UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | | | |

| o | | Preliminary Proxy Statement |

| | | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| x | | Definitive Proxy Statement |

| | | |

| o | | Definitive Additional Materials |

| | | |

| o | | Soliciting Material under Rule 14a-12 |

| |

| INSPERITY, INC. |

| (Name of registrant as specified in its charter) |

| |

| (Name of person(s) filing proxy statement, if other than the registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | | No fee required. |

| | | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| | | | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

Paul J. Sarvadi

Chairman of the Board

and Chief Executive Officer

May 27, 2016

Dear Stockholder:

On behalf of your Board of Directors and management, you are cordially invited to attend the Annual Meeting of Stockholders to be held at Insperity’s Corporate Headquarters, Centre I in the Auditorium, located at 19001 Crescent Springs Drive, Kingwood, Texas 77339, on June 30, 2016, at 10:00 a.m. Houston, Texas time.

It is important that your shares are represented at the meeting. Whether or not you plan to attend the meeting, please complete and return the enclosed proxy card in the accompanying envelope or vote using the telephone or Internet procedures that may be provided to you. Please note that using any of these methods to vote will not prevent you from attending the meeting and voting in person.

You will find information regarding the matters to be voted on at the meeting in the following pages. Our annual report on Form 10-K for the year ended December 31, 2015 is also enclosed with these materials.

Your interest in Insperity is appreciated, and we look forward to seeing you at the meeting.

Sincerely,

/s/ Paul J. Sarvadi

Paul J. Sarvadi

Chairman of the Board and Chief Executive Officer

INSPERITY, INC.

A Delaware Corporation

19001 Crescent Springs Drive

Kingwood, Texas 77339-3802

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 30, 2016

Kingwood, Texas

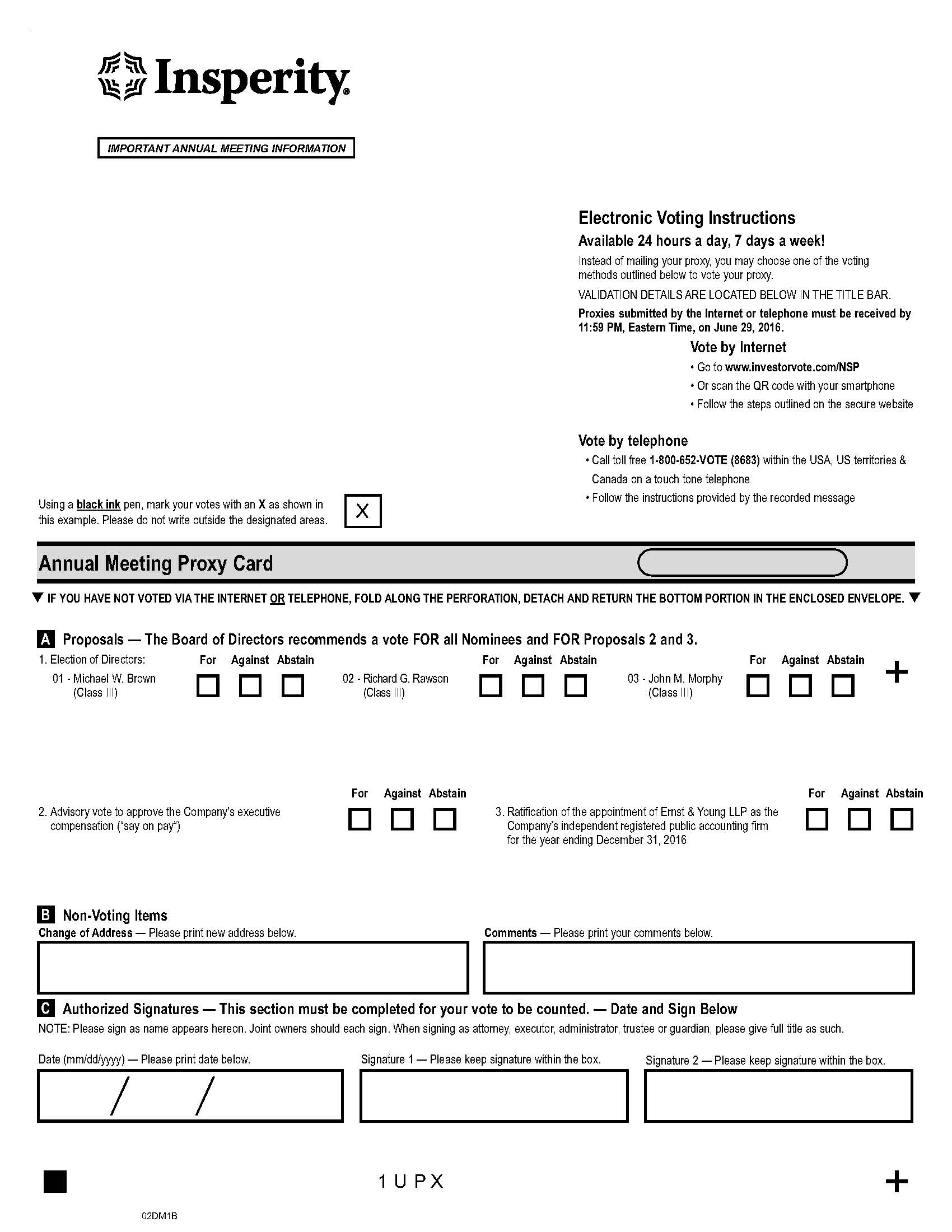

The Annual Meeting of Stockholders of Insperity, Inc., a Delaware corporation (the “Company”), will be held at the Company’s Corporate Headquarters in Centre I in the Auditorium, located at 19001 Crescent Springs Drive, Kingwood, Texas 77339, on June 30, 2016, at 10:00 a.m. (Houston, Texas time), for the following purposes:

| |

| 1. | To elect three nominees to the Board of Directors; |

| |

| 2. | To cast an advisory vote to approve the Company’s executive compensation (“say-on-pay” vote); and |

| |

| 3. | To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2016. |

Important Notice Regarding the Availability of Proxy Materials: A full set of all proxy materials for the Annual Meeting of Stockholders to be held on June 30, 2016 is enclosed with this Notice. Additionally, the Company’s proxy statement, most recent annual report on Form 10-K, and other proxy materials are available at www.insperity.com/annualmeeting.

Only stockholders of record at the close of business on May 9, 2016 are entitled to notice of, and to vote at, the meeting.

|

| | | | |

| It is important that your shares be represented at the Annual Meeting of Stockholders regardless of whether you plan to attend. Therefore, please mark, sign, date and return the enclosed proxy. If you are present at the meeting, and wish to do so, you may revoke the proxy and vote in person. |

By Order of the Board of Directors

/s/ Daniel D. Herink

Daniel D. Herink

Senior Vice President of Legal,

General Counsel and Secretary

May 27, 2016

Kingwood, Texas

INSPERITY, INC.

A Delaware Corporation

19001 Crescent Springs Drive

Kingwood, Texas 77339-3802

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF STOCKHOLDERS OF

INSPERITY, INC.

TO BE HELD ON THURSDAY, JUNE 30, 2016

Solicitation

The accompanying proxy is solicited by the Board of Directors (“the Board”) of Insperity, Inc., a Delaware corporation (the “Company” or “Insperity”), for use at the 2016 Annual Meeting of Stockholders to be held on June 30, 2016, and at any reconvened meeting after an adjournment thereof. The 2016 Annual Meeting of Stockholders will be held at 10:00 a.m. (Houston, Texas time), at the Company’s Corporate Headquarters, Centre I in the Auditorium located at 19001 Crescent Springs Drive, Kingwood, Texas 77339.

Voting Information

You may vote in one of four ways:

|

| | | | | | |

| | • | | by attending the meeting and voting in person; | | | |

| | • | | by signing, dating and returning your proxy in the envelope provided; | | |

| | • | | by submitting your proxy via the Internet at the address listed on your proxy card; or | |

| | • | | by submitting your proxy using the toll-free telephone number listed on your proxy card. |

For stockholders of record, if your shares are held in an account at a brokerage firm or bank, you may submit your voting instructions by signing and timely returning the enclosed voting instruction form, by Internet at the address shown on your voting instruction form, by telephone using the toll-free number shown on that form, or by providing other proper voting instructions to the registered owner of your shares. If shares are held in street name through a broker and the broker is not given direction on how to vote, the broker will not have discretion to vote such shares on non-routine matters, including the election of directors.

For stockholders of record, if you either return your signed proxy or submit your proxy using the Internet or telephone procedures that may be available to you, your shares will be voted as you direct. If the accompanying proxy is properly executed and returned, but no voting directions are indicated thereon, the shares represented thereby will be voted FOR the election as directors of the nominees listed herein, and FOR Proposals 2 and 3. In addition, the proxy confers discretionary authority to the persons named in the proxy authorizing those persons to vote, in their discretion, on any other matters properly presented at the 2016 Annual Meeting of Stockholders. The Board is not currently aware of any such other matters. Any stockholder of record giving a proxy has the power to revoke it at any time before it is voted by: (i) submitting written notice of revocation to the Secretary of the Company at the address listed above; (ii) submitting another proxy that is properly signed and later dated; (iii) submitting a proxy again on the Internet or by telephone; or (iv) voting in person at the 2016 Annual Meeting of Stockholders. Stockholders who hold their shares through a nominee or broker are invited to attend the meeting but must obtain a signed proxy from their nominee or broker in order to vote in person.

The Company pays the expense of preparing, printing and mailing proxy materials to our stockholders. We have retained Innisfree M&A Incorporated (”Innisfree”), a proxy solicitation firm, to assist us in soliciting proxies for the proposals described in this proxy statement. We will pay Innisfree a fee for such service, which is not expected to exceed $15,000 plus expenses. In addition to solicitation by mail, certain of our officers or employees (none of whom will receive additional compensation), and certain officers or employees of Innisfree, may solicit the return of proxies by telephone, email or personal interview. We will also reimburse brokerage houses and other nominees for their reasonable expenses in forwarding proxy materials to beneficial owners of our common stock.

The approximate date on which this proxy statement and the accompanying proxy card will first be sent to stockholders is June 2, 2016.

At the close of business on May 9, 2016, the record date for the determination of stockholders of the Company entitled to receive notice of, and to vote at, the 2016 Annual Meeting of Stockholders or any reconvened meeting after an adjournment thereof, 21,384,413

shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”), were outstanding. Each share of Common Stock is entitled to one vote upon each of the matters to be voted on at the meeting. The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock is required for a quorum. If a quorum is present at the meeting, under the Company’s Bylaws, action on a matter or to elect director nominees shall be approved if the votes cast in favor of the matter or nominee exceed the votes cast opposing the matter or such nominee, as applicable.

In determining the number of votes cast, shares abstaining from voting or not voted on a matter will not be treated as votes cast. Accordingly, although proxies containing broker non-votes (which result when a broker holding shares for a beneficial owner has not received timely voting instructions on certain matters from such beneficial owner and when the broker does not otherwise have discretionary power to vote on a particular matter) are considered “shares present” in determining whether there is a quorum present at the 2016 Annual Meeting of Stockholders, they are not treated as votes cast with respect to the election of directors, and thus will not affect the outcome of the voting on the election of directors or any of the other proposals on non-routine matters to be voted on at the 2016 Annual Meeting of Stockholders. However, a broker holding shares for a beneficial owner will have the discretion to vote such shares for a beneficial owner with respect to routine matters, such as the ratification of the appointment of the Company’s independent registered public accounting firm.

SECURITY OWNERSHIP

The table below sets forth, as of May 9, 2016, certain information with respect to the shares of Common Stock beneficially owned by: (i) each person known by the Company to beneficially own 5% or more of the Company’s Common Stock; (ii) each director and director nominee of the Company; (iii) each of the executive officers of the Company identified in the Summary Compensation Table; and (iv) all directors, director nominees and executive officers of the Company as a group.

|

| | | | | | | | |

| Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership1 | | Percent of Class |

| Michael W. Brown | | 36,846 |

| | | * |

| |

| Peter A. Feld | | 3,338,886 |

| 2 | | 15.61 | % | |

| Eli Jones | | — |

| | | * |

| |

| Carol R. Kaufman | | 10,627 |

| | | * |

| |

| Michelle McKenna-Doyle | | 1,447 |

| | | * |

| |

| John M. Morphy | | — |

| | | * |

| |

| Richard G. Rawson | | 625,382 |

| 3 | | 2.92 | % | |

| Paul J. Sarvadi | | 1,611,797 |

| 4 | | 7.54 | % | |

| Norman R. Sorensen | | 2,646 |

| | | * |

| |

| Austin P. Young | | 31,042 |

| | | * |

| |

| A. Steve Arizpe | | 110,408 |

| 5 | | * |

| |

| Jay E. Mincks | | 47,508 |

| | | * |

| |

| Douglas S. Sharp | | 25,252 |

| | | * |

| |

| Starboard Value LP | | 3,335,976 |

| 6 | | 15.60 | % | |

| BlackRock Fund Advisors | | 2,008,678 |

| 7 | | 9.39 | % | |

| The Vanguard Group, Inc. | | 1,564,844 |

| 8 | | 7.32 | % | |

| Executive Officers and Directors as a Group (14 Persons) | | 5,874,084 |

| | | 27.47 | % | |

_________________________

* Represents less than 1%.

| |

1 | Except as otherwise indicated, each of the stockholders has sole voting and investment power with respect to the securities shown to be owned by such stockholder. The address for each officer and director is in care of Insperity, Inc., 19001 Crescent Springs Drive, Kingwood, Texas 77339-3802. |

The number of shares of Common Stock beneficially owned by each person includes options exercisable on May 9, 2016, or within 60 days after May 9, 2016, and excludes options not exercisable within 60 days after May 9, 2016 (currently there are no unvested stock options). The number of shares of Common Stock beneficially owned by each person also includes unvested shares of restricted stock as of May 9, 2016 and excludes LTIP shares that are not available within 60 days after May 9, 2016. Each owner of restricted stock has the right to vote his or her shares but may not transfer them until they have vested.

|

| | | | | | | | | |

| | | Options | | |

| Name of Beneficial Owner | | Exercisable | | Not Exercisable | | Unvested Restricted Stock |

| | | | | | | |

| Michael W. Brown | | 20,513 |

| | — |

| | — |

|

| Peter A. Feld | | — |

| | — |

| | 1,447 |

|

| Eli Jones | | — |

| | — |

| | — |

|

| Carol R. Kaufman | | — |

| | — |

| | 647 |

|

| Michelle McKenna-Doyle | | — |

| | — |

| | 1,447 |

|

| John M. Morphy | | — |

| | — |

| | — |

|

| Norman R. Sorensen | | — |

| | — |

| | 1,447 |

|

| Austin P. Young | | 7,813 |

| | — |

| | — |

|

| A. Steve Arizpe | | — |

| | — |

| | 25,254 |

|

| Jay E. Mincks | | — |

| | — |

| | 25,254 |

|

| Richard G. Rawson | | — |

| | — |

| | 25,254 |

|

| Paul J. Sarvadi | | — |

| | — |

| | 42,509 |

|

| Douglas S. Sharp | | — |

| | — |

| | 16,581 |

|

| |

2 | Based on a Schedule 13D/A filed with the Securities and Exchange Commission (“SEC”) on March 15, 2016. Mr. Feld reported shared voting and dispositive power with respect to 3,335,976 shares and 2,910 shares held directly. See footnote 6 below for further information. |

| |

3 | Includes 263,676 shares owned by the RDKB Rawson LP, 229,512 shares owned by the R&D Rawson LP, and 350 shares owned by Dawn M. Rawson (spouse). Mr. Rawson shares voting and investment power over all such shares with his wife, except for 350 shares owned by his wife. |

| |

4 | Includes 917,396 shares owned by Our Ship Limited Partnership, Ltd., 453,069 shares owned by the Sarvadi Children’s Limited Partnership, 16,651 shares owned by Paul J. Sarvadi and Vicki D. Sarvadi (spouse), JT WROS and 19,644 shares owned by six education trusts established for the benefit of the children of Paul J. Sarvadi. Mr. Sarvadi shares voting and investment power over all such shares with his spouse. Also includes 220,000 shares pledged to banks as collateral for loans. The Board determined the amount of shares pledged by Mr. Sarvadi was insignificant under the Company’s pledging policy (see “Corporate Governance — Prohibition on Hedging and Pledging of Company Common Stock”). |

| |

5 | Includes 3,139 shares owned by A. Steve Arizpe and Charissa Arizpe (spouse). Mr. Arizpe shares voting and investment power over all such shares with his wife. |

| |

6 | Based on a Schedule 13D/A filed with the SEC on March 15, 2016, pursuant to which (a) each of Starboard Value LP, Starboard Value GP LLC, Starboard Principal Co LP and Starboard Principal Co GP LLC reported sole voting and dispositive power with respect to 3,335,976 shares; (b) Starboard Value and Opportunity Master Fund Ltd reported sole voting and dispositive power with respect to 1,986,958 shares; (c) Starboard Value and Opportunity S LLC reported sole voting and dispositive power with respect to 444,820 shares; (d) each of Starboard Value and Opportunity C LP, Starboard Value R LP and Starboard Value R GP LLC reported sole voting and dispositive power with respect to 241,324 shares; (e) each of Jeffrey C. Smith and Mark R. Mitchell reported shared voting and dispositive power with respect to 3,335,976 shares and (f) Peter A. Feld reported sole voting and dispositive power with respect to 1,120 shares and shared voting and dispositive power with respect to 3,335,976 shares. The address of the reporting persons is 777 Third Avenue, 18th Floor, New York, NY 10017. |

| |

7 | Based on a Schedule 13G/A filed with the SEC on January 26, 2016. BlackRock, Inc. reported sole voting power with respect to 1,944,675 shares and sole dispositive power with respect to 2,008,678 shares. The address of BlackRock, Inc. is 40 East 52nd Street, New York, NY 10022. |

| |

8 | Based on a Schedule 13G/A filed with the SEC on February 10, 2016. The Vanguard Group reported sole voting power with respect to 43,000 shares; sole dispositive power with respect to 1,522,844 shares and shared dispositive power with respect to 42,000 shares with Vanguard Fiduciary Trust Company. The address of the Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

PROPOSAL NUMBER 1:

ELECTION OF DIRECTORS

General

The Company’s Certificate of Incorporation and Bylaws provide that the number of directors on the Board of Directors (the “Board”) shall be fixed from time to time by the Board but shall not be less than three nor more than 15 persons. The number of members constituting the Board is currently fixed at ten.

In accordance with the Certificate of Incorporation of the Company, the members of the Board are divided into three classes. The Certificate of Incorporation also provides that such classes shall be as nearly equal in number as possible. The terms of office of the Class I, Class II and Class III directors expire at the Annual Meeting of Stockholders in 2017, 2018 and 2016, respectively. The term of office of each of Michael Brown, Eli Jones, John Morphy and Richard Rawson, who comprise the current Class III directors, expires at

the time of the 2016 Annual Meeting of Stockholders, or as soon thereafter as their successors are elected and qualified. As previously announced, Dr. Jones has decided not to stand for re-election to the Board and to retire from the Board at the 2016 Annual Meeting of Stockholders. Messrs. Brown, Morphy and Rawson have been nominated for re-election to the Board as described below. All nominees have consented to be named in this proxy statement and to serve as a director if elected.

Agreements with Starboard

2015 Agreement

On March 21, 2015, the Company entered into an Agreement (the “2015 Agreement”) with Starboard Value LP and certain of its affiliates named therein (collectively, “Starboard”). Pursuant to the 2015 Agreement, the Company appointed (a) Peter A. Feld and Michelle McKenna-Doyle as Class I directors; and (b) Norman R. Sorensen as a Class II director. In addition, pursuant to the 2015 Agreement, the Company nominated for election at the 2015 Annual Meeting of Stockholders (a) Carol Kaufman, Paul Sarvadi and Norman R. Sorensen for election to the Board as Class II directors with terms expiring at the 2018 Annual Meeting of Stockholders; and (b) Austin Young as a Class I director with a term expiring at the 2017 Annual Meeting of Stockholders. In addition, Starboard agreed to vote its shares of the Company’s Common Stock for the election of each of Ms. Kaufman and Messrs. Sarvadi, Sorensen and Young at the 2015 Annual Meeting of Stockholders. Substantially concurrently with the adjournment of the 2015 Annual Meeting of Stockholders, Dr. Jones and Mr. Brown resigned as Class I directors with terms expiring at the 2017 Annual Meeting of Stockholders and were immediately reappointed by the Board as Class III directors with terms expiring at the 2016 Annual Meeting of Stockholders.

2016 Agreement

On May 18, 2016, the Company entered into an Agreement (the “2016 Agreement”) with Starboard, which supersedes and replaces the 2015 Agreement. The following is a summary of the material terms of the 2016 Agreement. The following summary does not purport to be complete and is qualified in its entirety by reference to the 2016 Agreement, a copy of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on May 19, 2016 and is incorporated herein by reference.

Pursuant to the 2016 Agreement, immediately following the execution of the 2016 Agreement, the Company (i) appointed John Morphy as a Class III director with a term expiring at the 2016 Annual Meeting of Stockholders and (ii) set the size of the Board at ten directors.

The Company agreed that, promptly following the execution of the 2016 Agreement, the Nominating and Corporate Governance Committee will take all necessary actions to (i) commence a search for one new independent director (the “New Independent Director”) and (ii) retain a nationally-recognized director search firm to assist with such search. The New Independent Director shall (a) meet the independence requirements of the New York Stock Exchange (“NYSE”), (b) meet the requirements of the Company’s guidelines and policies with respect to service on the Board, (c) be independent of Starboard and (d) other than with respect to the Company, have not been nominated by Starboard to serve on any other board of directors and not serve on another board of directors with any other director of the Company. Subject to the selection procedures described in the 2016 Agreement, the Company will appoint the New Independent Director as a Class II director with a term expiring at the 2018 Annual Meeting of Stockholders. After the appointment of the New Independent Director and during the Standstill Period (as defined below), the Company agreed not to (x) increase the size of the Board to more than ten directors or (y) seek to change the classes on which the Board members serve, in each case without the prior consent of Starboard.

Starboard agreed, on behalf of itself and its affiliates, to irrevocably withdraw, concurrently with the execution of the 2016 Agreement, its notice of stockholder nomination of individuals for election as directors at the 2016 Annual Meeting of Stockholders previously submitted to the Company.

The Company also agreed that the Board shall take all action necessary to nominate Michael W. Brown, Richard G. Rawson and John Morphy for re-election to the Board at the 2016 Annual Meeting of Stockholders as Class III directors. In addition, Carol R. Kaufman executed and delivered to the Company an irrevocable letter pursuant to which she agreed to reduce her term of service as a director on the Board, to end at the conclusion of the 2017 Annual Meeting of Stockholders; provided that such reduction shall be revocable by Ms. Kaufman if, at any time prior to the conclusion of the 2017 Annual Meeting of Stockholders, either (i) Starboard’s aggregate beneficial ownership of Common Stock decreases to less than the Minimum Ownership Threshold (as defined below) or (ii) the Board resolves that such reduction may be revoked.

The 2016 Agreement further provides that Starboard will vote all shares of Common Stock beneficially owned by Starboard as of May 9, 2016, the record date for the 2016 Annual Meeting of Stockholders, (i) for the election of each of the nominees for director at the 2016 Annual Meeting of Stockholders and (ii) in favor of Proposal 2 and Proposal 3.

Starboard agreed that it will not nominate or recommend for nomination any person for election at the 2016 Annual Meeting of Stockholders, submit proposals for consideration or otherwise bring any business before the 2016 Annual Meeting of Stockholders, nor will it engage in certain activities related to “withhold” or similar campaigns with respect to the 2016 Annual Meeting of Stockholders.

Under the terms of the 2016 Agreement, until the earlier of (i) 15 business days prior to the deadline for the submission of stockholder nominations for the 2017 Annual Meeting of Stockholders pursuant to the Bylaws of the Company and (ii) the date that is 100 days prior to the first anniversary of the 2016 Annual Meeting of Stockholders (the “Standstill Period”), Starboard agreed to not to, among other things, solicit proxies regarding any matter to come before any annual or special meeting of stockholders, including for the election of directors, or enter into a voting agreement or any group with shareholders other than Starboard affiliates and current group members. In addition, among other standstill provisions, Starboard agreed that, during the Standstill Period, it (i) will not make any offer or proposal (with or without conditions) with respect to any merger, acquisition, recapitalization, restructuring, disposition or other business combination involving Starboard and the Company, (ii) unless authorized by the Board, will not affirmatively solicit any third party, on an unsolicited basis, in making, any offer or proposal with respect to any merger, acquisition, recapitalization, restructuring, disposition or other business combination involving the Company or encourage, initiate or support any third party in making such an offer or proposal, (iii) will not publicly comment on any third party proposal regarding any merger, acquisition, recapitalization, restructuring, disposition, or other business combination with respect to the Company by such third party prior to such proposal becoming public and (iv) will not seek, or encourage any person, to submit nominees in furtherance of a contested solicitation for the election or removal of directors.

If Peter A. Feld or Michelle McKenna-Doyle (or any replacement director therefor) is unable or unwilling to serve, resigns or is removed as a director prior to the 2017 Annual Meeting of Stockholders or if Norman R. Sorensen (or any replacement director therefor) is unable or unwilling to serve, resigns or is removed as a director prior to the 2018 Annual Meeting of Stockholders, and at such time Starboard beneficially owns in the aggregate at least the lesser of (i) 3.0% of the Company’s then outstanding shares of Common Stock and (ii) 641,581 shares of Common Stock (the “Minimum Ownership Threshold”), Starboard has the ability to recommend a replacement director in accordance with the terms of the 2016 Agreement.

If Mr. Morphy (or any replacement director therefor) is unable or unwilling to serve, resigns or is removed as a director prior to the 2019 Annual Meeting of Stockholders or if the New Independent Director (or any replacement director therefor) is unable or unwilling to serve, resigns or is removed as a director prior to the 2018 Annual Meeting of Stockholders, and at such time Starboard beneficially owns in the aggregate at least the Minimum Ownership Threshold, a substitute director shall be appointed in accordance with the terms of the 2016 Agreement.

Pursuant to the 2015 Agreement, Mr. Feld previously executed and delivered to the Company an irrevocable resignation letter pursuant to which he shall resign from the Board if, at any time, Starboard’s aggregate beneficial ownership of Common Stock decreases to less than the Minimum Ownership Threshold. Pursuant to the 2016 Agreement, such resignation letter will continue in full force in all respects. Additionally, Starboard agreed to obtain a similar irrevocable resignation letter from any replacement director for Mr. Feld who is an employee of Starboard or otherwise not independent of Starboard.

The Company also agreed to reimburse Starboard for its reasonable, documented out-of-pocket fees and expenses, including legal expenses, in connection with matters related to the 2016 Annual Meeting of Stockholders and the negotiation and execution of the 2016 Agreement, up to a maximum of $100,000.

Each of the parties to the 2016 Agreement also agreed to mutual non-disparagement obligations. In addition, the parties agreed that the confidentiality agreement entered into by Mr. Feld, Starboard and the Company pursuant to the 2015 Agreement will continue in full force in all respects.

Under the terms of the 2016 Agreement, the Board agreed to take all actions necessary to ensure that during the Standstill Period, each committee of the Board includes at least one of Mr. Morphy, Ms. McKenna-Doyle, Mr. Sorensen and Mr. Feld (or a replacement director therefor). In connection with his appointment to the Board, the Board determined that Mr. Morphy qualified as an independent director under the listing standards of the NYSE and applicable SEC rules. Additionally, in connection with the 2016 Agreement, the Board approved certain changes to the composition of the committees of the Board, including (i) effective as of the conclusion of the 2016 Annual Meeting of Stockholders, the appointment of Mr. Morphy to the Finance, Risk Management and Audit Committee of the Board, (ii) effective as of the conclusion of the 2016 Annual Meeting of Stockholders, the appointment of Ms. McKenna-Doyle to, and Mr. Brown as chairperson of, the Compensation Committee of the Board, and (iii) effective upon the execution of the 2016 Agreement, the appointment of Ms. McKenna-Doyle to and as chairperson of the Nominating and Corporate Governance Committee of the Board. See “— Summary of Committee Memberships” for a further description of the composition of these committees as a result of the 2016 Agreement.

As of the date of the appointment, Mr. Morphy has not entered into or proposed to enter into any transactions required to be reported under Item 404(a) of Regulation S-K. Mr. Morphy will be entitled to receive the Initial Director Award (as defined in the Company’s Directors Compensation Plan) effective as of the date of the 2016 Annual Meeting of Stockholders and to receive retainer fees from the date of the 2016 Agreement as contemplated by the Company’s Director Compensation Plan. Mr. Morphy will not be entitled to an Annual Director Award (as defined in the Company’s Director Compensation Plan) on the date of the 2016 Annual Meeting of Stockholders.

Voting; Approval Requirements

All proxies will be voted in favor of the nominees named below unless a stockholder has indicated otherwise. The affirmative vote of a majority of the votes cast by holders of the Common Stock present in person or by proxy at the 2016 Annual Meeting of Stockholders is required for election of the nominees. Abstentions and broker non-votes will be deemed votes not cast. Under our Bylaws and in accordance with Delaware law, a director’s term extends until his or her successor is duly elected and qualified, or until he or she resigns or is removed from office. Thus, an incumbent director who fails to receive the required vote for re-election at our Annual Meeting of Stockholders would continue serving as a director (sometimes referred to as a “holdover director”), generally until the next Annual Meeting of Stockholders. However, as a condition to being nominated to continue to serve as a director, the incumbent director nominees have submitted an irrevocable letter of resignation that is effective upon and only in the event that (i) such nominee fails to receive the required vote; and (ii) the Board accepts such resignation. In such an event, the Nominating and Corporate Governance Committee is required to make a recommendation to the Board as to whether the Board should accept the resignation, and the Board is required to decide whether to accept the resignation and to disclose its decision-making process within 90 days from the certification of the election results. In addition, if Mr. Feld, Ms. McKenna-Doyle, or Mr. Sorensen is not re-elected, then, pursuant to the 2016 Agreement, Starboard may have the right to nominate a replacement director as described above.

If, at the time of or prior to the 2016 Annual Meeting of Stockholders, any of the nominees should be unable or decline to serve, the discretionary authority provided in the proxy may be used to vote for a substitute or substitutes designated by the Board. The Board has no reason to believe that any substitute nominee or nominees will be required. No proxy will be voted for a greater number of persons than the number of nominees named herein.

Nominees for Director

The following individuals have been nominated for re-election to the Board as Class III directors with terms expiring at the 2019 Annual Meeting of Stockholders:

Michael W. Brown. Mr. Brown, age 70, joined the Company as a director in November 1997. Mr. Brown is the past chairman of the NASDAQ Stock Market Board of Directors and a past governor of the National Association of Securities Dealers. Mr. Brown joined Microsoft Corporation in 1989 as its treasurer and became its chief financial officer in 1993, in which capacity he served until his retirement in July 1997. Prior to joining Microsoft, Mr. Brown spent 18 years with Deloitte & Touche LLP. Mr. Brown is also a director of EMC Corporation (NYSE: EMC), Stifel Financial Corporation (NYSE: SF) and VMware, Inc. (NYSE: VMW). He serves on the audit and finance committees of EMC Corporation; audit and compensation committees of VMware, Inc.; and risk management/corporate governance committee of Stifel Financial Corporation. Mr. Brown also serves or has served as a director, trustee or advisor of several private businesses, civic and charitable organizations. Mr. Brown holds a Bachelor of Science degree in Economics from the University of Washington in Seattle.

Mr. Brown brings to the Board substantial expertise that includes an extensive knowledge of the complex financial and operational issues affecting large companies, and a deep understanding of accounting principles and financial reporting rules and regulations. His prior experience in public accounting and as a chief financial officer of a global technology company brings an important perspective to the Board. Mr. Brown also serves on the boards, as well as the audit committees and compensation committees, of multiple publicly traded companies in both the technology and financial services sectors, which provides us with valuable insight on technological and strategic issues affecting the Company. Mr. Brown’s prior service as chairman of the Nasdaq Stock Market Board of Directors and as a past governor of the National Association of Securities Dealers provides experience with issues affecting a publicly traded company as well as demonstrating Mr. Brown’s leadership and business acumen.

John M. Morphy. Mr. Morphy, age 68, joined the Company as a Class III director in May 2016 pursuant to the 2016 Agreement. Mr. Morphy previously served as Senior Vice President, Chief Financial Officer, Secretary and Treasurer of Paychex, Inc. (NASDAQ:PAYX), a leading provider of payroll, human resource, and benefits outsourcing solutions for small to medium-sized businesses ("Paychex"), from October 1996 until June 2011, at which time he was appointed vice president of finance at Paychex until he retired in January 2012. As chief financial officer of Paychex, Mr. Morphy reported directly to the chief executive officer and was responsible for all finance, legal, shareholder relations, purchasing, real estate and travel functions. Prior to joining Paychex in 1995, he served as the chief financial officer of Goulds Pumps, Inc. ("Goulds"), a then publicly traded global manufacturer of pumps for industrial, commercial

and water supply markets, from 1985 to 1993, and as group Vice President over industrial products at Goulds through 1995. From 1976 to 1985, Mr. Morphy was vice president and controller for Computer Consoles, Inc., and before that he was an accountant at Arthur Andersen & Company, an accounting firm. Mr. Morphy also previously served as a director of Inforte Corp., a then publicly traded customer and demand management consultancy, from April 2003 to August 2004. He earned his Bachelor of Science in Accounting from LeMoyne College and his Certified Public Accountant certificate in 1973.

Mr. Morphy's more than 20 years of financial leadership experience for various public corporations and experience in many facets of finance within varied environments, including rapid growth companies, global Fortune 500 industrial companies and major accounting firms, would make him a valuable member of the Board.

Richard G. Rawson. Mr. Rawson, age 67, President of the Company and the majority of its subsidiaries, has been a director of the Company since 1989. He has been President of the Company since August 2003. Before being elected president, he served as executive vice president of administration, chief financial officer and treasurer of the Company from February 1997 until August 2003. Prior to that, he served as senior vice president, chief financial officer and treasurer of the Company since 1989. Prior to joining the Company in 1989, Mr. Rawson served as a senior financial officer and controller for several companies in the manufacturing and seismic data processing industries. He has served NAPEO as president, first vice president, second vice president and treasurer, as well as chairman of the Accounting Practices Committee. Mr. Rawson has a Bachelor of Business Administration degree in Finance from the University of Houston and currently serves as a member of the board for the C.T. Bauer College of Business.

Mr. Rawson brings financial and operational experience to the Board. His lengthy service as president of the Company, as well as his prior service as chief financial officer and treasurer of the Company, provide in-depth knowledge and insight of Company operations and financial matters to the Board.

|

|

| The Board recommends that stockholders vote “For” all of the nominees listed above, and proxies executed and returned will be so voted unless contrary instructions are indicated thereon. |

Directors Not Currently Subject to Election

The following directors are not subject to election at the 2016 Annual Meeting of Stockholders:

Class III Director

Eli Jones. Dr. Jones, age 54, joined the Company as a director in April 2004. Dr. Jones has announced that he will not stand for re-election to the Board and will retire from the Board when his term expires at the 2016 Annual Meeting of Stockholders. Since July 2015, Dr. Jones has served as the Dean of the Mays Business School at Texas A&M University. Prior to his current position, from 2012, he was the Dean of the Sam M. Walton College of Business at the University of Arkansas and holder of the Sam M. Walton Leadership Chair in Business. Prior to joining the faculty at the University of Arkansas, he was Dean of the E. J. Ourso College of Business and Ourso Distinguished Professor of Business at Louisiana State University (“LSU”) from 2008 to 2012; Professor of Marketing and Associate Dean at the C.T. Bauer College of Business at the University of Houston from 2007 to 2008; an Associate Professor of Marketing from 2002 to 2007; and an assistant professor from 1997 until 2002. He taught at Texas A&M University for several years before joining the faculty of the University of Houston. Dr. Jones served as the executive director of the Program for Excellence in Selling and the founding director of the Sales Excellence Institute at the University of Houston from 1997 to 2007. Before becoming a professor, he worked in sales and sales management for three Fortune 100 companies: Quaker Oats, Nabisco and Frito-Lay. He received his Bachelor of Science degree in Journalism in 1982, his MBA in 1986, and his Ph.D. in 1997, all from Texas A&M University.

Dr. Jones brings to the Board significant experience and cutting-edge knowledge and expertise. He is considered a “sales scientist” in that he conducts and publishes cutting-edge research in sales, sales management, marketing strategy, leadership and customer relationship management based on data from organizations world-wide, which are areas critical to the Company. Dr. Jones is able to draw upon his research to provide the Board knowledge with respect to the Insperity sales force. Dr. Jones’ prior service as Dean of the E. J. Ourso College of Business and Ourso Distinguished Professor of Business at LSU and as Dean of the Sam M. Walton College of Business at the University of Arkansas and holder of the Sam M. Walton Leadership Chair in Business, as well as his new role as Dean of the Mays Business School at Texas A&M University, demonstrate his leadership and broad-based business acumen.

Class I Directors

Peter A. Feld. Mr. Feld, age 37, joined the Company as a director in March 2015 following his nomination by Starboard pursuant to the 2015 Agreement. Mr. Feld is a Managing Member and Head of Research of Starboard Value LP, a New York-based investment adviser with a focused and fundamental approach to investing in publicly traded U.S. companies, a position he has held since April 2011. From November 2008 to April 2011, Mr. Feld served as a Managing Director of Ramius LLC and a Portfolio Manager of Ramius Value and Opportunity Master Fund Ltd. From February 2007 to November 2008, Mr. Feld served as a Director at Ramius LLC. Since January 2016, he has served as a member of the board of directors of The Brink’s Company, a global leader in security-related services. Mr. Feld previously served as a member of the boards of directors of Darden Restaurants, Inc. (NYSE: DRI), a full service restaurant company from October 2014 to September 2015; Tessera Technologies, Inc. (Nasdaq: TSRA), which develops, invests in, licenses and delivers innovative miniaturization technologies and products for next-generation electronic devices, from June 2013 to April 2014; Integrated Device Technology, Inc. (Nasdaq: IDTI), a company which designs, develops, manufactures and markets a range of semiconductor solutions for the advanced communications, computing and consumer industries, from June 2012 to February 2014; Unwired Planet, Inc. (Nasdaq: UPIP) f/k/a Openwave Systems, Inc., a company with a portfolio of patents many of which are considered foundational to mobile communications, and span smart devices, cloud technologies and unified messaging, from July 2011 to March 2014 and as chairman from September 2011 to July 2013; and SeaChange International, Inc. (Nasdaq: SEAC), a leading global multi-screen video software company, from December 2010 to January 2013. Mr. Feld has also served as a member of the audit, compensation and nominating and corporate governance committees of several of the boards of directors on which he has served. Mr. Feld received a BA in economics from Tufts University.

Mr. Feld’s extensive knowledge of the capital markets and corporate governance practices as a result of his investment and private equity background makes him a valuable asset to the Board.

Michelle McKenna-Doyle. Ms. McKenna-Doyle, age 51, joined the Company as a director in April 2015 following her nomination by Starboard pursuant to the 2015 Agreement. Since October 2012, Ms. McKenna-Doyle has served as the Senior Vice President (“SVP”) and Chief Information Officer (“CIO”) of the NFL, a professional American football league. Prior to joining the NFL, from May 2011 to October 2012, she served as CIO at Constellation Energy Group, Inc., an energy supplier, where she implemented major technology strategic initiatives and led the company’s integration with Exelon in connection with the merger of the two companies. Ms. McKenna-Doyle served as the President of Vision Interactive Media Group, a global digital interactive media solutions nonprofit company, from September 2010 to June 2011. From May 2007 to May 2010, she served as SVP and CIO at Universal Orlando Resort, a theme park resort owned by NBCUniversal, and from April 2006 to May 2007 she served as CIO of Centex Destination Properties, a division of Centex Corporation, a home builder. She previously spent more than 13 years at the Walt Disney World Company, an American diversified multinational mass media corporation, where she held senior leadership positions in finance, marketing and information technology. In March 2015, Ms. McKenna-Doyle was appointed to the board of directors of RingCentral, Inc. (NYSE: RNG), where she serves on the audit and compensation committees. Ms. McKenna-Doyle received a Bachelor of Science degree in Accounting from Auburn University and an MBA from the Crummer Graduate School of Business, Rollins College. She was formerly licensed as a certified public accountant in the State of Georgia. She has extensive experience in the media and entertainment industry.

Ms. McKenna-Doyle brings to the Board extensive experience with technology management and senior leadership, including at service-related businesses, as well as financial and accounting acumen. Her background with information technology and data security further provides the Board with a key perspective on such matters that are increasingly important to the Company.

Austin P. Young. Mr. Young, age 75, joined the Company as a director in January 2003. He is the Company’s Lead Independent Director, chair of the Company’s Finance, Risk Management and Audit Committee and a member of the Company’s Nominating and Corporate Governance Committee. He was also a member of the Company’s Independent Advisory Committee. Mr. Young served as senior vice president, chief financial officer and treasurer of CellStar Corporation from 1999 to December 2001, when he retired. From 1996 to 1999, he served as executive vice president - finance and administration of Metamor Worldwide, Inc. Mr. Young also held the position of senior vice president and chief financial officer of American General Corporation for over eight years and was a partner in the Houston and New York offices of KPMG before joining American General. Mr. Young has served as a director of Amerisafe, Inc. (Nasdaq: AMSF) since November 2005, where he is also chairman of the audit committee. He served as a director and chairman of the audit committees of Tower Group International, Ltd. (former Nasdaq-listed company) and its predecessor company from 2004 until September 2014. He is a member of the Houston and State Chapters of the Texas Society of CPAs, the American Institute of CPAs, and the Financial Executives International. He holds an accounting degree from The University of Texas.

Mr. Young brings extensive financial and accounting experience to the Board. His prior experience as a partner in an international accounting firm, as a senior financial officer of large companies, and his service on the audit committees of publicly traded companies provide Mr. Young with a thorough understanding of generally accepted accounting principles and financial statements. Additionally, Mr. Young’s prior experience provides a solid background for him to advise and consult with the Board on financial and audit-related matters as chairperson of the Finance, Risk Management and Audit Committee, and to serve as the designated audit committee financial

expert of the Finance, Risk Management and Audit Committee. Mr. Young’s service on other boards and his extensive knowledge of the Company and its business provide us with additional valuable perspective on issues affecting the Company.

Class II Directors

Carol R. Kaufman. Ms. Kaufman, age 66, joined the Company as a director in November 2013. Ms. Kaufman is the executive vice president, secretary, chief administrative officer and chief governance officer of The Cooper Companies, Inc., a global medical device company, where she has served since October 1995, including as vice president of legal affairs beginning in March 1996, senior vice president beginning in October 2004 and her current position beginning in July 2011. From January 1989 through September 1995, she served as vice president, secretary and chief administrative officer of Cooper Development Company, a former affiliate of The Cooper Companies, Inc. Beginning in 1971, Ms. Kaufman held several financial positions, including deputy corporate controller, with Cooper Laboratories, Inc., the former parent of The Cooper Companies, Inc. Ms. Kaufman served as a director of Chindex, Inc. (former Nasdaq-listed company) from November 2000 until September 2014, serving on its audit and compensation committees and as chair of its governance and nominating committee. Ms. Kaufman earned a Bachelor of Science degree in Mathematics in 1971 from Boston University.

Ms. Kaufman brings extensive financial, accounting and business experience, including in corporate governance, to the Board. Her varied roles within The Cooper Companies, Inc. provide the Board with additional expertise on accounting and controls, and on evaluating and executing strategic initiatives.

Paul J. Sarvadi. Mr. Sarvadi, age 59, Chairman of the Board and Chief Executive Officer and co-founder of the Company and its subsidiaries, has been a director since the Company’s inception in 1986. He has also served as the Chairman of the Board and Chief Executive Officer of the Company since 1989 and as president of the Company from 1989 to August 2003. He attended Rice University and the University of Houston prior to starting and operating several small companies. Mr. Sarvadi has served as president of the National Association of Professional Employer Organizations (“NAPEO”) and was a member of its Board of Directors for five years. In 2001, Mr. Sarvadi was selected as the 2001 National Ernst & Young Entrepreneur of the Year ® for service industries. In 2004, he received the Conn Family Distinguished New Venture Leader Award from Mays Business School at Texas A&M University. In 2007, he was inducted into the Texas Business Hall of Fame.

Mr. Sarvadi brings substantial business and operational experience to the Board, including an extensive knowledge of sales, customer relationships, and issues affecting small to medium-sized businesses. Mr. Sarvadi’s role as a co-founder of the Company and lengthy service as chief executive officer of the Company provide to the Board extensive knowledge and insight of our operations and issues affecting the Company as well as the broader professional employer organization (“PEO”) industry. Mr. Sarvadi’s previous experience starting and operating several small businesses, as well as his frequent interaction with the Company’s clients, provide valuable insight to the challenges facing small to medium-sized businesses, which is a principal focus of the Company.

Norman R. Sorensen. Mr. Sorensen, age 70, joined the Company as a director in March 2015 following his nomination by Starboard pursuant to the 2015 Agreement. Mr. Sorensen formerly served as Chairman of the International Insurance Society, Inc., a professional organization for the insurance industry, from January 2010 to June 2013. Mr. Sorensen has served as a director of the International Insurance Society, Inc. since January 2005. Previously, from November 2011 until December 2012, he was Chairman of the International Advisory Council of Principal Financial Group, Inc., a global financial investment management company. He was Chairman of Principal International, Inc., from June 2011 to October 2012, and President and CEO of International Asset Management and Accumulation of Principal International, Inc., from January 2001 to June 2011. Mr. Sorensen has served as a director of Encore Capital Group, Inc. (Nasdaq: ECPG), a consumer banking company, since November 2011. Mr. Sorensen also served as a director of Sara Lee Corporation (former NYSE-listed company), an American consumer-goods company, from January 2007 to November 2011. He has served as Executive Vice President of both Principal Financial Group, Inc. and Principal Life Insurance Company, a life insurance company, since January 2007, and held a number of other senior management positions since 1998. Mr. Sorensen also served as Chairman of the U.S. Coalition of Service Industries, a leading forum for the services sector, from January 2003 to March 2005. Mr. Sorensen served as a senior executive of American International Group, Inc., an insurance services company, from 1989 to December 1998. He also formerly served as Chairman and director of DE Master Blenders 1753, a Dutch NYSE/Euronext-listed consumer goods company, from December 2011 until September 2013.

Mr. Sorensen’s qualifications include his experience as an executive officer of an international financial services and asset management company, with responsibility over international operations and oversight over asset management and financial services functions and multiple divisional chief financial officers. He has also served as an executive officer of several publicly traded companies.

Summary of Committee Memberships

The following table summarizes the committees to which each director will belong both before and after the 2016 Annual Meeting of Stockholders, including after giving effect to the covenants set forth in the 2016 Agreement and assuming that each of the nominees for director at the 2016 Annual Meeting of Stockholders are elected:

|

| | | |

| | Current | | After 2016 Annual Meeting of Stockholders |

| | | | |

| Compensation Committee | Jones (Chair) Brown Feld | | Brown (Chair) Feld McKenna-Doyle New Director1 |

| | | | |

| Finance, Risk Management and Audit Committee | Young (Chair) Kaufman McKenna-Doyle Sorensen | | Young (Chair) Kaufman Morphy Sorensen |

| | | | |

Nominating and Corporate Governance Committee2 | McKenna-Doyle (Chair) Brown Feld Young | | McKenna-Doyle (Chair) Brown Feld Young |

_________________________

| |

1 | Refers to the new independent director to be appointed by the Board pursuant to the 2016 Agreement. See “— General —Agreements with Starboard — 2016 Agreement.” |

| |

2 | Immediately prior to the effectiveness of the 2016 Agreement, the Nominating and Corporate Governance Committee was comprised as follows: Ms. Kaufman (Chair), and Messrs. Brown, Feld, Jones and Young. |

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Insperity has adopted Corporate Governance Guidelines, which include guidelines for, among other things, director responsibilities, qualifications and independence. The Board regularly monitors developments in corporate governance practices and regulatory changes and periodically assesses the adequacy of and modifies its Corporate Governance Guidelines and committee charters as warranted in light of such developments. You can access the Company’s Corporate Governance Guidelines in their entirety on the Company’s website at www.insperity.com in the Corporate Governance section under the Investor Relations tab. The information on our website is not, and shall not be deemed to be, a part of this proxy statement.

On an annual basis, each director and named executive officer is obligated to complete a questionnaire that requires disclosure of any transactions with the Company in which the director or executive officer, or any member of his or her immediate family, has a direct or indirect material interest, and must promptly advise us of any changes to the information previously provided.

Director Independence

Under rules of the NYSE, the Company must have a majority of independent directors. No director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). In evaluating each director’s independence, the Board considered all relevant facts and circumstances, and relationships and transactions between each director, her or his family members or any business, charity or other entity in which the director has an interest on the one hand, and the Company, its affiliates, or the Company’s senior management on the other. As a result of this review, at its meeting held on February 19, 2016, the Board affirmatively determined that all of the Company’s directors are independent from the Company and its management, with the exception of Messrs. Sarvadi and Rawson, both of whom are members of the senior management of the Company.

The Board has considered what types of disclosure should be made relating to the process of determining director independence. To assist the Board in making disclosures regarding its determinations of independence, the Board has adopted categorical standards as contemplated under the listing standards of the NYSE then in effect. Under the rules then in effect, relationships that were within the categorical standards were not required to be disclosed and their impact on independence was not required to be separately discussed, although the categorical standards, by themselves, did not determine the independence of a particular director. The Board considers all

relevant facts and circumstances in determining whether a director is independent. A relationship satisfies the categorical standards adopted by the Board if it:

|

| | | |

| | • | | is not a relationship that would preclude a determination of independence under Section 303A.02(b) of the NYSE Listed Company Manual; |

| | • | | consists of charitable contributions made by Insperity to an organization where a director is an executive officer and does not exceed the greater of $1 million or 2% of the organization’s gross revenue in any of the last three years; and |

| | • | | is not required to be, and it is not otherwise, disclosed herein. |

In the course of the Board’s determination regarding the independence of directors other than Messrs. Sarvadi and Rawson, it considered all transactions, relationships and arrangements in which such directors and Insperity were participants. The Board also considered any transactions amongst the directors, even if they did not involve Insperity. In particular, with respect to each of the most recent three fiscal years, the Board evaluated, with respect to Dr. Jones, its long-time employment of an individual who became Dr. Jones’ son-in-law. The Board has determined that this relationship is not material. In making this determination with respect to Dr. Jones, the Board considered that Dr. Jones’ son-in-law was employed as a manager of lead generation, held such position for several years prior to becoming a member of Dr. Jones’ family, and his salary was between the 25th and 75th percentile for the position.

Selection of Nominees for the Board of Directors

Identifying Candidates

The Nominating and Corporate Governance Committee solicits ideas for potential candidates for membership on the Board from a number of sources including members of the Board, executive officers of the Company, individuals personally known to the members of the Board, and research. The Nominating and Corporate Governance Committee also has sole authority to select and compensate a third-party executive search firm to help identify candidates, if it deems advisable. In addition, the Nominating and Corporate Governance Committee will consider candidates for the Board submitted by stockholders. Any such submissions should include the candidate’s name and qualifications for Board membership and should be directed to the Corporate Secretary of Insperity at 19001 Crescent Springs Drive, Kingwood, Texas 77339. Although the Nominating and Corporate Governance Committee does not require the stockholder to submit any particular information regarding the qualifications of the stockholder’s candidate, the level of consideration that the Nominating and Corporate Governance Committee will give to the stockholder’s candidate will be commensurate with the quality and quantity of information about the candidate that the stockholder makes available to the Committee. The Nominating and Corporate Governance Committee will consider all candidates identified through the processes described above, and will evaluate each of them on the same basis.

In addition, the Bylaws of the Company permit stockholders to nominate directors for election at an annual stockholders meeting whether or not such nominee is submitted to and evaluated by the Nominating and Corporate Governance Committee. To nominate a director using this process, the stockholder must follow the procedures described under “Additional Information — Stockholder Director Nominations for 2017 Annual Meeting of Stockholders.”

Further, pursuant to the 2016 Agreement, the Company agreed to appoint Mr. Morphy to the Board and to nominate Messrs. Brown, Morphy and Rawson for re-election as Class III directors at the 2016 Annual Meeting of Stockholders.

Evaluating Candidates

Each candidate must meet certain minimum qualifications, including:

|

| | | |

| | • | | the ability to represent the interests of all stockholders of the Company and not just one particular constituency; |

| | • | | independence of thought and judgment; |

| | • | | the ability to dedicate sufficient time, energy and attention to the performance of her or his duties, taking into consideration the prospective nominee’s service on other public company boards; and |

| | • | | skills and expertise that are complementary to the existing Board members’ skills; in this regard, the Board will consider the Board’s need for operational, sales, management, financial, governmental or other relevant expertise. |

In addition, the Nominating and Corporate Governance Committee considers other qualities that it may deem to be desirable from time to time, such as the extent to which the prospective nominee contributes to the diversity of the Board — with diversity being construed broadly to include a variety of perspectives, opinions, experiences and backgrounds. However, diversity is just one factor that the Nominating and Corporate Governance Committee may consider, and the Board does not have any particular policy with regard to

diversity. The Nominating and Corporate Governance Committee may also consider the ability of the prospective nominee to work within the then-existing interpersonal dynamics of the Board and her or his ability to contribute to the collaborative culture among Board members.

Generally, based on this initial evaluation, the chairperson of the Nominating and Corporate Governance Committee will determine whether to interview the nominee, and if warranted, will recommend that one or more members of the Nominating and Corporate Governance Committee, other members of the Board and senior management, as appropriate, interview the nominee in person or by telephone. After completing this evaluation and interview process, the Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation of the Nominating and Corporate Governance Committee.

Board of Directors Leadership

The Company does not have a policy with respect to whether the positions of Chairman of the Board and chief executive officer (“CEO”) should be held by the same person or two separate individuals, and believes that it is in the best interest of the Company to consider that question from time to time in the context of succession planning. At this time, the Board believes that it is in the best interest of the Company and an appropriate leadership structure to have the CEO also serve as Chairman of the Board. Combining the CEO and Chairman of the Board roles provides an efficient and effective leadership model that promotes unambiguous accountability and alignment on corporate strategy. Mr. Sarvadi co-founded the Company in 1986 and has served as Chairman of the Board and CEO since 1989. The Board believes that Mr. Sarvadi’s intimate knowledge of the daily operations of and familiarity with the Company and industry put him in the best position to provide leadership to the Board on setting the agenda, emerging issues facing the Company and the PEO industry, and strategic opportunities. Additionally, Mr. Sarvadi’s substantial financial stake in the Company creates a strong alignment of interests with other stockholders. Mr. Sarvadi’s combined roles also ensure that a unified message is conveyed to stockholders, employees and clients.

The Company’s Corporate Governance Guidelines established the position of lead independent director in 2012. Mr. Young is currently the lead independent director. The Board reevaluates the lead independent director position annually. The lead independent director has the following responsibilities in addition to the regular duties of a director:

|

| | |

| • | | prepare and set the agenda for and chair executive sessions of the outside directors; |

| • | | call or convene executive sessions of the outside directors; |

| • | | authority to set the agenda for meetings of the Board; |

| • | | preside at all meetings of the Board where the Chairman of the Board is not present or has a potential conflict of interest; |

| • | | serve as liaison and facilitate communications between the independent directors and the Chairman of the Board and CEO; |

| • | | consult with the Chairman of the Board and CEO on matters relating to corporate governance and performance of the Board; and |

| • | | collaborate with the rest of the Nominating and Corporate Governance Committee on possible director conflicts of interest or breaches of the Corporate Governance Guidelines. |

Board of Directors’ Role in Risk Oversight

The Board is responsible for overseeing the Company’s overall risk profile and assisting management in addressing specific risks. The Company’s Enterprise Risk Management Steering Committee (the “ERM Steering Committee”) is responsible for formally identifying and evaluating risks that may affect the Company’s ability to execute its corporate strategy and fulfill its business objectives. The ERM Steering Committee employs a disciplined approach to identifying, documenting, evaluating, communicating, and monitoring enterprise risk management within the Company. The ERM Steering Committee is chaired by the Company’s chief financial officer and includes the Company’s general counsel, internal audit director and other members of management. The ERM Steering Committee reports to the Board and the CEO. During 2015, the ERM Steering Committee completed a comprehensive review and update of the Company’s risks, including strategic, operational, financial, legal, regulatory and reputational risks. The ERM Steering Committee further reviewed and updated the mitigating factors associated with such risks, and prioritized the identified risks based upon the subjectively determined likelihood of the occurrence and the estimated resulting impact on the Company if the risk occurred. The ERM Steering Committee is charged with periodically reviewing the Company’s overall risk profile, as well as any significant identified risks, with both the Finance, Risk Management and Audit Committee and the entire Board.

The Board executes its risk oversight function both directly and through its standing committees, each of which assists the Board in overseeing a part of the Company’s overall risk management. Throughout the year, the Board and each such committee spend a portion

of their time reviewing and discussing specific risk factors, and risk assessments are part of all major decision making. The Board is kept informed of each committee’s risk oversight and related activities through regular reports from such committees. The Finance, Risk Management and Audit Committee is assigned primary responsibility for oversight of risk assessment with financial implications. In its periodic meetings with management, internal auditors and independent auditors, the Finance, Risk Management and Audit Committee reviews and monitors many factors relating to enterprise risk, including:

|

| | |

| • | | the financial affairs of the Company; |

| • | | the integrity of the Company’s financial statements and internal controls; |

| • | | the Company’s compliance with legal and regulatory requirements; |

| • | | the independent auditor’s qualifications, independence and performance; |

| • | | the performance of the personnel responsible for the Company’s internal audit function and independent auditors; and |

| • | | the Company’s policies and procedures with respect to risk management. |

The Compensation Committee has the primary responsibility to consider material risk factors relating to the Company’s compensation policies and practices. The Nominating and Corporate Governance Committee monitors governance and succession risks. As part of its review and approval of the Company’s capital budget, major acquisitions, material contracts, compensation and other similar matters, the Board retains ultimate authority over assessing the risks and their impacts on the Company’s business.

Prohibition on Hedging and Pledging of Company Common Stock

The Company has established strict standards regarding the speculative trading of Company Common Stock. In February 2013, the Company amended its internal policies to prohibit employees from engaging in hedging transactions involving Company Common Stock. The Board also adopted a formal policy prohibiting employees and directors from engaging in the significant pledging of shares of Company Common Stock. All pledging requests will be reviewed by the Board, which will consider the facts and circumstances and other information the Board deems relevant.

As of May 9, 2016, Mr. Sarvadi had 220,000 shares of Common Stock pledged. After a thorough review, the Board previously determined that the shares pledged by the CEO were not significant. In making this determination, the Board considered that the pledged shares only represent approximately 14% of the total shares beneficially owned by the CEO and approximately 1% of the Company’s total shares outstanding and market capitalization. The Board also considered the CEO’s significant number of founder’s shares that were not earned as compensation from the Company, and his compliance with the Company’s stock ownership guidelines, disregarding the pledged shares.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (the “Code”) governing the conduct of the Company’s directors, officers and employees. The Code, which meets the requirements of Rule 303A.10 of the NYSE Listed Company Manual and Item 406 of Regulation S-K, is intended to promote honest and ethical conduct, full, fair, accurate, timely and understandable disclosure in the Company’s public filings, compliance with laws and the prompt internal reporting of violations of the Code. You can access the Code on the Company’s website at www.insperity.com in the Corporate Governance section under the Investor Relations tab. Changes in and waivers to the Code for the Company’s directors, executive officers and certain senior financial officers will be posted on the Company’s Internet website within four business days of being approved and maintained for at least 12 months. If you wish to raise a question or concern or report a violation to the Finance, Risk Management and Audit Committee, you should visit www.ethicspoint.com or call the Ethicspoint toll-free hotline at 1-866-384-4277.

Stockholder Communications

Stockholders and other interested parties may communicate directly with the entire Board or the non-management directors as a group by sending an email to directors@insperity.com. Alternatively, you may mail your correspondence to the Board or non-management directors in care of the Corporate Secretary, 19001 Crescent Springs Drive, Kingwood, Texas 77339. In the subject line of the email or on the envelope, please specify whether the communication is addressed to the entire Board or to the non-management directors.

Unless any director directs otherwise, communications received (via U.S. mail or email) will be reviewed by the Corporate Secretary who will exercise his discretion not to forward to the Board correspondence that is inappropriate such as business solicitations, frivolous communications and advertising, routine business matters (i.e. business inquiries, complaints, or suggestions), and personal grievances.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors

Directors are expected to attend all or substantially all Board meetings and meetings of the Committees of the Board on which they serve. Directors are also expected to spend the necessary time to discharge their responsibilities appropriately (including advance review of meeting materials) and to ensure that other existing or future commitments do not materially interfere with their responsibilities as members of the Board. The Board met 13 times in 2015. All of the members of the Board participated in more than 75% of the meetings of the Board and Committees of which they were members during the fiscal year ended December 31, 2015. The Board encourages its members to attend the Annual Meeting of Stockholders. Last year, five of the Company’s directors attended the Annual Meeting of Stockholders.

Executive Sessions of the Board of Directors and the Lead Independent or Presiding Director

The Company’s non-management directors, all of whom are also independent, hold executive sessions at which the Company’s management is not in attendance at regularly scheduled Board meetings. The lead independent director, currently Mr. Young, establishes the agenda and serves as presiding director at the executive sessions. In the absence of a lead independent director, the chairperson of the Nominating and Corporate Governance Committee or an independent director designated by the outside directors shall preside at meetings of non-management directors.

Committees of the Board of Directors

The Board has appointed three standing committees: the Finance, Risk Management and Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. The charters for each of the three standing committees, which have been adopted by the Board, contain a detailed description of the respective standing committee’s duties and responsibilities and are available on the Company’s website at www.insperity.com in the Corporate Governance section under the Investor Relations tab. The Board also created a new, temporary Independent Advisory Committee pursuant to the 2015 Agreement. The Board has reviewed the applicable legal and NYSE standards for independence for members of each of Finance, Risk Management and Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee as well as the Company's independence standards for such Committees and has determined that the members of each of those Committees of the Board is “independent” under such requirements.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee met five times in 2015. The members of the Nominating and Corporate Governance Committee currently are: Ms. McKenna-Doyle, who serves as chairperson, and Messrs. Brown, Feld and Young. The composition of this Committee was revised in connection with the 2016 Agreement. See “Proposal Number 1: Election of Directors —General — Agreements with Starboard — 2016 Agreement.” The Nominating and Corporate Governance Committee: (i) identifies individuals qualified to become Board members, consistent with the criteria for selection approved by the Board; (ii) recommends to the Board a slate of director nominees to be elected by the stockholders at the next Annual Meeting of Stockholders and, when appropriate, director appointees to take office between Annual Meetings of Stockholders; (iii) develops and recommends to the Board a set of corporate governance guidelines for the Company; and (iv) oversees the evaluation of the Board.

Finance, Risk Management and Audit Committee

The Finance, Risk Management and Audit Committee met eight times in 2015. The members of this Committee currently are Mr. Young, who serves as chairperson, Ms. Kaufman, Ms. McKenna-Doyle and Mr. Sorensen. Pursuant to the 2016 Agreement, immediately following the 2016 Annual Meeting of Stockholders and assuming all director nominees are re-elected, the members of this Committee will be Mr. Young, who will continue to serve as chairperson, Ms. Kaufman, Mr. Morphy and Mr. Sorensen. The Board has determined that Mr. Young is an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC. The Finance, Risk Management and Audit Committee assists the Board in fulfilling its responsibility to oversee the financial affairs, risk management, accounting and financial reporting processes, and audits of financial statements of the Company by reviewing and monitoring: (i) the financial affairs of the Company; (ii) the integrity of the Company’s financial statements and internal controls; (iii) the Company’s compliance with legal and regulatory requirements; (iv) the independent auditor’s qualifications, independence and performance; (v) the performance of the personnel responsible for the Company’s internal audit function and the independent auditors; and (vi) the Company’s policies and procedures with respect to risk management, as well as other matters that may come before it as directed by the Board.

Compensation Committee