- MATV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Mativ (MATV) DEF 14ADefinitive proxy

Filed: 14 Mar 24, 5:08pm

| | | Sincerely, | |

| | | ||

| | |  | |

| | | ||

| | | John D. Rogers | |

| | | Chair, Board of Directors |

| 1. | To elect the two nominees for director named in the attached proxy statement for terms expiring at the 2027 Annual Meeting of Stockholders; |

| 2. | To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2024; |

| 3. | To hold a non-binding advisory vote to approve executive compensation; |

| 4. | To approve the adoption of the Mativ Holdings, Inc. 2024 Equity and Incentive Plan; and |

| 5. | To transact such other business as may properly be brought before the meeting or any adjournments or postponements thereof. |

| | | Sincerely, | |

| | |  | |

| | | Mark W. Johnson Chief Legal and Administrative Officer and Corporate Secretary |

| • | FOR the two nominees for election to the Board named in Proposal One - Election of Directors; |

| • | FOR Proposal Two - Ratification of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2024; |

| • | FOR Proposal Three - Non-Binding Advisory Vote to Approve Executive Compensation; and |

| • | FOR Proposal Four - Adoption of the Mativ Holdings, Inc. 2024 Equity and Incentive Plan. |

Class I – Current Term Ending at 2026 Annual Meeting | | | Class II - Current Term Ending at 2024 Annual Meeting | | | Class III - Nominees for Election at 2025 Annual Meeting |

Jeffrey J. Keenan | | | Shruti Singhal | | | Julie A. Schertell |

Marco Levi | | | Tony R. Thene | | | Kimberly E. Ritrievi, ScD |

William M. Cook | | | Anderson D. Warlick | | | John D. Rogers, PhD |

Shruti Singhal Age: 54 Director Since: 2022  | | | Business Experience: |

| | • President and Chief Executive Officer, Chroma Color Corporation, a leading formulator, and specialty color and additive concentrates supplier, since 2021 • President, DSM’s Engineering Materials Business, 2019 – 2021 | ||

| | |||

| | Public Company Directorships: | ||

| | • Director, Neenah Inc., 2021 – 2022 |

Anderson D. Warlick Age: 66 Director Since: 2009  | | | Business Experience: |

| | • Chairman and Chief Executive Officer of Parkdale, Inc., a textile and consumer products company, and its subsidiaries, since 2001 |

William M. Cook Age: 70 Director Since: 2022  | | | Business Experience: |

| | • President and Chief Executive Officer, Donaldson Company, Inc., 2004 – 2015 • Various leadership roles at Donaldson Company, Inc., 1994 – 2004 | ||

| | |||

| | Public Company Directorships: | ||

| | • Chairman of the Board, IDEX Corporation, 2020 – 2022; Director, IDEX Corporation, 2008 – 2022 • Director, AXALTA Coating Systems, Ltd., since 2019 • Director, Neenah Inc., 2016 – 2022 |

Jeffrey J. Keenan Age: 66 Director Since: 2016  | | | Business Experience: |

| | • Senior Advisor of Roark Capital Group, a private equity firm, 2015 – February 2020 • President, Chief Operating Officer and Chief Compliance Officer of Roark Capital Group, 2006 – 2015 • Co-Founder and Chairman of IESI Corporation, 1996 – 2005 |

Marco Levi Age: 64 Director Since: 2017  | | | Business Experience: |

| | • Chief Executive Officer, Ferroglobe PLC, a mining and metals company, since January 2020 • Chief Executive Officer, Thermission AG, a metals finisher, June 2018 – December 2019 • President and Chief Executive Officer, Ahlstrom Corporation, 2014 – 2016 • Senior Vice President and Business President of Emulsion Polymers, Styron Corporation, 2010 – 2014 | ||

| | |||

| | Public Company Directorships: | ||

| | • Director of Ferroglobe PLC, since 2020 |

Kimberly E. Ritrievi, ScD Age: 65 Director Since: 2018  | | | Business Experience: |

| | • President, The Ritrievi Group, LLC, since 2005 • Various leadership roles at Goldman Sachs & Co., 1997 – 2004 | ||

| | |||

| | Public Company Directorships: | ||

| | • Director of Tetra Tech, Inc., since 2013 |

John D. Rogers, PhD Age: 62 Director Since: 2009  | | | Business Experience: |

| | • President, Chief Executive Officer and Director of CFA Institute, an association of investment professionals, 2009 – 2014 • Founding Partner & Principal of Jade River Capital Management, LLC, 2007 – 2008 • President and Chief Executive Officer, Invesco Institutional N.A., Senior Managing Director and Head of Worldwide Institutional Business, AMVESCAP Plc, 2003 – 2006 |

Julie A. Schertell Age: 55 Director Since: 2022  | | | Business Experience: |

| | • President & Chief Executive Officer of the Company, since July 2022 • President & Chief Executive Officer, Neenah, Inc., a global manufacturer of specialty materials, May 2020 – July 2022 • Chief Operating Officer of Neenah, Inc., January 2020 – May 2020 • Various leadership roles at Neenah, Inc., 2008 – 2020 | ||

| | |||

| | Public Company Directorships: | ||

| | • Director of the Ingersoll Rand Company, since 2023 • Director, Neenah Inc., 2020 – 2022 |

Skills and Experience | | | W. Cook | | | J. Keenan | | | M. Levi | | | K. Ritrievi | | | J. Rogers | | | J. Schertell | | | S. Singhal | | | A. Warlick |

Current/Former CEO | | | X | | | X | | | X | | | | | X | | | X | | | X | | | X | |

Public Company Board Experience | | | X | | | X | | | X | | | X | | | X | | | X | | | | | X | |

Strategic Leadership | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X |

Audit/Accounting/ Financial Statements | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X |

M&A/Integration/ Transformation | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X |

Industrial/ Manufacturing Sector Experience | | | X | | | X | | | X | | | | | | | X | | | X | | | X | ||

International Experience | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | X |

Investor Relations | | | X | | | X | | | X | | | X | | | X | | | X | | | X | | | |

Innovation/R&D | | | X | | | | | X | | | X | | | | | X | | | X | | | X | ||

Human Capital | | | X | | | | | X | | | X | | | X | | | X | | | X | | | X | |

Executive Compensation | | | X | | | | | X | | | | | | | X | | | X | | | X | |||

Advertising/ Marketing/Sales | | | | | | | X | | | | | | | X | | | X | | | X | ||||

Communications | | | | | | | X | | | | | | | X | | | X | | | X | ||||

Enterprise Risk Management | | | X | | | X | | | | | X | | | X | | | X | | | | | X | ||

Legal/Regulatory | | | | | X | | | | | | | | | | | X | | | X | |||||

ESG/Sustainability | | | | | X | | | X | | | X | | | | | X | | | X | | | X |

Attributes | | | W. Cook | | | J. Keenan | | | M. Levi | | | K. Ritrievi | | | J. Rogers | | | J. Schertell | | | S. Singhal | | | A. Warlick |

Gender Diversity | | | | | | | | | | | | | | | | | ||||||||

Male | | | X | | | X | | | X | | | | | X | | | | | X | | | X | ||

Female | | | | | | | | | X | | | | | X | | | | | ||||||

Racial Diversity | | | | | | | | | | | | | | | | | ||||||||

Asian/Pacific Islander | | | | | | | | | | | | | | | X | | | |||||||

White/Caucasian | | | X | | | X | | | X | | | X | | | X | | | X | | | | | X |

| | |  | | |  | | |  |

Julie Schertell President and Chief Executive Officer | | | Greg Weitzel(2) Chief Financial Officer | | | Mark W. Johnson(3) Chief Legal and Administrative Officer and Corporate Secretary | | | Michael W. Rickheim Chief Human Resources and Communications Officer |

| (1) | For 2023, the Company’s Named Executive Officers also included R. Andrew Wamser, Jr., Former Chief Financial Officer, and Ricardo Nuñez, Former Chief Legal Officer, Secretary and Chief Compliance Officer (both not pictured above). Messrs. Wamser and Nuñez separated from the Company, effective April 1, 2023 and September 1, 2023, respectively. Please see “Wamser and Nuñez Separation Agreements” and “Potential Payments Upon Termination or Change in Control” below for additional information regarding Messrs. Wamser’s and Nuñez’s separation benefits. |

| (2) | Mr. Weitzel was appointed Chief Financial Officer, effective April 2, 2023. |

| (3) | Mr. Johnson commenced employment with the Company on September 1, 2023. |

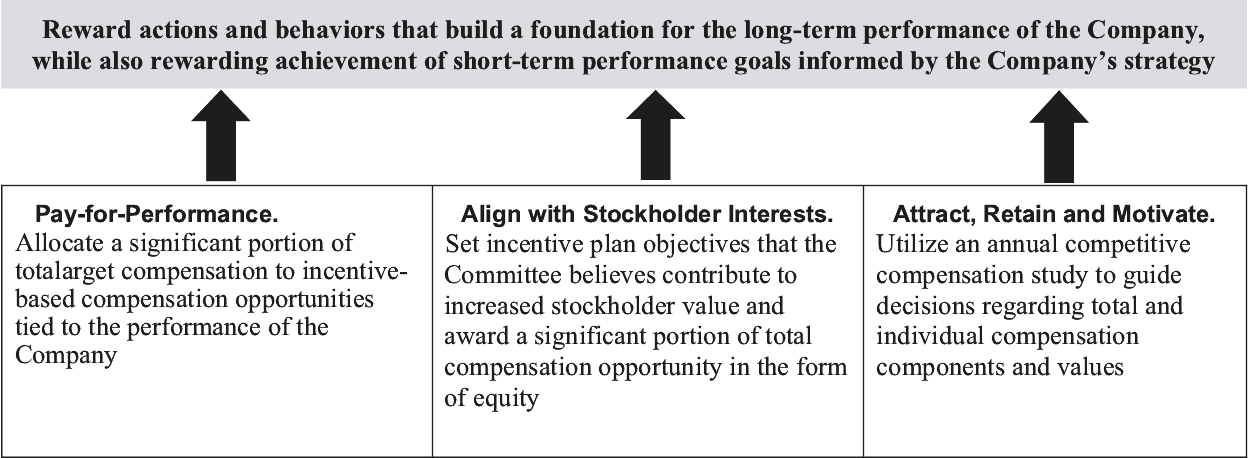

In 2023, in a non-binding advisory vote, the Board asked the Company’s stockholders to indicate whether they approved the Company’s compensation program for its Named Executive Officers, as disclosed in the 2023 proxy statement (“say on pay”). At its 2023 Annual Meeting of Stockholders, the Company’s stockholders approved the compensation program for its Named Executive Officers, with approximately 98% of the votes cast in favor of the say on pay proposal, which was generally consistent with the support we received on average for the three previous say on pay proposals of 97%. | | |  |

| | What We Do: | | |||||||||

| | ✔ | | | A significant portion of the Named Executive Officers’ compensation is delivered in the form of variable compensation that is connected to actual performance. | | | ✔ | | | Annual compensation risk assessment. | |

| | ✔ | | | Maximum payout caps for annual and long-term incentive compensation. | | | ✔ | | | Annual peer group review. | |

| | ✔ | | | Linkage between quantitative performance measures for incentive compensation and operating objectives. | | | ✔ | | | TSR modifier applicable to 2023 performance-based equity awards. | |

| | ✔ | | | Independent compensation consultant reporting directly to the Committee and providing no other services to the Company. | | | ✔ | | | Clawback policies. | |

| | ✔ | | | Robust stock ownership guidelines for Named Executive Officers. | | | | | | ||

| | What We Don’t Do: | | |||

| | ✘ | | | Change-in-control tax gross-ups. | |

| | ✘ | | | “Single trigger” vesting of equity awards in the event of a change-in-control. | |

| | ✘ | | | Re-price stock options or buy-back equity grants. | |

| | ✘ | | | Allow directors and key executives (including its Named Executive Officers) to hedge or pledge their Company securities. | |

| | ✘ | | | Executive employment contracts unless required by local law. | |

| | ✘ | | | Excessive perquisites. | |

| | | | Annual Pay Element* | | ||||||||||

| | | | Salary | | | Short-Term Incentive Plan | | | Service-Based Restricted Stock Units | | | Performance-Based Restricted Stock Units | | |

| | Who Receives | | |  | | |||||||||

| | When Granted | | |  | | |||||||||

| | Form of Delivery | | |  | | |||||||||

| | Why We Pay | | | Establish a pay foundation at competitive levels to attract and retain talented executives | | | Motivate and reward executives for performance related to key financial performance metrics Hold executives accountable, with payouts varying from target based on actual performance against pre-established and communicated performance goals | | | Align the interests of executives with those of the Company’s stockholders by subjecting payout to fluctuations in the Company’s stock price performance Competitive with market practices in order to attract and retain top executive talent | | | Align the interests of executives with those of the Company’s stockholders by focusing the executives on the Company’s financial performance over the performance period and further subjecting payout to fluctuations in the Company’s stock price performance Competitive with market practices in order to attract and retain top executive talent | |

| | Vesting/Performance Period | | | n/a | | | 1 year | | | 3 years pro-rata | | | 3 years cliff | |

| | | | Annual Pay Element* | | ||||||||||

| | | | Salary | | | Short-Term Incentive Plan | | | Service-Based Restricted Stock Units | | | Performance-Based Restricted Stock Units | | |

| | How Target and Payout Are Determined | | | Committee determines amounts and considers Chief Executive Officer recommendations for other Named Executive Officers Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant | | | Committee determines target amounts and considers Chief Executive Officer recommendations for other Named Executive Officers Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant Committee determines performance objectives and evaluates performance against objectives | | | Committee determines target amounts and considers Chief Executive Officer recommendations for other Named Executive Officers Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant | | | Committee determines target amounts and considers Chief Executive Officer recommendations for other Named Executive Officers Factors considered include individual and Company performance, compensation paid to similarly situated executives at the Company, competitive market median, and input from the independent compensation consultant Committee determines performance objectives and evaluates performance against objectives | |

| | Performance Measures | | | Individual | | | EBITDA, Synergies Achieved, Safety Scorecard | | | Change in Company stock price | | | Free Cash Flow as a Percent of Net Sales, Return on Invested Capital, Relative TSR | |

| * | Excludes sign-on compensation awarded to Mr. Johnson in connection with the commencement of his employment, as described below under “Mark W. Johnson New Hire Compensation.” |

Name | | | 2022 Annual Base Salary (July 6, 2022 – December 31, 2022) | | | 2023 Annual Base Salary |

Julie Schertell | | | $925,000 | | | $925,000 |

Greg Weitzel(1) | | | $275,000 | | | $425,000 |

Mark W. Johnson(2) | | | N/A | | | $470,000 |

Michael W. Rickheim | | | $425,000 | | | $425,000 |

R. Andrew Wamser, Jr.(3) | | | $575,000 | | | $575,000 |

Ricardo Nuñez(3) | | | $500,000 | | | $500,000 |

| (1) | Mr. Weitzel’s 2023 annual base salary represents his annual base salary, effective April 2, 2023. |

| (2) | Mr. Johnson’s 2023 annual base represents his annual base salary, effective September 1, 2023. |

| (3) | Messrs. Wamser and Nuñez ceased serving as employees of the Company, effective April 1, 2023 and September 1, 2023, respectively. The amounts reflected in the table above reflect their annualized base salary levels for 2023. Base salary amounts received by Messrs. Wamser and Nuñez accounted for time actually served in their respective roles during 2023. |

Name | | | 2022 Post-Merger Target Bonus (% of Base Salary) | | | 2023 Target Bonus (% of Base Salary) |

Julie Schertell | | | 115% | | | 115% |

Greg Weitzel(1) | | | 40% | | | 65% |

Mark W. Johnson | | | N/A | | | 65% |

Michael W. Rickheim | | | 65% | | | 65% |

R. Andrew Wamser, Jr.(2) | | | 75% | | | 75% |

Ricardo Nuñez(2) | | | 65% | | | 65% |

| (1) | Mr. Weitzel’s 2023 target award opportunity was pro-rated to reflect his target award opportunities in effect both prior to and after his promotion. |

| (2) | Pursuant to the terms of the Schweitzer-Mauduit International, Inc. 2016 Executive Severance Plan (the “SWM Executive Severance Plan”), Messrs. Wamser and Nuñez were entitled to receive a pro-rated target bonus for 2023 in connection with their separations from the Company. Accordingly, Messrs. Wamser and Nuñez received payouts equal to $107,813 and $216,667, respectively, pursuant to the terms of the SWM Executive Severance Plan. |

| | | 2023 Objectives(1) | |||||||

MEASUREMENT METRICS | | | Threshold (50%) | | | Target (100%) | | | Maximum (200%)(2) |

70% EBITDA Delivered(3) ($ in millions) | | | $372.0 | | | $408.0 | | | $460.0 |

20% Synergies Achieved(4) ($ in millions) | | | $20.0 | | | $25.0 | | | $40.0 |

10% Safety Scorecard(5) | | | 80% | | | 90% | | | 100% |

| (1) | For any actual performance which falls between two defined payout thresholds, the payout with respect to such performance criteria is determined using straight-line interpolation. |

| (2) | Achievement of the maximum performance level would result in a payout of 200% of target for the EBITDA Delivered and Synergies Achieved metrics and 125% of target for the Safety Scorecard metric. |

| (3) | EBITDA Delivered is determined on a consolidated basis for continuing operations and consists of the sum of (a) Net Income, (b) interest expense, (c) depreciation and amortization expense, and (d) taxes. For these purposes, “Net Income” does not include (a) any extraordinary gains or losses, (b) any nonrecurring gains or losses, (c) any gains or losses from asset sales, or (d) any facility/asset closure or restructuring costs. In accordance with the adjustment provisions included in the terms of the 2023 STIP related to the divestiture of our Engineered Paper business, EBITDA Delivered excludes the direct impact of (a) gain recognized from the sale, (b) acquisition, divestiture and/or restructuring costs, and (iii) realized synergies directly related to the Engineered Paper business. |

| (4) | Synergies Achieved is the year-over-year impact to EBITDA , resulting from cost synergy initiatives, excluding (i) any value creation resulting from Synergies Achieved below EBITDA other than the impact of any lower expenses incurred in respect of long-term incentive awards), and (ii) cash flow synergies. |

| (5) | Safety Scorecard is intended to focus the Named Executive Officers on the leading indicators of proactive risk reduction and is measured based on achievement with respect to certain goals relating to ergonomic risk assessments, job safety analysis, leader effectiveness in managing safety and pre-task risk assessments. |

| | | January 2023 – July 2023 Objectives | | | Results | ||||||||||

MEASUREMENT METRICS | | | Threshold (50%) | | | Target (100%) | | | Maximum (200%) | | | Actual Performance | | | Attainment Percentage |

EBITDA Delivered ($ in millions) | | | $221.0 | | | $242.0 | | | $273.0 | | | Below Threshold | | | 0.0% |

| | | August 2023 – December 2023 Objectives | | | Results | ||||||||||

MEASUREMENT METRICS | | | Threshold (50%) | | | Target (100%) | | | Maximum (200%) | | | Actual Performance | | | Attainment Percentage |

EBITDA Delivered ($ in millions) | | | $107.0 | | | $117.0 | | | $132.0 | | | Below Threshold | | | 0.0% |

Name | | | 2023 Target Bonus (% of Base Salary)(1) | | | 2023 Target Bonus Award Opportunity ($) | | | Final 2023 Bonus ($) | | | Final 2023 Bonus as a % of Target |

Julie Schertell | | | 115% | | | 1,063,750 | | | 425,500 | | | 40% |

Greg Weitzel | | | 65% | | | 249,760(2) | | | 99,904 | | | 40% |

Mark W. Johnson | | | 65% | | | 102,112(3) | | | 40,845 | | | 40% |

Michael W. Rickheim | | | 65% | | | 276,250 | | | 110,500 | | | 40% |

| (1) | Amounts are based on the base salaries in effect as of December 31, 2023. |

| (2) | Mr. Weitzel’s target award opportunity was pro-rated based on his target award opportunities in effect both prior to and after his promotion. |

| (3) | Mr. Johnson’s target cash incentive award opportunity was pro-rated based on his commencement date of September 1, 2023. |

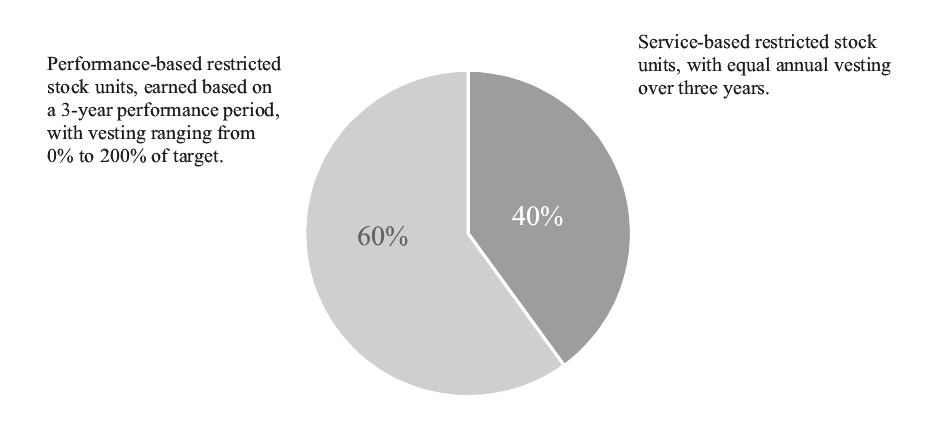

Name | | | 2022 Target LTIP (% of 2022 Base Salary) | | | 2023 Target LTIP (% of 2023 Base Salary) |

Julie Schertell | | | 324% | | | 324% |

Greg Weitzel | | | 40% | | | 125% |

Michael W. Rickheim | | | 100% | | | 100% |

R. Andrew Wamser, Jr. | | | 150% | | | 175% |

Ricardo Nuñez | | | 100% | | | 125% |

Name | | | Target LTIP (% of 2023 Base Salary) | | | Target LTIP Award Opportunity ($) | | | 2023 PSUs (Number of Target Shares) | | | 2023 Service-Based RSUs (Number of Shares) |

Julie Schertell | | | 324% | | | 2,997,000 | | | 72,171 | | | 48,114 |

Greg Weitzel | | | 125% | | | 531,250(1) | | | 12,790 | | | 8,527 |

Michael W. Rickheim | | | 100% | | | 425,000 | | | 10,234 | | | 19,330 |

R. Andrew Wamser, Jr.(2) | | | 175% | | | 1,006,250 | | | 24,231 | | | 16,154 |

Ricardo Nuñez(2) | | | 125% | | | 625,000 | | | 15,050 | | | 10,033 |

| (1) | Mr. Weitzel was granted long-term incentive awards with a target value of $110,000 in February 2023 and was granted additional long-term incentive awards in April 2023 with a target value of $421,250 in connection with his promotion to Chief Financial Officer. |

| (2) | Mr. Wamser and Mr. Nuñez forfeited their 2023 long-term incentive awards upon their separations from the Company. |

| | | 2023 | | | 2024 | | | 2025 | ||||||||||||||||||||||||||||

| | | Minimum (50%) | | | Target (100%) | | | Maximum (200%) | | | Actual | | | Minimum (50%) | | | Target (100%) | | | Maximum (200%) | | | Actual | | | Minimum (50%) | | | Target (100%) | | | Maximum (200%) | | | Actual | |

Free Cash Flow as a Percent of Net Sales | | | 3.0% | | | 5.0% | | | 7.0% | | | Below Threshold | | | * | | | * | | | * | | | * | | | * | | | * | | | * | | | * |

ROIC | | | 6.0% | | | 7.5% | | | 9.0% | | | Below Threshold | | | * | | | * | | | * | | | * | | | * | | | * | | | * | | | * |

Payout Result | | | | | | | | | 0% | | | | | | | | | * | | | | | | | | | * | |||||||||

Relative TSR Result | | |  | |||||||||||||||||||||||||||||||||

| * | Performance goals for the 2024 performance year were established at the beginning of 2024 and will be disclosed in next year’s proxy statement. Performance goals for the 2025 performance year will be established at the beginning of 2025. |

What Counts Toward the Guidelines | | | What Does Not Count Toward the Guidelines | ||||||

✔ | | | Shares owned outright (including through vesting of equity awards) | | | ✘ | | | Performance shares and performance-based restricted stock units |

✔ | | | Shares owned directly by a spouse, domestic partner, or minor child | | | ✘ | | | Service-based restricted stock and restricted stock units |

✔ | | | Shares owned indirectly through beneficial trust ownership | | | ✘ | | | Stock options (whether vested or unvested) |

✔ | | | Vested shares or stock units held in any Company equity plan, employee stock purchase plan, deferred compensation plan, retirement plan or similar Company plan | | | | | ||

Market Review | | | Internal Review | | | Pay Decisions |

• Performed by independent compensation consultant • Considers peer pay practices • Influences program design | | | • Chief Executive Officer evaluates performance • Chief Executive Officer and management review market data and internal comparable roles • Chief Executive Officer recommends to the Committee program changes and any pay adjustments | | | • Chief Executive Officer and management recommend to the Committee any program changes • Chief Executive Officer recommends pay adjustments • Committee carefully considers: ○ Historical and current market practices, ○ Internal pay equity, and ○ Established market trends • Committee approves any program and pay changes |

Peer Companies | |||

AptarGroup, Inc. | | | Greif, Inc. |

Ashland Global Holdings, Inc. | | | H.B. Fuller Company |

Avient Corporation (f/k/a PolyOne Corporation) | | | Ingevity Corporation |

Axalta Coating Systems Ltd. | | | Innospec Inc. |

Cabot Corporation | | | Mercer International Inc. |

Clearwater Paper Corporation | | | Minerals Technologies Inc. |

Donaldson Company, Inc. | | | Rayonier Advanced Materials Inc. |

Glatfelter Corporation | | | Trinseo PLC |

| • | base salary; |

| • | annual incentive bonus (assuming attainment of the target objective level, as a percentage of base salary); |

| • | target total cash compensation (base salary plus target level annual incentive); |

| • | long-term incentive compensation (assuming attainment of the target objective level); and |

| • | target total direct compensation, which is the sum of base salary plus annual incentive plus long-term incentive compensation at the target levels. |

Name and principal position (a) | | | Year (b) | | | Salary ($) (c) | | | Bonus ($) (d)(1) | | | Stock Awards ($) (e)(2) | | | Option Awards ($) (f) | | | Non–Equity Incentive Plan Compensation ($) (g)(3) | | | Change in Pension Value and Non– qualified Deferred Compensation Earnings ($) (h)(3) | | | All Other Compensation ($) (i)(4) | | | Total ($) (j) |

Julie Schertell President and Chief Executive Officer | | | 2023 | | | 925,000 | | | — | | | 1,800,426 | | | — | | | 425,500 | | | — | | | 302,736 | | | 3,453,662 |

| | 2022 | | | 436,290 | | | — | | | 1,790,000 | | | — | | | 1,106,971 | | | — | | | 142,782 | | | 3,476,043 | ||

| | | | | | | | | | | | | | | | | | | ||||||||||

Gregory Weitzel Chief Financial Officer | | | 2023 | | | 387,500 | | | 182,031 | | | 283,712 | | | — | | | 99,904 | | | — | | | 47,052 | | | 1,000,199 |

| | | | | | — | | | | | — | | | | | — | | | | | ||||||||

| | | | | | | | | | | | | | | | | | | ||||||||||

Michael W. Rickheim Chief Human Resources Officer and Administrative Officer | | | 2023 | | | 425,000 | | | — | | | 255,279 | | | — | | | 110,500 | | | — | | | 75,734 | | | 866,513 |

| | 2022 | | | 201,882 | | | — | | | 822,428 | | | — | | | 307,377 | | | — | | | 45,943 | | | 1,377,630 | ||

| | | | | | | | | | | | | | | | | | | ||||||||||

Mark W. Johnson Chief Legal and Administrative Officer & Corporate Secretary | | | 2023 | | | 155,462 | | | 100,000 | | | 300,002 | | | — | | | 40,845 | | | — | | | 11,463 | | | 607,772 |

| | | | | | | | | | | | | | | | | | | ||||||||||

R. Andrew Wamser, Jr. Former Executive Vice President, Finance and Chief Financial Officer(5) | | | 2023 | | | 143,750 | | | — | | | 603,837 | | | — | | | — | | | — | | | 3,497,333 | | | 4,244,920 |

| | 2022 | | | 531,731 | | | — | | | 3,195,831 | | | — | | | 488,901 | | | — | | | 177,813 | | | 4,394,276 | ||

| | 2021 | | | 471,636 | | | — | | | 751,999 | | | — | | | 227,957 | | | — | | | 101,514 | | | 1,553,106 | ||

| | | | | | | | | | | | | | | | | | | ||||||||||

Ricardo Nuñez Former Executive Vice President, General Counsel and Secretary(5) | | | 2023 | | | 336,538 | | | — | | | 375,021 | | | — | | | — | | | — | | | 3,398,851 | | | 4,110,410 |

| | 2022 | | | 489,904 | | | — | | | 2,261,378 | | | — | | | 391,605 | | | — | | | 131,805 | | | 3,274,692 | ||

| | 2021 | | | 468,383 | | | — | | | 506,775 | | | — | | | 208,971 | | | — | | | 90,623 | | | 1,274,752 |

| (1) | For Mr. Weitzel, the amount reflected in this column for 2023 represents a retention bonus of $97,031 and a bonus of $85,000 paid to him in recognition of his efforts related to the divestiture of our Engineered Paper business. The amount reflected for Mr. Johnson for 2023 represents a sign-on bonus. See discussion above in the Compensation Discussion and Analysis. |

| (2) | The amounts reported in this column for 2023 represent the annual grants of PSUs and RSUs, valued in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation-Stock Compensation (“FASB ASC Topic 718”). The amounts included in this column for the PSU awards granted in 2023 are calculated based on the probable satisfaction of the performance conditions for such awards at the time of grant. See Note 19 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 for a discussion of the relevant assumptions used in calculating the amounts reported for the applicable year. As disclosed in the Compensation Discussion and Analysis, for the 2023 PSUs, the Compensation Committee established the performance goals for the first year of the three-year performance period with the annual goals for the subsequent years in the three-year performance period to be set at the beginning of each applicable year during the performance period. In accordance with FASB ASC Topic 718, the value of the 2023 PSUs is based on one-third of the full number of shares subject to the 2023 PSUs for which the performance goals were established in 2023. The remaining portion of the 2023 PSUs that will be linked to goals for subsequent years will be reported in the Summary Compensation Table for those years in which the goals are established. Assuming the highest level of performance is achieved for the 2023 PSUs, the maximum value for the one-third portion of the 2023 PSUs granted in 2023 under FASB ASC Topic 718 would be as follows: |

Name | | | Maximum Value ($) |

Ms. Schertell | | | 1,443,420 |

Mr. Weitzel | | | 226,915 |

Mr. Rickheim | | | 204,660 |

Mr. Wamser, Jr. | | | 483,069 |

Mr. Nuñez | | | 299,997 |

| (3) | The amounts reported in this column for 2023 represent annual incentive awards earned based on 2023 performance for each Named Executive Officer. |

| (4) | The amounts reported in this column for 2023 for each Named Executive Officer includes the following: |

Name | | | Company contributions to qualified and nonqualified retirement plans ($) | | | Dividends/dividend equivalents paid at vesting ($) | | | Amounts paid due to separation(a) ($) | | | Other Executive Benefits(b) ($) | | | Total ($) |

Julie Schertell | | | 149,571 | | | 138,165 | | | — | | | 15,000 | | | 302,736 |

Gregory Weitzel | | | 23,320 | | | 12,193 | | | — | | | 11,539 | | | 47,052 |

Michael W. Rickheim | | | 35,100 | | | 24,914 | | | — | | | 15,720 | | | 75,734 |

Mark W. Johnson | | | 4,338 | | | 1,933 | | | — | | | 5,192 | | | 11,463 |

R. Andrew Wamser, Jr. | | | 17,400 | | | 35,266 | | | 3,444,676 | | | — | | | 3,497,333 |

Ricardo Nuñez | | | 17,400 | | | 50,369 | | | 3,331,082 | | | — | | | 3,398,851 |

| (a) | These amounts include the following: |

Name | | | Cash Severance ($) | | | Vacation Payout ($) | | | Benefits Continuation ($) | | | Total ($) |

R. Andrew Wamser, Jr. | | | 3,326,192 | | | 24,880 | | | 93,595 | | | 3,444,876 |

Ricardo Nuñez | | | 3,199,747 | | | 37,740 | | | 93,595 | | | 3,331,082 |

| (b) | The amounts reported in this column include monthly executive benefits allowance for Ms. Schertell, Mr. Weitzel, Mr. Rickheim, and Mr. Johnson for items such as tax services, executive physical, and financial planning and also includes health club dues for Mr. Rickheim. |

| (5) | The last dates of employment for Messrs. Wamser and Nunez were April 1, 2023 and September 1, 2023, respectively. |

| (6) | The amounts reported for 2022 have been updated for Messrs. Wamser and Nuñez to reflect $45,358 and $37,523, respectively, of additional annual incentive bonus that was paid in recognition of 2022 performance and which was excluded from the 2022 Summary Compensation Table. |

Name | | | Grant Date | | | Approval Date | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards (a) | | | Estimated Future Payouts Under Equity Incentive Plan Awards (b)[1] | | | All Other Stock Awards: Number of Shares of Stocks or Units (c) | | | Grant Date Fair Value of Stock and Option Awards(1) | ||||||||||||

| | | | | | | Threshold(2) ($)(d) | | | Target(2) ($)(e) | | | Maximum(2) ($)(f) | | | Threshold (#)(g) | | | Target (#)(h) | | | Maximum (#)(i) | | | (#)(j) | | | ($)(k) | |||

Julie Schertell | | | N/A(2) | | | | | 531,875 | | | 1,063,750 | | | 2,047,719 | | | — | | | — | | | — | | | — | | | — | |

| | 2/16/2023(3) | | | 2/13/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 48,114 | | | 1,199,001 | ||

| | 2/16/2023(4) | | | 2/13/2023 | | | — | | | — | | | — | | | 12,029 | | | 24,057 | | | 48,114 | | | — | | | 601,425 | ||

Gregory Weitzel | | | N/A(2) | | | | | 124,880 | | | 249,760 | | | 480,788 | | | — | | | — | | | — | | | — | | | — | |

| | 2/16/2023(3) | | | 2/13/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,765(3) | | | 43,984 | ||

| | 2/16/2023(4) | | | 2/13/2023 | | | — | | | — | | | — | | | 441 | | | 882 | | | 1,764 | | | — | | | 21,979 | ||

| | 4/2/2023(3) | | | 3/13/2023(5) | | | — | | | — | | | — | | | — | | | — | | | — | | | 6,762 | | | 145,180 | ||

| | 4/2/2023(3) | | | 3/13/2023(5) | | | — | | | — | | | — | | | 1,690 | | | 3,380 | | | 6,760 | | | — | | | 72,569 | ||

Michael Rickheim | | | N/A(2) | | | | | 138,125 | | | 276,250 | | | 531,781 | | | — | | | — | | | — | | | — | | | — | |

| | 2/16/2023(3) | | | 2/13/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 6,822 | | | 170,004 | ||

| | 2/16/2023(4) | | | 2/13/2023 | | | — | | | — | | | — | | | 1,706 | | | 3,411 | | | 6,822 | | | — | | | 85,275 | ||

Mark Johnson | | | N/A(2) | | | | | 51,056 | | | 102,112 | | | 196,566 | | | — | | | — | | | — | | | — | | | — | |

| | 9/1/2023(3) | | | 8/1/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 19,330 | | | 300,002 | ||

R. Andrew Wamser, Jr. | | | N/A(6) | | | | | 215,625 | | | 431,250 | | | 830,156 | | | — | | | — | | | — | | | — | | | — | |

| | 2/16/2023(3) | | | 2/13/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 16,154 | | | 402,558 | ||

| | 2/16/2023(4) | | | 2/13/2023 | | | — | | | — | | | — | | | 4,039 | | | 8,077 | | | 16,154 | | | — | | | 201,279 | ||

Ricardo Nuñez | | | N/A(6) | | | | | 162,500 | | | 325,000 | | | 625,625 | | | — | | | — | | | — | | | — | | | — | |

| | 2/16/2023(3) | | | 2/13/2023 | | | — | | | — | | | — | | | — | | | — | | | — | | | 10,033 | | | 250,022 | ||

| | 2/16/2023(4) | | | 2/13/2023 | | | — | | | — | | | — | | | 2,508 | | | 5,016 | | | 10,032 | | | — | | | 124,999 | ||

| (1) | The amounts shown in this column are valued based on the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 and, in the case of the PSUs, are based upon the probable outcome of the applicable performance conditions. See Note 19 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, for a discussion of the relevant assumptions used in calculating the amounts. |

| (2) | The amounts in columns (d), (e) and (f) consist of the threshold, target and maximum cash award levels. The amount actually earned by each continuing Named Executive Officer is included in the Non-Equity Incentive Plan Compensation column in the 2023 Summary Compensation Table. |

| (3) | These amounts in column (j) represent shares of service-based RSUs which vest pro rata over three years on each anniversary of the date of grant except that Mr. Weitzel's April 2023 grant will vest on the same dates as his February 2023 grant. |

| (4) | The amounts in columns (g), (h) and (i) consist of the threshold, target and maximum PSUs that can be earned during the 2023-2025 performance period based on the Company’s free cash flow as a Percentage of Net Sales and ROIC, subject to a +/- 20% modifier based on the Company’s relative TSR performance. As noted above, the Compensation Committee established the performance goals for the first year of the three-year performance period with the annual goals for the subsequent years in the three-year performance period to be set at the beginning of each applicable year during the performance period. In accordance with FASB ASC Topic 718, reported in this table is one-third of the full number of shares subject to the 2023 PSUs for which performance goals were established in 2023. |

| (5) | These grants for Mr. Weitzel were approved by the Compensation Committee on March 13, 2023, to coincide with Mr. Weitzel’s promotion to the Chief Financial Officer position, effective April 2, 2023. |

| (6) | The amounts in columns (d), (e) and (f) consist of the threshold, target and maximum cash award levels for a full year of participation. Because the individuals terminated employment during the year they received a prorated amount of target in connection with their separations from the Company. |

Name | | | Option Awards | | | Stock Awards | |||||||||||||||||||||

| | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(1) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(1) | ||

Julie Schertell | | | 5,934 | | | — | | | — | | | 31.54 | | | 1/27/2024 | | | — | | | — | | | — | | | — |

| | 5,948 | | | — | | | — | | | 43.98 | | | 1/26/2025 | | | — | | | — | | | — | | | — | ||

| | 8,142 | | | — | | | — | | | 42.68 | | | 1/25/2026 | | | — | | | — | | | — | | | — | ||

| | 9,621 | | | — | | | — | | | 60.50 | | | 1/29/2027 | | | — | | | — | | | — | | | — | ||

| | 9,758 | | | — | | | — | | | 68.75 | | | 1/29/2028 | | | — | | | — | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 4,613(2) | | | 70,625 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 32,285(2) | | | 494,283 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 11,812(3) | | | 180,842 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 41,341(4) | | | 632,931 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 75,944(5) | | | 1,162,703 | ||

| | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 24,057(6) | | | 368,313 | ||

| | — | | | — | | | — | | | — | | | — | | | 48,114(7) | | | 736,625 | | | — | | | — | ||

Gregory Weitzel | | | 382 | | | — | | | — | | | 43.98 | | | 1/26/2025 | | | — | | | — | | | — | | | — |

| | 1,066 | | | — | | | — | | | 42.68 | | | 1/25/2026 | | | — | | | — | | | — | | | — | ||

| | 1,116 | | | — | | | — | | | 60.50 | | | 1/29/2027 | | | — | | | — | | | — | | | — | ||

| | 1,006 | | | — | | | — | | | 68.75 | | | 1/29/2028 | | | — | | | — | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 210(2) | | | 3,215 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 1,472(2) | | | 22,536 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 584(3) | | | 8,941 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 2,039(4) | | | 31,217 | | | | | ||||

| | | | | | | | | | | | 1,722(8) | | | 26,364 | | | | | |||||||||

| | | | | | | | | | | | | | | | 882(6) | | | 13,503 | |||||||||

| | | | | | | | | | | | | | | | 3,380(6) | | | 51,748 | |||||||||

| | | | | | | | | | | | 1,765(7) | | | 27,022 | | | | | |||||||||

| | | | | | | | | | | | 6,762(7) | | | 103,526 | | | | | |||||||||

Michael Rickheim | | | — | | | — | | | — | | | — | | | — | | | 741(2) | | | 11,345 | | | — | | | — |

| | — | | | — | | | — | | | — | | | — | | | 5,179(2) | | | 79,290 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 2,011(3) | | | 30,788 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | 7,037(4) | | | 107,736 | | | — | | | — | ||

| | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 34,893(5) | | | 534,212 | ||

| | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 3,411(6) | | | 52,222 | ||

| | — | | | — | | | — | | | — | | | — | | | 6,822(7) | | | 104,445 | | | — | | | — | ||

Mark Johnson | | | — | | | — | | | — | | | — | | | — | | | 19,330(9) | | | 295,942 | | | — | | | — |

| (1) | Values calculated using the December 29, 2023 closing share price of $15.31. |

| (2) | This RSU award vested on February 2, 2024, subject to continued employment through the vesting date. |

| (3) | This RSU award vested or is scheduled to vest 50% on January 26, 2024 and 2025, subject to continued employment through each applicable vesting date. |

| (4) | This RSU award is scheduled to vest 100% on December 31, 2024, subject to continued employment through the vesting date. |

| (5) | This PSU award is scheduled to vest, to the extent earned, on December 31, 2024. The number of PSUs earned will be based on the Company’s Synergy Run Rate Achievement during the period beginning on July 6, 2022 and ending December 31, 2024. Number shown is based on target performance. |

| (6) | This PSU award is scheduled to vest, to the extent earned, on February 16, 2026. The number of PSUs earned will be based on the Company’s Free Cash Flow as a percentage of net sales and ROIC, adjusted for relative TSR performance, over the 2023-2025 fiscal years. Number shown is based on target performance. Excluded from this table are 48,114, 8,528, and 6,823 PSUs (at target) for Ms. Schertell, Mr. Weitzel, and Mr. Rickheim, respectively, with respect to the portion of the 2023 PSUs associated with performance goals established in 2024 and 2025. |

| (7) | This RSU award vested or is scheduled to vest one-third on February 16, 2024, 2025 and 2026, subject to continued employment through each applicable vesting date. |

| (8) | This RSU award is scheduled to vest 50% on April 14, 2024 and 2025, subject to continued employment through each applicable vesting date. |

| (9) | This RSU award is scheduled to vest one-third on September 1, 2024, 2025 and 2026, subject to continued employment through each applicable vesting date. |

| | | Option Awards | | | Stock Awards | |||||||

Name | | | Number of Shares Acquired on Exercise (#) | | | Value Realized on Exercise ($) | | | Number of Shares Acquired on Vesting (#) | | | Value Realized on Vesting ($) |

Julie Schertell | | | 6,654 | | | 22,625 | | | 5,772 | | | 280,021 |

Gregory Weitzel | | | — | | | — | | | 1,360 | | | 31,707 |

Michael W. Rickheim | | | — | | | — | | | 9,553 | | | 209,225 |

Mark W. Johnson | | | — | | | — | | | — | | | — |

R. Andrew Wamser, Jr. | | | — | | | — | | | 104,723 | | | 2,420,370 |

Ricardo Nuñez | | | — | | | — | | | 59,978 | | | 1,110,305 |

Name | | | Plan Name | | | Executive contributions in last FY ($)(1) | | | Registrant contributions in last FY ($)(2) | | | Aggregate earnings in last FY ($) | | | Aggregate withdrawals / distributions | | | Aggregate balance at last FYE ($)(3) |

Julie Schertell | | | SRP | | | — | | | 134,542 | | | 19,574 | | | — | | | 185,785 |

Gregory Weitzel | | | SRP | | | — | | | 15,128 | | | 1,174 | | | — | | | 16,302 |

Michael W. Rickheim | | | NDP | | | — | | | — | | | 5,361 | | | — | | | 30,691 |

| | DCP | | | 25,500 | | | 15,300 | | | 2,716 | | | — | | | 43,516 | ||

Mark W. Johnson | | | — | | | — | | | — | | | — | | | — | | | — |

R. Andrew Wamser, Jr. | | | DCP | | | 56,630 | | | — | | | 21,358 | | | — | | | 119,663 |

Ricardo Nuñez | | | DCP | | | 56,468 | | | — | | | 16,503 | | | — | | | 121,249 |

| (1) | These amounts represent deferrals of the participating Named Executive Officer’s salary and/or annual incentive compensation received under the annual incentive program and are included in the “Salary” and Non-Equity Incentive Plan Compensation” columns in the 2023 Summary Compensation Table. |

| (2) | Company contributions to the Neenah Deferred Compensation Plan “2” and the Supplemental RCP were 401(k) savings plan contributions that exceeded IRS limitations on qualified plan contributions and are included in the “All Other Compensation” column in the 2022 Summary Compensation Table. |

| (3) | Amounts in this column include the following amounts that were previously reported in the Summary Compensation Table as compensation for: Ms. Schertell — $31,281; Mr. Wamser — $95,546; Mr. Rickheim — $25,250; and Mr. Nuñez — $152,960. All amounts in this column are vested and would be payable in full following any termination. |

| • | Upon termination of a Named Executive Officer’s employment by the Company without “cause” outside of a change of control, such Named Executive Officer will be entitled to an amount equal to one and one-half times his or her base salary. |

| • | Upon termination of the Named Executive Officer’s employment by Neenah without “cause” within the two-year period following a change of control or by the Named Executive Officer for “good reason” within the two-year period following a change of control, the Neenah Severance Plan provides that such terminated Named Executive Officer will be entitled to the sum of: |

| • | two times the sum of his or her annual base salary; |

| • | the amount of his or her annual bonus that he or she has earned through the date of the change of control, plus two times his or her targeted annual bonus; |

| • | any profit-sharing contributions or pension plan benefits forfeited as a result of such termination; |

| • | the amount of profit-sharing contributions and pension plan benefits such participant would have received under the qualified and supplemental retirement plans but for his or her termination for the two-year period following his or her termination; and |

| • | the cost of medical and dental COBRA premiums for a period of two years. |

| | | | | With Change of Control | | | Without Change of Control(1) | ||||||||||||||

Name | | | Compensation Component | | | Retirement | | | Without Cause or Good Reason Termination | | | Death or Disability | | | Retirement | | | Without Cause or Good Reason Termination | | | Death or Disability |

Julie Schertell | | | Cash Severance | | | — | | | 3,977,500 | | | — | | | — | | | 3,977,500 | | | — |

| | Non-Equity Incentive Plan Compensation(2) | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | Long Term Incentives- Performance(3) | | | — | | | 2,267,641 | | | 979,431 | | | — | | | 2,267,641 | | | 979,431 | ||

| | Long Term Incentives- Time Based(3) | | | — | | | 2,115,306 | | | 2,115,306 | | | — | | | 2,115,306 | | | 2,115,306 | ||

| | Benefit Continuation | | | — | | | 208,092 | | | — | | | — | | | 208,092 | | | — | ||

| | Outplacement | | | — | | | 50,000 | | | — | | | — | | | 50,000 | | | — | ||

| | Total: | | | — | | | 8,618,539 | | | 3,094,737 | | | — | | | 8,618,539 | | | 3,094,737 | ||

Gregory Weitzel | | | Cash Severance | | | — | | | 1,402,500 | | | — | | | — | | | 1,402,500 | | | — |

| | Non-Equity Incentive Plan Compensation(2) | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | Long Term Incentives- Performance(3) | | | — | | | 195,815 | | | 59,490 | | | — | | | 195,815 | | | 59,490 | ||

| | Long Term Incentives- Time Based(3) | | | — | | | 222,821 | | | 222,821 | | | — | | | 222,821 | | | 222,821 | ||

| | Benefit Continuation | | | — | | | 116,728 | | | — | | | — | | | 116,728 | | | — | ||

| | Outplacement | | | — | | | 50,000 | | | — | | | — | | | 50,000 | | | — | ||

| | Total: | | | — | | | 1,987,864 | | | 282,311 | | | — | | | 1,987,864 | | | 282,311 | ||

Michael W. Rickheim | | | Cash Severance | | | — | | | 1,402,500 | | | — | | | — | | | 1,402,500 | | | — |

| | Non-Equity Incentive Plan Compensation(2) | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | Long Term Incentives- Performance(3) | | | — | | | 690,894 | | | 343,373 | | | — | | | 690,894 | | | 343,373 | ||

| | Long Term Incentives- Time Based(3) | | | — | | | 333,604 | | | 333,604 | | | — | | | 333,604 | | | 333,604 | ||

| | Benefit Continuation | | | — | | | 46,603 | | | — | | | — | | | 46,603 | | | — | ||

| | Outplacement | | | — | | | 50,000 | | | — | | | — | | | 50,000 | | | — | ||

| | Total: | | | | | 2,523,601 | | | 676,977 | | | | | 2,523,601 | | | 676,977 | ||||

| | | | | With Change of Control | | | Without Change of Control(1) | ||||||||||||||

Name | | | Compensation Component | | | Retirement | | | Without Cause or Good Reason Termination | | | Death or Disability | | | Retirement | | | Without Cause or Good Reason Termination | | | Death or Disability |

Mark W. Johnson | | | Cash Severance | | | — | | | 1,551,000 | | | — | | | — | | | 705,000 | | | — |

| | Non-Equity Incentive Plan Compensation(2) | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | Long Term Incentives- Performance(3) | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | Long Term Incentives- Time Based(3) | | | — | | | 295,942 | | | 295,942 | | | — | | | — | | | 295,942 | ||

| | Benefit Continuation | | | — | | | 46,603 | | | — | | | — | | | — | | | — | ||

| | Outplacement | | | — | | | 50,000 | | | — | | | — | | | 50,000 | | | — | ||

| | Total: | | | — | | | 1,943,545 | | | 295,942 | | | — | | | 755,000 | | | 295,942 | ||

| (1) | Because a change of control occurred at the time of the Merger (July 6, 2022), if any of the Named Executive Officers (except Mr. Johnson) have an involuntary termination without cause or resign for good reason prior to July 6, 2024, they will receive the payments and benefits associated with such terminations following a change of control. Please see above for a description of the payments and benefits that would be provided upon a termination without cause or resignation for good reason absent a change of control. |

| (2) | Because the termination events are assumed to occur on the last business day of the reporting year (2023), the amount of non-equity incentive plan compensation earned and reported in the Summary Compensation Table would be paid without regard to any special termination conditions and are not included in this table. |

| (3) | Represents the value of the accelerated vesting of performance-based or time-based long-term equity awards, as applicable. The value of the accelerated vesting of the equity awards reported in this table is based upon our closing stock price of $15.31 on December 29, 2023, the last trading day of 2023. |

| • | The median of the annual total compensation of all of our employees, other than Ms. Schertell, was $52,497. |

| • | Ms. Schertell’s annual total compensation was $3,456,572, which differs from the amount reported in the Total column of the Summary Compensation Table - 2023, as discussed further below. |

| • | Based on this information, the ratio of the annual total compensation of Ms. Schertell to the median of the annual total compensation of all employees is estimated to be 66 to 1. |

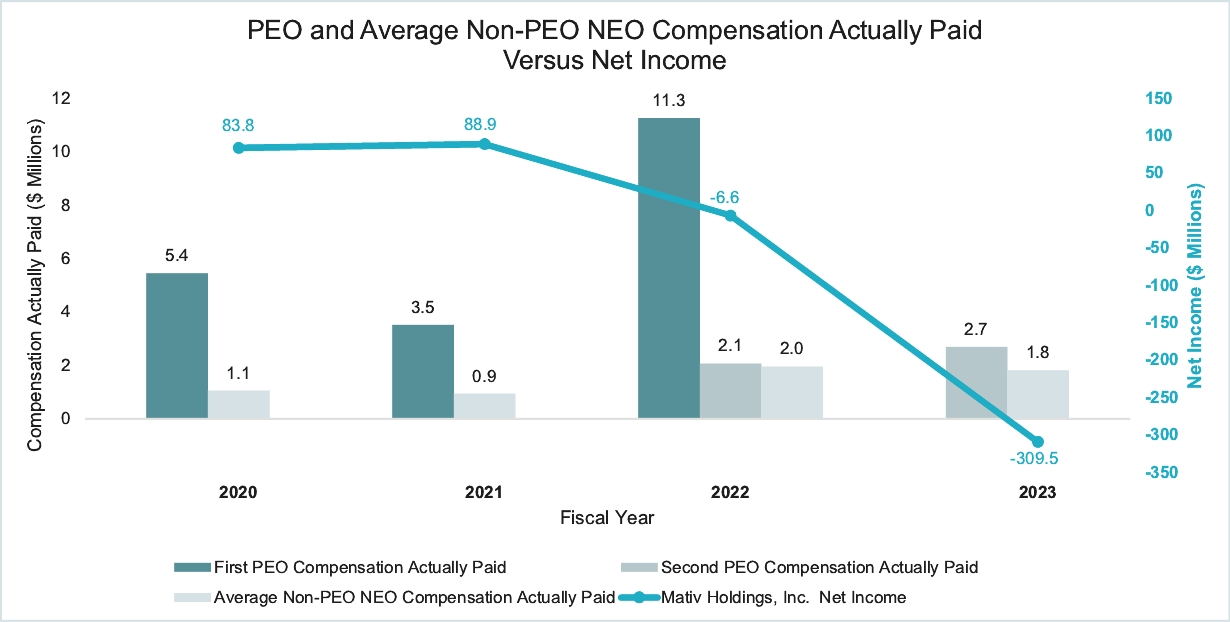

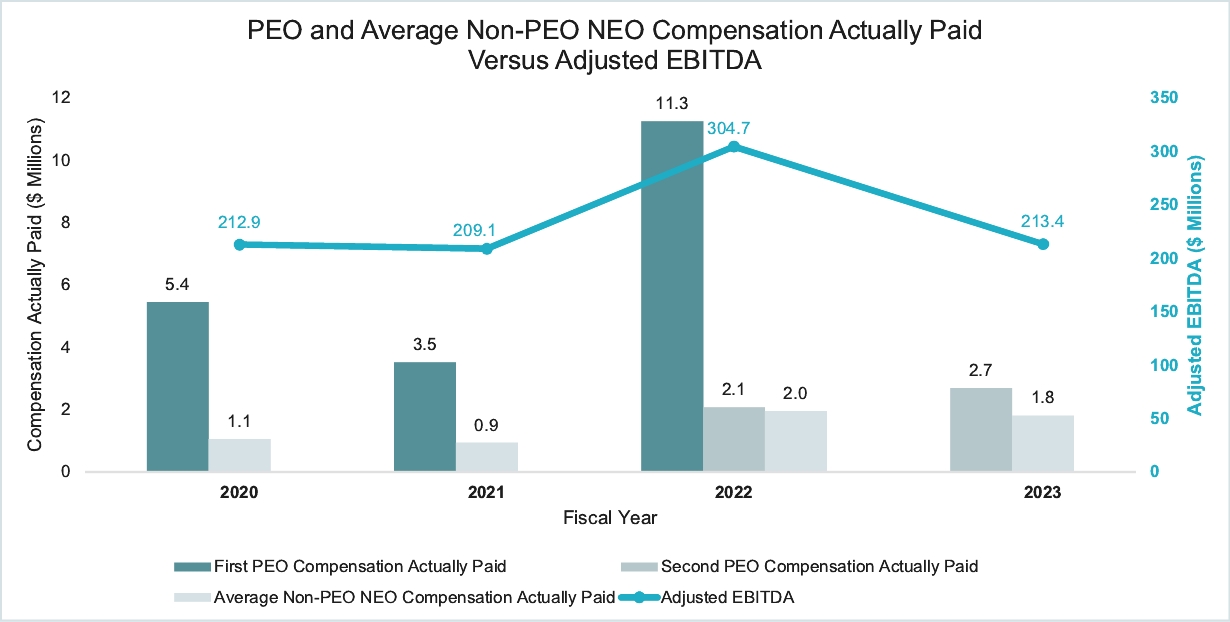

Year | | | Summary Compensation Table Total for First PEO1 ($) | | | Summary Compensation Table Total for Second PEO1 ($) | | | Compensation Actually Paid to First PEO1,2,3 ($) | | | Compensation Actually Paid to Second PEO1,2,3 ($) | | | Average Summary Compensation Table Total for Non-PEO NEOs1 ($) | | | Average Compensation Actually Paid to Non-PEO NEOs1,2,3 ($) | | | Value of Initial Fixed $100 Investment based on:4 | | | Net Income ($ Millions) | | | EBITDA Delivered ($ Millions) | |||

| | TSR ($) | | | Peer Group TSR ($) | | |||||||||||||||||||||||||

2023 | | | — | | | 3,453,662 | | | — | | | 2,691,524 | | | 2,165,963 | | | 1,807,267 | | | 45.40 | | | 163.35 | | | (309.5) | | | 213.4 |

2022 | | | 14,274,246 | | | 3,476,043 | | | 11,257,027 | | | 2,066,898 | | | 3,099,738 | | | 1,952,970 | | | 58.69 | | | 136.06 | | | (6.6) | | | 304.7 |

2021 | | | 5,150,672 | | | — | | | 3,516,159 | | | — | | | 1,290,711 | | | 938,432 | | | 78.52 | | | 144.89 | | | 88.9 | | | 209.1 |

2020 | | | 5,757,874 | | | — | | | 5,448,268 | | | — | | | 1,466,461 | | | 1,052,550 | | | 101.04 | | | 122.35 | | | 83.8 | | | 212.9 |

| 1. | The Principal Executive Officer (“PEO”) and Named Executive Officers for the applicable years were as follows: |

| • | 2023: Julie Schertell (“Second PEO”), served as the Company’s Chief Executive Officer for the entirety of 2023 and the Company’s other Named Executive Officers were: R. Andrew Wamser, Jr.; Gregory Weitzel; Michael W. Rickheim; Mark W. Johnson; and Ricardo Nuñez. |

| • | 2022: Julie Schertell assumed the role of the Company’s President and Chief Executive Officer on July 6, 2022, and Jeffrey Kramer, PhD (“First PEO”), served as the Company’s Chief Executive Officer during 2022 through July 5, 2022. The Company’s other Named Executive Officers were: R. Andrew Wamser, Jr.; Omar Hoek; Ricardo Nuñez; Michael W. Rickheim; and Tracey Peacock. |

| • | 2021: Jeffrey Kramer, PhD, served as the Company’s Chief Executive Officer for the entirety of 2021 and the Company’s other Named Executive Officers were: R. Andrew Wamser, Jr.; Omar Hoek; Ricardo Nuñez; and Tracey Peacock. |

| • | 2020: Jeffrey Kramer, PhD, served as the Company’s Chief Executive Officer for the entirety of 2020 and the Company’s other Named Executive Officers were: R. Andrew Wamser, Jr.; Omar Hoek; Ricardo Nuñez; and Daniel Lister. |

| 2. | The amounts shown for Compensation Actually Paid have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually earned, realized, or received by the Company’s NEOs. These amounts reflect the Summary Compensation Table Total with certain adjustments as described in footnote 3 below. |

| 3. | Compensation Actually Paid reflects the exclusions and inclusions of certain amounts for the PEO and the Non-PEO NEOs as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. Amounts in the Exclusion of Stock Awards column are based on the amounts from the Stock Awards column set forth in the Summary Compensation Table. |

Year | | | Summary Compensation Table Total for Second PEO ($) | | | Exclusion of Stock Awards for Second PEO ($) | | | Inclusion of Equity Values for Second PEO ($) | | | Compensation Actually Paid to Second PEO ($) |

2023 | | | 3,453,662 | | | (1,800,426) | | | 1,038,288 | | | 2,691,524 |

Year | | | Average Summary Compensation Table Total for Non-PEO NEOs ($) | | | Average Exclusion of Stock Awards for Non- PEO NEOs ($) | | | Average Inclusion of Equity Values for Non- PEO NEOs ($) | | | Average Compensation Actually Paid to Non- PEO NEOs ($) |

2023 | | | 2,165,963 | | | (363,570) | | | 4,874 | | | 1,807,267 |

Year | | | Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Second PEO ($) | | | Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards Second PEO ($) | | | Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Second PEO ($) | | | Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Second PEO ($) | | | Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Second PEO ($) | | | Value of Dividends or Other Earnings Paid on Equity Awards Not Otherwise Included for Second PEO ($) | | | Total - Inclusion of Equity Values for Second PEO ($) |

2023 | | | 780,963 | | | 196,804 | | | — | | | 60,521 | | | — | | | — | | | 1,038,288 |

Year | | | Average Year-End Fair Value of Equity Awards Granted During Year That Remained Unvested as of Last Day of Year for Non-PEO NEOs ($) | | | Average Change in Fair Value from Last Day of Prior Year to Last Day of Year of Unvested Equity Awards for Non-PEO NEOs ($) | | | Average Vesting-Date Fair Value of Equity Awards Granted During Year that Vested During Year for Non-PEO NEOs ($) | | | Average Change in Fair Value from Last Day of Prior Year to Vesting Date of Unvested Equity Awards that Vested During Year for Non-PEO NEOs ($) | | | Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs ($) | | | Average Value of Dividends or Other Earnings Paid on Equity Awards Not Otherwise Included for Non-PEO NEOs ($) | | | Total - Average Inclusion of Equity Values for Non-PEO NEOs ($) |

2023 | | | 109,015 | | | 42,608 | | | — | | | 3,274 | | | (150,023) | | | — | | | 4,874 |

| 4. | The Peer Group TSR set forth in this table utilizes the S&P SmallCap 600 Capped Materials Index, which we also utilize in the stock performance graph required by Item 201(e) of Regulation S-K included in our Annual Report for the year ended December 31, 2023. The comparison assumes $100 was invested for the period starting December 31, 2019, through the end of the listed year in the Company and in the S&P SmallCap 600 Capped Materials Index, respectively. Historical stock performance is not necessarily indicative of future stock performance. |

| 5. | We determined EBITDA Delivered to be the most important financial performance measure used to link Company performance to Compensation Actually Paid to our PEO and Non-PEO NEOs in 2023. EBITDA Delivered is a non-GAAP measure. For more information on EBITDA Delivered, please see the “2023 Short-Term Incentive Plan” section of the Compensation Discussion & Analysis in this proxy statement. This performance measure may not have been the most important financial performance measure for prior years, and we may determine a different financial performance measure to be the most important financial performance measure in future years. |

| • | An annual Board retainer of $95,000 in stock plus $70,000 in cash. Retainers are paid quarterly, with the stock retainer valuation based on the closing price on the trading day immediately preceding the grant date and prorated for one partial quarter of service. |

| • | Additional annual retainer for the Non-Executive Chairman was $75,000 per year, paid quarterly in cash. |

| • | Directors who serve on committees receive an additional annual retainer, paid quarterly in cash as follows: |

| • | Audit Committee: $30,000 for Chair; $15,000 for other members |

| • | Compensation Committee: $20,000 for Chair; $10,000 for other members |

| • | Nominating & Governance Committee: $15,000 for Chair; $10,000 for other members |

Name(1) | | | Fees Earned or Paid in Cash | | | Stock Awards ($)(2) | | | Total |

William Cook | | | 85,000 | | | 95,000 | | | 180,000 |

Jeffrey Keenan | | | 95,000 | | | 95,000 | | | 190,000 |

Marco Levi | | | 80,000 | | | 95,000 | | | 175,000 |

Kimberly Ritrievi | | | 100,000 | | | 95,000 | | | 195,000 |

John Rogers | | | 160,000 | | | 95,000 | | | 255,000 |

Shruti Singhal | | | 95,000 | | | 95,000 | | | 190,000 |

Tony Thene | | | 95,000 | | | 95,000 | | | 190,000 |

Anderson Warlick | | | 100,000 | | | 95,000 | | | 195,000 |

| (1) | Ms. Schertell is not included in this table as she is an employee of the Company and received no additional compensation for her service as a director. The 2023 compensation received by Ms. Schertell as an employee of the Company is shown in the 2023 Summary Compensation Table. |

| (2) | The amounts shown in this column are valued based on the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Grant date fair value is calculated by multiplying the number of shares granted by our closing share price on the grant date (or the last trading day prior to the grant date). As of December 31, 2023, the total number of stock awards outstanding per director, in the form of deferred shares or deferred share units, were as follows: Mr. Cook — 10,580; Mr. Keenan — 13,474; Mr. Levi — 0; Dr. Ritrievi — 6,735; Dr. Rogers — 6,735; Mr. Singhal — 0; Mr. Thene — 0; and Mr. Warlick — 13,828. These totals also include accumulated dividends on stock units. |

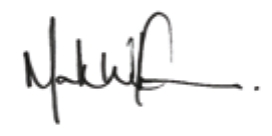

• Director skills and experience cover a well-rounded range of topics and issues • 88% of directors are independent (all except CEO) • Majority vote resignation policy for directors • Annual Board and committee evaluations • Regular executive sessions of independent directors • Executive officer and non-employee director stock ownership guidelines • No stockholder rights plan • Active oversight of enterprise risk management | | | • Directors are not eligible for reelection after the age of 72 • Hedging or pledging Company equity, directly or indirectly, is prohibited for directors and key executives, and all other employees are strongly discouraged from engaging in similar transactions • Policy on Orientation and Continuing Education for Board members, including training in compliance programs • Overboarding policy • Membership for each director in the National Association of Corporate Directors (NACD) |

| a. | A director who is employed by the Company or any of its affiliates for the current year or any of the past five years. |

| b. | A director who is, or in the past five years has been, affiliated with or employed by a (present or former) auditor of the Company (or of an affiliate). |

| c. | A director who is, or in the past five years has been, part of an interlocking directorate in which an executive officer of the Company serves on the compensation committee of another company that concurrently employs the director. |

| d. | A director who is, or in the past five years has been, a Family Member of an individual who was employed by the Company or any of its affiliates as an executive officer. The term “Family Member” shall mean a person’s spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law, and anyone (other than household employees) who shares such person’s home. |

| e. | A director who, during the current fiscal year or any of the past five fiscal years, personally provided services to the Company or its affiliates that had an annual value in excess of $60,000; or who was paid or accepted, or who has a non-employee Family Member who was paid or accepted, any payments from the Company or any of its affiliates in excess of $60,000 other than compensation for board service, benefits under a tax-qualified retirement plan, or non-discretionary compensation. |

| f. | A director who is a partner in, or a controlling stockholder or an executive officer of, any organization (profit or non-profit) to which the Company made, or from which the Company received, payments (other than those arising solely from investments in the Company’s securities) that exceed one percent (1%) of the recipient’s annual consolidated gross revenues in the current year or any of the past five fiscal years; unless, for provisions (e) and (f), the Board expressly determines in its business judgment that the relationship does not interfere with the director’s exercise of independent judgment. |

William M. Cook | | | Jeffrey J. Keenan |

Marco Levi | | | Kimberly E. Ritrievi |

John D. Rogers | | | Shruti Singhal |

Tony R. Thene | | | Anderson D. Warlick |

Members | | | Principal Functions | | | Meetings in 2023 | |||

Audit Committee Kimberly E. Ritrievi (Chair) William M. Cook Jeffrey J. Keenan John D. Rogers Shruti Singhal No member serves on the audit committee of more than three public companies, including the Company’s Audit Committee. Following the Annual Meeting, Dr. Rogers will serve as Chair of the Audit Committee and Mr. Singhal will no longer serve on the Audit Committee. | | | • | | | Appointment of outside auditors to audit the records and accounts of the Company | | | 7 |

| | | | | ||||||

| | • | | | Retain and compensate outside auditors | | ||||

| | | | | ||||||

| | • | | | Review scope of audits, provide oversight in connection with internal control, financial reporting and disclosure systems | | ||||

| | | | | ||||||

| | • | | | Monitor the Company’s compliance with legal and regulatory requirements | | ||||

| | | | | ||||||

| | • | | | The nature and scope of the Committee’s responsibilities are set forth in further detail under the caption “Audit Committee Report” | | ||||

| | | | | | | ||||

Compensation Committee Anderson D. Warlick (Chair) Marco Levi Tony Thene Following the Annual Meeting, Mr. Thene will be retiring from the Board and Mr. Singhal will join the Compensation Committee. | | | • | | | Evaluate and approve executive officer compensation | | | 5 |

| | | | | ||||||

| | • | | | Review compensation strategy, plans and programs and evaluate related risk | | ||||

| | | | | ||||||

| | • | | | Evaluate and make recommendations on director compensation | | ||||

| | | | | ||||||

| | • | | | The nature and scope of the Committee’s responsibilities are set forth in further detail under the caption “Compensation Discussion & Analysis” | | ||||

| | | | | | | ||||

Nominating & Governance Committee Shruti Singhal (Chair) Jeffrey Keenan Tony Thene Anderson D. Warlick Following the Annual Meeting, Mr. Thene will be retiring from the Board. | | | • | | | Review and recommend to the Board candidates for election by stockholders or to fill any vacancies on the Board; evaluate stockholder nominees | | | 5 |

| | | | | ||||||

| | • | | | Oversee the Board, committee and individual director evaluation processes | | ||||

| | | | | ||||||

| | • | | | Evaluate, monitor and recommend changes in the Company’s governance policies | | ||||

| | | | | ||||||

| | • | | | Oversee and report to the Board on the succession planning process with respect to directors and the Chief Executive Officer, including review of a transition plan in the event of an unexpected departure or incapacity of the Chief Executive Officer | | ||||

| | | | | ||||||

| | • | | | Oversight of environmental, social and governance (ESG) matters | | ||||

| • | Filtration Products that Benefit Society: Mativ produces a diverse portfolio of products that make water and air cleaner and safer. Our HVAC air filtration media can reach removal efficiencies as high as 99.9% while our ASD netting can provide up to a 20% decrease in pressure drop during Reverse Osmosis filtration, decreasing energy costs and allowing customers to provide energy efficient water filtration solutions. |

| • | Partnership with Planet Water Foundation: We partner with the Planet Water Foundation, a non-profit organization that helps bring clean water to the world’s most impoverished communities, to support the installation of water filtration systems and provide hygiene education. As an innovator and producer of products that enable access to fresh water across the world – a significant and urgent global societal need, we believe this to be a strong alignment with our business, expertise, and way to create material positive impacts for the communities where our solutions play a role. In 2023, through our support, the Foundation installed two AquaTower water systems in India, in the state of Tamil Nadu and two AquaTower water systems in Querétaro state in Mexico. Hygiene education programs were also deployed at the AquaTower project schools, reaching 2,600 students. Mativ also deployed an emergency AquaBlock water filtration system in Turkey in Hatay Province after the Kahramanmaras earthquake in February 2023. The five filtration systems are providing clean, safe drinking water for up to 17,200 people each day. Since our partnership with Planet Water Foundation began, Mativ has enabled access to fresh drinking water for up to 33,000 people. |

| • | FSC® Certification: All unprocessed wood fiber and pulp and wood-based bioenergy consumed are sourced exclusively from suppliers maintaining FSC and/or PEFC Chain of Custody certification and/or have achieved FSC and/or PEFC Mix Credit or Controlled Wood certification. The packaging we use for our own business purposes (as opposed to the packaging we sell) is not necessarily certified or derived from certified suppliers, as we often purchase from small suppliers for whom certification is cost-prohibitive. |

| • | Environmental Certification and Energy Efficiency: As of year-end 2023, 11 Mativ locations are certified to ISO 14001 for environmental management systems and 4 locations are certified to the ISO 50001 energy management standard. |

| • | Recycling: Our facilities recycled more than 13,500 metric tons of waste in 2023. When possible, materials are reintroduced into the manufacturing process to produce new products. |

| • | In addition to investing in area communities where our facilities are located by providing jobs and sourcing products, we support efforts to make our communities stronger through financial donations and volunteer participation. Most of our philanthropic efforts are locally directed, empowering our employees to contribute their time and expertise to organizations that matter to them and serve the unique needs of their communities. We donate to nonprofit or community organizations that support the communities where our plants are located. |

| • | Ethics and responsibilities in the workplace |

| • | Our responsibilities to one another |

| • | Our responsibilities to our customers and business partners |

| • | Our responsibilities in the marketplace |

| • | Our responsibilities as corporate citizens (includes corporate social responsibility standards) |

| • | The Mativ Ethics and Compliance Hotline |

| • | Whether the proposed transaction is on terms that are at least as favorable to the Company as those achievable with an unaffiliated third party; |

| • | Size of the transaction and amount of consideration; |

| • | Nature of the interest; |

| • | Whether the transaction involves a conflict of interest; |

| • | Whether the transaction involves services available from unaffiliated third parties; and |

| • | Any other factors that the Audit Committee or subcommittee deems relevant. |

Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership | | | Percent of Class* | | | Sole Voting Power | | | Shared Voting Power | | | Sole Investment Power | | | Shared Investment Power |

BlackRock Inc.(1) 50 Hudson Yards New York, NY 10001 | | | 8,815,096 | | | 16.2% | | | 8,683,945 | | | 0 | | | 8,815,096 | | | 0 |

| | | | | | | | | | | | ||||||||

The Vanguard Group, Inc.(2) 100 Vanguard Blvd Malvern, PA 19355 | | | 6,443,276 | | | 11.9% | | | 0 | | | 71,794 | | | 6,316,093 | | | 127,183 |

| | | | | | | | | | | | ||||||||

Allspring Global(3) 1415 Vantage Park Drive, 3rd Floor Charlotte, NC 28203 | | | 4,132,265 | | | 7.6% | | | 3,998,210 | | | 0 | | | 4,132,265 | | | 0 |

| | | | | | | | | | | | ||||||||

Rubric Capital Management LP(4) 155 East 44th St, Suite 1630 New York, NY 10017 | | | 4,000,000 | | | 7.4% | | | 0 | | | 4,000,000 | | | 0 | | | 4,000,000 |

| | | | | | | | | | | | | |||||||

Boundary Creek Advisors LP(5) 340 Madison Avenue, 12th Floor New York, NY 10173 | | | 3,800,054 | | | 7% | | | 0 | | | 3,800,054 | | | 0 | | | 3,800,054 |

| | | | | | | | | | | | | |||||||

Wellington Management(6) 280 Congress Street Boston, MA 02210 | | | 3,583,501 | | | 6.6% | | | 0 | | | 3,532,860 | | | 0 | | | 3,583,501 |

| | | | | | | | | | | | | |||||||

The Goldman Sachs Group, Inc.(7) 200 West Street New York, NY 10282 | | | 2,759,883 | | | 5.1% | | | 0 | | | 2,759,513 | | | 0 | | | 2,759,883 |

| * | Percentages are calculated based on 54,300,282 shares of Common Stock issued and outstanding on March 4, 2024. |

| (1) | Based solely on information contained in a Schedule 13G/A filed on January 22, 2024 by BlackRock Inc. to report its beneficial ownership of Common Stock. |

| (2) | Based solely on information contained in a Schedule 13G/A filed on February 13, 2024 by The Vanguard Group, Inc. to report its beneficial ownership of Common Stock. |

| (3) | Based solely on information contained in a Schedule 13G/A filed on January 12, 2024 by Allspring Global Investments Holdings, LLC (“AGIH”), Allspring Global Investments, LLC (“AGI”), and Allspring Funds Management, LLC (“AFM”) to report their beneficial ownership of Common Stock. AGIH reported sole voting power with respect to 3,998,210 shares of Common Stock and sole investment power with respect to 4,132,265 shares of Common Stock. AGI reported sole voting power with respect to 610,564 shares of Common Stock and sole investment power with respect to 4,128,028 shares of Common Stock. AFM reported sole voting power with respect to 3,387,646 shares of Common Stock and sole investment power with respect to 4,237 shares of Common Stock. |

| (4) | Based solely on information contained in a Schedule 13G/A filed on February 12, 2024 by Rubric Capital Management LP (“Rubric Capital”) and David Rosen (“Rosen”) to report beneficial ownership of Common Stock. Rubric Capital and Mr. Rosen each reported shared voting power and shared investment power with respect to 4,000,000 shares of Common Stock. |

| (5) | Based solely on information contained in a Schedule 13G filed on February 14, 2024 by Boundary Creek Advisors (“Boundary Creek”) and Peter Greatrex (“Greatrex”) to report beneficial ownership of Common Stock. Boundary Creek and Mr. Greatrex each reported shared voting power and shared investment power with respect to 3,800,054 shares of Common Stock, including 2,610,200 shares of Common Stock underlying call options. |

| (6) | Based solely on information contained in a Schedule 13G filed on February 8, 2024 by Wellington Management Group LLP (“WMG”), Wellington Group Holdings LLP (“WGH”), Wellington Investment Advisors Holdings LLP (“WIAH”) and Wellington Management Company LLP (“WMC”) to report their beneficial ownership of Common Stock. WMG reported shared voting power with respect to 3,532,860 shares of Common Stock and shared investment power with respect to 3,583,501 shares of Common Stock. WGH reported shared voting power with respect to 3,532,860 shares of Common Stock and shared investment power with respect to 3,583,501 shares of Common Stock. WIAH reported shared voting power with respect to 3,532,860 shares of Common Stock and shared investment power with respect to 3,583,501 shares of Common Stock. WMC reported shared voting power with respect to 3,424,077 shares of Common Stock and shared investment power with respect to 3,474,718 shares of Common Stock. |

| (7) | Based solely on information contained in a Schedule 13G filed on February 7, 2024 by The Goldman Sachs Group, Inc. (“Goldman”) and Goldman Sachs & Co. LLC (“GSC”) to report their beneficial ownership of Common Stock. Goldman reported shared voting power with respect to 2,759,513 shares of Common Stock and shared investment power with respect to 2,759,883 shares of Common Stock. GSC reported shared voting power with respect to 2,759,513 shares of Common Stock and shared investment power with respect to 2,759,883 shares of Common Stock. |

Name of Individual or Identity of Group | | | Amount and Nature of Beneficial Ownership | | | Number of Deferred Stock Units(1) | | | Percent of Class(2) |

William M. Cook(3) | | | 18,936 | | | 10,663 | | | * |

Mark W. Johnson | | | 19,330 | | | 0 | | | * |

Jeffrey J. Keenan(3) | | | 318,000 | | | 13,579 | | | * |

Marco Levi(3) | | | 20,442 | | | 0 | | | * |

Ricardo Nuñez(4) | | | 43,650 | | | 0 | | | * |

Kimberly E. Ritrievi(3) | | | 20,640 | | | 5,477 | | | * |

Michael W. Rickheim | | | 48,252 | | | 0 | | | * |

John D. Rogers(3) | | | 47,235 | | | 6,787 | | | * |

Julie A. Schertell(3) | | | 230,005 | | | 0 | | | * |

Shruti Singhal(3) | | | 7,611 | | | 0 | | | * |

Tony R. Thene(3) | | | 15,137 | | | 0 | | | * |

R. Andrew Wamser, Jr.(5) | | | 160,184 | | | 0 | | | * |

Anderson D. Warlick(3) | | | 75,013 | | | 13,936 | | | * |

Greg Weitzel | | | 15,566 | | | 0 | | | * |

All directors and executive officers as a group (14 persons) | | | 1,040,001 | | | 50,442 | | | 2.01% |

| (1) | Represents the equivalent of stock units, including accumulated dividends, held in deferral accounts. |

| (2) | Percentages are calculated based on 54,300,282 shares of Common Stock issued and outstanding on March 4, 2024, plus shares deemed outstanding pursuant to Rule 13d-3(d)(1). An asterisk shows ownership of less than 1% of the shares of Common Stock outstanding. |

| (3) | In addition, each then-serving director receives $23,750 in stock on the first day of each calendar quarter, based on the applicable stock price. Based on the closing stock price on March 4, 2024 of $17.94, each director would receive 1,045 shares of common stock on April 1, 2024. Ms. Schertell does not receive a quarterly stock grant as she is an employee of the Company and receives no additional compensation for her service as a director. |

| (4) | Mr. Nuñez separated from the Company effective September 1, 2023. |

| (5) | Mr. Wamser separated from the Company effective April 1, 2023. |

| | | 2023 | | | 2022 | |

Audit Fees(1) | | | 4,756,083 | | | 4,925,035 |

Audit-Related Fees(2) | | | 0 | | | 0 |

Total Audit and Audit-Related Fees | | | 4,756,083 | | | 4,925,035 |

Tax Compliance Services(3) | | | 434,100 | | | 191,798 |

Tax Consulting and Planning Services(4) | | | 2,061,584 | | | 717,673 |

Total Tax Fees | | | 2,495,684 | | | 909,471 |

All Other Fees(5) | | | 71,900 | | | 1,895 |

Total Fees | | | 7,323,667 | | | 5,836,401 |

| (1) | Includes fees billed for professional services rendered in connection with the audit of the annual financial statements, audit of the Company’s internal control over financial reporting and management’s assessment thereof, review of financial statements included in the Company’s quarterly reports on Form 10-Q and for services provided for statutory and regulatory filings or engagements. |

| (2) | Includes fees incurred for assurance and related services and consultation on regulatory matters or accounting standards, as well as consultations on internal controls. |

| (3) | Includes fees incurred for tax return preparation and compliance. |

| (4) | Includes non-audit fees incurred for tax advice and tax planning. |

| (5) | Includes fees primarily related to training and subscription services. |

| (1) | the integrity of the Company’s financial statements; |

| (2) | the Company’s compliance with legal and regulatory requirements; |

| (3) | the outside auditor’s qualifications and independence; and |