- RY Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Royal Bank of Canada (RY) 6-K2025 Q1 Current report (foreign)

Filed: 27 Feb 25, 6:29am

Royal Bank of Canada first quarter 2025 results |

Net income $5.1 Billion Up 43% YoY | Diluted EPS 1 $3.54 Up 42% YoY | Total PCL 1 $1,050 Million PCL on loans ratio 1 up 7 bps 1 QoQ | ROE 1, 2 16.8% Up 370 bps YoY | CET1 ratio 1 13.2% Above regulatory requirements | ||||||||||||

Adjusted net income 3 $5.3 Billion Up 29% YoY | Adjusted diluted EPS 3 $3.62 Up 27% YoY | Total ACL 1 $6.9 Billion ACL on loans ratio 1 up 4 bpsQoQ | Adjusted ROE 3 17.2% Up 230 bps YoY | LCR 1 128% Unchanged from 128% last quarter |

“RBC’s first quarter exemplifies our commitment to staying ahead of our clients’ expectations in an increasingly complex world. In Q1, we delivered strong results and client-driven growth across our businesses, while prudently managing risk and making investments in technology and talent to position the bank for the future. At our upcoming Investor Day, we look forward to sharing more about how we will capitalize on our financial and strategic strength to elevate the value we create for our clients and shareholders.” – Dave McKay, President and Chief Executive Officer of Royal Bank of Canada | ||

Q1 2025 Compared to Q1 2024 | Reported: • Net income of $5,131 million • Diluted EPS of $3.54 • ROE of 16.8% • CET1 ratio of 13.2% | h h h i | Adjusted 3 :• Net income of $5,254 million • Diluted EPS of $3.62 • ROE of 17.2% | h h h | ||||||

Q1 2025 Compared to Q4 2024 | • Net income of $5,131 million • Diluted EPSof $3.54 • ROE of 16.8% • CET1 ratio of 13.2% | h h h g | • Net income of $5,254 million • Diluted EPSof $3.62 • ROE of 17.2% | h h h | ||||||

| (1) | See the Glossary section of this Q1 2025 Report to Shareholders for composition of these measures. |

| (2) | Return on equity (ROE). This measure does not have a standardized meaning under generally accepted accounting principles (GAAP). For further information, refer to the Key performance and non-GAAP measures section of this Q1 2025Report to Shareholders. |

| (3) | These are non-GAAP measures. For further information, including a reconciliation, refer to the Key performance andnon-GAAP measures section of this Q1 2025Report to Shareholders. |

| (4) | When we say “we”, “us”, “our”, “the bank” or “RBC”, we mean Royal Bank of Canada and its subsidiaries, as applicable. |

| (5) | On March 28, 2024, we completed the acquisition of HSBC Canada (HSBC Canada transaction). HSBC Canada results reflect revenue, PCL, non-interest expenses and income taxes associated with the acquired operations and clients, which include the acquired assets, assumed liabilities and employees with the exception of assets and liabilities relating to treasury and liquidity management activities. For further details, refer to the Key corporate events section of this Q1 2025 Report to Shareholders. |

| (6) | Pre-provision, pre-tax (PPPT) earnings is calculated as income (January 31, 2025: $5,131 million; October 31, 2024: $4,222 million; January 31, 2024: $3,582 million) before income taxes (January 31, 2025: $1,302 million; October 31, 2024: $993 million; January 31, 2024: $766 million) and PCL (January 31, 2025: $1,050 million; October 31, 2024: $840 million; January 31, 2024: $813 million). For the three months ended January 31, 2025, pre-provision, pre-tax earnings excluding HSBC Canada results of $7,032 million is calculated aspre-provision, pre-tax earnings of $7,483 million less net income of $214 million, income taxes of $82 million, and PCL of $155 million. This is anon-GAAP measure. PPPT earnings do not have a standardized meaning under GAAP and may not be comparable to similar measures disclosed by other financial institutions. We use PPPT earnings to assess our ability to generate sustained earnings growth outside of credit losses, which are impacted by the cyclical nature of a credit cycle. We believe that certainnon-GAAP measures are more reflective of our ongoing operating results and provide readers with a better understanding of management’s perspective on our performance. |

1 | ||||

2 | ||||

2 | ||||

3 | ||||

| 3 | About Royal Bank of Canada | |||

| 4 | Selected financial and other highlights | |||

| 5 | Economic, market and regulatory review and outlook | |||

6 | ||||

7 | ||||

| 7 | Overview | |||

11 | ||||

| 11 | How we measure and report our business segments | |||

43 | ||||

| 43 | Summary of accounting policies and estimates | |||

| 43 | Controls and procedures | |||

43 | ||||

44 | ||||

47 | ||||

48 | (unaudited) | |||

53 | (unaudited) | |||

70 | ||||

Management’s Discussion and Analysis |

Caution regarding forward-looking statements |

Overview and outlook |

About Royal Bank of Canada |

Selected financial and other highlights |

| As at or for the three months ended | For the three months ended | |||||||||||||||||||||

| (Millions of Canadian dollars, except per share, number of and percentage amounts) | January 31 2025 (1) | October 31 2024 (1) | January 31 2024 | Q1 2025 vs. Q4 2024 | Q1 2025 vs. Q1 2024 | |||||||||||||||||

Total revenue | $ | 16,739 | $ | 15,074 | $ | 13,485 | $ | 1,665 | $ | 3,254 | ||||||||||||

Provision for credit losses (PCL) | 1,050 | 840 | 813 | 210 | 237 | |||||||||||||||||

Non-interest expense | 9,256 | 9,019 | 8,324 | 237 | 932 | |||||||||||||||||

Income before income taxes | 6,433 | 5,215 | 4,348 | 1,218 | 2,085 | |||||||||||||||||

Net income | $ | 5,131 | $ | 4,222 | $ | 3,582 | $ | 909 | $ | 1,549 | ||||||||||||

Net income – adjusted (2), (3) | $ | 5,254 | $ | 4,439 | $ | 4,066 | $ | 815 | $ | 1,188 | ||||||||||||

Segments – net income | ||||||||||||||||||||||

Personal Banking (4) | $ | 1,678 | $ | 1,579 | $ | 1,353 | $ | 99 | $ | 325 | ||||||||||||

Commercial Banking (4) | 777 | 774 | 650 | 3 | 127 | |||||||||||||||||

Wealth Management (4) | 980 | 969 | 664 | 11 | 316 | |||||||||||||||||

Insurance | 272 | 162 | 220 | 110 | 52 | |||||||||||||||||

Capital Markets | 1,432 | 985 | 1,154 | 447 | 278 | |||||||||||||||||

Corporate Support | (8 | ) | (247 | ) | (459 | ) | 239 | 451 | ||||||||||||||

Net income | $ | 5,131 | $ | 4,222 | $ | 3,582 | $ | 909 | $ | 1,549 | ||||||||||||

Selected information | ||||||||||||||||||||||

Earnings per share (EPS) – basic | $ | 3.54 | $ | 2.92 | $ | 2.50 | $ | 0.62 | $ | 1.04 | ||||||||||||

– diluted | 3.54 | 2.91 | 2.50 | 0.63 | 1.04 | |||||||||||||||||

– basic adjusted (2), (3) | 3.63 | 3.07 | 2.85 | 0.56 | 0.78 | |||||||||||||||||

– diluted adjusted (2), (3) | 3.62 | 3.07 | 2.85 | 0.55 | 0.77 | |||||||||||||||||

Return on common equity (ROE) (3) | 16.8% | 14.3% | 13.1% | 250 bps | 370 bps | |||||||||||||||||

ROE – adjusted (2), (3) | 17.2% | 15.1% | 14.9% | 210 bps | 230 bps | |||||||||||||||||

Average common equity (5) | $ | 118,550 | $ | 114,750 | $ | 107,100 | $ | 3,800 | $ | 11,450 | ||||||||||||

Net interest margin (NIM) – on average earning assets, net (3) | 1.60% | 1.68% | 1.41% | (8) bps | 19 bps | |||||||||||||||||

PCL on loans as a % of average net loans and acceptances | 0.42% | 0.35% | 0.37% | 7 bps | 5 bps | |||||||||||||||||

PCL on performing loans as a % of average net loans and acceptances | 0.03% | 0.09% | 0.06% | (6) bps | (3) bps | |||||||||||||||||

PCL on impaired loans as a % of average net loans and acceptances | 0.39% | 0.26% | 0.31% | 13 bps | 8 bps | |||||||||||||||||

Gross impaired loans (GIL) as a % of loans and acceptances | 0.78% | 0.59% | 0.48% | 19 bps | 30 bps | |||||||||||||||||

Liquidity coverage ratio (LCR) (3), (6) | 128% | 128% | 132% | – bps | (400) bps | |||||||||||||||||

Net stable funding ratio (NSFR) (3), (6) | 115% | 114% | 113% | 100 bps | 200 bps | |||||||||||||||||

Capital, Leverage and Total loss absorbing capacity (TLAC) ratios (3), (7) | ||||||||||||||||||||||

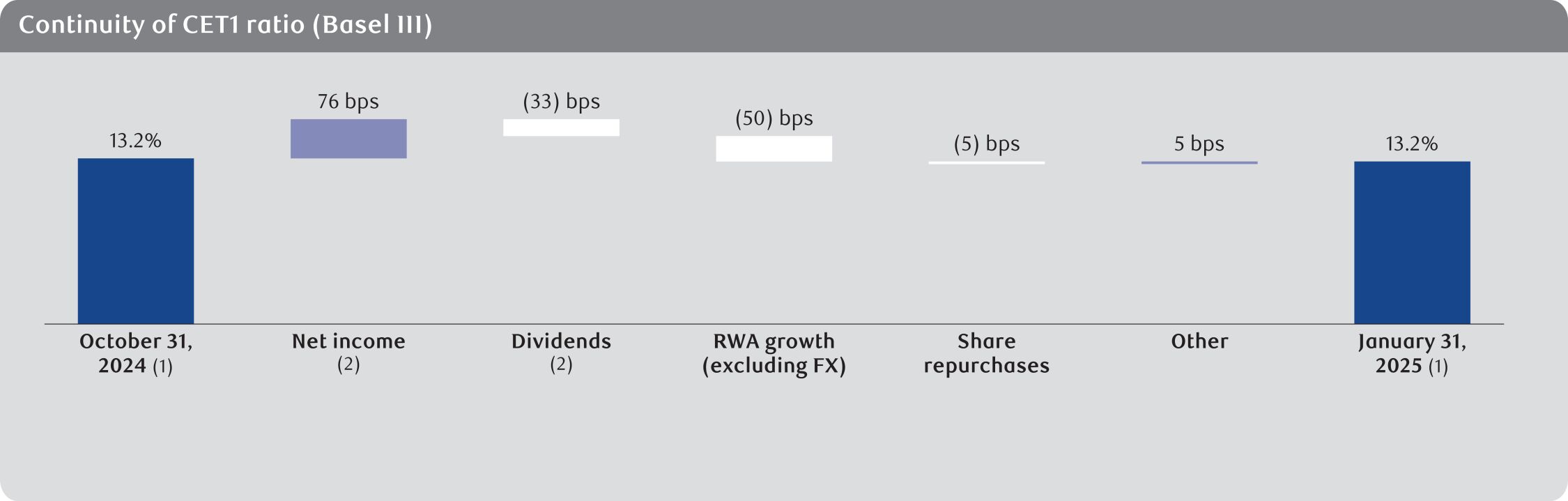

Common Equity Tier 1 (CET1) ratio | 13.2% | 13.2% | 14.9% | – bps | (170) bps | |||||||||||||||||

Tier 1 capital ratio | 14.6% | 14.6% | 16.3% | – bps | (170) bps | |||||||||||||||||

Total capital ratio | 16.4% | 16.4% | 18.1% | – bps | (170) bps | |||||||||||||||||

Leverage ratio | 4.4% | 4.2% | 4.4% | 20 bps | – bps | |||||||||||||||||

TLAC ratio | 29.8% | 29.3% | 31.4% | 50 bps | (160) bps | |||||||||||||||||

TLAC leverage ratio | 8.9% | 8.4% | 8.5% | 50 bps | 40 bps | |||||||||||||||||

Selected balance sheet and other information (8) | ||||||||||||||||||||||

Total assets | $ | 2,191,026 | $ | 2,171,582 | $ | 1,974,405 | $ | 19,444 | $ | 216,621 | ||||||||||||

Securities, net of applicable allowance | 488,025 | 439,918 | 405,813 | 48,107 | 82,212 | |||||||||||||||||

Loans, net of allowance for loan losses | 1,006,050 | 981,380 | 858,316 | 24,670 | 147,734 | |||||||||||||||||

Derivative related assets | 153,686 | 150,612 | 105,038 | 3,074 | 48,648 | |||||||||||||||||

Deposits | 1,441,940 | 1,409,531 | 1,241,168 | 32,409 | 200,772 | |||||||||||||||||

Common equity | 122,763 | 118,058 | 108,360 | 4,705 | 14,403 | |||||||||||||||||

Total risk-weighted assets (RWA) (3), (7) | 708,941 | 672,282 | 590,257 | 36,659 | 118,684 | |||||||||||||||||

Assets under management (AUM) (3) | 1,428,700 | 1,342,300 | 1,150,100 | 86,400 | 278,600 | |||||||||||||||||

Assets under administration (AUA) (3), (9) | 5,148,300 | 4,965,500 | 4,490,100 | 182,800 | 658,200 | |||||||||||||||||

Common share information | ||||||||||||||||||||||

Shares outstanding (000s) – average basic | 1,413,937 | 1,414,460 | 1,406,324 | (523 | ) | 7,613 | ||||||||||||||||

– average diluted | 1,416,502 | 1,416,829 | 1,407,641 | (327 | ) | 8,861 | ||||||||||||||||

– end of period | 1,412,878 | 1,414,504 | 1,408,257 | (1,626 | ) | 4,621 | ||||||||||||||||

Dividends declared per common share | $ | 1.48 | $ | 1.42 | $ | 1.38 | $ | 0.06 | $ | 0.10 | ||||||||||||

Dividend yield (3) | 3.4% | 3.5% | 4.5% | (10) bps | (110) bps | |||||||||||||||||

Dividend payout ratio (3) | 42% | 49% | 55% | (700) bps | (1,300) bps | |||||||||||||||||

Common share price (RY on TSX) (10) | $ | 177.18 | $ | 168.39 | $ | 131.21 | $ | 8.79 | $ | 45.97 | ||||||||||||

Market capitalization (TSX) (10) | 250,334 | 238,188 | 184,777 | 12,146 | 65,557 | |||||||||||||||||

Business information (number of) | ||||||||||||||||||||||

Employees (full-time equivalent) (FTE) | 94,624 | 94,838 | 90,166 | (214 | ) | 4,458 | ||||||||||||||||

Bank branches | 1,286 | 1,292 | 1,248 | (6 | ) | 38 | ||||||||||||||||

Automated teller machines (ATMs) | 4,358 | 4,367 | 4,341 | (9 | ) | 17 | ||||||||||||||||

Period average US$ equivalent of C$1.00 (11) | 0.699 | 0.733 | 0.745 | (0.034 | ) | (0.046 | ) | |||||||||||||||

Period-end US$ equivalent of C$1.00 | 0.687 | 0.718 | 0.744 | (0.031 | ) | (0.057 | ) | |||||||||||||||

| (1) | On March 28, 2024, we completed the HSBC Canada transaction. HSBC Canada results have been consolidated from the closing date, and are included in our Personal Banking, Commercial Banking, Wealth Management and Capital Markets segments. For further details, refer to the Key corporate events section. |

| (2) | These are non-GAAP measures. For further details, including a reconciliation, refer to the Key performance andnon-GAAP measures section. |

| (3) | See Glossary for composition of these measures. |

| (4) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (5) | Average amounts are calculated using methods intended to approximate the average of the daily balances for the period. |

| (6) | The LCR and NSFR are calculated in accordance with the Office of the Superintendent of Financial Institutions’ (OSFI) Liquidity Adequacy Requirements (LAR) guideline. LCR is the average for the three months ended for each respective period. For further details, refer to the Liquidity and funding risk section. |

| (7) | Capital ratios and RWA are calculated using OSFI’s Capital Adequacy Requirements (CAR) guideline, the Leverage ratio is calculated using OSFI’s Leverage Requirements (LR) guideline, and both the TLAC and TLAC leverage ratios are calculated using OSFI’s TLAC guideline. Both the CAR guideline and LR guideline are based on the Basel III framework. For further details, refer to the Capital management section. |

| (8) | Represents period-end spot balances. |

| (9) | AUA includes $15 billion and $6 billion (October 31, 2024 – $15 billion and $6 billion; January 31, 2024 – $14 billion and $6 billion) of securitized residential mortgages and credit card loans, respectively. |

| (10) | Based on TSX closing market price at period-end. |

| (11) | Average amounts are calculated using month-end spot rates for the period. |

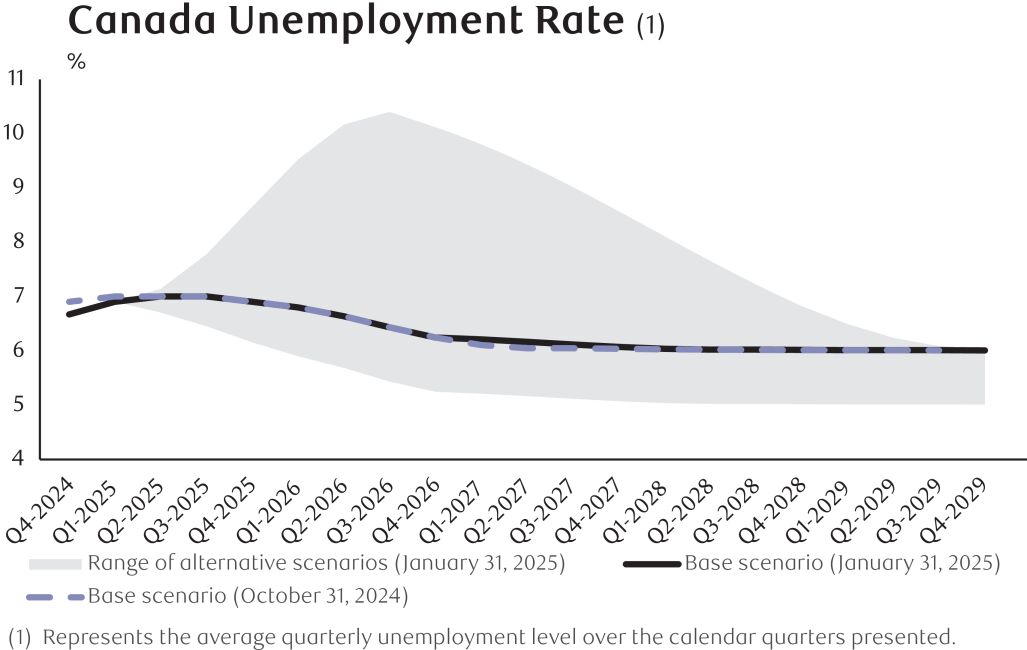

Economic, market and regulatory review and outlook – data as at February 26, 2025 |

| 1 | Annualized rate |

Key corporate events |

For the three months ended January 31, 2025 | ||||||||||||||||||||||||||||||||||||||||||||

Segment results – Personal Banking | Segment results – Commercial Banking | Consolidated results | ||||||||||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Excluding HSBC Canada | HSBC Canada | Total | Excluding HSBC Canada | HSBC Canada | Total | Excluding HSBC Canada | HSBC Canada | Total | |||||||||||||||||||||||||||||||||||

Net interest income | $ | 3,274 | $ | 231 | $ | 3,505 | $ | 1,470 | $ | 326 | $ | 1,796 | $ | 7,359 | $ | 589 | $ | 7,948 | ||||||||||||||||||||||||||

Non-interest income | 1,276 | 30 | 1,306 | 299 | 32 | 331 | 8,664 | 127 | 8,791 | |||||||||||||||||||||||||||||||||||

Total revenue | 4,550 | 261 | 4,811 | 1,769 | 358 | 2,127 | 16,023 | 716 | 16,739 | |||||||||||||||||||||||||||||||||||

PCL | 483 | 5 | 488 | 188 | 151 | 339 | 895 | 155 | 1,050 | |||||||||||||||||||||||||||||||||||

Non-interest expense | 1,885 | 130 | 2,015 | 604 | 106 | 710 | 8,991 | 265 | 9,256 | |||||||||||||||||||||||||||||||||||

Income before income taxes | 2,182 | 126 | 2,308 | 977 | 101 | 1,078 | 6,137 | 296 | 6,433 | |||||||||||||||||||||||||||||||||||

Income taxes | 595 | 35 | 630 | 273 | 28 | 301 | 1,220 | 82 | 1,302 | |||||||||||||||||||||||||||||||||||

Net income | $ | 1,587 | $ | 91 | $ | 1,678 | $ | 704 | $ | 73 | $ | 777 | $ | 4,917 | $ | 214 | $ | 5,131 | ||||||||||||||||||||||||||

Financial performance |

Overview |

| For the three months ended | ||||||||

| (Millions of Canadian dollars, except per share amounts) | Q1 2025 vs. Q1 2024 | Q1 2025 vs. Q4 2024 | ||||||

Increase (decrease): | ||||||||

Total revenue | $ | 477 | $ | 315 | ||||

PCL | 13 | 7 | ||||||

Non-interest expense | 261 | 167 | ||||||

Income taxes | 22 | 16 | ||||||

Net income | 181 | 125 | ||||||

Impact on EPS | ||||||||

Basic | $ | 0.13 | $ | 0.09 | ||||

Diluted | 0.13 | 0.09 | ||||||

| For the three months ended | ||||||||||||

| (Average foreign currency equivalent of C$1.00) (1) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

U.S. dollar | 0.699 | 0.733 | 0.745 | |||||||||

British pound | 0.556 | 0.558 | 0.588 | |||||||||

Euro | 0.669 | 0.665 | 0.683 | |||||||||

| (1) | Average amounts are calculated using month-end spot rates for the period. |

| For the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

Interest and dividend income | $ | 26,455 | $ | 26,498 | $ | 25,609 | ||||||

Interest expense | 18,507 | 18,827 | 19,277 | |||||||||

Net interest income | $ | 7,948 | $ | 7,671 | $ | 6,332 | ||||||

NIM | 1.60% | 1.68% | 1.41% | |||||||||

Insurance service result | $ | 286 | $ | 173 | $ | 187 | ||||||

Insurance investment result | 82 | 66 | 141 | |||||||||

Trading revenue | 1,195 | 383 | 804 | |||||||||

Investment management and custodial fees | 2,667 | 2,501 | 2,185 | |||||||||

Mutual fund revenue | 1,236 | 1,189 | 1,030 | |||||||||

Securities brokerage commissions | 471 | 428 | 388 | |||||||||

Service charges | 612 | 596 | 554 | |||||||||

Underwriting and other advisory fees | 674 | 656 | 606 | |||||||||

Foreign exchange revenue, other than trading | 318 | 301 | 262 | |||||||||

Card service revenue | 317 | 332 | 326 | |||||||||

Credit fees | 435 | 358 | 395 | |||||||||

Net gains on investment securities | 55 | 13 | 70 | |||||||||

Income (loss) from joint ventures and associates | 19 | 11 | 12 | |||||||||

Other | 424 | 396 | 193 | |||||||||

Non-interest income | 8,791 | 7,403 | 7,153 | |||||||||

Total revenue | $ | 16,739 | $ | 15,074 | $ | 13,485 | ||||||

Additional trading information | ||||||||||||

Net interest income (1) | $ | 364 | $ | 520 | $ | 344 | ||||||

Non-interest income | 1,195 | 383 | 804 | |||||||||

Total trading revenue | $ | 1,559 | $ | 903 | $ | 1,148 | ||||||

| (1) | Reflects net interest income arising from trading-related positions, including assets and liabilities that are classified or designated at fair value through profit or loss (FVTPL). |

| For the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts) | January 31 2025 | October 31 2024 | January 31 2024 (2) | |||||||||

Personal Banking | $ | 63 | $ | 131 | $ | 133 | ||||||

Commercial Banking | 30 | 66 | 16 | |||||||||

Wealth Management | 36 | (57 | ) | (27 | ) | |||||||

Capital Markets | (61 | ) | 68 | 10 | ||||||||

Corporate Support and other (3) | – | – | 1 | |||||||||

PCL on performing loans | 68 | 208 | 133 | |||||||||

Personal Banking | $ | 427 | $ | 361 | $ | 332 | ||||||

Commercial Banking | 308 | 233 | 154 | |||||||||

Wealth Management | 45 | 32 | 38 | |||||||||

Capital Markets | 205 | 14 | 161 | |||||||||

PCL on impaired loans | 985 | 640 | 685 | |||||||||

PCL – Loans | 1,053 | 848 | 818 | |||||||||

PCL – Other (4) | (3 | ) | (8 | ) | (5 | ) | ||||||

Total PCL | $ | 1,050 | $ | 840 | $ | 813 | ||||||

| PCL on loans is comprised of: | ||||||||||||

Retail | $ | 104 | $ | 138 | $ | 137 | ||||||

Wholesale | (36 | ) | 70 | (4 | ) | |||||||

PCL on performing loans | 68 | 208 | 133 | |||||||||

Retail | 485 | 424 | 359 | |||||||||

Wholesale | 500 | 216 | 326 | |||||||||

PCL on impaired loans | 985 | 640 | 685 | |||||||||

PCL – Loans | $ | 1,053 | $ | 848 | $ | 818 | ||||||

PCL on loans as a % of average net loans and acceptances | 0.42% | 0.35% | 0.37% | |||||||||

PCL on impaired loans as a % of average net loans and acceptances | 0.39% | 0.26% | 0.31% | |||||||||

| (1) | Information on loans represents loans, acceptances and commitments. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | Includes PCL recorded in Corporate Support and Insurance. |

| (4) | PCL – Other includes amounts related to debt securities measured at fair value through other comprehensive income (FVOCI) and amortized cost, accounts receivable, and financial and purchased guarantees. |

| For the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

Salaries | $ | 2,354 | $ | 2,345 | $ | 2,078 | ||||||

Variable compensation | 2,569 | 2,348 | 2,083 | |||||||||

Benefits and retention compensation | 686 | 582 | 605 | |||||||||

Share-based compensation | 378 | 148 | 397 | |||||||||

Human resources | 5,987 | 5,423 | 5,163 | |||||||||

Equipment | 681 | 674 | 619 | |||||||||

Occupancy | 429 | 514 | 407 | |||||||||

Communications | 327 | 348 | 321 | |||||||||

Professional fees | 502 | 657 | 624 | |||||||||

Amortization of other intangibles | 435 | 398 | 352 | |||||||||

Other | 895 | 1,005 | 838 | |||||||||

Non-interest expense | $ | 9,256 | $ | 9,019 | $ | 8,324 | ||||||

Efficiency ratio (1) | 55.3% | 59.8% | 61.7% | |||||||||

Efficiency ratio – adjusted (1), (2) | 54.3% | 57.9% | 57.9% | |||||||||

| (1) | See Glossary for composition of these measures. |

| (2) | This is a non-GAAP ratio. For further details, including a reconciliation, refer to the Key performance andnon-GAAP measures section. |

| For the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

Income taxes | $ | 1,302 | $ | 993 | $ | 766 | ||||||

Income before income taxes | 6,433 | 5,215 | 4,348 | |||||||||

Effective income tax rate | 20.2% | 19.0% | 17.6% | |||||||||

Adjusted results (1), (2) | ||||||||||||

Income taxes – adjusted | $ | 1,344 | $ | 1,074 | $ | 913 | ||||||

Income before income taxes – adjusted | 6,598 | 5,513 | 4,979 | |||||||||

Effective income tax rate – adjusted | 20.4% | 19.5% | 18.3% | |||||||||

| (1) | These are non-GAAP measures. For further details, including a reconciliation, refer to the Key performance andnon-GAAP measures section. |

| (2) | See Glossary for composition of these measures. |

Business segment results |

How we measure and report our business segments |

Key performance and non-GAAP measures |

| For the three months ended | ||||||||||||||||||||||||||||||||||||||||

January 31 2025 | October 31 2024 | January 31 2024 | ||||||||||||||||||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) | Personal Banking | Commercial Banking | Wealth Management | Insurance | Capital Markets | Corporate Support | Total | Total | Total | |||||||||||||||||||||||||||||||

Net income available to common shareholders | $ | 1,648 | $ | 758 | $ | 955 | $ | 270 | $ | 1,397 | $ | (17 | ) | $ | 5,011 | $ | 4,128 | $ | 3,522 | |||||||||||||||||||||

Total average common equity (1), (2) | 27,600 | 19,350 | 25,000 | 2,150 | 37,250 | 7,200 | 118,550 | 114,750 | 107,100 | |||||||||||||||||||||||||||||||

ROE | 23.7% | 15.5% | 15.2% | 49.9% | 14.9% | n.m. | 16.8% | 14.3% | 13.1% | |||||||||||||||||||||||||||||||

| (1) | Total average common equity represents rounded figures. |

| (2) | The amounts for the segments are referred to as attributed capital. |

| (3) | Effective the first quarter of 2025, we increased our capital attribution rates. For further details, refer to the How we measure and report our business segments section. |

| n.m. | not meaningful |

| • | HSBC Canada transaction and integration costs. |

| • | Management of closing capital volatility related to the HSBC Canada transaction. |

| As at or for the three months ended | ||||||||||||

| (Millions of Canadian dollars, except per share, number of and percentage amounts) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

Total revenue | $ | 16,739 | $ | 15,074 | $ | 13,485 | ||||||

PCL | 1,050 | 840 | 813 | |||||||||

Non-interest expense | 9,256 | 9,019 | 8,324 | |||||||||

Income before income taxes | 6,433 | 5,215 | 4,348 | |||||||||

Income taxes | 1,302 | 993 | 766 | |||||||||

Net income | $ | 5,131 | $ | 4,222 | $ | 3,582 | ||||||

Net income available to common shareholders | $ | 5,011 | $ | 4,128 | $ | 3,522 | ||||||

Average number of common shares (thousands) | 1,413,937 | 1,414,460 | 1,406,324 | |||||||||

Basic earnings per share (in dollars) | $ | 3.54 | $ | 2.92 | $ | 2.50 | ||||||

Average number of diluted common shares (thousands) | 1,416,502 | 1,416,829 | 1,407,641 | |||||||||

Diluted earnings per share (in dollars) | $ | 3.54 | $ | 2.91 | $ | 2.50 | ||||||

ROE | 16.8% | 14.3% | 13.1% | |||||||||

Effective income tax rate | 20.2% | 19.0% | 17.6% | |||||||||

Total adjusting items impacting net income (before-tax) | $ | 165 | $ | 298 | $ | 631 | ||||||

Specified item: HSBC Canada transaction and integration costs (1), (2) | 12 | 177 | 265 | |||||||||

Specified item: Management of closing capital volatility related to the HSBC Canada transaction (1) | – | – | 286 | |||||||||

Amortization of acquisition-related intangibles (3) | 153 | 121 | 80 | |||||||||

Total income taxes for adjusting items impacting net income | $ | 42 | $ | 81 | $ | 147 | ||||||

Specified item: HSBC Canada transaction and integration costs (1) | 6 | 43 | 47 | |||||||||

Specified item: Management of closing capital volatility related to the HSBC Canada transaction (1) | – | – | 79 | |||||||||

Amortization of acquisition-related intangibles (3) | 36 | 38 | 21 | |||||||||

Adjusted results | ||||||||||||

Income before income taxes – adjusted | $ | 6,598 | $ | 5,513 | $ | 4,979 | ||||||

Income taxes – adjusted | 1,344 | 1,074 | 913 | |||||||||

Net income – adjusted | 5,254 | 4,439 | 4,066 | |||||||||

Net income available to common shareholders – adjusted (4) | 5,134 | 4,345 | 4,006 | |||||||||

Average number of common shares (thousands) | 1,413,937 | 1,414,460 | 1,406,324 | |||||||||

Basic earnings per share (in dollars) – adjusted | $ | 3.63 | $ | 3.07 | $ | 2.85 | ||||||

Average number of diluted common shares (thousands) | 1,416,502 | 1,416,829 | 1,407,641 | |||||||||

Diluted earnings per share (in dollars) – adjusted | $ | 3.62 | $ | 3.07 | $ | 2.85 | ||||||

ROE – adjusted | 17.2% | 15.1% | 14.9% | |||||||||

Effective income tax rate – adjusted | 20.4% | 19.5% | 18.3% | |||||||||

Adjusted efficiency ratio | ||||||||||||

Total revenue | $ | 16,739 | $ | 15,074 | $ | 13,485 | ||||||

Add specified item: Management of closing capital volatility related to the HSBC Canada transaction (before-tax) (1) | – | – | 286 | |||||||||

Total revenue – adjusted (4) | $ | 16,739 | $ | 15,074 | $ | 13,771 | ||||||

Non-interest expense | $ | 9,256 | $ | 9,019 | $ | 8,324 | ||||||

Less specified item: HSBC Canada transaction and integration costs (before-tax) (1) | 12 | 177 | 265 | |||||||||

Less: Amortization of acquisition-related intangibles (before-tax) (3) | 153 | 121 | 80 | |||||||||

Non-interest expense – adjusted (4) | $ | 9,091 | $ | 8,721 | $ | 7,979 | ||||||

Efficiency ratio | 55.3% | 59.8% | 61.7% | |||||||||

Efficiency ratio – adjusted | 54.3% | 57.9% | 57.9% | |||||||||

| (1) | These amounts have been recognized in Corporate Support. |

| (2) | As at January 31, 2025, the cumulative HSBC Canada transaction and integration costs (before-tax) incurred were $1.4 billion. |

| (3) | Represents the impact of amortization of acquisition-related intangibles (excluding amortization of software), and any goodwill impairment. |

| (4) | See Glossary for composition of these measures. |

Personal Banking |

| As at or for the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts and as otherwise noted) | January 31 2025 (1) | October 31 2024 (1) | January 31 2024 (2) | |||||||||

Net interest income | $ | 3,505 | $ | 3,346 | $ | 2,854 | ||||||

Non-interest income | 1,306 | 1,312 | 1,177 | |||||||||

Total revenue | 4,811 | 4,658 | 4,031 | |||||||||

PCL on performing assets | 63 | 124 | 134 | |||||||||

PCL on impaired assets | 425 | 359 | 330 | |||||||||

PCL | 488 | 483 | 464 | |||||||||

Non-interest expense | 2,015 | 2,033 | 1,724 | |||||||||

Income before income taxes | 2,308 | 2,142 | 1,843 | |||||||||

Net income | $ | 1,678 | $ | 1,579 | $ | 1,353 | ||||||

Revenue by business | ||||||||||||

Personal Banking – Canada | $ | 4,499 | $ | 4,366 | $ | 3,753 | ||||||

Caribbean & U.S. Banking | 312 | 292 | 278 | |||||||||

Selected balance sheet and other information | ||||||||||||

ROE | 23.7% | 23.8% | 26.6% | |||||||||

NIM | 2.58% | 2.49% | 2.34% | |||||||||

Efficiency ratio | 41.9% | 43.6% | 42.8% | |||||||||

Operating leverage (3) | 2.5% | 2.1% | 0.0% | |||||||||

Average total earning assets, net | $ | 539,900 | $ | 534,500 | $ | 486,200 | ||||||

Average loans and acceptances, net | 530,100 | 525,000 | 476,600 | |||||||||

Average deposits | 437,200 | 431,000 | 369,700 | |||||||||

AUA (4) | 266,400 | 255,400 | 218,600 | |||||||||

Average AUA | 261,600 | 252,400 | 215,200 | |||||||||

PCL on impaired loans as a % of average net loans and acceptances | 0.32% | 0.27% | 0.28% | |||||||||

Other selected information – Personal Banking – Canada | ||||||||||||

Net income | $ | 1,583 | $ | 1,485 | $ | 1,259 | ||||||

NIM | 2.50% | 2.41% | 2.25% | |||||||||

Efficiency ratio | 40.5% | 41.8% | 41.2% | |||||||||

Operating leverage | 2.3% | 2.5% | (0.3)% | |||||||||

| (1) | On March 28, 2024, we completed the HSBC Canada transaction. HSBC Canada results have been consolidated from the closing date, which impacted results, balances and ratios for the periods ended January 31, 2025 and October 31, 2024. For further details, refer to the Key corporate events section. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | See Glossary for composition of this measure. |

| (4) | AUA represents period-end spot balances and includes securitized residential mortgages and credit card loans as at January 31, 2025 of $15 billion and $6 billion, respectively (October 31, 2024 – $15 billion and $6 billion; January 31, 2024 – $14 billion and $6 billion). |

Commercial Banking |

| As at or for the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts and as otherwise noted) | January 31 2025 (1) | October 31 2024 (1) | January 31 2024 (2) | |||||||||

Net interest income | $ | 1,796 | $ | 1,763 | $ | 1,282 | ||||||

Non-interest income | 331 | 314 | 331 | |||||||||

Total revenue | 2,127 | 2,077 | 1,613 | |||||||||

PCL on performing assets | 31 | 66 | 16 | |||||||||

PCL on impaired assets | 308 | 233 | 154 | |||||||||

PCL | 339 | 299 | 170 | |||||||||

Non-interest expense | 710 | 713 | 542 | |||||||||

Income before income taxes | 1,078 | 1,065 | 901 | |||||||||

Net income | $ | 777 | $ | 774 | $ | 650 | ||||||

Selected balance sheet and other information | ||||||||||||

ROE | 15.5% | 16.7% | 23.0% | |||||||||

NIM | 3.89% | 3.89% | 4.33% | |||||||||

Efficiency ratio | 33.4% | 34.3% | 33.6% | |||||||||

Operating leverage | 0.9% | 5.8% | 1.3% | |||||||||

Average total earning assets, net | $ | 183,300 | $ | 180,200 | $ | 117,800 | ||||||

Average loans and acceptances, net | 183,200 | 180,600 | 136,000 | |||||||||

Average deposits | 304,900 | 301,900 | 256,300 | |||||||||

PCL on impaired loans as a % of average net loans and acceptances | 0.67% | 0.52% | 0.45% | |||||||||

| (1) | On March 28, 2024, we completed the HSBC Canada transaction. HSBC Canada results have been consolidated from the closing date, which impacted results, balances and ratios for the periods ended January 31, 2025 and October 31, 2024. For further details, refer to the Key corporate events section. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

Wealth Management |

| As at or for the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts and as otherwise noted) | January 31 2025 (1) | October 31 2024 (1) | January 31 2024 (2) | |||||||||

Net interest income | $ | 1,394 | $ | 1,282 | $ | 1,230 | ||||||

Non-interest income | 4,174 | 3,904 | 3,457 | |||||||||

Total revenue | 5,568 | 5,186 | 4,687 | |||||||||

PCL on performing assets | 36 | (57 | ) | (27 | ) | |||||||

PCL on impaired assets | 45 | 32 | 38 | |||||||||

PCL | 81 | (25 | ) | 11 | ||||||||

Non-interest expense | 4,204 | 3,981 | 3,841 | |||||||||

Income before income taxes | 1,283 | 1,230 | 835 | |||||||||

Net income | $ | 980 | $ | 969 | $ | 664 | ||||||

Revenue by business | ||||||||||||

Canadian Wealth Management | $ | 1,693 | $ | 1,554 | $ | 1,327 | ||||||

U.S. Wealth Management (including City National) | 2,466 | 2,331 | 2,158 | |||||||||

U.S. Wealth Management (including City National) (US$ millions) | 1,722 | 1,709 | 1,609 | |||||||||

Global Asset Management | 867 | 768 | 725 | |||||||||

International Wealth Management | 344 | 350 | 317 | |||||||||

Investor Services | 198 | 183 | 160 | |||||||||

Selected balance sheet and other information | ||||||||||||

ROE | 15.2% | 16.0% | 11.5% | |||||||||

NIM | 3.34% | 3.31% | 3.25% | |||||||||

Pre-tax margin(3) | 23.0% | 23.7% | 17.8% | |||||||||

Number of advisors (4) | 6,180 | 6,116 | 6,125 | |||||||||

Average total earning assets, net | $ | 165,700 | $ | 153,900 | $ | 150,500 | ||||||

Average loans and acceptances, net | 122,100 | 115,100 | 113,400 | |||||||||

Average deposits | 183,700 | 167,600 | 160,000 | |||||||||

AUA (5) | 4,856,800 | 4,685,900 | 4,249,500 | |||||||||

AUM (5) | 1,419,200 | 1,332,500 | 1,141,200 | |||||||||

Average AUA | 4,778,100 | 4,621,700 | 4,204,100 | |||||||||

Average AUM | 1,361,700 | 1,289,500 | 1,122,100 | |||||||||

PCL on impaired loans as a % of average net loans and acceptances | 0.15% | 0.11% | 0.13% | |||||||||

Estimated impact of U.S. dollar, British pound and Euro translation on key income statement items (Millions of Canadian dollars, except percentage amounts) | For the three months ended | |||||||

Q1 2025 vs. Q1 2024 | Q1 2025 vs. Q4 2024 | |||||||

Increase (decrease): | ||||||||

Total revenue | $ | 200 | $ | 129 | ||||

PCL | 6 | 5 | ||||||

Non-interest expense | 158 | 102 | ||||||

Net income | 29 | 18 | ||||||

Percentage change in average U.S. dollar equivalent of C$1.00 | (6)% | (5)% | ||||||

Percentage change in average British pound equivalent of C$1.00 | (5)% | –% | ||||||

Percentage change in average Euro equivalent of C$1.00 | (2)% | 1% | ||||||

| (1) | On March 28, 2024, we completed the HSBC Canada transaction. HSBC Canada results have been consolidated from the closing date, which impacted results, balances and ratios for the periods ended January 31, 2025 and October 31, 2024. For further details, refer to the Key corporate events section. |

| (2) | Amounts have been revised from those previously presented to conform to our new basis of segment presentation. For further details, refer to the About Royal Bank of Canada section. |

| (3) | Pre-tax margin is defined as Income before income taxes divided by Total revenue. |

| (4) | Represents client-facing advisors across all of our Wealth Management businesses. |

| (5) | Represents period-end spot balances. |

Insurance |

| As at or for the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts and as otherwise noted) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

Non-interest income | ||||||||||||

Insurance service result | $ | 286 | $ | 173 | $ | 187 | ||||||

Insurance investment result | 82 | 66 | 141 | |||||||||

Other income | 38 | 39 | 35 | |||||||||

Total revenue | 406 | 278 | 363 | |||||||||

PCL | – | – | 1 | |||||||||

Non-interest expense | 87 | 75 | 71 | |||||||||

Income before income taxes | 319 | 203 | 291 | |||||||||

Net income | $ | 272 | $ | 162 | $ | 220 | ||||||

Selected balances and other information | ||||||||||||

ROE | 49.9% | 31.7% | 40.5% | |||||||||

Premiums and deposits (1) | $ | 2,317 | $ | 1,502 | $ | 1,346 | ||||||

Contractual service margin (CSM) (2) | 2,008 | 2,137 | 1,977 | |||||||||

| (1) | Premiums and deposits include premiums on risk-based individual and group insurance and annuity products as well as segregated fund deposits, consistent with insurance industry practices. |

| (2) | Represents the CSM of insurance contract assets and liabilities net of reinsurance contract held assets and liabilities. For insurance contracts, the CSM represents the unearned profit (net inflows) for providing insurance coverage. For reinsurance contracts held, the CSM represents the net cost or net gain of purchasing reinsurance. The CSM is not applicable to contracts measured using the premium allocation approach. |

Capital Markets |

| As at or for the three months ended | ||||||||||||

| (Millions of Canadian dollars, except percentage amounts and as otherwise noted) | January 31 2025 (1) | October 31 2024 (1) | January 31 2024 | |||||||||

Net interest income (2) | $ | 918 | $ | 941 | $ | 661 | ||||||

Non-interest income (2) | 2,838 | 1,962 | 2,290 | |||||||||

Total revenue (2) | 3,756 | 2,903 | 2,951 | |||||||||

| PCL on performing assets | (63 | ) | 68 | 6 | ||||||||

| PCL on impaired assets | 205 | 14 | 161 | |||||||||

| PCL | 142 | 82 | 167 | |||||||||

| Non-interest expense | 2,041 | 1,897 | 1,642 | |||||||||

| Income before income taxes | 1,573 | 924 | 1,142 | |||||||||

| Net income | $ | 1,432 | $ | 985 | $ | 1,154 | ||||||

| Revenue by business | ||||||||||||

Corporate & Investment Banking (3), (4) | $ | 1,715 | $ | 1,537 | $ | 1,380 | ||||||

Global Markets (3) | 2,079 | 1,349 | 1,682 | |||||||||

Other (4) | (38 | ) | 17 | (111 | ) | |||||||

| Selected balance sheet and other information | ||||||||||||

| ROE | 14.9% | 11.8% | 14.6% | |||||||||

| Average total assets | $ | 1,326,700 | $ | 1,099,000 | $ | 1,194,900 | ||||||

| Average trading securities | 211,600 | 173,700 | 204,100 | |||||||||

| Average loans and acceptances, net | 159,700 | 148,700 | 142,100 | |||||||||

| Average deposits | 360,300 | 301,100 | 292,500 | |||||||||

| PCL on impaired loans as a % of average net loans and acceptances | 0.51% | 0.04% | 0.45% | |||||||||

Estimated impact of U.S. dollar, British pound and Euro translation on key income statement items (Millions of Canadian dollars, except percentage amounts) | For the three months ended | |||||||||||

| Q1 2025 vs. Q1 2024 | Q1 2025 vs. Q4 2024 | |||||||||||

Increase (decrease): | ||||||||||||

| Total revenue | $ | 226 | $ | 145 | ||||||||

| PCL | 7 | 2 | ||||||||||

| Non-interest expense | 89 | 54 | ||||||||||

| Net income | 113 | 77 | ||||||||||

| Percentage change in average U.S. dollar equivalent of C$1.00 | (6)% | (5)% | ||||||||||

| Percentage change in average British pound equivalent of C$1.00 | (5)% | –% | ||||||||||

| Percentage change in average Euro equivalent of C$1.00 | (2)% | 1% | ||||||||||

| (1) | On March 28, 2024, we completed the HSBC Canada transaction. HSBC Canada results have been consolidated from the closing date, which impacted results, balances and ratios for the periods ended January 31, 2025 and October 31, 2024. For further details, refer to the Key corporate events section. |

| (2) | The taxable equivalent basis (teb) adjustment for the three months ended January 31, 2025 was $26 million (October 31, 2024 – $13 million; January 31, 2024 – $54 million). For further discussion, refer to the How we measure and report our business segments section of our 2024 Annual Report. |

| (3) | Effective the third quarter of 2024, we moved the majority of our debt origination business from Global Markets to Corporate & Investment Banking. Comparative amounts for the three months ended January 31, 2024 have been revised from those previously presented. |

| (4) | Comparative amounts have been revised from those previously presented. |

Corporate Support |

| For the three months ended | ||||||||||||

| (Millions of Canadian dollars) | January 31 2025 | October 31 2024 | January 31 2024 | |||||||||

Net interest income (loss) (1) | $ | 335 | $ | 339 | $ | 305 | ||||||

Non-interest income (loss)(1), (2) | (264 | ) | (367 | ) | (465 | ) | ||||||

Total revenue (1), (2) | 71 | (28 | ) | (160 | ) | |||||||

PCL | – | 1 | – | |||||||||

Non-interest expense(2) | 199 | 320 | 504 | |||||||||

Income (loss) before income taxes (1) | (128 | ) | (349 | ) | (664 | ) | ||||||

Income taxes (recoveries) (1) | (120 | ) | (102 | ) | (205 | ) | ||||||

Net income (loss) | $ | (8 | ) | $ | (247 | ) | $ | (459 | ) | |||

| (1) | Teb adjusted. |

| (2) | Revenue for the three months ended January 31, 2025 included gains of $112 million (October 31, 2024 and January 31, 2024 – gains of $47 million and gains of $222 million, respectively) on economic hedges of our U.S. Wealth Management (including City National) share-based compensation plans, and non-interest expense included $108 million (October 31, 2024 and January 31, 2024 – $50 million and $206 million, respectively) of share-based compensation expense driven by changes in the fair value of liabilities relating to our U.S. Wealth Management (including City National) share-based compensation plans. |

Quarterly results and trend analysis |

2025 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars, except per share and percentage amounts) | Q1 (2) | Q4 (2) | Q3 (2) | Q2 (2) | Q1 | Q4 | Q3 | Q2 | ||||||||||||||||||||||||||||||||

Personal Banking | $ | 4,811 | $ | 4,658 | $ | 4,490 | $ | 4,163 | $ | 4,031 | $ | 4,009 | $ | 3,898 | $ | 3,711 | ||||||||||||||||||||||||

Commercial Banking | 2,127 | 2,077 | 2,036 | 1,656 | 1,613 | 1,565 | 1,511 | 1,433 | ||||||||||||||||||||||||||||||||

Wealth Management | 5,568 | 5,186 | 4,964 | 4,789 | 4,687 | 4,332 | 4,556 | 4,548 | ||||||||||||||||||||||||||||||||

Insurance | 406 | 278 | 285 | 298 | 363 | 248 | 336 | 272 | ||||||||||||||||||||||||||||||||

Capital Markets (3) | 3,756 | 2,903 | 3,004 | 3,154 | 2,951 | 2,564 | 2,679 | 2,662 | ||||||||||||||||||||||||||||||||

Corporate Support (3) | 71 | (28 | ) | (148 | ) | 94 | (160 | ) | (33 | ) | (3 | ) | (181 | ) | ||||||||||||||||||||||||||

Total revenue | 16,739 | 15,074 | 14,631 | 14,154 | 13,485 | 12,685 | 12,977 | 12,445 | ||||||||||||||||||||||||||||||||

PCL | 1,050 | 840 | 659 | 920 | 813 | 720 | 616 | 600 | ||||||||||||||||||||||||||||||||

Non-interest expense | 9,256 | 9,019 | 8,599 | 8,308 | 8,324 | 8,059 | 7,765 | 7,400 | ||||||||||||||||||||||||||||||||

Income before income taxes | 6,433 | 5,215 | 5,373 | 4,926 | 4,348 | 3,906 | 4,596 | 4,445 | ||||||||||||||||||||||||||||||||

Income taxes | 1,302 | 993 | 887 | 976 | 766 | (33 | ) | 736 | 765 | |||||||||||||||||||||||||||||||

Net income | $ | 5,131 | $ | 4,222 | $ | 4,486 | $ | 3,950 | $ | 3,582 | $ | 3,939 | $ | 3,860 | $ | 3,680 | ||||||||||||||||||||||||

EPS – basic | $ | 3.54 | $ | 2.92 | $ | 3.09 | $ | 2.75 | $ | 2.50 | $ | 2.77 | $ | 2.73 | $ | 2.60 | ||||||||||||||||||||||||

– diluted | 3.54 | 2.91 | 3.09 | 2.74 | 2.50 | 2.76 | 2.73 | 2.60 | ||||||||||||||||||||||||||||||||

Effective income tax rate | 20.2% | 19.0% | 16.5% | 19.8% | 17.6% | (0.8)% | 16.0% | 17.2% | ||||||||||||||||||||||||||||||||

Period average US$ equivalent of C$1.00 | $ | 0.699 | $ | 0.733 | $ | 0.730 | $ | 0.734 | $ | 0.745 | $ | 0.732 | $ | 0.750 | $ | 0.737 | ||||||||||||||||||||||||

| (1) | Fluctuations in the Canadian dollar relative to other foreign currencies have affected our consolidated results over the period. |

| (2) | On March 28, 2024, we completed the HSBC Canada transaction. HSBC Canada results have been consolidated from the closing date, and are included in our Personal Banking, Commercial Banking, Wealth Management and Capital Markets segments. For further details, refer to the Key corporate events section. |

| (3) | Teb adjusted. For further discussion, refer to the How we measure and report our business segments section of our 2024 Annual Report. |

Financial condition |

Condensed balance sheets |

| As at | ||||||||

| (Millions of Canadian dollars) | January 31 2025 | October 31 2024 | ||||||

Assets | ||||||||

Cash and due from banks | $ | 71,200 | $ | 56,723 | ||||

Interest-bearing deposits with banks | 47,924 | 66,020 | ||||||

Securities, net of applicable allowance (1) | 488,025 | 439,918 | ||||||

Assets purchased under reverse repurchase agreements and securities borrowed | 280,451 | 350,803 | ||||||

Loans | ||||||||

Retail | 633,400 | 626,978 | ||||||

Wholesale | 379,250 | 360,439 | ||||||

Allowance for loan losses | (6,600 | ) | (6,037 | ) | ||||

Other – Derivatives | 153,686 | 150,612 | ||||||

– Other | 143,690 | 126,126 | ||||||

Total assets | $ | 2,191,026 | $ | 2,171,582 | ||||

Liabilities | ||||||||

Deposits | $ | 1,441,940 | $ | 1,409,531 | ||||

Other – Derivatives | 161,590 | 163,763 | ||||||

– Other | 440,563 | 457,550 | ||||||

Subordinated debentures | 13,670 | 13,546 | ||||||

Total liabilities | 2,057,763 | 2,044,390 | ||||||

Equity attributable to shareholders | 133,167 | 127,089 | ||||||

Non-controlling interests | 96 | 103 | ||||||

Total equity | 133,263 | 127,192 | ||||||

Total liabilities and equity | $ | 2,191,026 | $ | 2,171,582 | ||||

| (1) | Securities are comprised of trading and investment securities. |

Off-balance sheet arrangements |

Risk management |

Credit risk |

As at January 31, 2025 | ||||||||||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) | Residential mortgages | Home equity lines of credit | ||||||||||||||||||||||||||||

Insured | Uninsured | Total | Total | |||||||||||||||||||||||||||

Region (4) | ||||||||||||||||||||||||||||||

Canada | ||||||||||||||||||||||||||||||

Atlantic provinces | $ | 8,713 | 42 | % | $ | 11,921 | 58 | % | $ | 20,634 | $ | 1,683 | ||||||||||||||||||

Quebec | 11,639 | 25 | 35,405 | 75 | 47,044 | 3,332 | ||||||||||||||||||||||||

Ontario | 31,709 | 14 | 191,308 | 86 | 223,017 | 17,998 | ||||||||||||||||||||||||

Alberta | 18,584 | 43 | 24,818 | 57 | 43,402 | 4,410 | ||||||||||||||||||||||||

Saskatchewan and Manitoba | 8,437 | 41 | 12,313 | 59 | 20,750 | 1,674 | ||||||||||||||||||||||||

B.C. and territories | 12,432 | 14 | 75,981 | 86 | 88,413 | 8,081 | ||||||||||||||||||||||||

Total Canada (5) | 91,514 | 21 | 351,746 | 79 | 443,260 | 37,178 | ||||||||||||||||||||||||

U.S. | – | – | 35,235 | 100 | 35,235 | 2,320 | ||||||||||||||||||||||||

Other International | – | – | 3,427 | 100 | 3,427 | 1,411 | ||||||||||||||||||||||||

Total International | – | – | 38,662 | 100 | 38,662 | 3,731 | ||||||||||||||||||||||||

Total | $ | 91,514 | 19 | % | $ | 390,408 | 81 | % | $ | 481,922 | $ | 40,909 | ||||||||||||||||||

| As at October 31, 2024 | ||||||||||||||||||||||||||||||

(Millions of Canadian dollars, except percentage amounts) | Residential mortgages | Home equity lines of credit (2) | ||||||||||||||||||||||||||||

| Insured (3) | Uninsured | Total | Total | |||||||||||||||||||||||||||

Region (4) | ||||||||||||||||||||||||||||||

Canada | ||||||||||||||||||||||||||||||

Atlantic provinces | $ | 8,692 | 43 | % | $ | 11,688 | 57 | % | $ | 20,380 | $ | 1,704 | ||||||||||||||||||

Quebec | 11,781 | 25 | 35,129 | 75 | 46,910 | 3,346 | ||||||||||||||||||||||||

Ontario | 32,011 | 14 | 189,638 | 86 | 221,649 | 18,173 | ||||||||||||||||||||||||

Alberta | 18,804 | 43 | 24,459 | 57 | 43,263 | 4,448 | ||||||||||||||||||||||||

Saskatchewan and Manitoba | 8,549 | 41 | 12,258 | 59 | 20,807 | 1,718 | ||||||||||||||||||||||||

B.C. and territories | 12,607 | 14 | 75,575 | 86 | 88,182 | 8,061 | ||||||||||||||||||||||||

Total Canada (5) | 92,444 | 21 | 348,747 | 79 | 441,191 | 37,450 | ||||||||||||||||||||||||

U.S. | – | – | 33,092 | 100 | 33,092 | 2,144 | ||||||||||||||||||||||||

Other International | – | – | 3,261 | 100 | 3,261 | 1,421 | ||||||||||||||||||||||||

Total International | – | – | 36,353 | 100 | 36,353 | 3,565 | ||||||||||||||||||||||||

Total | $ | 92,444 | 19 | % | $ | 385,100 | 81 | % | $ | 477,544 | $ | 41,015 | ||||||||||||||||||

| (1) | Disclosure is provided in accordance with the requirements of OSFI’s Guideline B-20 (Residential Mortgage Underwriting Practices and Procedures). |

| (2) | Includes $40,892 million and $17 million of uninsured and insured home equity lines of credit, respectively (October 31, 2024 – $40,998 million and $17 million, respectively), reported within the personal loan category. The amounts in U.S. and Other International include term loans collateralized by residential properties. |

| (3) | Insured residential mortgages are mortgages whereby our exposure to default is mitigated by insurance through the Canadian Mortgage and Housing Corporation or other private mortgage default insurers. |

| (4) | Region is based upon the address of the property mortgaged. The Atlantic provinces are comprised of Newfoundland and Labrador, Prince Edward Island, Nova Scotia and New Brunswick; B.C. and territories are comprised of British Columbia, Nunavut, Northwest Territories and Yukon. |

| (5) | Total consolidated residential mortgages in Canada of $443 billion (October 31, 2024 – $441 billion) includes $12 billion (October 31, 2024 – $12 billion) of mortgages with commercial clients in Commercial Banking, of which $9 billion (October 31, 2024 – $9 billion) are insured, and $18 billion (October 31, 2024 – $18 billion) of residential mortgages in Capital Markets, of which $18 billion (October 31, 2024 – $18 billion) are held for securitization purposes. All of the residential mortgages held for securitization purposes are insured (October 31, 2024 – all insured). |

| As at | ||||||||||||||||||||||||||

January 31 2025 | October 31 2024 | |||||||||||||||||||||||||

Canada | U.S. and other International | Total | Canada (2) | U.S. and other International | Total | |||||||||||||||||||||

Amortization period | ||||||||||||||||||||||||||

≤ 25 years | 68 | % | 33 | % | 66 | % | 62 | % | 31 | % | 60 | % | ||||||||||||||

> 25 years ≤ 30 years | 32 | 67 | 34 | 28 | 69 | 30 | ||||||||||||||||||||

> 30 years ≤ 35 years | – | – | – | 10 | – | 10 | ||||||||||||||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||

| (1) | Disclosure is provided in accordance with the requirements of OSFI’s Guideline B-20 (Residential Mortgage Underwriting Practices and Procedures). |

| (2) | Our policy is to originate mortgages with amortization periods of 30 years or less. Amortization periods greater than 30 years reflect the impact of increases in interest rates on our variable rate mortgage portfolios. For these loans, the amortization period resets to the original amortization schedule upon renewal. We do not originate mortgage products with a structure that would result in negative amortization, as payments on variable rate mortgages automatically increase to ensure accrued interest is covered. |

| For the three months ended | ||||||||||||||||||

January 31 2025 | October 31 2024 | |||||||||||||||||

Uninsured | Uninsured | |||||||||||||||||

Residential mortgages | RBC Homeline Plan products | Residential mortgages (2) | RBC Homeline Plan products (3) | |||||||||||||||

Average of newly originated and acquired for the period, by region (4) | ||||||||||||||||||

Atlantic provinces | 70 | % | 70 | % | 70 | % | 69 | % | ||||||||||

Quebec | 70 | 70 | 71 | 70 | ||||||||||||||

Ontario | 70 | 64 | 70 | 64 | ||||||||||||||

Alberta | 71 | 69 | 72 | 69 | ||||||||||||||

Saskatchewan and Manitoba | 72 | 72 | 73 | 72 | ||||||||||||||

B.C. and territories | 67 | 63 | 67 | 61 | ||||||||||||||

U.S. | 71 | n.m. | 72 | n.m. | ||||||||||||||

Other International | 73 | n.m. | 66 | n.m. | ||||||||||||||

Average of newly originated and acquired for the period (5), (6) | 70 | % | 66 | % | 70 | % | 65 | % | ||||||||||

Total Canadian Banking residential mortgages portfolio (7) | 57 | % | 48 | % | 56 | % | 47 | % | ||||||||||

| (1) | Disclosure is provided in accordance with the requirements of OSFI’s Guideline B-20 (Residential Mortgage Underwriting Practices and Procedures). |

| (2) | Residential mortgages exclude residential mortgages within the RBC Homeline Plan products. |

| (3) | RBC Homeline Plan products are comprised of both residential mortgages and home equity lines of credit. |

| (4) | Region is based upon the address of the property mortgaged. The Atlantic provinces are comprised of Newfoundland and Labrador, Prince Edward Island, Nova Scotia and New Brunswick; B.C. and territories are comprised of British Columbia, Nunavut, Northwest Territories and Yukon. |

| (5) | The average LTV ratios for newly originated and acquired uninsured residential mortgages and RBC Homeline Plan products are calculated on a weighted basis by mortgage amounts at origination. |

| (6) | For newly originated mortgages and RBC Homeline Plan products, LTV is calculated based on the total facility amount for the residential mortgage and RBC Homeline Plan product divided by the value of the related residential property. |

| (7) | Weighted by mortgage balances and adjusted for property values based on the Teranet-National Bank House Price Index ‡ |

| n.m. | not meaningful |

| As at | ||||||||||||||||||||||||||||||||||||||||||

January 31 2025 | October 31 2024 | |||||||||||||||||||||||||||||||||||||||||

Asset type | Client type | |||||||||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Loans Outstanding | Securities (3) | Repo-style transactions | Derivatives | Financials | Sovereign | Corporate | Total | Total | |||||||||||||||||||||||||||||||||

Europe (excluding U.K.) | $ | 17,415 | $ | 33,383 | $ | 7,029 | $ | 4,468 | $ | 28,632 | $ | 15,641 | $ | 18,022 | $ | 62,295 | $ | 52,307 | ||||||||||||||||||||||||

U.K. | 13,743 | 23,203 | 4,148 | 2,361 | 16,867 | 14,922 | 11,666 | 43,455 | 36,311 | |||||||||||||||||||||||||||||||||

Caribbean | 6,850 | 12,323 | 2,895 | 1,027 | 9,891 | 4,528 | 8,676 | 23,095 | 22,612 | |||||||||||||||||||||||||||||||||

Asia-Pacific | 6,027 | 39,809 | 4,788 | 1,577 | 20,443 | 27,603 | 4,155 | 52,201 | 43,874 | |||||||||||||||||||||||||||||||||

Other (4) | 2,049 | 1,601 | 3,485 | 78 | 3,114 | 1,963 | 2,136 | 7,213 | 8,022 | |||||||||||||||||||||||||||||||||

Net International exposure (5), (6) | $ | 46,084 | $ | 110,319 | $ | 22,345 | $ | 9,511 | $ | 78,947 | $ | 64,657 | $ | 44,655 | $ | 188,259 | $ | 163,126 | ||||||||||||||||||||||||

| (1) | Geographic profile is based on country of risk, which reflects our assessment of the geographic risk associated with a given exposure. Typically, this is the residence of the borrower. |

| (2) | Exposures are calculated on a fair value basis and net of collateral, which includes $424 billion against repo-style transactions (October 31, 2024 – $459 billion) and $15 billion against derivatives (October 31, 2024 – $16 billion). |

| (3) | Securities include $20 billion of trading securities (October 31, 2024 – $14 billion), $37 billion of deposits (October 31, 2024 – $29 billion), and $53 billion of investment securities (October 31, 2024 – $44 billion). |

| (4) | Includes exposures in the Middle East, Africa and Latin America. |

| (5) | Excludes $7,387 million (October 31, 2024 – $6,950 million) of exposures to supranational agencies. |

| (6) | Reflects $5,912 million of mitigation through credit default swaps, which are largely used to hedge single name exposures and market risk (October 31, 2024 – $4,296 million). |

| As at and for the three months ended | ||||||||

| (Millions of Canadian dollars, except percentage amounts) | January 31 2025 | October 31 2024 | ||||||

Personal Banking | $ | 1,822 | $ | 1,652 | ||||

Commercial Banking | 2,742 | 2,372 | ||||||

Wealth Management | 482 | 508 | ||||||

Capital Markets | 2,830 | 1,335 | ||||||

Total GIL | $ | 7,876 | $ | 5,867 | ||||

Impaired loans, beginning balance | $ | 5,867 | $ | 5,685 | ||||

Classified as impaired during the period (new impaired) (1) | 3,044 | 1,343 | ||||||

Net repayments (1) | (293 | ) | (354 | ) | ||||

Amounts written off | (581 | ) | (721 | ) | ||||

Other (2) | (161 | ) | (86 | ) | ||||

Impaired loans, balance at end of period | $ | 7,876 | $ | 5,867 | ||||

GIL as a % of related loans and acceptances | ||||||||

Total GIL as a % of related loans and acceptances | 0.78% | 0.59% | ||||||

Personal Banking | 0.34% | 0.31% | ||||||

Personal Banking – Canada | 0.29% | 0.26% | ||||||

Commercial Banking | 1.47% | 1.29% | ||||||

Wealth Management | 0.38% | 0.42% | ||||||

Capital Markets | 1.74% | 0.88% | ||||||

| (1) | Certain GIL movements for Personal Banking – Canada retail and wholesale portfolios are generally allocated to new impaired, as Net repayments and certain Other movements are not reasonably determinable. Certain GIL movements for Caribbean Banking retail and wholesale portfolios are generally allocated to Net repayments and new impaired, as Net repayments and certain Other movements are not reasonably determinable. |

| (2) | Includes return to performing status during the period, recoveries of loans and advances previously written off, sold, amounts related to foreclosed properties held as investment properties and interests in joint ventures for certain co-lending arrangements, foreign exchange translation and other movements. |

| As at | ||||||||

| (Millions of Canadian dollars) | January 31 2025 | October 31 2024 | ||||||

Personal Banking | $ | 3,385 | $ | 3,273 | ||||

Commercial Banking | 1,882 | 1,626 | ||||||

Wealth Management | 521 | 466 | ||||||

Capital Markets | 1,144 | 986 | ||||||

Corporate Support and other | 1 | 1 | ||||||

ACL on loans | 6,933 | 6,352 | ||||||

ACL on other financial assets (1) | 12 | 12 | ||||||

Total ACL | $ | 6,945 | $ | 6,364 | ||||

ACL on loans is comprised of: | ||||||||

Retail | $ | 3,121 | $ | 3,011 | ||||

Wholesale | 1,827 | 1,825 | ||||||

ACL on performing loans | $ | 4,948 | $ | 4,836 | ||||

ACL on impaired loans | 1,985 | 1,516 | ||||||

| (1) | ACL on other financial assets mainly represents allowances on debt securities measured at FVOCI and amortized cost, accounts receivable and financial guarantees. |

Market risk |

January 31, 2025 | October 31, 2024 | January 31, 2024 | ||||||||||||||||||||||||||||||||||

For the three months ended | For the three months ended | For the three months ended | ||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | As at | Average | High | Low | As at | Average | As at | Average | ||||||||||||||||||||||||||||

Equity | $ | 13 | $ | 15 | $ | 23 | $ | 12 | $ | 23 | $ | 21 | $ | 10 | $ | 9 | ||||||||||||||||||||

Foreign exchange | 6 | 4 | 7 | 2 | 6 | 6 | 3 | 4 | ||||||||||||||||||||||||||||

Commodities | 7 | 7 | 11 | 5 | 11 | 8 | 5 | 5 | ||||||||||||||||||||||||||||

Interest rate (1) | 22 | 23 | 28 | 19 | 23 | 30 | 30 | 34 | ||||||||||||||||||||||||||||

Credit specific (2) | 8 | 8 | 9 | 7 | 8 | 8 | 8 | 7 | ||||||||||||||||||||||||||||

Diversification (3) | (33 | ) | (32 | ) | n.m. | n.m. | (37 | ) | (44 | ) | (31 | ) | (29 | ) | ||||||||||||||||||||||

Trading VaR | $ | 23 | $ | 25 | $ | 35 | $ | 20 | $ | 34 | $ | 29 | $ | 25 | $ | 30 | ||||||||||||||||||||

Total VaR | $ | 26 | $ | 32 | $ | 40 | $ | 25 | $ | 34 | $ | 34 | $ | 123 | $ | 122 | ||||||||||||||||||||

| (1) | General credit spread risk and funding spread risk associated with uncollateralized derivatives are included under interest rate VaR. |

| (2) | Credit specific risk captures issuer-specific credit spread volatility. |

| (3) | Trading VaR is less than the sum of the individual risk factor VaR results due to risk factor diversification. |

| n.m. | not meaningful |

| (1) | Trading revenue (teb) in the chart above excludes the impact of loan underwriting commitments. |

January 31 2025 | October 31 2024 | January 31 2024 | ||||||||||||||||||||||||||||||||||||||||||||

EVE risk | NII risk | |||||||||||||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Canadian dollar impact | U.S. dollar impact | Total | Canadian dollar impact | U.S. dollar impact | Total | EVE risk | NII risk (1) | EVE risk | NII risk (1) | ||||||||||||||||||||||||||||||||||||

Before-tax impact of: | ||||||||||||||||||||||||||||||||||||||||||||||

100 bps increase in rates | $ | (1,829 | ) | $ | (278 | ) | $ | (2,107 | ) | $ | 377 | $ | 126 | $ | 503 | $ | (2,076 | ) | $ | 400 | $ | (1,649 | ) | $ | 535 | |||||||||||||||||||||

100 bps decrease in rates | 1,649 | (5 | ) | 1,644 | (469 | ) | (120 | ) | (589 | ) | 1,663 | (502 | ) | 1,309 | (622 | ) | ||||||||||||||||||||||||||||||

| (1) | Represents the 12-month NII exposure to an instantaneous and sustained shift in interest rates. |

As at January 31, 2025 | ||||||||||||||

Market risk measure | ||||||||||||||

| (Millions of Canadian dollars) | Balance sheet amount | Traded risk | Non-traded risk | Non-traded riskprimary risk sensitivity | ||||||||||

Assets subject to market risk | ||||||||||||||

Cash and due from banks | $ | 71,200 | $ | – | $ | 71,200 | Interest rate | |||||||

Interest-bearing deposits with banks | 47,924 | 1 | 47,923 | Interest rate | ||||||||||

Securities | ||||||||||||||

Trading | 189,416 | 161,798 | 27,618 | Interest rate, credit spread | ||||||||||

Investment, net of applicable allowance | 298,609 | – | 298,609 | Interest rate, credit spread, equity | ||||||||||

Assets purchased under reverse repurchase agreements and securities borrowed | 280,451 | 235,353 | 45,098 | Interest rate | ||||||||||

Loans | ||||||||||||||

Retail | 633,400 | – | 633,400 | Interest rate | ||||||||||

Wholesale | 379,250 | 2,825 | 376,425 | Interest rate | ||||||||||

Allowance for loan losses | (6,600 | ) | – | (6,600 | ) | Interest rate | ||||||||

Other | ||||||||||||||

Derivatives | 153,686 | 150,971 | 2,715 | Interest rate, foreign exchange | ||||||||||

Other assets | 136,246 | 58,937 | 77,309 | Interest rate | ||||||||||

Assets not subject to market risk (3) | 7,444 | |||||||||||||

Total assets | $ | 2,191,026 | $ | 609,885 | $ | 1,573,697 | ||||||||

Liabilities subject to market risk | ||||||||||||||

Deposits | $ | 1,441,940 | $ | 67,363 | $ | 1,374,577 | Interest rate | |||||||

Other | ||||||||||||||

Obligations related to securities sold short | 45,460 | 45,238 | 222 | Interest rate, equity | ||||||||||

Obligations related to assets sold under repurchase agreements and securities loaned | 274,592 | 243,755 | 30,837 | Interest rate | ||||||||||

Derivatives | 161,590 | 156,653 | 4,937 | Interest rate, foreign exchange | ||||||||||

Other liabilities | 96,886 | 41,346 | 55,540 | Interest rate | ||||||||||

Subordinated debentures | 13,670 | – | 13,670 | Interest rate | ||||||||||

Liabilities not subject to market risk (4) | 23,625 | |||||||||||||

Total liabilities | $ | 2,057,763 | $ | 554,355 | $ | 1,479,783 | ||||||||

Total equity | 133,263 | |||||||||||||

Total liabilities and equity | $ | 2,191,026 | ||||||||||||

| (1) | Traded risk includes positions that are classified or designated as FVTPL and positions whose revaluation gains and losses are reported in revenue within our trading portfolios. Market risk measures of VaR and stress tests are used as risk controls for traded risk. |

| (2) | Non-traded risk includes positions used in the management of IRRBB and othernon-trading portfolios. Other materialnon-trading portfolios include positions from RBC Insurance and investment securities, net of applicable allowance, not included in IRRBB. |

| (3) | Assets not subject to market risk include physical and other assets. |

| (4) | Liabilities not subject to market risk include payroll related and other liabilities. |

| As at October 31, 2024 | ||||||||||||||

| Market risk measure | ||||||||||||||

| (Millions of Canadian dollars) | Balance sheet amount | Traded risk (1) | Non-traded risk (2) | Non-traded riskprimary risk sensitivity | ||||||||||

Assets subject to market risk | ||||||||||||||

Cash and due from banks | $ | 56,723 | $ | – | $ | 56,723 | Interest rate | |||||||

Interest-bearing deposits with banks | 66,020 | 3 | 66,017 | Interest rate | ||||||||||

Securities | ||||||||||||||

Trading | 183,300 | 161,031 | 22,269 | Interest rate, credit spread | ||||||||||

Investment, net of applicable allowance | 256,618 | – | 256,618 | Interest rate, credit spread, equity | ||||||||||

Assets purchased under reverse repurchase agreements and securities borrowed | 350,803 | 299,032 | 51,771 | Interest rate | ||||||||||

Loans | ||||||||||||||

Retail | 626,978 | – | 626,978 | Interest rate | ||||||||||

Wholesale | 360,439 | 3,152 | 357,287 | Interest rate | ||||||||||

Allowance for loan losses | (6,037 | ) | – | (6,037 | ) | Interest rate | ||||||||

Other | ||||||||||||||

Derivatives | 150,612 | 147,017 | 3,595 | Interest rate, foreign exchange | ||||||||||

Other assets | 115,133 | 47,936 | 67,197 | Interest rate | ||||||||||

Assets not subject to market risk (3) | 10,993 | |||||||||||||

Total assets | $ | 2,171,582 | $ | 658,171 | $ | 1,502,418 | ||||||||

Liabilities subject to market risk | ||||||||||||||

Deposits | $ | 1,409,531 | $ | 63,706 | $ | 1,345,825 | Interest rate | |||||||

Other | ||||||||||||||

Obligations related to securities sold short | 35,286 | 34,985 | 301 | Interest rate, equity | ||||||||||

Obligations related to assets sold under repurchase agreements and securities loaned | 305,321 | 280,386 | 24,935 | Interest rate | ||||||||||

Derivatives | 163,763 | 157,587 | 6,176 | Interest rate, foreign exchange | ||||||||||

Other liabilities | 94,666 | 39,802 | 54,864 | Interest rate | ||||||||||

Subordinated debentures | 13,546 | – | 13,546 | Interest rate | ||||||||||

Liabilities not subject to market risk (4) | 22,277 | |||||||||||||

Total liabilities | $ | 2,044,390 | $ | 576,466 | $ | 1,445,647 | ||||||||

Total equity | 127,192 | |||||||||||||

Total liabilities and equity | $ | 2,171,582 | ||||||||||||

| (1) | Traded risk includes positions that are classified or designated as FVTPL and positions whose revaluation gains and losses are reported in revenue within our trading portfolios. Market risk measures of VaR and stress tests are used as risk controls for traded risk. |

| (2) | Non-traded risk includes positions used in the management of IRRBB and othernon-trading portfolios. Other materialnon-trading portfolios include positions from RBC Insurance and investment securities, net of applicable allowance, not included in IRRBB. |

| (3) | Assets not subject to market risk include physical and other assets. |

| (4) | Liabilities not subject to market risk include payroll related and other liabilities. |

Liquidity and funding risk |

As at January 31, 2025 | ||||||||||||||||||||||||

| (Millions of Canadian dollars) | Bank-owned liquid assets | Securities received as collateral from securities financing and derivative transactions | Total liquid assets | Encumbered liquid assets | Unencumbered liquid assets | |||||||||||||||||||

Cash and deposits with banks | $ | 119,124 | $ | – | $ | 119,124 | $ | 3,393 | $ | 115,731 | ||||||||||||||

Securities issued or guaranteed by sovereigns, central banks or multilateral development banks (1) | 368,204 | 325,992 | 694,196 | 402,563 | 291,633 | |||||||||||||||||||

Other securities | 168,398 | 144,145 | 312,543 | 176,707 | 135,836 | |||||||||||||||||||

Other liquid assets (2) | 45,184 | – | 45,184 | 37,317 | 7,867 | |||||||||||||||||||

Total liquid assets | $ | 700,910 | $ | 470,137 | $ | 1,171,047 | $ | 619,980 | $ | 551,067 | ||||||||||||||

| As at October 31, 2024 | ||||||||||||||||||||||||

| (Millions of Canadian dollars) | Bank-owned liquid assets | Securities received as collateral from securities financing and derivative transactions | Total liquid assets | Encumbered liquid assets | Unencumbered liquid assets | |||||||||||||||||||

Cash and deposits with banks | $ | 122,743 | $ | – | $ | 122,743 | $ | 3,269 | $ | 119,474 | ||||||||||||||

Securities issued or guaranteed by sovereigns, central banks or multilateral development banks (1) | 323,826 | 385,479 | 709,305 | 426,552 | 282,753 | |||||||||||||||||||

Other securities | 165,875 | 126,205 | 292,080 | 163,635 | 128,445 | |||||||||||||||||||

Other liquid assets (2) | 37,601 | – | 37,601 | 31,583 | 6,018 | |||||||||||||||||||

Total liquid assets | $ | 650,045 | $ | 511,684 | $ | 1,161,729 | $ | 625,039 | $ | 536,690 | ||||||||||||||

| As at | ||||||||||||||||||||||||

| (Millions of Canadian dollars) | January 31 2025 | October 31 2024 | ||||||||||||||||||||||

Royal Bank of Canada | $ | 266,821 | $ | 243,915 | ||||||||||||||||||||

Foreign branches | 57,146 | 69,723 | ||||||||||||||||||||||

Subsidiaries | 227,100 | 223,052 | ||||||||||||||||||||||

Total unencumbered liquid assets | $ | 551,067 | $ | 536,690 | ||||||||||||||||||||

| (1) | Includes liquid securities issued by provincial governments and U.S. government-sponsored entities working under U.S. Federal government’s conservatorship (e.g., Federal National Mortgage Association and Federal Home Loan Mortgage Corporation). |

| (2) | Encumbered liquid assets amount represents cash collateral and margin deposit amounts pledged related to over-the-counter |

As at January 31, 2025 | ||||||||||||||||||||||||||||||||||||

Total Assets | Encumbered | Unencumbered | ||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Bank-owned assets | Securities received as collateral from securities financing and derivative transactions | Total | Pledged as collateral | Other | Available as collateral | Other | |||||||||||||||||||||||||||||

Cash and deposits with banks | $ | 119,124 | $ | – | $ | 119,124 | $ | – | $ | 3,393 | $ | 115,731 | $ | – | ||||||||||||||||||||||

Securities (4) | 498,827 | 526,646 | 1,025,473 | 604,411 | 30,437 | 387,296 | 3,329 | |||||||||||||||||||||||||||||

Loans, net of allowance for loan losses (5) | ||||||||||||||||||||||||||||||||||||

Mortgage securities | 56,017 | – | 56,017 | 27,222 | – | 28,795 | – | |||||||||||||||||||||||||||||

Mortgage loans | 425,269 | – | 425,269 | 68,925 | – | 42,693 | 313,651 | |||||||||||||||||||||||||||||

Other loans | 524,764 | – | 524,764 | 6,630 | – | 25,786 | 492,348 | |||||||||||||||||||||||||||||

Derivatives | 153,686 | – | 153,686 | – | – | – | 153,686 | |||||||||||||||||||||||||||||

Others (6) | 143,690 | – | 143,690 | 37,317 | – | 7,867 | 98,506 | |||||||||||||||||||||||||||||

Total | $ | 1,921,377 | $ | 526,646 | $ | 2,448,023 | $ | 744,505 | $ | 33,830 | $ | 608,168 | $ | 1,061,520 | ||||||||||||||||||||||

| As at October 31,2024 | ||||||||||||||||||||||||||||||||||||

| Total Assets | Encumbered | Unencumbered | ||||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Bank-owned assets | Securities received as collateral from securities financing and derivative transactions | Total | Pledged as collateral | Other (1) | Available as collateral (2) | Other (3) | |||||||||||||||||||||||||||||

Cash and deposits with banks | $ | 122,743 | $ | – | $ | 122,743 | $ | – | $ | 3,269 | $ | 119,474 | $ | – | ||||||||||||||||||||||

Securities (4) | 450,719 | 571,869 | 1,022,588 | 614,654 | 31,156 | 373,206 | 3,572 | |||||||||||||||||||||||||||||

Loans, net of allowance for loan losses (5) | ||||||||||||||||||||||||||||||||||||

Mortgage securities | 57,450 | – | 57,450 | 27,927 | – | 29,523 | – | |||||||||||||||||||||||||||||

Mortgage loans | 419,522 | – | 419,522 | 71,307 | – | 40,851 | 307,364 | |||||||||||||||||||||||||||||

Other loans | 504,408 | – | 504,408 | 6,343 | – | 25,250 | 472,815 | |||||||||||||||||||||||||||||

Derivatives | 150,612 | – | 150,612 | – | – | – | 150,612 | |||||||||||||||||||||||||||||

Others (6) | 126,126 | – | 126,126 | 31,583 | – | 6,018 | 88,525 | |||||||||||||||||||||||||||||

Total | $ | 1,831,580 | $ | 571,869 | $ | 2,403,449 | $ | 751,814 | $ | 34,425 | $ | 594,322 | $ | 1,022,888 | ||||||||||||||||||||||

| (1) | Includes assets restricted from use to generate secured funding due to legal or other constraints. |

| (2) | Represents assets that are immediately available for use as collateral, including National Housing Act Mortgage-Backed Securities (NHA MBS), our unencumbered mortgage loans that qualify as eligible collateral at Federal Home Loan Banks (FHLB), as well as loans that qualify as eligible collateral for discount window facility available to us and lodged at the Federal Reserve Bank of New York (FRBNY). |

| (3) | Other unencumbered assets are not subject to any restrictions on their use to secure funding or as collateral but would not be considered immediately available. |

| (4) | Includes bank-owned liquid assets and securities received as collateral from off-balance sheet securities financing, derivative transactions, and margin lending. Includes $30 billion (October 31, 2024 – $31 billion) of collateral received through reverse repurchase transactions that cannot be rehypothecated in its current legal form. |

| (5) | Effective the first quarter of 2025, mortgage securities, mortgage loans and other loans are presented net of allowance for loan losses. Comparative amounts have been revised from those previously presented to conform to the presentation adopted in the current period. |

| (6) | The Pledged as collateral amount represents cash collateral and margin deposit amounts pledged related to OTC and exchange-traded derivative transactions. |

Programs by geography |

Canada | U.S. | Europe | ||

• Canadian Shelf Program – $25 billion | • U.S. Shelf Program – US$75 billion | • European Debt Issuance Program – US$75 billion | ||

• Global Covered Bond Program – € 75 billion | ||||

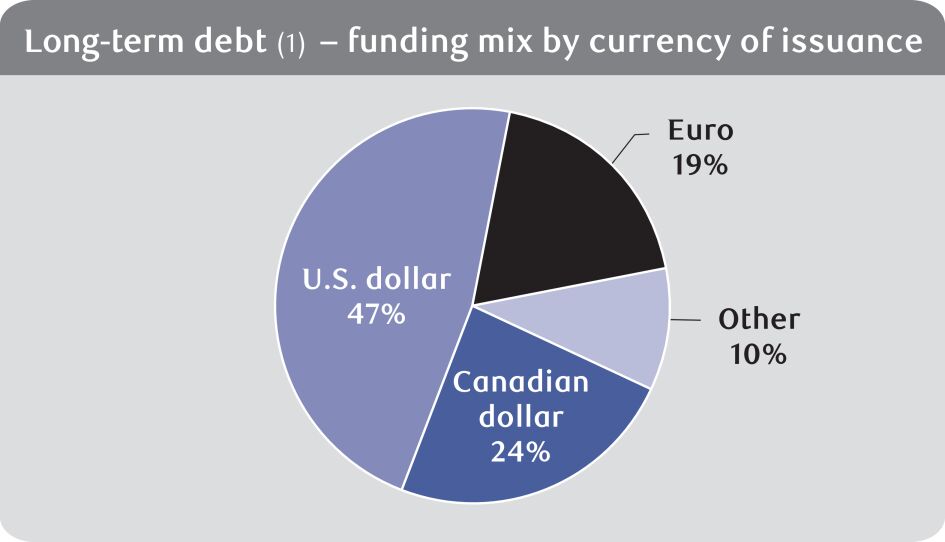

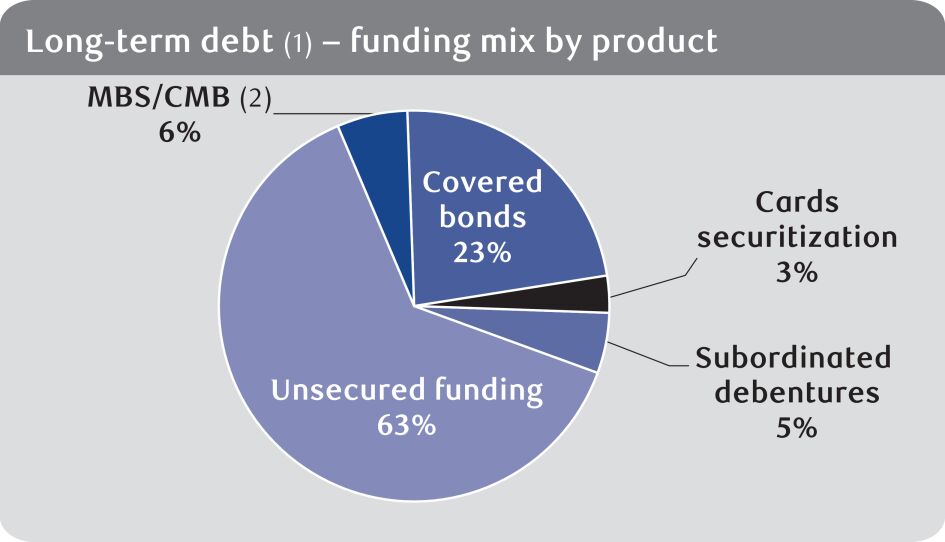

|  | |

(1) Includes unsecured and secured long-term funding and subordinated debentures with an original term to maturity greater than 1 year | (1) Includes unsecured and secured long-term funding and subordinated debentures with an original term to maturity greater than 1 year | |

(2) Mortgage-backed securities and Canada Mortgage Bonds |

As at January 31, 2025 | ||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Less than 1 month | 1 to 3 months | 3 to 6 months | 6 to 12 months | Less than 1 year sub-total | 1 year to 2 years | 2 years and greater | Total | ||||||||||||||||||||||||

Deposits from banks (2) | $ | 2,384 | $ | 143 | $ | 96 | $ | 1,287 | $ | 3,910 | $ | – | $ | – | $ | 3,910 | ||||||||||||||||

Certificates of deposit and commercial paper (3) | 10,240 | 12,324 | 28,781 | 40,621 | 91,966 | – | – | 91,966 | ||||||||||||||||||||||||

Asset-backed commercial paper (4) | 3,868 | 7,610 | 6,108 | 893 | 18,479 | – | – | 18,479 | ||||||||||||||||||||||||

Senior unsecured medium-term notes (5) | 52 | 7,432 | 8,554 | 11,689 | 27,727 | 30,221 | 57,639 | 115,587 | ||||||||||||||||||||||||

Senior unsecured structured notes (6) | 1,751 | 2,559 | 2,211 | 3,633 | 10,154 | 6,173 | 9,791 | 26,118 | ||||||||||||||||||||||||

Mortgage securitization | 23 | 1,015 | 727 | 757 | 2,522 | 2,341 | 11,809 | 16,672 | ||||||||||||||||||||||||

Covered bonds/asset-backed securities (7) | – | 1,508 | 4,122 | 6,748 | 12,378 | 23,947 | 28,589 | 64,914 | ||||||||||||||||||||||||

Subordinated liabilities | – | – | – | 2,182 | 2,182 | – | 11,556 | 13,738 | ||||||||||||||||||||||||

Other (8) | 5,079 | 994 | 1,327 | 530 | 7,930 | 20,138 | 189 | 28,257 | ||||||||||||||||||||||||

Total | $ | 23,397 | $ | 33,585 | $ | 51,926 | $ | 68,340 | $ | 177,248 | $ | 82,820 | $ | 119,573 | $ | 379,641 | ||||||||||||||||

Of which: | ||||||||||||||||||||||||||||||||

– Secured | $ | 8,848 | $ | 10,133 | $ | 10,957 | $ | 8,398 | $ | 38,336 | $ | 26,288 | $ | 40,398 | $ | 105,022 | ||||||||||||||||

– Unsecured | 14,549 | 23,452 | 40,969 | 59,942 | 138,912 | 56,532 | 79,175 | 274,619 | ||||||||||||||||||||||||

| As at October 31, 2024 | ||||||||||||||||||||||||||||||||

| (Millions of Canadian dollars) | Less than 1 month | 1 to 3 months | 3 to 6 months | 6 to 12 months | Less than 1 year sub-total | 1 year to 2 years | 2 years and greater | Total | ||||||||||||||||||||||||

Deposits from banks (2) | $ | 7,248 | $ | 118 | $ | 120 | $ | 1,025 | $ | 8,511 | $ | – | $ | – | $ | 8,511 | ||||||||||||||||

Certificates of deposit and commercial paper (3) | 8,377 | 10,413 | 16,882 | 37,702 | 73,374 | 139 | – | 73,513 | ||||||||||||||||||||||||

Asset-backed commercial paper (4) | 4,140 | 3,951 | 7,167 | 2,286 | 17,544 | – | – | 17,544 | ||||||||||||||||||||||||

Senior unsecured medium-term notes (5) | 5,436 | 7,786 | 7,253 | 12,750 | 33,225 | 20,453 | 57,351 | 111,029 | ||||||||||||||||||||||||