additional expenses. None of our policies is fundamental, and each may be changed without stockholder approval.

Comment 3: Does the prospectus describe fully all significant investment policies of the Fund that are not deemed fundamental and that may be changed without the approval of the holders of a majority of the voting securities?

Response: The Company has disclosed on page 24 of the Revised Registration Statement that the Board of Directors may change the Company’s operating policies and strategies without prior notice or shareholder approval.

Comment 4: Does the prospectus disclose the extent to which the Fund may engage in its fundamental and non- fundamental policies and the risks inherent in such policies?

Response: The Company has no fundamental and non-fundamental policies and has disclosed that the Company’s policies and strategies may be changed without prior notice or shareholder approval.

Comment 5: Please inform us whether the officers, directors, and beneficial owners of more than 10% of the Fund’s securities have filed the ownership reports (Forms 3, 4, and 5) required by Section 16(a) of the Securities Exchange Act of 1934.

Response: All of the Company’s officers, directors and 10% beneficial owners have filed the ownership reports required by Section 16(a) of the 1934 Act.

TELEPHONE COMMENTS

Comment 1: Schedule of Investments – Consider inclusion of the Schedule of Investments in the Company’s quarterly reports on Form 10-Q.

24

Response: Please see response 2 below under “EMAIL COMMENTS.”

Comment 2: Under the “Fees and Expenses – Example,” please confirm the calculation of the 1 year, 3 years, 5 years and 10 years expenses. Based on the fee table’s total annual expense ratio of 19.13%, the Staff’s calculation of expenses differs from what is disclosed in the Initial Registration Statement.

Response: The Company has revised the fee table’s expenses, which are now estimated for the current fiscal year based on the expenses for the fiscal year ended December 31, 2011. The Company has also revised the Example calculation of the 1 year, 3 years, 5 years and 10 years expenses based on the fee table’s total annual expense ratio of 16.58%. The Company has confirmed the calculation methodology based upon the new estimated total annual expense ratio.

Comment 3: Under the heading “We may have difficulty paying our required distributions . . .. .” on page 17 of the Initial Registration Statement, the Company describes the receipt of PIK interest. Disclose which securities are PIK loans and the amount of PIK interest payable attributable to the PIK loans.

Response: The Company has made the requested addition to the Consolidated Summary Schedule of Investments beginning on page F-36, identifying any loans with PIK interest payable and the amount of interest income capitalized into the outstanding investment balance.

Comment 4: On the Consolidated Balance Sheets on page F-4 of the Initial Registration Statement, confirm whether the Company held any money market fund investments under the category “cash and cash equivalents” that may require disclosure of acquired fund fees and expenses in the fee table.

Response: The Company’s cash is held in various bank accounts and it has no cash or cash equivalents in money market funds or other investment companies that would require disclosure of acquired fund fees and expenses in the fee table.

Comment 5: On the Consolidated Balance Sheets on page F-4 of the Initial Registration Statement, parenthetically disclose the cost of each category of investments and of the total investments in accordance with Rule 6-03 of Regulation S-X.

Response: The Company believes the existing presentation of the balance sheet is the most appropriate presentation for its investors. The Company notes that the Consolidated Summary Schedule of Investments beginning on page F-36 provides the cost of each category of investments as disclosed on the Consolidated Balance Sheets (Medallion loans, commercial loans, investment in Medallion Bank and other controlled subsidiaries, equity investments and investment securities) and also the cost of the total investments.

Comment 6: On the Consolidated Statements of Changes in Net Assets on page F-5 of the Initial Registration Statement, include the disclosure in footnote 2 for all periods presented.

Response: The Company has provided the requested disclosure on page F-6 of the Revised Registration Statement.

25

Comment 7: On the Consolidated Schedule of Investments on page F-37 of the Initial Registration Statement, consider including additional disclosure such as the range of interest rates and maturity dates for the investments. See Rule 12-12 of Regulation S-X. S-X Rule 12-12, footnote 2.

Response: The Company has provided a Consolidated Summary Schedule of Investments beginning on page F-36 that includes the interest rate and maturity date for the 50 largest issuers and any issuer the value of which exceeded one percent of net asset value as of December 31, 2011. The Company has also provided the range of maturity dates and the weighted average interest or dividend rate for the remaining investments.

Comment 8: Explain why Medallion Servicing Corporation (“MSC”) is not a consolidated portfolio company and whether additional disclosure is required in Note 1 to the Notes to Consolidated Financial Statements on page F-7 of the Initial Registration Statement.

Response: MSC provides loan servicing activities to Medallion Bank. The Company, in accordance with Rule 6-03(c)(1) under Regulation S-X, may not consolidate MSC because MSC is not an investment company. MSC is an immaterial portfolio company, and the Company does not believe additional disclosure in Note 1 is required.

Comment 9: Under the heading “Derivatives” on page F-16 of the Initial Registration Statement, the company discloses the use of interest rate cap derivatives. Include the disclosure requirements of FAS 161 related to derivatives.

Response: The Company has purchased interest rate caps as required under its credit facility with DZ Bank. The Company has purchased these from time to time from DZ Bank and Citibank. The costs of the interest rate caps are immediately expensed and the interest rate caps are immaterial to the Company. Because of the immaterial nature of the caps, the Company does not believe additional disclosure is warranted. The Company will include additional disclosure in the event the use of interest rate caps or other derivative instruments become material.

Comment 10: Under the heading “Selected Financial Ratios and Other Data” on page F-31 of the Initial Registration Statement, include the total net assets in the ratios/supplemental data.

Response: The Company has provided the requested disclosure on page F-31 of the Revised Registration Statement.

Comment 11: The Company’s Schedule of Investments should comply with Article 12-12 of Regulation S-X. Alternatively, the Company may present a Summary Schedule of Investments in accordance with Article 12-12C of Regulation S-X and file the Schedule of Investments as an exhibit to the Company’s Form 10-K filing. The Schedule of Investments should include the following:

| • | the fair value of investments; |

| • | the cost of each category of investments; |

| • | the percentage value of the investment to net assets; |

| • | identify securities that are non-income producing securities; |

26

| • | the tax cost of investments and unrealized appreciation and depreciation for tax purposes; |

| • | identify securities that are pledged securities; |