Conwed Plastics, LLC and Subsidiaries Consolidated Financial Statements December 31, 2015

Conwed Plastics LLC and Subsidiaries Index December 31, 2015 Page(s) Independent Auditor’s Report .............................................................................................................. 1–2 Consolidated Financial Statements Balance Sheet .............................................................................................................................................. 3 Statement of Operations .............................................................................................................................. 4 Statement of Comprehensive Income .......................................................................................................... 5 Statement of Changes in Member’s Equity .................................................................................................. 6 Statement of Cash Flows ............................................................................................................................. 7 Notes to Financial Statements ............................................................................................................... 8–17

PricewaterhouseCoopers LLP, 45 South Seventh Street, Suite 3400, Minneapolis, MN 55402 T: (612) 596 6000, F: (612) 373 7160, www.pwc.com/us Independent Auditor's Report To the Management of Conwed Plastics LLC and Subsidiaries We have audited the accompanying consolidated financial statements of Conwed Plastics LLC and its Subsidiaries, a wholly owned subsidiary of Leucadia National Corporation, which comprise the balance sheet as of December 31, 2015, and the related consolidated statements of operations, statement of comprehensive loss, changes in member’s equity, and of cash flows for the year then ended. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of the consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor's Responsibility Our responsibility is to express an opinion on the consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Company's preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

2 Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Conwed Plastics LLC and Subsidiaries as of December 31, 2015, and the results of their operations and their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. November 21, 2016 Minneapolis, Minnesota

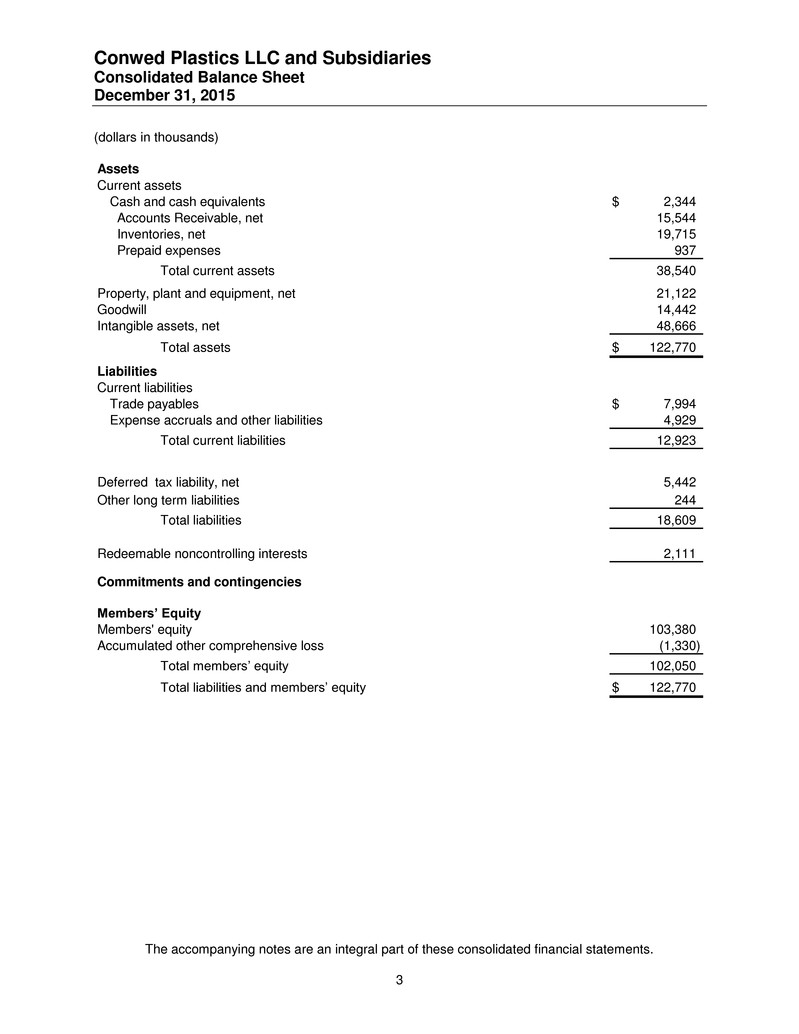

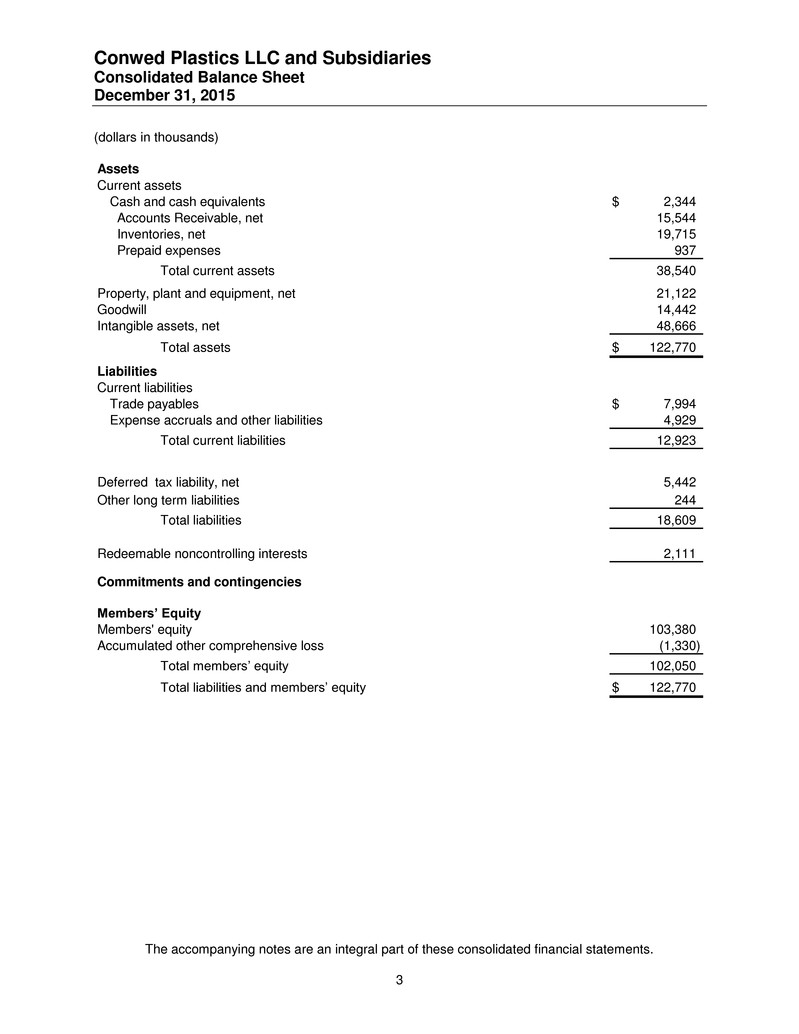

Conwed Plastics LLC and Subsidiaries Consolidated Balance Sheet December 31, 2015 (dollars in thousands) The accompanying notes are an integral part of these consolidated financial statements. 3 Assets Current assets Cash and cash equivalents 2,344$ Accounts Receivable, net 15,544 Inventories, net 19,715 Prepaid expenses 937 Total current assets 38,540 Property, plant and equipment, net 21,122 Goodwill 14,442 Intangible assets, net 48,666 Total assets 122,770$ Liabilities Current liabilities Trade payables 7,994$ Expense accruals and other liabilities 4,929 Total current liabilities 12,923 Deferred tax liability, net 5,442 Other long term liabilities 244 Total liabilities 18,609 Redeemable noncontrolling interests 2,111 Commitments and contingencies Members’ Equity Members' equity 103,380 Accumulated other comprehensive loss (1,330) Total members’ equity 102,050 Total liabilities and members’ equity 122,770$

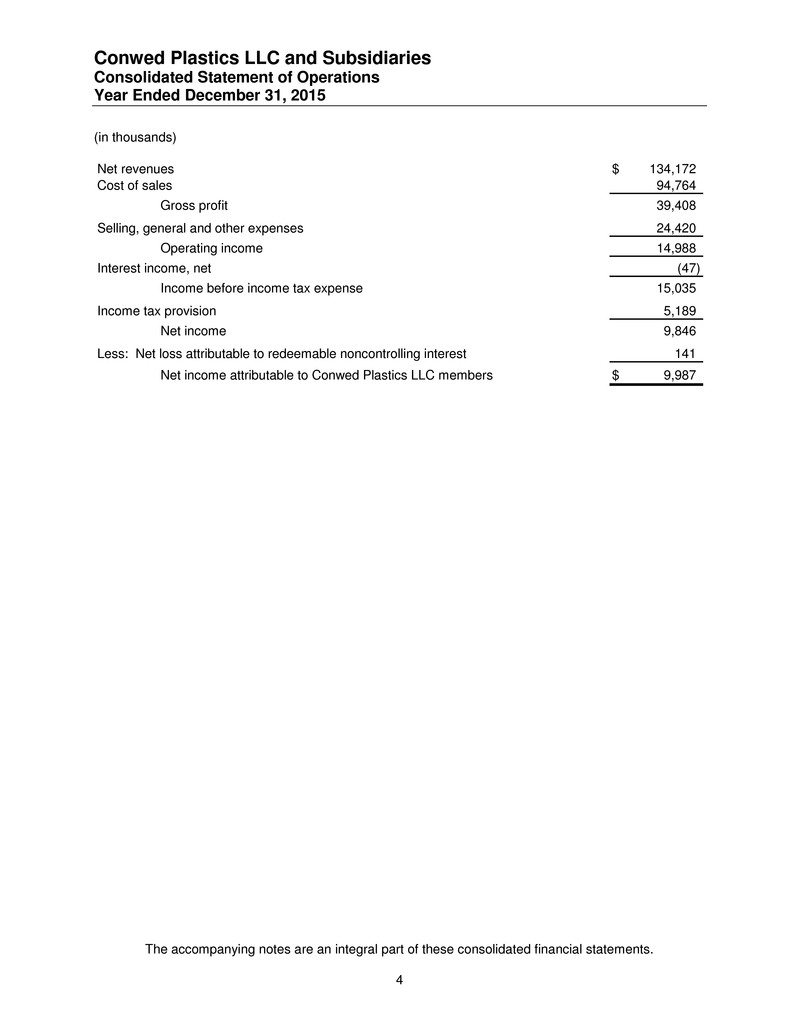

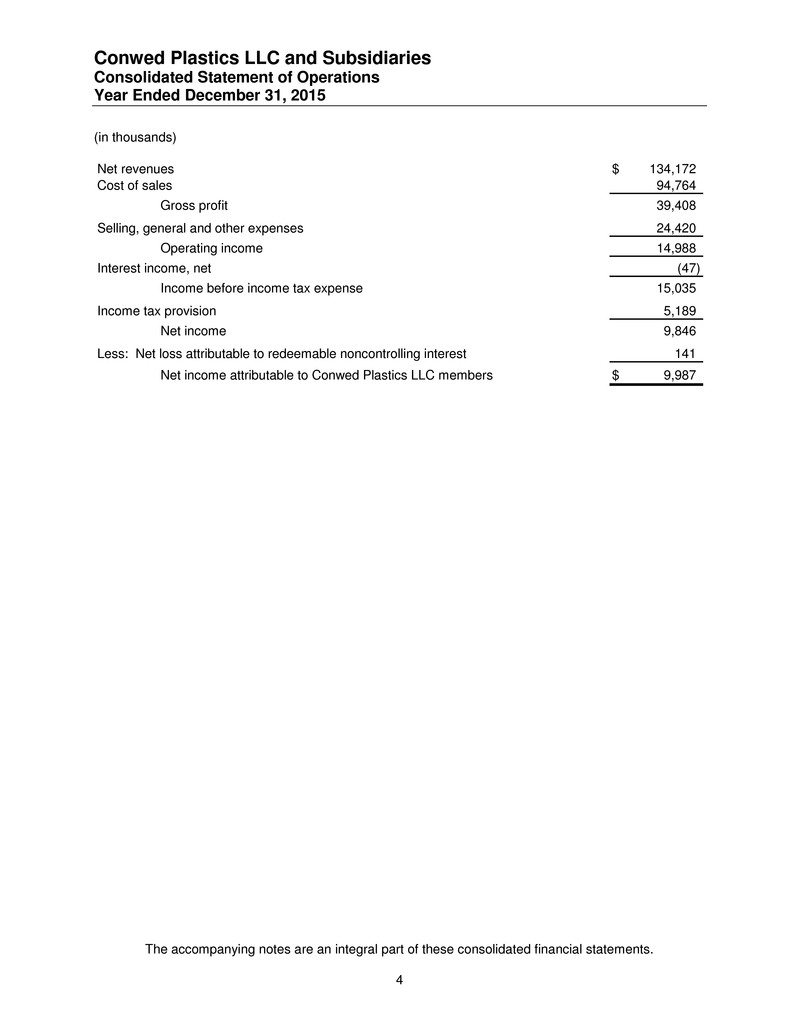

Conwed Plastics LLC and Subsidiaries Consolidated Statement of Operations Year Ended December 31, 2015 (in thousands) The accompanying notes are an integral part of these consolidated financial statements. 4 Net revenues 134,172$ Cost of sales 94,764 Gross profit 39,408 Selling, general and other expenses 24,420 Operating income 14,988 Interest income, net (47) Income before income tax expense 15,035 Income tax provision 5,189 Net income 9,846 Less: Net loss attributable to redeemable noncontrolling interest 141 Net income attributable to Conwed Plastics LLC members 9,987$

Conwed Plastics LLC and Subsidiaries Consolidated Statement of Comprehensive Income Year Ended December 31, 2015 (in thousands) The accompanying notes are an integral part of these consolidated financial statements. 5 Net i come 9,846$ Oth r comprehensive loss Change in foreign currency translation adjustments (724) Other comprehensive loss (724) Comprehensive income 9,122 Less: Comprehensive loss attributable to redeemable noncontrolling interest 141 Comprehensive income attributable to Conwed Plastics LLC members 9,263$

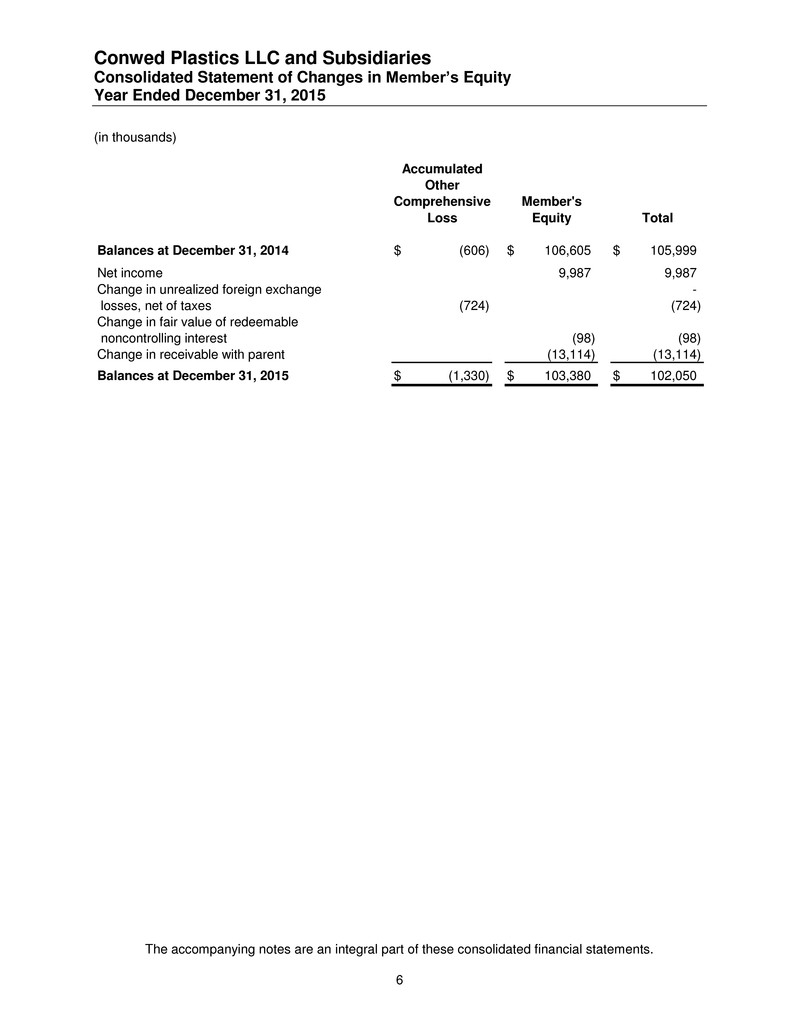

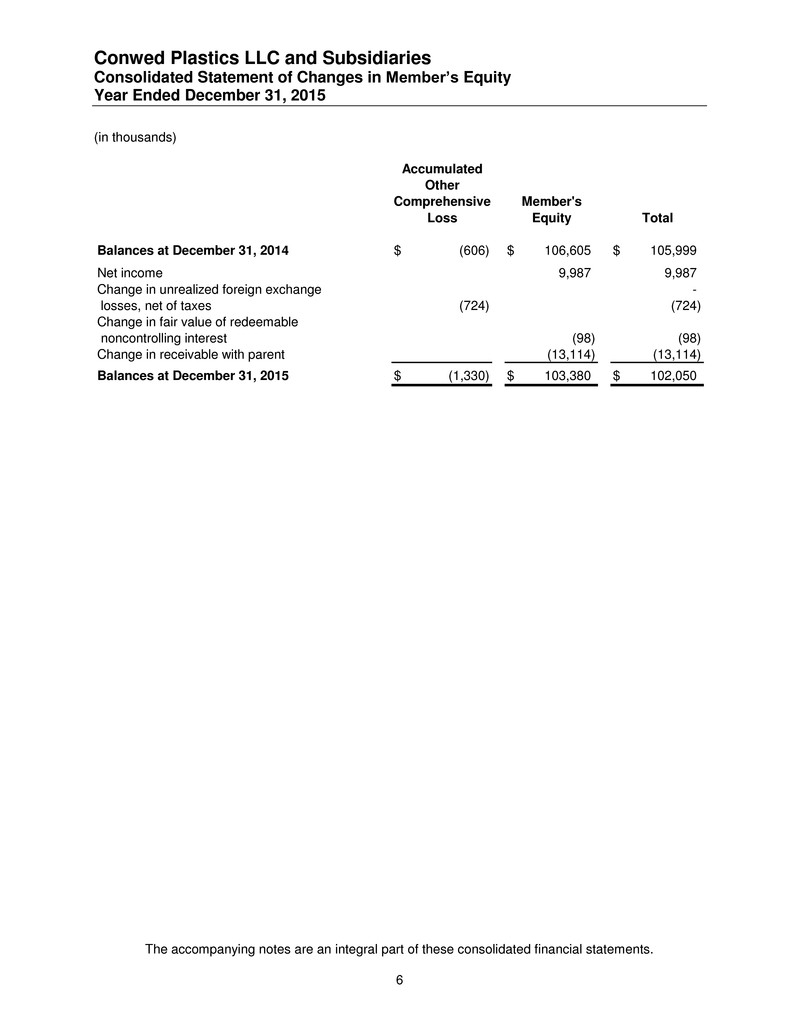

Conwed Plastics LLC and Subsidiaries Consolidated Statement of Changes in Member’s Equity Year Ended December 31, 2015 (in thousands) The accompanying notes are an integral part of these consolidated financial statements. 6 Accumulated Other Comprehensive Member's Loss Equity Total Bala ces at December 31, 2014 (606)$ 106,605$ 105,999$ Net income 9,987 9,987 Change in unrealized foreign exchange - losses, net of taxes (724) (724) Change in fair value of redeemable noncontrolling interest (98) (98) Change in receivable with parent (13,114) (13,114) Balances at December 31, 2015 (1,330)$ 103,380$ 102,050$

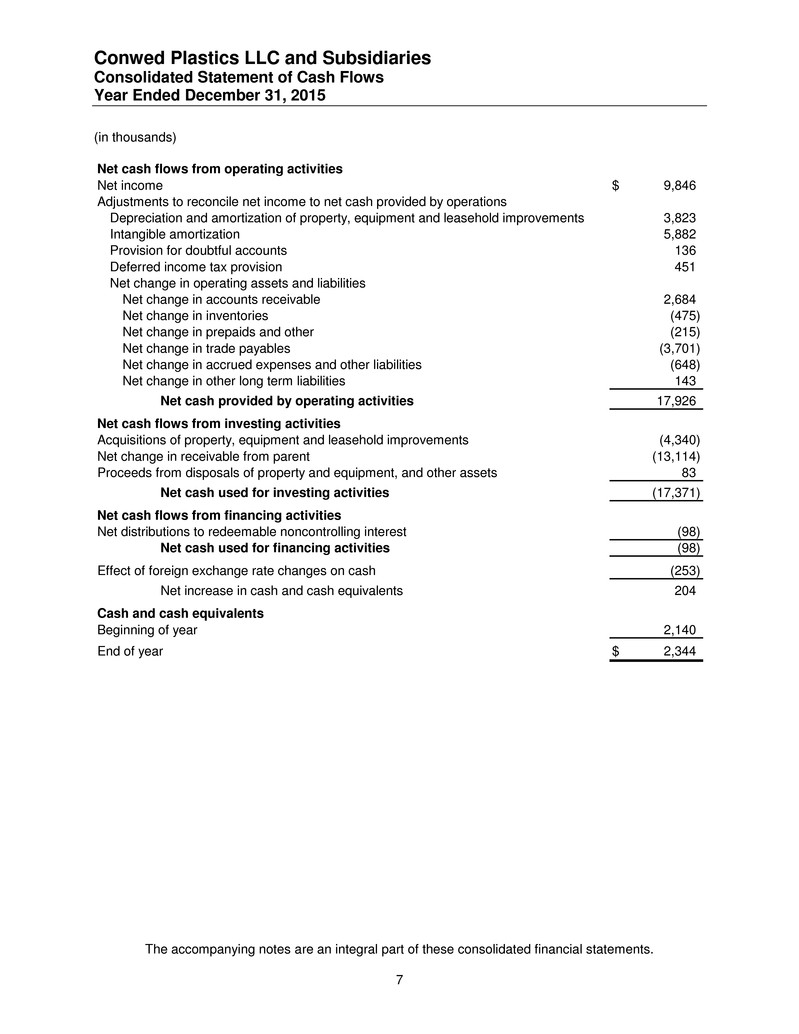

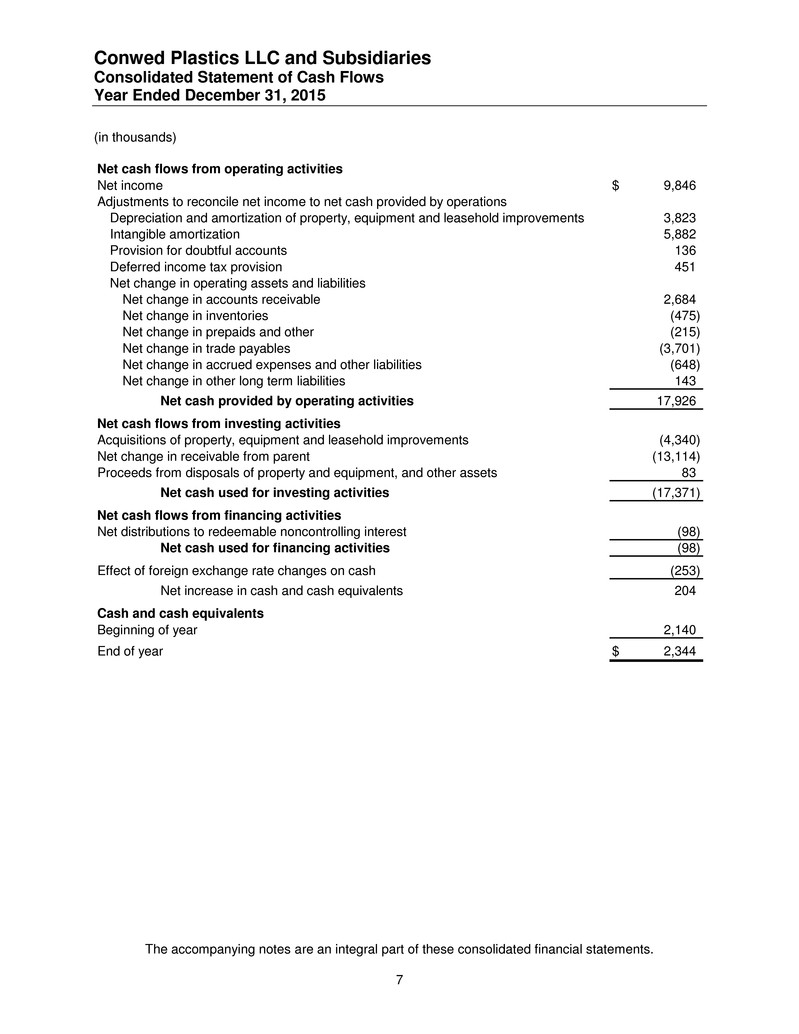

Conwed Plastics LLC and Subsidiaries Consolidated Statement of Cash Flows Year Ended December 31, 2015 (in thousands) The accompanying notes are an integral part of these consolidated financial statements. 7 Net cash flows from operating activities Net income 9,846$ Adjustments to reconcile net income to net cash provided by operations Depreciation and amortization of property, equipment and leasehold improvements 3,823 Intangible amortization 5,882 Provision for doubtful accounts 136 Deferred income tax provision 451 Net change in operating assets and liabilities Net change in accounts receivable 2,684 Net change in inventories (475) Net change in prepaids and other (215) Net change in trade payables (3,701) Net change in accrued expenses and other liabilities (648) Net change in other long term liabilities 143 Net cash provided by operating activities 17,926 Net cash flows from investing activities Acquisitions of property, equipment and leasehold improvements (4,340) Net change in receivable from parent (13,114) Proceeds from disposals of property and equipment, and other assets 83 Net cash used for investing activities (17,371) Net cash flows from financing activities Net distributions to redeemable noncontrolling interest (98) Net cash used for financing activities (98) Effect of foreign exchange rate changes on cash (253) Net increase in cash and cash equivalents 204 Cash and cash equivalents Beginning of year 2,140 End of year 2,344$

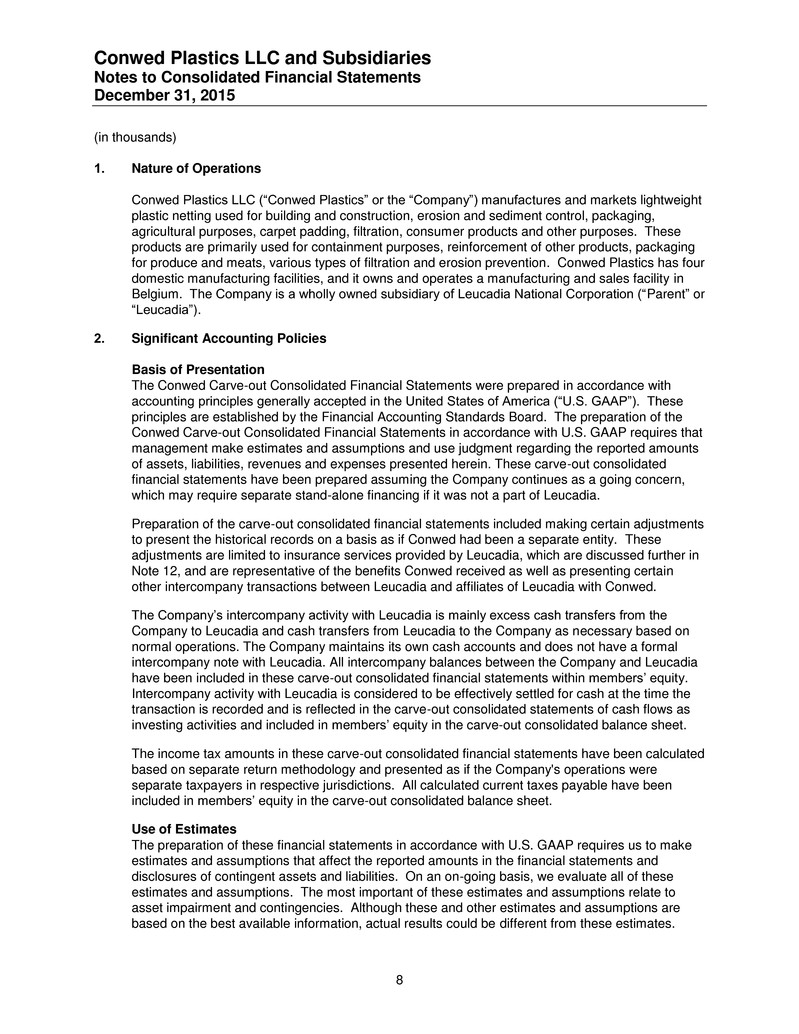

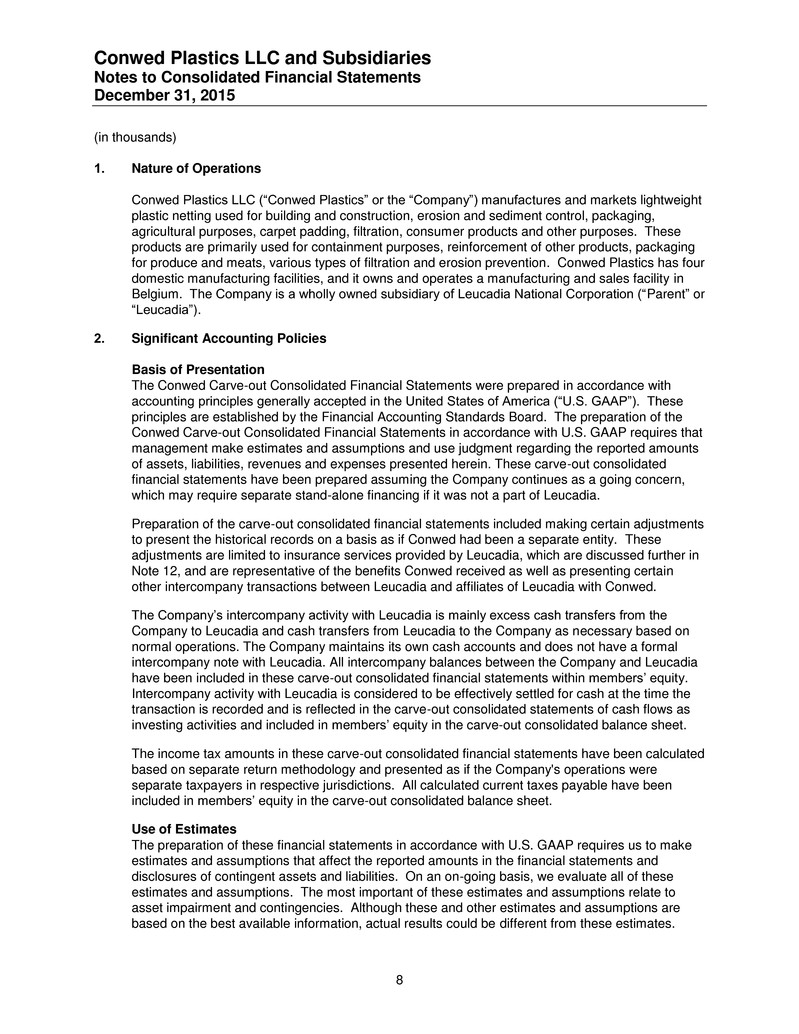

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 8 (in thousands) 1. Nature of Operations Conwed Plastics LLC (“Conwed Plastics” or the “Company”) manufactures and markets lightweight plastic netting used for building and construction, erosion and sediment control, packaging, agricultural purposes, carpet padding, filtration, consumer products and other purposes. These products are primarily used for containment purposes, reinforcement of other products, packaging for produce and meats, various types of filtration and erosion prevention. Conwed Plastics has four domestic manufacturing facilities, and it owns and operates a manufacturing and sales facility in Belgium. The Company is a wholly owned subsidiary of Leucadia National Corporation (“Parent” or “Leucadia”). 2. Significant Accounting Policies Basis of Presentation The Conwed Carve-out Consolidated Financial Statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). These principles are established by the Financial Accounting Standards Board. The preparation of the Conwed Carve-out Consolidated Financial Statements in accordance with U.S. GAAP requires that management make estimates and assumptions and use judgment regarding the reported amounts of assets, liabilities, revenues and expenses presented herein. These carve-out consolidated financial statements have been prepared assuming the Company continues as a going concern, which may require separate stand-alone financing if it was not a part of Leucadia. Preparation of the carve-out consolidated financial statements included making certain adjustments to present the historical records on a basis as if Conwed had been a separate entity. These adjustments are limited to insurance services provided by Leucadia, which are discussed further in Note 12, and are representative of the benefits Conwed received as well as presenting certain other intercompany transactions between Leucadia and affiliates of Leucadia with Conwed. The Company’s intercompany activity with Leucadia is mainly excess cash transfers from the Company to Leucadia and cash transfers from Leucadia to the Company as necessary based on normal operations. The Company maintains its own cash accounts and does not have a formal intercompany note with Leucadia. All intercompany balances between the Company and Leucadia have been included in these carve-out consolidated financial statements within members’ equity. Intercompany activity with Leucadia is considered to be effectively settled for cash at the time the transaction is recorded and is reflected in the carve-out consolidated statements of cash flows as investing activities and included in members’ equity in the carve-out consolidated balance sheet. The income tax amounts in these carve-out consolidated financial statements have been calculated based on separate return methodology and presented as if the Company's operations were separate taxpayers in respective jurisdictions. All calculated current taxes payable have been included in members’ equity in the carve-out consolidated balance sheet. Use of Estimates The preparation of these financial statements in accordance with U.S. GAAP requires us to make estimates and assumptions that affect the reported amounts in the financial statements and disclosures of contingent assets and liabilities. On an on-going basis, we evaluate all of these estimates and assumptions. The most important of these estimates and assumptions relate to asset impairment and contingencies. Although these and other estimates and assumptions are based on the best available information, actual results could be different from these estimates.

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 9 Consolidation Our policy is to consolidate all entities in which we can vote a majority of the outstanding voting stock. All intercompany transactions and balances are eliminated in consolidation. Revenue Recognition Policies Revenues are recognized when the following conditions are met: (1) collectability is reasonably assured; (2) title to the product has passed or the service has been rendered and earned; (3) persuasive evidence of an arrangement exists; and (4) there is a fixed or determinable price. Manufacturing revenues are recognized when title passes, which for the Company is usually upon shipment of goods. Revenues related to installation services provided are recognized when services are completed. Price discounts offered to customers are treated as a reduction to sales and are estimated and recorded at the time the product revenue is recognized. Cash and Cash Equivalents The Company maintains cash deposits with one financial institution which at times may exceed federally insured limits. The Company believes it is not exposed to significant credit risk in these accounts. Cash equivalents include highly liquid investments, not held for resale with original maturities of three months or less. Accounts Receivable and Provision for Doubtful Accounts The Company performs initial and continuous credit evaluations of its customers. The Company maintains an allowance for potential credit losses and carries a small amount of credit insurance for specific international customers and geographies. The Company’s credit risk is spread out over various customers and markets. The establishment of bad debt reserves is based on historical loss experience and specific trade receivables. Inventories and Cost of Sales Inventories consist of finished goods, work in process and raw materials and are stated at the lower of cost or market, which is not in excess of net realizable value. Standard costs are used, which approximate the first-in-first-out (“FIFO”) method. Cost of sales principally includes product and manufacturing costs, inbound and outbound shipping costs and handling costs. The value of inventory is adjusted for damaged, obsolete, excess and slow-moving inventory. Property, Plant and Equipment Property, plant and equipment are stated at cost, net of accumulated depreciation and amortization. Depreciation and amortization are provided on the straight-line method over the estimated useful lives of the assets or, if less, the term of the underlying lease. Expenditures for maintenance and repairs and minor renewals and betterments which do not improve or extend the life of the respective assets are expensed, while major renewals and betterments which extend the useful lives are capitalized. The cost and related accumulated depreciation of assets sold or otherwise disposed of are removed from the related accounts and the resulting gains or losses are reflected in operations. Intangible Assets Intangible assets deemed to have finite lives are amortized on a straight-line basis over their estimated useful lives, where the useful life is the period over which the asset is expected to contribute directly, or indirectly, to our future cash flows. Impairment of Long-Lived Assets We evaluate our long-lived assets for impairment whenever events or changes in circumstances indicate, in management’s judgment, that the carrying value of such assets may not be recoverable. When testing for impairment, we group our long-lived assets with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 10 flows of other assets and liabilities (or asset group). The determination of whether an asset group is recoverable is based on management’s estimate of undiscounted future cash flows directly attributable to the asset group as compared to its carrying value. If the carrying amount of the asset group is greater than the undiscounted cash flows, an impairment loss would be recognized for the amount by which the carrying amount of the asset group exceeds its estimated fair value. Goodwill Goodwill represents the excess of the purchase price over the fair value of the assets acquired and liabilities assumed. Goodwill is not amortized, but is tested for impairment annually or at the time impairment indicators are identified. Impairment testing of goodwill is done at a reporting unit level. Currently, the Company has determined that it has one reporting unit that contains goodwill. An impairment loss will generally be recognized whenever the estimated fair value of the reporting unit is less than the carrying value of the reporting unit’s net assets. For 2015 the Company performed a qualitative impairment analysis and determined that there was not any impairment of goodwill during the year presented. There was no goodwill activity within the year ended December 31, 2015. Income Taxes The results of operations of the Company are included in the consolidated Federal and applicable state and local income tax returns filed by the Parent. In states that neither accept nor require combined or unitary tax returns, the Company files separate state income tax returns. The Company is a single member LLC and subject to corporate tax rates. Subsidiaries of the Company also file in international jurisdictions, where applicable. The Company accounts for the provision for income taxes using a “separate return” method. Amounts provided for income taxes are based on income reported for financial statement purposes and do not necessarily represent income tax expense amounts currently payable or deferred taxes. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The realization of deferred tax assets is assessed and a valuation allowance is recorded to the extent that it is more likely than not that any portion of the deferred tax asset will not be realized. The Company has recorded an estimate of U.S. taxes on foreign operations. The Company recognizes tax positions in the financial statement only when it is more likely than not, based on the technical merits, that the position will be sustained upon examination by the relevant taxing authority. A tax position that meets the more-likely-than-not recognition threshold is measured at the largest amount of tax benefit that is greater than fifty percent likely of being realized upon settlement. Foreign Currency Translation and Transactions Assets and liabilities of foreign subsidiaries are translated to U.S. dollars using the currency exchange rates at the end of the relevant period. Revenues and expenses are translated at average exchange rates during the period. The effects of exchange rate changes on the translation of the balance sheet are included in other comprehensive loss in the consolidated statement of comprehensive income and classified as accumulated other comprehensive loss in the consolidated statement of changes in members’ equity. Amounts reclassified out of accumulated other comprehensive loss for the year ended December 31, 2015 are not material.The Company has sales transactions denominated in foreign currencies. Gains and losses may occur due to fluctuations in exchange rates and are included in earnings. Net foreign

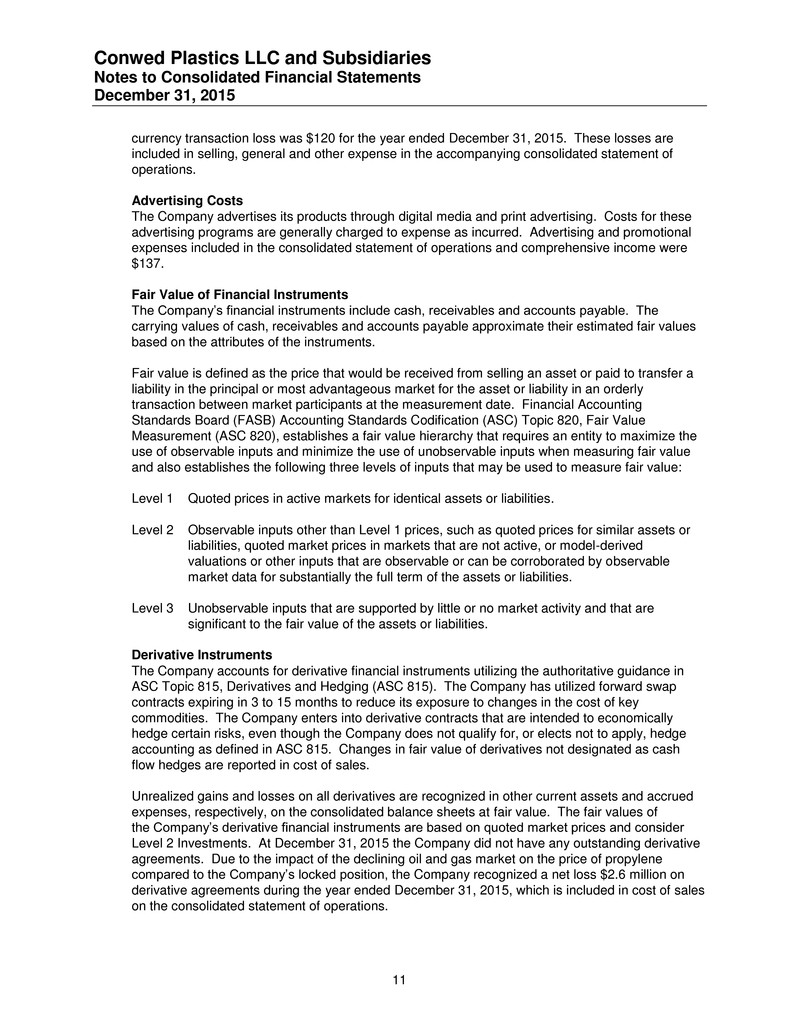

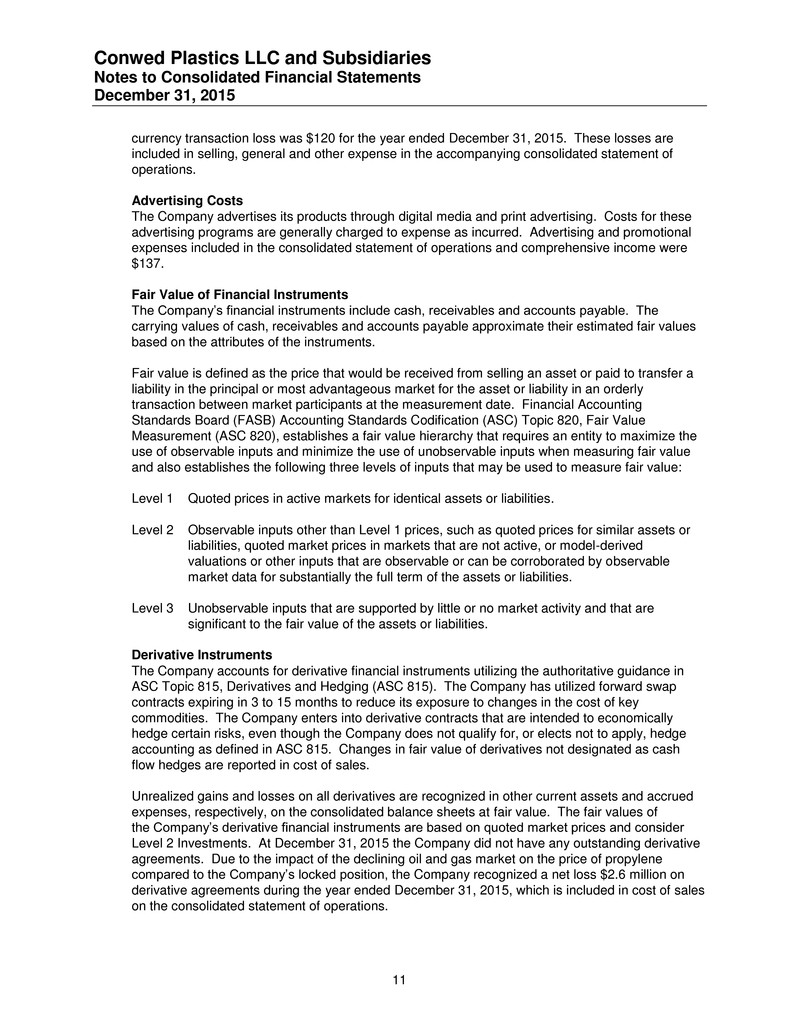

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 11 currency transaction loss was $120 for the year ended December 31, 2015. These losses are included in selling, general and other expense in the accompanying consolidated statement of operations. Advertising Costs The Company advertises its products through digital media and print advertising. Costs for these advertising programs are generally charged to expense as incurred. Advertising and promotional expenses included in the consolidated statement of operations and comprehensive income were $137. Fair Value of Financial Instruments The Company’s financial instruments include cash, receivables and accounts payable. The carrying values of cash, receivables and accounts payable approximate their estimated fair values based on the attributes of the instruments. Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 820, Fair Value Measurement (ASC 820), establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value and also establishes the following three levels of inputs that may be used to measure fair value: Level 1 Quoted prices in active markets for identical assets or liabilities. Level 2 Observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted market prices in markets that are not active, or model-derived valuations or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. Derivative Instruments The Company accounts for derivative financial instruments utilizing the authoritative guidance in ASC Topic 815, Derivatives and Hedging (ASC 815). The Company has utilized forward swap contracts expiring in 3 to 15 months to reduce its exposure to changes in the cost of key commodities. The Company enters into derivative contracts that are intended to economically hedge certain risks, even though the Company does not qualify for, or elects not to apply, hedge accounting as defined in ASC 815. Changes in fair value of derivatives not designated as cash flow hedges are reported in cost of sales. Unrealized gains and losses on all derivatives are recognized in other current assets and accrued expenses, respectively, on the consolidated balance sheets at fair value. The fair values of the Company’s derivative financial instruments are based on quoted market prices and consider Level 2 Investments. At December 31, 2015 the Company did not have any outstanding derivative agreements. Due to the impact of the declining oil and gas market on the price of propylene compared to the Company’s locked position, the Company recognized a net loss $2.6 million on derivative agreements during the year ended December 31, 2015, which is included in cost of sales on the consolidated statement of operations.

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 12 Vendor Concentration The Company has one raw material vendor that accounts for over 20% of total raw material purchases. Subsequent Events The Company has performed an evaluation of subsequent events and as of November 21, 2016, there are no subsequent events of a material nature to report. 3. Accounting Developments Revenue Recognition In May 2014, the FASB issued new guidance that defines how companies report revenues from contracts with customers, and also requires enhanced disclosures. The core principle of this new guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. This guidance originally was effective for annual periods beginning after December 15, 2017, and interim periods within fiscal years beginning after December 15, 2018. In August 2015, the FASB issued guidance that deferred the effective date by one year, with early adoption on the original effective date permitted. We are currently evaluating the impact this new guidance will have on our consolidated financial statements. Inventory In July 2015, the FASB issued new guidance that simplifies the measurement of inventory. Inventory measured using any method other than LIFO or the retail inventory method (for example, inventory measured using first-in, first-out (FIFO) or average cost) shall be measured at the lower of cost and net realizable value. When evidence exists that the net realizable value of inventory is lower than its cost, the difference shall be recognized as a loss in earnings in the period in which it occurs. This guidance will be effective for annual periods beginning after December 15, 2016 and interim periods within fiscal years beginning after December 15, 2017, and early adoption is permitted. We are currently evaluating the impact this new guidance will have on our consolidated financial statements. Leases In February 2016, the FASB issued new guidance that affects the accounting and disclosure requirements for leases. The FASB requires the recognition of lease assets and lease liabilities on the statement of financial condition. The guidance is effective for annual beginning after December 15, 2019 and interim periods within fiscal years beginning after December 15, 2020, and early adoption is permitted. We are currently evaluating the impact this new guidance will have on our consolidated financial statements.

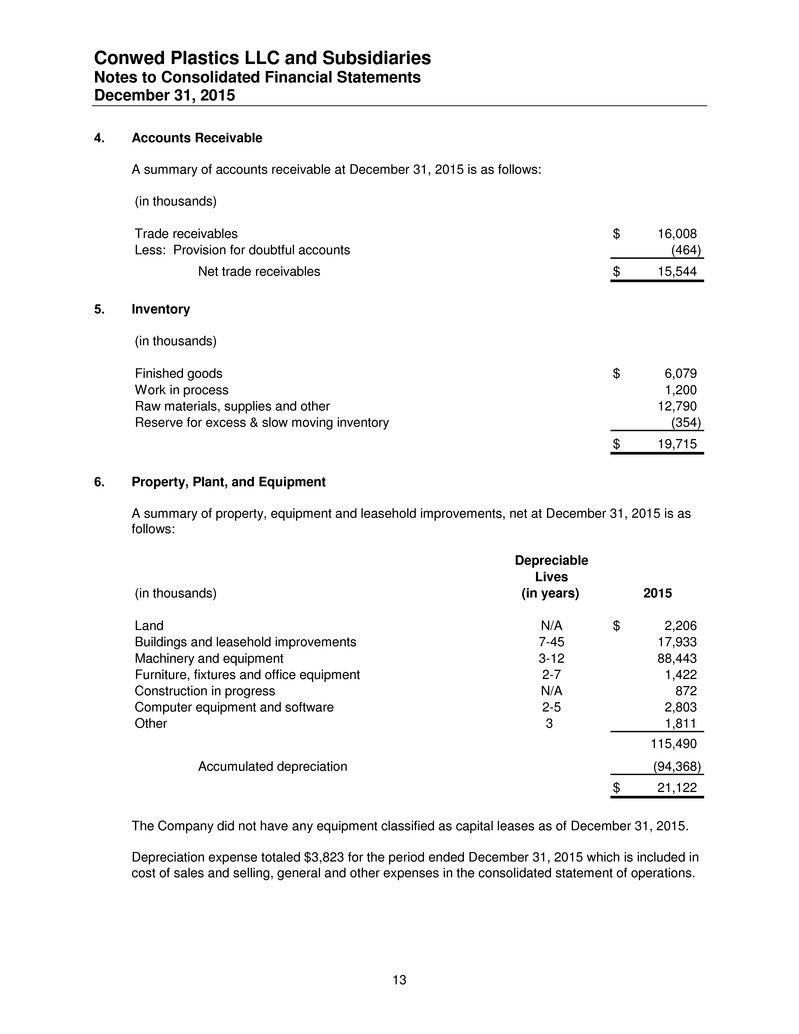

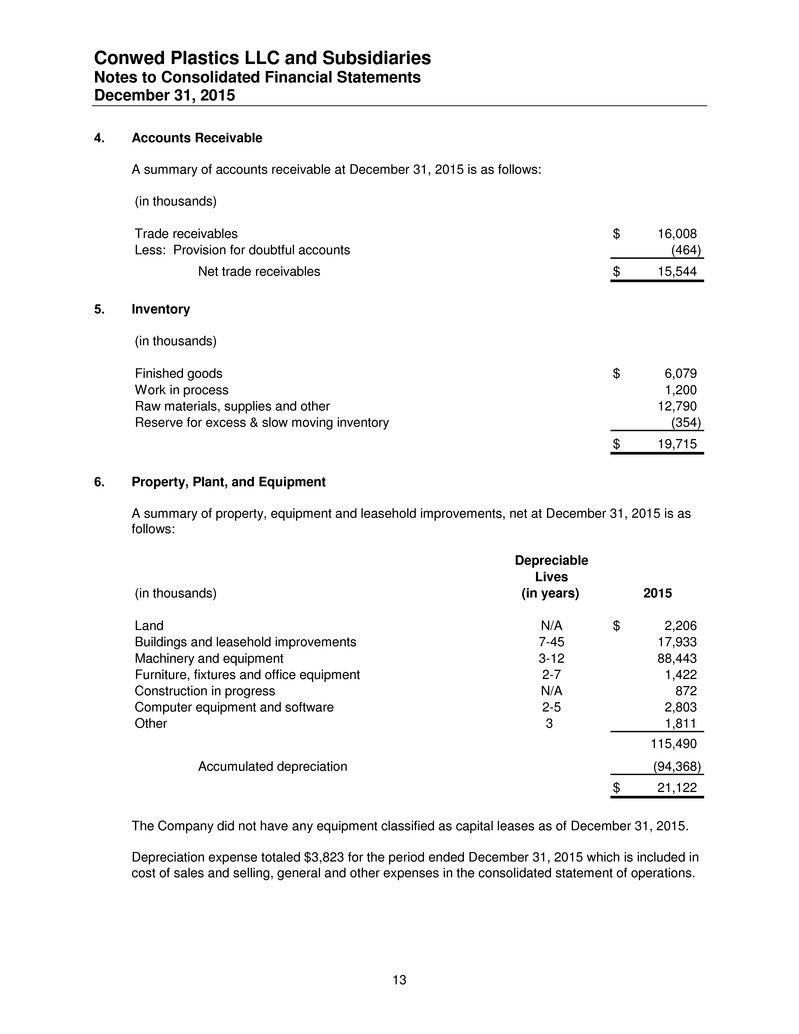

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 13 4. Accounts Receivable A summary of accounts receivable at December 31, 2015 is as follows: (in thousands) Trade receivables 16,008$ Less: Provision for doubtful accounts (464) Net trade receivables 15,544$ 5. Inventory (in thousands) Finished goods 6,079$ Work in process 1,200 Raw materials, supplies and other 12,790 Reserve for excess & slow moving inventory (354) 19,715$ 6. Property, Plant, and Equipment A summary of property, equipment and leasehold improvements, net at December 31, 2015 is as follows: Depreciable Lives (in thousands) (in years) 2015 Land N/A 2 206 Buildings and leasehold improvements 7-45 7 933 Machinery and equipment 3-12 88,443 Furniture, fixtures and office equipment 2-7 1,422 Construction in progress N/A 872 Computer equipment and software 2-5 2,803 Other 3 1,811 115,490 Accumulated depreciation (94,368) 21,122$ The Company did not have any equipment classified as capital leases as of December 31, 2015. Depreciation expense totaled $3,823 for the period ended December 31, 2015 which is included in cost of sales and selling, general and other expenses in the consolidated statement of operations.

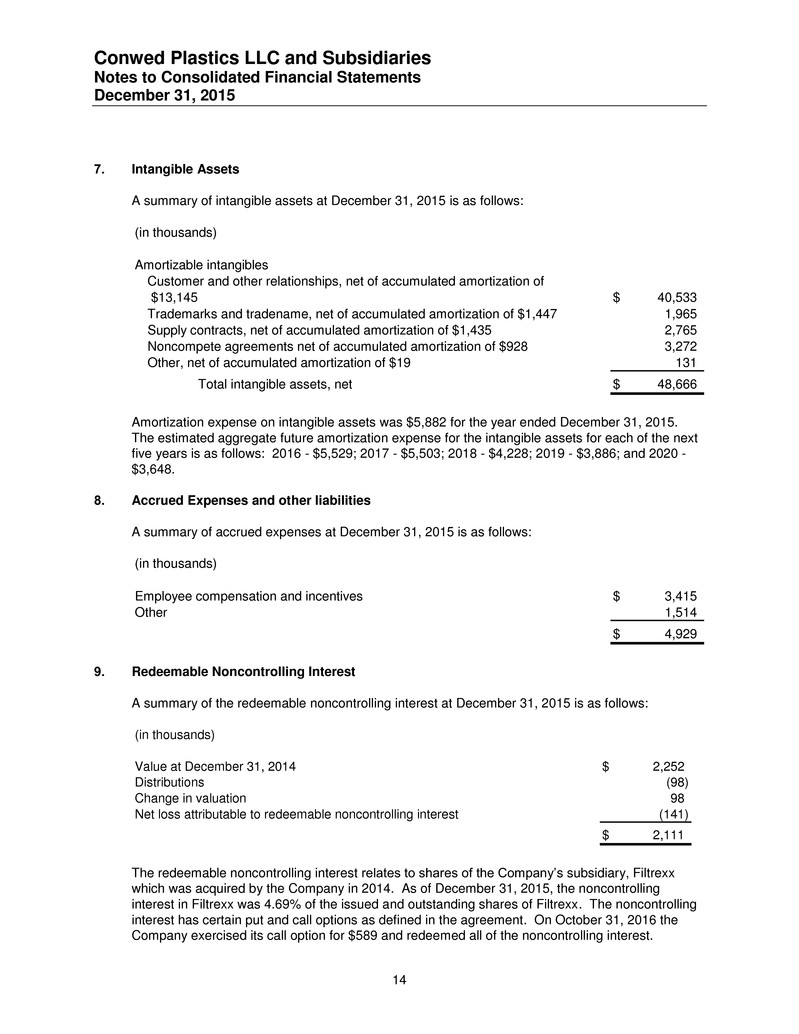

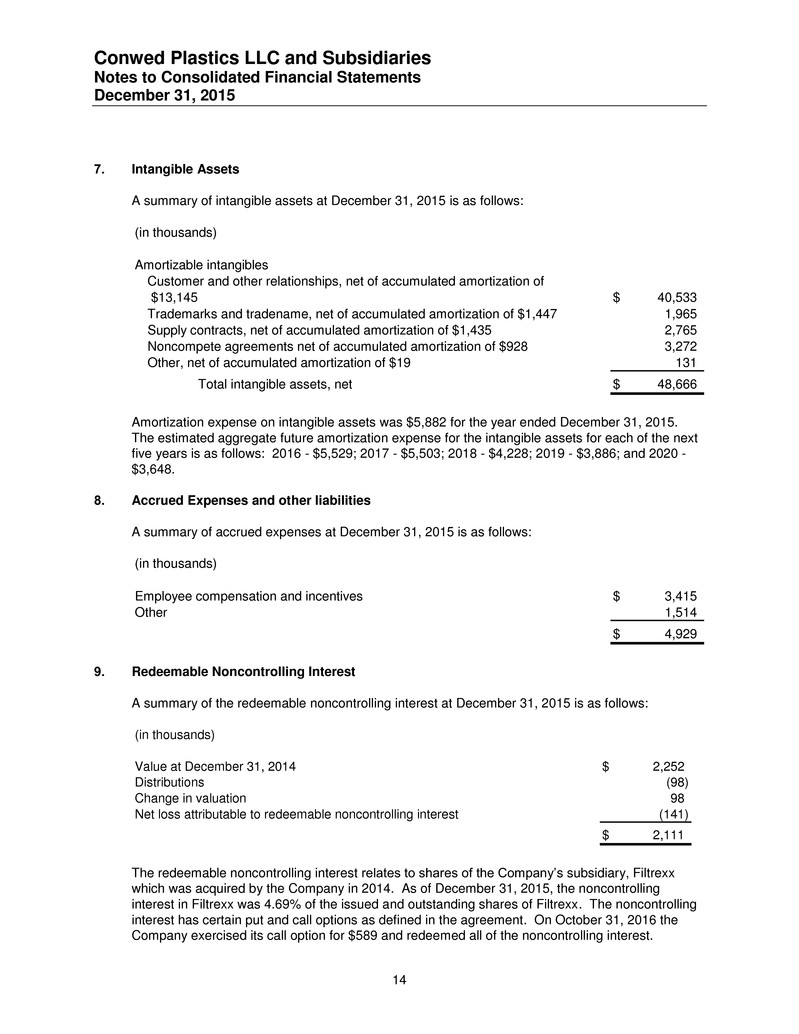

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 14 7. Intangible Assets A summary of intangible assets at December 31, 2015 is as follows: (in thousands) Amortizable intangibles Customer and other relationships, net of accumulated amortization of $13, 45 40,533$ Trademarks and tradename, net of accumulated amortization of $1,447 1,965 Supply contracts, net of accumulated amortization of $1,435 2,765 Noncompete agreements net of accumulated amortization of $928 3,272 Other, net of accumulated amortization of $19 131 Total intangible assets, net 48,666$ Amortization expense on intangible assets was $5,882 for the year ended December 31, 2015. The estimated aggregate future amortization expense for the intangible assets for each of the next five years is as follows: 2016 - $5,529; 2017 - $5,503; 2018 - $4,228; 2019 - $3,886; and 2020 - $3,648. 8. Accrued Expenses and other liabilities A summary of accrued expenses at December 31, 2015 is as follows: (in thousands) Employee compensation and incentives 3,415$ Other 1,514 4,929$ 9. Redeemable Noncontrolling Interest A summary of the redeemable noncontrolling interest at December 31, 2015 is as follows: (in th us nd ) Value at December 31, 2014 2,252$ Distributions (98) Change in valuation 98 Net loss attributable to redeemable noncontrolling interest (141) 2,111$ The redeemable noncontrolling interest relates to shares of the Company’s subsidiary, Filtrexx which was acquired by the Company in 2014. As of December 31, 2015, the noncontrolling interest in Filtrexx was 4.69% of the issued and outstanding shares of Filtrexx. The noncontrolling interest has certain put and call options as defined in the agreement. On October 31, 2016 the Company exercised its call option for $589 and redeemed all of the noncontrolling interest.

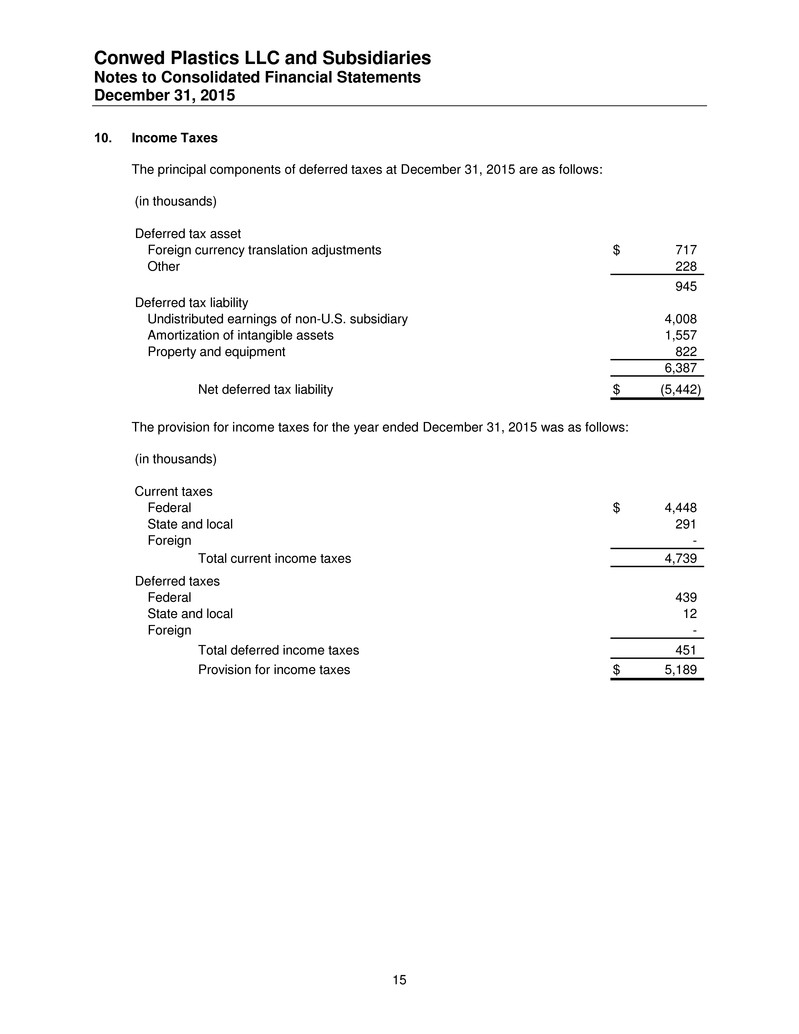

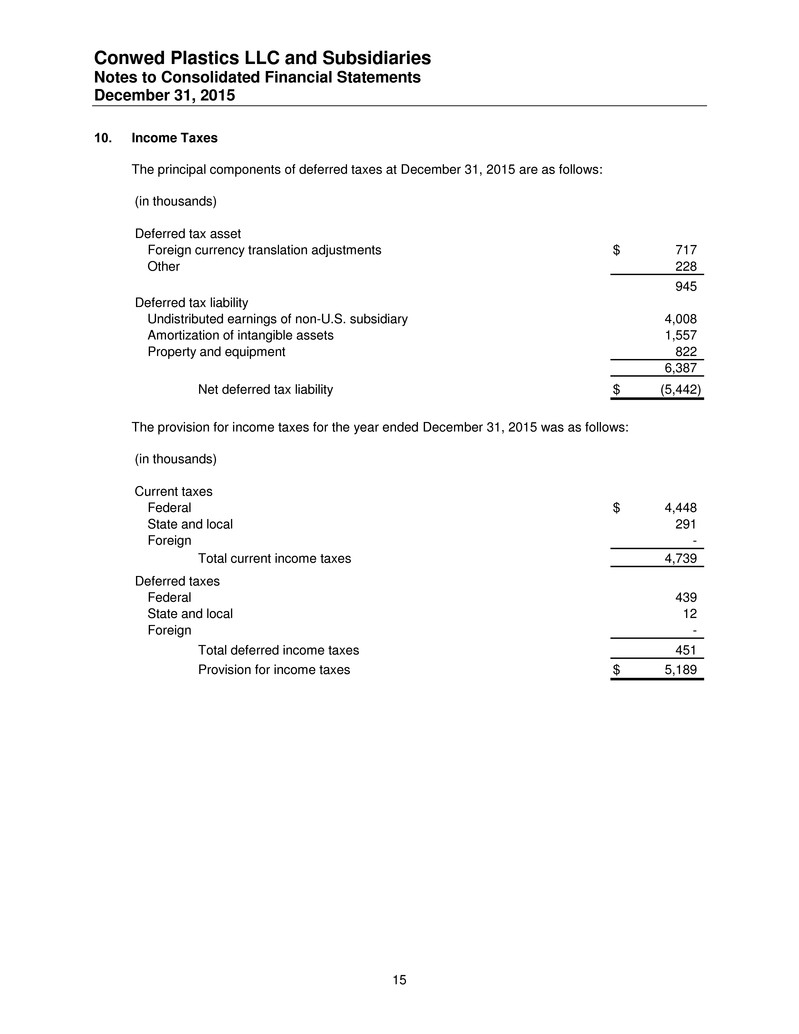

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 15 10. Income Taxes The principal components of deferred taxes at December 31, 2015 are as follows: (in thousands) Deferred tax asset Foreign currency translation adjustments 717$ Other 228 945 Deferr d tax liability Undistributed earnings of non-U.S. subsidiary 4,008 Amortization of intangible assets 1,557 Property and equipment 822 6,387 Net deferred tax liability (5,442)$ The provision for income taxes for the year ended December 31, 2015 was as follows: (in thousands) Current taxes Federal 4 448$ State and local 291 Foreign - Total current income taxes 4,739 Deferr taxes Federal 439 State and local 12 Foreign - Total deferred income taxes 451 Provision for income taxes 5,189$

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 16 The table below reconciles the expected statutory federal income tax to the actual income tax provision: (in thous nds) Expected federal income tax 5,263$ State income taxes, net of federal income tax benefit 303 Deduction for income attributable to Domestic Production Activities (429) Other 52 Actual income tax provision (benefit) 5,189$ At December 31, 2015, the Company has no unrecognized tax benefits and no provisions for interest or penalties related to unrecognized tax benefits. The Company does not expect that changes in the liability for unrecognized tax benefits during the next twelve months will have a significant impact on the Company’s financial position or results of operations. The Parent is currently under examination by the Internal Revenue Service and other major tax jurisdictions in which it has business operations. The Company does not expect that resolution of these examinations will have a material effect on the Statement of Financial Condition of the Company, but could have a material impact on the Statement of Earnings for the period in which such resolution occurs. 11. Defined Contribution Plans We have voluntary retirement 401(k) savings plan available to any employee who has met the requirements of the plan. Employee contributions of up to 6% of wages are partially or entirely matched by the Company. Amounts charged to expense related to such plans were $892 for the year ended December 31, 2015. 12. Commitments, Contingencies and Guarantees Commitments We and our subsidiaries rent office space and office equipment under noncancellable operating leases with terms varying principally from one to five years. Rental expense was $1,174 for the year ended December 31, 2015. Future minimum annual rentals (exclusive of month-to-month leases, real estate taxes, maintenance and certain other charges) under these leases at December 31, 2015 are as follows (in thousands): (in thousa ds) 20 6 1,121$ 2017 1,087 2018 891 2019 586 2020 540 Thereafter 856 5,081$

Conwed Plastics LLC and Subsidiaries Notes to Consolidated Financial Statements December 31, 2015 17 Contingencies We and our subsidiaries are parties to other legal and regulatory proceedings that are considered to be either ordinary, routine litigation incidental to their business or not significant to our consolidated financial position. We and our subsidiaries are also involved, from time to time, in other exams, investigations and similar reviews (both formal and informal) by governmental and self-regulatory agencies regarding our businesses, certain of which may result in judgments, settlements, fines, penalties or other injunctions. We do not believe that any of these actions will have a significant adverse effect on our consolidated financial position or liquidity, but any amounts paid could be significant to results of operations for the period. Related Parties Transactions For the year 2015 the Company was charged for insurance services provided by Leucadia. The amount paid to Leucadia was $842 and covered the following insurance policies for Conwed Plastics USA: D&O, General Liability, Auto, Risk Mgmt & Cyber Media, Foreign Liability, Employment Practice, Fiduciary, Kidnap/Ransom, Workers Comp, Property, Crime and audit or service fees related to the policies.