UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

| | | | | | | | | | | | | | |

| o | | Preliminary Proxy Statement |

| | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | | Definitive Proxy Statement |

| | |

| o | | Definitive Additional Materials |

| | |

| o | | Soliciting Material under Rule 14a-12 |

| |

| INSPERITY, INC. |

| (Name of registrant as specified in its charter) |

| |

| (Name of person(s) filing proxy statement, if other than the registrant) |

| |

| Payment of Filing Fee (Check all boxes that apply): |

| | |

| x | | No fee required. |

| | |

| o | | Fee paid previously with preliminary materials. |

| | |

| o | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Paul J. Sarvadi

Chairman of the Board

and Chief Executive Officer

April 17, 2023

Dear Fellow Stockholders:

On behalf of your Board of Directors and management, I am pleased to invite you to attend the Annual Meeting of Stockholders of Insperity, Inc. to be held in the Auditorium of Centre I of our corporate headquarters located at 19001 Crescent Springs Drive, Kingwood, Texas 77339, on May 22, 2023, at 1:30 p.m. Houston, Texas time.

Please carefully consider the information in the enclosed proxy statement regarding the proposals to be presented at the meeting. Our annual report on Form 10-K for the year ended December 31, 2022 is also enclosed.

It is important that your shares are represented at the meeting. Whether or not you plan to attend the meeting, please submit your proxy via the Internet or telephone or by completing and returning the enclosed proxy card or voting instruction card in the envelope provided. You may also attend and vote at the meeting by following the procedures that we have described in the proxy statement.

Thank you for your continued support and investment in our business. We look forward to seeing you at the meeting.

Sincerely,

Paul J. Sarvadi

Chairman of the Board and Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF INSPERITY, INC.

Date: May 22, 2023

Time: 1:30 p.m. Houston, Texas time

Place: The Auditorium in Centre I of our corporate headquarters

19001 Crescent Springs Drive, Kingwood, Texas 77339

At the meeting, stockholders will consider and act upon the following matters:

1.To elect the three nominees named in the proxy statement to the Board of Directors;

2.Approval of the Insperity, Inc. Incentive Plan;

3.To cast an advisory vote to approve executive compensation (“say-on-pay” vote);

4.To cast an advisory vote on the frequency of holding the advisory vote on executive compensation; and

5.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2023.

Important Notice Regarding the Availability of Proxy Materials: A full set of all proxy materials for the Annual Meeting of Stockholders to be held on May 22, 2023 is enclosed with this notice. Additionally, the Company’s proxy statement, most recent annual report on Form 10-K, and other proxy materials are available at www.insperity.com/annualmeeting.

Only stockholders of record at the close of business on April 4, 2023 are entitled to notice of, and to vote at, the meeting.

| | | | | | | | | | | | | | |

| It is important that your shares be represented at the Annual Meeting of Stockholders regardless of whether you plan to attend. Therefore, please submit your proxy via the Internet or telephone or by completing and returning the enclosed proxy card or voting instruction card. |

By Order of the Board of Directors

Daniel D. Herink

Executive Vice President of Legal,

General Counsel and Secretary

April 17, 2023

Kingwood, Texas

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Outstanding Equity Awards Table at 2022 Fiscal Year End | |

| |

| | | | | |

| Option Exercises and Stock Vested Table for Fiscal Year 2022 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Proposal Number 4 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Stockholder Proposals and Director Nominations for 2023 Annual Meeting of Stockholders | |

| Stockholder Proposals for Inclusion in Our 2024 Proxy Statement | |

| Stockholder Director Nominations and Proposals for 2024 Annual Meeting of Stockholders | |

| |

| |

| |

| |

INSPERITY, INC.

PROXY STATEMENT

SOLICITATION

The accompanying proxy is solicited by the Board of Directors, or Board, of Insperity, Inc., a Delaware corporation, for use at the 2023 Annual Meeting of Stockholders to be held on May 22, 2023, and at any reconvened meeting after an adjournment thereof. The 2023 Annual Meeting of Stockholders will be held at 1:30 p.m. (Houston, Texas time), in the Auditorium in Centre I of our corporate headquarters at 19001 Crescent Springs Drive, Kingwood, Texas 77339. The approximate date on which this proxy statement and the accompanying proxy card will first be sent to stockholders is April 18, 2023.

QUESTIONS AND ANSWERS ABOUT VOTING AND THE ANNUAL MEETING

Why am I receiving these materials?

We are providing these proxy materials to holders of shares of our common stock in connection with the solicitation of proxies by our Board to vote at the 2023 Annual Meeting of Stockholders, and at any adjournment(s) or postponement(s) thereof.

When and where is the 2023 Annual Meeting of Stockholders?

Our 2023 Annual Meeting of Stockholders will be held on May 22, 2023, at 1:30 p.m. (Houston, Texas time), in the Auditorium in Centre I of our corporate headquarters at 19001 Crescent Springs Drive, Kingwood, Texas 77339.

Who can vote at the 2023 Annual Meeting of Stockholders?

The Board has fixed April 4, 2023 as the record date for the 2023 Annual Meeting of Stockholders. Stockholders of record at the close of business on April 4, 2023 will be entitled to receive notice of, and vote at, the 2023 Annual Meeting of Stockholders or any reconvened meeting after an adjournment thereof. At the close of business on April 4, 2023, 38,203,488 shares of our common stock, par value $0.01 per share, were outstanding. Each share of our common stock is entitled to one vote upon each of the matters to be voted on at the 2023 Annual Meeting of Stockholders.

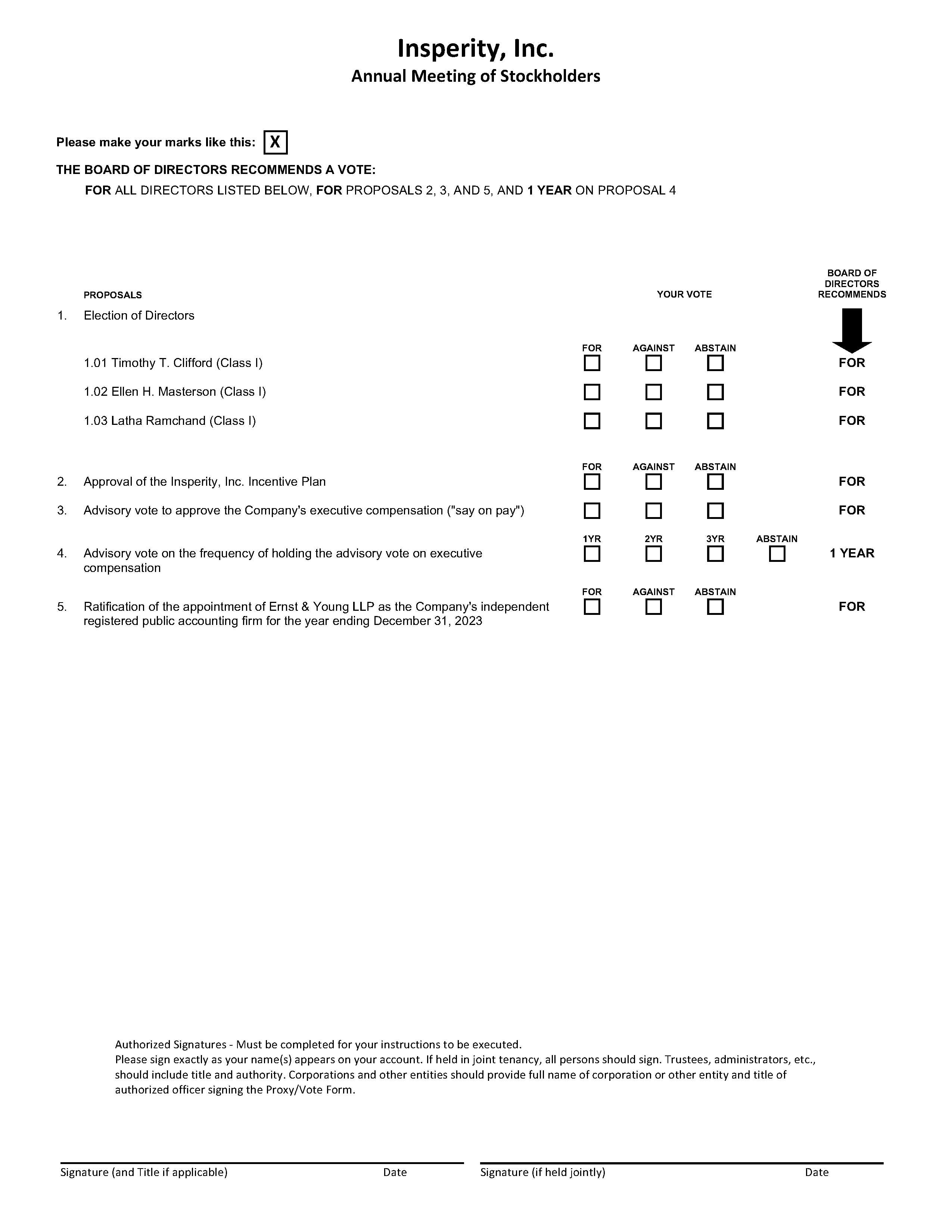

What matters will be voted on at the 2023 Annual Meeting of Stockholders, what are my voting choices, and how does the Board recommend that I vote?

At the 2023 Annual Meeting of Stockholders, you will be asked to vote on five proposals:

| | | | | | | | |

| Insperity | 1 | 2023 Proxy Statement |

| | | | | | | | |

| Proposal | Voting Choices | Board Recommendation |

Proposal 1: Election of the three director nominees named in this proxy statement to the Board of Directors | •For •Against •Abstain | FOR the election of all three director nominees |

Proposal 2: Vote to approve the Insperity, Inc. Incentive Plan | •For •Against •Abstain | FOR |

Proposal 3: Advisory vote to approve the Company’s executive compensation (“say-on-pay”) | •For •Against •Abstain | FOR |

Proposal 4: Advisory vote on the frequency of holding the advisory vote on executive compensation | •One year •Two years •Three years •Abstain | ONE YEAR |

Proposal 5: Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023 | •For •Against •Abstain | FOR |

In addition, you may vote on any other business as may properly come before the 2023 Annual Meeting of Stockholders or any adjournments or postponements thereof. The Board is not currently aware of any such other matters.

How many votes are needed to approve each proposal?

The following votes will be required to adopt each proposal:

•Proposal 1: A nominee for director will be elected if the votes cast “FOR” such nominee exceed the votes cast “AGAINST” such nominee.

•Proposal 2: The proposal will be approved if votes cast “FOR” such proposal exceed the votes cast “AGAINST” such proposal.

•Proposal 3: The proposal will be approved if votes cast “FOR” such proposal exceed the votes cast “AGAINST” such proposal.

•Proposal 4: The frequency receiving the greatest number of votes cast will be considered approved.

•Proposal 5: The proposal will be approved if votes cast “FOR” such proposal exceed the votes cast “AGAINST” such proposal.

In determining the number of votes cast, shares abstaining from voting or not voted on a matter will not be treated as votes cast. Accordingly, although proxies containing broker non-votes (which result when a broker holding shares for a beneficial owner has not received timely voting instructions on certain matters from such beneficial owner and when the broker does not otherwise have discretionary power to vote on a particular matter) are considered “shares present” in determining whether there is a quorum present at the 2023 Annual Meeting of Stockholders, they are not treated as votes cast with respect to the election of directors, and thus will not affect the outcome of the voting on the election of directors or any of the other proposals on non-routine matters to be voted on at the 2023 Annual Meeting of Stockholders.

What is the difference between holding shares as a “stockholder of record” and having shares held in “street name”?

If your name is registered on our stockholder records as the owner of the shares, then you are the “stockholder of record.” If your shares are held by a bank, broker, or other custodian, then your shares are considered held in “street name.”

If I am a stockholder of record, how can I vote my shares?

If you are a stockholder of record, then you may vote in one of four ways:

•by attending the meeting and voting at the meeting;

| | | | | | | | |

| Insperity | 2 | 2023 Proxy Statement |

•by mail by signing, dating, and returning your proxy in the envelope provided;

•via the Internet at the address listed on your proxy card; or

•by telephone using the toll-free number listed on your proxy card.

For stockholders of record, if you either return your signed proxy or submit your proxy using the Internet or telephone procedures available to you, your shares will be voted as you direct. If you properly execute and return the proxy without indicating a voting direction, then your shares will be voted FOR the election of the nominees listed herein as directors, FOR Proposals 2, 3, and 5, and ONE YEAR for Proposal 4. For stockholders of record, if you do not vote your shares as described above, then your shares will not be voted and will not be counted as present at the 2023 Annual Meeting of Stockholders for the purposes of establishing a quorum.

If my shares are held in street name, how can I vote my shares? Does my bank, broker, or other custodian need my instructions in order to vote my shares?

If your shares are held in street name, then the availability of telephone and Internet voting will depend on the processes of your custodian. Therefore, if your shares are held in street name, we recommend that you follow the voting instructions on the form that you receive from your custodian. If you hold your shares in street name through a custodian, you are invited to attend the 2023 Annual Meeting of Stockholders, but you must obtain a signed proxy from your custodian in order to vote your shares at the meeting.

If your shares are held in street name and you do not give your custodian direction on how to vote your shares, then your custodian will be unable to vote your shares on most matters. For the 2023 Annual Meeting of Stockholders, your custodian may not vote your shares on Proposal 1 (election of directors), Proposal 2 (approval of the Insperity, Inc. Incentive Plan), Proposal 3 (advisory approval of executive compensation), or Proposal 4 (advisory approval of frequency of advisory vote on executive compensation). This would be a “broker non-vote” and these shares will not be counted as having been voted on the applicable proposal and therefore will have no effect on the vote, assuming a quorum is present; however, your shares would be considered “present” for purposes of establishing a quorum. Please instruct your custodian so your vote can be counted. With respect to Proposal 5 (ratification of independent auditor), the custodian may exercise its discretion to vote for or against that proposal in the absence of your instruction.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid annual meeting. The presence, in person or by proxy, of a majority of the outstanding shares of our common stock is required for a quorum. If a quorum is present at the meeting, under our Bylaws, action on a matter or to elect director nominees shall be approved if the votes cast in favor of the matter or nominee exceed the votes cast opposing the matter or such nominee, as applicable. Your shares will be counted towards the quorum only if you submit a valid proxy, if a valid proxy is submitted on your behalf by your broker, bank or other agent, or if you vote live at our 2023 Annual Meeting of Stockholders. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the 2023 Annual Meeting of Stockholders may be adjourned to another date.

What if another matter is properly brought before the meeting?

The proxy confers discretionary authority to the persons named in the proxy authorizing those persons to vote, in their discretion, on any other matters properly presented at the 2023 Annual Meeting of Stockholders. The Board is not currently aware of any such other matters.

Who is paying for this proxy solicitation?

We pay the expense of preparing, printing, and mailing proxy materials to our stockholders. In addition to solicitation by mail, our officers or employees (none of whom will receive additional compensation) may solicit the return of proxies by telephone, email, or personal interview. We will also reimburse brokerage houses and other nominees for their reasonable expenses in forwarding proxy materials to beneficial owners of our common stock.

What does it mean if I receive more than one copy of the proxy materials?

If you receive more than one copy of the proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions accompanying each of the proxy materials that you receive to ensure that all of your shares are voted.

| | | | | | | | |

| Insperity | 3 | 2023 Proxy Statement |

Can I change or revoke my vote after submitting my proxy?

If you are a stockholder of record, you may change or revoke your vote by timely: (1) submitting written notice of revocation to the Secretary of the Company at the address for our corporate headquarters, provided above; (2) submitting another proxy card that is properly signed and later dated; (3) submitting a proxy again on the Internet or by telephone; or (4) voting in person at the 2023 Annual Meeting of Stockholders.

If you hold your shares in street name, you may change or revoke your vote by timely: (1) submitting new instructions in the manner provided by your custodian or (2) contacting your custodian to obtain a proxy to vote at the meeting.

How can I find out the results of the voting at the 2023 Annual Meeting of Stockholders?

Preliminary voting results will be announced at our 2023 Annual Meeting of Stockholders. In addition, final voting results will be published in a Current Report on Form 8-K that we expect to file with the U.S. Securities and Exchange Commission (“SEC”) within four business days after the 2023 Annual Meeting of Stockholders. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8‑K to publish the final results.

SECURITY OWNERSHIP

The following table sets forth the number and the percentage of shares of our common stock that were beneficially owned as of April 4, 2023 by: (1) each person known by us to beneficially own 5% or more of our common stock; (2) all current directors and persons nominated to become directors; (3) each of our executive officers identified in the Summary Compensation Table; and (4) all of our directors, director nominees and executive officers as a group.

| | | | | | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Amount and Nature of Beneficial Ownership1 | | Percent of Class |

| Timothy T. Clifford | | 14,907 | | | | * | |

| Eli Jones | | 4,573 | | | | * | |

| Carol R. Kaufman | | 35,997 | | | | * | |

| John L. Lumelleau | | 8,050 | | | | * | |

| Ellen H. Masterson | | 11,565 | | 2 | | * | |

| Randall Mehl | | 14,637 | | | | * | |

| John M. Morphy | | 9,041 | | | | * | |

| Latha Ramchand | | 8,050 | | | | * | |

| Richard G. Rawson | | 255,206 | | 3 | | * | |

| Paul J. Sarvadi | | 1,498,740 | | 4 | | 3.92 | % | |

| James D. Allison | | 47,570 | | | | * | |

| A. Steve Arizpe | | 186,382 | | 5 | | * | |

| Daniel D. Herink | | 24,099 | | | | * | |

| | | | | | |

| Douglas S. Sharp | | 26,174 | | | | * | |

| BlackRock, Inc. | | 5,592,538 | | 6 | | 14.64 | % | |

| | | | | | |

| Mawer Investment Management Ltd. | | 4,436,394 | | 7 | | 11.61 | % | |

| The Vanguard Group | | 3,692,828 | | 8 | | 9.67 | % | |

| Executive Officers and Directors as a Group (14 Persons) | | 2,144,991 | | | | 5.61 | % | |

_________________________

* Represents less than 1%.

1Except as otherwise indicated, each of the stockholders has sole voting and investment power with respect to the securities shown to be owned by such stockholder. The address for each officer and director is in care of Insperity, Inc., 19001 Crescent Springs Drive, Kingwood, Texas 77339.

As of April 4, 2023, none of these individuals held options exercisable for shares of our common stock. The number of shares of our common stock beneficially owned by each person includes unvested restricted stock units as of April 4, 2023. Restricted stock units do not have voting rights.

| | | | | | | | |

| Insperity | 4 | 2023 Proxy Statement |

| | | | | |

| Name of Beneficial Owner | Unvested Restricted Stock Units |

| Timothy T. Clifford | — |

| Eli Jones | — |

| Carol R. Kaufman | — |

| John Lumelleau | — |

| Ellen H. Masterson | — |

| Randall Mehl | — |

| John M. Morphy | — |

| Latha Ramchand | — |

| Richard G. Rawson | — |

| James D. Allison | 10,505 |

| A. Steve Arizpe | 16,040 |

| Daniel D. Herink | 10,505 |

| |

| Paul J. Sarvadi | 40,988 |

| Douglas S. Sharp | 13,752 |

2 Includes 100 shares owned by Conrad J. Masterson Jr. (spouse).

3 Includes 102,143 shares owned by the RDKB Rawson LP, 96,716 shares owned by the R&D Rawson LP, 51,796 owned by the DMR Spousal Lifetime Trust and 700 shares owned by Dawn M. Rawson (spouse). Mr. Rawson shares voting and investment power over all such shares with his wife, except for 700 shares owned by his wife.

4 Includes 947,612 shares owned by Our Ship Limited Partnership, Ltd. and 33,691 shares owned by Paul J. Sarvadi and Vicki D. Sarvadi (spouse). Mr. Sarvadi shares voting and investment power over all such shares with his spouse. Also includes shares pledged to banks as collateral for loans. The Board determined the amount of shares pledged by Mr. Sarvadi was insignificant under our pledging policy. See “Corporate Governance — Prohibition on Hedging and Pledging of Our Common Stock” for a further discussion. 5 Includes 109,808 shares owned by S.C.A Legacy, Ltd.

6 Based on a Schedule 13G/A filed with the SEC on January 26, 2023. BlackRock, Inc. reported sole voting power with respect to 5,336,386 shares and sole dispositive power with respect to 5,592,538 shares. The address of BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055.

7 Based on a Schedule 13G/A filed with the SEC on February 13, 2023. Mawer Investment Management Ltd. reported sole voting power with respect to 4,223,911 shares and sole dispositive power with respect to 4,436,394 shares. The address of Mawer Investment Management Ltd. is 600, 517 - 10th Avenue SW, Calgary, Alberta, Canada T2R 0A8.

8 Based on a Schedule 13G/A filed with the SEC on February 9, 2023. The Vanguard Group reported shared voting power with respect to 61,376 shares, sole dispositive power with respect to 3,595,835 shares and shared dispositive power with respect to 96,993 shares with Vanguard Fiduciary Trust Company. The address of the Vanguard Group is 100 Vanguard Blvd., Malvern, Pennsylvania 19355.

PROPOSAL NUMBER 1:

ELECTION OF DIRECTORS

General

In accordance with our Certificate of Incorporation, the members of the Board are divided into three classes. Our Certificate of Incorporation also provides that such classes shall be as nearly equal in number as possible. The terms of office of the Class I, Class II and Class III directors expire at the Annual Meeting of Stockholders in 2023, 2024, and 2025, respectively. The term of office of each of Timothy T. Clifford, Ellen H. Masterson, and Latha Ramchand, who comprise the current Class I directors, expires at the time of the 2023 Annual Meeting of Stockholders, or as soon thereafter as their successors (if any) are elected and qualified. All nominees have consented to be named in this proxy statement and to serve as a director if elected.

Our Certificate of Incorporation and Bylaws provide that the number of directors on the Board shall be fixed from time to time by the Board but shall not be less than three nor more than 15 persons. The number of members constituting the Board is currently fixed at ten.

| | | | | | | | |

| Insperity | 5 | 2023 Proxy Statement |

Voting; Approval Requirements

All proxies will be voted in favor of the nominees named below unless a stockholder has indicated otherwise. The affirmative vote of a majority of the votes cast by holders of our common stock present in person or by proxy at the 2023 Annual Meeting of Stockholders is required for election of the nominees. Abstentions and broker non-votes will be deemed votes not cast. Under our Bylaws and in accordance with Delaware law, a director’s term extends until his or her successor is duly elected and qualified, or until he or she resigns or is removed from office. Thus, an incumbent director who fails to receive the required vote for re-election at our Annual Meeting of Stockholders would continue serving as a director (sometimes referred to as a “holdover director”), generally until the next Annual Meeting of Stockholders. However, as a condition to being nominated to continue to serve as a director, each incumbent director nominee has submitted an irrevocable letter of resignation that is effective upon and only in the event that (1) he or she fails to receive the required vote; and (2) the Board accepts such resignation. In such an event, the Nominating and Corporate Governance Committee is required to make a recommendation to the Board as to whether the Board should accept the resignation, and the Board is required to decide whether to accept the resignation and to disclose its decision-making process within 90 days from the certification of the election results.

If, at or prior to the 2023 Annual Meeting of Stockholders, any nominee should be unable or decline to serve, the discretionary authority provided in the proxy may be used to vote for a substitute designated by the Board. The Board has no reason to believe that any substitute nominee will be required. No proxy will be voted for a greater number of persons than the number of nominees named herein.

Nominees for Director

The following individuals have been nominated for re-election to the Board as Class I directors with terms expiring at the 2026 Annual Meeting of Stockholders:

| | | | | | | | |

| Timothy T. Clifford | •Lead Independent Director •Director since: 2016 •Age: 67 •Committees: Compensation Committee (Chair); Nominating and Corporate Governance Committee |

Mr. Clifford joined the Board as a director in October 2016 and he currently serves as the Company’s lead independent director. Since September 2019, Mr. Clifford has served as an operating partner and consultant to Welsh, Carson, Anderson and Stowe, a private equity firm focused on investments in the technology and healthcare industries. In June 2022, he was appointed executive chairman and CEO of EMS LINQ, Inc., a cloud-based provider of nutrition, enterprise resource planning, portals and payments software to over 4,000 K-12 school districts in the U.S. Prior to his appointment as executive chairman and CEO, he served on the board of EMS LINQ since December 2021. From June 2015 through March 2019, Mr. Clifford served as president and chief executive officer of Frontline Education, a private-equity-backed cloud software company that manages human resources functions at over 80,000 public and private schools in the U.S. He is also a co-founder of the Frontline Research and Learning Institute, as well as The Line, a publication sharing new ideas and insight while encouraging civil discourse on the most challenging problems facing K-12 educators and administrators. Prior to joining Frontline Education, from 2010 through 2013, Mr. Clifford was a corporate officer and co-president of Automatic Data Processing (NYSE: ADP) National Accounts, a $2.5 billion human capital management software and services business serving the largest U.S. companies, and was the co-founder and chief executive officer of Workscape, Inc., a pioneering cloud software provider to the human capital management industry, from 1999 until its acquisition by ADP in 2010. Prior to founding Workscape, he held chief executive officer or senior leadership positions at HealthPlan Services, Consolidated Group and Prudential Insurance Company. From 2013 to 2015, he also served as a director and audit committee member of Carbonite Inc. (Nasdaq: CARB). Mr. Clifford holds a Bachelor of Liberal Arts degree from Northeastern University in Boston.

Mr. Clifford brings extensive technology, entrepreneurial and leadership experience to the Board. His substantial experience with providing HR-related services to businesses, along with his entrepreneurial background and knowledge of cloud-based software solutions for the HR services industry, provide key perspectives to the Board on matters that directly impact our business and the businesses of our customers.

| | | | | | | | |

| Insperity | 6 | 2023 Proxy Statement |

| | | | | | | | |

| Ellen H. Masterson | •Independent Director •Director since: 2017 •Age: 72 •Committees: Finance, Risk Management and Audit Committee (Chair) |

Ms. Masterson joined the Company as a director in September 2017. Since 2014, Ms. Masterson has served as an independent director of Westwood Holdings Group (NYSE: WHG), an investment management firm with over $10 billion in assets under management, and Westwood Trust, a Texas state-chartered trust company. Ms. Masterson is the chair of the audit committee of both WHG and Westwood Trust and serves as a member of the WHG governance committee. She joined the Board of Governors of The Doctors Company, a leading physician-owned medical malpractice insurer, in 2018 where she serves on the finance committee and is chair of the audit committee. Ms. Masterson retired as a partner with PricewaterhouseCoopers LLP ("PwC") in 2008, having served in this capacity since 1999 and from 1985 to 1997. At PwC, Ms. Masterson specialized in audits of companies involved in several sectors of the financial services industry and public companies with a focus on mergers and acquisitions. She held senior positions within the leadership of PwC from 2001 to 2008, including international responsibilities across the global network of PwC firms. From 1997 to 1999, Ms. Masterson served as senior vice president and chief financial officer of American General Corporation, prior to its acquisition by American International Group, Inc. Since 1982, she has served on numerous boards of non-profit and charitable organizations.

Ms. Masterson brings extensive knowledge of financial reporting and accounting issues faced by companies in the business services industry, as well as experience with strategic planning and corporate governance. With her experience as a partner in an international accounting firm, as a chief financial officer for a public company, and as an audit committee member of a public company board, Ms. Masterson strengthens the Board’s financial reporting and accounting acumen, and provides significant expertise from which she can draw to advise and consult with the Board and management on financial and audit-related matters.

| | | | | | | | |

| Latha Ramchand | •Independent Director •Director since: 2019 •Age: 62 •Committees: Finance, Risk Management and Audit Committee |

Dr. Ramchand joined the Company as a director in December 2019. Dr. Ramchand has served as Executive Vice Chancellor and Provost at the University of Missouri since her appointment in August 2018. Previously, Dr. Ramchand served as dean of the C.T. Bauer College of Business of the University of Houston from 2011 to 2018. Prior to her deanship, she served as associate dean from 2006. During her tenure as dean, Bauer College grew enrollment to over 6,400 students, oversaw the creation of a social entrepreneurship program, expanded programs in entrepreneurship and technology commercialization, and created a venture fund and a start-up accelerator. In her current role, she has led the development of a new responsibility-centered budget model, and the implementation of a new strategic plan for the University of Missouri. Dr. Ramchand is also a certified financial analyst and served on the advisory board of the CFP Board of Standards from 2019 to 2022. She received her Ph.D., Finance, from the Kellogg Graduate School of Management of Northwestern University in 1993, her M.A., Economics, from the University of Bombay in 1983 and a B.A., Economics, also from the University of Bombay in 1981.

Dr. Ramchand brings substantial leadership and financial experience to the Board, including extensive experience in managing large and complex organizations and ensuring fiscal responsibility in the management of academic enterprises and academic health centers. In addition, Dr. Ramchand’s experience with entrepreneurship and generational changes bolsters our Board’s insight into an important part of our client base.

| | |

| The Board recommends that stockholders vote “For” all of the nominees listed above, and proxies executed and returned will be so voted unless contrary instructions are indicated thereon. |

| | | | | | | | |

| Insperity | 7 | 2023 Proxy Statement |

Directors Not Currently Subject to Election

The following directors are not subject to election at the 2023 Annual Meeting of Stockholders:

Class II Directors (Term Expires at 2024 Annual Meeting of Stockholders)

| | | | | | | | |

| Carol R. Kaufman | •Independent Director •Director since: 2013 •Age: 73 •Committees: Nominating and Corporate Governance Committee (Chair); Compensation Committee |

Ms. Kaufman joined the Company as a director in November 2013. From July 2011 through April 2018, Ms. Kaufman served as the executive vice president, secretary, chief administrative officer and chief governance officer of The Cooper Companies, Inc. (NYSE: COO), a global medical device company, where she had previously served in a variety of capacities since October 1995, including as vice president of legal affairs beginning in March 1996 and senior vice president beginning in October 2004. From January 1989 through September 1995, she served as vice president, secretary and chief administrative officer of Cooper Development Company, a former affiliate of The Cooper Companies, Inc. Beginning in 1971, Ms. Kaufman held several financial positions, including deputy corporate controller, with Cooper Laboratories, Inc., the former parent of The Cooper Companies, Inc. Ms. Kaufman also served as a member of the western region advisory board for FM Global, the world’s largest property insurer. Ms. Kaufman has served on the University Advisory Board for Boston University and on the board of the University of St. Andrews American Foundation. Ms. Kaufman served as a director of Chindex, Inc. (former Nasdaq-listed company) from November 2000 until September 2014, serving on its audit and compensation committees and as chair of its governance and nominating committee, and as a member of its special transaction committee until its sale in 2014 to TPG. Ms. Kaufman earned a Bachelor of Science degree in Mathematics in 1971 from Boston University.

Ms. Kaufman brings extensive financial and business experience, including in corporate governance, risk management, executive compensation and employee benefits to the Board. Her varied roles within The Cooper Companies, Inc. and prior board service provide the Board with additional expertise on governance and on evaluating and executing strategic initiatives.

| | | | | | | | |

| John L. Lumelleau | •Independent Director •Director since: 2019 •Age: 71 •Committees: Finance, Risk Management and Audit Committee |

Mr. Lumelleau joined the Company as a director in December 2019. Mr. Lumelleau served as the president and chief executive officer of Lockton, Inc., the largest privately held independent insurance broker and a top 10 insurance broker globally, from 2002 until his retirement in 2017. Following his retirement, he served as an independent advisor to Lockton until 2021 and continues to serve on the board of directors of Lockton. In 2019, he also became chairman of the board of Orchid Underwriters Agency, LLC, a leading specialty underwriter of catastrophe exposed property insurance, and is a member of the management advisory board of TowerBrook Capital Partners. While he served as president and chief executive officer, Lockton’s revenues grew from $92 million to $1.4 billion and it expanded from 7 offices to 85 offices globally. Previously, he served as president of Lockton from 2000 to 2002 and as operations executive from 1997 to 1999. Prior to joining Lockton, Mr. Lumelleau held various roles at Alexander & Alexander, Inc. and its successor, AON Risk Services, from 1976 until 1997, including executive vice president of global retail sales. He currently serves on the board of trustees of Fordham University and previously served on the Board of Overseers of the St. John’s University School of Risk Management & Actuarial Sciences and the board of directors of The Council of Insurance Agents and Brokers. Mr. Lumelleau holds a Bachelor of Arts from Fordham University.

Mr. Lumelleau brings substantial leadership, industry and business experience to the Board, including an extensive knowledge of the insurance industry. Mr. Lumelleau’s previous experience as the long-time CEO of the world’s largest

| | | | | | | | |

| Insperity | 8 | 2023 Proxy Statement |

privately held insurance brokerage firm provides the Board with substantial knowledge, insight and key perspectives related to risk management and the opportunities and challenges faced by growth-oriented organizations.

| | | | | | | | |

| Paul J. Sarvadi | •Chairman of the Board and Chief Executive Officer •Director since: 1986 •Age: 66

|

Mr. Sarvadi, co-founder of the Company and its subsidiaries, has been a director since the Company’s inception in 1986. He has also served as the Chairman of the Board and Chief Executive Officer of the Company since 1989 and as president of the Company from 1989 to August 2003. He attended Rice University and the University of Houston prior to starting and operating several small companies. Mr. Sarvadi has served as president of the National Association of Professional Employer Organizations (“NAPEO”) and was a member of its board of directors for five years. In 2001, Mr. Sarvadi was selected as the 2001 National Ernst & Young Entrepreneur of the Year ® for service industries. In 2004, he received the Conn Family Distinguished New Venture Leader Award from Mays Business School at Texas A&M University. In 2007, he was inducted into the Texas Business Hall of Fame.

Mr. Sarvadi brings substantial business and operational experience to the Board, including an extensive knowledge of sales, customer relationships, and issues affecting small to medium-sized businesses. Mr. Sarvadi’s role as a co-founder of the Company and lengthy service as chief executive officer of the Company provide to the Board extensive knowledge and insight of our operations and issues affecting the Company as well as the broader Professional Employer Organization (“PEO”) industry. Mr. Sarvadi’s previous experience starting and operating several small businesses, as well as his frequent interaction with the Company’s clients, provide valuable insight to the challenges facing small to medium-sized businesses, which is a principal focus of the Company.

Class III Directors (Term Expires at 2025 Annual Meeting of Stockholders)

| | | | | | | | |

| Eli Jones | •Independent Director •Director since: 2020 •Age: 61 •Committees: Compensation Committee |

Dr. Eli Jones rejoined the Company as a Class III director in December 2020. Since June 2021, Dr. Jones has served as a marketing professor and endowed chair at Mays Business School at Texas A&M University. From July 2015 through May 2021, Dr. Jones served as the Dean of the Mays Business School. Dr. Jones has served as a member of the board of directors of First Financial Bankshares, Inc. (Nasdaq: FFIN) since January 2022. He has also served on the board of trustees of the Invesco family of funds since 2016, and served on their Governance Committee from 2016 until 2021. Dr. Jones was also a director of the Company from 2004 through June 2016. Before joining the Mays Business School, from 2012, he was the Dean of the Sam M. Walton College of Business at the University of Arkansas and holder of the Sam M. Walton Leadership Chair in Business. Prior to joining the faculty at the University of Arkansas, he was Dean of the E.J. Ourso College of Business and Ourso Distinguished Professor of Business at Louisiana State University (“LSU”) from 2008 to 2012; and Professor of Marketing and Associate Dean at the C.T. Bauer College of Business at the University of Houston from 2007 to 2008, where he also was an Associate Professor of Marketing from 2002 to 2007; and an assistant professor from 1997 until 2002. He taught at Texas A&M University for several years before joining the faculty of the University of Houston. Dr. Jones served as the executive director of the Program for Excellence in Selling and the founding director of the Sales Excellence Institute at the University of Houston from 1997 to 2007. Before becoming a professor, he worked in sales and sales management for three Fortune 100 companies: Quaker Oats, Nabisco and Frito-Lay. Dr. Jones has also published three books and approximately 50 research articles in leading peer-reviewed academic journals in sales and sales management. He received his Bachelor of Science degree in Journalism in 1982, his MBA in 1986, and his Ph.D. in 1997, all from Texas A&M University.

| | | | | | | | |

| Insperity | 9 | 2023 Proxy Statement |

Dr. Jones brings to the Board significant experience and cutting-edge knowledge and expertise. He is considered a “sales scientist” in that he conducts and publishes cutting-edge research in sales, sales management, marketing strategy, leadership and customer relationship management based on data from organizations world-wide, which are areas critical to the Company. Dr. Jones is able to draw upon his research to provide the Board knowledge with respect to the Insperity sales force. Dr. Jones’ prior service as Dean of the Mays Business School at Texas A&M University; Dean of the E.J. Ourso College of Business and Ourso Distinguished Professor of Business at LSU, Dean of the Sam M. Walton College of Business at the University of Arkansas and holder of the Sam M. Walton Leadership Chair in Business, demonstrate his leadership and broad-based business acumen.

| | | | | | | | |

| Randall Mehl | •Independent Director •Director since: 2017 •Age: 55 •Committees: Compensation Committee |

Mr. Mehl joined the Company as a director in December 2017. Mr. Mehl has served on the boards of ICF International, Inc. (Nasdaq: ICFI), a global consulting and technology services provider, since September 2017, and Kforce Inc. (Nasdaq: KFRC), a professional staffing firm, since January 2017. Mr. Mehl is the president of Stewardship Capital Advisors, LLC, which manages a family-office equity fund focused on making investments in business and technology services. Previously, he served as a managing director and a partner with Baird Capital, a middle market private equity group, and led a team focused on the business and technology services sector from 2005 until the end of 2016. From 1996 to 2005, Mr. Mehl was a senior equity research analyst with Robert W. Baird & Company, covering various areas within the broader business and technology services sector, including professional employer organizations. Prior to earning an MBA from The University of Chicago’s Booth School of Business in 1996, Mr. Mehl designed, developed, and used technology systems at Accenture and The Capital Group from 1990 to 1994. In addition to his public board experience, Mr. Mehl previously served on several private company boards and on the investment committee for several funds, and has expertise analyzing, acquiring, and selling businesses.

Mr. Mehl brings extensive experience in the technology and business process outsourcing sectors, including PEOs, which are directly relevant to our company’s objectives. His background as an investor, adviser and board member focused on these industries provides an important investor perspective to our Board and provides key insight to the Board as it analyzes our long-term objectives. Further, due to his experience in technology and with technology companies involved in software development and cybersecurity, Mr. Mehl brings additional insights to our Board regarding these areas that are critical to our business.

| | | | | | | | |

| John M. Morphy | •Independent Director •Director since: 2016 •Age: 75 •Committees: Finance, Risk Management and Audit Committee |

Mr. Morphy joined the Company as a director in May 2016. Mr. Morphy previously served as senior vice president, chief financial officer, secretary and treasurer of Paychex, Inc. (Nasdaq: PAYX), a leading provider of payroll, human resource, and benefits outsourcing solutions for small to medium-sized businesses, from October 1996 until June 2011, at which time he was appointed vice president of finance at Paychex until he retired in January 2012. As chief financial officer of Paychex, Mr. Morphy reported directly to the chief executive officer and was responsible for all finance, legal, shareholder relations, purchasing, real estate and travel functions. Prior to joining Paychex in 1995, he served as the chief financial officer of Goulds Pumps, Inc., a then publicly traded global manufacturer of pumps for industrial, commercial and water supply markets, from 1985 to 1993, and as group vice president over industrial products at Goulds through 1995. From 1976 to 1985, Mr. Morphy was vice president and controller for Computer Consoles, Inc., and before that he was an accountant at Arthur Andersen & Company, an accounting firm. Mr. Morphy also previously served as a director of Inforte Corp., a then publicly traded customer and demand management consultancy, from April 2003 to August 2004. He earned his Bachelor of Science in Accounting from LeMoyne College and his Certified Public Accountant certificate in 1973. Mr. Morphy was originally appointed to the Board pursuant to a prior agreement with a former significant stockholder.

| | | | | | | | |

| Insperity | 10 | 2023 Proxy Statement |

Mr. Morphy brings extensive financial, accounting and industry experience to the Board. His more than 20 years of financial leadership experience for various public corporations and experience in many facets of finance within varied environments, including rapid growth companies, global Fortune 500 industrial companies and major accounting firms, provide substantial knowledge and insight that are valuable to the Board.

| | | | | | | | |

| Richard G. Rawson | •Director since: 1989 •Age: 74 |

Mr. Rawson has been a director of the Company since 1989. In May 2018, Mr. Rawson retired from his position as president of the Company, a position that he had held since August 2003. Before being elected president, he served as executive vice president of administration, chief financial officer and treasurer of the Company from February 1997 until August 2003. Prior to that, he served as senior vice president, chief financial officer and treasurer of the Company since 1989. Before joining the Company in 1989, Mr. Rawson served as a senior financial officer and controller for several companies in the manufacturing and seismic data processing industries. He is the past president of the NAPEO. Mr. Rawson currently serves on the Executive Advisory Committee of the Bauer College Board of the C.T. Bauer College of Business at the University of Houston and the National Board of Directors for Genesys Works. Additionally, he is co-founder and chairman of Sciolytix, Inc. and co-founder and partner of Trinity Legacy Partners, a registered investment advisory firm. Mr. Rawson has a Bachelor of Business Administration degree in Finance from the University of Houston and received a Doctor of Humane Letters (honorary) from the University of Houston in December 2020.

Mr. Rawson brings financial and operational experience to the Board. His lengthy service as president of the Company, as well as his prior service as chief financial officer and treasurer of the Company, provide in-depth knowledge and insight of Company operations and financial matters to the Board.

Summary of Committee Memberships

The following table summarizes the committees of which each director is currently a member:

| | | | | | | | | | | | | | |

| Class

(Term Expires) | Compensation

Committee | Finance, Risk Management

& Audit Committee | Nominating & Corporate

Governance Committee |

| Timothy Clifford* | I (2023) | C | | l |

Eli Jones† | III (2025) | l | | |

Carol Kaufman† | II (2024) | l | | C |

John Lumelleau† | II (2024) | | l $ | |

Ellen H. Masterson† | I (2023) | | C $ | |

Randall Mehl† | III (2025) | l | | |

John Morphy† | III (2025) | | l $ | |

Latha Ramchand† | I (2023) | | l $ | |

| Richard G. Rawson | III (2025) | | | |

Paul J. Sarvadi‡ | II (2024) | | | |

_________________________ | | | | | | | | | | | |

| C | Committee Chair | * | Lead independent Director |

| l | Committee Member | † | Independent Director |

| $ | Audit committee financial expert | ‡ | Chairman of the Board and CEO |

| | | | | | | | |

| Insperity | 11 | 2023 Proxy Statement |

CORPORATE GOVERNANCE

Corporate Governance Guidelines

We have adopted Corporate Governance Guidelines, which include guidelines for, among other things, director responsibilities, qualifications and independence. The Board regularly monitors developments in corporate governance practices and regulatory changes and periodically assesses the adequacy of and modifies our Corporate Governance Guidelines and committee charters as warranted in light of such developments. You can access our Corporate Governance Guidelines in their entirety on our website at www.insperity.com under the Corporate Governance heading in the Investor Relations section. The information on our website is not, and shall not be deemed to be, a part of this proxy statement.

Director Independence

Under the rules of the NYSE, a majority of our directors must be independent. No director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). In evaluating each director’s independence, the Board considered all relevant facts and circumstances, and relationships and transactions between each director, her or his family members or any business, charity or other entity in which the director has an interest or a significant relationship on the one hand, and the Company, its affiliates, or our senior management on the other. As a result of this review, at its meeting held in February 2023, the Board affirmatively determined that all of the Company’s directors are independent, with the exception of Mr. Sarvadi, who is a member of our senior management, and Mr. Rawson, who was a member of our senior management until his retirement in May 2018, whose independence was not considered by the Board.

The Board has considered what types of disclosure should be made relating to the process of determining director independence. To assist the Board in making disclosures regarding its determinations of independence, the Board has adopted categorical standards as contemplated under the listing standards of the NYSE then in effect. Under the rules then in effect, relationships that were within the categorical standards were not required to be disclosed and their impact on independence was not required to be separately discussed, although the categorical standards, by themselves, did not determine the independence of a particular director. The Board considers all relevant facts and circumstances in determining whether a director is independent. A relationship satisfies the categorical standards adopted by the Board if it:

•is not a relationship that would preclude a determination of independence under Section 303A.02(b) of the NYSE Listed Company Manual;

•consists of charitable contributions made by us to an organization where a director is an executive officer and does not exceed the greater of $1 million or 2% of the organization’s gross revenue in any of the last three years; and

•is not required to be, and it is not otherwise, disclosed in this proxy statement.

In the course of the Board’s determination regarding the independence of those directors under consideration, it considered all transactions, relationships and arrangements in which such directors and the Company were participants or deemed to have an interest.

Selection of Nominees for the Board of Directors

Identification and Evaluation of Candidates for Nomination to the Board of Directors

The Nominating and Corporate Governance Committee may solicit ideas for potential candidates for membership on the Board from a number of sources, including members of the Board, our executive officers, individuals personally known to the members of the Board, research, and search firms. The Nominating and Corporate Governance Committee has authority to select and compensate a third-party executive search firm to help identify candidates, as it deems advisable. In addition, the Nominating and Corporate Governance Committee will consider candidates for the Board submitted by stockholders. Any such submissions should include the candidate’s name and qualifications for Board membership and should be directed to our Corporate Secretary at 19001 Crescent Springs Drive, Kingwood, Texas 77339. Although the Nominating and Corporate Governance Committee does not require the stockholder to submit any particular information regarding the qualifications of the stockholder’s candidate, the level of consideration that the Nominating and Corporate Governance Committee will give to the stockholder’s candidate will be commensurate with the quality and quantity of

| | | | | | | | |

| Insperity | 12 | 2023 Proxy Statement |

information about the candidate that the stockholder makes available to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will evaluate all candidates identified through the processes described above on the same basis.

In assessing a director candidate, the Nominating and Corporate Governance Committee considers the appropriate balance of experiences, skills and other qualifications required for service on the Board. See “— Director Qualifications” below for detailed information concerning directors’ qualifications. Additionally, the Nominating and Corporate Governance Committee also considers the extent to which a director candidate contributes to the diversity of the Board, with diversity being construed broadly to encompass a director candidate’s perspectives, opinions, experiences, background and other personal factors, including gender, race, ethnicity, and age. Generally, based on this initial evaluation, the chairperson of the Nominating and Corporate Governance Committee will determine whether to interview the candidate and, if warranted, will recommend that one or more members of the Nominating and Corporate Governance Committee, other members of the Board, and senior management, as appropriate, interview the candidate. After completing this evaluation and interview process, the Nominating and Corporate Governance Committee makes a recommendation to the entire Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation of the Nominating and Corporate Governance Committee. Director Qualifications

The following are core criteria that are expected of each director or nominee:

•high integrity and ethical standards;

•skills and expertise that are complementary to the existing Board members’ skills;

•independence of thought and judgment;

•the ability to dedicate sufficient time, energy and attention to the performance of her or his duties, taking into consideration any service on other public company boards; and

•the ability to represent the interests of all of our stakeholders and not just one particular constituency.

In addition to these core criteria, the Nominating and Corporate Governance Committee regularly assesses the areas of expertise that will promote an effective and high-functioning board and also considers other qualities that it may deem to be desirable, such as demonstrated business judgment, collaborative abilities, training and education, and relationships.

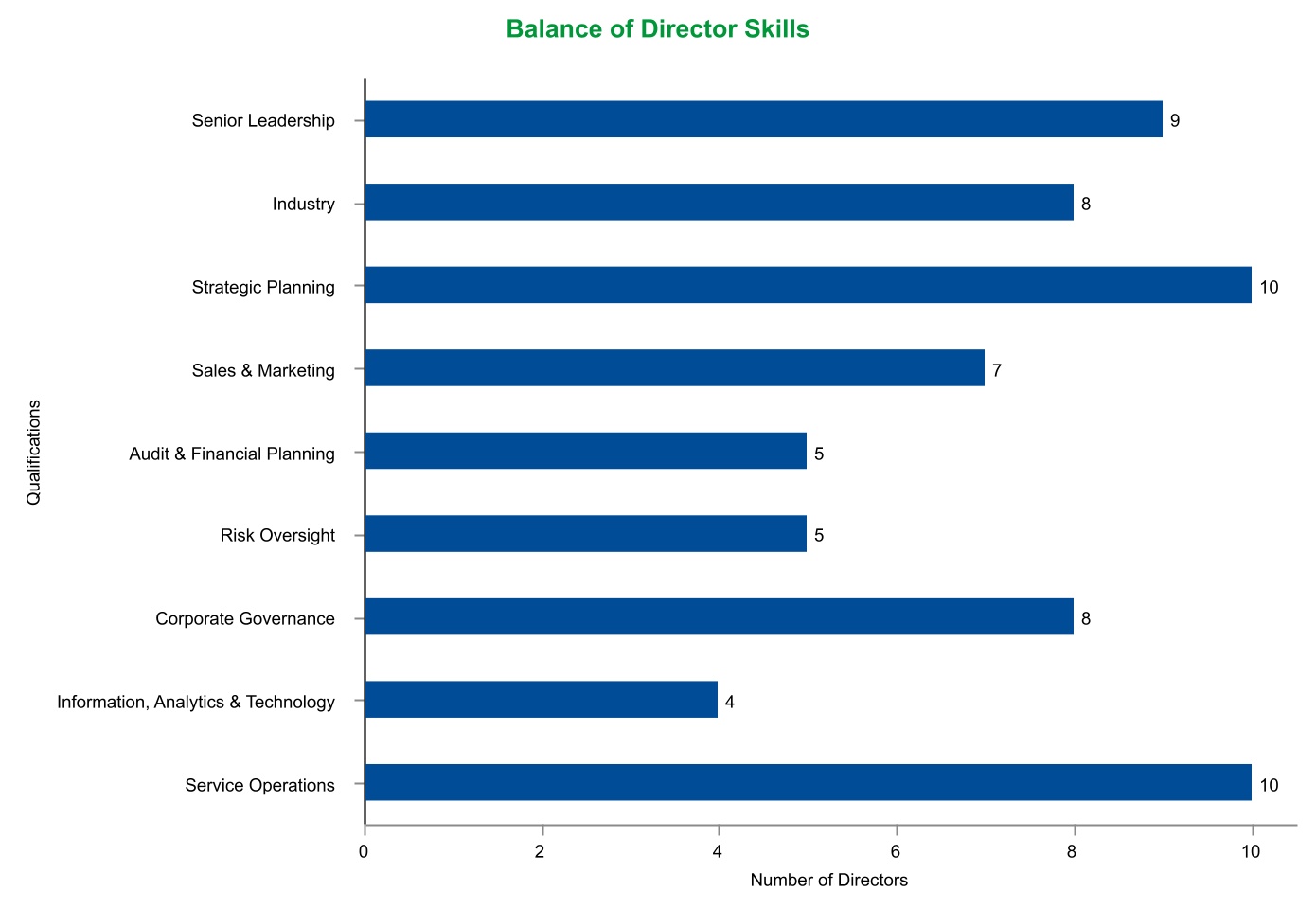

Below are the qualifications, skills, and expertise that the Nominating and Corporate Governance Committee considers critical to the Board’s ability to provide effective oversight of the Company and are directly relevant to our business, strategy and operations. Although a given director or director nominee need not individually possess the experience, skill, or other requisite qualification in all areas, the Nominating and Corporate Governance Committee believes that the Board, as a collective group, should have experience in such areas of expertise. The Nominating and Corporate Governance Committee regularly conducts assessments of the areas of expertise possessed by the current members of the Board and the collective Board, which is considered when developing the desired profile in candidate searches.

The chart that follows illustrates how these qualifications and skills are distributed among our directors and nominees as a collective group.

•Senior Leadership experience as a CEO or as another senior officer demonstrates leadership ability, as well as a practical understanding of complex organizations, processes, corporate culture, and the methods to drive change and growth.

•Industry experience in human capital management, human resources, insurance services, small businesses, or entrepreneurial ventures provides a valuable perspective on the Company’s business strategy, operations, key performance metrics, risks, target markets, competition, and other issues specific to the Company’s business.

| | | | | | | | |

| Insperity | 13 | 2023 Proxy Statement |

•Strategic Planning experience with significant corporate initiatives is valuable in assessing specific plans to capitalize on identified growth opportunities and evaluating the Company’s capital structure and capital allocation.

•Sales & Marketing experience is critical to assisting the Board with oversight of matters relating to a large sales organization, brand development, marketing to businesses, and digital marketing.

•Audit & Financial Planning experience is key to providing oversight to the Company’s internal controls and financial reporting and to critically evaluating metrics that measure our performance.

•Risk Oversight experience contributes to identification, assessment, and prioritization of significant risks facing the Company and facilitates the Board’s role in providing oversight of the Company’s policies and procedures that are designed to manage those risks.

•Corporate Governance experience, including experience with governance principles or environmental, social, and governance initiatives such as sustainability and diversity, equity, and inclusion, is important to the Board’s understanding of best practices in corporate governance matters and enhancing board effectiveness, and supports the Board’s goals of accountability, transparency and protection of stockholder interests.

•Information, Analytics & Technology experience assists the Board with understanding and oversight of cloud-based, mission-critical solutions, as well as cybersecurity and data privacy matters.

•Service Operations experience is valuable in understanding the issues related to a large service organization that offers business process outsourcing solutions to its clients.

| | | | | | | | |

| Insperity | 14 | 2023 Proxy Statement |

Board of Directors’ Leadership

We do not have a policy with respect to whether the positions of Chairman of the Board and chief executive officer (“CEO”) should be held by the same person or two separate individuals, and believe that it is in the best interest of the Company to consider that question from time to time in the context of succession planning. At this time, the Board believes that it is in the best interest of the Company, and is an appropriate leadership structure, to have the CEO also serve as Chairman of the Board. Combining the CEO and Chairman of the Board roles provides an efficient and effective leadership model that promotes unambiguous accountability and alignment on corporate strategy. Mr. Sarvadi co-founded the Company in 1986 and has served as Chairman of the Board and CEO since 1989. The Board believes that Mr. Sarvadi’s intimate knowledge of the daily operations of, and familiarity with, the Company and industry put him in the best position to provide leadership to the Board on setting the agenda, emerging issues facing the Company and the PEO industry, and strategic opportunities. Additionally, Mr. Sarvadi’s substantial financial stake in the Company creates a strong alignment of interests with other stockholders. Mr. Sarvadi’s combined roles also ensure that a unified message is conveyed to stockholders, employees and clients.

The position of lead independent director is established by our Corporate Governance Guidelines. Mr. Clifford is currently the lead independent director. The Board reevaluates the lead independent director position annually. The lead independent director has the following responsibilities in addition to the regular duties of a director:

•prepare and set the agenda for and chair executive sessions of the outside directors;

•call or convene executive sessions of the outside directors;

•authority to set the agenda for meetings of the Board;

•preside at all meetings of the Board where the Chairman of the Board is not present or has a potential conflict of interest;

•serve as liaison and facilitate communications between the independent directors and the Chairman of the Board and CEO;

•consult with the Chairman of the Board and CEO on matters relating to corporate governance and performance of the Board; and

•collaborate with the Finance, Risk Management and Audit Committee and with the rest of the Nominating and Corporate Governance Committee on possible director conflicts of interest or breaches of the Corporate Governance Guidelines.

Board of Directors’ Role in Risk Oversight

The Board is responsible for overseeing the Company’s overall risk profile and assisting management in addressing specific risks. Our Enterprise Risk Management Steering Committee (the “ERM Steering Committee”) is responsible for formally identifying and evaluating risks that may affect our ability to execute our corporate strategy and fulfill our business objectives. The ERM Steering Committee employs a disciplined approach to identifying, documenting, evaluating, communicating, and monitoring enterprise risk management within the Company. The ERM Steering Committee is chaired by the Company’s chief financial officer and includes the Company’s general counsel, internal audit director, and other members of management. The ERM Steering Committee reports to the Board and the CEO. The ERM Steering Committee conducts an annual comprehensive risk review of our overall risk profile and analyzes any significant identified risks, including consideration of risks relating to strategic, environmental, social, governance, health and safety, operational, financial, legal, regulatory, and reputational matters, which the ERM Steering Committee then presents and discusses with the Finance, Risk Management and Audit Committee and the entire Board. In addition to the formal annual review, members of the ERM Steering Committee review and provide periodic updates as appropriate regarding our overall risk profile and any significant identified risks to both the Finance, Risk Management and Audit Committee and the entire Board.

During 2022, the ERM Steering Committee completed its annual comprehensive review and update of the Company’s risks. The ERM Steering Committee further reviewed and updated the mitigating factors associated with such risks, and prioritized the identified risks based upon the subjectively determined likelihood of the occurrence and the estimated resulting impact on the Company if the risk occurred.

| | | | | | | | |

| Insperity | 15 | 2023 Proxy Statement |

The Board executes its risk oversight function both directly and through its standing committees, each of which assists the Board in overseeing a part of the Company’s overall risk management. Throughout the year, the Board and each such committee spend a portion of their time reviewing and discussing specific risk factors, and risk assessments are part of major decision making. The Board is kept informed of each committee’s risk oversight and related activities through regular reports from such committees. Members of senior management also update the Board and the committees during the year as appropriate to address key risk-related matters, including legal and regulatory developments, the assessment and management of environmental and climate change risks, cybersecurity and data privacy risks, and diversity, equity, and inclusion initiatives.

The Finance, Risk Management and Audit Committee is assigned primary responsibility for oversight of risk assessment with financial implications, as well as those that threaten the long-term sustainability of our business, such as risks associated with cybersecurity, data privacy, environmental (which would include climate change risks), health and safety, and social and governance matters. In its periodic meetings with management, internal auditors, and independent auditors, the Finance, Risk Management and Audit Committee reviews and monitors many factors relating to enterprise risk, including:

•the financial affairs of the Company;

•the integrity of the Company’s financial statements and internal controls;

•the Company’s compliance with legal and regulatory requirements;

•the independent auditor’s qualifications, independence, and performance;

•the performance of the personnel responsible for the Company’s internal audit function and independent auditors; and

•the Company’s policies and procedures with respect to risk management.

The Compensation Committee has primary responsibility to consider material risk factors relating to the Company’s compensation policies and practices.

The Nominating and Corporate Governance Committee monitors governance and succession risks.

As part of its review and approval of our capital budget, compensation, major acquisitions, material contracts, and other similar matters, the Board retains ultimate authority over assessing the risks and their impacts on our business.

Prohibition on Hedging and Pledging of Our Common Stock

We have established strict standards regarding the speculative trading of our common stock. We prohibit employees and directors from engaging in hedging transactions involving our common stock. The Board also adopted a formal policy prohibiting employees and directors from engaging in the significant pledging of shares of our common stock. Any requests to pledge shares or to increase existing amounts of pledged shares are reviewed by the Board, which considers the facts and circumstances and other information the Board deems relevant.

As of April 4, 2023, Mr. Sarvadi had 120,000 shares of our common stock pledged, which represented approximately 8.0% of the shares of our common stock Mr. Sarvadi beneficially owned. After a thorough review, the Board approved Mr. Sarvadi’s pledge of shares based on their determination that the number of shares pledged by him were not significant. In making this determination, the Board considered that the pledged shares did not represent a material portion of the total shares beneficially owned by him, were less than 1% of our total shares outstanding and market capitalization, and also represented an amount that could reasonably be expected to be sold in an orderly manner in a short period of time given the Company’s historic average daily trading volume. The Board also considered Mr. Sarvadi’s significant number of founder’s shares that were not earned as compensation from the Company, his compliance with our stock ownership guidelines (disregarding the pledged shares), and the purpose of his pledge being unrelated to an attempt to shift or hedge economic risk in owning Company shares.

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics (the “Code”) governing the conduct of our directors, officers and employees. The Code, which meets the requirements of Rule 303A.10 of the NYSE Listed Company Manual and Item 406 of Regulation S-K, is intended to promote honest and ethical conduct; full, fair, accurate, timely and

| | | | | | | | |

| Insperity | 16 | 2023 Proxy Statement |

understandable disclosure in our public filings; compliance with laws; and the prompt internal reporting of violations of the Code. Our new employees are required to certify that they have reviewed and understand the Code. In addition, our annual compliance training for all employees reminds them of their obligations under the Code and provides practical examples to foster a deeper understanding of its principles. You can access the Code on our website at www.insperity.com under the Corporate Governance heading in the Investor Relations section. The Finance, Risk Management and Audit Committee has responsibility for oversight of compliance with Code. Changes in and waivers to the Code for our directors, executive officers and certain senior financial officers will be posted on our Internet website within four business days of being approved and will be maintained for at least 12 months. If you wish to raise a question or concern or report a violation, including anonymously, to the Finance, Risk Management and Audit Committee, you should visit www.ethicspoint.com (or https://insperity.navexone.com/ on a mobile device) or call the toll-free reporting hotline at 1-844-606-3529.

Stockholder Communications and Engagement

Stockholders and other interested parties may communicate directly with the entire Board or the non-management directors as a group by sending an email to directors@insperity.com. Alternatively, you may mail your correspondence to the Board or non-management directors in care of the Corporate Secretary, 19001 Crescent Springs Drive, Kingwood, Texas 77339. In the subject line of the email or on the envelope, please specify whether the communication is addressed to the entire Board or to the non-management directors.

Unless any director directs otherwise, communications received (via U.S. mail or email) will be reviewed by our Corporate Secretary who will exercise his discretion not to forward to the Board correspondence that is inappropriate such as business solicitations, frivolous communications and advertising, routine business matters (i.e., business inquiries, complaints, or suggestions), and personal grievances.

In addition, members of management, including our Chairman of the Board and CEO, regularly meet with stockholders to review Company strategies, financial and operating performance, and other topics of interest. We share the feedback from these sessions with the Board to help ensure that both the Board and management understand and consider the issues that are important to our stockholders. Please also see “Compensation Discussion & Analysis – Stockholder Advisory Votes” for an additional discussion. MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors

Directors are expected to attend all or substantially all Board meetings and meetings of the Committees of the Board on which they serve. Directors are also expected to spend the necessary time to discharge their responsibilities appropriately (including advance review of meeting materials) and to ensure that other existing or future commitments do not materially interfere with their responsibilities as members of the Board. The Board met five times in 2022. During 2022, all of the members of the Board participated in at least 75% of the meetings of the Board and Committees of which they were members during the period of such director’s service. The Board encourages its members to attend the Annual Meeting of Stockholders. Last year, nine of our directors attended the Annual Meeting of Stockholders.

Executive Sessions of the Board of Directors and the Lead Independent or Presiding Director

Our outside directors hold executive sessions at which our management is not in attendance at regularly scheduled Board meetings, and our independent directors hold executive sessions at which only the independent directors are in attendance at least once per year. The lead independent director establishes the agenda and serves as presiding director at the executive sessions. In the absence of a lead independent director, the chairperson of the Nominating and Corporate Governance Committee (if different from the lead independent director) or an independent director designated by the outside directors will preside at meetings of non-management directors. Currently, Mr. Clifford serves as the lead independent director and Ms. Kaufman serves as the chairperson of the Nominating and Corporate Governance Committee.

| | | | | | | | |

| Insperity | 17 | 2023 Proxy Statement |

Committees of the Board of Directors

The Board has appointed three standing committees: the Finance, Risk Management and Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. The charters for each of the three standing Committees, which have been adopted by the Board, contain a detailed description of the respective standing committee’s duties and responsibilities and are available on our website at www.insperity.com under the Corporate Governance heading in the Investor Relations section. The Board has reviewed the applicable legal and NYSE standards for independence for members of each of the Finance, Risk Management and Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee, as well as our independence standards for such Committees, and has determined that the members of each of those Committees of the Board is “independent” under such requirements.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee met three times in 2022. The members of the Nominating and Corporate Governance Committee currently are Ms. Kaufman, who serves as chairperson and Mr. Clifford. The Nominating and Corporate Governance Committee: (1) identifies individuals qualified to become Board members, consistent with the criteria for selection approved by the Board; (2) recommends to the Board a slate of director nominees to be elected by the stockholders at the next Annual Meeting of Stockholders and, when appropriate, director appointees to take office between Annual Meetings of Stockholders; (3) develops and recommends to the Board a set of corporate governance guidelines for the Company; and (4) oversees the evaluation of the Board.

Finance, Risk Management and Audit Committee

The Finance, Risk Management and Audit Committee met eight times in 2022. The members of the Finance, Risk Management and Audit Committee currently are Ms. Masterson, who serves as chairperson, Mr. Lumelleau, Mr. Morphy, and Dr. Ramchand. The Board has determined that each member of the Finance, Risk Management and Audit Committee is an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC. The Finance, Risk Management and Audit Committee assists the Board in fulfilling its responsibility to oversee the financial affairs, risk management, accounting and financial reporting processes, and audits of financial statements of the Company by reviewing and monitoring: (1) the financial affairs of the Company; (2) the integrity of the Company’s financial statements and internal controls; (3) the Company’s compliance with legal and regulatory requirements; (4) the independent auditor’s qualifications, independence and performance; (5) the performance of the personnel responsible for our internal audit function and the independent auditors; and (6) our policies and procedures with respect to risk management, as well as other matters that may come before it as directed by the Board. The Finance, Risk Management and Audit Committee also reviews risk exposures that threaten the long-term sustainability of the Company’s business, such as risks associated with cybersecurity, data privacy, environmental (which would include climate change risks), health and safety, social and governance matters. In connection with those responsibilities, the Finance, Risk Management and Audit Committee oversees the Company’s process of preparing its annual Corporate Social Responsibility report.

Compensation Committee

The Compensation Committee met five times in 2022. The members of the Compensation Committee currently are Mr. Clifford, who serves as chairperson, Dr. Jones, Ms. Kaufman, and Mr. Mehl. The Compensation Committee: (1) oversees and administers the Company’s compensation policies, plans and practices; (2) reviews and discusses with management the Compensation Discussion and Analysis required by the rules of the SEC; and (3) prepares the annual report required by the rules of the SEC on executive compensation for inclusion in the Company’s annual report on Form 10-K or proxy statement for the Annual Meeting of Stockholders. To carry out these purposes, the Compensation Committee: (1) evaluates the performance of, and determines the compensation for, the CEO and, taking into consideration recommendations made by the CEO, our other executive officers; (2) administers our compensation programs; and (3) performs such other duties as may from time to time be directed by the Board.

Pursuant to the terms of the Insperity, Inc. 2012 Incentive Plan, as amended (the “2012 Incentive Plan”), the Board or the Compensation Committee may delegate authority under the 2012 Incentive Plan to the Chairman of the Board or a committee of one or more Board members, respectively, pursuant to such conditions and limitations as each may establish, except that neither may delegate to any person the authority to make awards, or take other action, under the 2012 Incentive Plan with respect to participants who may be subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| | | | | | | | |

| Insperity | 18 | 2023 Proxy Statement |

EXECUTIVE COMPENSATION

TABLE OF CONTENTS TO COMPENSATION DISCUSSION AND ANALYSIS

| | | | | | | | |

| Insperity | 19 | 2023 Proxy Statement |

Compensation Discussion and Analysis

Introduction